Filed pursuant to Rule 424(b)(3)

Registration No. 333-280341

TALEN ENERGY CORPORATION

36,825,683 Shares of Common Stock

This prospectus relates to the registration of up to 36,825,683 shares of our common stock, par value $0.001 per share (our “common stock”), which may be offered for resale from time to time by the stockholders named under the heading “Principal and Selling Stockholders” (the “Selling Stockholders”). The shares of our common stock offered under this prospectus may be resold by the Selling Stockholders at fixed prices, prevailing market prices at the times of sale, prices related to such prevailing market prices, varying prices determined at the times of sale or negotiated prices, and, accordingly, we cannot determine the price or prices at which shares of our common stock may be resold. The shares of our common stock offered by this prospectus and any prospectus supplement may be resold by the Selling Stockholders directly to investors or to or through underwriters, dealers or other agents, as described in more detail in this prospectus. We do not know if, when or in what amounts a Selling Stockholder may offer shares of our common stock for resale. The Selling Stockholders may resell all, some or none of the shares of our common stock covered by this prospectus in one or multiple transactions. For more information, see the section titled “Plan of Distribution.”

We will not receive any proceeds from the resale of shares of common stock by the Selling Stockholders, but we have agreed to pay certain registration expenses.

Our common stock is quoted on the OTCQX U.S. Market under the symbol “TLNE.” On July 8, 2024, the closing price of our common stock as reported on the OTCQX U.S. Market was $118.99 per share. We have been approved to list our common stock on the Nasdaq Global Select Market (“Nasdaq”) under the symbol “TLN.” Our common stock will begin trading on Nasdaq on or about July 10, 2024.

Investing in our common stock involves risks. See the section titled “Risk Factors” beginning on page 19 to read about factors you should carefully consider before buying shares of our common stock.

Neither the Securities and Exchange Commission nor any other regulatory body has approved or disapproved of these securities or passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

Prospectus dated July 9, 2024.

TABLE OF CONTENTS

| Page | |||||

i

ABOUT THIS PROSPECTUS

This prospectus is a part of a registration statement on Form S-1 that we filed with the Securities and Exchange Commission (the “SEC”), using a “shelf” registration or continuous offering process. Under this shelf process, the Selling Stockholders may, from time to time, sell the common stock covered by this prospectus in the manner described in the section titled “Plan of Distribution.” Additionally, we may provide a prospectus supplement to add information to, or update or change information contained in, this prospectus (except that any such additions, updates, or other changes to the section titled “Plan of Distribution” shall only be made pursuant to a post-effective amendment to the extent they are material). You may obtain this information without charge by following the instructions under the section titled “Where You Can Find Additional Information” appearing elsewhere in this prospectus. You should read carefully this prospectus and any prospectus supplement before deciding to invest in our common stock.

The Selling Stockholders may only offer to resell, and seek offers to buy, shares of our common stock in jurisdictions where offers and sales are permitted. You should rely only on the information contained in this prospectus and any accompanying prospectus supplement. Neither we, nor the Selling Stockholders, have authorized anyone to provide you with information other than that contained in this prospectus or any accompanying prospectus supplement, and if other information is provided to you, then you should not rely on it. Neither we, nor the Selling Stockholders, take any responsibility for, and can provide no assurance as to the accuracy or completeness of, any information that others may give you. Neither we, nor the Selling Stockholders, have authorized any other person to provide you with different or additional information. The information contained in this prospectus speaks only as of the date of this prospectus, regardless of the time of delivery of this prospectus or any sale of shares of our common stock hereunder. Our business, financial condition, cash flows, results of operations and prospects may have changed since the date on the front cover of this prospectus.

Neither we nor the Selling Stockholders are making an offer to sell the shares in any jurisdiction where the offer or sale is not permitted.

Basis of Presentation

Talen Energy Corporation (“TEC” or “Successor”) is a holding company whose only material businesses and properties are held through its direct and wholly owned subsidiary, Talen Energy Supply, LLC, (“TES” or the “Predecessor”). As used in this prospectus, and as further described below, for periods after May 17, 2023, the terms “Talen,” “Successor,” the “Company,” “we,” “us” and “our” refer to TEC and its consolidated subsidiaries (including TES), unless the context clearly indicates otherwise. For periods on or before May 17, 2023, the terms “Talen,” “Predecessor,” the “Company,” “we,” “us” and “our” refer TES and its consolidated subsidiaries (which does not include TEC), unless the context clearly indicates otherwise.

On May 9, 2022, TES and 71 of its subsidiaries each filed a voluntary petition for relief (the “Restructuring”) under Chapter 11 of the Bankruptcy Code (the “Bankruptcy Code”) in the United States Bankruptcy Court for the Southern District of Texas (Houston Division) (the “Bankruptcy Court”). While TEC’s management continued to operate TES and the other initial Debtors as debtors-in-possession during the pendency of the Restructuring, the activities that most significantly impacted TES’s and the other initial Debtors’ economic performance during this time required approval of the Bankruptcy Court. Accordingly, TEC deconsolidated TES for financial reporting purposes because TEC no longer controlled the activities of TES.

On December 12, 2022, TEC filed a petition to become a debtor in the Restructuring in order to facilitate the implementation of certain restructuring transactions contemplated under the Plan of Reorganization in the Restructuring (the “Plan of Reorganization”) and the Bankruptcy Court approved the joint administration of TEC’s voluntary petition for relief under Chapter 11 of the Bankruptcy Code with TES and the other initial Debtors. On December 20, 2022, the Bankruptcy Court confirmed the Plan of Reorganization.

On May 17, 2023, the Plan of Reorganization became effective and we emerged from the Restructuring (“Emergence”). Upon Emergence, TEC regained control of TES through a business combination that resulted in TEC again consolidating TES. The business combination was accounted for as a reverse acquisition based on the

ii

transaction’s economic substance, in which certain creditors of TES effectively equitized their claims against TES into the controlling equity interests of TES, which were then exchanged for the controlling equity interests of TEC.

Accordingly, the financial statements included elsewhere in this prospectus are issued under the name of TEC, the legal parent of TES and accounting acquiree, but represent the continuation of the financial statements of TES, the accounting acquirer. As a result, the consolidated financial statements of TEC after Emergence are not comparable to its consolidated financial statements prior to that date and have been presented with a black line division to delineate the lack of comparability between the Predecessor and Successor.

We completed the sale of our ERCOT fleet to CPS Energy in May 2024 (the “ERCOT Sale”). As a result, we have updated certain operational data presented in this prospectus to give effect to the ERCOT Sale. Our financial statements, segment information and related financial data as of and for the periods ending on or prior to March 31, 2024 include the results of operations from the ERCOT fleet. We intend to reevaluate our segment information for the first financial period after the ERCOT Sale, which is the quarter ending June 30, 2024.

All capitalized terms not defined herein have the meaning provided in the Glossary, unless otherwise expressly set forth herein.

Market and Industry Data

This prospectus includes estimates regarding market and industry data. Unless otherwise indicated, information concerning our industry and the markets in which we operate, including our general expectations, market position, market opportunity and market size, are based on our management’s knowledge and experience in the markets in which we operate, together with currently available information obtained from various sources, including publicly available information, industry reports and publications, surveys, our customers, trade and business organizations and other contacts in the markets in which we operate. Certain information is based on management estimates, which have been derived from third-party sources, as well as data from our internal research.

In presenting this information, we have made certain assumptions that we believe to be reasonable based on such data and other similar sources and on our knowledge of, and our experience to date in, the markets in which we operate. While we believe the estimated market and industry data included in this prospectus is generally reliable, such information is inherently uncertain and imprecise. Market and industry data is subject to change and may be limited by the availability of raw data, the voluntary nature of the data gathering process and other limitations inherent in any statistical survey of such data. In addition, projections, assumptions and estimates of the future performance of the markets in which we operate are necessarily subject to uncertainty and risk due to a variety of factors, including those described in “Risk Factors” and “Cautionary Note Regarding Forward-Looking Statements.” These and other factors could cause results to differ materially from those expressed in the estimates made by third parties and by us. Accordingly, you are cautioned not to place undue reliance on such market and industry data or any other such estimates.

iii

PROSPECTUS SUMMARY

This summary highlights selected information that is presented in greater detail elsewhere in this prospectus. This summary does not contain all of the information you should consider before investing in our common stock. You should read this entire prospectus carefully, including the sections titled “Risk Factors,” “Cautionary Note Regarding Forward-Looking Statements,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” and the consolidated financial statements and the related notes included elsewhere in this prospectus, before making an investment decision.

Our Business

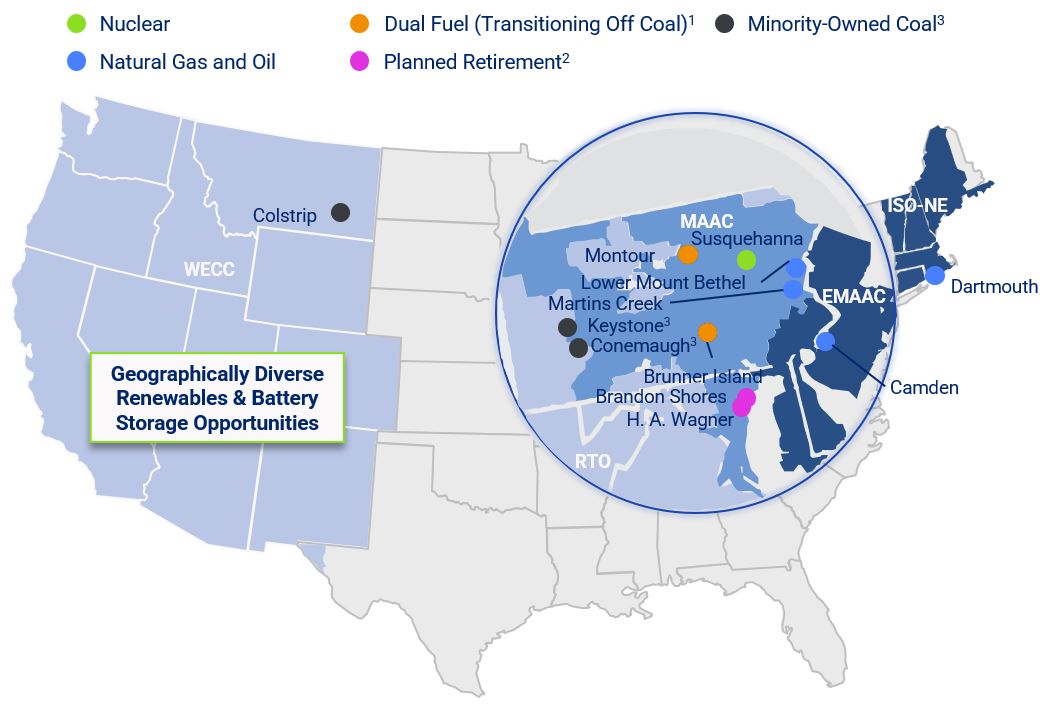

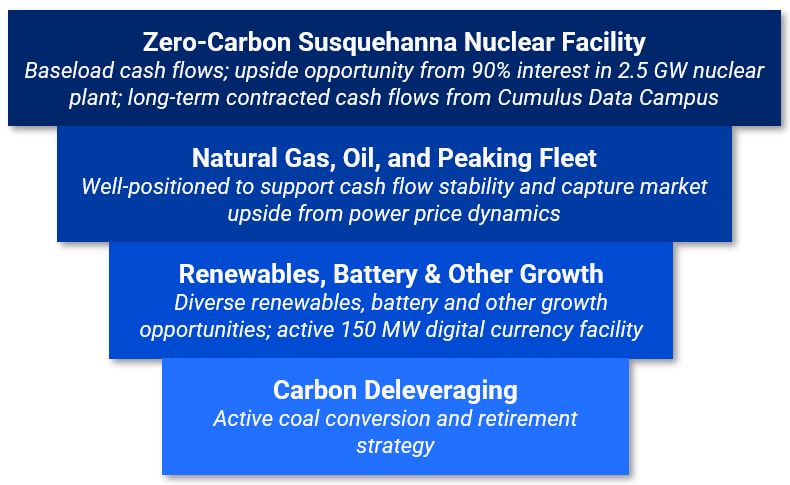

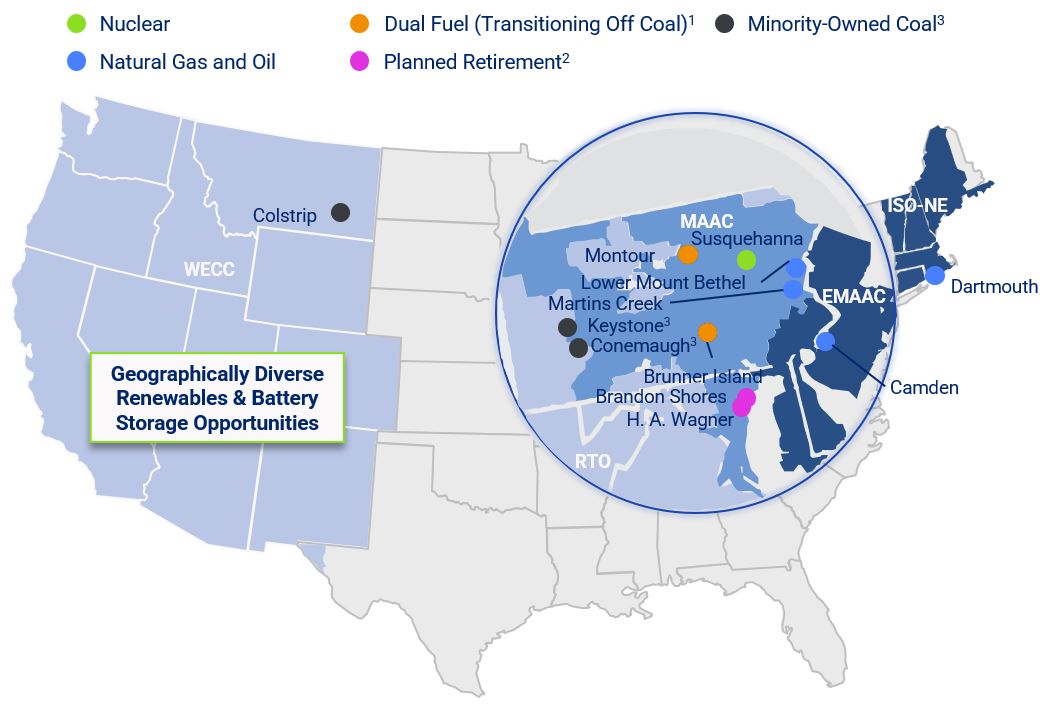

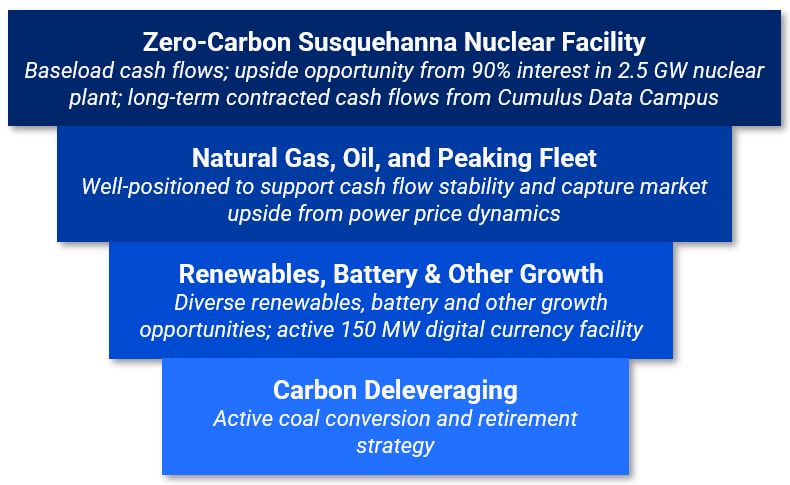

Talen owns and operates power infrastructure in the United States. We produce and sell electricity, capacity and ancillary services into wholesale power markets in the United States, primarily in PJM and WECC, with our generation fleet principally located in the Mid-Atlantic and Montana. We recently completed the sale of our ERCOT fleet (the “ERCOT Sale”). See “—Recent Developments—ERCOT Sale” for additional information. The majority of our generation is produced at zero-carbon nuclear and lower-carbon gas-fired facilities and we are continuing our decarbonization efforts. In addition, as part of our Cumulus digital infrastructure and energy transition platform, we developed, and recently sold (the “Cumulus Data Campus Sale”) to an affiliate of Amazon Web Services, Inc. (together with its affiliates, “AWS”), the infrastructure for a hyperscale data center campus (the “Cumulus Data Campus”) adjacent to our zero-carbon Susquehanna nuclear facility (“Susquehanna”) that will utilize carbon-free, low-cost energy provided directly from the plant, providing both an attractive source of demand for the plant and a new source of incremental revenues for us. See “—Recent Developments—Cumulus Data Campus Sale” for additional information. In 2023, we generated enough power for over 3 million average American homes (based on the U.S. Energy Information Administration’s 2022 estimate of 10,791 KWh per home). In the first three months of 2024, Talen generated $319 million of net income and approximately $289 million of Adjusted EBITDA. “Summary Historical and Unaudited Pro Forma Condensed Consolidated Financial Information—Non-GAAP Financial Measures” contains a description of Adjusted EBITDA and a reconciliation to the most directly comparable GAAP measure.

Our generation portfolio is anchored by our approximately 2.2 GW interest in the Susquehanna nuclear facility, which enabled us to produce over half of our generation carbon-free in 2023. As part of the Cumulus Data Campus Sale, we entered into agreements (the “Cumulus Data Campus PPA”) to supply long-term, zero-carbon power directly from Susquehanna to the Cumulus Data Campus through fixed-price power commitments, providing cash flow stability for an initial term of at least 10 years, in addition to various extension options that could extend through the life of the plant (including additional life from license renewals). For additional information about the Cumulus Data Campus PPA, see “—Recent Developments—Cumulus Data Campus Sale.” We also believe Susquehanna may further benefit from the nuclear production tax credit under the Inflation Reduction Act of 2022 (the “Nuclear PTC”), providing additional cash flow stability through 2032. Our 6.3 GW natural gas and oil fleet (of which 3.2 GW is from Brunner Island, Montour and Wagner Unit 3 after conversion, as discussed below) is reliable and dispatchable, and we believe these assets will become increasingly important for grid stabilization in the face of growing intermittent sources of generation in our core markets. These plants generate material annual capacity revenues and a seasoned operating team leads the monetization of seasonal commodity volatility. We have already completed the conversion of approximately 3.2 GW of our legacy coal fleet to natural gas or fuel oil, significantly reducing the carbon intensity of our fleet while extending the useful lives of certain assets.

In addition to our strong generation fleet, we are developing the Cumulus digital infrastructure and energy transition platform to explore growth opportunities complementary to our existing asset base. For instance, we developed the Cumulus Data Campus, the world’s first 24x7 carbon-free, direct-connect data center campus, to provide digital infrastructure powered by “behind-the-meter” generation directly from Susquehanna. Through both the direct proceeds of the Cumulus Data Campus Sale and entry into the related Cumulus Data Campus PPA, we are now realizing the value of our prior investments in the campus in a value accretive way. While maintaining capital discipline, Cumulus is evaluating additional ways to leverage the value of our existing sites and interconnections for potential renewable energy generation or battery storage projects. We believe our existing footprint, which includes zero-carbon sources of power, access to the power grid and significant land holdings, provides us with unique opportunities for growth.

1

We believe that we are well positioned to benefit from strong cash flows generated by our Susquehanna facility, meaningful capacity revenues and commodity upside from our natural gas, oil and peaking fleet, organic growth from additional power sales to the Cumulus Data Campus under the Cumulus Data Campus PPA, and potential additional upside from our development pipeline, all with an incredibly low carbon footprint. With a focus on the safe, efficient physical and financial operation of our core assets, together with disciplined financial policy and capital allocation, our experienced management team intends to unlock the significant value that we believe is embedded in our platform, enabling us to realize meaningful shareholder returns.

Our Platform

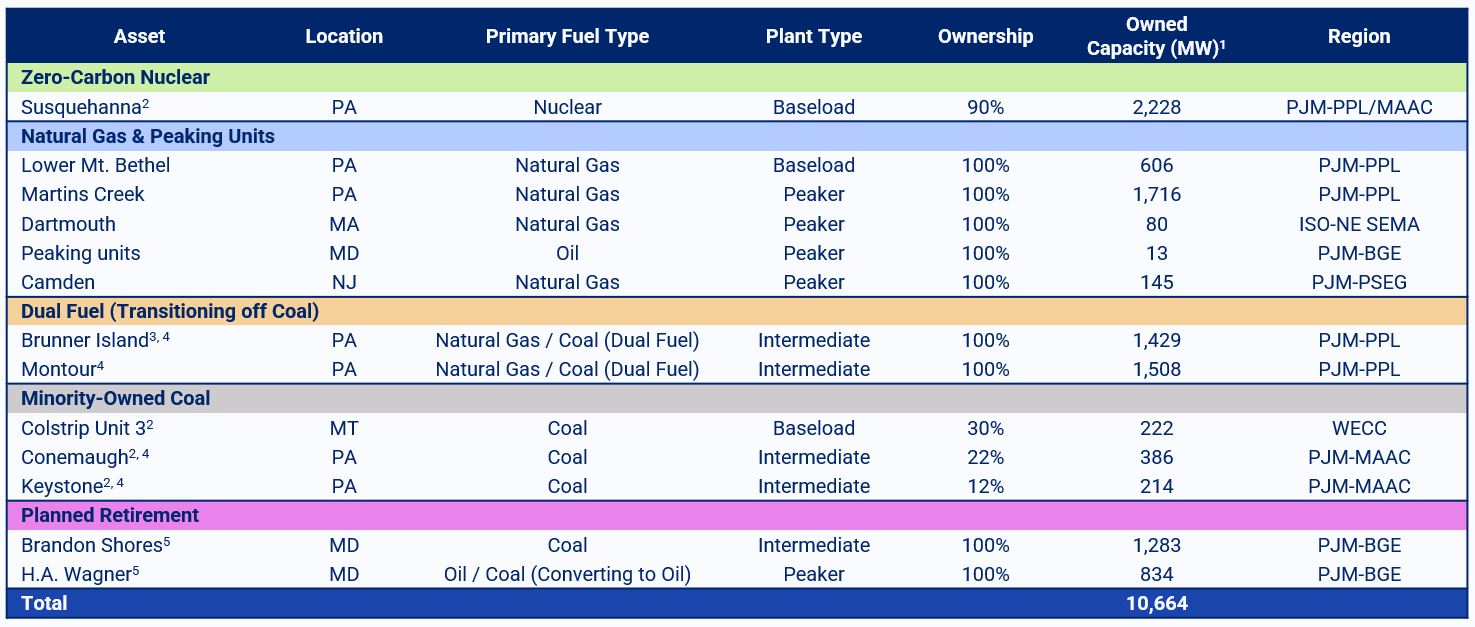

The following discussion provides a brief overview of the key building blocks of our platform. For additional detail regarding each of our facilities, please see “Business—Our Properties.”

Note: Fleet as of 3/31/2024, pro forma for the ERCOT Sale.

1.Brunner Island: Coal-to-dual fuel conversion completed in 2016; coal-fired generation is restricted during the EPA Ozone Season (May 1 to September 30 of each year) and will cease by year-end 2028, with the option of earlier coal retirement at the Company’s discretion.

Montour: Coal-to-gas conversion completed in 2023; coal-fired generation is required to cease by year-end 2025, with the option of earlier coal retirement at the Company’s discretion.

Montour: Coal-to-gas conversion completed in 2023; coal-fired generation is required to cease by year-end 2025, with the option of earlier coal retirement at the Company’s discretion.

2.Wagner and Brandon Shores: Coal-to-oil conversion of Wagner Unit 3 completed in late 2023. However, we have provided notice to PJM of deactivation of Wagner and Brandon Shores, effective June 1, 2025. PJM subsequently notified Talen that these facilities are needed for reliability. Both facilities have filed cost-of-service rate schedules for continued Reliability-Must-Run operations through 2028. Please see Note 8 to the Interim Financial Statements for additional information.

2

3.Keystone and Conemaugh: Coal-fired electric generation is required to cease by year-end 2028.

Zero-carbon Susquehanna nuclear facility. We own a 90% interest in and operate the 2.5 GW Susquehanna facility, the sixth largest nuclear-powered generation facility in the U.S. Susquehanna typically comprises 50% or more of our annual generation.

In 2023, Talen produced over 18,000 GWh of reliable, zero-carbon power from Susquehanna at a top-quartile low all-in cost of under $24 per MWh while maintaining leading safety performance. Susquehanna has historically generated revenues primarily from energy sales into the PJM wholesale market, PJM capacity revenues and strategic hedging. The co-located Cumulus Data Campus, initially under development by Cumulus Data and recently sold to AWS, now provides Susquehanna with additional contracted cash flows through the Cumulus Data Campus PPA. See “—Recent Developments—Cumulus Data Campus Sale” for additional information. We also believe the facility is now also poised to benefit substantially from the Nuclear PTC enacted under the Inflation Reduction Act, which would provide meaningful downside protection when annual revenues from nuclear generation are below $43.75 per MWh (indexed each year for inflation) while maintaining upside optionality in periods of higher pricing.

Susquehanna’s efficient cost structure is supported in part by a portfolio of supply contracts for all stages of the nuclear fuel cycle. Our nuclear fuel cycle is 100% contracted through the 2025 fuel load and at least 85% contracted through 2028. We have no ongoing fuel exposure to any Russian-affiliated counterparties.

We believe that nuclear generation is integral to the grid and the energy transition, particularly as we move toward a lower-carbon world. An increasingly positive public sentiment toward nuclear generation, bolstered by government support in the form of the Nuclear PTC, has resulted in improved market appetite for nuclear assets, as demonstrated by the recent resurgence in nuclear M&A transactions. Susquehanna’s two units are long-lived, with current licenses through 2042 and 2044 (and up to 20-year extensions possible with regulatory approval), and its dual-unit design contributes to maintenance, operational and other efficiencies, making Susquehanna an attractive asset in this space.

Natural gas and oil intermediate and peaking units. Our generation portfolio includes 7 technologically diverse natural gas and oil generation facilities across the generation stack (including intermediate and peaking dispatch), with certain units capable of utilizing multiple fuel sources. Our assets benefit from both a wholesale and a capacity market. Lower Mt. Bethel operates at a high Capacity Factor, enabled by advantaged gas supply. Neighboring Martins Creek, our largest non-nuclear facility, earns significant capacity revenues while keeping fixed costs relatively low, and its units are capable of cycling daily to capture peak energy prices. We recently refinanced a legacy project financing at these two high-quality assets, freeing their cash flows for broader utilization within our business. We have also recently converted some of our PJM assets to lower-carbon fuels, which extends their useful

3

lives and enables us to maintain both the associated capacity revenues and the additional commodity upside potential.

Our Cumulus platform opportunities. We believe our geographical footprint, supply of lower- and zero-carbon power, interconnection access and abundance of land all provide us with potential opportunities to extend the life and increase the value of our legacy assets through strategic development of growth projects where appropriate. With the majority of our planned capital expenditures for these projects having already been spent, we will continue to evaluate ways to find the highest and best use of our assets and capital, which may include advancing additional growth projects if justified by economics. These additional growth projects include our Cumulus renewables and battery storage initiatives, which are focused on the opportunity to leverage our substantial existing asset base in the development of future projects primarily through partnerships. The renewables and battery projects currently under evaluation require only modest incremental spend to maintain interconnection optionality. Nautilus, Cumulus Coin’s digital currency joint venture with TeraWulf, is now operational adjacent to Susquehanna and the Cumulus Data Campus. Although we do not view digital currency as core to our long-term business, the 150 gross MW Nautilus facility currently generates positive cash flows from operations in addition to being a firm purchaser of power generated by Susquehanna. We plan to evaluate a variety of structural alternatives to progress our currently identified opportunities in keeping with our commitment to appropriate leverage levels and to a thoughtful capital allocation framework.

Carbon deleveraging. We have committed to cease burning coal at all of our wholly-owned coal facilities by the end of 2028, either through conversions or retirements. We have recently completed the conversion of approximately 3.2 GW of our legacy coal fleet to lower-carbon fuels. The conversion of our Brunner Island facility to dual-fuel (natural gas and coal) capability was completed in 2016; the plant currently burns coal only outside of Ozone Season and has committed to cease burning coal completely by the end of 2028. The conversion of our Montour facility to natural gas was completed in 2023, with both converted units now fully operational on gas. Together, these two facilities represent nearly 25% of our total generation capacity. The conversion of our legacy coal facilities to alternative fuels meaningfully extends the life of certain assets, while also lowering the carbon profile of our fossil fleet, mitigating uncertainties associated with coal supply and improving system reliability. These transitions enable us to maintain the capacity revenues generated by the assets while providing additional commodity upside optionality.

In addition, the conversion of Wagner Unit 3 from coal to fuel oil was completed in 2023; however, for economic reasons, we have requested deactivation of Wagner in mid-2025. Our wholly-owned 1.3 GW Brandon Shores facility is required by both environmental permits and settlements to stop combusting coal by the end of 2025, and we have requested deactivation of Brandon Shores in mid-2025. However, PJM subsequently notified us that both Wagner and Brandon Shores are needed for reliability reasons. Both facilities have filed cost-of-service rate schedules, currently pending with FERC, for continued Reliability-Must-Run operations through 2028. For additional information, see Note 8 in Notes to the Interim Financial Statements.

We also own minority interests, totaling approximately 800 MW, in three coal-fired generation facilities in PJM and WECC. We are exploring ways to maximize the value of these assets in the context of our broader carbon deleveraging goals, and our key debt agreements provide us the ability to separate our minority-owned coal assets if we decide to do so.

Our Competitive Strengths

We believe the following strengths leave us well positioned to maximize the value of our business:

Stable cash flows from Susquehanna. Susquehanna is one of the largest baseload, carbon-free nuclear generation facilities in the United States. Susquehanna provides multiple paths to cash flow generation and value creation, including through the PJM wholesale and capacity markets. Historically, we sold our power via a combination of spot sales and hedging transactions. The Cumulus Data Campus now creates additional incremental value for Susquehanna, providing future cash flows through direct sales of power to a highly-rated counterparty at fixed prices under the long-term Cumulus Data Campus PPA. See “—Recent Developments—Cumulus Data Campus Sale” for additional information. When measured by the operational and safety standards adopted by the

4

nuclear industry, Susquehanna is one of the top performers in the United States. In 2023, Talen produced over 18,000 GWh of reliable, zero-carbon power from Susquehanna at a low all-in cost of less than $24 per MWh while maintaining leading safety performance.

Going forward, our commercial strategy at Susquehanna may also benefit from the Nuclear PTC, which provides for an up to $15 per MWh tax credit (indexed to inflation) related to energy produced at nuclear facilities through 2032. The Nuclear PTC provides meaningful downside protection when annual revenues fall below $43.75 per MWh (indexed to inflation) while maintaining upside optionality on Susquehanna’s generation for higher prices. Based on the latest guidance, we can use the Nuclear PTC to offset up to 75% of our federal cash taxes and may be able to monetize remaining credits through the sale to an eligible taxpayer.

Flexible and highly dispatchable natural gas and oil fleet provides the ability to capture significant incremental revenue and benefit from shifting market dynamics. Our 6.3 GW natural gas and oil generation fleet (of which 3.2 GW is from Brunner Island, Montour and Wagner Unit 3 after their recent conversions from coal) is comprised of diverse and strategically located assets, including significant generation in attractive wholesale markets, leaving our fleet well suited to benefit from varying market dynamics while also generating predictable capacity revenues. Our seasoned operating teams lead the monetization of commodity volatility. Our natural gas and oil generation fleet provides meaningful operational flexibility, enabling us to respond to pricing signals to capture upside from power price dynamics. We believe this capability will become increasingly valuable as a source of reliability in markets with increasing levels of intermittent generation assets. We believe that gas assets will be a core component of the power markets and grid reliability for the coming years, and we believe our natural gas and oil generation fleet is also poised to benefit from potential regulatory reforms and shifting market dynamics.

Strong balance sheet underpinned by robust liquidity, ample cash generation and modest leverage. We emerged from the Restructuring with a well-capitalized and strong balance sheet and have no significant debt maturities until 2030. As of March 31, 2024, we had unrestricted cash of approximately $597 million and $544 million of available commitments under our revolving credit facility, resulting in liquidity of approximately $1.1 billion. In addition, we have a $75 million secured bilateral letter of credit facility and a $470 million term loan C letter of credit facility. Our strong balance sheet also provides ample capacity and counterparty appetite for lien-based hedging, which does not require cash collateral posting. Our legacy debt service requirements were significantly reduced as a result of the Restructuring, and we intend to maintain a modest go-forward net leverage ratio of 3.5x or less. We believe these factors provide us with the flexibility to focus on maximizing value through the disciplined operation of our core business.

Experienced, principled and disciplined leadership team. We benefit significantly from the experience and industry expertise of our leadership team. Following the Restructuring, we have reorganized and refined our senior management team to more closely align with our go-forward objectives. Our management team draws from decades of strategic, operational, financial and legal experience as they seek to maximize the value of our business for our stakeholders. We are overseen by an independent Board of Directors with deep power industry experience across all relevant disciplines, markets and asset types, including significant commercial and risk management expertise. While we continue to maintain an internal risk management committee of senior management to monitor, measure and manage risks in accordance with our risk policy, we have also established an independent risk oversight committee of the Board of Directors that makes this a key strategic priority. See “Management.”

Our generation team continues to be led by Company veterans with a proven track record of operational excellence. Furthermore, our commercial team is comprised of seasoned veterans spanning all disciplines: asset optimization, trading, fuel-procurement, risk management, credit and power-flow modeling. We also benefit from hand-selected regional leadership and plant management teams who have significant experience in the power industry and with local and governmental stakeholders, providing us with a deep understanding of the regulatory, political and business environment in each of our key markets. We believe that this high level of experience strengthens our ability to effectively manage, improve and monetize our current power generation assets and to identify, evaluate and execute on opportunities to maximize the value of our platform. We are continually focused on capital discipline and commercial and risk management to ensure stable and predictable cash-flow generation and preserve margin.

5

Our Business Strategies

We believe our competitive strengths position us well to achieve our business objectives through the following strategies:

Continue our exceptional operations, with focus on continued cost savings and efficiencies. The foundation of our platform is safe, disciplined operational and commercial performance. We drive operational excellence by maximizing the safety, reliability and efficiency of our core assets, which in turn enhances our cash flows and financial position. While we will continue to evaluate ways to find the highest and best use of our assets and capital, we are committed to maintaining best-in-class operations at our core generation facilities, including through additional cost savings, where available, across all cost categories, in turn maximizing free cash flow from our core asset base and driving shareholder returns. Following the Restructuring, we expect our cost structure to be lower and more flexible due to many successful initiatives that have reduced our recurring operating costs, including significantly reducing our debt service obligations, renegotiating or rejecting fuel contracts, focusing generation facility investments on plant reliability, eliminating unnecessary overhead costs and rewarding our employees with cash flow performance-based compensation. In addition, as part of our cost savings initiative implemented in late 2023, we formally assessed our operational model and cost structure across the Company and executed on specific actions focused on reductions in run-rate O&M and G&A expenses.

To sustain our robust performance, our leadership team focuses on, among other priorities, maximizing reliability through carefully planned and periodic maintenance and upgrades of our equipment, retaining experienced facility managers and employees and positioning them on-site to address emerging issues quickly, capitalizing on procurement efficiencies across our platform and implementing redundancy in our generation facility design. Our leadership team continually sources ideas from, among others, generation facility management teams, asset managers and frontline workers and prioritizes them based on impact, feasibility and expected return on investment.

Focus and maintain our core generation that provides stable earnings and cash flows. Our core fleet generates stable earnings and cash flows backed by multiple sources. Our integrated generation, wholesale marketing and commercial capabilities enable us to produce significant recurring cash flow, and our commercial and risk management strategies provide cash flow stability while balancing operational, price and liquidity risk through physical and financial commodity transactions. In today’s robust but volatile energy markets, our team has been able to capture high realized pricing through both reliable generation and strategic risk management, resulting in $319 million of net income and approximately $289 million of Adjusted EBITDA in the first three months of 2024. “Summary Historical and Unaudited Pro Forma Condensed Consolidated Financial Information—Non-GAAP Financial Measures” contains a description of Adjusted EBITDA and a reconciliation to the most directly comparable GAAP measure. Capacity revenue is a key indicator of the important role that nuclear, natural gas and peaking generation all play in PJM grid reliability. In 2023, our PJM fleet generated approximately $241 million in capacity revenues. Following the Cumulus Data Campus Sale, we are poised to increasingly benefit from long-term, stable cash flows from fixed-price power sales under the Cumulus Data Campus PPA. See “—Recent Developments—Cumulus Data Campus Sale” for additional information. We now also have substantive federal support for nuclear generation, which is accretive to our portfolio, with the Nuclear PTC further de-risking our Susquehanna generation and enhancing its credit profile while maintaining upside optionality in high price environments. We also believe we are well positioned to benefit from current and anticipated proposed regulatory reforms in our key markets, and to respond to changing supply/demand dynamics, in part due to third-party asset and resource retirements.

Optimize risk management program and hedging. We are focused on implementing appropriate risk management policies in the context of a right-sized balance sheet and the cash flow stability provided by the Nuclear PTC. We maintain both an internal risk management committee, comprised of members of senior management from across the organization, and a Board-level risk oversight committee, comprised of members of our Board of Directors with extensive trading and risk backgrounds. We target a hedge range of 60-80% of our expected generation for the prompt 12 months and ratably scale the hedge percentage down further out in time to align with our financial objectives. Our strong balance sheet provides ample capacity and counterparty appetite for lien-based hedging, which does not require cash collateral posting. We will employ a disciplined go-forward strategy focused on first-lien hedging while minimizing exchange-based hedging and the associated margin requirements.

6

Importantly, there are lower overall hedging needs given the cash-flow stability afforded by the Nuclear PTC and significantly reduced debt service requirements.

Capitalize on low carbon-intensity generation to maintain and grow cash flows in a changing policy environment. In recent years, the power sector has undergone significant policy- and technology-driven changes that, when combined with aging infrastructure and evolving consumer, investor and commercial demands largely focused on ESG practices, are transforming the markets in which we operate. We view responsible ESG practices as a key component for achieving operational excellence, maintaining strong financial performance and maximizing the value of our platform over time. We have dramatically reduced our environmental footprint over the past several years, investing heavily in environmental controls and switching to cleaner fuels in response to market and other conditions. As of December 31, 2023, we have reduced our annual carbon dioxide emissions by approximately 75% when compared to 2010 levels.

Our environmental position is firmly anchored by Susquehanna, which enabled us to generate over half of our electricity output carbon-free in 2023. Our natural gas portfolio also includes a number of energy efficient assets with low heat rates. The overall carbon intensity of our generation was 0.29 metric tons per MWh in 2023, which is over approximately 50% lower than our carbon intensity in 2010. We expect to continue reducing our carbon footprint through the recently-completed conversions of 3.2 GW of our legacy coal fleet to lower-carbon fuels and the planned retirement of up to 1.6 GW of legacy coal assets at Wagner (Unit 3) and Brandon Shores, all with minimal remaining cost requirements.

As we retire older, economically nonviable conventional power generation assets, we are exploring opportunities to repurpose these sites to advance our carbon deleveraging. If ultimately developed, our growing carbon-free generation and storage capabilities will enable us to provide additional clean power while extending the life and increasing the value of our legacy assets.

Disciplined financial policy and capital allocation. We actively manage our capital structure, future capital commitments and asset base by following disciplined capital allocation principles focused on generating cash flow, maintaining reasonable leverage and reducing our cost of capital. We emerged from the Restructuring with a strong balance sheet underpinned by modest leverage and robust liquidity of approximately $875 million, increased to approximately $1.1 billion as of March 31, 2024. We also expect that our hedging program will be significantly less capital-intensive than historically, and that the Nuclear PTC will further hedge a substantial amount of our cash flows. We will continue exploring strategic growth opportunities, such as renewables and battery storage projects, if economically viable, but further investment will require a sound basis and an attractive returns profile when compared to other uses of capital. We may also explore partnerships with experienced long-term partners and investors to achieve the right cost of capital as we further progress any future growth projects. We believe that these factors, together with stable cash flows and limited requirements for go-forward capital expenditures, will maximize our free cash flows and enable us to focus on shareholder return programs as appropriate. In furtherance of our disciplined capital allocation strategy, we recently announced an upsizing of the remaining capacity under our share repurchase program to $1 billion through the end of 2025. As part of this program, we recently completed a tender offer for our common stock. See “—Recent Developments—Share Repurchase Program” for additional information.

We intend to target a modest leverage profile with a go-forward net leverage ratio of 3.5x or less, depending on seasonal dynamics. We also intend to prioritize balance sheet efficiency through the active preservation of liquidity, using solutions, where appropriate, such as first-lien, asset-backed hedging agreements in lieu of exchange-based hedging.

Maximize the value of our platform opportunities in a capital efficient manner. We believe there is significant value embedded in our platform, and our activities will be focused on driving both organic and inorganic strategy in ways that create the best sources of value for our company. In addition to focusing on the core operation of our business, we actively manage decision making to achieve the highest and best use of our assets to recognize the full value of our platform. We believe we have meaningful opportunities to unlock previously unrecognized value in our assets. Within our generation portfolio, we are focused on identifying the most valuable use of the reliable nuclear power generated at Susquehanna, including through long-term power sales to the Cumulus Data Campus and otherwise, and commercially managing our highly flexible gas fleet to capture extrinsic value. We also believe we

7

have opportunities to organize our assets to align with investor priorities and related costs of capital and we intend to thoughtfully consider market feedback regarding which strategies would be the most value accretive to us. While higher-carbon emitting assets remain important components of our portfolio, such assets are harder to finance and are more working capital intensive in contrast to certain of our more efficient and lower-emissions assets. Within our Cumulus platform, we have now made significant progress in monetizing our prior investments in the Cumulus Data Campus, and we have several other growth options under evaluation that require only modest incremental spend to maintain interconnection optionality. In furtherance of our value maximization efforts, the recent ERCOT Sale is another example of creating value for the Company by opportunistically engaging in market activities. We may commence a corporate realignment that focuses on nuclear, natural gas and digital assets as our core elements of value, and we are permitted to do so under our key debt documents. We expect to evolve our asset base both by continuing to evaluate opportunities to drive value uplift for our existing assets and by pursuing opportunistic acquisitions and divestitures in order to drive cash flow generation and investor returns.

Recent Developments

Share Repurchase Program

In October 2023, the Board of Directors approved a share repurchase program initially authorizing the Company to repurchase up to $300 million of the Company’s outstanding common stock through December 31, 2025. In May 2024, the Board of Directors approved an increase of the remaining capacity under the Company’s share repurchase program to $1 billion through the end of 2025. Repurchases may be made from time to time, at the Company’s discretion, in open market transactions at prevailing market prices, negotiated transactions, or other means in accordance with federal securities laws, and may be repurchased pursuant to a Rule 10b5-1 trading plan. The Company intends to fund repurchases from cash on hand. Repurchases by the Company will be subject to a number of factors, including the market price of the Company’s common stock, alternative uses of capital, general market and economic conditions, and applicable legal requirements, and the repurchase program may be suspended, modified or discontinued by the Board of Directors at any time without prior notice. The Company has no obligation to repurchase any amount of its common stock under the repurchase program. As of March 31, 2024, 493,000 shares of the Company’s common stock have been purchased under the share repurchase program for $39 million, inclusive of transaction costs. See Note 16 in Notes to the Annual Financial Statements for additional information. On July 1, 2024, the Company purchased an additional 5,027 shares under the share repurchase program for approximately $550,000.

In May 2024, the Company commenced a modified “Dutch auction” tender offer (the “Tender Offer”) to purchase shares of the Company’s common stock for cash. The Tender Offer resulted in the purchase for cash of 5,275,862 shares of its common stock, representing 9.0% of the Company’s outstanding common stock, at a clearing price per share of $116.00, or an aggregate of $612 million.

On July 1, 2024, we entered into a purchase agreement with entities affiliated with Rubric Capital Management LP (collectively, “Rubric”) pursuant to which Rubric agreed to sell, and we agreed to repurchase from Rubric, 2,413,793 Shares at $116.00 per share of the Company’s common stock (the “Rubric Share Repurchase”) for an aggregate purchase price of $280 million.

Remarketing of PEDFA Bonds

In June 2024, the Company completed a remarketing of $50 million in aggregate principal amount of its PEDFA 2009B and $80.6 million in aggregate principal amount of its PEDFA 2009C Bonds.

The PEDFA 2009B and PEDFA 2009C Bonds will now bear interest at 5.25% until the end of the new term rate period on June 1, 2027. In connection with the remarketing, the approximately $133 million of letters of credit that had previously backstopped the PEDFA 2009B and PEDFA 2009C Bonds will be terminated, providing the Company with increased capacity on its TLC.

8

Mandatory Share Exchange

In May 2024, each outstanding restricted share of the Company’s common stock issued with or under CUSIP No. 87422Q208 was exchanged for an unrestricted share of the Company’s common stock issued with or under CUSIP No. 87422Q109. The exchange was intended to provide stockholders with increased liquidity, permitting the previously restricted shares to now trade without restriction, subject to each holder’s compliance with (i) securities laws and (ii) rules promulgated by the OTCQX U.S. Market or Nasdaq, as applicable.

Term Loan Repricing

In May 2024, the Company completed a repricing transaction with respect to the TLB and TLC. The new rate applicable to the TLB and TLC is SOFR plus 350 basis points, which reduces the interest rate margin by 100 basis points. The applicable SOFR floor was reduced from 50 to 0 basis points. Additionally, in connection with the repricing, the lenders under the TLB and TLC agreed to: (i) waive any mandatory prepayment obligations in connection with the ERCOT Sale, and (ii) certain other amendments permitting Talen additional capacity for dispositions, restricted payments and investments under the Credit Agreement.

ERCOT Sale

In May 2024, the Company closed the previously announced sale of its approximately 1.7 GW generation portfolio located in the South Zone of the ERCOT market to CPS Energy for $785 million of gross proceeds (approximately $723 million in net proceeds after customary working capital adjustments and estimated taxes, transaction fees and other costs). These assets included the 897 MW Barney Davis and 635 MW Nueces Bay natural gas-fired generation facilities, both located in Corpus Christi, Texas, as well as the 178 MW natural gas-fired generation facility in Laredo, Texas.

Cumulus Digital Buyouts

In March 2024, TES acquired all of the equity units of Cumulus Digital Holdings held by affiliates of Orion and two former members of Talen senior management in exchange for $39 million. Following these transactions, TES owns 100% of the equity of Cumulus Digital Holdings. See “Certain Relationships and Related Party Transactions—Cumulus Investments—Cumulus Digital Holdings; Buyouts” for additional information.

Cumulus Data Campus Sale

In March 2024, AWS purchased substantially all the assets of Cumulus Data for gross proceeds of $650 million, with $350 million delivered to the Company at closing and the remaining $300 million of consideration held in escrow. The first $200 million of escrowed proceeds will be released upon a zoning amendment approval or ordinance allowing construction and operation of data center facilities on the property sufficient to consume an aggregate of at least 540 MW of energy, with the remaining $100 million released upon similar zoning amendment approval sufficient to allow aggregate consumption of at least 960 MW. If the 540 MW zoning amendment approval is not granted prior to March 1, 2025 (subject to certain limited extensions), then AWS has the option either to (i) retain the property and release all escrowed funds to the Company or (ii) revert all escrowed funds to AWS and allow the Company a one-time right to repurchase the property for $355 million. If the 540 MW zoning condition is met but the 960 MW zoning amendment approval is not granted prior to March 1, 2028, the remaining $100 million of escrowed funds will revert to AWS. The zoning amendment was approved by the applicable township on May 28, 2024 for the 960 MW. After a required 30 day public comment period, it is expected the zoning amendment will be approved and that the remaining $300 million of consideration will be released to the Company.

In connection with the Cumulus Data Campus Sale, the Company executed the Cumulus Data Campus PPA with AWS, pursuant to which the Company agreed to supply long-term, carbon-free power from Susquehanna to the Cumulus Data Campus through fixed-price power commitments. Under the Cumulus Data Campus PPA, AWS has minimum contractual power commitments that increase in 120 MW increments annually (or earlier, at AWS’s option), with a one-time option to either cap commitments at 480 MW (the “480 MW Case”) or otherwise purchase, in continuing annual steps, up to 960 MW. Each step up in capacity commitment has a fixed price for an initial 10-year term, after which AWS has the option to renew each step at a price that includes a fixed margin above then-

9

applicable PJM energy and capacity prices. The initial term of the Cumulus Data Campus PPA is 18 years, with two 10-year extensions at AWS’s option. Under a separate agreement, Talen will receive additional revenue from AWS related to the sales of carbon-free energy (“CFE”) to the grid. The following table shows the value of these agreements, to the extent reasonably estimable, based on the minimum commitments described above through achievement of the 480 MW case.

| Year | PTC Reference Price ($/MWh) (1) | Power Sales (MW) | Incremental EBITDA ($mm/year) (2)(3) | |||||||||||||||||

| 2024 | $44 | — | $15 | |||||||||||||||||

| 2025 | $45 | 120 | $20-35 | |||||||||||||||||

| 2026 | $45 | 240 | $55-80 | |||||||||||||||||

| 2027 | $46 | 360 | $65-110 | |||||||||||||||||

| 2028 | $46 | 480 | $85-140 | |||||||||||||||||

__________________

(1)Assumed “PTC Reference Price” represents the max price of the Nuclear PTC floor (assuming 2% annual inflation). Provided for illustrative purposes only; not Company projections.

(2)Incremental impact based on comparison of (1) Susquehanna revenues including AWS power sales and additional revenue from AWS related to sales of CFE vs. (2) Susquehanna revenues without AWS agreements, using the price floor set by the “PTC Reference Price.” Rounded to nearest $5mm.

(3)Financial outcomes reflected here are based on various offtake outcomes and are subject to confidential contractual provisions that may affect actual outcomes in either direction; EBITDA range bounded by minimum contractual payments not dependent on executed power purchases and payments for full consumption of power commitments under the 480 MW Case; outcomes may also be impacted by IRS guidance regarding the nuclear PTC. See “Cautionary Note Regarding Forward Looking Statements.”

PJM, PPL Electric Utilities Corporation (“PPL Electric,” a subsidiary of PPL), and Susquehanna have entered into an Amended Interconnection Service Agreement (the “Amended ISA”) allowing Susquehanna to increase the amount of “behind-the-meter” power that it can provide to directly connected load under the current ISA. In June 2024, certain intervenors filed with FERC a protest to the Amended ISA. Talen does not currently expect this proceeding to have material impacts on the AWS transaction. For additional information, see “Business—Regulatory Matters—Susquehanna ISA Amendment.”

Also in connection with the Cumulus Data Campus Sale, the Company terminated the Cumulus Digital TLF and the outstanding obligations thereunder were satisfied and discharged in full. The security interests granted under the Cumulus Digital TLF were terminated, discharged and released. See Note 11 in Notes to the Interim Financial Statements and Note 13 in Notes to the Annual Financial Statements for additional information.

PPL/Talen Montana Litigation Settlement

In December 2023, Talen reached a litigation settlement with PPL. Under the terms of the settlement agreement, PPL paid TEC’s indirect subsidiary, Talen Montana, $115 million in cash in exchange for a full release of Talen Montana’s claims against PPL. Separately, Talen Montana remitted $11 million of the PPL settlement proceeds to the general unsecured creditors trust that was established pursuant to the Plan of Reorganization. See “Business—Legal Matters—Resolved Legal Matters—PPL/Talen Montana Litigation” and Note 12 in Notes to the Annual Financial Statements for additional information.

Riverstone Repurchase

In September 2023, TEC paid Riverstone $40 million in exchange for the cancellation of all of its TEC common stock warrants and a tax indemnity agreement, as well as waiving its future rights to the Retail PPA Incentive Equity. Also, in September 2023, TES and Orion purchased all of the equity units of Cumulus Digital Holdings held by Riverstone for an aggregate purchase price of $20 million, of which TES paid $19 million. See “Certain Relationships and Related Party Transactions—Cumulus Investments—Cumulus Digital Holdings; Buyouts,” “Certain Relationships and Related Party Transactions—Riverstone Warrant Cancellation” and Note 16 in Notes to the Annual Financial Statements for additional information.

10

Reorganization and Emergence

On May 9, 2022, TES and 71 of its subsidiaries commenced the Restructuring, and in December 2022, TEC joined the Restructuring to facilitate the transactions contemplated by the Plan of Reorganization. In December 2022, the Bankruptcy Court confirmed the Plan of Reorganization that implemented, among other things, the settlement of certain claims and commitments of TES’s debt holders and certain other of its obligations and the Exit Financings, which provided for the infusion of $1.4 billion of new equity capital into our business pursuant to the Rights Offering, the issuance of $1.2 billion aggregate principal amount of the Secured Notes and our entry into the Credit Facilities, which included: (i) $700 million in revolving commitments and $475 million in LC commitments under the RCF, (ii) $1.05 billion in commitments under the Term Loans, $470 million of which is used to cash collateralize trade and standby LCs, and (iii) $75 million in commitments under the Bilateral LCF to support the issuance of standby LCs.

On May 17, 2023, upon receipt of applicable regulatory approvals and the consummation of the Exit Financings, the Plan of Reorganization became effective and we emerged from the Restructuring with a significantly deleveraged balance sheet, driven by the full repayment of TES’s first-lien funded debt outstanding at the commencement of the Restructuring and the consensual equitization of all of TES’s existing Prepetition Unsecured Notes and PEDFA 2009 Bonds outstanding at the commencement of the Restructuring, which resulted in an approximate $2.5 billion reduction in TES’s debt and an additional $530 million of other liabilities subject to compromise. For additional information on the Restructuring, Plan of Reorganization and Exit Financings, see “Business—Restructuring and Financing Transactions,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Liquidity and Capital Resources” and the notes to the consolidated financial statements included elsewhere in this prospectus.

Risk Factors Summary

An investment in our securities involves a high degree of risk. The occurrence of one or more of the events or circumstances described in the section titled “Risk Factors,” alone or in combination with other events or circumstances, may materially adversely affect our business, financial condition and operating results. In that event, the trading price of our securities could decline and you could lose all or part of your investment. Such risks include, but are not limited to:

Industry and Market Risks

•Changes in the market price of electricity, natural gas and other commodities may materially adversely impact our financial condition, results of operations, liquidity and cash flows.

•Declines in wholesale electricity prices or decreases in demand for electricity due to macroeconomic factors, such as the ongoing slowdown in the U.S. economy, significant advances in technology or changes in energy consumption, may significantly impact our margins and results of operations.

•We face intense competition in the competitive power generation market, which may adversely affect our ability to operate profitably and generate positive cash flow.

•Our business is subject to physical, market and economic risks relating to weather conditions, including the effects of climate change and extreme weather events, which may adversely affect our financial condition and results of operations.

Commercial and Operational Risks

•Operation of power generation facilities involves significant risks and hazards customary to the power industry that could have a material adverse effect on our financial condition and results of operations, and we may not have adequate insurance to cover the risks and hazards.

•Our ownership and operation of Susquehanna, which contributes a majority of our earnings associated with electric generation, subjects us to substantial risks associated with nuclear generation.

11

•Our operations may impact the environment or cause exposure to hazardous substances, and our properties may have environmental contamination, which could result in material liabilities to us.

•Uncertainties in the supply of fuel and other necessary products could adversely impact us.

•The retirement and potential reorganization of certain assets and subsidiaries could result in significant costs and have an adverse effect on our operating results.

Regulatory, Legislative and Legal Risks

•Any change in the structure and operation of, or the various pricing limitations imposed by, the RTOs and ISOs in regions where our generation is located may adversely affect the profitability of our generation facilities.

•Our ownership and operation of a nuclear power facility subjects us to regulations, costs and liabilities uniquely associated with these types of facilities.

•The availability and cost of emission allowances could negatively impact our operating costs.

•Changes in tax law (including any elimination of the Nuclear PTC), the implementation regulations of certain tax provisions or adverse decisions by tax authorities may adversely affect our business and financial condition.

•Our ability to utilize our tax attributes, including net operating loss carryforwards, remaining following Emergence, if any, may be limited.

•Our business may be affected by state interference in the competitive marketplaces.

Financial and Liquidity Risks

•Our historical financial information may not be indicative of our future financial performance.

•Our indebtedness could adversely affect our financial condition and impair our ability to operate our business.

•Indebtedness subjects us to the risk of higher interest rates, which could cause our future debt service obligations to increase significantly.

•Our debt agreements contain various covenants that impose restrictions on TES and certain of its subsidiaries that may affect our ability to operate our business and to make payments on our indebtedness.

Growth and Strategic Risks

•Our project development activities through our Cumulus Affiliates may consume a significant portion of our management’s focus and resources, and if not completed or successful, reduce our profitability.

•Joint ventures, joint ownership arrangements and other projects pose unique challenges to our Cumulus projects, and we may not be able to fully implement or realize synergies, expected returns or other anticipated benefits associated with such projects.

•Our interest in and operation of a Bitcoin mining facility subjects us to certain risks.

Risks Related to Ownership of Our Common Stock

•No prior public trading market existed for our common stock prior to trading on the OTC Pink Market, and an active trading market may not develop or be sustained following the registration of our common stock on Nasdaq, which may cause the market price of our common stock to decline significantly and make it difficult for investors to sell their shares in the future.

12

•We may not pay any dividends on our common stock in the future.

•The requirements of being a public company may strain our resources, increase our costs and distract management, and, as a result, we may be unable to comply with these requirements in a timely or cost-effective manner.

Corporate Information

We were incorporated in Delaware on June 6, 2014. Our principal executive offices are located at 2929 Allen Pkwy, Suite 2200, Houston, TX 77019 and our telephone number is (888) 211-6011. Our website address is www.talenenergy.com. Information contained on, or that can be accessed through, our website is not incorporated by reference into this prospectus, and you should not consider information on our website to be part of this prospectus.

13

THE OFFERING

Issuer | Talen Energy Corporation. | ||||

Outstanding common stock that may be offered by the Selling Stockholders | Up to 36,825,683 shares. | ||||

Common stock outstanding | 50,841,161 shares. | ||||

Use of proceeds | We will not receive any of the proceeds from the resale of our common stock by the Selling Stockholders, but we have agreed to pay certain registration expenses. See “Use of Proceeds” and “Principal and Selling Stockholders.” | ||||

Symbol for common stock | We have been approved to list our common stock on Nasdaq under the symbol “TLN.” | ||||

| Determination of offering price | The Selling Stockholders may resell all or any part of the shares of our common stock offered hereby from time to time at fixed prices, prevailing market prices at the times of sale, prices related to such prevailing market prices, varying prices determined at the times of sale or negotiated prices. | ||||

Dividend Policy | The holders of shares of common stock are entitled to receive such dividends and other distributions (payable in cash, property or capital stock of the Company) when, as and if declared thereon by our board of directors (“Board of Directors”) from time to time out of any assets or funds of the Company legally available for the payment of dividends and shall share equally on a per share basis in such dividends and distributions. Any future determination regarding the declaration and payment of dividends, if any, will be at the discretion of our Board of Directors and will depend on then-existing conditions, including our financial condition, results of operations, contractual restrictions, capital requirements, business prospects and other factors our Board of Directors may deem relevant. In addition, our ability to pay dividends may be restricted by any agreements we may enter into in the future. | ||||

Risk Factors | Before making a decision to invest in our common stock, you should carefully consider the information referred to under the heading “Risk Factors” beginning on page 19. | ||||

The information above excludes 7,083,461 shares of common stock reserved for issuance under our 2023 Equity Plan.

14

SUMMARY HISTORICAL AND UNAUDITED PRO FORMA CONDENSED CONSOLIDATED FINANCIAL INFORMATION

The following tables set forth summary historical and unaudited pro forma condensed consolidated financial information for the Successor for periods subsequent to Emergence and the Predecessor and its consolidated subsidiaries for periods prior to Emergence. The financial statements of the Successor are not entirely comparable to the financial statements of the Predecessor as those periods prior to Emergence do not give effect to any adjustments to the carrying values of assets or amounts of liabilities that resulted from the Plan of Reorganization and the related application of fresh-start reporting, which includes accounting policies implemented by the Successor that may differ from the Predecessor. The summary historical consolidated financial information as of March 31, 2024 and for the three months ended March 31, 2024 and 2023, respectively, is derived from the unaudited condensed consolidated financial statements of the Successor and Predecessor, which are included elsewhere in this prospectus. The summary historical consolidated financial information (i) as of December 31, 2023 and for the period from May 18, 2023 through December 31, 2023 and (ii) as of and for the years ended December 31, 2022 and 2021 and for the period from January 1, 2023 through May 17, 2023 is derived from the audited consolidated financial statements of the Successor and Predecessor, respectively, each as included elsewhere in this prospectus.

The pro forma information reflects the consolidated financial information of the Predecessor for the period from January 1, 2023 through May 17, 2023 and the Successor for the period from May 18, 2023 through December 31, 2023. The pro forma adjustments give effect to (i) various transactions effected pursuant to the Plan of Reorganization and (ii) the application of fresh-start accounting. The unaudited pro forma condensed consolidated statement of operations for the year ended December 31, 2023 gives effect to the pro forma adjustments as if each adjustment had occurred on January 1, 2023, the first day of the last fiscal year presented. The summary unaudited pro forma condensed consolidated financial information is provided for illustrative purposes only and does not purport to represent what our actual consolidated results of operations would have been had the adjustments occurred on the dates assumed, nor is it necessarily indicative of future consolidated results of operations.

These tables should be read in conjunction with “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” “Unaudited Pro Forma Condensed Consolidated Financial Information,” and the Interim Financial Statements and Annual Financial Statements, and, in each case, the related notes included elsewhere in this prospectus. In addition, as you review the consolidated Predecessor financial statements set forth herein you should be aware that such Predecessor financial statements may not be entirely comparable to our future financial statements because such Predecessor financial statements do not take into account the effects of the Plan of Reorganization and Emergence or any required adjustments for fresh-start reporting, in each case, which were taken into account in the Interim Financial Statements and the Annual Financial Statements and will be taken into account in our future financial statements.

Successor | Predecessor | Successor | Predecessor | Pro Forma | ||||||||||||||||||||||||||||||||||||||||||||||

Three Months Ended March 31, 2024 | Three Months Ended March 31, 2023 | Period From May 18, Through December 31, 2023 | Period From January 1, Through May 17, 2023 | Year Ended December 31, | Year Ended December 31, 2023 | |||||||||||||||||||||||||||||||||||||||||||||

| 2022 | 2021 | |||||||||||||||||||||||||||||||||||||||||||||||||

| (in millions, except per share amounts) | ||||||||||||||||||||||||||||||||||||||||||||||||||

Operating revenues | $ | 509 | $ | 1,073 | $ | 1,344 | $ | 1,210 | $ | 3,089 | $ | 928 | $ | 2,554 | ||||||||||||||||||||||||||||||||||||

Impairments | — | (365) | (3) | (381) | — | — | $ | (384) | ||||||||||||||||||||||||||||||||||||||||||

Operating income (loss) | 25 | 116 | 160 | (76) | 241 | (1,100) | $ | 117 | ||||||||||||||||||||||||||||||||||||||||||

Net income (loss) | 319 | 46 | 143 | 465 | (1,293) | (977) | $ | 85 | ||||||||||||||||||||||||||||||||||||||||||

Weighted average shares of common stock outstanding — basic | 58,807 | N/A | 59,029 | N/A | N/A | N/A | 59,029 | |||||||||||||||||||||||||||||||||||||||||||

15

Successor | Predecessor | Successor | Predecessor | Pro Forma | ||||||||||||||||||||||||||||||||||||||||||||||

Three Months Ended March 31, 2024 | Three Months Ended March 31, 2023 | Period From May 18, Through December 31, 2023 | Period From January 1, Through May 17, 2023 | Year Ended December 31, | Year Ended December 31, 2023 | |||||||||||||||||||||||||||||||||||||||||||||

| 2022 | 2021 | |||||||||||||||||||||||||||||||||||||||||||||||||

Weighted average shares of common stock outstanding — diluted | 60,716 | N/A | 59,399 | N/A | N/A | N/A | 59,399 | |||||||||||||||||||||||||||||||||||||||||||

Net income (loss) per weighted average share of common stock outstanding — basic | 5.00 | N/A | 2.27 | N/A | N/A | N/A | $ | 1.52 | ||||||||||||||||||||||||||||||||||||||||||

Net income (loss) per weighted average share of common stock outstanding — diluted | 4.84 | N/A | 2.26 | N/A | N/A | N/A | $ | 1.52 | ||||||||||||||||||||||||||||||||||||||||||

Successor | Predecessor | ||||||||||||||||||||||

As of March 31, 2024 | As of December 31, 2023 | As of December 31, 2022 | |||||||||||||||||||||

| (in millions) | |||||||||||||||||||||||

Total assets | $ | 7,265 | $ | 7,121 | $ | 10,722 | |||||||||||||||||

Long term debt (including current portion) | 2,628 | 2,820 | 3,504 | ||||||||||||||||||||

Total liabilities | 4,499 | 4,587 | 11,204 | ||||||||||||||||||||

Total equity | 2,766 | 2,534 | (482) | ||||||||||||||||||||

Non-GAAP Financial Measures

We include in this prospectus Adjusted EBITDA, which we use as a measure of our performance, and which is not a financial measure prepared under GAAP. Non-GAAP financial measures, such as Adjusted EBITDA, do not have definitions under GAAP and may be defined and calculated differently by, and not be comparable to, similarly titled measures used by other companies or used in our credit facilities, the indentures governing our notes or any of our other debt agreements. Non-GAAP measures are not intended to replace the most comparable GAAP measures as indicators of performance. Generally, non-GAAP financial measures are numerical measures of financial performance, financial position or cash flows that exclude (or include) amounts that are included in (or excluded from) the most directly comparable measure calculated and presented in accordance with GAAP. Management cautions investors not to place undue reliance on such non-GAAP financial measures, but to also consider them along with their most directly comparable GAAP financial measures. Non-GAAP measures have limitations as an analytical tool and should not be considered in isolation or as a substitute for analyzing our results as reported under GAAP.

Adjusted EBITDA

We use Adjusted EBITDA to: (i) assist in comparing operating performance and readily view operating trends on a consistent basis from period to period without certain items that may distort financial results; (ii) plan and forecast overall expectations and evaluate actual results against such expectations; (iii) communicate with our Board of Directors, shareholders, creditors, analysts, and the broader financial community concerning our financial performance; (iv) set performance metrics for our annual short-term incentive compensation; and (v) assess compliance with our indebtedness.

16

Adjusted EBITDA is computed as net income (loss) adjusted, among other things, for certain: (i) nonrecurring charges; (ii) non-recurring gains; (iii) non-cash and other items; (iv) unusual market events; (v) any depreciation, amortization, or accretion; (vi) mark-to-market gains or losses; (vii) gains and losses on the NDT; (viii) gains and losses on asset sales, dispositions, and asset retirement; (ix) impairments, obsolescence, and net realizable value charges; (x) interest expense; (xi) income taxes; (xii) legal settlements, liquidated damages, and contractual terminations; (xiii) development expenses; (xiv) Cumulus Digital (until December 31, 2023) and noncontrolling interests; and (xv) other adjustments. Such adjustments are computed consistently with the provisions of our indebtedness to the extent that they can be derived from the financial records of the business. Pursuant to TES’s debt agreements, Cumulus Digital contributes to Adjusted EBITDA beginning in the first quarter of 2024, following termination of the Cumulus Digital TLF and associated cash flow sweep.

Additionally, we believe investors commonly adjust net income (loss) information to eliminate the effect of nonrecurring restructuring expenses and other non-cash charges, which vary widely from company to company and from period to period and impair comparability. We believe Adjusted EBITDA is useful to investors and other users of the financial statements to evaluate our operating performance because it provides an additional tool to compare business performance across companies and across periods. Adjusted EBITDA is widely used by investors to measure a company’s operating performance without regard to such items described above. These adjustments can vary substantially from company to company depending upon accounting policies, book value of assets, capital structure and the method by which assets were acquired.

The following table presents a reconciliation of the GAAP financial measure of “Net Income (Loss)” presented on the Consolidated Statements of Operations to the non-GAAP financial measure of Adjusted EBITDA:

Successor | Predecessor | Successor | Predecessor | ||||||||||||||||||||||||||||||||||||||

| Three Months Ended March 31, | Three Months Ended March 31, | May 18 through December 31, | January 1 through May 17, | Year Ended December 31, | Year Ended December 31, | ||||||||||||||||||||||||||||||||||||

| (in millions) | 2024 | 2023 | 2023 | 2023 | 2022 | 2021 | |||||||||||||||||||||||||||||||||||

Net Income (Loss) | $ | 319 | $ | 46 | $ | 143 | $ | 465 | $ | (1,293) | $ | (977) | |||||||||||||||||||||||||||||

| Adjustments | |||||||||||||||||||||||||||||||||||||||||

| Interest expense and other finance charges | 50 | 104 | 181 | 163 | 365 | 336 | |||||||||||||||||||||||||||||||||||

| Income tax (benefit) expense | 69 | 14 | 51 | 212 | (35) | (300) | |||||||||||||||||||||||||||||||||||

| Depreciation, amortization and accretion | 75 | 132 | 165 | 200 | 520 | 524 | |||||||||||||||||||||||||||||||||||

| Nuclear fuel amortization | 35 | 24 | 108 | 33 | 94 | 96 | |||||||||||||||||||||||||||||||||||

Hedge termination losses, net (a) | — | — | — | — | 158 | — | |||||||||||||||||||||||||||||||||||

Reorganization (gain) loss, net (b) | — | 39 | — | (799) | 812 | — | |||||||||||||||||||||||||||||||||||

| Unrealized (gain) loss on commodity derivative contracts | 134 | (31) | (52) | 63 | (625) | 712 | |||||||||||||||||||||||||||||||||||

| Nuclear decommissioning trust funds (gain) loss, net | (75) | (46) | (108) | (57) | 184 | (196) | |||||||||||||||||||||||||||||||||||

Stock-based and other long-term incentive compensation expense | 8 | — | 21 | — | — | — | |||||||||||||||||||||||||||||||||||

Long-term incentive compensation expense | 10 | — | — | — | — | — | |||||||||||||||||||||||||||||||||||

Environmental and ARO revisions on fully depreciated property, plant and equipment (c) | — | — | 5 | — | 18 | (7) | |||||||||||||||||||||||||||||||||||

(Gain) loss on non-core asset sales, net (d) | (324) | (35) | (7) | (50) | (3) | (3) | |||||||||||||||||||||||||||||||||||

Non-cash impairments (e) | — | 365 | 3 | 381 | — | — | |||||||||||||||||||||||||||||||||||

Legal settlements and litigation costs (f) | (2) | — | (84) | 1 | 20 | 8 | |||||||||||||||||||||||||||||||||||

17

Unusual market events (g) | (1) | 13 | (19) | 14 | 33 | 78 | |||||||||||||||||||||||||||||||||||

Net periodic defined benefit cost (h) | — | (2) | 2 | (3) | 12 | 36 | |||||||||||||||||||||||||||||||||||

Operational and other restructuring activities (i) | 2 | 8 | 48 | 17 | 522 | 13 | |||||||||||||||||||||||||||||||||||

| Liability management costs and other professional fees | — | — | — | — | 46 | 29 | |||||||||||||||||||||||||||||||||||

| Development expenses | — | 7 | 7 | 10 | 17 | 8 | |||||||||||||||||||||||||||||||||||

Non-cash inventory net realizable value, obsolescence, and other charges (j) | 1 | 24 | 4 | 56 | (4) | 24 | |||||||||||||||||||||||||||||||||||

Consolidation of subsidiary (gain) loss, net | — | — | — | — | 170 | — | |||||||||||||||||||||||||||||||||||

Cumulus Digital activities and noncontrolling interest (k) | (11) | (3) | (42) | (14) | 3 | — | |||||||||||||||||||||||||||||||||||

| Other | (1) | 1 | — | 3 | 1 | 6 | |||||||||||||||||||||||||||||||||||

Total Adjusted EBITDA | $ | 289 | $ | 660 | $ | 426 | $ | 695 | $ | 1,015 | $ | 387 | |||||||||||||||||||||||||||||

__________________

(a)Nonrecurring terminated commercial contracts. See Note 5 in Notes to the Annual Financial Statements for additional information.

(b)See Note 2 in Notes to the Interim Financial Statements and Note 3 in Notes to the Annual Financial Statements for additional information.

(c)See Note 11 in Notes to the Annual Financial Statements for additional information.

(d)See Note 17 in Notes to the Interim Financial Statements and Note 22 in Notes to the Annual Financial Statements for additional information.

(e)See Note 8 in Notes to the Interim Financial Statements and Note 10 in Notes to the Annual Financial Statements for additional information.

(f)See Note 10 in Notes to the Interim Financial Statements and Note 12 in Notes to the Annual Financial Statements for additional information.

(g)Represents the effect of market losses and settlements for Winter Storm Elliott that occurred in 2022 and Winter Storm Uri that occurred in 2021.