UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended August 31, 2017

OR

o TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ______ to ______.

Commission File Number: 333-199583

|

DOCASA, INC. |

|

(Exact name of registrant as specified in its charter) |

|

Nevada |

|

47-1405387 |

|

(State or other jurisdiction of incorporation or organization) |

|

(IRS Employer Identification No.) |

|

| ||

|

1901 North Roselle Road, Suite 800 Schaumburg, Illinois |

|

60195 |

|

(Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code: (630) 250-2709

Securities registered under Section 12(b) of the Exchange Act:

None

Securities registered under Section 12(g) of the Exchange Act:

Common Stock, $0.001 Par Value

(Title of class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. o Yes x No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. x Yes o No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the preceding 12 months (or for such shorter period that the issuer was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. o Yes x No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). oYes x No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company filer. See definition of “large accelerated filer”, “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

Large Accelerated Filer |

¨ |

Accelerated Filer |

¨ |

|

Non-Accelerated Filer |

¨ |

Smaller Reporting Company |

x |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). o Yes x No

On February 28, 2017, the last business day of the registrant’s most recently completed second quarter, the aggregate market value of the registrant’s common stock held by non-affiliates of the registrant was $44,160,000, based upon the closing price on that date of the common stock of the registrant on the OTC Link system of $1.20/share. For purposes of this response, the registrant has assumed that its directors, executive officers and beneficial owners of 5% or more of its common stock are deemed affiliates of the registrant.

As of December 11, 2017, the registrant had 160,012,875 shares of its common stock, $0.001 par value, outstanding. The Company has 47,087,125 shares of its common stock conditionally issuable.

| 2 |

FORWARD LOOKING STATEMENTS

This Annual Report on Form 10-K contains forward-looking statements within the meaning of Rule 175 of the Securities Act of 1933, as amended, and Rule 3b-6 of the Securities Act of 1934, as amended, that involve substantial risks and uncertainties. These forward-looking statements are not historical facts, but rather are based on current expectations, estimates and projections about our industry, our beliefs and our assumptions. Words such as “anticipate,” “expects,” “intends,” “plans,” “believes,” “seeks” and “estimates” and variations of these words and similar expressions are intended to identify forward-looking statements. These statements are not guarantees of future performance and are subject to risks, uncertainties and other factors, some of which are beyond our control and difficult to predict and could cause actual results to differ materially from those expressed or forecasted in the forward-looking statements. You should not place undue reliance on these forward-looking statements, which apply only as of the date of this Form 10-K. Investors should carefully consider all of such risks before making an investment decision with respect to the Company’s stock. The following discussion and analysis should be read in conjunction with our financial statements for DOCASA, Inc. Such discussion represents only the best present assessment from our Management.

| 3 |

| Table of Contents |

General Overview

DOCASA, Inc. (the “Company,” “we,” “us,” “our,” or “DOCASA”) was incorporated in the State of Nevada on July 22, 2014, under the name of FWF Holdings, Inc. The Company changed its name on August 4, 2016. On August 4, 2016, the Company filed to change its fiscal year end from July 31st to August 31st.

On July 8, 2016, the Company experienced a change in control. Atlantik LP (“Atlantik”) acquired a majority of the issued and outstanding common stock of the Company in accordance with a stock purchase agreement by and between Atlantik and Nami Shams (the “Seller”). On the closing date, July 8, 2016, pursuant to the terms of the stock purchase agreement, Atlantik purchased from the Seller 115,000,000 shares of the Company’s outstanding restricted common stock for $200,000, representing 75.8% of the Company’s outstanding common stock at that time.

On September 1, 2016, the Company acquired 99.8% of the voting stock of the Department of Coffee and Social Affairs Limited, a United Kingdom corporation (the “DEPT-UK”), and the Company agreed to issue DEPT-UK’s majority shareholder 170,000,000 shares of the Company’s common stock—110,000,000 shares initially and 60,000,000 shares at a time determined by the Company’s Board of Directors but no later than August 31, 2017, which deadline was subsequently extended to August 31, 2018. Also on September 1, 2016, the Company acquired 115,000,000 shares of the Company’s common stock from Atlantik in exchange for issuing Atlantik a promissory note for $320,000, which shares were then cancelled and which note has since been paid in full. As a result of the acquisition and the issuance of the initial 110,000,000 shares of common stock, and the cancellation of the 115,000,000 Atlantik shares, DEPT-UK is now the majority-owned subsidiary of the Company, and the Company experienced a change of control.

DEPT-UK formed a wholly-owned subsidiary, Department of Coffee and Internal Affairs Limited (“DCIA”), on September 11, 2014, as filed with the Registrar of Companies for England and Wales. As of August 31, 2017, DCIA has had no operations or activity.

On April 5, 2017, the Company formed Department of Coffee and Social Affairs IL, Inc. (“DEPT-IL”), an Illinois corporation.

On May 18, 2017, the Company formed Department of Coffee and Social Affairs White Space Limited (“DEPT-UKWS”), as filed with the Registrar of Companies for England and Wales. It is a subsidiary of DEPT-UK.

For financial reporting purposes, the acquisition of DEPT-UK and the change of control in connection with acquisition represented a "reverse merger" rather than a business combination, and DEPT-UK is deemed to be the accounting acquirer in the transaction. For the periods subsequent to August 31, 2016, the acquisition is being accounted for as a reverse-merger and recapitalization. DEPT-UK is the acquirer for financial reporting purposes, and the Company (DOCASA, Inc., f/k/a FWF Holdings, Inc.) is the acquired company. Consequently, the assets and liabilities and the operations that are reflected in the historical financial statements prior to the acquisition are those of DEPT-UK and have been recorded at the historical cost basis of DEPT-UK, and the financial statements after completion of the acquisition include the assets and liabilities of both the Company and DEPT-UK, and the historical operations of DEPT-UK prior to closing and operations of both companies from the closing of the acquisition.

We are currently devoting all of our efforts to the specialty coffee industry, specifically with company-operated stores. The Company generates revenue through sales at fifteen existing and seven currently under construction, company-operated stores in the United Kingdom and the United States (“US”). Our objective is to continue to be recognized as one of the upper tier specialty coffee retail operations in our market. Similar to leading operators, we sell our proprietary coffee and related products, and complementary food and snacks.

Our growth plans currently include expansion in certain European countries, the US and China. The Company also intends to pursue commercial agreements in other countries through strategic licensing agreements.

The Company reports its business under the following SIC Codes:

|

SIC Code |

|

Description |

|

| ||

|

5810 |

|

Retail - Eating & Drinking Places |

|

5812 |

|

Eating Places |

Our corporate headquarters are located at 1901 North Roselle Road, Suite 800, Schaumburg, Illinois, 60195. The Company’s primary website is www.docasainc.com, and its website for its specialty coffee operations is www.departmentofcoffee.com. These websites are not incorporated in this Form 10-K.

| 4 |

| Table of Contents |

Overview

The Company’s main operational subsidiary, DEPT-UK (“Department of Coffee and Social Affairs Limited”), is a specialty artisan coffee company that serves premium single origin coffee to the United Kingdom’s discerning coffee drinkers as well as a selection of quality foods and coffee related retail products. Department of Coffee and Social Affairs served its first coffee in December 2010 and currently serves over 1,000,000 coffees per year. Department of Coffee and Social Affairs has fifteen existing and seven currently under construction, company-operated stores in the UK and the US, with an additional pipeline in the UK and the US and is seeking to rapidly grow to become the UK’s first truly nationwide specialty coffee company and to grow rapidly in select US cities.

To serve single origin coffee requires a sourcing chain that extends from the farm and workers, to picking and packaging, screening and grading, brokerage, shipping, roasting and – finally – coffee making. By working closely with our suppliers, we are able to bring some of the best coffees in the world to our customers. The grades of coffee we buy can only be produced by farmers who have a passion for their crop and are skilled in agribusiness.

Good quality coffee does not mean you will personally like it. That is why we sample our coffee blindly and judge on flavor clarity and ability to pique our interest. Because we buy from specific producers, we expect distinct and definable flavors, and we want those to be complimentary – or to collide in an interesting way. We encourage our customers to try as many coffees as possible to learn which types of flavor they enjoy. You will find that there is no such thing as the universal ‘perfect’ coffee. There are flavors that suit certain times, moods, foods and occasions.

The Department of Coffee and Social Affairs brand is an award-winning and recognized leader in the UK specialty coffee market. The plan for the Company is to continue to grow by implementing an aggressive roll out of further shops in London, other UK cities and certain cities in the US. Department of Coffee and Social Affairs will offer even more consumers access to premium quality coffee.

Less known about Department of Coffee and Social Affairs is the meaning behind the second part of our name, “Social Affairs,” which refers partly to our customers’ coffee drinking experience, but also refers to our humanitarian work. Members of our team are both board members and volunteers for a number of UK and international charities.

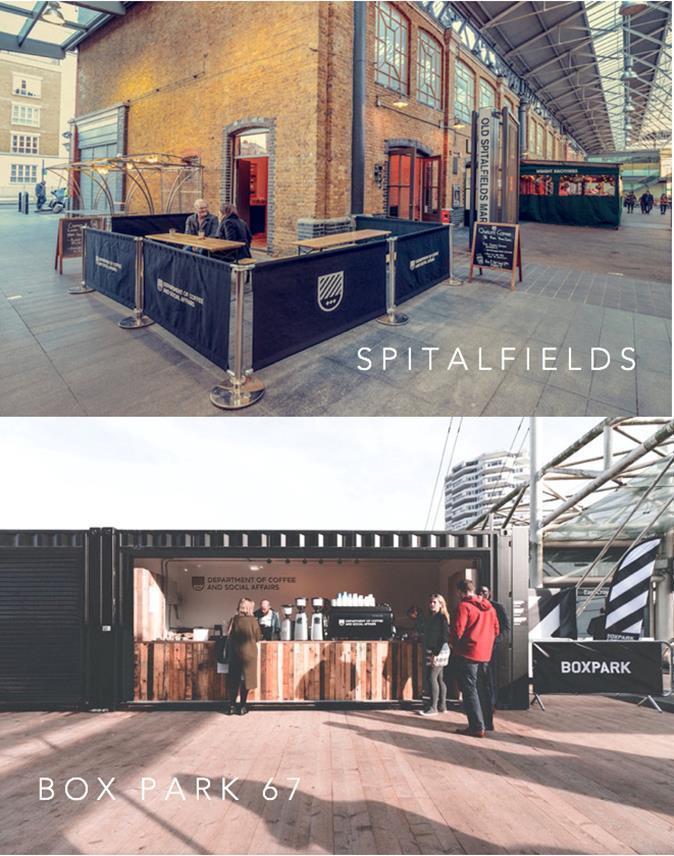

Company Operated Stores

Department of Coffee and Social Affairs operated stores are normally located in high foot traffic areas within close proximity to retail areas, transport stations, office buildings and university campuses. Due to our “no two shop looks alike policy,” we are able to turn unusual spaces into prime retail coffee locations. Our coffee shops range from 500 square feet to 3,000 square feet. The following our examples of spaces we have designed to fit the community our shops operates in.

| 5 |

| Table of Contents |

| 6 |

| Table of Contents |

| 7 |

| Table of Contents |

| 8 |

| Table of Contents |

| 9 |

| Table of Contents |

| 10 |

| Table of Contents |

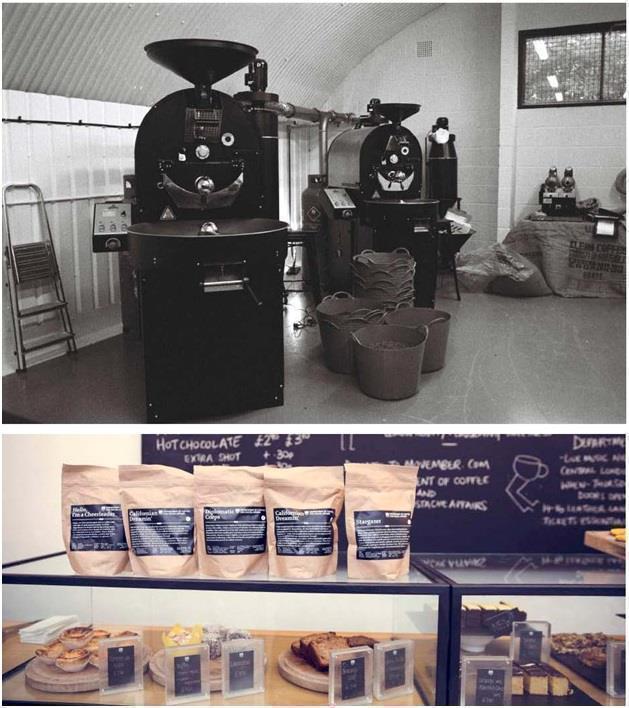

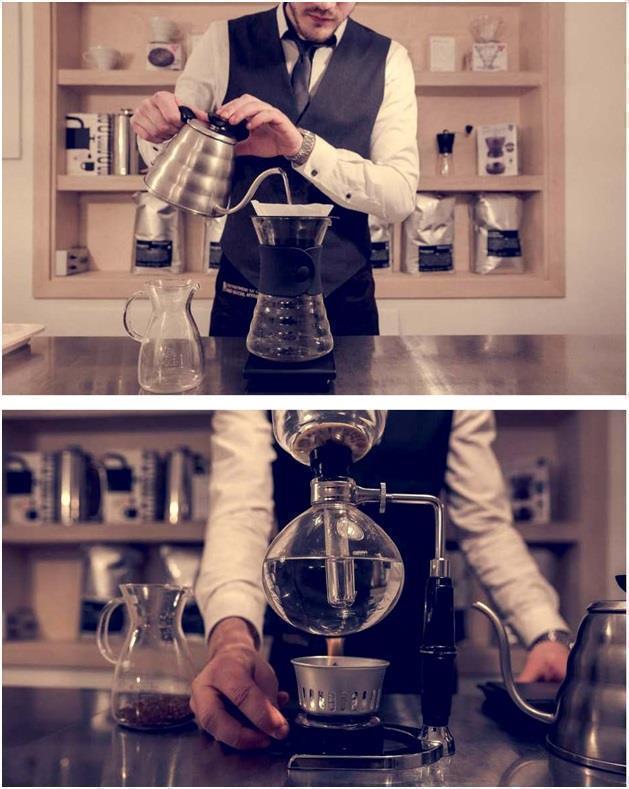

Our shops offer a range of coffee beans exclusive to Department of Coffee and Social Affairs. These beans are used to craft a selection of single origin espresso based coffees and filter (drip) coffee options. In addition to our core coffee menu, we offer Canton Tea (www.cantonteaco.com), a premium supplier of loose leaf and tea pyramids in the UK, cold pressed juices by MOJUÒ (www.mojudrinks.com), Karma ColaÓ (www.karmacola.co.uk) soft drink range and Thirsty Planet (www.thirstyplanet.net) bottled water. It is our goal to have unique high-quality beverages that are served alongside our specialty coffee.

| 11 |

| Table of Contents |

Department of Coffee and Social Affairs stores also offer an assortment of artisan cakes, pastries, sandwiches, savory foods and gluten free and health focused food ranges. Our food menu is selected to complement our single origin coffees; we only source high quality ingredients and flavors. A selection of home coffee making equipment, accessories and roasted coffee beans are sold in our stores.

| 12 |

| Table of Contents |

Internal Affairs

Department of Coffee and Social Affairs began to serve the needs of large organizations that were looking to create a better working environment for their employees by providing a quality coffee offering in their workplaces. It is an uncompromising Department of Coffee and Social Affairs offering.

After several months of research, we found out that 90% of employees are more productive if they can get a beverage they want at work and that 91% of employees believe that a hot-beverage break is a good way to reduce stress before starting a new activity and saw an increase in employee satisfaction after such a break. In addition, four out of five employees preferred better coffee options at work, and having such an option makes them less likely to want to leave the office. (Source: National Automatic Merchandising Association)

Our first Department of Coffee and Internal Affairs shop (which uses our Department of Coffee and Social Affairs brand) opened in July 2014, and we now operate 4 internal coffee bars across London.

|

|

|

|

2 locations at Warwick

Members Club

| 13 |

| Table of Contents |

|

|

|

In 2017, Department of Coffee and Social Affairs created Department of Coffee and Social Affairs Members Club, a new co-working concept inspired by customers who enjoy using coffee shops as a place to work and host business meetings. With 1.91 million professional freelancers in the UK, and a clear shift to the gig economy, the increasing demand for flexible workspace is constantly growing. We see this as an opportunity to capitalise on this demand by dedicating space in specific sites to cater for those professionals who need alternative co-working space. The Members Club will sell monthly and yearly memberships creating a highly scalable annuity style income for the Company and will be incorporated under the subsidiary, Department of Coffee and Social Affairs White Space Limited.

The first Members Club will open in Manchester, UK, in December 2017. The 3,000-square foot space will house a coffee shop at the front and state of the art co-working space at the back, the entire site having been designed to embody everything that a customer loves about working in a coffee shop but with the additional office amenities that nomadic workers need.

This new concept allows the Company to pursue larger locations in city centers, and this a concept that we will actively look to roll out across the country in line with our national rollout strategy. We will seek to launch the concept in Chicago in 2018.

Additional Revenue Segments

Roasted Coffee Beans

To serve single origin coffee requires a sourcing chain that extends from the farm and workers, to picking and packaging, screening and grading, brokerage, shipping, roasting and – finally – coffee making. By working closely with our partners, we are able to bring some of the best coffees in the world to our customers. The grades of coffee we buy can only be produced by farmers who have a passion for their crop and are skilled in agribusiness. Because we buy from specific producers, we expect distinct and definable flavors and we want those to be complementary – or to collide in an interesting way. We encourage our customers to try as many coffees as possible to learn which types of flavor they enjoy. There are flavors that suit certain times, moods, foods and occasions. Our selection of single origin coffee beans are exclusive to Department of Coffee and Social Affairs and are only available in our stores and on our website.

Home Barista

Our stores offer a range of home coffee brewing equipment and coffee accessories. We also offer a variety of Coffee School courses each week where customers learn the science and craft of espresso and home brewing techniques, customers enroll and pay via our website and courses are conducted after normal business hours in our various store locations. We want to be able to provide our customers with a specialty coffee drinking experience at home. Coffee School is also becoming an increasingly popular corporate event for companies looking to provide a different group experience for their staff and clients.

| 14 |

| Table of Contents |

| 15 |

| Table of Contents |

Online Store

Our online store sells coffee beans, coffee subscriptions, coffee machines, coffee making equipment, reusable branded travel coffee cups, coffee schools and gift cards. Our online store ships to the entire European Union allowing us access to different European markets.

| 16 |

| Table of Contents |

Customers

Our customer base is widespread with people from various backgrounds frequenting our shops. Due to the growth of the specialty coffee market and the rise of the conscious consumer, our customer base demands a high-quality product that is ethically sourced and produced. Coffee is an industry with no clear demographic, spanning all age groups and affluence and is a product that spans every corner of the UK and US.

Sales Targets

Our target customer market in the UK and US is coffee drinkers. As more consumers become interested in coffee and move towards the higher-end of the specialty coffee spectrum, our target market increases. We aim to educate consumers about the difference between specialty grade coffee and below standard grade coffee and, through this, we assist in raising their coffee expectations. In addition to serving specialty coffee, we offer our range of high-end teas to attract tea drinkers who also have high expectations of their tea providers enabling us to reach an even broader market.

Social Impact

“We measure our commercial success equally to our social impact; we think that every company, everywhere, should do the same.”

- Chairman Professor Stefan Allesch-Taylor CBE

We are committed to being a socially impactful company in the communities we work in and in certain places around the world that need positive change. Our Social Impact strategy is an important element of our overall business strategy. We believe through our Social Impact Strategy our stakeholders benefit, including employees, partners, customers, suppliers, shareholders and others.

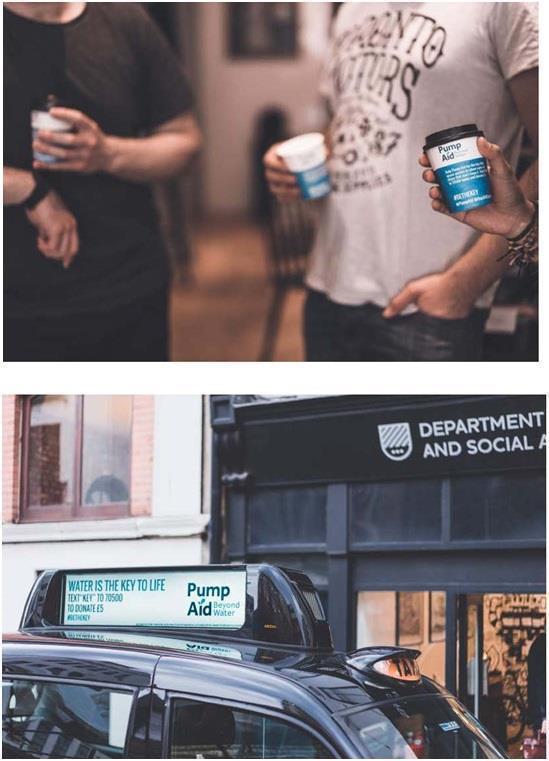

Less known about Department of Coffee and Social Affairs is the meaning behind the second part of our name, “Social Affairs,” which refers partly to our customers coffee drinking experience, but also refers to our humanitarian work.

| 17 |

| Table of Contents |

Members of our team are both board members and volunteers for a number of national and international charities. These include the award-winning Charity Pump Aid which provides safe clean water to over 1.35 million of the poorest people in Sub-Saharan Africa. We work on a number of joint awareness and marketing campaigns to raise awareness and funding for Pump Aid.

We provide mentoring and administrational support to The Afri-CAN Children’s Charity. Their mission is to create, finance and mentor sustainable programs, NGOs and social ventures in Sub-Saharan Africa to alleviate poverty and hunger, to improve education, to provide skills training, and to provide employment. They focus on the poorest communities in Sub-Saharan Africa.

We also support the London-based charity Team Up, Team Up trains volunteer undergrad students to tutor disadvantaged children in private lessons. We also fund the Central London Rough Sleeper Committee events which are held every two weeks providing hot meals and support to the homeless, where our staff are regular volunteers at these events.

| 18 |

| Table of Contents |

ABOUT THE UK COFFEE MARKET

After 18 years of considerable continued growth, the coffee shop market is one of the most successful in the UK economy. The total UK coffee shop market delivered a growth of 12% in turnover to reach £8.9 billion (US$11.7 billion) in 2016. The branded coffee shop chains had an estimated annual turnover of £3.7 billion (US$4.9 billion) in and sales growth of 11.2% in 2016. The branded coffee shop chain market is forecasted to reach £6 billion (US$7.9 billion) annual revenue by 2021.

The UK has become a nation of coffee drinkers, with coffee shop visitors purchasing an estimated 2.3 billion cups of coffee per year in stores. Consumers are more knowledgeable and empowered with choice than ever before, and the rise of artisan coffee has driven the desire for premium quality coffee. As coffee shops are increasingly viewed as the local of choice by British consumers, coffee shops are set to outnumber pubs in the UK by 2030.

The UK coffee shop market will continue to grow with the market forecasted to exceed £16 billion (approximately US$21.4 billion) per annum by 2025 (source: Allegra Strategies, World Coffee Portal, Project Café 2017 UK Report).

(Data obtained from reports and other information compiled by Allegra Strategies, World Coffee Portal 2017.)

FUTURE OF THE UK COFFEE MARKET

According to Allegra Strategies, “Small and medium sized boutique chains are gaining momentum and driving the comparable sales growth across the sector, ahead of the leading chains. Increased merger and acquisition activity throughout 2016 signifies the strength of the vibrant coffee shop market in the UK. Allegra identifies that a new 5th Wave, The Business of Coffee, represents an important new era for the global coffee industry. The 5th Wave encompasses a compelling combination of all four previous waves – Tradition, Chains, Artisan, and Science – where high quality boutique chains will be a major feature of the market going forward. These highly targeted operators are adopting a more advanced set of business practices to deliver authentic, artisan concepts at scale.” (Source: Allegra Strategies, World Coffee Portal, Project Café 2017 UK Report).

ABOUT THE US COFFEE MARKET

In 2016, the US coffee shop market had considerable growth with a 7.4% increase in revenue to reach US$41 billion, this is forecasted to reach US $85 billion by 2025. The coffee-focused-chain segment had an 8.2% revenue growth to reach US$29 billion.

The US is a nation of coffee drinkers consuming 23 cups of coffee a week in various location with regular coffee shop visitors consuming 4 cups of coffee per week in coffee shops on average. According to Allegra Strategies, “With the emergence of the rapidly expanding artisan scene, a growing number of Americans are becoming coffee connoisseurs demanding greater quality coffee wherever they are. 55% of the 5,000+ consumers surveyed by Allegra WCP state they would be willing to spend more for higher quality coffee in coffee shops, giving an average price ceiling of $3.18 per beverage. Millennials are the driving force in the increase of espresso-based beverage consumption and are much more likely to order cappuccino (19%) than a filter coffee (8%).” (Source: Allegra Strategies, World Coffee Portal, Project Café 2017 US Report).

More people are drinking coffee out-of-home than ever, reaching a high of 46% in 2017. Low unemployment and continued economic growth have enabled consumers to increase their coffee consumption out-of-home, and this trend should continue in 2017. Shifts in household composition are favoring the steady rise in out-of-home coffee sales. The growing importance of millennials in the US also supports more out-of-home and premium coffee consumption. They now make up the largest generation in US history, and next year, they will have the highest combined spending power of any living generation. (Source: Euromonitor, Rabobank 2016)

FUTURE OF THE US COFFEE MARKET

With the rise of an espresso-based coffee culture and increased consumer expectations for quality and experience, Allegra World Coffee Portal observes higher quality coffee standards across the market. The coffee shop market is moving beyond artisan coffee to a greater level of professionalism. In an environment transformed by technology, urbanization and instant access to information, consumers are becoming more sophisticated. Boutique chains are adopting more refined business practices to deliver higher standards of quality coffee. (Source: Allegra Strategies, World Coffee Portal, Project Café 2017 US Report).

COMPETITION AND COMPETITVE EDGE

The UK and US coffee shop market is made up of branded coffee-focused and food-focused chains, independent specialty shops and chains and non-specialist including supermarket cafes, department store cafes, retail shops with cafes, pubs, hotels, motorway service stations, forecourts and fast food outlets. Certain branded coffee-focused chains currently have longer operating histories, larger customer bases, greater brand recognition and significantly greater financial, marketing and other resources than we do, however their ability to deliver specialty quality coffee is limited. Our competitive edge is our focus and ability to deliver consistent quality coffee to consumers. This is done through the hiring and training of highly skilled baristas, sourcing only the highest-grade single origin green coffee available and working with experts in the specialty coffee industry to continually innovate the way we make and talk about coffee.

| 19 |

| Table of Contents |

Unlike other independent and specialty shops and chains who have shifted their proposition towards being more closely identified to a restaurant than a coffee shop, we have continued to focus predominately on coffee and in perfecting our craft. In doing so, our customer base understands our quality proposition and it enables us to create a differentiator with prospective landlords specifically seeking a quality coffee shop offering for premium locations rather than a restaurant offering.

Many of our competitors have a formulaic approach to site design and layout whereas our commitment is to ensure that no two shop designs will ever look alike because we always seek to be ‘the’ local coffee shop. We look for design and material originality that reflects the location wherever the shop is and that the unique design reflects the local community the shops are operating in is a part of our brand positioning. This is one of our unique selling points. According to Allegra Strategies, “Coffee shops are playing an increasingly important role in the UK, enhancing the social vibrancy of a community and contributing significantly to employment and the economy. The third wave/specialty coffee has raised consumer expectations about coffee quality and store design.” (Source: Allegra Strategies, World Coffee Portal, Project Café 2016 UK Report)

The ‘Social Affairs’ part of our name alludes to our desire to be a socially impactful company locally, nationally and internationally, consumers in the UK and elsewhere are holding their choice brands to an increasingly higher standard of social awareness and impact. We see our increasing social impact as both good business and a wholly responsible way of being part of a broader community. We see the benefit of nurturing and maintaining this culture in our Company every day.

Customers

Our customer base is widespread with people from various backgrounds frequenting our shops. Due to the growth of the specialty coffee market and the rise of the conscious consumer, our customer base demands a high-quality product that is ethically sourced and produced. Coffee is a product that spans every corner of the UK and the US.

Intellectual Property

Website

We assert common law copyright in the contents of our websites, www.docasainc.com and www.departmentofcoffee.com, and common law trademark rights in our business name and related product labels. We have not registered for the protection of all of our copyrights, trademarks, patents or designs, although we may do so in the future as we deem necessary to protect our business.

Trademarks

We have registered or filed for registration in Great Britain and Northern Ireland with the Trade Marks Registry for the following copyrights and trademarks: “Department of Coffee and Social Affairs,” “Coffeesmiths,” and “Elixir Espresso.”

|

20 |

| Table of Contents |

Reports to Security Holders

We intend to furnish our shareholders annual reports containing financial statements audited by our independent registered public accounting firm and to make available quarterly reports containing unaudited financial statements for each of the first three quarters of each year. We file Quarterly Reports on Form 10-Q, Annual Reports on Form 10-K and Current Reports on Form 8-K with the Securities and Exchange Commission in order to meet our timely and continuous disclosure requirements. We may also file additional documents with the Commission if they become necessary in the course of our company's operations.

The public may read and copy any materials that we file with the SEC at the SEC's Public Reference Room at 100 F Street, NE, Washington, D.C. 20549. The public may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. The SEC maintains an Internet site that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC. The address of that site is www.sec.gov.

Government Regulations

We believe that we are and will continue to be in compliance in all material respects with applicable statutes and the regulations passed in the United States. There are no current orders or directions relating to our company with respect to the foregoing laws and regulations.

Environmental Regulations

We do not believe that we are or will become subject to any environmental laws or regulations of the United States. While our products and business activities do not currently violate any laws, any regulatory changes that impose additional restrictions or requirements on us or on our products or potential customers could adversely affect us by increasing our operating costs or decreasing demand for our products or services, which could have a material adverse effect on our results of operations.

Employees

As of August 31, 2017, we have 119 employees, of which 24 are salaried and 95 of which are hourly (of which 53 are full-time and 42 are part-time).

Property

We lease office space in Schaumburg, Illinois, pursuant to a lease on a month-to-month basis. This facility serves as our corporate headquarters. Our operations in the United Kingdom (“UK”) have a UK administrative office and 15 storefronts. We have one storefront in the United States. Each location is subject to a lease agreement with different terms and conditions.

Available Information

All reports of the Company filed with the SEC are available free of charge through the SEC’s website at www.sec.gov. In addition, the public may read and copy materials filed by the Company at the SEC’s Public Reference Room located at 100 F Street, N.E., Washington, D.C. 20549. The public may also obtain additional information on the operation of the Public Reference Room by calling the Commission at 1-800-SEC-0330.

You should carefully consider the risks described below. If any of the risks and uncertainties described in the cautionary factors described below actually occurs, our business, financial condition and results of operations, and the trading price of our common stock could be materially and adversely affected. Moreover, we operate in a very competitive and rapidly changing environment. New factors emerge from time to time and it is not possible to predict the impact of all these factors on our business, financial condition or results of operations.

There are numerous and varied risks, known and unknown, that may prevent us from achieving our goals. If any of these risks actually occur, our business, financial condition or results of operation may be materially adversely affected. In such case, the trading price of our common stock could decline, and investors could lose all or part of their investment.

Risks Related to Our Business

We have limited operating history and our foreseeable future is uncertain.

DOCASA, Inc. had limited operations until the reverse merger on September 1, 2016, when the Company acquired Department of Coffee and Social Affairs Ltd. (“DEPT-UK”), which was initially formed in 2009. DEPT-UK opened its first store in December 2010. On August 31, 2017, the Company discontinued the prior operations of the Company. For our year ended August 31, 2017, we experienced net losses of $1,425,846. We used cash in operating activities of $731,424 in 2017. As of August 31, 2017, we had an accumulated deficit of $2,766,367. In addition, we could incur additional losses in the foreseeable future as we expand operations, and there can be no assurance that we will achieve profitability and/or maintain profitability, if achieved. Our future viability, profitability and growth depend upon our ability to successfully operate, expand our operations and obtain additional capital. There can be no assurance that any of our efforts will prove successful or that we will not continue to incur operating losses in the future.

| 21 |

| Table of Contents |

We currently do not have substantial cash resources to execute our expansion plans. If we cannot raise additional funds or generate more revenues, we will not be able to execute our expansion plans which would provide additional revenue, profits, and working capital and will probably not be able to continue as a going concern.

As of August 31, 2017, our available cash balance was $93,400. We will need to raise additional funds to execute our business plan. There can be no assurance that additional funds will be available when needed from any source or, if available, will be available on terms that are acceptable to us.

We may be required to pursue sources of additional capital through various means, including joint-venture projects and debt or equity financings. Future financings through equity investments will be dilutive to existing stockholders. Also, the terms of securities we may issue in future capital transactions may be more favorable for our new investors. Newly-issued securities may include preferences, superior voting rights, the issuance of warrants or other convertible securities, which will have additional dilutive effects. Further, we may incur substantial costs in pursuing future capital and/or financing, including investment banking fees, legal fees, accounting fees, printing and distribution expenses and other costs. We may also be required to recognize non-cash expenses in connection with certain securities we may issue, such as convertible notes and warrants, which will adversely impact our financial condition and results of operations.

Our ability to obtain needed financing may be impaired by such factors as the weakness of capital markets and the fact that we have not been profitable, which could impact the availability or cost of future financings. If the amount of capital we are able to raise from financing activities, together with our revenues from operations, is not sufficient to satisfy our capital needs, even to the extent that we reduce our operations accordingly, we may be required to cease operations.

We may not be able to secure additional financing to meet our future capital needs.

We anticipate needing significant capital to execute our expansion plans. We may use capital more rapidly than anticipated and incur higher operating expenses than expected, and will be depend on external financing to satisfy our operating and capital needs. Any sustained weakness in the general economic conditions and/or financial markets in the United Kingdom and/or the United States, as well as globally, could adversely affect our ability to raise capital on favorable terms or at all. We may also rely in the future, on access to financial markets as a source of liquidity to satisfy working capital requirements and for general corporate purposes. We may be unable to secure debt or equity financing on terms acceptable to us, or at all, at the time when we need such funding. If we do raise funds by issuing additional equity or convertible debt securities, the ownership percentages of existing stockholders would be reduced, and the securities that we issue may have rights, preferences or privileges senior to those of the holders of our common stock or may be issued at a discount to the market price of our common stock which would result in dilution to our existing stockholders. If we raise additional funds by issuing debt, we may be subject to debt covenants, which could place limitations on our operations including our ability to declare and pay dividends. Our inability to raise additional funds on a timely basis would make it difficult for us to achieve our business objectives and would have a negative impact on our business, financial condition and results of operations.

Our business and operating results could be harmed if we fail to manage our growth or change.

Our business may experience periods of rapid change and/or growth that could place significant demands on our personnel and financial resources. To manage possible growth and change, we must locate and retain skilled sales people, marketers, management, and other personnel, and solicit and obtain adequate funds in a timely manner. If we fail to effectively manage our human or financial resources during the growth of our business, our business may fail which would cause you to lose your investment.

Our profitability depends, in part, on our success and brand recognition, and we could lose our competitive advantage if we are not able to protect our trademarks against infringement, and any related litigation could be time-consuming and costly.

We believe our brand will gain substantial recognition by consumers in the United States, to complement our operations in the United Kingdom. We have registered the “Department of Coffee and Social Affairs” trademark with the applicable regulatory agencies in the United Kingdom and the United States. Use of our trademarks or similar trademarks by competitors in geographic areas in which we have not yet operated could adversely affect our ability to use or gain protection for our brand in those markets, which could weaken our brand and harm our business and competitive position. In addition, any litigation relating to protecting our intellectual property against infringement could be time-consuming and costly.

Attraction and retention of qualified personnel is necessary to implement and conduct our sales and marketing efforts.

Our future success will depend largely upon the continued services of our Board members, executive officers, and other key personnel. Our success will also depend on our ability to continue to attract and retain qualified personnel with industry experience. Key personnel represent a significant asset for us, and the competition for qualified personnel is intense. We do not have key-person life insurance coverage on any of our personnel. The loss of one or more of our key people or our inability to attract, retain and motivate other qualified personnel could negatively impact our ability to develop or to sustain our operations.

| 22 |

| Table of Contents |

We are exposed to risks associated with the ongoing financial crisis and weakening global economy, which increase the uncertainty of consumers purchasing products.

The recent severe tightening of the credit markets, turmoil in the financial markets, and weakening global economy are contributing to a decrease in consumer confidence. If these economic conditions are prolonged or deteriorate further, the market for our products will decrease accordingly.

RISKS ASSOCIATED WITH OUR INDUSTRY

Economic conditions in the United Kingdom and/or the United States could adversely affect our business and financial results.

We are a coffee shop company in the United Kingdom, which is expanding to the United States, and we are dependent upon consumer discretionary spending. Changes in economic conditions may affect our operations. Adverse economic conditions for our customers, which could have less money for discretionary purchases, could discontinue or decrease their purchases of our products. The resultant effect could decrease customer traffic and/or the average value per transaction. This effect will negatively impact our performance on a financial basis as reduced revenues without a parallel decrease in expenses, would potentially adversely affect profits. Reduction in sales would adversely affect our margins, comparable store sales, and ultimately, our earnings per share. There are additional risks that if negative economic conditions continue over an extended period of time or deteriorate more, consumers may make extended changes to their discretionary purchasing habits, which would include reduced discretionary purchases.

Incidents involving food or beverage-borne illnesses, contamination, mislabeling or tampering, whether or not substantive, as well as negative opinions, either publicly or medically, about the effects of consuming our products, could adversely affect our business.

Adverse instances or reports, whether true or not, of unclean water supply or food-safety issues, such as food or beverage-borne illnesses, tampering, contamination or mislabeling, either during growing, manufacturing, packaging, storing or preparation, have in the past severely injured the reputations of companies in the food and beverage processing, grocery and quick-service restaurant sectors and could affect us as well. Any report linking us to the use of unclean water, food or beverage-borne illnesses, tampering, contamination, mislabeling or other food or beverage-safety issues could damage our brand value and adversely affect sales of our food and beverage products and possibly lead to product liability claims, litigation (including class actions) or damages. Clean water is critical to the preparation of coffee and our ability to ensure a clean water supply to our stores can be limited, particularly in certain locations. If customers become ill from food or beverage-borne illnesses, tampering, contamination, mislabeling or other food or beverage-safety issues, we could be forced to temporarily close some stores and/or supply chain facilities, as well as recall products. In addition, instances of food or beverage-safety issues, even those involving solely the restaurants or stores of competitors or of suppliers or distributors (regardless of whether we use or have used those suppliers or distributors), could, by resulting in negative publicity about us or the foodservice industry in general, adversely affect our sales on a regional or national basis. A decrease in customer traffic as a result of food-safety concerns or negative publicity, or as a result of a temporary closure of any of our stores, product recalls or food or beverage-safety claims or litigation, could materially harm our business and results of operations.

Some of our products contain caffeine, dairy products, sugar and other compounds and allergens, the health effects of which are the subject of public and regulatory scrutiny, including the suggestion that excessive consumption of caffeine, dairy products, sugar and other compounds can lead to a variety of adverse health effects. Particularly in the U.S., there is increasing consumer awareness of health risks, including obesity, due in part to increased publicity and attention from health organizations, as well as increased consumer litigation based on alleged adverse health impacts of consumption of various food and beverage products. While we have a variety of beverage and food items, including items that are coffee-free and have reduced calories, an unfavorable report on the health effects of caffeine or other compounds present in our products, whether accurate or not, or negative publicity or litigation arising from certain health risks could significantly reduce the demand for our beverages and food products and could significantly adversely affect our business and results of operations.

The value of our brands is crucial to our success. Failure to preserve their value could have a negative impact on our financial results.

We have built brand recognition in the United Kingdom and have an excellent reputation. As we expand to the United States, the value of our brand should continue to increase as we strive to consistently provide the consumer a positive experience. Our business plan, which provides for continued expansion in the United Kingdom and the initial expansion in the United States, relies on the value of that brand and our relationships with business partners, third-party manufacturers, and others. Our logo will continue to be used, both by our internal operations as well as potential licensees and foodservice operations, as our logoed beverages and other complementary products are provided to our customers. We provide support to these third-parties, monitor their activities, but the quality of the product and service they provide to the consumer may be diminished by any number of factors beyond our control, including various pressures they may encounter. Our core belief is that consumers expect the same quality of products and service from any branded outlet for our products. Our products that we provide to our consumer are sourced from a wide variety of business partners in our supply chain operations, and in certain situations, the products are produced or sourced locally by our business partners. As these business partners utilize our logo as part of their service to the consumer, we do not monitor the quality of products not under our brand, which are served to consumers.

Adverse consumer incidents, whether isolated or recurring, whether caused by us or our business partners, that potentially tarnish our consumer’s trust, including, but not limited to, perceived breaches of privacy, contaminated products, product recalls or other potential incidents as included in this risk factors section, especially if the incident causes significant publicity, including the immediate distribution through social or digital media, or result in litigation, and our failure to respond accordingly to these incidents, could materially adversely impact our brand value and have a negative impact on our financial results. The demand by consumers for our products could decrease materially if we or other third-parties, including business partners, fail to maintain the quality of our products, are interpreted to act in an unethical or socially irresponsible manner, including with respect to the sourcing, content or sale of our products or the use of consumer data, fail to comply with laws and regulations or fail to deliver positive consumer experiences on continuously in all of our markets, including the ability to procure and retain employees that create a positive experience with our brand. Also, inadequate use of our brand and other intellectual properties, as well as the protection of these properties, including the unauthorized use of our brand or other intellectual properties, can adversely affect our customer’s perception of us which would adversely impact our financial results.

| 23 |

| Table of Contents |

The unauthorized access, theft or destruction of financial, customer or employee personal information, or of our intellectual property, or of other confidential information, as all are stored in our information systems, or by third-parties as contracted by us, could adversely affect our brand, reputation, and more, which could lead to potential liability and decreased revenues.

Our information technology systems, such as those we use for our point-of-sale, web and mobile platforms, including online and mobile payment systems and rewards programs, and for administrative functions, including human resources, payroll, accounting and internal and external communications, as well as the information technology systems of our third-party business partners and service providers, can contain personal, financial or other information that is entrusted to us by our customers and employees. Our information technology systems also contain our proprietary and other confidential information related to our business, such as business plans, product development initiatives and designs. Other retail companies, including our competitors, we could in the future have to deal with potential attempts to compromise our information technology systems. To the extent we or a third-party were to experience a material breach of our or such third-party’s information technology systems that result in the unauthorized access, theft, use or destruction of customers' or employees' data or that of the Company stored in such systems, including through cyber-attacks or other external or internal methods, it could result in a material loss of revenues from the potential adverse impact to our reputation and brand, our ability to retain or attract new customers and the potential disruption to our business and plans. Such security breaches also could result in a violation of applicable U.S. and international privacy and other laws, and subject us to private consumer or securities litigation and governmental investigations and proceedings, any of which could result in our exposure to material civil or criminal liability. Our reputation and brand and our ability to attract new customers could also be adversely impacted if we fail, or are perceived to have failed, to properly respond to these incidents. Such failure to properly respond could also result in similar exposure to liability. Significant capital investments and other expenditures could be required to remedy the problem and prevent future breaches, including costs associated with additional security technologies, personnel, experts and credit monitoring services for those whose data has been breached. These costs, which could be material, could adversely impact our results of operations in the period in which they are incurred and may not meaningfully limit the success of future attempts to breach our information technology systems.

Media or other reports of existing or perceived security vulnerabilities in our systems or those of our third-party business partners or service providers, even if no breach has been attempted or has occurred, can also adversely impact our brand and reputation and significantly impact our business. Additionally, the techniques and sophistication used to conduct cyber-attacks and breaches of information technology systems, as well as the sources and targets of these attacks, change frequently and are often not recognized until such attacks are launched or have been in place for a period of time. We will make significant investments in technology, third-party services and personnel to develop and implement systems and processes that are designed to anticipate cyber-attacks and to prevent or minimize breaches of our information technology systems or data loss, but these security measures cannot provide assurance that we will be successful in preventing such breaches or data loss.

Our business and financial results could be adversely impacted if we are not successful in implementing certain strategic initiatives or adequately managing our growth.

There is no assurance that we will be able to implement certain strategic initiatives in accordance with our business plan, which may result in a negative impact on our business and financial results. These strategic initiatives are designed to create growth, improve our results of operations and drive long-term shareholder value, and include:

|

|

• |

being an employer of choice and investing in employees to deliver a superior customer experience; | |||

|

|

|

| |||

|

|

• |

continuing our growth as defined in our business plan to become an internationally known and respected brand; | |||

|

|

| ||||

|

|

• |

increasing our expansion program, whether in the United Kingdom or the United States, with a controlled program for expansion; | |||

|

|

| ||||

|

|

• |

creating positive opportunities with new product offerings; | |||

|

|

| ||||

|

|

• |

establish our global growth of our business; | |||

|

|

| ||||

|

|

• |

driving convenience and brand engagement through our mobile, loyalty and digital capabilities. | |||

In addition to other factors listed in this risk factors section, factors that may negatively affect the successful implementation of these initiatives, which could adversely impact our business and financial results, include the following:

|

|

• |

increases in labor costs, such as general market and minimum wage levels and investing in competitive compensation, increased health care and workers’ compensation insurance costs and other benefits to attract and retain high quality employees with the right skill sets, whether due to regulatory mandates, changing industry practices or our expansion into new channels or technology dependent operations; | |

|

|

| ||

|

|

• |

increasing competition in channels in which we operate or seek to operate from new and existing large competitors that sell high-quality specialty coffee beverages; | |

|

|

| ||

|

|

• |

construction cost increases associated with new store openings and remodeling of existing stores; delays in store openings for reasons beyond our control or a lack of desirable real estate locations available for lease at reasonable rates, either of which could keep us from meeting annual store opening targets; | |

|

|

| ||

|

|

• |

not successfully scaling our supply chain infrastructure as our product offerings increase and as we continue to expand; | |

|

|

| ||

|

|

• |

lack of customer acceptance of new products, brands and platforms (i.e. mobile technology), or customers reducing their demand for our current offerings as new products are introduced; | |

|

|

| ||

|

|

• |

the level to which we enter into, maintain, develop and are able to negotiate appropriate terms and conditions of, and enforce, commercial and other agreements; | |

|

|

| ||

|

|

• |

not successfully consummating favorable strategic transactions or integrating acquired businesses; and | |

|

|

| ||

|

|

• |

the deterioration in our credit ratings, which could limit the availability of additional financing and increase the cost of obtaining financing to fund our initiatives. | |

| 24 |

| Table of Contents |

Additionally, our business is also in part dependent on the level of support our retail business partners provide our products, and in some markets, there are only a few retailers. If our strategic retail business partners do not provide sufficient levels of support for our products, which is at their discretion, it could limit our ability to grow our business.

Effectively managing growth can be challenging, especially as we expand into the United States, where we must manage the need for flexibility and a degree of autonomy for local management against the need for consistency with our goals, philosophy and standards. Growth can make it increasingly difficult to ensure a consistent supply of high-quality raw materials, to locate and hire sufficient numbers of key employees, to maintain an effective system of internal controls for a globally dispersed enterprise and to train employees worldwide to deliver a consistently high-quality product and customer experience. Furthermore, if we are not successful in implementing these strategic initiatives, we may be required to evaluate whether certain assets, including goodwill and other intangibles, have become impaired. In the event we record an impairment charge, it could have a material impact on our financial results.

We will face intense competition in our markets, which could cause reduced profitability.

The specialty coffee market is intensely competitive, including with respect to product quality, innovation, service, convenience, and price, and we face significant and increasing competition in all these areas in our current market, as well as our expansion. Accordingly, we do not have leadership positions in all markets. In our expansion in the United States, we are cognizant of our competitors, both regional and global, including the large presence of Starbucks®, which could lead to decreases in customer traffic to our stores and/or average value per transaction adversely affecting our sales and results of operations. Therefore, continued competition from well-established competitors in our markets could hinder growth and adversely affect our sales and results of operations in those markets. Increased competition in the United States packaged coffee, single-serve and ready-to-drink coffee beverage markets, including from new and large entrants to this market, could adversely affect the profitability of our stores. Additionally, declines in customer demand for specialty coffee products for any reason, including due to customer preference for other products, could have a negative effect on our business.

Increases in the cost of high-quality coffee beans or other commodities or decreases in the availability of high-quality coffee beans or other commodities could have a negative effect on our business and financial results.

We purchase, roast and sell high-quality whole bean coffee beans and related coffee products. The price of coffee is subject to significant volatility and has and may again increase significantly due to one or more of the factors described below. The high-quality coffee of the quality we seek tends to trade on a negotiated basis at a premium price. This premium depends upon the supply and demand at the time of purchase and the amount of the premium can vary significantly. Increases in the coffee commodity price does increase the price of high-quality coffee and also impact our ability to enter into fixed-price purchase commitments. We frequently enter into supply contracts whereby the quality, quantity, delivery period, and other negotiated terms are agreed upon, but the date, and therefore price, at which the base coffee commodity price component will be fixed has not yet been established. These are known as price-to-be-fixed contracts. The supply and price of coffee we purchase can also be affected by multiple factors in the producing countries, including weather, natural disasters, crop disease, general increase in farm inputs and costs of production, inventory levels and political and economic conditions, as well as the actions of certain organizations and associations that have historically attempted to influence prices of green coffee through agreements establishing export quotas or by restricting coffee supplies. Speculative trading in coffee commodities can also influence coffee prices. Because of the significance of coffee beans to our operations, combined with our ability to only partially mitigate future price risk through purchasing practices and hedging activities, increases in the cost of high-quality coffee beans could have an adverse impact on our profitability.

We also purchase significant amounts of dairy products, particularly fluid milk, to support the needs of our company-operated retail stores. Additionally, and although less significant to our operations than coffee or dairy, other commodities, including but not limited to tea and those related to food and beverage inputs, such as cocoa, produce, baking ingredients, meats, eggs and energy, as well as the processing of these inputs, are important to our operations. Increases in the cost of dairy products and other commodities, or lack of availability, whether due to supply shortages, delays or interruptions in processing, or otherwise, could have an adverse impact on our profitability.

Our financial condition and results of operations are sensitive to, and may be adversely affected by, a number of factors, many of which are largely outside our control.

Our operating results have been in the past and will continue to be subject to a number of factors, many of which are largely outside our control. Any one or more of the factors listed below or described elsewhere in this risk factors section could adversely impact our business, financial condition and/or results of operations:

|

|

• |

increases in real estate costs in certain markets; | ||

|

|

| |||

|

|

• |

adverse outcomes of litigation; and | ||

|

|

| |||

|

|

• |

in certain markets, labor discord, war, terrorism, political instability, boycotts, social unrest, and natural disasters, including health pandemics that lead to avoidance of public places or restrictions on public gatherings such as in our stores. | ||

Interruptions in our supply chain could adversely affect our ability to produce or deliver our products and could adversely impact our business and financial profits.

Any material interruption in our supply chain, such as material interruption of roasted coffee supply due to the casualty loss of any of our roasting plants, interruptions in service by our third-party logistic service providers or common carriers that ship goods within our distribution channels, trade restrictions, such as increased tariffs or quotas, embargoes or customs restrictions, or natural disasters that cause a material disruption in our supply chain could negatively impact our business and our profitability.

Our food, beverage and other products are sourced from a wide variety of business partners in our supply chain operations. We rely on these suppliers and vendors to provide high quality products and to comply with applicable laws. Our ability to find qualified suppliers and vendors who meet our standards and supply products in a timely and efficient manner is a significant challenge, especially countries or regions with diminished infrastructure, developing or failing economies or experiencing political instability or social unrest. For certain products, we may rely on one or very few suppliers or vendors. A supplier's or vendor's failure to meet our standards, provide products in a timely and efficient manner, or comply with applicable laws is beyond our control. These issues, especially for those products for which we rely on one or few suppliers or vendors, could negatively impact our business and profitability.

| 25 |

| Table of Contents |

Existing regulations, and changes to such regulations, may present technical, regulatory and economic barriers to the use of our products, which may significantly reduce demand for our products.

Our products are subject to various regulatory and economic barriers which could have an adverse effect on the Company.

Our company is projected to experience rapid growth in operations, which will place significant demands on its management, operational and financial infrastructure.

If the Company does not effectively manage its growth, the quality of its products could suffer, which could negatively affect the Company's brand and operating results. To effectively manage this growth, the Company will need to continue to improve its operational, financial and management controls and its reporting systems and procedures. Failure to implement these improvements could hurt the Company's ability to manage its growth and financial position.

The Company treats its proprietary information as confidential and relies on internal nondisclosure safeguards and on laws protecting trade secrets, all to protect its proprietary information.

There can be no assurance that these measures will adequately protect the confidentiality of the Company's proprietary information or that others will not independently develop products or technology that are equivalent or superior to those of the Company. The Company's patents, trademarks, trade secrets, copyrights and/or other intellectual property rights are important assets to the Company. Various events outside of the Company's control pose a threat to its intellectual property rights as well as to the Company's products and services. Although the Company seeks to obtain patent protection for its systems, it is possible that the Company may not be able to protect some of these innovations. There is always the possibility, despite the Company's efforts, that the scope of the protection gained will be insufficient or that an issued patent may be deemed invalid or unenforceable.

RISKS RELATED TO OUR ORGANIZATION AND THE MARKET FOR OUR STOCK

We are subject to the reporting requirements of federal securities laws, which can be expensive and may divert resources from other projects, thus impairing our ability to grow.

We are a public reporting company and, accordingly, subject to the information and reporting requirements of the Exchange Act and other federal securities laws, including compliance with the Sarbanes-Oxley Act of 2002 (the “Sarbanes-Oxley Act”). The costs of preparing and filing annual and quarterly reports, proxy statements and other information with the SEC (including reporting of the Merger) and furnishing audited reports to stockholders will cause our expenses to be higher than they would be if we remained privately held.

If we fail to establish and maintain an effective system of internal control, we may not be able to report our financial results accurately or to prevent fraud. Any inability to report and file our financial results accurately and timely could harm our reputation and adversely impact the trading price of our common stock.

It may be time consuming, difficult and costly for us to develop and implement the internal controls and reporting procedures required by the Sarbanes-Oxley Act. We may need to hire additional financial reporting, internal controls and other finance personnel in order to develop and implement appropriate internal controls and reporting procedures. Effective internal control is necessary for us to provide reliable financial reports and prevent fraud. If we cannot provide reliable financial reports or prevent fraud, we may not be able to manage our business as effectively as we would if an effective control environment existed, and our business and reputation with investors may be harmed. In addition, if we are unable to comply with the internal controls requirements of the Sarbanes-Oxley Act, then we may not be able to obtain the independent accountant certifications required by such act, which may preclude us from keeping our filings with the SEC current and may adversely affect any market for, and the liquidity of, our common stock.

Public company compliance may make it more difficult for us to attract and retain officers and directors.

The Sarbanes-Oxley Act and new rules subsequently implemented by the SEC have required changes in corporate governance practices of public companies. As a public company, we expect these new rules and regulations to increase our compliance costs and to make certain activities more time consuming and costly. As a public company, we also expect that these new rules and regulations may make it more difficult and expensive for us to obtain director and officer liability insurance in the future and we may be required to accept reduced policy limits and coverage or incur substantially higher costs to obtain the same or similar coverage. As a result, it may be more difficult for us to attract and retain qualified persons to serve on our board of directors or as executive officers.

Because we became public by means of a merger, we may not be able to attract the attention of major brokerage firms.

There may be risks associated with us becoming public through a merger. Securities analysts of major brokerage firms may not provide coverage of us since there is no incentive to brokerage firms to recommend the purchase of our common stock. No assurance can be given that brokerage firms will, in the future, want to conduct any secondary offerings on behalf of our post-Merger company.

| 26 |

| Table of Contents |

Our stock price may be volatile.

The market price of our common stock is likely to be highly volatile and could fluctuate widely in price in response to various factors, many of which are beyond our control, including the following:

|

|

· |

changes in our industry; |

|

|

· |

competitive pricing pressures; |

|

|

· |

Our ability to obtain working capital financing; |

|

|

· |

additions or departures of key personnel; |

|

|

· |

limited “public float” in the hands of a small number of persons whose sales or lack of sales could result in positive or negative pricing pressure on the market price for our common stock; |

|

|

· |

sales of our common stock; |

|

|

· |

our ability to execute our business plan; |

|

|

· |

operating results that fall below expectations; |

|

|

· |

loss of any strategic relationship; |

|

|

· |

regulatory developments; |

|

|

· |

economic and other external factors; and |

|

|

· |

period-to-period fluctuations in our financial results. |

In addition, the securities markets have from time to time experienced significant price and volume fluctuations that are unrelated to the operating performance of particular companies. These market fluctuations may also materially and adversely affect the market price of our common stock.

We may not pay dividends in the future. Any return on investment may be limited to the value of our common stock.

We do not anticipate paying cash dividends in the foreseeable future. The payment of dividends on our common stock will depend on earnings, financial condition and other business and economic factors affecting us at such time as our board of directors may consider relevant. If we do not pay dividends, our common stock may be less valuable because a return on your investment will only occur if our stock price appreciates.

We cannot ensure that a liquid trading market for our common stock will be sustained.

Our stock is currently quoted on the OTC Bulletin Board, but is traded sporadically. We cannot predict how liquid the market for our common stock might become. As soon as is practicable after becoming eligible, we anticipate applying for listing of our common stock on either the NYSE Amex Equities, The NASDAQ Capital Market or other national securities exchange, assuming that we can satisfy the initial listing standards for such exchange. We currently do not satisfy the initial listing standards for any of these exchanges, and cannot ensure that we will be able to satisfy such listing standards or that our common stock will be accepted for listing on any such exchange. Should we fail to satisfy the initial listing standards of such exchanges, or our common stock is otherwise rejected for listing and remains quoted on the OTC Bulletin Board or is suspended from the OTC Bulletin Board, the trading price of our common stock could suffer and the trading market for our common stock may be less liquid, and our common stock price may be subject to increased volatility.

Furthermore, for companies whose securities are quoted on the OTC Bulletin Board, it is more difficult (i) to obtain accurate quotations, (ii) to obtain coverage for significant news events because major wire services generally do not publish press releases about such companies, and (iii) to obtain needed capital.

| 27 |

| Table of Contents |

The market price of our common stock can become volatile, leading to the possibility of its value being depressed at a time when you may want to sell your holdings.

The market price of our common stock can become volatile. Numerous factors, many of which are beyond our control, may cause the market price of our common stock to fluctuate significantly. These factors include: our earnings releases, actual or anticipated changes in our earnings, fluctuations in our operating results or our failure to meet the expectations of financial market analysts and investors; changes in financial estimates by us or by any securities analysts who might cover our stock; speculation about our business in the press or the investment community; significant developments relating to our relationships with our customers or suppliers; stock market price and volume fluctuations of other publicly traded companies and, in particular, those that are in our industry; customer demand for our products; investor perceptions of our industry in general and our Company in particular; the operating and stock performance of comparable companies; general economic conditions and trends; announcements by us or our competitors of new products, significant acquisitions, strategic partnerships or divestitures; changes in accounting standards, policies, guidance, interpretation or principles; loss of external funding sources; sales of our common stock, including sales by our directors, officers or significant stockholders; and additions or departures of key personnel. Securities class action litigation is often instituted against companies following periods of volatility in their stock price. Should this type of litigation be instituted against us, it could result in substantial costs to us and divert our management's attention and resources.

Moreover, securities markets may from time to time experience significant price and volume fluctuations for reasons unrelated to the operating performance of particular companies. These market fluctuations may adversely affect the price of our common stock and other interests in our Company at a time when you want to sell your interest in us. We do not intend to pay dividends on shares of our common stock for the foreseeable future.

Our common stock is currently considered a “penny stock,” which may make it more difficult for our investors to sell their shares.

Our common stock is currently considered a “penny stock” and may continue in the future to be subject to the “penny stock” rules adopted under Section 15(g) of the Exchange Act. The penny stock rules generally apply to companies whose common stock is not listed on The NASDAQ Stock Market or other national securities exchange and trades at less than $5.00 per share, other than companies that have had average revenue of at least $6,000,000 for the last three years or that have tangible net worth of at least $5,000,000 ($2,000,000 if the company has been operating for three or more years). These rules require, among other things, that brokers who trade penny stock to persons other than “established customers” complete certain documentation, make suitability inquiries of investors and provide investors with certain information concerning trading in the security, including a risk disclosure document and quote information under certain circumstances. Many brokers have decided not to trade penny stocks because of the requirements of the penny stock rules and, as a result, the number of broker-dealers willing to act as market makers in such securities is limited. If we remain subject to the penny stock rules for any significant period, it could have an adverse effect on the market, if any, for our securities. Since our securities are subject to the penny stock rules, investors may find it more difficult to dispose of our securities.

Offers or availability for sale of a substantial number of shares of our common stock may cause the price of our common stock to decline.