UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

________________________________________

FORM

Commission file number

________________________________________

XBIOTECH INC.

(Exact name of Registrant as specified in its charter)

| | N/A | |

| (State or other jurisdiction of incorporation or organization) | (IRS Employer Identification No.) |

(Address of principal executive offices, including zip code)

Telephone Number (

(Registrant's telephone number, including area code)

________________________________________

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| | | |

Securities registered pursuant to Section 12(g) of the Act:

None

________________________________________

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the registrant has submitted electronically, every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ☐ | Accelerated filer ☐ | | Smaller Reporting Company | |||

| Emerging Growth Company |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report.

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes

The aggregate market value of the voting and non-voting common equity held by non-affiliates of the registrant as of June 30, 2021, was approximately $

As of March 15, 2022,

________________________________________

Documents incorporated by reference:

Certain portions, as expressly described in this Annual Report on Form 10-K, of the registrant’s Proxy Statement for the 2021 Annual Meeting of the Stockholders, to be filed not later than 120 days after the end of the year covered by this Annual Report, are incorporated by reference into Part III of this Annual Report where indicated.

TABLE OF CONTENTS

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This annual report contains forward-looking statements that involve substantial risks and uncertainties. All statements, other than statements of historical facts, included in this annual report, including, without limitation, statements regarding the assumptions we make about our business and economic model, our dividend policy, business strategy and other plans and objectives for our future operations, are forward-looking statements.

These forward-looking statements include declarations regarding our management’s beliefs and current expectations. In some cases, you can identify forward-looking statements by terminology such as “may,” “will,” “should,” “would,” “could,” “expects,” “plans,” “contemplate,” “anticipates,” “believes,” “estimates,” “predicts,” “projects,” “intend” or “continue” or the negative of such terms or other comparable terminology, although not all forward-looking statements contain these identifying words. Forward-looking statements are subject to inherent risks and uncertainties in predicting future results and conditions that could cause the actual results to differ materially from those projected in these forward-looking statements. Some, but not all, of the forward-looking statements contained in this annual report include, among other things, statements about the following:

| ● |

our ability to obtain regulatory approval to market and sell our product candidates in the United States, Europe and elsewhere; |

| ● |

the initiation, timing, cost, progress and success of our research and development programs, preclinical studies and clinical trials for our product candidates; |

| ● |

our ability to advance product candidates into, and successfully complete, clinical trials; |

| ● |

our ability to successfully commercialize the sale of our product candidates in the United States, Europe and elsewhere; |

| ● |

our ability to recruit sufficient numbers of patients for our future clinical trials for our pharmaceutical products; |

| ● |

our ability to achieve profitability; |

| ● |

the implementation of our business model and strategic plans; |

| ● |

our ability to develop and commercialize product candidates for orphan and niche indications independently; |

| ● |

our commercialization, marketing and manufacturing capabilities and strategy; |

| ● |

our ability to protect our intellectual property and operate our business without infringing upon the intellectual property rights of others; |

| ● |

our expectations regarding federal, state and foreign regulatory requirements; |

| ● |

the therapeutic benefits, effectiveness and safety of our product candidates; |

| ● |

the accuracy of our estimates of the size and characteristics of the markets that may be addressed by our products and product candidates; |

| ● |

the rate and degree of market acceptance and clinical utility of our future products, if any; |

| ● |

our expectations regarding market risk, including interest rate changes, foreign currency fluctuations and regional or global economic impacts caused by public health threats, such as the outbreak of coronavirus or other infectious diseases; |

| ● |

our ability to engage and retain the employees required to grow our business; |

| ● |

our future financial performance and projected expenditures; |

| ● |

developments relating to our competitors and our industry, including the success of competing therapies that are or become available; and |

| ● |

estimates of our expenses, future revenue, capital requirements and our needs for additional financing. |

You should also read the matters described in the “Risk Factors” and the other cautionary statements made in this annual report as being applicable to all related forward-looking statements wherever they appear in this annual report. We cannot assure you that the forward-looking statements in this annual report will prove to be accurate and therefore you are encouraged not to place undue reliance on forward-looking statements. You should read this annual report completely.

Overview

XBiotech Inc. (“XBiotech” or the “Company) is a biopharmaceutical company that discovers and develops True Human™ monoclonal antibodies for treating a variety of diseases. XBiotech was incorporated in Canada on March 22, 2005.

True Human™ monoclonal antibodies are derived from natural human immune responses—as opposed to being derived from animal immunization or otherwise engineered. XBiotech’s belief is that naturally occurring monoclonal antibodies have the potential to be safer, more effective and faster to develop than engineered counterparts. XBiotech has developed a pipeline of product candidates targeting both inflammatory and infectious diseases. The Company has also developed manufacturing technology that reduces the cost and time to launch new product candidates. Moreover, a state-of-the-art physical plant and infrastructure to manufacture product has been constructed and is operational at the Company’s 48 acre campus in Austin, Texas. XBiotech also has an in-house clinical operations group, with the capability to launch and manage clinical development of its candidate products. The Company thus represents a fully integrated developer of biopharmaceuticals.

An area of medical focus for XBiotech are therapies that block a potent substance naturally produced by body, known as interleukin-1 alpha (IL-1a), that mediates tissue breakdown, angiogenesis, the formation of blood clots, malaise, muscle wasting and inflammation. IL-1a is a protein that is on or in cells of the body and is involved in the body’s response to injury or trauma. In almost all chronic and in some acute injury scenarios (such as stroke or heart attack), IL-1a may mediate harmful disease-related activity.

XBiotech sold bermekimab, a True Human™ antibody that blocks IL-1a activity, for $1.35 billion in cash and potential milestone payments (the “Janssen Transaction”). As part of the Janssen Transaction, XBiotech agreed not to further develop any anti-IL-1a antibodies in dermatology. The Company is pursuing the development of other True Human™ antibodies targeting IL-1a for areas of medicine outside of dermatology. The Company has already identified new IL-1a targeting product candidates that it is has brought into clinical studies. While the Company previously was focused on a single True Human™ antibody targeting IL-1a, it is currently developing two product candidates, and may develop one or more others, that target IL-1a and are used in specific areas of medicine.

Financial

XBiotech received $675 million on December 30, 2019 and $75 million on June 30, 2021 from the sale of bermekimab. In February 2020, XBiotech used approximately $420 million to repurchase stock from its shareholders. In July 2021, XBiotech distributed $75 million cash dividend to its shareholders. The remaining cash was reserved for ongoing operations as part of its multi-year business plan to identify and develop True Human™ antibodies, including anti-Il-1a therapies, aiming for new potential transactions for these drug candidates.

Since January 1, 2020 XBiotech also used its proprietary manufacturing technology, its manufacturing plant and infrastructure to produce drug product for under a supply agreement with Janssen. In addition, during 2020 and 2021 XBiotech provided clinical trial operations services for two Phase II clinical studies. In 2022 XBiotech executed a new manufacturing supply agreement with a Janssen related company to extend its production of bermekimab. Revenue from contract manufacturing and clinical services has and continues to offset a significant portion of operating expenses. We believe that XBiotech is in a very favorable position for an R&D stage biopharmaceutical, with a strong cash position in its balance sheet related to sale of its drug candidate, the absence of debt, a robust pipeline and ongoing contract income.

Further Development of IL-1a Therapies

IL-1a plays a key role in disease. While it is produced naturally by the body, when not properly controlled, in situations of acute or chronic injury, IL-1a can contribute to the development and progression of a variety of medical conditions, such as cancer, stroke, heart attack or arthritis, to name a few. Completed clinical studies and a myriad of scientific research have shown that blocking IL-1a may have a beneficial effect in some or most of these medical conditions. The potential unmet medical need for blocking IL-1a is therefore very significant. In 2021, the Company entered the clinic with a molecule targeting IL-1⍺ in Oncology (Pancreatic Cancer). The company has also filed an INDs and started a clinical program in Rheumatology; and has filed IND for a different anti-IL-1⍺ antibody in cardiovascular medicine.

Because the potential medical uses for anti-IL-1a therapy is so large, the Company is developing more than one True Human™ antibody, each neutralizing IL-1a, but designating different antibodies for use in specific areas of medicine. This will potentially allow XBiotech to individually partner different antibodies according to unique medical areas. The Company expects this will diversify risk for anti-IL-1a therapies, allow multiple partnerships, maximize value and facilitate greater resource dedication to these True Human™ therapeutics.

Infectious Disease Pipeline

XBiotech continued to achieve significant milestones with its infectious disease pipeline in 2021. The Company has identified several major areas of urgent unmet medical need for True Human™ anti-infective antibody therapies. True Human™ antibodies may be used therapeutically or prophylactically to supplement immunity in aging individuals where a natural decline in the robustness of the immune system leaves gaps and vulnerability to infectious diseases. True Human™ antibodies derived from healthy individuals with strong natural immunity to specific diseases are the source of our product candidates, which we believe can be used to supplement the weakening immune system that occurs with age. The Company believes this can be a highly effective means for providing protection against viral diseases such as shingles or intestinal bacterial infections such as C. difficile.

True Human™ antibodies may also be used to provide highly potent and targeted immunity against infectious diseases in young otherwise healthy individuals where infectious agents have overwhelmed natural immunity. For example, this can occur during intravenous drug use, from a deep puncture wound, or from the result of surgery, where bacteria has gained unnatural entry into a body compartment where it can establish and evade the immune system. Staphylococcus aureus, including methicillin resistant (MRSA) variant, is an example of our candidate anti-infective therapeutics.

Another patient population where True Human™ antibodies may be particularly useful is in infants. Primary to developing strong immunity, infants can be vulnerable to infections. Particularly premature infants may need supplemental immunity against specific infectious agents, such as respiratory syncytial virus (RSV). In 2021, the Company continued making progress in its search for a True Human antibody therapeutic candidate for RSV.

In 2021, the Company also started antibody discovery projects to isolate neutralizing antibodies against Norovirus and Measles virus. Norovirus continues to cause outbreaks in the US over the years. According to the CDC report, during August 1, 2021 – January 8, 2022, there were 156 norovirus outbreaks reported by NoroSTAT-participating states. During the same period in 2020, there were 16 norovirus outbreaks reported by these states. A Norovirus therapeutic antibody is expected to decrease morbidity and mortality in high-risk populations. Similarly, measles outbreaks have occurred sporadically in the US due to the following reasons: an increase in the number of travelers who get measles abroad and bring it into the U.S., and further spread of measles in U.S. communities with pockets of unvaccinated people. Therefore a therapeutic candidate against measles continues to be an unmet need and is a part of the XBiotech R&D pipeline.

We believe True Human™ antibody therapies have a very important application in the case of potent viruses, like for example, influenza, where the aggressive nature of the virus takes even relatively strong immune systems to the limits. Here again, in elderly, the young or those with weakened immune systems, an aggressive virus like influenza can be life threatening. In 2020, XBiotech announced that it had developed an antibody cocktail that is capable of neutralizing all known forms of influenza— from the deadly 1918 strain to the most recent versions of flu.

In 2019, XBiotech completed the construction of a new infectious disease and animal facility laboratory. Located in a separate building on our campus, just a short walk from the Company’s main manufacturing headquarters, the new facility incorporates an animal biological safety level 2 (ABSL2) laboratory and other laboratories for in vitro and in vivo testing of the Company’s True Human™ antibodies against infectious disease targets.

The ABSL2 laboratory is currently being used to test XBiotech’s True Human™ antibodies derived from healthy persons with natural immunity to the varicella virus. Natural human immunity is very effective at neutralizing varicella for most of our lives, when we might have billions of different antibodies. Later in life, as we age, the quantity and diversity of our antibody repertoires diminishes. We produce less antibodies against fewer targets. Even though we may have had decades of antibodies protecting us against varicella, as we age a “hole” can develop in the antibody repertoire that was responsible for controlling varicella. When this happens, varicella virus that has been “hiding” in cells of our body can resurge, spread about the body and cause debilitating disease. XBiotech has isolated potent True Human™ antibodies from healthy donors with potent neutralizing antibodies against varicella. We believe that patients suffering from resurgent varicella due to aging immune systems may be effectively treated by supplementing with True Human™ antibody therapy against varicella. There is a substantial unmet medical need for shingles therapy; and other indications where uncontrolled varicella infections, such in infants whose immune systems are not yet adequately developed.

Infrastructure

During 2021 XBiotech undertook to expand its main integrated manufacturing and R&D center. The expansion of the main R&D center was ongoing throughout 2021 and is now complete. The expansion has resulted the creation of two new wings, one that provides laboratory research infrastructure for scientists and another general work areas for manufacturing, clinical personnel and others. The building additions have enhanced the Company’s ability to house a larger workforce, expand R&D activities and orchestrate the production of multiple drug products from its existing manufacturing and R&D center. XBiotech owns its 48-acre campus—and all structures on the property—debt-free.

Sale of Drug Candidate and Equity Transaction

The sale of the anti-IL-1a antibody provided sufficient capital to allow the Company to complete a modified Dutch auction tender offer in February 2020, in which the Company repurchased $420 million of its stock from shareholders. The tender offer provided liquidity to the Company’s shareholders while allowing the Company to consolidate its equity ownership and retain sufficient capital to continue pursuing its business objectives. Final results of the tender offer, announced on February 19, 2020, reported that the Company purchased 14,000,000 common shares at a price of $30.00 per share for an aggregate price of approximately $420 million (excluding fees and expenses related to the offer). The shares repurchased represented approximately 32.67% of the common shares outstanding. The final proration factor for shares that XBiotech purchased pursuant to the tender offer was ultimately deemed to be approximately 33.25%. No equity offerings were made during 2020. In July 2021, XBiotech distributed a cash dividend, in the aggregate amount of $75 million or approximately $2.50 per share, to its shareholders.

A Background on Therapeutic Antibodies

A century ago, scientists and physicians envisioned being able to custom design therapeutic "antibodies” that were highly specific for a single target. By selectively attacking disease while sparing healthy tissue, these “magic bullets” were anticipated to be ideal therapeutic agents. It was not until the early 1970’s, however, that this vision was realized when Kohler and Milstein developed a ground-breaking method for making target-specific monoclonal antibodies—a Nobel prize-winning endeavor. Using this new approach, numerous monoclonal antibody-based research, diagnostic, and therapeutic products developed.

Kohler and Milstein’s discovery was based on their knowledge that the immune system of higher animals produces antibodies as a method of protecting them from various harmful agents, such as viruses, bacteria, and diseased cells. White blood cells, known as B cells, produce billions of different types of antibodies, each with a unique potential to bind and neutralize different disease targets. The vast array of possible treatments based on antibodies led to the development of what is now a major industry around the use of therapeutic antibodies.

True Human™ Antibodies

White blood cells in the human body secrete billions of different antibodies that circulate through the blood to react and protect us from toxins, infectious agents or even other unwanted substances produced by our body. True Human™ antibodies, as the name implies, are simply those that are derived from a natural antibody identified from the blood of an individual. To develop a True Human™ antibody therapy, donors are screened to find an individual that has a specific antibody that matches the desired characteristics needed to obtain the intended medical benefit. White blood cells from that individual are obtained, the unique gene that produced the antibody is cloned, and the genetic information is used to produce an exact replica of the antibody sequence. A True Human™ antibody is, therefore, not to be confused with other marketed antibodies, such as so-called “fully human” antibodies—where antibody reactivity is developed through gene sequence engineering in the laboratory.

Fundamental Science of True Human™ Antibodies

To appreciate the background safety and tolerability of True Human™ antibodies, it is important to consider the fundamental biology of natural antibody production.

Billions of different white blood cells secrete billions of unique antibodies every day into circulation. The vast number of different antibodies (and cells that produce them), are essential to enable adequate molecular diversity to ward off a vast range of potential infectious or toxic threats. In other words, since antibodies act to bind and thereby neutralize unwanted agents, any given circulating antibody must be able to react with a potentially limitless number of existing or evolving disease entities.

The staggering number of different antibodies needed to achieve this level of preparedness, however, is a daunting concept from a genetics point of view. If an individual antibody gene was needed to encode each of a billion different antibodies, there would be approximately 20,000 times as many genes needed just for antibodies as there would be needed to encode the rest of the entire human genome. Individual cells would need to be gigantic, and monumental resources of the body would be required to make, copy and maintain all of the DNA. Clearly, the system of antibodies could not have evolved to protect us, had not an elegant solution emerged to deal with this genetic conundrum.

Thus, a hallmark of the immune physiology of all vertebrates (all have antibodies) is the ability to recombine and selectively mutate a relatively small number of gene segments to create a phenomenal and effectively unlimited number of antibody genes. By rearranging, recombining and mutating the genetic code, specialized white blood cells, or B lymphocytes, are able to create an unlimited array of antibody genes. The consequence of this genetic engineering, however, is that each antibody gene is unique to the individual B lymphocyte that created it—and no copy of the gene exists in the human germline. The only place to find a unique antibody gene is in the individual cells that created it.

The extraordinary process of gene rearrangement and mutation results in a multitude of unique B lymphocytes and consequently an incredibly diverse repertoire of antibodies in any given individual.

Elucidating the mechanisms behind the production of unique antibody genes must be considered one of the major achievements of medical research in the 20th century. Yet unfolding this mystery created another problem to solve: If antibodies were not produced from genes encoded in the human genome and the products of these genes were new to the body, why were these antibody molecules not recognized by the immune system as foreign substances—like any other foreign substance that they were intended to eradicate? How could the body distinguish the apparently “foreign” antibody molecules from the bona fide infectious intruders?

Unraveling the genetics of antibody production led to another major advance in medicine: the discovery of how an endless array of antibody proteins could be made in a way that individual molecules were always tolerated by the body.

In the early 1990s, research began to demonstrate that the production of antibodies was not an unregulated process. Rather, it was learned that the antibodies produced by each and every B lymphocyte were subject to intense scrutiny. Studies showed that B lymphocytes which produced acceptable antibodies were stimulated to grow while those that produced “autoreactive” antibodies were not. B lymphocytes that produced “good” antibodies were stimulated to proliferate and enabled to produce copious amounts of antibody in the event it was needed to ward off a harmful agent. B lymphocytes that rearranged genes to produce antibodies that were ineffective or were autoreactive were given signals that instructed them to engage in a process of programmed cell death. Thus, B lymphocytes producing harmful or useless antibodies are simply killed off. This mechanism for creating antibody diversity on the one hand, while protecting the individual from a mass of unwanted or intolerable antibody molecules on the other, was as elegant as it was fundamental to the success of vertebrate immune physiology.

This process of “selection” has been elucidated in great detail. There can be no more important feature of immune physiology than the process of selection. Selection is a fundamental step to enable the body to produce an extremely diverse set of antibody molecules without, in the process, producing an array of novel molecules that cause harm.

Industry Context

Until now each and every therapeutic antibody on the market has been derived from animals and/or through gene sequence modification in the laboratory to produce a desired antibody reactivity. Marketed antibodies to date, described as “fully human”, are not derived from human gene sequences that have undergone the crucial process of selection in a human.

Without exception, all marketed products to date that are described as “fully human”, are in fact engineered and are not selected based on natural tolerance in the human body. The use of the term “fully human” to describe these products has thus created considerable confusion. To our knowledge, there are at present no True Human™ antibodies manufactured, using recombinant protein technology, currently marketed.

Platform Technology

Our True Human™ antibody therapeutics are developed in-house using our proprietary discovery platform. There are significant technical challenges in identifying and cloning genes for True Human™ antibodies. A key problem to overcome can be to first identify individuals with the desired antibody reactivity. This can involve screening thousands of blood donors to enable the identification of a single, clinically relevant antibody—discovered from literally trillions of irrelevant background antibody molecules in the blood of donors. To distinguish the clinically relevant antibodies from irrelevant background antibody molecules in donor bloods, we use our Super High Stringency Antibody Mining (SHSAM™) technology. White blood cells from that individual can then be isolated, and the unique gene that produced the native antibody obtained. We currently obtain blood donor samples through a Research and Collaboration Agreement with the South Texas Blood & Tissue Center, a Texas 501(c)(3) non-profit corporation.

Novel cloning technologies developed at XBiotech have enabled us to clone the crucial antibody gene sequences from these donors in order to reproduce a True Human™ antibody for use in clinical therapy. A True Human™ monoclonal antibody should therefore not be confused with other marketed therapeutic monoclonal antibodies, such as those currently referred to as “fully human” antibodies.

Market Opportunity

We have a number of indications in various stages of clinical or pre-clinical development with significant market opportunities. These include an array of inflammatory conditions as well as infectious disease indications. The potential market opportunities in these various indications are vast and we believe our research and manufacturing technologies, designed to more rapidly, cost-effectively and flexibly produce new therapies, will be advantageous in each market space.

Our Strategy

Our objective is to fundamentally change the way drugs are developed and commercialized and become a leading biopharmaceutical company focused on the discovery, development and commercialization of therapeutic True Human™ antibodies. The key goals of our business strategy are to:

| • |

Advance our pipeline of therapeutic antibodies and initiate clinical programs in strategic therapeutic areas; |

| • |

Discover other True Human™ antibody therapies using our proprietary platform; and |

| • |

Leverage our manufacturing technology. |

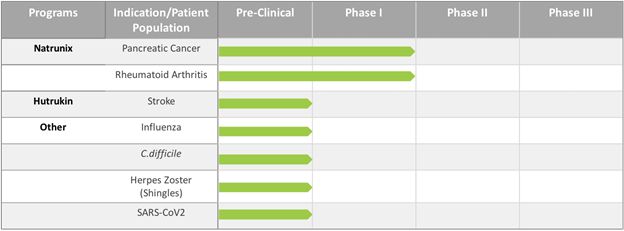

Product Pipeline

Our product development status for the end of the year 2021 was as follows:

Employees

As of December 31, 2021, we had 97 employees, all full-time employees.

Competition

The therapeutic antibody space is dynamic as there continues to be a highly active commercial pipeline of therapeutic antibodies globally, involving a complex array of development cycles as products reach the end of their patent life and as new candidate products proceed into pivotal studies and approach registration. There are numerous independent reviews on the subject in both trade journals and academic press (one such example being Reichert JM, Antibodies to watch in 2018 MAbs. 2018 Jan 4:1-21).

We believe True Human™ therapeutic antibodies have important differentiating factors from other monoclonal antibodies currently marketed. However, regardless of the potential advantages or uniqueness of our current or future product candidates in the market, we do expect these products to compete head-to-head with the numerous existing candidate antibody products in development, including emerging biosimilar therapeutic antibodies.

Safety

The Company’s True Human™ antibodies are derived from a natural human immune response. It is expected that this will facilitate better tolerability when used as a therapeutic compared to humanized or “fully human” monoclonal antibodies. Antibody therapies are known to be associated with significant risk for infusion reactions, including serious anaphylactic reactions. It is the Company’s belief that these reactions are, in large part, the result of using antibodies that were not derived from natural human immunity but rather had engineered specificities.

Intellectual Property

XBiotech has developed a large international intellectual property (IP) portfolio to protect important aspects of its technology, services, and products, including patents, trademarks and trade secrets.

Sale of a Portion of XBiotech’s IL-1a Patent Portfolio and Retention of Certain Rights Thereto.

On December 7, 2019, XBiotech entered into an Asset Purchase Agreement (the “Purchase Agreement”) under which it received $750 million upfront payment and the potential to receive another $600 million in milestone payments. Under the Purchase Agreement, XBiotech assigned a substantial portion of its patent portfolio covering the drug product candidate, bermekimab, that blocks the action of interleukin-1 alpha (IL-1a). Pursuant to the Purchase Agreement, on December 30, 2019, XBiotech assigned to the purchaser 12 patent families related to bermekimab and the use of IL-1α-specific antibodies for treating various conditions, including arthritis, neoplastic diseases, dermatological pathologies, vascular diseases, inflammatory skin disease and psychiatric conditions, cachexia, diabetes, atopic dermatitis and hidradenitis suppurativa.

An IP non-assertion and license agreement (the “IP Agreement”) incorporated into the Purchase Agreement allows XBiotech to develop and commercialize new antibody products which block IL-1a for all areas of medicine outside of dermatology without infringing the patent rights assigned under the Purchase Agreement. The IP Agreement further provides XBiotech the opportunity to enforce certain patent rights within the assigned portfolio that relate to the use of anti-IL-1a antibodies to treat non-dermatological disease against third parties in the event the purchaser elects not to do so.

Patent Rights Controlled by XBiotech.

As of December 31, 2021, XBiotech directly owns or controls through licenses the rights to several patent families. As set forth below, these include IL-1a related patent rights not assigned in the Purchase Agreement as well as others directed to our proprietary antibody discovery platform and to antibodies for treating and preventing S. aureus infections and cancer.

Patent Rights owned by XBiotech.

A. Treatment of Cancer with Anti-IL-1α Antibodies. This patent family relates to the use of anti-IL-1α antibodies to inhibit the metastatic potential of tumors by interrupting the role that tumor-derived IL-1α plays in tumor metastasis. As of December 31, 2021, XBiotech has been granted five patents for this family; including one in Australia, one in Canada, two in Japan, and one in Europe. As of December 31, 2021, this family has three pending patent applications (US, China, and Hong Kong). Unless extended, patents in this family expire in 2027.

B. Diagnosis, Treatment, and Prevention of Vascular Disorders. This patent family relates to methods of diagnosing, treating and preventing a variety of vascular disorder using IL-1a autoantibody. As of December 31, 2021, XBiotech has been granted seven patents in this family, including two in the U.S., one in Australia, one in Canada, one in Europe and two in Japan. Unless extended, patents in this family expire in 2026.

C. IL-1 Alpha Immunization Induces Autoantibodies Protective Against Atherosclerosis. This patent family relates to the use of IL-1α in a vaccine to generate anti-IL-1a antibodies to protect against atherosclerosis. As of December 31, 2021, XBiotech has been granted patents for this family in Australia and Europe. Unless extended, patents in this family expire in 2027.

D. Methods, Compositions, and Kits For Reducing Anti-Antibody Responses. This patent family relates to methods and compositions for reducing immune system-mediated reactions to allotypic determinants on administered antibody products. As of December 31, 2021, XBiotech has been granted one Australian patent in this family. Unless extended, patents in this family expire in 2030.

E. Identifying Affinity-Matured Human Antibodies. This patent family relates to methods and compositions for identifying affinity-matured True HumanTM monoclonal antibodies from donors. As of December 31, 2021, XBiotech has been granted 17 patents in this family (four in the U.S., two in Australia, one in China, one in Europe, one in India, , one in Japan, two in Israel, , one in South Korea, one in Mexico, two in Russia, and one in Hong Kong). As of December 31, 2021, this family has 3 pending patent applications (US, Canada, China, , Mexico, and Russia). Unless extended, patents in this family expire in 2032.

F. Compositions and Methods for Treating S. Aureus Infections. This patent family relates to antibodies for preventing and treating S. aureus infections. As of December 31, 2021, XBiotech has been granted 22 patents in this family, including five in the U.S, two in Australia, one in China, one in Colombia, one in Europe, one in Hong Kong, one in India, one in Indonesia, two in Japan, one in Mexico, one in the Philippines, one in Russia, one in Singapore, one in South Africa, and two in South Korea. As of December 31, 2021, this family has 17 pending patent applications (US, Brazil, Canada, China, Chile, Europe, India, Israel, Japan, Malaysia, Mexico, two in New Zealand, Philippines, Singapore, South Korea, and Russia) of which three (IL, RU, and PH) have been allowed. Unless extended, patents in this family expire in 2035.

G. Treatment of S. Aureus Infections. This patent family relates to the use of antibodies (Abs) which specifically bind interleukin-1α (IL-1α) for treating S. aureus bloodstream infections in human patients. As of December 31, 2021, XBiotech has one pending US application. Unless extended, patents in this family expire in 2038.

H. True Human Antibody Specific for Interleukin 1alpha (IL-1α). This patent family relates to fully human monoclonal Abs including an antigen-binding variable region that exhibits very high binding affinity for IL-1α. As of December 31 2021, XBiotech has one pending international patent application. Unless extended, patents in this family expire in 2041.

I. True Human Antibody Specific for Interleukin 1alpha (IL-1α). This patent family relates to fully human monoclonal Abs including an antigen-binding variable region that exhibits very high binding affinity for IL-1α. As of December 31 2021, XBiotech has one pending international patent application. Unless extended, patents in this family expire in 2041.

J. True Human Antibody Specific for Interleukin 1alpha (IL-1α). This patent family relates to fully human monoclonal Abs including an antigen-binding variable region that exhibits very high binding affinity for IL-1α. As of December 31 2021, XBiotech has one pending international patent application. Unless extended, patents in this family expire in 2041.

K. True Human Antibody Specific for Interleukin 1alpha (IL-1α). This patent family relates to fully human monoclonal Abs including an antigen-binding variable region that exhibits very high binding affinity for IL-1α. As of December 31 2021, XBiotech has one pending international patent application. Unless extended, patents in this family expire in 2041.

XBiotech has licensed exclusive rights to the intellectual property described below.

L. Monoclonal Human Tumor-Specific Antibody. This patent family relates generally to human tumor-specific antibodies as well as fragments, derivatives and variants thereof that recognize tumor-associated antigen NY-ESO-1. XBiotech acquired the use of patents within this family pursuant to its exclusive license agreement with CT Atlantic AG. As of December 31, 2021, this patent family includes 15 issued patents, including one in the U.S., one in Australia, one in Brazil, one in Canada, two in Europe, one in China, one in Israel, one in India, one in Japan, one in South Korea, one in New Zealand, one in Mexico, one in Russia, and one in South Africa. Unless extended, patents in this family expire in 2028.

M. Combination Therapy Including Tumor Associated Antigen-Binding Antibodies. This patent family relates generally to a combination therapy including tumor associated antigen binding antibodies. XBiotech acquired the use of patents within this family pursuant to its exclusive license agreement with CT Atlantic AG. As of December 31, 2021, this patent family includes pending applications in India and the U.S., and six issued patents, including one in Canada, one in China, one in Europe, one in India, one in Japan, and one in South Korea. Unless extended, patents in this family expire in 2032.

N. Treatment of Brain Ischemia-Reperfusion Injury. This patent family relates generally to reducing the sequelae of cerebral ischemia-reperfusion injury by administering to a subject an agent that selectively binds IL-1α. XBiotech and University of Zurich co-own this patent family. XBiotech acquired exclusive rights to this patent family pursuant to a license agreement with University of Zurich. As of December 31, 2021, this patent family includes seven pending patent applications (U.S., Australia, Canada, China, Europe, Japan, and South Korea). Unless extended, patents in this family expire in 2040.

Summary

The following summarizes some of the key risks and uncertainties that could materially adversely affect us. You should read this summary together with the more detailed description of each risk factor contained below.

Risks Related to our Business, Financial Condition and Capital Requirements

| ● |

We may incur significant losses during development of our current pipeline over the forseeable future. |

| ● |

Our business may be adversely affected by the ongoing COVID-19 pandemic. |

| ● |

We currently have limited source of revenue and may never sustain profitability. |

| ● |

Our future success is dependent on the regulatory approval and commercialization of our product candidates. |

| ● |

New laws or regulations could impact our ability to receive the necessary approvals to successfully market and commercialize our product candidates. |

| ● |

Product candidates we advance into clinical trials may not have favorable results in clinical trials or receive regulatory approval. |

| ● |

If we are unable to enroll subjects in clinical trials, we will be unable to complete these trials on a timely basis. |

| ● |

The regulatory approval processes of the FDA and comparable foreign regulatory authorities are lengthy, time consuming and inherently unpredictable. |

| ● |

Our product candidates may cause undesirable side effects or have other properties that could delay or prevent their regulatory approval, limit the commercial profile of an approved label, or result in significant negative consequences following any marketing approval. |

| ● |

Any product candidates that we commercialize may not receive coverage and adequate reimbursement from third-party payers. |

| ● |

If we are unable to establish an effective sales force and marketing infrastructure, or enter into acceptable third-party sales and marketing or licensing arrangements, we may be unable to generate any revenue. |

| ● |

Any approved product candidates may not achieve adequate market acceptance for commercial success. |

| ● |

We face substantial competition, which may result in others discovering, developing or commercializing products before or more successfully than we do. |

| ● |

Product liability lawsuits against us could cause us to incur substantial liabilities and to limit commercialization of any products that we may develop. |

| ● |

Any failure to meet our ongoing obligations to manufacture bermekimab for Janssen would adversely affect our financial condition and business reputation. |

| ● |

We may never achieve any of the potential milestone payments that were negotiated as a part of the Janssen Transaction. |

| ● |

We are highly dependent on our Chief Executive Officer. |

| ● |

We depend on key personnel to operate our business, and we may be unable to retain, attract and integrate qualified personnel. |

| ● |

Failure to comply with environmental, health and safety laws and regulations could subject us to fines, penalties or other costs. |

| ● |

Our business may be disrupted by natural disasters, infrastructure interruptions, COVID-19 or other public health threats. |

Risks Related to Intellectual Property

| ● |

We may be unable to obtain or protect intellectual property rights. |

| ● |

Intellectual property rights do not necessarily address all potential threats to any competitive advantage we may have. |

| ● |

Our technology may be found to infringe upon third-party intellectual property rights. |

| ● |

We may be unable to license needed intellectual property from third parties on commercially reasonable terms or at all. |

| ● |

If we are unable to protect the confidentiality of our trade secrets, our business and competitive position may be harmed. |

Risks Related to Owning Shares of our Common Stock

| ● |

Our share price may be volatile, which could subject us to securities class action lawsuits and prevent you from being able to sell your shares at or above the price at which you purchased them. |

| ● |

Our directors, executive officers and principal shareholders continue to have substantial control over our company and could hinder appropriate corporate control. |

| ● |

We have broad discretion in the use of the net proceeds from the Janssen Transaction and may not use them effectively. |

| ● |

Provisions in our charter documents under Canadian law could make an acquisition of us, which may be beneficial to our shareholders, more difficult. |

| ● |

Against the judgment of the Company, we may be considered a passive foreign investment company for US tax purposes which may negatively affect US investors. |

| ● |

We are governed by the corporate laws in British Columbia, Canada which in some cases have a different effect on shareholders than the corporate laws in Delaware. |

General Risk Factors

| ● |

Raising additional capital may cause dilution to our existing shareholders, restrict our operations or require us to relinquish rights to our technologies or product candidates. |

| ● |

Future sales, or the possibility of future sales, of a substantial number of our common stock could adversely affect the price of the shares and dilute shareholders. |

| ● |

Any inability to accurately report our financial results or prevent fraud due to a failure to maintain effective internal control over financial reporting could cause shareholders to lose confidence in our financial and other public reporting. |

Risks Related to our Business, Financial Condition and Capital Requirements

We have incurred significant losses since our inception and may incur significant losses in the future.

We are a pre-market pharmaceutical company with a limited operating history. We had no net income prior to the fourth quarter of 2019, when we sold certain assets to Janssen Biotech, Inc. and entered into certain related commercial agreements (the “Janssen Transaction”). Investment in pharmaceutical product development is highly speculative because it entails substantial upfront capital expenditures and significant risk that any potential product candidate will fail to demonstrate adequate efficacy or an acceptable safety profile, gain regulatory approval or become commercially viable. We do not have any products approved by regulatory authorities for marketing or commercial sale and have not generated any revenue from product sales, or otherwise, to date, and we continue to incur significant research, development and other expenses related to our ongoing operations. As a result, we incurred losses in every reporting period from our inception in 2005 through the third quarter of 2019. Although we were profitable during the fourth quarter and fiscal year ended December 31, 2019 due to the cash received in the Janssen Transaction, that was an extraordinary transaction outside of normal business operations that had never previously occurred and may not be repeated. We incurred a net loss for the fiscal year ended December 31, 2021.

We expect to continue to incur significant expenses and may incur operating losses for the foreseeable future. We anticipate these expenses will increase as we continue the research and development of, and seek regulatory approvals for our current and future product candidates in various indications, and potentially begin to commercialize any products that may achieve regulatory approval. We may encounter unforeseen expenses, difficulties, complications, delays and other unknown factors that may adversely affect our financial condition. The amount of our future net losses will depend, in part, on the rate of future growth of our expenses and our ability to generate revenues. Our prior losses have had, and any future losses may continue to have, an adverse effect on our financial condition. If any of our product candidates fail in clinical trials or do not gain regulatory approval, or if approved fail to achieve market acceptance, we may never sustain profitability.

Since inception, we have dedicated a majority of our resources to the discovery and development of our proprietary preclinical and clinical product candidates, and we expect to continue to expend substantial resources doing so for the foreseeable future. These expenditures will include costs associated with conducting research and development, manufacturing product candidates and products approved for sale, conducting preclinical experiments and clinical trials and obtaining and maintaining regulatory approvals, as well as commercializing any products later approved for sale. During the year ending December 31, 2021, we recognized approximately $28.3 million in expenses associated with research and development.

We completed our initial public offering on April 15, 2015 and additional registered offerings in March 2017 and May 2019. We also received a significant amount of cash proceeds from the Janssen Transaction. However, the net proceeds from these transactions and cash on hand may not be sufficient to complete clinical development of any of our product candidates nor may it be sufficient to commercialize any product candidate. In addition, we completed a modified Dutch auction tender offer for our common shares in February 2020, which consumed $420 million of our cash resources. We also distributed $75 million cash dividend to our investors in July 2021. Accordingly, we may require substantial additional capital to continue our clinical development and potential commercialization activities. Our future capital requirements depend on many factors, including but not limited to:

| • |

the number and characteristics of the future product candidates we pursue; |

| • |

the scope, progress, results and costs of researching and developing any of our future product candidates, and conducting preclinical research and clinical trials; |

| • |

the timing of, and the costs involved in, obtaining regulatory approvals for any future product candidates we develop; |

| • |

the cost of future commercialization activities for our product candidates and the cost of commercializing any future products approved for sale; |

| • |

the cost of manufacturing our future products; and |

| • |

the costs involved in preparing, filing, prosecuting, maintaining, defending and enforcing patents, including litigation costs and the outcome of any such litigation. |

We are unable to accurately estimate the funds we will actually require to complete research and development of our product candidates or the funds required to commercialize any resulting product in the future or the funds that will be required to meet other expenses. Our operating plan may change as a result of many factors currently unknown to us, and our expenses may be higher than expected. Raising funds in the future may present additional challenges and future financing may not be available in sufficient amounts or on terms acceptable to us, if at all.

Our business may be adversely affected by the ongoing COVID-19 pandemic.

Beginning in late 2019, the outbreak of COVID-19 has evolved into a global pandemic that is disrupting our business operations, which we expect to continue throughout the remainder of 2022 and possibly beyond. Depending upon the length and severity of the pandemic, which cannot be predicted, we may continue to experience disruptions that could materially and adversely impact our business including:

| • |

If any third parties in our supply chain are or continue to be adversely impacted by restrictions resulting from the COVID-19 pandemic, including staffing shortages, production slowdowns, or disruptions in freight and other transportation services and delivery distribution systems, our supply chain may be disrupted, which would limit our ability to manufacture our product candidates for our clinical trials, to meet our obligations to manufacture drugs for Janssen under our clinical manufacturing agreement, or to conduct our research, development and clinical operations. |

| • |

The pandemic has already affected and may continue to affect our obligations and performance under our agreements with Janssen. We cannot predict the likely potential adverse impact of COVID-19 on Janssen’s future purchase orders or our ability to complete the manufacturing required by those purchase orders. |

| • |

Various aspects of our clinical trials could be limited or take longer than expected, including delays or difficulties in enrolling patients in our clinical trials, in clinical trial site initiation, and in recruiting clinical site investigators and clinical site staff; increased rates of patients withdrawing from clinical trials; diversion of healthcare resources away from the conduct of clinical trials; interruption of key clinical trial activities such as clinical trials site data monitoring due to limitations on travel imposed or recommended by governmental authorities; impact on employees and others or interruption of clinical trial visits or study procedures which may impact the integrity of subject data and clinical study endpoints; and interruption or delays in the operations of the FDA and comparable foreign regulatory agencies, which may impact regulatory review and approval timelines. |

| • |

The FDA and comparable foreign regulatory agencies may experience disruptions, have slower response times or be under-resourced to continue to monitor our clinical trials or to conduct required activities and review of our product candidates seeking regulatory review, or may prioritize review and approval of COVID-19 treatments and vaccines over other product candidates, and such disruptions could materially affect the development, timing and approval of our product candidates. |

| • |

As a result of market volatility caused by continued effects of COVID-19 affecting the global economy, we may face difficulties raising capital through sales of our common stock or other securities at acceptable prices, on acceptable terms or at all. |

The COVID-19 pandemic continues to evolve. The ultimate impact of the pandemic on us is highly uncertain and subject to change and will depend on future developments, which cannot be accurately predicted. We do not yet know the full extent of potential delays or impacts on our business, our clinical trials, our research programs, our clinical manufacturing or clinical trial management agreements, the healthcare system or the global economy. Given the uncertainties, we may be unable to maintain operations as planned prior to the COVID-19 pandemic.

We currently have no source of product revenue and may never sustain profitability.

To date, we have not generated any revenues from commercial product sales. Our ability to generate revenue in the future from product sales and achieve profitability will depend upon our ability, alone or with any future collaborators, to commercialize products successfully, including any current product candidates or any product candidates that we may develop, in-license or acquire in the future. Even if we are able to achieve regulatory approval for any current or future product candidates, we do not know when any of these products will generate revenue from product sales, if at all. Our ability to generate revenue from product sales from any of our product candidates also depends on a number of additional factors, including our ability to:

| • |

complete development activities, including the necessary clinical trials; |

| • |

complete and submit new drug applications, or NDAs, to the US Food and Drug Administration, or FDA, and obtain regulatory approval for indications for which there is a commercial market; |

| • |

complete and submit applications to, and obtain regulatory approval from, foreign regulatory authorities such as the European Medicines Agency, or EMA; |

| • |

establish our manufacturing operations; |

| • |

develop a commercial organization capable of sales, marketing and distribution for our product candidates and any products for which we obtain marketing approval and intend to sell ourselves in the markets in which we choose to commercialize on our own; |

| • |

find suitable distribution partners to help us market, sell and distribute our approved products in other markets; |

| • |

obtain coverage and adequate reimbursement from third-party payers, including government and private payers; |

| • |

achieve market acceptance for our products, if any; |

| • |

establish, maintain and protect our intellectual property rights; and |

| • |

attract, hire and retain qualified personnel. |

In addition, because of the numerous risks and uncertainties associated with pharmaceutical product development, including that our product candidates may not advance through development or achieve the endpoints of applicable clinical trials, we are unable to predict the timing or amount of increased expenses, or if we will be able to sustain profitability. In addition, our expenses could increase beyond expectations if we decide to or are required by the FDA, or foreign regulatory authorities, to perform studies or trials in addition to those that we currently anticipate. Even if we are able to complete the development and regulatory process for our product candidates, we anticipate incurring significant costs associated with commercializing these products.

Even if we are able to generate revenues from the sale of any of our product candidates that may be approved, we may not become profitable and may need to obtain additional funding to continue operations. If we are unable to sustain profitability on a continuing basis, then we may be unable to continue our operations at planned levels and be forced to reduce our operations.

Our future success is dependent on the regulatory approval and commercialization of our product candidates.

We do not have any products that have gained regulatory approval. As a result, our ability to finance our operations and generate revenue, are substantially dependent on our ability to obtain regulatory approval for, and, if approved, to successfully commercialize our product candidates in a timely manner. We cannot commercialize our other product candidates in the U.S. without first obtaining regulatory approval for each product from the FDA; similarly, we cannot commercialize any product candidates outside of the U.S. without obtaining regulatory approval from comparable foreign regulatory authorities, including the EMA. The FDA review process typically takes years to complete and approval is never guaranteed. Before obtaining regulatory approvals for the commercial sale of any of our potential product candidates for a target indication, we must demonstrate with substantial evidence gathered in preclinical and well-controlled clinical studies, including two well-controlled Phase III studies, and, with respect to approval in the U.S. to the satisfaction of the FDA, and in Europe, to the satisfaction of the EMA, that the product candidate is safe and effective for use for that target indication; and that the manufacturing facilities, processes and controls are adequate. Obtaining regulatory approval for marketing of our current or future product candidates in one country does not ensure we will be able to obtain regulatory approval in other countries. A failure or delay in obtaining regulatory approval in one country may have a negative effect on the regulatory process in other countries.

Even if any of our product candidates were to successfully obtain approval from the FDA or comparable foreign regulatory authorities, any approval might contain significant limitations related to use restrictions for specified age groups, warnings, precautions or contraindications, or may be subject to burdensome post-approval studies or risk management requirements. If we are unable to obtain regulatory approval for our product candidates in one or more jurisdictions, or any approval contains significant limitations, we may not be able to obtain sufficient funding or generate sufficient revenue to continue the development of any of our other product candidates that we are developing or may discover, in-license, develop or acquire in the future. Also, any regulatory approval of our product candidates, once obtained, may be withdrawn. Furthermore, even if we obtain regulatory approval for any of our product candidates, their commercial success will depend on a number of factors, including the following:

| • |

development of a commercial organization within XBiotech or establishment of a commercial collaboration with a commercial infrastructure; |

| • |

establishment of commercially viable pricing and obtaining approval for adequate reimbursement from third-party and government payers; |

| • |

our ability to manufacture quantities of our product candidates using commercially satisfactory processes and at a scale sufficient to meet anticipated demand and enable us to reduce our cost of manufacturing; |

| • |

our success in educating physicians and patients about the benefits, administration and use of our product candidates; |

| • |

the availability, perceived advantages, relative cost, relative safety and relative efficacy of alternative and competing treatments; |

| • |

the effectiveness of our own or our potential strategic collaborators’ marketing, sales and distribution strategy and operations; |

| • |

acceptance as a safe and effective therapy by patients and the medical community; and |

| • |

a continued acceptable safety profile following approval. |

Many of these factors are beyond our control. If we are unable to successfully commercialize our product candidates, we may not be able to earn sufficient revenues to continue our business.

New laws or regulations may be promulgated or modified in the United States, in Europe, or other jurisdictions that could impact our ability to receive the necessary approvals to successfully market and commercialize our product candidates.

The pharmaceutical and biotechnology industry is one of the most regulated on a state, federal and international level. There are a number of laws, regulations, and court decisions which impact the daily activities of our business. As a result, we must ensure that strategies and planning in relation to our product candidates are in line with the current regulations governing our industry. When there are changes in leadership, whether within the U.S., or elsewhere, we must anticipate the possibility of shifts in regulatory policies as they pertain to our business. New or modified regulations may impact our ability to quickly respond with updates to our programs. While we may be able to anticipate certain changes, policy statements often are not always translated into actionable legislation. We continue to track updates and changes internally to ensure we are in compliance with regulatory authority guidelines and expectations. Court decisions at both the state and federal level can also impact the way in which we operate and make specific product related program decisions. New laws, regulations, or court orders could materially alter or impact our ability to receive necessary approvals from regulatory authorities to market and commercialize our product candidates.

Because the results of earlier clinical trials are not necessarily predictive of future results, product candidates we advance into clinical trials, may not have favorable results in later clinical trials or receive regulatory approval.

Success in preclinical testing and early clinical trials does not ensure that later clinical trials will generate adequate data to demonstrate the efficacy and safety of an investigational drug. A number of companies in the pharmaceutical and biotechnology industries, including those with greater resources and experience, have suffered significant setbacks in clinical trials, even after seeing promising results in earlier clinical trials. We do not know whether the clinical trials we are conducting, or may conduct, will demonstrate adequate efficacy and safety to result in regulatory approval to market any of our product candidates in any particular jurisdiction. Even if we believe that we have adequate data to support an application for regulatory approval to market our product candidates, the FDA or other comparable foreign regulatory authorities may not agree and could require us to conduct additional research studies, including late-stage clinical trials. If late-stage clinical trials do not produce favorable results, our ability to achieve regulatory approval for any of our product candidates may be adversely impacted.

If we are unable to enroll subjects in clinical trials, we will be unable to complete these trials on a timely basis.

Patient enrollment, a significant factor in the timing of clinical trials, is affected by many factors including the size and nature of the patient population, the proximity of subjects to clinical sites, the eligibility criteria for the trial, the design of the clinical trial, ability to obtain and maintain patient consents, risk that enrolled subjects will drop out before completion, competing clinical trials and clinicians’ and patients’ perceptions as to the potential advantages of the drug being studied in relation to other available therapies, including any new drugs that may be approved for the indications we are investigating. Furthermore, we rely on clinical trial sites to ensure the proper and timely conduct of our clinical trials, and while we have agreements governing their committed activities, we have limited influence over their actual, day-to-day performance. We may experience delays in starting-up clinical trial sites in a timely manner, enrolling subjects in our trials, and may not be able to enroll a sufficient number of subjects to complete the trials. In addition, travel restrictions, shutdowns of or occupancy limitations on certain businesses, bans or restrictions on large public gatherings and declarations of states of emergency remain in effect in some cities, states and countries around the world in response to the ongoing COVID-19 pandemic. Spikes in the numbers of infected patients, the rise and spread of new COVID-19 variants, delays in vaccine distribution or administration, adverse reactions to existing or future COVID-19 vaccines or future similar regional or global health concerns could negatively affect our ability to recruit and retain subjects in clinical trials if they disproportionately impact the sites in which we conduct any of our trials, which would have a material adverse effect on our business and our results of operation and financial condition.

If we experience delays in the completion or if there is termination of, any clinical trial of any current or future product candidates, the commercial prospects of our product candidates will be harmed, and our ability to generate product revenues from any of these product candidates will be delayed. In addition, any delays in completing our clinical trials will increase our costs, slow down our product candidate development and approval process and could shorten any periods during which we may have the exclusive right to commercialize our product candidates or allow our competitors to bring products to market before we do, and jeopardize our ability to commence product sales, which would impair our ability to generate revenues and may harm our business, results of operations, financial condition and cash flows and future prospects. In addition, many of the factors that could cause a delay in the commencement or completion of clinical trials may also ultimately lead to the denial of regulatory approval of our product candidates.

The regulatory approval processes of the FDA and comparable foreign regulatory authorities are lengthy, time consuming and inherently unpredictable, and if we are ultimately unable to obtain regulatory approval for our product candidates, our business may fail.

The time required to obtain approval by the FDA and comparable foreign regulatory authorities is unpredictable, but typically takes several years following the commencement of preclinical studies and clinical trials and depends upon numerous factors, including the substantial discretion of the regulatory authorities and any shifts in regulatory policy. In addition, approval policies, regulations, or the type and amount of clinical data necessary to gain approval may change during the course of a product candidate’s clinical development and may vary among jurisdictions. We have not obtained regulatory approval for any product candidate, and it is possible that none of the product candidates we are developing or may discover, in-license or acquire and seek to develop in the future will ever obtain regulatory approval.

Our product candidates could fail to receive marketing approval from the FDA or a comparable foreign regulatory authority for many reasons, including but not limited to:

| • |

disagreement over the design or implementation of our clinical trials; |

| • |

failure to demonstrate that a product candidate is safe and effective; |

| • |

failure of clinical trials to meet the level of statistical significance required for approval; |

| • |

failure to demonstrate that a product candidate’s clinical and other benefits outweigh its safety risks; |

| • |

disagreement over our interpretation of data from preclinical studies or clinical trials; |

| • |

disagreement over whether to accept efficacy results from clinical trial sites outside the United States where the standard of care is potentially different from that in the United States; |

| • |

the insufficiency of data collected from clinical trials of our product candidates to support the submission and filing of an NDA or other submission or to obtain regulatory approval; |

| • |

irreparable or critical compliance issues relating to our manufacturing and/clinical trial processes; or |

| • |

changes in the approval policies or regulations that render our preclinical and clinical data insufficient for approval. |

The FDA or a comparable foreign regulatory authority may require more information, including additional preclinical or clinical data to support approval, which may delay or prevent approval and our commercialization plans, or we may decide to abandon the development program altogether. Even if we do obtain regulatory approval, our product candidates may be approved for fewer or more limited indications than we request, approved contingent on the performance of costly post-marketing clinical trials, or approved with a label that does not include the labeling claims necessary or desirable for the successful commercialization of that product candidate. In addition, if any of our product candidates produce undesirable side effects or safety issues, the FDA may require the establishment of Risk Evaluation Mitigation Strategies, or REMS, or a comparable foreign regulatory authority may require the establishment of a similar strategy, that may, restrict distribution of our products and impose burdensome implementation requirements. Any of the foregoing scenarios could materially harm the commercial prospects for our product candidates.

Even if we believe any completed, current or planned clinical trials are successful, the FDA or a comparable foreign regulatory authority may not agree that our completed clinical trials provide adequate data on the safety or efficacy of our product candidates, permitting us to proceed to additional clinical trials. Approval by comparable foreign regulatory authorities does not ensure approval by the FDA and approval by one or more foreign regulatory authorities does not ensure approval by regulatory authorities in other countries or by the FDA. However, a failure or delay in obtaining regulatory approval in one country may have a negative impact on the regulatory process in others. We may not be able to file for regulatory approvals, and even if we file, we may not receive the necessary approvals to commercialize our products in any market.

Our product candidates may cause undesirable side effects or have other properties that could delay or prevent their regulatory approval, limit the commercial profile of an approved label, or result in significant negative consequences following any marketing approval.

Undesirable side effects caused by our product candidates could cause us or regulatory authorities to interrupt, delay or halt clinical trials and could result in a more restrictive label or the delay or denial of regulatory approval by the FDA or other comparable foreign regulatory authority. If toxicities occur in our current or future clinical trials they could cause delay or even the discontinuation of further development of our product candidates, which would impair our ability to generate revenues and would have a material adverse effect our business, results of operations, financial condition and cash flows and future prospects. There can be no assurance that side effects from our product candidates in future clinical trials or that side effects in general will not prompt the discontinued development or possible market approval of our product candidates. If serious side effects or other safety or toxicity issues are experienced in our clinical trials in the future, we may not receive approval to market any of our product candidates, which could prevent us from ever generating revenues from commercial product sales or sustaining profitability. Results of our trials could reveal an unacceptably high severity and prevalence of side effects. In such an event, our trials could be suspended or terminated and the FDA or comparable foreign regulatory authorities could order us to cease further development of or deny approval of our product candidates for any or all targeted indications. The drug-related side effects could affect patient recruitment or the ability of enrolled subjects to complete the trial or result in potential product liability claims. Any of these occurrences may have a material adverse effect on our business, results of operations, financial condition and cash flows and future prospects.

Additionally, if any of our product candidates receives marketing approval, and we or others later identify undesirable side effects caused by such product, a number of potentially significant negative consequences could result, including:

| • |

we may be forced to suspend marketing of such product; |

| • |

regulatory authorities may withdraw their approvals of such product; |

| • |

regulatory authorities may require additional warnings on the label that could diminish the usage or otherwise limit the commercial success of such product; |

| • |

the FDA or other regulatory bodies may issue safety alerts, Dear Healthcare Provider letters, press releases or other communications containing warnings about such product; |

| • |

the FDA may require the establishment or modification of REMS or a comparable foreign regulatory authority may require the establishment or modification of a similar strategy that may, for instance, restrict distribution of our product and impose burdensome implementation requirements on us; |

| • |

we may be required to change the way the product is administered or conduct additional clinical trials; |

| • |

we could be sued and held liable for harm caused to subjects or patients; |

| • |

we may be subject to litigation or product liability claims; and |

| • |

our reputation may suffer. |

Any of these events could prevent us from achieving or maintaining market acceptance of the particular product candidate, if approved.

Even if our product candidates receive regulatory approval, they may still face future challenges, including ongoing regulatory oversight and marketing challenges.

Even if we obtain regulatory approval for any of our product candidates, it would be subject to ongoing requirements by the FDA and comparable foreign regulatory authorities governing the manufacture, quality control, further development, labeling, packaging, storage, distribution, safety surveillance, import, export, advertising, promotion, recordkeeping and reporting of safety and other post-market information. The safety profile of any product will continue to be closely monitored by the FDA and comparable foreign regulatory authorities after approval. If the FDA or comparable foreign regulatory authorities become aware of new safety information after approval of any product candidate, they may require labeling changes or establishment of a REMS or similar strategy, impose significant restrictions on a product’s indicated uses or marketing, or impose ongoing requirements for potentially costly post-approval studies or post-market surveillance. For example, the label ultimately approved for any product candidate, if it achieves marketing approval, may include restrictions on use.