EX-99.1

Exhibit 99.1

Preliminary and Subject to Completion, dated April 21, 2015

INFORMATION STATEMENT

The Chemours Company

Common Stock, Par Value $0.01 Per Share

This information statement is

being furnished to the holders of common stock of E. I. du Pont de Nemours and Company (DuPont) in connection with the distribution of shares of common stock of The Chemours Company (Chemours). Chemours is a wholly owned subsidiary of DuPont that

operates DuPont’s Performance Chemicals segment, which includes its titanium technologies, fluoroproducts and chemical solutions businesses. DuPont will distribute all of the outstanding shares of Chemours common stock on a pro rata basis to

DuPont’s common stockholders.

Chemours was organized as a limited liability company under the laws of the State of Delaware, and, prior to the

distribution, will be converted to a Delaware corporation.

For every share of DuPont common stock held of record by you as of the close of business on [—], 2015, the record date for the distribution, you will receive [—] share[s] of Chemours common stock. No fractional shares of Chemours common stock

will be issued. Instead, you will receive cash in lieu of any fractional shares. As discussed under “The Distribution — Trading Between the Record Date and Distribution Date,” if you sell your DuPont common stock in the

“regular-way” market after the record date and before the separation and distribution, you also will be selling your right to receive shares of Chemours common stock in connection with the separation and distribution. We expect the shares

of Chemours common stock to be distributed by DuPont to you on July 1, 2015, pending final approval from DuPont’s board of directors. We refer to the date of the distribution of Chemours common stock as the “distribution date.” After

the distribution, we will be an independent, publicly traded company.

No vote of DuPont’s stockholders is required to effect the distribution.

Therefore, you are not being asked for a proxy to vote on the separation or the distribution, and you are requested not to send us a proxy. You do not need to pay any consideration, exchange or surrender your existing shares of DuPont common

stock or take any other action to receive your shares of Chemours common stock.

The distribution is intended to be tax-free to DuPont shareholders for

United States federal income tax purposes, except for cash received in lieu of fractional shares. The distribution is subject to the satisfaction or waiver by DuPont of certain conditions, including the continued effectiveness of a private letter

ruling that DuPont has received from the U.S. Internal Revenue Service and opinions of tax counsel confirming that the distribution and certain transactions entered into in connection with the distribution generally will be tax-free to DuPont and

its shareholders for U.S. federal income tax purposes, except for cash received in lieu of fractional shares. Cash received in lieu of any fractional shares of Chemours common stock will generally be taxable to you.

DuPont currently owns all of the outstanding shares of Chemours. Accordingly, there is no current trading market for Chemours common stock, although we expect

that a limited market, commonly known as a “when-issued” trading market, will develop on or shortly before the record date for the distribution, and we expect “regular-way” trading of Chemours common stock to begin on the first

trading day following the completion of the separation and distribution. Chemours intends to apply to have its common stock authorized for listing on the New York Stock Exchange, Inc. under the symbol “CC.”

In reviewing this information statement, you should carefully consider the matters described under the caption “Risk

Factors” beginning on page 20.

Neither the U.S. Securities and Exchange Commission nor any state securities commission has approved

or disapproved these securities or determined if this information statement is truthful or complete. Any representation to the contrary is a criminal offense.

This information statement does not constitute an offer to sell or the solicitation of an offer to buy any securities.

References in this information statement to specific codes, legislation or other statutory enactments are to be deemed as references to those codes,

legislation or other statutory enactments, as amended from time to time.

The date of this information statement is [—], 2015.

TABLE OF CONTENTS

The following is a summary of material information discussed in this information statement. This summary may

not contain all the details concerning the separation and distribution or other information that may be important to you. To better understand the separation, distribution and Chemours’ business and financial position, you should carefully

review this entire information statement. Except as otherwise indicated or unless the context otherwise requires, the information included in this information statement, including the combined financial statements of Chemours, which are comprised of

the assets and liabilities of DuPont’s Performance Chemicals segment, which includes its titanium technologies, fluoroproducts and chemical solutions businesses, and certain additional assets and liabilities associated with the DuPont business,

assumes the completion of all the transactions referred to in this information statement in connection with the separation and distribution. Unless the context otherwise requires, references in this information statement to “The Chemours

Company,” “The Chemours Company, LLC,” “Chemours,” “we,” “us,” “our” and “our company” refer to The Chemours Company and its combined subsidiaries. References in this information

statement to “DuPont” refer to E. I. du Pont de Nemours and Company, a Delaware corporation, and its consolidated subsidiaries (other than Chemours and its combined subsidiaries), unless the context otherwise requires. References to

“DuPont stockholders” refer to stockholders of DuPont in their capacity as holders of common stock only, unless context otherwise requires.

Chemours was organized as a limited liability company under the laws of the State of Delaware. In accordance with the separation and distribution, actions

will have been taken so as at the time immediately prior to the distribution, Chemours will have been converted from a limited liability company to a Delaware corporation.

This information statement describes the business to be transferred to Chemours by DuPont in the separation as if the transferred business were our

business for all historical periods described. References in this information statement to our historical assets, liabilities, products, businesses or activities of our business are generally intended to refer to the historical assets, liabilities,

products, businesses or activities of the transferred business as the business was conducted as part of DuPont and its subsidiaries prior to the separation and distribution.

This summary highlights information contained in this information statement and provides an overview of our company, our separation from DuPont and the

distribution of our common stock by DuPont to its stockholders. You should read this entire information statement carefully, including the risks discussed under “Risk Factors,” our audited and unaudited selected historical condensed

combined financial statements and notes thereto, and our unaudited pro forma combined financial statements and the notes thereto included elsewhere in this information statement. Some of the statements in this summary constitute forward-looking

statements. See “Cautionary Statement Concerning Forward-Looking Statements.”

You should not assume that the information contained in

this information statement is accurate as of any date other than the date set forth on the cover. Changes to the information contained in this information statement may occur after that date, and we undertake no obligation to update the information,

except in the normal course of our public disclosure obligations.

INFORMATION STATEMENT SUMMARY

Distributing Company

DuPont was founded in 1802 and was

incorporated in Delaware in 1915. Today, DuPont is creating higher growth and higher value by extending the company’s leadership in agriculture and nutrition, strengthening and growing capabilities in advanced materials and leveraging

cross-company skills to develop a world-leading bio-based industrial business. Through these strategic priorities, DuPont is helping customers find solutions to capitalize on areas of growing global demand — enabling more, safer, nutritious

food; creating high-performance, cost-effective energy efficient materials for a wide range of industries; and increasingly delivering renewably sourced bio-based materials and fuels. Total worldwide employment at December 31, 2014, was about

63,000 people. DuPont has operations in more than 90 countries worldwide and about 62 percent of consolidated net sales are made to customers outside the United States of America (U.S.).

1

Our Company

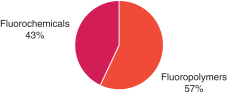

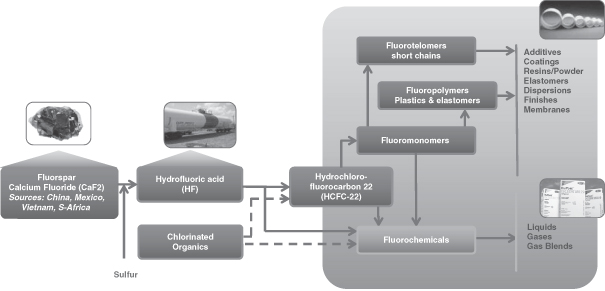

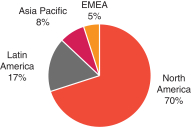

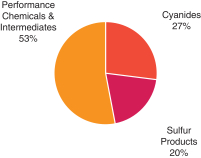

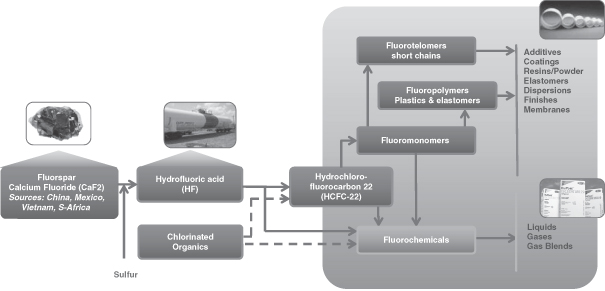

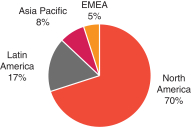

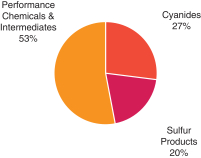

Chemours is a leading global provider of performance chemicals through three reporting segments: Titanium Technologies, Fluoroproducts and Chemical Solutions.

Our performance chemicals are key inputs into products and processes in a variety of industries. Our Titanium Technologies segment is the leading global producer of titanium dioxide (TiO2), a

premium white pigment used to deliver opacity. Our Fluoroproducts segment is a leading global provider of fluoroproducts, such as refrigerants and industrial fluoropolymer resins. Our Chemical Solutions segment is a leading North American provider

of industrial and specialty performance chemicals used in gold production, oil refining, agriculture, industrial polymers and other industries. Our position with each of these businesses reflects the strong value proposition we provide to our

customers based on our long history of innovation and our reputation within the chemical industry for safety, quality and reliability. We operate 37 production facilities located in 12 countries and serve several thousand customers located in more

than 130 countries.

Our Strengths

Our competitive

strengths include the following:

Leading Global Market Positions

We are the largest global producer of TiO2, with annual TiO2 capacity of approximately 1.2 million metric tons. We are in the process of expanding capacity at our Altamira, Mexico production facility by 200,000 metric tons. Production at the expansion

is scheduled to start up in mid-2016. Each of our TiO2 production facilities ranks among those with the largest capacity globally, and our production facilities at New Johnsonville, Tennessee

and DeLisle, Mississippi are the two largest capacity TiO2 production facilities in the world. We believe that our world-scale assets, consistent quality and delivery reliability differentiate

us from our competitors in the TiO2 market.

We are the market leader in fluoroproducts, with

leading positions in fluorinated refrigerants, and industrial fluoropolymer resins and downstream products. We have a leading position in hydrofluorocarbon (HFC) refrigerants and are at the forefront of developing high-performance sustainable

technologies such as our low global warming potential (GWP) hydrofluoro-olefin (HFO) refrigerants and foam expansion agents. We are also the market leader in industrial fluoropolymer resins and downstream products and coatings, marketed under the

well-known Teflon® brand name. Teflon® industrial resins are used in high-performance wire and cable and multiple components in

high-tech processing equipment.

We are the leading producer of solid sodium cyanide (primarily used in gold production) in the Americas. We lead in

production capability, product stewardship offerings and distribution capabilities. We are the largest provider of sulfuric acid regeneration in the U.S. Northeast and the second largest provider in the U.S. Gulf Coast. In North America, we maintain

market leading positions in aniline (primarily used to make polyurethane) and glycolic acid (primarily used in personal care products). We also have a strong market position in disinfectants used for water sanitization, animal health and

bio-security.

Our market-leading positions are due to the scale and scope of our operations, our outstanding process technology, our differentiated

products, our competitive pricing and efficient manufacturing base and long-standing partnerships with our customers.

Industry-leading Cost

Structure

We produce our products in cost-efficient manufacturing facilities that utilize proprietary process technologies to help drive our

industry-leading cost structure. We continue to focus on increasing manufacturing efficiencies and mitigating cost inflation through process improvements, selected capital investments and adoption of best practices.

2

Our Titanium Technologies segment, in particular, has high asset productivity. Our proprietary TiO2 process technology allows us to optimize the use of a variety of titanium-bearing ore types, providing us with a cost advantage. Our world-scale

TiO2 production facilities provide significant economies of scale. We operate large individual production lines at high utilization rates. The scale of our production facilities combined with

our process technology capabilities, has allowed us to achieve one of the lowest manufacturing costs per unit in the industry over a sustained period of time. Our new Altamira, Mexico TiO2

production line is expected to be one of the lowest cost production lines in the world. In addition, we continually strive to improve our productivity and optimize our capacity by applying our engineering and manufacturing technology expertise to

our production facilities.

Our leading fluoroproducts capacity, innovative production processes, effective supply chain and sourcing strategies make us

highly cost competitive also in the fluoroproducts market. Our use of local contract manufacturing and joint venture partners in selected countries as a source of regional access and asset-light manufacturing (where possible) further enhances the

overall cost position of our Fluoroproducts segment.

In Chemical Solutions, we believe we have highly attractive cost and asset positions within our

cyanides, sulfur, and clean and disinfect businesses as a result of our proprietary process technologies, manufacturing scale, efficient supply chain processes, and proximity to large customers.

Leading Technology and Intellectual Property

As

part of our DuPont heritage, our businesses have a long history of delivering innovative and high-quality products. We expect sustained technology leadership to be a key differentiator for Chemours, as the majority of our products are critical

inputs that significantly impact the functionality, performance and quality of our customers’ products. Our product offerings are enhanced by application technology scientists and laboratories across the globe, whose goal it is to deliver

formulation improvements to help our customers achieve lower costs, better performance and higher overall value-in-use from our products compared to those of our competitors.

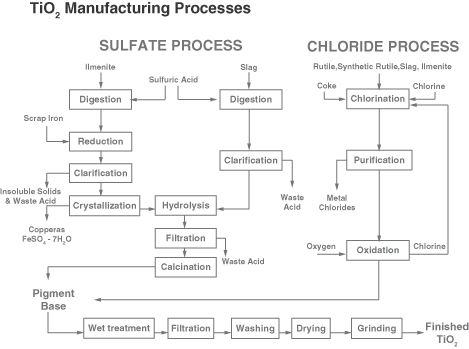

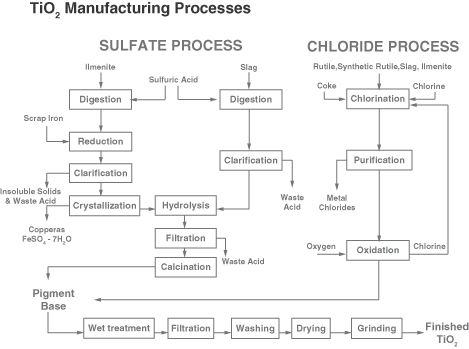

In our Titanium Technologies segment, we commercialized the chloride process for TiO2 production in

1953, providing products with better opacity and superior whiteness due to lower impurities, and generating lower waste and byproducts than the traditional sulfate production technology. Currently, we are one of the limited number of TiO2 producers with rights to chloride process for production of TiO2. We believe that our proprietary chloride technology enables us to operate

plants at a much higher capacity than other chloride technology based TiO2 producers, uniquely utilizing a broad spectrum of titanium bearing ore feedstocks and achieving the highest unit

margins in our industry. Our research and development (R&D) and technology efforts focus on improving production processes, developing and yielding TiO2 grades that help customers achieve

optimal performance. In our Fluoroproducts segment, we pioneered fluorine chemistry and invented polytetrafluoroethylene (PTFE), as well as developed the first generation of refrigeration agents in the first half of the 20th century. Our continuing

innovation focus places us at the forefront of industry and regulatory changes with a focus on sustainable solutions. In fluoroproducts, we led the industry in the Montreal-Protocol (1987) driven transition from chlorofluorocarbons (CFCs) to

the lesser ozone depleting hydrochlorofluorocarbons (HCFCs), and non-ozone depleting HFCs. In 1988 we committed to cease production of CFCs and started manufacturing non-ozone depleting HFCs in the early 1990s. Driven by new and emerging

environmental legislations and standards currently being implemented across the U.S., Europe, Latin America and Japan, we are now developing and commercializing Opteon®, a hydrofluoro-olefin

(HFO) based refrigerant with very low GWP and zero ozone depletion potential (ODP), for air conditioning, refrigeration and other applications. This new patented technology offers similar functionality to current HFC products but meets or exceeds

currently mandated environmental standards. Like Titanium Technologies and Fluoroproducts, our Chemical Solutions segment has strong technical capabilities and a reputation for its ability to manage hazardous materials. This ability is a key

competitive advantage for Chemical Solutions, as several of its products’ end-users demand the highest level of excellence in the safe manufacturing, handling and shipping of the materials. Chemical Solutions also holds and occasionally

licenses what it believes to be the leading process technologies for the production of aniline, acrylonitrile and hydrogen / sodium cyanide.

3

Our technological advantage is supported by our intellectual property portfolio of trade secrets, patents and

protected innovations, covering process technologies, product formulations and various end-use applications. We maintain a world-renowned trademark portfolio, including the widely recognized brands

Ti-Pure® and Vantage® for titanium dioxide products, Suva®, ISCEON®, Freon®, Opteon®,

Teflon®, Tefzel®, Viton®,

Krytox®, Formacel®, Dymel®, FM

200®, Nafion®, Capstone® for fluoroproducts, and Virkon® and Oxone® for Chemical Solutions.

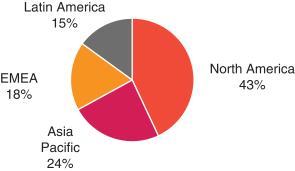

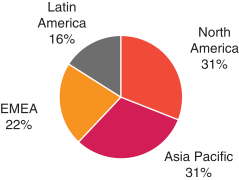

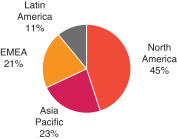

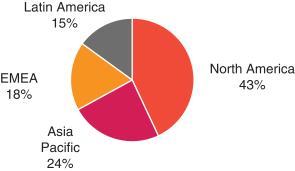

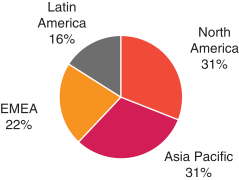

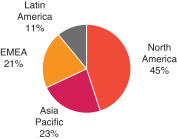

Geographically Diverse Revenue Base Well-Positioned to Capitalize on Economic Growth

We operate 37 production facilities located in 12 countries and serve several thousand customers located in more than 130 countries. As a result of our strong

global presence, we have a widely dispersed customer base that provides us with a geographically diversified revenue stream.

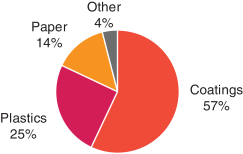

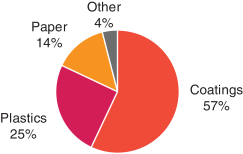

Demand for TiO2 comes from the coatings, paper and plastics industries and is highly correlated to growth in the global residential housing, commercial construction and packaging markets. Over the long-term,

global TiO2 demand has grown in line with gross domestic product (GDP). Growth in emerging markets, including China, however, may be greater than GDP-level growth due in part to the rising

middle class in such markets, which has become a key driver of demand for end products that use our TiO2.

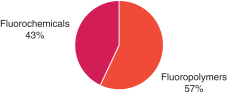

We believe our Fluoroproducts segment, particularly through its low-GWP and zero-ODP products, will benefit from regulatory changes requiring phase-out and

phase-downs of less sustainable incumbent products resulting in attractive margins and industry structure during sunset periods. In addition, customers continually require innovative next generation advanced materials, particularly industrial

fluoropolymer resins, driving new product development and growth. We believe fluoroproducts demand growth in developed markets will be in line with global GDP, whereas demand growth in emerging markets will be higher than GDP. We also believe

fluorochemicals growth will be driven by country-specific legislation phasing-down the current HFC-based refrigerants for which the new HFO-based products and blends are functional substitutes with a low environmental footprint. For fluoropolymers,

we believe growth will be driven by the extension of higher performance applications in developed markets to developing markets, e.g. aerospace, automotive, electronics and communications and semiconductors in China.

Our Chemical Solutions segment serves customers in a diverse range of end markets that we believe generally grow in line with global GDP.

Long Standing and Diverse Customer Base

We serve

approximately 5,000 customers across a wide range of end markets in more than 130 countries. Many of our commercial and industrial relationships have been in place for decades and are based on our proven value proposition of safely and reliably

supplying our customers with the materials needed for their operations. Our customers are comprised of a diverse group of companies, many of which are leaders in their respective industries. Our sales are not materially dependent on any single

customer. As of December 31, 2014, no one individual customer balance represented more than five percent of Chemours’ total outstanding receivables balance and no single customer represented more than ten percent of our sales. Knowledge of our

customers’ business needs is at the core of our innovative processes and forms the basis of our product development initiatives. We work closely with our customers to optimize their formulations and products. We also provide ongoing technical

support services to these customers, which helps them to maximize the effectiveness of our advanced performance products.

Strong Management Team

with Deep Industry Experience

Chemours has a strong executive management team that combines in-depth industry experience and demonstrated

leadership. Mark Vergnano, our Chief Executive Officer, previously served as Executive Vice

4

President of DuPont since 2009. His prior experience includes 35 years in a variety of general management, manufacturing and technical leadership positions, including vice president and general

manager for DuPont Nonwovens, DuPont Building Innovations and group vice president of DuPont Safety & Protection. Mark Newman, our Senior Vice President and Chief Financial Officer, previously served as senior vice president and chief

financial officer of SunCoke Energy Inc. Prior to his time at SunCoke, Mr. Newman served in a number of senior operating and finance leadership roles in the U.S. and China, primarily with the General Motors Corporation where he began his career

in 1986. Chemours’ segment presidents are B.C. Chong, Thierry Vanlancker and Chris Siemer, each of whom has been in chemical industry leadership positions for more than twenty-five years. Mr. Chong has served as president of DuPont’s

Titanium Technologies business since 2011. Previously, he held leadership positions in manufacturing operations, new business development, strategic planning and sales and marketing. Mr. Vanlancker was named president of DuPont’s

Fluoroproducts and Chemical Solutions business in 2012. He brings over a decade of experience in managing fluoro-based businesses and has held leadership positions in general management and sales and marketing. Mr. Siemer joined DuPont in 2010

and has managed global industrial and specialty chemical business portfolios for more than twenty years.

In addition to our strong executive management

team, we have an experienced group of employees who work to maintain our leading market positions with their commitment to safe and efficient production, technology leadership, expansion of product offerings and customer relationships.

Cash Flow Generation

We believe that after the

separation we will have a balance sheet supported by a world class asset base, adequate liquidity and substantial undrawn revolving credit facility, no pension or Other Post-Employment Benefits (OPEB) plans in the U.S. (except for a frozen

non-qualified pension restoration plan and a U.S. OPEB plan sponsored by an unconsolidated equity investment) and minimal unfunded non-U.S. pension liability. We expect our EBITDA to increase over time through low-cost incremental production and/or

overall unit cost reductions from Chemours’ TiO2 capacity expansion at its Altamira site, potential upside from an anticipated cyclical recovery in TiO2, EU-mandated environmental regulations driving conversion to refrigerants with low GWP, and our focus on productivity improvements. The completion of the Altamira expansion in mid-2016 will

meaningfully reduce our annual capital expenditures.

Our operating cash flow generation is driven by, among other things, global economic conditions

generally and the resulting impact on demand for our products, raw material and energy prices, and industry-specific issues, such as production capacity and utilization. We have generated strong operating cash flow through various industry and

economic cycles evidencing the operating strength of our businesses. Over the industry cycles in recent years, cash flows from operating activities increased in the years leading up to 2011, and have declined annually since the historical peak

profitability achieved in 2011. Despite challenging market conditions in the TiO2 industry since achieving a historical peak in terms of profitability in 2011 and what are believed to be

relatively weak market conditions in 2013 and 2014, we have generated strong operating cash flow. For each of the past four fiscal years, Chemours has generated cash flows from operating activities in excess of $500 million, with such cash flows

averaging approximately $1 billion per year. See our disclosure under “Management’s Discussion and Analysis of Financial Condition and Results of Operations — Liquidity & Capital Resources.”

Capital expenditures have on average equaled approximately $460 million per year during the past four years. A significant increase in each of the past

three fiscal years was due to expenditures relating to the expansion of the TiO2 production facility at Altamira, Mexico. We expect our capital expenditures to be reduced in 2016 and in the

near term thereafter due to the completion of the Altamira expansion, which should further bolster our free cash flow as the new capacity is expected to come online in mid-2016.

5

Our Strategy

Continue to Drive Operational Excellence and Asset Efficiency

Operational excellence, which includes a commitment to safety, environmental stewardship and improved reliability, is key to our future success. We continually

evaluate our business to identify opportunities to increase operational efficiency throughout our production facilities with a focus on maintaining operational excellence and maximizing asset efficiency. We continue to set new, stricter operational

excellence targets for each of our facilities based on industry-leading benchmarks. We intend to continue focusing on increasing manufacturing efficiencies through selected capital projects, process improvements and best practices in order to lower

unit costs. We will also carefully manage our portfolio, especially in our Chemical Solutions segment, and take appropriate actions to address product lines that face challenging market conditions and do not generate returns on invested capital that

we believe are sufficient to create long-term shareholder value.

Focus on Cash Flow Generation

Our goal is to focus on cash flow generation and return on invested capital through the continuing optimization of our cost structure, improvement in working

capital and supply chain efficiencies, and a disciplined approach to capital expenditures.

We have a proven track record of mitigating fixed cost

inflation with cost saving actions and productivity improvements. We intend to continue to identify incremental cost saving opportunities based in large part on benchmarks of industry-leading performance and productivity improvements by utilizing

our engineering and manufacturing technology expertise and partnerships with low cost producers. Our goal is to maintain a cost structure that positions us favorably to compete and grow. Our goal is to continue upgrading our customer and product mix

to increase our sales of value-added, differentiated products to achieve premium pricing to improve margins and enhance cash flow.

We intend to actively

manage our working capital by increasing inventory turnover and reducing finished goods and raw materials inventory without affecting our ability to deliver products to our customers. We strive to improve our supply chain efficiency by focusing on

reducing both operating costs and working capital needs. Our supply chain efforts to lower operating costs have consisted of reducing procurement spending, lowering transportation and warehouse costs and optimizing production scheduling.

We remain focused on disciplined capital allocation among our segments. We plan to allocate our capital expenditures to projects required to enhance the

reliability of our manufacturing operations and maintain the overall asset portfolio. This includes key maintenance and repair activities in each segment, and necessary regulatory and maintenance spending to ensure safe operations. We intend to

optimize capital spending on growth projects across our various businesses based on a thorough comparison of risk-adjusted returns for each project.

Maintain Strong Customer Focus

A key component of

our strategy is to produce innovative, high-performance products that offer enhanced value propositions to our customers at competitive prices. Our goal is to continually work closely with our customers to provide solutions and products that

optimize their formulations and products. This market-driven product development enables us to offer a high-quality product portfolio to our customers and provides our businesses with the ability to respond quickly and efficiently to changes in

market demands.

Leverage our Leadership to Drive Organic Growth

We plan to continue to capitalize on our global operations network, distribution infrastructure and technology to pursue global growth. We will focus our

efforts on those geographic areas and end products that we believe offer the most attractive growth and long-term profitability prospects.

6

Our strategy in our Titanium Technologies segment is to continue to strengthen our leading position from both

product offering and cost perspective in order to increase the segment’s sales and profitability. We intend to continue to position Chemours as the preferred supplier of TiO2 worldwide by

delivering the highest quality product offering to our customers coupled with superior technical expertise. We are currently expanding capacity at our Altamira, Mexico production facility, which will increase our global capacity by more than 15

percent and will be one of the lowest cost TiO2 production lines in the world. Production at the expansion is scheduled to start up in mid-2016.

Our Fluoroproducts segment plans to make ongoing, selective investments to capitalize on market opportunities based on our innovation capabilities and

industry dynamics. We intend to continue to leverage our fluoroproducts and process expertise to develop new high-performance, differentiated offerings and to promote industry transition towards more sustainable technologies. Specifically, our

strategy is to focus on development of proprietary, high-value, sustainable specialties (for example, Opteon® YF and HFO-1336, which are designed to meet tighter regulatory standards and

replace commodity HFC refrigerants or foaming agents).

Our Chemical Solutions segment intends to capitalize on potential growth opportunities in

businesses in which we have strong regional positions, e.g. sulfuric acid and sodium cyanide. We plan to make selective capital investments to grow our sulfur products and sodium cyanide businesses, in which we have leading market positions in the

Americas, and to take initiatives to improve profitability in the remainder of the businesses in our Chemical Solutions segment.

Deepen Our

Presence in Emerging Markets

Emerging markets are a strategic priority for a number of our businesses. We are well positioned not only to leverage

our strong market positions in mature but highly sophisticated markets in North America and Europe, but also to participate in the expected growth of emerging markets in Asia, Eastern Europe and Latin America. We believe that improving living

standards and growth in GDP across emerging markets are combining to create increased demand for our products. We expect to capitalize on this growth opportunity by expanding our customer base and local capabilities in order to increase our market

share across emerging markets, especially China. To accelerate our penetration of these markets and maintain our competitive cost position, we may develop relationships with leading local partners, especially in businesses where participation in the

fast-growing Chinese market is particularly important for long-term sustainable growth. For example, we are well positioned to leverage our strong production technology in our industrial fluoropolymers resins business, where the Chinese market is

expected to continue to evolve from low-end fluoropolymer applications to higher value PTFE, copolymer and fluoroelastomer products, as a result of an increasing percentage of aerospace, automotive, semiconductor, electronics and telecommunications

manufacturing transitions to China.

Drive Organizational Alignment

We believe that maintaining alignment of the efforts of our employees with our overall business strategy and operational excellence goals is critical to our

success. We have outstanding people and assets and, with the commitment to values of safety, customer appreciation, simplicity, collective entrepreneurship and integrity, we believe that we can maintain our competitiveness and help achieve our

operational excellence and asset efficiency strategic objectives.

Risks Associated with Our Business

An investment in Chemours common stock is subject to a number of risks. The following list of risk factors is not exhaustive. Please read the information in

the section captioned “Risk Factors” for a more thorough description of these and other risks.

| |

• |

|

Conditions in the global economy and global capital markets may adversely affect our results of operations, financial condition, and cash flows. |

7

| |

• |

|

Market conditions, as well as global and regional economic downturns that adversely affect the demand for the end-use products that contain TiO2, fluoroproducts or

our other products, could adversely affect the profitability of our operations and the prices at which we can sell our products, negatively impacting our financial results. |

| |

• |

|

The markets for many of our products have seasonally affected sales patterns. |

| |

• |

|

Changes in government policies and laws and certain geopolitical conditions and activities could adversely affect our financial results. |

| |

• |

|

Our reported results could be adversely affected by currency exchange rates and currency devaluation could impair our competitiveness. |

| |

• |

|

Price fluctuations in energy and raw materials could have a significant impact on our ability to sustain and grow earnings. |

| |

• |

|

We are subject to extensive environmental, health and safety laws and regulations that may result in unanticipated loss or liability, which could reduce our profitability. |

| |

• |

|

Hazards associated with chemical manufacturing, storage and transportation could adversely affect our results of operations. |

| |

• |

|

The businesses in which we compete are highly competitive. This competition may adversely affect our results of operations and operating cash flows. |

| |

• |

|

Our significant indebtedness could adversely affect our financial condition, and we could have difficulty fulfilling our obligations under our indebtedness, either of which could have a material adverse effect on the

value of our common stock. |

| |

• |

|

We may need additional capital in the future and may not be able to obtain it on favorable terms. |

| |

• |

|

The agreements governing our indebtedness will restrict our current and future operations, particularly our ability to respond to changes or to take certain actions. |

| |

• |

|

If we are unable to innovate and successfully introduce new products, or new technologies or processes reduce the demand for our products or the price at which we can sell products, our profitability could be adversely

affected. |

| |

• |

|

Our results of operations and financial condition could be seriously impacted by business disruptions and security breaches, including cybersecurity incidents. |

| |

• |

|

If our intellectual property were compromised or copied by competitors, or if our competitors were to develop similar or superior intellectual property or technology, our results of operations could be negatively

affected. |

| |

• |

|

As a result of our current and past operations, including operations related to divested businesses and our discontinued operations, we could incur significant environmental liabilities. |

| |

• |

|

Our results of operations could be adversely affected by litigation and other commitments and contingencies. |

The Separation and Distribution

On October 24,

2013, DuPont announced its intention to separate its Performance Chemicals segment, which includes its titanium technologies, fluoroproducts and chemical solutions businesses, from the other businesses of DuPont that comprise its Agriculture,

Electronics & Communications, Industrial Biosciences, Nutrition & Health, Performance Materials and Safety & Protection segments (the DuPont Business). The distribution is intended to be generally tax free for U.S. federal

income tax purposes.

8

In furtherance of this plan, on [—], 2015, DuPont’s

board of directors approved the distribution of all of the issued and outstanding shares of Chemours common stock on the basis of [—] share[s] of Chemours common stock for each share of DuPont

common stock issued and outstanding on [—], 2015, the record date for the distribution. As a result of the distribution, Chemours will become an independent, publicly traded company.

Internal Reorganization

DuPont will transfer the

entities and related assets and liabilities that are necessary in advance of the distribution so that Chemours is transferred the entities, assets and liabilities associated with DuPont’s Performance Chemicals segment, which includes its

titanium technologies, fluoroproducts and chemical solutions businesses, and certain additional assets and liabilities associated with the DuPont Business. We are currently a wholly owned subsidiary of DuPont. In connection with the distribution,

DuPont will undertake a series of internal reorganization transactions to facilitate the transfers of entities and the related assets and liabilities described above. See “Our Relationship with DuPont Following the Distribution —

Separation Agreement” for further discussion.

Chemours’ Post-Separation Relationship with DuPont

Chemours will enter into a Separation Agreement with DuPont, which is referred to in this information statement as the “Separation Agreement,” and

which will contain the principles governing the internal reorganization discussed above and will specify the terms of the distribution. In connection with the separation and distribution, Chemours will enter into various other agreements to effect

the separation and distribution and provide a framework for its relationship with DuPont after the separation and distribution. These other agreements will include a Transition Services Agreement, a Tax Matters Agreement, an Employee Matters

Agreement, an IP Cross-License Agreement and certain manufacturing and supply arrangements. These agreements will provide for the allocation between Chemours and DuPont of DuPont’s and Chemours’ assets, employees, liabilities and

obligations (including investments, property and employee benefits and tax-related assets and liabilities) attributable to periods prior to, at and after Chemours’ separation from DuPont, and will govern certain relationships between Chemours

and DuPont after the separation. For additional information regarding the Separation Agreement and other transaction agreements, see the sections entitled “Risk Factors — Risks Related to the Separation” and “Our Relationship

with DuPont Following the Distribution.”

Description of Indebtedness

We expect that, at the time of distribution, we will have significant third-party indebtedness, which we expect to incur through a bond offering, term loans or

a combination of these and other financing arrangements. The significant third-party indebtedness could, among other things, increase the risk that we may be unable to generate cash sufficient to pay interest and other amounts due in respect of such

indebtedness, make us more vulnerable to adverse changes in the general economic, industry and competitive conditions, limit our flexibility in planning for, or reacting to, changes in our business and contain significant operating and financial

maintenance covenants that limit our operations, including the ability to engage in activities that may be in our long-term best interests, each of which could have a material adverse effect on us. Further information regarding our indebtedness

following the distribution will be provided in subsequent amendments to this information statement.

Chemours’ Significant Separation Payments

and Costs

Prior to the distribution, we will make a $[—] cash distribution to DuPont, funded

primarily by third-party indebtedness that we will incur prior to the date of the distribution. In addition, DuPont has informed us that DuPont expects to incur and pay all one-time costs associated with the separation. We also expect to incur

certain ongoing costs associated with operating as an independent, publicly traded company. Such ongoing costs may adversely impact our profitability, financial condition and results of operations. For additional information, see the sections

entitled “Risk Factors — Risks Related to the Separation.”

9

Indemnification Obligations to DuPont

In connection with our separation we will assume, and indemnify DuPont for, certain liabilities, including, among others certain environmental liabilities and

specified litigation liabilities. Most of our indemnification obligations to DuPont may be uncapped, and may include, among other items, associated defense costs, settlement amounts and judgments. Payments pursuant to these indemnities may be

significant and could negatively impact our business. Each of these risks could negatively affect our business, financial condition, results of operations and cash flows. For additional information, see the sections entitled “Our Relationship

with DuPont Following the Distribution,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations — Environmental Matters,” “Risk Factors — Risks Related to the Separation and

Distribution” and “Financial Statements — Notes to the Combined Financial Statements.”

Regulatory Approvals

Chemours must complete the necessary registration under U.S. federal securities laws of Chemours common stock, as well as the applicable New York Stock

Exchange (NYSE) listing requirements for such shares.

Other than the requirements discussed above, we do not believe that any other material governmental

or regulatory filings or approvals will be necessary to consummate the distribution.

DuPont’s stockholders will not have any appraisal rights in

connection with the distribution.

Corporate Information

Chemours was organized in the state of Delaware on February 18, 2014 as Performance Operations, LLC, and changed its name to The Chemours Company, LLC on

April 15, 2014. In accordance with the separation and distribution, actions will have been taken so as at the time immediately prior to the distribution, Chemours will have been converted from a limited liability company to a Delaware

corporation. The address of Chemours’ principal executive offices is [—]. Chemours’ telephone number is [—].

10

QUESTIONS AND ANSWERS ABOUT THE SEPARATION AND DISTRIBUTION

| What is Chemours and why is DuPont separating the Chemours business and distributing Chemours’ stock?

|

Chemours currently is a wholly owned subsidiary of DuPont that was formed to operate DuPont’s Performance Chemicals segment, which includes its titanium technologies, fluoroproducts and chemical solutions businesses. The separation will be

effected by a distribution of Chemours common stock on a pro rata basis to DuPont’s stockholders. Following the separation and distribution, Chemours will be a separate company from DuPont, and DuPont will not retain any ownership interest in

Chemours. |

| |

The separation of Chemours from DuPont and the distribution of Chemours common stock are intended to provide you with equity investments in two separate companies that will be able to focus on each of their respective

businesses. DuPont and Chemours expect that the separation will result in enhanced long-term performance of each business for the reasons discussed in the sections entitled “The Distribution — Background of the Distribution” and

“The Distribution — Reasons for the Separation and Distribution.” |

| Why am I receiving this document? |

DuPont is delivering this document to you because you are a holder of DuPont common stock. If you are a holder of DuPont common stock as of the close of business on [—], 2015, the record date

for the distribution, you are entitled to receive [—] share[s] of our common stock for each share of DuPont common stock that you hold at the close of business on such date. This document will help

you understand how the separation and distribution will affect your investment in DuPont and your investment in Chemours after the separation. |

| What are the reasons for the separation? |

DuPont’s board of directors determined that the separation and distribution of the Chemours business from the DuPont Business would be in the best interests of DuPont and its stockholders and approved the plan of separation. A wide variety

of factors were considered by DuPont’s board of directors in evaluating the separation and distribution. Among other things, DuPont’s board of directors considered the following potential benefits of the separation and distribution:

|

| |

• |

|

Closer alignment of DuPont’s businesses with its evolving strategic direction — DuPont’s overall mission is to bring world-class

science and engineering to the global marketplace in the form of innovative products, materials and services. Increasingly, DuPont’s strategic direction and business model is focused on advancing the company’s integrated capabilities in

biology, chemistry and materials science to further strengthen its leading positions across three strategic priorities: agriculture and nutrition, advanced materials and biobased industrials. DuPont is focused on high potential commercial

opportunities in secular growth markets in food, energy, and protection where the company’s innovation, global scale and efficient execution have the potential to create valuable new outcomes. In addition, the Performance Chemicals Segment is

highly cyclical and its performance is volatile as compared to DuPont’s other businesses. Its leading businesses in |

11

| |

Titanium Technologies and Fluoroproducts, and Chemical Solutions, well-established positions in attractive markets, and cash flow generation will be better positioned as an independent company.

The separation and distribution will allow DuPont to continue its transformation into a higher growth, less cyclical company, resulting in greater value creation for its shareholders. |

| |

• |

|

Direct Access to Capital Markets — The distribution will create an independent equity and debt structure that will afford Chemours direct access to capital markets from what is expected to be a deep pool of

investors that target companies in Chemours’ industry and/or with its credit profile and facilitate the ability to capitalize on its unique growth opportunities. |

| |

DuPont’s board of directors considered a number of potentially negative factors in evaluating the separation and distribution, including risks relating to the creation of a new public company, possible increased

administrative costs and one-time separation costs, but concluded that the potential benefits of the separation and distribution outweighed these factors. For more information, see the sections entitled “The Distribution — Reasons for the

Separation and Distribution” and “Risk Factors” included elsewhere in this information statement. |

| Why is the separation of Chemours structured as a distribution? |

The board of directors of DuPont has approved a plan to separate DuPont’s performance chemicals business into a new publicly traded company. DuPont currently believes the separation by way of distribution is the most efficient way to

separate its performance chemicals business from DuPont for various reasons. In particular, we believe a separation will (i) provide a high degree of assurance that decisions regarding our capital structure will support future financial stability;

(ii) offer a high degree of certainty of completion in a timely manner, lessening disruption to current business operations; and (iii) generally be a tax-free distribution of Chemours shares to DuPont’s stockholders for U.S. federal income tax

purposes. After consideration of strategic opportunities, DuPont believes that a tax-free separation will enhance the long-term value of both DuPont and us. See “The Distribution — Reasons for the Separation and Distribution.”

|

| What do I have to do to participate in the distribution? |

Nothing. You are not required to take any action to receive your Chemours shares, although you are urged to read this entire document carefully. No stockholder approval of the distribution is required or sought. Therefore, you

are not being asked for a proxy to vote on the separation or the distribution, and you are requested not to send us a proxy. You will neither be required to pay anything for the shares of Chemours common stock nor be required to surrender any

shares of DuPont common stock to participate in the distribution. Please do not send in your DuPont stock certificates. |

12

| What is the record date for the distribution? |

DuPont will determine record ownership as of the close of business on [—], 2015, which we refer to as the “record date.” |

| What will I receive in distribution? |

If you hold DuPont common stock as of the record date, on the distribution date you will receive [—] share[s] of our common stock for every

[—] share[s] of DuPont common stock. You will receive only whole shares of our common stock in the distribution. For a more detailed description, see “The Distribution.”

|

| How will fractional shares be treated in the distribution? |

You will not receive any fractional shares of our common stock in connection with the distribution. Instead, the distribution agent will aggregate all fractional shares into whole shares and sell the whole shares in the open market at prevailing

market prices on behalf of DuPont stockholders entitled to receive a fractional share. The distribution agent will then distribute the aggregate cash proceeds of the sales, net of brokerage fees and other costs, pro rata to these holders (net of any

required withholding for taxes applicable to each holder). We anticipate that the distribution agent will make these sales in the “when-issued” market, and when-issued trades will generally settle within two weeks following the

distribution date. See “— How will Chemours common stock trade?” for additional information regarding when-issued trading and “The Distribution — The Number of Shares of Chemours Common Stock You Will Receive” for a

more detailed explanation of the treatment of fractional shares. |

| Will the number of DuPont shares I own change as a result of the distribution? |

No, the number of shares of DuPont common stock you own will not change as a result of the distribution. Your proportionate interest in DuPont will not change as a result of the separation and distribution. |

| How many shares of Chemours common stock will be distributed? |

The actual number of shares of our common stock that DuPont will distribute will depend on the number of shares of DuPont common stock outstanding on the record date. The shares of our common stock that DuPont distributes will constitute all of

the issued and outstanding shares of our common stock immediately prior to the distribution. For more information on the shares being distributed, see “Description of Our Capital Stock.” |

| When will the distribution occur? |

It is expected that the distribution will be effected after the closing of trading on the NYSE on July 1, 2015, pending final approval from DuPont’s board of directors, which we refer to as the “distribution date.” On or shortly

after the distribution date, the whole shares of our common stock will be credited in book-entry accounts for stockholders entitled to receive the shares in the distribution. We expect the distribution agent, acting on behalf of DuPont, to take

about two weeks after the distribution date to fully distribute to DuPont stockholders any cash in lieu of the fractional shares they are entitled to receive. See “— How will DuPont distribute shares of our common stock?” for more

information on how to access your book-entry account or your bank, brokerage or other account holding the Chemours common stock you receive in the distribution. |

13

| If I sell my shares of DuPont common stock on or before the distribution date, will I still be entitled to receive

shares of Chemours common stock in the distribution? |

If you hold shares of DuPont common stock on the record date and decide to sell them on or before the distribution date, you may choose to sell your DuPont common stock with or without your entitlement to our common stock. Beginning on or

shortly before the record date and continuing up to and through the distribution, it is expected that there will be two markets in DuPont common stock: a “regular-way” market and an “ex-distribution” market. Shares of DuPont

common stock that trade in the “regular-way” market will trade with an entitlement to shares of Chemours common stock distributed pursuant to the distribution. Shares that trade in the “ex-distribution” market will trade without

an entitlement to shares of Chemours common stock distributed pursuant to the distribution. |

| |

You should discuss these alternatives with your bank, broker or other nominee. See “The Distribution — Trading Between the Record Date and Distribution Date” for more information. |

| How will DuPont distribute shares of our common stock? |

Registered stockholders: If you are a registered stockholder (meaning you hold physical DuPont stock certificates or you own your shares of DuPont common stock directly through an account with DuPont’s transfer agent, Computershare Trust

Company, N.A. (Computershare), the distribution agent will credit the whole shares of our common stock you receive in the distribution to your book-entry account on or shortly after the distribution date. About two weeks after the distribution date,

the distribution agent will mail you a book-entry account statement that reflects the number of whole shares of our common stock you own, along with a check for any cash in lieu of fractional shares you are entitled to receive. You will be able to

access information regarding your book-entry account holding the Chemours shares at [—] using the same credentials that you use to access your DuPont account or via our transfer agent’s

interactive voice response system at [—]. |

| |

“Street name” or beneficial stockholders: If you own your shares of DuPont common stock beneficially through a bank, broker or other nominee, your bank, broker or other nominee will credit your account with

the whole shares of our common stock you receive in the distribution on or shortly after the distribution date, and the distribution agent will mail you a check for any cash in lieu of fractional shares you are entitled to receive. Please contact

your bank, broker or other nominee for further information about your account. |

| |

We will not issue any physical stock certificates to any stockholders, even if requested. See “The Distribution — When and How You Will Receive the Distribution” for a more detailed explanation.

|

| What are the conditions to the separation and distribution? |

The distribution is subject to a number of conditions, including, among others: |

| |

• |

|

the making of a $[—] cash distribution from Chemours to DuPont prior to the distribution, and the determination by DuPont in its sole discretion that following the

separation it shall have no further liability or obligation whatsoever under any financing arrangements that Chemours will be entering into in connection with the separation; |

14

| |

• |

|

the Securities and Exchange Commission (SEC) having declared effective the registration statement, of which this information statement forms a part, no stop order relating to the registration statement being in effect,

nor any proceeding seeking such stop order being pending, and the information statement having been distributed to DuPont’s stockholders; |

| |

• |

|

Chemours common stock having been approved and accepted for listing by the NYSE, subject to official notice of issuance; |

| |

• |

|

DuPont has received a ruling (IRS Ruling) from the U.S. Internal Revenue Service (IRS) substantially to the effect that, among other things, the distribution of our ordinary shares, together with certain related

transactions, will qualify under Sections 355 and 368(a) of the Internal Revenue Code of 1986, as amended (Code), with the result that DuPont and DuPont’s shareholders will not recognize any taxable income, gain or loss for U.S. federal income

tax purposes as a result of the distribution, except to the extent of cash received in lieu of fractional shares. As a condition to the distribution, the IRS Ruling must remain in effect as of the distribution date. In addition, the distribution is

conditioned on the receipt of an opinion of tax counsel (Tax Opinion), in form and substance acceptable to DuPont, substantially to the effect that certain requirements, including certain requirements that the IRS will not rule on, necessary to

obtain tax-free treatment, have been satisfied. See “Material U.S. Federal Income Tax Consequences of the Distribution”; |

| |

• |

|

the receipt of an opinion from an independent appraisal firm to the board of directors of DuPont confirming the solvency of each of DuPont and Chemours after the distribution that is in form and substance acceptable to

DuPont in its sole discretion; |

| |

• |

|

all permits, registrations and consents required under the securities or blue sky laws of states or other political subdivisions of the United States or of other foreign jurisdictions in connection with the distribution

having been received; |

| |

• |

|

no order, injunction, or decree issued by any court of competent jurisdiction or other legal restraint or prohibition preventing the consummation of the separation, distribution or any of the related transactions being

in effect; |

| |

• |

|

the reorganization of DuPont and Chemours businesses prior to the separation and distribution having been effectuated; |

| |

• |

|

the approval by the board of directors of DuPont of the distribution and all related transactions (and such approval not having been withdrawn); |

| |

• |

|

DuPont’s election of the individuals to be listed as members of our board of directors post-distribution, as described in this information statement, immediately prior to the distribution date; |

| |

• |

|

Chemours having entered into certain agreements in connection with the separation and distribution and certain financing arrangements prior to or concurrent with the separation; and |

15

| |

• |

|

no events or developments shall have occurred or exist that, in the sole and absolute judgment of DuPont’s board of directors, make it inadvisable to effect the distribution or would result in the distribution and

related transactions not being in the best interest of DuPont or its stockholders. |

| Can DuPont decide to cancel the separation even if all the conditions have been met? |

Yes. The separation is subject to the satisfaction or waiver by DuPont of certain conditions. See “The Distribution — Conditions to the Distribution.” Even if all such conditions are met, DuPont has the right not to complete the

separation if, at any time prior to the distribution, the board of directors of DuPont determines, in its sole discretion, that the separation is not in the best interests of DuPont or its stockholders, that a sale or other alternative is in the

best interests of DuPont or its stockholders, or that market conditions or other circumstances are such that it is not advisable at that time to separate the performance chemicals business from DuPont. DuPont has informed us that, to the extent the

board of directors of DuPont determines not to proceed with the separation, DuPont will issue a press release publicly announcing any such decision. |

| What are the U.S. federal income tax consequences of the distribution to me? |

The distribution is conditioned on the continued validity of the IRS Ruling, which DuPont has received from the IRS, and the receipt and continued validity of the Tax Opinion, in form and substance acceptable to DuPont, substantially to the

effect that, among other things, the distribution will qualify as a tax-free transaction under Section 355 and Section 368(a)(1)(D) of the Code, and certain transactions related to the transfer of assets and liabilities to Chemours in connection

with the separation will not result in the recognition of any gain or loss to DuPont, Chemours or their stockholders. Such conditions are waivable by DuPont’s board of directors in its sole and absolute discretion. DuPont received the IRS

Ruling from the IRS on September 30, 2014. Accordingly, and so long as the distribution so qualifies, for U.S. federal income tax purposes, no gain or loss will be recognized by you, and no amount will be included in your income, upon the receipt of

shares of our common stock pursuant to the distribution. However, any cash payments made instead of fractional shares will generally be taxable to you. For a more detailed description, see “The Distribution — Material U.S. Federal Income

Tax Consequences of the Distribution.” |

| How will the distribution affect my tax basis in my shares of DuPont common stock? |

Assuming that the distribution is tax-free to DuPont stockholders, your tax basis in your DuPont common stock held by you immediately prior to the distribution will be allocated between

your DuPont common stock and Chemours common stock that you receive in the distribution in proportion to the relative fair market values of each immediately following the distribution. DuPont will provide its stockholders with information to enable

them to compute their tax basis in both DuPont and Chemours shares. This information will be posted on DuPont’s website, www.dupont.com, promptly following the distribution date. You should consult your tax advisor about how this allocation

will work in your situation, including a situation where you have purchased DuPont shares at different times or for different amounts, and regarding |

16

| |

any particular consequences of the distribution to you. For a more detailed description, see “The Distribution — Material U.S. Federal Income Tax Consequences of the Distribution.”

|

| Will my shares of DuPont common stock continue to trade following the distribution? |

DuPont common stock will continue to trade on the NYSE under the symbol “DD” after the distribution. |

| How will Chemours common stock trade? |

Currently, there is no public market for our common stock. We intend to list our common stock on the NYSE under the symbol “CC.” |

| |

We anticipate that trading in our common stock will begin on a “when-issued” basis as early as [—] trading days prior to the record date for the distribution

and will continue up to and including the distribution date. When-issued trading in the context of a separation refers to a sale or purchase made conditionally on or before the distribution date because the securities of the separated entity have

not yet been distributed. When-issued trades generally settle within two weeks after the distribution date. On the first trading day following the distribution date, any when-issued trading of our common stock will end and “regular-way”

trading will begin. Regular-way trading refers to trading after the security has been distributed and typically involves a trade that settles on the third full trading day following the date of the trade. See “The Distribution — Trading

Between the Record Date and Distribution Date” for more information. We cannot predict the trading prices for our common stock before, on or after the distribution date. |

| What indebtedness will Chemours have following the separation? |

Prior to the separation and distribution, Chemours expects to issue senior notes and to enter into a credit agreement with a syndicate of banks to provide two senior secured credit facilities. Specifically, Chemours expects to issue senior notes

in multiple tranches with terms and maturities to be determined, and to enter into a credit agreement providing a seven-year $[—] billion senior secured Term Loan B Facility (the Term Loan

Facility) and a five-year $[—] billion senior secured Revolving Credit Facility (the Revolving Credit Facility and together with the Term Loan Facility, the Senior Secured Credit Facilities). At

the time of the spin-off, Chemours expects to have approximately $4.0 billion of indebtedness, of which approximately $4.0 billion will be paid or otherwise issued to DuPont as consideration for the contribution of assets to us by DuPont in

connection with the separation. For purposes of preparing the unaudited pro forma combined financial statements included elsewhere in this information statement, Chemours has assumed, based on its best current estimates, that total indebtedness will

be $4.0 billion. However, discussion of the terms of the notes and the Senior Secured Credit Facilities are ongoing, and this estimate is subject to change. Chemours will provide the final amount of the expected indebtedness and payment to DuPont in

a subsequent amendment to this information statement. See the sections entitled “Financing Arrangements” and “Unaudited Pro Forma Combined Financial Statements” for more information. |

17

| Will the separation affect the trading price of my DuPont common stock? |

We expect the trading price of shares of DuPont common stock immediately following the distribution to be lower than immediately prior to the distribution because the trading price will no longer reflect the value of the performance chemicals

business. Furthermore, until the market has fully analyzed the value of DuPont without Chemours, the trading price of shares of DuPont common stock may fluctuate. There can be no assurance that, following the distribution, the combined trading

prices of DuPont common stock and the Chemours common stock will equal or exceed what the trading price of DuPont common stock would have been in the absence of the separation, and it is possible the post-distribution combined equity value of DuPont

and Chemours will be less than DuPont’s equity value prior to the distribution. |

| Are there risks associated with owning shares of Chemours common stock? |

Yes. Our business faces both general and specific risks and uncertainties. Our business also faces risks relating to the separation. Following the separation, we will also face risks associated with being an independent, publicly traded company.

Accordingly, you should read carefully the information set forth in the section entitled “Risk Factors” in this information statement. |

| Does Chemours intend to pay cash dividends? |

Prior to the distribution, while we are a wholly-owned subsidiary of DuPont, our board of directors, consisting of DuPont employees, intends to declare a dividend of an aggregate amount of $100 million in total for the third quarter of 2015, to

be paid to our stockholders as of a record date following the distribution. Following the distribution, we expect to continue to pay regular quarterly dividends in an aggregate amount of $100 million, with an aggregate annual dividend of

approximately $400 million. The declaration, payment and amount of any subsequent dividend will be subject to the sole discretion of our post-distribution, independent board of directors and will depend upon many factors, including our financial

condition and prospects, our capital requirements and access to capital markets, covenants associated with certain of our debt obligations, legal requirements and other factors that our board of directors may deem relevant, and there can be no

assurances that we will continue to pay a dividend in the future. There can also be no assurance that the combined annual dividends on DuPont common stock and our common stock after the distribution, if any, will be equal to the annual dividends on

DuPont common stock prior to the distribution. |

| What will Chemours’ relationship be with DuPont following the separation and distribution? |

Chemours will enter into a Separation Agreement with DuPont to effect the separation and provide a framework for Chemours’ relationship with DuPont after the separation and

distribution and will also enter into certain other agreements, such as a Transition Services Agreement, a Tax Matters Agreement, an Employee Matters Agreement and an IP Cross-License Agreement and certain manufacturing and supply arrangements.

These agreements will provide for the terms of the separation between Chemours and DuPont of the assets, employees, liabilities and obligations (including its investments, property and employee benefits and tax-related assets and liabilities) of

DuPont and its subsidiaries attributable to periods |

18

| |

prior to, at and after Chemours’ separation from DuPont and will govern the relationship between Chemours and DuPont subsequent to the completion of the separation and distribution. For

additional information regarding the Separation Agreement and other transaction agreements, see the sections entitled “Risk Factors — Risks Related to the Separation” and “Our Relationship with DuPont Following the

Distribution.” |

| Do I have appraisal rights in connection with the separation and distribution? |

No. Holders of DuPont stock are not entitled to appraisal rights in connection with the separation and distribution. |

| Who is the transfer agent and registrar for Chemours common stock? |

Following the separation and distribution, [—] will serve as transfer agent and registrar for our common stock. |

| |

[—] has two additional roles in the distribution. |

| |

• |

|

Computershare currently serves and will continue to serve as DuPont’s transfer agent and registrar. |

| |

• |

|

In addition, [—] will serve as the distribution agent in the distribution and will assist DuPont in the distribution of our common stock to DuPont’s stockholders.

|

| Where can I get more information? |

If you have any questions relating to the mechanics of the distribution, you should contact the distribution agent at: |

| |

Before the separation and distribution, if you have any questions relating to the separation and distribution, you should contact DuPont at: |

| |

Individual Holders: After the separation and distribution, if you have any questions relating to Chemours, you should contact us at: |

| |

Individual Holders: After the separation and distribution, if you have any questions relating to DuPont, you should contact them at: |

| |

Institutional Holders: After the separation and distribution, if you have any questions relating to Chemours, you should contact us at: |

| |

Institutional Holders: After the separation and distribution, if you have any questions relating to DuPont, you should contact them at: |

19

RISK FACTORS

You should carefully consider the following risks and other information in this information statement in evaluating us and our common stock. The risk

factors generally have been separated into three groups: risks related to our business, risks related to the separation and risks related to our common stock.

Any of the following risks, as well as additional risks and uncertainties not currently known to us or that we currently deem immaterial, could materially

and adversely affect our business, results of operations or financial condition. Our operations could be affected by various risks, many of which are beyond our control. Based on current information, we believe that the following identifies the most

significant risk factors that could affect our business, results of operations or financial condition. Past financial performance may not be a reliable indicator of future performance and historical trends should not be used to anticipate results or

trends in future periods. See “Cautionary Statement Concerning Forward-Looking Statements” for more details.

Risks Related to Our

Business

Conditions in the global economy and global capital markets may adversely affect our results of operations, financial condition, and

cash flows.

Our business and operating results may in the future be adversely affected by global economic conditions, including instability in

credit markets, declining consumer and business confidence, fluctuating commodity prices and interest rates, volatile exchange rates, and other challenges such as the changing financial regulatory environment that could affect the global economy.

Our customers may experience deterioration of their businesses, cash flow shortages, and difficulty obtaining financing. As a result, existing or potential customers may delay or cancel plans to purchase products and may not be able to fulfill their

obligations to us in a timely fashion. Further, suppliers could experience similar conditions, which could impact their ability to supply materials or otherwise fulfill their obligations to us. Because we will have significant international

operations, there will be a large number of currency transactions that result from international sales, purchases, investments and borrowings. Also, our effective tax rate may fluctuate because of variability in geographic mix of earnings, changes

in statutory rates, and taxes associated with repatriation of non-U.S. earnings. Future weakness in the global economy and failure to manage these risks could adversely affect our results of operations, financial condition and cash flows in future

periods.

Market conditions, as well as global and regional economic downturns that adversely affect the demand for the end-use products that

contain TiO2, fluoroproducts or our other products, could adversely affect the profitability of our operations and the prices at which we can sell our products, negatively impacting our

financial results.

Our revenue and profitability is largely dependent on the TiO2 industry and the industries that are end users of our fluoroproducts. TiO2 and our fluoroproducts, such as refrigerants and resins, are used

in many “quality of life” products for which demand historically has been linked to global, regional and local GDP and discretionary spending, which can be negatively impacted by regional and world events or economic conditions. Such

events are likely to cause a decrease in demand for our products and, as a result, may have an adverse effect on our results of operations and financial condition. The future profitability of our operations, and cash flows generated by those