UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One) | |||||

þ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | ||||

For the fiscal year ended December 27, 2017 | |||||

OR | |||||

o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | ||||

For the transition period from _______ to ______ | |||||

Commission file number: 001-36823 | |||||

SHAKE SHACK INC.

(Exact name of registrant as specified in its charter)

Delaware | 47-1941186 | |||

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | |||

24 Union Square East, 5th Floor, New York, New York | 10003 | |||

(Address of principal executive offices) | (Zip Code) | |||

(646) 747-7200 | ||||

(Registrant's telephone number, including area code) | ||||

Securities registered pursuant to Section 12(b) of the Act: | ||||

Title of each class | Name of exchange on which registered | |||

Class A Common Stock, par value $0.001 | New York Stock Exchange | |||

Securities registered pursuant to Section 12(g) of the Act: None | ||||

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. o Yes þ No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. o Yes þ No

Indicate by check mark if the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. þ Yes o No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule-405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). þ Yes o No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of the registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer”, “smaller reporting company”, and "emerging growth company" in Rule 12b-2 of the Exchange Act.

Large accelerated filer | þ | Accelerated filer | o | |

Non-accelerated filer | o | (Do not check if a smaller reporting company) | Smaller reporting company | o |

Emerging growth company | o | |||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standard provided pursuant to Section 13(a) of the Exchange Act. o

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). o Yes þ No

The aggregate market value of the voting and non-voting stock held by non-affiliates of the Registrant, as of June 28, 2017, the last business day of the Registrant’s most recently completed second fiscal quarter, was approximately $778,146,403, computed using the closing price on that day of $35.64. Solely for purposes of this disclosure, shares of common stock held by members part of the Voting Group pursuant to to the Stockholders Agreement, as amended, of the Registrant as of such date have been excluded because such persons may be deemed to be affiliates. This determination of affiliates is not necessarily a conclusive determination for any other purposes.

As of February 14, 2018, there were 27,078,149 shares of Class A common stock outstanding and 9,701,815 shares of Class B common stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE |

Portions of the registrant’s definitive Proxy Statement for its 2018 Annual Meeting of Shareholders are incorporated by reference into Part III of this Form 10-K. |

SHAKE SHACK INC.

TABLE OF CONTENTS

2 | Shake Shack Inc.  Form 10-K

Form 10-K

Form 10-K

Form 10-KCautionary Note About Forward-Looking Information

This Annual Report on Form 10-K ("Form 10-K") contains forward-looking statements, within the meaning of the Private Securities Litigation Reform Act of 1995 ("PSLRA"), which are subject to known and unknown risks, uncertainties and other important factors that may cause actual results to be materially different. All statements other than statements of historical fact are forward-looking statements. Many of the forward-looking statements are located in Part II, Item 7 of this Form 10-K under the headings "Management's Discussion and Analysis of Financial Condition and Results of Operations", including, but not limited to, expected financial outlook for fiscal year 2018, expected Shack openings, expected same-Shack sales growth and trends in our business. Forward-looking statements discuss our current expectations and projections relating to our financial position, results of operations, plans, objectives, future performance and business. You can identify forward-looking statements by the fact that they do not relate strictly to historical or current facts. These statements may include words such as "aim," "anticipate," "believe," "estimate," "expect," "forecast," "outlook," "potential," "project," "projection," "plan," "intend," "seek," "may," "could," "would," "will," "should," "can," "can have," "likely," the negatives thereof and other similar expressions.

While we believe that our assumptions are reasonable, it is very difficult to predict the impact of known factors, and it is impossible to anticipate all factors that could affect our actual results. All forward-looking statements are expressly qualified in their entirety by these cautionary statements. You should evaluate all forward-looking statements made in this Form 10-K in the context of the risks and uncertainties disclosed in Part I, Item 1A of this Form 10-K under the heading "Risk Factors," which are incorporated herein by reference.

The forward-looking statements included in this Form 10-K are made only as of the date hereof. We undertake no obligation to publicly update or revise any forward-looking statement as a result of new information, future events or otherwise, except as otherwise required by law. If we do update one or more forward-looking statements, no inference should be made that we will make additional updates with respect to those or other forward-looking statements. We qualify all of our forward-looking statements by these cautionary statements.

Shake Shack Inc.  Form 10-K | 1

Form 10-K | 1

Form 10-K | 1

Form 10-K | 1Part I

Item 1. Business.

Shake Shack Inc. was formed on September 23, 2014 as a Delaware corporation. Shake Shack Inc. Class A common stock trades on the New York Stock Exchange under the symbol "SHAK." Unless the context otherwise requires, "we," "us," "our," "Shake Shack," the "Company" and other similar references refer to Shake Shack Inc. and, unless otherwise stated, all of its subsidiaries, including SSE Holdings, LLC, which we refer to as "SSE Holdings."

INITIAL PUBLIC OFFERING AND ORGANIZATIONAL TRANSACTIONS

On February 4, 2015, we completed an initial public offering ("IPO") of 5,750,000 shares of our Class A common stock at a public offering price of $21.00 per share, which includes 750,000 shares issued pursuant to the underwriters' over-allotment option. We received $112.3 million in proceeds, net of underwriting discounts and commissions, which we used to purchase newly-issued membership interests from SSE Holdings at a price per interest equal to the initial public offering price of our Class A common stock of $21.00.

Shake Shack is a holding company with no direct operations and our principal asset is our equity interest in SSE Holdings. In connection with the IPO, we completed a series of organizational transactions including the following:

▪ | We amended and restated the limited liability company agreement of SSE Holdings (as amended, the "SSE Holdings LLC Agreement") to, among other things, (i) provide for a new single class of common membership interests in SSE Holdings ("LLC Interests"), (ii) exchange all of the membership interests of the then-existing holders of SSE Holdings for LLC Interests and (iii) appoint Shake Shack as the sole managing member of SSE Holdings; |

▪ | We amended and restated our certificate of incorporation to, among other things, (i) provide for Class B common stock with voting rights but no economic interests (where “economic interests” means the right to receive any distributions or dividends, whether cash or stock, in connection with common stock) and (ii) issue shares of Class B common stock to the then-existing members of SSE Holdings on a one-to-one basis with the number of LLC Interests they own; |

▪ | We acquired, by merger, two entities that were owned by former indirect members of SSE Holdings, for which we issued 5,968,841 shares of Class A common stock as merger consideration (the "Mergers"). |

See Note 1 to the consolidated financial statements included in Part II, Item 8 for more information about the above-mentioned transactions as well as the other transactions completed in connection with our IPO, which we refer to collectively as the "Organizational Transactions." As of December 27, 2017, Shake Shack Inc. owned 72.1% of SSE Holdings and the non-controlling interest holders owned the remaining 27.9% of SSE Holdings.

OVERVIEW

Shake Shack is a modern day "roadside" burger stand serving a classic American menu of premium burgers, hot dogs, crispy chicken, frozen custard, crinkle cut fries, shakes, beer, wine and more. Originally founded by Danny Meyer's Union Square Hospitality Group ("USHG"), which owns and operates some of New York City's most acclaimed and popular restaurants—Union Square Cafe, Gramercy Tavern, Blue Smoke, The Modern at the Museum of Modern Art, Maialino, North End Grill, Untitled, Marta, Martina and Daily Provisions—Shake Shack originated as a hot dog cart in 2001 to support the rejuvenation of New York City's Madison Square Park through its Conservancy's first art installation, "I Y Taxi." The hot dog cart was an instant success, with lines forming daily throughout the summer months for the next three years. In response, the city's Department of Parks and Recreation awarded Shake

2 | Shake Shack Inc.  Form 10-K

Form 10-K

Form 10-K

Form 10-KShack a contract to create a kiosk to help fund the park's future. In 2004, Shake Shack officially opened and immediately became a community gathering place for New Yorkers and visitors from all over the world and has since become a beloved New York City institution, garnering significant media attention, critical acclaim and a passionately-devoted following. Since its inception, Shake Shack has grown rapidly—with 159 Shacks, as of December 27, 2017, in 11 countries and 20 states, as well as the District of Columbia—and we continue to expand outside our home market bringing the Shake Shack experience to new customers around the world.

THE SHACK PACT

Our commitment to the Shack Pact is stronger than ever. This is the agreement that our team makes at Shake Shack to lead our company with integrity, with purpose and with intention. It’s our mission and vision. Quite simply: it’s What We Do and Who We Are and it’s the ethos of our work each and every day as we grow Shake Shack. The Shack Pact™ is prominently displayed in the team member areas of every Shack, on the inside cover of the Shackademics™ book (our training manual) and acts as the template for every pre-meal meeting agenda (daily Shack team meeting).

WHAT WE DO:

We Stand For Something Good

WHO WE ARE:

We Are Boundless Hospitality

Hospitality is in our DNA. We take great pride in our culture and believe that it is the single most important factor in our success. Our mission to Stand For Something Good® permeates throughout every Shack we build, every ingredient we source and every team member we hire. We take care of each other first and foremost so that we can take care of our guests, our community, our suppliers and our investors. We aim to recruit people who have integrity, who are warm, friendly, motivated, caring, self-aware and intellectually curious—what we call "51%'ers." We use the term "51%" to describe the inherent interpersonal and emotional skills needed to thrive on the job and "49%" to describe the technical skills needed for the job. Our 51%'ers are excited and committed to champion performance, remarkable and enriching hospitality, embodying our culture, and actively growing themselves and the brand. Danny Meyer's original vision of Enlightened Hospitality™ guided the creation of the unique Shake Shack culture that, we believe, creates a differentiated experience for our guests at each of our Shacks around the world. Our team is trained to understand and practice the values of Enlightened Hospitality: caring for each other, caring for our guests, caring for our community, caring for our suppliers and caring for our investors. These principles have been championed by Danny Meyer throughout his career and are detailed in his New York Times best-selling book Setting the Table: The Transforming Power of Hospitality in Business, and they are fundamental to the way we operate our business.

The Bigger We Get, the Smaller We Act

With every passing year, this mantra continues to drive and challenge our strategy. As we continue to grow, it's more important than ever that we cherish our roots, continue the ethos that led to the creation of Shake Shack and to never veer from our original vision. We make decisions that focus on the core of who we are, staying true to our mission to Stand For Something Good and the principles of Enlightened Hospitality. These principles drive us to seek out the finest team members, the tastiest ingredients, the best suppliers and the best community partners.

Hospitality in the Digital Age

Shake Shack is devoted to its digital future, pursuing innovation in technology that seeks to create an active dialogue with our guests, drive higher engagement and raise the bar on operational excellence and overall guest experience.

An essential part of Shake Shack digital is the Shack App. Launched in 2017, the Shack App is our first-ever mobile ordering app-available on both IOS and Android nationwide. With the Shack App, we’re able to meet our guests where they are and provide them

Shake Shack Inc.  Form 10-K | 3

Form 10-K | 3

Form 10-K | 3

Form 10-K | 3a whole new way to experience Shake Shack. The Shack App was developed to elevate the in-Shack experience, aiming to provide shorter pick-up times and convenient mobile ordering. Guests can now order Shake Shack when they want it right from their phone, and it will be cooked-to-order and timed to their arrival. The Shack App features all our menu classics—all-natural beef burgers, flat-top dogs, chicken sandwiches, frozen custard, crinkle cut fries and more—and includes all the mobile ordering essentials: guests can pick from their favorite orders; keep track of food allergies; access nutritional information; see the latest events and promos; connect to all Shake Shack social media channels and share feedback. In 2017 our Shack App was awarded with an Appy Award by MediaPost for best app in the restaurants, food and beverage category, and was also a W3 Silver Award winner in the food and beverage category.

Shake Shack continues to seek out ways to innovate in the digital space and raise the bar on hospitality. In August 2017, we launched the Shake Shack chatbot. With the ability to answer guests’ most frequently asked questions in-channel on Twitter and Facebook and online at shakeshack.com, the ShackBot is another example of our commitment to creating a premium guest experience. Guests are now able to engage with the bot to learn more about the menu, featured items, nutritional information, hours and more. Guests are also invited to provide feedback and granted easy access to download the Shack App and sticker package.

In October 2017, we introduced our first kiosk-only ordering, cashless environment at our Astor Place Shack in New York City. The Shack kiosk was developed with an enhanced guest experience in mind, allowing us to serve more people at peak times—whether in-Shack, for pickup via the Shack App or even delivery—resulting in fewer lines, less wait time and less friction at every channel. The Shack kiosk replicates the experience of the Shack App with a sharp aesthetic, an intuitive touch screen interface and ease of ordering. Guests simply select their food, place an order and choose to receive an alert via text when their order is ready. Hospitality Champs are stationed around the kiosks to assist guests with their orders and answer any questions.

We continue to explore delivery as a way to bring Shake Shack to our guests wherever they are and whenever they want. As an essential part of how consumers eat today, delivery presents a unique opportunity to reach even more people and allow them to engage with Shake Shack on their terms. In 2017 we conducted delivery pilots with several potential partners. We also created and tested new packaging. We learned about our various Shacks' ability to handle delivery at peak times and gained perspective on the capabilities of delivery partners and the benefits of systems integration. We expect that our thoughtful, strategic approach to delivery will result in an overall better Shake Shack experience for our guests.

Technology touches all aspects of our business—we embrace it and know it to be an invaluable vehicle for enhancing guest experience and hospitality across all touchpoints.

We Are a Team: We Take Care of Each Other

Our people make all the difference. More than ever, it’s incredibly important to invest in our team. We believe the unity that we have built amongst our Shack teams and across the Company as a whole is a key driver of our ability to deliver a great guest experience and, therefore, continue to successfully grow our footprint. We seek to be the employer of choice by offering competitive wages, comprehensive benefits and a variety of incentive programs. As wages rise across all income levels, we continue to play offense to compensate our team at the right wage for their long term development. We believe that team members who are treated and trained well will deliver Enlightened Hospitality and a superior guest experience. Through our leadership development programs, we teach our team members the principles of Enlightened Hospitality and how to live and breathe our Shack Pact, the agreement that encompasses our value system and brand ethos. Ultimately, we know when we have the best team, we will reach our stated goals.

Leaders Training Future Leaders

We invest in our team through extensive leadership development programs to ensure that Shake Shack remains a great place to work and a real career choice for team members at every level. We have built a culture of active learning and we foster an environment of leadership development throughout the entire life cycle of employment. We believe that our culture of Enlightened Hospitality enables us to develop future leaders from within and deliver a consistent Shack experience as our team continues to grow.

The Shacksperience and Steppin' Up Model

The goal of our training programs is to develop leaders and to cross-utilize team members throughout our operations. We call our team member life cycle and overall employment experience, The Shacksperience™. The Steppin' Up Model is the growth model

4 | Shake Shack Inc.  Form 10-K

Form 10-K

Form 10-K

Form 10-Kfor Shake Shack employees which defines the steps in the employment life cycle, beginning with the team member position and working up through the general manager position. It clarifies the eligibility requirements and training necessary for each position, outlines the growth opportunities at all levels of the organization and furthers our philosophy of "leaders training future leaders." By creating this visual model, employees have a clear view of the career progression for a Shack employee, which in turn helps foster communication in achieving these goals. We train our culture and guiding principles first, then move to menu knowledge, followed by a focus on operational training. We believe that everyone learns differently and our training programs use various formats: online interactive, video, hands-on and paper-based. Every team member has access to ShackSource™, our proprietary online training portal, which is used not only as a learning platform, but also as a communication tool for our team. ShackSource also allows team members to send recognition messages, comments, praise and thanks to their fellow team members across the Company.

We care about our team and want to set them up for success in the future, both at Shake Shack and in their careers. We continue to invest in training materials that teach our team members how to reach the next step of the Steppin' Up Model. We've also developed training manuals on how to become a leader at Shake Shack. These training manuals lay out the specific certifications, procedures and modules each team member needs to complete in order to move up to the next level. Our shift manager position, a level between a team member and manager, allows team members to be introduced to certain managerial-level skills before making the full transition to manager. We are incredibly proud of the number of leaders who continue to graduate from hourly roles to shift managers, and on up the ladder of Shack leadership.

We Are Fine Casual: Inspired Food and Drink

We embrace our fine-dining heritage and are committed to sourcing premium, sustainable ingredients, such as all-natural, hormone and antibiotic-free beef, chicken and bacon, while offering excellent value to our guests. Our core menu remains focused, and is supplemented with targeted innovation inspired by the best versions of the classic American roadside burger stand. Always focused on culinary creativity and excellence, we collaborate with award-winning chefs, talented bakers, farmers and artisanal purveyors who work with us in different and engaging ways. We never stop looking for the best ingredients and the best culinary partners in order to exceed our guests' expectations in every aspect of their experience. As we grow across the country, we are excited to collaborate even more with the talented chefs and suppliers who are leading our industry.

Our signature items are our all-natural, hormone and antibiotic-free burgers, hot dogs, crispy chicken, crinkle cut fries, shakes and frozen custard. We cook our burgers and spin our shakes to order and strive to use the freshest premium ingredients available.

Our Menu

Our menu focuses on premium food and beverages, carefully crafted from a range of classic American foods at more accessible price points than full-service restaurants. The Shake Shack concept and core menu items have not materially changed since 2004, which speaks to the timeless and universal appeal of our food offerings.

| Burgers & Chicken |

Our burgers are made with a proprietary whole-muscle blend of 100% all-natural, hormone and antibiotic-free Angus beef, ground fresh daily, cooked to order and served on a non-GMO potato bun. We take great care in the preparation of our burgers—from sourcing, to handling, to cooking—to ensure that the taste and quality of the burgers we serve is second to none. Our signature burger is the ShackBurger®, which is a four-ounce cheeseburger topped with lettuce, tomato and ShackSauce™. Our burger offerings also include the SmokeShack®, 'Shroom Burger™ (our vegetarian burger), Shack Stack® and Hamburger. Our Chick’n Shack™ is a 100% all-natural, hormone and antibiotic-free cage-free chicken breast, slow cooked in buttermilk herbs, hand-battered, hand-breaded and crisp-fried to order. In January 2018, we were also proud to announce our limited time offer menu, the Griddled Chick'n Club. | |

| Crinkle Cut Fries |

Our classic and passionately loved crinkle cut fries are made from premium Yukon potatoes and are prepared 100% free of artificial trans-fat. Guests can also enjoy our Cheese Fries, which are our crinkle cut fries topped with a proprietary blend of cheddar and American cheese sauce. We believe the tactile pleasure and emotional attachment that our guests have to the crispiness and ridges of our crinkle cut fries is a nostalgic ode to the roadside burger stand of yesteryear. | |

Shake Shack Inc.  Form 10-K | 5

Form 10-K | 5

Form 10-K | 5

Form 10-K | 5 | Hot Dogs |

Shake Shack was born from a hot dog cart in 2001 and we believe that our hot dog category gives our guests another premium category from which to choose. Both our beef hot dogs and our chicken dogs are made from 100% all-natural, hormone and antibiotic-free beef and chicken. Our signature Shack-cago Dog® is our nod to the classic Chicago-style hot dog, topped with Shack relish, onion, cucumber, pickle, tomato, sport pepper, celery salt and mustard. | |

| Frozen Custard |

Our premium, dense, rich and creamy ice cream, hand-spun daily on-site, is crafted from our proprietary vanilla and chocolate recipes using only real sugar (no corn syrup) and milk from dairy farmers who pledge not to use artificial growth hormones. Shakes remain our guests' favorite in this category and are scooped and spun to order. Our concretes are made by blending frozen custard at high speed with premium mix-ins. Since each Shake Shack intends to engage its community, each Shack has signature concretes, distinct to its location, that use locally-sourced mix-ins made by artisanal producers whenever possible. | |

| Beer, Wine and Beverages |

Our proprietary ShackMeister® Ale, brewed by Brooklyn Brewery, was specifically crafted to complement the flavor profile of a ShackBurger. At select locations, we also offer local craft beers tailored to each Shack's geography. When it comes to wine, our organic and biodynamic Shack Red® and Shack White®, grown and bottled exclusively by Frog's Leap Vineyards in Napa Valley, accentuate our fine dining ethos and provide our guests with premium beverage options not commonly found in our industry. In addition, we serve Abita Root Beer, Shack-made Lemonade, organic fresh brewed iced tea, Fifty/Fifty™ (half lemonade, half organic iced tea), Stumptown cold brew coffee, Honest Kids organic apple juice and Shack|20® bottled water, from which 1% of the sales supports the clean-up of water sources around the world. | |

| Dogs Are Welcome Too |

We know that many dog owners treat their four-legged friends as family members. From our first Shack in Madison Square Park, we wanted to include dogs as part of the community gathering experience and developed the "Woof" section on our menu. ShackBurger dog biscuits, peanut butter sauce and vanilla custard make up our signature Pooch-ini®, which is available at Shacks with an outdoor space. We also serve dog biscuits to-go, handcrafted exclusively for us by a New York-based bakery. | |

Culinary Innovation

We continuously innovate around our core menu and our team is constantly experimenting with seasonal and local products, to enhance our menu, drive revenue and give our guests more reasons to keep coming back to Shake Shack.

Shack-Wide Limited Time Offerings ("LTO")

We continued our LTO program through fiscal 2017 where we featured a new premium burger or chicken menu item for varying time periods throughout the year. We will continue to supplement our core menu with targeted innovation inspired by the best versions of the classic American roadside burger stands.

▪ | BBQ Lineup — In February 2017 we launched a limited-edition lineup of BBQ items nationwide. The BBQ ShackMeister Burger is a 100% all-natural Angus beef cheeseburger topped with crispy ShackMeister Ale-marinated shallots and Shack BBQ sauce; the BBQ Chick’n Shack is a crispy 100% all-natural and antibiotic-free chicken breast with Shack BBQ sauce and pickles; and the BBQ Bacon Cheese Fries are crinkle-cut fries topped with all-natural smoked Niman Ranch bacon, Shack BBQ Sauce and cheese sauce. |

▪ | Chili Menu — In October 2017 we rolled out a chili-themed menu at Shacks nationwide, which initially debuted exclusively on the Shack App and subsequently was available for in-Shack ordering. The menu featured a Chili Cheeseburger, a Chili Cheese Dog and Chili Cheese Fries, in which each item is topped with a smoked and slow braised beef chili with ancho and chile de arbol peppers. |

6 | Shake Shack Inc.  Form 10-K

Form 10-K

Form 10-K

Form 10-K▪ | Trio of Featured Shakes — In 2017 we replaced the Shake of the Week with a trio of featured shakes, offering our guests a new slate of premium shake offerings for extended periods of time. For approximately three months each, we offered a trio of new featured shakes, which included: Mint Cookies & Cream, Salted Vanilla Toffee and Mud Pie; Chocolate Cookies & Cream, Raspberry Cheesecake and Salted Caramel Pretzel; and Frozen Hot Cocoa, Christmas Cookie and Chocolate Peppermint. |

Exclusive Offerings

In addition to supplementing our menu with LTOs, we also seek to create new and exciting offerings that are inspired by local favorites or special events. Some examples of our exclusive offerings from fiscal 2017 include:

▪ | The Salty Donut Concrete — To celebrate our newly expanded space in the Miami Beach Shack, in May 2017 we had a limited-edition collaboration with The Salty Donut and an exclusive retail collaboration with LYFE Brand. The Salty Donut concrete features a vanilla frozen custard blended with The Salty Donut's Dulce De Leche donut, banana and salted caramel, all topped with The Salted Donut's Mini Chocolate, Chocolate Donut. |

▪ | Seasonal Coffee Cake — In May 2017 the Madison Square Park Shack started serving breakfast daily. In addition to our signature breakfast sandwiches and Shack Apple Turnover, the Madison Square Park Shack offers a special seasonal coffee cake by Daily Provisions, a Union Square Hospitality Group eatery. This exclusive breakfast addition is a sour cream coffee cake made with seasonal fruit and topped with oat and cornmeal crumble. |

▪ | Hot Chick'n — The Hot Chick’n is a crispy chicken breast dusted with a guajillo and cayenne pepper blend and topped with slaw and pickles, which was offered at Shacks nationwide for a limited time in July 2017. The Hot Chick’n joins the award-winning Chick’n Shack, Shake Shack’s first-ever chicken sandwich that debuted in 2015. The Hot Chick'n debuted early exclusively via the Shack App before being rolled out for in-Shack ordering. |

▪ | Shack Everest — In celebration of Cory Richards and Adrian Ballinger's epic summit of Mount Everest, we whipped up a custom concrete just for them! The Shack Everest concrete is made as a double, with Mast Brothers dark chocolate chunks with vanilla frozen custard, chocolate sprinkles, whipped cream and topped with an “Everest” sugar cone peak. |

Chef Collaborations

Our fine dining heritage has enabled Shake Shack to team up with some of the world's best chefs for short-term special menu items. We devote significant resources to menu innovation and are frequently invited to participate and compete in chef events such as the South Beach Wine and Food Festival's Burger Bash, which allows us to test out new creations that can often lead to the introduction of new items. Some of our more notable collaborations in fiscal 2017 include:

▪ | Humm Burger and Patty Shack — In March 2017 we participated in a two-part collaboration with Chef Daniel Humm of NoMad at select LA Shacks and the NoMad Truck, in which we featured the Humm Burger and the Patty Shack. The Humm Burger, which was last served at our Decade of Shack celebrations in 2014, is a gruyère cheeseburger topped with applewood smoked bacon, celery relish, Bibb lettuce & truffle mayo, and the Patty Shack is our take on NoMad’s famous chicken burger —a black truffle chicken burger with cave-aged Jasper Hill Farm cheddar and gruyère cheese, onion, leek and ShackSauce. |

▪ | Golden State Shake — We collaborated with Nicole Rucker of Rucker's Pie in creating the Golden State Shake — a blend of vanilla frozen custard, salted honey butter sauce and finely crushed cornflakes topped with whipped cream, inspired by her famous honey cornflake donut. The Golden State Shake was available at all LA Shacks for the month of May. |

▪ | SmokeShack Rotolo and Chick'n Parm — We joined forces with Pizzeria Vetri in September 2017 to bring an exclusive menu to select Philly Shacks, all Philadelphia Pizzeria Vetri locations, the Logan Circle Shack and Pizzeria Vetri 14th Street Corridor. Playing on our classic SmokeShack, Pizzeria Vetri served up the SmokeShack Rotolo, a new take on their signature rotolo made with ground beef, all-natural smoked Niman Ranch bacon, Shack cheese sauce and chopped cherry pepper. Simultaneously, we offered the Chick’n Parm, a crispy chicken breast topped with Pizzeria Vetri marinara sauce, fresh mozzarella and basil. |

Shake Shack Inc.  Form 10-K | 7

Form 10-K | 7

Form 10-K | 7

Form 10-K | 7▪ | Den Shack — For one day only, we brought a taste of Tokyo to our Madison Square Park Shack. We teamed up with Michelin-starred Chef Zaiyu Hasegawa to offer the Den Shack, an all-natural 100% Angus beef burger topped with applewood-smoked bacon, DEN miso ShackSauce, sansho pepper and house-pickled cucumbers, which was previously exclusive at the Meiji-Jingu Gaien Shack. In addition to the Den Shack, we also offered a Black Sesame Shake, featuring vanilla frozen custard blended with black sesame puree. |

Shake Shack: Recipes & Stories

Guests and fans can now take Shake Shack home with them and try various recipes and inspired menu items in their own kitchen. In May 2017 we launched the Shake Shack cookbook, with 70 recipes, 200 photographs and plenty of stories, fun facts and pro tips for the home cook and Shack fan. The book is organized by menu item — burgers, chicken sandwiches, fries, concretes— and reveals some of our "secrets" for the Shake Shack guest to try at home.

We Are A Warm Community Gathering Place

Design Philosophy

The experience of Shake Shack continues to drive our strategy. Throughout fiscal 2017, and looking forward, we continued to enhance our design capability, simultaneously designing some of our most dynamic Shacks while gaining efficiency in the design process to prepare for the scalability of development ahead. The design of our Shacks is critical to the Shake Shack experience and we blend our core brand identifiers with features specifically designed for each Shack to be of its place and connect directly with its neighborhood. Whether domestic or international, we are passionate about securing vibrant sites and creating unique designs that give each Shack a hand-crafted look, are locally focused, and are appropriate for their respective communities. A typical domestic company-operated Shack is generally between 3,000 and 3,500 square feet with interior seating for between 75 and 100 guests. Additionally, whenever possible, our domestic company-operated Shacks feature either outdoor seating or easy access to a park or green space. We use high-quality tactile materials, warm lighting that focuses on every table and highlights the textured walls and seating layouts that encourage guests to relax and stay for a while. We take great care to build each Shack with thoughtful design, including distinctive architectural features, and compelling eco-friendly touches, such as a solar roof in a few of our free-standing Shacks—all while taking key inspiration from our first home in Madison Square Park. The original Shake Shack in Madison Square Park was designed by SITE Architecture and Design, led by James Wines and Denise Lee, in collaboration with Pentagram, led by Paula Scher. This design set the tone for a dynamic dialogue inside the park and our surrounding neighborhood that continues to drive our designs today. The overall atmosphere of our new Shacks evoke the very best from the original park kiosk, as well as the best of the fine dining experience in terms of the quality of design, materials used, lighting and music. We are mindful that each new Shack should embody the experience of the Madison Square Park Shake Shack—the line, the kiosk style, the experience of ordering food made just for you and the energetic open kitchen.

Each Shack is specifically designed to be of its place and connect with its neighborhood, but we have developed a number of iconic brand identifiers common to every Shack, including wrap-around steel beams, open kitchens, large distinctive menu boards and tables made from reclaimed bowling lanes from New York. Although no two Shacks are alike, we believe that these brand identifiers are key components to the expression of the brand and the experience of Shake Shack.

Often during the construction of new Shacks, particularly those in new markets, we re-imagine the often uninspiring plywood barriers that surround a construction site and use this as a canvas to begin the process of introducing Shake Shack to the community prior to our opening. We also collaborate with local artists and designers to bring beautiful artwork designs and installation to our Shacks from time to time. In 2017 we partnered with Brooklyn-based artist Laolu to reflect the vibrant life of our community with a three-part mural on the walls of the Flatbush Avenue Shack. We also worked with illustrator Leon Johnson who brought his inspiration of the community to life using mixed media, ink, paint and found objects to the walls of our Morningside Heights Shack.

Today, we continue to evolve our timeless designs through the engagement of different designers from around the country. We continue to develop our prototypes, “classic” Shack designs, free-standing, in-line and unique, one-of-a-kind formats. We are constantly pushing to be more creative and nimble, allowing us to ramp up our growth while making the Shack experience even more dynamic and accessible, as well as adapting to smaller footprints, proving our versatility and ability to enter and flourish in a variety of spaces. We currently use our second generation prototype model: a 3,200 square foot free-standing Shack that fits well in suburban locations, designed with more efficient use of materials while still offering the same full guest experience. Additionally, we further innovated our Shack design in the digital space by introducing a whole new guest flow with the opening of our first kiosk-

8 | Shake Shack Inc.  Form 10-K

Form 10-K

Form 10-K

Form 10-Konly ordering and cashless environment at Astor Place in October 2017. We designed an optimized kitchen, with a self-service beverage station, bringing it out of the kitchen, as well as a split-kitchen format that allows for greater output during peak times.

We also announced in fiscal 2017 that our home office headquarters will move to the West Village of New York City. Our new home office will feature expanded space for our home office employees, a Shack on the ground floor, a test kitchen facility on the lower level where our culinary team can continue to dream up new menu items, and a multi-purpose room to host special events and training. We engaged the team at Michael Hsu Office of Architecture in designing the new home office, who we have also worked with in bringing us designs at our Shacks, for example, in West Hollywood and South Lamar. Our new home office is an important investment in our team, our continued growth and our ability to innovate even more.

Beloved Lifestyle Brand

Since 2004, we have become a globally recognized brand with outsized consumer awareness relative to our current footprint of 159 Shacks, opening our first international Shack after only seven domestic Shacks. Shake Shack has become a New York City institution, a vibrant and authentic community gathering place that delivers an unparalleled experience to our loyal guests and a broad, global demographic. Shake Shack grew up alongside the emergence of social media and has benefited from an ongoing love affair with passionate fans who share their real-time experiences with friends. We aim to establish genuine connections with our guests and the communities in which they live. Shake Shack continues to be recognized in global media with impressions garnering attention well beyond our size.

Shake Shack was born as the modern version of the old roadside burger stand during the birth of social media and the digital age. The premium positioning and brand voice, derived from the spirit, integrity and humor of Shake Shack, are reinforced by our contemporary, responsible designs and hospitable team members who Stand For Something Good; this identity anchors our marketing efforts. We believe that our guests appreciate the experience of coming to Shake Shack as a community gathering place and, thus, the heart of our marketing strategy is to communicate and connect with our guests both at our Shacks and through social media.

Digital and Social Media

Much like we design our Shacks to be community gathering places, we execute a social media strategy that creates an online, on-brand community gathering place. Our guests and fans easily connect with us through Facebook, Instagram, Twitter, Tumblr, Pinterest and Snapchat. We recognize the impact of social media on today's consumers and we use these platforms to share information with our guests about new menu items, new Shack openings and other relevant Shake Shack information. As of December 27, 2017, globally, we had approximately 815,000 Facebook fans, 561,000 Instagram followers and 101,000 Twitter followers. We communicate with our fans in creative and organic ways that both strengthen our connection with them and increase brand awareness. We use Facebook live-streaming to post videos including interviews with our culinary partners, Shack leaders and sneak peeks into our new Shacks. In June 2016, we ranked #4 on Restaurant Social Media Index's top 250 restaurant brands, which is measured on influence, sentiment and engagement.

The launch of our Shack App provides a new way to experience Shake Shack and promote our signature menu items as well as our creative promotions. In addition to our social media presence, the Shack App is another digital tool that allows us to further expand our brand awareness and increase connectivity with our guests. Guests have the opportunity to take advantage of certain promotions and vouchers featured on the Shack App. After we launched the Shack App nationwide in January 2017, we ran a company-wide promotion offering a free single ShackBurger to each guest who downloads the new Shack App. On our shakeshack.com website we have a mobile-friendly interactive digital tool featuring allergen and nutritional data, dedicated Shack App page and a Shack city guide section with local geo-mapping. Additionally, in August 2017 we launched our Shake Shack chatbot , which was introduced through Facebook Messenger and Twitter DM, to answer guests’ most frequently asked questions.

Community and Charitable Partners

Each Shack focuses on conveying a consistent national brand message while also tailoring marketing efforts to each Shack. We always have menu items that feature local ingredients and beers that are specific to each Shack's community. We also aim marketing efforts at local events which help position Shake Shack as a premium brand that is connected to its neighborhood through participating in local celebrations and developing relationships within the community. Outside of local events, each Shack has a local charity partner to which it donates 5% of the sales from its Pie Oh My concrete. Beginning in August 2017, the D.C. Shacks, for instance, featured the "Livin' the Pie Life" and donates 5% of this Pie Oh My concrete's sales to Casey's Trees.

Shake Shack Inc.  Form 10-K | 9

Form 10-K | 9

Form 10-K | 9

Form 10-K | 9In addition to each Shack's local charity partner, Shacks will also participate or host other local charitable events. Some examples include:

▪ | Shake-speare Shake — The Upper West Side Shack paid tribute to Free Shakespeare in the Park with a limited-edition shake benefiting The Public Theater. The Shack served the Shake-speare Shake, a strawberry and rose shake topped with whipped cream and fairy dust sprinkles. 100% of the proceeds from the shake benefited The Public Theater’s wide range of programming, including its Free Shakespeare in the Park series, the bedrock of The Public Theater’s dedication to making theater accessible to all. The exclusive Shake-speare offering coincided with The Public Theater’s showing of the beloved comedy A Midsummer's Night Dream. |

▪ | Shake Shack x Bombas Community Initiative — In April 2017, we launched the Shake Shack x Bombas Community Initiative, where team members from Shake Shack and Bombas volunteer each month by donating burgers and socks to a shelter or program in their hometown of NYC. To celebrate the partnership, Bombas brought back its limited-edition Shake Shack x Bombas socks. The premium socks feature Bombas’ innovative sock-tech with their honeycomb arch support system and seamless toes for superior comfort and bold design and were offered at the Shack Shop, select Shake Shack locations and bombas.com for one day. |

▪ | Wellness in the Schools Mushroom Burger— At our Upper West Side Shack, we partnered with New York Chef Bill Telepan to create the Wellness in the Schools Mushroom Burger, available for one day only in April 2017. The Wellness in the Schools Mushroom Burger is a flat-top griddled mushroom burger topped with swiss cheese, pickled maitake aioli and crispy shallots. 100% of proceeds from the limited-edition burger went to Wellness in the Schools, a non-profit that inspires healthy eating and fitness for kids in public schools. |

▪ | Annual British Shake Sale — We held our 4th Annual British Shake Sale in August 2017 in support of Action Against Hunger. We teamed up with renowned pastry chef Dominique Ansel – named World’s Best Pastry Chef 2017 – and Dominique Ansel Bakery London to introduce a new limited-edition shake for the occasion, The Banoffee. The Banoffee features fresh, hand-spun vanilla custard blended with caramelized bananas, Dulce de Leche, Speculoos biscuits and a hint of sea salt, topped with Chantilly cream and Speculoos crumbles. Anyone who visited a Shack and donated £2 or more to Action Against Hunger in August, received a voucher for a complimentary hand-spun shake on their next visit. The 4th Great British Shake Sale followed the record breaking success of our Great American Shake Sale in the U.S. which was held in May 2017. |

Shack Track & Field

With our commitment to community and balance, Shake Shack offers Shack Track & Field, a free community fitness club offered on a monthly basis, open to the public of all ages and abilities. Shack Track & Field partners with local running stores and offers a variety of activities, including group runs, bike rides and yoga classes. The program is entirely free and includes a complimentary drink at the Shack after each event. Shack Track & Field currently has 10 chapters in cities across the country and continues to grow.

Burgers 'n' Brews

Shacks across the country host guided beer pairing dinners in partnership with local craft breweries. These ticketed events consist of three rounds of expertly paired Shack classics, specials and frozen custard beer floats. Guests walk out with custom swag items, full bellies and a deeper understanding of our brand. In 2018, we hosted eleven of these hyperlocal events.

Shack-wide Events

Shake Shack promotes annual events and limited-time offers to drive repeat visits and build intrigue among staff and guests.

Since 2012, Shake Shack has held The Great American Shake Sale™ during the month of May to raise money and awareness for childhood hunger. During The Great American Shake Sale, we encourage guests to donate $2 in exchange for a free shake (a $5 value) at their next visit. 100% of these donations go directly to Share Our Strength's No Kid Hungry campaign. In May 2017, we raised $633,000 across our domestic company-operated Shacks for this initiative.

10 | Shake Shack Inc.  Form 10-K

Form 10-K

Form 10-K

Form 10-KPop-ups and Promotions

Throughout fiscal 2017 we continued to do innovative branding by collaborating with other chefs and creating various pop-up concepts as well as offering exciting promotions to drive brand awareness. These pop-ups are a key part of building the growing strength of the Shake Shack brand while capturing these unique moments that differentiate our brand. Some notable collaborative pop-ups and promotions include:

▪ | Momofuku Pop-Up – For one day only in January 2017, we hosted a pop-up in Toronto at Momofuku Daisho, the first-ever taste of Shake Shack in Canada. We served up ShackBurgers and crinkle cut fries while Momofuku selected beverages from Steam Whistle Brewery and Norman Hardie Winery and Vineyard to pair with guests' burgers and fries. Additionally, $1 from every order was donated to SickKids Foundation contributing to child health research, learning and care. |

▪ | St. Louis Porano Pasta Pop-Up – In anticipation of our first Shack opening in St. Louis, we held a pop-up with Porano Pasta of Niche Food Group. We partnered with Chef Matthew Rice of Niche Food Group and created butterscotch frozen custard banana-oat cookie sandwich just for the occasion. Additionally, we partnered with local illustrator, Adam Koon, to create a whimsical piece showcasing beloved historical landmarks around the city. Guests in attendance received a free limited-edition tote bag featuring the illustration as a token of our appreciation. |

▪ | EMP Summer House – For one weekend in August, we served lunch on the patio of EMP Summer House in East Hampton, offering up classics like the ShackBurger, Bacon Double Cheeseburger and crinkle cut fries along with Hamptons-inspired specialty items like the CLAMBurger and Lobster Shack. We also offered up this exclusive menu at the Madison Square Park Shack during the same weekend, serving up the Lobster Shack. |

Product Placement

Shake Shack has been fortunate to receive considerable product placement in movies, TV shows and other media without any cost to the Company. In fact, Shake Shack has been able to charge fees for these location shoots, which have included scenes from the motion pictures Something Borrowed and Tower Heist, as well as the acclaimed HBO series The Newsroom , Showtime's Billions and Shameless, Amazon original series Bosch (which featured our West Hollywood Shack) and a mention in CBS' sitcom The Big Bang Theory. We have also been featured in segments on The Daily Show, Saturday Night Live, CBS Sunday Morning and Late Night with Jimmy Fallon.

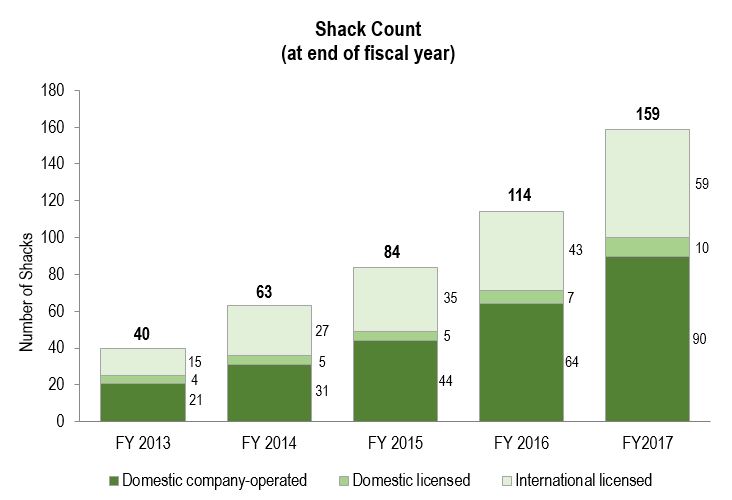

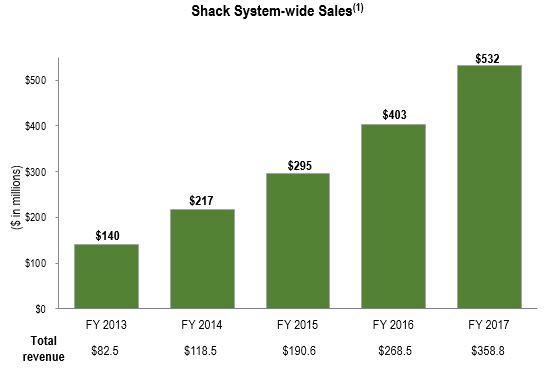

We Are Accountable For Results

Our brand power and thoughtful approach to growth have resulted in strong performance across a variety of geographic areas and formats. We grew from 40 Shacks in fiscal 2013 to 159 Shacks in fiscal 2017 spanning 20 states, the District of Columbia and 11 countries, representing a 41% compound annual growth rate ("CAGR"). As a result of our expansion and strong performance:

▪ | Our total revenue grew from $82.5 million in fiscal 2013 to $358.8 million in fiscal 2017, a 44% CAGR. Compared to fiscal 2016, total revenue increased 33.6% in fiscal 2017. |

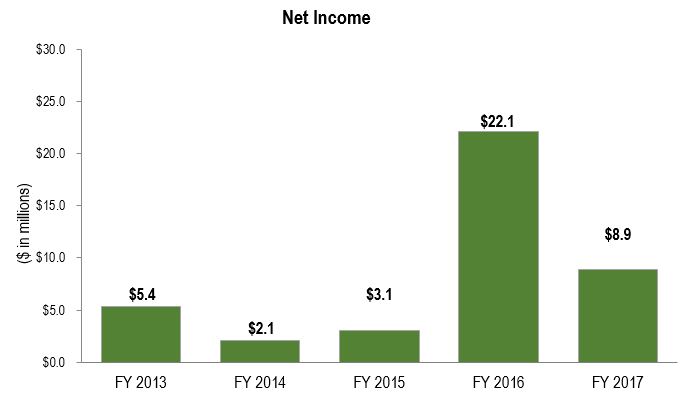

▪ | Net loss attributable to Shake Shack Inc. for fiscal 2017 was $0.3 million, compared to income of $12.4 million for fiscal 2016. |

▪ | Adjusted pro forma net income, a non-GAAP measure, increased 25.4% to $21.0 million, or $0.57 per fully exchanged and diluted share in fiscal 2017, compared to $16.8 million, or $0.46 per fully exchanged and diluted share in fiscal 2016. For a reconciliation of adjusted pro forma, a non-GAAP measure, to net income (loss) attributable to Shake Shack Inc., see "Non-GAAP Financial Measures—Adjusted Pro Forma Net Income and Adjusted Pro Forma Earnings Per Fully Exchanged and Diluted Share" in Part II, Item 7. |

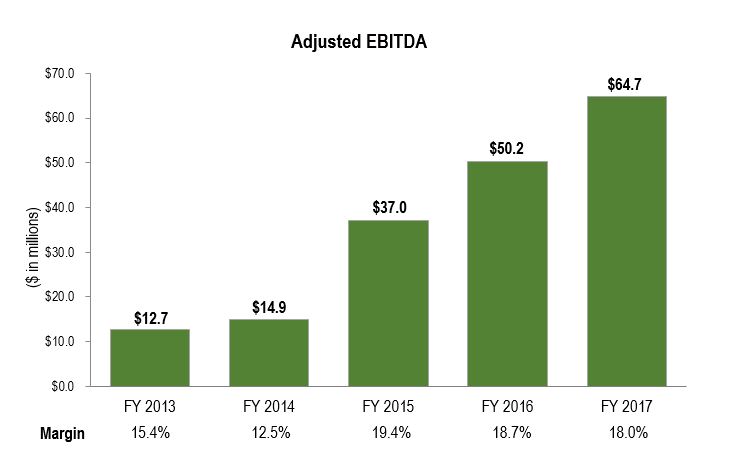

• | Adjusted EBITDA, a non-GAAP measure, increased 29% to $64.7 million for fiscal 2017 from $50.2 million for fiscal 2016. For a reconciliation of Adjusted EBITDA to net income, see "Non-GAAP Financial Measures—EBITDA and Adjusted EBITDA" in Part II, Item 7. |

Shake Shack Inc.  Form 10-K | 11

Form 10-K | 11

Form 10-K | 11

Form 10-K | 11

(1) | System-wide sales consists of sales from our domestic company-operated Shacks, our domestic licensed Shacks and our international licensed Shacks. We do not recognize the sales from our licensed Shacks as revenue. Of these amounts, our revenue is limited to Shack sales from domestic company-operated Shacks and licensing revenue based on a percentage of sales from domestic and international licensed Shacks. Our total revenue also includes certain up-front fees such as territory fees and opening fees we receive in connection with our licensing arrangements. |

COMPETITION

The restaurant industry is highly competitive and fragmented, with restaurants competing on factors such as taste, price, food quality, service, location and the ambiance and condition of the restaurant. Our primary competitors include "better burger" concept restaurants, as well as other fast casual restaurants, and, to a lesser extent, quick service and casual dining restaurants. Our competition includes multi-unit national and regional chains, as well as a wide variety of locally-owned restaurants. Our competitors may operate company-owned restaurants, franchised restaurants or some combination. Many of our competitors offer breakfast, lunch and dinner, as well as dine-in, carry-out and delivery services. We may also compete with companies outside of the traditional restaurant industry, such as grocery store chains, meal subscription services and delicatessens, especially those that target customers who seek high-quality food, as well as convenience food stores, cafeterias and other dining outlets. Our competition continues to intensify as new competitors enter both the burger and fast casual segments. We also face increasing competitive pressures from some of our competitors who have recently announced initiatives to offer better quality ingredients, such as antibiotic-free meat. For more information regarding the risks we face from our competitors, who may have, among other things, a more diverse menu, greater financial resources, lower operating costs, a more well-established brand, better locations and more effective

12 | Shake Shack Inc.  Form 10-K

Form 10-K

Form 10-K

Form 10-Kmarketing than we do, see "Risks Related to Operating in the Restaurant Industry—We face significant competition for guests, and if we are unable to compete effectively, our business could be adversely affected" in Item 1A, Risk Factors.

We specifically target guests that seek an engaging and differentiated guest experience that includes great food, unique and thoughtful integration with local communities and high standards of excellence and hospitality. We believe that we are well positioned to continue to grow our market position, as we believe consumers will continue to trade up to higher quality offerings given the increasing consumer focus on responsible sourcing, ingredients and preparation. Additionally, we believe that consumers will continue to move away from the added time commitment and cost of traditional casual dining. We believe that many consumers want to associate with brands whose ethos matches their own, and that Shake Shack, with our mission to Stand For Something Good and our culture of Enlightened Hospitality, is a distinct and differentiated global lifestyle brand.

GROWTH STRATEGIES

We believe that we are well-positioned to achieve significant, sustainable financial growth. Our goal — to be a growing and loyal brand, connected to our community, relentlessly focused on excellence, experience and hospitality. We plan to continue to expand our business, drive Shack sales and enhance our competitive positioning by executing on the following strategies:

Opening New Domestic Company-Operated Shacks

This is where our greatest opportunity for growth lies. Shake Shack’s business model remains strong and we intend to open many more Shacks. We waited nearly five years to open our second Shack, and we are still in the very nascent stage of our story, with only 90 domestic company-operated and 10 domestic licensed Shacks in 20 states and Washington, D.C. as of December 27, 2017. We believe there is tremendous whitespace opportunity to expand in both existing and new U.S. markets, and we will continue to invest in the infrastructure that will enable us to continue to grow rapidly and with discipline. In fiscal 2017, we significantly expanded our domestic company-operated footprint by opening 26 new Shacks representing a 40.6% increase in our domestic company-operated Shack count. We plan to open between 32 and 35 new domestic company-operated Shacks each year for the foreseeable future. We believe that over the long-term we have the potential to grow our current domestic company-operated Shack footprint to at least 450 Shacks by opening domestic company-operated Shacks in new and existing markets. The rate of future Shack growth in any particular period is inherently uncertain and is subject to numerous factors that are outside of our control. As a result, we do not currently have an anticipated timeframe for such expansion. We believe we have a versatile real estate model built for growth. We have adopted a disciplined expansion strategy designed to leverage the strength of our business model and our significant brand awareness to successfully develop new Shacks in an array of markets that are primed for growth, including new and existing, as well as small and large markets. We continue to be encouraged by the success of our multi-format strategy which includes Shacks in various formats including but not limited to urban centers, free-standing pads, mall locations, lifestyle centers, train stations, airports, stadiums, outlets and more.

We will continue to expand in existing markets (California, metro New York, Mid-Atlantic, Texas and more) in order to leverage operational effectiveness as we cluster in these high-density markets, but we will also enter new markets, such as Birmingham, Charlotte, Denver, Kansas City, Nashville, San Francisco and Seattle. With 159 Shacks around the world (as of December 27, 2017), we have identified many attractive and differentiated markets for the Shake Shack experience. In major metropolitan areas, we seek locations where communities gather, often with characteristics such as high foot traffic, substantial commercial density, reputable co-tenants and other traffic drivers such as proximity to parks, museums, schools, hospitals and tourist attractions. For every potential domestic company-operated Shack we consider, we apply rigorous financial metrics to ensure we maintain our targeted profitability.

Capitalizing on Our Outsized Brand Awareness

One of the great advantages for Shake Shack has been our birthplace and headquarters in New York City. Rarely has a brand of our type been born in New York, and from a fine dining company. This gives us a tremendous media and brand power which often outweighs our relative size. We focus our efforts on building a genuine connection with our guests and integrating into their communities through investment in innovative marketing and programming. We utilize various social media outlets to actively engage with our growing online following. We were named one of the 2017 Golden Chain Award winners by Nation's Restaurant News, as

Shake Shack Inc.  Form 10-K | 13

Form 10-K | 13

Form 10-K | 13

Form 10-K | 13well as one of Thrillist's "14 Restaurant Chains that Changed America." The Chick'n Shack received top honor at the 2017 MenuMasters Awards for outstanding menu research and development. In June 2016, we ranked #4 on Restaurant Social Media Index's top 250 restaurant brands, which is measured on influence, sentiment and engagement. Furthermore, we believe that our press and media impressions and industry recognition are a testament to the strength of our brand. We were listed number one on the New York Post's list of "America's 20 Best Chain Restaurants" in 2016, named as one of the "Best Burgers in the U.S."and one of the "50 best Things to Eat in NYC before you Die" in 2016 by MSN Food & Drink, "Best Burger" at the 2014 South Beach Wine and Food Festival's Burger Bash and more. Additionally, we give back to the communities in which we operate, and strengthen awareness for philanthropic causes such as Share Our Strength's No Kid Hungry campaign. We had the honor of being recognized at Compassion in World Farming’s 2017 Good Farm Animal Welfare Awards (GFAWA), which celebrates companies that use or have committed to use cage-free eggs or egg products. Our marketing efforts focus on interacting with our guests in an authentic, innovative manner which creates memorable, meaningful experiences. The experience that we provide for our guests and local communities has generated a growing loyal following that promotes our brand through word-of-mouth. We believe that this outsized brand awareness will continue to fuel our growth in existing and new markets.

Growing Same-Shack Sales

Given the significant awareness of our brand and the excitement we have been able to generate for our market launches, our Shacks in newer markets have generally opened with higher volumes and operating profits relative to their second year, following the strong initial honeymoon period. We expect our Shacks to deliver low single digit same-Shack sales growth in the longer term, while the number of new Shack openings relative to our comparable Shack base remains our primary driver of growth in the near term. We believe, based on our business strategy and various factors in and out of our control, that we will have quarters where our same Shack sales may be negative. We do, however, continually focus on improving our same-Shack sales performance by providing an engaging and differentiated guest experience that includes new seasonal and Shack-specific offerings, technological upgrades including the Shack App, unique and thoughtful integration with local communities and high standards of excellence and hospitality. We will continue to innovate around our core menu to keep our offerings fresh, while remaining focused on our signature items.

Thoughtfully Increasing Our Licensed Shacks

We will continue to grow our licensed portfolio by expanding further domestically, in the countries in which we currently have internationally licensed operations, as well as entering new international markets. This strategy historically has been a low-cost, high-return method of growing our brand awareness and providing an increasing source of cash flow. In December 2014, we entered into an exclusive licensing arrangement with a leading retail and food operator for the development of up to 10 new Shacks in Japan over the following five years. As of December 27, 2017 we have opened six Shacks in Tokyo—at the renowned Meiji-Jingu Park, Ebisu, the Tokyo International Forum, Shinjuku, Yokohama and Roppongi. In December 2015, we announced plans to enter South Korea with a new licensed partner for the development of 25 Shacks over the following 10 years, and as of December 27, 2017 we have opened five Shacks in Seoul, South Korea, in the Gangnam district, the Cheongdam neighborhood, Doota, AK Plaza and Starfield Goyang. In the summer of 2017, we announced our plans to bring Shake Shack to Hong Kong and Macau with a total of 14 Shacks to open through 2027, as well our plans to open 25 Shacks in greater Shanghai through 2028. We believe there are additional international markets that will embrace the Shake Shack concept. Domestically, we have continued to grow our licensed business at airport locations around the country, opening in LAX Terminal 3, as well as in sports arenas, opening in Minute Maid Park in Houston and M&T Bank Stadium in Baltimore. Given our position in New York and the success of our current licensed Shacks at home and abroad, we continue to attract substantial interest from potential international licensees around the world and we believe we have significant opportunities to expand our licensing footprint in existing and new international markets as our team, development opportunities and supply chain matures.

See Note 19 to the consolidated financial statements included in Part II, Item 8 for financial information about geographic areas.

14 | Shake Shack Inc.  Form 10-K

Form 10-K

Form 10-K

Form 10-KOPERATIONS

Sourcing and Supply Chain

Shake Shack has always been committed to working with best-in-class suppliers, across our supply chain. Our Stand For Something Good vision guides us in how we source and develop our ingredients, always looking for the best ways to provide top quality food at an excellent value and accessible to all. We pride ourselves on sourcing premium ingredients from like-minded producers—all-natural proteins, vegetarian fed, humanely raised and source verified, with no hormones or antibiotics. We're also proud to share our animal welfare policy which can be found on our Shake Shack website.

We have a regional strategy for ground beef production to ensure that we are always serving freshly ground and never frozen beef at our domestic Shacks. Initially, and around the time or our IPO, our beef production was focused in New York City. However, as we've grown around the country, we now have six butchers spread throughout the country who produce our burgers on a daily basis, and we will continue to partner with regional suppliers in new markets as we grow.

We have a limited number of suppliers for our major ingredients, including beef patties, chicken, potato buns, custard, Portobello mushrooms and cheese sauce. In fiscal 2017, we purchased all of our (i) ground beef patties from seven suppliers, with approximately 65% of our ground beef patties supplied by one supplier, (ii) chicken breast from one supplier, (iii) potato buns directly from one supplier, (iv) custard base from three suppliers, (v) 'Shroom Burgers from two suppliers, with approximately 95% of our 'Shroom Burgers supplied by one supplier and (vi) ShackSauce from one supplier. We have developed a reliable supply chain and continue to focus on identifying alternative sources to avoid any possible interruptions of service and product.

Distribution

We contract with one distributor, which we refer to as our "broadline" distributor, to provide virtually all of our food distribution services in the United States. As of December 27, 2017, approximately 84% of our core food and beverage ingredients and 100% of our paper goods and chemicals, collectively representing approximately 49% of our purchases, were processed through our broadline distributor for distribution and delivery to each Shack. As of December 27, 2017, we were utilizing 14 affiliated distribution centers to supply our domestic company-operated Shacks. We recognize that the safety and consistency of our products begins with our suppliers. Suppliers must meet certain criteria and strict quality control standards in the production and delivery of our food and other products. We regularly evaluate our broadline distributor to ensure that the products we purchase conform to our standards and that the prices they offer are competitive.

Food Safety and Quality Assurance

Food safety is a top priority and we are committed to serving safe, high quality food. We have rigorous quality assurance and food safety protocols in place throughout our supply chain. We have a comprehensive supplier and ingredient selection process and maintain a limited list of approved suppliers. We thoroughly review the results of suppliers' internal and external quality audits, insurance coverage and track record on an ongoing basis. We have a food safety site inspection process and periodically perform supplier site visits, as well as mock food recalls. We have developed and implemented training and operating standards related to the food preparation, cleanliness and safety in the Shacks. We have a dedicated Quality Assurance team to ensure food safety across all domestic company-operated Shacks as well as employing an external third-party to conduct additional audits of these Shacks at different times of the year.

Site Selection

Shake Shack is ultimately about the guest experience and our site selection focuses on choosing great sites where people want to be together. Our site selection process is actively led by our Real Estate Committee, which meets regularly and follows a detailed approval process to ensure quality, fiduciary responsibility and overall adherence to our strategic growth goals. We invest in analytical tools for extensive demographic analysis and data collection for both existing and new potential sites. In addition to our in-house team of experienced real estate professionals, we use a national real estate broker to manage a network of regional brokers in order to leverage external resources in pursuit of pipeline development and consistent deal flow.

Shake Shack Inc.  Form 10-K | 15

Form 10-K | 15

Form 10-K | 15

Form 10-K | 15Construction

A typical Shack takes between 14 and 20 weeks to build. In fiscal 2017 the cost to build a new Shack ranged from approximately $1.1 million to $3.3 million, with an average near-term build cost of approximately $1.7 million, excluding pre-opening costs. The total investment cost of a new Shack in fiscal 2017, which includes costs related to items such as furniture, fixtures and equipment, ranged from approximately $1.6 million to $3.7 million, with an average investment cost of approximately $2.2 million. We use a number of general contractors on a regional basis and employ a mixed approach of bidding and strategic negotiation in order to ensure the best value and highest quality construction.

Management Information Systems

Our domestic company-operated Shacks use computerized point-of-sale and back-office systems created by NCR Corporation, which we believe are scalable to support our growth plans. These point-of-sale systems are designed specifically for the restaurant industry and we use many customized features to increase operational effectiveness, internal communication and data analysis. This system provides a touch screen interface, graphical order confirmation display, touch screen kitchen display and integrated, high-speed credit card and gift card processing. The point-of-sale system is used to collect daily transaction data, which generates information about daily sales, product mix and average transaction size.

In January 2017 we rolled out nationwide our first-ever mobile ordering Shack App for iOS where guests are able to order Shack menu items directly from their phone. We followed this with our launch of the Shack App for Android in July 2017. The Shack App was created in collaboration with several key external partners, aiding in the mobile production, mobile ordering platform, guest engagement platform and digital experience testing services during its development. Information from the Shack App indirectly interfaces with our point-of-sale system.

In October 2017 we opened our first Shack, at Astor Place, where we feature a kiosk-only order, cashless environment. The Shack kiosk was developed to allow Shake Shack to serve more guests at peak times – whether in-Shack, for pickup via the Shack App, or even delivery. The Shack kiosk replicates the experience of the Shack App with a sharp aesthetic, an intuitive touch screen interface and ease of ordering. Guests simply select their food, place an order and choose to receive an alert via text when their order is ready.

Our back-office computer systems are designed to assist in the management of our domestic company-operated Shacks and provide real-time labor and food cost management tools. These tools provide the home office and operations management quick access to detailed business data and reduces the amount of time spent by our Shack-level managers on administrative needs.

INTELLECTUAL PROPERTY

Since our inception, we have undertaken to strategically and proactively develop our intellectual property portfolio by registering our trademarks and service marks worldwide. As of December 27, 2017, we had 20 registered marks domestically, including registrations in our core marks ("Shake Shack," "Shack Burger," " " and "

" and " ") and certain other marks, such as Stand for Something Good. Internationally, we have registered our core marks in over 82 countries spanning six continents. These marks are registered in multiple international trademark classes, including for restaurant services, food services, non-alcoholic beverages and apparel. We also own the domain www.shakeshack.com as well as over 350 other domain names for use in other markets.

") and certain other marks, such as Stand for Something Good. Internationally, we have registered our core marks in over 82 countries spanning six continents. These marks are registered in multiple international trademark classes, including for restaurant services, food services, non-alcoholic beverages and apparel. We also own the domain www.shakeshack.com as well as over 350 other domain names for use in other markets.

" and "

" and " ") and certain other marks, such as Stand for Something Good. Internationally, we have registered our core marks in over 82 countries spanning six continents. These marks are registered in multiple international trademark classes, including for restaurant services, food services, non-alcoholic beverages and apparel. We also own the domain www.shakeshack.com as well as over 350 other domain names for use in other markets.

") and certain other marks, such as Stand for Something Good. Internationally, we have registered our core marks in over 82 countries spanning six continents. These marks are registered in multiple international trademark classes, including for restaurant services, food services, non-alcoholic beverages and apparel. We also own the domain www.shakeshack.com as well as over 350 other domain names for use in other markets.In addition, we have agreements with the suppliers of our proprietary products stating that the recipes and production processes associated with those products are our property, confidential to us, and may not be provided to any other customer. Our proprietary products include the burger recipe for our whole muscle blend and the patty grinding procedure and the product formulations for our ShackSauce, 'Shroom Burger, chicken breast, chicken breader and buttermilk herb mayo, cheese sauce, unflavored custard base, chocolate custard base, and certain toppings and custard mix-ins. We also have exclusive arrangements with our suppliers of ShackMeister Ale, Shack Red wine, Shack White wine, all-natural hot dog and all-natural chicken sausage, relish and cherry peppers.

16 | Shake Shack Inc.  Form 10-K

Form 10-K

Form 10-K

Form 10-KGOVERNMENT REGULATION AND ENVIRONMENTAL MATTERS

We are subject to extensive federal, state, local and foreign laws and regulations, as well as other statutory and regulatory requirements, including those related to, among others, nutritional content labeling and disclosure requirements, food safety regulations, local licensure, building and zoning regulations, employment regulations and laws and regulations related to our licensed operations. New laws and regulations or new interpretations of existing laws and regulations may also impact our business. The costs of compliance with these laws and regulations are high and are likely to increase in the future and any failure on our part to comply with these laws may subject us to significant liabilities and other penalties. See "Regulatory and Legal Risks" in Item 1A, Risk Factors for more information.

We are not aware of any federal, state or local provisions that have been enacted or adopted regulating the discharge of materials into the environment, or otherwise relating to the protection of the environment, that have materially affected, or are reasonably expected to materially affect, our results of operations, competitive position, or capital expenditures.

SEASONALITY

Our business is subject to slight seasonal fluctuations during the summer months, affecting our second and third quarters in a fiscal year. Additionally, given our use of a fiscal calendar, there may be some fluctuations between quarters due to holiday shifts in the calendar year.

Shake Shack Inc.  Form 10-K | 17

Form 10-K | 17

Form 10-K | 17

Form 10-K | 17EMPLOYEES

As of December 27, 2017, we had 4,440 employees, of whom 3,738 were hourly team members, 564 were Shack-level managers and 138 were home office personnel.

EXECUTIVE OFFICERS OF THE REGISTRANT

The name, age and position held by each of our executive officers as of December 27, 2017 is set forth below.

Name | Age | Position | ||

Randy Garutti | 42 | Chief Executive Officer and Director | ||

Tara Comonte | 43 | Chief Financial Officer | ||

Zachary Koff | 38 | Chief Operating Officer | ||