☐ |

Preliminary Proxy Statement |

☐ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

☒ |

Definitive Proxy Statement |

☐ |

Definitive Additional Materials |

☐ |

Soliciting Material under §240.14a-12 |

☒ |

No fee required. |

☐ |

Fee paid previously with preliminary materials. |

☐ |

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

|

Restaurant Brands International Inc. Toronto, Ontario, Canada M5X 1E1

April 25, 2024 |

Dear Shareholder,

We invite you to attend Restaurant Brands International Inc.’s 2024 annual general meeting of shareholders (the “Meeting”) for the following purposes:

|

Elect ten directors specifically named in the management information circular and proxy statement that accompanies this Notice of Meeting (the “proxy statement”), each to serve until the close of the 2025 annual general meeting of shareholders (the “2025 Annual Meeting”) or until his or her successor is elected or appointed. | |

|

Approve, on a non-binding advisory basis, the compensation paid to our named executive officers. | |

|

Appoint KPMG LLP as our auditors to serve until the close of the 2025 Annual Meeting and authorize our directors to fix the auditors’ remuneration. | |

|

Consider shareholder proposals described in the accompanying proxy statement, if properly presented at the Meeting. | |

You will also be asked to transact any other business that may properly come before the Meeting. Only (1) holders of our common shares as of the close of business on the Record Date and (2) the trustee that holds our special voting share, are entitled to notice and to vote at the Meeting.

We are conducting a hybrid shareholder meeting, allowing participation both online and in person. Registered shareholders and duly appointed proxyholders can attend the Meeting in person at 130 King Street West, Suite 300, Toronto, Ontario, M5X 1E1 or online at https://web.lumiagm.com/472358988 where they can participate, vote, and submit questions during the meeting’s live webcast. Non-registered (beneficial) shareholders and holders of partnership units who have not duly appointed themselves as proxyholder will be able to attend the Meeting online as guests, but guests will not be able to vote or ask questions at the Meeting.

Proxies must be received no later than 11:59 p.m. (Eastern Time) on June 4, 2024 or, if the Meeting is adjourned or postponed, no later than 8:00 a.m. (Eastern Time) on the business day immediately preceding the reconvened Meeting day. The Chair of the Meeting has the discretion to accept proxies received from shareholders after such deadline (or to waive or extend the deadline) but may not waive the deadline for holders wishing to appoint another person to represent them at the Meeting.

Please read the enclosed proxy statement to learn more about the Meeting, our director nominees, and our executive compensation and governance practices. Thank you for your participation and we look forward to the Meeting.

Sincerely,

Jill Granat

General Counsel & Corporate Secretary

IT IS IMPORTANT THAT YOU CAREFULLY

READ THE PROXY STATEMENT AND VOTE

|

NOTICE OF 2024 ANNUAL GENERAL MEETING OF SHAREHOLDERS (“Notice of Meeting”)

Meeting Date: June 6, 2024

Time: 8:00 a.m. (Eastern Time)

Location: 130 King Street West, Suite 300, Toronto, Ontario, M5X 1E1, Canada

Record Date: April 12, 2024

We expect to mail an Important Notice Regarding Internet Availability of Proxy Materials for the 2024 Annual General Meeting of Shareholders on or about April 25, 2024.

We are providing access to the proxy statement and annual report via the Internet using the “notice and access” system. These materials are available on the website referenced in the Notice (www.envisionreports.com/ RBI2024).

To appoint a proxyholder other than one we designate (including beneficial holders wishing to appoint themselves), holders must follow the instructions in the proxy statement, including the additional step of registering the proxyholder with our transfer agent.

|

| Notice of Annual Meeting of Shareholders and 2024 Proxy Statement |

Restaurant Brands International |

Restaurant Brands International Inc.

130 King Street West, Suite 300

Toronto, Ontario, Canada M5X 1E1

April 25, 2024

MANAGEMENT INFORMATION CIRCULAR AND PROXY STATEMENT

Management Information Circular and Proxy Statement for 2024 Annual General Meeting of Shareholders

Restaurant Brands International Inc. (“RBI”) is making this management information circular and proxy statement (the “proxy statement”), including all schedules and appendices hereto, available to you in connection with the solicitation of proxies for use at the annual general meeting (the “Meeting”) of the shareholders of RBI to be held at 130 King Street West, Suite 300 Toronto, Ontario, Canada M5X 1E1 on June 6, 2024 at 8:00 a.m. (Eastern Time), or at any adjournment(s) or postponement(s) thereof, for the purposes set out in the Notice of Meeting. Shareholders and holders of Class B exchangeable partnership units (“Partnership exchangeable units”) of Restaurant Brands International Limited Partnership (“Partnership”) will have an equal opportunity to participate at the Meeting.

RBI is the sole general partner of Partnership. RBI’s common shares trade on the New York Stock Exchange (“NYSE”) and the Toronto Stock Exchange (“TSX”) under the ticker symbol “QSR”. As a result, RBI is subject to the applicable governance rules and listing standards of both the NYSE and TSX. The Partnership exchangeable units trade on the TSX under the ticker symbol “QSP”. Partnership is subject to the applicable governance rules and listing standards of the TSX to the extent not satisfied by RBI. In addition, each of RBI and Partnership is a reporting issuer in each of the provinces and territories of Canada and, as a result, is subject to Canadian continuous disclosure and other reporting obligations under applicable Canadian securities laws. Partnership has received exemptive relief dated October 31, 2014 from the Canadian securities regulators. This exemptive relief effectively allows Partnership to satisfy its Canadian continuous disclosure obligations by relying on the Canadian continuous disclosure documents filed by RBI, for so long as certain conditions are satisfied. For more discussion of this exemptive relief and the disclosure required by such relief, please see Appendix A.

We expect that the solicitation of proxies will be by mail. We have retained Alliance Advisors, LLC for certain advisory and solicitation services at a fee of approximately $35,000. Proxies may also be solicited personally, by telephone, e-mail, Internet, facsimile, or other means of communication by officers, employees, and agents of RBI. The cost of solicitation will be borne by RBI.

We are providing access to this proxy statement and our annual report on Form 10-K for the fiscal year ended December 31, 2023 (collectively the “proxy materials”) via the Internet using the “notice and access” system. On or about April 25, 2024, we expect to begin mailing a Notice Regarding Internet Availability of Proxy Materials (the “Notice”) to all holders of record of common shares and Partnership exchangeable units as of April 12, 2024. We will also post the proxy materials on the website referenced in the Notice (www.envisionreports.com/RBI2024). In the case of beneficial owners of these securities, the Notice is being sent indirectly through such shareholders’ or unitholders’ brokers or other intermediaries. We intend to reimburse these brokers or other intermediaries for permitted fees and costs incurred by them in mailing the Notice to beneficial owners of securities.

As more fully described in the Notice, all holders of common shares and Partnership exchangeable units may choose to access our proxy materials on the website referred to in the Notice or may request to receive a printed set of our proxy materials. In addition, the Notice and website provide information regarding how you may request to receive proxy materials in printed form by mail or electronically by email on an ongoing basis.

In this proxy statement, the words, “RBI”, “we”, “our”, “ours” and “us” refer to Restaurant Brands International Inc. Except as otherwise stated, the information contained herein is given as of April 22, 2024. Unless otherwise indicated, all references to “$” or “dollars” are to the currency of the United States and “Canadian dollars” or “C$” are to the currency of Canada.

The date of this proxy statement is April 25, 2024.

|

Restaurant Brands International |

Executive Summary

EXECUTIVE SUMMARY

Company at a Glance

Restaurant Brands International (“RBI”) is one of the world’s largest quick service restaurant companies with over $40 billion in annual system-wide sales1 and over 30,000 restaurants in more than 120 countries and territories as of December 31, 2023. We own four of the world’s most prominent and iconic quick service restaurant brands – TIM HORTONS®, BURGER KING®, POPEYES® and FIREHOUSE SUBS®. These independently operated brands have been serving their respective guests, franchisees, and communities for decades. Through its Restaurant Brands for Good framework, RBI is improving sustainable outcomes related to its food, the planet, and people and communities.

At RBI, our core values are:

We are committed to growing the TIM HORTONS®, BURGER KING®, POPEYES® and FIREHOUSE SUBS® brands by leveraging these core values, employee and franchisee relationships, and our long track records of community support. Beginning with the fourth quarter of 2023, RBI is reporting results under five segments: one for each of the brands in the U.S. and Canada and the fifth segment, International, which includes operations of all four brands outside the U.S. and Canada.

| Restaurant Brands International |

2024 Proxy Statement |

| |

Page i |

Executive Summary

2023 Business Performance

| SYSTEM-WIDE SALES GROWTH1 |

COMPARABLE SALES1 |

NET RESTAURANT GROWTH2 |

||||||||||

| TIM HORTONS® |

11.0 | % | 10.4 | % | 0.1 | % | ||||||

| BURGER KING® |

6.9 | % | 7.4 | % | (3.3 | )% | ||||||

| POPEYES® |

10.5 | % | 4.8 | % | 4.9 | % | ||||||

| FIREHOUSE SUBS® |

7.1 | % | 3.8 | % | 3.0 | % | ||||||

| INTERNATIONAL |

17.6 | % | 9.0 | % | 8.9 | % | ||||||

| CONSOLIDATED |

12.2 | % | 8.1 | % | 3.9 | % | ||||||

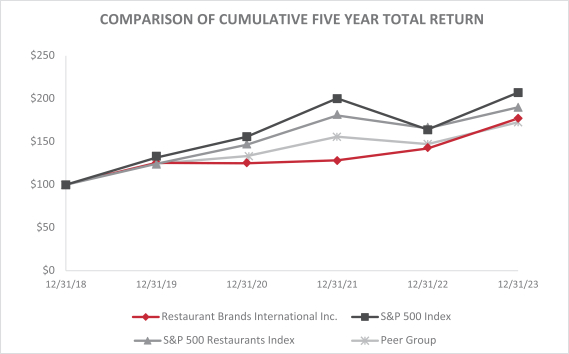

| › | Total Revenues of $7,022 million, an increase of 8% over 2022 |

| › | Net Income of $1,718 million, an increase of 16% over 2022 |

| › | Adjusted Operating Income3 of $2,200 million, an increase of 6% over 2022 |

| 1 | System-wide sales growth and comparable sales are calculated on a constant currency basis, which means the results exclude the effect of foreign currency translation (“FX Impact”). For system-wide sales growth and comparable sales, we calculate the FX Impact by translating prior year results at current year monthly average exchange rates. Comparable sales refers to the percentage change in restaurant sales in one period from the same prior year period for restaurants that have been open for 13 months or longer for TH, BK and FHS and 17 months or longer for PLK. Additionally, if a restaurant is closed for a significant portion of a month, the restaurant is excluded from the monthly comparable sales calculation. System-wide sales growth and comparable sales are presented on a system-wide basis, which means they include sales at franchise restaurants and company restaurants. System-wide sales are driven by our franchise restaurants, as approximately nearly all of system-wide restaurants are franchised. Franchise sales represent sales at all franchise restaurants and are our franchisees’ revenues. We do not record franchise sales as revenues; however, our royalty revenues and advertising fund contributions are calculated based on a percentage of franchise sales. |

| 2 | Net restaurant growth refers to the net increase in restaurant count (openings, net of permanent closures) over a trailing twelve-month period, divided by the restaurant count at the beginning of the trailing twelve-month period. |

| 3 | This is a non-GAAP financial measure. Non-GAAP measures do not have standardized meanings under GAAP and may differ from similarly captioned measures of other companies in our industry or otherwise. For further details regarding non-GAAP financial measures and a reconciliation to their most comparable GAAP measure, please see Appendix B of this proxy statement. |

Corporate Governance Highlights

| ✓ | 9 of 10 Director Nominees are independent under the NYSE and TSX listing standards |

| ✓ | Separate Executive Chair and CEO roles and a Lead Independent Director, with well-defined oversight responsibilities |

| ✓ | Each of our Board of Directors committees is comprised solely of independent directors |

| ✓ | All directors stand for election annually |

| ✓ | Average director tenure is ~4 years with 3 new directors onboarded since the end of 2022 |

| ✓ | Executive sessions of directors without management held at each regular meeting |

| ✓ | Robust Corporate Governance Guidelines |

| ✓ | Annual self-assessments for Board and Committees overseen by NCG Committee (as defined below) |

| ✓ | Majority voting for election of directors as provided in the Canada Business Corporations Act |

| ✓ | Culturally and geographically diverse mix of directors who live on three continents |

| ✓ | 3 of 10 director nominees are women |

|

Page ii |

| |

2024 Proxy Statement |

Restaurant Brands International |

Executive Summary

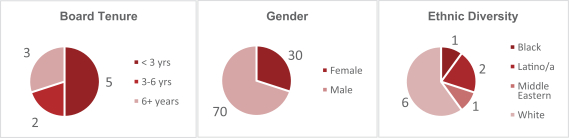

Board Highlights

The following matrix shows the balance of skills, qualifications, and demographic backgrounds our directors bring to their oversight of our company, based on information received from each of our directors in response to our annual director questionnaire. At least annually, the NCG Committee evaluates and reports to our Board on the skills, qualifications, and demographic backgrounds desirable for our Board to best advance our business strategies and serve the interests of all our stakeholders.

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||||||||||||||||||||||||||||||||||||||||

| Senior Leadership Experience |

☑ |

☑ |

☑ |

☑ |

☑ |

☑ |

☑ |

☑ |

☑ |

9 | |||||||||||||||||||||||||||||||||||||||||||||

| Business Development / M&A Experience |

☑ |

☑ |

☑ |

☑ |

☑ |

☑ |

☑ |

☑ |

8 | ||||||||||||||||||||||||||||||||||||||||||||||

| Financial Experience |

☑ |

☑ |

☑ |

☑ |

☑ |

☑ |

☑ |

☑ |

8 | ||||||||||||||||||||||||||||||||||||||||||||||

| Global Experience |

☑ |

☑ |

☑ |

☑ |

☑ |

☑ |

☑ |

7 | |||||||||||||||||||||||||||||||||||||||||||||||

| Human Resource / Compensation Experience |

☑ |

☑ |

☑ |

☑ |

☑ |

5 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Franchise / Brand Marketing / Retail Experience |

☑ |

☑ |

☑ |

☑ |

☑ |

☑ |

☑ |

7 | |||||||||||||||||||||||||||||||||||||||||||||||

| Restaurant Industry / Operations Expertise |

☑ |

☑ |

☑ |

☑ |

☑ |

5 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Real Estate Experience |

☑ |

☑ |

☑ |

3 | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Corporate Social Responsibility / Governance Experience |

☑ |

☑ |

2 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Digital / Technology Experience |

☑ |

☑ |

☑ |

☑ |

4 | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Government / Regulatory Expertise |

☑ |

1 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

Executive Chairman and Chief Executive Officer Transitions

To lead our next phase of growth, the Board appointed Joshua Kobza as our Chief Executive Officer effective March 1, 2023. Mr. Kobza has held increasingly senior roles with Restaurant Brands International over the last 11 years, most recently as Chief Operating Officer (2019-2023) and played a key role in the acquisitions of Tim Hortons in 2014, Popeyes in 2017 and Firehouse Subs in 2021.

This follows the November 2022 appointment of Patrick Doyle as our Executive Chairman. As the former CEO of Domino’s Pizza from 2010 to 2018, Mr. Doyle led one of the restaurant industry’s most successful transformations, driving the company’s culinary reinvention and pioneering new technology and other innovations that helped make Domino’s the largest pizza chain in the world.

| Restaurant Brands International |

2024 Proxy Statement |

| |

Page iii |

Executive Summary

Compensation Highlights

| What We Do | What We Don’t Do | |

| ✓ Incentives aligned with performance and ownership culture to align with shareholder interests |

| |

| ✓ Performance metrics support our growth strategy |

| |

| ✓ Incentive clawback policy |

| |

| ✓ Substantial stock ownership guidelines, CEO at 12x base salary |

| |

| ✓ Annual say on pay advisory vote |

| |

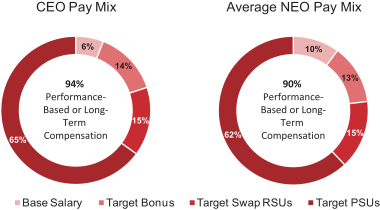

Our incentive plans and programs reinforce our culture of ownership, ensure alignment of executives’ and shareholders’ interests, and provide for a strong link between pay and performance.

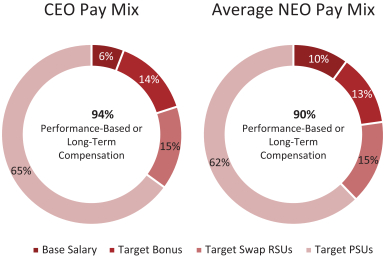

| › | For 2023, 94% of our CEO’s target total direct compensation and an average of 90% of each of our other named executive officers’ target total direct compensation was performance-based and/or long-term compensation. |

| › | Annual cash incentives are performance-based and are subject to achievement of our minimum financial goals for the calendar year. |

| › | We strive to create an ownership culture with performance-based long-term equity awards in addition to the bonus swap program. The bonus swap program provides equity awards to those executives who are willing to invest in the company through the purchase of shares at fair market value which are matched with restricted stock units that vest over time. The program encourages retention of those shares as the matching equity awards are forfeited if the purchased shares are sold prior to vesting of the awards. |

Sustainability Highlights

We believe that the delicious, affordable, and convenient meals you love must also be sustainable, and in 2023, we continued to bring that vision to life. This past year we continued to focus our efforts on executing against the sustainability strategy we spent the past four years building, including:

| • | advancing our ambitious climate targets, |

| • | increasing our use of sustainable materials and reducing our guest-facing packaging overall, |

| • | providing guests with high-quality ingredients, |

|

Page iv |

| |

2024 Proxy Statement |

Restaurant Brands International |

Executive Summary

| • | fulfilling our commitment to improving animal welfare outcomes, and |

| • | enhancing diversity across our teams at RBI. |

Our Audit Committee oversees our broad range of sustainability efforts and receives updates at least quarterly. See “Sustainability – Restaurant Brands for Good” on page 19, for more information.

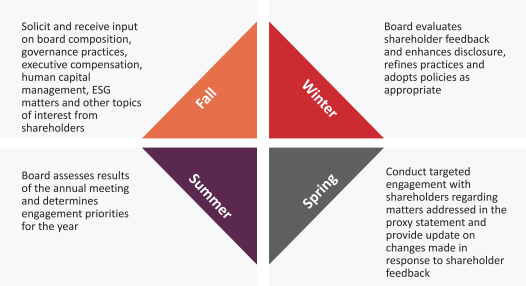

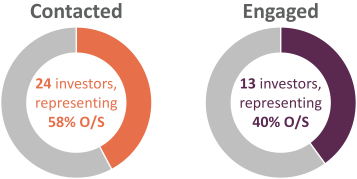

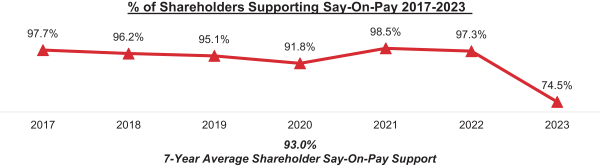

Shareholder Engagement

We actively engage with our shareholders and stakeholders in a number of forums on a year-round basis and also monitor developments in corporate governance and sustainability. During late fiscal 2023 and early 2024, we reached out to our top shareholders representing approximately 58% of our outstanding common shares. Thirteen shareholders representing 40% of our outstanding common shares agreed to meet with us to discuss a broad range of business strategy, executive compensation, governance, and sustainability topics. Shareholder feedback we received during these meetings was shared with our Board, which incorporated this input into its decision-making. See “Shareholder Engagement” on page 22, for more information.

Roadmap of Voting Items

| Voting Item | Board Recommendation | |

| Item 1. Election of Directors. We are asking shareholders to vote on each director nominee to the Board. We believe that each of our director nominees possesses the experience, skills, and qualities to fully perform his or her duties as a director and contribute to our success. |

FOR | |

| Item 2. Shareholder Advisory Vote to Approve Named Executive Officer Compensation. We believe that compensation is an important tool to further our long-term goal of creating shareholder value. We are seeking approval of a non-binding advisory vote from our shareholders in favor of the compensation of our named executive officers as described in this proxy statement. |

FOR | |

| Item 3. Appointment of KPMG LLP as our auditors. We are asking shareholders to vote on a proposal to appoint KPMG LLP as our independent auditors to serve until the close of the 2025 Annual Meeting and authorize our directors to fix the auditors’ remuneration. |

FOR | |

| Item 4-11. Shareholder Proposals |

AGAINST | |

| Restaurant Brands International |

2024 Proxy Statement |

| |

Page v |

Table of Contents

| 2 | ||

| 10 | ||

| 30 | ||

| 45 | ||

| 54 | ||

| Proposal 3 – Appointment of Independent Registered Public Accounting Firm |

55 | |

| 58 | ||

| 74 | ||

| 80 | ||

| 90 | ||

| Appendix A – Summary of the Terms of the Securities of RBI and Partnership |

A-1 | |

| B-1 | ||

| C-1 |

BUSINESS OF MEETING

DIRECTOR NOMINEES:

10 Nominees

Elected by majority vote

SAY ON EXECUTIVE COMPENSATION:

Support our pay for

performance practices

APPOINTMENT OF AUDITORS:

Recommended by Board

Approved by Shareholders

SHAREHOLDER PROPOSALS

| Restaurant Brands International |

2024 Proxy Statement |

| |

Page 1 |

Proposal 1 – Election of Directors

PROPOSAL 1 – ELECTION OF DIRECTORS

Our by-laws permit the Board of Directors (the “Board”) to determine the number of directors that constitute the Board, provided that the Board shall not consist of fewer than 3 or greater than 15 members. We currently have 10 members of the Board. In addition, our by-laws provide that at least 25% of the directors shall be resident Canadians, as required by the Canada Business Corporations Act (the “CBCA”).

Our Board consists of directors who have a diverse set of perspectives, backgrounds, and experiences. We believe a board of the proposed size and composition is appropriate and allows effective committee organization and the facilitation of efficient meetings and decision-making.

Our director nominees are: Messrs. Behring, de Limburg Stirum, Doyle, Hedayat, Lemann, Melbourne, and Schwartz, and Mses. Farjallat, Fribourg, and Sweeney. Messrs. Hedayat and Melbourne, and Ms. Sweeney are each a resident Canadian as defined by the CBCA.

Mr. Doyle joined RBI as Executive Chairman, an officer position, in November 2022. In January 2023, the Board appointed Mr. Doyle as Executive Chair of the Board. Mr. Doyle has extensive experience in the quick service industry and the success that he delivered at Domino’s Pizza positions him well to assist RBI in accelerating its growth, including through franchisee profitability initiatives. Mr. Doyle is also able to provide the Board and our senior executives, including our CEO, with unparalleled perspective, guidance, advice and strategic vision regarding the quick service industry and RBI’s business, operations and strategy. As Mr. Doyle does not have daily operational responsibilities, he is able to focus on leading the Board in fulfilling its oversight and governance responsibilities. Mr. Doyle acts as a bridge between the Board and the CEO, offering guidance and strategic direction.

Mr. Hedayat has served as Lead Independent Director since June 2023 and as a director since 2016. Mr. Hedayat is a seasoned investment banker and public company board director, bringing financial expertise, M&A integration experience and corporate governance oversight. Mr. Hedayat works closely with Mr. Doyle to provide an informed, independent perspective to all matters of the Board.

As we discuss under “Corporate Governance—Board Independence” on page 12 of this proxy statement, our Board conducts an evaluation of the independence of each director and has determined that all of our director nominees, except Mr. Doyle, qualify as “independent” directors under the NYSE listing standards, the rules of the TSX and Canadian securities laws.

We believe that each of our director nominees possesses the experience, skills, and qualities to fully perform his or her duties as a director and contribute to our success. Our director nominees were nominated because each is of high ethical character, is highly accomplished in his or her field with superior credentials and recognition, has a sound personal and professional reputation, has the ability to exercise sound business judgment, and is able to dedicate sufficient time to fulfilling his or her obligations as a director. Further, it is our view that these director nominees complement each other as a group. Our director nominees appear on the following pages. Each director nominee’s principal occupation and other pertinent information about particular experience, qualifications, attributes, and skills that led the Board to conclude that such person should serve as a director, appears on the following pages.

In accordance with the CBCA, a nominee will be elected only if the number of votes cast in the nominee’s favour represents a majority of the votes cast for and against them, subject to certain exceptions. See “Corporate Governance—Election of Directors—Majority Voting” beginning page 13 of this proxy statement.

|

Page 2 |

| |

2024 Proxy Statement |

Restaurant Brands International |

Proposal 1 – Election of Directors

Nominees For Director

| Alexandre Behring | ||

|

Independent

Committees: Compensation (Chair) Nominating and Corporate Governance (Chair) |

BUSINESS EXPERIENCE:

Mr. Behring has served on our Board since 2014, as Chair from December 2014 to January 2019 and as Co-Chair from January 2019 to January 2023. Mr. Behring is a Founding Partner and has been Managing Partner (now Co-Managing Partner) and a Board Member of 3G Capital Partners LP, a global investment firm (“3G Capital”), since 2004. Following the acquisition of Burger King Holdings, Inc. by 3G Capital, he served on the board of Burger King Worldwide, Inc. (“BKW”) and its predecessor as chairman from October 2010 until December 2014. Mr. Behring served as Chairman of the Kraft Heinz Company from July 2015, following Berkshire Hathaway and 3G Capital’s acquisition of H.J. Heinz Company in June 2013 and subsequent combination with Kraft Foods Group in July 2015, to May 2022. Since February 2022, he also serves as a director of Hunter Douglas Group, global leader in the window coverings industry. Mr. Behring also served as a director of Anheuser-Busch InBev, a global brewer, from March 2014 until March 2019.

Previously, Mr. Behring spent ten years at GP Investiments, one of Latin America’s premier private-equity firms, including eight years as a partner and member of the firm’s Investment Committee. He served for seven years, from 1998 until 2004, as Chief Executive Officer of America Latina Logistica (“ALL”), one of Latin America’s largest railroad and logistics companies. He also served as a director of ALL until December 2011. From July 2008 until May 2011, Mr. Behring served as a director of CSX Corporation, a U.S. rail-based transportation company. Mr. Behring is 57 years old and resides in Rio de Janeiro, Brazil. At our 2023 annual meeting, he received 89% votes in favor of his re-election.

QUALIFICATIONS

The Board nominated Mr. Behring due to his experience in executive roles at private equity firms and as CEO for a large railroad and logistics company as well as his experience as Chair of the Board of RBI and its predecessor and the Kraft Heinz Company. In addition, the Board considered his knowledge of strategy and business development, finance, risk assessment, logistics and leadership development. | |

| Restaurant Brands International |

2024 Proxy Statement |

| |

Page 3 |

Proposal 1 – Election of Directors

| Maximilien de Limburg Stirum | ||

|

Independent

Committees: Audit Conflicts |

BUSINESS EXPERIENCE:

Mr. de Limburg Stirum has served on our Board since June 2020. Mr. de Limburg Stirum has served as the Executive Chairman of Société Familiale d’Investissements (“SFI”), an investment holding company, since May 2012 and as Chief Executive Officer and a director of Denarius S.A., a private investment advisor to SFI. Prior to that, he served as Chief Investment Officer of Compagnie Nationale a Portefeuille, an investment firm, from January 1995 to December 2011. Mr. de Limburg Stirum has served as a director on a number of company boards, including Tikehau Capital, an asset management company listed in Paris, since May 2023, EPS, a company holding a significant investment in AB InBev, since June 2013 and Synatom, a nuclear energy company, since March 2021, on which he also serves on the audit committee. He previously served as a director and audit committee member of Forest and Biomass Holding from May 2015 to December 2018, of Quick Restaurants S.A., a quick service restaurant company in Belgium and of Groupe Flo, a restaurant company in France. Mr. de Limburg Stirum is 52 years old and resides in Brussels, Belgium. At our 2023 annual meeting, he received 99.6% votes in favor of his re-election.

QUALIFICATIONS

The Board nominated Mr. de Limburg Stirum due to his experience in executive roles at private investment firms and his experience in the quick service restaurant industry. In addition, the Board considered his global leadership experience in strategy and business development, finance, and leadership development as well as his insight into corporate governance, accounting, and mergers and acquisitions, with specific geographic expertise for Europe. | |

| J. Patrick Doyle | ||

|

Executive Chair

Committees: None. |

BUSINESS EXPERIENCE:

Mr. Doyle has served as Executive Chair of our Board since January 2023 and as Executive Chairman of RBI since November 2022. Most recently, he served as an executive partner focused on the consumer sector of the Carlyle Group, a global diversified investment firm, from September 2019 through November 2022. Prior to that he served as the chief executive officer of Domino’s Pizza, from March 2010 to June 2018, having served as president from 2007 to 2010, as executive vice president of Domino’s Team USA from 2004 to 2007 and as executive vice president of Domino’s Pizza International from 1999 to 2004. Mr. Doyle has served on the board of directors of Best Buy Co., Inc. since November 2014, has been the Chairman of Best Buy’s board since May 2020 and is stepping down in June 2024. Mr. Doyle earned his M.B.A. from The University of Chicago Booth School of Business, and his B.A. from The University of Michigan. Mr. Doyle is 60 years old and resides in Florida, United States. At our 2023 annual meeting, he received 99% votes in favor of his election.

QUALIFICATIONS

The Board nominated Mr. Doyle due to his experience as the former CEO of Domino’s Pizza. The Board also considered Mr. Doyle’s experience leading one of the restaurant industry’s most successful transformations by focusing on putting the guest experience first, franchisee profitability, and being the best at digital ordering and food quality. In addition, the Board considered his global leadership experience in strategy and business development, finance, and leadership development as well as his insight into brand marketing and mergers and acquisitions. | |

|

Page 4 |

| |

2024 Proxy Statement |

Restaurant Brands International |

Proposal 1 – Election of Directors

| Cristina Farjallat | ||

|

Independent

Committees: Compensation |

BUSINESS EXPERIENCE:

Ms. Farjallat has served on our Board since January 2023. Ms. Farjallat has served as regional sales director, mid-market Latin America for Facebook Brasil since March 2020. Prior to joining Facebook, Ms. Farjallat served as senior director of marketplace/chief marketing officer for Mercado Livre do Brasil, a marketplace and fintech company, from March 2017 through February 2020. She served as founder and chief executive officer of Tiena Indústria s Comércio de Cosméticos Ltda, a cosmetics company, from January 2009 to October 2016. Ms. Farjallat served as an advisor to Americanas, a publicly-traded retail, online commerce and fintech company, from December 2021 to April 2023 and served on its digital committee. From June 2021 to December 2021, she served as an independent board member of Lojas Americanas S.A., one of South America’s largest retailers. Ms. Farjallat earned her MBA from Harvard Business School and her bachelor’s degree from Universidade de São Paolo. Ms. Farjallat is 52 years old and resides in São Paolo, Brazil. At our 2023 annual meeting, she received 98% votes in favor of her election.

QUALIFICATIONS

The Board nominated Ms. Farjallat because of her experience in international executive leadership roles. In addition, the Board considered her knowledge of strategy, business development, marketing, and digital expertise. | |

| Jordana Fribourg | ||

|

Independent

Committees: None |

BUSINESS EXPERIENCE:

Ms. Fribourg has served on our Board since May 2023. Ms. Fribourg serves as Chief Talent Officer, Board Observer at Continental Grain Company, an international agribusiness and investment company based in New York City, NY since March 2020. Prior to taking this role, she was a Senior Associate, Corporate Investment from 2017 to 2020 supporting various transactions, including M&A, Capital Markets, Venture Capital and Private Equity funds. From 2010 to 2012, Ms. Fribourg had co-founded Arte Sempre LLC, a streetwear branding company making art accessible through the medium of hand-made sustainable sportswear. She has served on the board of directors of Kona Ice since 2023, Woof Gang Bakery since 2020 and the Fribourg Family Foundation since 2019. She also had served as a director of Joyride Coffee Distributors from 2018 to 2019. Ms. Fribourg received her MBA from Columbia Business School and her B.A. from Brown University. Ms. Fribourg is 36 years old and resides in New York, United States. At our 2023 annual meeting, she received 93% votes in favor of her election.

QUALIFICATIONS

The Board nominated Ms. Fribourg due to her experience in a leadership role of an international agribusiness and investment company, and as a director of several private companies that are in the food and franchise industries. In addition, the Board considered her knowledge of human capital, talent management and selection, capital allocation and investment, and corporate social responsibility and community involvement. | |

| Restaurant Brands International |

2024 Proxy Statement |

| |

Page 5 |

Proposal 1 – Election of Directors

| Ali Hedayat | ||

|

Lead Independent Director

Committees: Audit (Chair) Conflicts (Chair) Nominating and Corporate Governance |

BUSINESS EXPERIENCE:

Mr. Hedayat has served on our Board since July 2016. Mr. Hedayat is the founder and has been Managing Director of Maryana Capital, a financial firm in Toronto, Ontario, Canada, since March 2015. He previously cofounded Edoma Capital in London, a capital fund, where he worked from 2010 until December 2012, and was a partner at Indus Capital, a capital fund in London, from May 2013 until March 2015. Mr. Hedayat held progressively more senior roles at the Goldman Sachs Group from 1997 to 2010, including from 2005 to 2007 as Managing Director of the European Principal Strategies group and from 2007 to 2010 as Managing Director and Co-head of the Americas Principal Strategies group. Mr. Hedayat has served on the board of DRI Healthcare Trust, a TSX traded trust with a portfolio of pharmaceutical and biotechnology investments, since June 2020 and RMM Management, a public music royalty company, from August 2020 to July 2021. Mr. Hedayat previously served on the board and audit committee of U.S. Geothermal Inc., a renewable energy company, from February 2017 until March 2018 and, from May 2018 through July 2019, served on the board and governance and nomination committee of Crius Energy, an independent energy retailer in the United States. Mr. Hedayat is 49 years old and resides in Ontario, Canada. At our 2023 annual meeting, he received 95% votes in favor of his re-election.

QUALIFICATIONS

The Board nominated Mr. Hedayat because of his significant experience in investment banking and outside board service. In addition, the Board considered his international experience as well as his knowledge of finance, mergers and acquisitions and corporate governance. | |

| Marc Lemann | ||

|

Independent

Committees: None |

BUSINESS EXPERIENCE:

Mr. Lemann has served on our board since June 2021. Mr. Lemann is an investor and entrepreneur with a broad range of business and investment experience. He is the founder and director of Maai Ltd., which has invested in ventures and public equities since January 2018. He previously co-founded Go4it Capital, a venture capital firm that has invested in sports technology, digital media, health and wellbeing ventures, and has served as a director since February 2016. Mr. Lemann has served as a member of the general partner of Growth Interface Fund, a long-only public equities fund, since December 2017. Previously, from October 2015 until January 2022, Mr. Lemann served as a director of Go4it Esportes e Entretenimento S.A., a sports agency and business incubator he co-founded in Brazil. Since April 2022, Mr. Lemann has served as a member of the board of directors of São Carlos Empreendimentos e Participações S.A., a commercial real estate investment and management company in Brazil that is publicly held and listed on the Brazilian stock exchange, and was previously an alternate board member from April 2020 to April 2022. Mr. Lemann graduated from Columbia University with a Bachelor of Arts majoring in economics. Mr. Lemann is 32 years old and resides in Switzerland. At our 2023 annual meeting, he received 93% votes in favor of his re-election.

QUALIFICATIONS

The Board nominated Mr. Lemann due to his business, investment and merger and acquisition knowledge, including his experience in digital technology, venture financing, and real estate. | |

|

Page 6 |

| |

2024 Proxy Statement |

Restaurant Brands International |

Proposal 1 – Election of Directors

| Jason Melbourne | ||

|

Independent

Committees: Audit Compensation Conflicts |

BUSINESS EXPERIENCE:

Mr. Melbourne has served on our board since September 2020. Mr. Melbourne has been the Head of Canadian Capital Markets at Canaccord Genuity since June 2023 and is also a member of its global operating committee. Prior to this role, Mr. Melbourne was Global Head of Distribution at Canaccord Genuity from October 2020 to June 2023. He previously served as Global Head of Canadian Equities from May 2010 to October 2020 and as Principal, Sales & Trading for Genuity Capital Markets beginning in January 2005. Prior to his time at Canaccord Genuity, he was Director of Sales and Trading at CIBC World Markets from June 2001 to January 2005. Mr. Melbourne has served on the board of directors at Lay-Up, a youth basketball foundation that strives to empower youth with the confidence and life skills to become the community leaders of tomorrow, since March 2018, and Huron College – University of Western Ontario, since September 2021. From November 2019 to March 2021, he served on the board of directors of the Ontario Lottery and Gaming Corporation, an agency that develops world-class gaming entertainment in the Province of Ontario. Mr. Melbourne is 52 years old and resides in Ontario, Canada. At our 2023 annual meeting, he received 98% votes in favor of his re-election.

QUALIFICATIONS

The Board nominated Mr. Melbourne due to his experience in executive roles at a large financial services company. In addition, the Board considered his knowledge of finance and capital markets as well as his knowledge of the Canadian market. | |

| Daniel S. Schwartz | ||

|

Independent

Committees: None |

BUSINESS EXPERIENCE:

Mr. Schwartz has served on our Board since December 2014 and served as Co-Chair from January 2019 to January 2023. Mr. Schwartz served as the Chief Executive Officer of RBI and its predecessor BKW from June 2013 until January 2019 and as Executive Chairman from January 2019 through June 2019. Mr. Schwartz joined Burger King Holdings, Inc., the predecessor to BKW, in October 2010 as Executive Vice President, Deputy Chief Financial Officer. From January 2011 until March 2013, he served as Chief Financial Officer of BKW and from March 2013 until June 2013, he served as Chief Operating Officer. Mr. Schwartz is co-Managing Partner of 3G Capital, a global investment firm. Since February 2022, he has also served as a director of privately held Hunter Douglas Group, global leader in the window coverings industry. From 2012 until February 2015, Mr. Schwartz served as a director of Carrols Restaurant Group, Inc., RBI’s largest Burger King franchisee in the United States. Mr. Schwartz is 43 years old and resides in Florida, United States. At our 2023 annual meeting, he received 99.5% votes in favor of his re-election.

QUALIFICATIONS

The Board nominated Mr. Schwartz because of his experience as the CEO and Co-Chair/Executive Chairman of RBI and its predecessors. In addition, the Board considered his knowledge of strategy and business development, finance, marketing and consumer insights, risk assessment, mergers and acquisitions, leadership development and succession planning. | |

| Restaurant Brands International |

2024 Proxy Statement |

| |

Page 7 |

Proposal 1 – Election of Directors

| Thecla Sweeney | ||

|

Independent

Committees: Nominating and Corporate Governance |

BUSINESS EXPERIENCE:

Ms. Sweeney has served on our Board since January 2022. Ms. Sweeney is a partner and co-founder of Alphi Capital Inc., a private investment firm formed in August 2022. Prior to founding Alphi, from 2004 to 2022, Ms. Sweeney was a member of the investment team at Birch Hill Equity Partners, a leading Canadian mid-market private equity firm focused on investments in the consumer, healthcare and telecom industries. In the 12 years that Ms. Sweeney was a partner at Birch Hill, she spent the last four as an Operating Partner and Executive Chair and Chief Executive Officer for Motion LP, a privately-held provider of complex mobility and accessibility solutions in Canada. Prior to joining Birch Hill, Ms. Sweeney worked on the start-up of Porter Airlines, was a consultant at Bain & Company and spent three years in the Chairman’s Office of George Weston Limited. Since March 2023, she has served on the board of Dollarama Inc., a publicly-traded Canadian value retailer. She served on the board of directors of Motion LP from 2014 to January 2023. From 2010 to April 2022, she served on the board of Mastermind LP, a privately-held specialty toy retailer and from 2019 to July 2022 she served on the board of FlexNetworks LP, a privately-held telecom business. From 2012 to 2017, she served on the board of Sleep Country Canada, a specialty retailer of mattresses and accessories. Ms. Sweeney is 52 years old and resides in Ontario, Canada. At our 2023 annual meeting, she received 99.8% votes in favor of her re-election.

QUALIFICATIONS

The Board nominated Ms. Sweeney due to her experience as a CEO and as a director of multiple companies in various industries and as a consultant. In addition, the Board considered her knowledge of retail, operations, strategy and business development, and finance. | |

If elected, each of the aforementioned nominees has consented to serve as a director and hold office until the close of the 2025 Annual Meeting of Shareholders or until his or her respective successor has been elected or appointed.

Recommendation of the Board

The Board recommends a vote “FOR” each of the director nominees.

|

Page 8 |

| |

2024 Proxy Statement |

Restaurant Brands International |

In this section, you can read about

| Governance Guidelines | Page 10 | |

| Board Leadership Structure | Page 11 | |

| Meetings | Page 12 | |

| Board Independence | Page 12 | |

| Director Term Limits and Director Tenure | Page 13 | |

| Election of Directors - Majority Voting | Page 13 | |

| Director Orientation and Continuing Education | Page 13 | |

| Annual Evaluation Process | Page 14 | |

| Board Committees | Page 14 | |

| Compensation Committee Interlocks and Insider Participation | Page 16 | |

| Executive Officer Diversity | Page 18 | |

| Risk Management | Page 18 | |

| Sustainability-Restaurant Brands for Good | Page 19 | |

| Shareholder Engagement | Page 22 | |

| Communication with our Board | Page 24 | |

| Code of Ethics/Conduct | Page 24 | |

| Related Party Transaction Policy | Page 25 | |

| Certain Relationships and Related Transactions | Page 25 | |

| Director Compensation | Page 26 |

CORPORATE

GOVERNANCE

MAJORITY INDEPENDENT BOARD

Elected by

majority vote

Annual performance

self-evaluations

| Restaurant Brands International |

2024 Proxy Statement |

| |

Page 9 |

Corporate Governance

CORPORATE GOVERNANCE

Governance Guidelines

Our Board supervises and directs the management of our business and affairs and believes that good corporate governance is a critical factor in achieving business success and in fulfilling the Board’s responsibilities to shareholders.

The Restaurant Brands International Inc. Board of Directors Corporate Governance Guidelines, as amended (the “Governance Guidelines”) provide a framework for corporate governance in accordance with applicable Canadian and U.S. securities laws, the NYSE listing standards, the TSX rules, the requirements under the CBCA and our organizational documents.

Highlights of our Governance Guidelines are described below:

| › | A majority of members of the Board must be independent as defined by the NYSE and TSX listing standards and applicable U.S. and Canadian securities laws. |

| › | Our board strives for a balance of diverse characteristics among directors in terms of their race, gender, geography, thought, viewpoints, backgrounds, skills, experience, and expertise. The Board previously set a target to have women comprise at minimum 30% of its members by our 2024 Annual Meeting and met that target at our 2023 Annual General Meeting. |

| › | The committees of the Board are the Audit Committee, the Compensation Committee, the NCG Committee and the Conflicts Committee. The Board may create and maintain other committees from time to time. Committee membership assignments are determined by the Board, on recommendation of the NCG Committee, taking account of our needs, individual attributes, and other relevant factors. |

| › | Each director serving on the Audit Committee will be an independent director as determined in accordance with the listing standards of the NYSE and TSX and applicable securities laws and each director serving on the Conflicts Committee will be an independent director as defined under the partnership agreement. |

| › | Executive sessions or meetings of directors without management present will be held as part of each regularly scheduled Board meeting. |

| › | A director may not accept a position on the board or audit committee of any other public company without first reviewing the matter with the Executive Chair of the Board, subject to limitations on the number of other public boards as set forth in our Governance Guidelines. |

| › | Director orientation programs are provided to all new directors either prior to or within a reasonable period of time after their nomination or election to the Board. |

| › | The Board, with the assistance of the NCG Committee, will conduct an annual performance self-evaluation of the full Board to determine whether the Board and its committees are functioning effectively. |

| › | The NCG Committee oversees and evaluates the Board’s performance and its compliance with our Governance Guidelines and other corporate governance regulations and principles. |

The NCG Committee monitors compliance with the Governance Guidelines. In addition, the NCG Committee periodically reviews our Governance Guidelines, and, if appropriate, will recommend changes to the Board. The full text of our Governance Guidelines is available in the “Investors—Corporate Governance” section of our website at www.rbi.com, as well as under the RBI issuer profile on SEDAR+ at www.sedarplus.com and is incorporated herein by reference. No other information on our website or any other website referenced in this document is incorporated into this proxy statement, and such information should not be considered part of this proxy statement. Any request for a copy of the Governance Guidelines may be directed to Restaurant Brands International Inc., 130 King Street West, Suite 300, P.O. Box 339, Toronto, Ontario Canada M5X 1E1, Attention: Corporate Secretary. Upon receipt of a request, a copy will be provided free of charge.

|

Page 10 |

| |

2024 Proxy Statement |

Restaurant Brands International |

Corporate Governance

Board Leadership Structure

Our Board currently has an Executive Chair, Patrick Doyle, and a Lead Independent Director, currently Ali Hedayat. Mr. Doyle has served as Executive Chair of our Board since January 2023 and was appointed Executive Chairman of RBI, an officer position, in November 2022. Mr. Hedayat has served as Lead Independent Director since June 2023 and RBI has had a lead independent director role since October 2020.

Our governing documents provide us with the flexibility to determine the appropriate leadership structure that is in the best interests of RBI. Our Board has not adopted a formal policy regarding the need to separate or combine the offices of Chair of the Board and Chief Executive Officer as the Board believes it is important to retain its flexibility to allocate the responsibilities of the offices of the Chair and CEO in any way that it deems in the best interests of RBI at a given point in time. While our Board has not developed written position descriptions for these positions or the Chairs of our committees, our Governance Guidelines and the charter of each committee sets forth the role of the relevant Chair. At the present time, the positions of Executive Chair of the Board and CEO are filled by different individuals and our CEO does not sit on the Board. Under the authority and overall direction and supervision of the Board, the CEO is responsible for executing RBI’s current strategic plans and initiatives and overseeing and directing the operations of RBI, with the objective of enhancing long-term shareholder value. The Chair or Executive Chair, as the case may be, of the Board is responsible for facilitating a highly functioning and effective Board, providing overall leadership, encouraging open communications and guiding the Board in the development of a long-term value creation strategy for RBI.

Given the particular experience of Messrs. Doyle and Kobza, the Board believes this leadership structure is appropriate at this time because it separates the leadership of the Board from the duties of day-to-day leadership of the company. Mr. Doyle has extensive experience in the industry and is able to provide the Board and our senior executives, including our CEO, with unparalleled perspective, guidance, advice and leadership regarding RBI’s business, operations and strategy. As Mr. Doyle does not have daily operational responsibilities, he is able to focus on leading the Board in fulfilling its oversight and governance responsibilities. Mr. Doyle acts as a bridge between the Board and the CEO, offering guidance and strategic direction. Mr. Doyle also works collaboratively with our Lead Independent Director Mr. Hedayat. While Mr. Doyle, as Executive Chairman, is an officer of RBI and therefore not independent under the NYSE rules, he does not serve as CEO, is not responsible for the daily operations of the company and does not receive any salary or bonus in connection with his service to RBI.

Mr. Doyle’s primary responsibilities as Executive Chair of the Board include:

| • | regular engagement with the CEO to review business issues, results, strategy and key projects |

| • | focus on big growth unlocks, franchisee success, investor and media engagement |

| • | leading strategic discussions at full meetings of the Board |

| • | participation in offsite business reviews and annual senior leadership meetings |

| • | market visits on a regular cadence with members of senior management |

The primary responsibilities of our Lead Independent Director include:

| • | presiding at Board meetings at which the Executive Chair is not present; including executive sessions of independent directors; |

| • | serving as a liaison between the Executive Chair and the independent directors; |

| • | previewing information provided to the Board and approving meeting agendas, which may include consideration of risk matters; |

| • | calling meetings of independent directors; and |

| • | being available to represent the board in communications with shareholders and other stakeholders. |

The Chair of each committee also has a specific role on the Board and is responsible for setting the frequency and length of the meetings, setting meeting agendas consistent with the committee’s charter, and reporting on the activities of that committee to the full Board on a periodic basis.

| Restaurant Brands International |

2024 Proxy Statement |

| |

Page 11 |

Corporate Governance

Our Board has not developed a written position description for our CEO. Our Board and CEO develop, on an annual basis, corporate goals and objectives and parameters within which the CEO operates our business. Our Board and CEO also establish annual performance goals to measure the CEO’s individual achievement for purposes of our annual bonus program. The Compensation Committee of the Board is also responsible for annually evaluating the CEO against these objectives. For a further discussion of the corporate goals and objectives and the measures by which our CEO is evaluated, please see our Compensation Discussion & Analysis beginning on page 30 of this proxy statement.

Meetings

During 2023, the Board held a total of six meetings. Each incumbent director attended during 2023 at least 75% of the aggregate of (1) the total number of meetings of the Board and (2) the total number of meetings of each committee on which he or she served, in each case during the director’s term on the Board or such committee. The Audit Committee met six times, the Compensation Committee met two times and the NCG Committee met once during 2023 and all directors who were members of the applicable committee at the time attended all meetings of each such committee.

In accordance with our Governance Guidelines, the Executive Chair of the Board will generally determine the frequency and length of Board meetings and will set the agenda for each Board meeting, with the input of the Lead Independent Director. Board members are encouraged to suggest the inclusion of additional items on an agenda, and any director may request that an item be placed on an agenda. Board meetings are generally held pursuant to a pre-determined schedule, with additional meetings scheduled as necessary.

During 2023, Mr. Doyle presided over the executive sessions of the Board. In 2023, the Board met in executive session four times. Additionally, the Lead Independent Director presides over sessions of independent directors that are not affiliated with 3G Capital. One such meeting was held in 2023.

We encourage all directors to attend the annual meetings of our shareholders, and two of our directors attended our 2023 Annual General Meeting.

Board Independence

It is the policy of the Board that a majority of directors must (i) be independent with no direct or indirect material relationship or business conflict with RBI and (ii) otherwise meet the definition of an “independent” director under U.S. and Canadian securities laws and listing standards of the NYSE and the TSX. Our Board has affirmatively determined that the following nominees and former directors have, or while a director had, no material relationship with RBI and otherwise qualify, or while a director qualified, as independent based on the foregoing criteria: Messrs. Behring, Castro-Neves, de Limburg Stirum, Fribourg, Hedayat, Lemann, Melbourne, and Schwartz, and Mses. Farjallat, Fribourg, Khosrowshahi, and Sweeney.

Under the NYSE listing standards, a director qualifies as “independent” if the board of directors affirmatively determines that the director has no material relationship with the listed company. While the focus of the inquiry is independence from management, the board is required to consider broadly all relevant facts and circumstances in making an independence determination.

National Instrument 58-201–Corporate Governance Guidelines (“NI 58-201”), provides guidance on corporate governance practices with respect to director independence, which reflect best practices established by the Canadian Securities Administrators (the “CSA”), but are not intended to be prescriptive. Such best practices provide, among other things, that: (i) a company’s board of directors should have a majority of independent directors; (ii) the chair of the board should be an independent director; (iii) the board should appoint a nominating committee composed entirely of independent directors; and (iv) the board should appoint a compensation committee composed entirely of independent directors. Determinations in respect of “independence” for these purposes are similar to the requirements under the NYSE listing standards.

|

Page 12 |

| |

2024 Proxy Statement |

Restaurant Brands International |

Corporate Governance

In conducting its evaluations of Messrs. Behring, Castro-Neves and Schwartz, the Board considered their affiliation with 3G Capital and with 3G Restaurant Brands Holdings General Partner Ltd., which currently controls over 90% of the outstanding Partnership exchangeable units, representing approximately 27% of the combined voting interest in RBI. Additionally, in conducting its evaluation of Mr. Schwartz, the Board considered his role as the former CEO of RBI and its predecessor BKW, noting that it has been five years since his departure from the role of CEO. In conducting its evaluation of Mr. Lemann, the Board considered his father’s relationship with 3G Capital, noting that Mr. Lemann does not have any voting or other arrangement with his father or such 3G entities. Further, in conducting its evaluation of Ms. Fribourg, the Board noted that her father is a former director of RBI and that neither Continental Grain Company (“CGC”) nor its subsidiaries has any commercial agreement with RBI, and while noting the public disclosure of an investing relationship between CGC and 3G Capital, the Board determined that a business relationship between two independent shareholders should not affect the independence of directors affiliated with such shareholders.

Director Term Limits and Director Tenure

All directors are elected at the annual meeting of our shareholders for a term of one year. The Board does not believe it should expressly limit a director’s tenure on the Board or set an arbitrary retirement age policy. RBI values the contribution of directors who over time have developed greater insight into our company and operations and therefore provide an increasing contribution to the Board as a whole as well as the new perspectives of directors who more recently joined the Board. As an alternative to term limits or a retirement policy, prior to recommending to the Board that one or more current directors be submitted to the shareholders for re-election, the NCG Committee reviews the performance of each director potentially standing for election or re-election and makes appropriate recommendations to the Board concerning that director’s candidacy.

Overall, the average tenure of the nominees to our Board, as of the date of the Meeting, is approximately four years, with three directors joining since the beginning of 2022, five directors with less than 3 years tenure, two directors with 3 to 6 years tenure and three directors with more than six years tenure on our Board.

Election of Directors—Majority Voting

There are 10 positions available on the board for a one-year term ending at the next annual meeting of shareholders and 10 nominees listed in this circular. Shareholders can vote FOR or AGAINST each individual nominee.

Under the majority voting requirements under the CBCA, if there is only one nominee for each position available on the board, a nominee will be elected only if the number of votes cast in the nominee’s favour represents a majority of the votes cast for and against them, subject to certain exceptions described below. If there are more nominees than positions available on the board, the nominees receiving the highest number of votes FOR will be elected until all such positions have been filled.

If a nominee that is an incumbent director does not receive a majority of votes in their favor and positions remain available on the board, the nominee will be permitted to remain as a director until the earlier of the 90th day after the day of the election and the day on which their successor is appointed or elected. In addition, elected directors may also reappoint such an incumbent director even if they do not receive majority support in the most recent election in certain instances specified in the CBCA.

Director Orientation and Continuing Education

We provide access to appropriate orientation programs, sessions, or materials for new members of the Board for their benefit generally within a reasonable period of time after their election to the Board. We provided orientation sessions for Mr. Doyle, Ms. Farjallat and Ms. Fribourg, who joined the Board in 2023. These orientation sessions included written materials and presentations by various members of senior management regarding our businesses, strategic plans, and policies. We and our Board encourage, but do not require, directors to participate in relevant outside continuing education programs; for example, Mr. Lemann attended a seminar on The Making of a Corporate Athlete in November 2023.

| Restaurant Brands International |

2024 Proxy Statement |

| |

Page 13 |

Corporate Governance

Annual Evaluation Process

Our Board undertakes an annual evaluation process for the Board and each Committee that is overseen by the NCG Committee. This process includes feedback to determine how each Committee and the Board is functioning, including whether each contains the appropriate mix of members, skills, experience, and other characteristics. Additionally, the evaluation requests that directors specifically identify ways the Board and the Committees could improve effectiveness and functioning. The results of these assessments are reviewed by the entire Board. Additionally, the Board and the committees annually review the Corporate Governance Guidelines, committee charters and other policies for relevant updates.

Board Committees

The Board has three standing committees, the Audit Committee, the Compensation Committee, and the NCG Committee, as well as the Conflicts Committee. Each of the existing committees operates under a written charter. These charters set forth the responsibilities of each committee and are available in the “Investors—Corporate Governance” section of our website at www.rbi.com, and such information is also available in print to any shareholder who requests it through our Corporate Secretary.

Set forth below is a description of the responsibilities of each of our current Board committees and its current membership.

Audit Committee

| Audit Committee Members |

Audit Committee Functions | |

| • Ali Hedayat (Chair)

• Maximilien de Limburg Stirum

• Jason Melbourne |

› Oversee the quality and integrity of our consolidated financial statements and related disclosures;

› Oversee the qualifications, independence, performance and compensation of our independent auditor;

› Oversee any audit issues or difficulties and management’s response;

› Oversee the performance of our internal audit function;

› Oversee our systems of disclosure controls and procedures, and internal control over financial reporting;

› Oversee our compliance with all legal and regulatory requirements and our compliance program;

› Oversee risk assessment and risk management, including with respect to risks related to tax strategy, cash investing strategy, cybersecurity, data privacy and sustainability;

› Review and discuss with management workforce practices and risks that affect the brands and operations;

› Review and approve the Audit Committee report that is required by the SEC to be included in our annual proxy statement;

› Establish procedures for the receipt, retention and treatment of complaints regarding accounting, internal accounting controls or auditing matters; and

› Review and assess the effectiveness of our ESG strategies, policies, practices and programs around our Food, Planet and People and Communities pillars. |

Directors serving on our Audit Committee may not simultaneously serve on the audit committees of more than two other public companies unless the Board determines that such simultaneous service would not impair the ability of the director to effectively serve on the Audit Committee.

|

Page 14 |

| |

2024 Proxy Statement |

Restaurant Brands International |

Corporate Governance

The Board has determined that each member of the Audit Committee meets the independence requirements and is financially literate according to the NYSE listing standards and Canadian securities laws and that each member of the Audit Committee meets the enhanced independence standards for audit committee members required by the SEC. In 2023, the Board determined that Mr. Hedayat is qualified as an audit committee financial expert within the meaning of SEC rules and has accounting and related financial management expertise within the meaning of the NYSE listing standards. For more information regarding the business experience of Mr. Hedayat, see his biography under “Proposal 1 – Election of Directors.”

The discussion leader for executive sessions of the Audit Committee is generally Mr. Hedayat, the chair of the Audit Committee.

Compensation Committee

| Compensation Committee Members |

Compensation Committee Functions | |

| • Alexandre Behring (Chair)

• Cristina Farjallat

• Jason Melbourne |

› Oversee and set our compensation and benefits policies generally;

› Evaluate the performance of our CEO and the employees who report directly to the CEO (the “CEO Direct Reports”);

› Oversee and set compensation for the CEO, the CEO Direct Reports and the members of the Board;

› Administer equity compensation plans and stock ownership policies; and

› Review our management succession plan. |

The Compensation Committee establishes, reviews, and approves executive compensation based on, among other factors, an evaluation of the performance of the CEO and CEO Direct Reports in light of corporate goals and objectives relevant to executive compensation, including annual performance objectives, and makes recommendations to the Board with respect to the CEO’s compensation.

The Compensation Committee annually reviews succession planning for the CEO and CEO Direct Reports. This involves reviewing potential internal candidates for each of these roles, noting those that are ready in the short term and those that require additional development. The Board provides opportunities for directors to get to know employees who have been identified as succession candidates by inviting them to make presentations to the Board. For further details on executive compensation, see the CD&A, beginning on page 30 of this proxy statement.

Non-management director compensation is determined by the Board, upon recommendation of the Compensation Committee, taking into account general and specific demands of Board and committee service, Company performance, comparisons with other organizations of similar size and complexity, competitive factors, other forms of compensation received by directors, if any, and other factors which it deems relevant, all with the intent of aligning directors’ interests with the long-term interests of our shareholders. Other than Mr. Doyle, there are currently no management directors serving on the Board. For more details on director compensation, see the discussion under the heading “Director Compensation” below on page 26.

Pursuant to its charter, the Compensation Committee may delegate to one or more officers of RBI the authority to make grants and awards of stock rights or options to any persons other than the CEO, any CEO Direct Report, and any person covered by Section 16 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). The Compensation Committee has delegated this authority to the CEO. In addition, as permitted under applicable law and the NYSE listing standards, the Compensation Committee may delegate its authority to one or more subcommittees or the Chair of the Compensation Committee when it deems appropriate and in the best interests of RBI.

Pursuant to its charter, the Compensation Committee has the sole authority to retain and terminate any compensation consultant assisting the Compensation Committee in the evaluation of executive officer

| Restaurant Brands International |

2024 Proxy Statement |

| |

Page 15 |

Corporate Governance

compensation, including such compensation consultant’s fees and other retention terms. The Compensation Committee has engaged F.W. Cook to assist with developing a peer group to benchmark compensation.

The Board has determined that each member of the Compensation Committee (i) meets the independence requirements of the NYSE listing standards, including the heightened independence requirements specific to compensation committee members and (ii) meets the requirements of a non-employee director under the Exchange Act.

Our Board believes that the Compensation Committee charter outlines an objective process for determining executive compensation based on objective criteria such as evaluating the performance of our executive officers in light of defined performance objectives. The discussion leader for executive sessions of the Compensation Committee is generally Mr. Behring, the chair of the Committee.

Compensation Committee Interlocks and Insider Participation

From January 1, 2023 through May 23, 2023, Messrs. Behring and Fribourg and Ms. Khosrowshahi served on our Compensation Committee. From May 23, 2023 through December 31, 2023, Messrs. Behring and Melbourne and Ms. Farjallat served on our Compensation Committee. During 2023, none of these directors was an officer (as defined in Rule 3b-2 under the Exchange Act) or employee of RBI, or formerly an officer of RBI. None of our executive officers served on the compensation committee or board of any company that employed any person that served a member of the Compensation Committee or our Board during 2023.

Nominating and Corporate Governance Committee

| NCG Committee Members |

NCG Committee Functions | |

| • Alexandre Behring (Chair)

• Ali Hedayat

• Thecla Sweeney |

› Identify individuals qualified to serve as members of the Board and recommend to the Board proposed nominees;

› Advise the Board with respect to its composition, governance practices and procedures;

› Review and monitor criteria for the selection of new directors and nominees for vacancies on the Board, including procedures for reviewing potential nominees proposed by shareholders;

› Establish, monitor and recommend to the Board changes to the various committees and the qualifications and criteria for membership on each committee;

› Recommend to the Board directors to serve on each standing committee and assist the Board in evaluating independence of those directors;

› Recommend to the Board any action to be taken in connection with director resignations;

› Oversee and evaluate the Board’s performance and our compliance with corporate governance regulations, guidelines and principles; and

› Periodically review and recommend changes to our Governance Guidelines, articles of incorporation and by-laws as they relate to corporate governance issues. |

The Board is responsible for selecting and nominating directors for election, acting on the recommendation of the NCG Committee, and giving attention to the following qualifications and criteria:

| › | High personal and professional ethics, integrity, practical wisdom and mature judgment; |

|

Page 16 |

| |

2024 Proxy Statement |

Restaurant Brands International |

Corporate Governance

| › | Board training or prior public company board service, and/or senior executive experience in business, government, or education; |

| › | Expertise and skills that are useful to RBI and complementary to the background and experience of other Board members, as determined by the Board from time-to-time; |

| › | Diversity and balance among directors in terms of race, gender, geography, thought, viewpoints, backgrounds, skills, experience, and expertise from, among other areas, corporate environment (including different stakeholders in the quick service restaurant industry and the broader restaurant industry), accounting, finance, international, marketing, human resources, and legal services; and the target that 30% of directors are women by our 2024 Annual General Meeting, a target we met at our 2023 Annual General Meeting; |

| › | Willingness to devote the required amount of time to carrying out the duties and responsibilities of Board membership; |

| › | Commitment to serve on the Board over a period of several years to develop knowledge about RBI and its operations and provide continuity of Board members; |

| › | Willingness to represent our best interests and objectively appraise management’s performance; |

| › | Tenure with the Board, past contributions to the Board, and/or whether advanced age may impact the expected continued capacity to serve as a director; and |

| › | Anticipated future needs of the Board. |

Director Qualifications and Nomination

The NCG Committee believes that the Board should possess a broad range of skills, knowledge, business experience, and diversity of backgrounds that provides effective oversight of our business. In connection with the selection of any new director nominee, the NCG Committee will assess the skills and experience of the Board, as a whole, and of each of the individual directors. The NCG Committee will then seek to identify those qualifications and experience sought in any new candidate that will maintain a balance of knowledge, experience and capabilities on the Board and produce an effective Board.

Selection of candidates is based on, first, the needs of RBI, and second, identification of persons responsive to those needs. Although we do not have a formal, written policy relating to the identification and nomination of directors who are women, Aboriginal peoples, persons with disabilities or members of visible minorities, the NCG Committee seeks a diverse group of director candidates, including diversity with respect to race and gender. The NCG Committee believes that its goal is to assemble the best Board possible that will bring to us a variety of perspectives and skills derived from high quality business and professional experience. There are no specific, minimum qualifications that must be met by each nominee; however, the NCG Committee will evaluate a candidate’s experience, integrity and judgment as well other factors deemed appropriate in adding value to the composition of the Board as set forth in the Governance Guidelines.

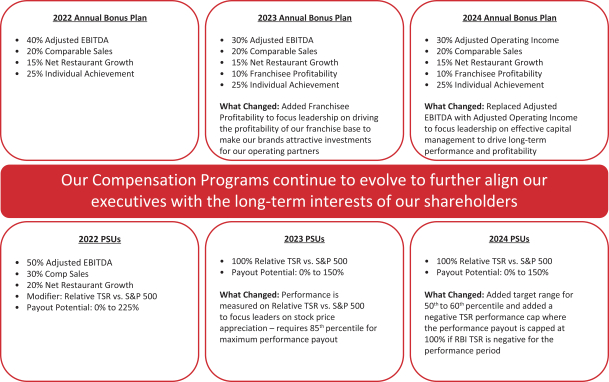

With regard to diversity, RBI is committed to seeking to attain a balance among directors. Specifically, any search firm retained to assist the NCG Committee in seeking new director candidates for the Board is instructed to seek to include diverse candidates in terms of race and gender as well as geography, thought, viewpoints, backgrounds, skills, experience, and expertise. The NCG Committee has sole authority to approve the search firm’s fees and other retention terms.