UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

Amendment No. 2

(Mark One)

For the fiscal year ended

or

|

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number:

(Exact name of registrant as specified in its charter)

|

|

|

|

(State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification Number) |

|

|

|

|

|

|

|

(Address of principal executive offices) |

(Zip code) |

(

(Registrant’s telephone number, including area code) Securities registered under Section 12(b) of the Exchange Act:

|

Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

|

|

|

|

Securities registered under Section 12(g) of the Exchange Act: None

| Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. | Yes ☐ | ||

| Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. | Yes ☐ | ||

| Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months, and (2) has been subject to such filing requirements for the past 90 days. | No ☐ | ||

| Indicate by check mark whether the registrant has submitted electronically every Interactive Date File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). | No ☐ |

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer |

☐ |

|

☒ |

|

Non-accelerated filer |

☐ |

Smaller reporting company |

|

|

|

|

Emerging growth company |

| If an emerging growth company, indicate by a check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. | ☐ | ||

| Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). | Yes |

No ☒ |

The aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such common equity, as of the last business day of the registrant’s most recently completed second fiscal quarter, was approximately $

Note.—If a determination as to whether a particular person or entity is an affiliate cannot be made without involving unreasonable effort and expense, the aggregate market value of the common stock held by non-affiliates may be calculated on the basis of assumptions reasonable under the circumstances, provided that the assumptions are set forth in this Form.

As of April 26, 2023, there were

Document Incorporated By Reference:

None.

| Auditor Name | Auditor Location | Auditor Firm ID | ||

| PCAOB ID |

EXPLANATORY NOTE

The Company has scheduled its 2023 Annual Meeting of Shareholders for July 27, 2023 with a record date of April 28, 2023. In light of this, the Company will not file its proxy statement within 120 days of December 31, 2022 such that the Part III information could be incorporated from such proxy statement into the Original Form 10-K. We are filing this Amendment No. 2 to present the information required by Part III.

The Original Form 10-K is hereby amended by deleting in its entirety Part III of the Original Form 10-K and replacing with Part III herein. In addition, in connection with the filing of this Amendment No. 2 and pursuant to Rule 12b-15 of the Securities and Exchange Act of 1934, as amended, we are including with this Amendment No. 2 new certifications of our principal executive officer and principal financial officer pursuant to Section 302 of the Sarbanes-Oxley Act of 2002. Because no financial statements have been included in this Amendment No. 2 and this Amendment No. 2 does not contain or amend any disclosure with respect to Items 307 and 308 of Regulation S-K, paragraphs 3, 4 and 5 of the certifications have been omitted. Item 15 of Part IV also has been amended to add these new certifications. Except as otherwise expressly noted herein, this Amendment No. 2 does not modify or update in any way the financial position, results of operations, cash flows, or other disclosures in, or exhibits to, the Original Form 10-K, nor does it reflect events occurring after the filing of the Original Form 10-K. Accordingly, this Amendment No. 2 should be read in conjunction with the Original Form 10-K.

When we refer in this Report to “we,” “our,” “us,” “Business First” and the “Company,” we are referring to Business First Bancshares, Inc. and its consolidated subsidiaries, including b1BANK, formerly known as Business First Bank, which we sometimes refer to as “the Bank”, unless the context indicates otherwise. Capitalized terms not defined herein have the meaning ascribed to them in the Original Form 10-K.

The information contained in this Amendment No. 2 is accurate only as of the date of this annual report and as of the dates specified herein.

PART III

ITEM 10. Directors, Executive Officers and Corporate Governance.

CURRENT EXECUTIVE OFFICERS AND DIRECTORS

General

Our articles of incorporation and bylaws provide that the number of directors of the Company shall be as determined from time to time by the board of directors. Each director shall hold office until the next annual meeting of shareholders or until his or her successor has been duly elected and qualified. Our board currently consists of 17 members. A brief description of the background of each of our directors is set forth below. Other than the Ambassador Agreement entered into with Mr. Brees, which is discussed further in the section entitled “Related Person Transactions” there are no arrangements between us and any person pursuant to which any nominee was elected as a director or is nominated to be elected as a director.

The directors of b1BANK are elected by us, as the sole shareholder of b1BANK, each year and they hold office for a term of one year or until their successors are chosen and qualified. The executive officers of b1BANK are appointed by and serve at the discretion of its board of directors. No director or executive officer has any family relationship, as defined in Item 401 of Regulation S-K, with any other director or executive officer or director.

Board of Directors

Drew C. Brees (44). Drew Brees serves as a director for Business First and b1BANK. Mr. Brees played in the National Football League for 20 seasons, where he was recognized as the 2006 Walter Payton Man of the Year, won Super Bowl XLIV and was its MVP, and was elected to 13 Pro Bowls. Mr. Brees, along with his wife Brittany, is a founder of the Brees Dream Foundation, which focuses on improving the quality of life for cancer patients and providing care, education, and opportunities for children and families in need. Mr. Brees has participated in five USO trips visiting Kuwait, Iraq, Afghanistan, Germany, Turkey, Djibouti, Dubai, Okinawa and Guantanamo Bay. Mr. Brees’ business experience includes, but is not limited to, being co-owner and partner of Walk-On’s Sports Bistreaux and a franchise owner of several Jimmy John’s restaurants. Mr. Brees attended Purdue University where he earned a bachelor’s degree in Industrial Management. While at Purdue, Mr. Brees lettered in football from 1997-2000 and led the Boilermakers to a Big Ten Championship and Rose Bowl appearance during the 2000 season.

James J. Buquet, III (56). JJ Buquet serves as a director for Business First and b1BANK. Mr. Buquet was a founding member of Coastal Commerce Bancshares, Inc., and its banking subsidiary Coastal Commerce Bank, where Mr. Buquet served as Chairman prior to its merger with Louisiana Community Bancorp. Mr. Buquet served as Vice Chair and Audit Chair of Louisiana Community Bancorp, which was renamed Pedestal Bancshares, Inc. in 2018 and merged with Business First in May 2020. Mr. Buquet is presently semi-retired as his family business was sold in June of 2022. Prior to that, Mr. Buquet served as President of Buquet Distributing Company (An Anheuser-Busch distributorship) since 1995. Until recently, Mr. Buquet served as board member and Audit & Finance Chair for the BevCap Captive Insurance Group. He has served as Chairman of Louisiana Beer Industry League and as a board member of the National Beer Wholesalers Association. In the early 1990s, Mr. Buquet’s family established the James J Buquet, Jr. Family Foundation where he presently serves as the managing board member. He has also served on the boards of numerous civic and charitable entities including Chairman of the Houma-Terrebonne Chamber of Commerce, Chairman of the South Louisiana Economic Council, board member of the Greater New Orleans Foundation, and Chairman of Terrebonne Foundation For Academic Excellence. He was a Founder and Chairman of the Bayou Community Foundation and remains on the board today. He also currently serves as Vice Chair of the Catholic Foundation for South Louisiana, board member of the South Central Industrial Association, the Terrebonne Economic Development Authority, the Public Affairs Research Council, the Council For A Better Louisiana, and the Max Charter School. Mr. Buquet holds a bachelor’s degree in general business from Washington & Lee University and Master of Business Administration from Tulane University.

Carol M. Calkins (74). Carol Calkins serves as a director for Business First and b1BANK. Ms. Calkins is a retired PricewaterhouseCoopers LLP (PwC) partner. She is a Certified Public Accountant (TX) and joins the board with over 30 years of tax, finance, audit, and environmental, social and governance criteria (ESG) experience. During her 22-year tenure at PwC, she held multiple national and regional roles including National Partner in Charge of PwC’s Sales & Use Tax Group, Central Region SALT Managing Partner, SALT Practice Partner for Technology & Section 302/404, Risk and Quality Assurance Partner based in NY for the National PwC Tax Practice and PwC’s National Co-Chair for Diversity and WorkLife Quality. Ms. Calkins has served as a lecturer, lobbyist, and author on state and local tax issues. She is the former Chair of the State Taxation Committee for the American Institute of Certified Public Accountants and the Texas Society of CPAs. Ms. Calkins is a graduate of Louisiana State University with a degree in accounting. Prior to PwC, she was with Sun Oil Company of Delaware and the Louisiana Department of Revenue. Her civic and philanthropic involvement has included the board of directors of the Texas Ballet, TACA-The Arts Community Alliance, The Dallas Theater Center and she served as a former Gun Barrel City Council member. Currently, she serves on the National Board of the LSU Foundation. She is the North Texas alumni fund raising campaign Leader for the LSU’s E J Ourso College of Business (COB), is a Past President of the COB Dean’s Advisory Council. Ms. Calkins also serves as a member of PwC’s Retired Partner Council and as an Advisory Board member to Honduras Threads. She is an inductee of New York City YWCA Top 100 Women in Business and LSU’s E J Ourso College of Business Hall of Distinction. Carol’s deep background in tax and finance and demonstrated passion for people, and her extensive connections in and commitment to both Louisiana and Texas make her a strong fit for our board.

Ricky D. Day (57). Ricky Day serves as a director for Business First and b1BANK. Mr. Day is Owner and President of Ricky Day Trucking which includes a fleet of 50 units operating in Louisiana and Texas. He also owns DeRidder Truck Parts and is co-owner of Southland Group which owns multiple companies operating in the timber industry. Mr. Day has extensive director experience, previously serving as director of Pedestal Bank and City Savings Bank.

John P. Ducrest (62). John Ducrest serves as a director for Business First and b1BANK. Mr. Ducrest is the former Commissioner of the Office of Financial Institutions (OFI) for the State of Louisiana. He retired from this position in December of 2020 after more than 16 years as commissioner and 35 years with OFI. Mr. Ducrest is a Certified Public Accountant-retired, Certified Fraud Examiner-retired, and Certified Examination Manager-retired. He is a graduate of the University of Southwestern Louisiana (now University of Louisiana at Lafayette) with a degree in Business Administration and the Graduate School of Banking at Louisiana State University. On the national level, Mr. Ducrest served as the Chairman of the Conference of State Bank Supervisors, being only the second Louisiana Commissioner to serve in this role. He was also a principal of the Financial Stability Oversight Council (FSOC) which was created by the Dodd-Frank Act and is chaired by the Secretary of the Treasury. FSOC is comprised of the heads of all federal financial regulators and a state bank, insurance, and securities commissioner. The Council seeks to address systemic risk to the financial system of the United States. Additionally, Mr. Ducrest served as a principal of the Federal Financial Institutions Examinations Council (FFIEC) which prescribes uniform principles, standards, and report forms for the federal examination of financial institutions by the FRB, the FDIC, the NCUA, the OCC, and the CFPB, and to make recommendations to promote uniformity in the supervision of financial institutions. Mr. Ducrest currently serves on the Board of Trustees for the 200-year-old Schools of the Sacred Heart, Grand Coteau, Louisiana.

Mark P. Folse (57). Mark Folse previously served as Executive Vice President and Chief Risk Officer of b1BANK and currently serves as a director of both Business First and b1BANK. Prior to joining b1BANK, he served as a founding organizer, President and Chief Executive Officer of Pedestal Bancshares, Inc., and its subsidiary Pedestal Bank, which merged with Business First in 2020. Prior to that, Mr. Folse served as General Counsel to the Louisiana Bankers Association. He holds a bachelor’s degree in finance, a Juris Doctor from the Louisiana State University Law Center and is a graduate of the Graduate School of Banking at Colorado. He has served the industry as a board member of the Louisiana Bankers Association, the American Bankers Association Community Bankers Council, and the Conference of State Bank Supervisors Bankers Advisory Board. He also has served as a board member of First National Bankers Bank. Community service has included board membership on the Houma-Terrebonne Chamber of Commerce, the Terrebonne Economic Development Authority, the South Louisiana Economic Council, the United Way for South Louisiana, and the Chabert Medical Center Foundation.

Robert S. Greer, Jr. (75). Bob Greer serves as Chairman of the board of Business First and b1BANK. Mr. Greer previously served as President of multiple insurance companies during his career. He retired in 2013 from his position as President and Chief Executive Officer of LEMIC Insurance Company, a workers’ compensation insurer in Baton Rouge, Louisiana. Prior to his retirement, Mr. Greer served as the President and Chief Executive Officer of LEMIC Insurance Company since 2001. Mr. Greer holds a bachelor’s degree in insurance from Louisiana State University. Mr. Greer also previously served as a director of Starmount Life Insurance and as a director of Woman’s Hospital. Mr. Greer benefits our board of directors through his extensive business knowledge and experience in the insurance industry as well as with valuable insight gained through his service on other boards of directors. His commitment to our success is also demonstrated by his service as our Chairman.

J. Vernon Johnson (71). J. Vernon Johnson serves as director for Business First and b1BANK. Mr. Johnson is a career banker, having served in various executive positions in the banking industry over the past forty-seven years. Mr. Johnson served most recently as Chairman of the Board of Pedestal Bancshares, Inc. and Pedestal Bank in Houma, Louisiana, which merged with Business First in 2020, and has previously served on the board of the Louisiana Bankers Association. He holds a bachelor’s degree in computer science and business from the University of Southwestern Louisiana (now University of Louisiana, Lafayette) and is a graduate of the Graduate School of Banking at Louisiana State University. Mr. Johnson’s extensive experience in banking and contacts in the banking industry provide our board with valuable insight regarding current banking issues and knowledge of financial markets.

Rolfe H. McCollister, Jr. (67). Rolfe McCollister is a founder and director of Business First and b1BANK. Mr. McCollister was the founder of Louisiana Business, Inc. Louisiana Business, Inc. published Greater Baton Rouge Business Report (started in 1982), 225 magazine, inRegister magazine, Daily Report online news, Louisiana NEXT, Welcome magazine, 10/12 Industry Report and other specialty publications. In 2021, Louisiana Business, Inc. was acquired by Melara Enterprises. Mr. McCollister serves as Chairman Emeritus of Melara, Inc. which, in addition to many of the previously mentioned publications, also produces the Baton Rouge Business Awards and Hall of Fame, Influential Women in Business, the Louisiana Business Symposium, Forty Under 40, Leadership Academy, and several other annual events. Mr. McCollister is a graduate of Louisiana State University and served two terms as a member of the LSU System Board of Supervisors, including being elected chairman. He was inducted into LSU’s E.J. Ourso College of Business Hall of Distinction. His business management experience, previous service on the board of directors of three banks, and many community contacts enable him to make valuable contributions to our board of directors.

Andrew D. McLindon (61). Andrew McLindon serves as a director for Business First and b1BANK. Mr. McLindon has served since 1989 as President and Chief Executive Officer of Mainspring Companies, a management firm that oversees the operations for the following companies: MBD Automation, a conveyor and automated equipment installation provider; Modus, LLC, a national facility services company; Pivotal, LLC., a commercial building construction and maintenance company Genlease, a provider of rental equipment used in e-commerce distribution facilities; McLindon Development Group, a real estate development company; GearTrain, a national program management company and Propel Productions, a video production company. Mr. McLindon earned a bachelor’s degree in construction management from Louisiana State University. Mr. McLindon brings executive decision-making, leadership, and risk assessment skills to our board of directors as a result of his experience in the construction industry. His experience in real estate development and construction also benefits our board of directors.

David R. Melville, III (48). David “Jude” Melville serves as President and Chief Executive Officer and a director of Business First and b1BANK. He has served in these capacities since 2011 and has held various management roles since the Bank’s chartering in 2006. Prior to becoming a community banker, Mr. Melville served as a captain in the U.S. Air Force. He earned a bachelor’s degree in social studies from Harvard College and a Master of Science in Management from the London School of Economics. Mr. Melville is also a graduate of the Graduate School of Banking at Louisiana State University. He serves as Chair of the Louisiana Association of Business and Industry, an executive board member of Louisiana’s Committee of 100, and formerly served as Chair of the Federal Reserve Depository Institutions Advisory Council, among other affiliations.

Patrick E. Mockler (54). Patrick Mockler serves as a director for Business First and b1BANK. Mr. Mockler served as President of Mockler Beverage Company, ALP from 2007 to 2018 and has been a partner of Mockler Beverage and Reiger Road Development, LLC since 1995 and 2000, respectively. He has been active in day-to-day operation of Mockler Beverage since 1994. Mr. Mockler has been a partner of New Orleans Eagle Investments, LLC since its inception in 2009 to acquire Southern Eagle Sales and Service in New Orleans. He became President of Southern Eagle in 2018. Additionally, he has experience as a director of b1BANK since 2006, served on the Loan Committee for three years, served on the Audit Committee for seven years, the Risk Committee for the last four years, the Compensation Committee for the last five years and is the current Chair of the Comp Committee. Mr. Mockler serves on the board of LWCC (Louisiana Workers Comp Corp) and its Investment Committee and has served on dozens of charitable boards and committees. He is a 1993 graduate of Louisiana State University with a degree in International Trade and Finance.

David A. Montgomery, Jr. (62). David Montgomery serves as a director for Business First and b1BANK. Mr. Montgomery has served as Vice President of Montgomery Agency, Inc., an independent insurance agency, since 1990. Mr. Montgomery is a 50% partner in Brothers Ventures, a Real Estate Investment LLC. Mr. Montgomery is a Certified Public Accountant, and he is currently a councilman at large with Bossier City, Louisiana. He also served for 17 years as the Chairman of the Budget Committee for the Bossier City Council. Since 1996, Mr. Montgomery has served on the Finance Committee for North Louisiana Volunteers of America. Mr. Montgomery holds a bachelor’s degree in accounting from Louisiana State University. Mr. Montgomery brings extensive knowledge of the insurance and accounting industries to our board of directors. He also provides valuable knowledge and insight derived from his service for civic and governmental organizations.

Arthur J. Price (57). Arthur Price serves as a director for Business First and b1BANK. Mr. Price has served as Vice President, Finance / CFO for Badger Oil Corporation for over thirty years and was named President / CFO in 2017. Badger Oil and its affiliates participate in the exploration, drilling and production of crude oil and natural gas, with primary operations in the Louisiana Gulf Coast region and the Outer Continental Shelf of the Gulf of Mexico. Prior to joining Badger Oil, Mr. Price worked as an oil and gas accountant with a specialized firm located in Lafayette, Louisiana. As a senior member of the oil and gas community, Mr. Price is an active board member of the Louisiana Oil and Gas Association, and past chairman of the Board, and the Louisiana Association of Business and Industry. Mr. Price is also a former member of the board of The Lafayette Petroleum Club, having served as Treasurer and President. Mr. Price received a Bachelor of Science degree in Business Administration from the University of Southwestern Louisiana (now The University of Louisiana, Lafayette) in 1989 and is a Certified Public Accountant.

Kenneth Wm. Smith, PE, PLS (60). Kenneth Smith serves as a director for Business First and b1BANK. Mr. Smith, a Professional Engineer and Land Surveyor, is President and Chief Executive Officer of T. Baker Smith, LLC, a professional services firm that provides planning, environmental, surveying, engineering, and construction management services. Mr. Smith has been with T. Baker Smith, LLC since 1980. He also serves as Managing Partner for the following companies: TBS Mexico, TBS Holding, LLC, a real-estate holding company; Four C’s of Houma, LLC, a personal investment company; and Mega Beast Commercial Realty, a commercial real estate company. Mr. Smith serves as a Partner at JPS Equipment Rentals, LLC. Mr. Smith served as the President for the Houma Terrebonne Chamber of Commerce, South Central Industrial Association, South Louisiana Economic Council, and the Louisiana Pipeliners Association, and he currently serves as a member of the Louisiana Oil & Gas Association and Louisiana Association of Business & Industry. Mr. Smith earned a degree in civil engineering from Louisiana Tech University. He brings extensive business skills and experience to our board of directors, having successfully managed his own business for many years. Mr. Smith is also an active leader in his community and serves on the boards of many civic organizations. His many professional and community contacts benefit our board of directors.

Keith Tillage (53). Keith Tillage serves as a director for Business First and b1BANK. Mr. Tillage is the co-founder and Chief Executive Officer of Tillage Construction, LLC, a minority full service commercial construction and construction management company. Tillage Construction has received numerous awards including being a finalist for the Black Enterprise Small Business of the year award, receiving the HUBZONE business of the year award, The United States Small Business Award for excellence, as well as being recognized as one of the fastest growing private companies in America by Inc. 500/5000 in 2011 and 2012. More recently, Keith was named Louisiana District and SBA Region 6 Minority Small Business Person of the Year and received the distinct honor of being selected as one of the 12 small business CEOs invited to the White House for the sole purpose of consulting President Obama on the Fiscal Cliff. Mr. Tillage has served on the board of the Minority Supply Diversity Council, YMCA – A.C. Lewis Branch, and the Baton Rouge Area Chamber. He is also a former member of US Black Chambers President’s Circle. Currently, he serves on the National GSA advisory council and the Louisiana State licensing board for contractors.

Steven G. White (63). Steve White serves as a director for Business First and b1BANK. Mr. White currently serves as the Chief Administrative Officer for The Carpenter Health Network, which is a health care continuum including Home Health, Hospice, Nurse Practitioner Home Services, Nursing Homes, and LTACH & Rehab facilities over a six-state area. He also serves as the Chairman for the William A. Robinson Foundation. Mr. White’s previous work experiences include serving in roles as President, Senior Vice President, and other executive roles in U.S. and international logistic businesses. He has served as a Chief Operations Officer in the home health and hospice industry. Mr. White graduated from Louisiana Tech University with a Bachelor of Science degree in petroleum engineering in 1985 and has attended several executive management programs at various universities. Mr. White’s experience in asset management and his knowledge of the oil & gas, logistics and the health care industry are valuable to our board of directors.

Board Diversity Matrix

|

Board Diversity Matrix (As of April 28, 2023) |

||||

|

Total Number of Directors |

17 |

|||

|

Gender: |

Male |

Female |

Non- Binary |

Gender Undisclosed |

|

Number of directors based on gender identity |

15 |

1 |

1 |

|

|

Number of directors who identify in any of the categories below: |

||||

|

African American or Black |

1 |

0 |

0 |

0 |

|

Alaskan Native or Native American |

0 |

0 |

0 |

0 |

|

Asian |

0 |

0 |

0 |

0 |

|

Hispanic or Latinx |

0 |

0 |

0 |

0 |

|

Native Hawaiian or Pacific Islander |

0 |

0 |

0 |

0 |

|

White |

14 |

1 |

0 |

0 |

|

Two or More Races or Ethnicities |

0 |

0 |

0 |

0 |

|

LGBTQ+ |

0 |

|||

|

Did Not Disclose Demographic Background |

1 |

|||

Executive Officers

The following table sets forth the current executive officers of Business First and b1BANK:

|

Name |

Age |

Title/Position with |

Position |

Title/Position with |

Position |

|||||||

|

Jesse Jackson |

47 | --- | --- |

Executive Vice President, Financial Institutions Group |

September 2020 |

|||||||

|

Philip Jordan |

50 | --- | --- |

Executive Vice President, Chief Banking Officer |

August 2018(1) |

|||||||

|

Mimi Singer Lee |

46 | --- | --- |

Executive Vice President, Chief Human Resources Officer |

July 2019 |

|||||||

|

Kathryn Manning |

36 | --- | --- |

Executive Vice President, Chief Risk Officer |

May 2022(2) |

|||||||

|

Keith Mansfield |

46 | --- | --- |

Executive Vice President, Chief Operations Officer |

January 2017(3) |

|||||||

|

Warren McDonald |

56 | --- | --- |

Chief Credit Officer |

February 2021(4) |

|||||||

|

David R. Melville, III |

48 |

President and Chief Executive Officer, Director |

March 2011(5) |

President and Chief Executive Officer, Director |

March 2011(5) |

|||||||

|

Gregory Robertson |

51 |

Chief Financial Officer and Treasurer |

January 2017(6) |

Executive Vice President, Chief Financial Officer |

January 2017(6) |

|||||||

|

Saundra Strong |

45 |

Secretary |

December 2021 |

Executive Vice President, General Counsel |

October 2021 |

|||||||

|

N. Jerome Vascocu, Jr. |

49 |

November 2022 |

Executive Vice President, Chief Administrative Officer |

November 2022 |

|

(1) |

Mr. Jordan has been with the Bank since August 2008, previously serving as its Chief Commercial Officer. |

|

|

(2) |

Ms. Manning has been with the Bank since September 2013, previously serving as its Chief Data Officer. |

|

|

(3) |

Mr. Mansfield has been with the Bank since April 2016, previously serving as its Chief Information Officer. |

|

|

(4) |

Mr. McDonald has been with the Bank since its inception in February 2006, previously serving as a Senior Commercial Lender and Market President. |

|

|

(5) |

Mr. Melville has been with the Bank since its inception in February 2006, previously serving as its Chief Administrative Officer. He was promoted to the position of Chief Executive Officer in March 2011. |

|

|

(6) |

Mr. Robertson has been with the Bank since August 2011, previously serving as its Chief Banking Officer. |

A brief description of the background of each of our non-director executive officers is set forth below:

Jesse Jackson. Jesse Jackson has been with b1BANK since September 2020 and currently serves as Executive Vice President & President of the Financial Institutions Group. Prior to joining b1BANK, Mr. Jackson was the Executive Vice President and Head of Commercial Banking at Texas Capital Bank in Dallas, TX. Prior to his promotion to Executive Vice President, Jackson was instrumental in growing and leading key national markets as Senior Vice President and Regional Executive for Texas Capital Bank’s Financial Institutions Group. Mr. Jackson holds an M.B.A. in Corporate Finance from the University of Dallas-Graduate School of Management and a B.S. in Business from Grambling State University. He has also completed post graduate programs at the Graduate School of Banking at Louisiana State University and Texas Tech University’s School of Bank Management.

Philip Jordan. Philip Jordan has been with b1BANK since August 2008 and currently serves as the Chief Banking Officer, leading the unified Commercial and Retail Banking teams in each of the Bank’s markets as well as the Treasury Management, Secondary Mortgage, and Guaranteed Lending divisions. Prior to January 2017, Mr. Jordan was the Western Region Chief Executive Officer which included the Southwest, Northwest, and Lafayette areas of Louisiana. Prior to his promotion to Executive Vice President in July 2015, Mr. Jordan served as Regional President of b1BANK’s Northwest Louisiana division. Mr. Jordan holds a Finance degree from Louisiana Tech University.

Margaret “Mimi” Singer Lee. Mimi Singer Lee has been with b1BANK since July 2019 and serves as the Executive Vice President, Chief Human Resources Officer. In this role, she provides leadership to the Human Resources, Talent Development and Marketing teams. She has over 20 years of comprehensive HR experience including recruitment, talent acquisition, retention, employee relations, policy administration, and training and development. Prior to joining b1BANK, Dr. Singer Lee served in progressively responsible positions in Human Resource Management at Louisiana State University, the state’s flagship university, including her most recent role as Interim Chief Human Resources Officer. Dr. Singer Lee was recently honored as one of Baton Rouge Business Report’s 2023 Influential Women in Business. She earned her PhD in Human Resource Education from Louisiana State University and has held the Professional in Human Resources certification from HRCI, along with the SHRM Certified Professional designation.

Kathryn Manning. Kathryn Manning serves as the Executive Vice President, Chief Risk Officer of b1BANK. In this role, she is responsible for overseeing the Company’s BSA, Compliance, Enterprise Risk, and Loan Review functions. Ms. Manning has been with b1BANK since September 2013 and previously served as its Chief Data Officer. Before joining b1BANK, Ms. Manning served various roles at other large financial institutions. She earned her Bachelor of Science and Master of Science degrees in Finance from Louisiana State University in 2009 and 2010, respectively.

Keith Mansfield. Keith Mansfield serves as Executive Vice President and Chief Operations Officer for b1BANK and has 25 years of banking experience. In his role as Chief Operations Officer, Mr. Mansfield is responsible for all aspects of the Bank’s operations, which include information technology, electronic banking, loan operations, deposit operations, transaction services, branch and treasury operations, business intelligence, facilities, information security operations, vendor management and project management. Mr. Mansfield served most recently as the Bank’s Chief Information Officer. Before joining b1BANK, Mr. Mansfield served as the Chief Technology Officer for a regional financial institution in the Southeast. Mr. Mansfield received a Bachelor of Business Administration in Accounting from the University of Tennessee at Martin.

Warren McDonald. Warren McDonald has been with b1BANK since opening in February 2006 and currently serves as the Chief Credit Officer. Mr. McDonald started at b1BANK as the Senior Commercial Lender in the Baton Rouge Market, and later served as the Market President for the Baton Rouge and Northshore Markets. Mr. McDonald began his commercial banking career in 1988 in the Management Trainee Program with Premier Bank (currently Chase Bank) and has worked in various commercial banking production capacities with Regions Bank and Whitney National Bank. Mr. McDonald graduated from Louisiana State University in 1988 with a BS in Finance and in 1994 with an MBA.

Gregory Robertson. Greg Robertson has served as the Executive Vice President and Chief Financial Officer of b1BANK since January 2017 and has been with Business First since 2011. He previously served as our Chief Banking Officer. He has been in the banking business since 1996. Mr. Robertson worked at City Savings Bank and Trust Co. from 1996 to 2011, where he served in many capacities, including branch manager, commercial lender, program manager for City Savings Financial Services, and Senior Vice President. As Chief Financial Officer for b1BANK, he leads the finance and risk areas of the Bank including accounting, treasury and investments, special assets, Bank Secrecy Act, compliance, internal audit, enterprise risk management, risk analytics, and project management. Mr. Robertson graduated from Northwestern State University in 1993 with a Bachelor of Science degree.

Saundra Strong. Saundra Strong has been with b1BANK since October 2021 and serves as the Executive Vice President, General Counsel and Corporate Secretary. In this role, she is responsible for overseeing the Company’s legal functions. Before joining b1BANK, Ms. Strong served as an Assistant General Counsel for a regional financial institution in the Southeast. She earned her Bachelor of Science from the University of Southern Mississippi in 2000 and her Juris Doctorate from Mississippi College School of Law in 2003.

N. Jerome “Jerry” Vascocu, Jr. Jerry Vascocu has served as the Executive Vice President and Chief Administrative Officer of b1BANK since November 2022. Mr. Vascocu has more than 27 years of banking experience, most recently serving as director of commercial banking strategy for First Horizon Bank. He spent 17 years with IberiaBank, serving as Acadiana market president and commercial relationship manager and team leader in Baton Rouge. Mr. Vascocu serves as a board member of Ochsner Lafayette General Hospital, Ochsner Lafayette General Foundation, Ragin Cajuns Athletic Foundation at the University of Louisiana Lafayette and is a member and past chairman of the Louisiana Chapter of Young Presidents Organization International. He has previously served as chairman of the board and finance chair of One Acadiana, commissioner with the Louisiana Economic Development Authority (LEDA), board member and chair of the Operational Excellence Committee for the United Way of Acadiana, chairman of the Ascension Episcopal School Board of Trustees and board member of the University of Louisiana at Lafayette B.I. Moody School of Business Advisory Council. He earned a Bachelor of Arts in Economics from Vanderbilt University.

Corporate Governance Principles and Related Matters

We are committed to having sound corporate governance principles, which are essential to running our business efficiently and maintaining our integrity in the marketplace. Our board of directors has adopted Corporate Governance Guidelines, which set forth the framework within which our board, assisted by our board committees, directs the affairs of our organization. The Corporate Governance Guidelines address, among other things, the composition and functions of the board, director independence, compensation of directors, management succession and review, board committees and selection of new directors. In addition, our board of directors adopted a Code of Business Conduct and Ethics that applies to all of our directors, officers, and employees. Our Corporate Governance Guidelines, as well the Code of Business Conduct and Ethics, are available on our website at www.b1bank.com under “Shareholder Info.” Any amendments to the Code of Business Conduct and Ethics, or any waivers of its requirements with respect to a senior executive officer, will be disclosed on our website, as well as any other means required by the rules of the Nasdaq Global Select Market.

Board Independence

Under the rules of the Nasdaq Global Select Market, independent directors must comprise a majority of our board of directors. The rules of the Nasdaq Global Select Market, as well as those of the Securities and Exchange Commission (the “SEC”), also impose several other requirements with respect to the independence of our directors.

Our board of directors has evaluated the independence of its members based upon the rules of the Nasdaq Global Select Market and the SEC. Applying these standards, our board of directors has affirmatively determined that all of our directors, except for Messrs. Brees, Folse and Melville, are “independent directors” under the applicable rules. We have determined that Mr. Melville is not an “independent director” under the applicable rules since he is an employee of both the Bank and the Company. We have determined that Mr. Folse is not an “independent director” under the applicable rules since he was an employee of the Bank and the Company in the last three years. We have determined that Mr. Brees is not an “independent director” under the applicable rules as a result of the Ambassador Agreement between Mr. Brees and the Bank. See “Related Person Transactions” on page 32 for more information.

Board Leadership Structure

Our board of directors does not have a formal policy regarding the separation of the roles of Chief Executive Officer and Chairman of the Board. It is our board of directors’ view that rather than having a rigid policy, the board of directors, with the advice and assistance of the Nominating/Corporate Governance Committee, and upon consideration of all relevant factors and circumstances, will determine, as and when appropriate, whether the two offices should be separate. Currently, our leadership structure separates the offices of Chief Executive Officer and Chairman of the Board, with Mr. Melville serving as our Chief Executive Officer and Mr. Greer as Chairman of the Board, reinforcing the leadership role of our board of directors in its oversight of our business and affairs.

Board Meetings

Our board of directors held 8 scheduled meetings in 2022. Information regarding meetings of the various committees is described below. All directors attended at least 75% of the board and committee meetings on which they served during 2022. Directors are encouraged to attend annual meetings of our shareholders, although we have no formal policy on director attendance at annual meetings. Sixteen of our directors attended our 2022 annual shareholder meeting.

Board Committees

Our board of directors has established standing committees in connection with the discharge of its responsibilities. These committees include the Audit Committee, the Compensation Committee, and the Nominating/Corporate Governance Committee. Our board of directors also may establish such other committees as it deems appropriate, in accordance with applicable law and regulations and our corporate governance documents.

Audit Committee

Our board of directors has established an Audit Committee to assist it in fulfilling its responsibilities for general oversight of the integrity of our consolidated financial statements, compliance with legal and regulatory requirements, the independent auditor’s qualifications and independence, and the performance of the independent auditors and our internal audit function. Our Audit Committee held 12 scheduled meetings and 5 special meetings in 2022. Current members of our Audit Committee include:

|

● |

James J. Buquet, III |

|

● |

Carol M. Calkins |

|

● |

J. Vernon Johnson |

|

● |

David A. Montgomery, Jr., Chairman |

|

● |

Steven G. White |

Our board of directors has evaluated the independence of each of the members of our Audit Committee and has affirmatively determined that (1) each of the members of our Audit Committee is an “independent director” under Nasdaq Global Select Market rules, (2) each of the members satisfies the additional independence standards under applicable SEC rules for audit committee service, and (3) each of the members has the ability to read and understand fundamental financial statements. Our board of directors has also determined that David A. Montgomery, Jr. qualifies as an “audit committee financial expert” under Item 407(d)(5) of Regulation S-K under the Securities Act and has the requisite accounting or related financial expertise required by applicable SEC rules.

Our Audit Committee has adopted a written charter, which sets forth the committee’s duties and responsibilities. The charter of the Audit Committee is available on our website at www.b1bank.com under “Shareholder Info.” The duties and responsibilities of the Audit Committee include, among other things:

|

● |

Reviewing the annual audited and quarterly unaudited financial statements and recommending inclusion of the annual audited consolidated financial statements in the Company’s annual report on Form 10‑K; |

|

● |

Periodically reviewing and discussing the adequacy of the Company’s internal controls and financial disclosure controls; |

|

● |

Approving all engagements for audit and non-audit services by the independent auditors; |

|

● |

Considering the independence of the independent auditors; |

|

● |

Appointing, retaining, and dismissing the independent auditors; |

|

● |

Overseeing the internal audit function; and |

|

● |

Reviewing and approving the Audit Committee’s charter. |

Compensation Committee

Our board of directors has established a Compensation Committee to assist it in its oversight of our overall compensation structure, policies and programs and assessing whether such structure meets our corporate objectives, the compensation of our named executive officers and the administration of our compensation and benefit plans. Our Compensation Committee held 4 scheduled meetings in 2022. Current members of our Compensation Committee include:

|

● |

James J. Buquet, III |

|

● |

Rolfe H. McCollister, Jr. |

|

● |

Patrick E. Mockler, Chairman |

|

● |

Kenneth W. Smith |

Our board of directors has evaluated the independence of each of the members of our Compensation Committee and has affirmatively determined that each of the members of our Compensation Committee meets the definition of an “independent director” under Nasdaq Global Select Market rules. Our board has also determined that each of the members of the Compensation Committee qualifies as a “nonemployee director” within the meaning of Rule 16b-3 under the Exchange Act and an “outside director” within the meaning of Section 162(m) of the Internal Revenue Code.

Our Compensation Committee has adopted a written charter, which sets forth the committee’s duties and responsibilities. The charter of the Compensation Committee is available on our website at www.b1bank.com under “Shareholder Info.” The duties and responsibilities of the Compensation Committee include, among other things:

|

● |

Reviewing and approving annual compensation and incentive opportunities of the Company’s executive officers, excluding the CEO, and recommending annual compensation and incentive opportunities for the CEO to the board of directors; |

|

● |

Reviewing, approving and authorizing employment related agreements (i.e., Change of Control Agreements) with executive officers and making recommendations regarding the same for the CEO to the board of directors; |

|

● |

Reviewing, determining, and recommending to the board of directors, policies relating to the Company’s philosophy and practices relating to compensation of its executive officers and directors; |

|

● |

Reviewing, approving and authorizing the establishment of performance measures applicable to performance-based cash and equity incentives; |

|

● |

Reviewing with management the compensation discussion in the Company’s annual proxy statement and other SEC filings; |

|

● |

Preparing the Compensation Committee Report; and |

|

● |

Retaining any compensation consultants, advisors and attorneys. |

Compensation Committee Interlocks and Insider Participation

During 2022, none of the members of our Compensation Committee were an officer or employee of Business First Bancshares, Inc. or b1BANK. In addition, none of our executive officers serve or have served as a member of the board of directors, compensation committee or other board committee performing equivalent functions of any other entity that has one or more executive officers serving as one of our directors or on our Compensation Committee.

Nominating/Corporate Governance Committee

Our board of directors has established a Nominating/Corporate Governance Committee to assist it in its oversight of identifying and recommending persons to be nominated for election as directors and to fill any vacancies on the board of directors of the Company and each of our subsidiaries, monitoring the composition and functioning of the standing committees of the board of directors of the Company and each of our subsidiaries, and in developing, reviewing and monitoring the corporate governance policies and practices of the Company and each of our subsidiaries. Our Nominating/Corporate Governance Committee held 2 scheduled meetings in 2022. Current members of our Nominating/Corporate Governance Committee include:

|

● |

Ricky D. Day |

|

● |

Robert S. Greer, Jr. |

|

● |

Rolfe H. McCollister |

|

● |

Keith A. Tillage |

|

● |

Steven G. White, Chairman |

Our board of directors has evaluated the independence of each of the members of our Corporate Governance/Nominating Committee and has affirmatively determined that each of the members of our Corporate Governance/Nominating Committee meets the definition of an “independent director” under Nasdaq Global Select Market rules.

Our Nominating/Corporate Governance Committee has adopted a written charter, which sets forth the committee’s duties and responsibilities. The charter of the Nominating/Corporate Governance Committee is available on our website at www.b1bank.com under “Shareholder Info.” The duties and responsibilities of the Compensation Committee include, among other things:

|

● |

Reviewing the corporate governance and leadership structure of the Company; |

|

● |

Recommending to the board of directors nominees for election to the board; |

|

● |

Monitoring the committees of the board, recommending any changes to the duties and responsibilities of those committees and the creation or elimination of any committees; |

|

● |

Developing, monitoring, and reviewing the Company’s compliance with corporate governance guidelines; and |

|

● |

Establishing the process for conducting the annual performance review of the board, its committees and each director and executive officer. |

Director Qualifications

In carrying out its functions, the Nominating/Corporate Governance Committee will develop qualification criteria for all potential nominees for election, including incumbent directors, board nominees and shareholder nominees to be included in the Company’s proxy statements. These criteria may include the following attributes:

|

● |

adherence to high ethical standards and high standards of integrity; |

|

● |

sufficient educational background, professional experience, business experience, service on other boards of directors and other experience, qualifications, diversity of viewpoints, attributes and skills that will allow the candidate to serve effectively on the board of directors and the specific committee for which he or she is being considered; |

|

● |

evidence of leadership, sound professional judgment and professional acumen; |

|

● |

evidence the nominee is well recognized in the community and has a demonstrated record of service to the community; |

|

● |

a willingness to abide by any published code of conduct or ethics for the Company and to objectively appraise management performance; |

|

● |

the ability and willingness to devote sufficient time to carrying out the duties and responsibilities required of a director; |

|

● |

any related person transaction in which the candidate has or may have a material direct or indirect interest and in which the Company participates; and |

|

● |

the fit of the individual’s skills and personality with those of other directors and potential directors in building a board of directors that is effective, collegial, and responsive to the needs of the Company and the interests of our shareholders. |

In addition, the Company’s board of directors and the Nominating/Corporate Governance Committee are committed to increasing the diversity of the Company’s board. In furtherance of that commitment, the Company’s board of directors has established a goal of 30% diversity as defined by gender and race by 2025. The Company continues to actively seek additional diverse candidates.

The Nominating/Corporate Governance Committee will also evaluate potential nominees for the Company’s board of directors to determine if they have any conflicts of interest that may interfere with their ability to serve as effective board members and to determine whether they are “independent” in accordance with applicable SEC and Nasdaq Global Select Market rules (to ensure that, at all times, at least a majority of our directors are independent). Although we do not have a separate diversity policy, the committee considers the diversity of the Company’s directors and nominees in terms of knowledge, experience, skills, expertise, and other demographics that may contribute to the Company’s board of directors.

Prior to nominating or, if applicable, recommending an existing director for re-election to the Company’s board of directors, the Nominating/Corporate Governance Committee will consider and review the following attributes with respect to each existing director:

|

● |

attendance and performance at meetings of the Company’s board of directors and the committees on which such director serves; |

|

● |

length of service on the Company’s board of directors; |

|

● |

experience, skills, and contributions that the existing director brings to the Company’s board of directors; |

|

● |

independence and any conflicts of interest; and |

|

● |

any significant change in the director’s status, including the attributes considered for initial membership on the Company’s board of directors. |

ITEM 11. Executive Compensation

This section describes and analyzes our executive compensation philosophy and program in the context of the compensation paid during our 2022 fiscal year. The Company’s named executive officers (NEOs) for 2022, which consist of its chief executive officer, chief financial officer and certain of the other most highly compensated executive officers, are:

|

• |

David R. (“Jude”) Melville, III, Business First’s and b1BANK’s President and Chief Executive Officer; |

|

• |

Gregory Robertson, Business First’s Chief Financial Officer and Treasurer and b1BANK’s Executive Vice President and Chief Financial Officer; |

|

• |

Philip Jordan, b1BANK’s Executive Vice President and Chief Banking Officer; |

|

• |

Keith Mansfield, b1BANK’s Executive Vice President and Chief Operations Officer; and |

|

• |

Saundra Strong, b1BANK’s Executive Vice President and General Counsel. |

We also have included tables containing specific information about the compensation earned by or paid to our NEOs in 2022. The discussion below is intended to summarize and explain the detailed information provided in those tables and to put that information into the context of our overall compensation strategy.

The Compensation Committee’s goal is to attract and retain highly qualified executives and to motivate them to maximize shareholder value while managing risk appropriately and maintaining the safety and soundness of the organization. Our compensation program is aligned with short-term and long-term Company performance and includes best practices designed to reflect sound corporate governance. The Compensation Committee believes that executive compensation should be designed to allow the Company to recruit, retain and motivate employees who play a significant role in the organization’s current and future success. Further, compensation policies and practices are designed to help develop management talent, promote teamwork among and high morale within executive management, establish effective corporate governance, and set compensation at competitive levels.

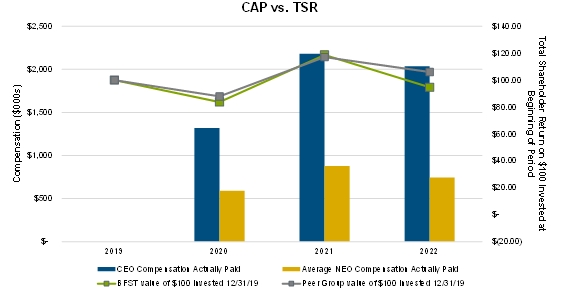

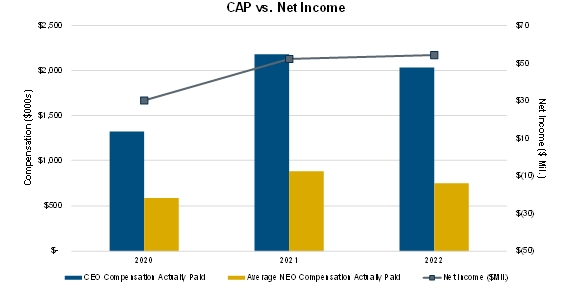

Alignment Between Pay and Performance

The Company is committed to aligning the compensation of its executive officers with the Company’s financial and operational performance. The Compensation Committee believes that its current executive compensation strategy is helping to achieve these goals by aligning compensation with the Company’s performance. The Compensation Committee uses both annual cash bonuses and time-based equity awards to link executive pay with the Company’s performance. Payouts under the annual management incentive plan are based on the Company’s achievement of key corporate, strategic and line of business performance goals. A minimum achievement of the threshold is required to earn the minimum annual cash bonus, and performance that exceeds the target results in higher bonus awards. As a result of the structure of the Company’s incentive plan, the Committee believes that compensation paid to its NEOs is effectively aligned with the Company’s performance.

2022 Say on Pay Vote

In 2022, the advisory shareholder vote on the Company’s executive compensation received approval of over 97% of the votes cast on the proposal. In light of such strong support, during the remainder of 2022 and in 2023, the Compensation Committee continued to apply the same compensation philosophy that was described in the 2022 proxy statement in determining amounts and types of executive compensation.

Board and Committee Process

In considering appropriate levels of compensation for executives, the Compensation Committee takes into account the Company’s performance and individual performance and experience, as well as peer and broader financial services industry comparisons (referred to as market data) and company affordability analysis. When deemed appropriate, the Committee requests that its independent compensation consultant, Pearl Meyer & Partners, LLC (Pearl Meyer), provide it with survey data of executive compensation for financial services companies that are comparable to the Company.

The Chair of the Compensation Committee works with the CEO and the Human Resources department to establish the agenda for Committee meetings. The CEO and Human Resources department also interface with the Committee in connection with the Committee’s executive compensation decision-making, providing comparative market data as well as making recommendations. The Committee periodically meets with the CEO and members of the Human Resources department to assess progress toward meeting objectives set by the Board for both annual and long-term compensation. The Committee also meets in executive session without management present when appropriate.

The Compensation Committee reviews all of the components of compensation in making determinations on the mix, amount and form of executive compensation. In making compensation decisions, the Committee seeks to promote teamwork among, and high morale within, executive management, including the NEOs. While the Committee does not use any quantitative formula or multiple for comparing or establishing compensation for executive management, it is mindful of internal pay equity considerations and assesses the relationship of the compensation of each executive to other members of executive management.

Role of the Compensation Consultant

The Committee relies on Pearl Meyer to provide information, analyses and advice to aid in the determination of competitive executive and non-employee director pay consistent with the Company’s compensation philosophy, and periodically engages Pearl Meyer to test the Company’s pay-for-performance alignment. The Committee has assessed the independence of Pearl Meyer pursuant to SEC and Nasdaq rules and has concluded that the advice it receives from Pearl Meyer is objective and not influenced by other relationships that could be viewed as conflicts of interest.

With respect to the Company’s compensation program for executives and non-employee directors, Pearl Meyer’s services for the Compensation Committee have or may include:

|

● |

providing market data regarding executive compensation in the banking and financial services industry, |

|

● |

providing recommendations regarding compensation for newly appointed executive officers and certain changes in executive compensation, |

|

● |

providing recommendations regarding director compensation, |

|

● |

providing recommendations regarding equity vesting practices impacting directors and executives, |

|

● |

providing recommendations regarding changes to director and executive stock ownership guidelines, |

|

● |

providing input on leadership succession planning, and |

|

● |

providing recommendations regarding the composition of the Company’s peer group and reviewing drafts of this Compensation Discussion and Analysis. |

Benchmarking

When determining the amount and form of compensation for executives, the Compensation Committee considers comparative executive compensation information provided by Pearl Meyer that is derived from two primary data sources: peer group data and broader compensation survey market data from the banking and financial services industry. The Compensation Committee uses peer group data and, as applicable, market survey data, to assist with assessing the Company’s compensation competitiveness. Recognizing that comparative pay assessments have inherent limitations, due to the lack of precise comparability of executive positions between companies, as well as the companies themselves, the comparative data are used only as a guide and the Committee does not fix any NEO’s compensation (or individual compensation elements) to a particular compensation level within this comparative data. In exercising its judgment to set pay levels, the Compensation Committee looks beyond the comparative data and also considers individual job responsibilities, individual performance, experience, compensation history (both at the Company and at prior employers in the case of newly hired employees), company performance and company goals.

Peer Group Data

The peer group data relied upon by the Company in making its 2022 compensation recommendations was gathered by Pearl Meyer from the proxy statements of a peer group of financial institutions in the United States. In making its 2022 compensation recommendations, the Committee considered market data comparisons prepared by Pearl Meyer, including an analysis of the 25th, 50th (median) and 75th percentile of the compensation for base salary (aged forward using a predetermined factor), annual cash incentive, equity incentives and the total of these elements as a point of reference for each NEO. The peer group is updated biennially by the Committee, based on a process that includes recommendations from internal sources, including the Human Resources department, and external sources such as Pearl Meyer, to reflect the companies against which the Company competes for executive talent or for shareholder investment. The specific characteristics of the financial institutions comprising the peer group may vary from year to year, but the companies are chosen based on a combination of various factors that include asset size and business mix.

Pearl Meyer’s most recent peer group analysis for the Company consisted of 21 peer companies. The specific asset sizes for the peer companies listed in the report presented to the Committee in 2022 ranged from approximately $2.9 billion to $10.5 billion. The Company’s peer group consisted of the following companies:

|

First Bancorp (FBNC) Veritex Holdings, Inc. (VBTX) Seacoast Banking Corporation of Florida (SBCF) Amerant Bancorp. Inc. (AMTB) Southside Bancshares, Inc. (SBSI) Stock Yards Bancorp, Inc. (SYBT) City Holding Company (CHCO) Great Southern Bancorp, Inc. (GSBC) |

Equity Bancshares, Inc. (EQBK) Red River Bancshares, Inc. (RRBI) CapStar Financial Holdings, Inc. (CSTR) Origin Bancorp, Inc. (OBNK) National Bank Holdings Corporation (NBHC) Triumph Bancorp, Inc. (TBK) The First Bancshares, Inc. (FBMS) HomeTrust Bancshares, Inc. (HTBI) |

South Plains Financial, Inc. (SPFI) SmartFinancial, Inc. (SMBK) Guaranty Bancshares, Inc. (GNTY) Southern First Bancshares, Inc. (SFST) Home Bancorp, Inc. (HBCP) |

Compensation Mix

While the Compensation Committee considers the overall mix of executives’ pay between base salary, annual cash bonus and long-term incentive compensation, the Compensation Committee does not target a specific allocation among the various compensation components. More than one-half of the CEO’s compensation is contingent on the Company’s performance and a significant part of the compensation provided to the other NEOs is contingent on performance. In allocating compensation among salary, bonus and equity-based compensation, the Committee believes that the compensation of the senior-most levels of management with the greatest ability to influence the Company’s performance should be significantly based on the Company’s performance, while lower levels of management should receive a greater portion of their compensation in base salary. The Committee also makes allocations between short-term and long-term compensation for NEOs.

Base Salaries

The Company’s goal is to provide its executive management with fixed cash compensation in the form of a base salary that will attract and retain highly qualified executives. The Company also uses base salary to reward top performance, industry and job specific knowledge, experience and leadership ability. The base salaries for the Company’s NEOs are typically established in the second quarter of the year after the Company’s financial information and performance results from the previous year are available, although other adjustments are made occasionally to reflect changes in responsibility or other developments. In establishing base salaries for our NEOs, the Compensation Committee has relied on external market data obtained from outside sources, including a peer bank salary study prepared by our independent compensation consultant, Pearl Meyer. In addition to considering the information obtained from such sources, the Compensation Committee has considered:

|

● |

each named executive officer’s scope of responsibility; |

|

● |

each named executive officer’s years of experience; |

|

● |

the types and amount of the elements of compensation to be paid to each named executive officer; |

|

● |

our overall financial performance and performance with respect to other aspects of our operations, such as our growth, asset quality, profitability, and other matters, including the status of our relationship with the banking regulatory agencies; and |

|

● |

each named executive officer’s individual performance and contributions to our company-wide performance, including leadership, teamwork, and community service. |

In establishing the CEO’s base salary, the Compensation Committee typically considers Pearl Meyer’s recommendations based on an analysis of peer group data and survey market data and also considers internal data provided by human resources personnel and the CEO’s individual performance and contributions relative to the Company’s corporate goals. In establishing base salaries of the Company’s other NEOs, the Committee typically considers the recommendations of the CEO, which are based on individual responsibility level, individual and company performance, total compensation histories for each NEO, the market data provided by Pearl Meyer for similar positions and a general understanding of executive compensation in the financial services industry. The CEO evaluates the other NEOs’ performance using the same metrics normally used for determining annual management incentive plan awards. The Compensation Committee considers each of these factors but does not assign a specific value to any of them. The Compensation Committee’s process also involves a qualitative component in evaluating each NEO’s overall span of responsibility and control, knowledge and leadership ability. The base salaries in effect during 2021 and 2022 were as shown below:

|

Name |

2021 Base Salary Paid ($) |

2022 Base Salary Paid ($) |

% Change (%) |

|||||||||

|

David R. (“Jude”) Melville |

612,500 | 662,500 | 8.16 | |||||||||

|

Gregory Robertson |

320,500 | 350,000 | 9.2 | |||||||||

|

Philip Jordan |

320,500 | 350,000 | 9.2 | |||||||||

|

Keith Mansfield |

320,500 | 350,000 | 9.2 | |||||||||

|

Saundra Strong(1) |

--- | --- | -- | |||||||||

|

(1) |

Ms. Strong joined the Company in October 2021. |

Cash Bonuses

The Compensation Committee typically awards cash bonuses utilizing a structured, objective approach based upon the achievement of performance objectives. At the beginning of each year, the Company develops a bonus matrix for the executive management team. The performance goals are tied to various corporate, strategic and, where applicable, line of business objectives, and the performance results at or slightly above the target levels are intended to be achievable but challenging. The CEO recommends the bonus matrix to the Compensation Committee, including overall incentive target payout levels for each NEO, stated as a percentage of base salary. The CEO also recommends the performance measures and the weightings to be assigned to the performance measures for each NEO.

The Committee reviews the CEO’s recommendations along with, as applicable, market data to ensure that proposed target payout levels provide an appropriate opportunity to earn bonuses and are competitive with the companies in the Company’s peer group. The Compensation Committee then makes a recommendation to the Board for approval. In making its recommendation, the Compensation Committee may consider events outside the influence or control of the NEOs and may adjust the performance goals to exclude the effect of these events. The Compensation Committee did not include any such adjustments when recommending the performance goals for 2022.

After the target levels and performance goals and weightings have been approved by the Board, the Committee retains the discretion to adjust the target levels and performance goals and weightings during the year, on an individual or group basis, if the Compensation Committee determines additional adjustments are appropriate for this purpose. The Committee did not make any such adjustments during 2022. Following the end of a year, the Compensation Committee also has discretion to increase or decrease the amount of an award earned under the plan, change the individual weightings or adjust the threshold payout level and minimum performance goals, including when the minimum performance goals are not achieved. The Compensation Committee’s exercise of discretion is intended to ensure the management incentive plan appropriately rewards performance and neither overpays for results nor under rewards accomplishments achieved during the year. The financial performance goals for 2022 are set forth below:

| Performance Goal | ||||||||||||||||||||

| Performance Measures | Weight | Threshold | Target | Superior | 2022 Actual Results | |||||||||||||||

|

Core ROA |

50 | % | 0.97 | 1.01 | 1.05 | 1.05 | ||||||||||||||

|

Core Efficiency Ratio |

15 | % | 66.00 | 65.60 | 64.30 | 62.77 | ||||||||||||||

|

Classified Assets Coverage Ratio |

15 | % | 12.0 | 10.0 | 8.0 | 4.0 | ||||||||||||||

|

Team/Individual |

20 | % |

Qualitative Assessment |

|||||||||||||||||

|

Grand Total |

100 | % | ||||||||||||||||||

* Core ROA and Core Efficiency Ratio are non-GAAP financial measures.

* The cash bonuses paid to the NEOs for 2020-2022 are set forth in the Summary Compensation Table below under Non-Equity Incentive Plan Compensation.

Equity Incentive Awards

Equity-based awards generally constitute the largest non-cash component of each NEO’s total compensation package. Pearl Meyer has provided the Compensation Committee with peer company data and published surveys to assist the Committee in setting the amount of annual equity-based awards. In establishing award levels, the Committee generally does not consider the equity ownership levels of the recipients or prior awards that are fully vested. Equity- based awards and the related performance goals for NEOs are recommended by Human Resources and approved by the Compensation Committee generally during the first quarter of each year. Awards are typically made as early as practicable in the year to maximize the time-period for achieving performance goals associated with the awards. Equity-based awards are granted under the Business First Bancshares, Inc. 2017 Equity Incentive Plan, as amended.

The Compensation Committee believes that time-based equity awards, which vest in three equal installments over a period of two years, beginning shortly after the grant date, promote an important goal of executive retention and help encourage greater levels of stock ownership by executives, while also having an incentive effect as a result of their value being linked to the Company’s stock price. The Compensation Committee will review the mix of incentive awards from time to time and make adjustments in the mix as needed to reflect the Company’s objectives for such awards. For 2022, Mr. Melville received annual equity-based awards tailored to his position as CEO. All other NEOs, with the exception of Ms. Strong who joined the Company in October 2021, received the same annual equity-based award. The performance measures used to determine these equity awards are as follows:

| Performance Goals (in Millions) | ||||||||||||||||||||

| Performance Measures | Weight | Threshold | Target | Superior | 2022 Actual Result | |||||||||||||||

|

% Asset Growth (Organic) (1) |

50 | % | 4.75 | % | 6.80 | % | 8.48 | % | 15.44 | % | ||||||||||

|

Core Diluted Earnings Per Share (2) |

50 | % | $ | 2.32 | $ | 2.43 | $ | 2.51 | $ | 2.52 | ||||||||||

|

Grand Total |

100 | % | ||||||||||||||||||

(1) Organic asset growth is a non-GAAP financial measure calculated by deducting assets acquired in corporate transactions, including the 2022 acquisition of Texas Citizens Bancorp, Inc.

(2) Core Diluted Earnings Per Share is a non-GAAP financial measure. See “Reconciliation of Non-GAAP Measures” on page 37 for more information.

The equity incentives granted to the NEOs for 2020-2022 are set forth in the “Stock Awards” column in the Summary Compensation Table below, and the “Outstanding Equity Awards at 2022 Fiscal Year End” table summarizes each NEO’s outstanding unvested equity awards and information about future vesting, each as of December 31, 2022.

Benefits and Perquisites

Generally, our named executive officers participate in the same benefit plans designed for all of our full-time employees, including health, dental, vision, disability, and basic group life insurance coverage. The purpose of our employee benefit plans is to help attract and retain quality employees, including executives, by offering benefit plans similar to those typically offered by our competitors.

We provide our named executive officers with a limited number of perquisites that we believe are reasonable and consistent with our overall compensation program to better enable us to attract and retain qualified executives. Our Compensation Committee periodically reviews the levels of perquisites and other personal benefits provided to named executive officers. In 2022, we provided certain of our named executives officers with an allowance for automobile-related expenses and paid for certain club memberships. We also provided certain of our named executive officers with certain medical allowances for health examination expenses.

Hedging and Pledging

Our Insider Trading Policy, available on our website at www.b1bank.com under “Shareholder Info,” strongly discourages our directors, officers and employees (together with the affiliates and immediately family members of each) from engaging in certain hedging and derivative transactions with respect to the Company’s securities. In addition, the Insider Trading Policy requires preclearance of any such transactions. Similarly, our Insider Trading Policy prohibits ownership of Company securities in a margin account and discourages pledging Company securities and requires preclearance of any pledging transactions.

Executive Compensation Recoupment

All compensation and awards payable or paid under the Company’s 2017 Equity Incentive Plan, as amended, are subject to the Company’s ability to recover incentive-based compensation from executive officers, as required by the Dodd-Frank Act, any rules or regulations promulgated thereunder, and any other “clawback” provision required by any other applicable law or the listing standards of any applicable stock exchange or national market system.

Summary Compensation Table

The following table provides information regarding the compensation of our named executive officers for the fiscal years ended December 31, 2020, 2021, and 2022.

|

Name and Principal Position with b1BANK |

Year |

Salary |

Stock ($) |

Bonus ($) |

Non-Equity Incentive Compensation ($) |

All Other ($) |

Total ($) |

|||||||||||||||||||

|

David R. (“Jude”) Melville, III |

2022 |

662,500 | 945,122 | --- | 658,125 | 255,288 | 2,521,035 | |||||||||||||||||||