2024 PROXY STATEMENT

AND

NOTICE OF ANNUAL MEETING

OF STOCKHOLDERS

Thursday, June 6, 2024

10:00 a.m., Eastern Time

☐ |

Preliminary Proxy Statement |

☐ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

☒ |

Definitive Proxy Statement |

☐ |

Definitive Additional Materials |

☐ |

Soliciting Material under § 240.14a-12 |

☒ |

No fee required. |

☐ |

Fee paid previously with preliminary materials. |

☐ |

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

2024 PROXY STATEMENT

AND

NOTICE OF ANNUAL MEETING

OF STOCKHOLDERS

Thursday, June 6, 2024

10:00 a.m., Eastern Time

Dear Fellow Stockholders,

At Evolent, we pursue a singular mission: to change the health of the nation by changing the way healthcare is delivered. Our dedication to this mission enabled us to end 2023 on a strong note, achieving all of our financial objectives. We also executed against our long-term core strategic priorities over the course of the year: strong organic growth, expanding margins, and optimal capital allocation.

To drive organic growth, in 2023, we unified our businesses under a shared mission and purpose, bringing our solutions together into one payer-independent platform. Much of our expertise had been housed across distinct brands, which have now been integrated into one Evolent organization, harnessing all of the human capital, global reach and technology expertise within Evolent under an organizational structure that focuses our strengths to meet our clients’ current and future needs. And in 2023, we grew Adjusted EBITDA, with strong profitability margins.

We continued to deploy capital strategically. We completed the acquisition of NIA from Centene, which helped to diversify our revenue base and increased cross-sell opportunities. We also improved our cash, as well as our balance sheet position, unlocking flexibility for the future.

As we focus on having the right Board to oversee our strategy, we’ve continued to discuss the ongoing evolution of our Board’s composition with our investors. Earlier this year, we welcomed Dr. Toyin Ajayi and Russell Glass as new members of our Board. Dr. Ajayi brings valuable experience in healthcare leadership and Russell brings critical experience in healthcare technology innovation at a pivotal time in Evolent’s history. We extend our deep appreciation to Dr. Tunde Sotunde, who retired from the Board in February, for his service and dedication to Evolent.

On behalf of our Board, I want to extend my thanks and gratitude to the thousands of dedicated Evolent employees. Evolent was able to achieve much of our financial and operational goals thanks in large part to their tireless efforts.

We continue to believe the current challenges facing the healthcare system represent future opportunities for us. We have the opportunity to improve quality, affordability and experience, all of which the healthcare market increasingly demands, and look forward to what the rest of 2024 will bring for all of us.

As always, thank you for your continued support of Evolent.

Sincerely,

Cheryl Scott

Chair of the Board of Directors

Evolent Health, Inc.

|

EVOLENT HEALTH, INC. 1812 N. Moore Street, Suite 1705 Arlington, VA 22209 |

NOTICE OF ANNUAL MEETING

OF STOCKHOLDERS

to be held on June 6, 2024

|

|

| ||

| Date & Time: Thursday, June 6, 2024, 10:00 a.m., Eastern Time |

Virtual Information: https://web.lumiconnect.com/209916247 password: evolent2024 |

Record Date: April 11, 2024 |

Dear Stockholder:

You are invited to attend the 2024 annual meeting of stockholders (the “Annual Meeting”) of Evolent Health, Inc. (the “Company”), a Delaware corporation, which will be held on Thursday, June 6, 2024, at 10:00 a.m., Eastern Time. The Annual Meeting will be held for the following purposes:

| 1. | To elect ten director nominees named in the proxy statement to serve on our Board of Directors; |

| 2. | To ratify the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2024; |

| 3. | To approve the compensation of our named executive officers for 2023 on an advisory basis; and |

| 4. | To select the frequency of future advisory votes on executive compensation on an advisory basis. |

In addition, stockholders may be asked to consider and vote upon any other matters that may properly be brought before the Annual Meeting and at any adjournments or postponements thereof.

We have determined that the Annual Meeting will be held in a virtual meeting format only, via the Internet, with no physical in-person meeting. Stockholders will be able to attend, vote and submit questions (for a portion of the meeting) from any location via the Internet at https://web.lumiconnect.com/209916247. The password for the Annual Meeting is “evolent2024”. To participate (e.g., submit questions and/or vote), you will need the control number provided on your proxy card, voting instruction form or notice.

Any action may be taken on the foregoing matters at the Annual Meeting on the date specified above, or on any date or dates to which the Annual Meeting may be adjourned, or to which the Annual Meeting may be postponed.

Our Board of Directors has fixed the close of business on April 11, 2024, as the record date for determining the stockholders entitled to notice of, and to vote at, the Annual Meeting and at any adjournments or postponements thereof.

We make proxy materials available to our stockholders on the Internet. You can access proxy materials at http://ir.evolenthealth.com/financial-info/annual-reports-and-proxy-statements/default.aspx. You also may authorize your proxy via the Internet by following the instructions on that website. In order to authorize your proxy via the Internet you must have the stockholder identification number that appears on the enclosed proxy card.

By Order of our Board of Directors,

Jonathan D. Weinberg

General Counsel and Secretary

Arlington, VA

April 26, 2024

Important Notice Regarding the Availability of Proxy Materials for the Stockholder Meeting to be Held on June 6, 2024

This proxy statement and our 2023 Form 10-K are available at

http://ir.evolenthealth.com/financial-info/annual-reports-and-proxy-statements/default.aspx

You may request and receive a paper or email copy of our proxy materials relating to the Annual Meeting and any future

stockholder meetings free of charge by emailing proxymaterials@evolent.com, calling 1-844-246-2928, or visiting http://ir.evolenthealth.com/financial-info/annual-reports-and-proxy-statements/default.aspx

TABLE OF CONTENTS

|

|

EVOLENT HEALTH, INC. 1812 N. Moore Street, Suite 1705 Arlington, VA 22209 |

PROXY STATEMENT

FOR OUR 2024 ANNUAL MEETING

OF STOCKHOLDERS

to be held on June 6, 2024

These proxy materials are being made available in connection with the solicitation of proxies by the Board of Directors (the “Board”) of Evolent Health, Inc., a Delaware corporation, for use at our 2024 annual meeting of stockholders (the “Annual Meeting”) to be held on Thursday, June 6, 2024, at 10:00 a.m., Eastern Time, in a virtual meeting format only, via the Internet at https://web.lumiconnect.com/209916247 (password “evolent2024”) or at any postponement or adjournment of the Annual Meeting. There is no physical location for the Annual Meeting. Stockholders will be able to view the Rules of Conduct for the Annual Meeting at http://ir.evolenthealth.com/financial-info/annual-reports-and-proxy-statements/default.aspx, and submit questions, at https://web.lumiconnect.com/209916247 (password “evolent2024”) on the day of the Annual Meeting, through the conclusion of the question and answer session that follows.

Distribution of this proxy statement and a proxy card to stockholders is scheduled to begin on or about April 26, 2024, which is also the date by which these materials will be posted. We encourage stockholder participation in the Annual Meeting, which we have designed to promote stockholder engagement. Stockholders will be permitted to ask questions on the ballot items during the Annual Meeting, and on other subjects in a question and answer session that will begin at the conclusion of the Annual Meeting. You will also be able to listen to the proceedings and cast your vote online.

As permitted by the rules of the U.S. Securities and Exchange Commission (the “SEC”), we are making this proxy statement and our Annual Report for the fiscal year ended December 31, 2023 (the “Annual Report”) available to our stockholders electronically via the Internet at http://ir.evolenthealth.com/financial-info/annual-reports-and-proxy-statements/default.aspx. On or about April 26, 2024, we mailed to our stockholders a Notice of Internet Availability of Proxy Materials (the “Internet Notice”), containing instructions on how to access this proxy statement and vote online. If you received an Internet Notice by mail, you will not receive a printed copy of the proxy materials in the mail unless you specifically request them pursuant to the instructions provided in the Internet Notice. The Internet Notice instructs you on how to access and review all of the important information contained in this proxy statement.

References in this proxy statement to “we,” “us,” “our,” “ours,” “Evolent,” and the “Company” refer to Evolent Health, Inc., unless the context otherwise requires.

| Evolent Health, Inc. Proxy Statement 2024 |

1 |

PROXY STATEMENT HIGHLIGHTS

This summary highlights selected information in this proxy statement — please review the entire document before voting.

Annual Meeting Information

| • | Thursday, June 6, 2024, at 10:00 a.m., Eastern Time. |

| • | Via a live audio-only webcast at https://web.lumiconnect.com/209916247 (password “evolent2024”). There is no physical location for the Annual Meeting. |

| • | The record date is April 11, 2024. |

All of our Annual Meeting materials are available in one place at http://ir.evolenthealth.com/financial-info/annual-reports-and-proxy-statements/default.aspx. There, you can download electronic copies of our Annual Report and proxy statement.

|

Voting Items |

Recommendation | |||||||

|

Item 1 |

||||||||

| Election of directors |

Our ten director nominees bring a valuable mix of skills and qualifications to our Board of Directors | ✔ | FOR

5 – 11 | |||||

| Item 2 |

||||||||

| Ratify the appointment of the Company’s independent registered public accounting firm for 2024 |

Based on its recent evaluation, our Audit Committee believes that the retention of Deloitte & Touche LLP is in the best interests of the Company and its stockholders | ✔ | FOR

12 – 13 | |||||

| Item 3 |

||||||||

| Say on pay—an advisory vote on the approval of the Company’s executive compensation |

Our executive compensation program reflects our commitment to paying for performance and reflects feedback received from stockholder outreach | ✔ | FOR

61 | |||||

| Item 4 |

||||||||

| Say on frequency—advisory vote on the frequency of future advisory votes on executive compensation |

Our Board has determined it is in the best interests of the Company and our stockholders to hold say on pay votes every year (as opposed to every 2 years or every 3 years) | ✔ | EVERY YEAR

62 - 65 | |||||

2023 Performance Highlights

Below are selected highlights of our financial and operational performance in 2023:

| Revenue |

Average Unique Members(1) |

Adjusted EBITDA(2) | ||||||||||

| $1,963.9 million |

41.3 million |

$194.7 million |

| (1) | As of December 31, 2023. See Appendix A for the definition of Average Unique Members. |

| (2) | Non-GAAP measure, see Appendix A for definition and reconciliation to net loss attributable to common shareholders of Evolent Health, Inc. Net loss attributable to common shareholders of Evolent Health, Inc. was $(142.3) million for the year ended December 31, 2023. |

| 2 | Evolent Health, Inc. Proxy Statement 2024 |

Proxy Statement Highlights

Governance Evolution

We are committed to establishing and maintaining strong corporate governance practices that reflect high standards of ethics and integrity and promote long-term stockholder value. Since the beginning of 2020, the Board has continued to evolve our governance practices and has directly incorporated feedback from our stockholders into the decision-making process. Feedback from our investors was shared with our full Board and directly informed implementation of the following key governance enhancements over the past three years:

|

Removal of remaining supermajority vote requirements for charter and by-law amendments; |

|

Transitioned to a fully declassified Board; |

|

Progress on workforce diversity and inclusion goals, including formalization of a Head of Diversity and Inclusion who focuses on Diversity, Inclusion and Corporate Responsibility; and |

|

Independent Board Chair with delineated duties. |

Board Leadership

Ms. Cheryl Scott has been our Independent Chair of our Board of Directors (the “Independent Board Chair”) since June 2022. As part of our ongoing commitment to strong and accountable corporate governance practices, the Nominating and Corporate Governance Committee of the Board (the “Nominating and Corporate Governance Committee”) regularly reviews the leadership structure of the Board, taking into account the Company and its needs, market practices, board skills and experiences, investor feedback, and corporate governance perspectives, among other things.

2023 Compensation Program Highlights

Our executive compensation program is designed to enable high performance and generate results that will create value for our stockholders. We structure compensation to pay for performance, and reward our executives with equity in the Company in order to align their interests with the interests of our stockholders and allow our executives to share in our stockholders’ success, which we believe continues to drive a performance culture, sustains morale and attracts, motivates and retains top executive talent.

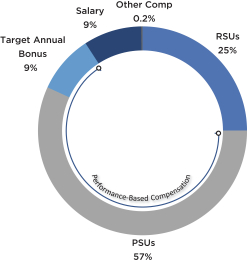

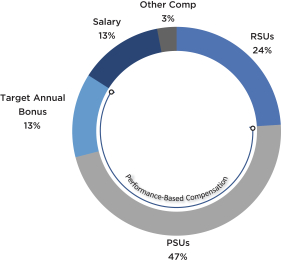

Compensation Mix (1)

| CEO: Target Pay | Other NEOs: Target Pay | |

|

|

|

| (1) | Consists of 2023 base salary (as reported in the Salary column of the 2023 Summary Compensation Table), 2023 target annual incentive opportunity, long-term incentive awards granted in 2023 (as reported in the Stock Awards column of the 2023 Summary Compensation Table) and other compensation (as reported in the All Other Compensation column of the 2023 Summary Compensation Table). |

| Evolent Health, Inc. Proxy Statement 2024 |

3 |

Proxy Statement Highlights

The primary elements of our fiscal year 2023 executive compensation program are base salary, annual bonuses, equity incentive awards and employee benefits. Our Board’s Compensation Committee (the “Compensation Committee”) reviews and approves our executive compensation program, and maintains the discretion to adjust awards and amounts paid to our executive officers as it deems appropriate. We believe our named executive officers (“NEOs”) are compensated in a manner consistent with our strategy, evolving compensation best practices and alignment with stockholders’ interests.

Below is a more detailed summary of evolving best practices that we have implemented with respect to the compensation of our NEOs because we believe they support our compensation philosophy and are in the best interests of our Company and our stockholders.

| What We Do |

|

What We Don’t Do | ||

|

|

| |||

| 4 | Evolent Health, Inc. Proxy Statement 2024 |

PROPOSAL 1:

ELECTION OF DIRECTORS

Our Board is elected annually by stockholders to oversee the Company’s business and strategy. The Nominating and Corporate Governance Committee is responsible for identifying, reviewing and recommending to the Board individuals for election to the Board. Our Board currently consists of ten members with terms expiring at the Annual Meeting.

Upon unanimous recommendation by the Nominating and Corporate Governance Committee, the Board proposes that the following nominees, Toyin Ajayi, MD, Craig Barbarosh, Seth Blackley, M. Bridget Duffy MD, Russell Glass, Peter Grua, Diane Holder, Richard Jelinek, Kim Keck and Cheryl Scott, be elected for new one-year terms and until their successors are duly elected and qualified. All of the nominees are current directors standing for election. Each of the nominees has consented to serve if elected. If any of them becomes unavailable to serve as a director, the Board may designate a substitute nominee. In that case, the persons named as proxy holders will vote for the substitute nominee designated by the Board. There is no limit on the number of terms a director may serve on our Board.

| Evolent Health, Inc. Proxy Statement 2024 |

5 |

Proposal 1: Election of Directors

| Director/Nominee Skills Matrix |

Ajayi | Barbarosh | Blackley | Duffy | Glass | Grua | Holder | Jelinek | Keck | Scott | ||||||||||||

|

|

Risk Oversight/Management Experience allows the Board to oversee and understand the most significant risks facing the Company |

|

|

|

|

|

|

|

|

|

| |||||||||||

|

|

Healthcare Industry Experience is critical for understanding and overseeing the Company’s strategy and challenges |

|

|

|

|

|

|

|

|

|

| |||||||||||

|

|

Financial Expertise/Literacy adds value in oversight of our financial reporting and internal controls |

|

|

|

|

|

|

|

|

| ||||||||||||

|

|

Executive Experience supports our management team through relevant advice and leadership |

|

|

|

|

|

|

|

| |||||||||||||

|

|

Technology Expertise brings value in overseeing innovative technology developments of our platform, as well as cybersecurity and data privacy |

|

|

|

|

|

|

|

|

|||||||||||||

|

|

ESG Expertise allows the Board to assess and consider adopting environmental, social and governance practices and interact effectively with stakeholders |

|

|

|

|

|

|

|

|

| ||||||||||||

|

|

Government/Regulatory/Public Policy Expertise adds value to the oversight of regulated aspects of our business and general industry developments |

|

|

|

|

|

|

|

|

|

| |||||||||||

| 6 | Evolent Health, Inc. Proxy Statement 2024 |

Proposal 1: Election of Directors

THE BOARD UNANIMOUSLY RECOMMENDS A VOTE “FOR” THE ELECTION OF EACH OF THE TEN DIRECTOR NOMINEES NAMED BELOW.

| Directors Standing for Election |

|

Independent Director

CEO and Co-Founder of

Director Since July 2023

Other Public Boards None

Evolent Board Committees • Compliance and Regulatory |

Toyin Ajayi, MD, Age 43

| |||

| Toyin Ajayi has served as the chief executive officer of Cityblock, a company focused on enabling a path to healthier communities through a digitally enabled, integrated primary care, behavioral health and social service delivery model for Medicaid and dually eligible populations with complex needs, since March 2022. Dr. Ajayi, who co-founded Cityblock, previously served as the company’s president from September 2017 through March 2022. Prior to Cityblock, Dr. Ajayi was the chief medical officer of Commonwealth Care Alliance, a nationally renowned integrated health plan and care delivery system for individuals eligible for both Medicare and Medicaid. Dr. Ajayi holds a Bachelor of Arts degree from Stanford University, a Doctor of Medicine from King’s College London School of Medicine and a master’s degree from the University of Cambridge. |

Qualifications: We believe that Dr. Ajayi is qualified to serve on our Board because of her extensive healthcare industry experience including as a CEO of Cityblock.

Skills:

| |||

|

Independent Director

Senior Managing Director,

Director Since December 2020

Other Public Boards Lifecore Biomedical, Inc. Sabra Health Care REIT, Inc.

Evolent Board Committees • Compensation, Strategy |

Craig Barbarosh, Age 56

| |||

| Craig Barbarosh has served as a senior managing director at Common Wealth Partners LLC since October 2023. Prior to this role he served as a partner at the law firm of Katten Muchin Rosenman LLP from 2012 to January 2023. From 1999 until joining Katten, Mr. Barbarosh was a partner at another international law firm. Mr. Barbarosh currently serves as the Chairman of the Board of Directors of Lifecore Biomedical, Inc. (NASDAQ: LFCR) and has been an independent director there since October 2019. Mr. Barbarosh is currently the Chair of the Audit Committee and a member of the Compensation Committee for Sabra Health Care REIT, Inc. (NASDAQ: SBRA). He previously served as the Vice Chairman of the Board of Directors of Nextgen Healthcare, Inc. (NASDAQ: NXGN) from November 2015 through August 2022, and was Chairman of the Compensation Committee and a member of the Nominating and Governance Committee Nextgen Healthcare, Inc., a board he served on from 2009 until November 2023. He previously served as an independent director on the Boards of Directors of Aratana Therapeutics, Inc., BioPharmX, Inc. and Bazaarvoice, Inc. Mr. Barbarosh also served as the independent board observer for Payless Holdings, LLC and as an independent director for Ruby Tuesday Inc. He holds his J.D. (with honors) from the University of the Pacific, McGeorge School of Law and earned his B.A. in Business Economics from the University of California at Santa Barbara. |

Qualifications: We believe that Mr. Barbarosh is qualified to serve on our Board because of his healthcare industry knowledge and experience as a business leader and public company board member.

Skills:

| |||

| Skills Key |

|

|

|

|

|

|

| |||||||

| Risk Oversight | Healthcare | Finance | Executive | Technology | ESG | Govt/Regulatory |

| Evolent Health, Inc. Proxy Statement 2024 |

7 |

Proposal 1: Election of Directors

|

Non-Independent Director

Chief Executive Officer,

Director Since April 2018

Other Public Boards None

Evolent Board Committees None |

Seth Blackley, Age 45

| |||

| Seth Blackley, our co-founder, has served as our Chief Executive Officer since October 2020, and served as our President from August 2011 until his promotion. Prior to co-founding the Company, Mr. Blackley was the Executive Director of Corporate Development and Strategic Planning at The Advisory Board from June 2007 to August 2011. From 2014 to 2016, Mr. Blackley served on the board of directors of Advanced Practice Strategies. Mr. Blackley began his career as an analyst in the Washington, D.C. office of McKinsey & Company. Mr. Blackley holds a Bachelor of Arts degree in business from The University of North Carolina at Chapel Hill, and a Master of Business Administration from Harvard Business School.

|

Qualifications: We believe that Mr. Blackley is qualified to serve on our Board because of his extensive experience in finance, strategy and operations, especially in the field of healthcare, and his extensive knowledge in all aspects of our business.

Skills:

| |||

|

Independent Director

Former Chief Medical Officer, Vocera, now part of Stryker

Director Since September 2017

Other Public Boards None

Evolent Board Committees • Compliance and Regulatory |

M. Bridget Duffy, MD, Age 64

| |||

| M. Bridget Duffy, MD served as the Chief Medical Officer at Vocera, now part of Stryker, from January 2013 to May 2022. Prior to her appointment at Vocera, Dr. Duffy co-founded and served as Chief Executive Officer of ExperiaHealth from November 2010 to December 2012. Dr. Duffy also served as the Chief Experience Officer at the Cleveland Clinic. Dr. Duffy holds a Bachelor of Science degree from the University of Minnesota and received her doctorate in medicine from the University of Minnesota. She completed her residency in internal medicine at Abbott Northwestern Hospital in Minneapolis, Minnesota.

|

Qualifications: We believe Dr. Duffy is qualified to serve on our Board because of her extensive experience in healthcare, including as Chief Medical Officer of Vocera.

Skills:

| |||

| Skills Key |

|

|

|

|

|

|

| |||||||

| Risk Oversight | Healthcare | Finance | Executive | Technology | ESG | Govt/Regulatory |

| 8 | Evolent Health, Inc. Proxy Statement 2024 |

Proposal 1: Election of Directors

|

Independent Director

CEO, Headspace

Director Since February 2024

Other Public Boards None

Evolent Board Committees None |

Russell Glass, Age 48

| |||

| Russell Glass has served as CEO of Headspace since 2021. Prior to that, he held multiple CEO roles, most recently at Ginger, an on-demand mental health platform that merged with Headspace in 2021, resulting in the creation of an end-to-end digital mental health platform. In addition, Mr. Glass founded and served as the CEO and president of Bizo, a B2B marketing and data platform, which he sold to LinkedIn in 2014. Following the sale of Bizo, Mr. Glass became a product vice president at LinkedIn, where he delivered industry-leading solutions to help marketers get to the right professionals while improving the online experience of LinkedIn members. He holds a Bachelor of Science in Engineering and Economics from Duke University.

|

Qualifications: We believe that Mr. Glass is qualified to serve on our Board because of his extensive experience in healthcare technology innovation and artificial intelligence including as CEO of Headspace.

Skills:

| |||

|

Independent Director

Managing Partner, HLM

Director Since January 2020

Other Public Boards None

Evolent Board Committees • Compensation, Strategy |

Peter Grua, Age 69

|

|||

| Peter Grua is currently a Managing Partner at HLM Venture Partners (“HLM”), a venture capital investment firm, where his investment activities focus on health services, medical technologies and healthcare information technologies. Prior to joining HLM, Mr. Grua was a Managing Director at Alex Brown & Sons, an investment banking firm, where he directed research in healthcare services and managed care. Mr. Grua was previously a director at The Advisory Board Company and Welltower Inc. (formerly Health Care REIT, Inc.), and currently serves as a director at numerous companies including MeQuilibrium, Oceans Healthcare LLC,. MyTown Health, Vaxcare and Linkwell Health, Inc. Mr. Grua holds a bachelor’s degree from Bowdoin College and a master’s degree in business administration from the Columbia University Graduate School of Business. |

Qualifications: We believe Mr. Grua is qualified to serve on our Board because of his extensive industry experience, including as an investment professional in the medical technologies and healthcare information technologies spaces.

Skills:

|

| Skills Key |

|

|

|

|

|

|

| |||||||

| Risk Oversight | Healthcare | Finance | Executive | Technology | ESG | Govt/Regulatory |

| Evolent Health, Inc. Proxy Statement 2024 |

9 |

Proposal 1: Election of Directors

|

Independent Director

EVP, UPMC

Director Since August 2011

Other Public Boards None

Evolent Board Committees • Audit, Compliance and |

Diane Holder, Age 74

| |||

| Diane Holder has served as an Executive Vice President of the University of Pittsburgh Medical Center (“UPMC”) since 2007, President of the UPMC Insurance Services Division and President and CEO of UPMC Health Plan since 2004. In 2023, Ms. Holder expanded her scope at UPMC and holds an additional title of President Community and Ambulatory Services Division, focused on integrating clinical delivery and financing strategies. She holds a Bachelor of Arts in psychology from the University of Michigan and a Master of Science in social work from Columbia University. |

Qualifications: We believe that Ms. Holder is qualified to serve on our Board because of her extensive career in healthcare, including as CEO of UPMC Health Plan, part of UPMC, a large integrated health delivery system.

Skills:

| |||

|

Independent Director

Former Executive Vice

Director Since Since June 2023

Other Public Boards None

Evolent Board Committees • Strategy |

Richard Jelinek, Age 58

| |||

| Richard Jelinek has served as Managing Partner at Czech One Capital Partners since May 2020. From November 2018 to May 2020, Mr. Jelinek previously served as Executive Vice President of CVS Health. Previously, Mr. Jelinek was Executive Vice President at Aetna from November 2015 to November 2018. Mr. Jelinek previously served on the Board of Directors of Altimar Acquisition Corp. III and Altimar Acquisition Corp II. He received a B.A. in Business Administration from the University of Southern California and an MBA and MHSA from the University of Michigan.

|

Qualifications: We believe that Mr. Jelinek is qualified to serve on our Board because of his extensive experience in the healthcare industry, particularly within the health insurance payer community and as a private equity investor in the healthcare space.

Skills:

| |||

| Skills Key |

|

|

|

|

|

|

| |||||||

| Risk Oversight | Healthcare | Finance | Executive | Technology | ESG | Govt/Regulatory |

| 10 | Evolent Health, Inc. Proxy Statement 2024 |

Proposal 1: Election of Directors

|

Independent Director

President and Chief

Director Since January 2021

Other Public Boards None

Evolent Board Committees • Audit, Nominating and |

Kim Keck, Age 60

|

|||

| Kim Keck has served as the President and CEO of Blue Cross Blue Shield Association since January 2021. From June 2016 to December 2020, Ms. Keck previously served as the President and Chief Executive Officer of Blue Cross Blue Shield of Rhode Island. Previously, Ms. Keck held several leadership roles at Aetna from 2001 to 2016, including Senior Vice President from 2010 to 2016. Ms. Keck serves on the Board of Directors of Blue Cross Blue Shield Association and previously served on the Board of Directors of Oak Street Health, Inc. She received a B.A. in Mathematics from Boston College and an MBA in Finance from the University of Connecticut and is a Chartered Financial Analyst.

|

Qualifications: We believe that Ms. Keck is qualified to serve on our Board because of her extensive experience in the healthcare industry, particularly within the health insurance payer community.

Skills:

|

|

Independent Board Chair, Main Principal, McClintock

Director Since November 2015

Board Chair Since June 2022

Other Public Boards Progyny, Inc.

Evolent Board Committees • Audit, Compensation, |

Cheryl Scott, Age 74

| |||

| Cheryl Scott has served as the Main Principal of the McClintock Scott Group since July 2017. From June 2006 to July 2017, Ms. Scott served as Senior Advisor to the Bill & Melinda Gates Foundation. Before joining the foundation, Ms. Scott served for eight years as President and Chief Executive Officer of Group Health Cooperative. She previously served as that organization’s Executive Vice President and Chief Operating Officer. Ms. Scott currently serves on a variety of private and not-for-profit boards. She serves on the Board of Directors of Progyny, Inc. (NASDAQ: PGNY), and was a member of the board of directors of Recreational Equipment Incorporated (REI) from 2005 to 2017. Ms. Scott received her bachelor’s degree in communications and master’s degree in health management from the University of Washington.

|

Qualifications: We believe that Ms. Scott is qualified to serve on our Board because of her extensive career in healthcare, leadership and corporate governance, including as the Chief Executive Officer of Group Health Cooperative.

Skills:

| |||

| Skills Key |

|

|

|

|

|

|

| |||||||

| Risk Oversight | Healthcare | Finance | Executive | Technology | ESG | Govt/Regulatory |

| Evolent Health, Inc. Proxy Statement 2024 |

11 |

PROPOSAL 2:

RATIFICATION OF APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The Audit Committee of the Board (“Audit Committee”) has appointed the accounting firm of Deloitte & Touche LLP (“Deloitte”) to serve as our independent registered public accounting firm to audit the Company’s consolidated financial statements as of and for the fiscal year ending December 31, 2024 and its internal control over financial reporting as of December 31, 2024.

Stockholder ratification of the appointment of Deloitte is not required by law, the New York Stock Exchange (“NYSE”) or the Company’s organizational documents. However, as a matter of good corporate governance, the Board has elected to submit the appointment of Deloitte to the stockholders for ratification at the Annual Meeting. Even if the appointment is ratified, the Audit Committee, in its discretion, may select a different independent registered public accounting firm at any time if the Audit Committee believes that such a change would be in the best interest of the Company and its stockholders. If stockholders do not ratify the appointment of Deloitte, the Audit Committee will take that fact into consideration, together with such other factors it deems relevant, in determining its selection of an independent registered public accounting firm. Deloitte is considered by our management to be well-qualified. Deloitte has advised us that neither it nor any member thereof has any financial interest, direct or indirect, in the Company or any of our subsidiaries in any capacity.

A representative of Deloitte will be present at the Annual Meeting, will be given the opportunity to make a statement at the Annual Meeting if he or she so desires and will be available to respond to appropriate questions.

A majority of all of the votes cast at the Annual Meeting at which a quorum is present in person (by virtual attendance) or represented by proxy is required for the ratification of the appointment of Deloitte as our independent registered public accounting firm for the fiscal year ending December 31, 2024. We will treat abstentions as shares that are present and entitled to vote for purposes of determining the presence or absence of a quorum. Abstentions will have no effect on this proposal. Because the ratification of the appointment of the independent auditor is considered a “routine” matter, there will be no broker non-votes with respect to this proposal.

Fee Disclosure

The following is a summary of the fees billed to us by Deloitte for professional services rendered for the fiscal years ended December 31, 2023 and 2022.

| 2023 |

2022 |

|||||||

| Audit Fees |

$ |

2,692,846 |

|

$ |

1,980,025 |

| ||

| Audit-Related Fees |

|

224,000 |

|

|

1,936,494 |

| ||

| Tax Fees |

|

24,621 |

|

|

160,180 |

| ||

| All Other Fees |

|

— |

|

|

— |

| ||

| Total |

$ |

2,941,467 |

|

$ |

4,076,699 |

| ||

Audit Fees

“Audit Fees” include fees associated with professional services rendered for the audit of the financial statements and services that are normally provided by Deloitte in connection with statutory and regulatory filings or engagements. For example, audit fees include fees for professional services rendered in connection with quarterly and annual reports, the issuance of consents by Deloitte to be named in our

| 12 | Evolent Health, Inc. Proxy Statement 2024 |

Proposal 2: Ratification of Appointment of Independent Registered Public Accounting Firm

registration statements and to the use of their audit report in the registration statements and the issuance of an attestation of management’s report on internal control over financial reporting.

Audit-Related Fees

“Audit-Related Fees” refers to fees for assurance services in connection with our securities offerings, as well as related services associated with transactions and proposed transactions (including acquisitions and securities offerings) and permissible internal control services for the SOC 2 reports and management assertion.

Tax Fees

“Tax Fees” refers to fees and related expenses for professional services for tax compliance, tax advice and tax planning.

All Other Fees

“All Other Fees” refers to fees and related expenses for products and services other than services described above, including fees to the independent registered public accounting firm or its affiliates for annual subscriptions to online accounting and tax research software applications and data.

Our Audit Committee considered whether the provision by Deloitte of any services that would be required to be described under “All Other Fees” would have been compatible with maintaining Deloitte’s independence from both management and the Company.

Pre-Approval Policies and Procedures of our Audit Committee

Consistent with SEC policies regarding auditor independence and the Audit Committee’s charter, the Audit Committee is directly responsible for the appointment, compensation, retention, removal and oversight of the independent registered public accounting firm engaged for the purpose of preparing or issuing an audit report or performing other audit, review or attestation services for the Company. Our Audit Committee must pre-approve all audit, non-audit and any other services to be provided by the independent registered public accounting firm. All of the fees billed by Deloitte for the professional services rendered for us for the fiscal years ended December 31, 2023 and 2022, were pre-approved by our Audit Committee.

THE BOARD UNANIMOUSLY RECOMMENDS A VOTE “FOR” THE RATIFICATION OF THE APPOINTMENT OF DELOITTE & TOUCHE LLP AS OUR INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM.

| Evolent Health, Inc. Proxy Statement 2024 |

13 |

AUDIT COMMITTEE REPORT

Notwithstanding anything to the contrary set forth in any of our previous or future filings under the Securities Act of 1933, as amended, (the “Securities Act”) or the Securities Exchange Act of 1934, as amended, (the “Exchange Act”) that might incorporate this proxy statement or future filing with the SEC, in whole or in part, the following report shall not be deemed incorporated by reference into any such filing.

The Audit Committee operates pursuant to a charter which is reviewed annually by the Audit Committee. Our management is responsible for the preparation, presentation and integrity of our financial statements, the application of accounting and financial reporting principles and our internal controls and procedures designed to assure compliance with accounting standards and applicable laws and regulations. The independent registered public accounting firm is responsible for auditing our financial statements, expressing an opinion as to their conformity with accounting principles generally accepted in the United States and auditing management’s assessment of the effectiveness of internal control over financial reporting.

The undersigned members of the Audit Committee of the Board of Directors of Evolent Health, Inc. submit this report in connection with the committee’s review of the financial reports for the fiscal year ended December 31, 2023 as follows:

| 1. | the Audit Committee has reviewed and discussed with management the audited financial statements and internal control over financial reporting of Evolent Health, Inc. for the fiscal year ended December 31, 2023; |

| 2. | the Audit Committee has discussed with representatives of Deloitte the matters required to be discussed with them pursuant to Auditing Standard No. 1301, “Communications with Audit Committees,” as adopted by the Public Company Accounting Oversight Board; and |

| 3. | the Audit Committee has received the written disclosures and the letter from Deloitte required by applicable requirements of the Public Company Accounting Oversight Board regarding Deloitte’s communications with the Audit Committee concerning independence and has discussed with Deloitte its independence. |

Based on the review and discussions referred to above, the Audit Committee recommended to the Board that the audited financial statements of Evolent Health, Inc. be included in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2023, which was filed with the SEC.

Submitted by the Audit Committee

Kim Keck (Chair)

Diane Holder

Cheryl Scott

| 14 | Evolent Health, Inc. Proxy Statement 2024 |

CORPORATE GOVERNANCE AND BOARD STRUCTURE

Corporate Governance Highlights

The Board continues to evaluate the Company’s corporate governance policies and practices to ensure that the right mix of directors are represented in our boardroom to best serve our stockholders by ensuring effective oversight of our strategy and management.

| Board Composition | Board Performance | |

| • Formal policy to ensure that Evolent considers diverse candidates for Board and CEO succession

• Independent Board Chair with delineated duties

• All Board committees consist solely of independent members

• Independent committee chairs

• Executive sessions of independent directors at each full Board meeting

• Board and committees may engage outside advisers independently of management

|

• Oversight of key human capital issues, including diversity and inclusion and executive succession planning

• Annual Board, committee and director evaluations

• Commitment to continuing director education

• Oversight of key risk areas and certain aspects of risk management efforts | |

| Policies, Programs and Guidelines | Stockholder Rights | |

| • Robust stock ownership guidelines for executives and directors

• Compensation clawback policy

• Comprehensive Code of Business Conduct and Ethics

• Prohibition on hedging and pledging for any officers or directors |

• Fully declassified Board

• No supermajority vote requirements

• Market standard proxy access by-law

• Directors elected by majority voting except in contested elections

• No stockholder rights plan or “poison pill” | |

We are committed to operating our business under strong and accountable corporate governance practices. Our committee charters, Code of Business Conduct and Ethics and Corporate Governance Guidelines are available on the Investor Relations page on our website at www.evolent.com. Any stockholder also may request them in print, without charge, by contacting our Secretary at Evolent Health, Inc., 1812 N. Moore Street, Suite 1705, Arlington, VA 22209.

| Evolent Health, Inc. Proxy Statement 2024 |

15 |

Corporate Governance and Board Structure

Stockholder Engagement

Our Board recognizes the importance of regular, two-way dialogue with our investors. Feedback from Evolent’s stockholders is integral to the Board’s decision-making process. In 2023, we contacted stockholders representing approximately 40% of Evolent’s outstanding shares of common stock at the time of outreach to conduct engagement. We met with stockholders representing approximately 24% of outstanding shares of common stock. Board members participated in select engagements, which allows for a direct line of communication with our Board.

In these conversations with stockholders, we discussed Evolent’s strategy & performance, Board, corporate governance, executive compensation, and environmental, social & governance (“ESG”) practices, including our human capital management initiatives.

During these discussions, our Board and management team gained valuable perspective from our investors on these topics. This feedback from our investors was shared with our full Board and directly informed our continued Board refreshment over the past year, including the addition of a Toyin Ajayi, MD and Russell Glass as our newest Board members. Other key governance enhancements informed by investor feedback in recent years include:

|

Robust stock ownership guidelines for our executive officers and directors |

|

Formal policies to ensure that Evolent considers diverse candidates when conducting Board and CEO succession planning |

|

Removal of remaining supermajority vote requirements for charter and by-law amendments |

|

Transitioned to fully declassified Board |

|

Market-standard proxy access by-law |

|

Progress on workforce diversity and inclusion goals, including formalization of a Head of Diversity and Inclusion who focuses on Diversity, Inclusion and Corporate Responsibility |

|

Independent Board Chair with delineated duties |

This stockholder outreach is incremental to, and often interlaced with, Evolent’s normal-course Investor Relations program in which we engage with stockholders, typically comprising a large majority of our shares of common stock, during road shows and conferences.

We value each conversation we have with our investors as we continue to enhance our practices related to corporate governance, executive compensation and ESG. We look forward to facilitating ongoing dialogue with our investors in 2024 and beyond.

Board Leadership Structure

Ms. Cheryl Scott has been our Independent Board Chair since June 2022. As part of our ongoing commitment to strong and accountable corporate governance practices, the Nominating and Corporate Governance Committee regularly reviews the leadership structure of the Board, taking into account the Company and its needs, market practices, board skills and experiences, investor feedback and corporate governance perspectives, among other things. The Board believes it is in the best interests of the Company and its stockholders for the Board to have flexibility in determining the Board leadership structure of the Company based on these factors.

The Board believes that having a strong Independent Board Chair and independent committee chairs provides an effective balance between strong company leadership and independent oversight. The Board is committed to continuously evaluating this structure to ensure that it promotes effective governance.

| 16 | Evolent Health, Inc. Proxy Statement 2024 |

Corporate Governance and Board Structure

Board of Directors Meetings and Committees

The Board met eight times during 2023. Each incumbent member of the Board attended 75% or more of the meetings of the Board and of the committees on which he or she served that were held during the period for which he or she was a director or committee member, respectively. We do not have a policy on director attendance at our Annual Meeting. Mr. Blackley and Ms. Scott attended our 2023 annual meeting of stockholders.

Committees of our Board include the Audit Committee, the Compensation Committee, the Nominating and Corporate Governance Committee, the Compliance and Regulatory Affairs Committee and the Strategy Committee. Set forth in the chart below is the current committee structure. Following the Annual Meeting, Dr. Ajayi will become a member of the Compliance and Regulatory and Affairs Committee and Mr. Jelinek will cease to be a member of the Compliance and Regulatory Affairs Committee. The principal functions of each of these committees are briefly described below. The Company’s Audit Committee, Compensation Committee, Nominating and Corporate Governance Committee, Compliance and Regulatory Affairs Committee and Strategy Committee are fully independent under the applicable NYSE listing standards and rules of the SEC. The current charters for each of the Audit Committee, Compensation Committee, Nominating and Corporate Governance Committee and Compliance and Regulatory Affairs Committee are available on the Investor Relations page on our website at www.evolent.com.

| Director/Nominee |

Audit | Compensation | Nominating and Corporate Governance |

Compliance and Regulatory Affairs |

Strategy | ||||||||||||||||||||

| Toyin Ajayi, MD |

|||||||||||||||||||||||||

| Craig Barbarosh |

X |

X* | |||||||||||||||||||||||

| Seth Blackley |

|||||||||||||||||||||||||

| M. Bridget Duffy, MD |

X* |

X |

|||||||||||||||||||||||

| Diane Holder |

X |

X* |

X | ||||||||||||||||||||||

| Russell Glass |

|||||||||||||||||||||||||

| Peter Grua |

X* |

X | |||||||||||||||||||||||

| Richard Jelinek |

X |

X | |||||||||||||||||||||||

| Kim Keck |

X* |

X |

|||||||||||||||||||||||

| Cheryl Scott† |

X |

X |

X |

||||||||||||||||||||||

| x | = Committee Member |

| * | = Chair |

| † | = Independent Chair |

| Evolent Health, Inc. Proxy Statement 2024 |

17 |

Corporate Governance and Board Structure

| Audit Committee |

||

| Members: Kim Keck (Chair) Cheryl Scott Diane Holder

Meetings in 2023: Five

The Board has determined that Kim Keck qualifies as an “audit committee financial expert”, as such term is defined in the rules of the SEC, and that Kim Keck, Cheryl Scott and Diane Holder meet the standards of independence required by SEC rules and NYSE listing standards applicable to members of audit committees; the Company’s Audit Committee is fully independent. |

The Audit Committee’s responsibilities:

• Oversees the quality and integrity of our financial statements and accounting practices;

• Selects and appoints an independent registered public accounting firm, such appointment to be ratified by stockholders at our Annual Meeting;

• Pre-approves all services to be provided to us by our independent registered public accounting firm;

• Reviews and evaluates the qualification, performance, fees and independence of our registered public accounting firm;

• Reviews with our independent registered public accounting firm and our management the plan and scope of the accounting firm’s proposed annual financial audit and quarterly review, including the procedures to be utilized;

• Reviews with our independent registered public accounting firm and our management the accounting firm’s significant findings and recommendations upon the completion of the annual financial audit and quarterly reviews;

• Oversees our internal audit function;

• Reviews our annual and interim financial statements, the report of our independent registered public accounting firm on our annual financial statements, Management’s Report on Internal Control over Financial Reporting and the disclosures under Management’s Discussion and Analysis of Financial Condition and Results of Operations in our periodic reports and other filings with the SEC;

• Meets with our independent registered public accounting firm and our management regarding our internal controls, critical accounting policies and practices and other matters;

• Discusses earnings releases and reports to rating agencies with our management;

• Assists our Board in the oversight of our financial structure, financial condition and capital strategy;

• Administers our policy governing related party transactions; and

• Oversees our compliance program, response to regulatory actions involving financial, accounting and internal control matters, internal controls and risk assessment policies. | |

| 18 | Evolent Health, Inc. Proxy Statement 2024 |

Corporate Governance and Board Structure

| Compensation Committee |

||

| Members: Peter Grua (Chair) Craig Barbarosh Cheryl Scott

Meetings in 2023: Seven

The Board has determined that all members of the Compensation Committee meet the standards of independence required by SEC rules and NYSE listing standards applicable to service on compensation committees; the Company’s Compensation Committee is fully independent. |

The Compensation Committee’s responsibilities:

• Sets and reviews our general policy regarding executive compensation;

• Determines the compensation (including salary, bonus, equity-based grants and any other long-term cash compensation) of our chief executive officer and our other executive officers;

• Oversees our disclosure regarding executive compensation;

• Administers our executive bonus and equity-based incentive plans;

• Reviews and makes recommendations to our Board with respect to non-employee director compensation; and

• Assesses the independence of compensation consultants, legal counsel and other advisors to the Compensation Committee and hires, approves the fees and oversees the work of, and terminates the services of such advisors. | |

|

Except as prohibited by law, applicable regulations of the NYSE, our charter or our third amended and restated by-laws, the Compensation Committee may delegate its responsibilities to subcommittees or individuals. | ||

Compensation Consultant

The Compensation Committee has the authority under its charter to retain outside consultants or advisors, as it deems necessary or advisable. In accordance with this authority, the Compensation Committee has directly engaged Exequity as its independent compensation consultant to provide it with objective and expert analyses, advice and information with respect to executive compensation. All executive compensation services provided by Exequity were directed or approved by the Compensation Committee and Exequity reports directly to the Compensation Committee on this assignment. Exequity attended a portion of each of the Compensation Committee meetings during 2023. The Compensation Committee has concluded that no conflict of interest exists with Exequity with respect to the services it provided to the Compensation Committee during 2023. Exequity did not provide any services to the Company or its management other than services to the Compensation Committee and we do not currently expect Exequity to provide other services to the Company while serving as the Compensation Committee’s consultant.

In addition to Exequity, members of our human resources, legal and finance departments support the Compensation Committee in its work management by providing data, analysis and recommendations regarding the Company’s executive and director compensation practices and policies and individual pay recommendations.

| Evolent Health, Inc. Proxy Statement 2024 |

19 |

Corporate Governance and Board Structure

Compensation Committee Interlocks and Insider Participation

Craig Barbarosh, Peter Grua and Cheryl Scott served on our Compensation Committee during 2023. None of the members of our Compensation Committee has at any time been an officer or employee of the Company. During 2023, none of our executive officers served as a member of the board of directors or a compensation committee of any entity for which a member of our Board or Compensation Committee served as an executive officer.

| Nominating and Corporate Governance Committee | ||

| Members: M. Bridget Duffy, MD (Chair) Kim Keck Cheryl Scott

Meetings in 2023: Six

The Board has determined that M. Bridget Duffy, MD, Kim Keck and Cheryl Scott meet the standards of independence required by SEC rules and NYSE listing standards; the Company’s Nominating and Corporate Governance Committee is fully independent. |

The Nominating and Corporate Governance Committee’s responsibilities:

• Oversees our corporate governance practices;

• Reviews our charter, by-laws, committee charters, Code of Business Conduct and Ethics and Corporate Governance Guidelines, and provides recommendations to the Board regarding possible changes;

• Evaluates the composition, size, leadership structure and governance of our Board and its committees and makes recommendations regarding the appointment of directors to our committees;

• Considers stockholder nominees for election to our Board;

• Evaluates and recommends candidates for election to our Board;

• Oversees the CEO and management succession planning process;

• Reviews the Company’s human resources policies and programs;

• Leads the self-evaluation process of our Board and oversees the Board succession planning process;

• Oversees the Company’s stockholder engagement program; and

• Oversees and monitors general governance matters, including communications with stockholders and regulatory developments relating to corporate governance. | |

| Compliance and Regulatory Affairs Committee | ||

| Members: Diane Holder (Chair) M. Bridget Duffy, MD Richard Jelinek

Meetings in 2023: Four |

The Compliance and Regulatory Affairs Committee’s responsibilities:

• Assists our Board in carrying out its responsibilities relating to regulatory compliance and ethics;

• Oversees our compliance program;

• Reviews and recommends for approval our code of business conduct and ethics and other risk oversight documentation;

• Provides oversight of risks from cybersecurity threats;

• Oversees our response to regulatory actions; and

• Reviews corrective measures for issues reported by our partners, our employees and our vendors. | |

| Strategy Committee | ||

| Members: Craig Barbarosh (Chair) Peter Grua Diane Holder Richard Jelinek

Meetings in 2023: Three |

The Strategy Committee of the Board was formed in January 2021 and makes recommendations to the Board with respect to value creation initiatives, including through improvements to the Company’s operations, financial performance, M&A divestitures and overall business strategy and direction. | |

| 20 | Evolent Health, Inc. Proxy Statement 2024 |

Corporate Governance and Board Structure

Code of Business Conduct and Ethics

Our Board has adopted a code of business conduct and ethics (the “Code of Business Conduct and Ethics”) that applies to all of our directors, officers and other employees, including our principal executive officer, principal financial officer and principal accounting officer. Any waiver of the Code of Business Conduct and Ethics for directors or executive officers and any amendment of the Code of Business Conduct and Ethics may be made only by our Board. We intend to make disclosures of such waivers or amendments required by SEC rules and NYSE listing standards, if any, through publication on our website, www.evolent.com.

Corporate Governance Guidelines

Our Board has adopted corporate governance guidelines (the “Corporate Governance Guidelines”) that serve as a flexible framework within which our Board and its committees operate. These guidelines cover a number of areas, including the size and composition of the Board, Board membership criteria and director qualifications, director responsibilities, Board agenda, roles of the Independent Board Chair and CEO, meetings of independent directors, committee composition, Board member access to management and independent advisors, director communications with third parties, director compensation, director orientation and continuing education, evaluation of senior management and management succession planning. In 2020, we amended our Corporate Governance Guidelines to, among other important governance enhancements, adopt formal policies to ensure that highly qualified candidates who would bring gender, racial, and/or ethnic diversity to the Board if chosen, are included in any pool of director candidates or candidates for CEO.

Executive Sessions of Non-Management Directors

Our Corporate Governance Guidelines provide that the independent directors serving on the Board will hold an executive session during each Board meeting. The executive sessions are chaired by our Independent Board Chair and facilitate candid discussion of the independent directors’ viewpoints regarding the performance of management and the Company.

| Evolent Health, Inc. Proxy Statement 2024 |

21 |

Corporate Governance and Board Structure

Corporate and Social Responsibility

We are committed to corporate and social responsibility and work collaboratively with our stakeholders to promote environmental sustainability, data and privacy security and social responsibility in our business practices. Our Board oversees our corporate and social responsibility programs and is committed to supporting our efforts to operate as a good corporate citizen. We recently formed a sustainability business resource group to harness the input from employees for future evolution of our efforts.

Our Future Forward Approach to Work Pay

We remain anchored by our mission, commitment to the health and safety of our employees, and our core value, “start by listening.” During the pandemic, our employees embraced remote work, while our business, culture and productivity continued to thrive. Based on employee feedback and our active listening through employee surveys, we implemented 100% work from home across our employee population and instituted work from home office set-up support. Today, we believe employees and prospective employees consider our workplace flexibility and culture as differentiators.

Taking Care of Our People

We believe that we have a responsibility to help maintain the health and well-being of our employees. We provide our employees with comprehensive benefits including medical insurance, dental, vision, PTO and 401(k) plan with company match for eligible employees. In addition, we offer fertility support, bariatric surgery, diabetes, and hypertension program offerings, as well as 100% paid pregnancy leave and parental leave. We have also continued to support work from home across our employee population.

Employees and their families can access mental health resources as part of their benefits, covering a spectrum of mental wellness needs. In addition, we have an active employee listening strategy, including employee surveys and personal impact days to promote social improvement engagement, an employee relief fund and holistic wellness initiatives during the year that include yoga, cooking sessions, meditation, and wellness challenges.

We also believe continued development of our talent is good for our employees and our business. We support a culture of growth and development through engaging and relevant resources including Evolent-exclusive live learnings and curated, on-demand content through LinkedIn Learning. Lastly, we maintain a commitment to internal mobility, encouraging employees to grow with us, and leveraging our human capital technology to enable transparency of opportunities for talent across the organization. We believe this not only benefits the personal growth of our employees but allows Evolent to retain key talent.

Diversity, Equity and Inclusion (“DE&I”)

We believe each person’s voice, perspective, and experience can contribute to our ability to change the way healthcare is delivered. We further believe DE&I enhances our culture and leads to a better-run business, populated with a highly motivated workforce, and produces a stronger bottom line. Evolent stands firm behind non-discrimination, is an equal opportunity employer and works to foster an environment where diverse perspectives can grow and lead. Evolent is recognized as a top place to work in healthcare nationally and has demonstrated its commitment to creating a supportive and inclusive workplace through several initiatives over the past several years. We continue to support our employee-led business resource groups that help foster a diverse and inclusive workplace.

We are proud of our progress in cultivating a diverse and supportive workplace. As of December 31, 2023:

|

50% of Evolent’s managing directors and above levels were women

|

|

30% of Evolent’s managing directors and above levels were minorities

|

We are committed to continuing our progress as a diverse and inclusive workplace. We were named to the Parity.org Best Companies for Women to Advance List 2023 for creating a fair and equitable work environment for women, for four years in a row.

Community Engagement

Evolent has fostered a mission-driven, service-oriented culture through embracing opportunities for our employees to give back to the community in which they live and work. Our formal program, Evolent Cares, promotes civic improvement engagements to help the communities where employees live and work reach their fullest potential. Employees leverage a quarterly personal impact day to engage in community work. By using time, talents, and finances, we are able to have a multiplier and positive effect on our mission to change the way healthcare is delivered.

| 22 | Evolent Health, Inc. Proxy Statement 2024 |

Corporate Governance and Board Structure

Board’s Role in Risk Oversight

| Our Board plays an active role in overseeing management of our risks. The committees of our Board assist our full Board in risk oversight by addressing specific matters within the purview of each committee. |

Our Audit Committee focuses on financial compliance (i.e., accounting and financial reporting), as well as internal controls and any audit steps taken in light of material control deficiencies. Our Audit Committee discusses our major financial and other risk exposures and the steps that management has taken to monitor and control such exposures, including the Company’s risk assessment and risk management policies.

| |||

| Our Compensation Committee focuses primarily on risks relating to executive compensation plans and policies.

| ||||

| Our Nominating and Corporate Governance Committee focuses on reputational and corporate governance risks relating to our company including the independence of our Board.

| ||||

| Our Compliance and Regulatory Affairs Committee focuses on our regulatory compliance and corporate ethics, as well as risks with respect of cybersecurity and privacy.

| ||||

|

While each of these committees is responsible for evaluating certain risks and overseeing the management of such risks, our full Board remains regularly informed regarding such risks through committee reports and otherwise. In addition, our Board and these committees receive regular reports from our Chief Executive Officer, Chief Operating Officer, Chief Financial Officer, General Counsel and other members of senior management regarding areas of significant risk to us, including operational, strategic, legal and regulatory, financial and reputational risks. We believe the leadership structure of our Board supports and promotes effective risk management and oversight.

| ||||

Cybersecurity Oversight

The Compliance and Regulatory Affairs Committee of the Board (the “Compliance and Regulatory Affairs Committee”) provides oversight of risks from cybersecurity threats. The Compliance and Regulatory Affairs Committee receives updates from our Chief Information Security Officer (“CISO”) and other members of management to, among other items, review material cybersecurity incidents, review key metrics on our cybersecurity program and related risk management programs, and discuss our cybersecurity programs and goals. The Compliance and Regulatory Affairs Committee updates the full Board on matters relating to cybersecurity. The Audit Committee of the Board provides an additional layer of cybersecurity oversight on specific financial matters.

Our management disclosure and compliance committees, which include representatives from our legal, financial and accounting and information technology (“IT”) teams, meet at least quarterly to monitor potential risks and review procedures and controls relating to cybersecurity. Management periodically assesses such risks and assists in the implementation of policies and procedures related to cybersecurity risk oversight in conjunction with the Compliance and Regulatory Affairs Committee.

Our CISO is responsible for assessing and managing the Company’s material risks from cybersecurity threats. Our CISO has served in this role for the past four years and has more than 25 years of experience in the aggregate in various roles involving managing information security, technology infrastructure, IT operations and developing cybersecurity strategy, and is a Certified Information Systems Security Professional (CISSP).

Our CISO is informed about and monitors the prevention, detection, mitigation and remediation of cybersecurity incidents through the management of and participation in the cybersecurity risk management and strategy process described above, including the operation of our incident response plan. As discussed above, our CISO reports to the Compliance and Regulatory Affairs Committee about the risks from cybersecurity threats among other cybersecurity related matters and meets regularly with our Chief Technology Officer.

| Evolent Health, Inc. Proxy Statement 2024 |

23 |

Corporate Governance and Board Structure

Director Independence

Our Corporate Governance Guidelines provide that our Board shall consist of such number of directors who are independent as is required and determined in accordance with applicable laws and regulations and requirements of the NYSE and SEC rules. The Board has determined affirmatively, based upon its review of all relevant facts and circumstances and after considering all applicable relationships of which the Board had knowledge, between or among the directors and the Company or our management (some of such relationships are described in the section of this proxy statement entitled “Certain Relationships and Related Party Transactions”), that each of the following directors and director nominees has no direct or indirect material relationship with us and is independent under the listing standards of the NYSE and SEC rules: Toyin Ajayi, MD, Craig Barbarosh, M. Bridget Duffy, MD, Russell Glass, Peter Grua, Diane Holder, Richard Jelinek, Kim Keck and Cheryl Scott. In determining the independence of Diane Holder, who is an employee of UPMC, our Board considered UPMC’s former investment in the Company, as well as commercial and other agreements between the Company and UPMC, but did not view these factors as materially impacting its independence determination.

Communications with the Board

Stockholders and other interested parties who wish to communicate with our Board, our Independent Board Chair, Cheryl Scott, our independent or non-employee directors as a group, any of the committees or any of the individual non-employee directors may do so by sending a letter to the intended recipient, in the care of our Secretary, at Evolent Health, Inc., 1812 N. Moore Street, Suite 1705, Arlington, VA 22209. Such correspondence will be relayed to the appropriate director or directors as appropriate.

Stockholders may communicate with Mr. Blackley, the Board’s employee-director, by sending a letter addressed to the intended recipient at Evolent Health, Inc., 1812 N. Moore Street, Suite 1705, Arlington, VA 22209.

Identification of Director Candidates

On an annual basis, our Board conducts a formal board self-evaluation led by our Nominating and Corporate Governance Committee to determine targeted focus areas. Our Board continually assesses and evaluates its composition, taking into account, among other things, the experience, skills, background and diversity of its members. The Nominating and Corporate Governance Committee evaluates director candidates in accordance with the director membership criteria described in our Corporate Governance Guidelines and our policy statement regarding director nominations. In addition, pursuant to our Corporate Governance Guidelines, we are committed to including in any pool of director candidates for consideration highly qualified candidates who would bring gender, racial, and/or ethnic diversity to the Board if chosen. In addition to satisfying relevant independence standards and the requirements of Section 8 of the Clayton Act, the following are the minimum qualifications that candidates for the Board must possess:

| • | Minimum of 21 years of age at the time they commence their term and will not be eligible for nomination or re-nomination to the Board if they are older than age 75; |

| • | Demonstrated reputation for integrity, judgment, acumen and high professional and personal ethics; |

| • | Financial literacy and significant experience at the policy-making level in business, government or the non-profit sector; |

| • | Time and ability to make a constructive contribution to the Board, and a clear commitment to fulfilling fiduciary duties and serving the interests of all the Company’s stockholders; and |

| • | An expectation of regularly attending meetings, staying informed about the Company and its businesses, participating in the discussions of the Board and its committees, complying with applicable Company policies, and taking an interest in the Company’s businesses and providing advice and counsel to the Chief Executive Officer. |

The Nominating and Corporate Governance Committee reviews a candidate’s qualifications to serve as a member of our Board based on the skills and characteristics of the individual as well as the overall composition of our Board in light of the Company’s current and expected structure and business needs,

| 24 | Evolent Health, Inc. Proxy Statement 2024 |

Corporate Governance and Board Structure

regulatory requirements, the diversity of viewpoints represented on the Board and committee membership requirements. The Nominating and Corporate Governance Committee evaluates a candidate’s professional skills and background, experience at the policy-making level in the business, government or non-profit sectors or as a director of a widely-held public corporation, financial literacy, age, independence and past performance (in the case of incumbent candidates), along with qualities expected of all directors, including integrity, judgment, acumen, high professional and personal ethics, familiarity with our business and the time and ability to make a constructive contribution to our Board. The Nominating and Corporate Governance Committee believes it would be desirable for new candidates to contribute to the variety of viewpoints on the Board, which may be enhanced by a mix of different professional and personal backgrounds and experiences. The Nominating and Corporate Governance Committee will consider director candidates recommended by stockholders. The Nominating and Corporate Governance Committee considers and reviews all candidates in the same manner regardless of the source of the recommendation. Our third amended and restated by-laws provide that any stockholder of record entitled to vote for the election of directors at the applicable meeting of stockholders may nominate persons for election to our Board, if such stockholder complies with the applicable notice procedures, which are discussed under the heading “Other Matters—Stockholder Proposals” in this proxy statement.

Corporate Governance Policies Related to Compensation and Equity

Please refer to the “Compensation Discussion and Analysis—Corporate Governance Policies” section of this proxy statement for discussion of our policies with respect to prohibiting derivative trading, hedging and pledging, clawback of compensation, stock ownership guidelines and the tax deductibility of compensation.

| Evolent Health, Inc. Proxy Statement 2024 |

25 |

COMPENSATION DISCUSSION AND ANALYSIS

Executive Summary

This Compensation Discussion and Analysis (“CD&A”) focuses on the Company’s 2023 compensation programs, actions and outputs relative to the Company’s 2023 performance. These compensation decisions reflect the Compensation Committee’s application of the Company’s compensation philosophy, plan objectives and performance standards against financial and individual executive performance through the end of 2023. The Company experienced a 17.6% increase in the stock price during 2023 due in part to the Company’s operational performance. As described further in this CD&A, the Company’s executive compensation programs strongly align realized compensation outcomes with the Company’s stock price performance.

Named Executive Officers (“NEOs”)

This CD&A describes the compensation of our NEOs named in the Summary Compensation Table for 20231:

Seth Blackley

Chief Executive Officer

John Johnson

Chief Financial Officer

Daniel McCarthy

President

Emily Rafferty(1)

Chief Operating Officer

Jonathan Weinberg

General Counsel

Steve Tutewohl(1)

Former Chief Operating Officer

| (1) | Ms. Rafferty was appointed Chief Operating Officer, effective July 3, 2023. Mr. Tutewohl departed from his position of Chief Operating Officer effective July 3, 2023, and remained an employee with the Company in a transitional role through July 31, 2023. |

2023 Highlights

Below are highlights of our performance in 2023:

| Revenue |

Average Unique Members1 |

Adjusted EBITDA2 | ||||||||||

| $1,963.9 million |

41.3 million |

$194.7 million |

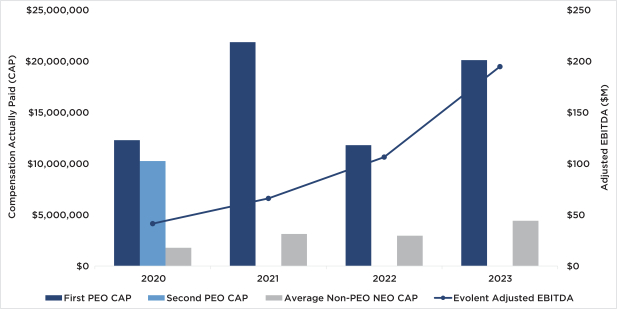

| (1) | As of December 31, 2023. See Appendix A for the definition of Average Unique Members. |