UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

________________________________________________

FORM 10-Q

_____________________________________________

(Mark One)

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |||||

For the quarterly period ended June 30, 2020

OR

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |||||

For the transition period from _______ to _______

Commission File Number: 001-38678

________________________________________________

(Exact Name of Registrant as Specified in its Charter)

________________________________________________

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | |||||||

| (Address of principal executive offices) | (Zip Code) | |||||||

(650 ) 316-7500

(Registrant’s telephone number, including area code)

_______________________________________________

Securities registered pursuant to Section 12(b) of the Act:

| Title of Each Class | Trading Symbol | Name of Each Exchange on Which Registered | ||||||

_______________________________________________

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| ☒ | Accelerated filer | ☐ | ||||||||||||

| Non-accelerated filer | ☐ | Smaller reporting company | ||||||||||||

| Emerging growth company | ||||||||||||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

As of July 31, 2020, there were 120,276,173 shares of the registrant’s common stock outstanding.

TABLE OF CONTENTS

| Page | ||||||||

| Special Note Regarding Forward-Looking Statements | ||||||||

| PART I—FINANCIAL INFORMATION | ||||||||

| Item 1. | Financial Statements (Unaudited) | |||||||

Condensed Consolidated Balance Sheets as of June 30, 2020 and December 31, 2019 | ||||||||

| Condensed Consolidated Statements of Operations for the Three and Six Months Ended June 30, 2020 and 2019 | ||||||||

| Condensed Consolidated Statements of Stockholders’ Equity for the Three and Six Months Ended June 30, 2020 and 2019 | ||||||||

| Condensed Consolidated Statements of Cash Flows for the Six Months Ended June 30, 2020 and 2019 | ||||||||

| Notes to Condensed Consolidated Financial Statements | ||||||||

| Item 2. | Management’s Discussion and Analysis of Financial Condition and Results of Operations | |||||||

| Item 3. | Quantitative and Qualitative Disclosures About Market Risk | |||||||

| Item 4. | Controls and Procedures | |||||||

| PART II—OTHER INFORMATION | ||||||||

| Item 1. | Legal Proceedings | |||||||

| Item 1A. | Risk Factors | |||||||

| Item 2. | Unregistered Sales of Equity Securities and Use of Proceeds | |||||||

| Item 6. | Exhibits | |||||||

| Signatures | ||||||||

Unless otherwise expressly stated or the context otherwise requires, references in this Quarterly Report on Form 10-Q (this “Quarterly Report” or “report”) to “Upwork,” “Company,” “our,” “us,” and “we” and similar references refer to Upwork Inc. and its wholly-owned subsidiaries.

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Quarterly Report contains forward-looking statements within the meaning of the federal securities laws. All statements contained in this Quarterly Report, other than statements of historical fact, including statements regarding our future operating results and financial position, our business strategy and plans, potential growth or growth prospects, future research and development, sales and marketing and general and administrative expenses, our objectives for future operations, and potential impacts of the COVID-19 pandemic, or expectations regarding actions we may take in response to the pandemic, are forward-looking statements. Words such as “believes,” “may,” “will,” “estimates,” “potential,” “continues,” “anticipates,” “intends,” “expects,” “could,” “would,” “projects,” “plans,” “targets,” and variations of such words and similar expressions are intended to identify forward-looking statements.

We have based these forward-looking statements largely on our current expectations and projections as of the date of this filing about future events and trends that we believe may affect our financial condition, results of operations, business strategy, short-term and long-term business operations and objectives, and financial needs. These forward-looking statements are subject to a number of risks, uncertainties and assumptions, including those described in Part II, Item 1A, “Risk Factors” in this Quarterly Report and the impact of the COVID-19 pandemic. Readers are urged to carefully review and consider the various disclosures made in this Quarterly Report and in other documents we file from time to time with the Securities and Exchange Commission (the “SEC”) that disclose risks and uncertainties that may affect our business. Moreover, we operate in a very competitive and rapidly changing environment. New risks emerge from time to time. It is not possible for us to predict all risks, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements we may make. In light of these risks, uncertainties, and assumptions, the future events and circumstances discussed in this Quarterly Report may not occur and actual results could differ materially and adversely from those anticipated or implied in the forward-looking statements.

You should not rely upon forward-looking statements as predictions of future events. The events and circumstances reflected in the forward-looking statements may not be achieved or occur. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, performance, or achievements. In addition, the forward-looking statements in this Quarterly Report are made as of the date of this filing, and we do not undertake, and expressly disclaim any duty, to update such statements for any reason after the date of this Quarterly Report or to conform statements to actual results or revised expectations, except as required by law.

You should read this Quarterly Report and the documents that we reference herein and have filed with the SEC as exhibits to this Quarterly Report with the understanding that our actual future results, performance, and events and circumstances may be materially different from what we expect.

1

PART I—FINANCIAL INFORMATION

Item 1. Financial Statements.

UPWORK INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

(In thousands, except share and per share data)

(Unaudited)

| June 30, 2020 | December 31, 2019 | ||||||||||

| ASSETS | |||||||||||

| Current assets | |||||||||||

| Cash and cash equivalents | $ | $ | |||||||||

| Marketable securities | |||||||||||

| Funds held in escrow, including funds in transit | |||||||||||

Trade and client receivables – net of allowance of $ | |||||||||||

| Prepaid expenses and other current assets | |||||||||||

| Total current assets | |||||||||||

| Property and equipment, net | |||||||||||

| Goodwill | |||||||||||

| Intangible assets, net | |||||||||||

| Operating lease asset | |||||||||||

| Other assets, noncurrent | |||||||||||

| Total assets | $ | $ | |||||||||

| LIABILITIES AND STOCKHOLDERS’ EQUITY | |||||||||||

| Current liabilities | |||||||||||

| Accounts payable | $ | $ | |||||||||

| Escrow funds payable | |||||||||||

| Debt, current | |||||||||||

| Accrued expenses and other current liabilities | |||||||||||

| Deferred revenue | |||||||||||

| Total current liabilities | |||||||||||

| Debt, noncurrent | |||||||||||

| Operating lease liability, noncurrent | |||||||||||

| Other liabilities, noncurrent | |||||||||||

| Total liabilities | |||||||||||

| Commitments and contingencies (Note 6) | |||||||||||

| Stockholders’ equity | |||||||||||

Common stock, $ | |||||||||||

| Additional paid-in capital | |||||||||||

| Accumulated deficit | ( | ( | |||||||||

| Total stockholders’ equity | |||||||||||

| Total liabilities and stockholders’ equity | $ | $ | |||||||||

The accompanying notes are an integral part of these condensed consolidated financial statements.

2

UPWORK INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(In thousands, except per share data)

(Unaudited)

| Three Months Ended June 30, | Six Months Ended June 30, | ||||||||||||||||||||||

| 2020 | 2019 | 2020 | 2019 | ||||||||||||||||||||

| Revenue | $ | $ | $ | $ | |||||||||||||||||||

| Cost of revenue | |||||||||||||||||||||||

| Gross profit | |||||||||||||||||||||||

| Operating expenses | |||||||||||||||||||||||

| Research and development | |||||||||||||||||||||||

| Sales and marketing | |||||||||||||||||||||||

| General and administrative | |||||||||||||||||||||||

| Provision for transaction losses | |||||||||||||||||||||||

| Total operating expenses | |||||||||||||||||||||||

| Loss from operations | ( | ( | ( | ( | |||||||||||||||||||

| Interest expense | |||||||||||||||||||||||

| Other (income) expense, net | ( | ( | ( | ||||||||||||||||||||

| Loss before income taxes | ( | ( | ( | ( | |||||||||||||||||||

| Income tax provision | ( | ( | ( | ( | |||||||||||||||||||

| Net loss | $ | ( | $ | ( | $ | ( | $ | ( | |||||||||||||||

| Net loss per share, basic and diluted | $ | ( | $ | ( | $ | ( | $ | ( | |||||||||||||||

| Weighted-average shares used to compute net loss per share, basic and diluted | |||||||||||||||||||||||

The accompanying notes are an integral part of these condensed consolidated financial statements.

3

UPWORK INC.

CONDENSED CONSOLIDATED STATEMENTS OF STOCKHOLDERS’ EQUITY

(In thousands, except share amounts)

(Unaudited)

| Three Months Ended June 30, 2020 | Common Stock | Additional Paid-in Capital | Accumulated Deficit | Total Stockholders’ Equity | |||||||||||||||||||||||||

| Shares | Amount | ||||||||||||||||||||||||||||

| Balances as of March 31, 2020 | $ | $ | $ | ( | $ | ||||||||||||||||||||||||

| Issuance of common stock upon exercise of stock options | — | ||||||||||||||||||||||||||||

| Stock-based compensation expense | — | — | — | ||||||||||||||||||||||||||

| Issuance of common stock for settlement of RSUs | — | — | — | ||||||||||||||||||||||||||

| Tides Foundation common stock warrant expense and other | — | — | — | ||||||||||||||||||||||||||

| Issuance of common stock in connection with employee stock purchase plan | — | — | |||||||||||||||||||||||||||

| Net loss | — | — | — | ( | ( | ||||||||||||||||||||||||

| Balances as of June 30, 2020 | $ | $ | $ | ( | $ | ||||||||||||||||||||||||

| Three Months Ended June 30, 2019 | Common Stock | Additional Paid-in Capital | Accumulated Deficit | Total Stockholders’ Equity | |||||||||||||||||||||||||

| Shares | Amount | ||||||||||||||||||||||||||||

| Balances as of March 31, 2019 | $ | $ | $ | ( | $ | ||||||||||||||||||||||||

| Issuance of common stock upon exercise of stock options and common stock warrants | — | — | |||||||||||||||||||||||||||

| Stock-based compensation expense | — | — | — | ||||||||||||||||||||||||||

| Issuance of common stock for settlement of RSUs | — | — | — | ||||||||||||||||||||||||||

| Issuance of common stock in connection with employee stock purchase plan | — | — | |||||||||||||||||||||||||||

| Net loss | — | — | — | ( | ( | ||||||||||||||||||||||||

| Balances as of June 30, 2019 | $ | $ | $ | ( | $ | ||||||||||||||||||||||||

4

| Six Months Ended June 30, 2020 | Common Stock | Additional Paid-in Capital | Accumulated Deficit | Total Stockholders’ Equity | |||||||||||||||||||||||||

| Shares | Amount | ||||||||||||||||||||||||||||

| Balances as of December 31, 2019 | $ | $ | $ | ( | $ | ||||||||||||||||||||||||

| Issuance of common stock upon exercise of stock options | — | ||||||||||||||||||||||||||||

| Stock-based compensation expense | — | — | — | ||||||||||||||||||||||||||

| Issuance of common stock for settlement of RSUs | — | — | — | ||||||||||||||||||||||||||

| Tides Foundation common stock warrant expense and other | — | — | — | ||||||||||||||||||||||||||

| Issuance of common stock in connection with employee stock purchase plan | — | — | |||||||||||||||||||||||||||

| Net loss | — | — | — | ( | ( | ||||||||||||||||||||||||

| Balances as of June 30, 2020 | $ | $ | $ | ( | $ | ||||||||||||||||||||||||

| Six Months Ended June 30, 2019 | Common Stock | Additional Paid-in Capital | Accumulated Deficit | Total Stockholders’ Equity | |||||||||||||||||||||||||

| Shares | Amount | ||||||||||||||||||||||||||||

| Balances as of December 31, 2018 | $ | $ | $ | ( | $ | ||||||||||||||||||||||||

| Cumulative effect adjustment from adoption of new accounting pronouncement | — | — | — | ( | ( | ||||||||||||||||||||||||

| Issuance of common stock upon exercise of stock options and common stock warrants | — | — | |||||||||||||||||||||||||||

| Stock-based compensation expense | — | — | — | ||||||||||||||||||||||||||

| Issuance of common stock for settlement of RSUs | — | — | — | ||||||||||||||||||||||||||

| Issuance of common stock in connection with employee stock purchase plan | — | — | |||||||||||||||||||||||||||

| Net loss | — | — | — | ( | ( | ||||||||||||||||||||||||

| Balances as of June 30, 2019 | $ | $ | $ | ( | $ | ||||||||||||||||||||||||

The accompanying notes are an integral part of these condensed consolidated financial statements.

5

UPWORK INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(In thousands)

(Unaudited)

| Six Months Ended June 30, | |||||||||||

| 2020 | 2019 | ||||||||||

| CASH FLOWS FROM OPERATING ACTIVITIES: | |||||||||||

| Net loss | $ | ( | $ | ( | |||||||

| Adjustments to reconcile net loss to net cash provided by (used in) operating activities: | |||||||||||

| Provision for transaction losses | |||||||||||

| Depreciation and amortization | |||||||||||

| Amortization of debt issuance costs | |||||||||||

| Amortization of discount on purchases of marketable securities | ( | ( | |||||||||

| Amortization of operating lease asset | |||||||||||

| Tides Foundation common stock warrant expense | |||||||||||

| Stock-based compensation expense | |||||||||||

| Changes in operating assets and liabilities: | |||||||||||

| Trade and client receivables | ( | ( | |||||||||

| Prepaid expenses and other assets | ( | ( | |||||||||

| Operating lease liability | ( | ( | |||||||||

| Accounts payable | ( | ||||||||||

| Accrued expenses and other liabilities | ( | ||||||||||

| Deferred revenue | |||||||||||

| Net cash provided by (used in) operating activities | ( | ||||||||||

| CASH FLOWS FROM INVESTING ACTIVITIES: | |||||||||||

| Purchases of marketable securities | ( | ( | |||||||||

| Proceeds from maturities of marketable securities | |||||||||||

| Purchases of property and equipment | ( | ( | |||||||||

| Internal-use software and platform development costs | ( | ( | |||||||||

| Net cash provided by (used in) investing activities | ( | ||||||||||

| CASH FLOWS FROM FINANCING ACTIVITIES: | |||||||||||

| Changes in escrow funds payable | |||||||||||

| Proceeds from exercises of stock options and common stock warrants | |||||||||||

| Proceeds from borrowings on debt | |||||||||||

| Repayment of debt | ( | ( | |||||||||

| Proceeds from employee stock purchase plan | |||||||||||

| Net cash provided by financing activities | |||||||||||

| NET CHANGE IN CASH, CASH EQUIVALENTS, AND RESTRICTED CASH | ( | ||||||||||

| Cash, cash equivalents, and restricted cash—beginning of period | |||||||||||

| Cash, cash equivalents, and restricted cash—end of period | $ | $ | |||||||||

| SUPPLEMENTAL DISCLOSURE OF CASH FLOW INFORMATION: | |||||||||||

| Cash paid for interest | $ | $ | |||||||||

| SUPPLEMENTAL DISCLOSURES OF NON-CASH INVESTING ACTIVITIES: | |||||||||||

| Property and equipment purchased but not yet paid | $ | $ | |||||||||

| Internal-use software and platform development costs incurred but not yet paid | $ | $ | |||||||||

The accompanying notes are an integral part of these condensed consolidated financial statements.

6

UPWORK INC.

Notes to Condensed Consolidated Financial Statements

(Unaudited)

Note 1—Description of Business

Upwork Inc. (the “Company” or “Upwork”) operates an online talent solution that enables businesses (“clients”) to find and work with highly-skilled independent professionals (“freelancers,” and, together with clients, “users”). The Company was originally incorporated in the state of Delaware in December 2013 prior to and in connection with the combination (the “Elance-oDesk Combination”) of Elance, Inc. (“Elance”) and oDesk Corporation (“oDesk”). The Company changed its name to Elance-oDesk, Inc. shortly before the Elance-oDesk Combination in March 2014, and later to Upwork Inc. in May 2015. In 2015, the Company relaunched as Upwork and commenced consolidation of its two operating platforms. In 2016, following completion of the platform consolidation, the Company began operating under a single platform. The Company is currently headquartered in Santa Clara, California.

Unless otherwise expressly stated or the context otherwise requires, the terms “Upwork” and the “Company” in these notes to the condensed consolidated financial statements refer to Upwork and its wholly-owned subsidiaries.

7

Note 2—Basis of Presentation and Summary of Significant Accounting Policies

Basis of Presentation

The accompanying unaudited condensed consolidated financial statements have been prepared in accordance with generally accepted accounting principles in the United States (“U.S. GAAP”) and applicable rules and regulations of the SEC regarding interim financial reporting. Certain information and note disclosures normally included in the financial statements prepared in accordance with U.S. GAAP have been condensed or omitted pursuant to such rules and regulations. As such, the information included in this Quarterly Report should be read in conjunction with the consolidated financial statements and notes thereto included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2019 (the “Annual Report”), filed with the SEC on March 2, 2020.

The condensed consolidated balance sheet as of December 31, 2019 included herein was derived from the audited financial statements as of that date, but does not include all disclosures including notes required by U.S. GAAP.

The condensed consolidated financial statements include the accounts of Upwork Inc. and its wholly-owned subsidiaries. All intercompany balances and transactions have been eliminated.

The accompanying condensed consolidated financial statements reflect all normal recurring adjustments necessary to present fairly the financial position, results of operations, changes in stockholders’ equity and cash flows for the interim periods, but do not purport to be indicative of the results of operations or financial condition to be anticipated for the full year ending December 31, 2020.

Use of Estimates

The preparation of the condensed consolidated financial statements in conformity with U.S. GAAP requires management to make certain estimates, judgments, and assumptions that affect the reported amounts of assets and liabilities, disclosure of contingent assets and liabilities at the date of the financial statements, and the reported amounts of revenue and expenses during the periods presented. Such estimates include, but are not limited to: the useful lives of assets; assessment of the recoverability of long-lived assets; goodwill impairment; standalone selling price of material rights and the period of time over which to defer and recognize the consideration allocated to the material rights; allowance for doubtful accounts; liabilities relating to transaction losses; the valuation of warrants; stock-based compensation; and accounting for income taxes. Management bases its estimates on historical experience and on various other assumptions that management believes to be reasonable under the circumstances. The Company evaluates its estimates, assumptions, and judgments on an ongoing basis using historical experience and other factors and revises them when facts and circumstances dictate.

Due to the COVID-19 pandemic, there has been uncertainty and disruption in the global economy. The Company is not aware of any specific event or circumstance that would require an update to its estimates or judgments or a revision of the carrying value of its assets or liabilities. These estimates may change as new events occur and additional information is obtained. Actual results could differ materially from these estimates under different assumptions or conditions.

Impacts of Recently Adopted Accounting Pronouncements on 2019 Interim Reporting

On December 31, 2019, the Company adopted Accounting Standards Update (“ASU”) No. 2014-09, Revenue from Contracts with Customers (“Topic 606”), ASU No. 2016-02, Leases (“Topic 842”), and ASU No. 2016-18, Statement of Cash Flows (Topic 230): Restricted Cash (“Topic 230”) effective as of January 1, 2019. As a result, interim results for reporting periods beginning on or after January 1, 2019 will differ from amounts previously reported on the Company’s quarterly reports on Form 10-Q. The following table summarizes the impacts of adopting these standards on the Company’s previously issued condensed consolidated statements of operations for

8

the three and six months ended June 30, 2019 and condensed consolidated statement of cash flows for the six months ended June 30, 2019 (in thousands):

| Balances, Previously Issued | Topic 606 | Topic 842 (1) | Topic 230 | Balances, as Reported | |||||||||||||

| Condensed Consolidated Statement of Operations for the Three Months Ended June 30, 2019 | |||||||||||||||||

| Revenue | $ | $ | ( | $ | $ | $ | |||||||||||

| Operating expense—General and administrative | ( | ||||||||||||||||

| Net loss | ( | ( | ( | ||||||||||||||

| Condensed Consolidated Statement of Operations for the Six Months Ended June 30, 2019 | |||||||||||||||||

| Revenue | $ | $ | ( | $ | $ | $ | |||||||||||

| Operating expense—General and administrative | ( | ||||||||||||||||

| Net loss | ( | ( | ( | ||||||||||||||

| Net loss per share, basic and diluted | ( | ( | ( | ||||||||||||||

| Condensed Consolidated Statement of Cash Flows for the Six Months Ended June 30, 2019 | |||||||||||||||||

| Operating activities | |||||||||||||||||

| Net loss | $ | ( | $ | ( | $ | $ | $ | ( | |||||||||

| Amortization of operating lease asset | |||||||||||||||||

| Trade and client receivables | ( | ( | |||||||||||||||

| Prepaid expenses and other assets | ( | ( | |||||||||||||||

| Operating lease liability | ( | ( | |||||||||||||||

| Accrued expenses and other liabilities | ( | ( | ( | ( | |||||||||||||

| Deferred revenue | |||||||||||||||||

| Investing activities—decrease (increase) in restricted cash | ( | ||||||||||||||||

| Financing activities—changes in funds held in escrow, including funds in transit | ( | ||||||||||||||||

| NET CHANGE IN CASH, CASH EQUIVALENTS, AND RESTRICTED CASH | ( | ( | |||||||||||||||

| Cash, cash equivalents, and restricted cash—beginning of period | |||||||||||||||||

| Cash, cash equivalents, and restricted cash—end of period | |||||||||||||||||

(1) Amounts include other adjustments made in conjunction with the adoption of Topic 842.

9

Recently Adopted Accounting Pronouncements

The significant accounting policies applied in the Company’s audited consolidated financial statements, as disclosed in the Annual Report, are applied consistently in these unaudited interim condensed consolidated financial statements, except as noted below.

In June 2016, the Financial Accounting Standards Board (the “FASB”) issued ASU No. 2016-13, Financial Instruments—Credit Losses (Topic 326): Measurement of Credit Losses on Financial Instruments. This standard changes the methodology for measuring credit losses on financial instruments and the timing of when such losses are recorded. The Company adopted ASU No. 2016-13 and related updates on January 1, 2020. The adoption did not have a material impact on the Company’s condensed consolidated financial statements.

In January 2017, the FASB issued ASU No. 2017-04, Intangibles—Goodwill and Others (Topic 350): Simplifying the Test for Goodwill Impairment. ASU No. 2017-04 eliminates Step 2 from the goodwill impairment test, which measures a goodwill impairment loss by comparing the implied fair value of a reporting unit’s goodwill with the carrying amount of that goodwill. The Company adopted ASU No. 2017-04 on January 1, 2020. The adoption did not have a material impact on the Company’s condensed consolidated financial statements.

In August 2018, the FASB issued ASU No. 2018-13, Fair Value Measurement (Topic 820): Disclosure Framework—Changes to the Disclosure Requirements for Fair Value Measurement, which modifies the disclosure requirements on fair value measurements. The Company adopted ASU No. 2018-13 on January 1, 2020. The adoption did not have a material impact on the Company’s condensed consolidated financial statements.

In August 2018, the FASB issued ASU No. 2018-15, Intangibles—Goodwill and Other—Internal-Use Software (Subtopic 350-40): Customer’s Accounting for Implementation Costs Incurred in a Cloud Computing Arrangement That Is a Service Contract. ASU No. 2018-15 aligns the requirements for capitalizing implementation costs in a cloud computing arrangement service contract with the requirements for capitalizing implementation costs incurred for an internal-use software license. The Company adopted ASU No. 2018-15 on January 1, 2020 using the prospective adoption method. The adoption did not have a material impact on the Company’s condensed consolidated financial statements.

Recent Accounting Pronouncements Not Yet Adopted

The Company has reviewed all other accounting pronouncements issued during the six months ended June 30, 2020 and concluded they were either not applicable or not expected to have a material impact on the Company’s condensed consolidated financial statements.

10

Note 3—Revenue

Disaggregation of Revenue

See “Note 9—Segment and Geographical Information” for the Company’s revenue disaggregated by type of service and geographic area.

Remaining Performance Obligations

As of June 30, 2020, the Company had approximately $18.5 million of remaining performance obligations. The Company’s remaining performance obligations consist of transaction price that has been allocated to unexercised material rights related to the Company’s arrangements with freelancers subject to tiered service fees, subscriptions, memberships, “Connects” (virtual tokens that allow freelancers to bid on projects on the Company’s platform), and certain incentive payments made to the Company by payment processors. As of June 30, 2020, the Company expects to recognize approximately $15.0 million over the next 12 months, with the remaining balance recognized thereafter.

The Company has applied the practical expedients and exemptions and does not disclose the value of remaining performance obligations for (i) contracts with an original expected length of one year or less; and (ii) contracts for which the variable consideration is allocated entirely to a wholly unsatisfied promise to transfer a distinct service that forms part of a single performance obligation under the series guidance.

Contract Balances

The following table provides information about the balances of the Company’s trade and client receivables, net of allowance and contract liabilities included in deferred revenue and other liabilities, noncurrent (in thousands):

| June 30, 2020 | December 31, 2019 | ||||||||||

| Trade and client receivables, net of allowance | $ | $ | |||||||||

| Contract liabilities | |||||||||||

| Deferred revenue | |||||||||||

| Deferred revenue (component of other liabilities, noncurrent) | |||||||||||

During the three and six months ended June 30, 2020, changes in the contract liabilities balances were a result of normal business activity, deferral of revenue related to arrangements with freelancers subject to tiered service fees and related allocation of transaction price to material rights, and a change in estimate related to the period of time over which to recognize the consideration allocated to the material rights.

11

Note 4—Fair Value Measurements

The Company defines fair value as the exchange price that would be received from the sale of an asset or paid to transfer a liability in the principal or most advantageous market for the asset or liability in an orderly transaction between market participants on the measurement date. Valuation techniques used to measure fair value must maximize the use of observable inputs and minimize the use of unobservable inputs. The authoritative guidance describes three levels of inputs that may be used to measure fair value:

•Level I—Observable inputs that reflect unadjusted quoted prices for identical assets or liabilities in active markets;

•Level II—Observable inputs other than Level I prices, such as unadjusted quoted prices for similar assets or liabilities in active markets, unadjusted quoted prices for identical or similar assets or liabilities in markets that are not active, or other inputs that are observable or can be corroborated by observable market data for substantially the full term of the assets or liabilities; and

•Level III—Unobservable inputs that are supported by little or no market activity and that are significant to the fair value of the assets or liabilities. These inputs are based on the Company’s own assumptions used to measure assets and liabilities at fair value and require significant management judgment or estimation.

The categorization of a financial instrument within the fair value hierarchy is based upon the lowest level of input that is significant to its fair value measurement. The Company’s assessment of the significance of a particular input to the fair value measurement in its entirety requires management to make judgments and consider factors specific to the assets or liabilities.

The Company’s financial instruments that are carried at fair value consist of Level I and Level II assets as of June 30, 2020 and December 31, 2019. The following tables set forth the fair value of the Company’s financial assets measured at fair value on a recurring basis based on the three-tier fair value hierarchy (in thousands):

| June 30, 2020 | |||||||||||||||||||||||

| Level I | Level II | Level III | Total | ||||||||||||||||||||

| Cash equivalents—money market funds | $ | $ | $ | $ | |||||||||||||||||||

| Marketable securities | |||||||||||||||||||||||

| Commercial paper | |||||||||||||||||||||||

| U.S. government securities | |||||||||||||||||||||||

| Total financial assets | $ | $ | $ | $ | |||||||||||||||||||

| December 31, 2019 | |||||||||||||||||||||||

| Level I | Level II | Level III | Total | ||||||||||||||||||||

| Cash equivalents—money market funds | $ | $ | $ | $ | |||||||||||||||||||

| Marketable securities | |||||||||||||||||||||||

| Commercial paper | |||||||||||||||||||||||

| U.S. government securities | |||||||||||||||||||||||

| Total financial assets | $ | $ | $ | $ | |||||||||||||||||||

For each of the three and six months ended June 30, 2020 and 2019, the gross unrealized gains and losses on the Company’s marketable securities were immaterial. As of June 30, 2020 and 2019, the Company considered any decreases in market value to be temporary in nature and did not consider any of the Company’s marketable securities to be other-than-temporarily impaired. As such, the Company did not record any impairment charges with respect to its marketable securities during each of the three and six months ended June 30, 2020 and 2019.

12

13

Note 5—Balance Sheet Components

Cash and Cash Equivalents, Restricted Cash, and Funds Held In Escrow, Including Funds In Transit

The following table reconciles cash and cash equivalents, restricted cash, and funds held in escrow that are restricted as reported in the condensed consolidated balance sheets to the total of the same amounts shown in the condensed consolidated statements of cash flows as of June 30, 2020 and December 31, 2019 (in thousands):

| June 30, 2020 | December 31, 2019 | ||||||||||

| Cash and cash equivalents | $ | $ | |||||||||

| Restricted cash | |||||||||||

| Funds held in escrow, including funds in transit | |||||||||||

| Total cash, cash equivalents, and restricted cash as shown in the condensed consolidated statement of cash flows | $ | $ | |||||||||

Property and Equipment, Net

Property and equipment, net consisted of the following (in thousands):

| June 30, 2020 | December 31, 2019 | ||||||||||

| Computer equipment and software | $ | $ | |||||||||

| Internal-use software and platform development | |||||||||||

| Leasehold improvements | |||||||||||

| Office furniture and fixtures | |||||||||||

| Total property and equipment | |||||||||||

| Less: accumulated depreciation | ( | ( | |||||||||

| Property and equipment, net | $ | $ | |||||||||

For the three months ended June 30, 2020 and 2019, depreciation expense related to property and equipment was $0.8 million and $0.6 million, respectively. For the six months ended June 30, 2020 and 2019, depreciation expense related to property and equipment was $1.5 million and $1.4 million, respectively.

For the three months ended June 30, 2020 and 2019, the Company capitalized $1.7 million and $1.4 million of internal-use software and platform development costs, respectively. For the six months ended June 30, 2020 and 2019, the Company capitalized $3.3 million and $2.5 million of internal-use software and platform development costs, respectively.

For the three and six months ended June 30, 2020, amortization expense related to the capitalized internal-use software and platform development costs was $1.1 million and $2.0 million, respectively. For the three and six months ended June 30, 2019, amortization expense related to the capitalized internal-use software and platform development costs was immaterial.

Intangible Assets, Net

All of the Company’s identifiable intangible assets were acquired in March 2014 from the Elance-oDesk Combination. For each of the three months ended June 30, 2020 and 2019, amortization expense of intangible assets was $0.7 1.3

14

Accrued Expenses and Other Current Liabilities

Accrued expenses and other current liabilities consisted of the following (in thousands):

| June 30, 2020 | December 31, 2019 | ||||||||||

| Accrued compensation and related benefits | $ | $ | |||||||||

| Accrued freelancer costs | |||||||||||

| Accrued indirect taxes | |||||||||||

| Accrued vendor expenses | |||||||||||

| Accrued payment processing fees | |||||||||||

| Operating lease liability, current | |||||||||||

| Other | |||||||||||

| Total accrued expenses and other current liabilities | $ | $ | |||||||||

In February 2020, the Company made changes to its organizational structure to better align with its business strategies and streamline the delivery of its end-to-end user experiences. During the six months ended June 30, 2020, the Company incurred and paid $1.6 million related to these initiatives.

Operating Leases

On January 1, 2020, the Company commenced an operating lease of one additional floor in its Chicago, Illinois office. As a result, the Company recognized a $1.7 million operating lease asset and $1.7 million operating lease liability on January 1, 2020, which are included in operating lease asset and operating lease liability, noncurrent, respectively, on the condensed consolidated balance sheet as of June 30, 2020. The lease has an initial term of five years with the option to renew for an additional five years at the end of the initial lease term. Total minimum lease payments under the initial term are $2.1 million. For the initial measurement of the present value of the lease payments associated with this lease, the Company used its incremental borrowing rate, which is a collateralized rate and approximates the rate at which the Company could borrow, on a secured basis for a similar term, an amount equal to its lease payments in a similar economic environment.

The Company includes lease payments associated with renewal options in its operating lease asset and liability only when it becomes reasonably certain that the Company will exercise the renewal option. The Company has not included renewal options for any of its operating leases in its determination of lease liabilities as of June 30, 2020.

15

Note 6—Commitments and Contingencies

Letters of Credit

In conjunction with the operating lease agreements, as of June 30, 2020 and December 31, 2019, the Company had three 1.0 million and $0.8 million, respectively. No amounts had been drawn against these letters of credit as of June 30, 2020 and December 31, 2019.

Contingencies

The Company accrues contingent liabilities when it is probable that future expenditures will be made and such expenditures can be reasonably estimated. From time to time in the normal course of business, various claims and litigation have been asserted or commenced. Due to uncertainties inherent in litigation and other claims, the Company can give no assurance that it will prevail in any such matters, which could subject the Company to significant liability or damages. Any claims or litigation could have an adverse effect on the Company’s business, financial position, results of operations, or cash flows in or following the period that claims or litigation are resolved.

As of June 30, 2020 and December 31, 2019, the Company was not a party to any material legal proceedings or claims, nor is the Company aware of any pending or threatened litigation or claims that could reasonably be expected to have a material adverse effect on its business, operating results, cash flows, or financial condition. Accordingly, the Company has determined that the existence of a material loss as of these dates is neither probable nor reasonably possible.

Indemnification

The Company has indemnification agreements with its officers, directors, and certain key employees to indemnify them while they are serving in good faith in their respective positions. In the ordinary course of business, the Company enters into contractual arrangements under which it agrees to provide indemnification of varying scope and terms to clients, business partners, vendors, and other parties, including, but not limited to, losses arising out of the Company’s breach of such agreements, claims related to potential data or information security breaches, intellectual property infringement claims made by third parties, and other liabilities relating to or arising from the Company’s products and services or its acts or omissions. In addition, subject to the terms of the applicable agreement, as part of the Company’s Upwork Enterprise offering, the Company indemnifies clients that subscribe to worker classification services for losses arising from worker misclassification. It is not possible to determine the maximum potential loss under these indemnification provisions due to the Company’s limited history of prior indemnification claims and the facts and circumstances involved in each particular provision.

16

Note 7—Debt

The following table presents the carrying value of the Company’s debt obligations as of June 30, 2020 and December 31, 2019 (in thousands):

| June 30, 2020 | December 31, 2019 | |||||||||||||

First Term Loan— | $ | $ | ||||||||||||

Second Term Loan— | ||||||||||||||

| Total debt | ||||||||||||||

| Less: unamortized debt discount issuance costs | ( | ( | ||||||||||||

| Balance | ||||||||||||||

| Debt, current | ( | ( | ||||||||||||

| Debt, noncurrent | $ | $ | ||||||||||||

| Weighted-average interest rate | % | % | ||||||||||||

Under the Loan Agreement, the aggregate amount of the facility is up to $49.0 million, consisting of a term loan in the original principal amount of $15.0 million (the “First Term Loan”), a term loan in the original principal amount of $9.0 million (the “Second Term Loan” and, together with the First Term Loan, the “Term Loans”), and a revolving line of credit, which permits borrowings of up to $25.0 million subject to customary conditions. Among other things, the Company may only borrow funds under the revolving line of credit if, after giving effect thereto, total borrowings under the line of credit do not exceed a specified percentage of eligible trade and client accounts receivable. The Company has granted its lender first-priority liens against substantially all of its assets, as collateral, excluding the Company’s intellectual property (but including proceeds therefrom) and the funds and assets held by the Company’s subsidiary, Upwork Escrow Inc. The Company has also agreed to a negative pledge on its intellectual property. The Loan Agreement also requires that the Company maintain an adjusted quick ratio of 1.75 . The Loan Agreement also includes a restrictive covenant on dividend payments other than dividends paid solely in common stock. The Company was in compliance with its covenants under the Loan Agreement as of June 30, 2020 and December 31, 2019.

As a result of the uncertainty caused by the COVID-19 pandemic, the Company drew down $15.0 million and $3.0 million under the revolving line of credit in March and April 2020, respectively, both of which the Company subsequently repaid in full in May 2020.

Pursuant to the terms of the Loan Agreement, the Company commenced repayment on the Term Loans in April 2019. During the three and six months ended June 30, 2020, the Company repaid $1.3 million and $2.5 million related to the First Term Loan, respectively, and $0.6 million and $1.3 million related to the Second Term Loan, respectively. During both the three and six months ended June 30, 2019, the Company repaid $1.3 0.6

17

Note 8—Net Loss per Share

The following table sets forth the computation of the Company’s basic and diluted net loss per share for the periods presented (in thousands, except share and per share data):

| Three Months Ended June 30, | Six Months Ended June 30, | ||||||||||||||||||||||

| 2020 | 2019 | 2020 | 2019 | ||||||||||||||||||||

| Numerator: | |||||||||||||||||||||||

| Net loss | $ | ( | $ | ( | $ | ( | $ | ( | |||||||||||||||

| Denominator: | |||||||||||||||||||||||

| Weighted-average shares used to compute net loss per share, basic and diluted | |||||||||||||||||||||||

| Net loss per share, basic and diluted | $ | ( | $ | ( | $ | ( | $ | ( | |||||||||||||||

The following potentially dilutive shares were excluded from the computation of diluted net loss per share because including them would have been anti-dilutive:

| As of June 30, | |||||||||||

| 2020 | 2019 | ||||||||||

| Options to purchase common stock | |||||||||||

| Common stock issuable upon exercise of common stock warrants | |||||||||||

| Common stock issuable upon vesting of restricted stock units | |||||||||||

| Common stock issuable in connection with employee stock purchase plan | |||||||||||

| Total | |||||||||||

18

Note 9—Segment and Geographical Information

The Company operates as one

The following table sets forth total revenue by type of service for the periods presented (in thousands):

| Three Months Ended June 30, | Six Months Ended June 30, | ||||||||||||||||||||||

| 2020 | 2019 | 2020 | 2019 | ||||||||||||||||||||

| Marketplace | $ | $ | $ | $ | |||||||||||||||||||

| Managed services | |||||||||||||||||||||||

| Total revenue | $ | $ | $ | $ | |||||||||||||||||||

The Company generates its revenue from freelancers and clients. The following table sets forth total revenue by geographic area based on the billing address of its freelancers and clients for the periods presented (in thousands):

| Three Months Ended June 30, | Six Months Ended June 30, | ||||||||||||||||||||||

| 2020 | 2019 | 2020 | 2019 | ||||||||||||||||||||

| Freelancers | |||||||||||||||||||||||

| United States | $ | $ | $ | $ | |||||||||||||||||||

| India | |||||||||||||||||||||||

| Philippines | |||||||||||||||||||||||

| Rest of world | |||||||||||||||||||||||

| Total freelancers | |||||||||||||||||||||||

| Clients | |||||||||||||||||||||||

| United States | |||||||||||||||||||||||

| Rest of world | |||||||||||||||||||||||

| Total clients | |||||||||||||||||||||||

| Total revenue | $ | $ | $ | $ | |||||||||||||||||||

Substantially all of the Company’s long-lived assets were located in the United States as of June 30, 2020 and December 31, 2019.

19

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations.

You should read the following discussion and analysis of our financial condition and results of operations together with the section titled “Risk Factors” and the condensed consolidated financial statements and related notes included elsewhere in this Quarterly Report. This discussion contains forward-looking statements based upon current expectations that involve risks and uncertainties, as well as assumptions that may never materialize or that may be proven incorrect. Our actual results may differ materially from those anticipated in these forward-looking statements as a result of various factors, including those discussed in the sections titled “Special Note Regarding Forward-Looking Statements” and “Risk Factors,” and in other parts of this Quarterly Report.

Overview

We operate the largest online talent solution that enables businesses to find and work with highly-skilled independent professionals, as measured by gross services volume (“GSV”). GSV represents the total amount that clients spend on our marketplace offerings and our managed services offering as well as additional fees we charge to both clients and freelancers for other services. Freelancers are an increasingly sought-after, critical, and expanding segment of the global workforce. We define freelancers as users of our platform that advertise and provide services to clients through our platform, and we define clients as users of our platform that work with freelancers through our platform. The freelancers on our platform include independent professionals and agencies of varying sizes. The clients on our platform range in size from small businesses to Fortune 100 companies. With users in over 180 countries, our platform enabled $0.6 billion and $0.5 billion of GSV for the three months ended June 30, 2020 and 2019, respectively, and $1.1 billion and $1.0 billion of GSV for the six months ended June 30, 2020 and 2019, respectively. For purposes of determining countries where we enable GSV, we include both the countries in which the clients that paid for the applicable services are located, as well as the countries in which the freelancers that provided those services are located.

We generate a majority of our revenue from fees charged to freelancers. We also generate revenue through fees charged to clients for transacting payments through our platform and fees for premium offerings, foreign currency exchange fees, purchases of “Connects” (virtual tokens that allow freelancers to bid on projects on our platform), and Upwork Payroll service fees. In addition, we provide a managed services offering where we engage freelancers to complete projects, directly invoice the client, and assume responsibility for work performed. For the three months ended June 30, 2020 and 2019, we generated total revenue of $87.5 million and $73.8 million, respectively, representing a period-over-period increase of 19%. For the six months ended June 30, 2020 and 2019, we generated total revenue of $170.7 million and $142.3 million, respectively, representing a period-over-period increase of 20%.

For the three months ended June 30, 2020, we generated a net loss of $11.0 million and adjusted EBITDA loss of $1.2 million, compared to a net loss of $2.5 million and adjusted EBITDA of $1.2 million for the three months ended June 30, 2019. For the six months ended June 30, 2020, we generated a net loss of $21.0 million and adjusted EBITDA loss of $2.2 million, compared to a net loss of $7.6 million and adjusted EBITDA of $2.0 million for the six months ended June 30, 2019. Our adjusted EBITDA loss of $2.2 million during the six months ended June 30, 2020, was driven primarily by a $1.6 million expense that we incurred related to our changes in organizational structure to better align with our business strategies and streamline the delivery of our end-to-end user experiences, as well as marketing expense of $4.4 million related to brand awareness and performance marketing. Adjusted EBITDA is a financial measure that is not prepared in accordance with, and is not an alternative to, financial measures prepared in accordance with U.S. generally accepted accounting principles (“U.S. GAAP”). See the section titled “Key Financial and Operational Metrics—Non-GAAP Financial Measures” below for a definition of adjusted EBITDA and information regarding our use of adjusted EBITDA and a reconciliation of adjusted EBITDA to net loss, the most directly comparable financial measure prepared under U.S. GAAP.

Impact of the COVID-19 Pandemic on Our Business

In March 2020, the World Health Organization declared the outbreak of COVID-19 to be a pandemic, which continues to spread throughout the United States and the world, and has resulted in authorities implementing numerous measures to contain the virus, including travel bans and restrictions, shelter-in-place orders, and business limitations and shutdowns. To support the health and well-being of our employees, clients, partners, and communities, nearly all of our employees are currently working remotely. With our unique, remote-based business

20

model, the COVID-19 pandemic has not impacted our clients’ access to highly-skilled independent professionals on our platform to complete short- and long-term projects.

Although the COVID-19 pandemic did not have a material adverse impact on our financial results for the three and six months ended June 30, 2020, the rapidly changing market and economic conditions caused by the COVID-19 pandemic has disrupted the businesses of many of our clients. We began seeing the impact of the pandemic on our results at the end of the first quarter, when we began to experience a reduction in the growth rate of GSV and revenue. This trend continued into the beginning of the second quarter, driven by spend contraction by many of our clients, as the COVID-19 pandemic continued to disrupt the businesses of many of our clients. These trends stabilized in the second half of the second quarter, but they contributed to a reduction in the growth rate of GSV and revenue in the second quarter. At the same time, we saw an increase in client acquisition that was driven by an acceleration in the shift toward remote work, due in part to the COVID-19 pandemic and the execution of our strategic initiatives, which together contributed to an increase in revenue for the second quarter compared to what we anticipated when we reported first quarter earnings in early May 2020. This increase in client acquisition drove an increase in freelancer billings at the higher rates of our tiered service fee structure, which, in turn, drove increases in marketplace revenue and marketplace take rate. We derive a substantial portion of our GSV and revenue from small- and medium-sized businesses, and the pandemic and related effects have affected and continue to significantly affect demand for our products and services from these clients, although we expect that economic conditions have and may continue to affect spend from clients of all sizes.

In light of the COVID-19 pandemic and the global macroeconomic downturn and their effect on client spend on our platform, we continue to identify opportunities to prioritize our advertising and marketing efforts in order to reach those new and existing clients seeking to engage with remote freelancers due to the governmental restrictions related to the COVID-19 pandemic. In addition, we may also implement a reduction or elimination of certain fees normally charged to users or may implement other promotions in an effort to support those affected by the COVID-19 pandemic or those seeking to engage freelancers for the first time, and any such changes may result in a reduction in revenue. We are continuously evaluating the nature and extent to which the ongoing COVID-19 pandemic will continue to have on our business, operating results, and financial condition.

While we have not incurred significant disruptions to our business thus far from the COVID-19 pandemic, at this time, we are unable to fully assess the aggregate impact it will have on our business due to various uncertainties, which include, but are not limited to, the duration of the pandemic, actions that may be taken by governmental authorities specific to the COVID-19 pandemic, the impact to the businesses of our clients, and other factors identified in Part II, Item 1A “Risk Factors” in this Quarterly Report, including the risk factor titled “Our business is experiencing, and is expected to continue to experience, an adverse impact from the ongoing COVID-19 pandemic.”

Key Financial and Operational Metrics

We monitor the following key financial and operational metrics to evaluate our business, measure our performance, identify trends affecting our business, formulate business plans, and make strategic decisions. Our key metrics were as follows as of or for the periods presented:

| Three Months Ended June 30, | Six Months Ended June 30, | ||||||||||||||||||||||

| 2020 | 2019 | 2020 | 2019 | ||||||||||||||||||||

| (in thousands) | |||||||||||||||||||||||

| GSV | $ | 581,950 | $ | 518,732 | $ | 1,141,444 | $ | 1,005,379 | |||||||||||||||

| Marketplace revenue | $ | 78,464 | $ | 65,728 | $ | 153,246 | $ | 126,183 | |||||||||||||||

| Marketplace take rate | 13.7 | % | 12.9 | % | 13.6 | % | 12.8 | % | |||||||||||||||

| Net loss | $ | (11,024) | $ | (2,451) | $ | (21,045) | $ | (7,611) | |||||||||||||||

Adjusted EBITDA (1) | $ | (1,184) | $ | 1,152 | $ | (2,202) | $ | 1,966 | |||||||||||||||

(1)Adjusted EBITDA is not prepared in accordance with, and is not an alternative to, financial measures prepared in accordance with U.S. GAAP. See “Key Financial and Operational Metrics—Non-GAAP Financial Measures” below for a definition of adjusted EBITDA and for information regarding our use of adjusted EBITDA and a reconciliation of adjusted EBITDA to net loss, the most directly comparable financial measure prepared under U.S. GAAP.

21

| As of June 30, | |||||||||||

| 2020 | 2019 | ||||||||||

| (in thousands, except percentages) | |||||||||||

| Core clients | 133.3 | 115.7 | |||||||||

| Client spend retention | 100 | % | 105 | % | |||||||

As discussed below with respect to each key metric, we believe these key financial and operational metrics are useful to evaluate period-over-period comparisons of our business and in understanding our operating results, and management uses these metrics to track our performance. GSV represents the total amount that clients spend on our marketplace offerings and our managed services offering, as well as additional fees we charge to both clients and freelancers for other services. We believe that GSV is an important metric, as it represents the overall amount of business transacted through our platform, which in turn is a key driver of our financial results. We believe our marketplace revenue, which represents a majority of our revenue, will grow as GSV grows, although they could grow at different rates. We evaluate the correlation between marketplace revenue and GSV by measuring marketplace take rate, which is calculated as marketplace revenue divided by marketplace GSV. We use the number of core clients to track the number of clients that we consider are actively using our platform, and this metric in any given period drives both GSV and client spend retention. Similarly, client spend retention impacts the growth rate of GSV. In light of the COVID-19 pandemic, rapidly changing market and economic conditions continue to disrupt the businesses of many of our clients, which has led, and may continue to lead, to downward pressure on the number of core clients, client spend retention, GSV, and marketplace revenue. For information on how we define core clients and how we calculate client spend retention and marketplace take rate, see “—Core Clients,” “—Client Spend Retention,” and “—Marketplace Take Rate,” respectively, below. For a discussion of limitations in the measurement of our key financial and operational metrics, see “Risk Factors—We track certain performance metrics with internal tools and do not independently verify such metrics. Certain of our performance metrics are subject to inherent challenges in measurement, and real or perceived inaccuracies in such metrics may harm our reputation and negatively affect our business” in Part II, Item 1A of this Quarterly Report.

Core Clients

We define a core client as a client that has spent in the aggregate at least $5,000 since it began using our platform and also had spend activity on our platform during the 12 months preceding the date of measurement. We believe that aggregate spend of at least $5,000 indicates that the client is actively using our platform. Historically, these core clients have been more likely to continue using our platform, although we saw a contraction in spend from many core clients during the second quarter that we believe is a result of the COVID-19 pandemic’s disruption of the businesses of these clients. Over the last two years, we have seen businesses of all sizes use our platform in a recurring way for larger, more complex projects; as a result, we have added between approximately 4,000 and 5,000 additional core clients per quarter over the last two years. We believe we will continue to add approximately 4,000 core clients per quarter in the coming quarters; however, the impact on the number of core clients resulting from the COVID-19 pandemic may not be evident until early 2021. The number of core clients could vary quarter by quarter depending, in part, on the extent to which the COVID-19 pandemic impacts our business, the businesses of our clients, and other factors identified in Part II, Item 1A “Risk Factors” in this Quarterly Report, including the risk factor titled “Our business is experiencing, and is expected to continue to experience, an adverse impact from the ongoing COVID-19 pandemic.” We believe that the number of core clients is a key indicator of our growth and the overall health of our business because core clients are a primary driver of GSV and, therefore, marketplace revenue.

Gross Services Volume

GSV includes both client spend and additional fees charged for other services. Client spend, which we define as the total amount that clients spend on both our marketplace offerings and our managed services offering, is the primary component of GSV. GSV also includes additional fees charged to both clients and freelancers for other services, such as freelancer memberships, purchases of Connects, freelancer withdrawals, and foreign currency exchange.

GSV is an important metric because it represents the amount of business transacted through our platform. Our marketplace revenue is primarily comprised of the service fees paid by freelancers as a percentage of the total

22

amount freelancers charge clients for services accessed through our platform. Therefore, marketplace revenue is correlated to GSV, and we believe that our marketplace revenue will grow as GSV grows, although they could grow at different rates. For a discussion of how we measure and evaluate the correlation between marketplace revenue and GSV, see “—Marketplace Take Rate” below. Growth in the number of core clients and increased client spend retention are the primary drivers of GSV growth, and we expect the client spend retention trends discussed in “—Client Spend Retention,” below, to affect the rate at which GSV grows. We derive a substantial portion of our GSV and revenue from small- and medium-sized businesses. In light of the COVID-19 pandemic, rapidly changing market and economic conditions continue to disrupt the businesses of many of our clients, which has led and may continue to lead to downward pressure on client spend on our platform and, in turn, GSV. We expect our GSV to fluctuate between periods due to a number of factors, including the volume of projects that are posted by clients on our platform as well as the characteristics of those projects, such as size, duration, pricing, and other factors, including the current COVID-19 pandemic, the impact of the pandemic on our clients’ businesses, and the timing of the removal of restriction-in-place orders, both globally and in localized areas.

Client Spend Retention

We calculate client spend retention by dividing our recurring client spend by our base client spend. We define base client spend as the aggregate client spend from all clients during the four quarters ended one year prior to the date of measurement. We define our recurring client spend as the aggregate client spend during the four quarters ended on the date of measurement from the same clients included in our measure of base client spend. Our business is recurring in nature even though clients are not contractually required to spend on a recurring basis. We believe that client spend retention is a key indicator of the value of our platform and the overall health of our business because it impacts the growth rate of GSV, and, therefore, marketplace revenue.

Long-term and recurring use by freelancers and clients are the primary drivers of growth in our marketplace and give us increased revenue visibility. While continued use of our platform by freelancers is a factor that impacts our ability to attract and retain clients, our platform currently has a significant surplus of freelancers in relation to the number of clients actively engaging freelancers. This surplus has increased as a result of the COVID-19 pandemic, as we have experienced an increase in the number of independent professionals applying to join our platform. As a result of this surplus, we primarily focus our efforts on retaining client spend and acquiring new clients, as opposed to acquiring new freelancers and retaining existing freelancers. Moreover, we generate revenue when clients engage and pay freelancers, therefore, our key metrics and operating results are directly impacted by client spend. On the other hand, the number of freelancers retained between periods is merely one of many factors that may impact client spend in a particular period and is not a primary driver of our key metrics and operating results. For these reasons, we do not calculate or consider freelancer retention metrics in evaluating our business.

As of June 30, 2020, client spend retention was 100%, down from 105% as of June 30, 2019. We believe that this decline in client spend retention is due in part to the impact of the rapidly changing market and economic conditions caused by the COVID-19 pandemic, which have disrupted the businesses of many of our clients, resulting in a contraction in spend from many of our clients in the first half of 2020. Additionally, client spend retention has declined—from its historically highest levels in 2018 and the first quarter of 2019—following an acceleration in client spend retention that occurred subsequent to the launch of our U.S.-to-U.S. domestic marketplace offering in the second half of 2017, which initiated a substantial increase in the average hourly earnings rate of freelancers. These hourly rates stabilized over the course of 2019, causing the reduction in retention rate. Moreover, following the launch of our U.S.-to-U.S. domestic marketplace offering, an increasing proportion of U.S. clients are engaging primarily U.S. freelancers. We are observing that U.S. clients that engage solely U.S. freelancers post higher-budget projects and pay higher rates initially but, to date, have exhibited lower client spend retention than the rest of our clients. As we acquire more mid-market, large enterprise, and global clients in current and future periods, we expect them to continue to make positive contributions to our client spend retention in future years. However, client spend retention will be challenged by the reduction in recurring client spend as a result of the COVID-19 pandemic. For these and other reasons, client spend retention will continue to vary from period to period due to client size and spending behavior, among other factors, including the impact of the ongoing COVID-19 pandemic, the related governmental restrictions intended to prevent its spread, and the resulting macroeconomic downturn on the businesses and spending behavior of our clients.

23

Marketplace Revenue

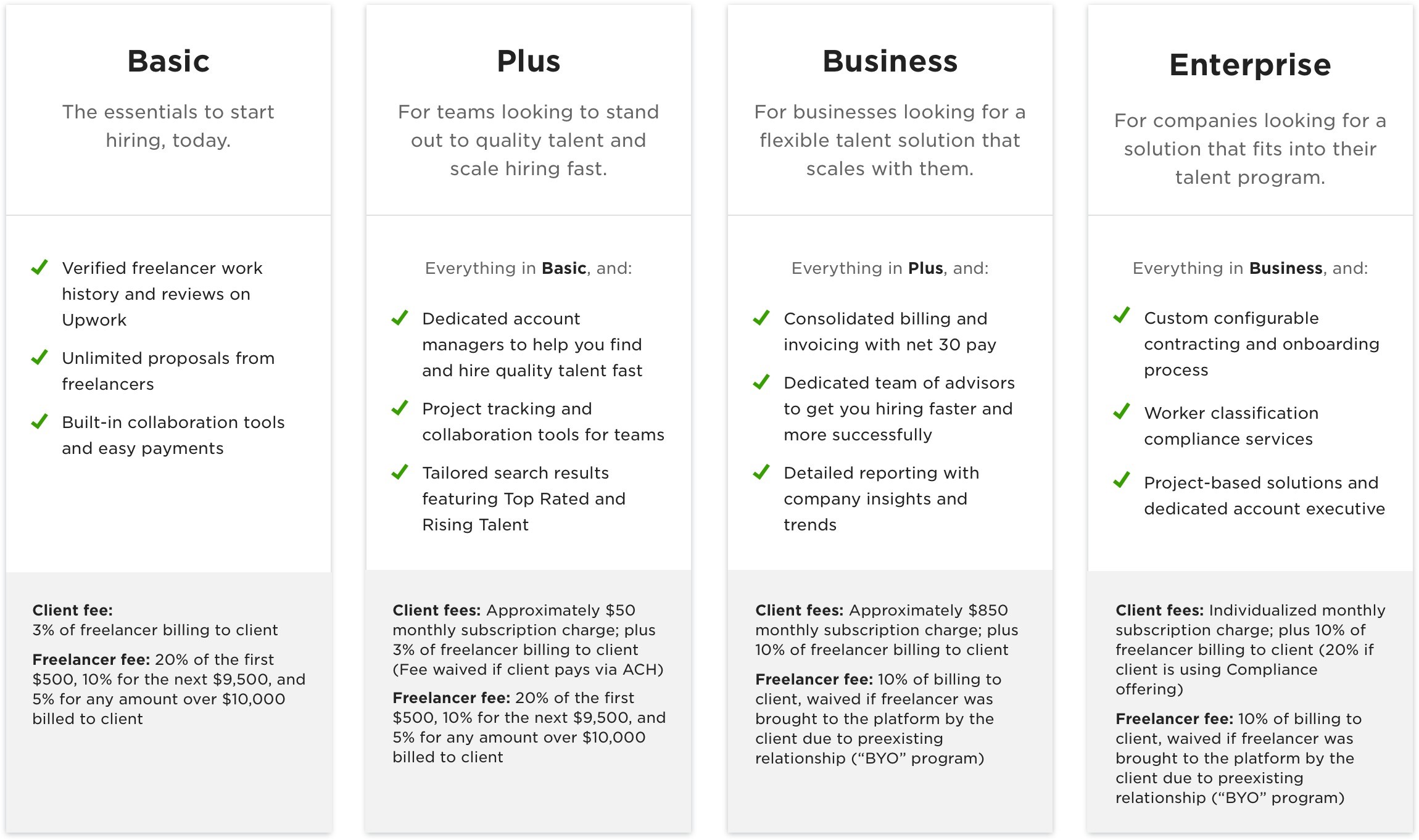

Marketplace revenue, which represents the majority of our revenue, consists of revenue derived from our Upwork Basic, Plus, Business, and Enterprise offerings, and our other premium offerings. We generate marketplace revenue from both freelancers and clients. Our marketplace revenue is primarily comprised of the service fees paid by freelancers as a percentage of the total amount freelancers charge clients for services accessed through our platform, and to a lesser extent, payment processing and administration fees charged to clients. We also generate marketplace revenue from fees for premium offerings, freelancer membership fees, Connects purchases, and other services, such as foreign currency exchange fees and Upwork Payroll service fees.

Marketplace revenue is an important metric because it is the primary driver of our business model, and we believe it provides greater comparability to other online marketplaces. The growth rate of marketplace revenue fluctuates in relation to the growth rate of GSV. Therefore, marketplace revenue is correlated to GSV, and we believe that our marketplace revenue will grow as GSV grows, although they could grow at different rates. We expect our marketplace revenue growth rates to continue to vary from period to period due to a variety of other factors such as the impact of the COVID-19 pandemic on the businesses and spending behavior of our current and prospective clients; the number of Sundays (i.e., the day we bill and recognize revenue for the majority of our freelancer service fees each week) in any given quarter, or the number of Mondays (i.e., the day we bill and recognize revenue for a substantial portion of our client fees each week); the lapping of significant launches of new products, pricing changes, and other monetization efforts; the performance of client spend retention; and the ability of the recent and continued investment in our enterprise sales team to accelerate the acquisition of, and achieve increased spend from, Upwork Enterprise and Business clients, and the timing of those results. In the second quarter of 2020, we saw an increase in client acquisition that was driven by an acceleration in the shift toward remote work, due in part to the COVID-19 pandemic and the execution of our strategic initiatives. This increase in client acquisition drove an increase in freelancer billings at the higher rates of our tiered service fee structure, which, in turn, drove an increase in marketplace revenue.

Marketplace Take Rate

Marketplace take rate measures the correlation between marketplace revenue and GSV and is calculated by dividing marketplace revenue by marketplace GSV. Marketplace take rate is an important metric because it is the key indicator of how well we monetize spend on our platform from our Upwork Basic, Plus, Business, and Enterprise offerings, and other premium offerings. We expect our marketplace take rate to vary from period to period as marketplace revenue and GSV vary as a result of a variety of factors, such as the number of Sundays (i.e., the day we bill and recognize revenue for the majority of our freelancer service fees each week) in any given quarter, or the number of Mondays (i.e., the day we bill and recognize revenue for a substantial portion of our client fees each week); pricing changes; the ability of the recent and continued investment in our enterprise sales team to accelerate the acquisition of, and achieve increased spend from, our Upwork Enterprise and Business clients and the timing of those results; and ongoing efforts to improve processes on our platform, including, but not limited to, project proposals and purchases of Connects. In the second quarter of 2020, our marketplace take rate increased primarily due to two factors. First, marketplace revenue increased as a result of an influx of new clients, which caused freelancers to bill at higher rates of our tiered service fee structure. Second, although GSV increased, it grew at a slower rate than marketplace revenue as a result of spend contraction by many of our clients whose businesses have been disrupted by the COVID-19 pandemic.

Non-GAAP Financial Measures

In addition to our results determined in accordance with U.S. GAAP, adjusted EBITDA is a non-GAAP measure that we believe is useful in evaluating our operating performance.

We define adjusted EBITDA as net income (loss) adjusted for stock-based compensation expense, depreciation and amortization, interest expense, other (income) expense, net, income tax (benefit) provision, and, if applicable, other non-cash transactions. Adjusted EBITDA is not prepared in accordance with, and is not an alternative to, financial measures prepared in accordance with U.S. GAAP.

24

The following table presents a reconciliation of net loss, the most directly comparable financial measure prepared in accordance with U.S. GAAP, to adjusted EBITDA for each of the periods indicated (in thousands):

| Three Months Ended June 30, | Six Months Ended June 30, | ||||||||||||||||||||||

| 2020 | 2019 | 2020 | 2019 | ||||||||||||||||||||

| Net Loss | $ | (11,024) | $ | (2,451) | $ | (21,045) | $ | (7,611) | |||||||||||||||

| Add back (deduct): | |||||||||||||||||||||||

| Stock-based compensation expense | 7,134 | 2,631 | 12,671 | 6,926 | |||||||||||||||||||

| Depreciation and amortization | 2,478 | 1,295 | 4,786 | 2,827 | |||||||||||||||||||

| Interest expense | 258 | 357 | 488 | 730 | |||||||||||||||||||

| Other (income) expense, net | (248) | (832) | 483 | (1,311) | |||||||||||||||||||

| Income tax provision | 30 | 27 | 39 | 28 | |||||||||||||||||||

| Tides Foundation common stock warrant expense | 188 | 125 | 376 | 377 | |||||||||||||||||||

| Adjusted EBITDA | $ | (1,184) | $ | 1,152 | $ | (2,202) | $ | 1,966 | |||||||||||||||

We use adjusted EBITDA as a measure of operational efficiency. We believe that this non-GAAP financial measure is useful to investors for period-to-period comparisons of our business and in understanding and evaluating our operating results for the following reasons:

•adjusted EBITDA is widely used by investors and securities analysts to measure a company’s operating performance without regard to items such as stock-based compensation expense, depreciation and amortization, interest expense, other (income) expense, net, income tax (benefit) provision, and, if applicable, other non-cash transactions that can vary substantially from company to company depending upon their financing, capital structures, and the method by which assets were acquired;

•our management uses adjusted EBITDA in conjunction with financial measures prepared in accordance with U.S. GAAP for planning purposes, including the preparation of our annual operating budget, as a measure of our core operating results and the effectiveness of our business strategy, and in evaluating our financial performance; and

•adjusted EBITDA provides consistency and comparability with our past financial performance, facilitates period-to-period comparisons of our core operating results, and also facilitates comparisons with other peer companies, many of which use similar non-GAAP financial measures to supplement their U.S. GAAP results.

Our use of adjusted EBITDA has limitations as an analytical tool, and you should not consider it in isolation or as a substitute for analysis of our financial results as reported under U.S. GAAP. Some of these limitations are as follows:

•adjusted EBITDA excludes stock-based compensation expense, which has recently been, and will continue to be for the foreseeable future, a significant recurring expense for our business and an important part of our compensation strategy;

•although depreciation and amortization expense are non-cash charges, the assets being depreciated and amortized may have to be replaced in the future, and adjusted EBITDA does not reflect cash capital expenditure requirements for such replacements or for new capital expenditure requirements;

•adjusted EBITDA does not reflect: (a) changes in, or cash requirements for, our working capital needs; (b) interest expense, or the cash requirements necessary to service interest or principal payments on our debt, which reduces cash available to us; or (c) tax payments that may represent a reduction in cash available to us; and

•other companies, including companies in our industry, may calculate adjusted EBITDA or similarly titled measures differently, which reduces the usefulness of this measure for comparative purposes.

25

Because of these and other limitations, you should consider adjusted EBITDA along with other financial performance measures, including net loss and our other financial results prepared in accordance with U.S. GAAP.

26

Components of Our Results of Operations

Revenue

Marketplace Revenue. Marketplace revenue is generated from our Upwork Basic, Plus, Business, and Enterprise offerings, and other premium offerings. Under these marketplace offerings, we generate revenue from both freelancers and clients. Marketplace revenue, which represents the majority of our total revenue, is primarily comprised of the service fees paid by freelancers as a percentage of the total amount that freelancers charge clients for services accessed through our platform and, to a lesser extent, payment processing and administration fees paid by clients.

Although the COVID-19 pandemic did not have a material adverse impact on our financial results for the three and six months ended June 30, 2020, it has resulted, and may continue to result, in significant reductions in demand for our products and services from many of our clients, especially with respect to our small- and medium-sized businesses, from which we derive a substantial portion of our GSV and revenue. We are continuously evaluating the nature and extent of the impact to our business, operating results, and financial condition.

Managed Services Revenue. Through our managed services offering, we are responsible for providing services and engaging freelancers directly or as employees of third-party staffing providers to perform services for clients on our behalf. The freelancers providing services in connection with our managed services include independent professionals and agencies of varying sizes. Under U.S. GAAP, we are deemed to be the principal in these managed services arrangements and therefore recognize the entire GSV of managed services projects as managed services revenue, as compared to recognizing only the percentage of the client spend that we receive, as we do with our marketplace offerings.

27

Cost of Revenue and Gross Profit