UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended June 30, 2021

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

Commission file number 333-202071

DATASEA INC.

(Exact name of registrant as specified in its charter)

|

Nevada |

45-2019013 | |

| (State or other jurisdiction of incorporation or organization) |

|

(I.R.S. Employer Identification No.) |

| 20th Floor, Tower B, Guorui Plaza 1 Ronghua South Road, Technological Development Zone Beijing, People’s Republic of China

|

100176 | |

| (Address of principal executive offices) |

(Zip Code) |

+86 10-56145240

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class |

Trading Symbol |

Name of each exchange on which registered | ||

| Common Stock, $0.001 par value | DTSS | NASDAQ Capital Market |

Securities registered pursuant to Section 12(g) of the Act: None.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer |

☐ |

Accelerated filer |

☐ |

|

Non-accelerated filer |

☐ |

Smaller reporting company |

☒ |

| Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

The aggregate market value of the shares of common stock outstanding, other than shares held by persons who may be deemed affiliates of the Registrant, computed by reference to the closing price for the Registrant’s common stock on December 31, 2020, as reported on Nasdaq Capital Market, was $12,944,578.

As of September 27, 2021, 23,911,042 shares of common stock, $0.001 par value per share, were issued and outstanding.

DATASEA INC.

Annual Report on Form 10-K

For the Fiscal Year Ended June 30, 2021

TABLE OF CONTENTS

All references to “we,” “us,” “our,” “Company,” “Registrant” or similar terms used in this report refer to Datasea Inc., a Nevada corporation, including its consolidated subsidiaries and variable interest entity (“VIE”), unless the context otherwise indicates. In the context of describing our business, “we,” “us,” “our,” or “Company” refers to our VIE, unless the context otherwise indicates.

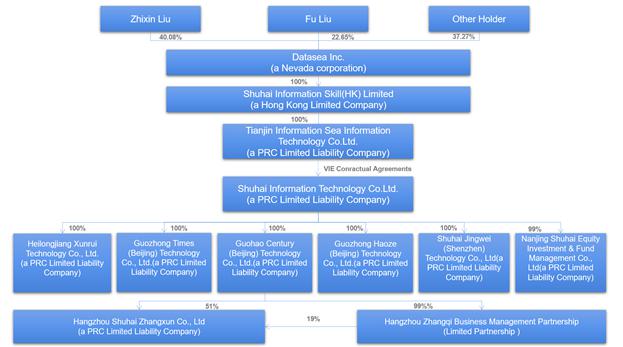

“VIE” or “consolidated VIE” is a variable interest entity whose financial statements are included in our consolidated financial statements as a result of a series of agreements which give us, through our WFOE, control of the entity and gives us effective ownership of its assets. Our VIE is Shuhai Information Technology Co., Ltd. (“Shuhai Beijing”).

“WFOE” or “PRC Subsidiary,” which is a wholly foreign owned entity and is a corporation organized under the laws of the PRC which is wholly owned by us, through our subsidiaries. Our WFOE is Tianjin Information Sea Information Technology Co., Ltd. (“Tianjin Information”).

“PRC” or “China” refers to the People’s Republic of China, excluding, for the purpose of this report, Taiwan, Hong Kong and Macau. “RMB” or “Renminbi” refers to the legal currency of China and “$”, “US$” or “U.S. Dollars” refers to the legal currency of the United States.

Our reporting currency is the US$. The functional currency of our entities located in China is the RMB. For the entities whose functional currency is the RMB, results of operations and cash flows are translated at average exchange rates during the period, assets and liabilities are translated at the exchange rate at the end of the period, and equity is translated at historical exchange rates. As a result, amounts relating to assets and liabilities reported on the statements of cash flows may not necessarily agree with the changes in the corresponding balances on the balance sheets. Translation adjustments resulting from the process of translating the local currency financial statements into US$ are included in determining comprehensive income/loss. Transactions denominated in foreign currencies are translated into the functional currency at the exchange rates prevailing on the transaction dates. Assets and liabilities denominated in foreign currencies are translated into the functional currencies at the exchange rates prevailing at the balance sheet date with any transaction gains and losses that arise from exchange rate fluctuations on transactions denominated in a currency other than the functional currency are included in the results of operations as incurred.

- i -

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This report contains forward-looking statements within the meaning of Section 27A of the Securities Act and Section 21E of the Exchange Act. All statements other than statements of historical fact are “forward-looking statements” for purposes of federal and state securities laws, including, but not limited to, any projections of earnings, revenue or other financial items; any statements of the plans, strategies and objectives of management for future operations; any statements concerning proposed new services or developments; any statements regarding future economic conditions of performance; and statements of belief; and any statements of assumptions underlying any of the foregoing. Such forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements.

In some cases, you can identify forward looking statements by terms such as “may,” “intend,” “might,” “will,” “should,” “could,” “would,” “expect,” “believe,” “anticipate,” “estimate,” “predict,” “potential,” or the negative of these terms. These terms and similar expressions are intended to identify forward-looking statements. The forward-looking statements in this report are based upon management’s current expectations and belief, which management believes are reasonable. However, we cannot assess the impact of each factor on our business or the extent to which any factor or combination of factors, or factors we are aware of, may cause actual results to differ materially from those contained in any forward-looking statements. You are cautioned not to place undue reliance on any forward-looking statements. These statements represent our estimates and assumptions only as of the date of this report. Except to the extent required by federal securities laws, we undertake no obligation to update any forward-looking statement to reflect events or circumstances after the date hereof or to reflect the occurrence of unanticipated events.

Recently, the Chinese government announced that it would step up supervision of Chinese firms listed offshore. Under the new measures, China will improve regulation of cross-border data flows and security, crack down on illegal activity in the securities market and punish fraudulent securities issuance, market manipulation and insider trading, China will also check sources of funding for securities investment and control leverage ratios. The Cyberspace Administration of China (“CAC”) has also opened a cybersecurity probe into several U.S.-listed tech giants focusing on anti-monopoly, financial technology regulation and more recently, with the passage of the Data Security Law, how companies collect, store, process and transfer data.

As a holding company with no material operations of our own, we conduct a substantial majority of our operations through our operating entities established in the People’s Republic of China, or the PRC, primarily our variable interest entity and its subsidiary, collectively, the VIE. Due to PRC legal restrictions on foreign ownership in certain internet-related businesses we may explore and operate in the future, we do not have any equity ownership of our VIE, instead we control and receive the economic benefits of our VIE’s business operations through certain contractual arrangements. Our shares of common stock listed on the Nasdaq Capital Market are shares of our Nevada holding company that maintains service agreements with the associated operating companies. As an investor of our common stock, you may never directly hold equity interests in the Chinese operating companies. There is a risk that the Chinese government may in the future seek to affect operations of any company with any level of operations in PRC, including its ability to offer securities to investors, list its securities on a U.S. or other foreign exchange, conduct its business or accept foreign investment. Substantial uncertainties and restrictions with respect to the political and economic policies of the PRC government and PRC laws and regulations could have a significant impact upon the business that we may be able to conduct in the PRC and accordingly on the results of our operations and financial condition. If the Chinese regulatory authorities could disallow our structure or any or all of the foregoing were to occur, it could, in turn, result in a material change in the Company’s operations and/or the value of its common stock and/or significantly limit or completely hinder its ability to offer or continue to offer securities to investors and cause the value of such securities to significantly decline or be worthless.

- ii -

You should be aware that our actual results could differ materially from those contained in the forward-looking statements due to a number of factors (some of which may be beyond our control), including:

| ● | uncertainties relating to our ability to establish and operate our business in China; uncertainties regarding the enforcement of laws and the fact that rules and regulations in China can change quickly with little advance notice, along with the risk that the Chinese government may intervene or influence our operations at any time, or may exert more control over offerings conducted overseas and/or foreign investment in China-based issuers could result in a material change in our operations, financial performance and/or the value of our common stock or impair our ability to raise money |

| ● | We depend upon the VIE Agreements in conducting our business in the PRC, which may not be as effective as a direct ownership structure. |

| ● | We may not be able to consolidate the financial results of some of our affiliated companies or such consolidation could materially adversely affect our operating results and financial condition. |

| ● | our ability to operate our company as a U.S. publicly-reporting and listed enterprise; |

| ● | uncertainties relating to general economic and business conditions in China and worldwide; |

| ● | industry trends and changes in demand for our products and services; |

| ● | uncertainties relating to customer plans and commitments and the timing of orders received from customers; |

| ● | announcements or changes in our pricing policies or that of our competitors; |

| ● | unanticipated delays in the development, commercialization or market acceptance of our products and services; |

| ● | changes in Chinese government regulations; |

| ● | availability, terms and deployment of capital; relationships with third-party equipment suppliers; and |

| ● | political stability and economic growth in China. |

- iii -

Item 1. Description of Business.

Overview

Datasea, Inc. (the “Company” or “Datasea”) was incorporated in Nevada on September 26, 2014. As a holding company with no material operations of our own, we conduct a substantial majority of our operations through our operating entities established in the People’s Republic of China, or the PRC, primarily our variable interest entity (the “VIE”). We do not have any equity ownership of our VIE, instead we control and receive the economic benefits of our VIE’s business operations through certain contractual arrangements. Our common stock that currently listed on the Nasdaq Capital Markets are shares of our Nevada holding company that maintains service agreements with the associated operating companies. For a description of our corporate structure and contractual arrangements, see “Corporate Structure” on page 24 and “VIE Agreements” on page F-10.

We are a fast-growing enterprise that leverages cutting edge technologies to provide smart security solutions. We also expand our business coverage strategically to areas like 5G messaging and smart payment solutions. Based in Beijing China, our proprietary technologies are geared towards a safe and stable society, and we answer to security needs of both enterprise and individual clients in scenarios including but not limited to residential communities, schools and scenic areas. We provide both hardware and software in our solutions.

The research and development of technology plays a vital role for the Company and is what makes us different. The Company does not only have visual intelligent algorithms such as facial recognition technology, but also develops non-visual intelligent algorithms like acoustic intelligence. Together with artificial intelligence, machine learning and data analytics capability, our solutions does not only provide visibility, but also identify the behavioural pattern and then use alerts to manage the situation actively. We create new opportunities for everything from intelligent detection to proactive optimization. The non-visual intelligent algorithms such as acoustic intelligence are the future of the smart security industry.

As our smart security technologies share similarities and connections with 5G messaging and smart payment solutions, we decided to tap into 5G messaging and smart payment market as a strategic move to enhance the Company’s competitiveness while creating new sources of revenue and profit.

Our Business Summary

1. Smart City Business

Based on the combination of a big data platform and a smart three-dimensional platform, the Company first developed smart campus, smart community, and smart scenic area system, and developed an epidemic prevention and control system under the situation of COVID-19 epidemic. These four application systems have formed the company’s smart city business ecosystem; In addition, the company has also developed a new technical system-satellite remote sensing image analysis system. The above constitute the “two platforms + five application systems” of the Company, and improved the Company’s market capabilities of smart city services. Satellite remote sensing image analysis system can provide powerful technical service support for government departments in urban public governance, such as natural disaster warning, meteorological warning, urban governance, scenic spot management, traffic control and so on.

- 1 -

During the reporting period, the Company completed various projects such as Harbin New District No. 1 School, Harbin No. 73 Middle School Smart Campus Security Control Platform Project, and China Pacific Life Insurance Heilongjiang Branch Office Building Access Control, Monitoring, and Alarm Projects. The Company’s deep cultivation in the northeast region has made effective progress has in the market. At the same time, the products have been recognized by well-known financial life insurance companies in the industry; In addition, Datasea and its wholly owned subsidiary company Guozhong Haoze (Beijing) Technology Ltd. (“Guozhong Haoze”), had signed a strategical agreement on September 22, 2021 with Eastcom Smart Chain (Beijing) Network Technology Co., Ltd. to provide smart systems and services for school canteens and restaurants in at least 200 schools and institutions in the next two years, with a total contract amount of not less than US$14,758,359 (RMB 95,339,000), indicating that the Company’s services in this field have further penetrated into subdivisions.

The Company has completed version 1.0 of the satellite remote sensing image analysis system, which has an innovative smart city management and control capabilities that can provide services for disaster early warning, urban planning, safety monitoring, environmental monitoring and other fields to meet needs of market, and lay the foundation for the Company to create operating income in the next fiscal year.

2. Acoustic Intelligent Business

Smart security products are mainly developed with traditional visual perception technology. However, non-visual perception technology is the future of the Smart security industry. Therefore, we introduced artificial intelligence technology to enhance the ability of our perceptual technologies. Also, by using multiple data sources, products are able to achieve greater accuracy, maintain competitive advantage, and be used in a wider range of applications. Therefore, in addition to the visual system, we developed acoustic intelligence to enhance our Smart security solutions. By capturing sound vibrations, sensors can shape unseen aspects and events in the environment.

The Company has reached a strategic cooperation with the Institute of Acoustics of The Chinese Academy of Sciences on April 8, 2021, the most authoritative research institute in acoustics in China, which supplies the core technologies including noise control, medical acoustics, ultrasound and vibroacoustics. These technologies will not only help to upgrade the Company’s current smart security solutions, break through the limitations of traditional image-based solutions, but also be used in the fields of smart cities, smart communities, smart terminals, 5G information, and other areas of the Company’s existing products and customer layouts. Besides, acoustic intelligence itself is very widely applicable, for example, there are demands in the global industrial Internet of Things, smart city, consumptions, medical beauty, medical care, agriculture and other areas.

At present, the acoustic intelligent technology of Datasea has reached the 1.0 stage, and the hardware products are in the stage of production, processing and design. The Company plans to launch and publish the “Acoustic Intelligent Technology White Paper” jointly with the national industry standard department in the near future.

During the reporting period, the Company established voice perception and acoustic effects as the two main technical directions, and has obtained 4 independent research and development core technology invention patents and 4 software copyrights. At the present, Datasea Acoustic Intelligent Technology has achieved stage 1.0, and has achieved certain results in the market application demonstration, indicating that Datasea has the ability to implement the acoustic intelligent landing project in the field of visual and non-perceptual fusion perception.

- 2 -

3. 5G Message Business

As our smart security technologies share similarities and connections with 5G messaging and smart payment solutions, we decided to tap into 5G messaging and smart payment market as a strategic move to enhance the Company’s competence while creating new sources of revenue and profit.

In November 2020, the Company established Hangzhou Shuhai Zhangxun Information Technology Co., Ltd (“Zhangxun”) to seize the market opportunities of the next generation of information services and take charge of the research and development, application and marketing of 5G message-related technologies. At the present, the Company has not only completed relevant product research and development, but also designed application templates for various industries including finance, e-commerce, logistics, tourism, government affairs, education and electricity, and successfully signed the first batch of enterprise customers and sales partners.

The 5G message marketing cloud platform developed by the Company aims to solve all communication and marketing needs of merchants and customers for communication, sales, and maintenance. This is a product intended to unify customer and prospect marketing signals in a single view with functions like precise SaaS value-added services, data monetization and message-marketing. The Company’s 5G messaging business and smart phones are combined into a three-dimensional touch mode to build private domain relations with customers. It can serve all industries with marketing needs for customers and has extremely broad application potential.

During the reporting period, the Company held 3 product cooperation distribution conferences, successfully signed up more than 14 partners, with a contract value of $316,718 (RMB 2.046 million), and realized cash flow income of more than $239,938 (RMB 1.55 million); the Company and YTO National Engineering Laboratory initiated the establishment of the “5G Message Application Research Joint Laboratory”, and became the secretary-general unit of the 5G Message Professional Committee of the China Association of Communications Enterprises to jointly formulate 5G message standards for the Chinese logistics industry. Also, the Company has become a member of the 5G messaging working group of the Ministry of Industry and Information Technology, and participate in the drafting and formulation of national 5G messaging related policies.

In terms of market coverage, 5G messaging product channels have expanded to 5 provinces and cities in Shanghai, Chongqing, Zhejiang, Yunnan and Shaanxi, accounting for 14% of China’s provincial-level administrative regions, greatly enhancing the Company’s national business scope. It also shows that the market awareness and acceptance of 5G messaging services are rapidly increasing; moreover, Zhangxun has signed a total value of approximately $8.20 Million (RMB 53 million) with China’s leading converged communications service providers Hubei Kuanyun and Beijing Quantum Communications which indicates that the Company’s technical standards and service capabilities have been recognized by major customers in the Chinese market; at the same time, the Company has become one of the major CSPs (content service providers) of the three major domestic telecom operators. The above laid the foundation for the rapid increase in revenue in the future.

- 3 -

4. Smart Payment Business

Our Smart Payment service provides customers with comprehensive payment and settlement services by using face recognition and big data analysis technologies. At the same time, combined with the Company’s existing 5G marketing cloud platform and other products, the Company strengthens the overall positioning of target customers, acquisition and service capabilities. The Company helps customers to enter into the overall service ecosystem composed of various systems and products, and strengthens the interconnection and linkage between products.

The Company’s payment and settlement system platform can be applied to PC, mobile terminals, intelligent terminal, and the unification of the POS machine. No matter which kinds of payment and settlement channels the customers use, they can use the payment and settlement system statements and data statistics, account settlement, data statistics, and the overall polymerization.

Relying on the account system, capital link and risk control system of payment, our smart payment system has established a comprehensive payment application system based on facial recognition, QR code recognition, big data analysis and other technologies based on the needs of different scenarios. Through the above industrial layout and the building of technical capability platform, the Company has initially formed the “intelligent ecology” of Datasea system, and gradually grown into the solution.

During the reporting period, the Company entered into service agreements involving its Smart Payment Service System with 11 institutions in the fields of consumption, finance, commerce and other industries and signed agreements, covering 8 cities including Shanghai, Shenzhen, Guangzhou, Dongguan, Shanwei, Xiamen, and Tianjin, expanding the smart payment business. At the same time, the data sea smart payment system is interconnected with the Company’s 5G messaging, smart community and other systems through the API interface, allowing consumers to enjoy the best user experience of obtaining information, service selection and purchase payment, and at the same time enabling the Company’s various systems to provide customers with the business needs.

Overall, after the current fiscal year, the Company continued to sign major customer agreements including Hubei Kuanyun and Quantum Communications. As of September 28, 2021, the total contract value in RMB is approximately US$8.2 million (RMB 53 million), both of which come from 2 contracts in the 5G messaging business segment.

As of September 2021, the Company’s business and customers covered 18 provinces in China, and about 60% of China’s provincial administrative regions achieved cumulative sales of the Company’s products; among which the Company has obtained 5G messaging business for the first time in Shanghai, Chongqing, Zhejiang and Guangdong during the reporting period, resulting in the Company’s series products being sold in 60% of China’s provincial administrative regions.

During the reporting period, we launched an office in New York for the Company’s board of directors and management to expand the Company’s business scope, institutional cooperation, investor relation base and international brand influence in the United States.

- 4 -

Impact of coronavirus outbreak

In December 2019, a novel strain of coronavirus (COVID-19) was reported in China, upon which the World Health Organization has declared the outbreak to constitute a “Public Health Emergency of International Concern.” During the period from January to March 2020, the Company’s marketing and business developments efforts were materially adversely affected since, among other reasons, the Company’s employees were not able to return to our offices to resume their duties. The Company resumed its operations in April 2020. As a recipient of the PRC government support programs intended to mitigate the adverse economic impact of the pandemic, the Company’s business operations has recovered and not be materially affected going forward. Its Smart security platform has enabled the Company’s R&D team to continue working in online mode during the pandemic. In addition, the Company believes its efforts to move its functions online were sufficiently prompt and effective to minimize adverse effects on the Company’s financial reporting and internal control over financing reporting systems. The Company does not anticipate any impairments of its assets. However, the Company expects that the impact of the COVID-19 outbreak on the United States and world economies may have a material adverse effect on the demand for the Company’s services. We currently believe that our financial resources will be adequate to see us through the outbreak. However, in the event that the pandemic continues on for a longer period of time, we may need to raise capital in the future.

The COVID-19 pandemic has prompted the Company to focus on developing epidemic related products to pursue new business opportunities. In connection with the intensifying efforts to contain the spread of COVID-19, the Chinese government has taken a number of actions, which included extending the Chinese Spring Festival in 2020, quarantining individuals infected with or suspected of having COVID-19, prohibiting residents from free travel, encouraging employees of enterprises to work remotely from home and cancelling public activities, among others. According to a press release of CNN Hong Kong dated August 23, 2021, China reported no new locally transmitted Covid-19 cases on August 23, 2021 for the first time since July this year, according to its National Health Commission (NHC), as authorities double down on the country’s stringent zero-Covid approach. In response to the entire country’s efforts to combat the spread of COVID-19, the Company integrated the epidemic prevention and control system and epidemic prevention and control functions as a sub-module into the regular Smart Campus System and Smart Public Community System.

Recent Developments

On August 17, 2020, Shuhai Information Technology Co., Ltd. (hereinafter referred to as Shuhai Beijing), the VIE of Datasea Inc., was registered and founded a wholly-owned subsidiary in Shenzhen, Guangdong —- Shuhai Jingwei (Shenzhen) Information Technology Co., Ltd., with the purpose of carrying out smart security business in the Guangdong-Hong Kong-Macao Greater Bay Area as well as international import and export in a timely manner.

- 5 -

In June 2020, the Company filed a Registration Statement on Form S-8 to register 4,000,000 shares issuable pursuant to the 2018 Plan. The 2018 Plan was intended to attract and retain the best available personnel and provide additional incentives to employees, directors and consultants. 3,692 shares have been granted under the 2018 Plan as of the date of this prospectus.

In June 2020, we filed a “shelf” registration statement on Form S-3 to from time to time issue and offer up to $100,000,000 aggregate dollar amount of common stock, debt securities, warrants or units of securities.

On October 22, 2020, the Company entered into a common stock purchase agreement with Triton Funds LP (“Triton”). Pursuant to the Purchase Agreement, subject to certain conditions set forth in the Purchase Agreement, Triton was obligated, pursuant to a purchase notice by the Company, to purchase up to $2 million of the Company’s common stock from time to time through March 31, 2021. The Company is precluded from submitting a purchase notice to Triton if the closing price is less than $1.65 per share as reported on the Nasdaq Stock Market.

On November 11, 2020, the Company and Triton closed an equity financing for the issuance of 520,000 shares of the Company’s common stock at $1.80 per share, the Company received $931,000 proceeds from the financing after deducting $5,000 expenses. Effective as of November 10, 2020, the Company exercised its right to terminate the Agreement.

On November 16, 2020, Guohao Century formed Hangzhou Zhangqi Business Management Limited Partnership (“Zhangqi”) with ownership of 99% as an ordinary partner. On November 19, 2020, Guohao Century formed a 51% owned subsidiary Hangzhou Shuhai Zhangxun Information Technology Co., Ltd (“Zhangxun”) Zhangqi owns 19% of Zhangxun; accordingly, Guohao Century ultimately owns 69.81% of Zhangxun. The purpose of the establishment of zhangxun is to expand the 5G field and 5G value-added service opportunities, and is responsible for the research and development, application and market promotion of 5G message-related technologies. It holds a business license issued by the Ministry of Industry and Information Technology of the People’s Republic of China to provide value-added telecommunications services.

On July 20, 2021, the Company entered into a securities purchase agreement with certain institutional investors, pursuant to which the Company agreed to sell to such investors an aggregate of 2,436,904 shares of common stock of the Company at a purchase price of $3.48 per share. The Company also sold warrants to purchase 1,096,608 shares of common stock to such investors in a concurrent private placement. The closing of the sales of these securities under the securities purchase agreement took place on July 22, 2021. The net proceeds from the transactions were approximately $7,636,796, after deducting certain fees due to the placement agent and the Company’s estimated transaction expenses, and will be used for working capital and general corporate purposes, and for the repayment of debt.

Corporate Business and Operational Developments

The Company’s current businesses include smart security solutions based on visual and non-visual multi-dimensional perception technologies, as well as strategic business expansions to 5G messaging and smart payment products which sharing similar underlying technologies. The products are divided into four categories, namely, Smart -City Solutions, Acoustic Intelligence, 5G messaging, and Smart Payment.

Our Detailed Business Analysis

1. Smart-City Business

The Company utilized visual perception technology and artificial intelligence data analysis solutions to develop a series of intelligent city. Our products are different from the traditional smart security solutions. They can not only conduct the identification process, but also the analysis and intervention process, making the overall protection more positive, active and intelligent. For the visual technology development, our products will further distinguish our existing products in the market, such as including certain acoustic intelligent multiple perception algorithm.

- 6 -

We have combined the gig data platform and the intelligent three-dimensional platform to develop four application systems to form a business ecosystem,, which will enhance the market capacity of our smart city business. Satellite remote sensing image analysis system can provide powerful technical service support for the government departments in urban public governance, such as natural disaster warning, meteorological warning, urban governance, scenic spot management, traffic control and so on.

Intelligent three-dimensional platform

Intelligent three-dimensional platform is an intelligent development, innovation and operation platform based on cloud computing, big data, artificial intelligence and the Internet of Things. The platform contributes to the urban governance, security, industrial development, public service in various fields such as digital transformation, and it improves the level of urban management, government management ability, and scientific management ability.

Intelligent three-dimensional platform makes use of rich urban data resources, technologically advanced computer vision algorithm, fusion algorithm of visual and non-visual perception, big data analysis engine, and global real-time analysis to correct operational defects of cities in real time, promote intelligent and sustainable development of cities, and realize urban governance. By opening up the neural network of the city, the whole city can be analyzed in real time, and the data can help the city think, make decisions and operate.

Platform highlights:

Intelligent Internet of Things

It provides a stable, efficient, high-performance and comprehensive Internet of Things platform, supports a variety of flexible delivery methods such as public cloud, privatization and independent deployment, and creates a three-dimensional foundation platform for enterprises.

Edge cloud fusion

It provides comprehensive functions, comprehensive coverage, and open source edge fusion capabilities for device edge, LAN edge, and network edge, so that business applications can run in a more convenient and flexible way between edge and cloud.

Multi-mode holographic sensing

The cloud center system is interconnected and analyzed by the cloud intelligent AI analysis system to generate and control the output of multi-mode data for analysis and display.

Visual emergency command

Around the unified data center, data visualization, command remote interconnection, data communication, system includes emergency on-duty, emergency but maps, remote collaboration, emergency rescue operation, comprehensive analysis and display, emergency rehearsal, resources information management, emergency rescue team management module, realize the remote unified management, unified monitoring, unified scheduling, Unified analysis of multidimensional emergency command.

Big data platform

The Company’s big data analysis system is based on an internet platform, and it provides the big data infrastructure and data application. A big data platform is highly scalability, real-time, high performance, low latency analysis, high fault tolerance, availability, support of heterogeneous environment, open, ease of use, and has lower cost; its core technologies include large-scale data flow processing technology, large-scale data management and analysis technology.

- 7 -

The system technology Architecture adopts service-oriented Architecture (SOA) and follows the principle of layering, with each layer providing services for the upper layer. The big data platform is analyzed layer by layer, including data interface layer, file storage layer, data storage layer, data analysis layer, data layer, business control layer, performance layer and system monitoring layer from bottom to top.

The big data platform provides precise, visual and dynamic data governance services for scenario-based applications in scenic areas, campuses, public communities and other industries. In addition, the platform covers the accumulation of rich data fields including big data basic technology, algorithms, models and data methodology, providing perfect and mature solutions. Through the full-link cloud data cooperation ecology including operation and maintenance support, data services and data products, it provides a comprehensive and full-coverage cloud experience for project requirements.

Platform highlights:

Lent Distributed data storage

The distributed network storage system uses an extensible system structure to meet the requirements of large-scale storage applications.

Massive data processing

The system processes TB or even PB data in seconds using a distributed architecture based on big data and a large-scale parallel processing system.

Real-time streaming computing

The robust computing power of cloud streaming computing services helps users build minute-level streaming computing applications such as clickstream analysis, e-commerce precise recommendation, financial real-time risk control and Internet of Things (IoT) monitoring.

Virtual Operation and Maintenance Management

A visual decision making product and AI service platform help customers to make integrated data decisions visually and intelligibly.

Based on the above two core platforms, the Company integrates intelligent hardware products including acoustic intelligent algorithms and hardware, high-precision face recognition as the core of a variety of sensory detectors, which helped to establish smart 3D security systems at the user side. Therefore, focusing on the basic areas like education, community and scenic area of smart city, we have developed three kinds of smart systems based on industrial scenarios to meet the increasing needs of customers, including smart campus system, smart community system, smart scenic area system and other industrial application systems.

In addition, after the outbreak of COVID-19 in 2020, the Company quickly developed an epidemic prevention and control system integrating temperature measurement, alarm and traceability, which is the fourth system in the Company’s smart city business sector, and also made contributions to the prevention and control of COVID-19 in China.

There are five systems of Smart-city business: smart campus system, smart community system, smart scenic area system, epidemic prevention and control system and satellite remote sensing image analysis system.

Smart Campus System

Relying on the integration of visual and non-visual perception algorithms, our Smart Campus security system is developed based on our big data security platform and smart 3D security platform, for the purpose of ensuring personal safety of teachers and students, improving campus security system, and enhancing overall prevention and control capacity throughout campus. We offer different options to meet the different requirements of kindergartens, primary schools, middle schools and colleges. Users can either buy the standard version (including basic function modules) or buy tailor-made system according to their specific needs. Information-based smart management all over the campus can now be implemented through data processing by such security system. So far, through systematic and statistical analysis of information, this system has been used for personnel identification management, alarm receipt and response management as well as file management so as to achieve intelligent data-based management of key targets (including people, location, object, matter, organization) as well as plans, contingencies and measures for prevention and control across the campus. In addition, with the increase in the number and frequency of individual users downloading and using the Smart Campus security system through their mobile devices, the Company has managed to explore the business model of providing individual users with value-added services like e-commerce platform interface.

Smart Public Community System

Our Smart public community security system has security functions of video surveillance, property management, vehicle analysis, electronic tour inspection and so on. Through real-time video monitoring, face recognition and other security functions, anomalies can be detected for risk control, and the application value of video can be improved in an efficient and simple way by transforming passive surveillance into active prevention, thus comprehensively improving the security prevention capacity throughout the community. The newly-designed module of smart community security system has been used in residential communities in Beijing Anhui, Fujian and other provinces. In order to satisfy diversified operational management requirements, the team has also developed different versions (WeChat applet, APP) mobile applications to meet the needs of households, property management and the whole community. Such system is designed to improve the efficiency of public community management and provide convenience for people in the community. We will promote this Smart public community security system nationwide in the near future.

- 8 -

Smart Scenic Area System

Based on our big data security platform and smart 3D security platform, our smart scenic area security system is developed as an all-round smart security solution towards users. Featuring a combination of functions (e.g. HD video surveillance, behavior and status analysis, electronic tour inspection system, statistical analysis of passenger flow and flow limiting system) and a number of systems like GIS map, comprehensive security management all over scenic area can be well implemented. Customers can either choose among different options according to the type of scenic areas or buy tailor-made systems according to their specific needs. Currently, the smart management system of scenic areas has realized data sharing through integration of multiple resources, and better ensured the orderly and secure operation of scenic areas through the visualized security management empowered by big data.

Our smart scenic area security system and will be officially launched on the market at a suitable time.

Datasea epidemic system

In the context of the COVID-19 pandemic, we made efforts to leverage our technological capabilities to develop an epidemic control system by using our big data security management platform and smart 3D security platform in a short period of time. Such system is mainly designed to provide public health data monitoring service for various end-users, including schools and public communities.

Characteristics - campus version

As part of Datasea’s Epidemic Control System (Campus Version), the Company’s R&D team has specifically developed an applet called Datasea Cloud School enabled by WeChat (student version and teacher version). This system can be integrated with functions like abnormal temperature reporting, real-time data uploading, anomaly alarming, assignment management, academic performance management, face recognition and so forth, thus helping schools carry out efficient epidemic control and ensure normal reaching and research operation.

Characteristics - public community version

The needs on security are more complicated in public places with dense population, such as residential communities, shopping malls and factories. Compared with the campus version, the community version also has functions of code scanning registration via mobile phones, thermal imaging temperature measurement, mask detection, home quarantine visits, etc., which has addressed the challenges of temperature detection of large passenger flows and low efficiency of epidemic detection that usually occurred in public places and has effectively cut off the spreading channels of the epidemic.

Given China’s market of normalized and persistence of epidemic prevention and control, according to the demand of the market and the characteristic, the Company developed the function of the epidemic prevention and control system, module based on embedded in the Company of Smart Campus system and public community wisdom in the system, to provide customers with conventional systems and services at the same time, meet the demand of school public and community of epidemic prevention. In late 2021, the Company has not carried out independent marketing for the epidemic system campus edition and public community office.

Satellite remote sensing image analysis system

Based on the application and market demand of the underlying platform of the existing big data platform and Intelligent three-dimensional platform, the Company integrated satellite remote sensing, telecom operator data, cloud management terminal and the technology application architecture of space and earth, to create an innovative smart city management and control system of “multi-source integration and integration of space, space and earth”.

Through independent innovation and cooperation with external scientific research institutions, the Company has created preliminary product and service capabilities. It mainly provides the following technical products and services for government departments and enterprises in the field of smart city construction, such as meteorological early warning, geological disaster early warning, urban planning, urban management, traffic control, disaster monitoring of agriculture, forestry, animal husbandry and fishery, safety monitoring, environmental monitoring and other smart city fields, as follows:

- 9 -

Remote sensing data processing

Through the transformation from IT to DT, the core technologies and service capabilities of remote sensing big data collection, storage, processing and mining are built to form a revenue model of remote sensing big data service.

A platform operation

Through implementing platform strategy and remote sensing market platform, we built remote sensing industry and application ecosystem, collect remote sensing data, technology, facilities, service providers and users, support mass entrepreneurship and crowdsourcing services, and form a profit model for cloud service platform operation.

Government Buy remote sensing products

Standardized remote sensing data and information products, remote sensing technical service products, remote sensing unmanned aerial system products and terminal application products are formed by implementing data acquisition and product production independently, forming a product sales revenue model.

Competitive analysis of Smart City Business:

In order to solve various problems arising from the process of, smart cities have become the main driving force for social development in recent years. At present, in the Chinese market, industry application solutions for smart cities are mainly concentrated in the fields of education, urban management, urban interconnection, people’s livelihood engineering and emergency response, and related system development and solutions are emerging one after another.

Datasea has a clear competitive advantage in the field of smart city solutions. Taking Datasea Smart Campus and Smart Community solutions as an example, the advantages mainly come from two aspects:

First, based on the Company’s big data platform and smart three-dimensional platform, the Company’s industry smart systems and solutions have comprehensive data analysis capabilities, efficient data management capabilities, and faster data operations among competing products in the same industry. ability. This made our products not only have strong analytical capabilities, but also good predictive capabilities and proactive intervention capabilities.

Second, the non-visual acoustic intelligent algorithm strengthened the original visual perception technology and it made the overall perception technology more diversified and integrated, which distinguishes the Company’s core technology from that of other competitors. The Company’s smart campus and smart community systems solutions integrated hardware and Company’s algorithms and software such as face recognition and voiceprint recognition, video recognition and audio recognition fusion, abnormal voice recognition, “semantic + voiceprint” voice perception, “integrated perception + intervention control” .

Industry Application:

There is a wide range of industry applications for China’s smart cities relevant fields, including the development of medical, transportation, logistics, finance, communications, education, energy, environmental protection and other fields, , and will help China expand domestic demand, adjust structure, and transform economic development. Therefore, promoting the “smart city” concept and relevant industry is a strategy that China will focus on developing in the future.

- 10 -

Relying on big data and three-dimensional intelligence platform, in addition to the existing industry applications in education, public communities and scenic spots, the Company can continuously develop and replicate the needs of related industries, and launch more targeted, innovative systems and solutions.

In addition, the Company’s multi-dimensional expansion will be carried out in response to the growing demand for new urban development. For example, in areas such as emergency rescue and natural disaster early warning, the Company has developed the fifth largest system of smart cities, the satellite remote sensing system, based on its own technology extension and industry and technical resource integration capabilities, as a new smart city business segment. The Company also added content to provide strong technical service support for government departments in urban public governance, such as weather warning, urban planning, and traffic control.

Market Expectation:

According to the 2018-2023 China industry market outlook and investment strategy planning analysis report, in 2019, China’s domestic smart city-related investment has reached approximately 22.9 billion U.S. dollars, and the global market has reached 1.1 trillion U.S. dollars. In the past ten years or so, countries have invested heavily in the construction of smart cities, and the amount of investment has increased year by year. According to the forecast of the Foresight Industry Research Institute, China’s smart city market will reach 25 trillion by 2022.

Business progress and development plan:

During the reporting period, the Company’s smart community system business achieved a new business model upgrade and expanded the product coverage to individual customers to expand the Company’s revenue sources. In addition to providing community intelligent management services and epidemic prevention and control system services for the clients of community property management companies, the Company also directly provides convenient value-added services such as online shopping malls for community residents, families and individuals. The Company’s strategic focus revolves around the needs and growth potential of the community, through providing individual users with comprehensive value-added services such as e-commerce to obtain sustained revenue and higher gross profit.

In this fiscal year, the Company completed the smart campus security management and control platform project of Harbin New District No. 1 School and 73rd Middle School of Harbin; China Pacific Life Insurance Heilongjiang branch office building access control, monitoring, and alarm projects, etc. The project is concretely implemented.

As a significant post-term matter, Datasea and its wholly owned subsidiary company Guozhong Haoze (Beijing) Technology Ltd. (“Guozhong Haoze”), had signed a strategical agreement with Eastcom Smart Chain (Beijing) Network Technology Co., Ltd. to provide smart systems and services for Canteens and restaurants in at least 200 schools and institutions in the next two years, with a total contract amount of not less than US$14,758,359 (RMB 95,339,000),indicating that the company’s services in the field of smart Campus have further penetrated into subdivisions and the Market Share will increase substantially.

Datasea Smart City is adhering to the development strategy of “platform + ecology”, and it gives full attention to its advantages in data, technology, ecology and security to support the development of cities in China. The goal is to provide industry-leading intelligent products and solutions for urban insights, urban governance, industrial development, and individual customers in the next three years. By 2025, our product service sales and market applications is predicted to achieve full coverage of 28 provinces in China, including more than 10,000 smart campus and smart community projects.

2. Acoustic Intelligence Business

Traditionally, Smart security products are mainly developed using visual perception technology. However, non-visual perception technology is the future of the smart security industry. The Company aims to stand at the forefront of innovation. We bring in AI technologies to empower our sensor devices to make them increasingly intelligent, and to make them able to communicate with one another and develop autonomous behavior. Also, by using multiple data sources, the products would achieve increased accuracy, a and can be applied in a wider range of applications. Therefore, other than the vision systems, we developed acoustic intelligence to enhance our smart security solutions. Audio sensing technology is as ubiquitous in day-to-day life, as it is in large-scale industrial projects. By capturing sound vibrations, sensors picked up the non-visible aspects and events of an environment.

- 11 -

Datasea Acoustic Intelligence mainly refers to the “acoustics + AI (artificial intelligence)” as the application innovation architecture, focusing on voice perception and acoustic effects and integrating algorithm models to achieve smarter technical products, services and solutions to meet the requirement of specific industry scenarios.

The Company has spent many years to develop acoustic algorithms and technical foundations. Most of the Company’s R&D personnel came from the Chinese Academy of Sciences, Nanjing University and other scientific research institutes in acoustics and signal processing and have long-term accumulation in underlying acoustic technology and algorithms. In addition, Datasea has reached a strategic cooperation with the Academy of Acoustics of the Chinese Academy of Sciences on April 8, 2021, the most authoritative research on acoustics in China.

Technical Description

| ● | The core technology of Datasea Acoustic Intelligence is divided into application layer, platform layer, data layer, and infrastructure layer from the architectural dimension. |

| ● | The core technology of Datasea Acoustic Intelligence is divided into algorithm learning and acoustic model establishment from the algorithm dimension. |

| ● | The core technology of Datasea Acoustic Intelligence is divided into voice perception and acoustic effects from the functional dimension. Among them, the voice perception category includes Datasea voice recognition technology, Datasea voiceprint recognition technology, and Datasea scene sound detection technology; acoustic effects include sound wave directional propagation control technology, high-intensity sound wave intervention technology, ultrasonic sound effect control technology, and infrasound sound effect control technology. The perception and cognitive recognition technology of the Company’s Acoustic Intelligence centered on the use of sound effects mainly includes speech recognition technology, voiceprint recognition technology, keyword detection technology, and scene detection technology; the active control technology of Datasea Acoustic Intelligence through acoustic effects mainly includes sound waves Directional propagation control technology, high-intensity sound wave intervention technology, ultrasonic sound effect control technology, infrasound sound effect control technology. |

The Industry Application:

Datasea has invested in research and development in acoustic technology fields to gradually formed six industry applications, such as the industrial Internet of Things, smart city, security, medical care, agriculture and other fields to provide ” “Sound+” innovative applications and solutions, and its software and hardware integration technology has a leading advantage in the industry chain.

Smart City Sector

Datasea has developed and upgraded its series of smart city products based on visual perception technology. The introduction of non-visual acoustic intelligence technology will bring our products to a higher level. Specifically, the application of acoustic intelligence in this product mainly includes Tianer voice recognition alarm, Tianer strong sound drive and Tianer natural disaster early warning system.

| ● | Tianer voice recognition alarm: This product uses voice recognition technology, special keyword monitoring technology, voiceprint recognition technology and sound perception algorithm model, divided into Tianer voice recognition alarm special version and Tianer voice recognition alarm audio and video Linkage version. The special version of Datasea Tianer Voice Recognition Alarm can accurately and efficiently identify semantic keyword extraction and voiceprint features in specific scenarios through the combination of this series of technology applications and sound perception algorithm model training, and supports flexible keyword customization. It can be widely used in public or private places such as public restrooms, dormitories, and hotel rooms for security monitoring and early warning needs. The audio-visual linkage version of the Tianer voice recognition alarm is embedded with a video surveillance machine vision module on the basis of a dedicated version. It also supports face recognition and behavior recognition, and can be widely used in various public places. |

- 12 -

| ● | Tianer Strong Acoustic Repellent. This product adopts the high-intensity sound wave intervention technology of several seas, and modulates with an acoustic algorithm to emit a strong stimulating sound wave of a specific frequency. The high-sound-pressure-level transducer array is used to achieve high-intensity sound waves. Long-distance directional transmission, used for propagating, warning and driving away, is a new generation of active voice security products. This product can be equipped with an infrasound module, which can be integrated into the infrasound module to achieve EEG shock waves, hallucinations, increase the frequency of terror, improve the dispersing effect, and solve the shortcomings of traditional outdoor speakers such as short sound transmission, poor directivity, and insufficient deterrence. |

| ● | Tianer natural disaster early warning system: This system adopts Datasea voiceprint recognition technology, Datasea scene sound detection technology and sound perception algorithm model. This system is a research product direction in the stage of Datasea Acoustics Intelligent Laboratory, mainly for major natural disasters. Infrasound signals are generated before the occurrence, and infrasound monitoring technology is used as an important means of natural disaster warning (such as earthquakes, tsunamis, typhoons, etc.) to directly serve human disaster prevention and mitigation, so as to avoid causing serious economic losses and casualties to humans. |

In addition to the application in the field of smart cities, because of the very wide applicability and applicability of acoustic intelligence, there are also objective needs in the fields of industrial Internet of things, people’s livelihood, medical beauty, medical care, and agriculture. In these fields and more industries and fields, Datasea has the ability and opportunity to provide technological products with technical content.

Industrial Internet of Things

The acoustic smart products developed by Datasea in the Industrial Internet of Things mainly include ultrasonic flaw detectors and abnormal sound monitors for electromechanical equipment.

Medical Cosmetology

It refers to the cosmetic method of repairing and reshaping the human appearance and the shape of various parts of the human body by using drugs, surgery, medical equipment and other traumatic or irreversible medical technology methods.

The products of Datasea Acoustic Intelligence in medical beauty applications include commercial ultrasonic beauty instruments and home ultrasonic beauty instruments. The product adopts Datasea ultrasonic and directional transmission control technology to realize the ultrasonic beauty function. Using ultrasonic beauty instruments on the face can cause skin cells to vibrate, produce subtle effects, change cell volume, thereby improving local blood and lymph circulation, enhancing cell permeability, improving tissue metabolism and regeneration capabilities, softening tissues, and stimulating nerves System and cell functions make the skin shiny and elastic.

- 13 -

Medical health Care

Medical health care is to carry out high-tech treatment, recuperation, health care and elderly care activities relying on medical technology and resources. At present, Datasea Acoustic Intelligence’s products in medical and health care applications include two types of hypnotic wake-up devices and sound therapy devices for senile dementia.

Hypnosis and Rejuvenation Apparatus: Adopt the directional transmission control technology of Datasea sound wave and the sound effect control technology of Datasea infrasound wave to interfere with the activity state of the sympathetic nerve of the human brain. It can be widely used in sleep disorders, insomnia and depression, etc.

Alzheimer’s Acoustic Therapy Apparatus: One of the high-end upgraded models of Hypnosis and Refreshing Apparatus in the prevention and treatment of Alzheimer’s disease. It has added inductive audio, low-frequency sound waves and other specific sound wave frequency technologies for the prevention and treatment of Alzheimer’s disease.

Consumption of Individual Customers

In the consumer products, Datasea Acoustic Intelligence is divided into two types of products: directional sound and directional sound module. In addition, Datasea Acoustic Intelligence pioneered the application of directional sound to audio solutions, which are widely used in advertising media and digital signage exhibitions in supermarkets, banks, hospitals, schools, homes and other places.

Agriculture

The main products of Datasea Acoustic Intelligence in agricultural applications are ultrasonic insect repellent and vocal assisting birth-inducing instrument.

Market Expectation:

According to the analysis of the 2021 China Intelligent Voice Industry Solution and Service Provider Brand Evaluation Report by Yiou Think Tank, under the drive of policy, economy, technology, and the digital transformation of traditional enterprises in 2020, the labor costs will gradually decreased. With the advantages of automated operation efficiency, intelligent voice systems have become the core support for the digital transformation of enterprises. According to the report, the scale of the smart voice market is expected to reach 56.48 billion yuan in 2023, the voice market still has a lot of room for development.

Business progress

Product development

The Company established an innovative architecture of “Acoustics + AI”. Datasea’s Acoustic Intelligence has created the core technologies represented by voice perception and acoustic effects. Through semantic recognition, voiceprint recognition, abnormal sound recognition, sound wave driving, Ultrasonic intervention, infrasound intervention and other aspects have developed specific applications in products. At the present, the acoustic intelligent technology is realized at stage 1.0. It has obtained 4 independent research and development core technology invention patents and 4 software copyrights. International intellectual property rights are in the process of implementation. In terms of product production, our hardware products are in the production and processing design stage, and some samples are made.

Market Development

We have initially met the needs for the global industrial Internet of Things, smart cities, people’s livelihood consumption, medical beauty, medical care, agriculture and other fields, providing technical product services and solutions, and have achieved certain results in market application demonstrations.

- 14 -

Team building

Relying on the technological advantages of the Technology Innovation Research Institute and the Acoustic Intelligence R&D Center, Datasea has further increased the recruitment of acoustic intelligence related technology research and development talent teams, including product managers, platform architects, hardware development engineers, software development engineers, Algorithm engineers, test engineers and other professional technical personnel, technical personnel account for more than 80% of the total number of project teams.

College cooperation

The Company has entered strategic cooperation with the Institute of Acoustics of the Chinese Academy of Sciences, the Institute of Artificial Intelligence of Beijing University of Posts and Telecommunications, China Academy of Information and Communications Technology, China Artificial Intelligence Industry Alliance, etc., and established the Acoustic Intelligence Key Laboratory and the Acoustic Intelligence Technology Task Force to jointly research and develop acoustic intelligence technology achievements, establish enterprise technical standards and industry technical standards, and hire relevant experts to become technical consultants for the Tianer project. In addition, we have jointly achieved the integration of production and education with colleges and universities to provide a platform for work practice and achievement incubation for students of acoustic intelligence related majors.

Management standards

The management has introduced international R&D management standards to ensure that R&D is carried out in an orderly manner in accordance with a relatively standardized process.

3. 5G Messaging Business Sector

The 5G messaging business segment is one of China’s 5G technology strategic emerging businesses. China Mobile, China Unicom, and China Telecom jointly released the 5G messaging white paper on April 8, 2020, officially opening the 5G messaging in China’s economic and social development China empowers long-term development opportunities for thousands of industries. The Company has now become the ISP (Internet Service Provider) and CSP (Content Service Provider) of China’s three major operators, and a member company of the China 5G Message Working Group.

5G Messaging service is referred to as RCS, which stands for Rich Communication Suite, functioning as an integration of phones, messages and contacts. Specifically, this communication suite enables users to enjoy various effective interface with integrated messages including texts, pictures, audio, video and emoji, radically breaking through the traditional text length limitations, and more diversified functions such as online payments, online-offline messages, and it can initiate group chats or send group messages even within unregistered friends.

When 5G messaging is applied into marketing, the faster speeds, better transmission quality, and lower latency create new customer experience for shoppers.

5 G message-marketing cloud platform (“5G MMCP”)

The 5G message-marketing cloud platform developed by the Company aims to provide an all-in-one solution to all the communication and marketing needs of merchants and customers from early communication, sales, and later maintenance. We hope to use data to empower marketing, drive user growth, lead enterprises to achieve digital innovation, and help enterprises create long-term value for customers.

- 15 -

The 5G message marketing cloud platform developed by the Company aims to one-stop solve all communication and marketing needs of merchants and customers for communication, sales, and maintenance. This is a product intended to unify customer and prospect marketing signals in a single view with functions like precise SaaS value-added services, data monetization and message-marketing. Through big data and Artificial Intelligence technology to deeply build NLP (natural language processing technology) and multi-industry business scene analysis ability, combined with artificial intelligence machine learning, deep learning ability, relying on SaaS marketing center and data center, Accurate marketing for enterprise customers and provide various message sending channels, industry templates, business scenarios, marketing tools and operation analysis and other applications and personalized services. The Company’s 5G messaging business and smart phones are combined into a three-dimensional touch mode to build private domain relations with customers and provide precise solutions. It can serve all industries with marketing needs for customers and has extremely broad application potential.

Datasea 5G message marketing cloud platform collects annual usage fees and renewals through SAAS services, SAAS value-added service fees, channel information fees, privatization deployment and private domain operations, system development fees and solution operation service fees, and big data labor Intelligent middle-office services charge corporate data value-added service fees and artificial intelligence value-added service fees.

| ● | Chatbot |

Chatbot is an intelligent robot and employs computer programs to automate interactions with prospects and customers. It adopts language processing NLP technology to respond to users at any time and provide message services such as sending, receiving, parsing and processing. It is a new human-computer interaction service mode with a higher degree of integration and can replace APP.

5G message-marketing cloud platform (“5G MMCP”) satisfies the communication between merchants and customers through Chatbot, and provides users with personalized services with AI deep learning according to chat scenarios.

| ● | Saas New marketing center Platform |

SaaS New Marketing Middle Platform includes a messaging center, a risk control center, a user center, a financial center, and an open interface center. The functions of each center can make the capabilities provided by the PaaS platform more cohesive, flexible, and open to meet the needs of different customers. With multi-dimensional requirements, customers can use and access PaaS capabilities based on their own demand.

| ● | AI Computing Center |

The AI computing center is the core of the data center which includes real-time calculation, offline calculation, data mining and other functions.

| ● | Messaging Center |

Message center is the basic capability, including short message, video message, 5G message sending, template making, Chatbot customization, sending result query, etc.

| ● | User center |

User center is the core basic ability, is the guarantee of customer center. Include account management, role management, user management, blacklist, user label management and other functions. Through user center configuration, the SaaS middle desk can be assigned according to the position of the user’s company and view the data. Can also let customers for their own users to play the label, user portrait, user analysis, can make customers know more about their own users.

- 16 -

| ● | The financial center |

The financial center provides recharge, reconciliation, statements, settlement, invoice management, payment management and other functions.

| ● | The interface open center |

The interface open center is the open capability of PaaS platform, the open interface of partial PaaS capability that has been developed, and the open capability application function.

| ● | Risk control center |

Risk control center is to ensure that the core of information security and compliance, contain artificial audit and audit ability, all of the messages to be sent to after the audit risk control center, intercept the message not compliance resource, pictures, video, voice, text as eroticism, gambling, poison, anti-spam audit, through intelligent audit, The identified non-compliance or suspected violations of resources transferred to human audit, after two audits, to ensure that the message sent percent lily rules. In addition, there are enterprise certification audit, preferential gift audit and other functions.

| ● | The enterprise service center |

The enterprise service center is the foundation of the enterprise one-stop operation, including the general template library of the industry, mainly to provide customers with professional templates of the industry, so that customers can quickly create their own templates through simple editing, so that they can send professional messages in the industry.

| ● | The marketing center |

The marketing center provides customers with a variety of marketing strategy management, marketing effect analysis reports and marketing tools (such as: seckill, group, coupons, etc.), providing customers with 5G message marketing value-added services.

| ● | The distribution center |

The distribution center provides customers with distribution tools, mainly including price management, distribution management, event management, social communication, commission management and data analysis functions, and provides customers with value-added services of 5G news distribution.

| ● | The customer data center |

The customer data center carries out multi-dimensional statistics on the user data generated by customers, including message sending statistics, user touch statistics, pull new statistics, user retention statistics, pull appeal statistics, customer screening, user portrait, evaluation and analysis, etc., to provide data support for customer marketing.

Highlights

| ● | Real-time collection of user usage scenarios and real-time analysis of user data; |

| ● | panoramic user portrait insight, accurate 5G message sending; |

- 17 -

| ● | increase the efficiency in client acquisition ; |

| ● | Multi-dimensional data support intelligent marketing and improve ROI |

| ● | Artificial intelligence data mining to support data realization; |

Competitive product analysis

Comparison with SMS

Shortcomings of traditional SMS:

| ● | The 70 characters of SMS are limited. |

| ● | Plain text information cannot meet the rich social needs of individual users; |

| ● | only text and only 70 words limits |

Advantages of 5G messaging over SMS:

| ● | The interactive content of video, audio, picture and text is not restricted by the form; |

| ● | The interactive content of video, audio, picture and text is not restricted by form; |

| ● | Multiple buttons to help guide users, greatly increasing the interaction between enterprises and users; |

| ● | SMS as a service platform, mobile terminal users as product users; |

| ● | AI reply, user uplink can quickly answer. |

Comparison with WeChat Mini Programs/Official Accounts, Alipay Mini Programs and Service Apps

In the B2C scenario, 5G messages will have greater advantages for WeChat Mini Programs/Official Accounts, Alipay Mini Programs and Life, Government and People’s Livelihood Service Apps: whether it is WeChat Mini Programs/Official Accounts, Alipay Mini Programs, or life, government and people’s livelihood services Similar to APPs, users need to search for their mini programs, or need to pay attention to their official accounts, or even need to download their APPs, and authenticate before sending messages, while 5G messages are sent directly through the recipient’s mobile phone number; secondly compared WeChat, Alipay and various service apps, 5G messaging can achieve the coverage and reach of all users, so they have very strong commercial value and service capabilities.5G

Industry application