Exhibit 10.1

Execution Version

SEPARATION AGREEMENT

AND GENERAL RELEASE OF CLAIMS

This SEPARATION AGREEMENT AND GENERAL RELEASE OF CLAIMS (this “Agreement”) is entered into by and among Holbrook F. Dorn (“Executive”) and Black Stone Natural Resources Management Company, a Delaware corporation (the “Company”). Black Stone Minerals GP, L.L.C., a Delaware limited liability company (the “General Partner”), joins this Agreement for the limited purpose of agreeing to Sections 2, 3 and 13 below. The Company, the General Partner, and Executive are each referred to herein individually as a “Party” and collectively as the “Parties.”

WHEREAS, Executive was employed by the Company as Senior Vice President, Business Development;

WHEREAS, Executive’s employment with the Company ended as of February 24, 2020 (the “Separation Date”), and the Company and the General Partner wish to provide Executive with certain compensation and benefits, the receipt of which is dependent upon Executive’s timely entry into (and non-revocation in the time provided to do so of) this Agreement and compliance with the terms of Articles III, IV and V of the Severance Agreement between Executive and the Company dated May 6, 2015 (the “Severance Agreement”), as such Severance Agreement may be amended pursuant to Section 2(f) and Section 2(g); and

WHEREAS, for the purposes of avoiding the uncertainty, expense, and burden associated with any dispute, the Parties desire to settle any potential disputes, including those that may arise by virtue of either the employment relationship between Executive and the Company or the end of such employment relationship.

NOW, THEREFORE, in consideration of the promises and benefits set forth herein, and for other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged by the Parties, the Parties hereby agree as follows:

1. Separation from Employment. Executive’s employment with the Company ended as of the Separation Date. As of the Separation Date, Executive was no longer employed by the Company or any other Released Party (as defined below). As of the Separation Date, Executive is deemed to have automatically resigned (a) as an officer of the Company and each of its Affiliates (as defined in the Severance Agreement), as applicable, and (b) from the board of managers, board of directors, or similar governing body of each of the Company’s Affiliates (as applicable) and any other corporation, limited liability company, or other entity in which the Company or any of its Affiliates holds an equity interest or with respect to which board (or similar governing body) Executive serves as the designee or other representative of the Company or any of its Affiliates.

2. Separation Benefits. Provided that Executive (x) executes this Agreement on or after the Separation Date and prior to April 9, 2020, returns a copy of this Agreement that has been executed by him to the Company so that it is received by Steve Putman, Senior Vice President and General Counsel, 1001 Fannin Street, Suite 2020, Houston, Texas 77002 (email: sputman@blackstoneminerals.com) no later than 5:00 pm Houston, Texas time on April 9, 2020; (y) does not revoke his acceptance of this Agreement pursuant to Section 9; and (z) remains in compliance with the other terms and conditions set forth in this Agreement, Executive shall receive the following consideration:

(a) The Company shall pay Executive $752,595.63 (the “Severance Payment”) in a single lump sum cash payment after the date that is 60 days after the Separation Date, but in no event later than the date that is 70 days after the Separation Date.

(b) If Executive timely and properly elects to continue coverage for Executive and Executive’s spouse and eligible dependents, if any, under the Company’s group health plans pursuant to the Consolidated Omnibus Budget Reconciliation Act of 1985 (“COBRA”) similar in the amounts and types of coverage provided by the Company to Executive prior to the Separation Date, then for a period of 12 months following the Separation Date, the Company shall promptly reimburse Executive on a monthly basis for the entire amount Executive pays to effect and continue such coverage; provided, however, that Executive’s rights to such reimbursements under this Section 2(b) shall terminate at the time Executive becomes eligible to be covered under a group health plan sponsored by another employer (and Executive shall immediately notify the Company in the event that Executive becomes so eligible) and such coverage becomes effective (so long as Executive elects such coverage upon his first opportunity to do so). Notwithstanding anything in the preceding provisions of this Section 2(b) to the contrary, the election of COBRA continuation coverage and the payment of any premiums due with respect to such COBRA continuation coverage will remain Executive’s sole responsibility, and the Company will assume no obligation for payment of any such premiums relating to such COBRA continuation coverage.

(c) Pursuant to the terms of Executive’s Restricted Unit Award Grant Notice and Restricted Unit Award Agreement dated February 20, 2018 and Restricted Unit Award Grant Notice and Restricted Unit Award Agreement dated February 7, 2019 (collectively, the Restricted Unit Agreements”), the Forfeiture Restrictions (as defined in the Restricted Unit Agreements) on the Applicable Restricted Units (as defined in the Restricted Unit Agreements), which consist of 3,696 common units (“Common Units”) in Black Stone Minerals, L.P., a Delaware limited partnership (the “Partnership”), shall automatically lapse as of the last day of the Release Revocation Period (as defined below) (such last day, the “Release Revocation Expiration Date”) and the Applicable Restricted Units shall immediately thereafter become Earned Units (as defined in the Restricted Unit Agreements).

(d) Pursuant to the terms of Executive’s LTI Award Grant Notice and LTI Award Agreement dated February 20, 2018 (the “2018 Performance Unit Agreement”), (i) 51,373 Performance Units (as defined in the 2018 Performance Unit Agreement) shall become earned and will be settled in Common Units and (ii) in accordance with Section 4 of the 2018 Performance Unit Agreement, additional Common Units will be issued to Executive in settlement of the tandem DERs (as defined in the 2018 Performance Unit Agreement) relating to the Performance Units that have become earned, in each case, as soon as administratively practicable following the Release Revocation Expiration Date but in any event within 60 days following the Release Revocation Expiration Date.

2

(e) Pursuant to the terms of Executive’s LTI Award Grant Notice and LTI Award Agreement dated February 7, 2019 (the “2019 Performance Unit Agreement” and together with the Restricted Unit Agreements and the 2018 Performance Unit Agreement, the “LTI Award Agreements”), (i) 26,205 Performance Units (as defined in the 2019 Performance Unit Agreement) shall become earned and will be settled in Common Units and (ii) in accordance with Section 4 of the 2019 Performance Unit Agreement, additional Common Units will be issued to Executive in settlement of the tandem DERs (as defined in the 2019 Performance Unit Agreement) relating to the Performance Units that have become earned, in each case, as soon as administratively practicable following the Release Revocation Expiration Date but in any event within 60 days following the Release Revocation Expiration Date.

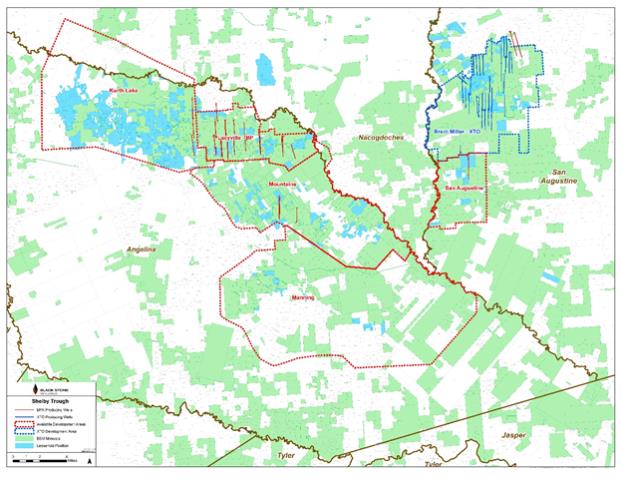

(f) Effective as of the Release Revocation Expiration Date, the definition of “Restricted Area” within the Severance Agreement shall be deemed modified so that, as of such date, the term “Restricted Area” within the Severance Agreement shall be interpreted and applied with respect to Executive to mean only that geographic area within the red and blue dashed line boundaries labeled “Available Development Areas” and “XTO Development Area” on the map attached hereto as Exhibit A. For the avoidance of doubt, if Executive fails to comply with the terms herein, including Section 3 below, this Section 2(f) shall be of no force or effect and the “Restricted Area” as defined in the Severance Agreement shall again have the meaning as in effect as of the Separation Date.

(g) Executive may prepare and, beginning on the Separation Date, share with third parties a summary “track record” reflecting the performance of acquisitions made during the term of Executive’s employment by the Company, substantially in the form of Exhibit C to this Agreement (the “Form Track Record”) or otherwise consistent with the conditions in this Section 2(g). The track record (including the Form Track Record):

(i) will not contain Company data (or be based on Company data) beyond that used to prepare the Form Track Record;

(ii) will not contain any material nonpublic information relating to the Company;

(iii) will be labeled to make clear that (A) it was prepared by the Executive and not the Company (B) the Company does not make any representation as to the accuracy of the information presented.

Executive acknowledges and agrees that the consideration described in this Section 2 represents the entirety of the amounts Executive is eligible to receive as separation pay and benefits from the Company and any other Released Party and that Executive was not entitled to such pay or benefits but for his timely entry into (and non-revocation of his acceptance of) this Agreement and compliance with the terms herein.

3. Post-Separation Consulting. Following the Separation Date, upon request from the Company or the General Partner, Executive agrees to cooperate with and assist the Company, the General Partner and their respective designees in order to provide such information and assistance as the Company or the General Partner may reasonably request from time to time, which cooperation and assistance may include providing consultation and advice with respect to the duties that Executive had performed for the Company and the General Partner and the transition of such duties. The Company agrees that it will promptly reimburse Executive for all pre-approved expenses incurred in connection with such post-separation consulting.

3

4. Release of Liability for Claims.

(a) For good and valuable consideration, including the consideration set forth in Section 2 (and any portion thereof), Executive hereby forever releases, discharges and acquits the Company, the Partnership, the General Partner, each of the foregoing entities’ respective Affiliates (as defined in the Severance Agreement), predecessors, successors, subsidiaries and benefit plans, and the foregoing entities’ respective equity-holders, officers, directors, managers, members, partners, employees, agents, representatives, and other affiliated persons, and the Company’s and its Affiliates’ benefit plans (and the fiduciaries and trustees of such plans) (collectively, the “Released Parties”), from liability for, and Executive hereby waives, any and all claims, damages, or causes of action of any kind related to Executive’s ownership of any interest in the Partnership or any other Released Party, his employment with any Released Party, the termination of such employment, and any other acts or omissions related to any matter occurring on or prior to the date that Executive executes this Agreement, including (i) any alleged violation through such time of: (A) any federal, state or local anti-discrimination or anti-retaliation law, regulation or ordinance, including the Age Discrimination in Employment Act of 1967 (including as amended by the Older Workers Benefit Protection Act), Title VII of the Civil Rights Act of 1964, the Civil Rights Act of 1991, Sections 1981 through 1988 of Title 42 of the United States Code and the Americans with Disabilities Act of 1990, as amended; (B) the Employee Retirement Income Security Act of 1974 (“ERISA”); (C) the Immigration Reform Control Act; (D) the National Labor Relations Act; (E) the Occupational Safety and Health Act; (F) the Family and Medical Leave Act of 1993; (G) the Texas Labor Code (including the Texas Payday law, the Texas Anti-Retaliation Act, Chapter 21 of the Texas Labor Code and the Texas Whistleblower Act; (H) any federal, state or local wage and hour law; (I) any other local, state or federal law, regulation or ordinance; or (J) any public policy, contract, tort, or common law claim; (ii) any allegation for costs, fees, or other expenses including attorneys’ fees incurred in or with respect to a Released Claim; (iii) any and all rights, benefits or claims Executive may have under any employment contract (including the Severance Agreement), incentive compensation plan or equity-based plan with any Released Party (including the LTI Award Agreements) or to any ownership interest in any Released Party; and (iv) any claim for compensation or benefits of any kind not expressly set forth in this Agreement (collectively, the “Released Claims”). This Agreement is not intended to indicate that any such claims exist or that, if they do exist, they are meritorious. Rather, Executive is simply agreeing that, in exchange for any consideration received by Executive pursuant to Section 2, any and all potential claims of this nature that Executive may have against the Released Parties, regardless of whether they actually exist, are expressly settled, compromised and waived. THIS RELEASE INCLUDES MATTERS ATTRIBUTABLE TO THE SOLE OR PARTIAL NEGLIGENCE (WHETHER GROSS OR SIMPLE) OR OTHER FAULT, INCLUDING STRICT LIABILITY, OF ANY OF THE RELEASED PARTIES.

(b) For the avoidance of doubt, nothing in this Agreement releases Executive’s rights to receive payments or benefits pursuant to Section 2 of this Agreement (including Executive’s right to the Severance Payment and the rights set forth in Section 2 with respect to the Restricted Unit Agreements, 2018 Performance Unit Agreement and 2019 Performance Unit Agreement). Further, in no event shall the Released Claims include (i) any claim that arises after

4

the date that Executive signs this Agreement; (ii) any claim to vested benefits under an employee benefit plan that is subject to ERISA; (iii) any claim relating to the settlement of the performance units granted under Executive’s LTI Award Grant Notice and LTI Award Agreement dated February 15, 2017; (iv) any claim for the payment of Executive’s short-term incentive award for the 2019 calendar year; or (v) any claim for breach of, or otherwise arising out of, this Agreement. Further notwithstanding this release of liability, nothing in this Agreement prevents Executive from filing any non-legally waivable claim (including a challenge to the validity of this Agreement) with the Equal Employment Opportunity Commission (“EEOC”) or comparable state or local agency or participating in (or cooperating with) any investigation or proceeding conducted by the EEOC or comparable state or local agency or cooperating in any such investigation or proceeding; however, Executive understands and agrees that Executive is waiving any and all rights to recover any monetary or personal relief from a Released Party as a result of such EEOC or comparable state or local agency or proceeding or subsequent legal actions. Further, nothing in this Release or the Separation Agreement prohibits or restricts Executive from filing a charge or complaint with, or cooperating in any investigation with, the Securities and Exchange Commission, the Financial Industry Regulatory Authority, or any other securities regulatory agency or authority (each, a “Government Agency”). This Release does not limit Executive’s right to receive an award for information provided to a Government Agency.

5. Representations and Warranties Regarding Claims. Executive represents and warrants that, as of the time at which he signs this Agreement, he has not filed or joined any claims, complaints, charges, or lawsuits against any of the Released Parties with any governmental agency or with any state or federal court or arbitrator for, or with respect to, a matter, claim, or incident that occurred or arose out of one or more occurrences that took place on or prior to the time at which Executive signs this Agreement. Executive further represents and warrants that he has not made any assignment, sale, delivery, transfer or conveyance of any rights Executive has asserted or may have against any of the Released Parties with respect to any Released Claim.

6. Affirmation of Restrictive Covenants; Prohibited Period.

(a) Executive acknowledges and agrees that in connection with Executive’s employment with the Company, Executive has obtained Confidential Information (as defined in the Severance Agreement) and that Executive has continuing obligations to the Company and each of its Affiliates pursuant to pursuant to Articles III, IV and V of the Severance Agreement (as amended by Section 2(f) and Section 2(g)). In entering into this Agreement, Executive acknowledges the validity, binding effect and enforceability of Articles III, IV and V of the Severance Agreement (as amended by Section 2(f), Section 2(g) and Section 6(b)) and expressly reaffirms Executive’s commitment to abide by such provisions of the Severance Agreement. Notwithstanding the foregoing or the provisions of Section 16, below, as further consideration for Executive’s entry into this Agreement, the Company agrees that: (i) Executive’s obligation to return to the Company documents and other materials constituting or reflecting Confidential Information shall be limited to an obligation to return (and permanently delete from Executive’s personal computers, as applicable) such materials constituting or containing material, non-public information of or regarding the Company, the General Partner, or any of their respective Affiliates that Executive is able to locate or otherwise identify after a diligent search; (ii) in the event that Executive wishes to use or otherwise disclose information or materials created by them in the course of their Company employment that constitutes Confidential Information (but does not

5

constitute material, non-public information), then Executive may request permission to use or disclose such information from the General Counsel of the General Partner, and which permission shall not be unreasonably withheld; and (iii) notwithstanding Section 5.2 of the Severance Agreement, Executive may pursue business opportunities that Executive became aware of in the course of Executive’s employment or affiliation with the Company or the General Partners (the “Business Opportunities”) unless the Business Opportunities relates to (including if such Business Opportunity involves any acreage within) the Restricted Area and arises or otherwise occurs during the Prohibited Period (a “Restricted Business Opportunity”). If Executive wishes to pursue a Restricted Business Opportunity, then Executive may request permission to pursue such opportunity from the General Counsel of the General Partner, and which permission may be withheld, at the General Partner’s sole discretion, for any reason or no reason at all.

(b) As a further incentive for the Company and the General Partner to enter into this Agreement, and to further protect the Company’s and its Affiliates’ (as defined in the Severance Agreement) legitimate business interests, including the protection of Confidential Information and the preservation of their goodwill, Employee and the Company agree that, effective as of the Release Revocation Expiration Date, the definition of the term “Prohibited Period” within the Severance Agreement shall be modified so that, as of the Release Revocation Expiration Date, the term “Prohibited Period” within the Severance Agreement shall be interpreted and applied to mean the following: “the period during which Executive is employed by the Company or any of its Affiliates and continuing until the date that is 24 months following the Date of Termination.”

(c) Notwithstanding the foregoing, nothing herein or in the Severance Agreement will prohibit or restrict Executive from lawfully: (i) initiating communications directly with, cooperating with, providing information to, causing information to be provided to, or otherwise assisting in an investigation by, any governmental authority regarding a possible violation of any law; (ii) responding to any inquiry or legal process directed to Executive from any such governmental authority; (iii) testifying, participating or otherwise assisting in any action or proceeding by any such governmental authority relating to a possible violation of law; or (iv) making any other disclosures that are protected under the whistleblower provisions of any applicable law. Additionally, pursuant to the federal Defend Trade Secrets Act of 2016, an individual shall not be held criminally or civilly liable under any federal or state trade secret law for the disclosure of a trade secret that: (A) is made (1) in confidence to a federal, state or local government official, either directly or indirectly, or to an attorney and (2) solely for the purpose of reporting or investigating a suspected violation of law; (B) is made to the individual’s attorney in relation to a lawsuit for retaliation against the individual for reporting a suspected violation of law; or (C) is made in a complaint or other document filed in a lawsuit or proceeding, if such filing is made under seal.

7. Covenant to Cooperate in Legal Proceedings. Executive agrees to cooperate in good faith with and provide reasonable assistance to the Company, upon its reasonable request, with respect to the defense or prosecution of any litigation, investigation or other legal proceeding involving the Company or any of its Affiliates.

6

8. Executive’s Acknowledgments. By executing and delivering this Agreement, Executive expressly acknowledges that:

(a) Executive has carefully read this Agreement;

(b) Executive has been given at least 45 days to review and consider this Agreement. If Executive signs this Agreement before the expiration of 45 days after Executive’s receipt of this Agreement, Executive has knowingly and voluntarily waived any longer consideration period than the one provided to Employee. No changes (whether material or immaterial) to this Agreement shall restart the running of this 45 day period.

(c) Executive is receiving, pursuant to this Agreement, consideration in addition to anything of value to which he is already entitled;

(d) Executive has been advised, and hereby is advised in writing, to discuss this Agreement with an attorney of Executive’s choice and that Executive has had an adequate opportunity to do so prior to executing this Agreement;

(e) Executive fully understands the final and binding effect of this Agreement; the only promises made to Executive to sign this Agreement are those stated herein; and Executive is signing this Agreement knowingly, voluntarily and of his own free will, and that Executive understands and agrees to each of the terms of this Agreement;

(f) The only matters relied upon by Executive and causing Executive to sign this Agreement are the provisions set forth in writing within the four corners of this Agreement;

(g) No Released Party has provided any tax or legal advice regarding this Agreement and he has had an adequate opportunity to receive sufficient tax and legal advice from advisors of his own choosing such that he enters into this Agreement with full understanding of the tax and legal implications thereof;

(h) Executive has been provided with, and attached to this Agreement as Exhibit B is a listing of: (A) the job titles and ages of all employees selected for participation in the exit incentive program or other employment termination program pursuant to which Executive is being offered this Agreement; (B) the job titles and ages of all employees in the same job classification or organizational unit who were not selected for participation in the program; and (C) information about the unit affected by the program, including any eligibility factors for such program and any time limits applicable to such program; and

(i) Executive has complied with all reporting requirements under Sections 13 and 16 of the Securities Exchange Act of 1934 with respect to transactions in Company securities made on or before the Separation Date.

9. Revocation Right. Notwithstanding the initial effectiveness of this Agreement, Executive may revoke the delivery (and therefore the effectiveness) of this Agreement within the seven-day period beginning on the date Executive executes this Agreement (such seven-day period being referred to herein as the “Release Revocation Period”). To be effective, such revocation must be in writing signed by Executive and must be delivered personally or by courier to the Company to the Company so that it is received by Steve Putman, Senior Vice President and General Counsel, 1001 Fannin Street, Suite 2020, Houston, Texas 77002 (email: sputman@blackstoneminerals.com) by 11:59 p.m., Houston, Texas time, on the Release

7

Revocation Expiration Date. If an effective revocation is delivered in the foregoing manner and timeframe, the release of claims set forth in Section 4 will be of no force or effect, Executive will not receive the payments, benefits or consideration set forth in Section 2, the provisions of Section 3 will be null and void, and the remainder of this Agreement will remain in full force and effect.

10. Governing Law. This Agreement is entered into under, and shall be governed for all purposes by, the laws of the State of Texas (other than Sections 2(c), 2(d) and 2(e), which shall be construed under and governed for all purposes by the laws of the State of Delaware) without regard to the principles of conflicts of law thereof.

11. Counterparts. This Agreement may be executed in one or more counterparts (including portable document format (.pdf) and facsimile counterparts), each of which shall be deemed to be an original, but all of which together will constitute one and the same Agreement.

12. Amendment; Entire Agreement. This Agreement may not be changed orally but only by an agreement in writing agreed to and signed by the Party to be charged. This Agreement, with respect to the covenants referenced in Section 6, the Severance Agreement, and with respect to Sections 2(c), 2(d) and 2(e), the LTI Award Agreements constitute the entire agreement of the Parties with regard to the subject matter hereof and supersede all prior and contemporaneous agreements and understandings, oral or written, between Executive and any Released Party with regard to the subject matter hereof.

13. Dispute Resolution. Any dispute, controversy or claim between Executive, on the one hand, and the Company, the General Partner or any of their Affiliates (as defined in the Severance Agreement), on the other hand, arising out of or relating to this Agreement shall be subject to the dispute resolution provisions set forth in Article VI of the Severance Agreement, which provisions are hereby incorporated by reference. IN ENTERING INTO THIS AGREEMENT, THE PARTIES EXPRESSLY ACKNOWLEDGE AND AGREE THAT THEY ARE KNOWINGLY, VOLUNTARILY AND INTENTIONALLY WAIVING THEIR RIGHTS TO JURY TRIAL.

14. Third-Party Beneficiaries. Executive expressly acknowledges and agrees that each Released Party that is not a party to this Agreement shall be a third-party beneficiary of Sections 3, 4, 6, 7 and 16 (to the extent such Sections reference such Released Party), and entitled to enforce such provisions as if it were a party hereto.

15. Further Assurances. Executive shall, and shall cause his Affiliates, representatives and agents to, from time to time at the request of the Company and without any additional consideration, furnish the Company with such further information or assurances, execute and deliver such additional documents, instruments and conveyances, and take such other actions and do such other things, as may be reasonably necessary or desirable, as determined in the sole discretion of the Company, to carry out the provisions of this Agreement.

16. Return of Property. Executive represents and warrants that, except as previously approved by the Company or otherwise stated herein (including, but not limited to, the provisions of Section 6(a), above), he has returned to the Company all property belonging to the Company or any other Released Party, including all computer files, electronically stored information,

8

computers and other materials and items provided to him by the Company or any other Released Party in the course of his employment and Executive further represents and warrants that he has not maintained a copy of any such materials or items in any form. The Parties expressly agree that Executive may keep his Company-issued cellular phone.

17. Severability. Any term or provision of this Agreement (or part thereof) that renders such term or provision (or part thereof) or any other term or provision (or part thereof) hereof invalid or unenforceable in any respect shall be severable and shall be modified or severed to the extent necessary to avoid rendering such term or provision (or part thereof) invalid or unenforceable, and such modification or severance shall be accomplished in the manner that most nearly preserves the benefit of the Parties’ bargain hereunder.

18. Headings; References; Interpretation. The Section headings have been inserted for purposes of convenience and shall not be used for interpretive purposes. The words “hereof,” “herein” and “hereunder” and other compounds of the word “here” shall refer to the entire Agreement and not to any particular provision hereof. The use herein of the word “including” following any general statement, term or matter shall not be construed to limit such statement, term or matter to the specific items or matters set forth immediately following such word or to similar items or matters, whether or not non-limiting language (such as “without limitation”, “but not limited to”, or words of similar import) is used with reference thereto, but rather shall be deemed to refer to all other items or matters that could reasonably fall within the broadest possible scope of such general statement, term or matter. The word “or” as used herein is not exclusive and is deemed to have the meaning “and/or.” Unless the context requires otherwise, all references herein to a law, agreement, instrument or other document shall be deemed to refer to such law, agreement, instrument or other document as amended, supplemented, modified and restated from time to time to the extent permitted by the provisions thereof. Neither this Agreement nor any uncertainty or ambiguity herein shall be construed against any Party, whether under any rule of construction or otherwise. This Agreement has been reviewed by each of the Parties and shall be construed and interpreted according to the ordinary meaning of the words used so as to fairly accomplish the purposes and intentions of the Parties.

19. Withholdings; Deductions. The Company may withhold and deduct from any benefits and payments and issuances of Common Units made or to be made pursuant to this Agreement (a) all federal, state, local and other taxes as may be required pursuant to any law or governmental regulation or ruling and (b) any deductions consented to in writing by Executive, including in accordance with the terms of the LTI Award Agreements.

20. Section 409A.

(a) This Agreement and the benefits provided hereunder are intended be exempt from, or compliant with, the requirements of Section 409A of the Internal Revenue Code of 1986 and the Treasury regulations and other guidance issued thereunder (collectively, “Section 409A”) and shall be construed and administered in accordance with such intent. Each installment payment under this Agreement shall be deemed and treated as a separate payment for purposes of Section 409A. Notwithstanding the foregoing, the Company makes no representations that the benefits provided under this Agreement are exempt from the requirements of Section 409A and in no event shall the Company or any of its Affiliates be liable for all or any portion of any taxes, penalties, interest or other expenses that may be incurred by Executive on account of non-compliance with Section 409A.

9

(b) To the extent that any right to reimbursement of expenses or payment of any benefit in-kind under this Agreement constitutes nonqualified deferred compensation (within the meaning of Section 409A), (i) any such expense reimbursement shall be made by the Company no later than the last day of Employee’s taxable year following the taxable year in which such expense was incurred by Employee, (ii) the right to reimbursement or in-kind benefits shall not be subject to liquidation or exchange for another benefit, and (iii) the amount of expenses eligible for reimbursement or in-kind benefits provided during any taxable year shall not affect the expenses eligible for reimbursement or in-kind benefits to be provided in any other taxable year; provided, that the foregoing clause shall not be violated with regard to expenses reimbursed under any arrangement covered by Section 105(b) of the Code solely because such expenses are subject to a limit related to the period in which the arrangement is in effect.

[Remainder of Page Intentionally Blank;

Signature Page Follows]

10

IN WITNESS WHEREOF, Executive has executed this Agreement and the Company, the Partnership and the General Partner have caused this Agreement to be executed by their duly authorized officer as of the dates set forth below, effective for all purposes as provided above.

| EXECUTIVE | ||

| /s/ Holbrook F. Dorn | ||

| Holbrook F. Dorn | ||

| Date: March 6, 2020 | ||

| BLACK STONE NATURAL RESOURCES MANAGEMENT COMPANY | ||

| By: | /s/ Steve Putman | |

| Steve Putman, Senior Vice President, General Counsel and Secretary | ||

| Date: March 6, 2020 | ||

| For the limited purpose of agreeing to Sections 2, 3 and 13: | ||

| BLACK STONE MINERALS GP, L.L.C. | ||

| By: | /s/ Steve Putman | |

| Steve Putman, Senior Vice President, General Counsel and Secretary | ||

| Date: March 6, 2020 | ||

SIGNATURE PAGE TO

SEPARATION AGREEMENT

AND GENERAL RELEASE OF CLAIMS

EXHIBIT A

EXHIBIT A

EXHIBIT B

The following information concerning involuntary terminations accompanies the Company’s Separation and Release Agreement (“Agreement”) and is provided to you consistent with the federal Older Workers Benefit Protection Act.

Decisional Unit: The decisional unit is all Company employees; in other words, all employees were eligible to be selected for this program.

Time Limits: You have 45 calendar days in which to sign and return the Agreement to the Company, and may take as much or as little of that time as you wish. Once the Agreement is signed and returned, you have seven (7) days to revoke the Agreement as more fully described in the Agreement.

Set forth below are the job titles and ages (as of February 24, 2020) of all individuals in the decisional unit who were selected for termination and offered an Agreement:

Set forth below are the ages (as of February 24, 2020) of all individuals in the decisional unit who were not selected for termination, and thus did not receive an Agreement:

EXHIBIT B

EXHIBIT B

Form Track Record

| WA Inv Date | Init Inv | Realized CF | Fut Proj CF | Total Rev | IRR | DPI | MOIC | NTM CF | NTM Yield | |||||||||||||||||||||||||||||||

| All Transactions |

May-14 | (1,367,778 | ) | 1,808,491 | 4,020,407 | 5,828,898 | 15.6 | % | 1.3x | 4.3x | 200,243 | 14.6 | % | |||||||||||||||||||||||||||

| 2010-2018 Incl ST |

Feb-16 | (1,060,459 | ) | 604,094 | 2,325,638 | 2,929,732 | 13.6 | % | 0.6x | 2.8x | 137,166 | 12.9 | % | |||||||||||||||||||||||||||

| 2004 |

||||||||||||||||||||||||||||||||||||||||

| Diversified M&R Portfolio |

Jan-04 | (45,900 | ) | 161,485 | 98,953 | 260,438 | 17.7 | % | 3.5x | 5.7x | 6,452 | 14.1 | % | |||||||||||||||||||||||||||

| Diversified M&R Portfolio |

Jun-04 | (176,395 | ) | 1,042,912 | 1,595,816 | 2,638,728 | 28.8 | % | 5.9x | 15.0x | 56,626 | 32.1 | % | |||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

| Total/Summary |

Apr-04 | (222,295 | ) | 1,204,397 | 1,694,769 | 2,899,166 | 26.5 | % | 5.4x | 13.0x | 63,078 | 28.4 | % | |||||||||||||||||||||||||||

| 2010-2014 |

||||||||||||||||||||||||||||||||||||||||

| Diversified M&R Portfolio |

May-10 | (62,624 | ) | 73,635 | 69,647 | 143,282 | 11.4 | % | 1.2x | 2.3x | 3,742 | 6.0 | % | |||||||||||||||||||||||||||

| Diversified M&R w Permain component |

Nov-10 | (9,261 | ) | 27,989 | 16,795 | 44,784 | 38.3 | % | 3.0x | 4.8x | 1,447 | 15.6 | % | |||||||||||||||||||||||||||

| Karnes / DeWitt EFS |

Jun-11 | (31,000 | ) | 65,124 | 20,327 | 85,451 | 24.1 | % | 2.1x | 2.8x | 2,713 | 8.8 | % | |||||||||||||||||||||||||||

| Dimmit County EFS |

Oct-11 | (5,094 | ) | 5,961 | 6,556 | 12,517 | 12.6 | % | 1.2x | 2.5x | 165 | 3.2 | % | |||||||||||||||||||||||||||

| Karnes / DeWitt EFS |

Dec-11 | (26,206 | ) | 62,708 | 56,188 | 118,896 | 28.1 | % | 2.4x | 4.5x | 7,484 | 28.6 | % | |||||||||||||||||||||||||||

| La Salle County EFS |

Apr-13 | (72,000 | ) | 62,177 | 60,440 | 122,617 | 9.0 | % | 0.9x | 1.7x | 4,602 | 6.4 | % | |||||||||||||||||||||||||||

| Dimmit County EFS |

Jun-13 | (10,477 | ) | 7,544 | 4,590 | 12,134 | 2.5 | % | 0.7x | 1.2x | 481 | 4.6 | % | |||||||||||||||||||||||||||

| McMullen County EFS |

Sep-13 | (30,621 | ) | 11,583 | 19,434 | 31,016 | 0.1 | % | 0.4x | 1.0x | 1,365 | 4.5 | % | |||||||||||||||||||||||||||

| McMullen County EFS |

Oct-13 | (12,263 | ) | 5,863 | 11,764 | 17,626 | 4.5 | % | 0.5x | 1.4x | 687 | 5.6 | % | |||||||||||||||||||||||||||

| McMullen / Atascosa County EFS |

Jan-14 | (11,850 | ) | 5,881 | 11,247 | 17,128 | 4.8 | % | 0.5x | 1.4x | 530 | 4.5 | % | |||||||||||||||||||||||||||

| Misc M&R |

Mar-14 | (2,258 | ) | 1,825 | 2,085 | 3,910 | 8.5 | % | 0.8x | 1.7x | 229 | 10.1 | % | |||||||||||||||||||||||||||

| Reagan County Midland |

Jul-14 | (16,000 | ) | 3,178 | 23,944 | 27,122 | 3.9 | % | 0.2x | 1.7x | 366 | 2.3 | % | |||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

| Total/Summary |

May-12 | (289,655 | ) | 333,467 | 303,017 | 636,484 | 12.1 | % | 1.2x | 2.2x | 23,811 | 8.2 | % | |||||||||||||||||||||||||||

| 2015-2018 |

||||||||||||||||||||||||||||||||||||||||

| Marcellus/Utica |

Jun-15 | (1,771 | ) | 333 | 4,908 | 5,241 | 12.2 | % | 0.2x | 3.0x | 208 | 11.7 | % | |||||||||||||||||||||||||||

| Midland Basin Various |

Jun-15 | (14,656 | ) | 3,640 | 70,353 | 73,993 | 14.2 | % | 0.2x | 5.0x | 1,447 | 9.9 | % | |||||||||||||||||||||||||||

| Midland County Midland Basin |

Jul-15 | (7,767 | ) | 1,377 | 12,387 | 13,763 | 4.6 | % | 0.2x | 1.8x | 183 | 2.4 | % | |||||||||||||||||||||||||||

| Midland County Midland Basin |

Aug-15 | (5,733 | ) | 449 | 21,315 | 21,763 | 11.0 | % | 0.1x | 3.8x | 90 | 1.6 | % | |||||||||||||||||||||||||||

| Midland County Midland Basin |

Sep-15 | (3,386 | ) | 1,240 | 13,479 | 14,719 | 21.5 | % | 0.4x | 4.3x | 1,989 | 58.7 | % | |||||||||||||||||||||||||||

| LaSalle EFS |

Sep-15 | (9,187 | ) | 9,742 | 24,134 | 33,876 | 27.6 | % | 1.1x | 3.7x | 2,360 | 25.7 | % | |||||||||||||||||||||||||||

| Midland Basin Various |

Sep-15 | (20,009 | ) | 7,644 | 44,868 | 52,513 | 10.5 | % | 0.4x | 2.6x | 2,847 | 14.2 | % | |||||||||||||||||||||||||||

| Northern Midland Basin ORRI |

Jan-16 | (10,000 | ) | 2,469 | 37,864 | 40,333 | 12.9 | % | 0.2x | 4.0x | 880 | 8.8 | % | |||||||||||||||||||||||||||

| Weld County DJ Basin |

Jun-16 | (34,018 | ) | 14,652 | 44,212 | 58,864 | 7.0 | % | 0.4x | 1.7x | 4,084 | 12.0 | % | |||||||||||||||||||||||||||

| Diversified M&R Portfolio |

Jun-16 | (88,233 | ) | 51,422 | 307,974 | 359,396 | 18.5 | % | 0.6x | 4.1x | 13,596 | 15.4 | % | |||||||||||||||||||||||||||

| Midland County Midland Basin |

Aug-16 | (8,312 | ) | 10,061 | 22,335 | 32,396 | 44.5 | % | 1.2x | 3.9x | 5,960 | 71.7 | % | |||||||||||||||||||||||||||

| Loving County Delaware |

Jan-17 | (23,513 | ) | 15,759 | 79,692 | 95,451 | 20.5 | % | 0.7x | 4.1x | 3,575 | 15.2 | % | |||||||||||||||||||||||||||

| Loving County Delaware |

Jan-17 | (17,069 | ) | 4,540 | 91,109 | 95,649 | 19.6 | % | 0.3x | 5.6x | 2,707 | 15.9 | % | |||||||||||||||||||||||||||

| Diversified M&R Portfolio |

Nov-17 | (334,543 | ) | 111,287 | 811,042 | 922,329 | 14.5 | % | 0.3x | 2.8x | 52,535 | 15.7 | % | |||||||||||||||||||||||||||

| Midland County Midland Basin |

Mar-18 | (22,569 | ) | 1,774 | 81,254 | 83,028 | 15.5 | % | 0.1x | 3.7x | 2,211 | 9.8 | % | |||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

| Total/Summary |

Apr-17 | (600,765 | ) | 236,389 | 1,666,925 | 1,903,313 | 15.4 | % | 0.4x | 3.2x | 94,671 | 15.8 | % | |||||||||||||||||||||||||||

| Last 24 Months |

||||||||||||||||||||||||||||||||||||||||

| Ward County Delaware |

Jun-18 | (14,579 | ) | N/A | 41,735 | 41,735 | 10.2 | % | N/A | 2.9x | N/A | N/A | ||||||||||||||||||||||||||||

| Various Midland and Delaware Basins |

Jul-18 | (10,803 | ) | N/A | 29,784 | 29,784 | 14.5 | % | N/A | 2.8x | N/A | N/A | ||||||||||||||||||||||||||||

| Midland County Midland Basin |

Aug-18 | (39,747 | ) | N/A | 124,300 | 124,300 | 11.6 | % | N/A | 3.1x | N/A | N/A | ||||||||||||||||||||||||||||

| Reeves County Delaware Basin |

Aug-18 | (7,200 | ) | N/A | 19,334 | 19,334 | 16.3 | % | N/A | 2.7x | N/A | N/A | ||||||||||||||||||||||||||||

| Culberson County Delaware |

Feb-19 | (8,611 | ) | N/A | 29,392 | 29,392 | 13.3 | % | N/A | 3.4x | N/A | N/A | ||||||||||||||||||||||||||||

| Midland County Midland Basin |

May-19 | (4,084 | ) | N/A | 13,362 | 13,362 | 12.8 | % | N/A | 3.3x | N/A | N/A | ||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

| Total/Summary |

Aug-18 | (85,024 | ) | N/A | 257,906 | 257,906 | 12.3 | % | N/A | 3.0x | N/A | N/A | ||||||||||||||||||||||||||||

| Shelby Trough Core |

Jan-17 | (63,728 | ) | 29,826 | 155,955 | 185,780 | 23.2 | % | 0.5x | 2.9x | 18,683 | 29.3 | % | |||||||||||||||||||||||||||

| Shelby Trough Expansion |

Jun-18 | (170,039 | ) | 34,238 | 355,697 | 389,935 | 9.9 | % | 0.2x | 2.3x | 18,683 | 11.0 | % | |||||||||||||||||||||||||||

Note: The track-record information provided here was not prepared by Black Stone Minerals, L.P., and Black Stone Minerals, L.P. makes no representations as to the accuracy of the information presented.

EXHIBIT C