UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form

(Amendment No.1)

(Mark One)

| ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |

| For the Fiscal Year Ended |

or

| TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission File No.

(Exact name of registrant as specified in its charter)

| (State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification Number) |

| | | |

| | ||

| (Address of principal executive offices) | | (Zip Code) |

(

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol | Name of each exchange on which registered |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if

the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Indicate by check mark if

the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨

Indicate by check mark whether

the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of

1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has

been subject to such filing requirements for the past 90 days.

Indicate by check mark whether

the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation

S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit

such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of "large accelerated filer," "accelerated filer," "smaller reporting company," and "emerging growth company" in Rule 12b-2 of the Exchange Act.

| x | Accelerated filer | ¨ | Non-accelerated filer | ☐ | Smaller reporting company | ||

| | | | | | | Emerging growth company |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Indicate by check mark whether

the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control

over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting

firm that prepared or issued its audit report.

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ¨

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ¨

Indicate by check mark whether

the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes

The aggregate market value

of the shares of Black Knight, Inc. common stock held by non-affiliates of the registrant as of June 30, 2022 was $

As of March 13, 2023, there were shares of Black Knight, Inc. common stock outstanding.

EXPLANATORY NOTE

Except for the changes to Part III and the filing of related certifications added to the list of Exhibits in Part IV, this Amendment makes no changes to the Form 10-K. This Amendment does not reflect events occurring after the filing of the Form 10-K or modify disclosures affected by subsequent events. Terms used but not otherwise defined in the Amendment have such meaning as ascribed to them in the Form 10-K.

Except where otherwise noted, all references to “we,” “us,” “our”, the “Company” or “Black Knight” are to Black Knight, Inc. and its subsidiaries.

2

BLACK KNIGHT, INC.

FORM 10-K/A

TABLE OF CONTENTS

3

PART III

| Item 10. | DIRECTORS AND OFFICERS OF THE REGISTRANT |

Certain Information about our Directors

Certain biographical information for our directors is below.

| Name | Position with Black Knight | Age | ||

| Anthony M. Jabbour | Executive Chairman | 55 | ||

| Catherine L. Burke | Member of the Corporate Governance and Nominating Committee | 47 | ||

| Thomas M. Hagerty* |

Lead Independent Director Chairman of the Compensation Committee Member of the Corporate Governance and Nominating Committee |

60 | ||

| David K. Hunt |

Chairman of the Corporate Governance and Nominating Committee Member of the Compensation Committee Member of the Risk Committee |

77 | ||

| Joseph M. Otting | Chairman of the Audit Committee | 65 | ||

| Ganesh B. Rao | Member of the Risk Committee | 46 | ||

| John D. Rood |

Chairman of the Risk Committee Member of the Audit Committee |

68 | ||

| Nancy L. Shanik | Member of the Audit Committee | 68 |

*As previously announced, Thomas M. Hagerty will retire at the end of his term at the Company’s 2023 Annual Meeting of Shareholders.

Anthony M. Jabbour has served as our Executive Chairman since June 2021 and as a director since April 2018. Mr. Jabbour served as our Chief Executive Officer from April 2018 until May 2022. Mr. Jabbour has served as the Chief Executive Officer and a director of Dun & Bradstreet Holdings, Inc. (DNB) since February 2019. He also serves on the board of Paysafe Ltd. Prior to joining Black Knight, Mr. Jabbour served as Corporate Executive Vice President and Co-Chief Operating Officer of Fidelity National Information Services, Inc. (FIS) from December 2015 through December 2017.

Mr. Jabbour served as Corporate Executive Vice President of the Integrated Financial Solutions segment of FIS from February 2015 until December 2015. He served as Executive Vice President of the North America Financial Institutions division of FIS from February 2011 to February 2015. Prior to that, Mr. Jabbour held positions of increasing responsibility in operations and delivery from the time he joined FIS in 2004. Prior to joining FIS, Mr. Jabbour worked for Canadian Imperial Bank of Commerce and for IBM’s Global Services group managing complex client projects and relationships.

Mr. Jabbour’s qualifications to serve on the Black Knight board of directors include his extensive experience in leadership roles with financial services and technology companies, resulting in his deep knowledge of our business and industry, as well as his strong leadership abilities.

Catherine (Katie) L. Burke has served on the board of Black Knight since October 2020. Ms. Burke is global Vice Chairman and Chief Corporate Strategy Officer at DJE Holdings, a portfolio of companies and divisions that provide communications, marketing, public affairs, government affairs, data and analytics, and advisory services across a variety of sectors and geographies. Mrs. Burke first joined Edelman – a division of DJE Holdings – in 2008 and served in a variety of roles at the firm including President, Practices and Sectors, Global Chairman of Public Affairs and Global Chief of Staff. Between 2015 and 2018 Mrs. Burke served as Executive Vice President of Marketing and Communications at Nielsen Holdings, Inc. and founded and managed a communications firm, Katie Burke Communications, until she returned to Edelman in 2018. She also serves as a director of NCR Corporation.

4

Ms. Burke’s qualifications include her extensive experience and senior leadership roles in marketing, communications strategy and execution, and operations; her domestic and international experience in these areas; her financial literacy; and her independence.

Thomas M. Hagerty has served on the board of Black Knight and its predecessors since January 2014. Mr. Hagerty is a Managing Director of Thomas H. Lee Partners, L.P. (THL), which he joined in 1988. Mr. Hagerty currently serves as a director of Fidelity National Financial, Inc. (FNF), FleetCor Technologies, Ceridian HCM Holding, Inc. and DNB. Mr. Hagerty formerly served on the boards of First Bancorp, MoneyGram International, FIS and Foley Trasimene Acquisition Corp.

Mr. Hagerty’s qualifications to serve on our board of directors include his managerial and strategic expertise working with large growth-oriented companies as a Managing Director of THL, a leading private equity firm, and his experience in enhancing value at such companies, along with his expertise in corporate finance and as a long-time director of public companies. He also has a strong background in the mortgage industry from serving as a long-time director of FNF and a deep knowledge of our business gained from serving on our board and the board of FIS.

David K. Hunt has served on the board of directors of Black Knight and its predecessors since April 2014. In addition, Mr. Hunt served as a director of FIS from June 2001 until May 2020 and served as a director of Lender Processing Services, Inc. (LPS) from February 2010 until January 2014, when LPS was acquired by FNF. Since December 2005, Mr. Hunt has been a private investor.

Mr. Hunt’s qualifications to serve on our board of directors include his long familiarity with our business and industry that he acquired as a director of LPS and FIS, as well as Mr. Hunt’s prior service as chairman of LPS’ risk and compliance committee and his deep understanding of the regulatory environment and other challenges facing our industry.

Joseph M. Otting has served on the board of Black Knight since June 2020. Mr. Otting is the former Comptroller of the Currency, a position for which he was nominated in June 2017, confirmed by the U.S. Senate and sworn in during November 2017, and in which Mr. Otting served until May 29, 2020. Mr. Otting also served as Acting Director of the Federal Housing Finance Agency, which oversees the government-sponsored enterprises Freddie Mac and Fannie Mae, from January 2020 through April 2020. Mr. Otting served as President, Chief Executive Officer, and a director of OneWest Bank, N.A. from October 2010 until August 2015, at which time OneWest Bank was merged with CIT Group. Mr. Otting served as President of CIT Bank and Co- President of CIT Group from August 2015 to December 2015. Prior to joining OneWest Bank, Mr. Otting served in various roles at U.S. Bank, a subsidiary of U.S. Bancorp, including as one of eight Vice Chairmen and as the head of the Commercial Banking Group. Mr. Otting also serves as a director of Blockchain.com Inc.

Mr. Otting’s qualifications to serve on our board of directors include his strong understanding of the risks, regulatory environment, and other challenges facing our business and industry that he gained as Comptroller of the Currency, his understanding of our clients that he gained in various leadership roles with OneWest Bank, CIT Group and U.S. Bank, and his experience running a complex and highly regulated business organization.

Ganesh B. Rao has served on the board of Black Knight and its predecessors since January 2014. Mr. Rao is a Managing Director of THL, which he joined in 2000. Prior to joining THL, Mr. Rao worked at Morgan Stanley & Co. Incorporated in the Mergers & Acquisitions Department. Mr. Rao also worked at Greenlight Capital, a hedge fund. Mr. Rao is currently a director of DNB and Ceridian HCM Holding, Inc. In his capacity as Managing Director of THL, Mr. Rao also serves on the boards of the following privately held companies: AbacusNext, AmeriLife Group, Auction.com, Carpe Data, Hexure, Hightower Advisors, Insurance Technologies Corporation, Nextech, Odessa and as a board observer of Guaranteed Rate. Mr. Rao is a former director of Comdata, MoneyGram International, Inc. and Nielsen Holdings N.V.

Mr. Rao’s qualifications to serve on our board of directors include his managerial and strategic expertise working with large growth-oriented companies as a Managing Director of THL, and his experience with enhancing value at such companies, along with his expertise in corporate finance.

5

John D. Rood has served on the board of Black Knight and its predecessors since January 2014. Mr. Rood is the founder and Chairman of The Vestcor Companies, a real estate firm with more than 30 years of experience in multifamily development and investment. Mr. Rood also serves on the boards of FNF and F&G Annuities & Life, Inc. From 2004 to 2007, Mr. Rood served as the US Ambassador to the Commonwealth of the Bahamas. Mr. Rood previously served on the board of Alico, Inc., and currently serves on several private boards. In 1999, he was appointed by Governor Jeb Bush to serve on the Florida Fish and Wildlife Commission where he served until 2004. He was appointed by Governor Charlie Crist to the Florida Board of Governors, which oversees the State of Florida University System, where he served until 2013. Mr. Rood was appointed by Mayor Lenny Curry to the JAXPORT Board of Directors, where he served from October 2015 to July 2016. Governor Rick Scott appointed Mr. Rood to the Florida Prepaid College Board in July 2016, where he serves as Chairman of the Board. Mr. Rood served on the Enterprise Florida and Space Coast Florida board of directors from September 2016 until February 2019.

Mr. Rood’s qualifications to serve on our board of directors include his experience in the real estate industry, his leadership experience as a United States Ambassador, his financial literacy and his experience as a director on boards of both public and private companies. Mr. Rood has participated in numerous risk and audit training programs with KPMG, Booz Allen and the National Association of Corporate Directors, or NACD. He is a Board Leadership Fellow with NACD.

Nancy L. Shanik is a private investor and has served on our board since December 2019. Ms. Shanik served as Chief Risk Officer of Citizens Financial Group, Inc. from November 2010 until April 2016, where she oversaw the risk management organization within Citizens. Prior to joining Citizens, Ms. Shanik served as a Managing Director of Alvarez & Marsal, a professional services firm focused on turnaround management, corporate restructuring and operational performance improvement, from 2009 to 2010. Prior to that, Ms. Shanik spent 31 years with Citigroup Inc. where she was both a Managing Director and Senior Credit Officer and served as the Chief Credit Officer of Citigroup Inc.’s Global Commercial Markets business. Ms. Shanik also serves on the board of directors of RBC US Group Holdings, which owns the U.S. operations of the Royal Bank of Canada. She also serves on the board of directors of City National Bank, which is a subsidiary of the Royal Bank of Canada.

Ms. Shanik’s qualifications to serve on our board of directors include her strong background in the financial services industry and oversight of risk enterprise management for a complex and highly regulated business organization, resulting in her deep understanding of the risks, regulatory environment and other challenges facing our business and industry.

Certain Information about our Executive Officers

The executive officers of the Company are set forth in the table below, together with biographical information, except for our Executive Chairman Mr. Jabbour, whose biographical information is included in this Annual Report on Form 10-K/A under the section titled “Certain Information about our Directors.”

| Name | Position with Black Knight | Age | ||

| Anthony M. Jabbour | Executive Chairman | 55 | ||

| Joseph M. Nackashi | Chief Executive Officer | 59 | ||

| Kirk T. Larsen | President and Chief Financial Officer | 51 | ||

| Michael L. Gravelle | Executive Vice President and General Counsel | 61 |

Joseph M. Nackashi has served as Chief Executive Officer since May 2022. He previously served as our President from July 2017 until May 2022. Mr. Nackashi served as President of our Servicing Software division from January 2014 until July 2017 and as our Chief Information Officer from January 2014 until June 2015. Mr. Nackashi previously served as Executive Vice President and Chief Information Officer of LPS from July 2008 until LPS was acquired by FNF in January 2014.

Kirk T. Larsen has served as our President since May 2022 and as our Chief Financial Officer since January 2014. From January 2014 to April 2015, Mr. Larsen also served as Executive Vice President and Chief Financial Officer of ServiceLink, LLC, a national provider of loan transaction services to the mortgage industry. Prior to joining Black Knight, Mr. Larsen served as the Corporate Executive Vice President, Finance and Treasurer of FIS from July 2013 until December 2013 and as Senior Vice President and Treasurer from October 2009 until July 2013.

6

Michael L. Gravelle has served as the Executive Vice President and General Counsel of Black Knight and its predecessors since January 2014 and served as Corporate Secretary of Black Knight from January 2014 until May 2018. Mr. Gravelle has also served as Executive Vice President, General Counsel and Corporate Secretary of FNF since January 2010, and as Executive Vice President, General Counsel and Corporate Secretary of Cannae Holdings, Inc. (Cannae) since April 2017. Mr. Gravelle also served as General Counsel and Corporate Secretary of the following special purpose acquisition companies: Austerlitz Acquisition Corporation I (from December 2020 to January 2023), Austerlitz Acquisition Corporation II (from January 2021 to January 2023), Foley Trasimene Acquisition Corp. (from April 2020 to July 2021) and Foley Trasimene Acquisition Corp. II (from July 2020 to March 2021).

Code of Ethics and Business Conduct

Our board of directors has adopted a Code of Ethics for Senior Financial Officers, which is applicable to our Chief Executive Officer, our Chief Financial Officer (who also serves as our principal accounting officer) and our Corporate Controller, and a Code of Business Conduct and Ethics, which is applicable to all our directors, officers and employees. The purpose of these codes is to: (i) promote honest and ethical conduct, including the ethical handling of conflicts of interest; (ii) promote full, fair, accurate, timely and understandable disclosure; (iii) promote compliance with applicable laws and governmental rules and regulations; (iv) ensure the protection of our legitimate business interests, including corporate opportunities, assets and confidential information; and (v) deter wrongdoing. Our codes of ethics were adopted to reinvigorate and renew our commitment to our longstanding standards for ethical business practices. Our reputation for integrity is one of our most important assets and each of our employees and directors is expected to contribute to the care and preservation of that asset. Under our codes of ethics, an amendment to or a waiver or modification of any ethics policy applicable to our directors or executive officers must be disclosed to the extent required under SEC and/or NYSE rules. We intend to disclose any such amendment or waiver by posting it on the Investors page of our website at www.BlackKnightInc.com.

Copies of our Code of Business Conduct and Ethics and our Code of Ethics for Senior Financial Officers are available for review on the Investors page of our website at www.BlackKnightInc.com.

Audit Committee

We have a standing audit committee. The members of our audit committee are Joseph M. Otting (Chair), John D. Rood and Nancy L. Shanik. The board has determined that each of the audit committee members is financially literate and independent as required by the rules of the SEC and NYSE, and that each of Mr. Otting, Mr. Rood and Ms. Shanik is an audit committee financial expert, as defined by the rules of the SEC.

7

| Item 11. | EXECUTIVE COMPENSATION |

COMPENSATION DISCUSSION AND

ANALYSIS AND EXECUTIVE AND

DIRECTOR COMPENSATION

Compensation Discussion and Analysis

The following discussion and analysis of compensation arrangements should be read with the compensation tables and related disclosures that follow.

In this compensation discussion and analysis, we provide an overview of our approach to compensating our named executive officers in 2022, including the objectives of our compensation programs and the principles upon which our compensation programs and decisions are based. In 2022, our named executive officers were:

| · | Anthony M. Jabbour, Executive Chairman |

| · | Joseph M. Nackashi, Chief Executive Officer |

| · | Kirk T. Larsen, President and Chief Financial Officer |

| · | Michael L. Gravelle, Executive Vice President and General Counsel | |

| · | Michele M. Meyers, Chief Accounting Officer and Treasurer (until March 12, 2022) |

Executive Leadership Transition

During 2022, the following executive leadership transitions occurred effective May 16, 2022:

| · | Anthony M. Jabbour, our former Chief Executive Officer, transitioned from his role as CEO and assumed the role of Executive Chairman of our board of directors. | |

| · | Joseph M. Nackashi, our former President, assumed the role of CEO. | |

| · | Kirk T. Larsen, our Chief Financial Officer assumed the additional role of President. |

Merger with ICE

As we discussed in our Form 10-K, filed with the SEC on February 28, 2023, on May 4, 2022, we entered into a definitive agreement to be acquired by Intercontinental Exchange, Inc. (ICE) (the Merger Agreement) a leading global provider of data, technology, and market infrastructure, in a transaction valued at approximately $13.1 billion, or $85 per share, based on ICE’s 10-day volume weighted average price as of May 2, 2022 of $118.09, with consideration in the form of a mix of cash (80%) and stock (20%) (the ICE Merger). On March 7, 2023, we entered into Amendment No. 1 to the Merger Agreement (the Amendment), which provides for, among other things, a reduction in the merger consideration to $75.00 per share, with consideration in the form of a mix of approximately $68.00 per share in cash and stock with an exchange ratio of 0.0682 based on ICE’s 10-day VWAP as of March 3, 2023 of $102.62. In connection with the Amendment, ICE has also committed to litigate with the Federal Trade Commission, if necessary, to obtain approval of the ICE Merger. In connection with the ICE Merger and pursuant to the terms of the Merger Agreement, our compensation committee approved certain compensation decisions, including with respect to severance arrangements and compensation adjustments, as discussed further below.

8

Executive Summary

Our Company had a solid year in 2022, despite a very challenging time for the markets we serve. A rapid rise in interest rates caused operational challenges for our clients and prospects and a heightened focus on expenses by clients and prospects as well as the proposed ICE Merger have elongated the sales cycle in the short term. Market conditions have also resulted in elevated originator consolidation and bankruptcies, resulting in associated client attrition. In the face of that challenging market backdrop, our team remained focused and continued to execute against our strategic initiatives to deliver profitable growth over the long term.

Our financial results for 2022 demonstrated our high recurring revenue business model and resilience in a challenging market environment. While the operating environment has created some near-term headwinds to our financial performance, we remain positive about our long-term growth opportunities and are committed to creating value for all of our stakeholders.

Our sales results for 2022 reflect the value that lenders, servicers and other market participants see in our solutions. To that end, we signed 13 new MSP® loan servicing system clients, 29 new Empower® loan origination system (LOS) clients or additional channels to existing clients, and 129 new Optimal BlueSM product, pricing and eligibility (PPE) engine clients. We also had continued success in cross-selling solutions to our existing clients.

Recognizing the strategic importance of our acquisition of Optimal Blue, we completed the acquisition of the minority interests of Optimal Blue that were previously held by Cannae Holdings, Inc. (Cannae) and Thomas H. Lee Partners, L.P. (THL) on February 15, 2022. The transaction had a positive impact on our 2022 Adjusted earnings per share (EPS) and simplified our organizational structure with Optimal Blue as a wholly-owned subsidiary of Black Knight.

Looking ahead to 2023, we will continue to act with focus and urgency to execute on our long-term strategic initiatives to drive growth by signing new clients, cross-selling to existing clients and delivering innovative solutions.

9

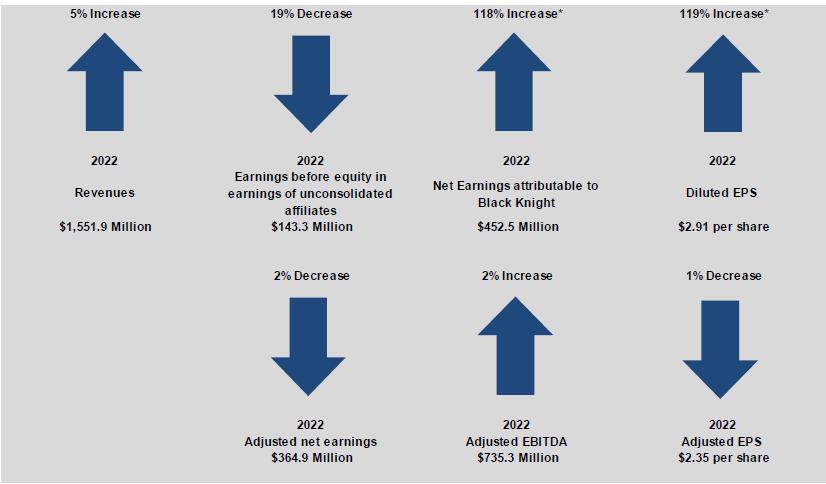

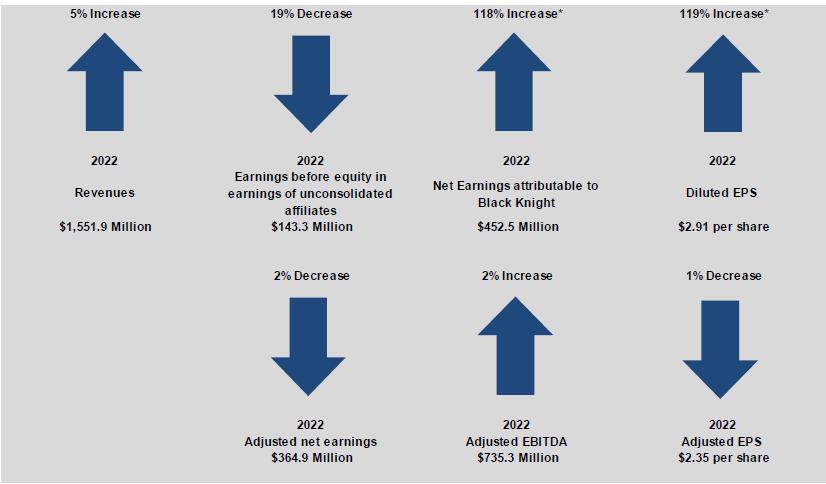

Financial Highlights

* In 2022, the effect of our investment in DNB was an increase in Net earnings attributable to Black Knight of $306.7 million, or $1.97 per diluted share, including a gain of $305.4 million, net of tax, or $1.96 per diluted share, recognized in the first quarter of 2022 as a result of the exchange of shares of DNB common stock as part of the consideration for acquiring the remaining 40% interest in Optimal Blue Holdco, LLC in February 2022, compared to an increase in Net earnings attributable to Black Knight of $2.6 million, or $0.02 per diluted share in 2021.

Adjusted revenues, Adjusted EBITDA, Adjusted net earnings and Adjusted EPS are non-GAAP financial measures. Please refer to "Non-GAAP Financial Measures" below for a reconciliation of these measures to the most directly comparable GAAP measures.

Our Compensation Programs are Driven by Our Business Objectives

Our compensation committee takes great care to develop and refine an executive compensation program that recognizes our stewardship responsibility to our shareholders while our talent strategy supports a culture of growth, innovation, and performance.

Our compensation committee believes it is important to reward our executives for strong performance in an industry with significant operational and regulatory challenges, and to incentivize them to deliver strong results for our investors by winning new clients, cross-selling to existing clients, innovating with urgency and executing acquisitions to further enhance our offerings.

At the same time, our compensation committee believes it is important to discourage our executives from taking unnecessary risks. The compensation committee believes that our compensation programs are structured to foster these goals.

10

We believe that our executive compensation programs are structured in a manner to support our Company and to achieve our business objectives. For 2022, our executive compensation approach was designed with the following goals:

| · | Sound Program Design. We designed our compensation programs to fit with our Company, our strategy and our culture. There are many facets and considerations that enter into this equation, some of which are discussed below in “—Compensation Best Practices.” Consequently, we aim to deliver a sound compensation program, reflecting a comprehensive set of data points and supporting our success. |

| · | Pay-for-Performance. We designed our compensation programs so that a substantial majority of our executives’ compensation is tied to our performance. We used pre-defined performance goals for our annual cash-incentives to make pay-for-performance the key driver of the cash compensation paid to our named executive officers. The performance measures used for our 2022 annual incentive plan are Adjusted revenues, Adjusted EBITDA, Adjusted EPS, Sales Annual Contract Value (ACV), and strategic risk management objectives. The financial performance measures we use are key components in the way we and our investors view our operating success and are highly transparent and objectively determinable. The committee includes the strategic risk management objective in our annual incentive plan because it is reflective of the priority our board places on our executives’ oversight and management of the risks facing our business, including those related to cybersecurity in particular. To complement the annual incentives, we used performance-based restricted stock awards in 2022. These grants tie executives to our shareholder return and our operating performance over the long-term. Our performance-based long-term incentives are linked to our executive stock ownership guidelines, where together the grants and the guidelines strongly promote long-term stock ownership and provide direct alignment with our shareholders. | |

| · | Competitiveness. Total compensation is intended to be competitive in order to attract, motivate and retain highly qualified and effective executives who can build shareholder value over the long-term. The level of pay our compensation committee sets for each named executive officer is influenced by the executive’s leadership abilities, scope of responsibilities, experience, effectiveness, and individual performance achievements, as well as a detailed assessment of the compensation paid by our peers. |

| · | Incentive Pay Balance. We believe the portion of total compensation contingent on performance should increase with an executive’s level of responsibility. Annual and long-term incentive compensation opportunities should reward the appropriate balance of short- and long-term financial and strategic business results. In the case of promotions, we use time-based restricted stock awards to bring our executives compensation to an acceptable range and to encourage retention. Our compensation committee believes long-term incentive compensation opportunities should significantly outweigh short-term cash-based opportunities. Annual objectives should be compatible with sustainable long-term performance. | |

| · | Investor Alignment and Risk Assumption. We place a strong emphasis on delivering long-term results for our investors and clients and discourage excessive risk taking by our executive officers. |

| · | Good Governance. Good compensation governance plays a prominent role in our approach to compensation. As discussed in the next section, our compensation committee reviews current trends in compensation governance and adopts policies that work for us. |

We believe it is important to deliver strong results for our investors and clients, and we believe our practice of linking compensation with corporate performance will help us to accomplish that goal.

11

Compensation Best Practices

We take a proactive approach to compensation governance. Our compensation committee regularly reviews our compensation programs and makes adjustments that it believes are in the best interests of the Company and our investors. As part of this process, our compensation committee reviews compensation trends and considers current best practices and makes changes in our compensation programs when the committee deems it appropriate, all with the goal of continually improving our approach to executive compensation. Our 2022 compensation programs include the following notable best practices:

| Things We Do: | |

| ✓ | Set a high ratio of performance-based compensation to total compensation, and a low ratio of non-performance-based compensation, including fixed benefits, perquisites and salary, to total compensation. |

| ✓ | Maintain aggressive stock ownership guidelines that are linked to a holding period requirement for executives and directors who have not met the guidelines. |

| ✓ | Clawback any overpayments of incentive-based or equity-based compensation that were attributable to restated financial results. |

| ✓ | Our compensation committee sets maximum levels payable under our annual incentives, and our equity incentive plan has a limited award pool. |

| ✓ | Our long-term equity incentive awards granted to our officers use a vesting schedule of at least three years, and awards granted under our omnibus incentive plan vest no sooner than one year after the grant date, except in the case of unanticipated, early vesting due to death, disability or a termination of employment in connection with a change in control, with a standard carveout for awards relating to no more than 5% of the plan’s share reserve. |

| ✓ | Generally, require achievement of a performance-based vesting goal in each year of the vesting term of our annual restricted stock awards to our officers. |

| ✓ | Dividends and dividend equivalents would be paid only on equity awards that vest. |

| ✓ | Limit perquisites. |

| ✓ | Our compensation committee uses an independent compensation consultant who reports solely to the compensation committee. |

| ✓ | The dilution rate from our equity-based incentive awards is well below industry average. |

| ✓ | Board compensation is below peer group average. |

| Things We Don’t Do: | |

| X | Provide tax gross-ups or reimbursement of taxes on perquisites. |

| X | Permit the repricing of stock options or any equivalent form of equity incentive. |

| X | Have multi-year guarantees for salary increases or guaranteed equity compensation in our executive employment agreements. |

| X | Employment agreements do not allow tax gross-ups for compensation paid due to a change of control and do not contain single trigger severance payment arrangements related to a change of control. |

| X | Supplemental executive retirement plans, executive pensions or excessive retirement benefits. |

12

2022 Shareholder Engagement

We are committed to hearing and responding to the views of our shareholders. In 2022, our officers met with investors on various occasions, both in group and one-on-one settings. The investors with whom we met in 2022 represented six of our top 15 shareholders, who collectively owned more than 27% of our shares as of December 31, 2022. At these meetings, our officers discuss a variety of topics, including our operational and stock performance, ESG, corporate governance and executive compensation matters. We report and discuss these meetings with our board or applicable board committees, as appropriate.

Overview of Our Compensation Programs

Principal Components of Compensation

We link a significant portion of each named executive officer’s total annual compensation to performance goals that are intended to deliver measurable results. Executives are generally rewarded only when and if the pre-established performance goals are met or exceeded. We also believe that material ownership stakes for executives assist in aligning executives’ interests with those of shareholders and strongly motivate executives to build long-term value. We structure our compensation programs to assist in creating this link. The principal components of our executive compensation program for 2022 were base salaries, annual cash incentives, and long-term performance-based equity incentive awards. In connection, with certain leadership transitions discussed below, we also granted time-based restricted stock awards to Messrs. Nackashi and Larsen under to our Amended and Rested 2015 Omnibus Incentive Plan (the Omnibus Incentive Plan). In connection with the ICE Merger, our compensation committee also approved certain compensation decisions, including with respect to fine-tuning certain provisions of our named executive officers’ employment agreements and accelerating discretionary bonus and 2022 annual cash incentive payments and the vesting of certain equity awards to mitigate the potential impact of Sections 280G and 4999 of the Internal Revenue Code on our executives and Black Knight.

13

The chart on the following page illustrates the principal elements of our named executive officer compensation program in 2022:

| Fixed Compensation | Short-Term Incentives | Long-Term Incentives | Benefits | |

| Base Salary | Annual

Cash Incentive |

Performance-based Restricted Stock |

Employee stock purchase plan; 401(k) plan and deferred compensation plan; and limited perquisites. | |

| Fixed cash component with annual merit increase opportunity based on responsibilities, individual performance results and other considerations. | Annual cash award for profitability, growth, operating strength and risk oversight during the year. | Annual restricted stock grants with service and performance-based vesting conditions tied to operating strength and efficiency. Our restricted stock awards also contain holding requirements tied to our stock ownership guidelines to promote significant long-term stock ownership. | ||

| Link

to Performance |

Link

to Performance |

Link

to Performance |

||

| Individual performance | Adjusted revenues, Adjusted EBITDA, Adjusted EPS, sales annual contract value and strategic risk management objectives | Adjusted EBITDA and shareholder return |

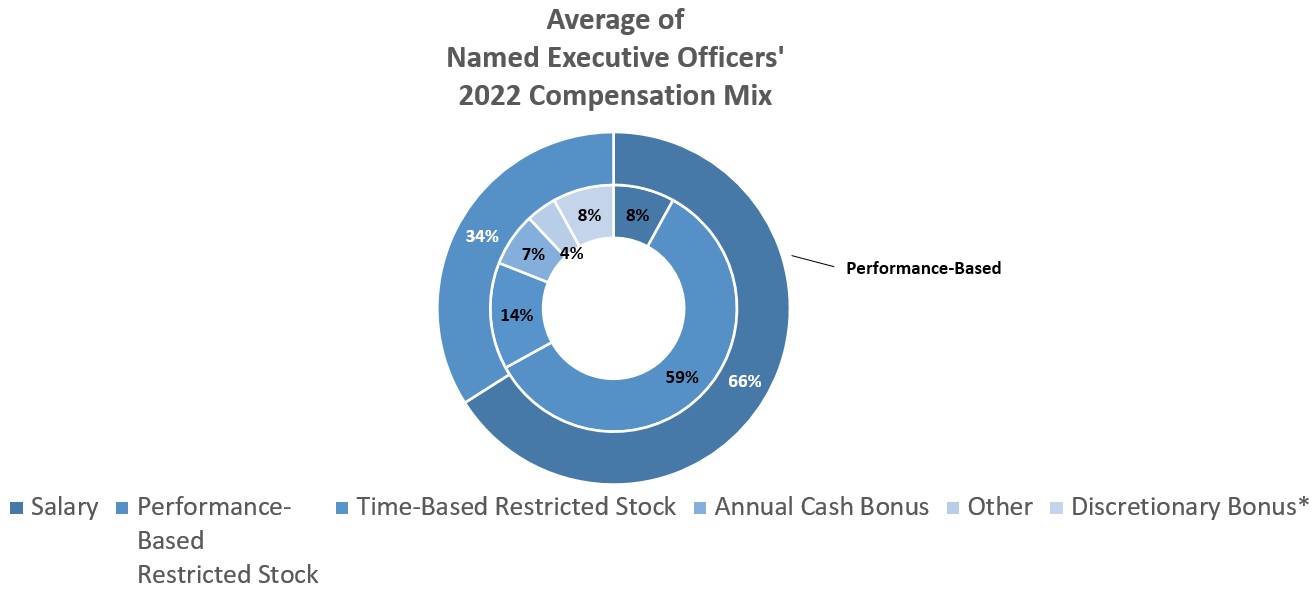

In 2022, our compensation committee placed heavy emphasis on the at-risk, performance-based components of performance-based cash incentives and performance-based equity incentive awards. The compensation committee determined the appropriate value of each component of compensation after considering each executive’s level of responsibility, the individual skills, experience and potential contribution of each executive, and the ability of each executive to impact Company-wide performance and create long-term value. As shown in the table on the following page, on average approximately 68% of total compensation of our named executive officers (other than Ms. Meyers, and excluding the one-time Discretionary Bonus paid to Mr. Jabbour in 2022 to mitigate the potential impact of Sections 280G and 4999 of the Internal Revenue Code on Mr. Jabbour and Black Knight) was based on performance-based incentives and benefits comprised less than 3% of total compensation. The compensation committee believes a significant portion of an executive officer’s compensation should be allocated to compensation that effectively aligns the interests of our executives with the long-term interests of our investors.

In particular, with respect to Mr. Nackashi, our compensation committee considered the increased responsibilities he would assume in connection with his transition from President to CEO, including the critical role he has played in the continued oversight and execution of our business strategy following the announcement of the ICE Merger. The committee also considered the below-market positioning of Mr. Nackashi’s base salary and determined to set his annual incentive at a higher level to drive performance and position his overall pay, including his long-term equity incentive, at an appropriate level. For Mr. Jabbour, the compensation committee considered the critical role he plays in our organization in shaping and providing continuity with respect to the Company’s strategic vision and his continued mentorship of Mr. Nackashi. For the last several years, Mr. Jabbour has led the execution of our strategic vision, including organically growing our software, data and analytics businesses with urgency through selling our products to new clients, cross-selling additional services to existing clients, and innovating through the development of new solutions and refining our current offerings to provide better insight to our clients, and selectively pursuing strategic acquisitions, while maintaining an efficient cost structure to create the most value for our shareholders. In 2022, Mr. Jabbour also played significant role in the negotiation of the ICE Merger, the value of which represents a 27% premium to our stock price on March 3, 2023 and a 27% premium to our stock price on April 4, 2022, the last date before the publication of news reports relating to a potential acquisition of Black Knight (in each case based upon a merger consideration value of $75 per share).

14

Allocation of Total Compensation for 2022

The following tables show the allocation of 2022 total compensation paid to our named executive officers as reported in the Summary Compensation Table below. The compensation committee believed this allocation to be appropriate after considering the factors described above, including the new roles and responsibilities of our executives and Mr. Jabbour’s significant role in executing on our growth strategies and negotiating a significant premium for our stockholders in connection with the ICE Merger.

| Name | Salary | Performance- Based Equity Incentives | Time-Based Equity Incentives | Annual Cash Incentive | Benefits & Other Compensation | Discretionary Bonus2 | Total Compensation | Performance- Based Compensation1 | ||||||||||||||||||||||||

| Anthony M. Jabbour | 1.2 | % | 14.9 | % | 0.0 | % | 1.2 | % | 1.2 | % | 81.5 | % | 100 | % | 16.1 | % | ||||||||||||||||

| Joseph M. Nackashi | 8.3 | % | 41.9 | % | 30.0 | % | 9.0 | % | 2.7 | % | 8.1 | % | 100 | % | 50.9 | % | ||||||||||||||||

| Kirk T. Larsen | 10.0 | % | 56.6 | % | 16.5 | % | 8.2 | % | 1.4 | % | 7.3 | % | 100 | % | 64.8 | % | ||||||||||||||||

| Michael L. Gravelle | 14.1 | % | 71.4 | % | 0.0 | % | 7.1 | % | 1.1 | % | 6.3 | % | 100 | % | 78.5 | % | ||||||||||||||||

| Michele M. Meyers | 86.6 | % | 0.0 | % | 0.0 | % | 0.0 | % | 13.4 | % | 0.0 | % | 100 | % | 0.0 | % | ||||||||||||||||

| 1. | Calculated from Total Compensation, less the amounts included in “Salary”, “Time-Based Equity Incentives”, “Discretionary Bonus,” and “Benefits and Other Compensation” | |

| 2. | Amounts include the amounts paid as annual performance-based cash incentives to Messrs. Jabbour, Nackashi, Larsen and Gravelle with respect to adjustments made to the performance results to account for the impact of the pending ICE Merger as described under the section titled “Annual Performance-Based Cash Incentive” below. With respect to Mr. Jabbour, the amount also includes a one-time $40,000,000 discretionary bonus paid with respect to the ICE Merger, which was paid in 2022 to mitigate the impact of Sections 280G and 4999 of the Internal Revenue Code following closing of the ICE Merger. |

The following table reflects the allocation of Mr. Jabbour’s 2022 total compensation excluding the impact of a one-time discretionary bonus paid to Mr. Jabbour in connection with the ICE Merger (the Discretionary Bonus). The Discretionary Bonus was paid after consideration of Mr. Jabbour’s significant contributions to the Company and the critical role he plays in our organization in shaping and providing continuity with respect to the Company’s strategic vision. The Discretionary Bonus, which is contingent upon the successful closing of the ICE Merger, was paid to Mr. Jabbour in December 2022 in connection with certain tax-planning actions to mitigate the potential impact of Sections 280G and 4999 of the Internal Revenue Code on Mr. Jabbour and Black Knight. In furtherance of the early payment of the Discretionary Bonus, the Company and Mr. Jabbour entered into a letter agreement that provides that (i) the after-tax proceeds of the Discretionary Bonus be placed into an escrow account, and (ii) if Mr. Jabbour is terminated by the Company for cause or Mr. Jabbour resigns his employment without good reason, in each case prior to consummation of the ICE Merger, or if the Merger Agreement is terminated without the consummation of the ICE Merger, Mr. Jabbour will be required to pay liquidated damages to Black Knight equal to the value of the after-tax proceeds of the Discretionary Bonus that would not have ultimately been paid absent the tax-planning actions described above (plus any tax refund he receives in respect of such payment).

| Name | Salary | Performance- Based Equity Incentives | Time-Based Equity Incentives | Annual Cash Incentive | Benefits & Other Compensation | Discretionary Bonus | Total Compensation | Performance- Based Compensation | ||||||||||||||||||||||||

| Anthony M. Jabbour | 5.9 | % | 73.7 | % | 0.0 | % | 5.9 | % | 5.6 | % | 8.8 | % | 100 | % | 79.6 | % | ||||||||||||||||

15

* Excludes Mr. Jabbour's Discretionary Bonus.

Analysis of Compensation Components

Note that the financial measures used as performance targets for our named executive officers described in this discussion are non-GAAP measures and differ from the comparable GAAP measures reported in our financial statements. We explain how we use these non-GAAP measures in our discussions about incentives below.

Base Salary

Base salaries reflect the fixed component of the compensation for an executive officer’s ongoing contribution to the operating performance of his or her area of responsibility. We provide our named executive officers with base salaries that are intended to provide them with a level of assured, regularly paid cash compensation that is competitive and reasonable.

Our compensation committee reviews salary levels annually as part of our performance review process, as well as in the event of promotions or other changes in our named executive officers’ positions or responsibilities. When establishing base salary levels, our compensation committee considered the peer compensation data provided by our independent compensation consultant, as well as a number of qualitative factors, including the named executive officer’s experience, knowledge, skills, level of responsibility and performance.

As discussed further below, Messrs. Nackashi’s and Larsen’s base salaries were adjusted in connection with the executive leadership transition.

Annual Performance-Based Cash Incentive

In 2022, we awarded annual cash incentive opportunities to each named executive officer. We use the annual incentives to provide a form of at risk, performance-based pay that is focused on achievement of critical, objectively measurable, financial objectives. These financial objectives are tied to our annual budget and our strategic planning process, which provide the basis for communicating our performance expectations to the investment community. It is reviewed in detail and approved by our board. Consistent with prior years, the 2022 annual cash incentives were conditioned upon the achievement of pre-defined objectives for fiscal year 2022, which were determined by our compensation committee. In 2022, 90% of our named executive officers’ target annual incentives were tied to four objective financial metrics, with the remaining 10% tied to strategic risk management objectives. The performance measures were formulaic, established by the compensation committee in writing in February 2022, and, as applicable, final payment amounts were derived from our audited and reported financial results. In setting the performance measures, the committee generally seeks to set targets that are higher than the prior year results. In May 2022, the compensation committee determined to increase Mr. Nackashi’s annual incentive target from 150% to 200% of his base salary in light of his increased responsibilities in connection with his transition to CEO and to encourage significant focus on execution of the Company’s strategic vision and operating performance.

16

Our annual cash incentives play an important role in our approach to total compensation. They motivate participants to work hard and proficiently toward improving our operating performance and achieving our business plan for a fiscal year. We believe that achieving our financial and risk objectives is a result of executing our business strategy, which is to drive growth by winning new clients, cross-selling to existing clients and innovating with urgency to further enhance our offerings, while successfully managing the financial and strategic risks of our business. The execution of our business strategy is important to delivering long-term value for our stakeholders. In addition, the annual cash incentive program helps to attract and retain a highly qualified workforce and to maintain a market competitive compensation program.

In the first quarter of 2022, our compensation committee approved the 2022 performance objectives and a target incentive opportunity for our named executive officers as well as the potential incentive opportunity range for threshold and maximum performance. No annual incentive payments were payable to an executive officer if the pre-established, threshold performance levels were not met, and payments were capped at the maximum performance payout level. The compensation committee had the authority to reduce (but not increase) an executive’s annual incentive award, and the annual incentive awards are subject to recoupment under our clawback policy.

The amount of the annual incentives actually paid depends on the level of achievement of the pre-established goals as follows:

| · | If threshold performance is not achieved, no incentive will be paid. |

| · | If threshold performance is achieved, the incentive payout will equal 50% of the executive officer’s target incentive opportunity. |

| · | If target performance is achieved, the incentive payout will equal 100% of the target incentive opportunity for Mr. Gravelle; and 150% for Mr. Larsen, and 200% for each of Messrs. Jabbour and Nackashi. |

| · | If maximum performance is achieved, the incentive payout will equal 200% of the executive officer’s target incentive opportunity, except for Mr. Jabbour whose 2022 maximum incentive opportunity was equal to 300% of his target incentive opportunity. |

| · | Between these levels, the payout is prorated. |

Threshold performance levels were established to challenge our executive officers. Maximum performance levels were established to limit annual incentive awards so as to avoid excessive compensation while encouraging executives to reach for performance beyond the target levels. An important tenet of our pay for performance philosophy is to utilize our compensation programs to motivate our executives to achieve performance levels that reach beyond what is expected of us as a company.

17

Target performance levels are intended to be difficult to achieve, but not unrealistic. The performance targets were based on discussions between management and our compensation committee. In setting 2022 performance metrics, our compensation committee considered our 2022 financial plan and sales pipeline, management’s continued focus on managing risk, and prior year performance.

The 2022 financial performance metrics and weightings were consistent with the 2021 financial performance metrics and weightings except Sales Contract Value was replaced with Sales Annual Contract Value (Sales ACV). These performance metrics are among the most important measures in evaluating the financial performance of our business, and they can have a significant effect on long-term value creation and the investment community’s expectations. In the following table, we explain how we calculate or assess the financial performance measures and why we use them.

| Performance Measure |

Weight | How Calculated | Reason for Use |

| Adjusted revenues |

20% | We define Adjusted revenues as Revenues adjusted to include the revenues that we did not record during the respective period due to the deferred revenue purchase accounting adjustment recorded in accordance with GAAP. We also exclude the effect of in-year acquisitions and divestitures and the market and/or legislative effect on origination and foreclosure volumes. | Adjusted revenues is an important measure of our performance as it reflects the execution of our growth strategy. Adjusted revenues is widely followed by the investment community. |

| Adjusted EBITDA |

20% | We define Adjusted EBITDA as Net earnings attributable to Black Knight, with adjustments to reflect the addition or elimination of certain statement of earnings items including, but not limited to (i) Depreciation and amortization; (ii) Impairment charges; (iii) Interest expense, net; (iv) Income tax expense; (v) Other (income) expense, net; (vi) Equity in (earnings) losses of unconsolidated affiliates, net of tax; (vii) (Gains) losses on sale of investments in unconsolidated affiliate, net of tax; (viii) Net earnings (losses) attributable to redeemable noncontrolling interests; (ix) deferred revenue purchase accounting adjustment; (x) equity-based compensation, including certain related payroll taxes; (xi) acquisition-related costs, including costs pursuant to purchase agreements; (xii) costs related to the ICE Transaction; and (xiii) costs associated with expense reduction initiatives. We also exclude the effect of in-year acquisitions and divestitures and the market and/or legislative effect on origination and foreclosure volumes. | Adjusted EBITDA is an important measure of our performance as it reflects growth and operational efficiency. Adjusted EBITDA is a common basis for enterprise valuation and widely followed by the investment community. |

| Adjusted EPS | 20% | We define Adjusted EPS as Adjusted net earnings divided by the diluted weighted average shares of common stock outstanding. Adjusted net earnings is defined as Net earnings attributable to Black Knight, with adjustments to reflect the addition or elimination of certain statement of earnings items including, but not limited to: (i) equity in (earnings) losses of unconsolidated affiliates, net of tax; (ii) (gains) losses on sale of investments in unconsolidated affiliate, net of tax; (iii) the net incremental depreciation and amortization adjustments associated with the application of purchase accounting; (iv) deferred revenue purchase accounting adjustment; (v) equity-based compensation, including certain related payroll taxes; (vi) costs associated with debt and/ or equity offerings; (vii) acquisition-related costs, including costs pursuant to purchase agreements; (viii) costs related to the ICE Transaction; (ix) costs associated with expense reduction initiatives; (x) costs and settlement (gains) losses associated with significant legal matters; (x) adjustment for income tax expense primarily related to the tax effect of non-GAAP adjustments and a discrete income tax benefit related to the establishment of a deferred tax asset as a result of our reorganization of certain wholly-owned subsidiaries; and (xi) adjustment for redeemable non-controlling interests primarily related to the effect of the non-GAAP adjustments. We also exclude the effect of in-year acquisitions and divestitures and the market and/or legislative effect on origination and foreclosure volumes. | Adjusted EPS is an important measure of our performance as it reflects growth and profitability as well as the effectiveness of our capital allocation. Adjusted EPS is a common basis for equity valuation and widely followed by the investment community. |

18

| Sales ACV | 30% | We define Sales ACV as the total annualized value of a contract. ACV is calculated by taking the total incremental revenue from a new client contract and dividing it by the number of years in the term of such contract. An assumed term of three years is used for contracts that do not have a specified term. ACV for transactional service contracts without minimums is estimated using conservative pro forma models based on historical usage rates. ACV excludes professional services deals unless it’s a net new dedicated team under contract for at least 12 months or an implementation fee that will be recognized over the life of a software contract. | Sales ACV is an important measure of our performance as it is a driver of future revenue growth. It rewards management for success at selling new products and services to our clients and gaining new clients. We believe this performance measure is a tangible indication of how well our executives’ immediate efforts will grow and impact Adjusted revenues, Adjusted EBITDA and Adjusted EPS in future years. |

Adjusted revenues, Adjusted EBITDA, and Adjusted EPS are non-GAAP financial measures that we believe are useful to investors in evaluating our overall financial performance. We believe these measures provide useful information about operating results and profitability, enhance the overall understanding of past financial performance and future prospects and allow for greater transparency with respect to key metrics used by management in its financial and operational decision making.

Final calculations of our achievement of the performance measures are subject to certain adjustments as described above, including the effect of in-year acquisitions and divestitures and the market and/or legislative effect on origination and foreclosure volumes. These adjustments encourage our executives to focus on achieving strong financial performance and efficient operation of our continuing businesses during the year to achieve the performance measures. The adjustments also ensure that the achievement of the performance measures, as determined by the compensation committee at the end of the performance period, correlate with the budget and thereby serve as barometers of management’s performance in growing our business and operating the business effectively and efficiently irrespective of impacts, positive or negative, of legislative or market influences. The adjustments also encourage our executives to focus on the long-term benefit of acquisitions or divestitures regardless of whether they may have a positive or negative impact on our Adjusted revenues, Adjusted EBITDA or Adjusted EPS in the current year.

Since 2018, our named executive officer’s annual incentives have also included a qualitative risk-based performance criteria, reflecting the importance our board places on management’s actions to manage and mitigate risk across Black Knight. To emphasize the significance of cybersecurity risk and other risks to our organization and to focus our executives on effectively managing these risks, the committee determined to once again tie 10% of our executives’ annual incentive awards to the achievement of the Company’s risk objectives for 2022. The maximum payout for achievement of the risk objectives is 100%, although the compensation committee may determine that the objective has been achieved at a level below 100%.

Set forth below are the relative percentage weights of the 2022 performance metrics, the threshold, target and maximum performance levels for each performance metric and 2022 performance results. In February 2022, our compensation committee set the target levels for Adjusted revenues, Adjusted EBITDA and Adjusted EPS targets for the 2022 incentives based on our 2022 financial plan, reflecting the committee’s commitment to using rigorous goals that incentivize and reward continued growth in these important measures. In February 2023, after consideration of the impact of the proposed ICE Merger on the achievement of the financial performance metrics under the annual incentive plan (as permitted by the Merger Agreement), including $7.7 million of Adjusted revenues, $11.7 million of Adjusted EBITDA, $0.09 of Adjusted EPS and $15.7 million of Sales ACV, the committee determined to make adjustments to the achievement of the performance results to account for the impact of the pending ICE Merger. For information on the ranges of possible annual incentive payments, see “—Grants of Plan Based Awards” under the column “Estimated Possible Payouts Under Non-Equity Incentive Plan Awards.” Dollar amounts are in millions.

19

| Performance Metric | Weight | Threshold | Target | Maximum | Performance Result Under Plan1 | Payout Factor Under Plan2 | Performance Result after Adjustment for Impact of ICE Merger3 | Payout Factor after Adjustment for Impact of ICE Merger2 | ||||||||||||||||||||||||

| Adjusted Revenues | 20 | % | $ | 1,570.0 | $ | 1,602.0 | $ | 1,618.0 | $ | 1,577.1 | 61 | % | $ | 1,584.8 | 73 | % | ||||||||||||||||

| Adjusted EBITDA | 20 | % | $ | 768.6 | $ | 794.0 | $ | 806.7 | $ | 758.0 | 0 | % | $ | 769.7 | 52 | % | ||||||||||||||||

| Adjusted EPS | 20 | % | $ | 2.56 | $ | 2.68 | $ | 2.74 | $ | 2.46 | 0 | % | $ | 2.55 | 0 | % | ||||||||||||||||

| Sales ACV | 30 | % | $ | 112.5 | $ | 125.0 | $ | 137.5 | $ | 123.3 | 93 | % | $ | 139.0 | 200 | % | ||||||||||||||||

| Strategic Risk Management Objectives4 | 10 | % | – | – | – | Achieved | 100 | % | 100 | % | ||||||||||||||||||||||

| 1. | Includes $25.2 million of Adjusted revenues, $22.7 million of Adjusted EBITDA, and $0.11 of Adjusted EPS related to legislative and market effect on origination and default volumes, as permitted under the 2022 annual incentive plan. |

| 2. | Payout factor reflects a target payout at 100% of the executives target incentive and a maximum payout of 200% of executive’s target incentive, except for Mr. Jabbour whose maximum payout is 300% of his target incentive. |

| 3. | In addition to the adjustments described in footnote 1 above, includes $7.7 million of Adjusted revenues, $11.7 million of Adjusted EBITDA, $0.09 of Adjusted EPS and $15.7 million of Sales ACV related to the estimated impact of the ICE Merger. |

| 4. | The compensation committee determined that the Company had achieved its risk management objectives based upon a report provided by our risk committee on the management of the Company’s overall risk profile and various risk-related achievements in 2022. |

The table below shows each named executive officer’s 2022 target incentive opportunity, and the annual incentive amounts actually paid with respect to 2022 performance and following adjustment for the impact of the ICE Merger. Performance was achieved at 50.2% of each executive’s target incentive opportunity under the annual incentive plan, and at 95.1% of Messrs. Nackashi’s, Larsen’s and Gravelle’s respective target incentive opportunities and 125.1% of Mr. Jabbour’s target incentive opportunity in each case following adjustment for the impact of the pending ICE Merger. Ms. Meyers’ 2022 annual incentive bonus was forfeited due to her departing the Company on March 12, 2022.

| Name | 2022 Base | 2022 Incentive | 2022 Incentive Pay Target | Performance Multiplier Under Plan | 2022

Total Incentive Earned Under Plan | Performance

Multiplier after Adjustment for Impact of ICE Merger | 2022

Total Incentive Earned after Adjustment for Impact of ICE Merger | |||||||||||||||||||||

| Anthony M. Jabbour | $ | 600,000 | 200 | % | $ | 1,200,000 | 50.2 | % | $ | 602,145 | 125.1 | % | $ | 1,500,602 | ||||||||||||||

| Joseph M. Nackashi | $ | 750,000 | 200 | % | $ | 1,500,000 | 50.2 | % | $ | 752,681 | 95.1 | % | $ | 1,425,753 | ||||||||||||||

| Kirk T. Larsen | $ | 575,000 | 150 | % | $ | 862,500 | 50.2 | % | $ | 432,792 | 95.1 | % | $ | 819,808 | ||||||||||||||

| Michael L. Gravelle | $ | 148,000 | 100 | % | $ | 148,000 | 50.2 | % | $ | 74,265 | 95.1 | % | $ | 140,674 | ||||||||||||||

| Michele M. Meyers | $ | 270,000 | 50 | % | $ | 135,000 | – | – | – | – | ||||||||||||||||||

On December 20, 2022, to mitigate the potential impact of Sections 280G and 4999 of the Internal Revenue Code, the compensation committee determined that the each of Messrs. Jabbour, Nackashi, Larsen and Gravelle would receive a 2022 annual cash incentive award equal to 75.0% of his target incentive opportunity, with such payment to be made no later than December 30, 2022. Subsequently, in February 2023, after consideration of the Company’s achievement of the performance metric objectives under the annual incentive plan, including adjustments for the impact of the pending ICE Merger, the Committee determined to that each executive would receive a supplemental annual cash incentive award equal to the difference between 95.1% (125.1% for Mr. Jabbour) of the executive’s target incentive opportunity and the 75% of the target incentive opportunity paid in December 2022.

20

Long-term Equity Incentives

Performance-based Restricted Stock

We typically approve our long-term equity incentive awards during the first quarter as the compensation committee sets our compensation strategy for the year. In March 2022, we used the Omnibus Incentive Plan to grant long-term incentive awards to our executive officers in the form of performance-based restricted stock, with both performance and service vesting requirements. The performance-based awards granted in 2022 vest over three years based on continued employment with us. The performance vesting requirements must be met before the time-based vesting would apply.

For the performance-based vesting requirements, in response to feedback received from our shareholders in 2019, our compensation committee determined to include three annual performance periods for the 2022 performance-based restricted stock awards. The first 1/3 of the award would vest only if the Company achieved Adjusted EBITDA of at least $724.2 million in 2022 (which was the 2021 Adjusted EBITDA); the second 1/3 of the award will vest only if the Company achieves Adjusted EBITDA in 2023 at least equal to the Adjusted EBITDA achieved in 2022; and the third 1/3 will vest only if the Company achieves Adjusted EBITDA in 2024 at least equal to the Adjusted EBITDA achieved in 2023. If we do not achieve the performance metric in any year, the portion of the award that was subject to achievement of that metric will be forfeited. In other words, there is no “catch-up” to allow a portion of an award to vest in a subsequent year if we fail to achieve the performance metric applicable to that year. We achieved Adjusted EBITDA of $758.0 million for the fiscal year 2022 performance period, including adjustments to exclude the negative effect of budgeted origination, foreclosure and bankruptcy volumes that were higher than actual volumes during 2022. For the time-based vesting requirements, 1/3 would vest per year and shall vest ratably on each of the first three anniversaries of the grant date, subject to the Company’s achievement of the applicable adjusted EBITDA targets.

For 2022, Mr. Gravelle’s 2022 long-term incentive award was increased from $675,000 to $750,000. Ms. Meyers did not receive a long-term incentive award in 2022 due to her departing the Company on March 12, 2022.

In setting the performance target for our long-term incentive awards, our compensation committee seeks to set a goal for our executives that requires them to achieve results that are better than the prior year. However, due to the importance of these awards in the retention of our executives and the design of our long-term incentives so that the entire award is forfeited if the performance target is not achieved, the committee does not set the performance target at a level that it considers to be a stretch for our executives. The committee’s approach in this respect is different than its approach in setting the goals for our annual cash-based incentive, where the committee sets the minimum, target and maximum performance targets at levels that are intended to drive superior performance by our executives. Furthermore, after the restricted shares have vested and if those shares have not otherwise satisfied the executive stock ownership guidelines, Section 16 officers are required to hold 50% of the vested shares for 6 months.

The awards were designed with a primary objective of creating a long-term retention incentive, the value of which is tied to our stock price performance, and a secondary objective of requiring that management achieve Adjusted EBITDA results during each year of the award that are equal to or better than the prior year performance.

We selected Adjusted EBITDA because it is one of the most important measures in evaluating the combination of growth and operational efficiency. It also reflects our ability to convert revenue into operating profits for shareholders and our progress toward achieving our long-term strategy. It is a key measure used by investors and has a significant effect on our long-term stock price. For our performance-based restricted stock, Adjusted EBITDA is calculated as noted above under “Annual Performance-based Cash Incentive,” including adjustments for the effect of in-year acquisitions and divestitures and the market and/or legislative effect on origination and foreclosure volumes.

21

To the extent we were to pay dividends on our shares, credit for such dividends would be provided on unvested shares, but payment of those dividends would be subject to the same vesting requirements as the underlying shares—in other words, if the underlying shares do not vest, the dividends are forfeited. We have not paid any cash dividends to date and have no current plans to pay any cash dividends for the foreseeable future.

One-Time Restricted Stock Awards

As discussed further below, in connection with the executive leadership transition, on May 16, 2022, our compensation committee approved the grant of supplemental time-based restricted stock awards under the Omnibus Incentive Plan to each of Messrs. Nackashi and Larsen with grant date fair values of $2,500,000 and $875,000 respectively, in each case with an effective date of grant of May 16, 2022 and 1/3 of which would vest on each of the first three anniversaries of the grant date.

Impact of ICE Merger on Outstanding Equity

Pursuant to the Merger Agreement with ICE, at the effective time of Closing of the ICE Merger each outstanding Black Knight restricted stock award, including those held by our named executive officers, will be automatically assumed and converted into a restricted stock award of ICE common stock based on the exchange ratio (as defined in the Merger Agreement), and will be subject to the same terms and conditions previously applicable to such Black Knight restricted stock award, except that each “performance restriction” will be deemed satisfied and a change of control will be deemed to have occurred.

Compensation Changes in Connection with Leadership Changes

In May 2022, the Company underwent an executive leadership transition. Mr. Jabbour transitioned from Chairman and CEO to Executive Chairman. In his role as Executive Chairman, Mr. Jabbour focuses on the strategic direction of Black Knight, capital allocation and works with the executive leadership team to extend the Company’s track record of success. Mr. Nackashi transitioned from President to CEO. In his role as CEO, Mr. Nackashi is responsible for oversight of the execution of our business strategies, including acting with urgency, treating each client like they are our only client, caring for our employees and delivering on our commitments to stakeholders. Mr. Larsen transitioned from CFO to President and CFO. In his expanded role, Mr. Larsen assumed responsibility for the compliance, enterprise risk management, human resources, legal and marketing functions and works closely with Messrs. Jabbour and Nackashi to achieve Black Knight’s strategic goals. Our board determined that this leadership structure is appropriate for the Company and will allow our Executive Chairman, CEO, and President and CFO to focus on the responsibilities of their respective offices while creating a collaborative relationship that benefits our Company and stakeholders.

In connection with the foregoing leadership transition, the compensation committee approved several changes to executive compensation, as well as related amendments to our named executive officers’ employment agreements, which are discussed in more detail below.

For Messrs. Nackashi and Larsen, the compensation committee approved changes to their minimum base salaries and target annual incentive opportunities, as well as supplemental time-based restricted stock awards under our Omnibus Incentive Plan. The changes to Messrs. Nackashi’s and Larsen’s base salaries and target annual incentive opportunities and the supplement restricted stock awards were approved following discussion with the compensation committee’s independent compensation consultant in consideration of Messrs. Nackashi’s and Larsen’s total compensation levels relative to their respective experience, duties and responsibilities in their new roles, as well as peer and market data.

In consideration of his new role as CEO, Mr. Nackashi’s base salary increased from $600,000 to $750,000, his target long-term incentive opportunity increased from 150% to 200% of his base salary, with a maximum payout of 400%, and he received a supplemental restricted stock grant with a grant date value of $2,500,000. In connection with his expanded role as President and CFO, Mr. Larsen’s base salary increased from $450,000 to $575,000, his target long-term incentive opportunity increased from 100% to 150%, and he received a supplemental time-based restricted stock award with a grant date value of $875,000. One-third (1/3) of Messrs. Nackashi’s and Larsen’s supplemental time-based restricted stock awards vest on each of the first three anniversaries of the grant date, and they are otherwise subject to similar terms and conditions as our annual performance-based restricted stock awards.

22

Payments in Connection with ICE Merger

In connection with the entry into the Merger Agreement with ICE and consistent with the terms of Mr. Jabbour’s employment agreement, dated as of April 1, 2018 and as amended as of May 16, 2022, the compensation committee determined to award Mr. Jabbour a discretionary bonus of $40,000,000 contingent upon the closing of the ICE Merger (the Discretionary Bonus). The Discretionary Bonus was paid after consideration of Mr. Jabbour’s significant contributions to the Company and the critical role he plays in our organization in shaping and providing continuity with respect to the Company’s strategic vision. For the last several years, Mr. Jabbour has led the execution of our strategic vision, including organically growing our software, data and analytics businesses with urgency through selling our products to new clients, cross-selling additional services to existing clients, and innovating through the development of new solutions and refining our current offerings to provide better insight to our clients, and selectively pursuing strategic acquisitions, while maintaining an efficient cost structure to create the most value for our shareholders. In 2022, Mr. Jabbour played significant role in the negotiation of the ICE Merger, the value of which represents a 27% premium to our stock price on March 3, 2023 and a 27% premium to our stock price on April 4, 2022, the last date before the publication of news reports relating to a potential acquisition of Black Knight (in each case based upon a merger consideration value of $75 per share).

In December 2022, in connection with certain tax-planning actions to mitigate the potential impact of Sections 280G and 4999 of the Internal Revenue Code on Mr. Jabbour and Black Knight, the compensation committee determined that such bonus would be paid to Mr. Jabbour no later than December 28, 2022, rather than upon closing of the ICE Merger, but would be contingent upon successful consummation of the ICE Merger. In furtherance of the early payment of the Discretionary Bonus, the Company and Mr. Jabbour entered into a letter agreement that provides that if Mr. Jabbour is terminated by the Company for cause or Mr. Jabbour resigns his employment without good reason, in each case prior to consummation of the ICE Merger, or if the Merger Agreement is terminated without the consummation of the ICE Merger, he will be required to pay liquidated damages to Black Knight equal to the value of the after-tax proceeds of the Discretionary Bonus that would not have ultimately been paid absent the tax-planning actions described above (plus any tax refund he receives in respect of such payment), which amount will be deposited in an escrow account established by Mr. Jabbour as security for the liquidated damages.

In addition, on December 20, 2022, to further mitigate the potential impact of Sections 280G and 4999 of the Internal Revenue Code on the applicable executive and Black Knight, the compensation committee determined that the outstanding equity awards granted to Mr. Jabbour that would otherwise have vested in the first quarter of 2023 would accelerate and vest, which were vested on December 20, 2022. The compensation committee further determined that each of Messrs. Jabbour, Nackashi, Larsen and Gravelle would receive a 2022 annual cash incentive award equal to 75.0% of his target incentive opportunity, with such payment to be made no later than December 30, 2022. For additional information concerning payments with respect to the 2022 annual cash incentive plan, see the section title “Annual Performance-Based Cash Incentive.”

23

We Promote Long-term Stock Ownership for our Executives

We have formal stock ownership guidelines for all corporate officers, including our named executive officers and members of our board of directors. The guidelines were established to encourage such individuals to hold a multiple of their base salary (or annual retainer) in our common stock and thereby align a significant portion of their own economic interests with those of our shareholders. Further, the award agreements for our 2022 restricted stock awards provide that our executives who do not hold shares of our stock with a value sufficient to satisfy the applicable stock ownership guidelines must retain 50% of the shares acquired as a result of the lapse of vesting restrictions (excluding shares withheld in satisfaction of tax withholding obligations) until the executive satisfies the applicable stock ownership guideline. The ownership levels are shown in the “Security Ownership of Management and Directors” table below. The guidelines call for the executive or director to reach the ownership multiple within four years. Shares of restricted stock count toward meeting the guidelines. The guidelines, including those applicable to non-employee directors, are as follows:

| Position | Minimum Aggregate Value |

| Chairman of the Board | 7 × annual base salary |

| Chief Executive Officer | 7 × base salary |

| Other Executive Officers | 2 × base salary |

| Members of the Board | 5 × annual cash retainer |