As filed with the Securities and Exchange Commission on December 1, 2023.

Registration No. 333-261705

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

Amendment No. 14

to

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

(Exact name of registrant as specified in its charter)

(State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification Number) |

People’s

Republic of China

+

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Nevada Agency and Transfer Company

50 West Liberty Street, Suite 880

Reno, NV 89501

(775) 322-0626

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies of all communications to:

| Anthony W. Basch, Esq. | Fang Liu, Esq. | |

| Yan (Natalie) Wang, Esq. | VCL Law LLP | |

| Kaufman & Canoles, P.C. | 1945 Old Gallows Road, Suite 260 | |

| 1021 E. Cary Street, Suite 1400 | Vienna, VA 22182 | |

| Richmond, VA 23219 | Telephone: (703) 919-7285 | |

| Telephone: (804) 771-5700 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this registration statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box: ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large Accelerated Filer ☐ | Accelerated Filer ☐ | Smaller

Reporting Company | ||||

| Emerging Growth Company

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall hereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

EXPLANATORY NOTE

This Registration Statement contains two prospectuses, as set forth below.

| ● | ||

| ● | Resale Prospectus. A prospectus to be used for the resale by the selling stockholders set forth therein of 2,250,000 shares of common stock of the registrant (the “Resale Prospectus”). |

The Resale Prospectus is substantially identical to the Public Offering Prospectus, except for the following principal points:

| ● | they contain different front cover pages and back cover pages; | |

| ● | they contain different The Offering sections in the Prospectus Summary; | |

| ● | they contain different Use of Proceeds sections; | |

| ● | the Capitalization section is deleted from the Resale Prospectus; | |

| ● | the Dilution section is deleted from the Resale Prospectus; | |

| ● | the Underwriting section from the Public Offering Prospectus is deleted from the Resale Prospectus and a Plan of Distribution section is inserted in its place; | |

| ● | a Selling Stockholders section is included in the Resale Prospectus; and | |

| ● | the Legal Matters section in the Resale Prospectus deletes the reference to counsel for the underwriter. |

The registrant has included in this registration statement a set of alternate pages after the outside back cover page of the Public Offering Prospectus, which we refer to as the Alternate Pages, to reflect the foregoing differences in the Resale Prospectus as compared to the Public Offering Prospectus. The Public Offering Prospectus will exclude the Alternate Pages and will be used for the public offering by the registrant. The Resale Prospectus will be substantially identical to the Public Offering Prospectus except for the addition or substitution of the Alternate Pages and will be used for the resale offering by the selling stockholders.

The sales of the shares of our common stock registered in the Public Offering Prospectus and the shares of our common stock registered in the Resale Prospectus may result in two offerings taking place concurrently, which could affect the price and liquidity of, and demand for, our securities. This risk and other risks are included in “Risk Factors” beginning on page 13 of the Public Offering Prospectus. The resale offering in the Resale Prospectus is contingent upon Nasdaq approval and consummation of the offering in the Public Offering Prospectus.

The information in this preliminary prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the SEC is effective. This preliminary prospectus is not an offer to sell nor does it seek an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

Subject to Completion, dated December 1, 2023

PRELIMINARY PROSPECTUS

Fortune Valley Treasures, Inc.

1,500,000 Shares of Common Stock

This prospectus relates to the offer and sale of 1,500,000 shares of common stock, par value $0.001 per share, of Fortune Valley Treasures, Inc. Our common stock is quoted on the OTC Pink Open Market under the symbol “FVTI.” We have applied to have our common stock listed on the NASDAQ Capital Market under the symbol “FVTI.” We believe that upon the completion of the offering contemplated by this prospectus, we will meet the standards for listing on the NASDAQ Capital Market. We cannot guarantee that we will be successful in listing our common stock on the NASDAQ Capital Market; however, we will not complete this offering unless we are so listed.

As of November 30, 2023, the last sale price of our common stock as reported on OTC Pink Open Market was $3.95 per share. The offering price of our common stock in this offering is assumed to be $4.00 per share. The actual public offering price per share will be determined between us and the underwriters at the time of pricing. Therefore, the assumed public offering price used throughout this prospectus may not be indicative of the final offering price.

Fortune Valley Treasures, Inc. (“FVTI” or “FVTI Nevada”) is not an operating company but a holding company incorporated in the State of Nevada. Substantially all of the business operations is conducted in the People’s Republic of China (“PRC” or “China”) by our PRC subsidiaries. Shares of common stock offered in this offering are shares of a U.S. holding company, which does not conduct operations. As used in this prospectus, “we,” “us,” “our” or “the Company” refers to FVTI Nevada, the U.S. holding company. While none of our PRC subsidiaries operates with a variable interest entity (“VIE”) structure, the Chinese regulatory authorities could disallow our current operating structure, which would likely result in a material change in our operations and/or a material change in the value of the securities we are registering for sale, including that it could cause the value of such securities to significantly decline or become worthless. See “Risk Factors — If the Chinese government determines that our corporate structure does not comply with Chinese regulations, or if Chinese regulations change or are interpreted differently in the future, Chinese regulatory authorities could disallow our current operating structure, which would likely result in a material change in our operations and/or a material change in the value of the securities we are registering for sale, including that it could cause the value of such securities to significantly decline or become worthless”; and “Risk Factors — The Chinese government may intervene or influence our operations at any time, or may exert more control over offerings conducted overseas and/or foreign investment in China-based issuers, which could result in a material change in our operations and/or the value of the securities we are registering for sale.”

We face various legal and operational risks and uncertainties relating to our subsidiaries’ operations in China. Because substantially all of our operations are conducted in China through our PRC subsidiaries, the Chinese government may intervene or influence the operation of our PRC subsidiaries and exercise significant oversight and discretion over the conduct of their business and may intervene in or influence their operations at any time, or may exert more control over securities offerings conducted overseas and/or foreign investment in China-based issuers, which could result in a material change in operations of our PRC subsidiaries and/or the value of our common stock. Further, any actions by the Chinese government to exert more oversight and control over offerings that are conducted overseas and/or foreign investment in China-based issuers could significantly limit or completely hinder our ability to offer or continue to offer securities to investors and cause the value of such securities to significantly decline or be worthless.

Recently, the PRC government initiated a series of regulatory actions and statements to regulate business operations in China with little advance notice, including cracking down on illegal activities in the securities market, adopting new measures to extend the scope of cybersecurity reviews, and expanding the efforts in anti-monopoly enforcement. We do not believe that we are directly subject to these regulatory actions or statements, as our PRC subsidiaries do not have a VIE structure and their operations are not subject to cybersecurity review requirements, or involve any type of restricted industry. Because these statements and regulatory actions are new, it is highly uncertain how soon legislative or administrative rule making bodies in China will respond to them, or what existing or new laws or regulations will be modified or promulgated, if any, or the potential impact such modified or new laws and regulations will have on our subsidiaries’ daily business operations or ability to accept foreign investments and list on an U.S. exchange. In July 2021, the Cyberspace Administration of China (“CAC”) opened cybersecurity probes into several U.S.-listed technology companies focusing on anti-monopoly regulation, and how companies collect, store, process and transfer data, among other things. On June 24, 2022, the Standing Committee of the National People’s Congress adopted the amended Anti-Monopoly Law, effective August 1, 2022, which increases the fines for illegal concentration of business operators to “no more than ten percent of its last year’s sales revenue if the concentration of business operator has or may have an effect of excluding or limiting competition; or a fine of up to RMB 5 million if the concentration of business operator does not have an effect of excluding or limiting competition.” On December 24, 2021, nine government agencies jointly issued the Opinions on Promoting the Healthy and Sustainable Development of Platform Economy, which provides that, among others, monopolistic agreements, abuse of dominant market position and illegal concentration of business operators in the field of platform economy will be strictly investigated and punished in accordance with the relevant laws. We do not hold a dominant market position in our product markets and we have not entered into any monopolistic agreement. We have not received any inquiry from the relevant governmental authorities. On July 10, 2021, the CAC published a revised draft revision to the Cybersecurity Review Measures for public comment, or the Draft Cybersecurity Measures, and together with 12 other Chinese regulatory authorities, released the final version of the Revised Measures for Cybersecurity Review, or the Revised Cybersecurity Measures, in December 2021, which took effect on February 15, 2022. Pursuant to the Revised Cybersecurity Measures, critical information infrastructure operators procuring network products and services and online platform operators carrying out data processing activities, which affect or may affect national security, shall conduct a cybersecurity review pursuant to the provisions therein. In addition, online platform operators possessing personal information of more than one million users seeking to be listed on foreign stock markets must apply for a cybersecurity review. We don’t believe that we are an “operator” within the meaning of the Revised Cybersecurity Measures, nor do we control more than one million users’ personal information, and therefore, we should not be required to undertake a cybersecurity review under the Revised Cybersecurity Measures. Further, an expert interpretation of the Revised Cybersecurity Measures published at the CAC’s website on February 17, 2022 indicated no application review is required for operators that have been listed abroad before the implementation of the Revised Cybersecurity Measures. The Revised Cybersecurity Measures apply to companies going abroad for secondary listing, dual primary listing and other new foreign listings and subject to the reporting requirements. On February 17, 2023, China Securities Regulatory Commission (the “CSRC”) issued the Trial Administrative Measures of Overseas Securities Offering and Listing by Domestic Enterprises, or the Trial Measures, and five application guidelines (collectively, the “Overseas Listing Rules”), which took effect on March 31, 2023. According to the Overseas Listing Rules, all China-based companies applying for overseas securities issuance, listing and post-listing capital operations shall be subject to statutory procedures, such as filing and information reporting requirements. After making the initial application with an overseas securities regulatory authority or stock exchange for an offering or listing, a China-based company shall file with the CSRC within three business days. Subsequent securities offerings of an issuer in the same overseas market where it has previously offered and listed securities shall be filed with the CSRC within three business days after the offering is completed. Subsequent securities offerings and listings of an issuer in other overseas markets than where it has offered and listed shall be filed with the CSRC within three business days after the application is made. In addition, overseas offerings and listings will be prohibited for China-based companies under certain circumstances as prescribed. The Overseas Listing Rules further provide that a fine between RMB 1 million and RMB 10 million may be imposed if a company fails to fulfil the filing requirements with the CSRC or conducts an overseas offering or listing in violation of the Overseas Listing Rules. Overseas offerings and listings subject to the Overseas Listing Rules include direct and indirect offerings and listings. We believe that this offering and the listing of our shares on Nasdaq Capital Market will be deemed as an indirect overseas offering and listing under the Overseas Listing Rules and one of our PRC operating subsidiaries shall complete the filing procedures and submit the relevant information to CSRC in connection with this offering. While we are required to complete the filing procedures, our PRC subsidiary only needs to submit the filing materials and no CSRC approval would be required under the rules. Because we are relying on an opinion of our counsel, Grandall Law Firm, there is uncertainty inherent in relying on an opinion of counsel in connection with whether we are required to obtain approvals or permissions from a PRC governmental authority for the conduct of our operations, securities offerings and/or listings. In the event that a government approval is required, we cannot assure you that we will be able to receive clearance in a timely manner, or at all. Any failure of us to fully comply with new regulatory requirements may significantly limit or completely hinder our ability to offer or continue to offer our common stock, cause significant disruption to our business operations, severely damage our reputation, materially and adversely affect our financial condition and results of operations and cause our shares to significantly decline in value or become worthless. See “Risk Factors — The Chinese government may intervene or influence the operations of our PRC subsidiaries and exercise significant oversight and discretion over the conduct of their business and may intervene in or influence their operations at any time, which could result in a material change in operations of our PRC subsidiaries and/or the value of our common stock”; “Risk Factors — Recent regulatory developments in China, including greater oversight and control by the CAC over data security, may subject us to additional regulatory review, and any actions by the Chinese government to exert more oversight and control over foreign investment in China-based issuers could significantly limit or completely hinder our ability to offer or continue to offer securities to investors and cause the value of such securities to significantly decline or be worthless”; and “Risk Factors — Any failure or perceived failure by our PRC subsidiaries to comply with the Anti-Monopoly Guidelines for Internet Platforms Economy Sector and other PRC anti-monopoly laws and regulations may result in governmental investigations or enforcement actions, litigation or claims against us and could have an adverse effect on our business, financial condition and results of operations.”

Cash may be transferred within our organization in the following manners: (i) FVTI Nevada may transfer funds to our subsidiaries, including our PRC subsidiaries, by way of capital contributions or loans, through intermediate holding subsidiaries or otherwise; (ii) we and our intermediate holding subsidiaries may provide loans to our operating subsidiaries and vice versa; and (iii) our subsidiaries, including our PRC subsidiaries, may make dividends or other distributions to us through intermediate holding companies or otherwise. As of the date of this prospectus, we have not made any cash transfers, capital contributions or loans to any of our subsidiaries. Any loans from us or our holding subsidiaries outside of China (including Hong Kong subsidiaries) to our PRC subsidiaries, which are treated as foreign-invested enterprises (“FIEs”) under PRC law, are subject to PRC regulations and foreign exchange loan registrations. Such loans to our FIE subsidiaries to finance their activities must be registered with the State Administration of Foreign Exchange (“SAFE”) or its local counterparts. Funds are transferred among our PRC subsidiaries for working capital purposes, primarily between Qianhai DaXingHuaShang Investment (Shenzhen) Co., Ltd. (“QHDX”), our wholly foreign owned enterprise (WFOE) subsidiary, and its operating subsidiaries. As advised by our PRC counsel, PRC laws, regulations and judicial interpretations thereof do not prohibit using cash generated from one subsidiary to fund another subsidiary’s operations by way of short term interest free loans. We have not been notified of any other restriction which could limit our PRC subsidiaries’ ability to transfer cash to other PRC subsidiaries. In addition, QHDX has maintained cash management policies which dictate the corporate approvals and procedure with respect to cash transfers with other PRC subsidiaries. QHDX conducts review and management of its subsidiaries’ cash transfers and reports to its board of directors. Other than QHDX, neither us nor other subsidiaries have cash management policies dictating how funds are transfer, albeit each company must comply with applicable laws or regulations with respect to transfer of funds, dividends and distributions. In the future, cash proceeds raised from overseas financing activities, including this offering, may be transferred by us to our Hong Kong subsidiaries and PRC subsidiaries via capital contributions or shareholder loans. As of the date of this prospectus, FVTI Nevada has not made dividend or other distributions to our shareholders. FVTI Nevada may pay dividends to our shareholders subject to our ability to service our debts as they become due and provided that our assets will exceed our liabilities after the payment of such dividends. As a holding company, FVTI Nevada may rely on dividends and other distributions on equity paid by our subsidiaries for our cash and liquidity requirements, including payment of any debt we may incur outside of China and our expenses. If any of our subsidiaries incurs debt on its own behalf in the future, the instruments governing such debt may restrict their ability to pay dividends to us. To the extent cash or assets in the business is in the PRC or Hong Kong or a PRC or Hong Kong subsidiary, the cash or assets may not be available to fund operations or for other use outside of the PRC or Hong Kong due to interventions in or the imposition of restrictions and limitations on our or our subsidiaries’ ability by the PRC government to transfer cash or assets. PRC laws and regulations applicable to our PRC subsidiaries permit payments of dividends only out of their retained earnings, if any, determined in accordance with applicable accounting standards and regulations. Our PRC subsidiaries may pay dividends only out of their respective accumulated after-tax profits as determined in accordance with PRC accounting standards and regulations. In addition, our subsidiaries are required to set aside at least 10% of its accumulated after-tax profits each year, if any, to fund certain statutory reserve funds, until the aggregate amount of such funds reaches 50% of its registered capital. At its discretion, a wholly foreign-owned enterprise may allocate a portion of its after-tax profits to discretionary funds. These reserve funds and discretionary funds are not distributable as cash dividends. Furthermore, dividends paid by our WFOE subsidiaries to their parent companies will be subject to a 10% withholding tax, which can be reduced to 5% if certain requirements are met. The PRC government also imposes restrictions on the conversion of RMB into foreign currencies and the remittance of currencies out of the PRC. As such, we may experience difficulties in completing the administrative procedures necessary to obtain and remit foreign currency for the payment of dividends from our profits, if any. As of the date of this prospectus, none of our subsidiaries has made any dividends or other distributions to us. Our WFOE subsidiary, QHDX, has paid on our behalf for professional service fees and U.S. federal income tax due. Our PRC subsidiaries presently intend to retain all earnings to fund their operations and business expansions. We do not anticipate paying dividends or other distributions to our shareholders in the foreseeable future. See the relevant discussions in “Prospectus Summary — Cash Flows, Dividends and Other Asset Transfers between the U.S. Holding Company and Our Subsidiaries” beginning on page 5; “Prospectus Summary — Dividend Policy” on page 7; “Summary Risk Factors — Risks Related to Doing Business in China” on page 7; “Risk Factors — PRC regulation of loans and direct investment by offshore holding companies in PRC entities may delay or prevent us from using the proceeds of our securities offerings to make loans or additional capital contributions to our PRC operating subsidiaries, which could materially and adversely affect our liquidity and our ability to fund and expand our business” on page 34; “Risk Factors — We may rely on dividends and other distributions on equity paid by our PRC subsidiaries to fund any cash and financing requirements we may have, and any limitation on the ability of our PRC subsidiaries to make payments to us could have a material and adverse effect on our ability to conduct our business” on page 35; “Risk Factors — Governmental control of currency conversion may affect the value of your investment” on page 35; and “Risk Factors — Payment of dividends is subject to restrictions under Nevada and the PRC laws” on page 39.

Our common stock may be prohibited from trading on a national exchange or “over-the-counter” markets under the Holding Foreign Companies Accountable Act (the “HFCAA”) if the Public Company Accounting Oversight Board (“PCAOB”) determines it is unable to inspect or investigate completely our auditors for two consecutive years. Pursuant to the HFCAA enacted in December 2020 and related legislation, if the SEC determines that a company has filed an audit report issued by a registered public accounting firm that has not been subject to inspection by the PCAOB for two consecutive years, the SEC is required to prohibit such company’s securities from being traded on a national securities exchange or in the over the counter trading market in the U.S. On August 26, 2022, the PCAOB signed a Statement of Protocol Agreement with the CSRC and the Ministry of Finance (the “MOF”) of the PRC, which establishes a method and framework for the PCAOB to conduct inspections and investigations of audit firms based in mainland China or Hong Kong. On December 15, 2022, the PCAOB announced that the PCAOB was able to secure complete access to inspect and investigate registered public accounting firms headquartered in mainland China and Hong Kong and vacated its previous 2021 determinations that the PCAOB was unable to inspect or investigate completely registered public accounting firms headquartered in mainland China and Hong Kong. However, should PRC authorities obstruct or otherwise fail to facilitate the PCAOB’s access in the future, the PCAOB will consider the need to issue a new determination. Our auditor, MaloneBailey, LLP, is headquartered in Houston, Texas, with offices in Beijing and Shenzhen and, as a PCAOB-registered public accounting firm, is required to undergo regular inspections by the PCAOB to assess its compliance with the laws of the U.S. and professional standards. MaloneBailey, LLP has been subject to PCAOB inspections and is not among the PCAOB-registered public accounting firms headquartered in the PRC or Hong Kong that are subject to PCAOB’s determination. Notwithstanding the foregoing, if it is later determined that the PCAOB is unable to inspect or investigate our auditor completely, if there is any regulatory change or step taken by PRC regulators that does not permit MaloneBailey, LLP to provide audit documentations located in China or Hong Kong to the PCAOB for inspection or investigation, or the PCAOB expands the scope of the Determination so that we are subject to the HFCAA, as the same may be amended, we would fail to meet the PCAOB’s requirements. Any audit reports not issued by auditors that are completely inspected or investigated by the PCAOB, or a lack of PCAOB inspections of audit work undertaken in China that prevents the PCAOB from regularly evaluating our auditors’ audits and their quality control procedures, could result in a lack of assurance that our financial statements and disclosures are adequate and accurate, which could result in limitation or restriction to our access to the U.S. capital markets, and trading of our securities, including trading on the national exchange and trading on “over-the-counter” markets, may be prohibited under the HFCAA. See “Risk Factors — Trading in our securities may be prohibited under the Holding Foreign Companies Accountable Act if the PCAOB determines that it cannot inspect or investigate completely our auditors for two consecutive years”; and “Risk Factors — Newly enacted Holding Foreign Companies Accountable Act, recent regulatory actions taken by the SEC and the Public Company Accounting Oversight Board, and proposed rule changes submitted by Nasdaq calling for additional and more stringent criteria to be applied to China-based public companies could add uncertainties to our capital raising activities and compliance costs.”

We anticipate that following the completion of this offering, our Chief Executive Officer, Yumin Lin, and our former director and a major shareholder, Minghua Cheng, will beneficially own an aggregate 65.30% our outstanding shares of common stock. We may be deemed to be a “controlled company” under the NASDAQ Marketplace Rules 5615(c). However, we do not intend to avail ourselves of the corporate governance exemptions afforded to a “controlled company” under the NASDAQ Marketplace Rules.

Investing in our securities involves a high degree of risk. See “Risk Factors” beginning on page 13.

| Per Share | Total | |||||||

| Public offering price | $ | $ | ||||||

| Underwriting discounts and commissions | $ | $ | ||||||

| Non-accountable expense allowance (1.5%)(1) | $ | $ | ||||||

| Proceeds to us, before expenses | $ | $ | ||||||

| (1) | Does not include accountable expense allowance payable to the underwriters. Please see the section of this prospectus entitled “Underwriting” for additional information regarding underwriter compensation. |

This offering is being conducted on a firm commitment basis. The underwriters are obligated to take and pay for all of the shares offered by this prospectus if any such shares are taken. The underwriters are not required to take or pay for the shares covered by the underwriters’ over-allotment option to purchase additional shares of common stock.

We have granted a 45-day option to the underwriters to purchase up to an additional 225,000 shares of common stock at the public offering price to cover over-allotments, if any.

Neither the Securities and Exchange Commission nor any other regulatory body has approved or disapproved these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The underwriters expect to deliver the Shares to purchasers on or about , 2023.

Joseph Stone Capital, LLC

The date of this prospectus is , 2023

| i |

TABLE OF CONTENTS

Through and including , 2023 (25 days after the commencement of this offering), all dealers effecting transaction in these securities, whether or not participating in this offering, may be required to deliver a prospectus. This delivery requirement is in addition to the obligation of dealers to deliver a prospectus when acting as underwriters and with respect to their unsold allotments or subscriptions.

You should rely only on the information contained in this prospectus and any free writing prospectus we may authorize to be delivered to you. We have not, and the underwriters have not, authorized anyone to provide you with information different from, or in addition to, that contained in this prospectus and any related free writing prospectus. We and the underwriters take no responsibility for, and can provide no assurances as to the reliability of, any information that others may give you. This prospectus is not an offer to sell, nor is it seeking an offer to buy, these securities in any jurisdiction where the offer or sale is not permitted. The information contained in this prospectus is only accurate as of the date of this prospectus, regardless of the time of delivery of this prospectus and any sale of our common stock. Our business, financial condition, results of operations and prospects may have changed since that date.

| ii |

PROSPECTUS SUMMARY

This summary contains basic information about us and the offering contained elsewhere in this prospectus. Because it is a summary, it does not contain all the information that you should consider before investing in our securities. You should read and carefully consider the entire prospectus before making an investment decision, especially the information presented under the headings “Risk Factors,” “Cautionary Note Regarding Forward-Looking Statements,” “Management’s Discussion and Analysis of Financial Condition and Results of Operation” and all other information included in this prospectus in its entirety before you decide whether to purchase any shares offered by this prospectus.

Unless the context requires otherwise, the words “we,” “us,” “our,” “our company,” “the Company,” “FVTI” and “FVTI Nevada” refer to Fortune Valley Treasures, Inc., a holding company incorporated in the State of Nevada.

Our Company

FVTI is a holding company incorporated in the State of Nevada. We conduct our business through our PRC subsidiaries, which are a food and beverage supply chain company group based in Guangdong province, China. With the mission to improve people’s lives by offering safe and quality foods, we are committed to building a first class food supply chain business in China and in the global markets. Through quality control and sales of selected branded products, we provide a one-stop quality food purchase experience for both businesses and individual customers.

Our vision is “Safe Foods for the People.” Our products are well recognized among consumer groups in the Pearl River Delta region of China. We strive to improve the consumers’ food experience in respect of brand, quality, service and speed. Through online and offline channels, we deliver quality food products to consumers through sales targeting national and regional wholesalers, major food and beverage chains, supermarkets and other retailers.

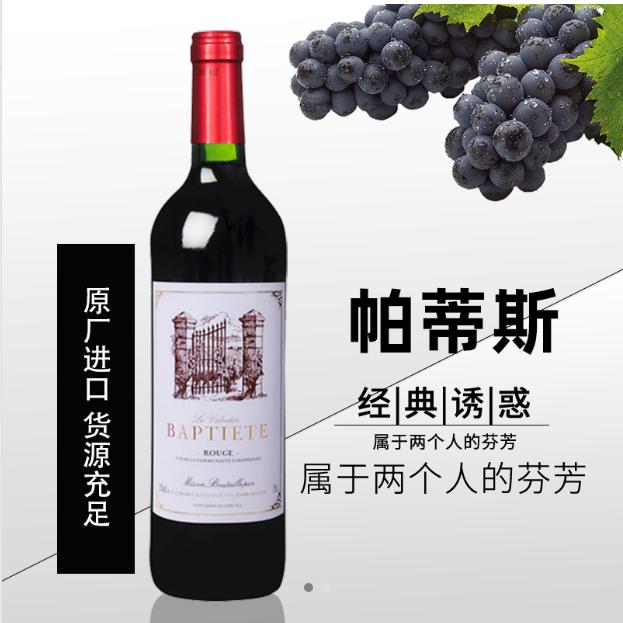

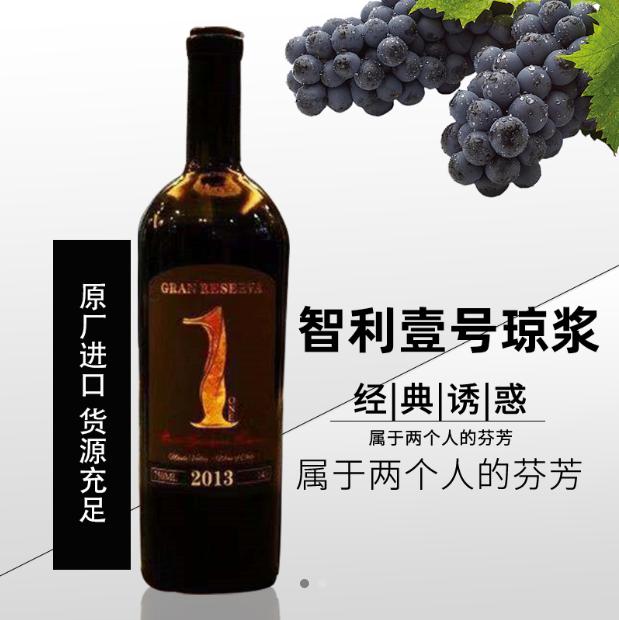

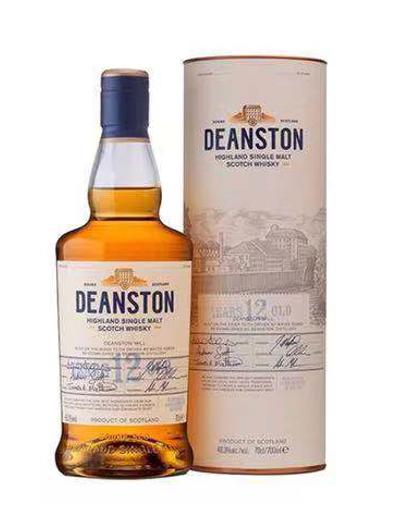

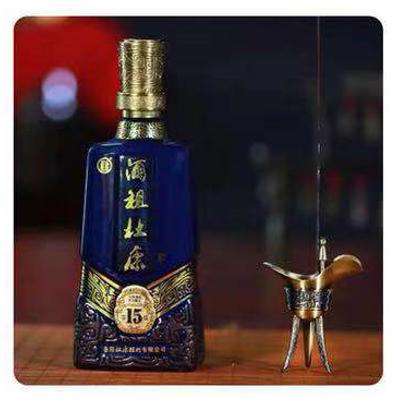

We purchase, supply, distribute and sell alcohol and non-alcohol beverages, packaged staple foods, and household drinking water related purification devices. Since our founding in 2011, we have primarily engaged in the wholesale distribution and retail sale of wine and liquor products in Southern China. In the recent years, we have expanded into the non-alcohol beverage and food markets through strategic acquisitions.

We manage the entire process of product procurement, warehousing, distribution, logistics, and delivery through our supply chain system. We cultivate long-term cooperation relationships with many high-quality upstream suppliers to secure the supply demand and stable product procurement. Through continuous optimization and management of supply planning, logistics management and quality assurance, we have improved product procurement efficiency and product flow management capabilities.

We sell products using a hybrid marketing model through our supply chain platform, social media, primarily WeChat, distributor network, key customer channels, product displays at our stores, and community promotions. We promote direct sales to business and individual consumers on our e-commerce supply chain platform – “FVTI Online” (or “Fugu Online”). Further, we make online or offline bulk sales through our agents and independent distributors. We have over a dozen brick and mortar stores in Dongguan City and elsewhere in Guangdong Province. We have established long-term and stable cooperative relations with certain core enterprises and achieved a substantial portion of our sales through key customer channels. We utilize promotions and cross-selling opportunities to expand our customer base and build brand awareness. In addition, we are actively seeking quality target companies in the food and beverage industries for mergers and acquisition for further development of our company.

We are on path to build a closed-loop industry supply chain system for our products. Through connecting upstream suppliers and downstream purchasers and consumers, we have formed a supply chain network, broadened market penetration through the technology driven e-commerce platform and services, and aligned supplier production, supply and marketing with distribution and sale to achieve cost reduction and efficiency.

| 1 |

Our Strengths

| ● | Our brand image and reputation give us a competitive advantage among the food and beverage supply chain businesses in China, especially in the Pearl River Delta region |

| ● | Diversified quality product portfolio enables us to enhance our sales volume and market influence |

| ● | Efficient product supply chain system is supported by procurement efficiency, logistics management and quality assurance |

| ● | Multi-channel marketing and sales models expand our customer base, enhance brand awareness and drive revenue growth |

| ● | Best in class customer experience and mature service management promote customer satisfaction and loyalty |

Our Strategies

| ● | Diversify our existing product portfolio strategically and provide our customers with a wider range of choices and broaden our existing customer base. |

| ● | Continue to solidify our relationships with our existing suppliers as well as identifying new suppliers. |

| ● | Further enhance brand awareness by increasing marketing and promotion efforts. |

| ● | Attract, motivate and retain high-quality talent. |

| ● | Seek opportunities to acquire quality companies in the food and beverage industry for further development of our company. |

| ● | Continue to explore additional services and products to enrich our one-stop services to our customers. |

Corporate Structure

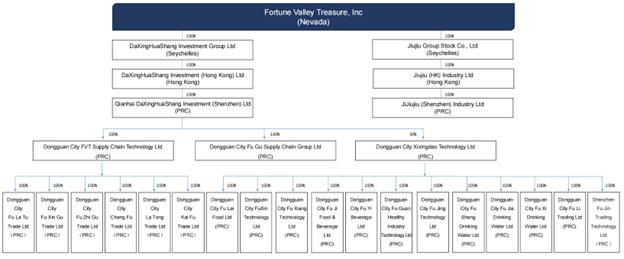

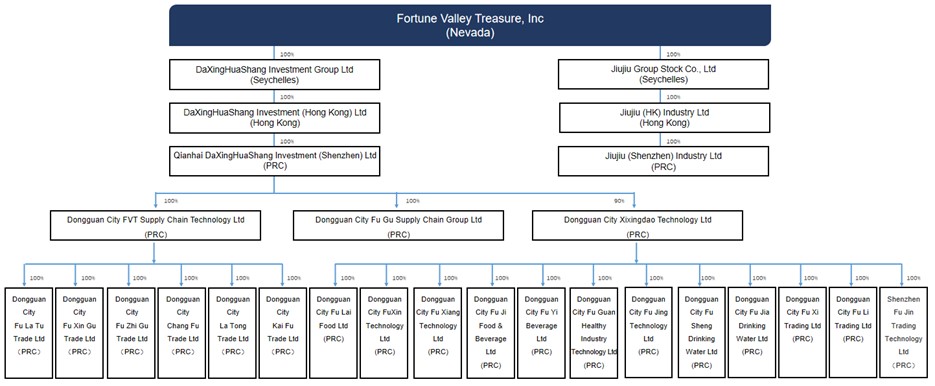

FVTI is a holding company incorporated in the State of Nevada that does not conduct any substantial business operations. FVTI, owns, through our wholly owned offshore non-PRC subsidiaries and WFOEs, all of the equity of FVT Supply Chain and FG Supply Chain, and 90% of the equity of Xixingdao, each of which, in turn, owns all of the equity of their subsidiaries. FVT Supply Chain, FG Supply Chain, Xixingdao and their respective subsidiaries are operating companies conducting business primarily in the PRC.

The following chart illustrates our current corporate organizational structure as of the date of this prospectus:

| 2 |

Permission Required from the PRC Authorities with respect to Operations and Securities Listing and Issuance

As of the date of this prospectus, as advised by our PRC legal counsel, Grandall Law Firm, we and our PRC subsidiaries have received all requisite permits, approvals and certificates from the PRC government authorities to conduct our business operations in China. To our knowledge, no permission or approval has been denied or revoked. As an enterprise group engaged in food and beverage product sale and distribution business, our PRC subsidiaries are not operating in an industry that prohibits or limits foreign investment. We and our PRC subsidiaries are not required to obtain permissions from the CSRC, the CAC or any other PRC authorities to operate, other than the permits and approvals our PRC subsidiaries have already received. However, if we or our subsidiaries do not receive or maintain required permissions or approvals, inadvertently conclude that such permissions or approvals are not required, or applicable laws, regulations, or interpretations change such that we are required to obtain such permissions or approvals in the future, we may be subject to governmental investigations or enforcement actions, fines, penalties, suspension of operations, or be prohibited from engaging in relevant business or conducting securities offering, and these risks could result in a material adverse change in our operations, significantly limit or completely hinder our ability to offer or continue to offer securities to investors, or cause such securities to significantly decline in value or become worthless.

Our PRC subsidiaries are required to obtain certain permits and licenses from the PRC government agencies to operate our business in China, including: (a) business licenses, (b) food business licenses, and (c) Electronic Data Interchange License (“EDI”). In addition, one of our PRC subsidiaries is subject to certain certification and registration requirements in connection with limited product import and export operations.

We conduct our business in China through our PRC subsidiaries. All of our PRC subsidiaries are required to obtain, and have obtained, the required business licenses from the State Administration for Market Regulation (“SAMR”). The PRC Food Safety Law mandates a licensing system for food production and trade and requires vendors engaging in food production or sale or catering services to obtain a food business license in accordance with the applicable laws. Among our PRC subsidiaries, the following fourteen companies are required to obtain food business licenses and have received such licenses pursuant to the PRC Food Safety Law: FVT Supply Chain, Xixingdao, Dongguan City Fu La Tu Trade Co., Ltd. (“FLTT”), Dongguan City Fu Xin Gu Trade Co., Ltd. (“FXGT”), Dongguan City Fu Lai Food Co., Ltd. (“FLFL”), Dongguan City Fu Xin Technology Co., Ltd. (“FXTL”), Dongguan City Fu Xiang Technology Co., Ltd (“FGTL”), Dongguan City Fu Ji Food & Beverage Co., Ltd. (“FJFL”), Dongguan City Fu Yi Beverage Co., Ltd. (“FYBL”), Dongguan City Fu Jing Technology Co., Ltd. (“FJTL”), Dongguan City Fu Sheng Drinking Water Co. Ltd. (“FSWL”), Dongguan City Fu Jia Drinking Water Co., Ltd. (“FJWL”), Dongguan City Fu Xi Trading Co., Ltd. (“FXWL”) and Shenzhen Fu Jin Trading Technology Co., Ltd. (“FJSTL”). Therefore, these fourteen subsidiaries have the required government permits to engage in food purchase and sale activities. However, a food business license is not required for the sale of edible agricultural products and prepacked food. Companies engaged in the sale of prepacked food must report to the food safety regulatory agencies of the local government for recordation. Seven of our subsidiaries, Dongguan City Fu Zhi Gu Trade Co., Ltd. (“FZGT”), Dongguan City Chang Fu Trade Co., Ltd. (“CFT”), Dongguan City La Tong Trade Co., Ltd. (“LTT”), Dongguan City Kai Fu Trade Co., Ltd. (“KFT”), Dongguan City Fu Guan Healthy Industry Technology Co., Ltd. (“FGHL”), Dongguan City Fu Li Trading Co., Ltd. (“FLTL”) and Dongguan City Fu Gu Supply Chain Group Co., Ltd. (“FGGC” or “FG Supply Chain”), are subject to such reporting requirement and have completed the recordation procedure. However, Guangdong provincial government has not issued detailed implementation rules, and as such, changes in rules and regulations may impose additional requirements for our subsidiaries in China.

The relevant PRC Telecommunications Regulations require a telecommunication service provider in China to obtain an operating license from the Ministry of Industry and Information Technology, or MIIT, or its provincial counterparts, prior to commencement of operations. Our subsidiary, FVT Supply Chain, engages in food, beverage and related product purchases and sales via its online platform. As a provider of online data processing and transaction processing services, FVT Supply Chain is required to obtain an Electronic Data Interchange (EDI) license and has obtained the EDI license. The relevant PRC regulations, including the Classification Catalogue of Telecommunications Services, are still evolving, and there have been limited guidance and interpretation with respect to the scope of various types of telecommunication services. We may be subject to additional license requirements if we further expand our online operations and services.

FVT Supply Chain is subject to certain certification and registration requirements in connection with its limited product import and export operations. FVT Supply Chain has applied and obtained the relevant certificates and government approvals, including the Record Registration Form for Foreign Trade Business Operators, Customs Declaration Entity Registration Certificate, and Filing Form for Enterprises Applying for Entry-Exit Inspection for the importing and exporting of certain categories of wines. If FVT Supply Chain is unable to obtain the requisite certificates and approvals, the PRC Customs would not perform the Customs declaration, acceptance and release procedures, and the limited product import and export operations conducted by FVT Supply Chain would be delayed, halted or otherwise materially adversely affected.

In addition, on November 14, 2021, the CAC published the Regulations of Network Data Security Management (Draft for Comments) (the “Draft Regulations on Network Data Security Management”), which further regulate the internet data processing activities and emphasize the supervision and management of network data security, and further stipulate the obligations of internet platform operators, such as us, to establish a system for disclosure of platform rules, privacy policies and algorithmic strategies related to data. The draft regulations require data processors to (i) adopt immediate remediation measures when finding that network products and services they use or provide have security defects and vulnerabilities, or threaten national security or endanger public interest, and (ii) follow a series of detailed requirements with respect to processing of personal information, management of important data and proposed overseas transfer of data. As of the date of this prospectus, the draft regulations have not been adopted and the final provisions are subject to changes. If the above proposed regulations are adopted as proposed, based on our initial evaluation, while we have implemented some of the data security measures, we would not be in full compliance with the new draft regulations. We are also still evaluating any additional necessary actions we should take pursuant to the proposed regulations to satisfy the personal information protection and internet data security regulatory requirements. Failure to comply with the effective cybersecurity, data privacy and internet data security regulatory requirements in a timely manner may subject us to government enforcement actions and investigations, fines, penalties, suspension or disruption of our operations, among other things.

On December 28, 2021, the CAC, NDRC, and other government agencies jointly issued the final version of the Revised Measures for Cybersecurity Review, or the Revised Cybersecurity Measures, which took effect on February 15, 2022 and replaced the previously issued Revised Measures for Cybersecurity Review. Under the Revised Cybersecurity Measures, an “online platform operator” in possession of personal data of more than one million users must apply for a cybersecurity review if it intends to list its securities on a foreign stock exchange. The operators of critical information infrastructure purchasing network products and services, and the online platform operators (together with the operators of critical information infrastructure, the “Operators”) carrying out data processing activities that affect or may affect national security, shall conduct a cybersecurity review, and any online platform operator who controls more than one million users’ personal information must go through a cybersecurity review by the cybersecurity review office if it seeks to be listed in a foreign country. Pursuant to the Revised Cybersecurity Measures, we don’t believe we will be subject to the cybersecurity review by the CAC, given that (i) we possess personal information of a relatively small number of users in our business operations as of the date of this prospectus, significantly less than the one million user threshold set for a data processing operator applying for listing on a foreign exchange that is required to pass such cybersecurity review; and (ii) data processed in our business does not have a bearing on national security and thus shall not be classified as core or important data by the authorities. We don’t believe that we are an Operator within the meaning of the Revised Cybersecurity Measures, nor do we control more than one million users’ personal information, and as such, we should not be required to apply for a cybersecurity review under the Revised Cybersecurity Measures. However, in view of the fact that the Revised Cybersecurity Measures was released recently and there is a general lack of guidance and substantial uncertainties exist with respect to their interpretation and implementation. For example, there is still no clear definition of “online platform operator.” Whether the data processing activities carried out by traditional enterprises (such as food, medicine, manufacturing, and merchandise sales enterprises) are subject to such review and the scope of the review remain to be further clarified by the regulatory authorities in the subsequent implementation process.

With regard to the current effective data security management regulations, we don’t believe that we are required to conduct data security review for listing overseas. However, according to the Draft Regulations on Network Data Security Management, as an overseas listed company, we will be required to conduct an annual data security review and to comply with the relevant reporting obligations. We have been closely monitoring the development in the regulatory landscape in China, particularly regarding the requirement of approvals, including on a retrospective basis, from the CSRC, the CAC or other PRC authorities with respect to securities issuances or overseas listing, as well as regarding any annual data security review or other procedures that may be imposed on us. If any approval, review or other procedure is in fact required, we cannot assure you that we will be able to obtain such approval or complete such review or other procedure timely or at all. For any approval that we may be able to obtain, it could nevertheless be revoked and the terms of its issuance may impose restrictions on our operations and offerings relating to our securities. The regulatory requirements with respect to cybersecurity and data privacy are constantly evolving and can be subject to varying interpretations, and significant changes, resulting in uncertainties about the scope of our responsibilities in that regard. Failure to comply with the cybersecurity and data privacy requirements in a timely manner, or at all, may subject us to government enforcement actions and investigations, fines, penalties, suspension or disruption of our operations, among other things. See “Risk Factors — Risks Related to Our Business and Industry — We may be unable to obtain or renew required permits, licenses or approvals necessary for our business operations, and could be imposed with fines and penalties for any violations of the license requirements”; “Risk Factors — Risks Related to Doing Business in China — The Chinese government may intervene or influence the operations of our PRC subsidiaries and exercise significant oversight and discretion over the conduct of their business and may intervene in or influence their operations at any time, which could result in a material change in operations of our PRC subsidiaries and/or the value of our common stock”; and “Risk Factors — Recent regulatory developments in China, including greater oversight and control by the CAC over data security, may subject us to additional regulatory review, and any actions by the Chinese government to exert more oversight and control over foreign investment in China-based issuers could significantly limit or completely hinder our ability to offer or continue to offer securities to investors and cause the value of such securities to significantly decline or be worthless.”

We are subject to PRC rules and regulations relating to overseas listing and securities offerings, and a substantial extension of the PRC government’s oversight over our business operations or overseas listings may hinder our ability to offer or continue to offer our securities. As advised by our PRC legal counsel, neither we nor our PRC subsidiaries are required to obtain any permission from the CSRC, the CAC, or any other PRC authorities for us to issue securities to investors or to list our securities on overseas stock exchanges, such as the Nasdaq. We have not submitted any application to the CSRC, the CAC or other PRC authorities for the approval of securities issuance, including this offering, or the Nasdaq listing. As of the date of this prospectus, we and our PRC subsidiaries have not received any inquiry, notice, warning or objection in relation to our stock issuances or trading or Nasdaq listing from the CSRC, the CAC or any other PRC authorities. We have been closely monitoring regulatory developments in China regarding any necessary approvals from the CSRC, the CAC or other PRC governmental authorities required for securities offerings and overseas listings.

| 3 |

On August 8, 2006, six PRC regulatory agencies, including the Ministry of Commerce, the State-owned Assets Supervision and Administration Commission, the State Administration for Taxation, the State Administration for Industry and Commerce, CSRC and the State Administration for Foreign Exchange (“SAFE”), jointly issued the Regulations on Mergers and Acquisitions of Domestic Enterprises by Foreign Investors (the “M&A Rule”), effective on September 8, 2006 and amended on June 22, 2009. The M&A Rule requires that an offshore special purpose vehicle (“SPV”) formed for listing purposes and controlled directly or indirectly by Chinese companies or individuals shall obtain the approval of the CSRC prior to the listing and trading of such SPV’s securities on an overseas stock exchange. On September 21, 2006, the CSRC published procedures specifying documents and materials required to be submitted to it by an SPV seeking CSRC approval of overseas listings. However, the provisions of the M&A Rule remain ambiguous as to the scope and applicability of the CSRC approval requirement. The CSRC has not issued any definitive rule or interpretations. Based on the current PRC law, rules and regulations, our Chinese legal counsel, Grandall Law Firm, is of the opinion that the M&A Rule and related regulations do not require the Company or PRC subsidiaries to obtain prior approval from CSRC for the listing and trading of our shares on an overseas securities market, given that our wholly foreign-owned enterprise subsidiaries were established by direct investment, rather than by a merger with or an acquisition of any PRC domestic companies as defined under the M&A Rule. However, there remains uncertainty as to how the M&A Rules will be interpreted or implemented, and the opinions of our PRC counsel are subject to any new laws, rules and regulations or detailed implementations and interpretations in any form relating to the M&A Rules. We cannot assure you that the relevant Chinese government agencies, including the CSRC, will reach the same conclusion.

On July 6, 2021, the General Office of the Central Committee of the Communist Party of China and the General Office of the State Council jointly issued the Opinions on Severely Cracking Down on Illegal Securities Activities According to Law, or the Opinions. The Opinions emphasize the need to strengthen the administration over illegal securities activities and the supervision over overseas listings by Chinese companies. Effective measures, such as promoting the construction of relevant regulatory systems, will be taken to address risks and incidents of China-based companies that are listed overseas, cybersecurity issues, data privacy protection requirements and other similar matters. As of the date of this prospectus, no official guidance or related implementation rules have been issued, and our PRC counsel is of the opinion that this offering does not constitute illegal securities activities under the Opinions. In addition, the Company has obtained all requisite licenses and operational permits and none of our permits has been denied. Notwithstanding the forgoing, there are still uncertainties as to how the Opinions will be interpreted and implemented by the relevant PRC governmental authorities.

In addition, on December 28, 2021, the CAC, the National Development and Reform Commission (“NDRC”), and several other governmental agencies jointly issued the Revised Cybersecurity Measures, which took effect on February 15, 2022. Under the Revised Cybersecurity Measures, an “online platform operator” in possession of personal data of more than one million users must apply for a cybersecurity review if it intends to list its securities on a foreign stock exchange. The operators of critical information infrastructure purchasing network products and services, and the online platform operators (together with the operators of critical information infrastructure, the “Operators”) carrying out data processing activities that affect or may affect national security, shall conduct a cybersecurity review, and any online platform operator who controls more than one million users’ personal information must go through a cybersecurity review by the cybersecurity review office if it seeks to be listed in a foreign country.

Further, the CAC released the Draft Regulations on Network Data Security Management in November 2021 for public comments, which among other things, stipulates that a data processor listed overseas must conduct an annual data security review by itself or by engaging a data security service provider and submit the annual data security review report for a given year to the municipal cybersecurity department before January 31 of the following year. If the Draft Regulations on Network Data Security Management are enacted in the current form, we, as an overseas listed company, would be required to carry out an annual data security review and comply with the relevant reporting obligations.

Under the data security regulations currently in effect, we don’t believe that we are required to conduct data security review for listing overseas. However, according to the Draft Regulations on Network Data Security Management, as an overseas listed company, we would be required to conduct an annual data security review and to comply with the relevant reporting obligations. We have been closely monitoring the development in the regulatory landscape in China, particularly regarding the requirement of approvals, including on a retrospective basis, from the CSRC, the CAC or other PRC authorities in relation to this offering, as well as regarding any annual data security review or other procedures that may be imposed on us. If any approval, review or other procedure is in fact required, we cannot assure you that we will be able to obtain such approval or complete such review or other procedure timely or at all. For any approval that we may be able to obtain, it could nevertheless be revoked and the terms of its issuance may impose restrictions on our operations and/or securities offerings. The PRC regulatory requirements with respect to cybersecurity and data security are constantly evolving and can be subject to varying interpretations and significant changes, resulting in uncertainties about the scope of our responsibilities in that regard. Failure to comply with these cybersecurity and data privacy requirements in a timely manner, or at all, may subject us to government enforcement actions and investigations, fines, penalties, suspension or disruption of our operations, among other things.

On February 17, 2023, the CSRC issued the Trial Administrative Measures of Overseas Securities Offering and Listing by Domestic Enterprises, or the Trial Measures, and five application guidelines (collectively, the “Overseas Listing Rules”), which took effect on March 31, 2023. According to the Overseas Listing Rules, among other things, after making initial applications with overseas stock markets for offerings or listings, all China-based companies shall file with the CSRC within three business days. Subsequent securities offerings of an issuer in the same overseas market where it has previously offered and listed securities shall be filed with the CSRC within three business days after the offering is completed. Subsequent securities offerings and listings of an issuer in other overseas markets than where it has offered and listed shall be filed with the CSRC within three business days after the applications are made. In addition, overseas offerings and listings are prohibited for such China-based companies when any of the following applies: (a) where such securities offering and listing is explicitly prohibited by provisions in PRC laws, administrative regulations and relevant state rules; (b) where the intended securities offering and listing may endanger national security as reviewed and determined by competent authorities under the State Council in accordance with law; (c) where the domestic company intending to make the securities offering and listing, or its controlling shareholders and the actual controller, have committed crimes such as corruption, bribery, embezzlement, misappropriation of property or undermining the order of the socialist market economy during the latest three years; (d) where the domestic company intending to make the securities offering and listing is suspected of committing crimes or major violations of laws and regulations, and is under investigation according to law, and no conclusion has yet been made thereof; (e) where there are material ownership disputes over equity held by the domestic company’s controlling shareholder or by other shareholders that are controlled by the controlling shareholder and/or actual controller. The Overseas Listing Rules further stipulate that a fine between RMB 1 million and RMB 10 million may be imposed if a company fails to fulfill the filing requirements with the CSRC or conducts an overseas offering or listing in violation of the Overseas Listing Rules.

Overseas offerings and listings subject to the Overseas Listing Rules include direct and indirect offerings and listings. Where an enterprise whose principal business activities are conducted in PRC seeks to issue and list its shares in the name of an overseas enterprise based on equity ownership, assets, income or other similar rights and interests of an PRC domestic enterprise, such activities are defined as an indirect overseas offering and listing under the Overseas Listing Rules.

According to the Notice on the Filing Management Arrangements for Overseas Offerings and Listings by Domestic Companies published by the CSRC on February 17, 2023, existing listed companies are not required to make any filings until they conduct a new offering or financing transaction in the future. A company is regarded as an existing listed company if it (a) has already completed overseas listing or offering, or (b) has already obtained the approval for the offering or listing from overseas securities regulatory authorities or stock exchanges but has not completed such offering or listing before the effective date of the Overseas Listing Rules and also completes the offering or listing before September 30, 2023. On the effective date of the Overseas Listing Rules, PRC companies that have already submitted offering and listing applications but have not yet obtained the approvals from overseas securities regulators or exchanges shall make filings with the CSRC at a reasonable time before the completion of the offerings or listings. For those that have already obtained CSRC’s approvals for overseas listings or offerings may continue their process without additional filings but shall make the filing pursuant to the Overseas Listing Rules if they cannot complete the offering or listing before the expiration of the original approval from CSRC.

As of the date of this prospectus, the Overseas Listing Rules have not impacted our ability to conduct our business or trade our securities at an overseas securities market. Our PRC counsel has advised us that this offering and the listing of our shares on the Nasdaq should be deemed as an indirect overseas offering and listing under the Overseas Listing Rules and will be required to complete the filing procedures and submit the relevant information to CSRC. While we are required to complete the filing procedures, our PRC subsidiary shall only submit the filing materials as provided by the rules and no CSRC approval is required under the rules. Because we are relying on an opinion of counsel, there is uncertainty inherent in relying on an opinion of counsel in connection with whether we are required to obtain permissions from a governmental agency that is required to approve of our operations and/or listings.

If the CSRC, CAC or any other governmental agency requires that we obtain their respective approval(s) for our securities issuances or overseas listing, the offering would be delayed until we have obtained such approval. There is also the possibility that we may not be able to obtain or maintain such approval or that we inadvertently concluded that such approval was not required. If we do not receive or maintain required permissions or approvals, inadvertently conclude that such permissions or approvals are not required, or applicable laws, regulations, or interpretations change and we are required to obtain such permissions or approvals in the future, we may face regulatory actions, investigations, disruption of our subsidiaries’ operations, or other sanctions from the CSRC, CAC or other Chinese regulatory authorities. These authorities may impose fines and penalties upon our subsidiaries’ operations in China, limit our operating privileges in China, delay or restrict the repatriation of the proceeds from this offering into China, or take other actions that could have a material adverse effect upon our business, financial condition, results of operations, reputation and prospects, as well as the trading price of our common stock. The CSRC, CAC or other Chinese regulatory agencies may also take actions requiring us, or making it advisable for us, to terminate this offering prior to closing. Any failure of us to fully comply with new or changed regulatory requirements may significantly limit or completely hinder our ability to offer or continue to offer the common stock, causing significant disruption to our business operations, severely damage our reputation, materially and adversely affect our financial condition and results of operations and cause the common stock to significantly decline in value or become worthless. See “Risk Factor — “The Chinese government may intervene or influence our operations at any time, or may exert more control over offerings conducted overseas and/or foreign investment in China-based issuers, which could result in a material change in our operations and/or the value of the securities we are registering for sale”; “Risk Factor — The Chinese government may intervene or influence the operations of our PRC subsidiaries and exercise significant oversight and discretion over the conduct of their business and may intervene in or influence their operations at any time, which could result in a material change in operations of our PRC subsidiaries and/or the value of our common stock”; and “Risk Factor — Recent regulatory developments in China, including greater oversight and control by the CAC over data security, may subject us to additional regulatory review, and any actions by the Chinese government to exert more oversight and control over foreign investment in China-based issuers could significantly limit or completely hinder our ability to offer or continue to offer securities to investors and cause the value of such securities to significantly decline or be worthless.”

| 4 |

Cash Flows, Dividends and Other Asset Transfers between the U.S. Holding Company and Our Subsidiaries

Cash may be transferred within our organization in the following manners: (i) we may transfer funds to our PRC subsidiaries by way of capital contributions or loans, through intermediate holding companies, such as our Hong Kong subsidiaries; (ii) we or our intermediate holding companies may provide loans to our PRC operating subsidiaries directly and vice versa; and (iii) our PRC subsidiaries may make dividends or other distributions to us through our intermediate holding subsidiaries.

We are a holding company with no material operations of our own and do not generate any revenue. We currently conduct substantially all of our operations through our PRC operating subsidiaries, QHDX and Xixingdao, and their subsidiaries. We are permitted under PRC laws and regulations to provide funding to PRC subsidiaries through loans or capital contributions, only if we satisfy the applicable PRC government registration and approval requirements. Any loans from us or our holding subsidiaries outside of China to our PRC subsidiaries, which are treated as FIEs under PRC law, are subject to PRC regulations and foreign exchange loan registration requirements. See “Risk Factors —PRC regulation of loans and direct investment by offshore holding companies to PRC entities may delay or prevent us from using the proceeds of our securities offerings to make loans or additional capital contributions to our PRC operating subsidiary, which could materially and adversely affect our liquidity and our ability to fund and expand our business” on page 34 of this prospectus.

Under Nevada law, we may pay dividends to our shareholders subject to our ability to service our debts as they become due and provided that our assets will exceed our liabilities after the payment of such dividends. As a holding company, we may rely on dividends and other distributions on equity paid by our subsidiaries for our cash and liquidity requirements, including funds necessary to pay dividends and other cash distributions to our shareholders or investors, or service any debt we may incur outside of China and pay our expenses. If any of our subsidiaries incurs debt on its own behalf in the future, the instruments governing such debt may restrict their ability to pay dividends to us. To the extent cash or assets in the business is in the PRC or Hong Kong or a PRC or Hong King subsidiary, the cash or assets may not be available to fund operations or for other use outside of the PRC or Hong Kong due to interventions in or the imposition of restrictions and limitations on our or our subsidiaries’ ability by the PRC government to transfer cash or assets. Under the PRC laws and regulations, our PRC subsidiaries may pay dividends only out of their respective accumulated after-tax profits as determined in accordance with PRC accounting standards and regulations. In addition, each of our PRC subsidiaries is required to set aside at least 10% of its accumulated after-tax profits each year, after making up for previous year’s accumulated losses, to fund certain statutory reserve funds, until the aggregate amount of such funds reaches 50% of its registered capital. At its discretion, a subsidiary may allocate a portion of its after-tax profits based on PRC accounting standards to discretional funds. These reserve funds and discretional funds are prohibited from being distributed to their shareholders as dividends. As of the date of this prospectus, there are no restrictions or limitations imposed by the Hong Kong government on the transfer of capital within, into and out of Hong Kong (including funds from Hong Kong to the PRC), except for transfer of funds involving money laundering and criminal activities. See “Risk Factors — We may rely on dividends and other distributions on equity paid by our PRC subsidiaries to fund any cash and financing requirements we may have, and any limitation on the ability of our PRC subsidiaries to make payments to us could have a material and adverse effect on our ability to conduct our business” and “Risk Factor — To the extent cash or assets in the business is in the PRC or Hong Kong or a PRC or Hong Kong entity, such cash or assets may not be available to fund operations or for other use outside of the PRC or Hong Kong due to interventions in or the imposition of restrictions and limitations on the ability of us or our subsidiaries by the PRC government to transfer cash or assets” on page 35 and “Risk Factors — Payment of dividends is subject to restrictions under Nevada and the PRC laws” on page 39 of this prospectus.

Remittance of funds by our subsidiaries out of China is subject to examination by the banks designated by SAFE and declaration and payment of withholding tax. Cash dividends, if any, on our common stock will be paid in U.S. dollars. The PRC government also imposes restrictions on the conversion of RMB into foreign currencies and the remittance of currencies out of the PRC. Foreign exchange transactions under the capital account remain subject to limitations and require approvals from, or registration with, SAFE and other relevant PRC governmental authorities. As such, we may experience difficulties in completing the administrative procedures necessary to obtain and remit foreign currency for the payment of dividends from our profits, if any. In addition, there can be no assurance that the PRC government will not intervene or impose additional restrictions on our ability to transfer cash or assets within our organization or to foreign investors, which could result in an inability or prohibition on making transfers or distributions outside of PRC, which may adversely affect our business, financial condition and results of operations. See “Risk Factors — Payment of dividends is subject to restrictions under Nevada and the PRC laws” on page 39; and “Risk Factors — Governmental control of currency conversion may affect the value of your investment” on page 35 of this prospectus.

If we are deemed by the PRC tax authorities as a PRC tax resident enterprise for tax purposes, any dividends we pay to our non-PRC resident shareholders and gains received by our non-PRC stockholders from sale of our shares may be regarded as China-sourced income and as a result, may be subject to PRC withholding tax at a rate of up to 10.0%. Pursuant to the Arrangement between Mainland China and the Hong Kong Special Administrative Region for the Avoidance of Double Taxation and Tax Evasion on Income, or the Double Tax Avoidance Arrangement, the 10% withholding tax rate may be reduced to 5% if a Hong Kong resident enterprise owns no less than 25% of a PRC entity. However, the 5% withholding tax rate does not automatically apply and certain requirements must be satisfied, including, without limitation, that (a) the Hong Kong entity must be the beneficial owner of the relevant dividends; and (b) the Hong Kong entity must directly hold no less than 25% share ownership in the PRC entity during the 12 consecutive months preceding its receipt of the dividends. In practice, a Hong Kong entity must obtain a tax resident certificate from the Hong Kong tax authority to apply for the 5% lower PRC withholding tax rate. As the Hong Kong tax authority will issue such a tax resident certificate on a case-by-case basis, we cannot be certain that we will be able to obtain the tax resident certificate from the relevant Hong Kong tax authority and enjoy the preferential withholding tax rate of 5% under the Double Taxation Arrangement with respect to any dividends to be paid by our WFOE, QHDX, to our Hong Kong subsidiary. Our WFOE currently does not have any plan to declare and pay dividends, and we have not applied for the tax resident certificate from the relevant Hong Kong tax authority. Our Hong Kong subsidiary will apply for the tax resident certificate when our WFOE plans to declare and pay dividends.

| 5 |

The following discussions illustrate taxes we would hypothetically be required to pay in China, assuming that: (i) our PRC subsidiaries have taxable earnings, and (ii) they determine to pay dividends in the future:

| Taxation Scenario Statutory Tax and Standard Rates | ||||

| Hypothetical pre-tax earnings | 100 | % | ||

| Tax on earnings at statutory rate of 25%(2) | (25 | )% | ||

| Net earnings available for distribution | 75 | % | ||

| Withholding tax at standard rate of 10%(3) | (7.5 | )% | ||

| Net distribution to Parent/Shareholders | 67.5 | % | ||

Notes:

| (1) | For purposes of this example, the tax calculation has been simplified. The hypothetical book pre-tax earnings amount, not considering timing differences, is assumed to equal taxable income in China. For income tax purposes, our PRC subsidiaries file income tax returns on a separate company basis. | |

| (2) | All of our PRC subsidiaries qualify for the preferential income tax rate of 5% for small-scale and low-profit enterprises in China. However, such rates are subject to qualification, are temporary in nature, and may not be available in the future when distributions are paid. For purposes of this hypothetical example, the table above reflects a maximum tax scenario under which the full statutory rate would be effective. | |

| (3) | The PRC Enterprise Income Tax Law imposes a withholding income tax of 10% on dividends distributed by a foreign invested enterprise, or FIE, to its immediate holding company outside of China. Pursuant to the Arrangement between Mainland China and the Hong Kong Special Administrative Region for the Avoidance of Double Taxation and Tax Evasion on Income, or the Double Tax Avoidance Arrangement, a lower withholding income tax rate of 5% is applied, subject to a qualification review at the time of the distribution. For purposes of this hypothetical example, the table above assumes a maximum tax scenario under which the full withholding tax would be applied. |