UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

(Exact name of registrant as specified in its charter)

(State or other jurisdiction of incorporation) |

(Commission File Number) |

(IRS Employer Identification Number) |

| (Address of principal executive offices, including Zip Code) |

Registrant's telephone number, including

area code: (

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading symbol(s) | Name of each exchange on which registered |

Indicate by check mark whether the registrant is an emerging growth company as defined

in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934

(17 CFR §240.12b-2). Emerging growth company

If an emerging growth company, indicate by check mark if the registrant has elected not

to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to

Section 13(a) of the Exchange Act.

Item 1.01 Entry Into a Material Definitive Agreement.

On October 5, 2020, Corvus Pharmaceuticals, Inc. (“Corvus” or the “Company”), entered into, and consummated certain transactions contemplated by, a Framework Agreement (the “Framework Agreement”) by and among Corvus Hong Kong Limited, a wholly-owned subsidiary of Corvus Cayman (as defined below) (“Corvus HK”), Angel Pharmaceuticals Co., Ltd., a wholly-owned subsidiary of Corvus HK (“Angel Pharmaceuticals”), Jiaxng Puissance Angel Equity Investment Partnership (Limited Partnership) (the “Investment Entity”) and AP BIOTECH DEVELOPMENT CORP. (“AP BIOTECH”), pursuant to which, and on the terms and subject to the conditions thereof, Corvus will grant a license to Angel Pharmaceuticals for certain of its intellectual property and dispose of certain assets comprised of the share capital of certain of its wholly-owned subsidiaries. In particular, pursuant to the Framework Agreement and the agreements contemplated therein:

| i. | Corvus, Corvus Biopharma International Ltd., a wholly-owned subsidiary of Corvus (“Corvus Cayman”) and Corvus HK will grant Angel Pharmaceuticals the right to develop and commercialize Corvus’ three clinical-stage candidates, ciforadenant, CPI-006 and CPI-818, in greater China and global rights with respect to Corvus’ BTK inhibitor preclinical programs; |

| ii. | the Investment Entity will invest RMB 235 million in Angel Pharmaceuticals in exchange for registered capital in the amount of $56,400 (representing an equity interest of approximately 35.0% in Angel Pharmaceuticals) and AP BIOTECH will receive registered capital in the amount of $13,900 (representing an equity interest of approximately 8.6% in Angel Pharmaceuticals) (collectively, the “Initial Capital Increase”); |

| iii. | upon completion of the Initial Capital Increase, Corvus HK will issue warrants to purchase its ordinary shares to the Investment Entity and AP BIOTECH and will enter into a related equity transfer agreement with such parties to provide them with an ownership interest in Corvus HK that shall be equal to but replace their ownership interest in Angel Pharmaceuticals following any determination by the board of directors of Angel Pharmaceuticals to list the shares of Angel Pharmaceuticals publicly; and |

| iv. | following the Initial Capital Increase, Angel Pharmaceuticals will enable Hangzhou Betta Investment Management Co., Ltd. (“Betta”) to subscribe for increased registered capital of Angel Pharmaceuticals in an amount of $6,000 (representing an equity interest of approximately 3.5% in Angel Pharmaceuticals) in exchange for investments of RMB 25 million and Hangzhou Tiger Equity Investment Partnership LP (“Tigermed”) to subscribe for increased registered capital of Angel Pharmaceuticals in an amount of $4,800 (representing an equity interest of approximately 2.8% in Angel Pharmaceuticals) in exchange for investments of RMB 20 million (the “Second Capital Increase” and, together with the Initial Capital Increase, the “Capital Increases”). |

Following the consummation of the foregoing transactions, it is expected that Corvus HK will hold a 49.7% equity interest in Angel Pharmaceuticals and that Angel Pharmaceuticals will have received aggregate proceeds from the Capital Increases of approximately $41.0 million, indicative of a post-money valuation of approximately $106.0 million. Corvus expects Angel Pharmaceuticals to use the proceeds from the Capital Increases for development of Corvus’ product candidate pipeline and no amount of the proceeds will be available for use by Corvus.

In connection with and subject to the consummation of the foregoing transactions, each of Corvus HK, the Investment Entity, AP BIOTECH, Betta and Tigermed will enter into a shareholders agreement relating to shareholder rights, governance and management of Angel Pharmaceuticals, and pursuant to which Corvus will be entitled to designate three individuals on Angel Pharmaceuticals’ five-person board of directors. It is currently contemplated that the board of directors of Angel Pharmaceuticals will initially be comprised of Richard Miller, chairman and chief executive officer of Corvus, Leiv Lea, chief financial officer of Corvus, Peter Thompson, co-founder and board member of Corvus, and Ted Wang, chief investment officer of Puissance Capital. In addition, Dr. Miller will serve as Angel Pharmaceutical’s interim chief executive officer.

The foregoing description of the Framework Agreement and the transactions contemplated thereunder is not complete and is qualified in its entirety by reference to the Framework Agreement, a copy of which is hereby filed as Exhibit 2.1 to this Current Report on Form 8-K and incorporated herein by reference.

Item 2.01 Completion of Acquisition or Disposition of Assets.

The information set forth in Item 1.01 of this Current Report on Form 8-K is incorporated by reference into this Item 2.01.

Item 8.01 Other Events.

Angel Pharmaceuticals Co., Ltd.

On October 5, 2020, Corvus announced the formation and launch of Angel Pharmaceuticals, a new China-based biopharmaceutical company with a mission to bring innovative quality medicines to Chinese patients for treatment of serious diseases including cancer, autoimmune diseases and infectious diseases. It was formed as a Corvus wholly-owned subsidiary and was launched with a post-money valuation of approximately $106.0 million, based on an approximate $41.0 million cash investment from a Chinese investor group that includes funds associated with Tigermed and Betta Pharmaceuticals, Hisun Pharmaceuticals and Zhejiang Puissance Capital, which investments are subject to the satisfaction of certain customary conditions. Contemporaneously with the financing, Angel Pharmaceuticals obtained the rights to develop and commercialize Corvus’ three clinical-stage candidates – ciforadenant, CPI-006 and CPI-818 – in greater China and obtained global rights to Corvus’ BTK inhibitor preclinical programs. Under the collaboration, Corvus will initially retain a 49.7% equity stake in Angel Pharmaceuticals and will be entitled to designate three individuals on Angel’s five-person Board of Directors.

The formation of Angel Pharmaceuticals:

| · | provides Corvus with a 49.7% ownership in a uniquely positioned biopharmaceutical company in the rapidly growing Chinese market; |

| · | could enable clinical study synergies and accelerated timelines, whereby data from patients enrolled in China studies could potentially be used as part of U.S. regulatory submissions as part of a global pivotal study protocol; |

| · | could enable research and development synergies, whereby Corvus will benefit from Angel’s research and development efforts and China’s deep pool of talented researchers; and |

| · | establishes a collaboration with leading Chinese investors, biopharmaceutical companies and scientists with experience in regulatory affairs, clinical development, manufacturing and commercialization. |

Angel Pharmaceuticals will be responsible for the clinical development and commercialization, including all related expenses, of the licensed pipeline programs in China, and for the pre-clinical BTK program globally. It plans to initiate clinical trials in China for ciforadenant, CPI-006 and CPI-818 in the next 12 to 18 months. In the United States, Corvus is planning to meet with the U.S. Food & Drug Administration (“FDA”) in December 2020 to discuss the study design and plans for a pivotal ciforadenant study in advanced refractory renal cell cancer (“RCC”) using the Adenosine Gene Signature as a biomarker. Angel Pharmaceuticals’ clinical trial activity in China is expected to be part of this global pivotal study. Angel Pharmaceuticals’ cash position at launch is expected to provide sufficient capital through at least its first two years based upon current plans and expenditures. Such cash will not be available for use by Corvus.

Angel Pharmaceuticals will have experienced local pharmaceutical executives with management experience in multinational companies in clinical, regulatory and research. At launch, the senior team includes seven leaders that hold a medical degree or Ph.D., and the company plans to expand its team with leading scientific talent in China. In addition, Dr. Miller, a co-founder of Angel, will serve as Chairman of the Board and interim chief executive officer, working closely with the founding leadership team.

CPI-006 COVID-19 Phase 1 Clinical Trial Update

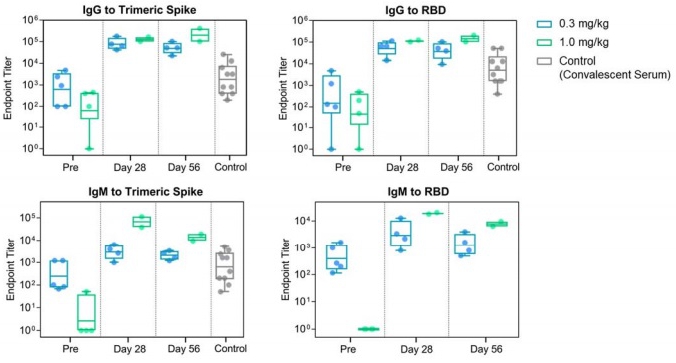

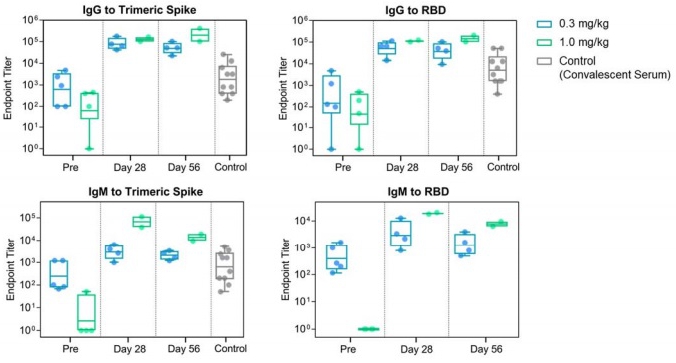

On October 5, 2020, Corvus announced updated data from its ongoing Phase 1 study investigating the potential for CPI-006 to provide a novel immunotherapy approach for patients with COVID-19. The updated data includes 56-day follow-up results from the first two cohorts (0.3 mg/kg and 1.0 mg/kg dose) and initial results from the third cohort (3.0 mg/kg) of the study. The 56-day follow-up results showed a dose-response, with higher and more prolonged titers of anti-SARS-CoV-2 antibodies in the 1.0 mg/kg cohort compared to the 0.3 mg/kg cohort. In addition, the results showed increased levels of memory B cells and memory T cells, and there have been no reports of any drug-related safety issues in any of the 15 patients treated as of September 17, 2020.

These results build on the initial data from the first two cohorts (0.3 mg and 1.0 mg doses) of the study that was published online in September 2020. In addition to detailing the initial results, the published manuscript provides additional details on the unique properties of CPI-006 and on the study rationale and design, along with context on the broad potential for CPI-006 for the treatment and prevention of COVID-19.

To-date, the first three cohorts of the study have been enrolled and the final cohort is currently enrolling patients. A new study site, El Centro Regional Medical Center in El Centro, CA, which is affiliated with the U.C. San Diego Health Care Network and serves Imperial and Riverside counties in southern California, has also begun enrolling patients. The Company continues to anticipate that it will complete the study and report results during the fourth quarter of 2020, including a presentation of data at the Society for Immunotherapy of Cancer (SITC) annual meeting in November. Based on these interim data, and assuming the remainder of the data in the study supports it, the Company plans to initiate a pivotal, randomized, double blind study in hospitalized COVID-19 patients before year-end.

CPI-006 COVID-19 Phase 1 Study Update

The open-label, Phase 1 study is expected to enroll up to 30 hospitalized COVID-19 patients with mild to moderate symptoms. Patients will receive a single dose of CPI-006, with levels of 0.3, 1.0, 3.0 and 5.0 mg/kg, escalating in four cohorts as the study progresses. Patients will receive medications, therapies, and interventions per standard treatment protocols for COVID-19 for the duration of the study. The primary efficacy endpoint is the change in serum immunoglobulin (IgM and IgG) anti-SARS-CoV-2 levels compared to baseline at day 28. The study also will examine safety and other clinical endpoints, including time to resolution of symptoms and duration of hospitalization.

In the first three cohorts of the study, the median age of the patients was 63 years (range 26-76 years) and 12 of 15 patients are minorities at higher risk for COVID-19 disease complications (7 African American and 5 Latino). All of the patients had comorbidities that increased their COVID-19 risk including diabetes, hypertension, obesity, chronic lung disease and/or cancer. The median duration of symptoms prior to treatment with CPI-006 was five days (range 1-21 days). The key highlights from these 15 patients, beyond the data already reported from the first 10 patients in the published manuscript, include:

| · | 14 of 14 patients with pre-treatment serum samples available had low pre-treatment levels of anti-SARS-CoV-2 antibodies independent of the duration of their prior COVID-19 symptoms. | |

| · | IgG and IgM antibody titers against the SARS-CoV-2 trimeric spike and/or receptor binding domain (“RBD”) increased in all evaluable patients within 7 days of a single infusion of CPI-006. As previously reported, one patient did not have a pre-treatment serum sample available but had a sample collected one day after receiving CPI-006 and this sample exhibited a high titer, which continued to increase as of September 28, 2020. | |

| · | In 11 of 11 patients with serum samples available to be tested, the combined IgG and IgM antibody responses continued to increase out to 28 days post treatment with CPI-006 as of September 28, 2020, in-line with the prior study data. | |

| · | In three of three patients tested, memory B cells, and memory CD4 and CD8 T effector memory cells, increased at 28 days post-treatment, and for one of such patients, memory B cells increased from 1.8% to 7.9% of B cells at 56 days post-treatment. Corvus believes this level of increase could induce prolonged immunity. | |

| · | As of September 28, 2020, 14 of 15 patients were discharged from the hospital with clinical improvement after a median of 4.5 days. One patient remains in the hospital with improvement of symptoms. | |

| · | There have been no drug-related toxicity or safety issues reported. |

Dose-Response Observed in Cohort 1 and Cohort 2

The 28-day and 56-day anti-SARS-CoV-2 antibody data for patients receiving 0.3 mg/kg (cohort 1) and 1.0 mg/kg (cohort 2) doses showed a dose-response with higher and more prolonged titers observed in the 1.0 mg/kg cohort compared to the 0.3 mg/kg cohort (see charts below).

| · | IgG and IgM titers to trimeric spike and receptor binding domain (RBD) of SARS-CoV-2 were measured and compared to convalescent serum obtained from recovered COVID-19 patients. | |

| · | Geometric mean titers (and range) were evaluated and revealed robust response at 28 days for both cohorts with higher and more sustained levels at day 56 seen in the 1.0 mg cohort. For example, day 56 IgG to spike protein titer was 49,519 as compared to 204,800 in patients receiving 0.3 and 1.0 mg/kg, respectively. Day 56 titers to RBD were 37,286 as compared to 144,815 in patients receiving 0.3 and 1.0 mg/kg, respectively. | |

| · | Sustained and high IgM titers were also observed and exhibited a similar dose-response. |

Anti-SARS-CoV-2 antibody response (IgG and IgM) to spike protein and RBD of SARS-CoV-2. Patients receive 0.3 or 1.0 mg/kg single dose of CPI-006 and antibody titers measured at pre-treatment and at Days 28 and 56. Data are shown as box and whisker plot with geometric mean and interquartile ranges.

Corvus believes the totality of the data from the Phase 1 clinical continues to support the potential of CPI-006 as a treatment for COVID-19. CPI-006, when administered at very low doses, has demonstrated a boost antibody responses to the SARS-CoV-2 virus. The responses have been long-lived and the data reflects a clear dose response relationship with 1.0 mg/kg having produced higher and more prolonged titers than 0.3 mg/kg; especially of IgM.

Forward-Looking Statements

To the extent that statements contained herein are not descriptions of historical facts regarding Corvus, they are forward-looking statements, including statements related to the potential safety and efficacy of CPI-006, the Company’s ability to develop and advance product candidates into and successfully complete clinical trials, including the Company’s Phase 1 clinical trial of CPI-006 for COVID-19, and the planned completion and timing of the transactions contemplated by the Framework Agreement. All statements other than statements of historical fact contained in this press release are forward-looking statements. These statements often include words such as “believe,” “expect,” “anticipate,” “intend,” “plan,” “estimate,” “seek,” “will,” “may” or similar expressions. Forward-looking statements are subject to a number of risks and uncertainties, many of which involve factors or circumstances that are beyond the Company’s control. The Company’s actual results could differ materially from those stated or implied in forward-looking statements due to a number of factors, including but not limited to, risks detailed in the Company’s Quarterly Report on Form 10-Q for the quarter ended June 30, 2020, filed with the Securities and Exchange Commission on July 30, 2020, as well as other documents that may be filed by the Company from time to time with the Securities and Exchange Commission. In particular, the following factors, among others, could cause results to differ materially from those expressed or implied by such forward-looking statements: the Company’s ability to demonstrate sufficient evidence of efficacy and safety in its clinical trials of CPI-006; the accuracy of the Company’s estimates relating to its ability to initiate and/or complete clinical trials; the results of preclinical studies may not be predictive of future results; the unpredictability of the regulatory process in the United States; regulatory developments in the United States, China and other foreign countries; the effects of COVID-19 on the Company’s and Angel Pharmaceutical’s respective clinical programs and business operations; the unpredictability of the regulatory approval process in China; and the satisfaction of all obligations by each of the counterparties to the Framework Agreement and agreements contemplated by the Framework Agreement.

Item 9.01 Financial Statements and Exhibits.

|

Exhibit No. |

Description | |

| 2.1† | Framework Agreement, dated October 5, 2020, by and among Corvus Hong Kong Limited, Angel Pharmaceutical Co., Ltd., Jiaxng Puissance Angel Equity Investment Partnership (Limited Partnership) and AP BIOTECH DEVELOPMENT CORP. | |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

| † | Schedules and attachments to this exhibit have been omitted pursuant to Regulation S-K, Item 601(a)(5). |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| CORVUS PHARMACEUTICALS, INC. | ||

| Date: October 5, 2020 | By: | /s/ Leiv Lea |

| Leiv Lea | ||

| Chief Financial Officer | ||