UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM | |||||

(Mark One) | |||||||||||

| QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |||||||||||

For the quarterly period ended June 29, 2024

OR

| TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |||||

For the transition period from to

Commission file numbers:

| (Exact name of registrant as specified in its charter) | ||

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | |||||||

| (Zip Code) | ||||||||

| (Address of principal executive offices) | ||||||||

Registrant's telephone number, including area code: (303 ) 893-0012

Not Applicable

(Former name, former address and former fiscal year, if changed since last report)

| Securities registered pursuant to Section 12(b) of the Act: | ||||||||||||||

| Title of each class | Trading symbol(s) | Name of each exchange on which registered | ||||||||||||

| Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. | ||||||||||||||||||||||||||||||||

| ☒ | No | ☐ | ||||||||||||||||||||||||||||||

| Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S‑T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). | ||||||||||||||||||||||||||||||||

| ☒ | No | ☐ | ||||||||||||||||||||||||||||||

| Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act. | ||||||||||||||||||||||||||||||||

| ☒ | Accelerated filer | ☐ | ||||||||||||||||||||||||||||||

| Non-accelerated filer | ☐ | Smaller reporting company | ||||||||||||||||||||||||||||||

| Emerging growth company | ||||||||||||||||||||||||||||||||

| If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. | ||||||||||||||||||||||||||||||||

| Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). | ||||||||||||||||||||||||||||||||

| Yes | ☐ | No | ||||||||||||||||||||||||||||||

As of August 2, 2024, the number of shares of Summit Materials, Inc.’s outstanding Class A and Class B common stock, par value $0.01 per share for each class, was 175,586,471 and 0 , respectively.

EXPLANATORY NOTE

Summit Materials, Inc. a Delaware Corporation ("Summit Inc." and, together with its subsidiaries, "Summit," "we," "us," "our" or "the Company").

Summit Inc. was formed on September 23, 2014 to be a holding company. As of June 29, 2024, it held 100.0% of the economic interest and 100% of the voting rights of Summit Materials Holdings L.P., a Delaware limited partnership (“Summit Holdings”), which is the indirect parent of Summit Materials, LLC ("Summit LLC"). Summit LLC is a co-issuer of our outstanding 6 1/2 % senior notes due 2027 (“2027 Notes”), our 5 1/4% senior notes due 2029 (“2029 Notes”) and our 7 1/4% senior notes due 2031 (“2031 Notes” collectively with the 2027 Notes and 2029 Notes, the “Senior Notes”) and borrower under our senior credit facilities. Summit Inc. controls all of the business and affairs of Summit Holdings and, in turn, Summit LLC.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This report includes “forward-looking statements” within the meaning of the federal securities laws, which involve risks and uncertainties. Forward-looking statements include all statements that do not relate solely to historical or current facts, and you can identify forward-looking statements because they contain words such as “believes,” “expects,” “may,” “will,” “should,” “seeks,” “intends,” “trends,” “plans,” “estimates,” “projects” or “anticipates” or similar expressions that concern our strategy, plans, expectations or intentions. All statements made relating to our estimated and projected earnings, margins, costs, expenditures, cash flows, growth rates and financial results are forward-looking statements. These forward-looking statements are subject to risks, uncertainties and other factors that may cause our actual results, performance or achievements to be materially different from future results, performance or achievements expressed or implied by such forward-looking statements. We derive many of our forward-looking statements from our operating budgets and forecasts, which are based upon many detailed assumptions. While we believe that our assumptions are reasonable, it is very difficult to predict the effect of known factors, and, of course, it is impossible to anticipate all factors that could affect our actual results. In light of the significant uncertainties inherent in the forward-looking statements included herein, the inclusion of such information should not be regarded as a representation by us or any other person that the results or conditions described in such statements or our objectives and plans will be realized. Important factors could affect our results and could cause results to differ materially from those expressed in our forward-looking statements, including but not limited to the factors discussed in the section entitled “Risk Factors” in Summit Inc.’s Annual Report on Form 10-K for the fiscal year ended December 30, 2023 (the “Annual Report”), as filed with the Securities and Exchange Commission (the “SEC”), the factors discussed in the section entitled “Risk Factors” of this report and the following:

•our dependence on the construction industry and the strength of the local economies in which we operate, including residential;

•the cyclical nature of our business;

•risks related to weather and seasonality;

•risks associated with our capital-intensive business;

•competition within our local markets;

•risks related to the integration of Argos USA and realization of intended benefits within the intended timeframe;

•our ability to execute on our acquisition strategy and portfolio optimization strategy and, successfully integrate acquisitions with our existing operations;

•our dependence on securing and permitting aggregate reserves in strategically located areas;

•the impact of rising interest rates;

•declines in public infrastructure construction and delays or reductions in governmental funding, including the funding by transportation authorities, the federal government and other state agencies particularly;

•our reliance on private investment in infrastructure, which may be adversely affected by periods of economic stagnation and recession;

•environmental, health, and safety laws or governmental requirements or policies concerning zoning and land use;

•rising prices for, or more limited availability of, commodities, labor and other production and delivery inputs as a result of inflation, supply chain challenges or otherwise;

•our ability to accurately estimate the overall risks, requirements or costs when we bid on or negotiate contracts that are ultimately awarded to us;

•material costs and losses as a result of claims that our products do not meet regulatory requirements or contractual specifications;

•cancellation of a significant number of contracts or our disqualification from bidding for new contracts;

•special hazards related to our operations that may cause personal injury or property damage not covered by insurance;

•unexpected factors affecting self-insurance claims and reserve estimates;

•our current level of indebtedness, including our exposure to variable interest rate risk;

•potential incurrence of substantially more debt;

•restrictive covenants in the instruments governing our debt obligations;

•our dependence on senior management and other key personnel, and our ability to retain and attract qualified personnel;

•supply constraints or significant price fluctuations in the coal, electricity, diesel fuel, natural gas, liquid asphalt and other petroleum‑based resources that we use;

•climate change and climate change legislation or other regulations;

•evolving corporate governance and corporate disclosure regulations and expectations, including with respect to environmental, social and governance matters;

•unexpected operational failures or difficulties;

•costs associated with pending and future litigation;

•interruptions in our information technology systems and infrastructure, including cybersecurity and data leakage risks;

•potential labor disputes, strikes, other forms of work stoppage or other union activities; and

•material or adverse effects related to the Argos USA combination.

All subsequent written and oral forward-looking statements attributable to us, or persons acting on our behalf, are expressly qualified in their entirety by these cautionary statements.

Any forward-looking statement that we make herein speaks only as of the date of this report. We undertake no obligation to publicly update or revise any forward-looking statement as a result of new information, future events or otherwise, except as required by law.

SUMMIT MATERIALS, INC.

FORM 10-Q

TABLE OF CONTENTS

| Page No. | ||||||||

PART I—Financial Information | ||||||||

Consolidated Balance Sheets as of June 29, 2024 (unaudited) and December 30, 2023 | ||||||||

Unaudited Consolidated Statements of Operations for the three and six months ended June 29, 2024 and July 1, 2023 | ||||||||

Unaudited Consolidated Statements of Comprehensive Income for the three and six months ended June 29, 2024 and July 1, 2023 | ||||||||

Unaudited Consolidated Statements of Cash Flows for the six months ended June 29, 2024 and July 1, 2023 | ||||||||

Unaudited Consolidated Statements of Changes in Stockholders’ Equity for the three and six months ended June 29, 2024 and July 1, 2023 | ||||||||

PART II — Other Information | ||||||||

PART I—FINANCIAL INFORMATION

ITEM 1. FINANCIAL STATEMENTS

SUMMIT MATERIALS, INC. AND SUBSIDIARIES

Consolidated Balance Sheets

(In thousands, except share and per share amounts)

| June 29, 2024 | December 30, 2023 | ||||||||||

| (unaudited) | (audited) | ||||||||||

| Assets | |||||||||||

| Current assets: | |||||||||||

| Cash and cash equivalents | $ | $ | |||||||||

| Restricted cash | |||||||||||

| Accounts receivable, net | |||||||||||

| Costs and estimated earnings in excess of billings | |||||||||||

| Inventories | |||||||||||

| Other current assets | |||||||||||

| Current assets held for sale | |||||||||||

| Total current assets | |||||||||||

Property, plant and equipment, less accumulated depreciation, depletion and amortization (June 29, 2024 - $ | |||||||||||

| Goodwill | |||||||||||

Intangible assets, less accumulated amortization (June 29, 2024 - $ | |||||||||||

Deferred tax assets, less valuation allowance (June 29, 2024 - $ | |||||||||||

| Operating lease right-of-use assets | |||||||||||

| Other assets | |||||||||||

| Total assets | $ | $ | |||||||||

| Liabilities and Stockholders’ Equity | |||||||||||

| Current liabilities: | |||||||||||

| Current portion of debt | $ | $ | |||||||||

| Current portion of acquisition-related liabilities | |||||||||||

| Accounts payable | |||||||||||

| Accrued expenses | |||||||||||

| Current operating lease liabilities | |||||||||||

| Billings in excess of costs and estimated earnings | |||||||||||

| Total current liabilities | |||||||||||

| Long-term debt | |||||||||||

| Acquisition-related liabilities | |||||||||||

| Tax receivable agreement liability | |||||||||||

| Deferred tax liabilities | |||||||||||

| Noncurrent operating lease liabilities | |||||||||||

| Other noncurrent liabilities | |||||||||||

| Total liabilities | |||||||||||

| Commitments and contingencies (see note 12) | |||||||||||

| Stockholders’ equity: | |||||||||||

Class A common stock, par value $ | |||||||||||

Class B common stock, par value $ | |||||||||||

Preferred Stock, par value $ | |||||||||||

| Additional paid-in capital | |||||||||||

| Accumulated earnings | |||||||||||

| Accumulated other comprehensive income | |||||||||||

| Stockholders’ equity | |||||||||||

| Noncontrolling interest in Summit Holdings | |||||||||||

| Total stockholders’ equity | |||||||||||

| Total liabilities and stockholders’ equity | $ | $ | |||||||||

See notes to unaudited consolidated financial statements.

1

SUMMIT MATERIALS, INC. AND SUBSIDIARIES

Unaudited Consolidated Statements of Operations

(In thousands, except share and per share amounts)

| Three months ended | Six months ended | ||||||||||||||||||||||

| June 29, 2024 | July 1, 2023 | June 29, 2024 | July 1, 2023 | ||||||||||||||||||||

| Revenue: | |||||||||||||||||||||||

| Product | $ | $ | $ | $ | |||||||||||||||||||

| Service | |||||||||||||||||||||||

| Net revenue | |||||||||||||||||||||||

| Delivery and subcontract revenue | |||||||||||||||||||||||

| Total revenue | |||||||||||||||||||||||

| Cost of revenue (excluding items shown separately below): | |||||||||||||||||||||||

| Product | |||||||||||||||||||||||

| Service | |||||||||||||||||||||||

| Net cost of revenue | |||||||||||||||||||||||

| Delivery and subcontract cost | |||||||||||||||||||||||

| Total cost of revenue | |||||||||||||||||||||||

| General and administrative expenses | |||||||||||||||||||||||

| Depreciation, depletion, amortization and accretion | |||||||||||||||||||||||

| Transaction and integration costs | |||||||||||||||||||||||

| Gain on sale of property, plant and equipment | ( | ( | ( | ( | |||||||||||||||||||

| Operating income | |||||||||||||||||||||||

| Interest expense | |||||||||||||||||||||||

| Loss on debt financings | |||||||||||||||||||||||

| Gain on sale of businesses | ( | ( | |||||||||||||||||||||

| Other income, net | ( | ( | ( | ( | |||||||||||||||||||

| Income from operations before taxes | |||||||||||||||||||||||

| Income tax expense | |||||||||||||||||||||||

| Net income | |||||||||||||||||||||||

| Net income (loss) attributable to noncontrolling interest in Summit Holdings | ( | ||||||||||||||||||||||

| Net income attributable to Summit Inc. | $ | $ | $ | $ | |||||||||||||||||||

| Earnings per share of Class A common stock: | |||||||||||||||||||||||

| Basic | $ | $ | $ | $ | |||||||||||||||||||

| Diluted | $ | $ | $ | $ | |||||||||||||||||||

| Weighted average shares of Class A common stock: | |||||||||||||||||||||||

| Basic | |||||||||||||||||||||||

| Diluted | |||||||||||||||||||||||

See notes to unaudited consolidated financial statements.

2

SUMMIT MATERIALS, INC. AND SUBSIDIARIES

Unaudited Consolidated Statements of Comprehensive Income

(In thousands)

| Three months ended | Six months ended | ||||||||||||||||||||||

| June 29, 2024 | July 1, 2023 | June 29, 2024 | July 1, 2023 | ||||||||||||||||||||

| Net income | $ | $ | $ | $ | |||||||||||||||||||

| Other comprehensive income (loss): | |||||||||||||||||||||||

| Foreign currency translation adjustment | ( | ( | |||||||||||||||||||||

| Less tax effect of other comprehensive income (loss) items | ( | ( | |||||||||||||||||||||

| Other comprehensive (loss) income | ( | ( | |||||||||||||||||||||

| Comprehensive income | |||||||||||||||||||||||

| Less comprehensive income (loss) attributable to Summit Holdings | ( | ||||||||||||||||||||||

| Comprehensive income attributable to Summit Inc. | $ | $ | $ | $ | |||||||||||||||||||

See notes to unaudited consolidated financial statements.

3

SUMMIT MATERIALS, INC. AND SUBSIDIARIES

Unaudited Consolidated Statements of Cash Flows

(In thousands)

| Six months ended | |||||||||||

| June 29, 2024 | July 1, 2023 | ||||||||||

| Cash flows from operating activities: | |||||||||||

| Net income | $ | $ | |||||||||

| Adjustments to reconcile net income to net cash provided by operating activities: | |||||||||||

| Depreciation, depletion, amortization and accretion | |||||||||||

| Share-based compensation expense | |||||||||||

| Net gain on asset and business disposals | ( | ( | |||||||||

| Non-cash loss on debt financings | |||||||||||

| Change in deferred tax asset, net | |||||||||||

| Other | ( | ||||||||||

| Decrease (increase) in operating assets, net of acquisitions and dispositions: | |||||||||||

| Accounts receivable, net | ( | ( | |||||||||

| Inventories | ( | ( | |||||||||

| Costs and estimated earnings in excess of billings | ( | ( | |||||||||

| Other current assets | ( | ||||||||||

| Other assets | |||||||||||

| (Decrease) increase in operating liabilities, net of acquisitions and dispositions: | |||||||||||

| Accounts payable | |||||||||||

| Accrued expenses | ( | ||||||||||

| Billings in excess of costs and estimated earnings | ( | ||||||||||

| Tax receivable agreement (benefit) expense | ( | ||||||||||

| Other liabilities | ( | ( | |||||||||

| Net cash provided by operating activities | |||||||||||

| Cash flows from investing activities: | |||||||||||

| Acquisitions, net of cash acquired | ( | ( | |||||||||

| Purchase of intellectual property | ( | ||||||||||

| Purchases of property, plant and equipment | ( | ( | |||||||||

| Proceeds from the sale of property, plant and equipment | |||||||||||

| Proceeds from sale of businesses | |||||||||||

| Other | ( | ( | |||||||||

| Net cash used in investing activities | ( | ( | |||||||||

| Cash flows from financing activities: | |||||||||||

| Proceeds from debt issuances | |||||||||||

| Debt issuance costs | ( | ( | |||||||||

| Payments on debt | ( | ( | |||||||||

| Payments on acquisition-related liabilities | ( | ( | |||||||||

| Proceeds from stock option exercises | |||||||||||

| Other | ( | ( | |||||||||

| Net cash provided by (used in) financing activities | ( | ||||||||||

| Impact of foreign currency on cash | ( | ||||||||||

| Net decrease in cash and cash equivalents and restricted cash | ( | ( | |||||||||

| Cash and cash equivalents and restricted cash—beginning of period | |||||||||||

| Cash and cash equivalents and restricted cash—end of period | $ | $ | |||||||||

See notes to unaudited consolidated financial statements.

4

SUMMIT MATERIALS, INC. AND SUBSIDIARIES

Unaudited Consolidated Statements of Changes in Stockholders’ Equity

(In thousands, except share amounts)

| Summit Materials, Inc. | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Accumulated | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Other | Class A | Class B | Additional | Noncontrolling | Total | ||||||||||||||||||||||||||||||||||||||||||||||||

| Accumulated | Comprehensive | Common Stock | Common Stock | Paid-in | Interest in | Stockholders’ | |||||||||||||||||||||||||||||||||||||||||||||||

| Earnings | income | Shares | Dollars | Shares | Dollars | Capital | Summit Holdings | Equity | |||||||||||||||||||||||||||||||||||||||||||||

| Balance - December 30, 2023 | $ | $ | $ | $ | $ | $ | $ | ||||||||||||||||||||||||||||||||||||||||||||||

| Net loss | ( | — | — | — | — | — | — | ( | ( | ||||||||||||||||||||||||||||||||||||||||||||

| LP Unit exchanges | — | — | — | — | ( | ||||||||||||||||||||||||||||||||||||||||||||||||

| Other comprehensive loss, net of tax | — | ( | — | — | — | — | — | — | ( | ||||||||||||||||||||||||||||||||||||||||||||

| Stock option exercises | — | — | — | — | — | — | |||||||||||||||||||||||||||||||||||||||||||||||

| Class B share cancellation | — | — | — | — | ( | — | — | — | — | ||||||||||||||||||||||||||||||||||||||||||||

| Share-based compensation | — | — | — | — | — | — | — | ||||||||||||||||||||||||||||||||||||||||||||||

| Issuance of Class A Shares | — | — | — | — | — | ||||||||||||||||||||||||||||||||||||||||||||||||

| Shares redeemed to settle taxes and other | — | — | — | — | ( | ( | |||||||||||||||||||||||||||||||||||||||||||||||

| Balance — March 30, 2024 | $ | $ | $ | $ | $ | $ | $ | ||||||||||||||||||||||||||||||||||||||||||||||

| Net income | — | — | — | — | — | — | — | ||||||||||||||||||||||||||||||||||||||||||||||

| Other comprehensive loss, net of tax | — | ( | — | — | — | — | — | — | ( | ||||||||||||||||||||||||||||||||||||||||||||

| Stock option exercises | — | — | — | — | — | ||||||||||||||||||||||||||||||||||||||||||||||||

| Share-based compensation | — | — | — | — | — | — | — | ||||||||||||||||||||||||||||||||||||||||||||||

| Shares redeemed to settle taxes and other | — | — | — | — | — | ||||||||||||||||||||||||||||||||||||||||||||||||

| Balance - June 29, 2024 | $ | $ | $ | $ | $ | $ | $ | ||||||||||||||||||||||||||||||||||||||||||||||

5

| Summit Materials, Inc. | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Accumulated | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Other | Class A | Class B | Additional | Noncontrolling | Total | ||||||||||||||||||||||||||||||||||||||||||||||||

| Accumulated | Comprehensive | Common Stock | Common Stock | Paid-in | Interest in | Stockholders’ | |||||||||||||||||||||||||||||||||||||||||||||||

| Earnings | income | Shares | Dollars | Shares | Dollars | Capital | Summit Holdings | Equity | |||||||||||||||||||||||||||||||||||||||||||||

| Balance — December 31, 2022 | $ | $ | $ | $ | $ | $ | $ | ||||||||||||||||||||||||||||||||||||||||||||||

| Net loss | ( | — | — | — | — | — | — | ( | ( | ||||||||||||||||||||||||||||||||||||||||||||

| LP Unit exchanges | — | — | — | — | — | ( | |||||||||||||||||||||||||||||||||||||||||||||||

| Other comprehensive income, net of tax | — | — | — | — | — | — | |||||||||||||||||||||||||||||||||||||||||||||||

| Stock option exercises | — | — | — | — | — | — | |||||||||||||||||||||||||||||||||||||||||||||||

| Share-based compensation | — | — | — | — | — | — | — | ||||||||||||||||||||||||||||||||||||||||||||||

| Shares redeemed to settle taxes and other | — | — | — | — | ( | ( | ( | ||||||||||||||||||||||||||||||||||||||||||||||

| Balance — April 1, 2023 | $ | $ | $ | $ | $ | $ | $ | ||||||||||||||||||||||||||||||||||||||||||||||

| Net income | — | — | — | — | — | — | |||||||||||||||||||||||||||||||||||||||||||||||

| Other comprehensive income, net of tax | — | — | — | — | — | — | |||||||||||||||||||||||||||||||||||||||||||||||

| Stock option exercises | — | — | — | — | — | — | |||||||||||||||||||||||||||||||||||||||||||||||

| Share-based compensation | — | — | — | — | — | — | — | ||||||||||||||||||||||||||||||||||||||||||||||

| Shares redeemed to settle taxes and other | — | — | — | — | ( | ||||||||||||||||||||||||||||||||||||||||||||||||

| Balance — July 1, 2023 | $ | $ | $ | $ | $ | $ | $ | ||||||||||||||||||||||||||||||||||||||||||||||

See notes to unaudited consolidated financial statements.

6

SUMMIT MATERIALS, INC. AND SUBSIDIARIES

NOTES TO UNAUDITED CONSOLIDATED FINANCIAL STATEMENTS

(Dollars in tables in thousands, except per share amounts or otherwise noted)

1.SUMMARY OF ORGANIZATION AND SIGNIFICANT ACCOUNTING POLICIES

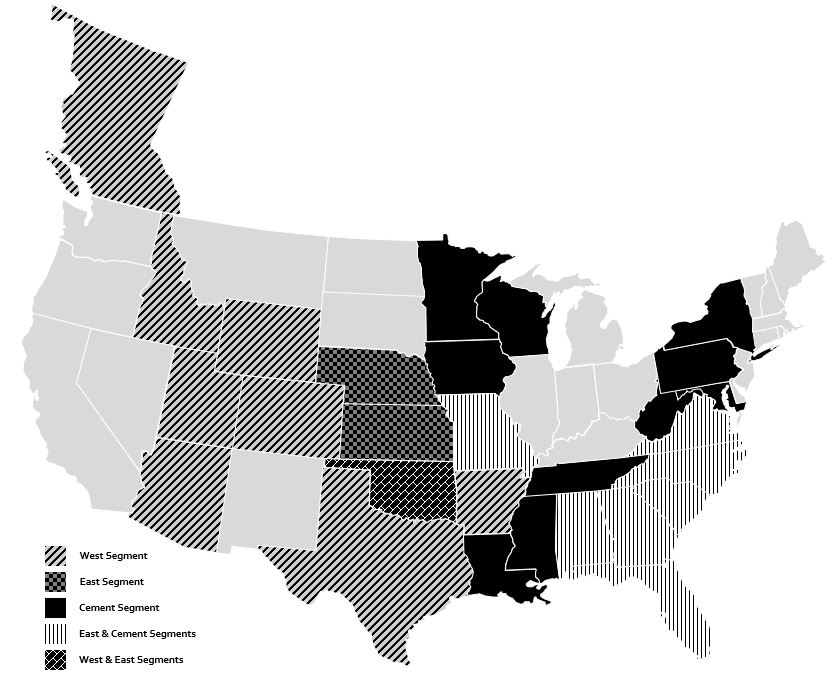

Summit Materials, Inc. ("Summit Inc." and together with its subsidiaries, "Summit," "we," "our" or the Company") is a vertically-integrated construction materials company. The Company is engaged in the production and sale of aggregates, cement, ready-mix concrete, asphalt paving mix and concrete products and owns and operates quarries, sand and gravel pits, six cement plants, cement distribution terminals, ready-mix concrete plants, asphalt plants and landfill sites. It is also engaged in paving and related services. The Company’s three

Substantially all of the Company’s construction materials, products and services are produced, consumed and performed outdoors, primarily in the spring, summer and fall. Seasonal changes and other weather-related conditions can affect the production and sales volumes of its products and delivery of services. Therefore, the financial results for any interim period are typically not indicative of the results expected for the full year. Furthermore, the Company’s sales and earnings are sensitive to national, regional and local economic conditions, weather conditions and to cyclical changes in construction spending, among other factors.

On September 23, 2014, Summit Inc. was formed as a Delaware corporation to be a holding company. As of March 30, 2024, Summit Inc. held 100% of the economic interests and voting power of Summit Materials Holdings L.P. (“Summit Holdings”). Pursuant to a reorganization into a holding company structure (the “Reorganization”) consummated in connection with Summit Inc.’s March 2015 initial public offering ("IPO"), Summit Inc. became a holding corporation operating and controlling all of the business and affairs of Summit Holdings and its subsidiaries. Summit Inc. directly and indirectly owns all of the partnership interests of Summit Holdings (see note 9, Stockholders’ Equity). Summit Materials, LLC (“Summit LLC”) an indirect wholly owned subsidiary of Summit Holdings, conducts the majority of our operations. Summit Materials Finance Corp. (“Summit Finance”), an indirect wholly owned subsidiary of Summit LLC, has jointly issued our Senior Notes as described below.

On January 12, 2024, Summit completed a combination with Argos North America Corp. ("Argos USA"), Cementos Argos S.A. ("Cementos Argos"), Argos SEM LLC and Valle Cement Investments, Inc. (the "Argos Parties," and together with Argos USA, "Argos"), pursuant to which Summit acquired all of the outstanding equity interests (the "Transaction") of Argos USA from the Argos SEM LLC and Valle Cement Investments, Inc. in exchange for $1.2 billion of cash, the issuance of 54,720,000 shares of the Summit Inc.'s Class A common stock and one preferred share in a transaction valued at approximately $3.1 billion. The cash consideration was funded from the net proceeds of an $800 million offering of Senior Notes due 2031 and new term loan borrowings under our current credit facility. The purchase price is subject to customary adjustments, with any upward or downward adjustments made against the cash consideration. The Transaction Agreement, dated as of September 7, 2023, contains customary representations and warranties, covenants and agreements, including a Stockholder Agreement. For additional details related to the Transaction, see Note 2, Acquisitions, Dispositions, Goodwill and Intangibles.

Basis of Presentation—These unaudited consolidated financial statements were prepared in accordance with U.S. generally accepted accounting principles (“U.S. GAAP”) for interim financial information, without audit, pursuant to the rules and regulations of the Securities and Exchange Commission (“SEC”). Certain information and footnote disclosures typically included in financial statements prepared in accordance with U.S. GAAP have been condensed or omitted pursuant to such rules and regulations. These unaudited consolidated financial statements should be read in conjunction with the Company's audited consolidated financial statements and the notes thereto as of and for the year ended December 30, 2023. The Company continues to follow the accounting policies set forth in those audited consolidated financial statements.

Management believes that these consolidated interim financial statements include all adjustments, normal and recurring in nature, that are necessary to present fairly the financial position of the Company as of June 29, 2024, the results of operations for the three and six months ended June 29, 2024 and July 1, 2023 and cash flows for the six months ended June 29, 2024 and July 1, 2023.

7

Principles of Consolidation—The consolidated financial statements include the accounts of Summit Inc. and its majority owned subsidiaries. All intercompany balances and transactions have been eliminated.

For a summary of the changes in Summit Inc.’s ownership of Summit Holdings, see Note 9, Stockholders’ Equity.

Use of Estimates—Preparation of these consolidated financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions. These estimates and the underlying assumptions affect the amounts of assets and liabilities reported, disclosures about contingent assets and liabilities and reported amounts of revenue and expenses. Such estimates include the valuation of accounts receivable, inventories, valuation of deferred tax assets, goodwill, intangibles and other long-lived assets, tax receivable agreement ("TRA") liability, pension and other postretirement obligations and asset retirement obligations. Estimates also include revenue earned on contracts and costs to complete contracts. Most of the Company’s paving and related services are performed under fixed unit-price contracts with state and local governmental entities. Management regularly evaluates its estimates and assumptions based on historical experience and other factors, including the current economic environment. As future events and their effects cannot be determined with precision, actual results can differ significantly from estimates made. Changes in estimates, including those resulting from continuing changes in the economic environment, are reflected in the Company’s consolidated financial statements when the change in estimate occurs.

Revenue Recognition—We earn revenue from the sale of products, which primarily include aggregates, cement, ready-mix concrete and asphalt, but also include concrete products and plastics components, and from the provision of services, which are primarily paving and related services, but also include landfill operations, the receipt and disposal of waste that is converted to fuel for use in our cement plants.

Products: Revenue for product sales is recognized when the performance obligation is satisfied, which generally is when the product is shipped.

Services: We earn revenue from the provision of services, which are primarily paving and related services, which are typically calculated using monthly progress based on a method similar to percentage of completion or a customer’s engineer review of progress.

The majority of our construction service contracts are completed within one year, but may occasionally extend beyond this time frame. The majority of our construction service contracts are for work that occurs mostly during the spring, summer and fall. We generally measure progress toward completion on long-term paving and related services contracts based on the proportion of costs incurred to date relative to total estimated costs at completion.

Estimating costs to be incurred for revenue recognition involves the use of various estimating techniques to project costs at completion, and in some cases includes estimates of recoveries asserted against the customer for changes in specifications or other disputes.

Earnings per Share—The Company computes basic earnings per share attributable to stockholders by dividing income attributable to Summit Inc. by the weighted-average shares of Class A common stock outstanding. Diluted earnings per share reflects the potential dilution beyond shares for basic earnings per share that could occur if securities or other contracts to issue common stock were exercised, converted into common stock, or resulted in the issuance of common stock that would have shared in the Company’s earnings. In addition, as the shares of Class A common stock are issued by Summit Inc., the earnings and equity interests of noncontrolling interests are not included in basic earnings per share.

Prior Year Reclassifications — We have reclassified transaction costs of $1.7 million and $2.1 million for the three and six months ended July 1, 2023, respectively, from general and administrative expenses to a separate line item included in operating income to conform to the current year presentation. We have also reclassified our deferred tax liabilities of $15.9 million as of December 30, 2023, from other non-current liabilities to a separate line item in long term liabilities.

8

2.ACQUISITIONS, DISPOSITIONS, GOODWILL AND INTANGIBLES

Acquisition of Argos USA

On January 12, 2024, Summit completed its acquisition of all of the outstanding equity interests of Argos USA from Argos SEM LLC and Valle Cement Investments, Inc. for total consideration of approximately $3.1 billion. Summit acquired all of the outstanding equity interests of Argos USA in exchange for (i) $1.2 billion of cash (subject to customary adjustments), (ii) 54,720,000 shares of Class A Common Stock and (iii) one share of preferred stock, par value $0.01 per share, of Summit Inc. (together with the Class A Consideration, the “Stock Consideration”).

The Argos USA assets include four integrated cement plants, two grinding facilities, 140 ready-mix concrete plants, eight ports and 10 inland terminals across the East and Gulf Coast regions, with a total installed cement grinding capacity of 9.6 million tons per annum and a total import capacity of 5.4 million tons of cement per annum.

The results of Argos USA’s operations are included in these consolidated financial statements from the closing date of the Transaction. Argos USA revenues and net income included in the consolidated income statement for the period from January 12, 2024 to June 29, 2024 was $805.9 million and $81.8 million, respectively.

The following table includes unaudited pro forma financial information that presents the consolidated results of operations for the three and six months ended June 29, 2024 and July 1, 2023 as if the Transaction had occurred on January 1, 2023.

| Three months ended | Six months ended | ||||||||||||||||||||||

| June 29, 2024 | July 1, 2023 | June 29, 2024 | July 1, 2023 | ||||||||||||||||||||

| Total Revenues | $ | $ | $ | $ | |||||||||||||||||||

| Net income attributable to Summit Inc. | $ | $ | $ | $ | |||||||||||||||||||

The unaudited pro forma information has been calculated after adjusting the results of Argos USA for the following impacts of the Transaction, among other items:

•Additional depreciation, depletion, and amortization for property, plant, and equipment and intangible assets acquired.

•Interest expense adjustments to reflect the payoff of Argos USA debt obligations and new debt issued by the Company to complete the Transaction.

•Elimination of royalties expenses paid to the parent of Argos USA which will not be incurred post-combination.

•Elimination of historical transaction expenses of Argos USA incurred to pursue an initial public offering.

The Company incurred combination-related costs of $71.0 million in the six months ended June 29, 2024 and none for the six months ended July 1, 2023. These expenses are included in transaction and integration costs on consolidated income statement and are reflected in pro forma net income attributable to Summit Inc. for the six months ended July 1, 2023 in the table above. The pro forma results do not include any cost savings or associated costs to achieve such savings from operating efficiencies or synergies that may result from the combination.

The unaudited pro forma financial information is provided for informational purposes only and is not necessarily indicative of the consolidated results of operations of the Company had the combination actually occurred on January 1, 2023, nor of the results of our future operations of the combined business. The pro forma results are based on the preliminary purchase price allocation and will be updated to reflect the final amounts as the allocation is finalized during the measurement period.

Fair value of consideration transferred

| Cash consideration | $ | ||||

| Fair value of stock consideration issued | |||||

| Total fair value of consideration transferred | $ | ||||

Summit Inc. issued 54,720,000 shares of common stock and calculated the fair value of stock consideration using a per share price of $36.07 on January 12, 2024, the closing date of the Transaction. The fair value of preferred stock is immaterial.

The preferred stock is non-transferable and has no economic rights or ordinary voting rights. The preferred stock was issued to ensure the Argos Parties’ voting interests are not involuntarily diluted and provides a short window to purchase shares of Class A Common Stock in the market, in certain limited circumstances, to prevent the Argos Parties voting interests from dropping below 25.01 % of the total Summit common stock.

9

Argos USA Preliminary Purchase Price Allocation

The acquisition of all of the outstanding equity interests of Argos USA was accounted for in accordance with Accounting Standards Codification 805, Business Combinations. The identifiable assets acquired and liabilities assumed were recorded at their estimated preliminary acquisition date fair values. The excess purchase price over the fair values of identifiable assets and liabilities is recorded as goodwill. The following table summarizes the preliminary allocation of the purchase price to the fair value of assets acquired and liabilities assumed.

| Purchase Price | $ | ||||

| Asset acquired: | |||||

| Cash and cash equivalents | |||||

| Accounts receivable, net | |||||

| Inventories | |||||

| Other current assets | |||||

| Intangible assets, net | |||||

| Property, plant and equipment, net | |||||

| Operating lease right of use assets | |||||

| Other assets | |||||

| Liabilities assumed: | |||||

| Accounts payable | ( | ||||

| Accrued expenses | ( | ||||

| Current operating lease liabilities | ( | ||||

| Noncurrent operating lease liabilities | ( | ||||

| Deferred tax liabilities | ( | ||||

| Other noncurrent liabilities | ( | ||||

| Fair value of identifiable net assets acquired | |||||

| Goodwill | $ | ||||

The purchase price has been preliminarily allocated to the assets acquired and liabilities assumed based on their estimated fair values as of the acquisition date. The fair value estimates of assets acquired and liabilities assumed are pending the completion of various items, including obtaining further information regarding the identification and valuation of all assets acquired and liabilities assumed.

Certain of the more significant balances that are not yet finalized include the valuation of property, plant and equipment, intangible assets (including goodwill), inventories, and other working capital accounts, and related income tax considerations. Accordingly, management considers the balances above to be preliminary, and there could be adjustments to the consolidated financial statements in subsequent periods, including changes to depreciation and amortization expense related to the property, plant, and equipment and intangible assets acquired and their respective useful lives, among other adjustments.

Certain measurement period adjustments were recorded in these consolidated financial statement due to the receipt of additional information and updated preliminary valuation reports. Significant adjustments during the three months ended June 29, 2024 included:

i.$92 million decrease in property, plant, and equipment and a $37 million increase in other noncurrent liabilities related to updated valuations due to revised information included in preliminary valuation reports.

ii.$38 million decrease in deferred tax liabilities related to the adjustments noted in (i.) above, among others.

The final determination of the fair values of the assets acquired and liabilities assumed will be completed within the measurement period of up to one year from the acquisition date.

The identified intangible assets acquired include Customer Relationships and Contractual Intangible Assets, with preliminary fair values of $85.0 million and $15.0 million, respectively, and expected to be amortized over a weighted average amortization period of 3 and 8 years, respectively.

Goodwill

10

Goodwill recognized includes synergies expected to be achieved from the operations of the combined company, the assembled workforce of Argos USA, and intangible assets that do not qualify for separate recognition. Expected synergies include both increased revenue opportunities and the cost savings from the planned integration of platform infrastructure, facilities, personnel, and systems. The transaction is considered a non-taxable business combination and the goodwill is not deductible for tax purposes. The allocation of goodwill to the Company’s reporting units is not complete and is subject to change during the measurement period. On a preliminary basis, all goodwill was assigned to the Cement reportable segment.

Intellectual Property License Agreement

In connection with the Transaction, the Company and Argos USA entered into an Intellectual Property License Agreement with the Argos Parties pursuant to which the parties will grant each other various intellectual property licenses. Certain intellectual property licenses from the Argos Parties, including the "Argos" trade name in Canada and the United States, are provided on a royalty-fee basis. The $21.4 million paid to Argos Parties, which is also the fair value of these intangible assets acquired by the Company was excluded and recorded separately from the business combination.

Other Acquisitions

The financial results of each acquisition have been included in the Company’s consolidated results of operations beginning on the respective closing dates of the acquisitions. The Company measures all assets acquired and liabilities assumed at their acquisition-date fair value. Goodwill acquired during a business combination has an indefinite life and is not amortized.

The following table summarizes the Company’s other acquisitions by region and period:

| Six months ended | Year ended | ||||||||||

| June 29, 2024 | December 30, 2023 | ||||||||||

| West* | |||||||||||

| East* | |||||||||||

| Cement* | |||||||||||

_______________________________________________________________________

* The combination with Argos USA affected all three reporting segments. In addition to the acquisition of all of the outstanding equity interests of Argos USA, we also acquired two aggregates-based operations, one in each of our West and East segments.

The purchase price allocation, primarily the valuation of property, plant and equipment, as well as considerations for contracts assumed in the acquisition, for the acquisitions completed during the six months ended June 29, 2024, as well as the acquisitions completed during 2023 that occurred after July 1, 2023, have not yet been finalized due to the recent timing of the acquisitions, status of the valuation of property, plant and equipment and finalization of related tax returns. The following table summarizes aggregated information regarding the fair values of the assets acquired and liabilities assumed as of the respective acquisition dates:

| Six months ended | Year ended | ||||||||||

| June 29, 2024 | December 30, 2023 | ||||||||||

| Financial assets | $ | $ | |||||||||

| Inventories | |||||||||||

| Property, plant and equipment | |||||||||||

| Other assets | |||||||||||

| Financial liabilities | ( | ( | |||||||||

| Other long-term liabilities | ( | ( | |||||||||

| Net assets acquired | |||||||||||

| Goodwill | |||||||||||

| Purchase price | |||||||||||

| Other | ( | ||||||||||

| Net cash paid for acquisitions | $ | $ | |||||||||

Changes in the carrying amount of goodwill, by reportable segment, from December 30, 2023 to June 29, 2024 are summarized as follows:

11

| West | East | Cement | Total | ||||||||||||||||||||

| Balance—December 30, 2023 | $ | $ | $ | $ | |||||||||||||||||||

| Acquisitions (1) | |||||||||||||||||||||||

| Dispositions (2) | ( | ( | |||||||||||||||||||||

| Foreign currency translation adjustments | ( | ( | |||||||||||||||||||||

| Balance—June 29, 2024 | $ | $ | $ | $ | |||||||||||||||||||

_______________________________________________________________________

(1) Reflects goodwill from 2024 acquisitions and working capital adjustments from prior year acquisitions.

(2) Reflects goodwill derecognition from dispositions completed during 2024.

The Company’s intangible assets subject to amortization are primarily composed of operating permits, mineral lease agreements and reserve rights. Operating permits relate to permitting and zoning rights acquired outside of a business combination. The assets related to mineral lease agreements reflect the submarket royalty rates paid under agreements, primarily for extracting aggregates. The values were determined as of the respective acquisition dates by a comparison of market-royalty rates. The reserve rights relate to aggregate reserves to which the Company has certain rights of ownership, but does not own the reserves. The intangible assets are amortized on a straight-line basis over the lives of the leases or permits. The following table shows intangible assets by type and in total:

| June 29, 2024 | December 30, 2023 | ||||||||||||||||||||||||||||||||||

| Gross Carrying Amount | Accumulated Amortization | Net Carrying Amount | Gross Carrying Amount | Accumulated Amortization | Net Carrying Amount | ||||||||||||||||||||||||||||||

| Operating permits | $ | $ | ( | $ | $ | $ | ( | $ | |||||||||||||||||||||||||||

| Mineral leases | ( | ( | |||||||||||||||||||||||||||||||||

| Reserve rights | ( | ( | |||||||||||||||||||||||||||||||||

| Intellectual property | ( | ||||||||||||||||||||||||||||||||||

| Other | ( | ( | |||||||||||||||||||||||||||||||||

| Total intangible assets | $ | $ | ( | $ | $ | $ | ( | $ | |||||||||||||||||||||||||||

Amortization expense totaled $11.0 million and $20.2 million for the three and six months ended June 29, 2024, respectively, and $0.9 million and $1.8 million for the three and six months ended July 1, 2023, respectively. The estimated amortization expense for the intangible assets for each of the five years subsequent to June 29, 2024 is as follows:

| 2024 (six months) | $ | ||||

| 2025 | |||||

| 2026 | |||||

| 2027 | |||||

| 2028 | |||||

| 2029 | |||||

| Thereafter | |||||

| Total | $ | ||||

3.REVENUE RECOGNITION

We derive our revenue predominantly by selling construction materials, products and providing paving and related services. Construction materials consist of aggregates and cement. Products consist of related downstream products, including ready-mix concrete, asphalt paving mix and concrete products. Paving and related service revenue is generated primarily from the asphalt paving services that we provide.

Revenue by product for the three and six months ended June 29, 2024 and July 1, 2023 is as follows:

12

| Three months ended | Six months ended | ||||||||||||||||||||||

| June 29, 2024 | July 1, 2023 | June 29, 2024 | July 1, 2023 | ||||||||||||||||||||

| Revenue by product*: | |||||||||||||||||||||||

| Aggregates | $ | $ | $ | $ | |||||||||||||||||||

| Cement | |||||||||||||||||||||||

| Ready-mix concrete | |||||||||||||||||||||||

| Asphalt | |||||||||||||||||||||||

| Paving and related services | |||||||||||||||||||||||

| Other | |||||||||||||||||||||||

| Total revenue | $ | $ | $ | $ | |||||||||||||||||||

*Revenue from liquid asphalt terminals is included in asphalt revenue.

Accounts receivable, net consisted of the following as of June 29, 2024 and December 30, 2023:

| June 29, 2024 | December 30, 2023 | ||||||||||

| Trade accounts receivable | $ | $ | |||||||||

| Construction contract receivables | |||||||||||

| Retention receivables | |||||||||||

| Accounts receivable | |||||||||||

| Less: Allowance for doubtful accounts | ( | ( | |||||||||

| Accounts receivable, net | $ | $ | |||||||||

Retention receivables are amounts earned by the Company but held by customers until paving and related service contracts and projects are near completion or fully completed. Amounts are generally billed and collected within one year .

4.INVENTORIES

Inventories consisted of the following as of June 29, 2024 and December 30, 2023:

| June 29, 2024 | December 30, 2023 | ||||||||||

| Aggregate stockpiles | $ | $ | |||||||||

| Finished goods | |||||||||||

| Work in process | |||||||||||

| Raw materials | |||||||||||

| Total | $ | $ | |||||||||

5.ACCRUED EXPENSES

Accrued expenses consisted of the following as of June 29, 2024 and December 30, 2023:

| June 29, 2024 | December 30, 2023 | ||||||||||

| Interest | $ | $ | |||||||||

| Payroll and benefits | |||||||||||

| Finance lease obligations | |||||||||||

| Insurance | |||||||||||

| Current portion of accrued taxes and TRA liability | |||||||||||

| Deferred asset purchase payments | |||||||||||

| Professional fees | |||||||||||

| Other (1) | |||||||||||

| Total | $ | $ | |||||||||

(1)Consists primarily of current portion of asset retirement obligations and miscellaneous accruals.

13

6.DEBT

Debt consisted of the following as of June 29, 2024 and December 30, 2023:

| June 29, 2024 | December 30, 2023 | ||||||||||

| Term Loan, due 2029: | |||||||||||

$ | $ | $ | |||||||||

61⁄2% Senior Notes, due 2027 | |||||||||||

51⁄4% Senior Notes, due 2029 | |||||||||||

71⁄4% Senior Notes, due 2031 | |||||||||||

| Total | |||||||||||

| Current portion of long-term debt | |||||||||||

| Long-term debt | $ | $ | |||||||||

The contractual payments of long-term debt, including current maturities, for the five years subsequent to June 29, 2024, are as follows:

| 2024 (six months) | $ | ||||

| 2025 | |||||

| 2026 | |||||

| 2027 | |||||

| 2028 | |||||

| 2029 | |||||

| Thereafter | |||||

| Total | |||||

| Less: Original issue net discount | ( | ||||

| Less: Deferred financing costs | ( | ||||

| Total debt | $ | ||||

Senior Notes— On December 14, 2023, Summit LLC and Summit Finance (together, the “Issuers”) issued $800.0 million in aggregate principal amount of 7.250 % senior notes due January 15, 2031 (the “2031 Notes”). The 2031 Notes were issued at 100.0 % of their par value with proceeds of $788.3 million, net of related fees and expenses. The 2031 Notes were issued under an indenture dated as of December 14, 2023 (the "2031 Notes Indenture"). The 2031 Notes Indenture contains covenants limiting, among other things, Summit LLC and its restricted subsidiaries’ ability to incur additional indebtedness or issue certain preferred shares, pay dividends, redeem stock or make other distributions, make certain investments, sell or transfer certain assets, create liens, consolidate, merge, sell or otherwise dispose of all or substantially all of its assets, enter into certain transactions with affiliates, and designate subsidiaries as unrestricted subsidiaries. The 2031 Notes Indenture also contains customary events of default. The gross proceeds of the 2031 Notes were held in escrow as of December 30, 2023 as the proceeds were restricted to use for the cash consideration for the Transaction. The proceeds were released upon closing of the Transaction on January 12, 2024. Interest on the 2031 Notes is payable semi-annually on January 15 and July 15 of each year commencing on July 15, 2024.

On August 11, 2020, the Issuers issued $700.0 million in aggregate principal amount of 5.250 % senior notes due January 15, 2029 (the “2029 Notes”). The 2029 Notes were issued at 100.0 % of their par value with proceeds of $690.4 million, net of related fees and expenses. The 2029 Notes were issued under an indenture dated August 11, 2020, the terms of which are generally consistent with the 2031 Notes Indenture. Interest on the 2029 Notes is payable semi-annually on January 15 and July 15 of each year commencing on January 15, 2021.

On March 15, 2019, the Issuers issued $300.0 million in aggregate principal amount of 6.500 % senior notes due March 15, 2027 (the “2027 Notes”). The 2027 Notes were issued at 100.0 % of their par value with proceeds of $296.3 million, net of related fees and expenses. The 2027 Notes were issued under an indenture dated March 25, 2019, the terms of which are generally consistent with the 2031 Notes Indenture. Interest on the 2027 Notes is payable semi-annually on March 15 and September 15 of each year commencing on September 15, 2019.

As of June 29, 2024 and December 30, 2023, the Issuers were in compliance with all covenants under the applicable indentures.

14

Senior Secured Credit Facilities—

On January 12, 2024, Summit LLC entered into Amendment No. 7 to the credit agreement governing the Senior Secured Credit Facilities (the “Credit Agreement”), which among other things:

(1) established new term loans in an aggregate principal amount of $1.010 billion (the "Term Loan Facility") bearing interest, at Summit LLC’s option, based on either the base rate or Term SOFR rate and an applicable margin of (i) 1.50 % per annum with respect to base rate borrowings and a floor of 1.00 % per annum or (ii) 2.50 % per annum with respect to Term SOFR borrowings and a floor of zero, resulting in a current interest rate as of June 29, 2024 of 7.80 %. Amendment No. 7 also extended the maturity date for the Term Loan Facility to January 12, 2029. In addition, the new term loan is subject to a 1.00 % prepayment premium in respect of any principal amount repaid in connection with certain repricing transactions occurring within six months following the Amendment No. 7 Effective Date and requires quarterly amortization payments of 0.25 % of the principal amount of the Term Loan Facility on the Amendment No. 7 effective date and due on the last business day or each March, June, September and December, commencing with the June 2024 payment. The proceeds of the new term loans were used to (i) fund a portion of the cash consideration in connection with the closing of the Transaction, (ii) refinance the $504.5 million prior term loans outstanding, resulting in charges of $5.5 million which were recognized for the six months ended June 29, 2024, which included charges of $4.0 million for the write-off of original issue discount and $1.5 million for the write-off of deferred financing fees and (iii) pay fees, commissions and expenses in connection with the foregoing. In July 2024, Summit LLC entered into Amendment No. 8 which reduced the applicable margin on Term SOFR borrowings from 2.50 % to 1.75 % per annum;

(2) in respect of the revolving credit facility thereunder (the “Revolving Credit Facility”), (a) increased the total aggregate commitments under the Revolving Credit Facility from $395.0 million to $625.0 million and (b) reduced the applicable margin (with no leverage-based step downs) to (i) 1.50 % per annum with respect to base rate borrowings and a floor of 1.00 % per annum or (ii) 2.50 % per annum with respect to Term SOFR borrowings and a floor of zero ; and

(3) modified certain covenants to provide greater flexibility for Summit LLC under the Credit Agreement.

The revolving credit facility matures on January 10, 2028, provided that if more than $125 million of the 2027 Notes are outstanding as of December 14, 2026, then the maturity date of the revolving credit facility will be December 14, 2026. There were no 592.7 million remaining as of June 29, 2024, which is net of $32.3 million of outstanding letters of credit. The outstanding letters of credit are renewed annually and support required bonding on construction projects, large leases, workers compensation claims and the Company’s insurance liabilities. In connection with the combination with Argos USA described above, Summit LLC assumed a letter of credit related to Argos USA's workers compensation claims and insurance liabilities equal to $11.4 million.

Summit LLC’s Consolidated First Lien Net Leverage Ratio, as such term is defined in the Credit Agreement, should be no greater than 4.75 :1.0 as of each quarter-end. As of June 29, 2024 and December 30, 2023, Summit LLC was in compliance with all financial covenants.

Summit LLC’s wholly-owned domestic subsidiary companies, subject to certain exclusions and exceptions, are named as subsidiary guarantors of the Senior Notes and the Senior Secured Credit Facilities. In addition, Summit LLC has pledged substantially all of its assets as collateral, subject to certain exclusions and exceptions including a real property exception, for the Senior Secured Credit Facilities.

In September 2023, in connection with our agreement to acquire all of the outstanding equity interests of Argos USA, we obtained a $1.3 billion 364-day term loan bridge facility commitment from various financial institutions. The term loan bridge facility expired unused upon the closing of the Transaction in January 2024.

15

The following table presents the activity for the deferred financing fees for the six months ended June 29, 2024 and July 1, 2023:

| Deferred financing fees | |||||

| Balance—December 30, 2023 | $ | ||||

| Loan origination fees | |||||

| Amortization | ( | ||||

| Write off of deferred financing fees | ( | ||||

| Balance—June 29, 2024 | $ | ||||

| Balance—December 31, 2022 | $ | ||||

| Loan origination fees | |||||

| Amortization | ( | ||||

| Write off of deferred financing fees | ( | ||||

| Balance—July 1, 2023 | $ | ||||

Other—On January 15, 2015, the Company’s wholly-owned subsidiary in British Columbia, Canada entered into an agreement with a major Canadian Bank, which was amended on November 30, 2020, for a (i) $6.0 million Canadian dollar (“CAD”) revolving credit commitment to be used for operating activities that bears interest per annum equal to the bank’s prime rate plus 0.20 %, (ii) $0.5 million CAD revolving credit commitment to be used for capital equipment that bears interest per annum at the bank’s prime rate plus 0.20 % and (iii) $1.5 million CAD revolving credit commitment to provide guarantees on behalf of that subsidiary and (iv) $10.0 million CAD revolving foreign exchange facility available to purchase foreign exchange forward contracts. There were no

7.INCOME TAXES

Summit Inc.’s tax provision includes its proportional share of Summit Holdings’ tax attributes. Summit Holdings’ subsidiaries are primarily limited liability companies but do include certain entities organized as C corporations and a Canadian subsidiary. The tax attributes related to the limited liability companies are passed on to Summit Holdings and then to its partners, including Summit Inc. The tax attributes associated with the C corporation and Canadian subsidiaries are fully reflected in the Company’s accounts.

Our income tax expense was $25.8 million and $14.8 million in the three and six months ended June 29, 2024, respectively, and our income tax expense was $22.5 million and $16.0 million in the three and six months ended July 1, 2023, respectively. The effective tax rate for Summit Inc. differs from the federal statutory tax rate primarily due to (1) basis differences in assets divested, (2) tax depletion expense in excess of the expense recorded under U.S. GAAP, (3) state taxes, (4) various other items such as limitations on meals and entertainment, certain stock compensation, non-deductible compensation paid to covered employees, and other costs.

As of each of June 29, 2024 and December 30, 2023, Summit Inc. had a valuation allowance of $1.1

Tax Receivable Agreement—The Company is party to a TRA with certain former holders of Class A limited partnership units of Summit Holdings ("LP Units") that provides for the payment by Summit Inc. to exchanging holders of LP Units of 85 % of the benefits, if any, that Summit Inc. actually realizes (or, under certain circumstances such as an early termination of the TRA, is deemed to realize) as a result of increases in the tax basis of tangible and intangible assets of Summit Holdings and certain other tax benefits related to entering into the TRA, including tax benefits attributable to payments under the TRA.

16

8.EARNINGS PER SHARE

Basic earnings per share is computed by dividing net earnings by the weighted average common shares outstanding and diluted net earnings is computed by dividing net earnings, adjusted for changes in the earnings allocated to Summit Inc. as a result of the assumed conversion of LP Units, by the weighted-average common shares outstanding assuming dilution.

The following table shows the calculation of basic and diluted earnings per share:

| Three months ended | Six months ended | ||||||||||||||||||||||

| June 29, 2024 | July 1, 2023 | June 29, 2024 | July 1, 2023 | ||||||||||||||||||||

| Net income attributable to Summit Inc. | $ | $ | $ | $ | |||||||||||||||||||

| Weighted average shares of Class A stock outstanding | |||||||||||||||||||||||

| Add: Nonvested restricted stock awards of retirement eligible shares | |||||||||||||||||||||||

| Weighted average shares outstanding | |||||||||||||||||||||||

| Basic earnings per share | $ | $ | $ | $ | |||||||||||||||||||

| Diluted net income attributable to Summit Inc. | $ | $ | $ | $ | |||||||||||||||||||

| Weighted average shares outstanding | |||||||||||||||||||||||

| Add: stock options | |||||||||||||||||||||||

| Add: warrants | |||||||||||||||||||||||

| Add: restricted stock units | |||||||||||||||||||||||

| Add: performance stock units | |||||||||||||||||||||||

| Weighted average dilutive shares outstanding | |||||||||||||||||||||||

| Diluted earnings per share | $ | $ | $ | $ | |||||||||||||||||||

Excluded from the above calculations were the shares noted below as they were antidilutive:

| Three months ended | Six months ended | ||||||||||||||||||||||

| June 29, 2024 | July 1, 2023 | June 29, 2024 | July 1, 2023 | ||||||||||||||||||||

| Antidilutive shares: | |||||||||||||||||||||||

| LP Units | |||||||||||||||||||||||

9.STOCKHOLDERS’ EQUITY

In March 2022, our Board of Directors authorized a share repurchase program, whereby we can repurchase up to $250 million of our Class A common stock. As of June 29, 2024, there was $149.0 million available for purchase, upon which they will be retired.

The following table summarizes the changes in our ownership of Summit Holdings:

17

| Summit Inc. Shares (Class A) | LP Units | Total | Summit Inc. Ownership Percentage | ||||||||||||||||||||

| Balance — December 30, 2023 | % | ||||||||||||||||||||||

| Exchanges during period | ( | ||||||||||||||||||||||

| Stock option exercises | — | ||||||||||||||||||||||

| Issuance of Class A common stock | — | ||||||||||||||||||||||

| Other equity transactions | — | ||||||||||||||||||||||

| Balance — June 29, 2024 | % | ||||||||||||||||||||||

| Balance — December 31, 2022 | % | ||||||||||||||||||||||

| Exchanges during period | ( | ||||||||||||||||||||||

| Stock option exercises | — | ||||||||||||||||||||||

| Other equity transactions | — | ||||||||||||||||||||||

| Balance — July 1, 2023 | % | ||||||||||||||||||||||

Summit Inc. is Summit Holdings’ primary beneficiary and thus consolidates Summit Holdings in its consolidated financial statements with a corresponding noncontrolling interest reclassification, which was 0.0 % and 0.6 % as of June 29, 2024 and December 30, 2023, respectively.

Accumulated other comprehensive income (loss) —The changes in each component of accumulated other comprehensive income (loss) consisted of the following:

| Change in retirement plans | Foreign currency translation adjustments | Accumulated other comprehensive income (loss) | |||||||||||||||

| Balance — December 30, 2023 | $ | $ | $ | ||||||||||||||

| Foreign currency translation adjustment, net of tax | — | ( | ( | ||||||||||||||

| Balance — June 29, 2024 | $ | $ | ( | $ | |||||||||||||

| Balance — December 31, 2022 | $ | $ | ( | $ | |||||||||||||

| Foreign currency translation adjustment, net of tax | — | ||||||||||||||||

| Balance — July 1, 2023 | $ | $ | ( | $ | |||||||||||||

10.SUPPLEMENTAL CASH FLOW INFORMATION

Supplemental cash flow information is as follows:

| Six months ended | |||||||||||

| June 29, 2024 | July 1, 2023 | ||||||||||

| Cash payments: | |||||||||||

| Interest | $ | $ | |||||||||

| Payments for income taxes, net | |||||||||||

| Operating cash payments on operating leases | |||||||||||

| Operating cash payments on finance leases | |||||||||||

| Finance cash payments on finance leases | |||||||||||

| Non cash investing and financing activities: | |||||||||||

| Accrued liabilities for purchases of property, plant and equipment | $ | $ | |||||||||

| Right of use assets obtained in exchange for operating lease obligations | |||||||||||

| Right of use assets obtained in exchange for finance leases obligations | |||||||||||

| Exchange of LP Units to shares of Class A common stock | |||||||||||

| Issuance of Class A common stock | |||||||||||

On January 12, 2024, Summit completed a combination with Argos USA, Cementos Argos, Argos SEM LLC and Valle Cement Investments, Inc., pursuant to which Summit acquired all of the outstanding equity interests of Argos USA from

18

the Argos SEM LLC and Valle Cement Investments, Inc.. Non-cash transactions related to the combination includes issuance of 54,720,000 shares of Summit Inc.'s Class A common stock and 1 preferred share.

11.LEASES

We lease construction and office equipment, distribution facilities and office space. Leases with an initial term of 12 months or less, including month to month leases, are not recorded on the balance sheet. Lease expense for short-term leases is recognized on a straight line basis over the lease term. For lease agreements we have entered into or reassessed, we combine lease and nonlease components. While we also own mineral leases for mining operations, those leases are outside the scope of Accounting Standards Update No. 2016-2, Leases (Topic 842). Assets acquired under finance leases are included in property, plant and equipment.

19

| Three months ended | Six months ended | ||||||||||||||||||||||

| June 29, 2024 | July 1, 2023 | June 29, 2024 | July 1, 2023 | ||||||||||||||||||||

| Operating lease cost | $ | $ | $ | $ | |||||||||||||||||||

| Variable lease cost | |||||||||||||||||||||||

| Short-term lease cost | |||||||||||||||||||||||

| Financing lease cost: | |||||||||||||||||||||||

| Amortization of right-of-use assets | |||||||||||||||||||||||

| Interest on lease liabilities | |||||||||||||||||||||||

| Total lease cost | $ | $ | $ | $ | |||||||||||||||||||

| June 29, 2024 | December 30, 2023 | ||||||||||||||||||||||

| Supplemental balance sheet information related to leases: | |||||||||||||||||||||||

| Operating leases: | |||||||||||||||||||||||

| Operating lease right-of-use assets | $ | $ | |||||||||||||||||||||

| Current operating lease liabilities | $ | $ | |||||||||||||||||||||

| Noncurrent operating lease liabilities | |||||||||||||||||||||||

| Total operating lease liabilities | $ | $ | |||||||||||||||||||||

| Finance leases: | |||||||||||||||||||||||

| Property and equipment, gross | $ | $ | |||||||||||||||||||||

| Less accumulated depreciation | ( | ( | |||||||||||||||||||||

| $ | $ | ||||||||||||||||||||||

| $ | $ | ||||||||||||||||||||||

| Total finance lease liabilities | $ | $ | |||||||||||||||||||||

| Weighted average remaining lease term (years): | |||||||||||||||||||||||

| Operating leases | |||||||||||||||||||||||

| Finance lease | |||||||||||||||||||||||

| Weighted average discount rate: | |||||||||||||||||||||||

| Operating leases | % | % | |||||||||||||||||||||

| Finance leases | % | % | |||||||||||||||||||||

Maturities of lease liabilities, as of June 29, 2024, were as follows: | |||||||||||||||||||||||

| Operating Leases | Finance Leases | ||||||||||||||||||||||

| 2024 (six months) | $ | $ | |||||||||||||||||||||

| 2025 | |||||||||||||||||||||||

| 2026 | |||||||||||||||||||||||

| 2027 | |||||||||||||||||||||||

| 2028 | |||||||||||||||||||||||

| 2029 | |||||||||||||||||||||||

| Thereafter | |||||||||||||||||||||||

| Total lease payments | |||||||||||||||||||||||

| Less imputed interest | ( | ( | |||||||||||||||||||||

| Present value of lease payments | $ | $ | |||||||||||||||||||||

12.COMMITMENTS AND CONTINGENCIES

The Company is party to certain legal actions arising from its ordinary course of business activities. In the opinion of management, these actions will not have a material effect on the Company’s financial position, results of operations or liquidity. The Company’s policy is to record legal accruals when the outcome is probable and can be reasonably estimated and to record legal fees as incurred.

20

In March 2018, we were notified of an investigation by the Canadian Competition Bureau (the “CCB”) into pricing practices by certain asphalt paving contractors in British Columbia, including Winvan Paving, Ltd. (“Winvan”). We believe the investigation is focused on time periods prior to our April 2017 acquisition of Winvan and we are cooperating with the CCB. Although we currently do not believe this matter will have a material adverse effect on our business, financial condition or results of operations, we are currently not able to predict the ultimate outcome or cost of the investigation.

On January 4, 2021, prior to the closing of the Transaction, Argos USA entered into a Deferred Prosecution Agreement (“DPA”) with the U.S. Department of Justice (“DOJ”) related to the sale of ready-mix concrete in the greater Savannah, Georgia area by a small number of employees who joined the Company in October 2011 and were subsequently terminated. Pursuant to the DPA, Argos USA paid a monetary penalty of $20.0 million and was required, among other things, to periodically review and update its antitrust compliance program. The three-year term of the DPA expired on January 4, 2024. As Argos USA fully complied with the terms of the DPA, on January 18, 2024, following the conclusion of the DPA’s three-year term, the United States District Court for the Southern District of Georgia dismissed the criminal charge that was filed against the company in January 2021. Argos USA’s failure to comply with the terms and conditions of the DPA could result in additional criminal prosecution or penalties as well as continued expenses in defending these proceedings. In addition, Argos USA has been named a defendant in a putative class action filed under the caption Pro Slab, Inc. et al. v. Argos USA LLC et al. on behalf of purchasers of ready-mix concrete on November 22, 2017 in the U.S. District Court for the District of South Carolina and includes allegations of price-fixing, market allocation and other anti-competitive practices in the Savannah, Georgia and Charleston, South Carolina markets, seeking monetary damages and other remedies. This case was stayed on February 9, 2022 pending the resolution of the same criminal indictments, and only limited, written discovery may proceed while this stay is in effect.

On June 13, 2023, prior to the closing of the Transaction, Argos USA entered into a settlement and compliance agreement with the Federal Highway Administration of the U.S. Department of Transportation that requires, among other things, appointment of an independent monitor until June 2025 to monitor, among other things, bids or awards of publicly funded contracts in Georgia and South Carolina for our ready-mix and cement business, as well as our code of business conduct, antitrust compliance policy, and antitrust compliance program.

Environmental Remediation and Site Restoration —The Company’s operations are subject to and affected by federal, state, provincial and local laws and regulations relating to the environment, health and safety and other regulatory matters. These operations require environmental operating permits, which are subject to modification, renewal and revocation. The Company regularly monitors and reviews its operations, procedures and policies for compliance with these laws and regulations. Despite these compliance efforts, risk of environmental liability is inherent in the operation of the Company’s business, as it is with other companies engaged in similar businesses and there can be no assurance that environmental liabilities or noncompliance will not have a material adverse effect on the Company’s consolidated financial condition, results of operations or liquidity.

The Company has asset retirement obligations arising from regulatory and contractual requirements to perform reclamation activities at the time certain quarries and landfills are closed. As of June 29, 2024 and December 30, 2023, $44.1 million and $44.8 million, respectively, were included in other noncurrent liabilities on the consolidated balance sheets and $6.5 million and $5.1 million, respectively, were included in accrued expenses for future reclamation costs. The total undiscounted anticipated costs for site reclamation as of June 29, 2024 and December 30, 2023 were $171.4 million and $141.8 million, respectively.

Payment In Lieu Of Taxes (“PILOT”) Agreement — In connection with the Transaction, Summit assumed a PILOT agreement related to the Martinsburg, West Virginia cement plant entered into by Argos USA pursuant to an acquisition that occurred in 2016. This agreement, which includes a continuing employment base requirement and other requirements, is in effect through fiscal year 2034. Under this agreement, certain property was conveyed to the West Virginia Economic Development Authority in exchange for certain local tax incentives. The $460.0 million receivable from the municipality related to the conveyance of the property, and the $460.0 million liability associated with the financing, have been offset in the consolidated balance sheets as the opening balance sheet. The annual payment related to the financing, and receipts related to the conveyance of the property for year-ended December 30, 2023 approximated $27.1 million.

Other—The Company is obligated under various firm purchase commitments for certain raw materials and services that are in the ordinary course of business. Management does not expect any significant changes in the market value of these goods and services during the commitment period that would have a material adverse effect on the financial condition,

21

results of operations and cash flows of the Company. The terms of the purchase commitments generally approximate one year .

13.FAIR VALUE

Fair Value Measurements—Certain acquisitions made by the Company require the payment of contingent amounts of purchase consideration. These payments are contingent on specified operating results being achieved in periods subsequent to the acquisition and will only be made if earn-out thresholds are achieved. Contingent consideration obligations are measured at fair value each reporting period. Any adjustments to fair value are recognized in earnings in the period identified.

The fair value of contingent consideration as of June 29, 2024 and December 30, 2023 was:

| June 29, 2024 | December 30, 2023 | ||||||||||

| Current portion of acquisition-related liabilities and Accrued expenses: | |||||||||||

| Contingent consideration | $ | $ | |||||||||

| Acquisition-related liabilities and Other noncurrent liabilities: | |||||||||||

| Contingent consideration | $ | $ | |||||||||

The fair value of contingent consideration was based on unobservable, or Level 3, inputs, including projected probability-weighted cash payments and a 10.0 % discount rate, which reflects a market discount rate. Changes in fair value may occur as a result of a change in actual or projected cash payments, the probability weightings applied by the Company to projected payments or a change in the discount rate. Significant increases or decreases in any of these inputs in isolation could result in a lower, or higher, fair value measurement. There were no

Financial Instruments—The Company’s financial instruments include debt and certain acquisition-related liabilities (deferred consideration and noncompete obligations). The carrying value and fair value of these financial instruments as of June 29, 2024 and December 30, 2023 was:

| June 29, 2024 | December 30, 2023 | ||||||||||||||||||||||

| Fair Value | Carrying Value | Fair Value | Carrying Value | ||||||||||||||||||||

| Level 1 | |||||||||||||||||||||||

| Long-term debt(1) | $ | $ | $ | $ | |||||||||||||||||||

| Level 3 | |||||||||||||||||||||||