UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2017

Commission file number 001-37437

XBIOTECH INC.

(Exact name of Registrant as specified in its charter)

| British Columbia, Canada | N/A |

| (State or other jurisdiction of incorporation or organization) | (IRS Employer Identification No.) |

8201 E. Riverside Drive, Bldg. 4, Suite 100

Austin TX 78744

(Address of principal executive offices, including zip code)

Telephone Number (512) 386-2900

(Registrant's telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Name of each exchange on which registered |

| Common Stock, par value $0.0001 per share | NASDAQ Global Market |

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ý

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ý

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ý No ☐

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ý

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the

Exchange Act.

| Large accelerated filer ☐ | Accelerated filer ý | Non-accelerated filer ☐ | Smaller Reporting Company ☐ | |||

| Emerging growth company ý |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ý

The aggregate market value of the voting and non-voting common equity held by non-affiliates of the registrant as of December 31, 2017, was approximately $139,630,732, based upon the closing sales price for the registrant’s common stock, as reported on the NASDAQ Global Market. The calculation of the aggregate market value of voting and non-voting common equity excludes 10,387,160 shares of common stock the registrant held by executive officers, directors and shareholders that the registrant concluded were affiliates of the registrant on that date. Exclusion of such shares should not be construed to indicate that any such person possesses the power, direct or indirect, to direct or cause the direction of management or policies of the registrant or that such person is controlled by or under common control with the registrant.

As of March 15, 2018, 35,439,272 shares of the registrant’s Common Stock were outstanding.

Documents incorporated by reference:

Certain portions, as expressly described in this Annual Report on Form 10-K, of the registrant’s Proxy Statement for the 2018 Annual Meeting of the Stockholders, to be filed not later than 120 days after the end of the year covered by this Annual Report, are incorporated by reference into Part III of this Annual Report where indicated.

TABLE OF CONTENTS

PART I

| 2 |

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This annual report contain forward-looking statements that involve substantial risks and uncertainties. All statements, other than statements of historical facts, included in this annual report, including, without limitation, statements regarding the assumptions we make about our business and economic model, our dividend policy, business strategy and other plans and objectives for our future operations, are forward-looking statements.

These forward-looking statements include declarations regarding our management’s beliefs and current expectations. In some cases, you can identify forward-looking statements by terminology such as “may,” “will,” “should,” “would,” “could,” “expects,” “plans,” “contemplate,” “anticipates,” “believes,” “estimates,” “predicts,” “projects,” “intend” or “continue” or the negative of such terms or other comparable terminology, although not all forward-looking statements contain these identifying words. Forward-looking statements are subject to inherent risks and uncertainties in predicting future results and conditions that could cause the actual results to differ materially from those projected in these forward-looking statements. Some, but not all, of the forward-looking statements contained in this annual report include, among other things, statements about the following:

| · | our ability to obtain regulatory approval to market and sell Xilonix™ in the United States, Europe and elsewhere; |

| · | the initiation, timing, cost, progress and success of our research and development programs, preclinical studies and clinical trials for Xilonix™ and other product candidates; |

| · | our ability to advance product candidates into, and successfully complete, clinical trials; |

| · | our ability to successfully commercialize the sale of Xilonix™ in the United States, Europe and elsewhere; |

| · | our ability to recruit sufficient numbers of patients for our future clinical trials for our pharmaceutical products; |

| · | our ability to achieve profitability; |

| · | our ability to obtain funding for our operations, including research funding; |

| · | our ability to identify additional new products using our True Human™ antibody discovery platform; |

| · | the implementation of our business model and strategic plans; |

| · | our ability to develop and commercialize product candidates for orphan and niche indications independently; |

| · | our commercialization, marketing and manufacturing capabilities and strategy; |

| · | our ability to protect our intellectual property and operate our business without infringing upon the intellectual property rights of others; |

| · | our expectations regarding federal, state and foreign regulatory requirements; |

| 3 |

| · | the therapeutic benefits, effectiveness and safety of our product candidates; |

| · | the accuracy of our estimates of the size and characteristics of the markets that may be addressed by our products and product candidates; |

| · | the rate and degree of market acceptance and clinical utility of Xilonix™ and future products, if any; |

| · | the timing of and our collaborators’ ability to obtain and maintain regulatory approvals for our product candidates; |

| · | our expectations regarding market risk, including interest rate changes and foreign currency fluctuations; |

| · | our belief in the sufficiency of our cash flows to meet our needs for at least the next 12 to 24 months; |

| · | our expectations regarding the timing during which we will be an emerging growth company under the JOBS Act; |

| · | our ability to engage and retain the employees required to grow our business; |

| · | our future financial performance and projected expenditures; |

| · | developments relating to our competitors and our industry, including the success of competing therapies that are or become available; and |

| · | estimates of our expenses, future revenue, capital requirements and our needs for additional financing. |

You should also read the matters described in the “Risk Factors” and the other cautionary statements made in this annual report as being applicable to all related forward-looking statements wherever they appear in this annual report. We cannot assure you that the forward-looking statements in this annual report will prove to be accurate and therefore you are encouraged not to place undue reliance on forward-looking statements. You should read this annual report completely.

| 4 |

PART I

| ITEM 1 | BUSINESS |

Overview

XBiotech Inc. (“XBiotech” or the “Company) is a pre-market biopharmaceutical company engaged in discovering and developing True Human™ monoclonal antibodies for treating a variety of diseases. True Human™ monoclonal antibodies are those which occur naturally in human beings—as opposed to being derived from animal immunization or otherwise engineered. We believe that naturally occurring monoclonal antibodies have the potential to be safer and more effective than their non-naturally occurring counterparts. XBiotech is focused on developing its True Human™ pipeline and manufacturing system.

The majority of our efforts to date have been concentrated on developing our lead product candidate, MABp1 (also known as Xilonix™, CA-18C3, CV-18C3, RA-18C3, and T2-18C3), a therapeutic antibody which specifically neutralizes interleukin-1 alpha (IL-1 a). IL-1a is a pro-inflammatory protein produced by leukocytes and other cells, where it plays a key role in inflammation. When unchecked, inflammation can contribute to the development and progression of a variety of different diseases, such as cancer, vascular disease, inflammatory skin disease, and diabetes. Our clinical studies have shown that blocking IL-1a with our lead product candidate may have a beneficial effect on several diseases.

In June of 2017, the Company announced discontinuation of its global phase III study for treatment of advanced colorectal cancer (CRC) patients under U.S. FDA regulatory guidance after an Independent Data Monitoring Committee (IDMC) performed the second prospectively planned, unblinded analysis and recommended the early termination of the study since the findings were not sufficient to meet efficacy or the threshold for continuation, which involved a prospectively defined acceptance boundary for the interim analysis. XBiotech completed a Phase III study in Europe under European Medicine Agency (EMA) regulatory guidance for the treatment of symptomatic CRC in which the study’s primary endpoint was met. XBiotech submitted a Marketing Authorization Application (MAA) to the EMA in March 2016. In May 2017, the Company announced that it received a negative opinion from the EMA’s Committee for Medicinal Products for Human Use (“CHMP”) for the MAA in Europe. XBiotech subsequently pursued the EMA’s re-examination procedure in which new Rapporteurs were assigned to reevaluate the initial opinion after receiving the Company’s grounds for re-examination. In September 2017, the CHMP issued its opinion on the re-examination of the Company’s MAA and maintained its initial negative opinion issued in May 2017. No further EMA procedures are available to us for the present application. Although all statutory procedures available to the Company as provided by the EMA are exhausted in the application process, the Company continues to pursue clinical development of its oncology program.

An investigator sponsored study was launched in September 2017 at Cedars Sinai Medical Center located in Los Angeles, California for MABp1 to be used in combination with OnivydeⓇ (Irinotecan liposome injection) and 5-fluorouracil/folinic acid for treatment of advanced pancreatic adenocarcinoma. Andrew Hendifar, M.D., Principal Investigator of the study, Medical Oncology lead for the Gastrointestinal Disease Research Group at Cedars-Sinai and Co-Director of Pancreas Oncology, will be leading the study which is planned to enroll a total of 16 patients at the Cedars-Sinai Medical Center. The Phase I study will determine a maximum tolerated dose as well as assess efficacy. Other studies with MABp1 in oncology are also being considered and these will be announced if and when further progress is made in these directions.

We have also investigated our lead product candidate in clinical trials for other inflammatory conditions, including vascular disease (which led to fast track designation from the FDA to develop MABp1 as a therapy to reduce the need for re-intervention after treatment of peripheral vascular disease with angioplasty or other endovascular methods of treatment), type II diabetes, acne, psoriasis, pyoderma gangrenosum (PG) and hidradenitis suppurativa (HS). Data from each of these trials have been published in journals, with the exception of PG. A listing of these publications is included in the Summary of Clinical Findings to Date section of this document.

The most recent publication comes from a completed phase II, double-blinded, placebo-controlled investigator-sponsored study evaluating MABp1 for the treatment of hidradenitis suppurativa (HS), an inflammatory skin disease of such severity that it is often treated through surgical removal of lesions. In October 2017, data from this study was published in the Journal of Investigative Dermatology, which highlights results of twenty patients enrolled in the study with moderate to severe hidradenitis that had progressed on standard therapies. Patients received MABp1 for 12 weeks and were then followed an additional 12 weeks to observe durability of treatment. Efficacy measures include assessment of Hidradenitis Suppurativa Clinical Response (HiSCR) scores, a validated method for evaluating efficacy in HS patients, as well as quality of life assessment (as measured by the Dermatology Life Quality Index, (DLQI). Study results demonstrated a response rate in patients treated with MABp1 versus placebo of 60% vs 10%, respectively (p=0.035).

| 5 |

The Company has completed its Phase I/II study evaluating dosing, safety and efficacy of its novel antibody, 514G3. 514G3 was developed from a healthy human donor with natural antibodies effective at neutralizing Methicillin-resistant Staphylococcus aureus (MRSA) and non-MRSA forms of Staphylococcus aureus (S. aureus). 514G3 works to eliminate the principle immune evasion mechanism of the bacteria, allowing white blood cells to detect and destroy the bacteria. 514G3 has potential to treat all strains of MRSA and can be used without consideration for strain-specific resistance to various antibiotics. As a True Human monoclonal antibody, 514G3 is expected to be well tolerated without the side effects or risks of antibiotics, including the lack of risk of antibiotic resistance. This proprietary antibody received Fast Track Designation by the FDA for the treatment of all forms of S. aureus infections, including Methicillin-resistant S. aureus (MRSA). Top line results from the Phase I/II study were announced in April 2017 and reported a reduction in adverse events and shorter hospitalization associated with the 514G3 therapy, even with 514G3-treated subjects tending to be sicker than those receiving placebo. Research involving 514G3 was published in January 2018 in the journal PLOS ONE in a manuscript titled, “A Natural Human Monoclonal Antibody Targeting Staphylococcus Protein A Protects Against Staphylococcus aureus (S. aureus) Bacteremia.”

The Company is also developing other infectious disease therapies in its pipeline. XBiotech is using its True Human™ antibody technology to develop a first-in-class oral monoclonal antibody against clostridium difficile (C. diff). C. diff is a bacterium that can cause severe infections in the gastrointestinal tract. The infection is greatest for individuals who are being treated with antibiotics, those that are hospitalized or the elderly, particularly those in care facilities. Additionally, about 1 in 5 patients that become infected with C. diff experience a relapse and need to be re-treated. Recent outbreaks and increased virulence of C. diff suggest the urgent need to identify novel approaches to treat the disease. The Company has now shortlisted fourteen anti-C. diff antibody candidates against three different bacterial surface proteins, which are now being tested in vitro and in-vivo efficacy studies in C. diff infection models. The Company has shortlisted eight therapeutic antibody candidates against herpes zoster that are being tested in vitro for efficacy. In parallel, the Company is also working on generating cell lines for large scale manufacturing of these therapeutics, and working on formulating the same. The isolation of candidate True HumanTM therapeutic antibodies against influenza are ongoing, and the Company already has shortlisted a set of antibodies to be tested in vitro.

In November 2017, data was presented at the American Heart Association’s Scientific Sessions which provided the first evidence that IL-1a is associated with Neutrophil Extracellular Traps (NETs) and plays a key role in endothelial activation and thrombogenesis. The data stems from a Material Transfer Agreement (MTA) signed in 2016 with Brigham and Women’s Hospital and Massachusetts General Hospital in which Dr. Peter Libby, a renowned Cardiovascular medicine specialist at Brigham and Women’s Hospital (BWH) and the Mallinckrodt Professor of Medicine at Harvard Medical School, was named principal investigator of the research. The study probed the influence of NETs on the endothelial cell (EC) functions related to erosion-associated thrombosis. The data shows that exposure of human saphenous veins ECs (HSVECs) to NETs cause an increase in expression of cell surface adhesions such as VCAM-1 and ICAM-1, which may participate in atherogenesis. In addition, pre-treatment of NETs with MABp1or IL-1R antagonist, but not with an anti-IL-1β-neutralizing antibody, blocked the initiation of VCAM-1, ICAM-1, and TF expression, each of which have been linked to coronary thrombosis. In conclusion, it was found that NETs act to increase thrombogenicity in vitro through a response mediated by IL-1⍺. These data suggest a potentially important role for MABp1 therapy in heart disease. It also expands treatment opportunities for other inflammatory diseases in which NETs play a deleterious role, such as cancer as well as pulmonary, autoimmune and gastrointestinal diseases. The Company is currently conducting internal research to identify the presence of IL-1alpha in proteins extracted from NET preparations by mass sepectrometry.

Our True Human™ antibody therapeutics are developed in-house using our proprietary discovery platform. Identifying True Human™ antibodies useful for therapeutics may involve screening thousands of blood donors. To distinguish the clinically relevant antibodies from irrelevant background antibody molecules in donor bloods, we use our Super High Stringency Antibody Mining (SHSAM™) technology. After we identify donors, we undertake the complex process of identifying the unique genes for producing the native antibody. Once the nucleic acid sequence is isolated, we are able to introduce these sequences into engineered production cells to manufacture large quantities of product candidate for use in humans. All patents and other intellectual property relating to both the composition of matter and methods of use of our True Human™ antibodies were developed internally by us. We manufacture these antibodies using a proprietary expression system licensed from Lonza Sales AG. The manufacturing process we have developed incorporates both proprietary and non-proprietary technology.

A key aspect of our manufacturing system involves the use of simple disposable bioreactor technology. Our manufacturing operations are currently located within our 86,000 ft2 operations in Austin, Texas. Part of this includes a nearly 40,000 ft2 commercial manufacturing facility that the Company opened in August 2016. This new facility is located on XBiotech’s own 48-acre location just 15 minutes from the Texas capital in Austin. The building will provide a significant increase in the Company’s manufacturing and quality operations in anticipation of commercialization of the Company’s product pipeline. The new facility will increase about ten-fold the Company’s current production capacity. Completion of this building is the first phase in the Company’s plan to develop the 48-acre property to house additional production facilities, laboratories and administrative operations, creating a headquarter campus as the center of its global operations.

| 6 |

A Background on Therapeutic Antibodies

A century ago scientists and physicians envisioned being able to custom design therapeutic agents that were highly specific for a single biological target. By selectively attacking disease while sparing healthy tissue, these “magic bullets” were thought to be ideal therapeutic agents. It was not until the early 1970’s, however, that this vision was realized when Kohler and Milstein developed a ground-breaking method for making target-specific monoclonal antibodies—a Nobel prize-winning endeavor. Using this new approach, numerous monoclonal antibody-based research, diagnostic, and therapeutic products have been developed.

Kohler and Milstein’s discovery was based on their knowledge that the immune system of higher animals produces antibodies as a method of protecting them from various, potentially damaging, agents, such as viruses, bacteria, and diseased cells. White blood cells, known as B cells, produce billions of different types of antibodies, each with a unique potential to selectively attach to and neutralize different disease targets. The vast array of possible treatments based on antibodies led to the development of what is now a major industry around the use of therapeutic antibodies.

True Human™ Antibodies

White blood cells in the human body secrete billions of different antibodies that circulate through the blood to react and protect us from toxins, infectious agents or even other unwanted substances produced by our body. True Human™ antibodies, as the name implies, are simply those that are derived from a natural antibody identified from the blood of an individual. To develop a True Human™ antibody therapy, donors are screened to find an individual that has a specific antibody that matches the desired characteristics needed to obtain the intended medical benefit. White blood cells from that individual are obtained, the unique gene that produced the antibody is cloned, and the genetic information is used to produce an exact replica of the antibody sequence. A True Human™ antibody is, therefore, not to be confused with other marketed antibodies, such as so-called fully human antibodies—where antibody reactivity is developed through gene sequence engineering in the laboratory.

| 7 |

Fundamental Science of True Human™ Antibodies

To appreciate the background safety and tolerability of True Human™ antibodies, it is important to consider the fundamental biology of natural antibody production.

Billions of different white blood cells secrete billions of unique antibodies every day into circulation. The vast number of different antibodies (and cells that produce them), are essential to enable adequate molecular diversity to ward off all potential infectious or toxic threats. In other words, since antibodies act to bind and thereby neutralize unwanted agents, any given circulating antibody must be able to react with a potentially limitless number of existing or evolving disease entities.

The staggering number of different antibodies needed to achieve this level of preparedness, however, is a daunting concept from a genetics point of view. If an individual antibody gene was needed to encode each of a billion different antibodies, there would be 20,000 times as many genes needed just for antibodies as there would be needed to encode the rest of the entire human genome. Individual cells would need to be gigantic, and monumental resources would be required to make, copy and maintain all of the DNA. Clearly, the system of antibodies could not have evolved to protect us, had not an elegant solution emerged to deal with this genetic conundrum.

Thus, a hallmark of the immune physiology of all vertebrates (all have antibodies) is the ability to recombine and selectively mutate a relatively small number of gene segments to create a phenomenal and effectively unlimited number of antibody genes. By rearranging, recombining and mutating the genetic code, specialized white blood cells, or B lymphocytes, are able to create an unlimited array of antibody genes. The consequence of this genetic engineering, however, is that each antibody gene is unique to the individual B lymphocyte that created it—and no copy of the gene exists in the human germline. The only place to find a unique antibody gene is in the individual cells that created it.

The extraordinary process of gene rearrangement and mutation results in a multitude of unique B lymphocytes and consequently an incredibly diverse repertoire of antibodies in any given individual.

Elucidating the mechanisms behind the production of unique antibody genes must be considered one of the major achievements of medical research in the 20th century. Yet unfolding this mystery created another problem to solve: If antibodies were not produced from genes encoded in the human genome and the products of these genes were new to the body, why were these antibody molecules not recognized by the immune system as foreign substances—like any other foreign substance that they were intended to eradicate? How could the body distinguish the apparently “foreign” antibody molecules from the bona fide infectious intruders?

Unraveling the genetics of antibody production led to another major advance in medicine: the discovery of how an endless array of antibody proteins could be made in a way that individual molecules were always tolerated by the body.

In the early 1990s, research began to demonstrate that the production of antibodies was not an unregulated process. Rather, it was learned that the antibodies produced by each and every B lymphocyte were subject to intense scrutiny. Studies showed that B lymphocytes which produced acceptable antibodies were stimulated to grow while those that produced “autoreactive” antibodies were not. B lymphocytes that produced “good” antibodies were stimulated to proliferate, and enabled to produce copious amounts of antibody in the event it was needed to ward off a harmful agent. B lymphocytes that rearranged genes to produce antibodies that were ineffective or were autoreactive were given signals that instructed them to engage in a process of programmed cell death. Thus B lymphocytes producing harmful or useless antibodies are simply killed off. This mechanism for creating antibody diversity on the one hand, while protecting the individual from a mass of unwanted or intolerable antibody molecules on the other, was as elegant as it was fundamental to the success of vertebrate immune physiology.

This process of “selection” has been elucidated in great detail. There can be no more important feature of immune physiology than the process of selection. Selection is a fundamental step to enable the body to produce an extremely diverse set of antibody molecules without, in the process, producing an array of novel molecules that cause harm.

| 8 |

Industry Context

Until now each and every therapeutic antibody on the market has been derived from animals and/or through gene sequence modification in the laboratory to produce a desired antibody reactivity. Marketed antibodies to date, described as “fully human”, are not derived from human gene sequences that have undergone the crucial process of selection in a human.

Without exception, all marketed products to date that are described as “fully human”, are in fact engineered and are not selected based on natural tolerance in the human body. The use of the term “fully human” to describe these products has thus created considerable confusion. To our knowledge, there are at present no True Human™ antibodies manufactured, using recombinant protein technology, currently marketed. If successful in clinical development, our lead product candidate is expected to be the first True Human™ therapeutic antibody to be commercialized.

Platform Technology

There are significant technical challenges in identifying and cloning genes for True Human™ antibodies. A key problem to overcome can be to first identify individuals with the desired antibody reactivity. This can involve screening hundreds of donors to enable the identification of a single, clinically relevant antibody—discovered from literally trillions of irrelevant background antibody molecules in the blood of donors. We screen human donors to find an individual who has in his or her blood a specific antibody that we believe will be protective against a certain disease. White blood cells from that individual can then be isolated, and the unique gene that produced the antibody obtained. We currently obtain blood donor samples through a Research and Collaboration Agreement with the South Texas Blood & Tissue Center, a Texas 501(c)(3) non-profit corporation. See "Intellectual Property- Other Commercial Licenses."

Novel cloning technologies developed at XBiotech have enabled us to clone the crucial antibody gene sequences from these donors in order to reproduce a True Human™ antibody for use in clinical therapy. A True Human™ monoclonal antibody should therefore not be confused with other marketed therapeutic monoclonal antibodies, such as those currently referred to as “fully human” antibodies.

Market Opportunity

We have a number of indications in various stages of clinical or pre-clinical development with significant market opportunities. These include oncology, dermatology, diabetes, and other inflammatory conditions, as well as infectious disease indications. The potential market opportunities in these various indications are vast and we believe our research and manufacturing technologies, designed to more rapidly, cost-effectively and flexibly produce new therapies, will be advantageous in each market space.

Our Strategy

Our objective is to fundamentally change the way drugs are developed and commercialized, and become a leading biopharmaceutical company focused on the discovery, development and commercialization of therapeutic True Human™ antibodies. The key goals of our business strategy are to:

| • | Obtain regulatory approval to market and sell our lead product candidate and/or our other product candidates in the United States, Europe and other markets, and begin commercial sale; |

| • | Continue our research and clinical work on infectious diseases, including S. aureus; |

| • | Advance our pipeline of therapeutic antibodies and other possible clinical programs in strategic therapeutic areas; |

| • | Discover other True Human™ antibody therapies using our proprietary platform; and |

| • | Leverage our manufacturing technology. |

| 9 |

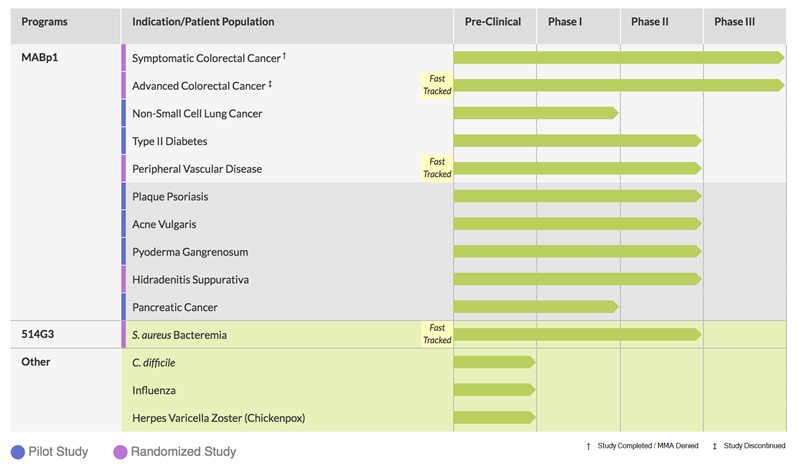

Product Pipeline

Our product development status for the fourth quarter of 2017 was as follows:

Competition

The therapeutic antibody space is dynamic as there continues to be a highly active commercial pipeline of therapeutic antibodies globally, involving a complex array of development cycles as products reach the end of their patent life and as new candidate products proceed into pivotal studies and approach registration. There are numerous independent reviews on the subject in both trade journals and academic press (one such example being Reichert JM, Antibodies to watch in 2018 MAbs. 2018 Jan 4:1-21).

We believe True Human™ therapeutic antibodies have important differentiating factors from other monoclonal antibodies currently marketed. The unique activity of our lead anti-cancer therapeutic has the potential ability to both improve well-being and extend life. We feel our product candidates will be highly differentiated in the market place for therapeutics in various indications including but not limited to cancer and dermatology. However, regardless of the potential advantages or uniqueness of our lead product candidate in the market, we do expect these products to compete head-to-head with the numerous existing candidate antibody products in development, including emerging biosimilar therapeutic antibodies.

Current Clinical and/or Regulatory Activity

European Registration Study Oncology

| 10 |

XBiotech has completed a Phase III study in Europe for treatment of symptomatic CRC. XBiotech proceeded with the submission of a Marketing Authorization Application (MAA) to the European Medicines Agency (EMA) in March 2016. In May 2017, the Company announced that it received a negative opinion from the EMA’s Committee for Medicinal Products for Human Use (“CHMP”) for the MAA in Europe. XBiotech subsequently pursued the EMA’s re-examination procedure in which new Rapporteurs were assigned to reevaluate the initial opinion after receiving the Company’s grounds for re-examination. In September 2017, the CHMP issued its opinion on the re-examination of the Company’s MAA and maintained its initial negative opinion issued in May 2017. No further EMA procedures are available to us for the present application.

In the double-blind placebo-controlled Phase III study, 309 patients were randomized (2:1) to receive Xilonix™ plus best supportive care (BSC) versus placebo plus BSC. Study participants had failed all available chemotherapy and had metastatic disease with one or more symptoms of metabolic dysfunction and functional impairment (i.e., elevated systemic inflammation, unintentional weight loss, pain, fatigue, anorexia). Patients were required to have an Eastern Cooperative Oncology Group (ECOG) function status of only 1 or 2. Elderly patients (>70 years of age) were eligible as well, in contrast to many studies of anti-cancer therapies in advanced disease. The primary endpoint in the study was a composite measure of stable or increased lean body mass (as measured by dual energy X-ray absorptiometry (DEXA)) and stability or improvement of two of three symptom measures of the EORTC QLQ-C30 (pain, fatigue, or anorexia) at week 8 compared with baseline measurements. Secondary endpoints evaluated paraneoplastic thrombocytosis and systemic inflammation. The results of this study were published in The Lancet Oncology in January 2017 in an article titled, “MABp1 as a Novel Antibody Treatment for Advanced Colorectal Cancer: A Randomised, Double-Blind, Placebo-Controlled, Phase 3 Study.”

US Registration Study Oncology

Enrollment was recently completed in the global randomized, double-blind, placebo-controlled Phase III study evaluating the Company’s lead product candidate as a treatment for advanced CRC. The Phase III study is being conducted under Fast Track designation from the FDA and involves over 600 advanced cancer patients from various countries worldwide.

In February 2017, the Company announced an affirmative outcome in the first interim analysis of this study, prospectively planned to occur at 50% of events. The Independent Data Monitoring Committee (IDMC) performed the unblinded analysis and reported the study had no safety concerns and that indications of efficacy thus far were sufficient to recommend proceeding with the study without modification. Per the DMC charter, this was the first of two interim efficacy analyses planned prior to the final analysis for overall survival. In June 2017, the Company announced discontinuation of the study after the IDMC performed the second prospectively planned, unblinded analysis at 75% of events and recommended the early termination of the study since the findings were not sufficient to meet efficacy or the threshold for continuation, which involved a prospectively defined acceptance boundary for the interim analysis (≤ p=0.08).

The double-blind, placebo-controlled Phase III study was randomized 2:1 with patients receiving Xilonix™ or placebo plus best supportive care. Patients were required to have metastatic CRC, and were required to have failed regimens that include flouropyrimidines, oxaliplatin, irinotecan, and Cetuximab or Panitumumab for patients with V-Ki-ras2Kirsten rat sarcoma (KRAS) mutation. Patients continued on the study until there was evidence of radiographic progression. The primary endpoint of this study was overall survival, with secondary endpoints including objective response rate, progression free survival, change in lean body mass as measured by DEXA, and patient reported quality of life using the validated European Organization for Research and Treatment of Cancer Quality of Life in cancer Questionnaire (EORTC QLQ C30 questionnaire).

| 11 |

Phase I Pancreatic Cancer Combination Study

In September 2017, an investigator sponsored study was launched at Cedars Sinai Medical Center located in Los Angeles, California for MABp1 to be used in combination with OnivydeⓇ (Irinotecan liposome injection) and 5-fluorouracil/folinic acid for treatment of advanced pancreatic adenocarcinoma. Andrew Hendifar, M.D., Principal Investigator of the study, Medical Oncology lead for the Gastrointestinal Disease Research Group at Cedars-Sinai and Co-Director of Pancreas Oncology, will be leading the study which is planned to enroll a total of 16 patients at the Cedars-Sinai Medical Center. The Phase I study will determine a maximum tolerated dose as well as assess efficacy.

Phase I/II Study for Staphylococcus aureus

In December 2016, the Company completed enrollment in its randomized, placebo-controlled Phase I/II study evaluating dosing, safety and efficacy of the Company’s novel antibody therapy, 514G3. This proprietary antibody therapy has received Fast Track Designation by the FDA for the treatment of all forms of Staphylococcus aureus infections, including Methicillin-resistant S. aureus (MRSA). Top line results from this study were announced in April 2017 and reported a reduction in adverse events and shorter hospitalization associated with the 514G3 therapy, even with 514G3-treated subjects tending to be sicker than those receiving placebo.

In the study, hospitalized adult patients with confirmed blood infections were randomized 3:1 (514G3 vs placebo) during a dose escalation phase to establish a phase II dose. The phase II portion was randomized 2:1 at the established phase II dose of 40mg/kg. A total of 52 patients were enrolled: 36 received 514G3 and 16 received placebo. Thirty of the 36 patients that were given 514G3 received the established phase II dose (40mg/kg).

| 12 |

Phase II Study for Hidradenitis Suppurativa (HS)

The Company completed enrollment in a double-blinded, placebo-controlled investigator-sponsored study for HS, an inflammatory skin disease of such severity that is often treated through surgical removal of lesions. Twenty patients with moderate to severe HS that had progressed on standard therapies were enrolled in this study. Patients received MABp1 for 12 weeks and were then followed for an additional 12 weeks to observe durability of treatment. Efficacy measures include assessment of Hidradenitis Suppurativa Clinical Response (HiSCR) scores, a validated method for evaluating efficacy in HS patients, as well as quality of life assessment (as measured by DLQI. The Company announced topline results from this study in February 2017, reporting a response rate in patients treated with MABp1 versus placebo of 60% vs 10%, respectively (p=0.035). Results from this study were published in the peer-reviewed, Journal of Investigative Dermatology in November 2017 in an article titled, “MABp1 Targeting IL-1α for Moderate to Severe Hidradenitis Suppurativa Not Eligible for Adalimumab: a Randomized Study.”

Summary of Clinical Findings to Date

Safety

Our lead product under development is derived from a natural human immune response. We expected that this would facilitate better tolerability when used as a therapeutic compared to humanized or “fully human” monoclonal antibodies. Antibody therapies are known to be associated with significant risk for infusion reactions, including serious anaphylactic reactions. We believe that these reactions are the result of using antibodies that were not derived from natural human immunity but rather had engineered specificities. Based on scientific principles of antibody physiology, a fundamentally important premise was that our True HumanTM antibody therapy should be safer and result in less infusion-related complications than engineered human antibodies when used in clinical studies.

Therapeutic monoclonal antibodies, even those so-called “fully human,” have been associated with infusion reactions. Comparably administration of our lead product candidate is associated with a reduced number of infusion related reactions.

To date the Company has published data from 7 of its clinical studies. The table below outlines each of these publications.

| Indication | Journal | Title |

| Oncology | The Lancet Oncology | MABp1 as a novel antibody treatment for advanced colorectal cancer: a randomised, double-blind, placebo-controlled, phase 3 study |

| Oncology | The Lancet Oncology | MABp1, a first-in-class true human antibody targeting interleukin-1α in refractory cancers: an open-label, phase 1 dose-escalation and expansion study |

| Oncology | Investigational New Drugs | Xilonix, a novel true human antibody targeting the inflammatory cytokine interleukin-1 alpha, in non-small cell lung cancer |

| Psoriasis | JAMA Dermatology | Open-label trial of MABp1, a true human monoclonal antibody targeting interleukin 1α, for the treatment of psoriasis |

| Acne | Journal of Drugs in Dermatology | An open label, phase 2 study of MABp1 monotherapy for the treatment of acne vulgaris and psychiatric comorbidity |

| Cardiovascular | Journal of Vascular Surgery | A randomized phase II study of Xilonix, a targeted therapy against interleukin 1α, for the prevention of superficial femoral artery restenosis after percutaneous revascularization |

| Diabetes | Journal of Diabetes and Its Complications | Safety, pharmacokinetics, and preliminary efficacy of a specific anti-IL-1alpha therapeutic antibody (MABp1) in patients with type 2 diabetes mellitus |

| Hidradenitis Suppurativa | Journal of Investigative Dermatology | MABp1 Targeting Interleukin-1Alpha for Moderate to Severe Hidradenitis Suppurativa not Eligible for Adalimumab: A Randomized Study |

| 13 |

Intellectual Property

XBiotech has developed a large international intellectual property (IP) portfolio to protect important aspects of its technology, services and products, including patents, trademarks and trade secrets. As of December 31, 2017, XBiotech’s patent portfolio consisted of 18 patent families, and included 97 issued patents or allowed patent applications, and 111 (not including allowed) pending patent applications in various countries around the world. XBiotech’s IP portfolio is designed to protect XBiotech’s drug products, therapies and to some extent, its discovery technology. It includes patents and applications that protect MABp1 as a composition of matter and methods of using anti-IL-1a antibodies for the treatment of various diseases including cancer, vascular disorders, inflammatory skin diseases, diabetes, and arthritis. XBiotech’s IP portfolio also includes patents and applications directed to some aspects of our proprietary antibody discovery platform, as well as treating and preventing S. aureus infections.

XBiotech owns or licenses the rights to the patent families described in more detail below.

A. Interleukin-1 Alpha Antibodies and Methods of Use. This patent family relates to the development of IL-1a-specific True HumanTM monoclonal antibodies, including MABp1. As of December 31, 2017, XBiotech has been granted 31 patents in this family; including nine in the U.S., and others in Australia, Chile, China, Europe, Hong Kong, Indonesia, Israel, Japan, South Korea, Malaysia, Mexico, New Zealand, the Philippines, Russia, Singapore, and South Africa. Unless extended, patents in this family expire in 2029.

B. Treatment of Cancer with Anti- IL-1α Antibodies. This patent family relates to the use of anti- IL-1α antibodies to inhibit the metastatic potential of tumors by interrupting the role that tumor-derived IL-1α plays in tumor metastasis. As of December 31, 2017, XBiotech has been granted four patents for this family; including one in Australia, one in Canada, one in Japan, and one in Europe. Unless extended, patents in this family expire in 2027.

C. Treatment of Neoplastic Diseases. This patent family relates to the administration of anti- IL-1α antibodies to treat various tumor-associated diseases and the administration of a monoclonal antibody that specifically binds IL-1α to reduce the size of tumors in human patients suffering from cancer. As of December 31, 2017, XBiotech has been granted nine patents for this family including two in Australia, one in Europe, one in Japan, one in Mexico, one in New Zealand, one in the Philippines, one in Singapore, and one in South Africa.

D. Diagnosis, Treatment, and Prevention of Vascular Disorders. This patent family relates to methods of diagnosing, treating and preventing a variety of vascular disorder using IL-1a autoantibody. As of December 31, 2017, Xbiotech has been granted seven patents in this family, including two in the U.S., one in Australia, one in Europe and two in Japan. Unless extended, patents in this family expire in 2026.

E. IL-1 Alpha Immunization Induces Autoantibodies Protective Against Atherosclerosis. This patent family relates to the use of IL-1α in a vaccine to generate anti-IL-1a antibodies to protect against atherosclerosis. As of December 31, 2017, XBiotech has been granted patents for this family in Australia and Europe. Unless extended, patents in this family expire in 2027.

F. Targeting Pathogenic Monocytes. This patent family relates to the discovery that IL-1α is expressed on the proinflammatory, disease-associated CD14+CD16+ monocyte subset in humans, and describes targeting IL-1α to deplete these pathogenic cells or to modulate their function. As of December 31, 2017, XBiotech has been granted four patents in this family; including two in the U.S., one in Australia, and one in Japan. Unless extended, patents in this family expire in 2029.

G. Arthritis Treatment. This patent family relates to the administration of anti- IL-1α antibodies to treat conditions associated with arthritis. As of December 31, 2017, XBiotech has been granted three patents in this family, including two in Australia and one in Israel,. Unless extended, patents in this family expire in 2031.

H. Cachexia Treatment. This patent family relates to the administration of anti- IL-1α antibodies to treat cachexia. As of December 31, 2017, XBiotech has been granted four patents in this family, including one in the U.S., one in Japan, one in Russia, and one in South Africa. A further patent application has been allowed in Australia. Unless extended, patents in this family expire in 2032.

| 14 |

I. Treatment of Diabetes. This patent family relates to the administration of anti- IL-1α antibodies to treat diabetes. As of December 31, 2017, XBiotech has been granted one U.S. patent. Unless extended, patents in this family expire in 2033.

J. Treating Vascular Disease and Complications Thereof. This patent family relates to the administration of IL-1α targeting agents to reduce the chance or severity of a major adverse clinical event occurring in a patient who has received or is expected to receive surgical treatment for a stenosed blood vessel. As of December 31, 2017, XBiotech has been granted one patent in South Africa. Applications in this family were pending in the U.S., Australia, Canada, China, Europe, Israel, Japan, Mexico, New Zealand, Russia, South Korea, and Hong Kong. Unless extended, patents in this family expire in 2033.

K. Treatment of Inflammatory Skin Disease and Psychiatric Conditions. This patent family relates to the administration of anti- IL-1α antibodies to treat inflammatory skin diseases such as acne and psoriasis, as well as to treat psychiatric conditions such as anxiety. As of December 31, 2017, XBiotech has been granted three patents in this family, including one in the U.S., one in Australia, and one in Japan. A further application was allowed in the U.S. Other applications were pending in the U.S., Australia, Canada, China, Europe, Japan, Hong Kong, and South Korea. Unless extended, patents in this family expire in 2033.

L. Methods, compositions, and kits for reducing anti-antibody responses. This patent family relates to methods and compositions for reducing immune system-mediated reactions to allotypic determinants on administered antibody products. As of December 31, 2017, XBiotech has been granted one Australian patent in this family. Unless extended, patents in this family expire in 2030.

M. Identifying Affinity-Matured Human Antibodies. This patent family relates to methods and compositions for identifying affinity-matured True HumanTM monoclonal antibodies from donors. As of December 31, 2017, XBiotech has been granted eight patents in this family (four in the U.S., one in Australia, one in China, one in Russia, and one in Hong Kong)), and applications were pending in Australia, Canada, China, Europe, India, Israel, Japan, Mexico, Russia, and South Korea. Unless extended, patents in this family expire in 2032.

N. Compositions and Methods for Treating S. Aureus Infections. This patent family relates to antibodies for preventing and treating S. aureus infections. As of December 31, 2017, XBiotech has been granted eight patents, in this family, including three in the U.S, one in Colombia, one in Japan, one in Russia, one in Singapore, and one in South Korea. Two further applications were allowed in China and Mexico. Applications were pending in the U.S., Australia, Brazil, Canada, Chile, China, Europe, India, Indonesia, Israel, Japan, Malaysia, Mexico, New Zealand, the Philippines, Russia, Singapore, South Korea, and South Africa. Unless extended, patents in this family expire in 2035.

O. Antibacterial antibodies and Methods of Use. This patent family relates to antibodies for preventing and treating S. aureus infections. XBiotech acquired the use of patents within this family pursuant to its exclusive license agreement with STROX Biopharmaceuticals, LLC. As of December 31, 2017, this patent family includes three patents in the U.S., each expiring in 2019, unless extended.

P. Staphylococcus Aureus-Specific Antibody Preparations. This patent family relates to antibodies for preventing and treating S. aureus infections. XBiotech acquired use of patents within this family pursuant to its exclusive license agreement with STROX Biopharmaceuticals, LLC. As of December 31, 2017, this patent family includes one Australian and one Israeli patent. Unless extended, patents in this family expire in through 2029.

Q. Treatment of Hidradenitis Suppurativa. This invention relates to the use of antibodies (Abs) which specifically bind interleukin-1α (IL-1α) to treat Hidradenitis suppurativa. As of December 31, 2017, XBiotech has one pending U.S. application.

R. Treatment of S. Aureus Infections. This invention relates to the use of antibodies (Abs) which specifically bind interleukin-1α (IL-1α) for treating S. aureus infections. As of December 31, 2017, XBiotech has one pending U.S. application.

Because the patent positions of pharmaceutical, biotechnology, and diagnostics companies are highly uncertain and involve complex legal and factual questions, the patents owned and licensed by us, or any future patents, may not prevent other companies from developing similar or therapeutically equivalent products or ensure that others will not be issued patents that may prevent the sale of our products or require licensing and the payment of significant fees or royalties. Furthermore, to the extent that any of our future products or methods are not patentable, that such products or methods infringe upon the patents of third parties, or that our patents or future patents fail to give us an exclusive position in the subject matter claimed by those patents, we will be adversely affected. We may be unable to avoid infringement of third party patents and may have to obtain a license, defend an infringement action, or challenge the validity of the patents in court. A license may be unavailable on terms and conditions acceptable to us, if at all. Patent litigation is costly and time consuming, and we may be unable to prevail in any such patent litigation or devote sufficient resources to even pursue such litigation.

| 15 |

Employees

At December 31, 2017, we had 51 employees, 8 of whom hold a Ph.D. or M.D. (or equivalent) degree. None of our employees are represented by a labor union or covered by a collective bargaining agreement, nor have we experienced work stoppages. We believe that relations with our employees are good.

Corporate Information

XBiotech Inc. was incorporated in Canada on March 22, 2005. XBiotech USA Inc., a wholly-owned subsidiary of the Company, was incorporated in Delaware, United States in November 2007. XBiotech Switzerland AG, a wholly-owned subsidiary of the Company, was incorporated in Zug, Switzerland in August 2010. XBiotech Japan KK, a wholly-owned subsidiary of the Company, was incorporated in Tokyo, Japan in March 2013. XBiotech Germany GmbH, a wholly-owned subsidiary of the Company, was incorporated in Germany in January 2014. The Company’s headquarters are located in Austin, Texas.

Investor Information

We maintain an Internet website at http://www.xbiotech.com. The information on our website is not incorporated by reference into this annual report on Form 10-K and should not be considered to be a part of this annual report on Form 10-K. Our reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as amended, our quarterly reports on Form 10-Q and our current reports on Form 8-K, and amendments to those reports, are accessible through our website, free of charge, as soon as reasonably practicable after these reports are filed electronically with, or otherwise furnished to, the SEC. We also make available on our website the charters of our audit committee, compensation committee, nominating and corporate governance committee, as well as our corporate governance guidelines and our code of business conduct and ethics. In addition, we intend to disclose on our web site any amendments to, or waivers from, our code of business conduct and ethics that are required to be disclosed pursuant to the SEC rules.

| 16 |

| ITEM 1A | RISK FACTORS |

Risks Related to our Financial Condition and Capital Requirements

We have incurred significant losses every quarter since our inception and anticipate that we will continue to incur significant losses in the future.

We are a pre-market pharmaceutical company with no revenue and a limited operating history. Investment in pharmaceutical product development is highly speculative because it entails substantial upfront capital expenditures and significant risk that any potential product candidate will fail to demonstrate adequate efficacy or an acceptable safety profile, gain regulatory approval or become commercially viable. We do not have any products approved by regulatory authorities for marketing or commercial sale and have not generated any revenue from product sales, or otherwise, to date, and we continue to incur significant research, development and other expenses related to our ongoing operations. As a result, we are not profitable and have incurred losses in every reporting period since our inception in 2005. For the years ended December 31, 2015, 2016, and 2017, we reported a net loss of $37.5 million, $52.8 million and $33.2 million respectively. As of December 31, 2017, we had an accumulated deficit since inception of approximately $216.6 million.

We expect to continue to incur significant expenses and operating losses for the foreseeable future. We anticipate these losses will increase as we continue the research and development of, and seek regulatory approvals for our lead product candidate in various indications and any of our other product candidates, and potentially begin to commercialize any products that may achieve regulatory approval. We may encounter unforeseen expenses, difficulties, complications, delays and other unknown factors that may adversely affect our financial condition. The amount of our future net losses will depend, in part, on the rate of future growth of our expenses and our ability to generate revenues. Our prior losses and expected future losses have had, and will continue to have, an adverse effect on our financial condition. If our lead product candidate or any other product candidate fails in clinical trials or does not gain regulatory approval, or if approved and fails to achieve market acceptance, we may never become profitable. Even if we achieve profitability in the future, we may not be able to sustain profitability in subsequent periods. We will need to raise significant additional funding, which may not be available on acceptable terms, if at all. Failure to obtain this necessary capital when needed may force us to delay, limit or terminate our product development efforts or other operations.

Since inception, we have dedicated a majority of our resources to the discovery and development of our proprietary preclinical and clinical product candidates, and we expect to continue to expend substantial resources doing so for the foreseeable future. These expenditures will include costs associated with conducting research and development, manufacturing product candidates and products approved for sale, conducting preclinical experiments and clinical trials and obtaining and maintaining regulatory approvals, as well as commercializing any products later approved for sale. During the year ending December 31, 2017, we recognized approximately $26.4 million in expenses associated with research and development and clinical trials.

We completed our initial public offering on April 15, 2015 and a registered direct offering in March 2017. However, the net proceeds from these offerings and cash on hand may not be sufficient to complete clinical development of any of our product candidates nor may it be sufficient to commercialize any product candidate. Accordingly, we may require substantial additional capital beyond the offering to continue our clinical development and potential commercialization activities. Our future capital requirements depend on many factors, including but not limited to:

| • | the number and characteristics of the future product candidates we pursue; |

| • | the scope, progress, results and costs of researching and developing any of our future product candidates, and conducting preclinical research and clinical trials; |

| • | the timing of, and the costs involved in, obtaining regulatory approvals for any future product candidates we develop; |

| • | the cost of future commercialization activities for our lead product candidate and the cost of commercializing any future products approved for sale; |

| 17 |

| • | the cost of manufacturing our future products; and |

| • | the costs involved in preparing, filing, prosecuting, maintaining, defending and enforcing patents, including litigation costs and the outcome of any such litigation. |

We are unable to estimate the funds we will actually require to complete research and development of our product candidates or the funds required to commercialize any resulting product in the future or the funds that will be required to meet other expenses. Our operating plan may change as a result of many factors currently unknown to us, and our expenses may be higher than expected. We may need to seek additional funds sooner than planned, through public or private equity or debt financings, government or other third-party funding, marketing and distribution arrangements and other collaborations, strategic alliances and licensing arrangements or a combination of these approaches. Raising funds in the future may present additional challenges and future financing may not be available in sufficient amounts or on terms acceptable to us, if at all.

Raising additional capital may cause dilution to our existing shareholders, restrict our operations or require us to relinquish rights to our technologies or product candidates.

The terms of any financing arrangements we enter into may adversely affect the holdings or the rights of our shareholders and the issuance of additional securities, by us, or the possibility of such issuance, may cause the market price of our shares to decline. The sale of additional equity or convertible securities would dilute all of our shareholders. The incurrence of indebtedness would result in increased fixed payment obligations and, potentially, the imposition of restrictive covenants. Those covenants may include limitations on our ability to incur additional debt, limitations on our ability to acquire, sell or license intellectual property rights and other operating restrictions that could adversely impact our ability to conduct our business. We could also be required to seek funds through arrangements with collaborators or otherwise at an earlier stage than otherwise would be desirable resulting in the loss of rights to some of our product candidates or other unfavorable terms, any of which may have a material adverse effect on our business, operating results and prospects. Additional fundraising efforts may divert our management from their day-to-day activities, which may adversely affect our ability to develop and commercialize our products.

We are subject to an ongoing shareholder class action lawsuit in California, which may adversely affect our business, financial condition, results of operations and cash flows.

We and certain of our executive officers and directors are defendants in a federal securities class action lawsuit filed in state court in California. The federal securities class action lawsuit in Texas was dismissed in October 2016. The California lawsuit and the previous lawsuit in Texas, including the current status, are described in Part I, Item 3 “Legal Proceedings” in this Form 10-K. We continue to believe the ongoing lawsuit to be without merit and intend to vigorously defend ourselves, however we cannot guarantee any particular outcome. These and any similar future matters may divert our attention from our ordinary business operations, and we may incur significant expenses associated with them (including, without limitation, substantial attorneys’ fees and other fees of professional advisors and potential obligations to indemnify the underwriter for our initial public offering and current and former officers and directors who are or may become parties to or involved in such matters). Depending on the outcome of such matters, we could be required to pay material damages and/or suffer other penalties, remedies or sanctions. Accordingly, the ultimate resolution of this pending matter or any similar future matters could have a material adverse effect on our business, financial condition, results of operations, cash flows, liquidity and could negatively impact the trading price of our common stock. Any existing or future shareholder lawsuits could also adversely impact our reputation, our relationships with our customers and our ability to generate revenue.

Risks Related to Our Business

We currently have no source of product revenue and may never become profitable.

To date, we have not generated any revenues from commercial product sales, or otherwise. Our ability to generate revenue in the future from product sales and achieve profitability will depend upon our ability, alone or with any future collaborators, to commercialize products successfully, including our lead product candidate or any future product candidates that we may develop, in-license or acquire in the future. Even if we are able to achieve regulatory approval successfully for our lead product candidate or any future product candidates, we do not know when any of these products will generate revenue from product sales, if at all. Our ability to generate revenue from product sales from our lead product candidate or any of our other product candidates also depends on a number of additional factors, including our ability to:

| 18 |

| • | complete development activities, including the necessary clinical trials; |

| • | complete and submit new drug applications, or NDAs, to the US Food and Drug Administration, or FDA, and obtain regulatory approval for indications for which there is a commercial market; |

| • | complete and submit applications to, and obtain regulatory approval from, foreign regulatory authorities such as the European Medicines Agency, or EMA; |

| • | establish our manufacturing operations; |

| • | develop a commercial organization capable of sales, marketing and distribution for our lead product candidate and any products for which we obtain marketing approval and intend to sell ourselves in the markets in which we choose to commercialize on our own; |

| • | find suitable distribution partners to help us market, sell and distribute our approved products in other markets; |

| • | obtain coverage and adequate reimbursement from third-party payers, including government and private payers; |

| • | achieve market acceptance for our products, if any; |

| • | establish, maintain and protect our intellectual property rights; and |

| • | attract, hire and retain qualified personnel. |

In addition, because of the numerous risks and uncertainties associated with pharmaceutical product development, including that our lead product candidate or any other product candidates may not advance through development or achieve the endpoints of applicable clinical trials, we are unable to predict the timing or amount of increased expenses, or when or if we will be able to achieve or maintain profitability. In addition, our expenses could increase beyond expectations if we decide to or are required by the FDA, or foreign regulatory authorities, to perform studies or trials in addition to those that we currently anticipate. Even if we are able to complete the development and regulatory process for our lead product candidate or any other product candidates, we anticipate incurring significant costs associated with commercializing these products.

Even if we are able to generate revenues from the sale of our lead product candidate or any other product candidates that may be approved, we may not become profitable and may need to obtain additional funding to continue operations. If we fail to become profitable or are unable to sustain profitability on a continuing basis, then we may be unable to continue our operations at planned levels and be forced to reduce our operations.

Our future success is dependent on the regulatory approval and commercialization of our lead product candidate and any of our other product candidates.

We do not have any products that have gained regulatory approval. The Company’s Phase III symptomatic colorectal cancer study has been completed and XBiotech proceeded with the submission of a Marketing Authorization Application (MAA) to the European Medicines Agency (EMA) in March 2016. In May 2017, the Company announced that it received a negative opinion from the EMA’s Committee for Medicinal Products for Human Use (“CHMP”) for the MAA in Europe. XBiotech subsequently pursued the EMA’s re-examination procedure in which new Rapporteurs were assigned to reevaluate the initial opinion after receiving the Company’s grounds for re-examination. In September 2017, the CHMP issued its opinion on the re-examination of the Company’s MAA and maintained its initial negative opinion issued in May 2017. In June 2017, XBiotech reported discontinuation of its second Phase III study, a double-blind placebo controlled study for improving survival in metastatic colorectal cancer, following the Independent Data Monitoring Committee’s (IDMC) second prospectively planned, unblinded interim analysis at 75% of events in the study.

| 19 |

As a result, our ability to finance our operations and generate revenue, are substantially dependent on our ability to obtain regulatory approval for, and, if approved, to successfully commercialize our lead product candidate in a timely manner. We cannot commercialize our lead product candidate or our other product candidates in the U.S. without first obtaining regulatory approval for each product from the FDA; similarly, we cannot commercialize our lead product candidate or our other product candidates outside of the U.S. without obtaining regulatory approval from comparable foreign regulatory authorities, including the EMA. The FDA review process typically takes years to complete and approval is never guaranteed. Before obtaining regulatory approvals for the commercial sale of our lead product candidate or any of our other potential product candidates for a target indication, we must demonstrate with substantial evidence gathered in preclinical and well-controlled clinical studies, including two well-controlled Phase III studies, and, with respect to approval in the U.S. to the satisfaction of the FDA, and in Europe, to the satisfaction of the EMA, that the product candidate is safe and effective for use for that target indication; and that the manufacturing facilities, processes and controls are adequate. Obtaining regulatory approval for marketing of our lead product candidate or our future product candidates in one country does not ensure we will be able to obtain regulatory approval in other countries. A failure or delay in obtaining regulatory approval in one country may have a negative effect on the regulatory process in other countries.

Even if our lead product candidate or any of our other product candidates were to successfully obtain approval from the FDA or comparable foreign regulatory authorities, any approval might contain significant limitations related to use restrictions for specified age groups, warnings, precautions or contraindications, or may be subject to burdensome post-approval studies or risk management requirements. If we are unable to obtain regulatory approval for our lead product candidate in one or more jurisdictions, or any approval contains significant limitations, we may not be able to obtain sufficient funding or generate sufficient revenue to continue the development of any of our other product candidates that we are developing or may discover, in-license, develop or acquire in the future. Also, any regulatory approval of our lead product candidate or our other product candidates, once obtained, may be withdrawn. Furthermore, even if we obtain regulatory approval for our lead product candidate or our other product candidates, its commercial success will depend on a number of factors, including the following:

| • | development of a commercial organization within XBiotech or establishment of a commercial collaboration with a commercial infrastructure; |

| • | establishment of commercially viable pricing and obtaining approval for adequate reimbursement from third-party and government payers; |

| • | our ability to manufacture quantities of our lead product candidate using commercially satisfactory processes and at a scale sufficient to meet anticipated demand and enable us to reduce our cost of manufacturing; |

| • | our success in educating physicians and patients about the benefits, administration and use of our lead product candidate; |

| • | the availability, perceived advantages, relative cost, relative safety and relative efficacy of alternative and competing treatments; |

| • | the effectiveness of our own or our potential strategic collaborators’ marketing, sales and distribution strategy and operations; |

| • | acceptance as a safe and effective therapy by patients and the medical community; and |

| • | a continued acceptable safety profile following approval. |

Many of these factors are beyond our control. If we are unable to successfully commercialize our lead product candidate, we may not be able to earn sufficient revenues to continue our business.

New laws or regulations may be promulgated or modified in the United States, in Europe, or other jurisdictions that could impact our ability to receive the necessary approvals to successfully market and commercialize our lead product candidate or any of our other product candidates.

| 20 |

The pharmaceutical and biotechnology industry is one of the most regulated on a state, federal and international level. There are a number of laws, regulations, and court decisions which impact the daily activities of our business. As a result, we must ensure that strategies and planning in relation to our product candidates are in line with the current regulations governing our industry. When there are changes in leadership, whether within the U.S., or elsewhere, we must anticipate the possibility of shifts in regulatory policies as they pertain to our business. New or modified regulations may impact our ability to quickly respond with updates to our programs. While we may be able to anticipate certain changes, policy statements often are not always translated into actionable legislation. We continue to track updates and changes internally to ensure we are in compliance with regulatory authority guidelines and expectations. Court decisions at both the state and federal level can also impact the way in which we operate and make specific product related program decisions. New laws, regulations, or court orders could materially alter or impact our ability to receive necessary approvals from regulatory authorities to market and commercialize our lead product candidate or any of our other product candidates.

We submitted a Marketing Authorization Application to the EMA for our lead product candidate after successfully completing a Phase III study in Europe which was ultimately denied by the Agency. Even if the EMA or FDA approves our lead product candidate in the future, there are a number of obstacles to consider in the post-marketing approval and commercialization processes in Europe and/or the U.S.

In March 2016, we submitted a Marketing Authorization Application to the EMA Committee for Human Medicinal Products, or CHMP, for the Phase III study of our lead product candidate completed in Europe during Q4 2015. In May 2017, the Company announced that it received a negative opinion from the EMA’s Committee for Medicinal Products for Human Use (“CHMP”) for the MAA in Europe. XBiotech subsequently pursued the EMA’s re-examination procedure in which new Rapporteurs were assigned to reevaluate the initial opinion after receiving the Company’s grounds for re-examination. In September 2017, the CHMP issued its opinion on the re-examination of the Company’s MAA and maintained its initial negative opinion issued in May 2017. In June 2017, XBiotech reported discontinuation of its second Phase III study, a double-blind placebo controlled study for improving survival in metastatic colorectal cancer, following the Independent Data Monitoring Committee’s (IDMC) second prospectively planned, unblinded interim analysis at 75% of events in the study. Therefore, the Company does not currently have any marketing applications under review with any regulatory agencies.

During the EMA’s assessment period, our manufacturing facilities were audited. They were determined, by the EMA, to have met the standards of Good Manufacturing Practices, (GMP) in October 2016. Additionally, our new manufacturing facility, which opened in September 2016, must go through validation with the appropriate regulatory agency prior to commercial production. The new facility might fail validation or not meet regulatory standards for a commercial manufacturing facility. Also, during the assessment period, our clinical research sites engaged to recruit patients into the clinical trial were audited to ensure standards of Good Clinical Practice, (GCP). Even though there were no major findings resulting from the audit of the selected clinical research site, this was merely a sampling by the EMA and may not be representative of other research sites that participated in the clinical trial.

If the Company does seek approval in the EU in the future, we must also gain reimbursement approval in specific EU countries, as well as, buy-in from patients and health care professionals alike for the use of lead product candidate or our other product candidates to treat any relevant indication(s). If we do not receive reimbursement from countries or private payers in the EU, our lead product candidate may not reach or be accessible to patients or health care professionals. Even if our lead product candidate or our other product candidates is approved for reimbursement in EU countries, it may not always maintain its reimbursement status. There are a number of scenarios where we may encounter tight price controls, continuous negotiations, and other variety of outcomes that could challenge our ability to effectively sell the product in certain EU countries. Some countries may decide to no longer reimburse our lead product candidate or our other product candidates for a number of reasons. Further, patients and health care professionals may reject one lead product candidate or our other product candidates as a standard of care treatment for any relevant indication(s). If patients and healthcare professionals reject one of our product candidates, then it will be difficult to generate revenue for the company. There will be a similar scenario if the Company seeks approval in the U.S.