UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

|

☒ |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended June 30, 2019

OR

|

☐ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

FOR THE TRANSITION PERIOD FROM TO

Commission File Number 001-36908

PARAMOUNT GOLD NEVADA CORP.

(Exact name of Registrant as specified in its Charter)

|

Nevada |

98-0138393 |

|

( State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer |

|

|

|

|

665 Anderson Street Winnemucca, NV |

89445 |

|

(Address of principal executive offices) |

(Zip Code) |

Registrant’s telephone number, including area code: (775) 625-3600

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

|

Common Stock, $0.01 Par Value Per Share |

|

PZG |

|

NYSE American |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. YES ☐ NO ☒

Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. YES ☐ NO ☒

Indicate by check mark whether the Registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. YES ☒ NO ☐

Indicate by check mark whether the Registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the Registrant was required to submit such files). YES ☒ NO ☐

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definition of “large accelerated filer”, “accelerated filer”, “smaller reporting company” and emerging growth company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer |

|

☐ |

|

Accelerated filer |

|

☐ |

|

|

|

|

|

|||

|

Non-accelerated filer |

|

☒ |

|

Small reporting company |

|

☒ |

|

|

|

|

|

|

|

|

|

|

|

|

|

Emerging growth company |

|

☒ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). YES ☐ NO ☒

The aggregate market value of the voting and non-voting common equity held by non-affiliates of the Registrant, based on the closing price of the shares of common stock on the NYSE American LLC on December 31, 2018, was $14,800,948.

The number of shares of Registrant’s Common Stock outstanding as of September 12, 2019 was 27,616,745.

Portions of the Registrant’s Definitive Proxy Statement relating to the Annual Meeting of Shareholders (the “2019 Proxy Statement”) are incorporated by reference into Part III of this Report where indicated. The 2018 Proxy Statement will be filed with the U.S. Securities Exchange Commission within 120 days after the end of the fiscal year to which this report relates.

|

|

|

|

|

Page |

|

PART I |

|

|

|

|

|

Item 1. |

|

|

4 |

|

|

Item 1A. |

|

|

6 |

|

|

Item 1B. |

|

|

13 |

|

|

Item 2. |

|

|

13 |

|

|

Item 3. |

|

|

22 |

|

|

Item 4. |

|

|

22 |

|

|

|

|

|

|

|

|

PART II |

|

|

|

|

|

Item 5. |

|

|

23 |

|

|

Item 6. |

|

|

24 |

|

|

Item 7. |

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

|

24 |

|

Item 7A. |

|

|

28 |

|

|

Item 8. |

|

|

28 |

|

|

Item 9. |

|

Changes in and Disagreements With Accountants on Accounting and Financial Disclosure |

|

29 |

|

Item 9A. |

|

|

29 |

|

|

Item 9B. |

|

|

29 |

|

|

|

|

|

|

|

|

PART III |

|

|

|

|

|

Item 10. |

|

|

30 |

|

|

Item 11. |

|

|

30 |

|

|

Item 12. |

|

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

|

30 |

|

Item 13. |

|

Certain Relationships and Related Transactions, and Director Independence |

|

30 |

|

Item 14. |

|

|

30 |

|

|

|

|

|

|

|

|

PART IV |

|

|

|

|

|

Item 15. |

|

|

31 |

i

Cautionary Note Regarding Forward-Looking Statements

This Form 10-K contains “forward-looking statements” within the meaning of applicable securities laws relating to Paramount Gold Nevada Corp. (“Paramount”, “we”, “us”, “our”, or the “Company”) which represent our current expectations or beliefs including, but not limited to, statements concerning our operations, performance, and financial condition. These statements by their nature involve substantial risks and uncertainties, credit losses, dependence on management and key personnel, variability of quarterly results, and our ability to continue growth. Statements in this annual report regarding planned drilling activities and any other statements about Paramount’s future expectations, beliefs, goals, plans or prospects constitute forward-looking statements. You should also see our risk factors beginning on page 6. For this purpose, any statements contained in this Form 10-K that are not statements of historical fact are forward-looking statements. Without limiting the generality of the foregoing, words such as “may”, “anticipate”, “intend”, “could”, “estimate”, or “continue” or the negative or other comparable terminology are intended to identify forward-looking statements. Other matters such as our growth strategy and competition are beyond our control. Should one or more of these risks or uncertainties materialize or should the underlying assumptions prove incorrect, actual outcomes and results could differ materially from those indicated in the forward-looking statements.

Any forward-looking statement speaks only as of the date on which such statement is made, and we undertake no obligation to update any forward-looking statement or statements to reflect events or circumstances after the date on which such statement is made or to reflect the occurrence of unanticipated events. New factors emerge from time to time and it is not possible for us to predict all of such factors, nor can we assess the impact of each such factor on the business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements.

GLOSSARY OF MINING TERMS

In this report, the following terms have the following meanings:

alteration – any change in the mineral composition of a rock brought about by physical or chemical means.

assay – a measure of the valuable mineral content.

development stage – a “development stage” project is one which is undergoing preparation of an established commercially mineable deposit for its extraction but which is not yet in production. This stage occurs after completion of a feasibility study.

dip – the angle that a structural surface, a bedding or fault plane, makes with the horizontal, measured perpendicular to the strike of the structure.

disseminated – where minerals occur as scattered particles in the rock.

exploration stage – an “exploration stage” prospect is one which is not in either the development or production stage.

fault – a surface or zone of rock fracture along which there has been displacement.

feasibility study – a comprehensive study of a mineral deposit in which all geological, engineering, legal, operating, economic, social, environmental and other relevant factors are considered in sufficient detail that it could reasonably serve as the basis for a final decision by a financial institution to finance the development of the deposit for mineral production.

formation – a distinct layer of sedimentary rock of similar composition.

geochemistry – the study of the distribution and amounts of the chemical elements in minerals, ores, rocks, solids, water, and the atmosphere.

geophysical surveys – a survey method used primarily in the mining industry as an exploration tool, applying the methods of physics and engineering to the earth’s surface.

grade – quantity of metal per unit weight of host rock.

heap leach – a mineral processing method involving the crushing and stacking of an ore on an impermeable liner upon which solutions are sprayed to dissolve metals, e.g., gold, copper etc.; the solutions containing the metals are then collected and treated to recover the metals.

1

host rock – the rock in which a mineral or an ore body may be contained.

induced polarization – is a geophysical imaging technique used to identify the electrical chargeability of subsurface materials, such as ore.

in-situ – in its natural position.

mapped or geological mapping – the recording of geologic information including rock units and the occurrence of structural features, attitude of bedrock, and mineral deposits on maps.

mineral – a naturally occurring inorganic crystalline material having a definite chemical composition.

mineralization – a natural accumulation or concentration in rocks or soil of one or more potentially economic minerals; also the process by which minerals are introduced or concentrated in a rock.

mineralized material – refers to material that is not included in the reserve as it does not meet all of the criteria for adequate demonstration for economic or legal extraction.

open pit or open cut – surface mining in which the ore is extracted from a pit or quarry, the geometry of the pit may vary with the characteristics of the ore body.

ore – mineral bearing rock that can be mined and treated profitably under current or immediately foreseeable economic conditions.

ore body – a mostly solid and fairly continuous mass of mineralization estimated to be economically mineable.

outcrop – that part of a geologic formation or structure that appears at the surface of the earth.

oxide – gold-bearing ore that results from the oxidation of near surface sulfide ore.

preliminary economic assessment – a study that includes an economic analysis of the potential viability of mineral resources taken at an early stage of the project prior to the completion of a preliminary feasibility study.

preliminary feasibility study (pre-feasibility study) – comprehensive study of a range of options for the technical and economic viability of a mineral project that has advanced to a stage where a preferred mining method, in the case of underground mining, or the pit configuration, in the case of an open pit, is established and an effective method of mineral processing is determined. It includes a financial analysis based on reasonable assumptions on mining, processing, metallurgical, economic, marketing, legal, environmental, social and governmental considerations and the evaluation of any other relevant factors. probable reserve – refers to reserves for which quantity and grade and/or quality are computed from information similar to that used for proven (measured) reserves, but the sites for inspection, sampling, and measurement are farther apart or are otherwise less adequately spaced. The degree of assurance, although lower than that for proven reserves, is high enough to assume continuity between points of observation.

production stage – a “production stage” project is actively engaged in the process of extraction and beneficiation of mineral reserves to produce a marketable metal or mineral product.

proven reserve – refers to reserves for which (a) quantity is computed from dimensions revealed in outcrops, trenches, workings or drill holes; grade and/or quality are computed from the results of detailed sampling and (b) the sites for inspection, sampling and measurement are spaced so closely and the geologic character is so well defined that size, shape, depth and mineral content of reserves are well-established.

quartz – a mineral composed of silicon dioxide, SiO2 (silica)

RC (reverse circulation) drilling – a drilling method using a tri-cone bit or hammer bit, during which rock cuttings are pushed from the bottom of the drill hole to the surface through an inner tube, by liquid and/or air pressure moving through an outer tube.

reserve – refers to that part of a mineral deposit which could be economically and legally extracted or produced at the time of the reserve determination. Reserves must be supported by a feasibility study done to bankable standards that demonstrates the economic extraction. (“Bankable standards” implies that the confidence attached to the costs and achievements developed in the study is sufficient for the project to be eligible for external debt financing.) A reserve includes adjustments to the in-situ tons and grade to include diluting materials and allowances for losses that might occur when the material is mined.

2

rock – indurated naturally occurring mineral matter of various compositions.

sediment – particles transported by water, wind, gravity or ice.

sedimentary rock – rock formed at the earth’s surface from solid particles, whether mineral or organic, which have been moved from their position of origin and re-deposited.

strike – the direction or trend that a structural surface, e.g. a bedding or fault plane, takes as it intersects the horizontal.

strip – to remove barren rock or overburden in order to expose ore.

sulfide – a mineral including sulfur (S) and iron (Fe) as well as other elements; metallic sulfur-bearing mineral often associated with gold mineralization.

3

PART I

Paramount Gold Nevada Corp. is a Nevada corporation formed on June 15, 1992 under the name X-Cal (USA), Inc. Paramount Gold Nevada Corp. common stock trades on the NYSE American LLC under the symbol “PZG.” Unless the context otherwise requires, reference to “we,” “us,” “our,” “Paramount,” the “Company” and other similar references refer to Paramount Gold Nevada Corp.

INITIAL PUBLIC OFFERING AND ORGANIZATIONAL TRANSACTIONS

On April 17, 2015, we entered into the previously disclosed separation and distribution agreement (the “Separation Agreement”) with Paramount Gold and Silver Corp. (“PGSC”), to effect the separation (the “separation”) of the Company from PGSC, and to provide for the allocation between the Company and PGSC of the Company’s and PGSC’s assets, liabilities and obligations attributable to periods prior to, at and after the separation.

We filed a registration statement on Form S-1 in connection with the distribution (the “distribution”) by PGSC to its stockholders of all the outstanding shares of common stock of the Company, par value $0.01 per share. The registration statement was declared effective by the Securities and Exchange Commission (“SEC”) on April 9, 2015. On April 6, 2015, the Company filed a Form 8-A with the SEC to register its shares of common stock under Section 12(b) of the Securities Exchange Act of 1934, as amended. The distribution, which effected a spin-off of the Company from PGSC, was made on April 17, 2015, to PGSC stockholders of record on April 14, 2015. On the distribution date, stockholders of PGSC received one share of Company common stock for every 20 shares of PGSC common stock held. Up to and including the distribution date, PGSC common stock traded on the “regular-way” market; that is, with an entitlement to shares of Company common stock distributed pursuant to the distribution. As a result of the distribution, the Company is now a publicly traded company independent from PGSC. On April 20, 2015, the Company’s shares of common stock commenced trading on the NYSE American LLC (formerly NYSE MKT) under the symbol “PZG”. An aggregate of 8,101,371 shares of Company common stock were distributed in the distribution. In connection with our separation from PGSC and PGSC’s merger with and into Coeur Mining, Inc. (“Coeur”), PGSC contributed approximately $8.45 million to us as an equity contribution, and we issued 417,420 shares of our common stock, par value $0.01 per share, to Coeur in exchange for a cash payment by Coeur in the amount of $1.47 million.

On March 14, 2016, Paramount Gold Nevada Corp. and Calico Resources Corp. (“Calico”) entered into an Arrangement Agreement providing for the acquisition of Calico by Paramount. On July 7, 2016, after having received the approval of the Supreme Court of British Columbia to the transaction, Paramount and Calico completed the transaction contemplated by the Arrangement Agreement, pursuant to which Calico became a wholly-owned subsidiary of Paramount.

On November 14, 2016, Calico Resources Corp. was merged into Calico Resources USA Corp. As a result, Calico Resources USA Corp. became a wholly owned subsidiary of Paramount.

OVERVIEW OF PARAMOUNT GOLD NEVADA CORP.

We are an emerging growth company engaged in the business of acquiring, exploring and developing precious metal projects in the United States of America. Paramount owns advanced stage exploration projects in the states of Nevada and Oregon. We enhance the value of our projects by implementing exploration and engineering programs that are likely to expand and upgrade known mineralized material to reserves. Paramount believes there are several ways to realize the value of its projects: selling its projects to producers; joint venturing its projects with other companies; or building and operating small mines on its own.

The Company’s principal Nevada interest, the Sleeper Gold Project, is located in Humboldt County, Nevada, and was a producing mine until 1996.

Our project located in Oregon, known as the Grassy Mountain Project (“Grassy Mountain”), is located in Malheur County, Oregon, and was acquired by way of statutory plan of arrangement in the Province of British Columbia, Canada with Calico in July 2016.

INTER-CORPORATE RELATIONSHIPS

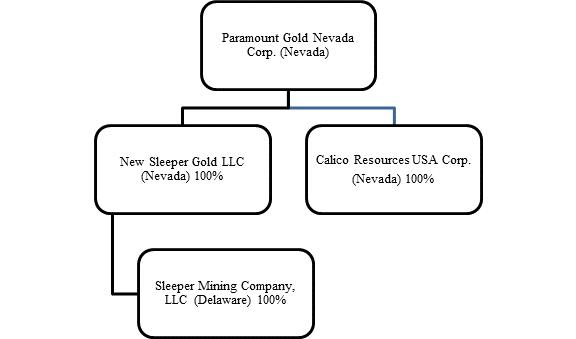

We currently have three active wholly owned direct subsidiaries:

New Sleeper Gold LLC and Sleeper Mining Company, LLC, which operate our mining interests in Nevada.

Calico Resources USA Corp., which holds our interest in the Grassy Mountain Project in Oregon.

4

The Company’s corporate structure is as follows:

COMPETITION

The mineral exploration industry is highly competitive. We compete with junior and senior mineral exploration companies, independent producers and institutional and individual investors who are actively seeking to acquire mineral exploration properties throughout the United States together with the equipment, labor and materials required to explore on those properties. Competition for the acquisition of mineral exploration interests is intense with many mineral exploration leases or concessions available through a competitive bidding process in which we may lack the technological information or expertise available to other bidders. Accordingly, these competitors may be able to spend greater amounts on acquiring mineral exploration interests of merit or on exploring or developing their mineral exploration properties. This advantage could enable our competitors to acquire mineral exploration properties of greater quality and interest to prospective investors who may choose to finance their exploration and development projects instead of the Company’s. Such competition could adversely impact our ability to attain the financing necessary for us to acquire further mineral exploration interests.

We do not compete with anyone with respect to our existing mineral claims because they are 100% controlled or owned by us. We believe we have or can acquire on reasonable terms the equipment, labor and materials necessary to explore our current properties. Because there is presently no known mineral reserve at this time on our existing properties, we have not determined the impact of any capital expenditures on our earnings or competitive position in the event a potentially commercially mineable ore deposit is discovered.

UNITED STATES REGULATIONS

Mining Claims: Exploration activities on our properties are conducted both upon federally-owned land and private land. Most federally-owned land is administered by the Bureau of Land Management (“BLM”). On existing claims owned by the federal government, we are required to pay annual claim maintenance fees of $165 per claim on or before September 1st at the State Office of the BLM. In addition, we are required to pay the county recorder of the county in which the claim is situated an annual fee. The county fees in Nevada and Oregon are $12.00 and $5.00 per claim, respectively. On certain claims, we are required to pay a fee for each 20 acres of an association placer. For any new claims we acquire by staking, we must file a certificate of location with the State Office of the BLM within 90 days of making the claim along with a fee equal to the amount of the annual claim maintenance fee.

5

Annual Payments made to federal and other state agencies to maintain claims:

|

Property |

|

Number of Claims |

|

Federal payments to Bureau of Land Management |

|

|

Payment to Local County |

|

|

Total Annual Payment to Maintain Claims |

|

|||

|

Sleeper Gold Project and Other Nevada Claims |

|

2,358 |

|

$ |

398,805 |

|

|

$ |

28,806 |

|

|

$ |

427,611 |

|

|

Grassy Mountain Project and Other Oregon Claims |

|

554 |

|

$ |

95,700 |

|

|

$ |

3,219 |

|

|

$ |

98,919 |

|

|

Total Annual Payment to Maintain Mining Claims |

|

|

|

|

|

|

|

|

|

|

|

$ |

526,530 |

|

Mining Exploration: BLM regulations require, and we have obtained, permits for surface disturbances to conduct our exploration activities. At our Sleeper Gold Project, there are also numerous permits in place that are maintained from the previous mine operations. We maintain these permits for ease in updating should a decision be made to reinitiate production at the Sleeper Gold mine. Maintenance of these permits includes monthly, quarterly and annual monitoring and reporting to various government agencies and departments.

Environmental and Reclamation: Our Sleeper Gold Project is currently operated as an advanced exploration project and is subject to various permit requirements. We are required to submit a plan of operation, obtain permitting and post bonds that guarantee that reclamation is performed on lands associated with exploration.

We are also responsible for managing the reclamation requirements from the previous mine operations and have a bond posted with the BLM to guarantee that reclamation is performed on the associated mine facilities and activities.

We expect that our annual obligations to satisfy reclamation requirements to be approximately $361,389 for the next five years. Annual outlays are reimbursed by the existing reclamation bond and reimbursements are expected to approximate the actual outlays. In August 2016, the Company’s mine closure plan was determined to be sufficient by the BLM.

EMPLOYEES

As of June 30, 2019, we employed seven full-time employees and two consultants.

FACILITIES

Our principal office is located at 665 Anderson Street, Winnemucca, Nevada, 89445.

Described below are certain risks that we believe apply to our business and the industry in which we operate. You should carefully consider each of the following risk factors in conjunction with other provided in this Annual Report on Form 10-K and in our other public disclosure. The risks described below highlight potential events, trends or other circumstances that could adversely affect our business, financial condition, results of operations, cash flows, liquidity or access to sources of financing, and consequently, the market value of our common stock. These risks could cause our future results to differ materially from historical results. The risks described below are those that we have identified as material and is not an exhaustive list of all the risks we face. There may be others that we have not identified or that we have deemed to be immaterial. All forward-looking statements made by us or on our behalf are qualified by the risks described below.

Risks Related to our Business Operations

It is possible investors may lose their entire investment in the Company.

Prospective investors should be aware that if we are not successful in our endeavors, your entire investment in the Company could become worthless. Even if we are successful in identifying mineral reserves that can be commercially developed, there can be no assurances that we will generate any revenues and therefore our losses will continue.

No revenue generated from operations.

We have not generated any revenues from operations. Our net loss for the fiscal year ended June 30, 2019 totaled $5,970,048. We have incurred losses in the past and we will likely continue to incur losses in the future. Even if our drilling programs identify gold, silver or other mineral reserves, there can be no assurance that we will be able to commercially exploit these resources, generate any revenues or generate sufficient revenues to operate profitably.

6

We will require significant additional capital to continue our exploration activities, and, if warranted, to develop mining operations.

None of our projects currently have proven or probable reserves. Substantial expenditures will be required to determine if proven and probable mineral reserves exist at any of our properties, to develop metallurgical processes to extract metal, to develop the mining and processing facilities and infrastructure at any of our properties or mine sites and, in certain circumstances, to acquire additional property rights. We have spent and will be required to continue to expend significant amounts of capital for drilling, geological and geochemical analysis, assaying, and, when warranted, feasibility studies with regard to the results of our exploration. We may not benefit from these investments if we are unable to identify commercially exploitable mineralized material. If we decide to put one or more of our properties into production, we will require significant amounts of capital to develop and construct the mining and processing facilities and infrastructure required for mining operations. Our ability to obtain necessary funding for these purposes, in turn, depends upon a number of factors, including the status of the national and worldwide economy and the price of gold, silver and other precious metals. We may not be successful in obtaining the required financing, or if we can obtain such financing, such financing may not be on terms that are favorable to us. Failure to obtain such additional financing could result in delay or indefinite postponement of further exploration or development and the possible, partial or total loss of our potential interest in certain properties. Any such delay could have a material adverse effect on our results of operations or financial condition.

We cannot be assured that any of our projects are economically feasible or that feasibility studies will accurately forecast operating results.

Our future profitability depends on the economic feasibility of our projects. We have not completed any feasibility studies for any of our projects. There can be no assurance that the results of a feasibility study for either the Grassy Mountain Project or the Sleeper Gold Project will be positive. Economic feasibility depends on many factors which include estimates on production rates, revenues, operating and capital costs. If we complete a feasibility study for any our projects and obtain financing to construct and initiate mining operations, there can be no assurance that actual operating results will not vary unfavorably from the estimates and assumptions included in the feasibility study.

We may acquire additional exploration stage properties, and we may face negative reactions if reserves are not located on acquired properties.

We may acquire additional exploration stage properties. There can be no assurance that we will be able to identify and complete the acquisition of such properties at reasonable prices or on favorable terms or that reserves will be identified on any properties that we acquire. We may also experience negative reactions from the financial markets if we are unable to successfully complete acquisitions of additional properties or if reserves are not located on acquired properties. These factors may adversely affect the trading price of our common stock or our financial condition or results of operations.

Our industry is highly competitive, attractive mineral lands are scarce, and we may not be able to obtain quality properties.

We compete with many companies in the mining industry, including large, established mining companies with substantial capabilities, personnel and financial resources. There is a limited supply of desirable mineral lands available for claim staking, lease or acquisition in the United States of America where we may conduct exploration activities. We may be at a competitive disadvantage in acquiring mineral properties because we compete with these individuals and companies, many of which have greater financial resources and larger technical staffs.

Title to mineral properties can be uncertain, and we are at risk of loss of ownership of one or more of our properties. Our ability to explore and operate our properties depends on the validity of our title to that property. A significant amount of our mineral properties consist of leases of unpatented mining claims. Unpatented mining claims provide only possessory title and their validity is often subject to contest by third parties or the federal government, which makes the validity of unpatented mining claims uncertain and generally more risky. These uncertainties relate to such things as the sufficiency of mineral discovery, proper posting and marking of boundaries, assessment work and possible conflicts with other claims not determinable from public record. Since a substantial portion of all mineral exploration, development and mining in the United States now occurs on unpatented mining claims, this uncertainty is inherent in the mining industry. We have not obtained title opinions covering our entire property, with the attendant risk that title to some claims, particularly title to undeveloped property, may be defective. There may be valid challenges to the title to our property which, if successful, could impair development and/or operations.

There are no confirmed commercially mineable ore deposits on any properties from which we may derive any financial benefit.

Neither we nor any independent geologist, has confirmed commercially mineable ore deposits on any of our properties. In order to carry out additional exploration programs of any potential ore body and to place it into commercial production, we will require substantial additional funding.

7

We have no mining operations and no history as a mining company.

We are an exploration stage mining company and have no ongoing mining operations of any kind. We have interests in mining claims which may or may not lead to production.

We have no history of earnings or cash flow from mining operations. If we are able to proceed to production, commercial viability will be affected by factors that are beyond our control such as the particular attributes of the deposit, the fluctuation in metal prices, the cost of constructing and the operation of a mine, prices and refining facilities, the availability of economic sources for energy, government regulations including regulations relating to prices, royalties, restrictions on production, quotas on exploration of minerals, as well as the costs of protection of the environment.

If our exploration costs are higher than anticipated, then our profitability will be adversely affected.

We are currently proceeding with plans to explore our mineral properties on the basis of estimated exploration costs. If our exploration costs are greater than anticipated, then we will have fewer capital resources for other expenses and losses could increase. Factors that could cause exploration costs to increase include adverse weather conditions, difficult terrain, increased government regulation and shortages of qualified personnel.

Assuming no adverse developments outside of the ordinary course of business, our exploration and development budget will be approximately $4.0 million for the next twelve months. Exploration will be funded by our available cash reserves and future issuances of common stock, warrants or units. Our exploration program may vary significantly from what we have budgeted depending upon the results we achieve. Even if we identify mineral reserves which have the potential to be commercially developed, we will not generate revenues until such time as we undertake mining operations. Mining operations will involve a significant capital infusion. Mining costs are speculative and dependent on a number of factors including mining depth, terrain and necessary equipment. We do not believe that we will have sufficient funds to implement mining operations without additional capital raises of debt and or equity or without a joint venture partner, of which there can be no assurance.

Our continuing reclamation obligations at our properties could require significant additional expenditures.

We are responsible for the reclamation obligations related to disturbances located on all of our properties, including the Sleeper Gold Project. We have posted a bond in the amount of the estimated reclamation obligation at the Sleeper Gold Project. Every three years, we are required to submit a mine closure plan to the BLM for the Sleeper Gold Project. Based on a review by the BLM of our mine closure plan that Paramount submitted in June 2016, the BLM determined that our existing bond was sufficient. There is a risk that any cash bond, even if increased based on the analysis and work performed to update the reclamation obligations, could be inadequate to cover the actual costs of reclamation when carried out. The satisfaction of bonding requirements and continuing reclamation obligations will require a significant amount of capital. There is a risk that we will be unable to fund these additional bonding requirements, and further, that the regulatory authorities may increase reclamation and bonding requirements to such a degree that it would not be commercially reasonable to continue exploration activities, which may adversely affect our results of operations, financial performance and cash flows.

Mining operations are hazardous, raise environmental concerns and raise insurance risks.

The development and operation of a mine or mineral property involves many risks, which even a combination of experience, knowledge and careful evaluation may not be able to overcome. These risks include, among other things, ground fall, flooding, environmental hazards and the discharge of toxic chemicals, explosions and other accidents. Such occurrences may result in work stoppages, delays in production, increased production costs, damage to or destruction of mines and other producing facilities, injury or loss of life, damage to property, environmental damage and possible legal liability for such damages as well. Although the Company maintains liability coverage in an amount which it considers adequate for its operations, such occurrences, against which the Company may not be able, or may elect not to insure, may result in a material adverse change in the Company’s financial position. The nature of these risks is such that liabilities may exceed policy limits, in which event the Company would incur substantial uninsured losses.

There may be insufficient mineral reserves to develop any of our properties, and our estimates may be inaccurate.

There is no certainty that any expenditures made in the exploration of any properties will result in discoveries of commercially recoverable quantities of ore. Most exploration projects do not result in the discovery of commercially mineable deposits of ore and no assurance can be given that any particular level of recovery of precious metals from discovered mineralization will in fact be realized or that any identified mineral deposit will ever qualify as a commercially mineable ore body which can be legally and economically exploited. Estimates of reserves, mineral deposits and production costs can also be affected by such factors as environmental regulations and requirements, weather, environmental factors, unforeseen technical difficulties, unusual or unexpected geological formations and work interruptions. In addition, the grade of ore ultimately mined may differ from that indicated by drilling results.

8

Short term factors relating to reserves, such as the need for orderly development of ore bodies or the processing of new or different grades, may also have an adverse effect on mining operations and on the results of operations. There can be no assurance that precious metals recovered in small scale laboratory tests will be duplicated in large scale tests under on-site production conditions. Material changes in estimated reserves, grades, stripping ratios or recovery rates may affect the economic viability of any project.

We have no proven reserves.

All of our properties are in the exploration stages only and are without known bodies of commercial ore. Development of these properties will follow only upon obtaining satisfactory exploration results. The long-term profitability of the Company’s operations will be in part directly related to the cost and success of its exploration and development programs. Mineral exploration and development are highly speculative businesses, involving a high degree of risk. Few properties which are explored are ultimately developed into producing mines. There is no assurance that our mineral exploration and development activities will result in any discoveries of commercial quantities of ore. There is also no assurance that, even if commercial quantities of ore are discovered, a mineral property will be brought into commercial production. Discovery of mineral deposits is dependent upon a number of factors, not the least of which is the technical skill of the exploration personnel involved. The commercial viability of a mineral deposit once discovered is also dependent upon a number of factors, many of which are beyond the Company’s control, such as the particular attributes of the deposit (such as size, grade and proximity to infrastructure), metal prices and government regulations, including regulations relating to royalties, allowable production, importing and exporting of minerals, and environmental protection.

In the course of exploration, development, and mining of mineral properties, certain unanticipated conditions may arise or unexpected or unusual events may occur, including rock bursts, cave-ins, fires, floods, or earthquakes. It is not always possible to fully insure against such risks and we may decide not to take out insurance against such risks as a result of high premiums or for other reasons. Should such liabilities arise, they may reduce or eliminate any future profitability and may result in a decline in the value of the securities of the Company.

We face fluctuating gold and mineral prices.

The value of any mineral reserves we develop, and consequently the value of our common stock, depends significantly on the value of such minerals. The price of gold and silver as well as other precious and base metals have experienced volatile and significant price movements over short periods of time and are affected by numerous factors beyond our control, including international economic and political trends, expectations of inflation, interest rates, global or regional consumption patterns, speculative activities and increases in production due to improved mining and production methods. The supply of and demand for gold and silver, as well as other precious and base metals, are affected by various factors, including political events, economic conditions and production costs in major mineral producing regions.

Our estimates of mineralized material and other mineral resources are subject to uncertainty.

Estimates of mineralized material and other mineral resources are subject to considerable uncertainty. Such estimates are arrived at using standard acceptable geological techniques, and are based on the interpretations of geological data obtained from drill holes and other sampling techniques. Engineers use feasibility studies to derive estimates of cash operating costs based on anticipated tonnage and grades of ore to be mined and processed, the predicted configuration of the ore bodies, expected recovery rates of metal from ore, comparable facility and operating costs and other factors. Actual cash operating costs and economic returns on projects may differ significantly from the original estimates, primarily due to fluctuations in the current prices of metal commodities extracted from the deposits, changes in fuel costs, labor rates, changes in permit requirements, and unforeseen variations in the characteristics of the ore body. Due to the presence of these factors, there is no assurance that any geological reports will accurately reflect actual quantities of gold, silver or other metals that can be economically processed and mined by us.

If we are unable to obtain all of our required governmental permits, our operations could be negatively impacted.

Our future operations, including exploration and development activities, required permits from various governmental authorities. Such operations are and will be governed by laws and regulations governing prospecting, development, mining, production, exports, taxes, labor standards, occupational health, waste disposal, toxic substances, land use, environmental protection, mine safety and other matters. There can be no assurance that we will be able to acquire all required licenses or permits or to maintain continued operations at our properties.

9

We are subject to numerous environmental and other regulatory requirements.

All phases of mining and exploration operations are subject to governmental regulation including environmental regulation. Environmental legislation is becoming stricter, with increased fines and penalties for non-compliance, more stringent environmental assessments of proposed projects and heightened responsibility for companies and their officers, directors and employees. There can be no assurance that possible future changes in environmental regulation will not adversely affect our operations. As well, environmental hazards may exist on a property in which we hold an interest that was caused by previous or existing owners or operators of the properties and of which the Company is not aware at present.

Government approvals and permits are required to be maintained in connection with our mining and exploration activities. Although we believe we currently have all required permits for our operations as currently conducted, there is no assurance that delays will not occur in connection with obtaining all necessary renewals of such permits for the existing operations or additional permits for any possible future changes to the Company’s operations, including any proposed capital improvement programs. Failure to comply with applicable laws, regulations and permitting requirements may result in enforcement actions thereunder, including orders issued by regulatory or judicial authorities causing operations to cease or be curtailed, and may include corrective measures requiring capital expenditures, installation of additional equipment, or remedial actions. Parties engaged in mining operations may be required to compensate those suffering loss or damage by reason of the mining activities and may be liable for civil or criminal fines or penalties imposed for violations of applicable laws or regulations. Amendments to current laws, regulations and permitting requirements, or more stringent application of existing laws, may have a material adverse impact on the Company resulting in increased capital expenditures or production costs, reduced levels of production at producing properties or abandonment or delays in development of properties.

There is no assurance that there will not be title or boundary disputes.

Although we have investigated the right to explore and exploit our properties and obtained records from government offices with respect to all of the mineral claims comprising our properties, this should not be construed as a guarantee of title. Other parties may dispute the title to any of our properties or any property may be subject to prior unregistered agreements and transfers or land claims by aboriginal, native, or indigenous peoples. The title may be affected by undetected encumbrances or defects or governmental actions.

Local infrastructure may impact our exploration activities and results of operations.

Mining, processing, development and exploration activities depend, to one degree or another, on adequate infrastructure. Reliable roads, bridges, power and water supplies are important determinants that affect capital and operating costs. Unusual or infrequent weather phenomena, sabotage or government or other interference in the maintenance or provision of such infrastructure could adversely affect our activities and profitability.

Because of the speculative nature of exploration for gold and silver properties, there is substantial risk that our business will fail.

The search for precious metals as a business is extremely risky. We cannot provide any assurances that the gold or silver mining interests that we acquired will contain commercially exploitable reserves of gold or silver. Exploration for minerals is a speculative venture necessarily involving substantial risk. Any expenditure that we make may not result in the discovery of commercially exploitable reserves of precious metals.

10

The precious metals markets are volatile markets. This will have a direct impact on our revenues (if any) and profits (if any) and could have an adverse effect on our ongoing operations.

The price of both gold and silver has fluctuated significantly over the past few years. Despite the volatility in the price of gold, there continues to be interest in gold and silver mining and companies engaged in that business, including the exploration for both gold and silver. However, in the event that the price of these metals falls, the interest in the gold and silver mining industry may decline and the value of our business could be adversely affected. Even if we are able to generate revenues, there can be no assurance that any of our operations will prove to be profitable. Finally, in recent decades, there have been periods of both overproduction and underproduction of both gold and silver resources. Such conditions have resulted in periods of excess supply of and reduced demand on a worldwide basis and on a domestic basis. These periods have been followed by periods of short supply of and increased demand for both gold and silver. We cannot predict what the market for gold or silver will be in the future.

Government regulation or changes in such regulation may adversely affect our business.

We have and will in the future engage experts to assist us with respect to our operations. We deal with various regulatory and governmental agencies and the rules and regulations of such agencies. No assurances can be given that we will be successful in our efforts or dealings with these agencies. Further, in order for us to operate and grow our business, we need to continually conform to the laws, rules and regulations of the jurisdictions in which we operate. It is possible that the legal and regulatory environment pertaining to the exploration and development of precious metals mining properties will change. Uncertainty and new regulations and rules could increase our cost of doing business or prevent us from conducting our business.

We are in competition with companies that are larger, more established and better capitalized than we are.

Many of our potential competitors have greater financial and technical resources, as well as longer operating histories and greater experience in mining.

Exploration for economic deposits of minerals is speculative.

The business of mineral exploration is very speculative, since there is generally no way to recover any of the funds expended on exploration unless the existence of mineable reserves can be established. We can exploit those reserves by either commencing mining operations, selling or leasing our interest in the property or entering into a joint venture with a larger resource company that can further develop the property to the production stage. Unless we can establish and exploit reserves before our funds are exhausted, we will have to discontinue operations, which could make our stock valueless.

The loss of key members of our senior management team could adversely affect the execution of our business strategy and our financial results.

We believe that the successful execution of our business strategy and our ability to move beyond the exploratory stages depends on the continued employment of key members of our senior management team. If any members of our senior management team become unable or unwilling to continue in their present positions, our financial results and our business could be materially adversely affected.

We operate in a regulated industry and changes in regulations or violations of regulations may result in increased costs or sanctions that could reduce our revenues.

Our organization is subject to extensive and complex federal and state laws and regulations. If we fail to comply with the laws and regulations that are directly applicable to our business, we could suffer civil and/or criminal penalties or be subject to injunctions or cease and desist orders. While we believe that we are currently compliant with applicable rules and regulations, if there are changes in the future, there can be no assurance that we will be able to comply in the future, or that future compliance will not significantly adversely impact our operations.

We rely on independent analysis to analyze our drilling results and planned exploration activities.

We rely on independent geologists to analyze our drilling results and to prepare resource reports on several of our mining claims. While these geologists rely on standards established by the Canadian Institute of Mining, Metallurgy and Petroleum, Standards on Mineral Resources and Mineral Reserves and other standards established by various licensing bodies, there can be no assurance that their estimates or results will be accurate. Analyzing drilling results and estimating reserves or targeted drilling sites is not a certainty. Miscalculations and unanticipated drilling results may cause the geologists to alter their estimates. If this should happen, we would have devoted resources to areas where resources could have been better allocated.

11

We are an “emerging growth company”, and we cannot be certain if the reduced disclosure requirements applicable to emerging growth companies will make our common stock less attractive to investors.

As an “emerging growth company,” as defined in the Jumpstart Our Business Startups Act (“JOBS Act”), we intend to take advantage of certain exemptions from various reporting requirements that are applicable to other public companies that are not “emerging growth companies” including not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act, and reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements. Further, Section 102(b)(1) of the JOBS Act exempts emerging growth companies from being required to comply with new or revised financial accounting standards until private companies (that is, those that have not had a Securities Act registration statement declared effective or do not have a class of securities registered under the Exchange Act) are required to comply with the new or revised financial accounting standards. The JOBS Act provides that a company can elect to opt out of the extended transition period and comply with the requirements that apply to non-emerging growth companies but any such election to opt out is irrevocable. We have elected not to opt out of such extended transition period, which means that when a standard is issued or revised and it has different application dates for public or private companies, we, as an emerging growth company, can adopt the new or revised standard at the time private companies adopt the new or revised standard. This may make our financial statements not comparable with those of another public company which is neither an emerging growth company nor an emerging growth company which has opted out of using the extended transition period because of the potential differences in accounting standards used.

We cannot predict if investors will find our common stock less attractive if we rely on these exemptions. If some investors find our common stock less attractive as a result, there may be a less active trading market for our common stock and our stock price may be more volatile.

If we fail to maintain an effective system of internal controls, we may not be able to accurately report our financial results or prevent fraud. As a result, current and potential stockholders could lose confidence in our financial reporting, which would harm our business and the trading price of our common stock.

Effective internal controls are necessary for us to provide reliable financial reports, prevent fraud and operate successfully as a public company. If we cannot provide reliable financial reports or prevent fraud, our reputation and operating results would be harmed. We cannot be certain that our efforts to develop and maintain our internal controls will be successful, that we will be able to maintain adequate controls over our financial processes and reporting in the future or that we will be able to comply with our obligations under Section 404 of the Sarbanes-Oxley Act of 2002. Any failure to develop or maintain effective internal controls, or difficulties encountered in implementing or improving our internal controls, could harm our operating results or cause us to fail to meet our reporting obligations. Ineffective internal controls could also cause investors to lose confidence in our reported financial information, which would likely have a negative effect on the trading price of our common stock.

The JOBS Act allows us to delay the adoption of new or revised accounting standards that have different effective dates for public and private companies.

We have elected to use the extended transition period for complying with new or revised accounting standards under Section 102(b)(1) of the JOBS Act. This election allows us to delay the adoption of new or revised accounting standards that have different effective dates for public and private companies until those standards apply to private companies. As a result of this election, our financial statements may not be comparable to companies that comply with public company effective dates.

Risks Related to Our Common Stock

Our stock price may be volatile.

The market price of our common stock has been volatile. We believe investors should expect continued volatility in our stock price. Such volatility may make it difficult or impossible for you to obtain a favorable selling price for our shares.

We do not intend to pay dividends for the foreseeable future.

We have never declared or paid any dividends on our common stock. We intend to retain all of our earnings, if any, for the foreseeable future to finance the operation and expansion of our business, and we do not anticipate paying any cash dividends in the future. As a result, you may only receive a return on your investment in our common stock if the market price of our common stock increases. Our board of directors retains discretion to change this policy.

12

The exercise of our outstanding options and warrants may depress our stock price.

The exercise of outstanding options and warrants, and the subsequent sale of the underlying common stock in the public market, or the perception that future sales of these shares could occur, could have the effect of lowering the market price of our common stock below current levels and make it more difficult for us and our stockholders to sell our equity securities in the future.

Sales or the availability for sale of shares of common stock by stockholders could cause the market price of our common stock to decline and could impair our ability to raise capital through an offering of additional equity securities.

Item 1B. Unresolved Staff Comments.

Not applicable as a smaller reporting company.

SLEEPER GOLD PROJECT

Overview and Location

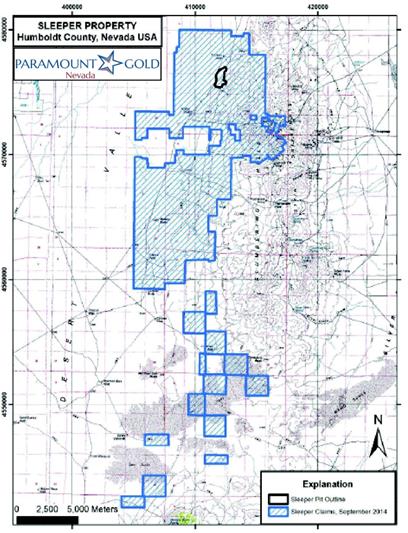

Sleeper is a material exploration property of the Company. The Company has the rights to explore, develop and mine the property through our 100% ownership of unpatented lode mining claims. Sleeper is located 26 miles northwest of Winnemucca, Nevada. Automobile and truck access to the property is by Interstate Highway 80 to Winnemucca, north on Highway 95 for 32 miles, west on Highway 140 for 14 miles, and then south for 6 miles on the maintained gravel Sod House Road to the project site. An office building, heavy equipment enclosure and warehousing facility are present on the Sleeper Gold Property. Necessary supplies, equipment and services to carry out full sequence exploration and mining development projects are available in Winnemucca, Reno, and Elko, Nevada.

Mining Claims

The Sleeper Gold mine and its 1,044 unpatented lode mining claims were acquired by PGSC through its acquisition of X-Cal Resources Ltd. in August 2010. Additional mining claims have been staked or acquired which now comprise the Sleeper Gold Project.

The 100% owned mining claims are summarized in the following table:

|

The Sleeper Gold Project Properties |

|

Claims |

|

|

Approx sq. miles |

|

||

|

Sleeper Gold Mine |

|

|

1,044 |

|

|

|

34 |

|

|

Dunes |

|

|

394 |

|

|

|

13 |

|

|

Mimi |

|

|

884 |

|

|

|

29 |

|

|

Total |

|

|

2,322 |

|

|

|

76 |

|

13

The following map illustrates the general location of the Sleeper Gold Project and the associated mining claims:

Property Agreements and Royalty Obligations:

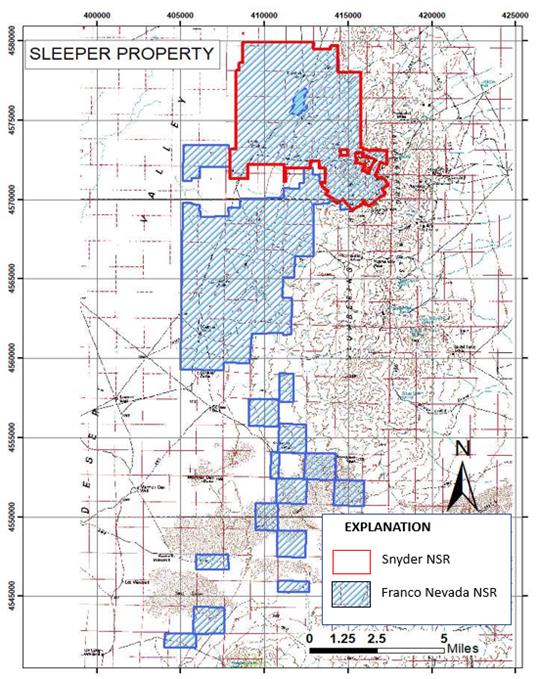

The Snyder Syndicate, a private company, holds a 1% net smelter returns royalty on the 1,044 Sleeper Gold mine claims in a mining scenario.

Franco-Nevada U.S. Corporation (“Franco”), holds a two percent (2%) net smelter return royalty on minerals produced from the 2,322 mining claims at the Sleeper Gold Project.

14

The following map illustrates the claims subject to the royalty:

History of Previous Operations

The Sleeper Gold Project includes a historic open pit mine (the “Sleeper Gold mine”) operated by AMAX Gold Inc. (“Amax”) from 1986 until 1996, which produced 1.66 million ounces of gold and 2.3 million ounces of silver. All processing facilities and equipment related to the mining operations conducted by Amax have been removed from the site.

15

Power and Water

As a result of Amax’s mine operation from 1986 to 1996, electrical power is provided to the property by power lines. Water is available by two deep wells located on the property.

Paramount’s Exploration History at Sleeper Gold Project

PGSC conducted its first exploration program at the Sleeper Gold mine in October 2010. It consisted of 19 drill holes totaling 18,065 feet and focused on verifying data on existing models and confirming continuity and strike extension of known mineralized zones. From July 1, 2011 through June 30, 2012, PGSC completed 79 drill holes totaling 21,013 feet and followed that up in the period from July 1, 2012, through June 30, 2013, with 38 drill holes totaling 55,104 feet.

In August 2011, PGSC announced the acquisition of 606 unpatented lode mining claims (the “Dunes Project”) located eleven miles south of the Sleeper Gold mine from ICN Resources Ltd. (“ICN”). In consideration, PGSC issued 400,000 shares of its common stock to ICN.

In September 2011, PGSC announced the results of a new material estimate on the Sleeper Gold mine prepared by SRK Consulting (“SRK”). Such estimate was conducted in accordance with the Canadian standards set forth in National Instrument 43-101. Based on the results of the report, the Company commissioned Scott E. Wilson Consulting Inc. (“SEWC”) to prepare a Preliminary Economic Assessment (“PEA”) for the project. The PEA is designed to evaluate both the technical and financial aspects of various production scenarios using the material estimate developed by SRK.

In July 2012, PGSC announced the staking of 920 new lode mining claims (the “Mimi Project”) adjacent to the west and immediately south, of the Sleeper Gold mine. The Mimi Project totals 18,400 acres.

In July 2012, PGSC announced the results of the PEA completed by SEWC on the Sleeper Gold mine property. SEWC concluded that the most attractive development scenario consists of a large-scale open pit mining operation with a heap leach processing plant handling both oxide and sulfide material, producing a gold-silver dore. The PEA assumes an 81,000 ton per day operation resulting in a projected 17-year operation with an average annual production of 172,000 ounces of gold and 263,000 ounces of silver. Paramount received the completed PEA report in September 2012.

In 2013, PGSC announced several results of a drilling campaign which was focused in and around the existing resource and pit areas. Assay results extended the mineralization east and south of the existing resource, opened up new depth potential below the existing sleeper pit and intercepted exceptional results in several zones. Additionally, PGSC undertook an extensive database review and as a result, a total of 473 core and RC holes have been re-logged and new cross-sections were generated. Paramount completed a re-interpreted lithological and structural model which will allow us to plan a new drill program and to update our mineralized material estimate model.

In August 2014, PGSC dropped a total of 212 mining claims from the Dunes and Mimi areas of the Sleeper Gold Project. These claims no longer had any geological value to the Company.

In May 2015, Paramount announced the results of its updated mineralized material estimate for its Sleeper Gold Project. The estimate incorporated all new drilling since the last mineralized material estimate that was completed in September 2011. Both estimations were completed by SRK.

In August 2015, we completed an initial geophysical survey which consisted of a helicopter magnetometry study. The survey defined several possible exploration targets which are being reviewed by our geological team. Additional surveys on areas covered by overburden will be evaluated for further testing. This testing can include Induced Polarization programs or other indirect methodologies. The Company believes that the resulting data derived from the geophysical program will produce valuable drilling targets. Future drill programs will be designed with the aim identifying new zones of mineralization with an emphasis on areas covered with overburden.

In October 2015, we released the results of a new PEA for our Sleeper Gold Project in Nevada. The PEA was completed by Metal Mining Consultants Inc. (“MMC”) of Denver, Colorado. MMC concluded that the optimal mining scenario is a 30,000 tonnes per day heap leach process facility fed by an open pit.

This mining scenario results in an average annual production of 102,000 ounces of gold and 105,000 ounces of silver for seven years with additional metal recovered over the following two years during final leaching of 37,850 ounces of gold and 30,500 ounces of silver. The life of mine average cash operating are estimated to be $529 per equivalent gold ounce produced and the total life of mine capital requirements are estimated to be $258.8 Million.

16

This PEA is preliminary in nature and should not be considered to be a pre-feasibility or feasibility study, as the economics and technical viability of the Sleeper Gold Project have not been demonstrated at this time. Therefore, there can be no certainty that the estimates contained in the PEA will be realized.

Geology and Mineralization

The Sleeper Gold Project is situated within the western, apparently older, part of the Northern Nevada Rift geologic province of Miocene age, along the western flank of the Slumbering Hills within Desert Valley. The geological structures that underlie Desert Valley appear to have been down-dropped 3,000 to 3,300 feet along the north-to northeast-trending normal faults along the western edge of the Slumbering Hills.

Four main types of gold mineralization are found within the Sleeper Gold Project deposit and may represent a continuum as the system evolved from a high level, high sulfidation system dominated by intrusion related fluids and volatiles to a low sulfidation meteoric water dominant system. In this setting the paragenetic relationships of the differing mineralization styles are as follows:

|

|

• |

Early – quartz-pyrite-marcasite stockwork; |

|

|

• |

Intermediate – medium-grade, silica-pyrite-marcasite cemented breccias localized on zones of structural weakness; |

|

|

• |

Late – high-grade, banded, quartz-adularia-electrum-(sericite) veins; and |

|

|

• |

Post – alluvial gold-silver deposits in Pliocene gravels. |

Grassy Mountain Gold Project

Overview and Location

The Grassy Mountain Project is located in Malheur County, Oregon, approximately 22 miles south of Vale, Oregon, and roughly 70 miles west of Boise, Idaho. The property is accessed by vehicle from the town of Vale by a private and BLM maintained dirt road. The project site is situated in the rolling hills of the high desert region of the far western Snake River Plain and consists of 442 unpatented lode claims and 3 patented lode claims all totaling roughly 9,300 acres. The local terrain is gentle to moderate, with elevations ranging from 3300 to 4,300 feet above mean sea level.

17

Power and Water

To effect mining operations power and water source infrastructure would need to be developed as it does not currently exist.

Property Agreements and Royalty Obligations

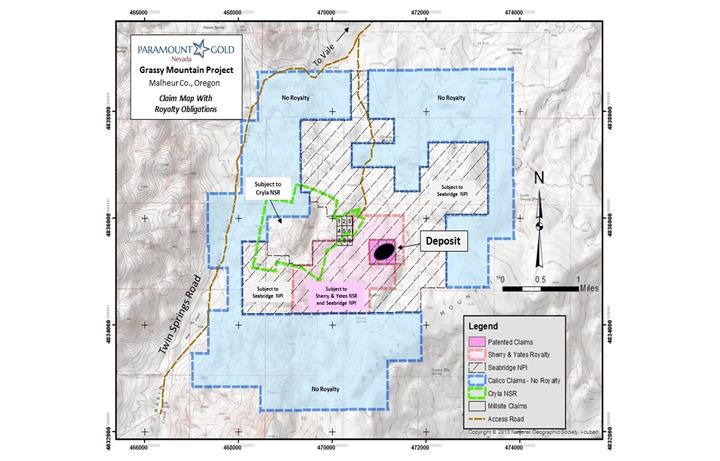

The following map illustrates the mining claims subject to royalty payments at the Grassy Mountain Project:

Sherry and Yates Inc.

Prior to 2018, Calico had an annual lease agreement in place with Sherry & Yates Inc. Under the agreement Calico was required to make annual advance royalty payments at a rate of $100,000 per year. In a mining production scenario, the agreement provided for a production royalty payments based on the price of gold. In February 2018, Paramount exercised its option to reduce the existing Net Smelter Royalty from 6% down to 1.5% and acquired all the rights to the unpatented and patented mining claims subject to the agreement at the Grassy Mountain Project for a total payment of $2.4 million.

Seabridge Gold

Seabridge Gold Inc. (“Seabridge”), a NYSE listed company, holds a net profits interest (“NPI”) in a mining scenario at Grassy Mountain. The NPI is calculated at a rate of 10% on net profits on certain mining claims. Seabridge also holds an NPI put option in which during the 30 day period immediately following the day that Calico had delivered notice to Seabridge that a positive production decision has been made and construction financing has been secured with respect to the Grassy Mountain Project, Seabridge may cause Calico to purchase the NPI for CDN$10,000,000. If Seabridge exercises the right to cause Calico to purchase the NPI, the Company would likely need to seek additional equity or other financing to fund the purchase, which financing may not be available to the Company on favorable terms or at all.

18

Bishop Lease

An annual lease agreement for unpatented mining claims is currently in place between Calico and the Bishop Brothers. Calico is required to make annual advance royalty payments at a rate of $33,000 per year. In a mining scenario, the agreement provides for a production royalty payment base on the price of gold of 6%.

Exploration History at Grassy Mountain

The Atlas Era

In 1986 Atlas Precious Metals (“Atlas”) acquired the Grassy Mountain property from two independent geologists, Dick Sherry and Skip Yates.

Atlas recognized soil geochemistry as an important tool for locating buried hydrothermal cells at Grassy Mountain. Most of the Atlas exploration targets were identified by claim-corner (600’ X 1500’ grid) soil sampling anomalies. Atlas conducted detailed soil and float sampling on several anomalies and identified a genetic link between gold mineralization and silicification. Between 1986 and 1991, Atlas completed 403 drill holes totalling 221,500 feet on the Grassy Mountain property. Out of the total, 193 were vertically oriented RC holes on 75 to 100 feet centers within the Grassy Mountain resource area. The remaining drill holes were located on prospects away from the main Grassy Mountain resource area. Many of these represent future exploration targets.

Atlas expanded the original claim block and collected additional geologic, mine engineering, civil engineering, and environmental baseline data to support a feasibility study, which was completed in 1990.

Declining gold prices and the perception of an unfavorable permitting environment at that time discouraged Atlas from developing the project, and the property was optioned to Newmont Exploration Ltd (“Newmont”) in 1992.

The Newmont Era

Newmont leased the Grassy Mountain property from Atlas in September 1992 for $30 million. In 1993, Newmont geologists mapped 40 square miles at a scale of 1:6000 and collected approximately 2,600 soil samples on a 400-feet by 200-feet grid to identify anomalies missed by the coarser Atlas grid. During 1993 and 1994, Newmont collected more than 400 rock chip samples and conducted several geophysical programs. A ground-based gravity survey was carried out along roadways and airborne magnetic and radiometric surveys were flown over the entire property. Ground based gradient array and ground magnetic surveys were conducted over primary target areas.

Newmont initiated an eleven-hole (11,472 feet) inclined diamond core drilling program designed to intersect and define the geometry of potential high-grade gold zones. Additionally, Newmont drilled one wedge hole off of their initial core drill hole. Three additional holes (2,912 feet) were drilled as RC pilot holes with core tails.

In late 1994, Newmont drilled 15 holes totalling approximately 15,000 feet and completed a mineral resource estimate that became the basis for an economic and mining method evaluation that was completed in 1995. Newmont determined that the project did not meet corporate objectives and returned the property to Atlas in September 1996.

The Tombstone Era

In January 1998, Atlas granted Tombstone Exploration Company Ltd (“Tombstone”) the option to purchase 100% of the property. Tombstone executed the option agreement and conducted an exploration program which included eight reverse circulation and two core holes totalling roughly 8,072 feet.

Prior to finalizing their agreement with Atlas, Tombstone completed an extensive review of previous work at the property and commissioned an economic study of alternative development scenarios. Relying heavily on Newmont’s gradient array surveys to define the drill targets. Lack of capital resources forced Tombstone to return the property to Atlas in May 1998.

The Seabridge/Calico Era

In February 2000, Seabridge entered an option agreement with Atlas to acquire a 100% interest in the Grassy Mountain property. Seabridge completed its acquisition of the Grassy Mountain Project in April 2003, and in April 2011, signed an option agreement granting Calico the sole and exclusive right and option to earn a 100% interest in the project.

19

During the 2011 exploration program, Calico mapped and sampled the Grassy Mountain deposit and completed three core and nine reverse circulation drill holes in the primary zone of mineralization on the property. Calico’s exploration strategy was to target areas where resource expansion was most probable. Historical data was thoroughly reviewed prior to drilling, and fresh sets of cross-sections and long-sections were constructed based on existing information. New interpretations of the orientation of mineralization and geology were plotted on the new sections. The new sections were then used to select areas where in-fill drilling was needed and areas where gold mineralization was open-ended and resource expansion probable. A detailed geologic model was produced based on the results of the 2011 exploration work, and subsequent supporting geophysical surveys were completed in March, 2012. On February 5, 2013, Calico exercised its option to acquire a 100% interest in the Grassy Mountain Project from Seabridge.

A mineralized material estimate was prepared by Hardrock Consulting Inc. in November, 2014. An independent preliminary economic assessment (“PEA”) was prepared in February, 2015 by MMC, which verified the mineralized material estimate and included all drill data obtained as of September 26, 2014. The PEA concluded that potential exists for the discovery of additional mineralized material at exploration target areas identified within the Grassy Mountain claim block and the current mineralized material at Grassy Mountain is sufficient to warrant continued planning and effort to explore, permit, and develop the Grassy Mountain Project. There is sufficient data to support a basic geologic model and continuing development of the project and the detailed geologic model described in the PEA, along with the results of the exploration, drilling, and geophysical surveys completed as of October 2014, are sufficient to support preparation of a Preliminary Feasibility Study.

There is no certainty that the scenarios or estimated economics in the PEA will be realized.

Paramount Era

In November, 2016, Paramount received approval from the Oregon Department of Geology and Mineral Industries (“DOGAMI”) under Division 37 guidelines to commence its 30 hole drill program at its 100%-owned Grassy Mountain Gold Project in Eastern Oregon. The drill program is a key component of its NI 43-101 Pre-Feasibility Study (“PFS”) that the Company began in August. Drilling was commenced in late November and was completed in the Company’s fourth quarter.

In May 2018, we released the results of a new PFS for our Grassy Mountain Project in Oregon. The PFS was completed by Mine Development Associates (“MDA”) of Reno Nevada. MDA concluded the extraction of the estimated mineralized material will be accessed via a proposed underground mine that will be accessed via one decline and a system of internal ramps. The mine design is based on a production rate of 1,300 to 1,400 tons per day over four days per week, with two shifts per day, and will provide sufficient material to feed the 750 tons per day to the mill on a seven day per week basis.

The mineralization is considered to be amenable to a combination of gravity concentration and cyanide leaching. The recovery plan will be a conventional CIL type and will produce gold doré bars to be sold to gold refiners.

This mining scenario results in an average annual production of 47,000 ounces of gold and 50,000 ounces of silver for seven years. The metal prices used for the economic analysis includes $1,300 per ounce of gold sold and $16.75 per ounce of silver sold. The life of mine average cash operating are estimated to be $528 per gold ounce including silver revenues as credit produced and the total life of mine capital requirements are estimated to be $110 Million.

This PFS should not be considered to be a feasibility study, as the economics and technical viability of the Grassy Mountain Project have not been demonstrated at this time. Therefore, there can be no certainty that the estimates contained in the PFS will be realized.

Geology and Mineralization