TPG RE Finance Trust, Inc.

888 Seventh Avenue, 35th Floor

New York, New York 10106

NOTICE OF 2024 ANNUAL MEETING OF STOCKHOLDERS

To our Stockholders:

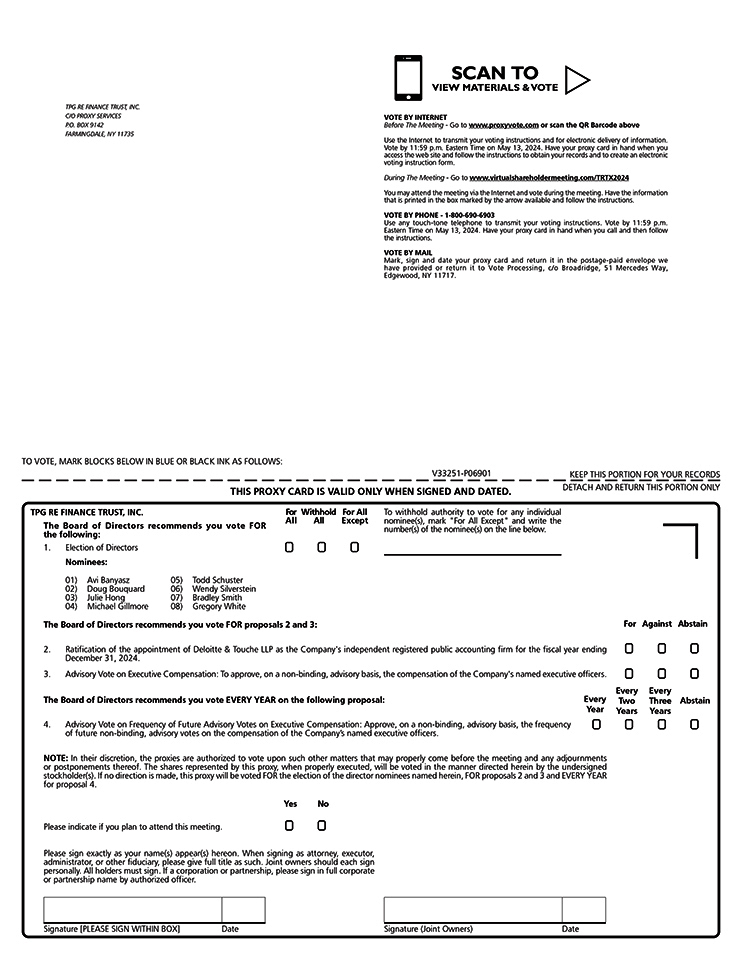

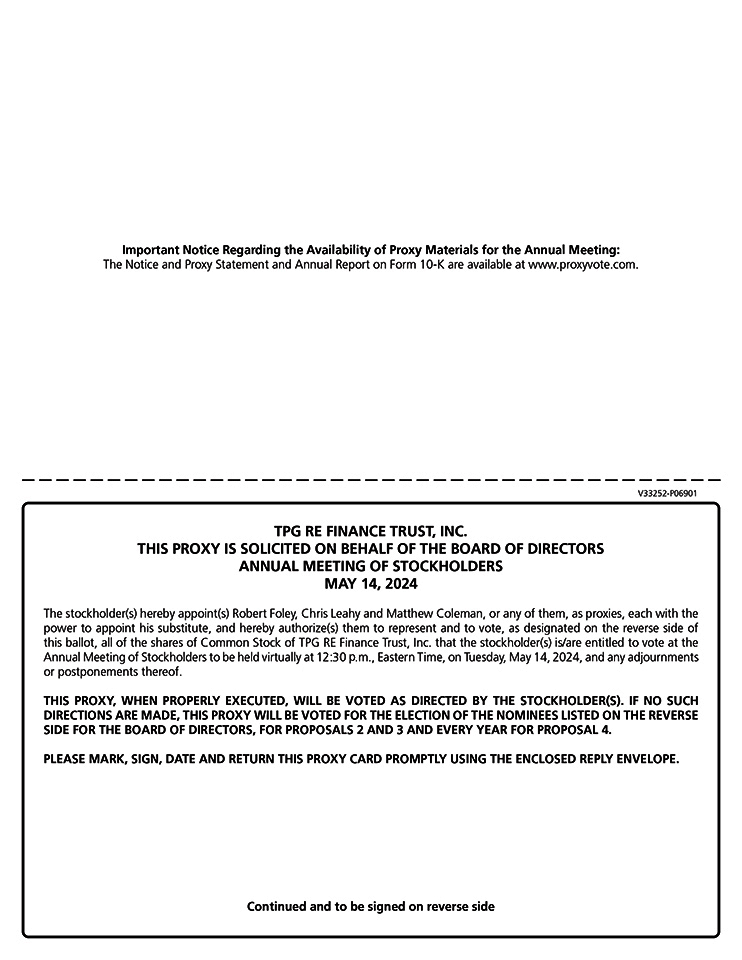

The 2024 Annual Meeting of Stockholders of TPG RE Finance Trust, Inc., a Maryland corporation (the “Company”) will be held on Tuesday, May 14, 2024 at 12:30 p.m., Eastern Time. In accordance with the Company’s recent practice and to maintain ease of access for the Company’s stockholders, this year’s Annual Meeting will be held in a virtual meeting format only. You will be able to attend the Annual Meeting virtually and vote and submit questions during the Annual Meeting by visiting www.virtualshareholdermeeting.com/TRTX2024.

At the Annual Meeting, stockholders will be asked to consider and vote on the following matters, each as more fully described in the accompanying proxy statement:

1. the election of eight directors, each to hold office until the Company’s annual meeting of stockholders in 2025 and until his or her successor is duly elected and qualifies;

2. the ratification of the appointment of Deloitte & Touche LLP as the Company’s independent registered public accounting firm for 2024;

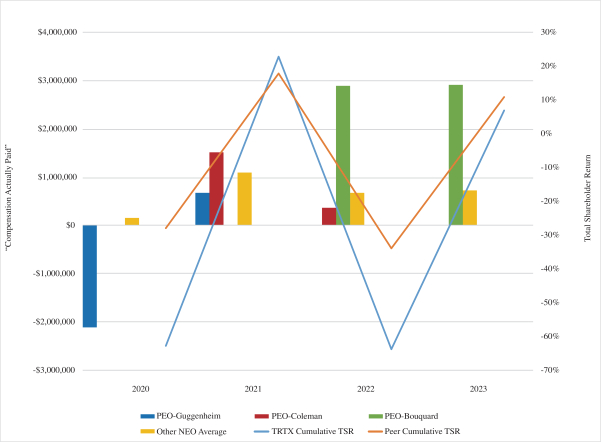

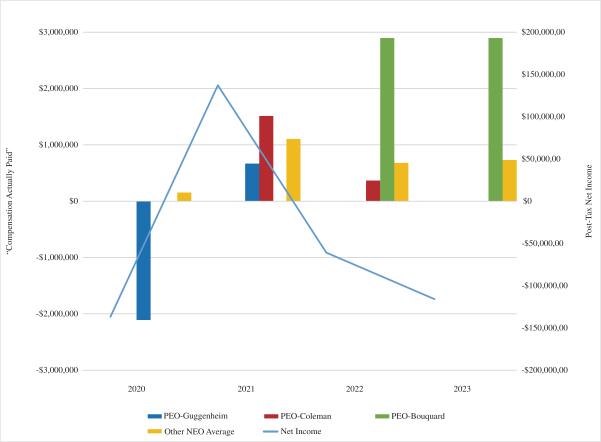

3. a proposal to approve, on a non-binding, advisory basis, the compensation of the Company’s named executive officers;

4. a proposal to approve, on a non-binding, advisory basis, the frequency of future non-binding, advisory votes on the compensation of the Company’s named executive officers; and

5. such other business as may properly come before the Annual Meeting and any adjournments or postponements thereof.

Holders of record of the Company’s common stock as of the close of business on March 25, 2024, the date fixed by the Company’s board of directors as the record date for the Annual Meeting, are the only stockholders entitled to notice of and to vote at the Annual Meeting.

Your vote is important. Whether or not you plan to attend the Annual Meeting, you are requested to authorize a proxy to vote your shares electronically via the Internet, by telephone or by completing and returning the proxy card if you requested paper copies of the Company’s proxy materials. Any person giving a proxy has the power to revoke it at any time prior to the Annual Meeting, and stockholders who are present at the Annual Meeting may withdraw their proxies and vote online at the Annual Meeting.

By Order of the Board of Directors,

/s/ Christopher Leahy

Christopher Leahy

Secretary

April 3, 2024