ANNUAL INFORMATION FORM

FOR THE FISCAL YEAR ENDED

DECEMBER 31, 2020

DATED AS OF MARCH 26, 2021

TABLE OF CONTENTS

GENERAL MATTERS

The information contained in this Annual Information Form, unless otherwise indicated, is given as of December 31, 2020, with specific updates post-financial year end where specifically indicated. More current information may be available on our public website at www.osiskogr.com, on SEDAR at www.sedar.com and on EDGAR at www.sec.gov. In addition, we generally maintain supporting materials on our website which may assist in reviewing (but are not to be considered part of) this Annual Information Form.

All capitalized terms used in this Annual Information Form and not defined herein have the meaning ascribed in the "Glossary of Terms" or elsewhere in this Annual Information Form.

Unless otherwise noted or the context otherwise indicates, the term "Osisko" refers to Osisko Gold Royalties Ltd and its subsidiaries.

For reporting purposes, Osisko presents its financial statements in Canadian dollars and in conformity with International Financial Reporting Standards as issued by the International Accounting Standards Board ("IFRS").

Unless otherwise indicated herein, references to "$", "C$" or "Canadian dollars" are to Canadian dollars, and references to "US$" or "U.S. dollars" are to United States dollars. See "Exchange Rate Data". See also "Cautionary Statement Regarding Forward-Looking Statements".

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

Certain statements contained in this Annual Information Form may be deemed "forward looking information" and "forward-looking statements" within the meaning of applicable Canadian Securities Laws and the United States Private Securities Litigation Reform Act of 1995 (collectively, the "forward-looking statements"). All statements in this Annual Information Form, other than statements of historical fact, that address future events, developments or performance that Osisko expects to occur including management's expectations regarding Osisko's growth, results of operations, estimated future revenues, requirements for additional capital, mineral reserve and mineral resource estimates, production estimates, production costs and revenue estimates, future demand for and prices of commodities, business prospects and opportunities and outlook on gold, silver, diamonds, other commodities and currency markets are forward-looking statements. In addition, statements (including data in tables) relating to mineral reserves and mineral resources and gold equivalent ounces are forward-looking statements, as they involve implied assessment, based on certain estimates and assumptions, and no assurance can be given that the estimates will be realized. Forward-looking statements are statements that are not historical facts and are generally, but not always, identified by the words "expects", "plans", "anticipates", "believes", "intends", "estimates", "projects", "potential", "scheduled" and similar expressions or variations (including negative variations), or that events or conditions "will", "would", "may", "could" or "should" occur including, without limitation, the performance of the assets of Osisko, any estimate of gold equivalent ounces to be received in 2021, the realization of the anticipated benefits deriving from Osisko's investments and transactions, the actual results of exploration and development activities and Osisko's ability to seize future opportunities. Although Osisko believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements involve known and unknown risks, uncertainties and other factors and are not guarantees of future performance and actual results may accordingly differ materially from those in forward-looking statements. Factors that could cause the actual results to differ materially from those in forward-looking statements include, without limitation: fluctuations in the prices of the commodities that drive royalties, streams, offtakes and investments held by Osisko; fluctuations in the value of the Canadian dollar relative to the U.S. dollar; regulatory changes in national and local government, including permitting and licensing regimes and taxation policies; whether or not Osisko is determined to have "passive foreign investment company" status ("PFIC") as defined in Section 1297 of the United States Internal Revenue Code of 1986, as amended; regulations and political or economic developments in any of the countries where properties in which Osisko holds royalties, streams or other interests are located or through which they are held; risks related to the operators of the properties in which Osisko holds royalties, streams or other interests; influence of macroeconomic developments; the unfavorable outcome of litigation relating to any of the properties in which Osisko holds a royalty, stream or other interests; business opportunities that become available to, or are pursued by Osisko; continued availability of capital and financing and general economic, market or business conditions; litigation; title, permit or license disputes related to interests on any of the properties in which Osisko holds royalties, streams or other interests; development, permitting, infrastructure, operating or technical difficulties on any of the properties in which Osisko holds royalties, stream or other interests; rate and timing of production differences from resource estimates or production forecasts by operators of properties in which Osisko holds royalties, streams or other interests; risks and hazards associated with the business of exploring, development and mining on any of the properties in which Osisko holds royalties, streams or other interests, including, but not limited to unusual or unexpected geological and metallurgical conditions, slope failures or cave-ins, flooding and other natural disasters or civil unrest or other uninsured risks, the responses of relevant governments to the COVID-19 outbreak and the effectiveness of such response and the potential impact of COVID-19 on Osisko's business, operations and financial condition and the integration of acquired assets. The forward-looking statements contained in this Annual Information Form are based upon assumptions management believes to be reasonable, including, without limitation: the ongoing operation by the operators of the properties in which Osisko holds royalties, streams or other interests by the operators of such properties in a manner consistent with past practice; the accuracy of public statements and disclosures made by the operators of such underlying properties; the absence of material adverse change in the market price of the commodities that underlie the asset portfolio; Osisko's ongoing income and assets relating to determination of its PFIC status; no adverse development in respect of any significant property in which Osisko holds royalties, streams or other interests; the accuracy of publicly disclosed expectations for the development of underlying properties that are not yet in production; integration of acquired assets; and the absence of any other factors that could cause actions, events or results to differ from those anticipated, estimated or intended.

Although Osisko has attempted to identify important factors that could cause actual plans, actions, events or results to differ materially from those described in forward-looking statements, there may be other factors that cause plans, actions, events or results not to be as anticipated, estimated or intended. There can be no assurance that forward-looking statements will prove to be accurate, as actual plans, results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements.

Certain of the forward-looking statements and other information contained herein concerning the mining industry and Osisko's general expectations concerning the mining industry are based on estimates prepared by Osisko using data from publicly available industry sources as well as from market research and industry analysis and on assumptions based on data and knowledge of this industry which Osisko believes to be reasonable. However, although generally indicative of relative market positions, market shares and performance characteristics, this data is inherently imprecise. While Osisko is not aware of any misstatement regarding any industry data presented herein, the mining industry involves risks and uncertainties that are subject to change based on various factors.

The readers are cautioned not to place undue reliance on forward-looking statements. Osisko undertakes no obligation to update any of the forward-looking statements in this Annual Information Form, except as required by law. Unless otherwise indicated, these statements are made as of the date of this Annual Information Form.

CAUTIONARY NOTE TO U.S. INVESTORS REGARDING

PREPARATION OF FINANCIAL INFORMATION

As a Canadian company, Osisko prepares its financial statements in accordance with IFRS. Consequently, all of the financial statements and financial information of Osisko is prepared in accordance with IFRS, which are materially different than financial statements and financial information prepared in accordance with U.S. generally accepted accounting principles.

CAUTIONARY NOTE TO U.S. INVESTORS REGARDING

THE USE OF MINERAL RESERVE AND MINERAL RESOURCE ESTIMATES

Osisko is subject to the reporting requirements of the applicable Canadian securities laws, and as a result reports information regarding mineral properties, mineralization and estimates of mineral reserves and mineral resources in accordance Canadian reporting requirements, which are governed by Canadian National Instrument 43-101 Standards of Disclosure for Mineral Projects. As such, the information contained in this Annual Information Form concerning mineral properties, mineralization and estimates of mineral reserves and mineral resources is not comparable to similar information made public by U.S. companies subject to the reporting and disclosure requirements of the U.S. Securities and Exchange Commission.

CAUTIONARY STATEMENT REGARDING THIRD PARTY INFORMATION

The disclosure in this Annual Information Form relating to the properties in which Osisko holds royalties, streams or other interests and the operations on such properties is based on information publicly disclosed by the owners or operators of these properties and information or data available in the public domain as at March 26, 2021 (except where stated otherwise), and none of this information or data has been independently verified by Osisko. As a holder of royalties, streams and other interests, Osisko generally has limited, if any, access to the properties included in or relating to its asset portfolio. Therefore, in preparing disclosure pertaining to the properties in which Osisko holds royalties, streams or other interests and the operations on such properties, Osisko is dependent on information publicly disclosed by the owners or operators of these properties and information or data available in the public domain and generally has limited or no ability to independently verify such information or data. Although Osisko has no knowledge that such information or data is incomplete or inaccurate, there can be no assurance that such third party information or data is complete or accurate. Additionally, some information or data publicly reported by the owners or operators may relate to a larger property than the area covered by the royalties, streams or other interests of Osisko. Sometimes, the royalties, streams or other interests of Osisko cover less than 100% and sometimes only a portion of the publicly reported mineral reserves, mineral resources or production of a property.

NON-IFRS FINANCIAL PERFORMANCE MEASURES

Osisko has included certain non-IFRS measures including "Adjusted Earnings" and "Adjusted Earnings per basic share" (which have no standard definition under IFRS) to supplement its consolidated financial statements, which are presented in accordance with IFRS. Osisko believes that these measures, together with measures determined in accordance with IFRS, provide investors with an improved ability to evaluate the underlying performance of Osisko. Non-IFRS measures do not have any standardized meaning prescribed under IFRS, and, therefore, they may not be comparable to similar measures employed by other companies. The data is intended to provide additional information and should not be considered in isolation or as a substitute for measures of performance prepared in accordance with IFRS.

For information regarding the non-IFRS financial measures used by Osisko, see "Non-IFRS Financial Performance Measures" in Osisko's management's discussion and analysis for the year ended December 31, 2020, which section is incorporated by reference herein. The financial statements and management's discussion and analysis of Osisko are available on SEDAR at www.sedar.com.

EXCHANGE RATE DATA

The following table sets forth the high and low exchange rates for one U.S. dollar expressed in Canadian dollars for each period indicated, the average of the exchange rates for each period indicated and the exchange rate at the end of each such period, based upon the exchange rates provided by the Bank of Canada:

|

|

Year Ended December 31 |

||

|

2020 |

2019 |

2018 |

|

|

($C) |

($C) |

($C) |

|

|

High |

1.4496 |

1.3600 |

1.3642 |

|

Low |

1.2718 |

1.2988 |

1.2288 |

|

Average rate for period |

1.3415 |

1.3269 |

1.2957 |

|

Rate at end of period |

1.2732 |

1.2988 |

1.3642 |

On March 26, 2021, the exchange rate for one U.S. dollar expressed in Canadian dollars as reported by the Bank of Canada, was 1.2580.

GLOSSARY OF TERMS

In this Annual Information Form, the following capitalized words and terms shall have the following meanings:

"2019 Underwriters" means a syndicate of underwriters led by CIBC Capital Markets and BMO Capital Markets.

"2019 Underwriting Agreement" means the underwriting agreement dated June 25, 2019 between the 2019 Underwriters and Osisko.

"2021 NCIB Program" has the meaning ascribed under the heading "Description of Capital Structure - Renewal of Normal Course Issuer Bid".

"affiliate" has the meaning ascribed in the Securities Act (Québec), unless stated otherwise.

"Ag" is the chemical symbol for silver.

"Agnico" means Agnico Eagle Mines Limited.

"associate" has the meaning ascribed in the Securities Act (Québec), unless stated otherwise.

"Au" is the chemical symbol for gold.

"BAPE" means the Bureau des Audiences Publiques sur l'Environnement.

"Barkerville" means Barkerville Gold Mines Ltd.

"Barkerville Arrangement" has the meaning ascribed under the heading "General Development of Osisko's Business - Launch of Osisko Development Corp.".

"Barkerville Arrangement Effective Date" means November 21, 2019.

"Barkerville Options" means the options to purchase Barkerville Shares granted under the Barkerville stock option plan that were outstanding on the Barkerville Arrangement Effective Date.

"Barkerville Shares" means common shares in the capital of Barkerville.

"Bonanza Ledge Phase II Property" means the mineral property and high grade deposit located within the Cariboo Gold Project (in the Cariboo Gold District of British Columbia).

"Brucejack Stream" means OBL's interest in the 4.0% gold and silver stream on the Brucejack gold mine located in British Columbia, Canada, which was fully repurchased by Pretium Exploration on December 19, 2018 for proceeds of US$118.5 million ($159.4 million).

"Canadian Malartic Corporation" means Canadian Malartic Corporation (formerly Osisko Mining Corporation).

"Canadian Malartic Properties" means the properties that are subject to the Canadian Malartic Royalty.

"Canadian Malartic Report" has the meaning ascribed under "Schedule B - Technical Information Underlying the Canadian Malartic Property".

"Canadian Malartic Royalty" has the meaning ascribed under the heading "Material Mineral Project - The Canadian Malartic Royalty".

"Canadian Malartic Royalty Agreement" means the amended and restated net smelter return royalty agreement dated June 16, 2014 between Osisko and Canadian Malartic GP.

"Cariboo Gold Project" means the mineral property located in the historical Wells-Barkerville mining camp (also known as the Cariboo Gold District) of British Columbia and extending for approximately 60 km from northwest to southeast.

"Caterpillar" means Caterpillar Financial Services Limited.

"CDPQ" means Caisse de dépôt et placement du Québec.

"CIM" means the Canadian Institute of Mining, Metallurgy and Petroleum.

"Coulon Project" means the Coulon zinc project, a mineral exploration property located in northern Québec.

"CRA" means the Canada Revenue Agency.

"Credit Facility" means the revolving credit facility of $400 million with a syndicate of financial institutions with a maturity date of November 14, 2023, including an additional uncommitted accordion of up to $100 million for a total availability of up to $500 million.

"Cu" is the chemical symbol for copper.

"Dalradian" means Dalradian Resources Inc.

"Debentures" has the meaning ascribed under the heading "Description of Capital Structure - Debentures".

"Dividend Reinvestment Plan" means Osisko's dividend reinvestment plan.

"EDGAR" means the Electronic Data Gathering, Analysis and Retrieval system.

"Falco" means Falco Resources Ltd.

"Falco Convertible Loan" has the meaning ascribed under the heading "General Development of Osisko's Business - Falco Silver Stream".

"Falco Maturity Extension" has the meaning ascribed under the heading "General Development of Osisko's Business - Falco Silver Stream".

"Falco Secured Loan" has the meaning ascribed under the heading "General Development of Osisko's Business - Falco Silver Stream".

"Falco Shares" means common shares in the share capital of Falco.

"Falco Silver Stream" has the meaning ascribed under the heading "General Development of Osisko's Business - Falco Silver Stream".

"Falco Warrants" means common share purchase warrants of Falco.

"Fonds FTQ" means Fonds de solidarité des travailleurs du Québec (F.T.Q.).

"forward-looking statements" has the meaning ascribed under the heading "Cautionary Statement Regarding Forward-Looking Statements".

"GEOs" means gold equivalent ounces.

"Guerrero Properties" means the mineral exploration properties consisting of approximately 900,000 hectares located in the Guerrero Gold Belt in Guerrero, Mexico.

"g/t" means gram per tonne.

"ha" means hectare.

"Horne 5 Project" means Falco's development-stage project located in Rouyn-Noranda, Québec.

"IFRS" means International Financial Reporting Standards adopted by the International Accounting Standards Board, as updated and amended from time to time.

"IT" means information technology.

"James Bay Properties" means a group of 26 mineral exploration properties located in the James Bay area of Québec (excluding the Coulon Project).

"k" means thousand.

"kg" means kilogram.

"km" means kilometre.

"km²" means square kilometre.

"kV" means kilovolt.

"l" means litre.

"L" means Mine level (depth below surface in metres).

''LLCFZ'' means Larder Lake-Cadillac Fault Zone.

"Lydian" means Lydian International Limited.

"LOM" means life-of-mine.

"m" means metre.

"m²" means square metre.

"m3" means cubic metre.

"Mantos" means Mantos Copper S.A.

"Mantos Blancos Mine" means the Mantos Blancos copper mine located in northern Chile operated by Mantos.

"Mantos Stream Amendment Transaction" has the meaning ascribed under the heading "General Development of Osisko's Business - Silver Stream on Mantos Blancos Copper Mine".

"mineralization" means rock containing an undetermined amount of minerals or metals.

"mm" means millimetre.

"Mt" means million tonnes (metric tons).

"NI 43-101" means National Instrument 43-101 - Standards of Disclosure for Mineral Projects (or Regulation 43-101 respecting Standards of Disclosure for Mineral Projects in the Province of Québec).

"NI 51-102" means National Instrument 51-102 - Continuous Disclosure Obligations (or Regulation 51-102 respecting Continuous Disclosure Obligations in the Province of Québec).

"NI 52-110" means National Instrument 52-110 - Audit Committees (or Regulation 52-110 respecting Audit Committees in the Province of Québec).

"NSR" means net smelter return.

"NYSE" means the New York Stock Exchange.

"OBL" means Osisko Bermuda Limited, a wholly-owned subsidiary of Osisko.

"Odyssey Study" has the meaning ascribed under "Schedule B - Technical Information Underlying the Canadian Malartic Property".

"ODV Transaction" has the meaning ascribed under the heading "General Development of Osisko's Business - Launch of Osisko Development Corp.".

"Orion Acquisition Agreement" means the acquisition agreement dated June 4, 2017 among Osisko and the Orion Parties, including all schedules attached thereto.

"Orion Aggregate Purchase Price" has the meaning ascribed under the heading "General Development of Osisko's Business - Share Repurchase and Secondary Offering".

"Orion Parties" means, collectively, Orion Mine Finance (Master) Fund I LP, Orion Mine Finance (Master) Fund I-A LP, Orion Stream I, Orion Stream II, Orion Co-Investments IV LP, 8248567 Canada Limited and Lynx Metals Limited.

"Orion Secondary Offering" has the meaning ascribed under the heading "General Development of Osisko's Business - Share Repurchase and Secondary Offering".

"Orion Share Repurchase" has the meaning ascribed under the heading "General Development of Osisko's Business - Share Repurchase and Secondary Offering".

"Orion Stream I" means Orion Co-Investments I (Stream) LLC (now OBL).

"Orion Stream II" means Orion Co-Investments II (Stream) Limited (now OBL).

"Osisko" or "Corporation" means Osisko Gold Royalties Ltd.

"Osisko Board" means the board of directors of Osisko, as the same is constituted from time to time.

"Osisko Development" means Osisko Development Corp.

"Osisko DSUs" means Osisko's Deferred Share Units granted under the DSU Plan.

"Osisko DSU Plan" means Osisko's Deferred Share Unit Plan.

"Osisko Mining" means Osisko Mining Inc.

"Osisko Options" means the outstanding options to purchase Osisko Shares granted under Osisko Stock Option Plan or otherwise granted by Osisko.

"Osisko Preferred Shares" has the meaning ascribed under the heading "Description of Capital Structure - Osisko Preferred Shares".

"Osisko RSUs" means Osisko's Restricted Share Units granted under the Osisko RSU Plan.

"Osisko RSU Plan" means Osisko's Restricted Share Unit Plan.

"Osisko Shareholders" means the holders of Osisko Shares.

"Osisko Shares" means common shares in the share capital of Osisko.

"Osisko Stock Option Plan" means the stock option plan of Osisko.

"oz" means ounce.

"Pb" is the chemical symbol for lead.

"PEA" means preliminary economic assessment.

"PFIC" means "passive foreign investment company" status as defined in Section 1297 of the United States Internal Revenue Code of 1986, as amended.

"Pretium" means, collectively, Pretium Exploration and Pretium Resources.

"Pretium Exploration" means Pretium Exploration Inc.

"Pretium Resources" means Pretium Resources Inc.

"QA/QC" means quality assurance and quality control.

"QBCA" means the Business Corporations Act (Québec) and the regulations made thereunder.

"qualified person" has the meaning ascribed in NI 43-101.

"Renard Diamond Mine" means the Renard diamond mine located in north-central Québec, which is held by SDCI.

"Renard Stream" means a 9.6% diamond stream on the Renard Diamond Mine.

"Renard Streamers" means Osisko along with CDPQ, Triple Flag Mining Finance Bermuda Ltd., Albion Exploration Fund, LLC and Washington State Investment Board.

"Replacement Osisko Options" means, collectively, the options to purchase Osisko Shares that were granted by Osisko on the Barkerville Arrangement Effective Date in exchange for Barkerville Options.

"Ressources Québec" means Ressources Québec inc., a wholly-owned subsidiary of Investissement Québec until its winding-up into Investissement Québec on December 31, 2019.

"ROM" means run-of-mine.

"San Antonio Gold Project" means the mineral property located in Sonora, Mexico.

"SDCI" means Stornoway Diamonds (Canada) Inc., the current holder of the Renard Diamond Mine.

"SEC" means the United States Securities and Exchange Commission.

"SEDAR" means the System for Electronic Document Analysis and Retrieval.

"SOX" means the Sarbanes-Oxley Act of 2002.

"Stornoway" means Stornoway Diamond Corporation or, if the context requires, SDCI.

"Stornoway Bridge Facility" has the meaning ascribed under the heading "General Development of Osisko's Business - Renard Stream".

"Stornoway Credit Bid Transaction" has the meaning ascribed under the heading "General Development of Osisko's Business - Renard Stream".

"Stornoway Bridge Lenders" has the meaning ascribed under the heading "General Development of Osisko's Business - Renard Stream".

"Stornoway Secured Creditors" has the meaning ascribed under the heading "General Development of Osisko's Business - Renard Stream".

"Subscription Receipts" has the meaning ascribed under the heading "General Development of Osisko's Business - Launch of Osisko Development Corp.".

"t" means tonne.

"Taseko" means Taseko Mines Limited.

"tpd" means tonnes per day.

"TSX" means the Toronto Stock Exchange.

"TSXV" means the TSX Venture Exchange.

"U.S. Exchange Act" means the U.S. Securities Exchange Act of 1934, as amended.

"V" means volts.

"Victoria" means Victoria Gold Corp.

"Yamana" means Yamana Gold Inc.

"Zn" is the chemical symbol for zinc.

NI 43-101 Definitions

|

"Indicated Mineral Resource" |

Refers to that part of a Mineral Resource for which quantity, grade or quality, densities, shape and physical characteristics can be estimated with a level of confidence sufficient to allow the appropriate application of technical and economic parameters, to support mine planning and evaluation of the economic viability of the deposit. The estimate is based on detailed and reliable exploration and testing information gathered through appropriate techniques from locations such as outcrops, trenches, pits, workings and drill holes that are spaced closely enough for geological and grade continuity to be reasonably assumed. |

|

"Inferred Mineral Resource" |

Refers to that part of a Mineral Resource for which quantity and grade or quality can be estimated on the basis of geological evidence and limited sampling and reasonably assumed, but not verified, geological and grade continuity. The estimate is based on limited information and sampling gathered through appropriate techniques from locations such as outcrops, trenches, pits, workings and drill holes. |

|

"Measured Mineral Resource" |

Refers to that part of a Mineral Resource for which quantity grade or quality, densities, shape and physical characteristics are so well established that they can be estimated with confidence sufficient to allow the appropriate application of technical and economic parameters, to support production planning and evaluation of the economic viability of the deposit. The estimate is based on detailed and reliable exploration, sampling and testing information gathered through appropriate techniques from locations such as outcrops, trenches, pits, workings and drill holes that are spaced closely enough to confirm both geological and grade continuity. |

|

"Mineral Reserve" |

A Mineral Reserve is the economically mineable part of a Measured and/or Indicated Mineral Resource. It includes diluting materials and allowances for losses, which may occur when the material is mined or extracted and is defined by studies at pre-feasibility or feasibility level as appropriate that include application of Modifying Factors. Such studies demonstrate that, at the time of reporting, extraction could reasonably be justified. |

|

|

Mineral Reserves are categorized as follows on the basis of the degree of confidence in the estimate of the quantity and grade of the deposit: probable Mineral Reserves and proven Mineral Reserves. |

|

"Mineral Resource" |

A Mineral Resource is a concentration or occurrence of solid material of economic interest in or on the Earth's crust in such form, grade or quality and quantity that there are reasonable prospects for eventual economic extraction. The location, quantity, grade or quality, continuity and other geological characteristics of a Mineral Resource are known, estimated or interpreted from specific geological evidence and knowledge, including sampling. |

|

"Modifying Factors" |

Modifying Factors are considerations used to convert Mineral Resources to Mineral Reserves. These include, but are not restricted to, mining, processing, metallurgical, infrastructure, economic, marketing, legal, environmental, social and governmental factors. |

|

|

|

|

"NI 43-101" |

National Instrument 43-101 - Standards of Disclosure for Mineral Projects. An instrument developed by the Canadian Securities Administrators (an umbrella group of Canada's provincial and territorial securities regulators) that governs public disclosure by mining and mineral exploration issuers. The instrument establishes certain standards for all public disclosure of scientific and technical information concerning mineral projects. |

|

"pre-feasibility study" |

Refers to a comprehensive study of the viability of a mineral project that has advanced to a stage where the mining method, in the case of underground mining, or the pit configuration, in the case of an open pit, has been established and an effective method of mineral processing has been determined, and includes a financial analysis based on reasonable assumptions of technical, engineering, legal, operating, economic, social, and environmental factors and the evaluation of other relevant factors which are sufficient for a qualified person, acting reasonably, to determine if all or part of the Mineral Resource may be classified as a Mineral Reserve. Feasibility studies have a greater degree of confidence associated with all aspects. |

|

"preliminary |

The term "preliminary assessment" or "preliminary economic assessment", commonly referred to as a scoping study, means a study that includes an economic analysis of the potential viability of Mineral Resources taken at an early stage of the project prior to the completion of a preliminary feasibility study. |

|

"Probable Mineral |

Refers to an economically mineable part of an Indicated, and in some circumstances, a Measured Mineral Resource. The confidence in the Modifying Factors applying to a Probable Mineral Reserve is lower than that applying to a Proven Mineral Reserve. |

|

"Proven Mineral |

A Proven Mineral Reserve is the economically mineable part of a Measured Mineral Resource. A Proven Mineral Reserve implies a high degree of confidence in the Modifying Factors. |

|

"qualified person" |

Means an individual who (a) is an engineer or geoscientist with at least five years experience in mineral exploration, mine development or operation or mineral project assessment, or any combination of these; (b) has experience relevant to the subject matter of the mineral project and the technical report; and (c) is a member in good standing of a professional association that, among other things, is self-regulatory, has been given authority by statute, admits members based on their qualifications and experience, requires compliance with professional standards of competence and ethics and has disciplinary powers to suspend or expel a member, as defined in NI 43-101. |

The terms "Mineral Resource", "Measured Mineral Resource", "Modifying Factors", "Indicated Mineral Resource", "Inferred Mineral Resource", "Probable Mineral Reserve" and "Proven Mineral Reserve" used are Canadian mining terms as defined in accordance with NI 43-101 under the guidelines set out in the CIM Standards.

Conversion Factors

|

To Convert From

|

To

|

Multiply By

|

|

Feet |

Metres |

0.305 |

|

Metres |

Feet |

3.281 |

|

Acres |

Hectares |

0.405 |

|

Hectares |

Acres |

2.471 |

|

Grams |

Ounces (Troy) |

0.03215 |

|

Grams/Tonnes |

Ounces (Troy)/Short Ton |

0.02917 |

|

Tonnes (metric) |

Pounds |

2,205 |

|

Tonnes (metric) |

Short Tons |

1.1023 |

CORPORATE STRUCTURE

Name, Address and Incorporation

Osisko was incorporated on April 29, 2014 under the name "Osisko Gold Royalties Ltd / Redevances Aurifères Osisko Ltée" pursuant to the QBCA, as a wholly-owned subsidiary of Osisko Mining Corporation (now Canadian Malartic Corporation). On January 1, 2017, Osisko and its wholly-owned subsidiary Osisko Exploration James Bay Inc. amalgamated under the name "Osisko Gold Royalties Ltd / Redevances Aurifères Osisko Ltée".

The Osisko Shares are listed on the TSX and on the NYSE under the symbol "OR".

Warrants of Osisko are listed on the TSX under the symbol OR.WT (exercise price: $36.50 / expiry date: March 5, 2022).

The Debentures are listed on the TSX under the symbol "OR.DB" (conversion price $22.89 per Osisko Share and conversion rate of 43.6872 Osisko Shares per $1,000 principal amount of Debentures).

As of the date of this Annual Information Form, Osisko is a reporting issuer in British Columbia, Alberta, Saskatchewan, Manitoba, Ontario, Québec, New Brunswick, Nova Scotia, Prince Edward Island and Newfoundland. Osisko is also a reporting issuer in the United States.

Osisko's head office is located at 1100 avenue des Canadiens-de-Montréal, Suite 300, Montreal, Québec H3B 2S2.

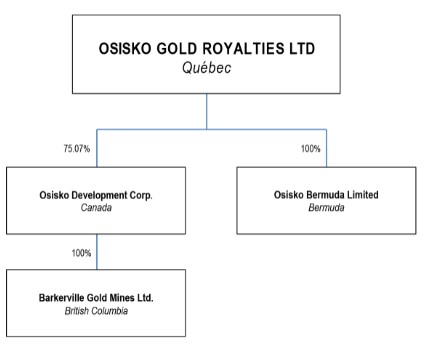

Intercorporate Relationships

As of December 31, 2020, Osisko's only material subsidiaries for the purposes of NI 51-102 were: (a) OBL, a wholly-owned subsidiary of Osisko; and (b) Barkerville, a wholly-owned subsidiary of Osisko Development. As of December 31, 2020, Osisko held an interest of 84.1% in Osisko Development. As of March 26, 2021, following several financings completed by Osisko Development in 2021, this holding was reduced to 75.07%.

DESCRIPTION OF BUSINESS

Description of the Business

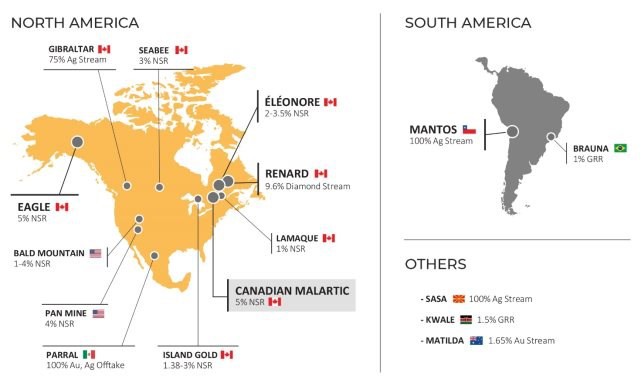

Osisko is engaged in the business of acquiring and managing precious metal and other high-quality royalties, streams and similar interests. Osisko owns a portfolio of royalties, streams, offtakes, options on royalty/stream financings and exclusive rights to participate in future royalty/stream financings on various projects. Osisko's cornerstone asset is a 5% NSR royalty on the Canadian Malartic mine, located in Canada.

In November 2020, Osisko completed the spin out transaction of its mining assets and certain equity investments to Osisko Development, a newly created company engaged in the exploration, evaluation and development of mining projects in Canada and in Mexico. The common shares of Osisko Development began trading on the TSXV on December 2, 2020 under the symbol "ODV". Osisko Development's main asset is the Cariboo Gold Project in Canada. Osisko expects the advancement of the assets held by Osisko Development to be funded through the public markets such that Osisko's ownership in Osisko Development will be diluted as the assets are advanced. Osisko will also seek to promote a larger trading float for Osisko Development as opportunities arise, while aiming to maximize the value of its investment for shareholders of Osisko.

Business Model and Strategy

Osisko is a growth-oriented precious metal royalty and streaming company that is focused on maximizing returns for its shareholders by growing its asset base, both organically and through accretive acquisitions of precious metal and other high-quality royalties, streams and similar interests and by returning capital to its shareholders through a quarterly dividend payment.

Osisko's main focus is on high quality, long-life precious metals assets located in favourable jurisdictions and operated by established mining companies, as these assets provide the best risk/return profile. Osisko also evaluates and invests in opportunities in other commodities and jurisdictions. Given that a core aspect of Osisko's business is the ability to compete for investment opportunities, Osisko plans to maintain a strong balance sheet and ability to deploy capital.

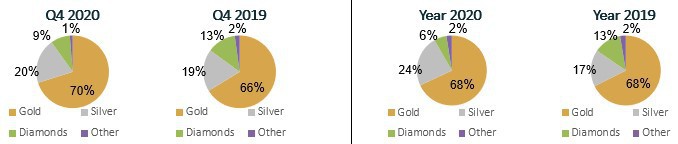

Highlights - 2020

-

Gold equivalent ounces (GEOs1 ) earned of 66,113, excluding 1,754 GEOs earned from the Renard diamond stream in the fourth quarter of 2020 (compared to 78,006 in 2019), above revised guidance;

-

Record cash flows provided by operating activities of $108.0 million (compared to $91.6 million in 2019);

-

Record revenues from royalties and streams of $156.6 million (compared to $140.1 million in 2019);

-

Net earnings attributable to Osisko's shareholders of $16.9 million, $0.10 per basic share (compared to a net loss of $234.2 million, $1.55 per basic share in 2019);

__________________________________

1 GEOs are calculated on a quarterly basis and include royalties, streams and offtakes. Silver earned from royalty and stream agreements was converted to gold equivalent ounces by multiplying the silver ounces by the average silver price for the period and dividing by the average gold price for the period. Diamonds, other metals and cash royalties were converted into gold equivalent ounces by dividing the associated revenue by the average gold price for the period. Offtake agreements were converted using the financial settlement equivalent divided by the average gold price for the period. Refer to the "Portfolio of Royalty, Stream and Other Interests" section for average metal prices used.

-

Adjusted earnings2 of $43.7 million, $0.29 per basic share (compared to $41.9 million, $0.28 per basic share in 2019);

-

Completed the spin-out of mining assets and certain equity positions through a reverse take-over transaction and the creation of a North American gold development company, Osisko Development, which concurrently completed a $100.1 million bought deal financing;

-

In December 2020, Osisko Development closed a brokered private placement for gross proceeds of $40.2 million, in January and February 2021, Osisko Development received additional proceeds aggregating $79.8 million from a non-brokered private placement and in March 2021, Osisko Development closed a bought deal private placement of flow-through shares and charity flow-through shares for aggregate gross proceeds of approximately $33.6 million;

-

Closed a non-brokered private placement of $85.0 million with Investissement Québec;

-

Improved its silver stream on the Gibraltar mine by investing $8.5 million to reduce the transfer price from US$2.75 per ounce of silver to nil;

-

Commercial production was declared by the operator of the Eagle Gold mine on July 1, 2020, on which Osisko holds a 5% NSR royalty;

-

Acquired the San Antonio gold project in Mexico for US$42.0 million, which was transferred to Osisko Development in November 2020;

-

Acquired an additional 15% ownership in a Canadian precious metal royalty portfolio, including royalties on the Island Gold and Lamaque mines;

-

Announced that the Renard diamond mine, operated by SDCI, restarted operations in September 2020;

-

Strategic partnership with Regulus Resources Inc. which has agreed to grant Osisko an initial NSR royalty of 0.75%-1.5% on the Mina Volare claim of the AntaKori project and certain future royalty rights in exchange for an upfront cash payment of US$12.5 million ($16.6 million);

-

Acquired for cancellation 429,722 Osisko Shares for $3.9 million (average acquisition cost of $9.15 per share); and

-

Declared quarterly dividends totaling $0.20 per common share for 2020.

Highlights - Subsequent to December 31, 2020

-

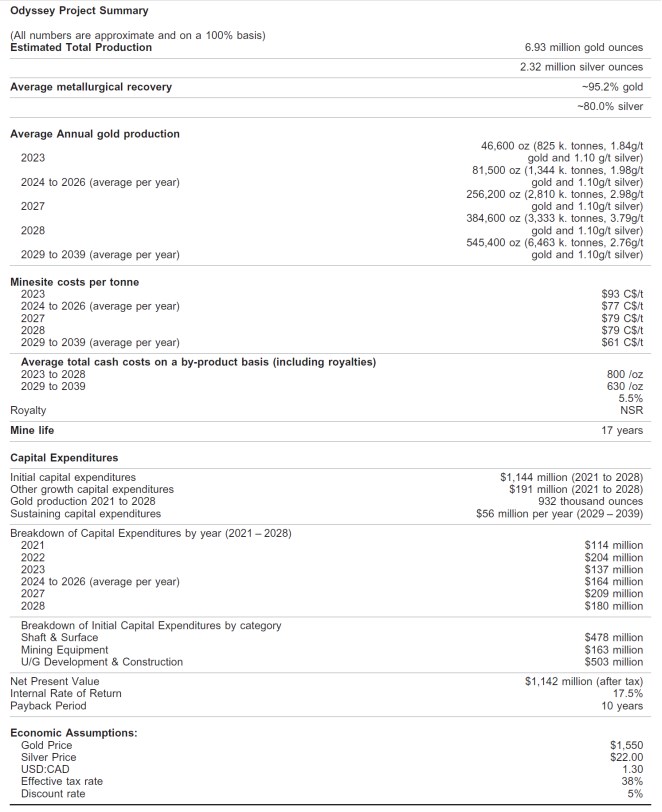

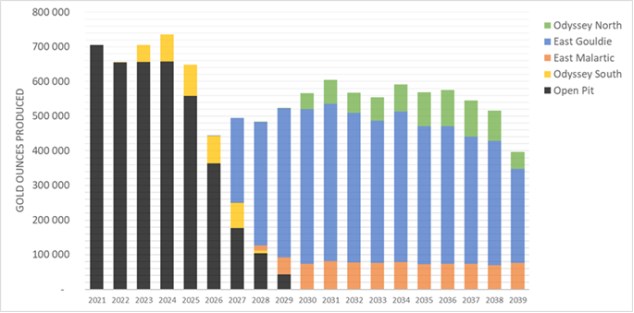

In February 2021, Agnico and Yamana announced that they have approved construction of the Odyssey underground mine project. The preliminary economic study shows a total of 7.29 million ounces of production (6.18 million tonnes at 2.07 g/t gold indicated resources and 75.9 million tonnes at 2.82 g/t gold inferred resources). Underground mine production is planned to start in 2023 and is expected to ramp up to an average of 545,400 gold ounces per year from 2029 to 2039;

-

In February 2021, Osisko repaid a $50.0 million convertible debenture and drew its credit facility by the same amount; and

__________________________________

2 "Adjusted earnings" and "Adjusted earnings per basic share" are non-IFRS financial performance measures which have no standard definition under IFRS. Refer to the non-IFRS measures provided under the Non-IFRS Financial Performance Measures section of Osisko's Management's Discussion and Analysis for the year ended December 31, 2020.

- Declared a quarterly dividend of $0.05 per common share payable on April 15, 2021 to shareholders of record as of the close of business on March 31, 2021.

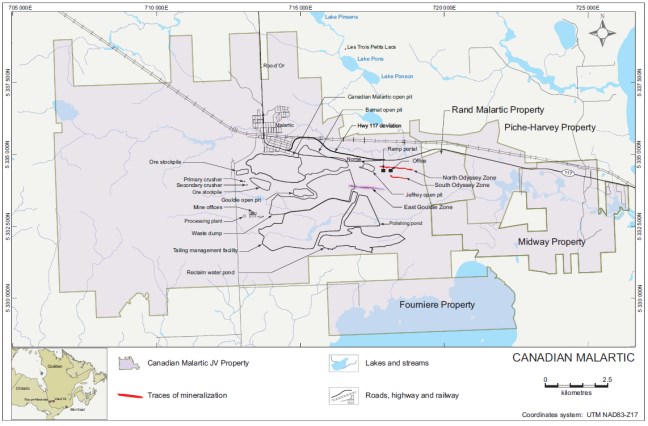

Cornerstone Asset : Canadian Malartic Royalty (5% NSR)

Osisko's cornerstone asset is the Canadian Malartic Royalty (5.0% NSR) on the Canadian Malartic open pit mine located in Malartic, Québec and operated by Agnico and Yamana. Canadian Malartic is Canada's largest producing gold mine.

In 2020, Agnico and Yamana produced 568,634 ounces of gold, which is nearly 10,000 ounces higher than guidance provided in April 2020. Production in 2020 was impacted by COVID-19 related restrictions on mining in Québec.

The operation processed a record 62,000 tonnes per day during the fourth quarter of 2020. Mining is transitioning from the Canadian Malartic pit to the Barnat pit, which is now in commercial production, and 70% of the total tonnes mined in 2021 are expected to come from the higher grade Barnat pit.

On January 25, 2021, Yamana reported production guidance of 700,000 ounces of gold at Canadian Malartic for the year 2021

Odyssey Underground Mine Project

On February 11, 2021, Agnico and Yamana announced that, following the completion of an internal technical study in late 2020, Canadian Malartic GP has approved construction of a new underground mining complex.

In addition to the open pit at Canadian Malartic, the asset hosts the recently discovered "Odyssey underground" project which is contained within three main underground-mineralized zones: East Gouldie, East Malartic and Odyssey, the latter of which is sub-divided into the Odyssey North, Odyssey South and Odyssey Internal zones.

On March 25, 2021, Agnico filed the Canadian Malartic Report to present and support the results of an updated mineral resource and mineral reserve estimates, summarize the current open pit mining operation and disclose the results of a PEA for the underground Odyssey project.

Osisko holds a 5% NSR royalty on East Gouldie, Odyssey South and the western half of East Malartic and a 3% NSR royalty on Odyssey North and the eastern half of East Malartic, which are located adjacent to the Canadian Malartic mine. Osisko also holds a C$0.40/tonne processing royalty on any ore from outside its royalty boundaries processed through the Canadian Malartic mill, potentially adding further regional exploration upside.

For further details, see Schedule "B" entitled "Technical Information underlying the Canadian Malartic Property".

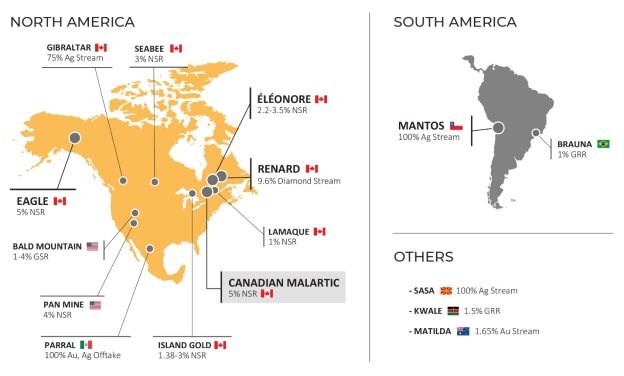

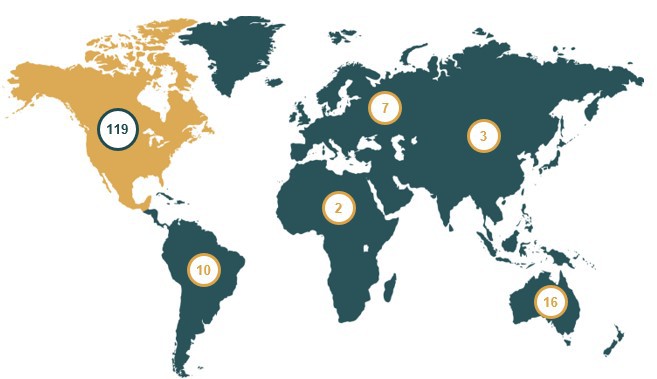

Summary of Principal Royalties, Streams and Other Interests

As of March 26, 2021, 2021, Osisko owned a portfolio of 143 royalties, 10 streams and 4 offtakes assets3 , as well as 36 royalty options.

Currently, Osisko has 17 producing assets.

__________________________________

3 Including five (5) royalties and one (1) stream which are not presented in Osisko's financial statements as Osisko consolidates the assets of its subsidiaries, and therefore intercompany transactions with subsidiaries are cancelled on consolidation.

Producing assets

|

Asset |

Operator |

Interest |

Commodity |

Jurisdiction |

|

|

|

|

|

|

|

North America |

|

|

|

|

|

Canadian Malartic |

Agnico and Yamana |

5% NSR royalty |

Au, Ag |

Canada |

|

Éléonore |

Newmont Corporation |

2.2-3.5% NSR royalty |

Au |

Canada |

|

Eagle Gold(i) |

Victoria |

5% NSR royalty |

Au |

Canada |

|

Renard(ii) |

SDCI |

9.6% stream |

Diamonds |

Canada |

|

Gibraltar |

Taseko |

75% stream |

Ag |

Canada |

|

Seabee |

SSR Mining Inc. |

3% NSR royalty |

Au |

Canada |

|

Island Gold(iii) |

Alamos Gold Inc. |

1.38-3% NSR royalty |

Au |

Canada |

|

Bald Mtn. Alligator Ridge / Duke & Trapper |

Kinross Gold Corporation |

1% / 4% GSR royalty(viii) |

Au |

USA |

|

Pan |

Fiore Gold Ltd. |

4% NSR royalty |

Au |

USA |

|

Parral |

GoGold Resources Inc. |

100% offtake |

Au, Ag |

Mexico |

|

Lamaque South(iii) |

Eldorado Gold Corporation |

1% NSR royalty |

Au |

Canada |

|

Outside of North America |

|

|

|

|

|

Mantos Blancos |

Mantos Copper Holding SpA |

100% stream |

Ag |

Chile |

|

Sasa |

Central Asia Metals plc |

100% stream |

Ag |

Macedonia |

|

Kwale |

Base Resources Limited |

1.5% GRR(iv) |

Rutile, Ilmenite, Zircon |

Kenya |

|

Brauna |

Lipari Mineração Ltda |

1% GRR(iv) |

Diamonds |

Brazil |

|

Matilda |

Blackham Resources Limited |

1.65% stream |

Au |

Australia |

|

Fruta del Norte |

Lundin Gold Inc. |

0.1% NSR royalty |

Au |

Ecuador |

Key development / exploration and evaluation assets (v)

|

Asset |

Operator |

Interest |

Commodities |

Jurisdiction |

|

|

|

|

|

|

|

Altar |

Aldebaran and Sibanye-Stillwater |

1% NSR royalty |

Cu, Au |

Argentina |

|

Arctic |

South 32 / Trilogy Metals Inc. |

1% NSR royalty |

Cu |

USA |

|

Amulsar(vi) |

Lydian Canada Ventures Corporation |

4.22% Au / 62.5% Ag stream |

Au, Ag |

Armenia |

|

Amulsar |

Lydian Canada Ventures Corporation |

81.9% offtake |

Au |

Armenia |

|

Back Forty |

Aquila Resources Inc. |

18.5% Au / 85% Ag streams |

Au, Ag |

USA |

|

Canadian Malartic Underground |

Agnico and Yamana |

3.0 - 5.0% NSR royalty |

Au |

Canada |

|

Cariboo(v) |

Osisko Development |

5% NSR royalty |

Au |

Canada |

|

Casino |

Western Copper & Gold Corporation |

2.75% NSR royalty |

Au, Ag, Cu |

Canada |

|

Cerro del Gallo |

Argonaut Gold Inc. |

3% NSR royalty |

Au, Ag, Cu |

Mexico |

|

Copperwood |

Highland Copper Company Inc. |

3% NSR royalty(vii) |

Ag, Cu |

USA |

|

Ermitaño |

First Majestic Silver Corp. |

2% NSR royalty |

Au, Ag |

Mexico |

|

Hammond Reef |

Agnico |

2% NSR royalty |

Au |

Canada |

|

Hermosa |

South 32 Limited |

1% NSR royalty |

Zn, Pb, Ag |

USA |

|

Horne 5 |

Falco |

90%-100% stream |

Ag |

Canada |

|

Ollachea |

Kuri Kullu / Minera IRL |

1% NSR royalty |

Au |

Peru |

|

San Antonio(v) |

Osisko Development |

15% Au & Ag stream |

Au, Ag |

Mexico |

|

Santana |

Minera Alamos Inc. |

3% NSR royalty |

Au |

Mexico |

|

Asset |

Operator |

Interest |

Commodities |

Jurisdiction |

|

Spring Valley |

Waterton Global Resource Management |

0.5% NSR royalty |

Au |

USA |

|

Upper Beaver |

Agnico |

2% NSR royalty |

Au, Cu |

Canada |

|

Wharekirauponga (WKP) |

OceanaGold Corporation |

2% NSR royalty |

Au |

New Zealand |

|

Windfall Lake |

Osisko Mining |

2.0 - 3.0% NSR royalty |

Au |

Canada |

(i) The Eagle Gold mine poured its first gold bar in September 2019 and Osisko received its first royalty in October 2019. The operator declared commercial production at the Eagle Gold mine on July 1, 2020.

(ii) Osisko became a 35.1% shareholder of the private entity holding the Renard diamond mine on November 1, 2019 (refer to section "General Development of Osisko's Business - Renard Stream"). In April 2020, the mine was placed on care and maintenance, given the structural challenges affecting the diamond market sales as well as the depressed prices for diamonds due to COVID-19. In September 2020, the mine restarted its operations.

(iii) In August 2020, Osisko acquired the remaining 15% ownership that it did not already own on the Island Gold and Lamaque mines royalties.

(iv) Gross revenue royalty ("GRR").

(v) The 5% NSR royalty on the Cariboo gold project and the 15% gold and silver stream on the San Antonio gold project held by Osisko are not presented in Osisko's financial statements as Osisko consolidates the assets of Osisko Development.

(vi) As at December 31, 2019, Lydian International Limited, the owner of the Amulsar project, was granted protection under the Companies' Creditors Arrangement Act. In July 2020, a credit bid was completed and Osisko became a 36.2% shareholder of Lydian Canada Ventures Corporation, which is the private entity now holding the Amulsar project in Armenia.

(vii) 3.0% NSR royalty on the Copperwood project. Upon closing of the acquisition of the White Pine project, Highland Copper Company Inc. will grant Osisko a 1.5% NSR royalty on all metals produced from the White Pine project, and Osisko's royalty on Copperwood will be reduced to 1.5%.

(viii)Gross smelter royalty ("GSR").

Main Producing Assets

Geographical Distribution of Assets

Equity Investments

Osisko's assets include a portfolio of shares, mainly of publicly traded exploration and development mining companies. Osisko invests from time to time in companies where it holds a royalty, stream or similar interest and in various companies within the mining industry for investment purposes and with the objective of improving its ability to acquire royalties, streams or similar interests. In addition to investment objectives, in some cases, Osisko may decide to take a more active role, including providing management personnel and/or administrative support, as well as nominating individuals to the investee's board of directors.

Main Investments

The following table presents the main investments of Osisko in marketable securities as at December 31, 2020:

|

Investment |

|

Company holding the investment |

|

Number of Shares Held |

|

Ownership |

|

|

|

|

|

|

|

|

% |

|

|

Osisko Mining Inc. |

|

Osisko |

|

50,023,569 |

|

14.5 |

|

|

Osisko Metals Incorporated |

|

Osisko |

|

31,127,397 |

|

17.4 |

|

|

Falco |

|

Osisko Development (i) |

|

41,385,240 |

|

18.2 |

|

(i) This investment is held by Barkerville Gold Mines Ltd, a wholly-owned subsidiary of Osisko Development.

Sustainability Activities

Osisko views sustainability as a key part of its strategy to create value for its shareholders and other stakeholders.

Osisko focuses on the following key areas:

• Promoting the mining industry and its benefits to society;

• Maintaining strong relationships with the federal government and the provincial, municipal and first nations governments;

• Supporting the economic development of regions where Osisko operates (directly or indirectly through its interests);

• Supporting university education in mining fields and employee development;

• Promoting diversity throughout the organization and the mining industry; and

• Encouraging partner companies to adhere to the same areas of focus in sustainability.

Human Resources

As of December 31, 2020, Osisko had 31 employees and 2 employees of OBL.

Osisko has a succession plan in order to mitigate the risk of being dependent on key management. From time to time, Osisko may also need to identify and retain additional skilled management and specialized technical personnel to efficiently operate its business.

Outlook

Osisko's 2021 outlook on royalty, stream and offtake interests is largely based on publicly available forecasts from its operating partners. When publicly available forecasts on properties are not available, Osisko obtains internal forecasts from the producers or uses management's best estimate.

GEOs and cash margin by interest, excluding the Renard stream, are estimated as follows for 2021:

|

|

|

Low |

|

High |

|

Cash margin |

|

|

|

|

(GEOs) |

|

(GEOs) |

|

(%) |

|

|

|

|

|

|

|

|

|

|

|

Royalty interests |

|

59,750 |

|

62,800 |

|

100 |

|

|

Stream interests |

|

17,400 |

|

18,250 |

|

87 |

|

|

Offtake interests |

|

850 |

|

950 |

|

3 |

|

|

|

|

78,000 |

|

82,000 |

|

97* |

|

|

* Excluding the offtake interests |

|

|

|

|

|

||

For the 2021 guidance, silver and cash royalties have been converted to GEOs using commodity prices of US$1,800 per ounce of gold, US$25 per ounce of silver and an exchange rate (US$/C$) of 1.28. Any GEOs (and the related cash margin) from the Renard diamond stream were excluded from the outlook above. For 2021, GEOs from the Renard diamonds stream are estimated at 8,126; however, Osisko has committed to reinvest the net proceeds from the stream through the bridge loan facility provided to the operator.

Material Mineral Project

Osisko considers that the Canadian Malartic Royalty is currently its only material mineral project for the purposes of NI 43-101.

GENERAL DEVELOPMENT OF OSISKO'S BUSINESS

The following is a description of the events that have influenced the general development of Osisko's business over the last three (3) completed financial years.

Board and Senior Management Appointments

In January, 2021, Osisko announced the appointment of Ms. Candace MacGibbon to the Osisko Board and the appointment of Ms. Heather Taylor as Vice President, Investor Relations.

On November 25, 2020, Mr. Sandeep Singh (who was appointed as President of Osisko on December 31, 2019) became the President, Chief Executive Officer of Osisko and a member of the Osisko Board and Mr. Sean Roosen was appointed as Executive Chair of the Osisko Board, transitioning from his role as Chief Executive Officer of Osisko to Chief Executive Officer of Osisko Development.

On April 6, 2020, Osisko announced the appointment of The Hon. John Baird to the Osisko Board and on February 20, 2020, Osisko appointed Mr. Frédéric Ruel as Chief Financial Officer and Vice President, Finance and Mr. Iain Farmer as Vice President, Corporate Development.

Launch of Osisko Development Corp.

On September 6, 2018, Osisko increased its existing royalty on the Cariboo Gold Project located in British Columbia, Canada, to a total of 4% NSR through the acquisition of a 1.75% NSR royalty for a consideration of $20 million. Osisko was also granted the option to acquire an additional 1% NSR royalty for an additional consideration of $13 million.

On November 21, 2019, Osisko acquired all of the issued and outstanding common shares of Barkerville that it did not own by way of a court approved plan of arrangement pursuant to which each shareholder of Barkerville (excluding Osisko) received 0.0357 of an Osisko Share for each share of Barkerville held.

On November 25, 2020, Osisko transferred to Barolo several mining properties (or securities of the entities that directly or indirectly own such mining properties), and a portfolio of marketable securities valued at approximately $116 million, in exchange for Barolo Shares, resulting in a "reverse take-over" of Barolo under the policies of the TSXV (the "ODV Transaction").

In connection with the ODV Transaction, the following mining properties were transferred (directly or indirectly) to Osisko Development: (a) the Cariboo Gold Project; (b) the San Antonio Gold Project; (c) the Bonanza Ledge Phase II Property; (d) the Coulon Project; (e) the James Bay Properties; and (f) the Guerrero Properties. As part of the Osisko Development Transaction, Osisko exercised its royalty option on the Cariboo Gold Project and increased its existing royalty to 5% NSR.

Following the ODV Transaction, Osisko retains the following royalty or stream interests in the assets of Osisko Development: (a) a 5% NSR royalty on the Cariboo Gold Project and Bonanza Ledge Phase II Property; (b) a 15% gold and silver stream (with ongoing per-ounce payments equal to 15% of the prevailing price of gold and silver, as applicable) on the San Antonio Gold Project; and (c) 3% NSR royalties on the James Bay Properties, Coulon Property and Guerrero Properties. Osisko was also granted a right of first refusal on all future royalties and streams to be offered by Osisko Development, a right to participate in buybacks of existing royalties held by Osisko Development and other rights customary with a transaction of this nature.

The Cariboo Gold Project is advancing through permitting as a 4,750 tonne per day underground operation with a feasibility study on track for completion in 2021, permits expected in 2022, followed by a short construction period given the significant infrastructure already at site (including a functioning mill that was operated in 2018). The Cariboo Gold Project has current resources totaling 3.2 million ounces in the measured and indicated resource category and 2.7 million ounces in the inferred resource category on a brownfield site in British Columbia, Canada.

The San Antonio Gold Project is a past producing mine that went into receivership as an oxide copper mine. The gold potential of the asset has never been properly evaluated, and Osisko Development will focus on amending existing permits to transition the mine production to a gold heap leach operation. There is also significant exploration potential to expand both oxide and sulphide resources. Recent metallurgical testing has shown that the sulphide resources are highly-amenable to heap leaching.

As part of the ODV Transaction, a "bought deal" private placement was conducted through the issuance of 13,350,000 subscription receipts (the "Subscription Receipts"), at a subscription price of $7.50 per Subscription Receipt, for gross proceeds of $100 million. Each Subscription Receipt entitled the holder thereof to receive (after giving effect to a 60:1 share consolidation) one (1) Osisko Development Share and one-half-of-one Osisko Development Warrant. Each Osisko Development Warrant entitles the holder thereof to purchase one (1) Osisko Development Share at a price of $10.00 for a 36 month period following the closing of the ODV Transaction.

On December 2, 2020, the Osisko Development Shares began trading under the ticker symbol "ODV" on the TSXV.

Acquisition of an Additional 15% Ownership in a Canadian Precious Metal Royalty Portfolio

On August 12, 2020, Osisko announced its acquisition of the outstanding 15% ownership in a portfolio of Canadian precious metals royalties held by CDPQ for cash consideration of $12.5 million. This 15% interest represented the remaining portion of the portfolio of royalties purchased by Osisko from Teck Resources Ltd. in October 2015.

Gibraltar Silver Stream

On April 29, 2020, Osisko and Taseko amended the silver stream with respect to the Gibraltar copper mine located in British Columbia, Canada by reducing the price paid by Osisko for each ounce of refined silver from US $2.75 to nil in exchange for cash consideration of $8.5 million to Taseko.

Eagle Gold Project

On April 16, 2018, Osisko announced the completion of a $148 million financing transaction with Victoria pursuant to which Osisko acquired a 5% NSR royalty for $98 million on the Dublin Gulch property which hosts the Eagle Project located in Yukon, Canada. As part of the transaction, Osisko also purchased on a private placement basis, 100,000,000 common shares of Victoria at a price of $0.50 per common share, for total financing by Osisko of $148 million. The 5% NSR royalty is on all metals and minerals produced from the Dublin Gulch property until an aggregate of 97,500 ounces of refined gold have been delivered to Osisko, and a 3% NSR royalty thereafter. A first tranche of $49 million was advanced as of April 16, 2018 and the second tranche of $49 million was funded pro rata to drawdowns under the subordinated debt component of the Orion debt facilities. Commercial production was declared by the operator of the Eagle gold mine on July 1, 2020.

Silver Stream on Mantos Blancos Copper Mine

On September 3, 2019, Osisko announced that OBL entered into a definitive agreement with Mantos to enhance its existing silver purchase agreement (the "Mantos Stream Amendment Transaction") with respect to 100% of the silver produced from the Mantos Blancos Mine located in Chile, pursuant to which OBL agreed to provide an additional deposit of US$25 million to Mantos in exchange for certain amendments to the existing silver purchase agreement, including: (a) reduction of the ongoing transfer price payment per ounce from 25% to 8% of the spot silver price on the date of delivery; and (b) increase in the tail stream from 30% to 40% of payable silver after 19.3 million ounces of refined silver have been delivered. Mantos's right to buy back 50% of the silver stream was also terminated.

Private Placement with Investissement Québec of $85M

On April 1, 2020, Osisko announced the closing of a private placement with Investissement Québec of 7,727,273 Osisko Shares at a premium price of $11.00 per share for total gross proceeds of $85,000,003.

Share Repurchase and Secondary Offering

On June 25, 2019, Osisko announced that Betelgeuse LLC ("Orion"), a jointly owned subsidiary of certain investment funds managed by Orion Resource Partners, entered into an underwriting agreement pursuant to which the 2019 Underwriters agreed to purchase, on a bought deal basis, an aggregate of 7,850,000 Osisko Shares held by Orion at an offering price of $14.10 per Osisko Share for total gross proceeds to Orion of $110,685,000 (the "Orion Secondary Offering"). On July 11, 2019, the Orion Secondary Offering closed. On July 18, 2019, the 2019 Underwriters purchased an additional 1,177,500 Osisko Shares held by Orion following the exercise in full of their option to purchase additional shares.

In a concurrent transaction, Osisko agreed to purchase for cancellation an aggregate of 12,385,717 Osisko Shares from Orion at $14.10 per Osisko Share, for an aggregate purchase price paid by Osisko to Orion (the "Orion Share Repurchase") of approximately $174.6 million (the "Orion Aggregate Purchase Price"). Osisko sold to separate entities managed by Orion Resource Partners all of the shares of Victoria and Dalradian held by Osisko. The Orion Aggregate Purchase Price was satisfied by cash in the amount of $129.5 million as well as the direct transfer of certain other equity securities of exploration and development companies held by Osisko. On June 28, 2019, a first tranche of the Orion Share Repurchase closed for 7,319,499 Osisko Shares. On July 15, 2019, the second and final tranche of the Orion Share Repurchase closed for 5,066,218 Osisko Shares. In a concurrent transaction, Osisko disposed of all of the common shares of Victoria then held by Osisko to another entity managed by Orion Resource Partners for cash consideration of $71.4 million.

Brucejack Stream and Brucejack Offtake Agreement

On September 16, 2019, Osisko announced that OBL had entered into an agreement with Pretium Exploration, a subsidiary of Pretium Resources, in regards to the sale of OBL's interest in the Brucejack gold offtake agreement for a cash purchase price of US$41.3 million. On September 30, 2019, Pretium made a payment of US$31.2 million to OBL and the remainder of the purchase price was paid on November 29, 2019.

On December 19, 2018, Osisko announced the receipt of proceeds of US$118.5 million ($159.4 million) from Pretium Exploration in regards to the exercise of its option to fully repurchase OBL's interest in the Brucejack Stream.

Renard Stream

Pursuant to the Stornoway Stream Agreement, the Renard Streamers hold a 20% interest (9.6% stream attributable to Osisko) in all diamonds produced from the Renard Diamond Mine for the life of mine. Upon the completion of a sale of diamonds, the Renard Streamers will remit to Stornoway a cash transfer payment which shall be the lesser of 40% of achieved sales price and US$40 per carat. On October 2, 2018, the Renard Streamers paid Stornoway the U.S. dollar equivalent of $45 million in cash ($21.6 million attributable to Osisko) as an additional up-front deposit.

On June 11, 2019, Osisko and certain secured lenders provided to Stornoway a senior-secured bridge credit facility (the "Stornoway Bridge Facility") and agreed to advance an amount equivalent to the stream net proceeds payable under the Stornoway Stream Agreement, up to an estimated amount of $5.9 million ($2.8 million attributable to Osisko). The Stornoway Bridge Facility is secured by a first-ranking security interest over all present and future assets and property of Stornoway.

On September 9, 2019, Osisko announced the execution of a letter of intent with Stornoway and other secured creditors under the Stornoway Bridge Facility (collectively the "Stornoway Secured Creditors"), pursuant to which Osisko and the Stornoway Secured Creditors agreed to form an entity to acquire, by way of a credit bid transaction, all or substantially all of the assets and properties of Stornoway, and assume the debts and liabilities owing to the Stornoway Secured Creditors as well as the ongoing obligations relating to the operation of the Renard Diamond Mine, subject to certain limited exceptions (the "Stornoway Credit Bid Transaction"). Osisko and certain of the Stornoway Secured Creditors also entered into a working capital facility agreement with Stornoway providing for a working capital facility in an initial amount of $20 million (approximately $7 million attributable to Osisko), which facility is secured by a priority charge over the assets of Stornoway and can be increased for additional amounts at the option of the Stornoway Secured Creditors.

The Stornoway Credit Bid Transaction closed on November 1, 2019 and Osisko became a 35.1% shareholder of 11272420 Canada Inc., who holds a 100% interest in SDCI, the company holding the Renard Diamond Mine. Pursuant to the Stornoway Credit Bid Transaction, Osisko maintained its 9.6% diamond stream and will continue to receive stream deliveries, and agreed to reinvest its proceeds from the stream for a period of one (1) year following closing of the Stornoway Credit Bid Transaction.

As at March 31, 2020. Osisko recorded an impairment charge of $26.3 million ($19.3 million, net of income taxes) on the Renard diamond stream.

On September 14, 2020, Osisko announced that the shareholders of Stornoway have committed to reinvest up to $30M (up to $7.5M for Osisko, of which $6.0M was drawn as of December 31, 2020) in a senior secured working capital facility. As part of the new commitment, the shareholders and streamers have agreed to continue deferring payments on their respective instruments until April 2022. Payments can be made prior to this date if the financial situation of Stornoway allows it.

Falco Silver Stream

On February 22, 2019, Osisko closed $10 million senior secured loan (the "Falco Secured Loan") with Falco. The Falco Secured Loan had an initial maturity date of December 31, 2019.

On February 27, 2019, Osisko entered into a senior secured silver stream facility with Falco pursuant to which Osisko agreed to commit up to $180 million through a silver stream toward the funding of the development of the Horne 5 Project, including an optional payment of $40 million at the sole discretion of Osisko to increase stream percentage from 90% to 100% (the "Falco Silver Stream"). Under the terms of the Falco Silver Stream, Osisko will purchase up to 100% of the refined silver from the Horne 5 Project and Osisko will pay Falco ongoing payments equal to 20% of the spot price of silver on the day of delivery, subject to a maximum payment of US$6 per silver ounce. The Falco Silver Stream is secured by the assets of Falco. This transaction included the repayment of a $10 million loan originally made in May 2016 to Falco (as amended from time to time).

On November 22, 2019, the Falco Secured Loan was amended, increasing the principal amount by $5.9 million to $15.9 million and the maturity date was extended to December 31, 2020.

On January 31, 2020, Falco and Osisko executed an amendment agreement to the Falco Silver Stream, whereby Osisko agreed to postpone by one (1) year each of the deadlines granted to Falco to achieve milestones set as a condition precedent to Osisko funding the stream deposit and certain other deadlines.

On November 17, 2020, Osisko entered into an agreement with Falco in order to extend the maturity date of the Falco Secured Loan from December 31, 2020 to December 31, 2022 (the "Falco Maturity Extension"). In consideration for the Falco Maturity Extension, the Falco Secured Loan was amended to become convertible (the "Falco Convertible Loan") after the first anniversary of the closing date into Falco Shares at a conversion price of $0.55 per Falco Share. The Falco Convertible Loan bears interest at a rate of 7.0% per annum, compounded quarterly, and will continue to be secured by a hypothec on certain assets of Falco. In consideration for the Falco Maturity Extension, Falco issued to Osisko 10,664,324 Falco Warrants, each exercisable for one Falco Share at an exercise price of $0.69 up to 24 months from the date of issuance of the Falco Warrants.

Lydian International Limited

Osisko, through OBL, owns a 4.22% gold stream and 62.5% silver stream on the Amulsar project, owned by Lydian Canada Ventures Corporation and located in southern Armenia. On December 23, 2019, Osisko was informed that Lydian and its direct and indirect wholly owned subsidiaries, Lydian Canada Ventures Corporation and Lydian U.K. Corporation Limited, have obtained an initial order as a result of the ongoing unlawful activities against Lydian's Amulsar project in Armenia.

On July 6, 2020, Lydian completed a plan of arrangement with its secured creditors, including Osisko, as part of its corporate restructuring and winding up. As a result thereof, Osisko became a 23.4% shareholder of Lydian Canada Ventures Corporation, which is the private entity now holding the Amulsar project and an associate of Osisko.

Significant Acquisitions

Osisko has not completed any significant acquisition during its most recently completed financial year and for which disclosure is required under Part 8 of NI 51-102.

RISK FACTORS

In evaluating Osisko and its business, the readers should carefully consider the risk factors which follow. These risk factors may not be a definitive list of all risk factors associated with an investment in Osisko or in connection with the business and operations of Osisko.

Commodity Price Risks

Changes in the market price of the commodities underlying Osisko's interests may affect the profitability of Osisko and the revenue generated therefrom

The revenue derived by Osisko from its portfolio of royalties, streams and other interests and investments might be significantly affected by changes in the market price of the commodities underlying its agreements. Commodity prices, including those to which Osisko is exposed, fluctuate on a daily basis and are affected by numerous factors beyond the control of Osisko, including levels of supply and demand, industrial development levels, inflation and the level of interest rates, the strength of the U.S. dollar and geopolitical factors. All commodities, by their nature, are subject to wide price fluctuations and future material price declines could result in a decrease in revenue or, in the case of severe declines that cause a suspension or termination of production by relevant operators, a complete cessation of revenue from royalties, streams or other interests applicable to one or more relevant commodities. Moreover, the broader commodity market tends to be cyclical, and a general downturn in overall commodity prices could result in a significant decrease in overall revenue. Any such price decline may result in a material adverse effect on Osisko's profitability, results of operations and financial condition.

Hedging Risk

Osisko has a foreign exchange hedging policy and may consider adopting a precious metal policy that permits hedging its foreign exchange and precious metal price exposures to reduce the risks associated with currency and precious metal price fluctuations. Hedging involves certain inherent risks including: (a) credit risk - the risk that the creditworthiness of a counterparty may adversely affect its ability to perform its payment and other obligations under its agreement with Osisko or adversely affect the financial and other terms the counterparty is able to offer Osisko; (b) market liquidity risk - the risk that Osisko has entered into a hedging position that cannot be closed out quickly, by either liquidating such hedging instrument or by establishing an offsetting position; and (c) unrealized fair value adjustment risk - the risk that, in respect of certain hedging products, an adverse change in market prices for commodities, currencies or interest rates will result in Osisko incurring losses in respect of such hedging products as a result of the hedging products being out-of-the money on their settlement dates. There is no assurance that a hedging policy designed to reduce the risks associated with foreign exchange/currency or precious metal price fluctuations would be successful. Although hedging may protect Osisko from adverse changes in foreign exchange/currency or precious metal price fluctuations, it may also prevent Osisko from fully benefitting from positive changes.

Third Party Operator Risks

Osisko has limited access to data regarding the operation of mines in which it has royalties, streams or other interests

As a holder of royalties, streams or other interests, Osisko does not serve as the mine's operator and has little or no input into how the operations are conducted. As such, Osisko has varying access to data on the operations or to the actual properties themselves. This could affect its ability to assess the value of its interest or enhance the performance thereof. It is difficult or impossible for Osisko to ensure that the properties are operated in its best interest. Payments related to Osisko's royalties, streams or other interests may be calculated by the payors in a manner different from Osisko's projections. Osisko does, however, have rights of audit with respect to such royalties, streams or other interests.

Osisko has little or no control over mining operations in which it holds royalties, streams or other interests

Osisko has few or no contractual rights relating to the operation or development of mines in which it only holds royalties, streams or other interests. Osisko may not be entitled to any material compensation if these mining operations do not meet their forecasted production targets in any specified period or if the mines shut down or discontinue their operations on a temporary or permanent basis. Certain of these properties may not commence production within the time frames anticipated, if at all, and there can be no assurance that the production, if any, from such properties will ultimately meet forecasts or targets. At any time, any of the operators of the mines or their successors may decide to suspend or discontinue operations. Osisko is subject to the risks that the mines shut down on a temporary or permanent basis due to issues including, but not limited to, economic, lack of financial capital, floods, fire, mechanical malfunctions, social unrest, expropriation, community relations and other risks. These issues are common in the mining industry and can occur frequently.