UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

For the fiscal year ended

OR

Commission file number:

(Name of registrant as specified in its charter)

| (State or other jurisdiction of | (I.R.S. Employer | |

| incorporation or organization) | Identification No.) |

| (Address of principal executive offices) | (Registrant’s telephone number) |

SECURITIES REGISTERED PURSUANT TO SECTION 12(b) OF THE EXCHANGE ACT:

| Title of each Class: | Trading Symbol | Name of Each Exchange | ||

| The |

SECURITIES REGISTERED PURSUANT TO SECTION 12(g) OF THE EXCHANGE ACT:

None.

Indicate by check mark if the Registrant is a

well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐

Indicate by check mark if the Registrant is not

required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐

Indicate by check mark whether the Registrant

(1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12

months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements

for the past 90 days.

Indicate by check mark whether the registrant

has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T during the preceding

12 months (or for such shorter period that the registrant was required to submit such files).

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of Registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ |

| ☒ | Smaller reporting company | ||

| Emerging growth company |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant

has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial

reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or

issued its audit report. Yes ☐ No

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant

is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No

As of June 30, 2022, the last business day of

the Registrant’s most recently completed second fiscal quarter, the market value of our common stock held by non-affiliates was

approximately $

The number of shares of the Registrant’s

common stock, $0.0001 par value per share, outstanding as of March 30, 2023, was

Documents incorporated by reference: NONE

TABLE OF CONTENTS

i

Forward-Looking Statements

CERTAIN STATEMENTS IN THIS ANNUAL REPORT ON FORM 10-K MAY CONSTITUTE “FORWARD LOOKING STATEMENTS”. WHEN THE WORDS “BELIEVES,” “EXPECTS,” “PLANS,” “PROJECTS,” “ESTIMATES,” “OBJECTIVES,” “MAY,” “MIGHT,” “PREDICT,” “TARGET,” “POTENTIAL,” “WILL,” “WOULD,” “COULD,” “SHOULD,” “CONTINUE,” AND SIMILAR EXPRESSIONS ARE USED, THEY IDENTIFY FORWARD-LOOKING STATEMENTS. THESE FORWARD-LOOKING STATEMENTS ARE BASED ON MANAGEMENT’S CURRENT BELIEFS AND ASSUMPTIONS AND INFORMATION CURRENTLY AVAILABLE TO MANAGEMENT AND INVOLVE KNOWN AND UNKNOWN RISKS, UNCERTAINTIES AND OTHER FACTORS WHICH MAY CAUSE THE ACTUAL RESULTS, PERFORMANCE OR ACHIEVEMENTS OF THE COMPANY TO BE MATERIALLY DIFFERENT FROM ANY FUTURE RESULTS, PERFORMANCE OR ACHIEVEMENTS EXPRESSED OR IMPLIED BY THESE FORWARD-LOOKING STATEMENTS. INFORMATION CONCERNING FACTORS THAT COULD CAUSE OUR ACTUAL RESULTS TO DIFFER MATERIALLY FROM THESE FORWARD-LOOKING STATEMENTS CAN BE FOUND IN OUR PERIODIC REPORTS FILED WITH THE SECURITIES AND EXCHANGE COMMISSION. YOU SHOULD READ THIS ANNUAL REPORT ON FORM 10-K AND THE DOCUMENTS THAT WE HAVE FILED AS EXHIBITS TO THIS ANNUAL REPORT ON FORM 10-K COMPLETELY. WE UNDERTAKE NO OBLIGATION TO PUBLICLY RELEASE REVISIONS TO THESE FORWARD-LOOKING STATEMENTS TO REFLECT FUTURE EVENTS OR CIRCUMSTANCES OR REFLECT THE OCCURRENCE OF UNANTICIPATED EVENTS, EXCEPT AS REQUIRED BY APPLICABLE LAW.

Unless otherwise indicated, references to “we,” “us,” “our,” “Company,” or “Avalon” mean Avalon GloboCare Corp. and its subsidiaries, and references to “fiscal” mean the Company’s fiscal year ended December 31. References to the “parent company” mean Avalon GloboCare Corp.

ii

PART I

ITEM 1. BUSINESS

Overview

We are a clinical-stage, vertically integrated, leading CellTech bio-developer dedicated to advancing and empowering innovative and transformative immune effector cell therapy and laboratory services. Through our membership interest in Lab Services MSO (“Lab Services”), we plan to focus on precision diagnostics along with toxicology and wellness testing. Through our subsidiary structure with unique integration of verticals from innovative R&D to automated bioproduction and accelerated clinical development, we are establishing a leading role in the fields of cellular immunotherapy (including CAR-T), and laboratory services.

Laboratory Services is focused on delivering high quality services related to toxicology and wellness testing and provides a broad portfolio of diagnostic tests including drug testing, toxicology, and a broad array of test services, from general bloodwork to anatomic pathology, and urine toxicology. Specific capabilities include STAT blood testing, qualitative drug screening, genetic testing, urinary testing, sexually transmitted disease testing and more. The panels that we test for are thyroid panel, comprehensive metabolic panel, kidney profile, liver function tests, and other individual tests. Through Laboratory Services, we use fast, accurate, and efficient equipment to provide practitioners with the tools to quickly determine if a patient is following their designated treatment plan. In most instances, we are able to provide a practitioner with qualitative drug class results the same day the sample is received. We provide an extensive chemistry test menu that gives physicians the information to better treat their patients and maintain their overall wellness and have developed a premier reputation for customer service and fast turnaround times in the industry.

We are also focused on achieving and fostering seamless integration of unique verticals to bridge and accelerate innovative research, bio-process development, clinical programs and product commercialization. Avalon’s upstream innovative research includes:

| ● | Novel therapeutic and diagnostic targets development utilizing QTY-code protein design technology with Massachusetts Institute of Technology (MIT) including using the QTY code protein design technology for development of novel therapeutic and diagnostic targets. |

| ● | Co-development of next generation, mRNA-based (Flash-CARTM) CAR-T, CAR-NK and other immune effector cell therapeutic modalities with Arbele Limited. |

Avalon’s midstream bio-processing and bio-production facility is affiliated with the University of Pittsburgh Medical Center where our leading candidate AVA-011, as described below, is undergoing process development to generate clinical grade CAR-T cells for upcoming clinical trial in the US.

Avalon’s downstream medical team and facility consists of top-rated affiliated hospital network and experts specialized in hematology, oncology, cellular immunotherapy, hematopoietic stem/progenitor cell transplant, as well as regenerative therapeutics. Our major clinical programs include:

| ● | AVA-001: Avalon has initiated its first-in-human clinical trial of CD19 CAR-T candidate, AVA-001 in August 2019 at the Hebei Yanda Lu Daopei Hospital and Beijing Lu Daopei Hospital in China (the world’s single largest CAR-T treatment network for the indication of relapsed/refractory B-cell acute lymphoblastic leukemia (B-ALL). The AVA-001 candidate (co-developed with China Immunotech Co. Ltd) is characterized by the utilization of 4-1BB (CD137) co-stimulatory signaling pathway, conferring a strong anti-cancer activity during pre-clinical study. It also features a shorter bio-manufacturing time which leads to the advantage of prompt treatment to patients where timing is important related hematologic malignancies. We have successfully completed the first-in-human clinical trial of our AVA-001 anti-CD19 CAR-T cell therapy as a bridge to allogeneic bone marrow transplantation for patients with relapsed/refractory B-ALL at the Lu Daopei Hospital (registered clinical trial number NCT03952923) with excellent efficacy (90% complete remission rate) and minimal adverse side effects. We are currently expanding the indication and plan to recuit patients in the USA for AVA-001 to include both relapsed/refractory B-ALL and non-Hodgkin lymphoma patients. |

1

| ● | AVA-011 and FLASH-CAR™: Avalon advanced its next generation immune cell therapy using mRNA-based, non-viral FLASH-CAR™ technology co-developed with our strategic partner Arbele Limited. The adaptable FLASH-CAR™ platform can be used to create personalized cell therapy from a patient’s own cells, as well as off-the-shelf cell therapy from a universal donor. Our leading candidate, AVA-011, is currently at process development stage to generate clinical-grade cell-therapy products for subsequent clinical studies. In July 2021, we and the University of Pittsburgh of the Commonwealth System of Higher Education (the “University”) entered into a Corporate Research Agreement (the “University Agreement”). Pursuant to the University Agreement, for a term of two years the University agreed to use its reasonable efforts to perform academic research funded by us in connection with the development of point-of-care modular autonomous processing system to generate clinical-grade AVA-011, a RNA-based chimeric antigen receptor (CAR) T-cell therapy candidate with the appointment of Dr. Yen Michael S. Hsu as Principal Investigator. We are in the process of renegotiating this agreement to extend the term through 2023 and complete some of the research contemplated in the original agreement. |

| ● | AVA-Trap™: Avalon’s AVA-Trap™ therapeutic program plans to enter animal model testing followed by expedited clinical studies with the goal of providing an effective therapeutic option to combat COVID-19 and other life-threatening conditions involving cytokine storms. We initiated a sponsored research and co-development project with Massachusetts Institute of Technology (MIT) led by Professor Shuguang Zhang as Principal Investigator in May 2019. Using the unique QTY code protein design platform, six water-soluble variant cytokine receptors have been successfully designed and tested to show binding affinity to the respective cytokines. AVA-TrapTM can potentially generate novel therapeutic targets for cellular therapy, as well as in the field of precision diagnostics. We do not have a timeline for the next steps of this study. |

For the year ended December 31, 2022, we generated rental revenue from our commercial real property in New Jersey, where we are headquartered. Starting in 2023, in addition to the rental, we also plan to generate income through our membership interest in Lab Services MSO.

Corporate and Available Information

We are incorporated in Delaware. Our website is located at http://www.avalon-globocare.com. On our website, investors can obtain, free of charge, a copy of our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, our Code of Conduct and Business Ethics, including disclosure related to any amendments or waivers thereto, other reports and any amendments thereto filed or furnished pursuant to Section 13(a) or 15(d) of the Exchange Act of 1934, as amended, as soon as reasonably practicable after we file such material electronically with, or furnish it to, the Securities and Exchange Commission, or the SEC. None of the information posted on our website is incorporated by reference into this Annual Report. The SEC also maintains a website at http://www.sec.gov that contains reports, proxy and information statements and other information regarding us and other companies that file materials with the SEC electronically.

China Operations

Due to the winding down of the medical related consulting services segment, in November 2022, we decided to cease all operations in the People’s Republic of China (the “PRC”) with the exception of a small administrative office, in Shanghai. We, through our Nevada Subsidiary Avactis Biosciences Inc., will continue to own Avactis Nanjing Biosciences Ltd., which only owns a patent and is not considered an operating entity. In addition, we reconstituted our board in December 2022 at our annual meeting of stockholders and our directors who were citizens of China did not stand for re-election at our annual meeting. We do not expect nor do we plan that we will further operate in the PRC or generate revenue from PRC operations for the foreseeable future.

2

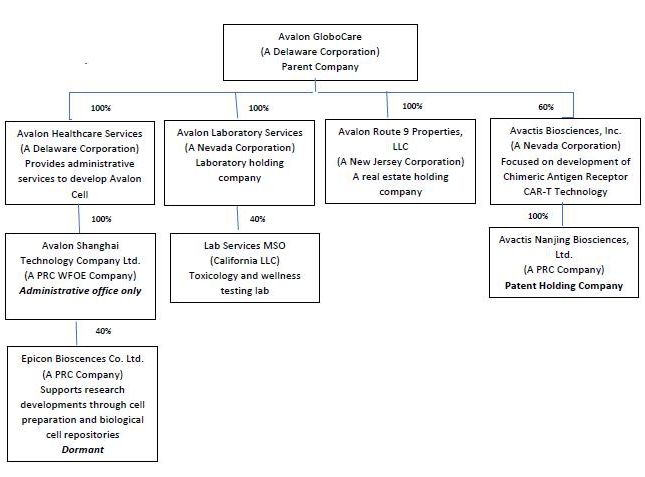

The following diagram illustrates our corporate structure:

Recent Developments

In the fourth quarter of 2022, we conducted a private placement offering for shares of our newly designated Series A Convertible Preferred Stock, stated value $1,000 per share (the “Series A Preferred Stock”). We entered into a securities purchase agreement (the “Securities Purchase Agreement”), with certain accredited investors named therein, including Wenzhao Lu, the chairman of our board of directors, pursuant to which we sold an aggregate of 9,000 shares of our Series A Preferred Stock for the gross proceeds of $9,000,000, which funds were used to pay the cash purchase price in connection with our acquisition of Lab Services.

On February 9, 2023, we entered into and closed an Amended and Restated Membership Interest Purchase Agreement (the “Amended MIPA”), by and among Avalon Laboratory Services, Inc., a wholly-owned subsidiary of us (“Avalon Laboratory Services”), SCBC Holdings LLC, Laboratory Services, the Zoe Family Trust, Bryan Cox and Sarah Cox. The Amended MIPA amended and restated, in its entirety, that certain Membership Interest Purchase Agreement, dated November 7, 2022 (the “Original MIPA”).

Under the Amended MIPA, we acquired from SCBC Holdings LLC through our subsidiary Avalon Laboratory Services, forty percent (40%) of all the issued and outstanding equity interests of Laboratory Services, free and clear of all liens (the “Laboratory Services MSO Acquisition”). As part of the consideration for the Laboratory Services MSO Acquisition, we issued shares of our newly designated Series B Convertible Stock, stated value $1,000 per share (“the Series B Preferred Stock”). Further, Avalon Laboratory Services paid SCBC Holdings LLC $21,000,000 for all the issued and outstanding equity interests of Laboratory Services, which comprised of (i) $9,000,000 in cash, (ii) $11,000,000 pursuant to the issuance of the Series B Preferred Stock, and (iii) a $1,000,000 cash payment on February 9, 2024.

In addition, at any time during the period beginning on the closing date of the Laboratory Services MSO Acquisition and ending on the date nine (9) months after such closing date, Avalon Laboratory Services, or its designated affiliates under the Amended MIPA, may purchase from SCBC Holdings LLC twenty percent (20%) of the total issued and outstanding equity interests of Laboratory Services MSO for the purchase price of (i) $6,000,000 in cash and (ii) the issuance of an additional 4,000 shares of Series B Preferred Stock valued at $4,000,000, in accordance with the terms and conditions set forth in the Amended MIPA.

Sales and Marketing

We seek to develop new business through relationships driven by our senior management, which have extensive contacts throughout the healthcare system. Our senior management will be seeking opportunities for joint ventures, strategic relationships and acquisitions in consulting, biomedical innovations, laboratory, and medical device companies. In addition, through our membership interest in Lab Services, we plan to generate revenue from toxicology and wellness laboratory testing. We also intend to seek opportunities to expand the operations of Lab Services, through acquisition of additional lab companies and through the opening of new lab locations.

3

Consulting Services

Due to the winding down of the medical related consulting services in 2022, the Company decided to cease all operations of Avalon Shanghai and no longer has any material revenues or expenses in Avalon Shanghai.

Markets

Laboratory Services

Through our membership interest in Laboratory Services, we are focused on delivering high quality services related to toxicology and wellness testing. We use fast, accurate, and efficient equipment to provide practitioners with the tools to quickly determine if a patient is following their designated treatment plan. In most instances, we are able to provide a practitioner with qualitative drug class results the same day the sample is received. We provide an extensive chemistry test menu that gives physicians the information to better treat their patients and maintain their overall wellness. The panels that we test for are thyroid panel, comprehensive metabolic panel, kidney profile, liver function tests, and other individual tests.

Cellular Therapy

We focus on the following markets in developing our cellular therapy business:

| ● | Cellular Immunotherapy in Oncology: Regarded as the future of medicine, we believe cell-based technologies and therapeutics will replace pharmaceuticals as a more effective and functional modality in certain unmet medical areas. We are actively engaging in this revolutionary trend and positioning to take a leading role in immune effector cell therapies in the immuno-oncology domai. |

| ● | QTY-Code Protein Design: Novel therapeutic and diagnostic targets development utilizing QTY-code protein design technology with Massachusetts Institute of Technology (MIT) including using the QTY code protein design technology for development of a hemofiltration device to treat Cytokine Storm (aka Cytokine Release Syndrome). QTY-code can be applied to generate water-soluble, antibody-like molecular variants of native membrane-bound receptors, which may expand the repertoire of therapeutic targets in CAR-T cell therapies. |

Revenue

Avalon RT 9 Properties, LLC

In May 2017, we acquired commercial property located in Freehold, New Jersey. This property is now our corporate headquarters and contains several commercial tenants that generate revenue through rental income.

Laboratory Services

On February 9, 2023, we acquired membership interest in Lab Services. We anticipate generating revenue through this membership interest in the areas of toxicology and wellness testing.

Strategic Development

Through our wholly owned subsidiary Lab Services, we plan to embark in a rollup acquisition strategy of small to medium size laboratories accretive to our strategy and complimentary to our membership interest in Lab Services. We also intend to pursue the acquisition and development of healthcare related technologies for cell related diagnostics and therapeutics through acquisition, licensing or joint ventures with major universities and biotech companies. seeking laboratory or medical device acquisitions.

Intellectual Property

Our goal is to obtain, maintain and enforce patent rights for our products, formulations, processes, methods of use and other proprietary technologies, preserve our trade secrets, and operate without infringing on the proprietary rights of other parties, both in the United States and abroad. Our policy is to actively seek to obtain, where appropriate, the broadest intellectual property protection possible for our current product candidates and any future product candidates, proprietary information and proprietary technology through a combination of contractual arrangements and patents, both in the United States and abroad. Even patent protection, however, may not always afford us with complete protection against competitors who seek to circumvent our patents. If we fail to adequately protect or enforce our intellectual property rights or secure rights to patents of others, the value of our intellectual property rights would diminish. To this end, we require all of our employees, consultants, advisors and other contractors to enter into confidentiality agreements that prohibit the disclosure and use of confidential information and, where applicable, require disclosure and assignment to us of the ideas, developments, discoveries and inventions relevant to our technologies and important to our business.

4

Competition

Laboratory Services

While there has been consolidation in the diagnostic information services industry in recent years, the laboratory testing industry is fragmented and highly competitive. We primarily compete with three types of clinical testing providers: commercial clinical laboratories IDN-affiliated laboratories and physician-office laboratories. Our largest commercial clinical laboratory competitors are Quest Diagnostic Laboratories and Laboratory Corporation of America. In addition, we compete with many smaller regional and local commercial clinical laboratories, specialized advanced laboratories and providers of consumer-initiated testing. There also has been a trend among physician practices to establish their own histology laboratory capabilities and/or bring pathologists into their practices, thereby reducing referrals from these practices and increasing the competitive position of these practices.

In addition, we believe that consolidation in the diagnostic information services industry will continue. A significant portion of clinical testing is likely to continue to be performed by independent delivery networks (including hospitals and hospital health systems) (“IDNs”), which generally have affiliations with community clinicians and may have more, or more convenient, locations in a market. As a result, we compete against these affiliated laboratories primarily on the basis of service capability, quality and pricing. In addition, market activity may increase the competitive environment. For example, IDN ownership of physician practices may enhance the ties of the clinicians to IDN-affiliated laboratories, enhancing the competitive position of IDN-affiliated laboratories.

The diagnostic information services industry is faced with changing technology, new product introductions and new service offerings. Competitors may compete using advanced technology, including technology that enables more convenient or cost-effective testing. Digital pathology, still in an emerging state, is an example of this. Competitors also may compete on the basis of new service offerings. Competitors also may offer testing to be performed outside of a commercial clinical laboratory, such as (1) point-of-care testing that can be performed by physicians in their offices; (2) testing that can be performed by IDNs in their own laboratories; and (3) home testing that can be carried out without requiring the services of outside providers.

Clinical

The development and commercialization of new drug products is highly competitive. We expect that we will face significant competition from major pharmaceutical companies, specialty pharmaceutical companies and biotechnology companies worldwide with respect to our product candidates that we may seek to develop or commercialize in the future. Specifically, due to the large unmet medical need, global demographics and relatively attractive reimbursement dynamics, the markets in which we are seeking to develop products are fiercely competitive and there are a number of large pharmaceutical and biotechnology companies that currently market and sell products or are pursuing the development of product candidates similar to ours. Our competitors may succeed in developing, acquiring or licensing technologies and drug products that are more effective, have fewer or more tolerable side effects or are less costly than any product candidates that we are currently developing or that we may develop, which could render our product candidates obsolete and noncompetitive.

Our commercial opportunity could be reduced or eliminated if our competitors develop and commercialize products that are safer, more effective, have fewer or less severe side effects, are more convenient or are less expensive than any products that we may develop. Our competitors also may obtain FDA or other marketing approval for their products before we are able to obtain approval for ours, which could result in our competitors establishing a strong market position before we are able to enter the market.

5

General

Many of our existing and potential future competitors have significantly greater financial resources and expertise in lab services and operations, research and development, manufacturing, preclinical testing, conducting clinical studies, obtaining marketing approvals and marketing approved products than we do. Mergers and acquisitions in the pharmaceutical and biotechnology industries may result in even more resources being concentrated among a smaller number of our competitors. Smaller, or early stage, companies may also prove to be significant competitors, particularly through collaborative arrangements with large and established companies. These competitors also compete with us in recruiting and retaining qualified scientific and management personnel and establishing clinical study sites and patient registration for clinical studies, as well as in acquiring technologies complementary to, or necessary for, our programs.

We expect that our ability to compete effectively will depend upon our ability to:

| ● | successfully operate and expand our lab services and locations; |

| ● | successfully and rapidly complete adequate and well-controlled clinical studies that demonstrate statistically significant safety and efficacy and to obtain all requisite regulatory approvals in a cost-effective manner; |

| ● | maintain a proprietary position for our manufacturing processes and other technology; |

| ● | produce our products in accordance with FDA and international regulatory guidelines; |

| ● | attract and retain key personnel; and |

| ● | build or access an adequate sales and marketing infrastructure for any approved products. |

Failure to do one or more of these activities could have an adverse effect on our business, financial condition or results of operations.

Avalon RT 9 Properties LLC

Our executive commercial building in Freehold, New Jersey is located on a major highway and is one of the largest buildings in the surrounding areas. It is centrally located and maintains high occupancy. There are other commercial properties in the vicinity that offer similar amenities. However, premier executive offices are limited and as such we expect to continue to maintain high occupancy in the near term.

Employees

As of March 30, 2023, we employed six employees, five of which are full time employees. None of our employees are represented by a collective bargaining arrangement.

Government Regulation

Overview

The healthcare industry in the U.S. is highly regulated and subject to changing political, legislative, regulatory, and other influences. Further, the healthcare industry is currently undergoing rapid change. We are uncertain how, when or in what context these new changes will be adopted or implemented. These new regulations could create unexpected liabilities for us, could cause us or our members to incur additional costs and could restrict our or our clients’ operations. Many of the laws are complex and their application to us, our clients, or the specific services and relationships we have with our members are not always clear. Our failure to anticipate accurately the application of these laws and regulations, or our other failure to comply, could create liability for us, result in adverse publicity, and otherwise negatively affect our business.

6

Holding Foreign Companies Accountable Act Compliance

The Holding Foreign Companies Accountable Act, or the HFCA Act, was enacted on December 18, 2020. According to the HFCA Act, if the SEC determines that Avalon has filed audit reports issued by a registered public accounting firm that has not been subject to inspection by the PCAOB for three consecutive years beginning in 2021, the SEC will prohibit Avalon’s securities from being traded on a national securities exchange or in the over-the-counter trading market in the United States.

On December 16, 2021, the PCAOB issued a Determination Report which reported that the PCAOB is unable to inspect or investigate completely registered public accounting firms headquartered in: (1) mainland China of the People’s Republic of China, because of a position taken by one or more authorities in mainland China; and (2) Hong Kong, a Special Administrative Region of the PRC, because of a position taken by one or more authorities in Hong Kong.

Avalon’s auditor is Marcum LLP (“Marcum”), based in New York, New York. Marcum is registered with the PCAOB and is subject to laws in the United States pursuant to which the PCAOB conducts regular inspections to assess their compliance with the applicable professional standards. Since Marcum is located in the United States, the PCAOB has been able to conduct inspections of Marcum. In addition, Marcum is not among the PCAOB registered public accounting firms registered in mainland China or Hong Kong that are subject to PCAOB’s determination on December 16, 2021.

Although the audit reports of Avalon are prepared by U.S. auditors that are subject to inspection by the PCAOB, the PCAOB is currently unable to conduct inspections over the audit work of Avalon’s independent registered public accounting firms with respect to Avalon’s operations in mainland China without the approval of certain Chinese authorities. Also, there is no guarantee that future audit reports will be prepared by auditors that are completely inspected by the PCAOB and, as such, future investors may be deprived of such inspections, which could result in limitations or restrictions to Avalon’s access of the U.S. capital markets.

Inspections of certain other firms that the PCAOB has conducted outside of China have identified deficiencies in those firms’ audit procedures and quality control procedures, which may be addressed as part of the inspection process to improve future audit quality. However, the PCAOB is currently unable to inspect an auditor’s audit work related to a company’s operations in China where such documentation of the audit work is located in China. As a result, Avalon’s investors may be deprived of the benefits of the PCAOB’s oversight of auditors that are located in China through such inspections.

On March 24, 2021, the SEC adopted interim final rules relating to the implementation of certain disclosure and documentation requirements of the HFCA Act. Avalon will be required to comply with these rules if the SEC identifies us as having a “non-inspection” year under a process to be subsequently established by the SEC. The SEC is assessing how to implement other requirements of the HFCA Act, including the listing and trading prohibition requirements described above.

On June 22, 2021, the U.S. Senate passed a bill which, if passed by the U.S. House of Representatives and signed into law, would reduce the number of consecutive non-inspection years required for triggering the prohibitions under the HFCA Act from three years to two, which would shorten the timeframe before Avalon’s share may be delisted and before the trading in Avalon’s shares is prohibited.

On November 5, 2021, the SEC approved Rule 6100 adopted by the PCAOB to determine its inability to inspect or investigate registered firms completely under the HFCA Act. This rule establishes the framework for the PCAOB to make these required determinations. The trading in Avalon’s securities may be prohibited under the HFCA Act if the PCAOB subsequently determines Avalon’s audit work is performed by auditors that the PCAOB is unable to inspect or investigate completely pursuant to Rule 6100, and as a result, U.S. national securities exchanges, such as Nasdaq, may determine to delist Avalon’s securities. Such a delisting would likely cause the value of such securities to significantly decline or become worthless.

7

The SEC may propose additional regulatory or legislative requirements or guidance that could impact us if our auditor is not subject to PCAOB inspection. For example, on August 6, 2020, the President’s Working Group on Financial Markets, or the PWG, issued the Report on Protecting United States Investors from Significant Risks from Chinese Companies to the then President of the United States. This report recommended the SEC implement five recommendations to address companies from jurisdictions that do not provide the PCAOB with sufficient access to fulfil its statutory mandate. Some of the concepts of these recommendations were implemented with the enactment of the HFCA Act. However, some of the recommendations were more stringent than the HFCA Act. For example, if a company was not subject to PCAOB inspection, the report recommended that the transition period before a company would be delisted would end on January 1, 2022.

The SEC has announced that the SEC staff is preparing a consolidated proposal for the rules regarding the implementation of the HFCA Act and to address the recommendations in the PWG report. It is unclear when the SEC will complete its rulemaking and when such rules will become effective and what, if any, of the PWG recommendations will be adopted. The implications of this possible regulation in addition to the requirements of the HFCA Act are uncertain. Although Avalon is currently not subject to the HFCA Act, any uncertainty of its applicability to Avalon, for example if Avalon switched to using a PRC-based auditing firm, could cause the market price of Avalon’s securities to be materially and adversely affected and could cause Avalon’s securities to be delisted or prohibited from being traded “over-the-counter”. If Avalon’s securities are unable to be listed on another securities exchange, such a delisting would substantially impair your ability to sell or purchase Avalon’s securities when you wish to do so, and the risk and uncertainty associated with a potential delisting would have a negative impact on the price of Avalon’s securities. See “Risk Factors— Trading in Avalon’s securities may be restricted under the Holding Foreign Companies Accountable Act if the PCAOB determines that it cannot inspect or fully investigate Avalon’s auditors, and as a result, U.S. national securities exchanges, such as Nasdaq, may determine to delist Avalon’s securities.

Drug Approval Process

The research, development, testing, manufacture, labeling, promotion, advertising, distribution and marketing, among other things, of our product candidates are extensively regulated by governmental authorities in the United States and other countries. In the United States, the FDA regulates drugs under the Federal Food, Drug, and Cosmetic Act, or the FDCA, and its implementing regulations. Failure to comply with the applicable U.S. requirements may subject us to administrative or judicial sanctions, such as the FDA’s refusal to approve a pending new drug application, or NDA, or a pending biologics license application, or BLA, warning letters, product recalls, product seizures, total or partial suspension of production or distribution, injunctions and/or criminal prosecution.

Pharmaceutical products such as ours may not be commercially marketed without prior approval from the FDA and comparable regulatory agencies in other countries. In the United States, the process to receiving such approval is long, expensive and risky, and includes the following steps:

| ● | pre-clinical laboratory tests, animal studies, and formulation studies; |

| ● | submission to the FDA of an IND for human clinical testing, which must become effective before human clinical trials may begin; |

| ● | adequate and well-controlled human clinical trials to establish the safety and efficacy of the drug for each indication; |

| ● | submission to the FDA of an NDA or BLA; |

| ● | satisfactory completion of an FDA inspection of the manufacturing facility or facilities at which the drug is produced to assess compliance with current good manufacturing practices, or cGMPs; |

| ● | a potential FDA audit of the preclinical and clinical trial sites that generated the data in support of the NDA or BLA; |

| ● | the ability to obtain clearance or approval of companion diagnostic tests, if required, on a timely basis, or at all; and |

| ● | FDA review and approval of the NDA or BLA. |

8

Regulation by U.S. and foreign governmental authorities is a significant factor affecting our ability to commercialize any of our products, as well as the timing of such commercialization and our ongoing research and development activities. The commercialization of drug products requires regulatory approval by governmental agencies prior to commercialization. Various laws and regulations govern or influence the research and development, non-clinical and clinical testing, manufacturing, processing, packing, validation, safety, labeling, storage, record keeping, registration, listing, distribution, advertising, sale, marketing and post-marketing commitments of our products. The lengthy process of seeking these approvals, and the subsequent compliance with applicable laws and regulations, require expending substantial resources.

The results of pre-clinical testing, which include laboratory evaluation of product chemistry and formulation, animal studies to assess the potential safety and efficacy of the product and its formulations, details concerning the drug manufacturing process and its controls, and a proposed clinical trial protocol and other information must be submitted to the FDA as part of an IND that must be reviewed and become effective before clinical testing can begin. The study protocol and informed consent information for patients in clinical trials must also be submitted to an independent Institutional Review Board, or IRB, for approval covering each institution at which the clinical trial will be conducted. Once a sponsor submits an IND, the sponsor must wait 30 calendar days before initiating any clinical trials. If the FDA has comments or questions within this 30-day period, the issue(s) must be resolved to the satisfaction of the FDA before clinical trials can begin. In addition, the FDA, an IRB or the company may impose a clinical hold on ongoing clinical trials due to safety concerns. If the FDA imposes a clinical hold, clinical trials can only proceed under terms authorized by the FDA. Our pre-clinical and clinical studies must conform to the FDA’s Good Laboratory Practice, or GLP, and Good Clinical Practice, or GCP, requirements, respectively, which are designed to ensure the quality and integrity of submitted data and protect the rights and well-being of study patients. Information for certain clinical trials also must be publicly disclosed within certain time limits on the clinical trial registry and results databank maintained by the NIH.

Typically, clinical testing involves a three-phase process; however, the phases may overlap or be combined:

| ● | Phase I clinical trials typically are conducted in a small number of volunteers or patients to assess the early tolerability and safety profile, and the pattern of drug absorption, distribution and metabolism; |

| ● | Phase II clinical trials typically are conducted in a limited patient population with a specific disease in order to assess appropriate dosages and dose regimens, expand evidence of the safety profile and evaluate preliminary efficacy; and |

| ● | Phase III clinical trials typically are larger scale, multicenter, well-controlled trials conducted on patients with a specific disease to generate enough data to statistically evaluate the efficacy and safety of the product, to establish the overall benefit-risk relationship of the drug and to provide adequate information for the registration of the drug. |

A therapeutic product candidate being studied in clinical trials may be made available for treatment of individual patients, in certain circumstances. Pursuant to the 21st Century Cures Act (Cures Act), which was signed into law in December 2016. The manufacturer of an investigational product for a serious disease or condition is required to make available, such as by posting on its website, its policy on evaluating and responding to requests for individual patient access to such investigational product.

The results of the pre-clinical and clinical testing, chemistry, manufacturing and control information, proposed labeling and other information are then submitted to the FDA in the form of either an NDA or BLA for review and potential approval to begin commercial sales. In responding to an NDA or BLA, the FDA may grant marketing approval, request additional information in a Complete Response Letter, or CRL, or deny the approval if it determines that the NDA or BLA does not provide an adequate basis for approval. A CRL generally contains a statement of specific conditions that must be met in order to secure final approval of an NDA or BLA and may require additional testing. If and when those conditions have been met to the FDA’s satisfaction, the FDA will typically issue an approval letter, which authorizes commercial marketing of the product with specific prescribing information for specific indications, and sometimes with specified post-marketing commitments and/or distribution and use restrictions imposed under a Risk Evaluation and Mitigation Strategy program. Any approval required from the FDA might not be obtained on a timely basis, if at all.

9

Among the conditions for an NDA or BLA approval is the requirement that the manufacturing operations conform on an ongoing basis with cGMPs. In complying with cGMPs, we must expend time, money and effort in the areas of training, production and quality control within our own organization and at our contract manufacturing facilities. A successful inspection of the manufacturing facility by the FDA is usually a prerequisite for final approval of a pharmaceutical product. Following approval of the NDA or BLA, we and our manufacturers will remain subject to periodic inspections by the FDA to assess compliance with cGMPs requirements and the conditions of approval. We will also face similar inspections coordinated by foreign regulatory authorities.

Disclosure of Clinical Trial Information

Sponsors of certain clinical trials of FDA-regulated products are required to register and disclose certain clinical trial information. Information related to the product, patient population, phase of investigation, trial sites and investigators, and other aspects of the clinical trial are then made public as part of the registration. Sponsors are also obligated to disclose the results of their clinical trials after completion. Disclosure of the results of these trials can be delayed in certain circumstances for up to two years after the date of completion of the trial. Competitors may use this publicly available information to gain knowledge regarding the progress of development programs.

Expedited Development and Review Programs

The FDA has a Fast Track program that is intended to expedite or facilitate the process for reviewing new drugs and biological products that meet certain criteria. Specifically, new drugs and biological products are eligible for Fast Track designation if they are intended to treat a serious or life-threatening condition and demonstrate the potential to address unmet medical needs for the condition. Fast Track designation applies to the combination of the product and the specific indication for which it is being studied. The sponsor of a new drug or biologic may request the FDA to designate the drug or biologic as a Fast Track product at any time during the clinical development of the product. Unique to a Fast Track product, the FDA may consider for review sections of the marketing application on a rolling basis before the complete application is submitted, if the sponsor provides a schedule for the submission of the sections of the application, the FDA agrees to accept sections of the application and determines that the schedule is acceptable, and the sponsor pays any required user fees upon submission of the first section of the application.

Any product submitted to the FDA for marketing, including under a Fast Track program, may be eligible for other types of FDA programs intended to expedite development and review, such as priority review and accelerated approval. Under the Breakthrough Therapy program, products intended to treat a serious or life-threatening disease or condition may be eligible for the benefits of the Fast Track program when preliminary clinical evidence demonstrates that such product may have substantial improvement on one or more clinically significant endpoints over existing therapies. Additionally, FDA will seek to ensure the sponsor of a breakthrough therapy product receives timely advice and interactive communications to help the sponsor design and conduct a development program as efficiently as possible. Any product is eligible for priority review if it has the potential to provide safe and effective therapy where no satisfactory alternative therapy exists or a significant improvement in the treatment, diagnosis or prevention of a disease compared to marketed products. The FDA will attempt to direct additional resources to the evaluation of an application for a new drug or biological product designated for priority review in an effort to facilitate the review. Additionally, a product may be eligible for accelerated approval. Drug or biological products studied for their safety and effectiveness in treating serious or life-threatening illnesses and that provide meaningful therapeutic benefit over existing treatments may receive accelerated approval, which means that they may be approved on the basis of adequate and well-controlled clinical studies establishing that the product has an effect on a surrogate endpoint that is reasonably likely to predict a clinical benefit, or on the basis of an effect on a clinical endpoint other than survival or irreversible morbidity. As a condition of approval, the FDA may require that a sponsor of a drug or biological product receiving accelerated approval perform adequate and well-controlled post-marketing clinical studies. In addition, the FDA currently requires as a condition for accelerated approval the pre-approval of promotional materials, which could adversely impact the timing of the commercial launch of the product. Fast Track designation, Breakthrough Therapy designation, priority review and accelerated approval do not change the standards for approval but may expedite the development or approval process.

10

Regenerative Medicine Advanced Therapies (RMAT) Designation

The FDA has established a Regenerative Medicine Advanced Therapy, or RMAT, designation as part of its implementation of the 21st Century Cures Act, or Cures Act. The RMAT designation program is intended to fulfill the Cures Act requirement that the FDA facilitate an efficient development program for, and expedite review of, any drug that meets the following criteria: (1) it qualifies as a RMAT, which is defined as a cell therapy, therapeutic tissue engineering product, human cell and tissue product, or any combination product using such therapies or products, with limited exceptions; (2) it is intended to treat, modify, reverse, or cure a serious or life-threatening disease or condition; and (3) preliminary clinical evidence indicates that the drug has the potential to address unmet medical needs for such a disease or condition. Like breakthrough therapy designation, RMAT designation provides potential benefits that include more frequent meetings with FDA to discuss the development plan for the product candidate, and eligibility for rolling review and priority review. Products granted RMAT designation may also be eligible for accelerated approval on the basis of a surrogate or intermediate endpoint reasonably likely to predict long-term clinical benefit, or reliance upon data obtained from a meaningful number of sites, including through expansion to additional sites. RMAT-designated products that receive accelerated approval may, as appropriate, fulfill their post-approval requirements through the submission of clinical evidence, clinical studies, patient registries, or other sources of real world evidence (such as electronic health records); through the collection of larger confirmatory data sets; or via post-approval monitoring of all patients treated with such therapy prior to approval of the therapy.

Post-Approval Requirements

Oftentimes, even after a drug has been approved by the FDA for sale, the FDA may require that certain post-approval requirements be satisfied, including the conduct of additional clinical studies. If such post-approval requirements are not satisfied, the FDA may withdraw its approval of the drug. In addition, holders of an approved NDA or BLA are required to report certain adverse reactions to the FDA, comply with certain requirements concerning advertising and promotional labeling for their products, and continue to have quality control and manufacturing procedures conform to cGMPs after approval. The FDA periodically inspects the sponsor’s records related to safety reporting and/or manufacturing facilities; this latter effort includes assessment of compliance with cGMPs. Accordingly, manufacturers must continue to expend time, money, and effort in the area of production and quality control to maintain cGMPs compliance.

Other Healthcare Fraud and Abuse Laws

In the U.S., our activities are potentially subject to regulation by various federal, state and local authorities in addition to the FDA, including but not limited to, the Centers for Medicare and Medicaid Services, or CMS, other divisions of the U.S. Department of Health and Human Services (such as the Office of Inspector General and the Health Resources and Service Administration), the U.S. Department of Justice, or the DOJ, and individual U.S. Attorney offices within the DOJ, and state and local governments. For example, sales, marketing and scientific/educational grant programs may have to comply with the anti-fraud and abuse provisions of the Social Security Act, the false claims laws, the privacy and security provisions of the Health Insurance Portability and Accountability Act, or HIPAA, and similar state laws, each as amended, as applicable.

The federal Anti-Kickback Statute prohibits, among other things, any person or entity from knowingly and willfully offering, paying, soliciting or receiving any remuneration, directly or indirectly, overtly or covertly, in cash or in kind, to induce or in return for purchasing, leasing, ordering or arranging for the purchase, lease or order of any item or service reimbursable, in whole or in part, under Medicare, Medicaid or other federal healthcare programs. The term remuneration has been interpreted broadly to include anything of value. The Anti-Kickback Statute has been interpreted to apply to arrangements between therapeutic product manufacturers on one hand and prescribers, purchasers, and formulary managers on the other. There are a number of statutory exceptions and regulatory safe harbors protecting some common activities from prosecution. The exceptions and safe harbors are drawn narrowly and practices that involve remuneration that may be alleged to be intended to induce prescribing, purchasing or recommending may be subject to scrutiny if they do not qualify for an exception or safe harbor. Failure to meet all of the requirements of a particular applicable statutory exception or regulatory safe harbor does not make the conduct per se illegal under the Anti-Kickback Statute. Instead, the legality of the arrangement will be evaluated on a case-by-case basis based on a cumulative review of all of its facts and circumstances. Additionally, the intent standard under the Anti-Kickback Statute was amended by the ACA to a stricter standard such that a person or entity no longer needs to have actual knowledge of the statute or specific intent to violate it in order to have committed a violation. In addition, the ACA codified case law that a claim including items or services resulting from a violation of the federal Anti-Kickback Statute constitutes a false or fraudulent claim for purposes of the federal False Claims Act, or FCA.

11

The federal false claims and civil monetary penalty laws, including the FCA, which imposes significant penalties and can be enforced by private citizens through civil qui tam actions, prohibit any person or entity from, among other things, knowingly presenting, or causing to be presented, a false or fraudulent claim for payment to, or approval by, the federal healthcare programs, including Medicare and Medicaid, or knowingly making, using, or causing to be made or used a false record or statement material to a false or fraudulent claim to the federal government. A claim includes “any request or demand” for money or property presented to the U.S. government. For instance, historically, pharmaceutical and other healthcare companies have been prosecuted under these laws for allegedly providing free product to customers with the expectation that the customers would bill federal programs for the product. Other companies have been prosecuted for causing false claims to be submitted because of the companies’ marketing of the product for unapproved, off-label, and thus generally non-reimbursable, uses.

HIPAA created additional federal criminal statutes that prohibit, among other things, knowingly and willfully executing, or attempting to execute, a scheme to defraud or to obtain, by means of false or fraudulent pretenses, representations or promises, any money or property owned by, or under the control or custody of, any healthcare benefit program, including private third-party payors, willfully obstructing a criminal investigation of a healthcare offense, and knowingly and willfully falsifying, concealing or covering up by trick, scheme or device, a material fact or making any materially false, fictitious or fraudulent statement in connection with the delivery of or payment for healthcare benefits, items or services. Like the Anti-Kickback Statute, the ACA amended the intent standard for certain healthcare fraud statutes under HIPAA such that a person or entity no longer needs to have actual knowledge of the statute or specific intent to violate it in order to have committed a violation.

Many states have similar, and typically more prohibitive, fraud and abuse statutes or regulations that apply to items and services reimbursed under Medicaid and other state programs, or, in several states, apply regardless of the payor. Additionally, to the extent that our product candidates may in the future be sold in a foreign country, we may be subject to similar foreign laws.

We may be subject to data privacy and security regulations by both the federal government and the states in which we conduct our business. HIPAA, as amended by the Health Information Technology for Economic and Clinical Health Act, or HITECH, and its implementing regulations, imposes requirements relating to the privacy, security and transmission of individually identifiable health information. Among other things, HITECH makes HIPAA’s privacy and security standards directly applicable to business associates, independent contractors, or agents of covered entities that receive or obtain protected health information in connection with providing a service on behalf of a covered entity. HITECH also created four new tiers of civil monetary penalties, amended HIPAA to make civil and criminal penalties directly applicable to business associates, and gave state attorneys general new authority to file civil actions for damages or injunctions in federal courts to enforce HIPAA and seek attorneys’ fees and costs associated with pursuing federal civil actions. In addition, many state laws govern the privacy and security of health information in specified circumstances, many of which differ from each other in significant ways, are often not pre-empted by HIPAA, and may have a more prohibitive effect than HIPAA, thus complicating compliance efforts.

We expect our product, after approval, may be eligible for coverage under Medicare, the federal health care program that provides health care benefits to the aged and disabled, and covers outpatient services and supplies, including certain pharmaceutical products, that are medically necessary to treat a beneficiary’s health condition. In addition, the product may be covered and reimbursed under other government programs, such as Medicaid and the 340B Drug Pricing Program. The Medicaid Drug Rebate Program requires pharmaceutical manufacturers to enter into and have in effect a national rebate agreement with the Secretary of the Department of Health and Human Services as a condition for states to receive federal matching funds for the manufacturer’s outpatient drugs furnished to Medicaid patients. Under the 340B Drug Pricing Program, the manufacturer must extend discounts to entities that participate in the program. As part of the requirements to participate in certain government programs, many pharmaceutical manufacturers must calculate and report certain price reporting metrics to the government, such as average manufacturer price, or AMP, and best price. Penalties may apply in some cases when such metrics are not submitted accurately and timely.

12

Additionally, the federal Physician Payments Sunshine Act, or the Sunshine Act, within the ACA, and its implementing regulations, require that certain manufacturers of drugs, devices, biological and medical supplies for which payment is available under Medicare, Medicaid or the Children’s Health Insurance Program (with certain exceptions) report annually to CMS information related to certain payments or other transfers of value made or distributed to physicians and teaching hospitals, or to entities or individuals at the request of, or designated on behalf of, the physicians and teaching hospitals and to report annually certain ownership and investment interests held by physicians and their immediate family members. Failure to report accurately could result in penalties. In addition, many states also govern the reporting of payments or other transfers of value, many of which differ from each other in significant ways, are often not pre-empted, and may have a more prohibitive effect than the Sunshine Act, thus further complicating compliance efforts.

New Legislation and Regulations

From time to time, legislation is drafted, introduced and passed in Congress that could significantly change the statutory provisions governing the testing, approval, manufacturing and marketing of products regulated by the FDA. In addition to new legislation, FDA regulations and policies are often revised or interpreted by the agency in ways that may significantly affect our business and our products. It is impossible to predict whether further legislative changes will be enacted or whether FDA regulations, guidance, policies or interpretations will be changed or what the effect of such changes, if any, may be.

ITEM 1A. RISK FACTORS

You should carefully consider the following material risk factors as well as all other information set forth or referred to in this report before purchasing shares of our common stock. Investing in our common stock involves a high degree of risk. We may not be successful in preventing the material adverse effects that any of the following risks and uncertainties may cause. These potential risks and uncertainties may not be a complete list of the risks and uncertainties facing us. There may be additional risks and uncertainties that we are presently unaware of, or presently consider immaterial, that may become material in the future and have a material adverse effect on us. You could lose all or a significant portion of your investment due to any of these risks and uncertainties.

Summary of Risk Factors

Our business is subject to numerous risks and uncertainties that you should consider before investing in our company, as fully described below. The principal factors and uncertainties that make investing in our company risky include, among others:

General Operating and Business Risks

| ● | Our limited operating history makes it difficult for us to evaluate our future business prospects and make decisions based on those estimates of our future performance. | |

| ● | Our results of operations have not resulted in profitability and we may not be able to achieve profitability going forward. | |

| ● | There is substantial doubt about our ability to continue as a going concern, which will affect our ability to obtain future financing and may require us to curtail our operations. | |

| ● | Our cash will only fund our operations for a limited time and we will need to raise additional capital in order to support our development. |

| ● | The Laboratory Services MSO Acquisition will result in organizational changes that could create significant growth for our business. If we fail to effectively manage this growth and adapt our business structure in a manner that preserves our reputation, then our business, financial condition and results of operations could be harmed. |

| ● | We must effectively manage the growth of our operations, or our company will suffer. |

13

| ● | Our prospects will suffer if we are not able to hire, train, motivate, manage, and retain a significant number of highly skilled employees. |

| ● | Potential liability claims may adversely affect our business. |

| ● | In accordance with our strategic development policy, we may invest in companies for strategic reasons and may not realize a return on our investments. |

| ● | Obtaining and maintaining patent protection depends on compliance with various procedural, document submission, fee payment and other requirements imposed by governmental patent agencies, and any patent protection we may obtain in the future could be reduced or eliminated for non-compliance with these requirements. |

| ● | It is difficult and costly to protect our proprietary rights, and we may not be able to ensure their protection. If we fail to protect or enforce our intellectual property rights adequately or secure rights to patents of others, the value of our intellectual property rights would diminish. |

| ● | If any of our trade secrets, know-how or other proprietary information is disclosed, the value of our trade secrets, know-how and other proprietary rights would be significantly impaired and our business and competitive position would suffer. |

Risk Factors Related to our Laboratory Services Business

| ● | Continued changes in healthcare reimbursement models and products, changes in government payment and reimbursement systems, or changes in payer mix could have a material adverse effect on our revenues, profitability and cash flow. | |

| ● | The clinical testing business is highly competitive, and if we fail to provide an appropriately priced level of service or otherwise fail to compete effectively it could have a material adverse effect on our revenues and profitability. | |

| ● | Failure to obtain and retain new customers, the loss of existing customers or material contracts, or a reduction in services or tests ordered or specimens submitted by existing customers, or the inability to retain existing and/or create new relationships with health systems could impact our ability to successfully grow our business. |

| ● | Discontinuation or recalls of existing testing products; failure to develop or acquire licenses for new or improved testing technologies; or our customers using new technologies to perform their own tests could adversely affect our business. | |

| ● | Continued and increased consolidation of pharmaceutical, biotechnology and medical device companies, health systems, physicians and other customers could adversely affect our business. |

Risk Factors Related to Clinical and Commercialization Activity

| ● | We may not be able to file INDs to commence additional clinical trials on the timelines we expect, and even if we are able to do so, the FDA may not permit us to proceed. | |

| ● | We have limited experience in conducting clinical trials. | |

| ● | Delays in the commencement, enrollment, and completion of clinical testing could result in increased costs to us and delay or limit our ability to obtain regulatory approval for our product candidates. | |

| ● | As the results of earlier pre-clinical studies or clinical trials are not necessarily predictive of future results, any product candidate we advance into clinical trials may not have favorable results in later clinical trials or receive regulatory approval. | |

| ● | Even if our product candidates receive regulatory approval, we may still face future development and regulatory difficulties. | |

| ● | Any cell based therapies we develop may become subject to unfavorable pricing regulations, third party coverage and reimbursement practices or healthcare reform initiatives, thereby harming our business. |

14

Risks Related to Our Securities

| ● | Our officers, directors and principal stockholders own a significant percentage of our capital stock and will be able to exert significant control over matters that are subject to stockholder approval. |

| ● | If we are unable to maintain listing of our securities on the Nasdaq Capital Market or another reputable stock exchange, it may be more difficult for our stockholders to sell their securities. | |

| ● | The price of our common stock may be volatile and fluctuate substantially, which could result in substantial losses for our stockholders. | |

| ● | You may experience dilution of your ownership interests because of the future issuance of additional shares of our common or preferred stock or other securities that are convertible into or exercisable for our common or preferred stock. |

General Operating and Business Risks

Our limited operating history makes it difficult for us to evaluate our future business prospects and make decisions based on those estimates of our future performance.

We did not begin operations of our business through AHS until May 2015. We have a limited operating history and limited revenue. As a consequence, it is difficult, if not impossible, to forecast our future results based upon our historical data. Reliance on the historical results may not be representative of the results we will achieve, particularly in our combined form. Because of the uncertainties related to our lack of historical operations, we may be hindered in our ability to anticipate and timely adapt to increases or decreases in revenues or expenses. If we make poor budgetary decisions as a result of unreliable historical data, we could be less profitable or incur losses, which may result in a decline in our stock price.

Our results of operations have not resulted in profitability and we may not be able to achieve profitability going forward.

We incurred net losses amounting to $11,930,847 and $9,090,499 for the years ended December 31, 2022 and 2021, respectively. As of December 31, 2022, we had an accumulated deficit of approximately $63.1 million. If we incur additional significant losses, our stock price may decline, perhaps significantly. Our management is developing plans to achieve profitability. Our business plan is speculative and unproven. There is no assurance that we will be successful in executing our business plan or that even if we successfully implement our business plan, that we will be able to curtail our losses now or in the future. Further, as we are a new enterprise, we expect that net losses will continue.

There is substantial doubt about our ability to continue as a going concern, which will affect our ability to obtain future financing and may require us to curtail our operations.

Our financial statements as of December 31, 2022 were prepared under the assumption that we will continue as a going concern. The independent registered public accounting firm that audited our 2022 financial statements, in their report, included an explanatory paragraph referring to our recurring losses since inception and expressing management’s assessment and conclusion that there is substantial doubt in our ability to continue as a going concern. Our financial statements do not include any adjustments that might result from the outcome of this uncertainty. Our ability to continue as a going concern depends on our ability to obtain additional equity or debt financing, attain further operating efficiencies, reduce expenditures, and, ultimately, to generate revenue. We cannot assure you, however, that we will be able to achieve any of the foregoing. See Note 2 to our Consolidated Financial Statements for further details.

15

Our cash will only fund our operations for a limited time and we will need to raise additional capital in order to support our development.

We are currently operating at a loss and expect our operating costs will increase significantly as we continue to grow our operations. The independent registered public accounting firm that audited our 2022 financial statements, in their report, included an explanatory paragraph referring to our recurring losses since inception and expressing management’s assessment and conclusion that there is substantial doubt in our ability to continue as a going concern. At December 31, 2022, we had cash of approximately $2.0 million. We will need to raise additional capital or generate substantial revenue in order to support our development and commercialization efforts.

If our available cash balances are insufficient to satisfy our liquidity requirements, including due to risks described herein, we may seek to raise additional capital through equity offerings, debt financings, collaborations or licensing arrangements. We will need to raise additional capital, and we may also consider raising additional capital in the future to expand our business, to pursue strategic investments, to take advantage of financing opportunities, or for other reasons, including to:

| ● | fund development and expansion of our operations; |

| ● | acquire, license or invest in technologies and additional laboratories; |

| ● | acquire or invest in complementary businesses or assets; and |

| ● | finance capital expenditures and general and administrative expenses. |

Our present and future funding requirements will depend on many factors, including:

| ● | our revenue growth rate and ability to generate cash flows from operating activities; |

| ● | our sales and marketing and research and development activities; and |

| ● | changes in regulatory oversight applicable to our products and services. |

Other than our debt facility with our chairman, we have no arrangements or credit facilities in place as a source of funds, and there can be no assurance that we will be able to raise sufficient additional capital on acceptable terms, or at all, and if we are not successful in raising additional capital, we may not be able to continue as a going concern. We may seek additional capital through a combination of private and public equity offerings, debt financings and strategic collaborations. Debt financing, if obtained, may involve agreements that include covenants limiting or restricting our ability to take specific actions, such as incurring additional debt, that could increase our expenses and require that our assets secure such debt. Equity financing, if obtained, could result in dilution to our then existing stockholders and/or require such stockholders to waive certain rights and preferences. If such financing is not available on satisfactory terms, or is not available at all, we may be required to delay, scale back or eliminate the development of business opportunities and our operations and financial condition may be materially adversely affected. We can provide no assurances that any additional sources of financing will be available to us on favorable terms, if at all. Future capital raises may dilute our existing stockholders’ ownership and/or have other adverse effects on our operations.

If we raise additional capital by issuing equity securities, our existing stockholders’ percentage ownership will be reduced and these stockholders may experience substantial dilution.

If we raise additional funds by issuing debt securities, these debt securities would have rights senior to those of our Common Stock and the terms of the debt securities issued could impose significant restrictions on our operations, including liens on our assets. If we raise additional funds through collaborations and licensing arrangements, we may be required to relinquish some rights to our technologies or products, or to grant licenses on terms that are not favorable to us.

We have significant outstanding debt obligations and servicing these debt obligations will require a significant amount of capital, and our business may not be able to pay our substantial debt.

As of December 31, 2022, we had $4.8 million of outstanding indebtedness. In order to service this indebtedness and any additional indebtedness we may incur in the future, we will need to generate cash from our operating activities. Our ability to generate cash is subject, in part, to our ability to successfully execute our business strategy, as well as general economic, financial, competitive, regulatory and other factors beyond our control. If we are unable to generate sufficient cash to repay our debt obligations when they become due and payable, either when they mature, or in the event of a default, we may not be able to obtain additional debt or equity financing on favorable terms, if at all, which may negatively impact our business operations and financial condition.

16

If we breach any of the undertakings or default on any of our obligations under our agreements with our lenders, our outstanding indebtedness could become immediately due and payable, which would harm our business, financial condition and results of operations and could require us to reduce or cease operations. If our indebtedness were to be accelerated, there can be no assurance that our assets would be sufficient to repay in full that indebtedness.

Our business is subject to risks arising from epidemic diseases, such as the outbreak of the COVID-19 illness.

The Coronavirus Disease 2019, or COVID-19, pandemic which has been declared by the World Health Organization to be a “public health emergency of international concern,” spread across the globe and impacted worldwide economic activity. Although several vaccines have been developed, a public health epidemic, including COVID-19, poses the risk that we or our employees, contractors, suppliers, and other partners may be prevented from conducting business activities for an indefinite period of time, including due to shutdowns that may be requested or mandated by governmental authorities. While it is not possible at this time to estimate the full impact that future pandemics, including COVID-19, could have on our business, the continued spread of COVID-19 and the measures taken by the governments of countries affected could disrupt the supply chain and adversely impact our business, financial condition or results of operations. Future pandemics, including COVID-19, and mitigation measures may also have an adverse impact on global economic conditions which could have an adverse effect on our business and financial condition. The extent to which these pandemics impact our results will depend on future developments that are highly uncertain and cannot be predicted, including new information that may emerge concerning the severity of the virus and the actions to contain its impact.

We depend upon key personnel and need additional personnel.