-8UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

(Mark One)

For the fiscal year ended

OR

FOR THE TRANSITION PERIOD FROM TO

Commission File Number

(Exact name of Registrant as specified in its Charter)

(State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer |

|

|

(Address of principal executive offices) |

(Zip Code) |

Registrant’s telephone number, including area code: (

Securities registered pursuant to Section 12(b) of the Act:

Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

|

|

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. YES

Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. YES

Indicate by check mark whether the Registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. NO

Indicate by check mark whether the Registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the Registrant was required to submit such files). NO

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definition of “large accelerated filer”, “accelerated filer”, “smaller reporting company” and emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer |

|

|

|

Accelerated filer |

|

|

|

|

|

|

|||

|

|

|

Small reporting company |

|

||

|

|

|

|

|

|

|

|

|

|

|

Emerging growth company |

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report.

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements.

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). YES NO

The aggregate market value of the voting and non-voting common equity held by non-affiliates of the Registrant, based on the closing price of the shares of common stock on the NYSE American LLC on December 31, 2022, was $

The number of shares of Registrant’s Common Stock outstanding as of September 21, 2023 was

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Registrant’s Definitive Proxy Statement relating to the Annual Meeting of Shareholders (the “2023 Proxy Statement”) are incorporated by reference into Part III of this Report where indicated. The 2023 Proxy Statement will be filed with the U.S. Securities Exchange Commission within 120 days after the end of the fiscal year to which this report relates.

Table of Contents

|

|

|

|

Page |

PART I |

|

|

|

|

Item 1. |

|

|

5 |

|

Item 1A. |

|

|

8 |

|

Item 1B. |

|

|

14 |

|

Item 2. |

|

|

14 |

|

Item 3. |

|

|

31 |

|

Item 4. |

|

|

31 |

|

|

|

|

|

|

PART II |

|

|

|

|

Item 5. |

|

|

32 |

|

Item 6. |

|

|

33 |

|

Item 7. |

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

|

33 |

Item 7A. |

|

|

37 |

|

Item 8. |

|

|

37 |

|

Item 9. |

|

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure |

|

38 |

Item 9A. |

|

|

38 |

|

Item 9B. |

|

|

38 |

|

Item 9C |

|

Disclosure Regarding Foreign Jurisdictions that Prevent Inspections |

|

38 |

|

|

|

|

|

PART III |

|

|

|

|

Item 10. |

|

|

39 |

|

Item 11. |

|

|

39 |

|

Item 12. |

|

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

|

39 |

Item 13. |

|

Certain Relationships and Related Transactions, and Director Independence |

|

39 |

Item 14. |

|

|

39 |

|

|

|

|

|

|

PART IV |

|

|

|

|

Item 15. |

|

|

40 |

i

Cautionary Note Regarding Forward-Looking Statements

This Form 10-K contains “forward-looking statements” within the meaning of applicable securities laws relating to Paramount Gold Nevada Corp. (“Paramount”, “we”, “us”, “our”, or the “Company”) which represent our current expectations or beliefs including, but not limited to, statements concerning our operations, performance, and financial condition. These statements by their nature involve substantial risks and uncertainties, credit losses, dependence on management and key personnel, variability of quarterly results, and our ability to continue growth. Statements in this annual report regarding planned drilling activities and any other statements about Paramount’s future expectations, beliefs, goals, plans or prospects constitute forward-looking statements. You should also see our risk factors beginning on page 8. For this purpose, any statements contained in this Form 10-K that are not statements of historical fact are forward-looking statements. Without limiting the generality of the foregoing, words such as “may”, “anticipate”, “intend”, “could”, “estimate”, or “continue” or the negative or other comparable terminology are intended to identify forward-looking statements. Other matters such as our growth strategy and competition are beyond our control. Should one or more of these risks or uncertainties materialize or should the underlying assumptions prove incorrect, actual outcomes and results could differ materially from those indicated in the forward-looking statements.

Any forward-looking statement speaks only as of the date on which such statement is made, and we undertake no obligation to update any forward-looking statement or statements to reflect events or circumstances after the date on which such statement is made or to reflect the occurrence of unanticipated events. New factors emerge from time to time and it is not possible for us to predict all of such factors, nor can we assess the impact of each such factor on the business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements.

CAUTIONARY NOTE REGARDING DISCLOSURE OF MINERAL PROPERTIES

Mineral Reserves and Resources

We are subject to the reporting requirements of the Securities Exchange Act of 1934, as amended, and applicable Canadian securities laws, and as a result we report our mineral reserves and mineral resources according to two different standards. U.S. reporting requirements, for disclosure of mineral properties, are governed by Item 1300 of Regulation S-K (“S-K 1300”), as issued by the U.S. Securities and Exchange Commission (“SEC”). Canadian reporting requirements for disclosure of mineral properties are governed by National Instrument 43-101 Standards of Disclosure for Mineral Projects (“NI 43-101”), as adopted from the definitions provided by the Canadian Institute of Mining, Metallurgy and Petroleum. Both sets of reporting standards have similar goals in terms of conveying an appropriate level of confidence in the disclosures being reported, but the standards embody slightly different approaches and definitions.

In our public filings in the U.S. and Canada and in certain other announcements not filed with the SEC, we disclose proven and probable reserves and measured, indicated and inferred resources, each as defined in S-K 1300. The estimation of measured resources and indicated resources involves greater uncertainty as to their existence and economic feasibility than the estimation of proven and probable reserves, and therefore investors are cautioned not to assume that all or any part of measured or indicated resources will ever be converted into S-K 1300-compliant reserves. The estimation of inferred resources involves far greater uncertainty as to their existence and economic viability than the estimation of other categories of resources, and therefore it cannot be assumed that all or any part of inferred resources will ever be upgraded to a higher category. Therefore, investors are cautioned not to assume that all or any part of inferred resources exist, or that they can be mined legally or economically.

Technical Report Summaries and Qualified Persons

The scientific and technical information concerning our mineral projects in this Form 10-K have been reviewed and approved by “qualified persons” under S-K 1300. For a description of the key assumptions, parameters and methods used to estimate mineral reserves and mineral resources included in this Form 10-K, as well as data verification procedures and a general discussion of the extent to which the estimates may be affected by any known environmental, permitting, legal, title, taxation, sociopolitical, marketing or other relevant factors, please review the Technical Report Summaries for each of the Company’s material properties which are included as exhibits to, and incorporated by reference into, this Report.

1

GLOSSARY OF MINING TERMS

In this report, the following terms have the following meanings:

alteration – any change in the mineral composition of a rock brought about by physical or chemical means.

assay – a measure of the valuable mineral content.

cut-off grade - is the grade (i.e., the concentration of metal or mineral in rock) that determines the destination of the material during mining. For purposes of establishing “prospects of economic extraction,” the cut-off grade is the grade that distinguishes material deemed to have no economic value (it will not be mined in underground mining or if mined in surface mining, its destination will be the waste dump) from material deemed to have economic value (its ultimate destination during mining will be a processing facility). Other terms used in similar fashion as cut-off grade include net smelter return, pay limit, and break-even stripping ratio.

development stage – is an issuer that is engaged in the preparation of mineral reserves for extraction on at least one material property.

development stage property - is a property that has mineral reserves disclosed, pursuant to S-K 1300, but no material extraction.

dip – the angle that a structural surface, a bedding or fault plane, makes with the horizontal, measured perpendicular to the strike of the structure.

disseminated – where minerals occur as scattered particles in the rock.

exploration results - are data and information generated by mineral exploration programs (i.e., programs consisting of sampling, drilling, trenching, analytical testing, assaying, and other similar activities undertaken to locate, investigate, define or delineate a mineral prospect or mineral deposit) that are not part of a disclosure of mineral resources or reserves. A registrant must not use exploration results alone to derive estimates of tonnage, grade, and production rates, or in an assessment of economic viability.

exploration stage property – is a property that has no mineral reserves disclosed.

fault – a surface or zone of rock fracture along which there has been displacement.

feasibility study – is a comprehensive technical and economic study of the selected development option for a mineral project, which includes detailed assessments of all applicable modifying factors, as defined by this section, together with any other relevant operational factors, and detailed financial analysis that are necessary to demonstrate, at the time of reporting, that extraction is economically viable. The results of the study may serve as the basis for a final decision by a proponent or financial institution to proceed with, or finance, the development of the project.

formation – a distinct layer of sedimentary rock of similar composition.

geochemistry – the study of the distribution and amounts of the chemical elements in minerals, ores, rocks, solids, water, and the atmosphere.

geophysical surveys – a survey method used primarily in the mining industry as an exploration tool, applying the methods of physics and engineering to the earth’s surface.

grade – quantity of metal per unit weight of host rock.

heap leach – a mineral processing method involving the crushing and stacking of an ore on an impermeable liner upon which solutions are sprayed to dissolve metals, e.g., gold, copper etc.; the solutions containing the metals are then collected and treated to recover the metals.

host rock – the rock in which a mineral or an ore body may be contained.

indicated mineral resource - is that part of a mineral resource for which quantity and grade or quality are estimated on the basis of adequate geological evidence and sampling. The level of geological certainty associated with an indicated mineral resource is sufficient to allow a qualified person to apply modifying factors in sufficient detail to support mine planning and evaluation of the economic viability of the deposit. Because an indicated mineral resource has a lower level of confidence than the level of confidence of a measured mineral resource, an indicated mineral resource may only be converted to a probable mineral reserve.

2

initial assessment - is a preliminary technical and economic study of the economic potential of all or parts of mineralization to support the disclosure of mineral resources. The initial assessment must be prepared by a qualified person and must include appropriate assessments of reasonably assumed technical and economic factors, together with any other relevant operational factors, that are necessary to demonstrate at the time of reporting that there are reasonable prospects for economic extraction. An initial assessment is required for disclosure of mineral resources but cannot be used as the basis for disclosure of mineral reserves.

induced polarization – is a geophysical imaging technique used to identify the electrical chargeability of subsurface materials, such as ore.

inferred mineral resource - is that part of a mineral resource for which quantity and grade or quality are estimated on the basis of limited geological evidence and sampling. The level of geological uncertainty associated with an inferred mineral resource is too high to apply relevant technical and economic factors likely to influence the prospects of economic extraction in a manner useful for evaluation of economic viability. Because an inferred mineral resource has the lowest level of geological confidence of all mineral resources, which prevents the application of the modifying factors in a manner useful for evaluation of economic viability, an inferred mineral resource may not be considered when assessing the economic viability of a mining project, and may not be converted to a mineral reserve.

in-situ – in its natural position.

mapped or geological mapping – the recording of geologic information including rock units and the occurrence of structural features, attitude of bedrock, and mineral deposits on maps.

measured mineral resource - is that part of a mineral resource for which quantity and grade or quality are estimated on the basis of conclusive geological evidence and sampling. The level of geological certainty associated with a measured mineral resource is sufficient to allow a qualified person to apply modifying factors, as defined in this section, in sufficient detail to support detailed mine planning and final evaluation of the economic viability of the deposit. Because a measured mineral resource has a higher level of confidence than the level of confidence of either an indicated mineral resource or an inferred mineral resource, a measured mineral resource may be converted to a proven mineral reserve or to a probable mineral reserve.

mineral resource – is a concentration or occurrence of material of economic interest in or on the Earth's crust in such form, grade or quality, and quantity that there are reasonable prospects for economic extraction. A mineral resource is a reasonable estimate of mineralization, taking into account relevant factors such as cut-off grade, likely mining dimensions, location or continuity, that, with the assumed and justifiable technical and economic conditions, is likely to, in whole or in part, become economically extractible. It is not merely an inventory of all mineralization drilled or sampled.

mineralization – a natural accumulation or concentration in rocks or soil of one or more potentially economic minerals; also the process by which minerals are introduced or concentrated in a rock.

open pit or open cut – surface mining in which the ore is extracted from a pit or quarry, the geometry of the pit may vary with the characteristics of the ore body.

ore – mineral bearing rock that can be mined and treated profitably under current or immediately foreseeable economic conditions.

ore body – a mostly solid and fairly continuous mass of mineralization estimated to be economically mineable.

outcrop – that part of a geologic formation or structure that appears at the surface of the earth.

preliminary economic assessment – a study that includes an economic analysis of the potential viability of mineral resources taken at an early stage of the project prior to the completion of a preliminary feasibility study.

preliminary feasibility study ( or pre-feasibility study or PFS) – is a comprehensive study of a range of options for the technical and economic viability of a mineral project that has advanced to a stage where a qualified person has determined (in the case of underground mining) a preferred mining method, or (in the case of surface mining) a pit configuration, and in all cases has determined an effective method of mineral processing and an effective plan to sell the product.

(1) A pre-feasibility study includes a financial analysis based on reasonable assumptions, based on appropriate testing, about the modifying factors and the evaluation of any other relevant factors that are sufficient for a qualified person to determine if all or part of the indicated and measured mineral resources may be converted to mineral reserves at the time of reporting. The financial analysis must have the level of detail necessary to demonstrate, at the time of reporting, that extraction is economically viable.

(2) A pre-feasibility study is less comprehensive and results in a lower confidence level than a feasibility study. A pre-feasibility study is more comprehensive and results in a higher confidence level than an initial assessment.

probable mineral reserve - is the economically mineable part of an indicated and, in some cases, a measured mineral resource.

3

production stage property – is a property with material extraction of mineral reserves.

proven mineral reserve – is the economically mineable part of a measured mineral resource and can only result from conversion of a measured mineral resource.

qualified person - is an individual who is:

(1) A mineral industry professional with at least five years of relevant experience in the type of mineralization and type of deposit under consideration and in the specific type of activity that person is undertaking on behalf of the registrant; and

(2) An eligible member or licensee in good standing of a recognized professional organization at the time the technical report is prepared. For an organization to be a recognized professional organization, it must:

(i) Be either:

(A) An organization recognized within the mining industry as a reputable professional association; or

(B) A board authorized by U.S. federal, state or foreign statute to regulate professionals in the mining, geo-science or related field;

(ii) Admit eligible members primarily on the basis of their academic qualifications and experience;

(iii) Establish and require compliance with professional standards of competence and ethics;

(iv) Require or encourage continuing professional development;

(v) Have and apply disciplinary powers, including the power to suspend or expel a member regardless of where the member practices or resides; and

(vi) Provide a public list of members in good standing.

quartz – a mineral composed of silicon dioxide, SiO2 (silica)

RC (reverse circulation) drilling – a drilling method using a tri-cone bit or hammer bit, during which rock cuttings are pushed from the bottom of the drill hole to the surface through an inner tube, by liquid and/or air pressure moving through an outer tube.

rock – indurated naturally occurring mineral matter of various compositions.

sediment – particles transported by water, wind, gravity or ice.

sedimentary rock – rock formed at the earth’s surface from solid particles, whether mineral or organic, which have been moved from their position of origin and re-deposited.

strike – the direction or trend that a structural surface, e.g. a bedding or fault plane, takes as it intersects the horizontal.

strip – to remove barren rock or overburden in order to expose ore.

sulfide – a mineral including sulfur (S) and iron (Fe) as well as other elements; metallic sulfur-bearing mineral often associated with gold mineralization.

4

PART I

Item 1. Business.

Paramount Gold Nevada Corp. is a Nevada corporation formed on June 15, 1992 under the name X-Cal (USA), Inc. Paramount Gold Nevada Corp. common stock trades on the NYSE American LLC under the symbol “PZG.” Unless the context otherwise requires, reference to “we,” “us,” “our,” “Paramount,” the “Company” and other similar references refer to Paramount Gold Nevada Corp.

INITIAL PUBLIC OFFERING AND ORGANIZATIONAL TRANSACTIONS

On April 17, 2015, we entered into the previously disclosed separation and distribution agreement (the “Separation Agreement”) with Paramount Gold and Silver Corp. (“PGSC”), to effect the separation (the “separation”) of the Company from PGSC, and to provide for the allocation between the Company and PGSC of the Company’s and PGSC’s assets, liabilities and obligations attributable to periods prior to, at and after the separation.

We filed a registration statement on Form S-1 in connection with the distribution (the “distribution”) by PGSC to its stockholders of all the outstanding shares of common stock of the Company, par value $0.01 per share. The registration statement was declared effective by the Securities and Exchange Commission (“SEC”) on April 9, 2015. On April 6, 2015, the Company filed a Form 8-A with the SEC to register its shares of common stock under Section 12(b) of the Securities Exchange Act of 1934, as amended. The distribution, which effected a spin-off of the Company from PGSC, was made on April 17, 2015, to PGSC stockholders of record on April 14, 2015. On the distribution date, stockholders of PGSC received one share of Company common stock for every 20 shares of PGSC common stock held. Up to and including the distribution date, PGSC common stock traded on the “regular-way” market; that is, with an entitlement to shares of Company common stock distributed pursuant to the distribution. As a result of the distribution, the Company is now a publicly traded company independent from PGSC. On April 20, 2015, the Company’s shares of common stock commenced trading on the NYSE American LLC (formerly NYSE MKT) under the symbol “PZG”. An aggregate of 8,101,371 shares of Company common stock were distributed in the distribution. In connection with our separation from PGSC and PGSC’s merger with and into Coeur Mining, Inc. (“Coeur”), PGSC contributed approximately $8.45 million to us as an equity contribution, and we issued 417,420 shares of our common stock, par value $0.01 per share, to Coeur in exchange for a cash payment by Coeur in the amount of $1.47 million.

On March 14, 2016, Paramount Gold Nevada Corp. and Calico Resources Corp. (“Calico”) entered into an Arrangement Agreement providing for the acquisition of Calico by Paramount. On July 7, 2016, after having received the approval of the Supreme Court of British Columbia to the transaction, Paramount and Calico completed the transaction contemplated by the Arrangement Agreement, pursuant to which Calico became a wholly owned subsidiary of Paramount.

On November 14, 2016, Calico Resources Corp. was merged into Calico Resources USA Corp. As a result, Calico Resources USA Corp. became a wholly owned subsidiary of Paramount.

OVERVIEW OF PARAMOUNT GOLD NEVADA CORP.

We are engaged in the business of acquiring, exploring and developing precious metals projects in the United States of America. Paramount owns both exploration and development stage projects in the states of Nevada and Oregon. We enhance the value of our projects by implementing exploration and engineering programs that are likely to expand and upgrade known mineral resources to mineral reserves. To further advance our projects towards the production decision, we manage the completion of the appropriate technical studies including feasibility studies and undertake permitting processes with the relevant local, state and federal regulators. Paramount believes there are several ways to realize the value of its projects: selling its projects to producers; joint venturing its projects with other companies; or building and operating small mines on its own.

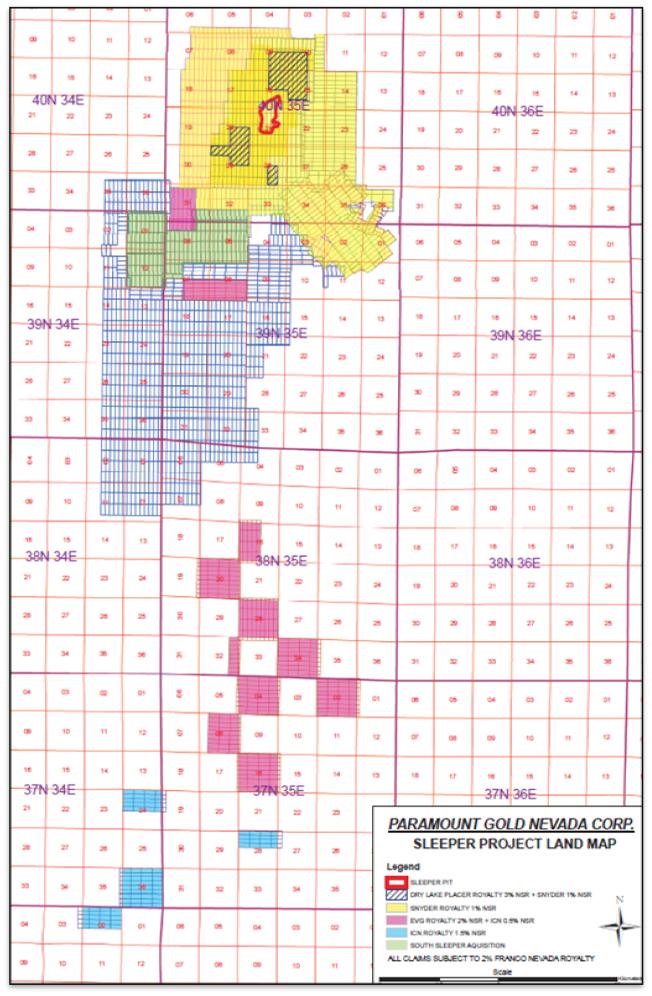

The Company’s material Nevada property, the Sleeper Gold Project ("Sleeper"), is located in Humboldt County, Nevada.

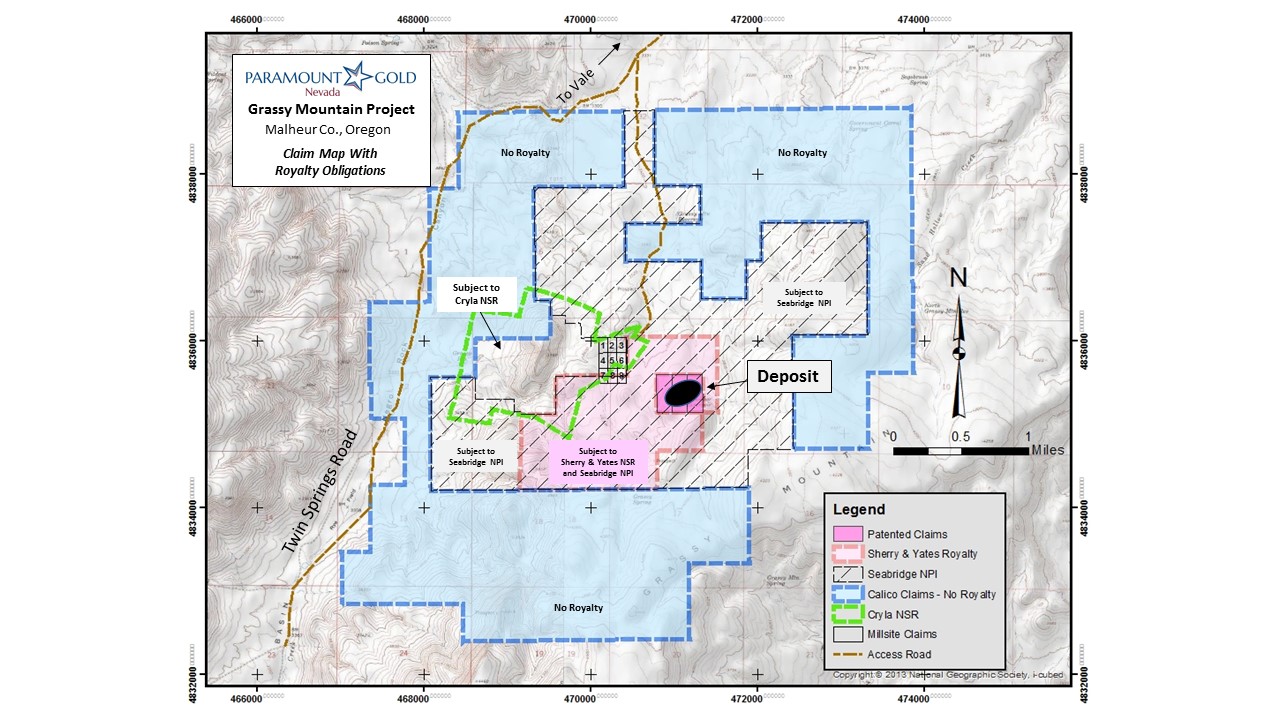

Our material Oregon property, known as the Grassy Mountain Project (“Grassy Mountain”), is located in Malheur County, Oregon, and was acquired by way of statutory plan of arrangement in the Province of British Columbia, Canada with Calico in July 2016.

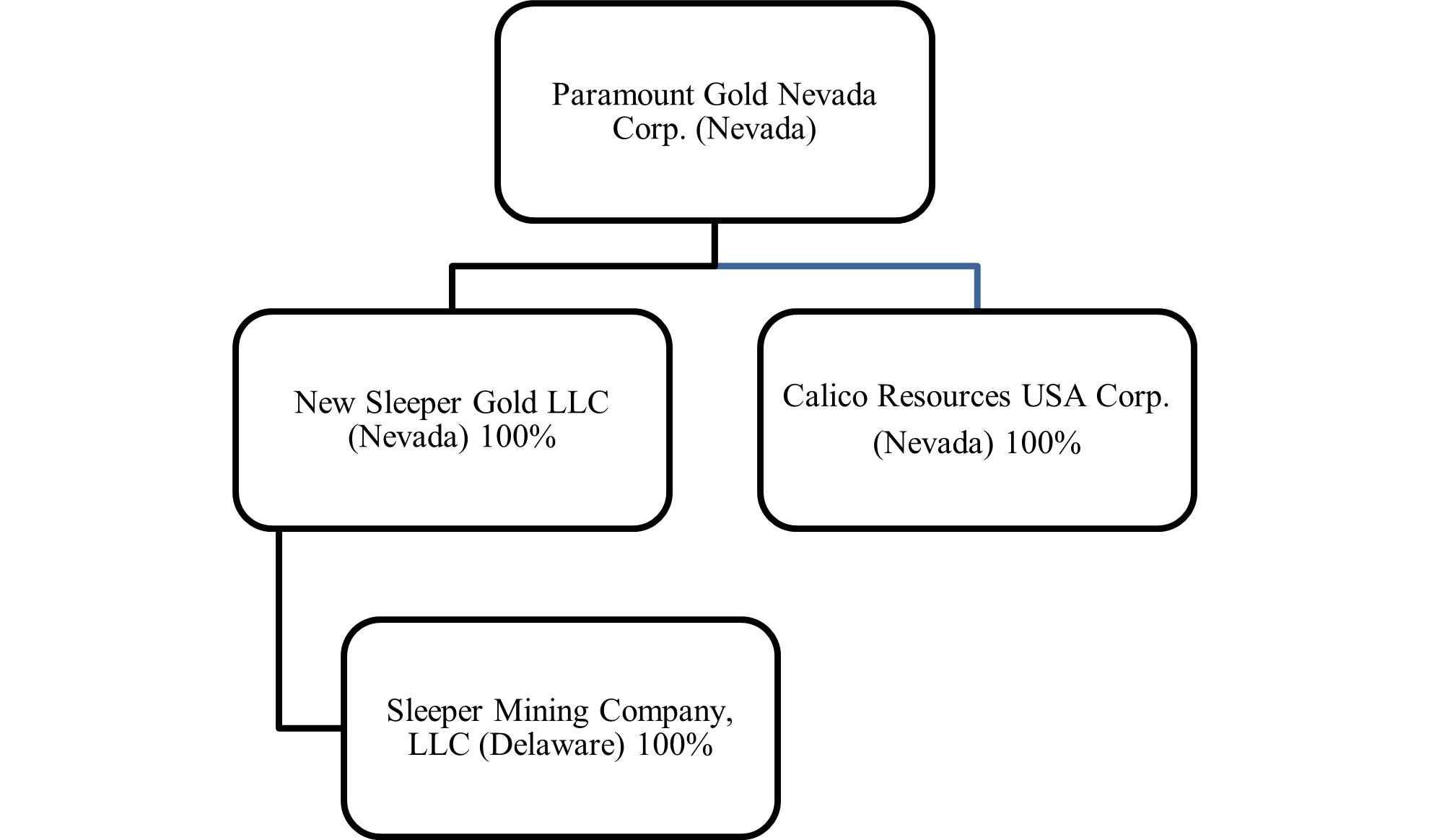

INTER-CORPORATE RELATIONSHIPS

We currently have three active wholly owned direct subsidiaries:

New Sleeper Gold LLC and Sleeper Mining Company, LLC, which operate our mining interests in Nevada.

5

Calico Resources USA Corp., which holds our interest in the Grassy Mountain Project in Oregon.

The Company’s corporate structure is as follows:

COMPETITION

The mineral exploration industry is highly competitive. We compete with junior and senior mineral exploration companies, independent producers and institutional and individual investors who are actively seeking to acquire mineral exploration properties throughout the United States together with the equipment, labor and materials required to explore on those properties. Competition for the acquisition of mineral exploration properties is intense with many mineral exploration leases or concessions available through a competitive bidding process in which we may lack the technological information or expertise available to other bidders. Accordingly, these competitors may be able to spend greater amounts on acquiring mineral exploration interests of merit or on exploring or developing their mineral exploration properties. This advantage could enable our competitors to acquire mineral exploration properties of greater quality and interest to prospective investors who may choose to finance their exploration and development projects instead of the Company’s. Such competition could adversely impact our ability to attain the financing necessary for us to acquire further mineral exploration properties.

We do not compete with anyone with respect to our existing mineral claims because they are 100% controlled or owned by us. We believe we have or can acquire on reasonable terms the equipment, technical expertise and materials necessary to explore and develop our current properties.

GOVERNMENT REGULATION

General

Our business is subject to extensive federal, state and local laws governing the exploring, development, production, mine closure and reclamation, labor standards, taxes, protection of wildlife and other matters. The costs to comply with government regulations are substantial and possible future regulation could cause additional expenditures, restrictions and delays in the exploration and development of our properties. We cannot predict to extent future regulations might have an impact. Future changes to U.S. federal, state or local laws and regulations could have a material adverse effect upon us and our results of operations. For additional information regarding key regulatory risks, please the section titled "Risk Factors" included in Item 1A.

Mining Claim Maintenance

6

Activities on our properties are conducted both upon federally owned land and private land. Most federally owned land is administered by the Bureau of Land Management (“BLM”). On existing claims owned by the federal government, we are required to pay annual claim maintenance fees of $165 per claim on or before September 1st at the State Office of the BLM. In addition, we are required to pay the county recorder of the county in which the claim is situated an annual fee. The county fees in Nevada and Oregon are $12.00 and $5.00 per claim, respectively. On certain claims we own, we are required to pay a fee of $165.00 for each 20 acres of an association placer. For any new claims we acquire by staking, we must file a certificate of location with the State Office of the BLM within 90 days of making the claim along with a fee equal to the amount of the annual claim maintenance fee.

Annual Payments we have made to federal and other state agencies to maintain our claims for the upcoming 2023-24 year are as follows:

Property |

|

Number of Claims1 |

|

|

|

Total Annual Payment to Maintain Claims2 |

|

|

Sleeper Gold Project and Other Nevada Claims |

|

2,623 |

|

|

|

$ |

490,194 |

|

Grassy Mountain Project and Other Oregon Claims |

|

548 |

|

|

|

$ |

97,313 |

|

Total Annual Payment to Maintain Mining Claims |

|

|

|

|

|

$ |

587,507 |

|

1. Does not include any placer claims contained within existing unpatented lode claims

2. Includes all fees paid to the BLM, respective counties and legal fees to file the claims

Permitting

The Grassy Mountain, Sleeper and other properties are subject to extensive U.S. federal and state permitting laws and regulations for the exploration, development and reclamation activities we undertake. For exploration activities on U.S. federally owned land, we are required to submit a Plan of Operation ("PoO") with the BLM, obtain permits and post financial security bonds that guarantee that reclamation is performed. We have received all permits required to carry out exploration activities for our material properties.

We are currently in the application phase of the permitting process of obtaining both state and federal permits that will allow us to build and operate a mine at Grassy Mountain. The permitting process for both federal and state levels requires us, among other things, a thorough study to determine the baseline conditions of the mining site and surrounding area, an environmental impact analysis, and proposed mitigation measures to minimize and offset the environmental impact of mining operations.

Reclamation of Previous Operations

Paramount is responsible for managing the reclamation activities from the previous mine operations at the Sleeper Gold Mine as directed by the BLM and the Nevada State Department of Environmental Protection ("NDEP"). As part of the comprehensive reclamation program, we undertake activities that include on-going monitoring and reporting, stabilizing, contouring, pond conversions and re-vegetating activities. Reclamation activities are conducted in accordance in with detailed plans which must be reviewed and approved by the both the BLM and NDEP. Additional information regarding our reclamation activities at Sleeper on Page 23.

HUMAN CAPITAL RESOURCES

As of June 30, 2023, we employed seven full-time employees and one consultant.

As an organization, we maintain a comprehensive compensation and benefits program to attract, retain and reward the talented employees who contribute to our business. In addition to a competitive base salary, our compensation and benefits program includes equity-based compensation and cash bonuses. We align the interest of our employees, consultants and directors with those of our shareholders by granting equity compensation with vesting conditions contingent upon meeting defined performance goals. These compensation programs are continually evaluated and updated by our Compensation Committee, our Board of Directors (our "Board") and management team, as appropriate, to reflect the evolving nature of our business and to remain competitive in attracting and retaining skilled talent.

ENVIRONMENTAL, SOCIAL AND GOVERNANCE RESPONSIBILITY

At Paramount, we are committed to ensuring our business practices integrate to the fullest extent our corporate sustainability policy and environmental, social and governance priorities ("ESG"). Our sustainability framework was developed by engaging our key stakeholders with to goal of integrating sustainability into the Paramount business planning process. Paramount is committed to being the partner of choice by communities where it operates. To do this we need to build and maintain a strong reputation based on environmental stewardship and cultivating societal success. As we advance with our permitting efforts at our Grassy Mountain Project in Oregon we strive to achieve the following: i) achieve the smallest physical imprint when we close a mine and leave the land

7

as close to the way we found it as possible, ii) work actively with the local communities in which we operate to participate in long-term economic development, and iii) implementing strong governance practices that promote environmental stewardship, societal success and strengthen equity performance.

AVAILABLE INFORMATION

We file electronically with the SEC our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Exchange Act. We make available on our website at http://www.paramountnevada.com, free of charge, copies of these reports and other information as soon as reasonably practicable after we electronically file such material with, or furnish it to, the SEC. Information found on, or accessible through, our website is not a part of, and is not incorporated into, this Annual Report on Form 10-K. The SEC maintains an internet site that also contains these filings at http://www.sec.gov.

Item 1A. Risk Factors.

Described below are certain risks that we believe apply to our business and the industry in which we operate. You should carefully consider each of the following risk factors in conjunction with others provided in this Annual Report on Form 10-K and in our other public disclosures. The risks described below highlight potential events, trends or other circumstances that could adversely affect our business, financial condition, results of operations, cash flows, liquidity or access to sources of financing, and consequently, the market value of our common stock. These risks could cause our future results to differ materially from historical results. The risks described below are those that we have identified as material and is not an exhaustive list of all the risks we face. There may be others that we have not identified or that we have deemed to be immaterial. All forward-looking statements made by us or on our behalf are qualified by the risks described below.

Risk Related to Our Industry

The estimation of mineral reserves and mineral resources is imprecise and depends upon subjective factors.

Estimated mineral reserves and mineral resources may not be realized in actual production. Our results of operations and financial position may be adversely affected by inaccurate estimates. The mineral reserve and mineral resource figures presented in our public filings are estimates made by independent mining consultants with whom we contract. Mineral reserve and mineral resource estimates are a function of geological and engineering analyses that require us to make assumptions about production costs, recoveries and gold and silver market prices. Mineral reserve and mineral resource estimation is an imprecise and subjective process. The accuracy of such estimates is a function of the quality of available data and of engineering and geological interpretation, judgment and experience. Assumptions about gold and silver market prices are subject to great uncertainty as those prices fluctuate widely. Declines in the market prices of gold, silver, zinc or lead may render mineral reserves and mineral resources containing relatively lower grades of mineralization uneconomic to exploit, and we may be required to reduce mineral reserve and mineral resource estimates, discontinue development at one or more of our properties or write down assets as impaired. New or updated technical or geological information may also impact anticipated metal recovery rates. Any of these adjustments may adversely affect our financial condition, results of operations and cash flows.

The precious metals markets are volatile markets. This will have a direct impact on our revenues (if any) and profits (if any) and could have an adverse effect on our ongoing operations.

The price of both gold and silver has fluctuated significantly over the past few years. Despite the volatility in the price of gold, there continues to be interest in gold and silver mining and companies engaged in that business, including the exploration for both gold and silver. However, in the event that the price of these metals falls, the interest in the gold and silver mining industry may decline and the value of our business could be adversely affected. Even if we are able to generate revenues, there can be no assurance that any of our operations will prove to be profitable. Finally, in recent decades, there have been periods of both overproduction and underproduction of both gold and silver resources. Such conditions have resulted in periods of excess supply of and reduced demand on a worldwide basis and on a domestic basis. These periods have been followed by periods of short supply of and increased demand for both gold and silver. We cannot predict what the market for gold or silver will be in the future.

Mining operations are hazardous, raise environmental concerns and raise insurance risks.

The development and operation of a mine or mineral property involves many risks, which even a combination of experience, knowledge and careful evaluation may not be able to overcome. These risks include, among other things, ground fall, flooding, environmental hazards and the discharge of toxic chemicals, explosions and other accidents. Such occurrences may result in work stoppages, delays in production, increased production costs, damage to or destruction of mines and other producing facilities, injury or loss of life, damage to property, environmental damage and possible legal liability for such damages as well. Although the Company

8

maintains liability coverage in an amount which it considers adequate for its operations, such occurrences, against which the Company may not be able, or may elect not to insure, may result in a material adverse change in the Company’s financial position. The nature of these risks is such that liabilities may exceed policy limits, in which event the Company would incur substantial uninsured losses.

We are subject to numerous environmental and other regulatory requirements.

All phases of mining and exploration operations are subject to governmental regulation including environmental regulation. Environmental legislation is becoming stricter, with increased fines and penalties for non-compliance, more stringent environmental assessments of proposed projects and heightened responsibility for companies and their officers, directors and employees. There can be no assurance that possible future changes in environmental regulation will not adversely affect our operations. As well, environmental hazards may exist on a property in which we hold an interest that was caused by previous or existing owners or operators of the properties and of which the Company is not aware at present.

Government approvals and permits are required to be maintained in connection with our mining and exploration activities. Although we believe we currently have all required permits for our operations as currently conducted, there is no assurance that delays will not occur in connection with obtaining all necessary renewals of such permits for the existing operations or additional permits for any possible future changes to the Company’s operations, including any proposed capital improvement programs. Failure to comply with applicable laws, regulations and permitting requirements may result in enforcement actions thereunder, including orders issued by regulatory or judicial authorities causing operations to cease or be curtailed, and may include corrective measures requiring capital expenditures, installation of additional equipment, or remedial actions. Parties engaged in mining operations may be required to compensate those suffering loss or damage by reason of the mining activities and may be liable for civil or criminal fines or penalties imposed for violations of applicable laws or regulations. Amendments to current laws, regulations and permitting requirements, or more stringent application of existing laws, may have a material adverse impact on the Company resulting in increased capital expenditures or production costs, reduced levels of production at producing properties or abandonment or delays in development of properties.

Risks Related to our Business Operations

There is substantial doubt about our ability to continue as a going concern.

The accompanying consolidated financial statements have been prepared assuming the Company will continue as a going concern. This assumes continuing operations and the realization of assets and liabilities in the normal course of business.

We have incurred significant losses since our inception and expect to continue to incur losses as a result of costs and expenses related to maintaining our properties and general and administrative expenses. As of June 30, 2023, we had cash of approximately $0.8 million and an accumulated deficit of approximately $74.3 million. As a result of our evaluation of the Company’s liquidity for the next twelve months, we have included a discussion about our ability to continue as a going concern in our consolidated financial statements, and our independent auditor’s report for year ended June 30, 2023 includes an explanatory paragraph that expresses substantial doubt about our ability to continue as a “going concern.” Our capital needs have, in recent years, been funded through sales of our debt and equity securities. In the event that we are unable to raise sufficient additional funds, we may be required to delay, reduce or severely curtail our operations or otherwise impede our on-going business efforts, which could have a material adverse effect on our business, operating results, financial condition, long-term prospects and ability to continue as a viable business.

It is possible investors may lose their entire investment in the Company.

Prospective investors should be aware that if we are not successful in our endeavors, your entire investment in the Company could become worthless. Even if we are successful in identifying mineral reserves that can be commercially developed, there can be no assurances that we will generate any revenues and therefore our losses will continue.

No revenue generated from operations.

We have not generated any revenues from operations. Our net loss for the fiscal year ended June 30, 2023 totaled $6.45 million. We have incurred losses in the past, and we will likely continue to incur losses in the future. Even if our drilling programs identify gold, silver or other mineral deposits, there can be no assurance that we will be able to commercially exploit these resources, generate any revenues or generate sufficient revenues to operate profitably.

9

We will require significant additional capital to continue our exploration activities, and, if warranted, to develop mining operations.

None of our projects currently have proven or probable reserves. Substantial expenditures will be required to determine if proven and probable mineral reserves exist at any of our properties, to develop metallurgical processes to extract metal, to develop the mining and processing facilities and infrastructure at any of our properties or mine sites and, in certain circumstances, to acquire additional property rights. We have spent and will be required to continue to expend significant amounts of capital for drilling, geological and geochemical analysis, assaying, and, when warranted, feasibility studies with regard to the results of our exploration. We may not benefit from these investments if we are unable to identify commercially exploitable mineral reserves. If we decide to put one or more of our properties into production, we will require significant amounts of capital to develop and construct the mining and processing facilities and infrastructure required for mining operations. Our ability to obtain necessary funding for these purposes, in turn, depends upon a number of factors, including the status of the national and worldwide economy and the price of gold, silver and other precious metals. We may not be successful in obtaining the required financing, or if we can obtain such financing, such financing may not be on terms that are favorable to us. Failure to obtain such additional financing could result in delay or indefinite postponement of further exploration or development and the possible, partial or total loss of our potential interest in certain properties. Any such delay could have a material adverse effect on our results of operations or financial condition.

We cannot be assured that any of our projects are economically feasible or that feasibility studies will accurately forecast operating results.

Our future profitability depends on the economic feasibility of our projects. We have completed a feasibility study on our Grassy Mountain Project. There can be no assurance that the results of any feasibility study for the Sleeper Gold Project will be positive. Economic feasibility depends on many factors which include estimates on production rates, revenues, operating and capital costs. Completed feasibility studies for any of our projects and obtain financing to construct and initiate mining operations, there can be no assurance that actual operating results will not vary unfavorably from the estimates and assumptions included in a feasibility study.

We may acquire additional exploration stage properties, and we may face negative reactions if reserves are not located on acquired properties.

We may acquire additional exploration stage properties. There can be no assurance that we will be able to identify and complete the acquisition of such properties at reasonable prices or on favorable terms or that reserves will be identified on any properties that we acquire. We may also experience negative reactions from the financial markets if we are unable to successfully complete acquisitions of additional properties or if reserves are not located on acquired properties. These factors may adversely affect the trading price of our common stock or our financial condition or results of operations.

Our industry is highly competitive, attractive mineral lands are scarce, and we may not be able to obtain quality properties.

We compete with many companies in the mining industry, including large, established mining companies with substantial capabilities, personnel and financial resources. There is a limited supply of desirable mineral lands available for claim staking, lease or acquisition in the United States of America where we may conduct exploration activities. We may be at a competitive disadvantage in acquiring mineral properties because we compete with these individuals and companies, many of which have greater financial resources and larger technical staffs.

Title to mineral properties can be uncertain, and we are at risk of loss of ownership of one or more of our properties. Our ability to explore and operate our properties depends on the validity of our title to that property. A significant amount of our mineral properties consist of leases of unpatented mining claims. Unpatented mining claims provide only possessory title and their validity is often subject to contest by third parties or the federal government, which makes the validity of unpatented mining claims uncertain and generally more risky. These uncertainties relate to such things as the sufficiency of mineral discovery, proper posting and marking of boundaries, assessment work and possible conflicts with other claims not determinable from public record. Since a substantial portion of all mineral exploration, development and mining in the United States now occurs on unpatented mining claims, this uncertainty is inherent in the mining industry. We have not obtained title opinions covering our entire properties, with the attendant risk that title to some claims, particularly title to undeveloped property, may be defective. There may be valid challenges to the title to our property which, if successful, could impair development and/or operations.

We have no mining operations and no history as a mining company.

We are a development stage company and have no ongoing mining operations of any kind. We have interests in mining claims which may or may not lead to production.

10

We have no history of earnings or cash flow from mining operations. If we are able to proceed to production, commercial viability will be affected by factors that are beyond our control such as the particular attributes of the deposit, the fluctuation in metal prices, the cost of constructing and the operation of a mine, prices and refining facilities, the availability of economic sources for energy, government regulations including regulations relating to prices, royalties, restrictions on production, quotas on exploration of minerals, as well as the costs of protection of the environment.

If our exploration and development costs are higher than anticipated, then our profitability will be adversely affected.

We are currently proceeding with plans to explore and develop our mineral properties on the basis of estimated costs. If our exploration and development costs are greater than anticipated, then we will have fewer capital resources for other expenses and losses could increase. Factors that could cause exploration and development costs to increase include adverse weather conditions, difficult terrain, increased government regulation and shortages of qualified personnel.

Assuming no adverse developments outside of the ordinary course of business, our exploration and development budget will be approximately up to $4.0 million for the next twelve months. Exploration will be funded by our available cash reserves and future issuances of common stock, warrants or units. Our exploration program may vary significantly from what we have budgeted depending upon the results we achieve. Even if we identify mineral reserves which have the potential to be commercially developed, we will not generate revenues until such time as we undertake mining operations. Mining operations will involve a significant capital infusion. Mining costs are speculative and dependent on a number of factors including mining depth, terrain and necessary equipment. We do not believe that we will have sufficient funds to implement mining operations without additional capital raises of debt and or equity or without a joint venture partner, of which there can be no assurance.

Our continuing reclamation obligations at our properties could require significant additional expenditures.

We are responsible for the reclamation obligations related to disturbances located on all of our properties. We have posted a bond in the amount of the estimated reclamation obligation at the Sleeper Gold Project and the Grassy Mountain Project. At the Sleeper Gold Project, we are required to submit a mine closure plan to the BLM every three years. Based on a review by the BLM of our mine closure plan that Paramount submitted in July 2020, the BLM determined that our existing bond was sufficient. There is a risk that any cash bond, even if increased based on the analysis and work performed to update the reclamation obligations, could be inadequate to cover the actual costs of reclamation when carried out. The satisfaction of bonding requirements and continuing reclamation obligations will require a significant amount of capital. There is a risk that we will be unable to fund these additional bonding requirements, and further, that the regulatory authorities may increase reclamation and bonding requirements to such a degree that it would not be commercially reasonable to continue exploration activities, which may adversely affect our results of operations, financial performance and cash flows.

There may be insufficient mineral reserves to develop any of our properties, and our estimates may be inaccurate.

There is no certainty that any expenditures made in the exploration of any properties will result in discoveries of commercially recoverable quantities of ore. Most exploration projects do not result in the discovery of commercially mineable deposits of ore and no assurance can be given that any particular level of recovery of precious metals from discovered mineralization will in fact be realized or that any identified mineral deposit will ever qualify as a commercially mineable ore body which can be legally and economically exploited. Estimates of reserves, mineral deposits and production costs can also be affected by such factors as environmental regulations and requirements, weather, environmental factors, unforeseen technical difficulties, unusual or unexpected geological formations and work interruptions. In addition, the grade of ore ultimately mined may differ from that indicated by drilling results. Short term factors relating to reserves, such as the need for orderly development of ore bodies or the processing of new or different grades, may also have an adverse effect on mining operations and on the results of operations. There can be no assurance that precious metals recovered in small scale laboratory tests will be duplicated in large scale tests under on-site production conditions. Material changes in estimated reserves, grades, stripping ratios or recovery rates may affect the economic viability of any project.

We face fluctuating gold and mineral prices.

The value of any mineral reserves we develop, and consequently the value of our common stock, depends significantly on the value of such minerals. The price of gold and silver as well as other precious and base metals have experienced volatile and significant price movements over short periods of time and are affected by numerous factors beyond our control, including international economic and political trends, expectations of inflation, interest rates, global or regional consumption patterns, speculative activities and increases in production due to improved mining and production methods. The supply of and demand for gold and silver, as well as other precious and base metals, are affected by various factors, including political events, economic conditions and production costs in major mineral producing regions.

11

Our estimates of mineral reserves and mineral resources are subject to uncertainty.

Estimates of mineral reserves and other mineral resources are subject to considerable uncertainty. Such estimates are arrived at using standard acceptable geological techniques and are based on the interpretations of geological data obtained from drill holes and other sampling techniques. Engineers use feasibility studies to derive estimates of cash operating costs based on anticipated tonnage and grades of ore to be mined and processed, the predicted configuration of the ore bodies, expected recovery rates of metal from ore, comparable facility and operating costs and other factors. Actual cash operating costs and economic returns on projects may differ significantly from the original estimates, primarily due to fluctuations in the current prices of metal commodities extracted from the deposits, changes in fuel costs, labor rates, changes in permit requirements, and unforeseen variations in the characteristics of the ore body. Due to the presence of these factors, there is no assurance that any geological reports will accurately reflect actual quantities of gold, silver or other metals that can be economically processed and mined by us.

If we are unable to obtain all of our required governmental permits, our operations could be negatively impacted.

Our future operations, including exploration and development activities, required permits from various governmental authorities. Such operations are and will be governed by laws and regulations governing prospecting, development, mining, production, exports, taxes, labor standards, occupational health, waste disposal, toxic substances, land use, environmental protection, mine safety and other matters. There can be no assurance that we will be able to acquire all required licenses or permits or to maintain continued operations at our properties.

There is no assurance that there will not be title or boundary disputes.

Although we have investigated the right to explore and exploit our properties and obtained records from government offices with respect to all of the mineral claims comprising our properties, this should not be construed as a guarantee of title. Other parties may dispute the title to any of our properties or any property may be subject to prior unregistered agreements and transfers or land claims by aboriginal, native, or indigenous peoples. The title may be affected by undetected encumbrances or defects or governmental actions.

Local infrastructure may impact our exploration activities and results of operations.

Mining, processing, development and exploration activities depend, to one degree or another, on adequate infrastructure. Reliable roads, bridges, power and water supplies are important determinants that affect capital and operating costs. Unusual or infrequent weather phenomena, sabotage or government or other interference in the maintenance or provision of such infrastructure could adversely affect our activities and profitability.

Because of the speculative nature of exploration for gold and silver properties, there is substantial risk that our business will fail.

The search for precious metals as a business is extremely risky. We cannot provide any assurances that the gold or silver mining interests that we acquired will contain commercially exploitable reserves of gold or silver. Exploration for minerals is a speculative venture necessarily involving substantial risk. Any expenditure that we make may not result in the discovery of commercially exploitable reserves of precious metals.

We are in competition with companies that are larger, more established and better capitalized than we are.

Many of our potential competitors have greater financial and technical resources, as well as longer operating histories and greater experience in mining.

Exploration for economic deposits of minerals is speculative.

The business of mineral exploration is very speculative, since there is generally no way to recover any of the funds expended on exploration unless the existence of mineable reserves can be established. We can exploit those reserves by either commencing mining operations, selling or leasing our interest in the property or entering into a joint venture with a larger resource company that can further develop the property to the production stage. Unless we can establish and exploit reserves before our sources of funds are exhausted, we will have to discontinue operations, which could make our stock valueless.

12

The loss of key members of our senior management team could adversely affect the execution of our business strategy and our financial results.

We believe that the successful execution of our business strategy and our ability to move beyond the exploratory stages depends on the continued employment of key members of our senior management team. If any members of our senior management team become unable or unwilling to continue in their present positions, our financial results and our business could be materially adversely affected.

We operate in a regulated industry and changes in regulations or violations of regulations may result in increased costs or sanctions that could reduce our revenues.

Our organization is subject to extensive and complex federal and state laws and regulations. If we fail to comply with the laws and regulations that are directly applicable to our business, we could suffer civil and/or criminal penalties or be subject to injunctions or cease and desist orders. While we believe that we are currently compliant with applicable rules and regulations, if there are changes in the future, there can be no assurance that we will be able to comply in the future, or that future compliance will not significantly adversely impact our operations.

If we fail to maintain an effective system of internal controls, we may not be able to accurately report our financial results or prevent fraud. As a result, current and potential stockholders could lose confidence in our financial reporting, which would harm our business and the trading price of our common stock.

Effective internal controls are necessary for us to provide reliable financial reports, prevent fraud and operate successfully as a public company. If we cannot provide reliable financial reports or prevent fraud, our reputation and operating results would be harmed. We cannot be certain that our efforts to develop and maintain our internal controls will be successful, that we will be able to maintain adequate controls over our financial processes and reporting in the future or that we will be able to comply with our obligations under Section 404 of the Sarbanes-Oxley Act of 2002. Any failure to develop or maintain effective internal controls, or difficulties encountered in implementing or improving our internal controls, could harm our operating results or cause us to fail to meet our reporting obligations. Ineffective internal controls could also cause investors to lose confidence in our reported financial information, which would likely have a negative effect on the trading price of our common stock.

We are dependent upon information technology systems, which are subject to cybersecurity incidents, disruption, damage, failure and other risks associated with implementation and integration.

Our information technology systems used in our operations are subject to disruption, damage or failure from a variety of sources, including, without limitation, computer viruses, security breaches, cyber attacks, natural disasters and defects in design. Cybersecurity incidents, in particular, are evolving and include, but are not limited to, malicious software, attempts to gain unauthorized access to data or machines and equipment, and other electronic security breaches that could lead to disruptions in systems, unauthorized release of confidential or otherwise protected information, the corruption of data or the disabling, misuse or malfunction of machines and equipment. Various measures have been implemented to manage our risks related to information technology systems and network disruptions. However, given the unpredictability of the timing, nature and scope of information or operational technology disruptions, we could potentially be subject to production downtime, operational delays, operating accidents, the compromising of confidential or otherwise protected information, destruction or corruption of data, security breaches, other manipulation or improper use of our systems and networks or financial losses from remedial actions, any of which could have a material adverse effect on cash flows, financial condition or results of operations.

We could also be adversely affected by system or network disruptions if new or upgraded information technology systems are defective, not installed properly or not properly integrated into operations. Various measures have been implemented to manage the risks related to the system implementation and modification, but system modification failures could have a material adverse effect on our business, financial position and results of operations.

Risks Related to Our Common Stock and Indebtedness

Our stock price may be volatile.

The market price of our common stock has been volatile. We believe investors should expect continued volatility in our stock price. Such volatility may make it difficult or impossible for you to obtain a favorable selling price for our shares.

13

We may not have sufficient cash to meet our debt obligation.

As of June 30, 2023, we have $4.3 million in outstanding indebtedness in the form of convertible notes and $1.6 million in the form of a note payable. Our ability to repay the outstanding debt on at maturity will depend on the Company having sufficient cash on hand. We could face substantial liquidity problems and could be forced to reduce or delay investments and capital expenditures, dispose of material assets or operations, seek additional debt or equity capital or restructure or refinance our indebtedness. We cannot predict whether we would be able to refinance debt, issue equity or debt securities or dispose of assets to raise funds on a timely basis or on satisfactory terms. In a rising interest rate environment, the costs of borrowing additional funds or refinancing outstanding indebtedness would also be expected to increase. We may not be able obtain proceeds in an amount sufficient to meet any debt service obligations when due.

We do not intend to pay dividends for the foreseeable future.

We have never declared or paid any dividends on our common stock. We intend to retain all of our earnings, if any, for the foreseeable future to finance the operation and expansion of our business, and we do not anticipate paying any cash dividends in the future. As a result, you may only receive a return on your investment in our common stock if the market price of our common stock increases. Our board of directors retains discretion to change this policy.

The exercise of our outstanding options may depress our stock price.

The exercise of outstanding options and the subsequent sale of the underlying common stock in the public market, or the perception that future sales of these shares could occur, could have the effect of lowering the market price of our common stock below current levels and make it more difficult for us and our stockholders to sell our equity securities in the future.

Sales or the availability for sale of shares of common stock by stockholders could cause the market price of our common stock to decline and could impair our ability to raise capital through an offering of additional equity securities.

Item 1B. Unresolved Staff Comments.

Not applicable as a smaller reporting company.

Item 2. Properties.

The following description of the Company’s mining properties is qualified in its entirety by reference to the Technical Report Summary for each of the properties included as exhibits to this Annual Report on Form 10-K (“Report”) and incorporated by reference into this Item 2. The information concerning our mining properties in this Report has been prepared in accordance with the requirements of subpart 1300 of Regulation S-K. Subpart 1300 of Regulation S-K requires us to disclose our mineral resources, in addition to our mineral reserves, as of the end of our most recently completed fiscal year in the aggregate and for each of our individually material mining properties.

You are cautioned that mineral resources do not have demonstrated economic value. Mineral resources are subject to further exploration and development, are subject to additional risks, and no assurance can be made that they will eventually convert to future reserves. Investors are cautioned not to assume that any part of all of the Inferred Resource exists or is economically or legally mineable. See Item 1A, Risk Factors.

14

Summary Disclosure

None of the Company’s material properties are in the production stage.

As summary overview of each material property is as follows:

Property: |

Grassy Mountain |

Stage: |

Development |

Location: |

Oregon |

Ownership: |

100% |

Titles and Mining Claims: |

3 patented lode claims (62 acres), 455 unpatented lode claims (8,173 acres), 9 mill site claims (45 acres) and totaling approximately 8,280 acres |

Key Permit Conditions: |

Private and BLM administered land. Plan of Operations and other required State permits in place for exploration. |

Mine Type: |

Underground |

Commodity: |

Gold, Silver |

Mineralization Styles: |

Hot Spring Style, Low Sulfidation Epithermal |

Other: |

• Certain royalty interests have been granted with respect to the Grassy Mountain Project • A security interest in the Grassy Mountain Project has been granted in favor of the Convertible Note Holders (as defined below) |

Property: |

Sleeper Gold |

15

Stage: |

Exploration |

Location: |

Nevada |

Ownership: |

100% |

Titles and Mining Claims: |

2474 unpatented lode claims (approximately 44,917 acres) |

Key Permit Conditions: |

BLM administered land. Plan of Operations and other required State permits in place for exploration. |

Mine Type: |

Open Pit Heap Leach |

Commodity: |

Gold, Silver |

Mineralization Styles: |

Low Sulfidation, Vein |

Other: |

• Certain royalty interests have been granted with respect to the Sleeper Gold Project • A security interest in the Sleeper Gold Project has been granted in favor of the Convertible Note Holders (as defined below) |

Summary Gold Mineral Resources as of June 30, 2023(1,2,4,9):

|

|

Measured Mineral Resources |

|

|

Indicated Mineral Resources |

|

|

Measured + Indicated Mineral Resources |

|

|

Inferred Mineral Resources |

|

||||||||||||||||||||||||||||||||||||

|

|

Tons (000s) |

|

|

Grade (oz./ton) |

|

|

Ounces (000s) |

|

|

Tons (000s) |

|

|

Grade (oz./ton) |

|

|

Ounces (000s) |

|

|

Tons (000s) |

|

|

Grade (oz./ton) |

|

|

Ounces (000s) |

|

|

Tons (000s) |

|

|

Grade (oz./ton) |

|

|

Ounces (000s) |

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

United States |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

Grassy Mountain 3, 5, |

|

|

21,153 |

|

|

|

0.017 |

|

|

|

363 |

|

|

|

12,902 |

|

|

|

0.030 |

|

|

|

392 |

|

|

|

34,055 |

|

|

|

0.022 |

|

|

|

755 |

|

|

|

1,151 |

|

|

|

0.037 |

|

|

|

42 |

|

Sleeper 6, 7, 8 |

|

|

5,403 |

|

|

|

0.016 |

|

|

|

85 |

|

|

|

174,535 |

|

|

|

0.010 |

|

|

|

1,812 |

|

|

|

179,938 |

|

|

|

0.011 |

|

|

|

1,897 |

|

|

|

132,176 |

|

|

|

0.009 |

|

|

|

1,214 |

|

Total |

|

|

26,556 |

|

|

|

0.017 |

|

|

|

448 |

|

|

|

187,437 |

|

|

|

0.012 |

|

|

|

2,204 |

|

|

|

213,993 |

|

|

|

0.012 |

|

|

|

2,652 |

|

|

|

133,327 |

|

|

|

0.009 |

|

|

|

1,256 |

|

Summary of Silver Mineral Resources as of June 30, 2023(1,2,4,9):

|

|

Measured Mineral Resources |

|

|

Indicated Mineral Resources |

|

|

Measured + Indicated Mineral Resources |

|

|

Inferred Mineral Resources |

|

||||||||||||||||||||||||||||||||||||

|

|

Tons (000s) |

|

|

Grade (oz./ton) |

|

|

Ounces (000s) |

|

|

Tons (000s) |

|

|

Grade (oz./ton) |

|

|

Ounces (000s) |

|

|

Tons (000s) |

|

|

Grade (oz./ton) |

|

|

Ounces (000s) |

|

|

Tons (000s) |

|

|

Grade (oz./ton) |

|

|

Ounces (000s) |

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

United States |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

Grassy Mountain 3, 5, |

|

|

21,153 |

|

|

|

0.072 |

|

|

|

1,529 |

|

|

|

12,902 |

|

|

|

0.115 |

|

|

|

1,480 |

|

|

|

34,055 |

|

|

|

0.088 |

|

|

|

3,009 |

|

|

|

1,151 |

|

|

|

0.109 |

|

|

|

126 |

|

Sleeper 6, 7, 8 |

|

|

5,403 |

|

|

|

0.105 |

|

|

|

570 |

|

|

|

174,535 |

|

|

|

0.118 |

|

|

|

20,661 |

|

|

|

179,938 |

|

|

|

0.118 |

|

|

|

21,231 |

|

|

|

132,176 |

|

|

|

0.071 |

|

|

|

9,454 |

|

Total |

|

|

26,556 |

|

|

|

0.079 |

|

|

|

2,099 |

|

|

|

187,437 |

|

|

|

0.118 |

|

|

|

22,141 |

|

|

|

213,993 |

|

|

|

0.113 |

|

|

|

24,240 |

|

|

|

133,327 |

|

|

|

0.071 |

|

|

|

9,580 |

|

16

Summary Gold Mineral Reserves as of June 30, 2023(1,2,3,4):

|

|

Proven Mineral Reserves |

|

|

Probable Mineral Reserves |

|

|

Total Mineral Reserves |

|

|||||||||||||||||||||||||||

|

|

Tons (000s) |

|

|

Grade (oz./ton) |

|

|

Ounces (000s) |

|

|

Tons (000s) |

|