-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM

(Mark One) | |

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the Quarterly Period Ended

OR

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number:

(Exact name of registrant as specified in its charter)

(State or other jurisdiction of incorporation or organization) | (IRS Employer Identification No.) |

(Address of principal executive offices) | (Zip code) |

Registrant’s telephone number, including area code: (

Former name, former address and former fiscal year, if changed since last report: N/A

Securities registered pursuant to Section 12(b) of the Act:

Title of each class | Trading symbol(s) | Name of each exchange on which registered |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or any emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer”, “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer ☐ | Accelerated filer ☐ |

Smaller reporting company | |

Emerging growth company |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes

As of May 7, 2024,

CORVUS PHARMACEUTICALS, INC.

QUARTERLY REPORT ON FORM 10-Q FOR THE QUARTER ENDED MARCH 31, 2024

TABLE OF CONTENTS

2

PART I - FINANCIAL INFORMATION

Item 1. Unaudited Condensed Consolidated Financial Statements

CORVUS PHARMACEUTICALS, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

(in thousands, except share and per share data)

(unaudited)

March 31, | December 31, | |||||

| 2024 |

| 2023 | |||

Assets |

|

|

|

| ||

Current assets: |

|

|

|

| ||

Cash and cash equivalents | $ | | $ | | ||

Marketable securities |

| |

| | ||

Accounts receivable - related party |

| |

| | ||

Prepaid and other current assets |

| |

| | ||

Total current assets |

| |

| | ||

Property and equipment, net |

| |

| | ||

Operating lease right-of-use asset | | | ||||

Investment in Angel Pharmaceuticals | | | ||||

Other assets | | | ||||

Total assets | $ | | $ | | ||

Liabilities and Stockholders’ Equity |

|

|

| |||

Current liabilities: |

|

|

|

| ||

Accounts payable | $ | | $ | | ||

Operating lease liability | | | ||||

Accrued and other liabilities |

| |

| | ||

Total current liabilities |

| |

| | ||

Total liabilities |

| |

| | ||

Commitments and contingencies (Note 13) |

|

|

|

| ||

Stockholders’ equity: |

|

|

|

| ||

Preferred stock: $ | ||||||

Common stock: $ |

| |

| | ||

Additional paid-in capital |

| |

| | ||

Accumulated other comprehensive loss |

| ( |

| ( | ||

Accumulated deficit |

| ( |

| ( | ||

Total stockholders’ equity |

| |

| | ||

Total liabilities and stockholders’ equity | $ | | $ | | ||

The accompanying notes are an integral part of these condensed consolidated financial statements.

3

CORVUS PHARMACEUTICALS, INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE LOSS

(in thousands, except share and per share data)

(unaudited)

Three Months Ended | |||||||

March 31, | |||||||

| 2024 |

| 2023 |

| |||

Operating expenses: |

|

|

| ||||

Research and development | $ | | $ | | |||

General and administrative |

| |

| | |||

Total operating expenses |

| |

| | |||

Loss from operations |

| ( |

| ( | |||

Interest income and other expense, net |

| |

| | |||

Sublease income - related party | — | | |||||

Loss before equity method investment | ( | ( | |||||

Income (loss) from equity method investment | | ( | |||||

Net loss | $ | ( | $ | ( | |||

Net loss per share, basic and diluted | ( | ( | |||||

Shares used to compute net loss per share, basic and diluted |

| |

| | |||

Other comprehensive loss: |

|

|

| ||||

Unrealized gain (loss) on marketable securities |

| ( |

| | |||

Cumulative foreign currency translation adjustment |

| ( |

| | |||

Comprehensive loss | $ | ( | $ | ( | |||

The accompanying notes are an integral part of these condensed consolidated financial statements.

4

CORVUS PHARMACEUTICALS, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CHANGES IN STOCKHOLDERS’ EQUITY

(in thousands, except share data)

(unaudited)

Three Months Ended March 31, 2024 | |||||||||||||||||

|

|

| Accumulated |

|

| ||||||||||||

Additional | Other | Total | |||||||||||||||

Common Stock | Paid-in | Comprehensive | Accumulated | Stockholders’ | |||||||||||||

| Shares |

| Amount |

| Capital |

| Income |

| Deficit |

| Equity | ||||||

Balance at December 31, 2023 | | $ | | $ | | $ | ( | $ | ( | $ | | ||||||

Stock-based compensation expense | — | — | | — | — | | |||||||||||

Unrealized loss on marketable securities | — | — | — | ( | — | ( | |||||||||||

Foreign currency translation adjustment | — | — | — | ( | — | ( | |||||||||||

Net loss | — | — | — | — | ( | ( | |||||||||||

Balance at March 31, 2024 | | $ | | $ | | $ | ( | $ | ( | $ | | ||||||

Three Months Ended March 31, 2023 | |||||||||||||||||

|

|

| Accumulated |

|

| ||||||||||||

Additional | Other | Total | |||||||||||||||

Common Stock | Paid-in | Comprehensive | Accumulated | Stockholders’ | |||||||||||||

| Shares |

| Amount |

| Capital |

| Income |

| Deficit |

| Equity | ||||||

Balance at December 31, 2022 | | $ | | $ | | $ | ( | $ | ( | $ | | ||||||

Common stock issued on exercise of stock options | | — | | — | — | | |||||||||||

Stock-based compensation expense | — | — | | — | — | | |||||||||||

Unrealized gain on marketable securities | — | — | — | | — | | |||||||||||

Foreign currency translation adjustment | — | — | — | | — | | |||||||||||

Net loss | — | — | — | — | ( | ( | |||||||||||

Balance at March 31, 2023 | | $ | | $ | | $ | ( | $ | ( | $ | | ||||||

The accompanying notes are an integral part of these condensed consolidated financial statements.

5

CORVUS PHARMACEUTICALS, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(in thousands)

(unaudited)

Three Months Ended | |||||||

March 31, | |||||||

| 2024 |

| 2023 |

| |||

Cash flows from operating activities |

|

|

| ||||

Net loss | $ | ( | $ | ( | |||

Adjustments to reconcile net loss to net cash used in operating activities: |

|

|

|

| |||

Depreciation and amortization |

| |

| | |||

Accretion related to marketable securities |

| ( |

| ( | |||

Stock-based compensation |

| |

| | |||

Income (loss) from equity method investment |

| ( |

| | |||

Changes in operating assets and liabilities: |

|

|

|

| |||

Accounts receivable - related party |

| — |

| | |||

Prepaid and other current assets |

| |

| | |||

Operating lease right-of-use asset | | | |||||

Accounts payable |

| |

| ( | |||

Accrued and other liabilities |

| |

| ( | |||

Operating lease liability | ( | ( | |||||

Net cash used in operating activities |

| ( |

| ( | |||

Cash flows from investing activities |

|

|

|

| |||

Purchases of marketable securities |

| ( |

| ( | |||

Maturities of marketable securities |

| |

| | |||

Purchases of property and equipment |

| — |

| ( | |||

Net cash (used in) provided by investing activities |

| ( |

| | |||

Cash flows from financing activities |

|

|

|

| |||

Proceeds from exercise of common stock options |

| — |

| | |||

Net cash provided by financing activities |

| — |

| | |||

Net decrease in cash and cash equivalents |

| ( |

| ( | |||

Cash and cash equivalents at beginning of the period |

| |

| | |||

Cash and cash equivalents at end of the period | $ | | $ | | |||

The accompanying notes are an integral part of these condensed consolidated financial statements.

6

CORVUS PHARMACEUTICALS, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (unaudited)

1. Organization

Corvus Pharmaceuticals, Inc. (“Corvus” or the “Company”) was incorporated in Delaware on January 27, 2014 and commenced operations in November 2014. Corvus is a clinical-stage biopharmaceutical company. The Company’s operations are located in Burlingame, California.

Presentation

The condensed consolidated financial statements include the accounts of the Company and its wholly-owned subsidiaries, Corvus Biopharmaceuticals, Ltd. and Corvus Hong Kong Limited. All intercompany accounts and transactions have been eliminated from the condensed consolidated financial statements.

Initial Public Offering

On March 22, 2016, the Company’s registration statement on Form S-1 (File No. 333-208850) relating to its initial public offering (“IPO”) of its common stock was declared effective by the Securities and Exchange Commission (“SEC”) and the shares of its common stock began trading on the Nasdaq Global Market on March 23, 2016. The public offering price of the shares sold in the IPO was $

Follow-on Public Offerings

In March 2018, the Company completed a follow-on public offering in which the Company sold

In February 2021, the Company completed a follow-on public offering in which the Company sold

Liquidity

The Company is subject to risks and uncertainties common to early-stage companies in the biotechnology industry, including, but not limited to, development by competitors of new technological innovations, protection of proprietary technology, dependence on key personnel, contract manufacturer and contract research organizations, compliance with government regulations and the need to obtain additional financing to fund operations. Since commencing operations in 2014, the majority of the Company’s efforts have been focused on the research and development of soquelitinib, ciforadenant and mupadolimab. The Company believes that it will continue to expend substantial resources for the foreseeable future as it continues clinical development of, seek regulatory approval for and, if approved, prepare for the commercialization of soquelitinib, ciforadenant and mupadolimab, as well as product candidates under the Company’s other development programs. These expenditures will include costs associated with research and development, conducting preclinical studies and clinical trials, obtaining regulatory approvals,

7

manufacturing and supply, sales and marketing and general operations. In addition, other unanticipated costs may arise. Because the outcome of any clinical trial and/or regulatory approval process is highly uncertain, the Company may not be able to accurately estimate the actual amounts necessary to successfully complete the development, regulatory approval process and commercialization of soquelitinib, ciforadenant and mupadolimab or any other product candidates.

The Company has incurred significant losses and negative cash flows from operations in all periods since inception and had an accumulated deficit of $

As of March 31, 2024, the Company had cash, cash equivalents and short-term marketable securities of $

2. Summary of Significant Accounting Policies

Basis of Presentation

The accompanying condensed consolidated financial statements have been prepared in conformity with accounting principles generally accepted in the United States of America (“U.S. GAAP”). The Company’s functional and reporting currency is the U.S. dollar, except for its investment in its equity method investee which is the Chinese renminbi (RMB). The accompanying condensed consolidated financial statements have been prepared on a going-concern basis, which contemplates the realization of assets and discharge of liabilities in the normal course of business.

Unaudited Interim Financial Information

The accompanying interim condensed consolidated financial statements and related disclosures are unaudited, have been prepared on the same basis as the annual financial statements and, in the opinion of management, reflect all adjustments, which include only normal recurring adjustments, necessary for fair statement of the condensed consolidated financial statements presented.

The condensed consolidated balance sheet as of December 31, 2023 was derived from audited financial statements, but does not include all disclosures required by GAAP. The condensed consolidated results of operations for the three months ended March 31, 2024 are not necessarily indicative of the results to be expected for the full year or for any other future year or interim period. The accompanying condensed consolidated financial statements should be read in conjunction with the audited financial statements and the related notes for the year ended December 31, 2023 included in the Company’s Annual Report on Form 10-K filed with the SEC on March 19, 2024.

8

Use of Estimates

The preparation of the Company’s condensed consolidated financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect the amounts reported in the condensed consolidated financial statements and accompanying notes. Actual results could differ from such estimates.

Investments in Equity Securities

The Company uses the equity method of accounting for its equity investment if the investment provides the ability to exercise significant influence, but not control, over operating and financial policies of the investee.

The Company’s proportionate share of the net income (loss) resulting from the equity method investment is reported under the line item captioned “income (loss) from equity method investment” in the Condensed Consolidated Statements of Operations and Comprehensive Loss and the carrying value of the equity method investments is reported under the line captioned “Investment in Angel Pharmaceuticals” in the Condensed Consolidated Balance Sheets. The Company’s equity method investments are reported at cost and adjusted each period for the Company’s share of the investee’s income or loss and the foreign currency translation adjustment as applicable.

For equity method investees with a functional currency different than the Company’s reporting currency, the Company follows the guidance under ASC 830-10-15-5, pursuant to which, the foreign currency financial statements of a foreign investee accounted for by the equity method should be translated to the reporting entity's reporting currency.

The Company evaluates equity method investments for impairment whenever events or changes in circumstances indicate that the carrying amount of the investment might not be recoverable. Factors considered by the Company when reviewing an equity method investment for impairment include the length of time (duration) and the extent (severity) to which the fair value of the equity method investment has been less than cost, the investee’s financial condition and near-term prospects and the intent and ability to hold the investment for a period of time sufficient to allow for anticipated recovery. An impairment that is other-than-temporary is recognized in the period identified.

See Note 5, “Equity Method Investment,” for further information.

Concentrations of Credit Risk and Other Risks and Uncertainties

Substantially all of the Company’s cash and cash equivalents are deposited in accounts with

The Company is subject to a number of risks similar to other early stage biopharmaceutical companies, including, but not limited to, the need to obtain adequate additional funding, possible failure of preclinical testing or clinical trials, its reliance on third parties to conduct its clinical trials, the need to obtain marketing approval for its product candidates, competitors developing new technological innovations, the need to successfully commercialize and gain market acceptance of the Company’s product candidates, its right to develop and commercialize its product candidates pursuant to the terms and conditions of the licenses granted to the Company, and protection of proprietary technology. If the Company does not successfully commercialize or partner any of its product candidates, it will be unable to generate product revenue or achieve profitability.

9

Segments

Operating segments are identified as components of an enterprise about which separate discrete financial information is available for evaluation by the chief operating decision-maker in making decisions regarding resource allocation and assessing performance. The Company views its operations and manages its business in

Significant Accounting Policies

The Company’s significant accounting policies are described in Note 2 to its condensed consolidated financial statements for the year ended December 31, 2023, included in its Annual Report on Form 10-K. There have been no material changes to the Company’s significant accounting policies during the three months ended March 31, 2024.

Recent Accounting Pronouncements

In October 2023, the FASB issued ASU 2023-06, Disclosure Improvements: Codification Amendments in Response to the SEC's Disclosure Update and Simplification Initiative, which modifies the disclosure or presentation requirements related to variety of FASB Accounting Standard Codification topics. The effective date for each amendment will be the date on which the SEC's removal of that related disclosure from Regulation S-X or Regulation S-K is effective. If by June 30, 2027, the SEC has not removed the applicable requirement from Regulation S-X or Regulation S-K, the pending content of the associated amendment will be removed from the Codification and will not become effective for any entities. The Company is currently evaluating the effect of adopting this ASU.

In December 2023, the FASB issued ASU 2023-09, Improvements to Income Tax Disclosures, which amends the guidance in ASC 740, Income Taxes. The ASU is intended to improve the transparency of income tax disclosures by requiring (1) consistent categories and greater disaggregation of information in the rate reconciliation and (2) income taxes paid disaggregated by jurisdiction. It also includes certain other amendments to improve the effectiveness of income tax disclosures. The ASU’s amendments are effective for public business entities for annual periods beginning after December 15, 2024. Entities are permitted to early adopt the standard “for annual financial statements that have not yet been issued or made available for issuance.” As adoption is either prospectively or retrospectively, the Company will adopt this ASU on a prospective basis. The Company is currently evaluating the impact of this ASU but does not expect any material impacts upon adoption.

10

3. Net Loss per Share

The following table shows the calculation of net loss per share (in thousands, except share and per share data):

Three Months Ended | |||||||

March 31, | |||||||

| 2024 |

| 2023 |

| |||

Numerator: |

|

|

| ||||

Net loss - basic and diluted | $ | ( | $ | ( | |||

Denominator: |

|

|

| ||||

Weighted average common shares outstanding used to compute basic and diluted net loss per share |

| |

| | |||

Net loss per share, basic and diluted | ( | ( | |||||

The amounts in the table below were excluded from the calculation of diluted net loss per share, due to their anti-dilutive effect:

Three Months Ended | |||||

March 31, | |||||

| 2024 |

| 2023 |

| |

Outstanding options | |

| | ||

4. Fair Value Measurements

Financial assets and liabilities are measured and recorded at fair value. The Company is required to disclose information on all assets and liabilities reported at fair value that enables an assessment of the inputs used in determining the reported fair values. The fair value hierarchy prioritizes valuation inputs based on the observable nature of those inputs. The fair value hierarchy applies only to the valuation inputs used in determining the reported fair value of the investments and is not a measure of the investment credit quality. The hierarchy defines three levels of valuation inputs:

| ● | Level 1—Quoted prices in active markets for identical assets or liabilities |

| ● | Level 2—Inputs other than quoted prices included within Level 1 that are observable for the asset or liability, either directly or indirectly |

| ● | Level 3—Unobservable inputs that reflect the Company’s own assumptions about the assumptions market participants would use in pricing the asset or liability |

There have been no transfers of assets and liabilities between levels of hierarchy.

The Company’s Level 2 investments are valued using third-party pricing sources. The pricing services utilize industry standard valuation models, including both income and market-based approaches, for which all significant inputs are observable, either directly or indirectly, to estimate fair value. These inputs include reported trades of and broker/dealer quotes on the same or similar investments, issuer credit spreads, benchmark investments, prepayment/default projections based on historical data and other observable inputs.

11

The following tables present information as of March 31, 2024 and December 31, 2023 about the Company’s assets that are measured at fair value on a recurring basis and indicate the level of the fair value hierarchy the Company utilized to determine such fair values (in thousands):

March 31, 2024 | ||||||||||||

Fair Value Measured Using | Total | |||||||||||

| (Level 1) |

| (Level 2) |

| (Level 3) |

| Balance | |||||

Assets |

|

|

|

|

|

|

|

| ||||

Cash equivalents | $ | | $ | — | $ | — | $ | | ||||

Marketable securities |

| |

| |

| — |

| | ||||

$ | | $ | | $ | — | $ | | |||||

December 31, 2023 | ||||||||||||

Fair Value Measured Using | Total | |||||||||||

| (Level 1) |

| (Level 2) |

| (Level 3) |

| Balance | |||||

Assets |

|

|

|

|

|

|

|

| ||||

Cash equivalents | $ | | $ | — | $ | — | $ | | ||||

Marketable securities | |

| |

| — |

| | |||||

$ | | $ | | $ | — | $ | | |||||

As of March 31, 2024 marketable securities had a maximum remaining maturity of

As of March 31, 2024 and December 31, 2023, the fair value of available for sale marketable securities by type of security were as follows (in thousands):

March 31, 2024 | ||||||||||||

|

| Gross |

| Gross |

| |||||||

Amortized | Unrealized | Unrealized | Fair | |||||||||

Cost | Gains | Losses | Value | |||||||||

U.S. Treasury securities | $ | | $ | — | $ | — | $ | | ||||

U.S. Government agency securities | | — | — | | ||||||||

$ | | $ | — | $ | — | $ | | |||||

December 31, 2023 | ||||||||||||

|

| Gross |

| Gross |

| |||||||

Amortized | Unrealized | Unrealized | Fair | |||||||||

Cost | Gains | Losses | Value | |||||||||

U.S. Treasury securities | $ | | $ | | $ | — | $ | | ||||

U.S. Government agency securities | | | — | | ||||||||

$ | | $ | | $ | — | $ | | |||||

5. Equity Method Investment

Angel Pharmaceuticals Co. Ltd. (“Angel”) is a corporate venture in the People’s Republic of China designed to develop, manufacture, and commercialize soquelitinib, ciforadenant and mupadolimab compounds for distribution within the countries of China, Taiwan, Macao, and Hong Kong based on intellectual property licenses to be contributed to Angel by the Company.

As of March 31, 2024 and December 31, 2023, the Company’s ownership interest in Angel was approximately

12

Summary Financial Information

Summary financial information for Angel Pharmaceuticals is as follows:

As of | As of | |||||

Balance Sheet Data |

| March 31, 2024 | December 31, 2023 | |||

| (in thousands) | |||||

Current assets | $ | | $ | | ||

Non-current assets |

| |

| | ||

Current liabilities |

| |

| | ||

Non-current liabilities |

| |

| | ||

Stockholders' equity | | | ||||

Three Months Ended | ||||||

March 31, | ||||||

Statement of Operations Data |

| 2024 | 2023 | |||

| (in thousands) | |||||

Revenue | $ | — | $ | — | ||

Gross Profit |

| — |

| — | ||

Net income (loss) | | ( | ||||

Share of loss from investments accounted for using the equity method |

| |

| ( | ||

6. License and Collaboration Agreements

Scripps Licensing Agreement

In December 2014, the Company entered into a license agreement with The Scripps Research Institute (“Scripps”), pursuant to which it was granted a non-exclusive, world-wide license for all fields of use under Scripps’ rights in certain know-how and technology related to a mouse hybridoma clone expressing an anti-human CD73 antibody, and to progeny, mutants or unmodified derivatives of such hybridoma and any antibodies expressed by such hybridoma, from which we developed mupadolimab. Scripps also granted the Company the right to grant sublicenses in conjunction with other proprietary rights the Company holds, or to others collaborating with or performing services for the Company. Under this license agreement, Scripps has agreed not to grant any additional commercial licenses with respect to such materials, other than march-in rights granted to the U.S. government.

Upon execution of the agreement, the Company made a one-time cash payment to Scripps of $

The Company’s license agreement with Scripps will terminate upon expiration of its obligation to pay royalties to Scripps under the license agreement. The Company’s license agreement with Scripps is terminable by the consent of the parties, at will by the Company upon providing

13

Scripps, that the Company has not used commercially reasonable efforts as required under the agreement, subject to a specified notice and cure period.

Vernalis Licensing Agreement

In February 2015, the Company entered into a license agreement with Vernalis (R&D) Limited (“Vernalis”), which was subsequently amended as of November 5, 2015, and, pursuant to which the Company was granted an exclusive, worldwide license under certain patent rights and know-how, including a limited right to grant sublicenses, for all fields of use to develop, manufacture and commercialize products containing certain adenosine receptor antagonists, including ciforadenant. Pursuant to this agreement, the Company made a one-time cash payment to Vernalis in the amount of $

The Company has also agreed to pay Vernalis tiered incremental royalties based on the annual net sales of licensed products containing ciforadenant on a product-by-product and country-by-country basis, subject to certain offsets and reductions. The tiered royalty rates for products containing ciforadenant range from the mid-single digits up to the low-double digits on a country-by-country net sales basis. The royalties on other licensed products that do not include ciforadenant also increase with the amount of net sales on a product-by-product and country-by-country basis and range from the low-single digits up to the mid-single digits on a country-by-country net sales basis. The Company is also obligated to pay to Vernalis certain sales milestones as indicated above when worldwide net sales reach specified levels over an agreed upon time period.

The agreement will expire on a product-by-product and country-by-country basis upon the expiration of the Company’s payment obligations to Vernalis in respect of a particular product and country. Both parties have the right to terminate the agreement for an uncured material breach by the other party. The Company may also terminate the agreement at its convenience by providing

Monash License Agreement

In April 2017, the Company entered into a license agreement with Monash University (Monash), pursuant to which the Company was granted an exclusive, sublicensable worldwide license under certain know-how, patent rights and other intellectual property rights controlled by Monash to research, develop, and commercialize certain antibodies directed to CXCR2 for the treatment of human diseases.

Upon execution of the agreement, the Company made a one time cash payment to Monash of $

14

met with respect to the licensed product, after which no further maintenance fee will be due. The Company is also required to make development and sales milestone payments to Monash with respect to the licensed products. During the three months ended March 31, 2024 and 2023,

The term of the Company’s agreement with Monash continues until the expiration of its obligation to pay royalties to Monash thereunder. The license agreement is terminable at will by the Company upon providing

7. Balance Sheet Components (in thousands)

March 31, | December 31, | ||||||

| 2024 |

| 2023 |

| |||

Prepaid and Other Current Assets | |||||||

Interest receivable | $ | | $ | | |||

Prepaid research and development manufacturing expenses | | | |||||

Prepaid facility expenses | | | |||||

Prepaid insurance | | | |||||

Other |

| |

| | |||

$ | | $ | | ||||

Property and Equipment | |||||||

Laboratory equipment | $ | | $ | | |||

Computer equipment and purchased software |

| |

| | |||

Leasehold improvements |

| |

| | |||

| |

| | ||||

Less: accumulated depreciation and amortization |

| ( |

| ( | |||

$ | | $ | | ||||

Accrued and Other Liabilities | |||||||

Accrued clinical trial expense | $ | | $ | | |||

Accrued manufacturing expense |

| |

| | |||

Personnel related |

| |

| | |||

Accrued legal and accounting | | | |||||

Other |

| |

| | |||

$ | | $ | | ||||

During the three months ended March 31, 2024 and 2023, the Company recorded approximately $

8. Common Stock

As of March 31, 2024, the amended and restated certificate of incorporation authorizes the Company to issue

Each share of common stock is entitled to

15

On March 28, 2023, the Company entered into an open market sale agreement (the “2023 Sales Agreement”) with Jefferies LLC (“Jefferies”) to sell shares of the Company’s common stock, from time-to-time, with aggregate gross sales proceeds of up to $

During the three months ended March 31, 2024, the Company did not sell any shares of common stock under its at-the-market offering program. As of March 31, 2024, $

The Company has reserved shares of common stock for issuance as follows:

March 31, | December 31, | ||||

| 2024 |

| 2023 |

| |

Shares available for future option grants | | | |||

Outstanding options |

| | |

| |

Shares reserved for employee stock purchase plan |

| | |

| |

Total |

| | |

|

9. Stock Option Plans

In February 2014, the Company adopted the 2014 Equity Incentive Plan (the “2014 Plan”), which was subsequently amended in November 2014, July 2015 and September 2015, under which it granted incentive stock options (“ISOs”) or non-qualified stock options (“NSOs”). Terms of stock agreements, including vesting requirements, are determined by the board of directors or a committee authorized by the board of directors, subject to the provisions of the 2014 Plan. In general, awards granted by the Company vest over

In connection with the consummation of the IPO in March 2016, the 2016 Equity Incentive Award Plan (the “2016 Plan”), became effective. Under the 2016 Plan, incentive stock options, non-statutory stock options, stock purchase rights and other stock-based awards may be granted. Terms of stock agreements, including vesting requirements, are determined by the board of directors or a committee authorized by the board of directors, subject to the provisions of the 2016 Plan. In general, awards granted by the Company vest over

Activity under the Company’s stock option plans is set forth below:

16

Options Outstanding | |||||||

|

|

| Weighted ‑ | ||||

Shares | Average | ||||||

Available | Number of | Exercise | |||||

| for Grant |

| Options |

| Price | ||

Balance at December 31, 2023 |

| |

| | $ | | |

Additional shares authorized |

| |

| — |

| — | |

Options granted |

| ( |

| |

| | |

Options exercised |

| — |

| — |

| — | |

Options forfeited |

| |

| ( |

| | |

Balance at March 31, 2024 |

| |

| | $ | | |

10. Stock-Based Compensation

The Company’s results of operations include expenses relating to employee and non-employee stock-based awards as follows (in thousands):

Three Months Ended | |||||||

March 31, | |||||||

| 2024 |

| 2023 |

| |||

Research and development | $ | | $ | | |||

General and administrative |

| |

| | |||

Total | $ | | $ | | |||

11. Income Taxes

During the three months ended March 31, 2024 and 2023, the Company recorded

12. Facility Lease

In January 2015, the Company signed an initial operating lease, effective February 1, 2015 for

17

As of March 31, 2024 and December 31, 2023, the right-of-use asset under operating lease was $

Three Months Ended | ||||||||

| Statements of operations and | March 31, | ||||||

comprehensive loss location |

| 2024 |

| 2023 | ||||

Costs of operating lease | ||||||||

Operating lease costs | Research and development, | $ | | $ | | |||

Costs of non-lease components (previously common area maintenance) | Research and development, | | | |||||

Total operating lease cost | $ | | $ | | ||||

Other Information | ||||||||

Operating cash flows used for operating lease | $ | | $ | | ||||

Remaining lease term |

|

| ||||||

Discount rate |

|

| ||||||

As of March 31, 2024, minimum rental commitments under this lease were as follows (in thousands):

Year Ended December 31 (in thousands) |

| ||

2024* | | ||

Total lease payments |

| | |

Less: imputed interest | ( | ||

Total |

| $ | |

* Remainder of the year

As of December 31, 2023, minimum rental commitments under this lease were as follows (in thousands):

Year Ended December 31 (in thousands) |

| ||

2024 | $ | | |

Total lease payments |

| | |

Less: imputed interest | ( | ||

Total |

| $ | |

13. Commitments and Contingencies

In August 2015, the Company entered into an agreement for a line of credit of $

Pursuant to the Company’s license agreements with each of Vernalis, Scripps and Monash, it has obligations to make future milestone and royalty payments to these parties, respectively. However, because these amounts are contingent, they have not been included on the Company’s balance sheet. For further discussion of the Vernalis, Scripps and Monash licensing agreements, see Note 6.

Indemnifications

In the ordinary course of business, the Company enters into agreements that may include indemnification provisions. Pursuant to such agreements, the Company may indemnify, hold harmless and defend an indemnified party

18

for losses suffered or incurred by the indemnified party. Some of the provisions will limit losses to those arising from third-party actions. In some cases, the indemnification will continue after the termination of the agreement. The maximum potential amount of future payments the Company could be required to make under these provisions is not determinable. The Company has never incurred material costs to defend lawsuits or settle claims related to these indemnification provisions. The Company has also entered into indemnification agreements with its directors and officers that may require the Company to indemnify its directors and officers against liabilities that may arise by reason of their status or service as directors or officers to the fullest extent permitted by Delaware corporate law. There have been no claims to date and the Company has a directors and officers insurance policy that may enable it to recover a portion of any amounts paid for future claims.

Legal Proceedings

The Company is not a party to any material legal proceedings.

14. Related Party Transactions

The Company holds a

In addition to the provision of clinical supplies to Angel Pharmaceuticals, Angel Pharmaceuticals may provide clinical supplies or research services to the Company on an as needed basis. These costs are recorded as research and development expense. During the three months ended March 31, 2023, Angel Pharmaceuticals billed the Company for approximately $

In August 2021, the Company entered into an agreement to sublease

In July 2021, Linda S. Grais, M.D., J.D., a member of the Company’s Board of Directors, was appointed as a non-executive member of the Board of Directors of ICON plc (“ICON”), effective upon completion of ICON’s acquisition of PRA Health Sciences, Inc. ICON is a clinical research organization and provides services to support the Company’s clinical trials. During the three months ended March 31, 2024 and 2023, the Company recorded approximately $

19

15. Subsequent Events

On May 6, 2024, the Company closed a registered direct offering which resulted in gross proceeds of approximately $

As part of the registered direct offering, an institutional investor and 10% shareholder affiliated with one of the Company’s directors, the Company’s chief executive officer, an executive officer of the Company and an investment fund controlled by the founder and current board member of Angel Pharmaceuticals purchased a total of

Amendment to 2023 Sales Agreement

On May 1, 2024, the Company and Jefferies entered into an amendment to the 2023 Sales Agreement pursuant to which the aggregate gross sales proceeds were decreased from $

.

20

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations

You should read the following discussion and analysis of our financial condition and results of operations together with our unaudited condensed consolidated financial statements and related notes thereto included in Part I, Item 1 of this Quarterly Report on Form 10-Q and with our audited condensed consolidated financial statements and notes for the year ended December 31, 2023, included in our Annual Report on Form 10-K filed with the U.S. Securities and Exchange Commission (“SEC”) on March 19, 2024.

This discussion and other parts of this report contain forward-looking statements that involve risks and uncertainties, such as statements of our plans, objectives, expectations and intentions. Our actual results could differ materially from those discussed in these forward-looking statements. Factors that could cause or contribute to such differences include, but are not limited to, those discussed in the section of this report entitled “Risk Factors.” Except as may be required by law, we assume no obligation to update these forward-looking statements or the reasons that results could differ from these forward-looking statements.

Overview

We are a clinical stage biopharmaceutical company. Our strategy is to focus our efforts on the development of immune modulator product candidates with the potential to treat solid cancers, T cell lymphomas, autoimmune, allergic and infectious diseases. We have three product candidates which are in clinical development for the treatment of various solid tumors, lymphomas and autoimmune diseases.

Our lead product candidate is soquelitinib (formerly CPI-818), a selective, covalent inhibitor of ITK (interleukin 2 inducible T cell kinase), and it is in a multi-center Phase 1/1b clinical trial in patients with various recurrent, malignant T cell lymphomas. Soquelitinib is designed to inhibit the proliferation of certain malignant T cells and also to affect the differentiation of normal T cells, which could enhance immunity to tumor cells. We believe these properties have the potential to regulate the growth and activity of both abnormal malignant T cells and abnormal T cells involved in autoimmunity and allergy.

Soquelitinib is an investigational selective, orally bioavailable, covalent inhibitor of ITK. ITK, an enzyme that functions in T cell signaling and differentiation, is expressed predominantly in T cells, which are lymphocytes that play a vital role in immune responses. T cell lymphomas are malignancies of T cells that proliferate and spread throughout the body. These lymphomas often have tonic signaling through the T cell receptor pathway, which involves ITK. Inhibition of ITK could result in blockade of this signaling pathway and control the growth of the malignancy. In addition, one of the key survival mechanisms of both lymphomas and solid tumors is believed to be the reprogramming of normal T cells to create an environment in the tissues that inhibits an anti-tumor immune response and favors tumor growth. We believe highly selective inhibitors of this enzyme will facilitate induction of normal T cell anti- tumor immunity and may be useful in the treatment of solid tumors as well as lymphomas.

Selective inhibition of ITK can block the production and function of Th2 and Th17 cells, potentially leading to a biasing toward the differentiation of naïve T cells into Th1 cells, a process known as Th1 skewing. Th1 cells lead to the generation of killer T cells that can eliminate tumor cells or viral infected cells. Th1 cells produce interferon gamma and tumor necrosis factor that are cytokines known to destroy cancer cells. We believe that soquelitinib can lead to reprogramming of normal immune responses that also could be beneficial for the treatment of certain autoimmune and allergic diseases. Overactive Th2 and Th17 cells play a role in autoimmune and allergic diseases, which can potentially be ameliorated by selective ITK inhibition by blocking Th2 and Th17 function and their production of inflammatory cytokines such as IL4, IL5, IL13, IL17 and others.

T cell signaling involving ITK is required in the development of many T cell lymphomas. The ITK cell signaling pathway is similar to the signaling that occurs in B cells, which is mediated by a homologous enzyme known as BTK, the target of ibrutinib, an approved treatment for patients with B cell lymphomas and leukemias. ITK is expressed in many T cell lymphomas, including peripheral T cell lymphoma (“PTCL”), angioimmunoblastic T cell lymphoma (“AITL”), cutaneous T cell lymphomas (“CTCL”), anaplastic large cell lymphomas (“ALCL”), natural killer T cell lymphomas (“NKTCL”) and other T cell malignancies.

21

In ITK genetic knockout mice, which completely lack expression of ITK, T cells exhibit defects in T helper cell differentiation and cytokine secretion but retain the ability to differentiate into cytotoxic T cells that secrete IL-2 and interferon gamma (“IFNg”), which are the cells responsible for tumor rejection. We believe that skewing T helper cell differentiation to favor cytotoxic T cells, known as Th1 skewing, may be beneficial in treating T cell lymphomas and many other types of cancer. Mice with genetic knock-out of ITK also demonstrate a reduction in Th2 cells, which produce the cytokines that are often responsible for autoimmunity and allergy.

We developed soquelitinib by covalently targeting the cysteine amino acid residue at position 442 in the ITK protein. We believe this irreversible targeting of ITK has the potential to provide a potent, selective and prolonged duration of activity without the need for high systemic exposures and thereby may improve the therapeutic window. This approach was previously used by our cofounders to generate ibrutinib. We believe that the potential selectivity of soquelitinib could mimic the immune effects seen in ITK knockout mice and skew the immune response toward a more favorable anti-tumor immune response as well as reducing the activity of Th2 and Th17 cells. The blockade of Th2 and Th17 differentiation has the potential to suppress inflammatory reactions involved in various autoimmune and allergic diseases. Soquelitinib was designed to have the necessary selectivity to specifically block ITK function without altering other closely related enzymes involved in T cell differentiation. We believe such selectivity is required for achieving Th1 skewing and Th2/Th17 blockade, as established by ITK genetic knockout studies in mice. ITK also plays a role in the proliferation of some T cell lymphomas and we believe its inhibition could lead to growth arrest and/or tumor cell cytotoxicity. In our preclinical studies of soquelitinib, objective tumor responses were observed in dogs with spontaneous T cell lymphomas.

Soquelitinib is currently being studied in a Phase 1/1b clinical trial that was designed to select the optimal dose of soquelitinib and evaluate its safety, pharmacokinetics (“PK”), target occupancy, immunologic effects, biomarkers and efficacy in patients with various T cell lymphomas. The study employs an adaptive, expansion cohort design, with an initial phase that evaluated escalating doses (100, 200, 400 or 600 mg taken twice a day) in successive cohorts of patients, followed by a second phase that is designed to evaluate safety and tumor response to the recommended dose of soquelitinib in disease-specific patient cohorts. The study has enrolled patients from the United States, Australia, China and South Korea with several types of advanced, refractory T cell lymphomas. No dose limiting toxicities were observed in any of the dose levels. As of January 22, 2024, and in a safety population of 73 patients, no hematologic, renal or hepatic treatment-related adverse events were observed and the most common grade 3 to 4 adverse event was pruritus, seen in four patients with lymphoma involving skin. The optimum dose was determined to be 200 mg twice per day based on anti- tumor efficacy and pharmacodynamic studies which revealed full occupancy of the ITK active site by the drug. This dose was also consistent with dose-response effects seen in preclinical experiments both in vitro and in vivo.

Soquelitinib is designed to induce a host anti-tumor cell mediated immune response that requires normal functioning T cells and an adequately functioning immune system. Therapies for T cell lymphomas, such as chemotherapy, are frequently immunosuppressive. Data from the Phase 1/1b clinical trial suggest that the number of prior therapies and immunocompetence were associated with tumor response to soquelitinib and are important patient eligibility requirements, with an optimum range of ≥1 to ≤3 prior therapies.

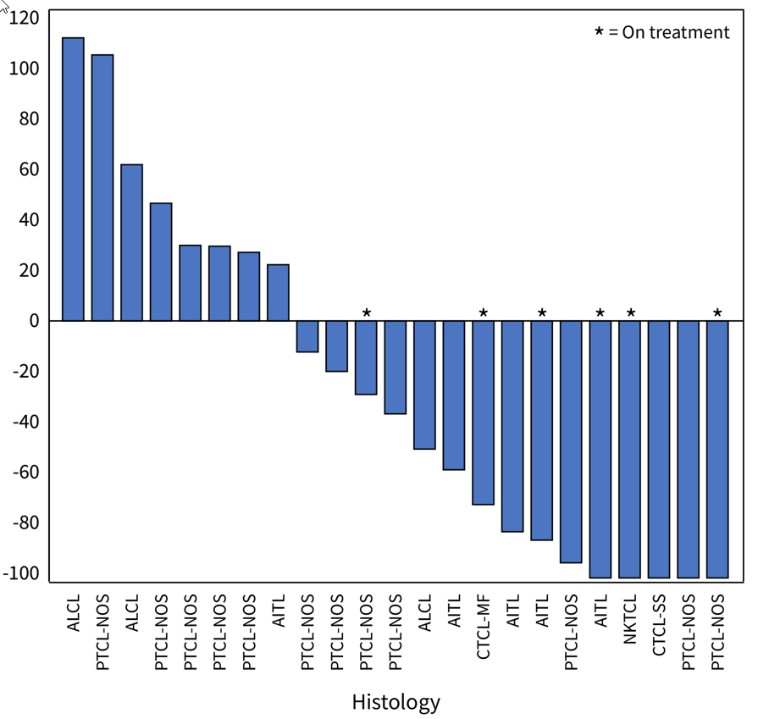

Interim data from the Phase 1/1b clinical trial were presented at the American Society of Hematology Annual Meeting (“ASH”) in December 2023. At that time, we also announced interim data from the trial as of November 21, 2023 on 21 evaluable patients receiving a dose of 200 mg twice per day and revealed an objective response rate (“ORR”) of 33.3% with 3 complete responses (“CRs”) and 4 partial responses (“PRs”). Since that report, one of the patients achieving a PR continued to respond and showed a CR resulting in an ORR of 33.3% with 4 CRs and 3 PRs as of an updated cutoff date of January 22, 2024. As of May 3, 2024, 25 patients were enrolled in the trial at the optimal dose, including 23 evaluable patients. For the 23 evaluable patients, objective responses (complete response, CR plus partial response, PR) were seen in nine patients (39%), including five CRs (23%) and four PRs. See waterfall plot below. Disease control (CR, PR and stable disease) was seen in 14 of 23 patients (61%). The stable disease group included five patients who achieved tumor reductions that did not meet the criteria for a PR. Several patients experiencing tumor regression are continuing on therapy as of the data cutoff.

22

Waterfall Plot for Patients in the 200 mg Dose Cohort of the Soquelitinib Phase 1/1b Clinical Trial for Peripheral T Cell Lymphoma. The plot shows the best percent change in tumor volume in the 23 evaluable patients (eligible patient population), as of May 3, 2024, that were measurable by CT scan or by Modified Severity-Weighted Assessment Tool (mSWAT) for patients with cutaneous involvement. PTCL-NOS, peripheral T cell lymphoma not otherwise specified; CTCL, cutaneous T cell lymphoma of either Sezary or mycosis fungoides type; NKTCL, natural killer cell T cell lymphoma; ALCL, anaplastic large cell lymphoma; AITL, angioimmunoblastic T cell lymphoma.

In August 2023, we completed an End-of-Phase/Pre-Phase 3 meeting with the Food and Drug Administration (“FDA”) regarding our plans to conduct a potentially registrational Phase 3 clinical trial of soquelitinib in relapsed PTCL. The FDA provided feedback on our proposed registration trial, including the proposed endpoints. We anticipate that we will be able to initiate this clinical trial in the third quarter of 2024. The clinical trial is designed to enroll a total of 150 patients with relapsed PTCL that have received ≥ 1 prior therapy and≤3 prior therapies. The number of prior therapies in this range selects for immunocompetent patients. Patients will be randomized 1:1 to soquelitinib 200 mg two-times a day or one of the standard of care chemotherapies. The standard of care agent will be based on the physician’s choice of either belinostat or pralatrexate. The primary endpoint will be progression-free survival. Secondary endpoints will include objective response rate, overall survival and duration of response. We are recruiting investigators and anticipate that leading academic and private medical centers with significant experience in lymphoma research will participate in the trial, including investigators who have conducted other Phase 3 clinical trials in T cell lymphoma and authored many peer-reviewed articles on lymphomas. There are currently no FDA fully approved agents for the treatment of relapsed PTCL.

As reported at the International Conference of Malignant Lymphoma in June 2023, preclinical data suggest that ITK

23

inhibition with soquelitinib has the potential to treat solid and hematological cancers based on its novel proposed mechanism of action. Tumor immune responses were enhanced by the modulation of T cell differentiation resulting in increased T cell cytolytic capacity, increased migration of T cells into the tumor and reduced T cell exhaustion. Highlights of the presentation included:

| ● | monotherapy provided statistically significant inhibition of tumor growth in established tumors in the following cancer models: EL4 TCL (T cell lymphoma), A20 B cell lymphoma and CT26 colon cancer. |

| ● | In the EL4 TCL model, treatment with soquelitinib led to increased infiltration of normal CD8+ T cells into the tumor. In addition, these CD8+ T cells had higher expression of perforin, an effector molecule produced by killer T cells that is involved in killing cancer cells. |

| ● | In the CT26 colon cancer model, the depletion of normal CD8 cells reduced the activity observed for soquelitinib treatment, suggesting that its potential mechanism of action involves the production of normal CD8+ T cells. |

| ● | In the CT26 colon cancer model, treatment with soquelitinib reduced the expression of T cell exhaustion markers. T cell exhaustion is a phenomenon seen in tumors and chronic infections where prolonged exposure to antigens results in exhausted or ineffective T cell function and inability to eliminate tumors or infections. |

| ● | In other murine studies using antigen primed T cells that were repeatedly stimulated, soquelitinib reduced the development of T cell exhaustion and reversed it in already exhausted T cells. These reinvigorated T cells regained their cancer cell killing capacity. |

We believe these findings suggest that the inhibition of ITK by soquelitinib produced changes in the tumor microenvironment that enhanced anti-tumor immunity creating a less favorable environment for tumor growth and provides the rationale for clinical investigation in a monotherapy trial of soquelitinib in solid tumors. We are planning a Phase 1b/2 clinical trial, in collaboration with the Kidney Cancer Research Consortium, of soquelitinib in solid tumors in patients with renal cell cancer (“RCC”) who have failed checkpoint inhibitor therapy.

In July 2023, we announced the posting of preclinical data on soquelitinib in bioRxiv, the online archive for unpublished preprints in the life sciences, which highlighted the potential of selective inhibition of ITK to enhance anti-tumor immune response to hematologic and solid tumors and provide a novel approach to cancer immunotherapy. Key results from the preclinical studies described in the paper demonstrated that soquelitinib:

| ● | Selectively bound to and inhibited ITK function while sparing other closely related kinases, including resting lymphocyte kinase (“RLK”). |

| ● | Inhibited Th2 T cell function and the production of various Th2 cytokines leading to Th1 skewing and production of interferon gamma and tumor necrosis factor, which are important cytokines in tumor rejection. Th2 cytokines have been previously implicated in promoting tumor growth and are also involved in autoimmune and allergic diseases. |

| ● | Activated cytotoxic killer cells and increases infiltration of these cells into tumors. |

| ● | Reduced and reversed T cell exhaustion resulting in a more potent and prolonged immune response. T cell exhaustion is often a major reason for resistance to immune checkpoint therapy. |

| ● | Led to in vivo anti-tumor activity in several mouse tumor models, including colon, renal, melanoma, B cell and T cell tumor. |

In September 2023, a paper was published by an independent academic group in Scientific Reports supporting the potential of ITK inhibition for treatment of solid tumors. The preclinical data demonstrated a reduction and reversal of T cell exhaustion markers and an increase in the infiltration of killer T cells into tumors, consistent with soquelitinib’s proposed mechanism of action. The paper highlights the potential of selective ITK inhibition for the treatment of cancers and helps to confirm preclinical and clinical results generated by Corvus.

24

In November 2023, we announced the posting of preclinical data on soquelitinib in bioRxiv that demonstrated that ITK’s selective inhibition produced therapeutic benefits in several autoimmune and allergy preclinical models, including psoriasis, asthma, pulmonary fibrosis, scleroderma and graft versus host disease. The mechanism of action involves the inhibition of Th2 and Th17 cells and their subsequent production of cytokines such as IL-4, IL-5, IL-17 and other cytokines involved in these diseases. The novel mechanism is a result of ITK inhibition and blockade of formation of Th2 and Th17 cells.

We are enrolling patients at multiple clinical sites in a randomized, placebo-controlled Phase 1 clinical trial of soquelitinib in patients with moderate to severe atopic dermatitis. The trial is planned to enroll 64 patients that have failed at least one prior therapy across four different 28-day dosing regimens of soquelitinib compared to a placebo group. The endpoints include safety and improvement in Eczema Area and Severity Index (“EASI”). Patients and physicians will be blinded to treatment assignment. We expect initial data for this clinical trial before year-end 2024.

We continue to advance our next-generation ITK inhibitor preclinical product candidates, which were designed to deliver precise T-cell modulation that is optimized for specific immunology indications. The next-generation ITK inhibitor candidates are part of our ongoing business development efforts to maximize the potential of the our ITK inhibitor programs and other programs.

We have issued patents covering composition of matter and uses of our ITK inhibitors and hold exclusive worldwide rights (except for greater China) for all indications.

Our second product candidate, ciforadenant, is an oral, small molecule antagonist of the A2A receptor for adenosine designed to disable a tumor’s ability to subvert attack by the immune system by blocking the binding of immunosuppressive adenosine in the tumor microenvironment to the A2A receptor. In 2018, we published preclinical findings in animal tumor models demonstrating that treatment with anti-CTLA4 antibody combined with ciforadenant provided synergistic anti-tumor activity based on a novel mechanism of action. We are collaborating with the Kidney Cancer Research Consortium to evaluate ciforadenant in an open label Phase 1b/2 clinical trial as a first line therapy for metastatic RCC in combination with ipilimumab (anti-CTLA-4) and nivolumab (anti-PD-1). The efficacy endpoint for the trial is deep response rate, defined as CR plus PRs of greater than 50% tumor volume reduction. The clinical trial is expected to enroll up to 60 patients and as of May 2, 2024, a total of 27 patients were enrolled in the trial. The protocol defined pre-specified statistical threshold for efficacy is a 50% increase above the 32% deep response rate seen with previous ipilimumab/nivolumab combination trials in RCC conducted by investigators at the Kidney Cancer Research Consortium. As of May 2, 2024, the interim analysis of the clinical trial has met the threshold for efficacy and therefore enrollment continues.

Ciforadenant preclinical data were presented at the Japanese Cancer Association and American Association for Cancer Research Precision Cancer Medicine International Conference, which took place June 28 to June 30, 2023 in Kyoto, Japan. The presentation highlighted data supporting the synergy between ciforadenant and immune checkpoint blockade (“ICB”), leading to a proinflammatory response. Highlights of the presentation included:

| ● | Depletion of myeloid cells abolished the synergy of ciforadenant and ICB in a murine melanoma model. |

| ● | The combination of ciforadenant with ICB upregulated the genes involved in the IL-12/STAT4 signaling axis, which led to the development of CXCR3+ IFNγ-producing Th1 helper cells. |

| ● | Ciforadenant treatment increased production of chemokine CXCL10, a ligand for recruitment of CXCR3+ Th1 helper cells into the tumor. |

| ● | Ciforadenant modulated antitumor responses by turning the tumor microenvironment into the proinflammatory state. |

| ● | The combination of ciforadenant with ICB promoted the production of several proinflammatory cytokines such as IL-6, TNFa, and IFNg. |

Our third product candidate is mupadolimab, a humanized monoclonal antibody that is designed to react with a specific site on CD73. In both preclinical and in vivo studies, mupadolimab has demonstrated binding to various immune cells and the enhancement of immune responses by activating B cells. While we believe mupadolimab has the potential

25

to be an important new therapeutic agent with a novel mechanism of action for the treatment of a broad range of cancers and infectious diseases, we are waiting to initiate a potential Phase 2 randomized clinical trial in order to prioritize the development of our other two lead product candidates. Angel Pharmaceuticals Co. Ltd. (“Angel Pharmaceuticals”) is continuing the development of mupadolimab in China and is enrolling patients in a Phase 1/1b clinical trial with mupadolimab alone and together with pembrolizumab in patients with advanced NSCLC and head and neck squamous cell cancer (“HNSCC”).

Our molecularly targeted product candidates are designed to exhibit a high degree of specificity, which we believe have the potential to provide greater safety compared to other cancer therapies and may facilitate their development either as monotherapies or in combination with other cancer therapies such as immune checkpoint inhibitors or chemotherapy.

We believe the breadth and status of our pipeline demonstrates our management team’s expertise in understanding and developing immunology focused assets as well as in identifying product candidates that can be in-licensed and further developed internally to treat many types of cancer. We hold worldwide rights to all of our product candidates (other than in greater China).

Our diverse and versatile product candidates also have enabled us to take steps to address markets in foreign countries. In October 2020, we announced the formation and launch of Angel Pharmaceuticals, a China-based biopharmaceutical company with a mission to bring innovative quality medicines to Chinese patients for treatment of serious diseases including cancer, autoimmune diseases and infectious diseases. We formed Angel Pharmaceuticals as a wholly owned subsidiary and it launched with a post-money valuation of approximately $106.0 million, based on an approximate $41.0 million cash investment from a Chinese investor group that includes funds associated with Tigermed and Betta Pharmaceuticals, Hisun Pharmaceuticals and Zhejiang Puissance Capital. Such cash is not available for our use. Contemporaneously with the financing, Angel Pharmaceuticals licensed the rights to develop and commercialize our three clinical-stage candidates – soquelitinib, ciforadenant and mupadolimab – in greater China and obtained global rights to our BTK inhibitor preclinical programs. Under the collaboration, we currently have a 49.7% equity interest in Angel Pharmaceuticals, excluding 7% of Angel’s equity reserved for issuance under the Employee Stock Ownership Plan (“ESOP”), and are entitled to designate three individuals on Angel’s five-person board of directors.

To date, the majority of our efforts have been focused on the research, development and advancement of soquelitinib, ciforadenant, and mupadolimab, and we have not generated any revenue from product sales and, as a result, we have incurred significant losses. We expect to continue to incur significant research and development and general and administrative expenses related to our operations. Our net loss for the three months ended March 31, 2024 was $5.7 million. As of March 31, 2024, we had an accumulated deficit of $340.4 million. We expect our losses will increase as we continue our development of, seek regulatory approval for and begin to commercialize soquelitinib, ciforadenant and mupadolimab, and as we develop other product candidates. Even if we achieve profitability in the future, we may not be able to sustain profitability in subsequent periods.

Since our inception and through March 31, 2024, we have funded our operations primarily through the sale and issuance of preferred and common stock, including through our initial public offering (“IPO”) in March 2016, in which we raised net proceeds of approximately $70.6 million, a follow-on offering of our common stock in March 2018, in which we raised net proceeds of approximately $64.9 million and a follow on offering in February 2021, in which we raised net proceeds of approximately $32.0 million, in each case net of underwriting discounts and commissions and offering expenses. Immediately prior to the consummation of the IPO, all of our outstanding shares of redeemable convertible preferred stock were converted into 14.3 million shares of our common stock.

On March 28, 2023, we entered into an open market sale agreement (the “2023 Sales Agreement”) with Jefferies LLC (“Jefferies”) to sell shares of our common stock, from time-to-time, with aggregate gross sales proceeds of up to $90.0 million, through an at-the-market equity offering program under which Jefferies will act as our sales agent. The issuance and sale of shares of common stock pursuant to the 2023 Sales Agreement are deemed an “at-the-market” offering under the Securities Act of 1933, as amended. Jefferies is entitled to compensation for its services equal to 3.0% of the gross proceeds of any shares of common stock sold through Jefferies under the 2023 Sales Agreement.

26

During the three months ended March 31, 2024, we did not sell any shares of common stock under our at-the-market offering program. As of March 31, 2024, $81.9 million remained available for sale under the 2023 Sales Agreement. On May 1, 2024, we amended the 2023 Sales Agreement to decrease the aggregate gross sales proceeds from $90.0 million to $8.2 million, which decreased the amount available for sale under the 2023 Sales Agreement from $81.9 million to $100,000.

Our three product candidates, soquelitinib, ciforadenant and mupadolimab, are in clinical development by us and / or our partner, Angel Pharmaceuticals. Except for Greater China, we own the world-wide rights to these product candidates.

We plan to focus our development efforts in 2024 on soquelitinib with the start of a potentially registrational Phase 3 clinical trial of soquelitinib in relapsed PTCL and a randomized, placebo-controlled Phase 1 trial of soquelitinib in patients with moderate to severe atopic dermatitis. As a result of our ongoing development efforts, we anticipate needing to spend substantial resources for the foreseeable future. Consequently, we will need additional financing to support our continuing operations. Until such time as we can generate significant revenue from product sales, if ever, we expect to finance our operations through a combination of public or private equity or debt financings or other sources, which may include collaborations with third parties. Such financing could result in dilution to stockholders and may include the imposition of debt covenants and repayment obligations or other restrictions that may affect our business. If we raise additional capital through strategic collaboration agreements, we may have to relinquish valuable rights to our product candidates, including potential future revenue streams. Adequate additional financing may not be available to us on acceptable terms, or at all. For example, the trading prices for our and other biopharmaceutical companies’ stock have been highly volatile as a result of factors such as the impacts of pandemics, such as COVID-19, and increases in inflation rates or interest rates. As a result, we may face difficulties raising capital through sales of our common stock and any such sales may be on unfavorable terms. Our inability to raise capital as and when needed would have a negative impact on our financial condition and our ability to pursue our business strategy. We will need to generate significant revenue to achieve profitability, and we may never do so.

As of March 31, 2024, we had capital resources consisting of cash, cash equivalents and marketable securities of approximately $22.1 million. On May 6, 2024, we closed a registered direct offering which resulted in gross proceeds of approximately $30.6 million. Based on our currently available cash resources, the proceeds from our recent financing and our currently planned level of operations and cash flows, we expect that our cash resources will be sufficient to enable us to advance our programs into the fourth quarter of 2025. In accordance with applicable accounting standards, we evaluated whether there are conditions and events, considered in the aggregate, that raise substantial doubt about our ability to continue as a going concern for at least the next 12 months after the date of the issuance of the condensed consolidated financial statements included elsewhere in this Quarterly Report on Form 10-Q and concluded that our existing cash, cash equivalents and marketable securities, including the approximate gross proceeds of $30.6 million from our May 2024 registered direct offering, are sufficient to fund our operations for at least the next 12 months from issuance of the condensed consolidated financial statements. However, the Company will need to continue to raise additional capital to fund its operations. See “Risk Factors—Risks Related to Our Limited Operating History, Financial Condition and Need for Additional Capital.”

We currently have no manufacturing capabilities and do not intend to establish any such capabilities. We have no commercial manufacturing facilities for our product candidates. As such, we are dependent on third parties to supply our product candidates according to our specifications, in sufficient quantities, on time, in compliance with appropriate regulatory standards and at competitive prices.

Significant Accounting Policies

Our significant accounting policies are described in Note 2 to our condensed consolidated financial statements for the year ended December 31, 2023 included in our Annual Report on Form 10-K. There have been no material changes to our significant accounting policies during the three months ended March 31, 2024.

27

Components of Results of Operations

Revenue

To date, we have not generated any revenues. We do not expect to receive any revenues from any product candidates that we develop unless and until we obtain regulatory approval and commercialize our products or enter into revenue-generating collaboration agreements with third parties.

Research and Development Expenses

Our research and development expenses consist primarily of costs incurred to conduct research and development of our product candidates. We record research and development expenses as incurred. Research and development expenses include:

| ● | employee-related expenses, including salaries, benefits, travel and non-cash stock-based compensation expense; |

| ● | external research and development expenses incurred under arrangements with third parties, such as contract research organizations, preclinical testing organizations, contract manufacturing organizations, academic and non-profit institutions and consultants; |

| ● | costs to acquire technologies to be used in research and development that have not reached technological feasibility and have no alternative future use; |

| ● | license fees; and |

| ● | other expenses, which include direct and allocated expenses for laboratory, facilities and other costs. |

We plan to increase our research and development expenses substantially as we continue the development and potential commercialization of our product candidates. Our current planned research and development activities include the following:

| ● | completion of our ongoing Phase 1/1b clinical trial of soquelitinib in PTCL; |

| ● | completion of our ongoing Phase 1 clinical trial of soquelitinib in atopic dermatitis; |

| ● | a potential Phase 3 registrational clinical trial for soquelitinib in PTCL; |

| ● | enrollment and completion of our Phase 1b/2 clinical trial with ciforadenant in collaboration with the Kidney Cancer Research Consortium; |

| ● | a potential clinical trial of soquelitinib in solid tumors; |

| ● | process development and manufacturing of drug supply of soquelitinib and ciforadenant; and |

| ● | preclinical studies under our other programs in order to select development product candidates. |

In addition to our product candidates that are in clinical development, we believe it is important to continue substantial investment in potential new product candidates to build the value of our product candidate pipeline and our business.

Our expenditures on current and future preclinical and clinical development programs are subject to numerous uncertainties related to timing and cost to completion. The duration, costs and timing of clinical trials and development

28

of product candidates will depend on a variety of factors, including many of which are beyond our control. The process of conducting the necessary clinical research to obtain regulatory approval is costly and time consuming, and the successful development of our product candidates is uncertain. The risks and uncertainties associated with our research and development projects are discussed more fully in “Part II, Item 1A—Risk Factors.” As a result of these risks and uncertainties, we are unable to determine with any degree of certainty the duration and completion costs of our research and development projects or if, when or to what extent we will generate revenues from the commercialization and sale of any of our product candidates that obtain regulatory approval. We may never succeed in achieving regulatory approval for any of our product candidates.

General and Administrative Expenses

General and administrative expenses include personnel costs, expenses for outside professional services and allocated expenses. Personnel costs consist of salaries, benefits and stock-based compensation. Outside professional services consist of legal, accounting and audit services and other consulting fees. Allocated expenses consist of rent expense related to our office and research and development facility.

We expect that our general and administrative expenses will increase in the future as we increase our headcount to support our continued research and development and potential commercialization of one or more of our product candidates.

Results of Operations

Comparison of the periods below as indicated (in thousands):

Three Months Ended | |||||||||||

|

| March 31, |

|

| |||||||

2024 | 2023 | Change | |||||||||

Operating expenses: |

|

|

|

|

|

|

| ||||

Research and development | $ | 4,075 | $ | 4,594 | $ | (519) | |||||

General and administrative |

| 2,178 |

| 1,980 |

| 198 | |||||

Total operating expenses |

| 6,253 |

| 6,574 |

| (321) | |||||

Loss from operations |

| (6,253) |

| (6,574) |

| 321 | |||||

Interest income and other expense, net |

| 316 |

| 376 |

| (60) | |||||

Sublease income - related party |

| — |

| 56 |

| (56) | |||||

Loss before equity method investment | (5,937) | (6,142) | 205 | ||||||||

Income (loss) from equity method investment |

| 236 |

| (1,731) |

| 1,967 | |||||

Net loss | $ | (5,701) | $ | (7,873) | $ | 2,172 | |||||

Research and Development Expenses

Research and development expenses for the three months ended March 31, 2024 and 2023 consisted of the following costs by program as well as unallocated employee costs and overhead costs (specific program costs consist solely of external costs) (in thousands):

Three Months Ended | ||||||||||

| March 31, |

|

| |||||||

2024 |

| 2023 | Change | |||||||

Soquelitinib | $ | 1,338 | $ | 1,647 | $ | (309) | ||||

Ciforadenant | 182 | 218 | (36) | |||||||

Mupadolimab |

| 96 |

| 119 |

| (23) | ||||

Unallocated employee and overhead costs |

| 2,459 |

| 2,610 |

| (151) | ||||

$ | 4,075 | $ | 4,594 | $ | (519) | |||||

29

For the three months ended March 31, 2024, the decrease in soquelitinib costs of $0.3 million as compared to the three months ended March 31, 2023, primarily consisted of a decrease of $0.8 million in drug manufacturing costs and a decrease of $0.1 million in clinical trial expenses, which were partially offset by an increase of $0.6 million in other outside service costs.

For the three months ended March 31, 2024, the decrease in ciforadenant and mupadolimab costs were negligible.

For the three months ended March 31, 2024, the decrease in unallocated costs of $0.2 million as compared to the three months ended March 31, 2023, primarily consisted of a decrease in other outside service costs.

General and Administrative Expense

For the three months ended March 31, 2024, the increase in general and administrative expenses of $0.2 million as compared to the three months ended March 31, 2023, primarily consisted of an increase in personnel and related costs.

Interest Income and Other Expense, net

For the three months ended March 31, 2024, the decrease in interest income and other expense, net of $0.1 million as compared to the three months ended March 31, 2023, primarily consisted of a decrease in interest income earned due to a decrease in cash equivalents and marketable securities.

Sublease Income – Related Party