UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

(Mark One)

For the quarterly period ended

OR

For the transition period from _____to _____

Commission file number:

(Exact name of registrant as specified in its charter)

|

|

|

|

|

(

(Registrant’s telephone number, including area code)

Not applicable

(Former name, former address and former fiscal year, if changed since last report)

Securities registered pursuant to Section 12(b) of the Act:

Title of each class |

| Trading Symbol |

| Name of each exchange on which registered |

The |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. ⌧

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). ⌧

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer ◻ |

| Accelerated filer ◻ | |

Smaller reporting company | |||

Emerging growth company |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ◻

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ◻ No

As of May 11, 2023, the registrant had

TABLE OF CONTENTS

2

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

Statements made in this Quarterly Report on Form 10-Q, or this Quarterly Report, that are not statements of historical or current facts, such as those under the heading “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements discuss our current expectations and projections relating to our financial condition, results of operations, plans, objectives, future performance and business. These statements may be preceded by, followed by or include the words “aim,” “anticipate,” “believe,” “continues,” “estimate,” “expect,” “forecast,” “intend,” “outlook,” “plan,” “potential,” “project,” “projection,” “seek,” “may,” “could,” “would,” “will,” “should,” “can,” “can have,” “likely,” the negatives thereof and other words and terms of similar meaning.

Forward-looking statements are inherently subject to risks, uncertainties and assumptions; they are not guarantees of performance. You should not place undue reliance on these statements. We have based these forward-looking statements on our current expectations and projections about future events. Although we believe that our assumptions made in connection with the forward-looking statements are reasonable, we cannot assure you that the assumptions and expectations will prove to be correct.

You should understand that the following important factors could affect our future results and could cause those results or other outcomes to differ materially from those expressed or implied in our forward-looking statements:

| ● | our expectations, projections and estimates regarding expenses, future revenue, capital requirements, incentive and other tax credit eligibility, collectability and timing and availability of and the need for additional financing; |

| ● | the results, cost and timing of our preclinical studies and clinical trials, including any delays to such clinical trials relating to enrollment or site initiation, as well as the number of required trials for regulatory approval and the criteria for success in such trials; |

| ● | our dependence on third parties in the conduct of our preclinical studies and clinical trials; |

| ● | legal and regulatory developments in the United States and foreign countries, including any actions or advice that may affect the design, initiation, timing, continuation, progress or outcome of clinical trials or result in the need for additional clinical trials; |

| ● | the results of our preclinical studies and earlier clinical trials of our product candidates may not be predictive of future results and we may not have favorable results in our ongoing or planned clinical trials; |

| ● | the difficulties and expenses associated with obtaining and maintaining regulatory approval of our product candidates, and the indication and labeling under any such approval; |

| ● | our plans and ability to develop and commercialize our product candidates; |

| ● | the successful development of our commercialization capabilities, including sales and marketing capabilities, whether alone or with potential future collaborators; |

| ● | the size and growth of the potential markets for our product candidates, the rate and degree of market acceptance of our product candidates and our ability to serve those markets; |

| ● | the coverage and reimbursement status for our product candidates from third-party payors; |

| ● | the success of competing therapies and products that are or become available; |

| ● | our ability to limit our exposure under product liability lawsuits, shareholder class action lawsuits or other litigation; |

| ● | our ability to obtain and maintain intellectual property protection for our product candidates; |

| ● | legislative developments impacting our industry or the healthcare system broadly, including but not limited to the Inflation Reduction Act of 2022 and proposed changes to the Patient Protection and Affordable Care Act; |

| ● | our ability to obtain and maintain third-party manufacturing for our product candidates on commercially reasonable terms; |

| ● | delays, interruptions or failures in the manufacture and supply of our product candidates; |

| ● | the performance of third parties upon which we depend, including third-party contract research organizations, or CROs, contract manufacturing organizations, or CMOs, contract laboratories and independent contractors; |

| ● | our ability to recruit or retain key scientific, commercial or management personnel or to retain our executive officers; |

| ● | our ability to maintain proper functionality and security of our internal computer and information systems and to prevent or avoid cyberattacks, malicious intrusion, breakdown, destruction, loss of data privacy or other significant disruption; |

3

| ● | the extent to which health epidemics and other outbreaks of communicable diseases, including COVID-19 and higher influenza and respiratory syncytial virus (RSV) rates, could disrupt our operations or materially and adversely affect our business and financial conditions; |

| ● | our ability to regain and maintain compliance with the continued listing requirements of The Nasdaq Capital Market; |

| ● | a deterioration of the credit rating for U.S. long-term sovereign debt, and/or actions and uncertainties surrounding the debt ceiling and the federal budget; |

| ● | adverse developments affecting the financial services industry, such as actual events or concerns involving liquidity, defaults or non-performance by financial institutions or transactional counterparties, could adversely affect our current and projected business operations, financial condition and results of operations; |

| ● | the extent to which the volatility of the global financial markets, inflationary pressures and global instability, including political instability, such as a deterioration in the relationship between the U.S. and China or the ongoing conflict between Russia and Ukraine, including any additional resulting sanctions, export controls or other restrictive actions that may be imposed by the U.S. and/or other countries against governmental or other entities in, for example, Russia, may disrupt our business operations and/or our financial condition; and |

| ● | the other risks, uncertainties and factors discussed in our Annual Report on Form 10-K for the fiscal year ended December 31, 2022, or our 2022 Annual Report, under the caption “Item 1A. Risk Factors”. |

In light of these risks and uncertainties, expected results or other anticipated events or circumstances discussed in this Quarterly Report (including the exhibits hereto) might not occur. We undertake no obligation, and specifically decline any obligation, to publicly update or revise any forward-looking statements, even if experience or future developments make it clear that projected results expressed or implied in such statements will not be realized, except as may be required by law.

4

PART I – FINANCIAL INFORMATION

Item 1. Consolidated Financial Statements (Unaudited)

ZYNERBA PHARMACEUTICALS, INC.

CONSOLIDATED BALANCE SHEETS

(UNAUDITED)

March 31, | December 31, |

| |||||

| 2023 |

| 2022 |

| |||

Assets | |||||||

Current assets: | |||||||

Cash and cash equivalents | $ | | $ | | |||

Incentive and tax receivables |

| |

| | |||

Prepaid expenses and other current assets |

| |

| | |||

Total current assets |

| |

| | |||

Property and equipment, net |

| |

| | |||

Incentive and tax receivables |

| |

| — | |||

Right-of-use assets |

| |

| | |||

Total assets | $ | | $ | | |||

Liabilities and Stockholders' Equity | |||||||

Current liabilities: | |||||||

Accounts payable | $ | | $ | | |||

Accrued expenses |

| |

| | |||

Lease liabilities |

| |

| | |||

Total current liabilities |

| |

| | |||

Lease liabilities, long-term | | | |||||

Total liabilities | | | |||||

Stockholders' equity: | |||||||

Preferred stock, $ | |||||||

Common stock, $ |

| |

| | |||

Additional paid-in capital |

| |

| | |||

Accumulated deficit |

| ( |

| ( | |||

Total stockholders' equity |

| |

| | |||

Total liabilities and stockholders' equity | $ | | $ | | |||

See accompanying notes to unaudited consolidated financial statements.

5

ZYNERBA PHARMACEUTICALS, INC.

CONSOLIDATED STATEMENTS OF OPERATIONS

(UNAUDITED)

Three months ended March 31, | ||||||

| 2023 |

| 2022 | |||

Operating expenses: | ||||||

Research and development | $ | | $ | | ||

General and administrative |

| |

| | ||

Total operating expenses |

| |

| | ||

Loss from operations |

| ( |

| ( | ||

Other income (expense): | ||||||

Interest income |

| |

| | ||

Foreign exchange (loss) gain | ( | | ||||

Total other income (expense) | | | ||||

Net loss | $ | ( | $ | ( | ||

Net loss per share basic and diluted | ( | ( | ||||

Basic and diluted weighted average shares outstanding |

| |

| | ||

See accompanying notes to unaudited consolidated financial statements.

6

ZYNERBA PHARMACEUTICALS, INC.

CONSOLIDATED STATEMENTS OF STOCKHOLDERS’ EQUITY

(UNAUDITED)

Three months ended March 31, 2023 | |||||||||||||

Total | |||||||||||||

Common stock | Additional | Accumulated | stockholders' | ||||||||||

Shares |

| Amount |

| paid-in capital |

| deficit |

| equity | |||||

Balance at December 31, 2022 | | $ | | $ | | $ | ( | $ | | ||||

Issuance of common stock, net of issuance costs | | | | — | | ||||||||

Issuance of restricted stock | |

| |

| ( |

| — |

| — | ||||

Common stock issued in lieu of annual bonus | | | | — | | ||||||||

Stock-based compensation expense | — | — | | — | | ||||||||

Net loss | — | — | — | ( |

| ( | |||||||

Balance at March 31, 2023 | | $ | | $ | | $ | ( | $ | | ||||

Three months ended March 31, 2022 | |||||||||||||

Total | |||||||||||||

Common stock | Additional | Accumulated | stockholders' | ||||||||||

Shares |

| Amount |

| paid-in capital |

| deficit |

| equity | |||||

Balance at December 31, 2021 | | $ | | $ | | $ | ( | $ | | ||||

Issuance of common stock, net of issuance costs | | | | — | | ||||||||

Issuance of restricted stock | |

| |

| ( |

| — |

| — | ||||

Stock-based compensation expense | — | — | | — | | ||||||||

Net loss | — | — | — | ( |

| ( | |||||||

Balance at March 31, 2022 | | $ | | $ | | $ | ( | $ | | ||||

See accompanying notes to unaudited consolidated financial statements.

7

ZYNERBA PHARMACEUTICALS, INC.

CONSOLIDATED STATEMENTS OF CASH FLOWS

(UNAUDITED)

Three months ended March 31, | |||||||

| 2023 |

| 2022 |

| |||

Cash flows from operating activities: | |||||||

Net loss | $ | ( | $ | ( | |||

Adjustments to reconcile net loss to net cash (used in) provided by operating activities: | |||||||

Depreciation |

| |

| | |||

Stock-based compensation | | | |||||

Changes in operating assets and liabilities: | |||||||

Incentive and tax receivables |

| ( |

| | |||

Prepaid expenses and other assets |

| |

| | |||

Right-of-use assets and liabilities | | | |||||

Accounts payable |

| |

| ( | |||

Accrued expenses |

| |

| ( | |||

Net cash (used in) provided by operating activities |

| ( |

| | |||

Cash flows from investing activities: | |||||||

Purchases of property and equipment |

| ( |

| ( | |||

Net cash used in investing activities |

| ( |

| ( | |||

Cash flows from financing activities: | |||||||

Proceeds from the issuance of common stock |

| |

| | |||

Payment of financing fees and expenses |

| ( |

| ( | |||

Net cash provided by financing activities |

| |

| | |||

Net (decrease) increase in cash and cash equivalents |

| ( |

| | |||

Cash and cash equivalents at beginning of period |

| |

| | |||

Cash and cash equivalents at end of period | $ | | $ | | |||

Supplemental disclosures of cash flow information: | |||||||

Financing costs included in accounts payable and accrued expenses at end of period | $ | | $ | | |||

Property and equipment acquired but unpaid at end of period | $ | | $ | — | |||

See accompanying notes to unaudited consolidated financial statements

8

(1) Nature of Business and Liquidity

Zynerba Pharmaceuticals, Inc., together with its subsidiary, Zynerba Pharmaceuticals Pty Ltd (collectively, “Zynerba,” the “Company,” or “we”), is a clinical stage specialty pharmaceutical company focused on the development of pharmaceutically-produced transdermal cannabinoid therapies for orphan neuropsychiatric disorders, including Fragile X syndrome (“FXS”) and chromosome 22q11.2 deletion syndrome (“22q”). We have been granted orphan drug designations from the United States Food and Drug Administration (“FDA”) and the European Commission for the use of cannabidiol for the treatment of FXS and 22q. In addition, we have received Fast Track designation from the FDA for treatment of behavioral symptoms associated with FXS. The Company has decided to prioritize its resources on FXS and 22q, both of which have no approved products. While we believe the data from the Company’s autism spectrum disorder (“ASD”) clinical development program to date are compelling, given the difficult financial market, the Company has decided to defer the start of the Phase 3 development program in ASD.

The Company has incurred losses and negative cash flows from operations since inception and has an accumulated deficit of $

Management believes that the Company’s cash and cash equivalents as of March 31, 2023 are sufficient to fund operations and capital requirements to mid-year 2024. Substantial additional financings will be needed by the Company to fund its operations, and to complete clinical development of and to commercially develop its product candidates. The Company’s ability to access the capital markets or otherwise raise such capital may be adversely impacted by geopolitical tensions and macroeconomic events and the recent disruptions to, and volatility in, financial markets in the United States and globally resulting from multiple factors such as COVID-19, inflationary pressures, rising interest rates and the ongoing conflict in Ukraine. There is no assurance that such financing will be available when needed or on acceptable terms.

The Company is subject to those risks associated with any clinical stage pharmaceutical company that has substantial expenditures for research and development. There can be no assurance that the Company's research and development projects will be successful, that products developed will obtain necessary regulatory approval, or that any approved product will be commercially viable. In addition, the Company operates in an environment of rapid technological change and is largely dependent on the services of its employees and consultants.

(2) Summary of Significant Accounting Policies

a. Basis of Presentation

The accompanying unaudited interim consolidated financial statements of the Company have been prepared in accordance with U.S. generally accepted accounting principles (“GAAP”) for interim financial information and with the instructions to Form 10-Q and Article 10 of Regulation S-X. The interim unaudited consolidated financial statements have been prepared on the same basis as the consolidated financial statements as of and for the year ended December 31, 2022 included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2022 (the “2022 Annual Report”), filed with the Securities and Exchange Commission (the “SEC”). In the opinion of management, the accompanying consolidated financial statements of the Company include all normal and recurring adjustments (which consist primarily of accruals, estimates and assumptions that impact the consolidated financial statements) considered necessary to present fairly the Company's financial position as of March 31, 2023 its results of operations for the three months ended March 31, 2023 and 2022 and cash flows for the three months ended March 31, 2023 and 2022. Operating results for any interim period are not necessarily indicative of results for any future interim period or for the entire year. The accompanying unaudited interim consolidated financial statements should be read in conjunction with the consolidated financial statements and related notes included in the 2022 Annual Report.

9

ZYNERBA PHARMACEUTICALS, INC.

NOTES TO UNAUDITED CONSOLIDATED FINANCIAL STATEMENTS (Continued)

b. Use of Estimates

The preparation of consolidated financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosures of contingent assets and liabilities at the date of the financial statements and reported amounts of expenses during the reporting period. Actual results could differ from such estimates.

c. Incentive and Tax Receivables

The Company’s subsidiary, Zynerba Pharmaceuticals Pty Ltd (the “Subsidiary”), is incorporated in Australia. The Subsidiary is eligible to participate in an Australian research and development tax incentive program. As part of this program, the Subsidiary is eligible to receive a cash refund from the Australian Taxation Office for a percentage of the research and development costs expended by the Subsidiary in Australia. The cash refund is available to eligible companies with an annual aggregate revenue of less than $

In addition, the Subsidiary incurs Goods and Services Tax (“GST”) on services provided by Australian vendors. As an Australian entity, the Subsidiary is entitled to a refund of the GST paid. The Company’s estimate of the amount of cash refund it expects to receive related to GST incurred is included in “Incentive and tax receivables” in the accompanying consolidated balance sheets. As of March 31, 2023, incentive and tax receivables included $

Current incentive and tax receivables consisted of the following as of March 31, 2023 and December 31, 2022:

|

| March 31, |

| December 31, | ||

2023 | 2022 | |||||

Research and development incentive | $ | | $ | | ||

Goods and services tax | | | ||||

Total incentive and tax receivables - current assets | $ | | $ | | ||

As of March 31, 2023, the Company’s estimate of the amount of cash refund it expects to receive for 2022 eligible spending as part of this incentive program was $

d. Research and Development

Research and development costs are expensed as incurred and are primarily comprised of external research and development expenses incurred under arrangements with third parties, such as contract research organizations, contract manufacturing organizations, consultants and employee-related expenses including salaries and benefits. At the end of each reporting period, the Company compares the payments made to each service provider to the estimated progress towards completion of the related project. Factors that the Company considers in preparing these estimates include the number of patients enrolled in studies, milestones achieved and other criteria related to the efforts of its vendors. These estimates will be subject to change as additional information becomes available. Depending on the timing of payments to vendors and estimated services provided, the Company will record net prepaid or accrued expenses related to these costs. Research and development expenses are recorded net of expected refunds of eligible research and development costs paid pursuant to the Australian research and development tax incentive program and GST incurred on services provided by Australian vendors.

10

ZYNERBA PHARMACEUTICALS, INC.

NOTES TO UNAUDITED CONSOLIDATED FINANCIAL STATEMENTS (Continued)

The following table summarizes research and development expenses for the three months ended March 31, 2023 and 2022:

Three months ended March 31, | |||||

2023 | 2022 | ||||

Research and development expenses - before R&D incentive | $ | | $ | | |

Research and development incentive | ( | ( | |||

Total research and development expenses | $ | | $ | | |

e. Net Loss Per Share

Basic net loss per share is determined using the weighted average number of shares of common stock outstanding during each period. Diluted net income per share includes the effect, if any, from the potential exercise or conversion of securities, such as restricted stock and stock options, which would result in the issuance of incremental shares of common stock. Basic and dilutive computations of net loss per share are the same in periods in which a net loss exists as the dilutive effects of restricted stock and stock options would be anti-dilutive.

The following potentially dilutive securities outstanding as of March 31, 2023 and 2022 have been excluded from the computation of diluted weighted average shares outstanding, as their effects on net loss per share for the periods presented would be anti-dilutive:

March 31, | |||||

2023 | 2022 | ||||

Stock options |

| |

| |

|

Unvested restricted stock |

| |

| |

|

| |

| |

| |

f. Recent Accounting Pronouncements

In November 2021, the Financial Accounting Standards Board (“FASB”) issued Accounting Standards Update No. 2021-10, Government Assistance (Topic 832): Disclosure by Business Entities about Government Assistance (“ASU 2021-10”), which improves the transparency of government assistance received by most business entities by requiring the disclosure of: (1) the types of government assistance received; (2) the accounting for such assistance; and (3) the effect of the assistance on a business entity’s financial statements. This guidance is effective for financial statements issued for annual periods beginning after December 15, 2021. The Company adopted ASU 2021-10 effective January 1, 2022, and the adoption did not have a material impact on its consolidated financial statements.

(3) Fair Value Measurements

The Company measures certain assets and liabilities at fair value in accordance with Accounting Standards

Codification (“ASC 820”), Fair Value Measurements and Disclosures. ASC 820 defines fair value as the price that would be received to sell an asset or paid to transfer a liability (the exit price) in an orderly transaction between market participants at the measurement date. The guidance in ASC 820 outlines a valuation framework and creates a fair value hierarchy that serves to increase the consistency and comparability of fair value measurements and the related disclosures. In determining fair value, the Company maximizes the use of quoted prices and observable inputs. Observable inputs are inputs that market participants would use in pricing the asset or liability based on market data obtained from independent sources. The fair value hierarchy is broken down into three levels based on the source of inputs as follows:

Level 1 — Valuations based on unadjusted quoted prices in active markets for identical assets or liabilities.

11

ZYNERBA PHARMACEUTICALS, INC.

NOTES TO UNAUDITED CONSOLIDATED FINANCIAL STATEMENTS (Continued)

Level 2 — Valuations based on observable inputs and quoted prices in active markets for similar assets and liabilities.

Level 3 — Valuations based on unobservable inputs and models that are supported by little or no market activity.

In accordance with the fair value hierarchy described above, the following table sets forth the Company's financial assets measured at fair value on a recurring basis as of March 31, 2023 and December 31, 2022:

| |||||||||||||

Fair Value Measurement |

| ||||||||||||

Carrying amount | as of March 31, 2023 |

| |||||||||||

| as of March 31, 2023 |

| Level 1 |

| Level 2 |

| Level 3 |

| |||||

Cash equivalents (money market accounts) | $ | | $ | | $ | — | $ | — | |||||

| $ | |

| $ | | $ | — | $ | — | ||||

|

| ||||||||||||

Fair Value Measurement |

| ||||||||||||

Carrying amount | as of December 31, 2022 |

| |||||||||||

| as of December 31, 2022 |

| Level 1 |

| Level 2 |

| Level 3 |

| |||||

Cash equivalents (money market accounts) | $ | | $ | | $ | — | $ | — | |||||

$ | | $ | | $ | — | $ | — | ||||||

(4) Prepaid Expenses and Other Current Assets

Prepaid expenses and other current assets consisted of the following as of March 31, 2023 and December 31, 2022:

| March 31, |

| December 31, |

| |||

2023 | 2022 |

| |||||

Prepaid development expenses | $ | | $ | | |||

Prepaid insurance |

| |

| | |||

Deferred financing costs | | | |||||

Other current assets |

| |

| | |||

Total prepaid expenses and other current assets | $ | | $ | | |||

(5) Property and Equipment

Property and equipment consisted of the following as of March 31, 2023 and December 31, 2022:

| Estimated |

|

|

| |||||

useful life | March 31, | December 31, |

| ||||||

(in years) | 2023 | 2022 |

| ||||||

Equipment |

| $ | |

| $ | | |||

Computer equipment |

|

| |

|

| | |||

Furniture and fixtures |

|

| |

|

| | |||

Leasehold improvements |

|

| |

|

| | |||

Construction in process |

|

|

| |

|

| | ||

Total cost |

| |

|

| | ||||

Less accumulated depreciation |

| ( |

|

| ( | ||||

Property and equipment, net | $ | |

| $ | | ||||

Depreciation expense was $

12

ZYNERBA PHARMACEUTICALS, INC.

NOTES TO UNAUDITED CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(6) Accrued Expenses

Accrued expenses consisted of the following as of March 31, 2023 and December 31, 2022:

| March 31, |

| December 31, |

| |||

2023 | 2022 |

| |||||

Accrued compensation | $ | | $ | | |||

Accrued research and development |

|

| | ||||

Other |

| |

| | |||

Total accrued expenses | $ | $ | | ||||

(7) Common Stock

a. At-The-Market Financing

On May 11, 2021, the Company entered into a Controlled Equity OfferingSM Sales Agreement (the “2021 Sales Agreement”) with Cantor Fitzgerald & Co., Canaccord Genuity, LLC, H.C. Wainwright & Co. LLC and Ladenburg Thalmann & Co. Inc., as sales agents, pursuant to which, under a prospectus filed by the Company in May 2022, the Company may sell, from time to time, up to $

During the three months ended March 31, 2023, the Company sold and issued

b. Equity Purchase Agreement

On July 21, 2022 (the “Effective Date”), the Company entered into a Purchase Agreement (the “Purchase Agreement”) with Lincoln Park Capital Fund, LLC (“Lincoln Park”) pursuant to which Lincoln Park committed to purchase up to $

Pursuant to the terms of the Purchase Agreement, in July 2022, the Company issued

During the three months ended March 31, 2023, the Company sold and issued

13

ZYNERBA PHARMACEUTICALS, INC.

NOTES TO UNAUDITED CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(8) Stock-Based Compensation

The Company maintains the Amended and Restated 2014 Omnibus Incentive Compensation Plan, as amended (the “2014 Plan”), which allows for the granting of incentive stock options, nonqualified stock options, stock appreciation rights, stock awards, stock units, performance units and other stock-based awards to employees, officers, non-employee directors, consultants, and advisors. In addition, the 2014 Plan provides selected employees with the opportunity to receive bonus awards that are considered qualified performance-based compensation. The 2014 Plan is subject to automatic annual increases in the number of shares authorized for issuance under the 2014 Plan on the first trading day of January each year equal to the lesser of

Options issued under the 2014 Plan have a contractual life of

| a. | Time-Based Restricted Stock Awards: |

During 2022, the Company granted

| b. | Restricted Stock Awards in Lieu of Bonus: |

During the three months ended March 31, 2023, the Company granted

| c. | Performance-Based Restricted Stock Awards: |

Stock-based compensation expense for performance-based grants are recorded when management estimates that the vesting of these shares is probable based on the status of the Company’s research and development programs and other relevant factors, which were established by the Company’s board of directors. The Company’s board of directors determines if the performance conditions have been met.

During 2021, the Company granted

14

ZYNERBA PHARMACEUTICALS, INC.

NOTES TO UNAUDITED CONSOLIDATED FINANCIAL STATEMENTS (Continued)

During 2022, the Company granted

For the three months ended March 31, 2023 and 2022, the Company recorded stock-based compensation expense related to its stock option grants and restricted stock awards, as follows:

Stock Option Grants | Restricted stock awards | Total | ||||||||||||||||

| 2023 |

| 2022 |

| 2023 |

| 2022 | 2023 |

| 2022 | ||||||||

Research and development | $ | | $ | | $ | | $ | | $ | | $ | | ||||||

General and administrative | |

| |

| |

| |

| |

| | |||||||

$ | | $ | | $ | | $ | | $ | | $ | | |||||||

The following table summarizes the Company’s stock option activity for the three months ended March 31, 2023:

|

| Weighted- |

| Weighted- |

| |||||

Average | Average | Aggregate | ||||||||

Number | Exercise | Contractual | Intrinsic | |||||||

of Shares | Price | Life (in Years) |

| Value | ||||||

Outstanding as of December 31, 2022 |

| | $ | |

| |||||

Granted | — | — | ||||||||

Exercised | — | — | ||||||||

Forfeited | — | — | ||||||||

Outstanding as of March 31, 2023 |

| | $ | |

| $ | — | |||

Exercisable as of March 31, 2023 |

| | $ | |

| $ | — | |||

Vested and expected to vest as of March 31, 2023 |

| | $ | | ||||||

The weighted-average grant date fair values of options granted during the three months ended March 31, 2022 was $

The fair values of stock options granted were calculated using the Black-Scholes option pricing model with the following weighted-average assumptions:

| Three months ended March 31, | |||

| 2023 |

| 2022 | |

Weighted-average risk-free interest rate |

| n/a | ||

Expected term of options (in years) |

| n/a | ||

Expected stock price volatility |

| n/a | ||

Expected dividend yield |

| n/a | ||

As of March 31, 2023, there was $

15

ZYNERBA PHARMACEUTICALS, INC.

NOTES TO UNAUDITED CONSOLIDATED FINANCIAL STATEMENTS (Continued)

The following table summarizes the Company’s restricted stock award activity under the 2014 Plan for the three months ended March 31, 2023:

Weighted |

| |||||||

Average | Aggregate | |||||||

Grant Date | Intrinsic | |||||||

| Shares |

| Fair Value | Value | ||||

Unvested as of December 31, 2022 | | $ | |

|

| |||

Granted | |

| | |||||

Vested | ( |

| | |||||

Unvested as of March 31, 2023 | | $ | | $ | | |||

Expected to vest as of March 31, 2023 |

| | $ | | $ | | ||

As of March 31, 2023, excluding performance-based restricted stock awards that have not been deemed probable, there was $

(9) Operating Lease Obligations

The Company adopted Accounting Standards Update No. 2016-02, Leases (Topic 842), Accounting Standards Codification 842 prospectively using the modified-retrospective method and elected the

The Company leases its headquarters where it occupies

As of March 1, 2021, the effective date of the lease modification, the Company remeasured the lease liability for the remaining portion of the lease and adjusted the lease liability to $

Other operating lease information as of March 31, 2023:

Weighted-average remaining lease term - operating leases | years | ||

Weighted-average discount rate - operating leases | % |

The following is a maturity analysis of the annual undiscounted cash flows of the operating lease liabilities as of March 31, 2023:

March 31, | |||

Year ending: | 2023 | ||

December 31, 2023 | $ | | |

December 31, 2024 | | ||

Total minimum lease payments | | ||

Less: imputed lease interest | ( | ||

Total lease liabilities | $ | | |

16

ZYNERBA PHARMACEUTICALS, INC.

NOTES TO UNAUDITED CONSOLIDATED FINANCIAL STATEMENTS (Continued)

Lease expense for the three months ended March 31, 2023 and 2022 was comprised of the following:

Three months ended March 31, | ||||||

2023 |

| 2022 | ||||

Operating lease expense | $ | | $ | | ||

Variable lease expense |

| |

| | ||

Total lease expense | $ | | $ | | ||

Total cash payments related to leases were $

17

Item 2. Management's Discussion and Analysis of Financial Condition and Results of Operations

You should read the following discussion and analysis of our financial condition and results of operations together with our unaudited interim consolidated financial statements and related notes appearing elsewhere in this Quarterly Report and the audited consolidated financial statements and notes thereto for the year ended December 31, 2022 and the related Management’s Discussion and Analysis of Financial Condition and Results of Operations, both of which are contained in our 2022 Annual Report. The following discussion contains forward-looking statements that involve risks, uncertainties and assumptions. Our actual results and the timing of certain events could differ materially from those anticipated in these forward-looking statements as a result of many factors. We discuss factors that we believe could cause or contribute to these differences below and elsewhere in this Quarterly Report, including those set forth under “Cautionary Note Regarding Forward-looking Statements” and “Risk Factors” in this Quarterly Report and our 2022 Annual Report.

Overview

Company Overview

We are the leader in pharmaceutically-produced transdermal cannabinoid therapies for orphan neuropsychiatric disorders. We are committed to improving the lives of patients and their families living with severe, chronic health conditions, including Fragile X syndrome, or FXS, and chromosome 22q11.2 deletion syndrome, or 22q.

Cannabinoids are a class of compounds derived from Cannabis plants. The two primary cannabinoids contained in Cannabis are cannabidiol and tetrahydrocannabinol, or THC. Clinical and preclinical data suggest that cannabidiol may have positive effects on treating behavioral symptoms of FXS and 22q.

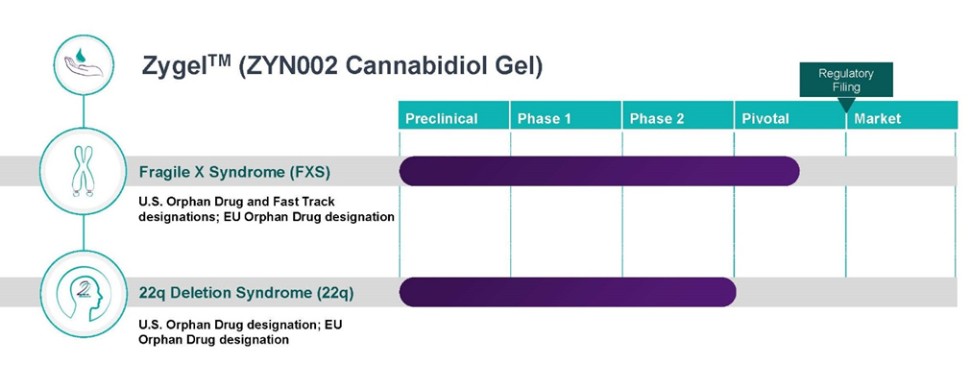

We are currently developing Zygel (also known as ZYN002), the first and only pharmaceutically-produced cannabidiol formulated as a permeation-enhanced gel for transdermal delivery and manufactured without the presence of THC, which is patent protected through 2030. Additional patents expiring between 2026 and 2040 are directed to methods of use relating to Zygel, including methods of treating FXS or 22q.

In preclinical animal studies, Zygel’s permeation enhancer increased delivery of cannabidiol through the layers of the skin and into the circulatory system. These preclinical studies suggest increased bioavailability, consistent plasma levels and the avoidance of first-pass liver metabolism of cannabidiol when delivered transdermally. In addition, an in vitro study published in Cannabis and Cannabinoid Research in April 2016 demonstrated that cannabidiol is degraded to THC (the major psychoactive cannabinoid in Cannabis) in an acidic environment such as the stomach. As a result, we believe such degradation may lead to increased psychoactive effects if cannabidiol is delivered orally. These effects may be avoided with the transdermal delivery of Zygel, which maintains cannabidiol in a neutral pH.

Zygel is being developed as a clear gel and is targeting treatment of behavioral symptoms of FXS and 22q. We have received orphan drug designations from the United States Food and Drug Administration, or FDA, and the European Commission for cannabidiol, the active ingredient in Zygel, for the treatment of FXS and 22q. In May 2019, we received Fast Track designation from the FDA for treatment of behavioral symptoms associated with FXS. The FDA’s Fast Track program is designed to facilitate the development of drugs intended to treat serious conditions and fill unmet medical needs and can lead to expedited review by the FDA in order to get new important drugs to the patient earlier.

18

Clinical Development Programs

Our clinical programs for Zygel include ongoing and planned clinical trials evaluating Zygel in the treatment of behavioral symptoms of FXS and 22q.

The Zygel safety database across all clinical studies conducted by us includes data from more than 900 volunteers and patients. Across these clinical studies, Zygel has been generally well-tolerated to date, with a safety profile that has been consistent across our Phase 2 and Phase 3 clinical trials.

FXS

CONNECT-FX Trial

In June 2020, we announced results of our CONNECT-FX clinical trial, a multi-national randomized, double-blind, placebo-controlled, 14-week study designed to assess the efficacy and safety of Zygel in children and adolescents ages three through 17 years who have full mutation of the FMR1 gene. While Zygel did not achieve statistical significance versus placebo in the primary endpoint of improvement in the Social Avoidance subscale of the Aberrant Behavior Checklist – Community FXS, or ABC-CFXS, a pre-planned ad hoc analysis of the most severely impacted patients in the trial, as defined by patients having at least 90% methylation (“highly methylated”) of the impacted FMR1 gene, demonstrated that those patients receiving Zygel achieved statistical significance in the primary endpoint of improvement at 12 weeks of treatment in the Social Avoidance subscale of the ABC-CFXS compared to placebo. We performed a subsequent analysis of the CONNECT-FX population within those patients having 100% or complete methylation of the impacted FMR1 gene, which demonstrated that these patients having complete methylation and receiving Zygel similarly achieved statistical significance in the primary endpoint of improvement at 12 weeks of treatment in the Social Avoidance subscale of the ABC-CFXS compared to placebo.

RECONNECT Trial

In September 2021, we initiated our RECONNECT (A Randomized, Double-Blind, Placebo-Controlled, Multiple-Center, Efficacy and Safety Study of ZYN002 Administered as a Transdermal Gel to Children, Adolescents and Young Adults with Fragile X Syndrome) trial, a pivotal, multi-national, confirmatory Phase 3 trial of Zygel in patients with FXS. The trial is designed to confirm the positive results observed in patients having 100% or complete methylation of the impacted FMR1 gene in our CONNECT-FX trial.

RECONNECT is an 18-week trial that is expected to enroll approximately 200 patients, aged three through 22 years, at 29 clinical sites in the United States, Australia and the United Kingdom. Approximately 160 of the patients enrolled will have complete (100%) methylation of their FMR1 gene and approximately 40 patients will have partial methylation of their FMR1 gene. Patients will be randomized 1:1 to either Zygel or placebo. Randomization will be stratified by gender, methylation status and weight.

19

The primary endpoint for the trial will be the change from baseline to the end of the treatment period in the ABC-CFXS Social Avoidance subscale in patients who have complete methylation of their FMR1 gene. The ABC-CFXS Social Avoidance subscale is the same primary endpoint used in the CONNECT-FX trial.

Key secondary efficacy endpoints include: (i) the change from baseline to the end of the treatment period in the ABC-CFXS Irritability subscale in patients who have complete methylation of their FMR1 gene; (ii) the percent of patients with any improvement on the Caregiver Global Impression of Change, or CaGI-C, at the end of the treatment period for Social Interactions among patients with complete methylation of the FMR1 gene; (iii) the percent of patients rated as improved on the Clinical Global Impression- Improvement, or CGI-I, scale among patients with complete methylation (100%) of the FMR1 gene; and (iv) the change from baseline to the end of the treatment period in the ABC-CFXS Social Avoidance subscale among all randomized patients (complete and partial methylation of the FMR1 gene).

Top-line results for the RECONNECT trial are expected in the first half of 2024. All patients who complete dosing in the RECONNECT trial will be eligible to enroll in our ongoing open-label extension trial.

22q

Phase 2 INSPIRE Trial

In June 2022, we announced top-line results from our Phase 2 INSPIRE clinical trial, a 14-week, open-label clinical trial designed to assess the safety, tolerability and efficacy of Zygel for treatment of behavioral symptoms of 22q. The Phase 2 trial was designed for signal detection by assessing the safety, tolerability and efficacy of Zygel for the treatment of behavioral symptoms of 22q in children and adolescents. Zygel was administered to patients with 22q as an add-on therapy to their standard of care and utilized a variety of efficacy assessments. Patients who completed the initial 14-week treatment period and met certain requirements were eligible to enroll in a 24-week open label extension for a total treatment period of 38 weeks. In December 2022, we announced additional data from patients who completed 38 weeks of treatment in the INSPIRE trial. Key findings from the trial include:

| ● | The total score and all five subscales of the Anxiety, Depression and Mood Scale (ADAMS) showed statistically significant improvements at 14 and 38 weeks of treatment compared to baseline; |

| ● | All five subscales of the Aberrant Behavior Checklist – Community, or ABC-C, showed statistically significant improvements at 14 and 38 weeks of treatment compared to baseline; |

| ● | The Pediatric Anxiety Rating Scale (PARS – R) showed statistically significant improvements at 14 and 38 weeks of treatment compared to baseline; and |

| ● | The majority of patients showed clinically meaningful improvements at week 14 as demonstrated by the CGI-I. Seventy-five percent of patients were rated by the clinicians as “improved,” “much improved” or “very much improved” with nearly two-thirds (62.5%) of the patients being “much improved” or “very much improved.” |

Zygel was shown to be generally well tolerated over 38 weeks, and the safety profile was consistent with previously released data from other Zygel clinical trials. Three patients reported treatment related adverse events which were all mild application site adverse events. One patient discontinued treatment due to adverse events not related to Zygel.

Based on the positive Phase 2 data, we held an initial meeting with the FDA to obtain feedback on the data and the regulatory path forward for Zygel in the treatment of children and adolescents with 22q. We expect that we will continue a productive dialogue with the FDA on this topic in 2023 and arrive at an acceptable trial design by the end of 2023. The Company does not expect to commence another trial in 22q until after the RECONNECT top line results are available in the first half of 2024.

Impact of COVID-19, Respiratory Syncytial Virus (RSV) and Influenza

We continue to closely monitor the status of COVID-19, including its potential impact on our clinical development plans, patient recruitment and overall clinical trial timelines going forward. In response to the impact of COVID-19, for our current clinical development programs, we implemented multiple measures consistent with the FDA’s guidance on the conduct of clinical trials of medical products during COVID-19, including remote site monitoring and patient visits

20

using telemedicine where needed and appropriate, direct-to-patient drug shipments and local study-related clinical laboratory collection.

There is a possibility that our current or future clinical trial sites may be affected by COVID-19 due to prioritization of hospital resources toward COVID-19, as well as the inability to access sites for initiation, patient enrollment and monitoring. As a result, patient screening, new patient enrollment, monitoring and data collection may be affected or delayed.

In the fall of 2022, there was a significantly higher prevalence of influenza and RSV, in addition to the ongoing presence of COVID-19, leading to a “tripledemic”. The impact of the tripledemic was greatest in children, who are the primary population for our clinical trials.

We are aware that several clinical sites involved in our clinical trials have in the past temporarily stopped or delayed enrolling new patients, with exemptions if appropriate, and it is possible that these or other clinical sites may be similarly affected in the future. These developments may delay or extend our projected clinical trial timelines. Some of our third-party manufacturers, which we use for the supply of materials for product candidates or other materials necessary to manufacture products to conduct preclinical tests and clinical trials, and contract research organizations may be impacted by COVID-19. Should they experience disruptions, such as temporary closures or suspension of services, we would likely experience delays in advancing our current or planned clinical trials. As of the date of these financial statements, we are not aware of any specific event or circumstance that would require us to update our estimates, assumptions and judgments or revise the carrying value of its assets or liabilities. Actual results could differ from these estimates, and any such differences may be material to our consolidated financial statements.

Operations

We have never been profitable and have incurred net losses since inception. Our net losses were $10.1 million and $8.5 million for the three months ended March 31, 2023 and 2022, respectively. As of March 31, 2023, our accumulated deficit was $284.6 million. We expect to incur losses for the foreseeable future, and we expect these losses to increase as we continue our development of, and seek regulatory approvals for, our product candidates. Because of the numerous risks and uncertainties associated with product development, we are unable to predict the timing or amount of increased expenses or when, or if, we will be able to achieve or maintain profitability.

Financial Operations Overview

The following discussion sets forth certain components of our consolidated statements of operations as well as factors that impact those items.

Research and Development Expenses

Our research and development expenses relating to our product candidates consisted of the following:

| ● | expenses associated with preclinical development and clinical trials; |

| ● | personnel-related expenses, such as salaries, benefits, travel and other related expenses, including stock-based compensation; |

| ● | payments to third-party CROs, CMOs, contractor laboratories and independent contractors; and |

| ● | depreciation, maintenance and other facility-related expenses. |

We expense all research and development costs as incurred. Clinical development expenses for our product candidates are a significant component of our current research and development expenses. Generally, expenses associated with clinical trials will increase as our clinical trials progress. Product candidates in later stage clinical development generally have higher research and development expenses than those in earlier stages of development, primarily due to increased size and duration of the clinical trials. We track and record information regarding external research and development expenses for each grant, study or trial that we conduct. We use third-party CROs, CMOs, contractor laboratories and independent contractors in preclinical studies and clinical trials. We recognize the expenses associated with third parties

21

performing these services for us in our preclinical studies and clinical trials based on the percentage of each study completed at the end of each reporting period.

Our Australian subsidiary, Zynerba Pharmaceuticals Pty Ltd, or the Subsidiary, is incorporated in Australia and is eligible to participate in an Australian research and development tax incentive program. As part of this program, the Subsidiary is eligible to receive a cash refund from the Australian Taxation Office, or the ATO, for a percentage of the research and development costs expended by the Subsidiary in Australia. The cash refund is available to eligible companies with an annual aggregate revenue of less than $20.0 million (Australian) during the reimbursable period. We estimate the amount of cash refund we expect to receive related to the Australian research and development tax incentive program and record the incentives when it is probable (1) we will comply with relevant conditions of the program and (2) the incentive will be received. We evaluate the Subsidiary’s eligibility under tax incentive programs as of each balance sheet date based on the most current and relevant data available. If the Subsidiary is deemed to be ineligible or unable to receive the Australian research and development tax credit, or the Australian government significantly reduces or eliminates the tax credit, the actual cash refund we receive may materially differ from our estimates.

The following table summarizes research and development expenses for the three months ended March 31, 2023 and 2022:

Three months ended March 31, | |||||

2023 | 2022 | ||||

Research and development expenses - before R&D incentive | $ | 7,392,490 | $ | 5,404,208 | |

Research and development incentive | (314,409) | (257,603) | |||

Total research and development expenses | $ | 7,078,081 | $ | 5,146,605 | |

We expect research and development expenses to increase for the year ending December 31, 2023 as compared to 2022, as we continue to conduct our RECONNECT clinical trial for FXS. These expenditures are subject to numerous uncertainties regarding timing and cost to completion. The impact of inflation could significantly impact the cost of our ongoing operations. Completion of our preclinical development and clinical trials may take several years or more and the length of time generally varies according to the type, complexity, novelty and intended use of a product candidate. The cost of clinical trials may vary significantly over the life of a project as a result of differences arising during clinical development, including, among others:

| ● | the number of sites included in the clinical trials; |

| ● | the length of time required to enroll suitable patients; |

| ● | the size of patient populations participating in the clinical trials; |

| ● | the duration of patient follow-ups; |

| ● | the development stage of the product candidates; and |

| ● | the efficacy and safety profile of the product candidates. |

Due to the early stages of our research and development, we are unable to determine the duration or completion costs of our development of our product candidates. As a result of the difficulties of forecasting research and development costs of our product candidates as well as the other uncertainties discussed above, we are unable to determine when and to what extent we will generate revenue from the commercialization and sale of an approved product candidate.

General and Administrative Expenses

General and administrative expenses consist primarily of salaries, benefits and other related costs, including stock-based compensation, for personnel serving in our executive, finance, legal, human resource, investor relations and commercial functions. Our general and administrative expenses also include facility and related costs not included in research and development expenses, professional fees for legal services, including patent-related expenses, litigation settlement expenses, consulting, tax and accounting services, insurance, market research and general corporate expenses. We expect that our general and administrative expenses will increase for the next several years due to inflation and increased labor

22

costs, and as we increase our headcount with the continued development and potential commercialization of our product candidates.

Interest Income

Interest income primarily consists of interest earned on balances maintained in our money market bank account.

Foreign Exchange Loss

Foreign exchange loss relates to the effect of exchange rates on transactions incurred by the Subsidiary.

Critical Accounting Estimates

Our management’s discussion and analysis of our financial condition and results of operations is based on our consolidated financial statements, which have been prepared in accordance with U.S. generally accepted accounting principles, or GAAP. The preparation of these financial statements requires us to make estimates and judgments that affect the reported amounts of assets and liabilities, disclosure of contingent assets and liabilities at the date of the financial statements, and the reported amounts of revenues and expenses during the reported period. In accordance with GAAP, we base our estimates on historical experience, known trends and events and various other factors that we believe to be reasonable under the circumstances, the results of which form the basis for making judgments about the carrying amounts of assets and liabilities that are not readily apparent from other sources. Actual results may differ from these estimates under different assumptions or conditions.

We define our critical accounting policies as those that require us to make subjective estimates and judgments about matters that are uncertain and are likely to have a material impact on our financial condition and results of operations as well as the specific manner in which we apply those principles. Critical accounting estimates and the accounting policies critical to the process of making significant judgments and estimates in the preparation of our consolidated financial statements are discussed in our 2022 Annual Report under Part II, Item 7, “Critical Accounting Estimates.” During the three months ended March 31, 2023, there have been no material changes to the critical accounting estimates or critical accounting policies discussed in our 2022 Annual Report.

Research and Development Expenses – Critical Accounting Estimates

We rely on third parties to conduct our preclinical studies and clinical trials, and to provide services, including data management, statistical analysis and electronic compilation. At the end of each reporting period, we compare the payments made to each service provider to the estimated progress towards completion of the related project. Factors that we will consider in preparing these estimates include the number of patients enrolled in studies, milestones achieved and other criteria related to the efforts of our vendors. These estimates will be subject to change as additional information becomes available. Depending on the timing of payments to vendors and estimated services provided, we will record net prepaid or accrued expenses related to these costs.

Results of Operations

Comparison of the Three Months Ended March 31, 2023 and 2022

Research and Development Expenses

Research and development expenses increased by $1.9 million, or 38%, to $7.1 million for the three months ended March 31, 2023 from $5.1 million for the three months ended March 31, 2022. The increase was primarily related to increases in manufacturing and clinical costs associated with our Zygel program slightly offset by lower stock-based compensation expenses.

23

General and Administrative Expenses

General and administrative expenses decreased by $0.4 million, or 10%, to $3.4 million for the three months ended March 31, 2023 from $3.8 million for the three months ended March 31, 2022. The decrease was primarily related to lower stock-based compensation expenses and a decrease in directors’ and officers’ liability insurance costs.

Other Income (Expense)

During the three months ended March 31, 2023 and 2022, we recognized $0.4 million and $0.1 million, respectively, in interest income. The increase in interest income was due to higher average interest rates earned on our investments. During the three months ended March 31, 2023 and 2022, we recognized a foreign currency loss of $0.1 million and a foreign currency gain of $0.3 million, respectively. Foreign currency gains and losses are due primarily to the remeasurement of the Subsidiary’s assets and liabilities, which are denominated in the local currency to the Subsidiary’s functional currency, which is the U.S. dollar.

Liquidity and Capital Resources

Since our inception in 2007, we have devoted most of our cash resources to research and development and general and administrative activities. We have financed our operations primarily with the proceeds from the issuance and sale of equity securities (most notably our initial public offering, our follow-on public offerings and sales under our “at-the-market” offerings and through the Purchase Agreement), convertible promissory notes, state and federal grants and research services.

To date, we have not generated any revenue from the sale of products, and we do not anticipate generating any revenue from the sales of products for the foreseeable future. We have incurred losses and generated negative cash flows from operations since inception. As of March 31, 2023, our principal sources of liquidity were our cash and cash equivalents of $44.4 million. Our working capital was $38.0 million as of March 31, 2023.

Management believes that cash and cash equivalents as of March 31, 2023 are sufficient to fund operations and capital requirements to mid-year 2024. Substantial additional financings will be needed to fund our operations and to complete clinical development of and to commercially develop our product candidates. There can be no assurance that such financing will be available when needed or on acceptable terms. Our ability to access the capital markets or otherwise raise such capital may be adversely impacted by geopolitical tensions and macroeconomic events and the recent disruptions to, and volatility in, financial markets in the United States and globally resulting from multiple factors such as COVID-19, inflationary pressures, rising interest rates and the ongoing conflict in Ukraine.

At-The-Market Financings

On May 11, 2021, we entered into a Controlled Equity OfferingSM Sales Agreement, or the 2021 Sales Agreement, with Cantor Fitzgerald & Co., Canaccord Genuity, LLC, H.C. Wainwright & Co. LLC and Ladenburg Thalmann & Co. Inc., as sales agents, pursuant to which, under a prospectus filed in May 2022, we may sell, from time to time, up to $75.0 million of our common stock. We are currently subject to General Instruction I.B.6 of Form S-3, and the amount of funds we can raise through primary public offerings of securities in any twelve-month period using our existing registration statement on Form S-3 is limited to one-third of the aggregate market value of the voting and non-voting common equity held by non-affiliates. We will be subject to this limit until such time as our public float exceeds $75.0 million.

During the three months ended March 31, 2023, we sold and issued 1,179,077 shares of common stock under the 2021 Sales Agreement in the open market at a weighted average selling price of $0.56 per share, resulting in gross proceeds of $0.7 million. Net proceeds after deducting commissions and offering expenses were $0.6 million.

24

Equity Purchase Agreement

On July 21, 2022, we entered into a purchase agreement, or the Purchase Agreement, with Lincoln Park Capital Fund, LLC, or Lincoln Park, pursuant to which Lincoln Park committed to purchase up to $20.0 million of our common stock. Under the terms and subject to the conditions of the Purchase Agreement, we have the right, but not the obligation, to sell to Lincoln Park, and Lincoln Park is obligated to purchase up to $20.0 million of our common stock. Such sales of common stock will be subject to certain limitations, and may occur from time to time, at our sole discretion, over the 36-month period commencing on July 21, 2022. The number of shares we may sell to Lincoln Park on any single business day in a regular purchase is 150,000, but that amount may be increased up to 300,000 shares, depending upon the market price of our common stock at the time of sale and subject to a maximum limit of $2.0 million per regular purchase. The purchase price per share for each such regular purchase will be based on prevailing market prices of our common stock immediately preceding the time of sale as computed under the Purchase Agreement. In addition to regular purchases, we may also direct Lincoln Park to purchase other amounts as accelerated purchases or as additional accelerated purchases. During the three months ended March 31, 2023, we sold and issued 2,100,000 shares of common stock under the Purchase Agreement at a weighted average selling price of $0.53 per share, resulting in gross and net proceeds of $1.1 million. From April 1, 2023 through May 11, 2023, we sold and issued 150,000 shares of common stock under the Purchase Agreement at a weighted average selling price of $0.41 per share, resulting in gross and net proceeds of $0.1 million.

Debt

We had no debt outstanding as of March 31, 2023 or December 31, 2022.

Future Capital Requirements

During the three months ended March 31, 2023, net cash used in operating activities was $7.9 million, and our accumulated deficit as of March 31, 2023 was $284.6 million. Our expectations regarding future cash requirements do not reflect the potential impact of any future acquisitions, mergers, dispositions, joint ventures or investments that we may make in the future. To the extent that we enter into any of those types of transactions, we may need to raise substantial additional capital.

We expect to continue to incur substantial additional operating losses for at least the next several years as we continue to develop our product candidates and seek marketing approval and, subject to obtaining such approval, the eventual commercialization of our product candidates. If we obtain marketing approval for any of our product candidates, we will incur significant sales, marketing and manufacturing expenses. In addition, we expect to incur additional expenses to add operational, financial and information systems and personnel, including personnel to support our planned product commercialization efforts. We also expect to continue to incur significant costs to comply with corporate governance, internal controls and similar requirements associated with operating as a public reporting company.

Our future use of operating cash and capital requirements will depend on many forward-looking factors, including the following:

| ● | the initiation, progress, timing, costs and results of preclinical studies and clinical trials for our product candidates; |

| ● | the clinical development plans we establish for these product candidates; |

| ● | the number and characteristics of product candidates that we may develop or in-license; |

| ● | the terms of any collaboration agreements we may choose to execute; |

| ● | the outcome, timing and cost of meeting regulatory requirements established by the FDA, the European Medicines Agency or other comparable foreign regulatory authorities; |

25

| ● | the cost of filing, prosecuting, defending and enforcing our patent claims and other intellectual property rights; |

| ● | the cost of defending intellectual property disputes, including patent infringement actions brought by third parties against us; |

| ● | costs and timing of the implementation of commercial scale manufacturing activities; |

| ● | the cost of establishing, or outsourcing, sales, marketing and distribution capabilities for any product candidates for which we may receive regulatory approval in regions where we choose to independently commercialize our products; |

| ● | the extent to which health epidemics and other outbreaks of communicable diseases, including COVID-19, could disrupt our operations or materially and adversely affect our business and financial conditions; |

| ● | the timing and outcome of the ATO’s review regarding our eligibility to receive tax credits related to the research and development tax incentive program; and |

| ● | liquidity constraints, failures and instability in U.S. and international financial banking systems. |

To the extent that our capital resources are insufficient to meet our future operating and capital requirements, we will need to finance our cash needs through the sale of equity securities via the 2021 Sales Agreement or the Purchase Agreement, public or private equity offerings, debt financings, collaboration and licensing arrangements or other financing alternatives. Other than the Purchase Agreement, we have no committed external sources of funds. Additional equity or debt financing or collaboration and licensing arrangements may not be available on acceptable terms, if at all.

If we raise additional funds by issuing equity securities, including through our 2021 Sales Agreement or Purchase Agreement, our stockholders will experience dilution.

Cash Flows

The following table summarizes our cash flows from operating, investing and financing activities for the three months ended March 31, 2023 and 2022.

Three Months Ended March 31, |

| ||||||

| 2023 |

| 2022 |

| |||

Statement of Cash Flows Data: | |||||||

Total net cash (used in) provided by: | |||||||

Operating activities | $ | (7,880,288) | $ | 200,632 | |||

Investing activities |

| (89,552) |

| (51,607) | |||

Financing activities |

| 1,729,191 |

| 1,740,840 | |||

Net (decrease) increase in cash and cash equivalents | $ | (6,240,649) | $ | 1,889,865 | |||

Operating Activities

For the three months ended March 31, 2023, cash used in operating activities was $7.9 million compared $0.2 million of cash provided by operating activities for the three months ended March 31, 2022. The change from the comparable 2022 period was primarily due to the Company receiving payment of $8.0 million from the ATO, during the three months ended March 31, 2022, for the research and development incentive for the years ended December 31, 2018, 2019 and 2020. Our cash flows used in operations may differ substantially from our net loss due to non-cash charges and changes in balance sheet accounts.

26

Excluding the $8.0 million of cash received from the ATO in 2022, we expect cash used in operating activities to increase for the year ending December 31, 2023 as compared to 2022, as we continue to conduct our RECONNECT clinical trial for FXS.

Investing Activities

For the three months ended March 31, 2023 and 2022, cash used in investing activities represented the cost of expenditures made for manufacturing equipment.

Financing Activities

Cash provided by financing activities for the three months ended March 31, 2023 consisted of $0.6 million in net proceeds from sales of our shares of common stock under the 2021 Sales Agreement and $1.1 million in net proceeds from sales of our shares under the Purchase Agreement. Cash provided by financing activities for the three months ended March 31, 2022 consisted of $1.7 million in net proceeds from sales of our shares of common stock under the 2021 Sales Agreement.

Recently Adopted Accounting Pronouncements

In November 2021, the Financial Accounting Standards Board, or FASB, issued Accounting Standards Update No. 2021-10, Government Assistance (Topic 832): Disclosure by Business Entities about Government Assistance, or ASU 2021-10, which improves the transparency of government assistance received by most business entities by requiring the disclosure of: (1) the types of government assistance received; (2) the accounting for such assistance; and (3) the effect of the assistance on a business entity’s financial statements. This guidance is effective for financial statements issued for annual periods beginning after 15 December 2021. The adoption of the guidance on January 1, 2022 did not have a material impact on our consolidated financial statements.

Item 3. Quantitative and Qualitative Disclosures About Market Risk

We are exposed to various market risks, which may result in potential losses arising from adverse changes in market rates, such as interest rates and foreign exchange rates. We do not enter into derivatives or other financial instruments for trading or speculative purposes, nor do we engage in any hedging activities. As of March 31, 2023, we had cash and cash equivalents of $44.4 million consisting primarily of cash and money market account balances. Because of the short-term maturities of our cash and cash equivalents, we do not believe that an immediate 10% increase in interest rates would have any significant impact on the realized value of our investments. Accordingly, we do not believe we are exposed to material market risk with respect to our cash and cash equivalents.

We have engaged third parties to manufacture our product candidates in Australia, Canada and the United Kingdom and to conduct clinical trials for our product candidates in the United States, Australia and New Zealand. Manufacturing and research costs related to these operations are paid for in a combination of U.S. dollars and local currencies, limiting our foreign currency exchange rate risk, however, our consolidated financial statements are reported in U.S. dollars and changes in foreign currency exchange rates could significantly affect our financial condition, results of operations, or cash flows. If we conduct clinical trials and seek to manufacture a more significant portion of our product candidates outside of the United States in the future, we could incur significant foreign currency exchange rate risk.

27

Item 4. Controls and Procedures.

Evaluation of Disclosure Controls and Procedures

Our management, with the participation of our Chief Executive Officer and Chief Financial Officer, evaluated the effectiveness of our disclosure controls and procedures as of March 31, 2023. The term “disclosure controls and procedures,” as defined in Rules 13a-15(e) and 15d-15(e) under the Securities Exchange Act of 1934, as amended, or the Exchange Act, means controls and other procedures of a company that are designed to ensure that information required to be disclosed by a company in the reports that it files or submits under the Exchange Act is recorded, processed, summarized and reported, within the time periods specified in the rules and forms, promulgated by the Securities and Exchange Commission. Management recognizes that any controls and procedures, no matter how well designed and operated, can provide only reasonable assurance of achieving their objectives and management necessarily applies its judgment in evaluating the cost-benefit relationship of possible controls and procedures. Based on the evaluation of the effectiveness of the design and operation of our disclosure controls and procedures as of March 31, 2023, our Chief Executive Officer and Chief Financial Officer concluded that, as of such date, our disclosure controls and procedures were effective at the reasonable assurance level.

Changes in Internal Control Over Financial Reporting

There were no changes in our internal control over financial reporting during the three months ended March 31, 2023 that have materially affected, or are reasonably likely to materially affect, our internal control over financial reporting.

28

PART II—OTHER INFORMATION

Item 1. Legal Proceedings.

We may become engaged in legal actions arising in the ordinary course of our business (such as, for example, proceedings relating to employment matters or the initiation or defense of proceedings relating to intellectual property rights) from time to time and, while there can be no assurance, we believe that the ultimate outcome of these legal actions will not have a material adverse effect on our business, results of operations, financial condition or cash flows.

Item 1A. Risk Factors.

You should carefully consider the risk factors described in our 2022 Annual Report under the caption “Item 1A. “Risk Factors.” Except as set forth below, there have been no material changes in our risk factors included in our 2022 Annual Report. The risks described in our 2022 Annual Report are not the only risks facing our company. Additional risks and uncertainties not currently known to us or that we currently deem to be immaterial also may materially adversely affect our business, financial condition or future results.

Adverse developments affecting the financial services industry, including events or concerns involving liquidity, defaults or non-performance by financial institutions or transactional counterparties, could adversely affect our business, financial condition or results of operations.

Events involving limited liquidity, defaults, non-performance or other adverse developments that affect financial institutions, transactional counterparties or other companies in the financial services industry or the financial services industry generally, or concerns or rumors about any events of these kinds or other similar risks, have in the past and may in the future lead to market-wide liquidity problems. For example, on March 10, 2023, Silicon Valley Bank was closed by the California Department of Financial Protection and Innovation, which appointed the Federal Deposit Insurance Corporation, or FDIC, as receiver. Similarly, on March 12, 2023, Signature Bank and Silvergate Capital Corp. were each swept into receivership. Most recently, First Republic Bank was acquired by JPMorgan Chase after being seized by the FDIC. Although we assess our banking and customer relationships as we believe necessary or appropriate, our access to funding sources and other credit arrangements in amounts adequate to finance or capitalize our current and projected future business operations could be significantly impaired by factors that affect us, the financial services industry or economy in general. These factors could include, among others, events such as liquidity constraints or failures, the ability to perform obligations under various types of financial, credit or liquidity agreements or arrangements, disruptions or instability in the financial services industry or financial markets, or concerns or negative expectations about the prospects for companies in the financial services industry.