UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

Amendment 1 to

FORM S-1

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

| NASCENT BIOTECH INC. |

| (Exact name of registrant as specified in its charter) |

NEVADA

(State or other jurisdiction of incorporation or organization)

2834

(Primary Standard Industrial Classification Code Number)

46-5001940

(I.R.S. Employer Identification Number)

6330 Nancy Ridge Drive Suite 105

San Diego, CA 92121

(612) 961-5656

(Address and telephone number of registrant’s principal

executive offices and principal place of business)

Corporate Administrative Services, Inc.

1955 Baring Blvd.

Sparks NV 89434

(775) 358-1412

(Name, address and telephone number of agent for service)

Communication Copies to:

Poole Shaffery & Koegle, LLP

Claudia J. McDowell, Esq.

25350 Magic Mountain Parkway Suite 250

Santa Clarita, California 91355

(661) 290-2991

From time to time after the effective date of this Registration Statement

(Approximate date of commencement of proposed sale to the public)

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act Registration Statement number of the earlier effective Registration Statement for the same offering. If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act Registration Statement number of the earlier effective Registration Statement for the same offering. ☐

If delivery of the prospectus is expected to be made pursuant to Rule 424, check the following box. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ |

| Non-accelerated filer | ☒ | Smaller reporting company | ☒ |

|

|

| Emerging growth company | ☒ |

If an emerging growth company, indicate by checkmark if the registrant has not elected to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

CALCULATION OF REGISTRATION FEE

| Title of Each Class of Securities to be Registered |

| Amount Registered (1) |

|

| Proposed Maximum Offering Price Per Share (2) |

|

| Proposed Maximum Aggregate Offering Price |

|

| Amount of Registration Fee |

| ||||

| Common Stock, $0.001 par value per share, issuable upon conversion of Series A Convertible Preferred Shares (as defined below) |

|

| 26,300,000 | (3) |

| $ | 0.10 |

|

| $ | 2,630,000 |

|

| $ | 272.75 |

|

| Common Stock, $0.001 par value per share, issuable upon exercise of the Warrants (as defined below) |

|

| 3,700,000 | (4) |

| $ | 0.15 |

|

| $ | 555,000.00 |

|

| $ | 60.55 |

|

| Total |

|

|

|

|

| $ | 0.11 |

|

| $ | 3,055,000.00 |

|

| $ | 333.30 |

|

__________

| (1) | All shares registered pursuant to this registration statement are to be offered by the Selling Security Holders. Pursuant to Rule 416 under the Securities Act of 1933, as amended (the “Securities Act”), this registration statement also covers such indeterminate number of additional shares of the registrant’s Common Stock, $0.001 par value per share, issued to prevent dilution resulting from stock splits, stock dividends or similar events. |

|

| |

| (2) | Estimated solely for purposes of calculating the amount of the registration fee in accordance with Rule 457(c) under the Securities Act based on the average of the high and low sales prices of the registrant’s Common Stock on the OTCQB Market on, which date is within five (5) business days of the filing of this registration statement. |

|

| |

| (3) | Represents shares of the registrant’s Common Stock issuable upon conversion of Series A Preferred Convertible Shares. Such shares will be issued to the Selling Security Holders named in this registration statement upon purchase. |

|

|

|

| (4) | Represents shares of the registrant’s Common Stock issuable upon exercise of Common Stock Purchase Warrants. Such shares will be issued to the Warrant holders named in this registration statement upon exercise of the Warrants. |

The registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with section 8(A) of the Securities Act or until the Registration Statement shall become effective on such date as the Commission, acting pursuant to said section 8(A), may determine.

| 2 |

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting offers to buy these securities in any jurisdiction where the offer or sale is not permitted.

| PRELIMINARY PROSPECTUS | SUBJECT TO COMPLETION | DATED DECEMBER 18, 2020 |

NASCENT BIOTECH INC.

___________ Shares of Common Stock

This prospectus relates to the conversion and resale of up to: (i) 30,000,000 shares of our common stock, par value $0.001 per share (the “Common Stock”) issuable to certain selling shareholders (the “Selling Security Shareholders”) upon conversion of previously issued shares of our Series A Preferred Convertible Shares (“Series A Shares”); and (ii) 3,700,000 shares of Common Stock underlying that certain common stock purchase warrants (the “Warrants”) issued to the Selling Security Holders which the Selling Security Holders may exercise at $0.15 per warrant exercised.

We will not receive any of the proceeds from the sale of the Common Stock by the Selling Security Holders; however, we will receive the proceeds from any warrants exercised as described herein.

The Selling Security Holders identified in this prospectus may offer the shares of Common Stock from time to time through public or private transactions at prevailing market prices or at privately negotiated prices. The Selling Security Holders can offer all, some or none of their shares of Common Stock, thus we have no way of determining the number of shares of Common Stock they will hold after this offering. See “Plan of Distribution.”

Our Common Stock is currently quoted on the OTCQB under the symbol “NBIO”. On December 15, 2020, the last reported sale price of our Common Stock on the OTCQB was $0.06.

The Selling Security Holders are “underwriters” within the meaning of Section 2(a)(11) of the Securities Act of 1933, as amended (the “Securities Act”).

We are an “emerging growth company” as the term is used in the Jumpstart Our Business Startups Act of 2012 (the “JOBS Act”) and, as such, have elected to comply with certain reduced public company reporting requirements for this and future filings.

Investing in our Common Stock involves a high degree of risk. You should review carefully the risks and uncertainties described under the heading “Risk Factors” beginning on page 9 of this prospectus, and under similar headings in any amendments or supplements to this prospectus.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus is __

| 3 |

|

|

| Page |

|

|

| 5 |

| |

|

| 5 |

| |

|

| 6 |

| |

|

| 7 |

| |

|

| 9 |

| |

|

| 14 |

| |

|

| 15 |

| |

|

| 15 |

| |

|

| 16 |

| |

|

| 17 |

| |

| MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATION |

| 18 |

|

|

| 24 |

| |

| DIRECTORS, EXECUTIVE OFFICERS, PROMOTERS AND CONTROL PERSONS |

| 36 |

|

|

| 38 |

| |

|

| 41 |

| |

| SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT |

| 41 |

|

|

| 42 |

| |

|

| 45 |

| |

|

| 47 |

| |

|

| 49 |

| |

| SECURITIES AUTHORIZED FOR ISSUANCE UNDER EQUITY COMPENSATION PLANS |

| 49 |

|

| DISCLOSURE OF COMMISSION POSITION ON INDEMNIFICATION FOR SECURITIES ACT |

| 49 |

|

|

| 49 |

| |

|

| 49 |

| |

|

| 50 |

| |

| INCORPORATION BY REFERENCE |

|

|

|

|

| F-1 |

|

You should rely only on the information contained in this prospectus. We have not authorized anyone to provide you with information different from that which is contained in this prospectus. This prospectus may be used only where it is legal to sell these securities. The information in this prospectus may only be accurate on the date of this prospectus, regardless of the time of delivery of this prospectus or of any sale of securities.

| 4 |

The registration statement of which this prospectus forms a part that we have filed with the Securities and Exchange Commission, or SEC, includes exhibits that provide more detail of the matters discussed in this prospectus. You should read this prospectus and the related exhibits filed with the SEC, together with the additional information described under the headings “Where You Can Find More Information” and “Incorporation by Reference” before making your investment decision.

You should rely only on the information provided in this prospectus or in any prospectus supplement or any free writing prospectuses or amendments thereto. Neither we, nor the Selling Security Holders, have authorized anyone else to provide you with different information. If anyone provides you with different or inconsistent information, you should not rely on it. You should assume that the information in this prospectus is accurate only as of the date hereof. Our business, financial condition, results of operations and prospects may have changed since that date.

Neither we, nor the Selling Security Holders, are offering to sell or seeking offers to purchase these securities in any jurisdiction where the offer or sale is not permitted. Neither we, nor the Selling Security Holders, have done anything that would permit this offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. Persons outside the United States who come into possession of this prospectus must inform themselves about, and observe any restrictions relating to, the offering of the securities as to distribution of the prospectus outside of the United States.

Information contained in, and that can be accessed through, our web site, www.nascentbiotech.com, does not constitute part of this prospectus.

This prospectus includes market and industry data that has been obtained from third party sources, including industry publications, as well as industry data prepared by our management on the basis of its knowledge of and experience in the industries in which we operate (including our management’s estimates and assumptions relating to such industries based on that knowledge). Management’s knowledge of such industries has been developed through its experience and participation in these industries. While our management believes the third-party sources referred to in this prospectus are reliable, neither we nor our management have independently verified any of the data from such sources referred to in this prospectus or ascertained the underlying economic assumptions relied upon by such sources. Internally prepared and third-party market forecasts in particular are estimates only and may be inaccurate, especially over long periods of time. In addition, the underwriters have not independently verified any of the industry data prepared by management or ascertained the underlying estimates and assumptions relied upon by management. Furthermore, references in this prospectus to any publications, reports, surveys or articles prepared by third parties should not be construed as depicting the complete findings of the entire publication, report, survey or article. The information in any such publication, report, survey or article is not incorporated by reference in this prospectus.

This summary highlights information contained elsewhere in this prospectus; it does not contain all the information you should consider before investing in our Common Stock. You should read the entire prospectus before making an investment decision. Throughout this prospectus, the terms the “Company”, “Nascent”, “we,” “us,” “our,” and “our company” refer to Nascent Biotech Inc., a Nevada corporation.

Company Overview

NASCENT BIOTECH INC., a Nevada corporation (“Nascent” or the “Company”), is actively developing its primary asset, Pritumumab, for the treatment of brain cancer and pancreatic cancer. Nascent is also actively researching other cancers that have a high probability of benefiting from the therapeutic effects of Pritumumab because they share a common molecular target. Pritumumab has shown to have positive therapeutic effect at low doses in previous clinical studies in Japan.

| 5 |

| Table of Contents |

Where You Can Find Us

Our executive offices are located at 6330 Nancy Ridge Drive, Suite 105, San Diego, California 92121, and our telephone number is (612) 961-5656. Our website address is www.nascentbiotech.com. Information contained on our website does not form part of this prospectus and is intended for informational purposes only.

Current Business

We are a clinical-stage biopharmaceutical company that develops monoclonal antibodies for the treatment of various forms of cancer. We focus on biologic drug candidates that are undergoing or have already completed initial clinical testing for the treatment of cancer and then seek to further develop those drug candidates for commercial use. We currently own a drug candidate, Pritumumab, which we are developing.

Recent Developments

Om August 7, 2019, Nascent Biotech Inc. (the “Company”) entered into a clinical trial agreement with Hoag Memorial Hospital (“Hoag”) for the Company to conduct a clinical trial of its drug, Pritumumab, at Hoag. The Company anticipates commencing the clinical trial before the end of this year or by the first quarter 2020.

| Common Stock to be offered by the Selling Security Holders |

| 30,000,000 shares of Common Stock consisting of: | |

|

|

|

|

|

|

|

| · | 26,300,000 shares of Common Stock, issuable upon conversion of the Series A Preferred Convertible Shares; |

|

|

|

|

|

|

|

| · | 3,700,000 shares of Common Stock, issuable upon exercise of the Warrants; |

|

|

|

|

|

| Common Stock outstanding before the offering |

| 86,168,411 shares of Common Stock. | |

|

|

|

|

|

| Common Stock to be outstanding after giving effect to the issuance of 26,300,000 shares of Common Stock |

| 112,468,411 shares of Common Stock | |

|

|

|

|

|

| Use of Proceeds |

| We will not receive any of the proceeds from any sale of the shares of Common Stock by the Selling Security Holders. We may receive proceeds in the event any of the Warrants are exercised. See “Use of Proceeds.” | |

|

|

|

|

|

| Risk Factors |

| The Common Stock offered hereby involves a high degree of risk and should not be purchased by investors who cannot afford the loss of their entire investment. See “Risk Factors” beginning on page 9. | |

|

|

|

|

|

| Trading Symbol |

| The Company’s Common Stock is quoted on the OTC Markets QB Market quotation service platform under the symbol “NBIO”. | |

The number of shares of Common Stock outstanding is based on an aggregate of 86,168,411 shares outstanding as of December 18, 2020 and excludes the shares of Common Stock issuable upon conversion of the Series A Shares and the shares of Common Stock issuable upon exercise of the Warrants.

For a more detailed description of the Series A Shares and the Warrants, see “Private Placement”.

| 6 |

| Table of Contents |

Statement of Operations Data:

|

|

| Six Months ended September 30, |

|

| Years Ended March 31, |

| ||||||||||

|

|

| 2020 |

|

| 2019 |

|

| 2020 |

|

| 2019 |

| ||||

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||

| Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

| ||||

| Consulting expense |

| $ | 720,735 |

|

| $ | 313,040 |

|

| $ | 2,832,672 |

|

| $ | -- |

|

| General and administrative expense |

|

| 168,171 |

|

|

| 160,578 |

|

|

| 320,930 |

|

|

| 1,114,942 |

|

| Research and development |

|

| 223,445 |

|

|

| 127,653 |

|

|

| 293,709 |

|

|

| 254,006 |

|

| Income (loss) from operations |

|

| (1,112,351 | ) |

|

| (601,271 | ) |

|

| (3,447,311 | ) |

|

| (1,368,948 | ) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Other income (expense): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Interest income |

|

| 3 |

|

|

| 6 |

|

|

| 6 |

|

|

| 41 |

|

| Financing cost |

|

| (3,000 | ) |

|

| -- |

|

|

|

|

|

|

| -- |

|

| Interest expense |

|

| (146,946 | ) |

|

| (4,323 | ) |

|

| (86,632 | ) |

|

| -- |

|

| Gain (loss) on change in fair value of derivative liabilities |

|

| 640,030 |

|

|

| -- |

|

|

| (470,216 | ) |

|

| -- |

|

| Total other expense |

|

| 490,087 |

|

|

| (4,317 | ) |

|

| (556,848 | ) |

|

| 41 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income (loss) before income tax |

|

| (622,265 | ) |

|

| (605,594 | ) |

|

| (4,004,153 | ) |

|

| (1,368,907 | ) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Income tax |

|

| -- |

|

|

| -- |

|

|

| -- |

|

|

| - |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income (loss) |

| $ | (622,265 | ) |

| $ | (605,594 | ) |

| $ | (4,004,153 | ) |

| $ | (1,368,907 | ) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income (loss) per share, basic and diluted |

| $ | (0.01 | ) |

| $ | (0.02 | ) |

| $ | (0.12 | ) |

| $ | (0.05 | ) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Weighted average number of shares outstanding, basic and diluted |

|

| 57,531,414 |

|

|

| 33,176,663 |

|

|

| 34,392,716 |

|

|

| 30,090,416 |

|

| 7 |

| Table of Contents |

Balance Sheet Data:

|

|

| September 30, |

|

| March 31, |

| ||||||

|

|

| 2020 |

|

| 2020 |

|

| 2019 |

| |||

|

|

| (Unaudited) |

|

|

|

|

| |||||

| ASSETS |

|

|

|

|

|

|

|

|

| |||

| Current assets: |

|

|

|

|

|

|

|

|

| |||

| Cash |

| $ | 99,198 |

|

| $ | 3,218 |

|

| $ | 131,472 |

|

| Total current assets |

|

| 99,198 |

|

|

| 3,218 |

|

|

| 131,472 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total assets |

| $ | 99,198 |

|

| $ | 3,218 |

|

| $ | 131,472 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| LIABILITIES AND STOCKHOLDERS’ EQUITY (DEFICIT) |

|

|

|

|

|

|

|

|

|

|

|

|

| Current liabilities: |

|

|

|

|

|

|

|

|

|

|

|

|

| Accounts payable and accrued expense |

| $ | 715,154 |

|

| $ | 852,664 |

|

| $ | 525,636 |

|

| Convertible note- net of discount |

|

| 11,250 |

|

|

| 88,815 |

|

|

| -- |

|

| Derivative liability |

|

| 13,806 |

|

|

| 603,836 |

|

|

| -- |

|

| Note payable |

|

| -- |

|

|

| 50,000 |

|

|

| -- |

|

| Due related parties |

|

| 170,000 |

|

|

| 1,283,607 |

|

|

| 88,000 |

|

| Total current liabilities |

|

| 910,210 |

|

|

| 2,878,922 |

|

|

| 613,636 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total liabilities |

|

| 910,210 |

|

|

| 2,878,922 |

|

|

| 613,636 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Commitments and Contingencies |

|

| -- |

|

|

| -- |

|

|

| -- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Stockholders’ equity: |

|

|

|

|

|

|

|

|

|

|

|

|

| Preferred stock, $0.001 par value, 10,000,000 authorized, 60,000 Series A and zero issued and outstanding, respectively |

|

| -- |

|

|

| 60 |

|

|

| -- |

|

| Common stock, $0.001 par value, 100,000,000 authorized, 67,180,691, 44,890,262 and 32,646,635 issued and outstanding, respectively |

|

| 67,181 |

|

|

| 44,890 |

|

|

| 32,647 |

|

| Additional paid-in capital |

|

| 16,580,981 |

|

|

| 13,916,995 |

|

|

| 12,318,685 |

|

| Accumulated deficit |

|

| (17,459,914 | ) |

|

| (16,837,649 | ) |

|

| (12,833,496 | ) |

| Total stockholders’ equity (deficit) |

|

| 811,012 | ) |

|

| (2,875,704 | ) |

|

| (482,164 | ) |

| Total liabilities and stockholders’ equity |

| $ | 99,198 |

|

| $ | 3,218 |

|

| $ | 131,472 |

|

| 8 |

| Table of Contents |

An investment our Common Stock is highly speculative and involves a high degree of risk. The risk factors described below summarize some of the material risks inherent in an investment in us. These risk factors are not presented in any particular order of significance. Each prospective investor should carefully consider the following risk factors inherent in and affecting our business and the Offering before making an investment decision. You should also refer to the other information set forth in this prospectus and to the risk factors in our SEC filings.

The occurrence of an uncontrollable event such as the COVID-19 pandemic may negatively affect our operations. A pandemic typically results in social distancing, travel bans, and quarantine. This may limit access to our, suppliers, management, support staff and professional advisors. Although the Company’s operations are virtual, we depend on numerous third party consultants and contract suppliers so we cannot measure the impact on our operations or financial condition at this point in time.

Risks Related to Our Business and Industry

We currently have no product revenues and no products approved for marketing and will need to raise additional capital to operate our business.

To date, we have generated no product revenues. Until, and unless, we receive approval from the U.S. Food and Drug Administration, or FDA, and other regulatory authorities overseas for one or more of our drug candidates, we cannot market or sell our products and will not have product revenues. Currently, our only drug candidate is Pritumumab, and this product is not approved by the FDA for sale in the United States or by other regulatory authorities for sale outside the United States. We have not begun any clinical trial for Pritumumab.

Moreover, each of these drug indications except brain cancer will require time and capital before we can even apply for an IND for approval from the FDA or commence clinical trials. Therefore, for the foreseeable future, we do not expect to achieve any product revenues and will have to fund all of our operations and capital expenditures from cash on hand, licensing fees and grants, and potentially, future offerings. We will need to seek additional sources of financing, which may not be available on favorable terms, if at all. If we do not succeed in timely raising additional funds on acceptable terms, we may be unable to complete planned pre-clinical and clinical trials or obtain approval of any drug candidates from the FDA and other regulatory authorities. In addition, we could be forced to discontinue product development and forego attractive business opportunities. Any additional sources of financing will likely involve the issuance of additional equity securities, which will have a dilutive effect on our stockholders.

We intend to use the services of outside service providers to conduct our clinical trials and manufacture our products. We have not entered into any agreements with any outside service providers to provide these services to us and there can be no assurance as to what it may cost the Company to secure these outside services.

Development, Regulatory Approval and Marketing of Products

The outcome of the lengthy and complex process of identifying new compounds and developing new products is inherently uncertain and involves a high degree of risk and cost. Drug discovery and development is time-consuming, expensive and unpredictable. The process from early discovery or design to development to regulatory approval can take many years. Drug candidates can fail at any stage of the process, including as the result of unfavorable clinical trial results. There can be no assurance regarding our ability to meet anticipated clinical trial commencement and completion dates, regulatory submission dates, and launch dates for product candidates, or as to whether or when we will receive regulatory approval for new products or for new indications or dosage forms for existing products. Decisions by regulatory authorities regarding labeling, ingredients and other matters could adversely affect the availability or commercial potential of our products, and there is no assurance that any of our proposed products will receive regulatory approval and/or be commercially successful.

| 9 |

| Table of Contents |

Post-Approval Data

As a condition to granting marketing approval of a product, the FDA may require a company to conduct additional clinical trials. The results generated in these Phase IV trials could result in loss of marketing approval, changes in product labeling, and/or new or increased concerns about the side effects or efficacy of a product. The Food and Drug Administration Amendments Act of 2007 (the FDAAA) gave the FDA enhanced post-market authority, including the explicit authority to require post-market studies and clinical trials, labeling changes based on new safety information, and compliance with FDA-approved risk evaluation and mitigation strategies. The FDA’s exercise of its authority under the FDAAA has in some cases resulted, and in the future, could result, in delays or increased costs during product development, clinical trials and regulatory review, increased costs to comply with additional post-approval regulatory requirements and potential restrictions on sales of approved products. Non-U.S. regulatory agencies often have similar authority and may impose comparable costs. Post-marketing studies, whether conducted by us or by others and whether mandated by regulatory agencies or voluntary, and other emerging data about marketed products, such as adverse event reports, may also adversely affect sales of our products. Further, the discovery of significant problems with a product similar to one of our products that implicate (or are perceived to implicate) an entire class of products could have an adverse effect on sales of the affected products. Accordingly, new data about our proposed products, or products similar to our proposed products, could negatively impact demand for these products due to real or perceived side effects or uncertainty regarding efficacy and, in some cases, could result in updated labeling, restrictions on use, product withdrawal or recall. Furthermore, new data and information, including information about product misuse, may lead government agencies, professional societies, practice management groups or organizations involved with various diseases to publish guidelines or recommendations related to the use of these products or the use of related therapies or place restrictions on sales. Such guidelines or recommendations may lead to lower sales of these products if and when they reach the market.

The expiration or loss of patent protection may affect future revenues and operating income.

The Company’s proposed products may rely on patent and trademark and other intellectual property protection. To the extent any of the Company’s intellectual property are successfully challenged, invalidated, or circumvented or to the extent it does not allow the Company to compete effectively, our business may suffer.

On October 12, 2017, the Company signed a consulting agreement with the former license holder. Under the terms of the agreement the Company, commencing February 1, 2018 and after the completion of the present agreement, will pay the consultant $1,000 per month for 24 months. In addition, the Company will pay the consultant an additional $24,000 during the term of the agreement at the Company’s discretion. In return, the consultant forgave all royalty payments per the previous agreement dated September 21, 2015, plus provides consulting services to the Company as directed by the Company.

Competitors’ intellectual property may prevent the Company from selling its proposed products or have a material adverse effect on the Company’s future profitability and financial condition.

Competitors may claim that our product infringes upon their intellectual property. Resolving an intellectual property infringement claim can be costly and time consuming and may require the Company to enter into license agreements. The Company cannot guarantee that it would be able to obtain license agreements on commercially reasonable terms. A successful claim of patent or other intellectual property infringement could subject the Company to significant damages or an injunction preventing the manufacture, sale or use of affected products. Any of these events could have a material adverse effect on our profitability and financial condition.

The Company research and development efforts may not succeed in developing commercially successful products and technologies, which may cause revenue and profitability to decline.

The Company is committing substantial efforts, funds, and other resources to research and development of its proposed products. A high rate of failure is inherent in the research and development of new products and technologies. The Company will be required to make ongoing substantial expenditures without any assurance that its efforts will be commercially successful. Failure can occur at any point in the process, including after significant funds have been invested.

Promising new product candidates may fail to reach the market or may only have limited commercial success because of efficacy or safety concerns, failure to achieve positive clinical outcomes, inability to obtain necessary regulatory approvals, limited scope of approved uses, excessive costs to manufacture, the failure to establish or maintain intellectual property rights, or infringement of the intellectual property rights of others. Even if the Company successfully develops new products or enhancements, they may be quickly rendered obsolete by changing customer preferences, changing industry standards, or competitors’ innovations. Innovations may not be accepted quickly in the marketplace because of, among other things, entrenched patterns of clinical practice or uncertainty over third-party reimbursement. The Company cannot state with certainty when or whether any of its products under development will be launched, whether it will be able to develop, license, or otherwise acquire compounds or products, or whether any products will be commercially successful. Failure to launch successful new products or new indications for existing products may cause the Company’s products to become obsolete, causing our revenue and operating results to suffer.

New products and technological advances by our competitors may negatively affect our results of operations.

Any products that the Company is able to develop will face intense competition from its competitors’ products. Competitors’ products may be safer, more effective; more effectively marketed or sold, or have lower prices or superior performance features than our products. We cannot predict with certainty the timing or impact of the introduction of competitors’ products.

| 10 |

| Table of Contents |

Product liability claims may occur for our products, which could have a material adverse effect on revenues and financial condition.

The Company, once its product(s) make it to market, may be subject to product liability claims and lawsuits alleging that its products have resulted or could result in an unsafe condition for or injury to patients. Product liability claims and lawsuits, safety alerts or product recalls, and other allegations of product safety or quality issues, regardless of their validity or ultimate outcome, may have a material adverse effect on our business and reputation and on our ability to attract and retain customers. Consequences may also include additional costs, a decrease in market share for the products, lower income or exposure to other claims. The Company will attempt to obtain sufficient product liability insurance but may not be able to obtain such coverage or obtain sufficient coverage to product itself completely from said potential claims. Product liability claims could have a material adverse effect on our profitability and financial condition.

We have a limited operating history and are not profitable and may never become profitable.

We have a history of operating losses and no meaningful operations upon which to evaluate our business. Our accumulated deficit since inception through March 31, 2020 was $16,837,649. We expect to incur substantial losses and negative operating cash flow for the foreseeable future as we commence clinical trials of our drug candidates, which we do not expect will be commercially available for a number of years, if at all. Even if we succeed in developing and commercializing one or more drug candidates, we expect to incur substantial losses for the foreseeable future and may never become profitable. The successful development and commercialization of any drug candidates will require us to perform a variety of functions, including:

|

| · | undertaking clinical trials; |

|

| · | hiring additional personnel; |

|

| · | participating in the regulatory approval processes; |

|

| · | manufacturing and formulating products; |

|

| · | initiating and conducting sales and marketing activities; and, |

|

| · | implementing additional internal systems and infrastructure. |

We will need to raise additional capital in order to fund our business and generate significant revenue in order to achieve and maintain profitability. Additional financing may cause dilution to current investors and there can be no assurance that any additional financing will be on terms that are favorable to the Company and our shareholders. Without ongoing revenue, our ability to stay in business is contingent on outside capital and we currently have no commitments for such capital.

The departure of certain key personnel could affect the financial condition of the Company due to the loss of their expertise.

Our business plan was developed by our officers and will depend on their ability to develop pharmaceutical products. Without their expertise, it is unlikely we will be able to complete the development, testing and FDA approval process. We do not have the funds, at this time, to hire additional personnel and without our current management team; it is unlikely we would be able to obtain further funding. The loss of any member of management would severely hinder our ability to develop our proposed products. A failure on our part to retain the services of these key personnel could have a material adverse effect on our operating results and financial conditions. We do not maintain key man life insurance on any of our officers or employees.

Our auditors have expressed substantial doubt about our ability to continue as a going concern. If we do not have sufficient funding, we may have to suspend or cease operations within twelve months.

Our audited financial statements for the year ended March 31, 2020 were prepared using the assumption that we will continue our operations as a going concern. We were incorporated in 2014 and do not have a history of earnings except for the year ended March 31, 2017. As a result, our independent registered public accounting firm, in their audit report, has expressed substantial doubt about our ability to continue as a going concern. Continued operations are dependent on our ability to complete equity or debt financing activities or to generate profitable operations. Such activities may not be available or may not be available on reasonable terms. We believe that if we do not have sufficient funding, we may have to suspend or cease operations within twelve months. Therefore, we may be unable to continue operations in the future as a going concern. If we cannot continue as a viable entity, our stockholders may lose some or all their investment in the Company.

| 11 |

| Table of Contents |

We may be exposed to risks relating to management’s conclusion that our disclosure controls and procedures and internal controls over financial reporting are ineffective.

Currently, we do not have an independent audit committee. Our independent Director along with the other Directors functions as our audit committee and is comprised of four directors, three of whom are not considered to be “independent” in accordance with the requirements of Rule 10A-3 under the Securities Exchange Act of 1934. An independent audit committee plays a crucial role in the corporate governance process, assessment of the Company’s processes relating to its risks and control environment, oversight of financial reporting, and evaluation of internal and independent audit processes. The lack of an independent audit committee may prevent the Board of Directors from being independent in its judgments and decisions and its ability to pursue the committee’s responsibilities, which could compromise the management of our business.

Risks Relating to Our Common Stock

We intend to take advantage of the disclosure requirements of the JOBS Act provided for emerging growth companies including not providing all the accounting disclosure that other companies will be required to provide which may limit an investor’s ability to compare our financial statements with other companies.

Under the JOBS Act, we can elect to not comply with new or revised accounting standards which will allow us to delay the adoption of new or revised accounting standards that have different effective dates for public and private companies. As such, our financial statements may not be comparable to companies that comply with public company effective dates. This could affect an investor’s ability to evaluate our financial statements compared to other public companies. In addition to the financial statements, the JOBS Act along with being a “Smaller Reporting Company” allows us to provide less disclosure on certain issues such as executive compensation as other companies which could affect an investor’s ability to compare us to other companies.

The Company’s stock price may be volatile.

The market price of the Company’s common stock is likely to be highly volatile and could fluctuate widely in price in response to various factors, many of which are beyond the Company’s control, including the following:

|

| · | technological innovations or new products and services by the Company or its competitors; |

|

| · | additions or departures of key personnel; |

|

| · | the Company’s ability to execute its business plan; |

|

| · | operating results that fall below expectations; |

|

| · | loss of any strategic relationship; |

|

| · | industry developments; |

|

| · | economic and other external factors; and, |

|

| · | period-to-period fluctuations in the Company’s financial results. |

In addition, the securities markets have from time to time experienced significant price and volume fluctuations that are unrelated to the operating performance of particular companies. These market fluctuations may also materially and adversely affect the market price of the Company’s common stock.

| 12 |

| Table of Contents |

We may in the future issue additional shares of our common stock which would reduce investors’ ownership interests in the Company and which may dilute our share value.

Our Articles of Incorporation authorizes the issuance of 500,000,000 shares of common stock, par value $0.001 per share and 50,000,000 shares of preferred stock, $0.001 par value. The future issuance of all or part of our remaining authorized common stock may result in substantial dilution in the percentage of our common stock held by our then existing stockholders. We may value any common stock issued in the future on an arbitrary basis. The issuance of common stock for future services or acquisitions or other corporate actions may have the effect of diluting the value of the shares held by our investors and might have an adverse effect on any trading market for our common stock.

In the future, the Company might authorize a class of preferred stock with rights and preferences superior to those of the common stockholders and which might contain provisions giving them priority over the rights of the common stockholders. Any such class of preferred stock may result in substantial dilution to our common stockholders and have an adverse effect on any trading market for our common stock.

FINRA sales practice requirements may limit a stockholder’s ability to buy and sell our stock.

The Financial Industry Regulatory Authority (“FINRA”) has adopted rules that relate to the application of the SEC’s penny stock rules in trading our securities and require that a broker/dealer have reasonable grounds for believing that the investment is suitable for that customer, prior to recommending the investment. Prior to recommending speculative, low priced securities to their non-institutional customers, broker/dealers must make reasonable efforts to obtain information about the customer’s financial status, tax status, investment objectives and other information.

Under interpretations of these rules, FINRA believes that there is a high probability that speculative, low priced securities will not be suitable for at least some customers. FINRA’s requirements make it more difficult for broker/dealers to recommend that their customers buy our common stock, which may have the effect of reducing the level of trading activity and liquidity of our common stock. Further, many brokers charge higher transactional fees for penny stock transactions. As a result, fewer broker/dealers may be willing to make a market in our common stock, reducing a shareholder’s ability to resell shares of our common stock.

The Company’s common stock is currently deemed to be “penny stock,” which makes it more difficult for investors to sell their shares.

The Company’s common stock is and will be subject to the “penny stock” rules adopted under section 15(g) of the Exchange Act. The penny stock rules apply to companies whose common stock is not listed on the NASDAQ Stock Market or other national securities exchange and trades at less than $5.00 per share or that have tangible net worth of less than $5,000,000 ($2,000,000 if the company has been operating for three or more years). These rules require, among other things, that brokers who trade penny stock to persons other than “established customers” complete certain documentation, make suitability inquiries of investors and provide investors with certain information concerning trading in the security, including a risk disclosure document and quote information under certain circumstances. Many brokers have decided not to trade penny stocks because of the requirements of the penny stock rules and, as a result, the number of broker-dealers willing to act as market makers in such securities is limited. If the Company remains subject to the penny stock rules for any significant period, it could have an adverse effect on the market, if any, for the Company’s securities. If the Company’s securities are subject to the penny stock rules, investors will find it more difficult to dispose of the Company’s securities.

There is currently a limited public market for our Common Stock. Failure to develop or maintain a trading market could negatively affect its value and make it difficult or impossible for you to sell your shares.

Our Common Stock trades on the OTCQB Market under the symbol “NBIO”. There has been a limited public market for our Common Stock and an active public market for our Common Stock may not develop. Failure to develop or maintain an active trading market could make it difficult for you to sell your shares or recover any part of your investment in us. Even if a market for our Common Stock does develop, the market price of our Common Stock may be highly volatile. In addition to the uncertainties relating to future operating performance and the profitability of operations, factors such as variations in interim financial results or various, as yet unpredictable, factors, many of which are beyond our control, may have a negative effect on the market price of our Common Stock.

| 13 |

| Table of Contents |

We have paid no dividends.

We never have paid any dividends on our Common Stock and we do not intend to pay any dividends in the foreseeable future.

Future issuances of common shares may be adversely affected by the CSPA.

The market price of our Common Stock could decline as a result of issuances and sales by us, including pursuant to the Common Stock Purchase Agreement (the “CSPA”), or sales by our existing shareholders, of Common Stock, or the perception that these issuances and sales could occur. Sales by our shareholders might also make it more difficult for us to issue and sell Common Stock at a time and price that we deem appropriate. It is likely that the sale of shares by Selling Shareholder may depress the market price of our Common Stock.

Limitations on director and officer liability and indemnification of our officers and directors by us may discourage stockholders from bringing suit against a director.

The Company’s Articles of Incorporation and Bylaws provide, with certain exceptions as permitted by governing state law, that a director or officer shall not be personally liable to us or our stockholders for breach of fiduciary duty as a director, except for acts or omissions which involve intentional misconduct, fraud or knowing violation of law, or unlawful payments of dividends. These provisions may discourage stockholders from bringing suit against a director for breach of fiduciary duty and may reduce the likelihood of derivative litigation brought by stockholders on our behalf against a director. In addition, the Company’s Articles of Incorporation and Bylaws may provide for mandatory indemnification of directors and officers to the fullest extent permitted by governing state law.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus, including the sections entitled “Risk Factors”, “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and “Business”, contains forward-looking statements that include information relating to future events, future financial performance, strategies, expectations, our competitive environment, regulation and availability of resources. These forward-looking statements include, without limitation, statements regarding: proposed new products or services; our statements concerning litigation or other matters; statements concerning projections, predictions, expectations, estimates or forecasts for our business, financial and operating results and future economic performance; statements of management’s goals and objectives; trends affecting our financial condition, results of operations or future prospects; our financing plans or growth strategies; and other similar expressions concerning matters that are not historical facts. Words such as “may”, “will”, “should”, “could”, “would”, “predicts”, “potential”, “continue”, “expects”, “anticipates”, “future”, “intends”, “plans”, “believes” and “estimates,” and similar expressions, as well as similar statements in the future tense, identify forward-looking statements.

Forward-looking statements should not be read as a guarantee of future performance or results and will not necessarily be accurate indications of the times at, or by which, that performance or those results will be achieved. Forward-looking statements are based on information available at the time they are made and/or management’s good faith belief as of that time with respect to future events and are subject to risks and uncertainties that could cause actual performance or results to differ materially from what is expressed in or suggested by the forward-looking statements.

Forward-looking statements speak only as of the date they are made. You should not put undue reliance on any forward-looking statements. We assume no obligation to update forward-looking statements to reflect actual results, changes in assumptions or changes in other factors affecting forward-looking information, except to the extent required by applicable securities laws. If we do update one or more forward-looking statements, no inference should be drawn that we will make additional updates with respect to those or other forward-looking statements.

| 14 |

| Table of Contents |

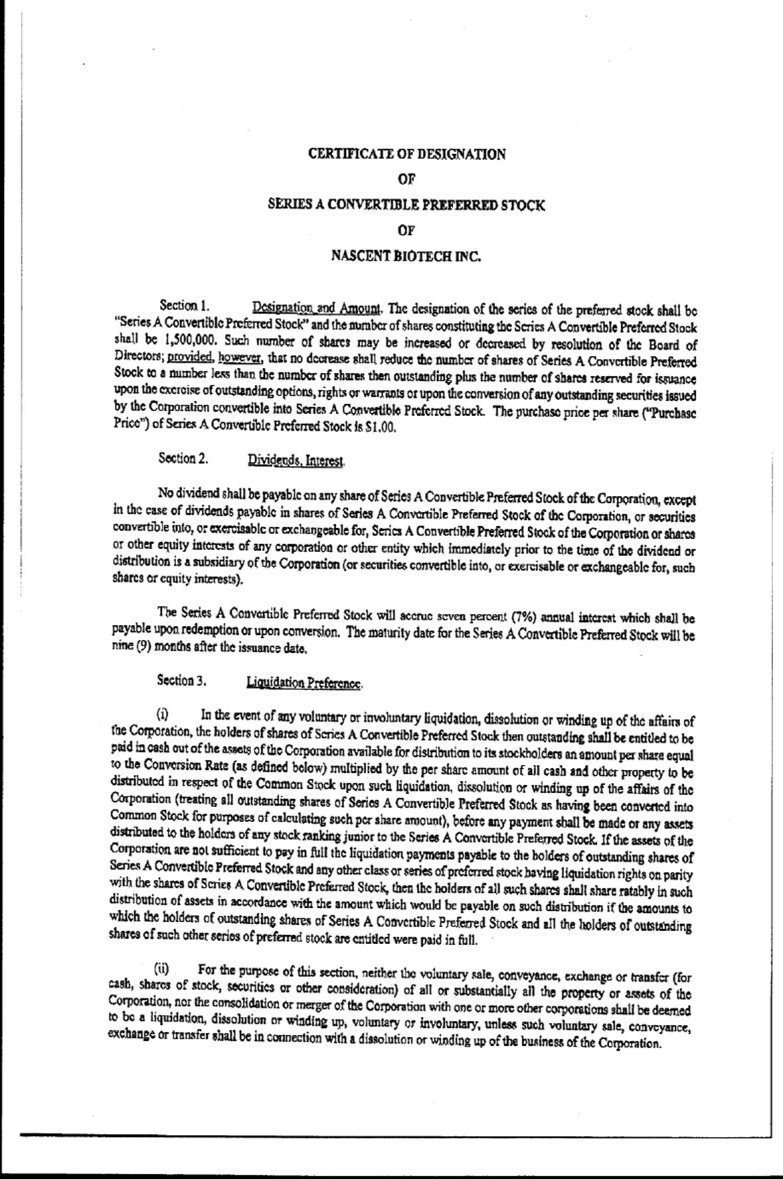

Series A Convertible Preferred

The Company sold 740,000 shares Series A Convertible Preferred (the “Series A Shares), pursuant to which the Company agreed to convert the Series A Shares into Common Stock of the Company’s common stock, par value $0.001 (the “Common Stock”). The Company has agreed to register the shares of the Common Stock which will be issued upon conversion of the Series A Shares at the same time as the parties executed Subscription Agreements. The price of the shares to be sold will depend on, among other things, the market price of the Company’s stock at the time that the conversion notice is delivered.

Conversion Notice

Pursuant to the terms of the Subscription agreements, the Selling Security Holders, at their sole discretion, may deliver a conversion notice (the “Conversion Notice”) to which states the number of shares of Common Stock the Selling Security Holders are electing to convert and the conversion price. The number of securities to be converted pursuant to a Conversion Notice shall be calculated by multiplying the fifty percent (50%) of the lowest trading price five (5) business days prior to the date of the Conversion Notice or ten cents ($0.10) per share, whichever is lower. The conversion price cannot exceed $0.10 per share of common stock

Warrants

The Warrants entitles the Selling Security Holders to purchase up to 3,700,000 shares of Common Stock at $0.15 per share for two years commencing on of the issuance of the Warrants. The adjustment for dilution is subject to adjustment for anti-dilution protection of asset distributions stock dividends, stock splits, combinations or similar events. The exercise price may be adjusted for any exercise price for a similar instrument if that instrument has a lower exercise price.

The Selling Security Holders have no right to exercise the Warrants to the extent that such exercise would result in any of them being the beneficial owner in excess of 4.99% (or, upon election of the Selling Security Holders, 9.99%), which beneficial ownership limitation may be increased or decreased up to 9.99%.

The Selling Security Holders will receive all the proceeds from the sale of shares of Common Stock under this prospectus. We will not receive any proceeds from these sales. To the extent we receive proceeds from the exercise of the Warrants, we will use those proceeds for working capital, our clinical studies, retirement of debt, officer salaries, product development and testing. We have agreed to bear the certain expenses relating to the registration of the shares of Common Stock being registered herein for each of the Selling Security Holders.

See “Plan of Distribution” elsewhere in this prospectus for more information.

The Selling Security Holder will receive all the proceeds from the sale of shares of Common Stock under this prospectus. We will not receive any proceeds from these sales. To the extent we receive proceeds from the future exercise of the Warrants, we will use those proceeds for clinical trials, working capital, retirement of debt and officer salaries. We have agreed to bear the certain expenses relating to the registration of the shares of Common Stock being registered herein for Selling Security Holder.

See “Plan of Distribution” elsewhere in this prospectus for more information.

| 15 |

| Table of Contents |

This prospectus covers the offering of up to 26,300,000 shares of Common Stock being offered by the Selling Security Holders of Common Stock acquirable upon the issuance of Conversion Notice from the Selling Security Holders to the Company as described herein. We are registering the shares of Common Stock in order to permit the Selling Security Holders to offer their shares of Common Stock for resale from time to time.

The table below lists the Selling Security Holders and other information regarding the “beneficial ownership” of the shares of Common Stock by the Selling Security Holders. In accordance with Rule 13d-3 of the Exchange Act, “beneficial ownership” includes any shares of Common Stock as to which the Selling Security Holders have sole or shared voting power or investment power and any shares of Common Stock the Selling Security Holders have the right to acquire within sixty (60) days.

The Selling Security Holders are “underwriters” within the meaning of Section 2(a)(11) of the Securities Act.

The first column indicates the beneficial owners of the shares to be sold.

The second column indicates the number of shares of Common Stock beneficially owned by the Selling Security Holders, based on its ownership as of December 18, 2020. The second column also assumes purchase of all shares of stock to be acquired under the maximum amount of securities to be issued by the Company to the Selling Security Holders, without regard to any limitations on purchase described in this prospectus or in the Subscription Agreement.

The third column lists the shares of Common Stock being offered by this prospectus by the Selling Security Holders. Such aggregate amount of Common Stock does not take into account any applicable limitations on purchase of the securities under the Subscription Agreement.

The fourth column indicates the amount in cash paid for the securities to be sold.

The sixth column indicates the number of warrants convertible to common shares for sale.

This prospectus covers the resale of (i) all of the shares of Common Stock issued and issuable by the Company upon receiving a Notice of Conversion from the Selling Security Holders, and (ii) any securities issued or then issuable upon any full anti-dilution protection, stock split, dividend or other distribution, recapitalization or similar event with respect to the common shares.

Because the issuance price of the common shares may be adjusted, the number of shares of Common Stock that will actually be issued upon issuance of the common shares may be more or less than the number of shares of Common Stock being offered by this prospectus. The Selling Security Holders can offer all, some or none of its shares of Common Stock, thus we have no way of determining the number of shares of Common Stock it will hold after this offering. Therefore, the fourth and fifth columns assume that the Selling Security Holders will sell all shares of Common Stock covered by this prospectus. See “Plan of Distribution.”

The offering of the securities was completed on August 7, 2020.

The Selling Security Holders identified below has confirmed to us that they are not a broker-dealer or an affiliate of a broker-dealer within the meaning of United States federal securities laws.

|

|

| Beneficial owner of the entity holding the shares |

| Number of Shares of Common Stock Owned Prior to Offering |

|

| Maximum Number of Shares of Common Stock to be Sold Pursuant to this Prospectus |

|

| Consideration in cash paid for shares |

|

| Number of Shares of Common Stock Owned After Offering |

|

| Number of warrants owned for conversio n to shares to be sold per this Prospectus |

|

| Percentage Beneficially Owned After Offering |

| ||||||

| EROP Capital , LLC |

| Vince S barra |

|

| 0 |

|

|

| 4,721,395 |

|

|

| 150,000 |

|

|

| 4,721,395 |

|

|

| 750,000 |

|

|

| 4.20 | % |

| Maenza Enterprises LLC Dba Trendix Enterprises, LLC |

| Joe Maenza |

|

| 80,000 |

|

|

| 7,000,000 |

|

|

| 190,000 |

|

|

| 7,080,000 |

|

|

| 950,000 |

|

|

| 6.29 | % |

| Thirty 05, LLC |

| Saeb Jannoun |

|

| 10,000 |

|

|

| 7,297,356 |

|

|

| 200,000 |

|

|

| 7,307,356 |

|

|

| 1,000,000 |

|

|

| 6.50 | % |

| Sidney J Lorio JR, Gloria Lorio, JTWROS |

| Sidney and Gloria Lorio |

|

| 0 |

|

|

| 7,281,249 |

|

|

| 200,000 |

|

|

| 7,281,249 |

|

|

| 1,000,000 |

|

|

| 6.47 | % |

| TOTAL |

|

|

|

| 90,000 |

|

|

| 26,300,000 |

|

|

| 740,000 |

|

|

| 26,390,000 |

|

|

| 3,700,000 |

|

|

| 23.46 | % |

Material Relationships with Selling Security Holders

The Selling Security Holders has not at any time during the past three (3) years acted as one of our employees, officers or directors or had a material relationship with us except with respect to transactions described above in “Private Placement.”

| 16 |

| Table of Contents |

MARKET PRICE OF COMMON STOCK AND OTHER STOCKHOLDER MATTERS

Our Common Stock is currently quoted on the OTCQB Market, which is sponsored by OTC Markets Group, Inc. The OTCQB Market is a network of security dealers who buy and sell stock. The dealers are connected by a computer network that provides information on current “bids” and “asks,” as well as volume information. Our shares are quoted on the OTCQB Market under the symbol “NBIO.”

The following table sets forth the range of high and low bid quotations for our Common Stock for each of the periods indicated as reported by the OTCQB Market. These quotations reflect inter-dealer prices, without retail mark-up, mark-down or commission and may not necessarily represent actual transactions.

Trading Market

| Quarter Ended (1) |

| High |

|

| Low |

| ||

| September 30, 2020 |

|

| 0.12 |

|

|

| 0.05 |

|

| June 30, 2020 |

|

| 0.29 |

|

|

| 0.07 |

|

| March 31, 2020 |

|

| 0.33 |

|

|

| 0.08 |

|

| December 31, 2019 |

|

| 0.21 |

|

|

| 0.05 |

|

| September 30, 2019 |

|

| 0.21 |

|

|

| 0.11 |

|

| June 30, 2019 |

|

| 0.21 |

|

|

| 0.11 |

|

| March 31, 2019 |

|

| 0.21 |

|

|

| 0.12 |

|

| December 31, 2018 |

|

| 0.36 |

|

|

| 0.10 |

|

| September 30, 2018 |

|

| 0.57 |

|

|

| 0.12 |

|

| June 30, 2018 |

|

| 0.77 |

|

|

| 0.15 |

|

| (1) | Over-the-counter market quotations reflect inter-dealer prices without retail mark-up, mark-down, or commission, and may not represent actual transactions. |

Approximate Number of Equity Security Holders

As of December 18, 2020, there were approximately 156 stockholders of record. Because shares of our Common Stock are held by depositaries, brokers and other nominees, the number of beneficial holders of our shares is substantially larger than the number of stockholders of record.

Dividends

Holders of our Common Stock are entitled to receive dividends if, as and when declared by the Board of Directors out of funds legally available, therefore. We have never declared or paid any dividends on our Common Stock. We intend to retain any future earnings for use in the operation and expansion of our business. Consequently, we do not anticipate paying any cash dividends on our Common Stock to our stockholders for the foreseeable future.

Penny Stock

Our stock is considered a penny stock. The SEC has adopted rules that regulate broker-dealer practices in transactions in penny stocks. Penny stocks are generally equity securities with a market price of less than $5.00, other than securities registered on certain national securities exchanges or quoted on the NASDAQ system, provided that current price and volume information with respect to transactions in such securities is provided by the exchange or system. The penny stock rules require a broker-dealer, prior to a transaction in a penny stock, to deliver a standardized risk disclosure document prepared by the SEC, that: (a) contains a description of the nature and level of risk in the market for penny stocks in both public offerings and secondary trading; (b) contains a description of the broker’s or dealer’s duties to the customer and of the rights and remedies available to the customer with respect to a violation of such duties or other requirements of the securities laws; (c) contains a brief, clear, narrative description of a dealer market, including bid and ask prices for penny stocks and the significance of the spread between the bid and ask price; (d) contains a toll-free telephone number for inquiries on disciplinary actions; (e) defines significant terms in the disclosure document or in the conduct of trading in penny stocks; and (f) contains such other information and is in such form, including language, type size and format, as the SEC shall require by rule or regulation.

| 17 |

| Table of Contents |

The broker-dealer also must provide, prior to effecting any transaction in a penny stock, the customer with: (a) bid and offer quotations for the penny stock; (b) the compensation of the broker-dealer and its salesperson in the transaction; (c) the number of shares to which such bid and ask prices apply, or other comparable information relating to the depth and liquidity of the market for such stock; and (d) a monthly account statement showing the market value of each penny stock held in the customer’s account. In addition, the penny stock rules require that prior to a transaction in a penny stock not otherwise exempt from those rules, the broker-dealer must make a special written determination that the penny stock is a suitable investment for the purchaser and receive the purchaser’s written acknowledgment of the receipt of a risk disclosure statement, a written agreement as to transactions involving penny stocks, and a signed and dated copy of a written suitability statement.

These disclosure requirements may have the effect of reducing the trading activity for our Common Stock. Therefore, stockholders may have difficulty selling our securities.

MANAGEMENT’S DISCUSSION AND ANALYSIS OF

FINANCIAL CONDITION AND RESULTS OF OPERATION

Overview

We intend for this discussion to provide information that will assist in understanding our financial statements, the changes in certain key items in those financial statements, and the primary factors that accounted for those changes, as well as how certain accounting principles affect our financial statements. This discussion should be read in conjunction with our financial statements and accompanying notes for the fiscal years ended March 31, 2020 and 2019.

General Overview of Our Business

Overview

We intend for this discussion to provide information that will assist in understanding our financial statements, the changes in certain key items in those financial statements, and the primary factors that accounted for those changes, as well as how certain accounting principles affect our financial statements.

Business Overview

The Company is actively developing its primary asset, Pritumumab, for the treatment of brain cancer and pancreatic cancer. Nascent is also actively researching other cancers that have a high probability of benefiting from the therapeutic effects of Pritumumab because they share a common molecular target. Pritumumab has shown to have positive therapeutic effect at low doses in previous clinical studies in Japan.

Current Business

We are a clinical-stage biopharmaceutical company that develops monoclonal antibodies for the treatment of various forms of cancer. We focus on biologic drug candidates that are undergoing or have already completed initial clinical testing for the treatment of cancer and then seek to further develop those drug candidates for commercial use. We currently own a drug candidate, Pritumumab, which we are developing.

Plan of Operation

We are focused on developing Pritumumab for the treatment of patients with brain cancer malignancies such as glioblastoma and malignant astrocytoma. The Company filed an Investigational New Drug (“IND”) application with the US Food and Drug Administration (“FDA”) for Phase I clinical trials on March 31, 2017. The FDA place the submission on clinical hold requesting more data and clarification of some parts of the submission. On March 31, 2018, the Company amended its IND filing and, again, was not cleared to begin clinical trials by the FDA. On December 7, 2018, the Company received FDA clearance on its drug product lot to begin clinical trials. On May 6, 2019, the Company filed a submission with the FDA to gain complete release of the partial clinical hold. On August 7, 2019, Nascent Biotech Inc. (the “Company”) entered into a clinical trial agreement with Hoag Memorial Hospital (“Hoag”) for the Company to conduct its clinical trial of its drug, Pritumumab, at Hoag. The Company anticipates commencing the clinical trial during the first calendar quarter 2021.

| 18 |

| Table of Contents |

Use of Estimates

The preparation of financial statements in conformity with generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosures of contingent assets and liabilities at the date of the financial statements and the reported amounts of income and expenses during the reporting period. Actual results could differ from those estimates.

Recently Issued Accounting Pronouncements

The Company has implemented all new accounting pronouncements that are in effect and that may impact its financial statements and does not believe that there are any other new accounting pronouncements that have been issued that might have a material impact on its financial position or results of operations.

Results of Operations

The following summary of our results of operations should be read in conjunction with our consolidated financial statements for the years ended March 31, 2020 and 2019, which are included herein.

Expenses

Operating expenses for the year ended March 31, 2019 were $1,368,948 including research and development costs of $254,006,general and administrative expenses of $447,505 and consulting of $667,437 compared to the year ended March 31, 2020 in which our operating expenses were $3,447,311 with research and development costs of $293,709,general and administrative costs of $320,903 and consulting of $2,832,672, representing increase of $2,078,363 in operating expenses in fiscal 2020 over 2019.

Operating expenses for the six months ended September 30, 2020 was $1,112,351 including research and development of $223,445, consulting fees of $720,735 and general and administrative of $168,171 compared to operating expenses of $601,271 with research and development of $127,653, consulting of $313,040, and general and administrative of $160,578.

Other income totaled $41 for the year ended March 31, 2019 compared to other expense of $556,848 consisting of interest expense of $86,632 and a loss in fair value of $470,216 for the same period in 2020.

Other income and expense for the three months ended June 30, 2020 was income of $347,377 and income of $5 for the same period in 2019. Other income and expense for the period ending June 30, 0202 consisted of interest expense of $88,190, finance costs of$3,000 and a gain in fair value of $438,567 compared to other income of $5 in the same period in 2019.

Revenue, Net Income and Loss

The Company recorded no revenues for the years ended March 31, 2020 and 2019 and six months ended September 30, 2020 and 2019.

| 19 |

| Table of Contents |

Our net loss for the year ended March 31, 2019 was $1,368,907 compared to a net loss of $4,004,153 during the year ended March 31, 2020. The increase in net loss is due to higher general and administrative costs specifically stock based compensation cost in 2020 over 2019.

Our net loss for the six months periods ended September 30, 2020 and 2019 were $622,265 and $605,594 respectively.

Our operations to date have been financed by the sale of our common stock and initial payment of a licenses sale. Our largest expenses to date have been research and development, IND filings and tests required for the filing and consulting fees. The research and development will grow as the product begins it clinical trials later this fiscal year.

We do not anticipate generating revenues in the foreseeable future other than future licenses sales or additional payments from licenses in effect, and any revenues that we generate may not be sufficient to cover our operating expenses. If we do not succeed in raising additional capital, we may have to cease operations and you may lose your entire investment.

Liquidity and Capital Resources

At March 31, 2019, we had cash of $131,472 as compared to $3,218 in cash at March 31, 2020. Our accounts payable and accrued expense at March 31, 2019 was $525,636 consisting of $510,636 in accounts payable and $15,000 in accrued expense as compared to $852,664 in accounts payable as of March 31, 2020 consisting of accounts payable of $738,778, accrued consulting of $97,500 and accrued interest of $16,386.

As of September 30, 2020 the Company had cash of $98,198. Our accounts payable and accrued expense was $715,154. In addition the Company liabilities included convertible notes of $11,250 and due related parties of $170,000.

We have no revenues to satisfy our ongoing liabilities, however it is not known how much and the timing of the receipts of revenue. Our auditors have issued a going concern opinion. Unless we secure additional equity or debt financing, of which there can be no assurance, we may not be able to continue any operations.

Working Capital

Our total current assets, as of March 31, 2019, consisted of $131,472 in cash as compared to total current assets of $3,218 in cash as of March 31, 2020 and cash of $432 as of June 30, 2020. The decrease in current assets was due to the lack of funding during the year ended March 31, 2020 plus the three months ended June 30, 2020.

Our total current liabilities as of March 31, 2019 were $613,636 as compared to total current liabilities of $2,878,922 as of March 31, 2020 The increase in current liabilities was primarily attributed to due related parties of $1,283,607 for accrual of amounts due per contract, derivative liability of $603,836 verse none in 2019 and notes payable for convertible note of $88,815 net of discount and note payable of $50,000.

Total current liabilities as of September 30, 2020 consisted of accounts payable and accrued expense was $715,154. In addition the Company liabilities included convertible notes of $11,250 and due related parties of $170,000.

As of March 31, 2019, the Company’s negative working capital was $482,164 compared to negative working capital of $2,875,704 as of March 31, 2020. The increase in negative working capital of $2,396,758 from 2019 to 2020 can be attributed to additional costs with the convertible debt fair value valuation of $603,836, increase payables and accrued expenses of $327,028 and the increase of accrual due related parties of $1,195,607.

As of September 30 ,2020 the Company’s negative working capital was $811,012.

| 20 |

| Table of Contents |

Cash Flows

Operating Activities

Cash used in operating activities was $711,808 for the fiscal year ended March 31, 2019 compared to cash used in operating activities of $554,325 for the fiscal year ended March 31, 2020. The decrease in cash used in operating activities is attributed mainly to increased stock based compensation, the change in fair value of the derivative liability and accrual of amounts due related parties plus increased accounts payable in 2020 over 2019.

Cash used in operating activities for the six months periods ending September 30, 2020 and 2019 were $594,020 and $237,072, respectively. Lower losses in the six month period in 2019 accounted for lower cash use over 2020.

Investing Activities

Cash used in investing activities was zero for the fiscal years ended March 31, 2020 and 2019 and the interim period ended September 30, 2020.

Financing Activities

Cash provided by financing activities during the fiscal year ended March 31, 2019 was $726,286, compared to $426,071 for the fiscal year ended March 31, 2020. The cash provided by financing activities is due to the sale of common stock of $115,000, sale of preferred shares for $110,000, proceeds from convertible note of $150,000, proceeds from note payable of $50,000, and conversion of warrants of $1,071 in 2020 compared to the sale of common stock and warrants of $643,000 and the exercise of warrants of $83,286 for the same period in 2019.