UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

For

the fiscal year ended

For the transition period from ____________to ____________

Commission

File Number:

(Exact name of registrant as specified in its charter)

| (State or other jurisdiction of | (I.R.S. Employer | |

| incorporation or organization) | Identification Number) |

(Address of principal executive office and zip code)

(

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act: None

Securities registered pursuant to Section 12(g) of the Act: Common stock, par value $0.001 per share

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes

☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes

☐

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the issuer was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ |

| ☒ | Smaller reporting company | ||

| Emerging growth company |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate

by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness

of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered

public accounting firm that prepared or issued its audit report.

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes

☐

The

aggregate market value of the voting stock and non-voting common equity held by non-affiliates of the registrant as of June 30, 2021,

the last business day of the registrant’s most recently completed second fiscal quarter, was approximately $

As of March 31, 2022, the number of shares outstanding of the registrant’s common stock, $0.001 par value, was shares.

Documents

Incorporated by Reference:

TABLE OF CONTENTS

| 2 |

CAUTIONARY NOTES REGARDING FORWARD-LOOKING STATEMENTS

This annual report on Form 10-K (“Annual Report”) contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”) and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). These forward-looking statements are not historical facts but rather are based on current expectations, estimates and projections. We may use words such as “anticipate,” “expect,” “intend,” “plan,” “believe,” “foresee,” “estimate” and variations of these words and similar expressions to identify forward-looking statements. These statements are not guarantees of future performance and are subject to certain risks, uncertainties and other factors, some of which are beyond our control, are difficult to predict and could cause actual results to differ materially from those expressed or forecasted. These risks and uncertainties include, but are not limited to, the following:

| ● | the availability and adequacy of working capital to meet our requirements; | |

| ● | the consummation of any potential acquisitions; | |

| ● | actions taken or to be taken by legislative, regulatory, judicial and other governmental authorities in China and the United States; | |

| ● | changes in our business strategy or development plans; | |

| ● | our ability to continue as a going concern; | |

| ● | the availability of additional capital to support capital improvements and development; | |

| ● | the impact of the COVID-19 pandemic on our business and operations and our ability to address challenges associated with the COVID-19 pandemic outbreaks in China and around the world; | |

| ● | our ability to address and as necessary adapt to changes in foreign, cultural, economic, political and financial market conditions which could impair our future operations and financial performance; | |

| ● | other risks identified in this report and in our other filings with the Securities and Exchange Commission (the “SEC”); and | |

| ● | the availability of new business opportunities. |

This Annual Report on Form 10-K should be read completely and with the understanding that actual future results may be materially different from what we expect. The forward-looking statements included in this Annual Report on Form 10-K are made as of the date of this Annual Report on Form 10-K and should be evaluated with consideration of any changes occurring after the date of this Annual Report on Form 10-K. We will not update forward-looking statements even though our situation may change in the future and we assume no obligation to update any forward-looking statements, whether as a result of new information, future events or otherwise.

Disclosures Relating to the Operations of Our PRC Subsidiaries

Fortune Valley Treasures, Inc. (“FVTI” or “FVTI Nevada”) is not an operating company but a holding company incorporated in the State of Nevada. Substantially all of the business operations is conducted in the People’s Republic of China (“PRC” or “China”) by our PRC subsidiaries. None of our PRC subsidiaries operates with a variable interest entity (“VIE”) structure, but Chinese regulatory authorities could disallow our current operating structure, which would likely result in a material change in our operations and/or cause the value of such securities to significantly decline or become worthless. See “Risk Factors — If the Chinese government determines that our corporate structure does not comply with Chinese regulations, or if Chinese regulations change or are interpreted differently in the future, Chinese regulatory authorities could disallow our current operating structure, which would likely result in a material change in our operations and/or cause the value of such securities to significantly decline or become worthless”; “Risk Factors — The Chinese government may intervene or influence our operations at any time, or may exert more control over offerings conducted overseas and/or foreign investment in China-based issuers, which could result in a material change in our operations and/or cause the value of our securities to significantly decline or be worthless.”

We face significant legal and operational risks and uncertainties relating to our subsidiaries’ operations in China. Because substantially all of our operations are conducted in China through our PRC subsidiaries, the Chinese government may intervene or influence the operation of our PRC subsidiaries and exercise significant oversight and discretion over the conduct of their business and may intervene in or influence their operations at any time, or may exert more control over securities offerings conducted overseas and/or foreign investment in China-based issuers, which could result in a material change in operations of our PRC subsidiaries and/or the value of our common stock. Further, any actions by the Chinese government to exert more oversight and control over offerings that are conducted overseas and/or foreign investment in China-based issuers could significantly limit or completely hinder our ability to offer or continue to offer securities to investors and cause the value of such securities to significantly decline or be worthless.

Recently, the PRC government initiated a series of regulatory actions and statements to regulate business operations in China with little advance notice, including cracking down on illegal activities in the securities market, adopting new measures to extend the scope of cybersecurity reviews, and expanding the efforts in anti-monopoly enforcement. We do not believe that we are directly subject to these regulatory actions or statements, as we do not have a variable interest entity structure and our operations are not subject to cybersecurity review requirements, or involve any other type of restricted industry. Because these statements and regulatory actions are new, however, it is highly uncertain how soon legislative or administrative regulation making bodies in China will respond to them, or what existing or new laws or regulations will be modified or promulgated, if any, or the potential impact such modified or new laws and regulations will have on our daily business operations or our ability to accept foreign investments and list on an U.S. exchange. In July 2021, the Cyberspace Administration of China (“CAC”) opened cybersecurity probes into several U.S.-listed technology companies focusing on anti-monopoly regulation, and how companies collect, store, process and transfer data, among other things. On July 10, 2021, the CAC published a revised draft revision to the existing Cybersecurity Review Measures for public comment, or the Revised Cybersecurity Measures, and together with 12 other Chinese regulatory authorities, released the final version of the Revised Cybersecurity Measures, or the “Measures,” in December 2021, which took effect on February 15, 2022. Pursuant to the Measures, critical information infrastructure operators procuring network products and services and online platform operators carrying out data processing activities, which affect or may affect national security, shall conduct a cybersecurity review pursuant to the provisions therein. In addition, online platform operators possessing personal information of more than one million users seeking to be listed on foreign stock markets must apply for a cybersecurity review. We don’t believe that we are an “operator” within the meaning of the Measures, nor do we control more than one million users’ personal information, and therefore, we should not be required to undertake a cybersecurity review under the Measures. Further, an expert interpretation of the Measures published at the CAC’s website on February 17, 2022 indicated no application review is required for operators that have been listed abroad before the implementation of the Measures. The Measures apply to companies going abroad for secondary listing, dual primary listing and other newly initiated foreign listings and subject to the reporting requirements. On December 24, 2021, China Securities Regulatory Commission (the “CSRC”) issued the Administrative Provisions of the State Council Regarding the Overseas Issuance and Listing of Securities by Domestic Enterprises (the “Draft Administrative Provisions”) and the Measures for the Overseas Issuance of Securities and Listing Record-Filings by Domestic Enterprises (Draft for Comments) (the “Draft Filing Measures”), collectively, the Draft Overseas Listing Rules, which are currently published for public comments only. According to the Draft Overseas Listing Rules, among other things, all China-based companies applying for overseas securities issuance, listing and post-listing capital operations shall be subject to statutory procedures, such as filing and information reporting requirement. After making initial applications with overseas stock markets for offerings or listings, all China-based companies shall file with the CSRC within three business days. In addition, overseas offerings and listings may be prohibited for such China-based companies under certain circumstances, including if the securities offerings and listings are prohibited by applicable PRC laws and rules, or if securities offerings and listings may constitute a threat to, or endanger national security as reviewed and determined by PRC authorities or other circumstances as provided. The Draft Administrative Provisions further provide that a fine between RMB 1 million and RMB 10 million may be imposed if a company fails to fulfill the filing requirements with the CSRC or conducts an overseas offering or listing in violation of the Draft Overseas Listing Rules. In the case of severe violations, an order to suspend relevant businesses or halt operations for rectification may be issued, and relevant business permits or operational license revoked. Overseas issuance and listings subject to the Draft Overseas Listing Rules include direct and indirect issuance and listings. We believe that our proposed listing of our shares on Nasdaq Capital Market and securities offerings would be deemed an Indirect Overseas Issuance and Listing under the Draft Overseas Listing Rules and would be required to complete the filing procedures and submit the relevant information to CSRC if the final rules are promulgated as proposed in the current Draft Overseas Listing Rules. As of the date of this report, such rules have not become effective and we are not required to complete the filing procedures if our common stock is listed on the Nasdaq before the rules take effect. In addition, after the rules take effect, we would only need to submit the filing materials and no CSRC approval would be required under the rules. Because we are relying on an opinion of counsel, there is uncertainty inherent in relying on an opinion of counsel in connection with whether we are required to obtain permissions from a governmental agency that is required to approve of our operations and/or listings. In the event that an government approval is required, we cannot assure you that we will be able to receive clearance in a timely manner, or at all. Any failure of us to fully comply with new regulatory requirements may significantly limit or completely hinder our ability to offer or continue to offer our common stock, cause significant disruption to our business operations, severely damage our reputation, materially and adversely affect our financial condition and results of operations and cause our shares to significantly decline in value or become worthless.

Cash may be transferred within our organization in the following manners: (i) we/FVTI Nevada may transfer funds to our subsidiaries, including our PRC subsidiaries, by way of capital contributions or loans, through intermediate holding companies or otherwise; (ii) we and our intermediate holding subsidiaries may provide loans to our operating subsidiaries and vice versa; and (iii) our subsidiaries, including our PRC subsidiaries, may make dividends or other distributions to us through intermediate holding companies or otherwise. As a holding company, FVTI Nevada, may rely on dividends and other distributions on equity paid by our subsidiaries for our cash and liquidity requirements. If any of our subsidiaries incurs debt on its own behalf in the future, the instruments governing such debt may restrict their ability to pay dividends to us. As of the date of this report, FVTI Nevada has not made any transfers, distribution or loans to any of our subsidiaries, and none of our subsidiaries has made any dividends or other distributions to FVTI Nevada, nor have we ever made a dividend or distribution to our shareholders. Our PRC subsidiaries presently intend to retain all earnings to fund their operations and business expansions. We do not anticipate paying dividends or other distributions to our shareholders in the foreseeable future. See “Item 1. Business — Cash Flows, Dividends and Other Asset Transfers between the U.S. Holding Company and Our Subsidiaries” and “Item 5. Market for Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities — Dividends.”

Our common stock may be prohibited from trading on a national exchange or “over-the-counter” markets under the HFCAA if the PCAOB determines it is unable to inspect or investigate completely our auditors for three consecutive years beginning in 2021. Further, on June 22, 2021, the U.S. Senate passed the Accelerating Holding Foreign Companies Accountable Act (“AHFCAA”) and on February 4, 2022, the U.S. House of Representatives passed the America Creating Opportunities for Manufacturing Pre-Eminence in Technology and Economic Strength (COMPETES) Act of 2022, or the COMPETES Act. If either the AHFCAA or COMPETES Act is enacted into law, it would amend the HFCAA and require the SEC to prohibit an issuer’s securities from trading on any U.S. stock exchanges if its auditor is not subject to PCAOB inspections or complete investigations for two consecutive years instead of three. Pursuant to the HFCAA, the PCAOB issued a Determination Report on December 16, 2021 which found that the PCAOB is unable to inspect or investigate completely registered public accounting firms headquartered in: (1) mainland China and (2) Hong Kong. In addition, the PCAOB’s report identified the specific registered public accounting firms which are subject to these determinations. Our auditor, MaloneBailey, LLP, is headquartered in Houston, Texas, with offices in Beijing and Shenzhen. and has been inspected by the PCAOB on a regular basis. MaloneBailey, LLP is a firm registered with the PCAOB and is required by the laws of the U.S. to undergo regular inspections by the PCAOB to assess its compliance with the laws of the U.S. and professional standards. MaloneBailey, LLP has been subject to PCAOB inspections, and is not among the PCAOB-registered public accounting firms headquartered in the PRC or Hong Kong that are subject to PCAOB’s determination on December 16, 2021 of having been unable to inspect or investigate completely. Notwithstanding the foregoing, in the future, if it is later determined that the PCAOB is unable to inspect or investigate our auditor completely, or if there is any regulatory change or step taken by PRC regulators that does not permit MaloneBailey, LLP to provide audit documentations located in China or Hong Kong to the PCAOB for inspection or investigation, or the PCAOB expands the scope of the Determination so that we are subject to the HFCAA, as the same may be amended, you may be deprived of the benefits of such inspection. Any audit reports not issued by auditors that are completely inspected or investigated by the PCAOB, or a lack of PCAOB inspections of audit work undertaken in China that prevents the PCAOB from regularly evaluating our auditors’ audits and their quality control procedures, could result in a lack of assurance that our financial statements and disclosures are adequate and accurate. which could result in limitation or restriction to our access to the U.S. capital markets and trading of our securities, including trading on the national exchange and trading on “over-the-counter” markets, may be prohibited under the HFCAA. See “Risk Factors — Trading in our securities may be prohibited under the Holding Foreign Companies Accountable Act if the PCAOB determines that it cannot inspect or investigate completed our auditors for three consecutive years beginning in 2021, or for two consecutive years if the Accelerating Holding Foreign Companies Accountable Act or the America COMPETES Act becomes law.”

| 3 |

Summary Risk Factors

Our business and prospects may be limited by a number of risks and uncertainties that we currently face, including without limitation, the following:

Risks Related to Our Business and Industry

| ● | The COVID-19 pandemic has had, and may continue to have, an adverse effect on our business and our financial results | |

| ● | We have a limited operating history in the food supply chain industry in China and cannot ensure the long-term successful operation of all of our businesses | |

| ● | Failure to successfully execute our online and offline-channel strategy and the cost of our investments in our online platform and technology may materially adversely affect our gross profit, net sales and financial performance | |

| ● | We operate in the highly competitive food and beverage industry, and our failure to compete effectively could adversely affect our market share, revenues and growth prospects | |

| ● | Supply chain issues that increase our costs or cause a delay in our ability to fulfill orders could have an adverse impact on our business and operating results | |

| ● | Our failure to appropriately respond to changing consumer preferences and demand for new products could significantly harm our customer relationships and product sales | |

| ● | We have a history of operating losses, and continued future operating losses would have a material adverse effect on our ability to continue as a going concern | |

| ● | We may be unable to obtain or renew required permits, licenses or approvals necessary for our business operations, and could be imposed with fines and penalties for violations of the license requirements |

Risks Related to Doing Business in China

| ● | China’s political climate and economic conditions, as well as changes in government policies, laws and regulations which may be quick with little advance notice, could have a material adverse effect on our business, financial condition and results of operations. | |

| ● | Uncertainties with respect to the PRC legal system could adversely affect us, including risks and uncertainties regarding the enforcement of laws and that rules and regulations in China can change quickly with little advance notice. | |

| ● | The Chinese government may intervene or influence the operations of our PRC subsidiaries and exercise significant oversight and discretion over the conduct of their business and may intervene in or influence their operations at any time, which could result in a material change in operations of our PRC subsidiaries and/or the value of our common stock. | |

| ● | If the Chinese government determines that our corporate structure does not comply with Chinese regulations, or if Chinese regulations change or are interpreted differently in the future, Chinese regulatory authorities could disallow our current operating structure, which would likely result in a material change in our operations and/or cause the value of such securities to significantly decline or become worthless | |

| ● | The Chinese government may intervene or influence our operations at any time, or may exert more control over offerings conducted overseas and/or foreign investment in China-based issuers, which could result in a material change in our operations and/or cause the value of our securities to significantly decline or be worthless. | |

| ● | Recent regulatory developments in China, including greater oversight and control by the CAC over data security, may subject us to additional regulatory review, and any actions by the Chinese government to exert more oversight and control over foreign investment in China-based issuers could significantly limit or completely hinder our ability to offer or continue to offer securities to investors and cause the value of such securities to significantly decline or be worthless. |

| 4 |

| ● | Trading in our securities may be prohibited under the Holding Foreign Companies Accountable Act if the PCAOB determines that it cannot inspect or investigate completed our auditors for three consecutive years beginning in 2021, or for two consecutive years if the Accelerating Holding Foreign Companies Accountable Act or the America COMPETES Act becomes law. | |

| ● | There are uncertainties under the PRC laws relating to the procedures for U.S. regulators to investigate and collect evidence from companies located in the PRC. | |

| ● | Chinese economic growth slowdown may have a negative effect on our business. | |

| ● | You may have difficulty enforcing judgments against us. |

| ● | Failure to comply with laws and regulations applicable to our business in China could subject us to fines and penalties and could also cause us to lose customers or otherwise harm our business. | |

| ● | Under the Enterprise Income Tax Law, we may be classified as a “Resident Enterprise” of China. Such classification will likely result in unfavorable tax consequences to us and our non-PRC stockholders. | |

| ● | PRC regulation of loans and direct investment by offshore holding companies in PRC entities may delay or prevent us from using the proceeds of our securities offerings to make loans or additional capital contributions to our PRC operating subsidiaries, which could materially and adversely affect our liquidity and our ability to fund and expand our business. | |

| ● | Failure to comply with the Individual Foreign Exchange Rules relating to the overseas direct investment or the engagement in the issuance or trading of securities overseas by our PRC resident stockholders may subject such stockholders to fines or other liabilities. | |

| ● | We may be exposed to liabilities under the Foreign Corrupt Practices Act, and any determination that we violated the foreign corrupt practices act could have a material adverse effect on our business. | |

| ● | Governmental control of currency conversion may affect the value of our investment. | |

| ● | Payment of dividends is subject to restrictions under Nevada and the PRC laws. |

Risks Related to our Securities

| ● | Our common stock may not develop an active trading market and the price and trading volume of our shares may fluctuate significantly | |

| ● | If our shares trade under $5.00 per share, they will be considered penny stock; and trading in penny stocks has many restrictions, which could severely affect the price and liquidity of our shares. | |

| ● | We do not anticipate paying cash dividends on our Common Stock in the foreseeable future | |

| ● | Our Chief Executive Officer, Mr. Yumin Lin, and our Director, Mr. Minghua Cheng, own a majority of our outstanding shares of common stock and could significantly influence the outcome of our corporate matters | |

| ● | The price of our common stock may be volatile or may decline regardless of our operating performance, and stockholders may not be able to resell their shares |

| 5 |

| ● | Future sales of substantial amounts of the shares of our Common Stock by existing shareholders could adversely affect the price of our Common Stock |

In addition, we face other risks and uncertainties that may materially affect our business prospects, financial condition and results of operations. You should consider the risks discussed in “Risk Factors” and elsewhere in this report before investing in our common stock.

Conventions and Terminology

Except as otherwise indicated by the context hereof, references in this report to “Company,” “FVTI,” “FVTI Nevada,” “we,” “us” and “our” are to Fortune Valley Treasures, Inc., a holding company incorporated under Nevada law.

References to our “PRC Subsidiaries” are to our subsidiaries incorporated in mainland China, including:

| ● | Qianhai DaXingHuaShang Investment (Shenzhen) Co., Ltd. (“QHDX” or a “WFOE”), a wholly-owned subsidiary of DaXingHuaShang Investment (Hong Kong) Limited (“DILHK”); |

| ● | Jiujiu (Shenzhen) Industry Co., Ltd. (“JJSZ” or a “WFOE”), a wholly-owned subsidiary of Jiujiu (HK) Industry Limited (“JJHK”); |

| ● | Dongguan Xixingdao Technology Co., Ltd. (“Xixingdao”), a 90%-owned subsidiary of QHDX; |

| ● | Dongguan City FVT Supply Chain Technology Co., Ltd. (“FVTL or FVT Supply Chain”), a wholly-owned subsidiary of QHDX; |

| ● | Guangdong Fu Gu Supply Chain Group Co., Ltd. (“FGGC” or “FG Supply Chain”), a wholly-owned subsidiary of QHDX; |

| ● | Dongguan City Fu La Tu Trade Co., Ltd. (“FLTT”), a wholly-owned subsidiary of FVTL; |

| ● | Dongguan City Fu Xin Gu Trade Co., Ltd. (“FXGT”), a wholly-owned subsidiary of FVTL; |

| ● | Dongguan City Fu Lai Food Co., Ltd. (“FLFL”), a wholly-owned subsidiary of Xixingdao; |

| ● | Dongguan City Fu Xin Technology Co., Ltd. (“FXTL”), a wholly-owned subsidiary of Xixingdao; |

| ● | Dongguan City Fu Xiang Technology Co., Ltd (“FGTL”), a wholly-owned subsidiary of Xixingdao; |

| ● | Dongguan City Fu Ji Food & Beverage Co., Ltd. (“FJFL”), a wholly-owned subsidiary of Xixingdao; |

| ● | Dongguan City Fu Yi Beverage Co., Ltd. (“FYBL”), a wholly-owned subsidiary of Xixingdao; |

| ● | Dongguan City Fu Guan Healthy Industry Technology Co., Ltd. (“FGHL”), a wholly-owned subsidiary of Xixingdao; |

| ● | Dongguan City Fu Jing Technology Co., Ltd. (“FJTL”), a wholly-owned subsidiary of Xixingdao; |

| ● | Dongguan City Fu Sheng Drinking Water Co. Ltd. (“FSWL”), a wholly-owned subsidiary of Xixingdao; |

| ● | Dongguan City Fu Jia Drinking Water Co., Ltd. (“FJWL”), a wholly-owned subsidiary of Xixingdao; |

| ● | Dongguan City Fu Xi Drinking Water Co., Ltd. (“FXWL”), a wholly-owned subsidiary of Xixingdao; |

| ● | Dongguan City Fu Li Trading Co., Ltd. (“FLTL”), a company incorporated in the PRC and a wholly-owned subsidiary of Xixingdao; and |

| ● | Shenzhen Fu Jin Trading Technology Co., Ltd. (“FJSTL”), a wholly-owned subsidiary of Xixingdao. |

References to our “Offshore Subsidiaries” are to all of our subsidiaries except our PRC subsidiaries, including our Hong Kong Subsidiaries and Seychelles Subsidiaries.

References to our “Seychelles Subsidiaries” are to our holding subsidiaries incorporated under the laws of the Republic of Seychelles, including:

| ● | DaXingHuaShang Investment Group Limited (“DIGLS”), a wholly owned subsidiary of FVTI; and |

| ● | Jiujiu Group Stock Co., Ltd. (“JJGS”), a wholly owned subsidiary of FVTI. |

References to our “Hong Kong Subsidiaries” are to our subsidiaries incorporated under the laws of Hong Kong Special Administrative Region (SAR), including:

| ● | DaXingHuaShang Investment (Hong Kong) Limited, a wholly owned subsidiary of DIGLS; and |

| ● | Jiujiu (HK) Industry Limited (“JJHK”), a wholly owned subsidiary of JJGS. |

All references to “USD” or U.S. Dollars (US$) are to the legal currency of the United States of America. All references to “RMB” are to the legal currency of People’s Republic of China.

| 6 |

PART I

Item 1. Business

Overview

We conduct our business through our PRC subsidiaries, which are a food and beverage supply chain company group based in Guangdong province, China. With the mission to improve people’s lives by offering safe and quality foods, we are committed to building a first class food supply chain business in China and in the global markets. Through quality control and sales of selected branded products, we provide a one-stop quality food purchase experience for both businesses and individual customers. Our products are well recognized among consumer groups in the Pearl River Delta region of China.

Our vision is “Safe Foods for the People.” We strive to improve the consumers’ food experience in respect of brand, quality, service and speed. Through online and offline channels, we deliver quality food products to consumers through sales targeting regional wholesalers, major food and beverage chains, supermarkets and other retailers.

We purchase, supply, distribute and sell alcohol and non-alcohol beverages, packaged staple foods, condiments and seasonings, and household drinking water related purification devices. Since our founding in 2011, we have primarily engaged in the wholesale distribution and retail sale of wine and liquor products in Southern China. In the recent years, we have expanded into the non-alcohol beverage and food markets through strategic acquisitions.

We currently mainly purchase and sell four categories of food and beverage and related products. Our offerings have evolved over our history of development. Our current core lines of products include the following four categories:

| ● | Alcohol beverage, including wine, liquor and spirits; |

| ● | Non-alcohol beverage, primarily bottled drinking water; |

| ● | Packaged food products, primarily including edible oil, condiments and seasonings; |

| ● | Drinking water purification products, such as whole house water filtration systems and purification solution products. |

We manage the entire process of product procurement, warehousing, distribution, logistics, and delivery through our supply chain system. We cultivate long-term cooperation relationships with many high-quality upstream suppliers to secure the supply demand and stable product procurement. We continuously enhance food quality and safety standards through our quality control system and supplier development management system. Through continuous optimization and management of supply planning, logistics management and quality assurance, we have improved product procurement efficiency and order management capabilities.

We advertise and sell products using a hybrid marketing model through our supply chain platform, social media, primarily WeChat, distributor network, key customer channels, product displays at our stores, and community promotions. We promote direct sales to business and individual consumers on our e-commerce supply chain platform – “Fugu Online.” Further, we make online or offline bulk sales through our agents and independent distributors. Prior to the launching of our supply chain platform, the majority of our sales had been made through independent distributors. We believe our distribution network is still an important component of our hybrid sales model. The agent and distributor sales model helps enhance the brand awareness of our products among end customers. Furthermore, we have achieved a substantial portion of our sales through key customer channels. We have established long-term and stable cooperative relations with certain large enterprises. We hold periodic offline promotions, offline anniversary activities, and offer loyalty rewards to key customers. We initiate promotions to expand our customer base and build brand awareness. As we have multiple product lines, there are many opportunities for cross-selling across our platform as we seek to introduce customers to all product offerings. We also believe our strong reputation is a factor in retaining and attracting customers.

We are on path to build a closed-loop industry supply chain system for our products. Through connecting upstream suppliers and downstream enterprises, we have formed a supply chain network, broadened market penetration through the technology driven e-commerce platform and services, and aligned third-party production, supply and marketing with distribution and sale to achieve cost reduction and efficiency.

| 7 |

With our deeply rooted brand image, fast and efficient multi-channel sales model, precise consumer positioning, superior service experience, and an online platform connecting suppliers, core enterprises, and customers in the food supply chain, today we are well positioned to become a competitive leader in the food supply chain market in China.

Corporate History and Structure

FVTI was incorporated under the laws of the State of Nevada on March 21, 2014 under the name Crypto-Services, Inc. The company was originally formed with the purpose of providing users with up-to-date information on digital currencies. On September 22, 2016, the company amended its articles of incorporation to change its name from “Crypto-Services, Inc.” to “Fortune Valley Treasures, Inc.”

On April 11, 2018, FVTI entered into a share exchange agreement with DaXingHuaShang Investment Group Limited, a company incorporated under the laws of the Republic of Seychelles (“DIGLS”), and its shareholders, Yumin Lin, Gaosheng Group Co., Ltd. and China Kaipeng Group Co., Ltd, pursuant to which FVTI issued 15,000,000 shares of common stock (split-adjusted) to the shareholders of DIGLS in exchange for 100% of the issued shares of DIGLS (the “Share Exchange”). Upon the consummation of the Share Exchange on April 19, 2018, DIGLS became our wholly owned subsidiary.

DIGLS is a holding company and owns all of the equity of DaXingHuaShang Investment (Hong Kong) Limited (“DILHK”), a private company limited by shares formed under the laws of Hong Kong. DILHK owns 100% of the equity of Qianhai DaXingHuaShang Investment (Shenzhen) Co., Ltd. (“QHDX”), a wholly foreign owned enterprise organized under the laws of China, which, in turn, owns 100% of the equity of FVT Supply Chain, an operating subsidiary.

On March 1, 2019, FVTI entered into a share purchase agreement to acquire 100% of the shares of Jiujiu Group Stock Co., Ltd. (“JJGS”), a company incorporated under the laws of the Republic of Seychelles, with the shareholders of JJGS in exchange for 5 shares of our common stock (split-adjusted). Following the closing of the acquisition on March 1, 2019, JJGS became our wholly owned subsidiary. JJGS owns all of the equity of Jiujiu (HK) Industry Limited (“JJHK”), a Hong Kong company limited by shares. JJHK owns 100% of the equity of Jiujiu (Shenzhen) Industry Co., Ltd. (“JJSZ”), a PRC operating company engaged in retail and wholesale distribution of alcohol beverage products.

On July 13, 2019, FVTI and QHDX entered into an equity interest transfer agreement, which was amended on September 12, 2019, with the controlling shareholder of Yunnan Makaweng Wine & Spirits Co., Ltd. (“Makaweng”), a PRC limited liability company engaged in the business of distribution of wine and beer. Pursuant to the agreement, QHDX would purchase 51% of Makaweng’s equity interest from the controlling shareholder of Makaweng in exchange for shares of FVTI common stock. On August 28, 2019, the registration of the transfer of the 51% of equity interest of Makaweng to QHDX with local government agencies was completed. On December 3, 2020, QHDX and the controlling shareholder of Makaweng entered into a share transfer agreement, pursuant to which the parties agreed that QHDX would transfer all of the 51% of Makaweng equity interest back to the controlling shareholder. Upon the effectiveness of the agreement, QHDX no longer owned an equity interest in Makaweng. FVTI has not issued any shares to the controlling shareholder and the control of Makaweng has never been transferred to QHDX. However, the registration of the transfer of the 51% interest by QHDX to the controlling shareholder has not been completed as of the date hereof.

On June 22, 2020, FVTI and QHDX entered into a share purchase agreement with Dongguan Xixingdao Technology Co., Ltd. (“Xixingdao”), a PRC company, and the two former shareholders of Xixingdao, who collectively owned all of the equity interest in Xixingdao. Xixingdao is engaged in the business of drinking water distribution and delivery in Dongguan City, Guangdong Province. Pursuant to the agreement, QHDX purchased 90% of Xixingdao’s equity interest from the sellers in exchange for 243,135 shares of FVTI’s common stock (split-adjusted). We obtained the control of Xixingdao and Xixingdao became our subsidiary on August 31, 2020. The shares were issued on December 28, 2020.

On September 28, 2021, FVTI effected a one-for-twenty reverse stock split (referred to herein as “reverse split”) of the issued and outstanding shares of common stock, $0.001 par value, by filing a Certificate of Change with the Secretary of State of the State of Nevada. The reverse split became effective with FINRA and in the OTC marketplace on October 21, 2021 when the common stock began trading on a split-adjusted basis. Prior to the reverse split, FVTI was authorized to issue 3,000,000,000 shares of common stock and there were 313,098,220 shares of common stock outstanding. As a result of the reverse split, FVTI is authorized to issue 150,000,000 shares of common stock, and there are currently 15,655,038 shares of common stock outstanding. Unless otherwise stated, all shares and per share amounts in this report have been retroactively adjusted to give effect to this reverse stock split.

Corporate Structure

The chart below depicts the corporate structure of the Company as of the date of this report.

| 8 |

Business Plan and Recent Development

Coronavirus (COVID-19) Update

In December 2019, a novel strain of coronavirus (COVID-19) was first identified in China and has since spread rapidly globally. The outbreak of COVID-19 has resulted in quarantines, travel restrictions, and the temporary closure of stores and business facilities globally. In March 2020, the World Health Organization declared the COVID-19 a pandemic. In 2020, COVID-19 had a material impact on our business, financial condition, and results of operations. including, but not limited to, the following:

| ● | We temporally closed our offices in early 2020, as required by relevant PRC regulatory authorities. Our offices were subsequently reopened pursuant to local guidelines. In 2020, the pandemic caused disruptions in our operations and supply chains, which resulted in delays in the shipment of products to certain of our customers. | |

| ● | A large number of our employees were in mandatory self-quarantine and the entire business operations of the Company halted for over a month from February to March 2020. | |

| ● | Our customers were negatively impacted by the pandemic, which reduced the demand of our products. As a result, our revenue and income were negatively impacted in the first half of 2020. |

After the second quarter of 2020, the COVID outbreak in China has gradually been controlled. Our business has also returned to normal operations, although management assessed that our results of operations had been negatively impacted for the 2020 fiscal year. COVID-19 could adversely affect our business and results of operations in 2022 if any COVID resurgence causes significant disruptions to our operations or the business of our supply chain, logistics and service providers. We cannot predict the severity and duration of the impact from such resurgence, if any. If any new outbreak of COVID-19 is not effectively and timely controlled, or if government responses to outbreaks or potential outbreaks are severe or long-lasting, our business operations and financial condition may be materially and adversely affected as a result of the deteriorating market outlook, the slowdown in regional and national economic growth, weakened liquidity and financial condition of our customers or other factors that we cannot foresee. Any of these factors and other factors beyond our control could have an adverse effect on the overall business environment, cause uncertainties in the regions where we conduct business, and could materially and adversely impact our business, financial condition and results of operations.

Valley Holdings Acquisition

Our business plan is to extend our market share through acquiring quality businesses in the food and beverage industries, in order to increase our customer base and supply channels, as well as to acquire more skilled employees and business connections in the industries. We plan to further develop our online marketing platform and internal operation management system by engaging an external IT company during 2021. In the past year, we successfully acquired Xixingdao, a drinking water distribution business. We expect to continue to explore new opportunities to acquire additional quality and compatible businesses in our industries. Our management believes that successful acquisitions will bring synergies to our business and enhance our shareholders’ value.

We consider the following factors when evaluating quality acquisition targets: (i) costs involved in an acquisition; (ii) financial performance of the target; (iii) the reputation of the target in its industry; (iv) the target’s existing customer base; (v) the target’s supplier network; (vi) the expertise and experience of the target’s management and employees; and (vii) the inventory condition of the target.

On January 6, 2021, we entered into an equity interest transfer agreement (the “Valley Holdings Agreement”) with Valley Holdings Limited (“Valley Holdings”), a Hong Kong company, and Angel International Investment Holdings Limited (the “Valley Holdings Seller”), a 70% shareholder of Valley Holdings. Valley Holdings owns approximately 88.44% of the equity interest of Valley Foods Holdings (Guangzhou) Co., Ltd. (“Valley Food”), a limited liability company incorporated in China and engaged in the business of food wholesale and production and sale of food additives in China. Pursuant to the agreement, we would purchase 70% of Valley Holdings’ equity interest from the Valley Holdings Seller in consideration of shares of our common stock valued at $10.5 million (subject to certain adjustments). According to the agreement, the total number of issuable shares will be determined based on the average of the closing prices of our common stock for the 30 business days preceding the date of the closing.

The closing of the acquisition has not occurred as of the date of the report as a result of delays in satisfaction of the closing conditions. The closing is subject to certain conditions, including but not limited to (a) completion of due diligence review of Valley Holdings and its subsidiaries to our satisfaction, (b) completion of the audited consolidated financial statements of Valley Holdings as provided in the agreement, (c) execution of non-competition agreements and confidentiality agreements with the senior management members of Valley Holdings and its subsidiaries, and (d) assignment to Valley Holdings of all of the intellectual property related to the operations of Valley Holdings and its subsidiaries.

Our industry and Market

We obtained the industry and market data used throughout industry publications and research, studies and other similar third-party sources, as well as our estimates based on such data. All of the market data and estimates used in this report involve a number of assumptions and limitations, and you are cautioned not to give undue weight to such data and estimates. We believe that the data from these third-party sources is reliable; however, we have not independently verified the data, besides our business and the industry which we are operating is subject to a high degree of risk and uncertainties.

Growth in food and beverage market in China

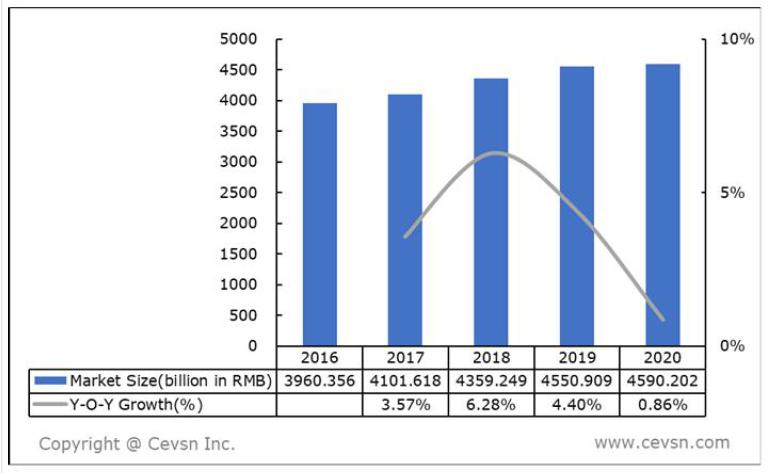

According to China Economic Vision, a research and consulting company with the research coverage mainly in China, the growth rate of food and beverage market in China reached 6.28% in 2018 and then declined to 4.40% in 2019. The decline was mainly due to the drop in demand of liquor products and dairy products. In 2020, the COVID-19 pandemic led to a sharp decrease in the growth rate of the industry, the market reached RMB4,590.2 billion, and a year-over-year (“YoY”) growth of 0.86%. The decrease in the growth rate was mainly due to the quarantine measures implemented in some areas, store and office closures, lockdown and social gatherings restrictions to control the COVID-19 outbreaks in China.

| 9 |

Food and Beverage Market Scale in China from 2016 to 2020

Source: China Economic Vision

China Economic Vision estimated that, with the orderly recovery of the overall economic and the upgrading of product consumption structure, the food and beverage industry will develop favorably in the future, but the growth rate will slow down. The food and beverage market in China is expected to reach RMB5608.8 billion by 2025, and a YoY growth of 3.45%.

Food and Beverage Market Forecast in China from 2021 to 2025

Source: China Economic Vision

Growth of alcohol beverage market in China

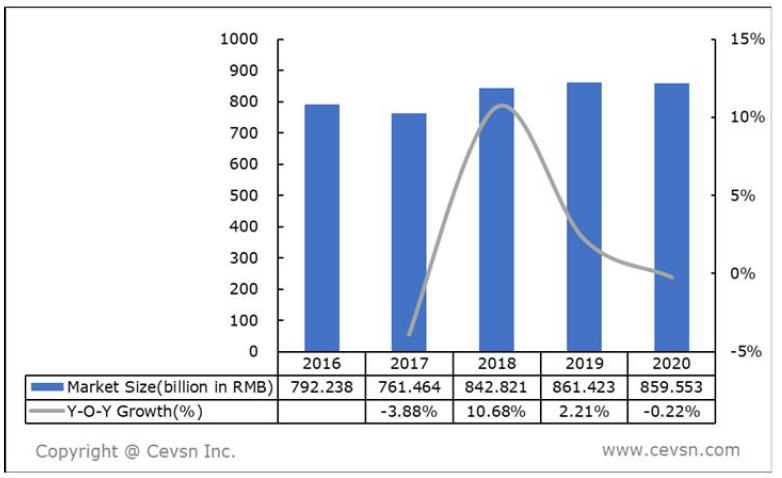

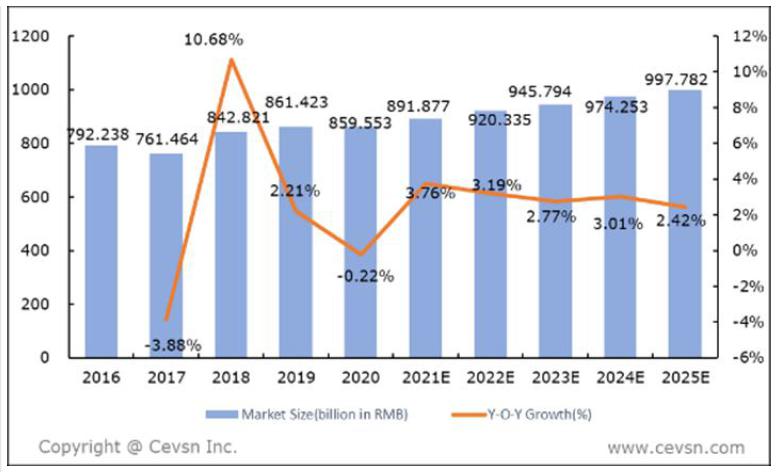

In 2018, the growth rate of alcohol beverage market in China reached 10.68% driven by multiple factors, such as industrial restructure adjustment, consumption upgrading, and the rapidly growth of the Baijiu (Chinese alcohol beverage) industry. In 2019, the growth rate dropped to 2.21% because the market returned to rationality which caused the decrease of Baijiu sales; the downtrend of domestic wine production and sales; and the reduction of imported wines.

In 2020, the alcohol beverage products market scale in China reached RMB 859.6 billion, and the YoY negative growth of 0.22%. It was mainly due to the city lockdown order and the prohibition of social gatherings.

| 10 |

Alcohol Beverage Products Market in China from 2016 to 2020

Source: China Economic Vision

China Economic Vision estimated that, although the pandemic has brought uncertainties to the alcohol beverage products market, the trend of raising quality standard of production for the alcohol beverage products market has never changed. Alcohol consumption has gradually changed from basic consumption to personalized and diversified high-quality consumption. With the orderly recovery of the consumption in China, the market will continue to develop steadily in the future. The alcohol beverage products market in China is expected to reach 997.8 billion in RMB by 2025, and a YoY growth of 2.24%.

Alcohol Beverage Products Market Forecast in China from 2021 to 2025

Growth of bottled water market in China

The bottled water industry in China has a vigorous development in recent years. More household users have changed their drinking water habits and demanded for high-quality drinking water, especially natural mineral water, which has been the major driver for the growth in bottled water products (with natural mineral). The bottled water market in China reached RMB107.8 billion in 2019, with a YoY growth of 20.58%.

According to China Economic Vision, a large number of companies, which were the main consumers of the bottled water market, stopped the operation and production and reduced their use of bottled water the during the COVID-19 pandemic in 2020. In addition, to avoid the risk of spreading the COVID-19, people are recommended to use the bottled water only without returning buckets and promoted to use one-time disposable packaged water. These measures caused the decline in the demand for bottled water. The bottled water market in China reached RMB113.6 billion in 2020, and the YoY growth of 5.38%.

| 11 |

Bottled Water Market in China from 2016 to 2020

Source: China Economic Vision

Compared with bottled water, disposable medium and large packaged water has better quality and consumption experience, and its cost is lower than the bottled water, which is suitable for the household consumption. Based on China Economic Vision’s estimate, even with the gradual replacement of disposable medium and large packaged water, it will have a limited impact on the bottled water market in the short term, but the growth rate of bottled water market will slow down in the long run. The bottled water market in China is expected to reach RMB223.7 billion by 2025, and the YoY growth was 14.13%.

Bottled Water Market Forecast in China from 2021 to 2025

Source: China Economic Vision

Our Business

We sell a variety of wines, such as dry red wine, dry white wine, rosé wine, and sweet wine. Currently we sell about 40 different brands of wine, most of which are imported from France and Spain.

We sell a variety of water, peanut oil, soybean oil and blended oil. Currently we sell about 30 different brands of water and 3 different brands of oil.

We have put significant efforts in developing and promoting our brand name in different regions of China. Our products are mainly sold to retailers, such as wine and water retail stores, convenience stores and supermarkets. The selling price varies by quantities of products each retailer orders from us.

We have cultivated business relationships and achieved recognitions with different organizations over the years, which have improved our business and management efficacy. Specifically, we have been collaborating with Shenzhen Institute of Tsinghua University since 2011, who has been helping us develop an innovative management model, operating model and franchising model. We have been a member of Guangdong Provincial Liquor Industry Association since 2011.

Our wine product operations are based in Humen Town, Dongguan City. We lease a six-floor building with a total floor area of 1,200 square meters. Our wine retail store is located on the first floor which we use exclusively as a retail store and for sample products display. We use the remaining five floors as the Company’s conference room, offices and storage.

| 12 |

Our water and oil product management office is also located in Humen Town, Dongguan City. We lease the building which has over 1,300 square meters. It includes sales, customer service, warehouse, delivery and finance departments. The office manages one office, seven wholesales stores and one warehouse. We also maintain one registered office for the subsidiary with lease term of three years. As of December 31, 2021, the Company has total three office spaces, one warehouse and thirteen stores in PRC with remaining lease terms of from 21 months to 76 months.

We have developed our WeChat applet “FVTI food safety & healthy supply platform” (short name “Fu Gu Online”). Some of our agents and wholesalers have ordered from this platform.

Our Products

We purchase, distribute and sell a wide range of beverage and foods through our supply chain online platform and offline sales channels. We also develop some of the water products we distribute. We offer the following four categories of food and beverage products:

Product Category |

Products | Number of brands offered | Product Sources | |||

| 1. Alcohol beverage | Wine

Liquor/Spirits |

Over 30 | Europe

South America

China | |||

| 2. Non-alcohol beverage | Bottled Water | 36 | China | |||

| 3. Packaged staple foods | Edible Oil

Condiments and seasonings |

5 | China | |||

| 4. Household products | Water purification system

Water filtration |

5 | China |

1. Wine and Liquor Products

We offer a variety of wine products including dry red wine, dry white wine, rose wine and sweet wine. Our liquor products include imported liquor and domestically produced spirits. We currently sell over 30 different types of wine, liquor and spirits products.

We launched our brand “Falantu Art Winery,” with the goal to cultivate a wine-centered food and art culture, advocate healthy living, and bring romance to people’s lives. Our supply chain brings together high-quality wines from most major French producing regions and selected wine production countries. We forge alliance relationship with vineyards at French Burgundy (Bourgogne), Bordeaux (Bordeaux), Chile’s Central Valley, Spanish wineries and other high-quality wine makers. To increase our market share, we have set up multiple branches in Guangdong, China, to promote wine sale and wine culture to Chinese consumers.

2. Bottled Water and Soft Beverage Products

Our drinking water products we sell mainly include bottled water of different sizes. The sources of our bottled water are from tap water or extracted groundwater. In addition to selling on our supply chain platform, these different brands of bottled water are available at supermarkets, grocery stores, other E-commerce platforms, and through the manufacturer’s distributors.

| 13 |

We currently sell 36 different brands of bottled water products. In response to consumer preferences, our water products are packaged in individual containers of difference sizes, ranging from small single serving bottles of 380 milliliter to 750 milliliters, to medium-sized jugs of 1.5 to 5 liter and large 15 to 19 liter carboys. Below are some of branded bottled water products that have generated large sales volume on our supply chain platform.

3. Pre-package Foods

Pre-packaged foods include various brands of edible oils, condiments and seasonings.

| (a) | Edible oil |

We have selected to sell edible oil based on their quality and popularity among the customers

| (b) | Condiments and seasonings |

We offer a variety of kitchen condiment products on the platform, and through multiple layers of screening, brands that are widely welcomed by consumers in the Pearl River Delta region are selected.

4. Household drinking water purification products

Xixingdao sells a series drinking household water treatment systems and devices that improve water quality and healthy lifestyle. They include whole house water purification systems and water filtration devices.

New Products

We are continuously seeking new and suitable brands of products for sales to enrich our product varieties. We have recently added several new brands of wine and liquor products to our product portfolio. We aim to offer more high-quality wine and liquor products for our customers. Providing a wide variety of wine and liquor products to the customers will continue to be our alcohol beverage segment operational strategies.

Our Product Distribution / Supply Chain Operations

Our supply chain system manages the entire process of product procurement, warehousing, distribution, logistics and delivery. Through our digital management system, we can fully track our products from upstream suppliers to downstream end customers.

We emphasize to provide products with high standard of food safety and quality, therefore we carefully select high quality products. We conduct market research and supplier information review to select manufacturers and products, and carry out our own and third parties sample testing on their products to ensure the product with high quality and safety. When we completed the selection process with satisfactory results, we will sign a contact with the suppliers to purchase selected products from selected manufactures and seek to maintain a long-term cooperation relationship to secure stable supply and quality control. To maintain the standard of food safety and quality, we conduct sample checking on the products on a regular basis and evaluate the suppliers’ performance annually.

Our Customers

We mainly have two types of customers: retailer customers and wholesale distributors. For the year ended December 31, 2019, sales to one customer accounted for 10% or more of our revenue and approximately 80% of our revenue were generated from that customer. After 2019, we had successfully expanded our customer base and launched more products. As a result, none of our customers accounted for 10% or more of our revenue. We have generated income from a wider range of customers for the years ended December 31, 2021 and 2020.

| 14 |

Competitive Strength

Well recognized brand

We believe that our brand image and reputation give us a distinct competitive advantage among the food and beverage companies in Guangdong Province and the Pearl Delta Region. Since the launch of our wine distribution business in 2011, we have demonstrated a strong brand advantage in the food and beverage industry and become a well-recognized brand among consumers in the geographic areas in which we operate, especially in Guangdong Province. In recent years, our offline sales mainly in Dongguan City, and online sales have covered major online sales channels. With a greater brand influence and revenue growth, we are able to further strengthen our product procurement capacity. Our growing business scale, increasingly diversified sales channels and reliable product supplies have further promoted our company’s brand awareness and influence. The strength of our brands facilitates the organic growth of customer traffic on our platform, enhances buyer loyalty and attracts more sellers to our platform.

Diversified quality product portfolio

We have built a diversified product portfolio spanning primarily from alcohol beverage and drinking water, to pre-packaged staple foods, condiments, and household water purification devices and systems. A diversified product mix enables us to enhance our company’s sales volume and market influence. We strive to create a one-stop shopping experience and become one of the first places for food shopping for consumers.

We independently manage the core links of the food and beverage industry supply chain and achieve product quality control through supplier access, quality inspection and other measures. Leveraging our information technology capability, we utilize our information management platform to effectively control all links in the industry chain to achieve the full traceability of product quality.

Efficient product supply chain system

We manage the entire process of product procurement, distribution, logistics, and delivery through our supply chain system. Our supply chain e-commerce platform is our central control hub that is facilitated by logistics management to ensure product supply and quality management to reinforce safety and quality assurance. We continuously strengthen cooperation with reputable suppliers to form a stable and long-term relationship and optimize procurement costs while ensuring product quality. On product source, our supply planning team, based on the sales history and trend forecasts of various channels, analyzes and forecasts sales and supply, formulate procurement plans, and improve procurement efficiency. We also formulate a complete product quality control system to enhance product quality assurance. Through continuous optimization and management of supply planning, logistics management and quality assurance, we have improved product procurement efficiency and order management capabilities while ensuring high product quality.

Multi-channel marketing and sales model

We have established a multi-channel marketing and sales model consisting of e-commerce supply chain platform, social media, primarily WeChat, distributor network, key customer channels, product displays at our brick and mortar stores, and community promotions. Our Fugu Online platform not only identifies potential customers and market products and services to targeted groups based on data collected through our information systems, it also serves as our O2O management platform, which can provide marketing services to traditional merchants. Our online and offline bulk sales through our agents and independent distributors help enhance the brand awareness of our products among end customers and collect feedback for us to improve our product selection and management. Our key customer and large enterprise sales channels, online and offline promotions, and community activities all offer loyalty rewards to key customers. Our brand reputation and cross-selling across our platform further strengthen our ability to retain customers and drive revenue growth.

| 15 |

Best in class customer services management

As a food industry enterprise, we have been focused on improving the consumer shopping experience since our establishment, have built a customer-oriented corporate culture and best in class customer service capabilities. Combining with our own brand positioning, we promote a corporate culture with a customer first mindset with the highest quality service as our purpose. We are committed to improving customer satisfaction and loyalty. We improve the pre-sales and after-sales service system to enhance consumer stickiness. Further, we have established a membership system to promote customer loyalty. We are able to conduct a more in-depth analysis of customer needs and historical buying habits through the purchase tracking, which provides us with valuable information related to future product procurement and marketing promotion.

Growth Strategies

Diversify our product portfolio and provide our customers with a wider range of choices

We believe continuous expansion of our existing product portfolio and accommodation of evolving demand and customers’ preferences will distinguish us from our competitors, while providing our customers with a wider range of choices will facilitate the broadening of our customer base as well as reinforcing our market presence in wine industry.

Continue to solidify our relationships with supply chain participants

We intend to continue solidifying our relationship with our existing suppliers as well as identifying new suppliers. We intend to increase our market share by diversifying our existing product portfolio and procuring products which we anticipate demand. We believe that our strategic diversification will further complement our existing product portfolio, enhance our product mix and strengthen our market position in the food and beverage industry in China.

Strengthen our corporate image by increasing marketing and promotion efforts.

We believe our brands and reputation are critical to our business development. To further enhance customer awareness of our brands, we will continue our effective and targeted marketing efforts. This may include (i) placing mass media commercials, (ii) advertising in newspapers, magazines, the internet, billboards and banners, and (iii) sponsoring programs. We also utilize innovative multimedia promotional channels such as social media and mobile phone applications.

Attract, motivate and retain high-quality talent.

Our customer-oriented business philosophy emphases on delivering excellent customer service. We believe maintaining a positive working environment will encourage better staff relations and talent retention, as well as enhancing the quality of our customer service by motivating staff. In order to foster a work environment that attracts and inspires our people to achieve excellent performance, we seek to motivate and retain valuable and talented staff by aligning compensation and remuneration with performance. As part of our continuing efforts to enhance our customer service, we will also continue to enhance our employee training programs by developing our orientation program, coaching, on-the-job training to enhance individual staff skills and knowledge of sales and marketing techniques, customer services, product information, quality control and industry knowledge.

Seek opportunities to acquire quality companies in the food and beverage industry for further development of our company.

One of our key corporate strategies has been to expand our market share through acquiring quality businesses in the food and beverage industries, in order to increase our customer base and supply channels, as well as to acquire more skilled employees and business connections in the industries. We have previously successfully acquired Xixingdao, a drinking water distribution and delivery company. We expect to continue to explore new opportunities to acquire additional quality and compatible businesses in our industries. Our management believes that successful acquisitions will bring synergies to our business and increase long term value to our shareholders.

| 16 |

Expand and explore additional services and products to enrich our one-stop services to our customers.

We will continue to strive to provide our customers with the convenience of our one-stop shopping experience and a wide variety of unique, quality products at reasonable and competitive prices. We believe this is one of the keys to differentiating ourselves from our competitors in the food and beverage industry in China. To further strengthen our services, we will continue to refine our product related services to our customers by enhancing our product consultation services, sourcing services, delivery services, and post-sale evaluation with improved customer service and service options. With our continued expansion and dedication to exploring additional product related services to amplify our one-stop services to our customers, we believe we can strengthen and maintain our position in the food and beverage industry in China.

Permission Required from the PRC Authorities to Operate and Securities Listing and Issuance

Permission required for the Operations of Our PRC Subsidiaries

Our PRC subsidiaries are required to obtain certain permits and licenses from the PRC government agencies to operate our business in China, including: (a) business licenses, (b) food business licenses, and (c) Electronic Data Interchange License (“EDI”) license.

We conduct our business in China through our PRC subsidiaries. All of our PRC subsidiaries are required to obtain, and have obtained, the required business licenses from the State Administration for Market Regulation (“SAMR”). The PRC Food Safety Law mandates a licensing system for food production and trade and requires vendors engaging in food production or sale or catering services to obtain a food business license in accordance with the applicable laws. Among our PRC subsidiaries, the following thirteen companies are required to obtain food business licenses and have received such licenses pursuant to the PRC Food Safety Law: Dongguan City FVT Supply Chain Technology Co., Ltd. (“FVTL or FVT Supply Chain”), Dongguan Xixingdao Technology Co., Ltd. (“Xixingdao”), Dongguan City Fu La Tu Trade Co., Ltd. (“FLTT”), Dongguan City Fu Xin Gu Trade Co., Ltd. (“FXGT”), Dongguan City Fu Lai Food Co., Ltd. (“FLFL”), Dongguan City Fu Xin Technology Co., Ltd. (“FXTL”), Dongguan City Fu Xiang Technology Co., Ltd (“FGTL”), Dongguan City Fu Ji Food & Beverage Co., Ltd. (“FJFL”), Dongguan City Fu Yi Beverage Co., Ltd. (“FYBL”), Dongguan City Fu Jing Technology Co., Ltd. (“FJTL”), Dongguan City Fu Sheng Drinking Water Co. Ltd. (“FSWL”), Dongguan City Fu Jia Drinking Water Co., Ltd. (“FJWL”), and Shenzhen Fu Jin Trading Technology Co., Ltd. (“FJSTL”). Therefore, these thirteen subsidiaries have the required government permits to engage in food purchase and sale activities. However, a food business license is not required for the sale of edible agricultural products and prepacked food. Companies engaged in the sale of prepacked food must report to the food safety regulatory agencies of the local government for recordation. Four of our subsidiaries, Dongguan City Fu Guan Healthy Industry Technology Co., Ltd. (“FGHL”), Dongguan City Fu Xi Drinking Water Co., Ltd. (“FXWL”), Dongguan City Fu Li Trading Co., Ltd. (“FLTL”) and Guangdong Fu Gu Supply Chain Group Co., Ltd. (“FGGC” or “FG Supply Chain”), are subject to such reporting requirement and are in the process of completing the recordation procedure. Guangdong provincial government has not issued detailed implementation rules, and as such, changes in rules and regulations may impose additional requirements for our subsidiaries in China.

The relevant PRC Telecommunications Regulations require a telecommunication service provider in China to obtain an operating license from the Ministry of Industry and Information Technology, or MIIT, or its provincial counterparts, prior to commencement of operations. Our subsidiary, FVT Supply Chain, engages in food, beverage and related product purchases and sales via its online platform. As a provider of online data processing and transaction processing services, FVT Supply Chain is required to obtain an Electronic Data Interchange (EDI) license and has obtained the EDI license. The relevant PRC regulations, including the Classification Catalogue of Telecommunications Services, are still evolving, and there have been limited guidance and interpretation with respect to the scope of various types of telecommunication services. We may be subject to additional license requirements if we further expand our online operations and services.

| 17 |

In addition, on November 14, 2021, the CAC published the Regulations of Internet Data Security Management (Draft for Comments) (the “Internet Data Security Regulations”), which further regulate the internet data processing activities and emphasize the supervision and management of network data security, and further stipulate the obligations of internet platform operators, such as to establish a system for disclosure of platform rules, privacy policies and algorithmic strategies related to data. The draft regulations require data processors to (i) adopt immediate remediation measures when finding that network products and services they use or provide have security defects and vulnerabilities, or threaten national security or endanger public interest, and (ii) follow a series of detailed requirements with respect to processing of personal information, management of important data and proposed overseas transfer of data. As of the date of this report, the draft regulations have not been adopted and the final provisions are subject to changes. If the above proposed regulations are adopted as proposed, based on our initial evaluation, while we have implemented some of the data security measures, we would not be in full compliance with the new draft regulations. We are also still evaluating any additional necessary actions we should take pursuant to the proposed regulations to satisfy the personal information protection and internet data security regulatory requirements. Failure to comply with the effective cybersecurity, data privacy and internet data security regulatory requirements in a timely manner may subject us to government enforcement actions and investigations, fines, penalties, suspension or disruption of our operations, among other things.

On December 28, 2021, the CAC, NDRC, and several other agencies jointly issued the Cybersecurity Review Measures, or the Measures, which took effect on February 15, 2022 and replaced the previously issued Revised Measures for Cybersecurity Review. Under the Measures, an “online platform operator” in possession of personal data of more than one million users must apply for a cybersecurity review if it intends to list its securities on a foreign stock exchange. The operators of critical information infrastructure purchasing network products and services, and the online platform operators (together with the operators of critical information infrastructure, the “Operators”) carrying out data processing activities that affect or may affect national security, shall conduct a cybersecurity review, and any online platform operator who controls more than one million users’ personal information must go through a cybersecurity review by the cybersecurity review office if it seeks to be listed in a foreign country. Pursuant to the Measures, we don’t believe we will be subject to the cybersecurity review by the CAC, given that (i) we possess personal information of a relatively small number of users in our business operations as of the date of this report, significantly less than the one million user threshold set for a data processing operator applying for listing on a foreign exchange that is required to pass such cybersecurity review; and (ii) data processed in our business does not have a bearing on national security and thus shall not be classified as core or important data by the authorities. We don’t believe that we are an Operator within the meaning of the Measures, nor do we control more than one million users’ personal information, and as such, we should not be required to apply for a cybersecurity review under the Measures. However, in view of the fact that the Measures was released recently and there is a general lack of guidance and substantial uncertainties exist with respect to their interpretation and implementation. For example, there is still no clear definition of “online platform operator.” Whether the data processing activities carried out by traditional enterprises (such as food, medicine, automobile and other production enterprises) are subject to such review and the scope of the review remain to be further clarified by the regulatory authorities in the subsequent implementation process.