Exhibit 99(a)(1)(A)

OFFER TO PURCHASE THE COMMON SHARES OF

CAREY CREDIT INCOME FUND 2016 T

FOR THE QUARTER ENDED SEPTEMBER 30, 2016

CAREY CREDIT INCOME FUND 2016 T

FOR THE QUARTER ENDED SEPTEMBER 30, 2016

AT A PURCHASE PRICE OF $9.13 PER SHARE IN CASH

THE OFFER WILL EXPIRE AND THE LETTER OF TRANSMITTAL

MUST BE RECEIVED BY CAREY CREDIT INCOME FUND 2016 T BY

THE OFFER WILL EXPIRE AND THE LETTER OF TRANSMITTAL

MUST BE RECEIVED BY CAREY CREDIT INCOME FUND 2016 T BY

5:00 P.M., CENTRAL TIME, ON DECEMBER 19, 2016

UNLESS THE OFFER IS EXTENDED.

UNLESS THE OFFER IS EXTENDED.

To the Shareholders of Carey Credit Income Fund 2016 T:

Carey Credit Income Fund 2016 T, an externally managed, non-diversified, closed-end management investment company organized as a Delaware statutory trust (the “Company,” “we,” “us,” or “our”), is offering to purchase up to 71,951 shares of our issued and outstanding common shares (“Shares”). The purpose of the offer is to provide our shareholders (“Shareholders”) with limited interim liquidity, because there is otherwise no public market for the Shares. See Section 2 below. The offer is for cash at a price equal to $9.13 per share (“Purchase Price”), which is equal to the Company's net asset value per share ( "NAV") as of September 30, 2016, and is made upon the terms and subject to the conditions set forth in this Offer to Purchase and the related Letter of Transmittal (which, together with any amendments or supplements thereto, collectively constitute, the “Offer”). As the Company invests substantially all of its assets in shares of Carey Credit Income Fund, a Delaware statutory trust (the “Master Fund”), the Company’s offer to purchase Shares is being made at the same time as, and in parallel with, a corresponding offer by the Master Fund to the Company and its other feeder funds (the "Corresponding Offer"). The Offer will expire at 5:00 p.m., Central Time, on December 19, 2016 (the “Expiration Date”), and the Corresponding Offer will expire at 5:00 p.m., Central Time, on December 23, 2016, unless extended.

THE OFFER IS NOT CONDITIONED ON ANY MINIMUM NUMBER OF SHARES BEING TENDERED. HOWEVER, THE OFFER IS SUBJECT TO OTHER CONDITIONS, INCLUDING THE OCCURRENCE OF THE CORRESPONDING OFFER. SEE, SECTION 3 BELOW.

IMPORTANT INFORMATION

Shareholders who desire to tender their Shares should either: (i) properly complete and sign the Letter of Transmittal, provide thereon the original of any required signature guarantee(s), and mail or deliver it and any other documents required by the Letter of Transmittal; or (ii) request their broker, dealer, commercial bank, trust company or other nominee to effect the tender on their behalf. Shareholders who desire to tender Shares registered in the name of such a firm must contact that firm to affect a tender on their behalf. Tendering Shareholders will not be obligated to pay brokerage commissions in connection with their tender of Shares, but they may be charged a fee by such a firm for processing the tender(s). The Company reserves the absolute right to reject tenders determined not to be in appropriate form.

IF YOU DO NOT WISH TO TENDER YOUR SHARES, YOU NEED NOT TAKE ANY ACTION.

NONE OF THE COMPANY, ITS BOARD OF TRUSTEES (THE “BOARD”), THE MASTER FUND, CAREY CREDIT ADVISORS, LLC (“W. P. CAREY”), GUGGENHEIM PARTNERS INVESTMENT MANAGEMENT, LLC (TOGETHER WITH W. P. CAREY, THE “ADVISORS”) OR CAREY FINANCIAL, LLC (THE "DEALER MANAGER"), MAKES ANY RECOMMENDATION TO ANY SHAREHOLDER AS TO WHETHER TO TENDER OR REFRAIN FROM TENDERING SHARES. NO PERSON HAS BEEN AUTHORIZED TO MAKE ANY RECOMMENDATION ON BEHALF OF THE COMPANY, THE BOARD, THE MASTER FUND, THE ADVISORS OR THE DEALER MANAGER, AS TO WHETHER SHAREHOLDERS SHOULD TENDER OR REFRAIN FROM TENDERING SHARES PURSUANT TO THE OFFER OR TO MAKE ANY REPRESENTATION OR TO GIVE ANY INFORMATION IN CONNECTION WITH THE OFFER OTHER THAN AS CONTAINED HEREIN OR IN THE ACCOMPANYING LETTER OF TRANSMITTAL. IF MADE OR GIVEN, ANY SUCH RECOMMENDATION, REPRESENTATION OR INFORMATION MUST NOT BE RELIED UPON AS HAVING BEEN AUTHORIZED BY THE COMPANY, THE BOARD, THE MASTER FUND OR THE ADVISORS. SHAREHOLDERS ARE URGED TO EVALUATE CAREFULLY ALL INFORMATION IN THE OFFER, CONSULT THEIR OWN INVESTMENT AND TAX ADVISORS AND MAKE THEIR OWN DECISIONS WHETHER TO TENDER OR REFRAIN FROM TENDERING THEIR SHARES.

Neither the Securities and Exchange Commission nor any state securities commission nor any other regulatory authority has approved or disapproved of the Offer or determined if the information contained in the Offer materials is truthful or complete. Any representation to the contrary is a criminal offense.

The Offer does not constitute an offer to buy or the solicitation of an offer to sell securities in any circumstances or jurisdiction in which such offer or solicitation is unlawful. The delivery of the Offer materials shall not under any circumstances create any implication that the information contained therein is current as of any time subsequent to the date of such information.

The Date of this Offer to Purchase is November 10, 2016.

2

SUMMARY TERM SHEET

(Section references are to this Offer to Purchase)

This Summary Term Sheet highlights the material information concerning the Offer. For a more complete discussion of the terms and conditions of the Offer, you should read carefully this entire Offer to Purchase and the accompanying Letter of Transmittal.

What is the Offer?

• | This Offer is made to all of our Shareholders, without regard to the date you purchased your Shares. We are offering to purchase up to 71,951 Shares. The Offer is for cash at a Purchase Price of $9.13 per Share, upon the terms and subject to the conditions set forth in this Offer to Purchase and the accompanying Letter of Transmittal. Our NAV can vary on a daily basis. We only report our NAV on a quarterly basis in periodic reports and in current reports when we reprice our Shares in accordance with our repricing policy in connection with the sales of our Shares under a continuous offering. As a result, the Purchase Price may be higher or lower than the then current NAV at any given time during the Offer and at the conclusion of the Offer. The Purchase Price may be lower or higher than the price you paid for your Shares. |

• | The Company’s Offer is being made at the same time as, and in parallel with the Master Fund's Corresponding Offer, which is offering to purchase Master Fund shares in an amount up to 2.5% of the Master Fund's weighted average number of outstanding shares for the trailing four quarters. Participation by the Company (a Master Fund shareholder) in the Master Fund's Corresponding Offer is subject to the Master Fund’s 2.5% limitation on shares tendered. |

Why is the Company making the Offer?

• | The Offer is designed to provide limited interim liquidity for our Shareholders, since there is no current public market for our Shares. Under our share repurchase program, we intend to conduct quarterly tender offers for approximately 2.5% per quarter of our weighted average number of outstanding Shares for the trailing four quarters (the "Share Repurchase Program"). |

When will the Offer expire, and may the Offer be extended?

• | The Offer will expire at 5:00 p.m., Central Time, on December 19, 2016, unless extended. The Company may extend the period of time the Offer will be open by issuing a press release or making some other public announcement no later than 9:00 a.m., Eastern Time, on the next business day after the Offer otherwise would have expired. See Section 14 below. |

Are there conditions to the Offer?

• | Yes. If the total number of shares tendered in the Offer exceeds the maximum number of Shares we seek to repurchase, then we will repurchase Shares on a pro rata basis. Additionally, if the total number of Master Fund shares tendered in the Master Fund's Corresponding Offer exceeds the maximum number of shares the Master Fund seeks to repurchase, the Master Fund will repurchase its shares on a pro rata basis which may effect the number of Shares that we are allowed to repurchase from our Shareholders. See Section 3 below, for a more complete description of the conditions to the Offer. |

How do I tender my Shares?

• | If your Shares are registered in your name, you should obtain the Offer, which consists of the Offer to Purchase, the related Letter of Transmittal and any amendments or supplements thereto, read the materials, and if you should decide to tender, complete a Letter of Transmittal and submit any other documents required by the Letter of Transmittal. These materials must be received by the Company at the address listed in Section 4 of this Offer to Purchase, in proper form, before 5:00 p.m., Central Time, on December 19, 2016 (unless the Offer is extended by the Company, in which case the new deadline will be as stated in the public announcement of the extension). If your Shares are held by a broker, dealer, commercial bank, trust company or other nominee (i.e., in “street name”), you should contact that firm to obtain the package of information necessary to make your decision, and you can only tender your Shares by directing that firm to complete, compile and deliver the necessary documents for submission to the Company by 5:00 p.m., Central Time, on December 19, 2016 (or if the Offer is extended, the Expiration Date as extended). See Section 4 below. |

Is there any cost to me to tender?

• | There is no cost charged by the Company in connection with the Offer. Your broker, dealer, investment advisor, custodian, commercial bank, trust company or other nominee may charge you fees according to its individual policies. See the accompanying Letter of Transmittal. |

3

May I withdraw my Shares after I have tendered them and, if so, how and by when?

• | Yes, you may withdraw your Shares at any time prior to the expiration of the Offer (including any extension period) by submitting a letter of instruction to the Company at the address listed in Section 4 of this Offer to Purchase. In addition, you may withdraw your tendered Shares after the expiration of the Offer, in the event that the tendered Shares have not been accepted for payment by January 18, 2017 (which is 40 business days after the commencement of the Offer). See Section 5 below for more details. |

If I change my mind after tendering my shares and it is past the Expiration Date, and I have received payment for my tendered Shares may I rescind my tender?

• | No. |

May I place any conditions on my tender of Shares?

• | No. |

Who may sign on my behalf?

• | Only the holder of record as registered on the account. |

Is there a limit on the number of Shares I may tender?

• | You may tender some or all of the Shares you own as of the Expiration Date of the Offer. However, we are limiting the aggregate number of Shares to be repurchased from our Shareholders to 71,951 Shares. Additionally, the Master Fund is limiting the aggregate number of its shares to be repurchased from all of its shareholders to 226,583 shares. See Section 1 below. |

What if more Shares are tendered (and not timely withdrawn) than the number of Shares that may be repurchased in the Offer?

• | The Company will purchase duly tendered Shares from tendering Shareholders pursuant to the terms and conditions of the Offer on a pro rata basis in accordance with the number of Shares tendered by each Shareholder (and not timely withdrawn). Additionally, the Master Fund will purchase duly tendered shares from its tendering shareholders pursuant to the terms and conditions of the Corresponding Offer on a pro rata basis in accordance with the number of shares tendered by each of its shareholder (and not timely withdrawn), which may limit the amount of Shares that we are able to purchase pursuant to the Offer. |

If I decide not to tender, how will the Offer affect the Shares I hold?

• | If the Company purchases any Shares, then your percentage ownership interest in the Company will increase after completion of the Offer. See Section 10 below. |

Does the Company have the financial resources to make payment for Shares accepted in the Offer?

• | Yes. See Section 7 below. |

If Shares I tender are accepted by the Company, when will payment be made?

• | Payment for properly tendered Shares (not timely withdrawn) will be made as promptly as practicable following the expiration of the Offer. See Section 6 below. |

Is my sale of Shares in the Offer a taxable transaction?

• | We anticipate U.S. Shareholders, other than those who are tax-exempt, who sell Shares in the Offer will recognize capital gain or loss for U.S. federal income tax purposes equal to the difference between the cash they receive for the Shares sold and their adjusted tax basis in the Shares. At the end of the calendar year, most taxpayers who sell their Shares will receive a Form 1099-B which will also be provided to the Internal Revenue Service. See Section 13 below, for details, including the nature of the income or loss and the possibility of other tax treatment. Section 13 also presents a discussion of tax matters for Non-U.S. Shareholders. Please consult your tax advisor as well. |

Is the Company required to complete the Offer and purchase all Shares tendered, assuming the total Shares tendered are less than the total Shares offered?

• | Under most circumstances, yes. There are certain circumstances, however, in which the Company will not be required to purchase any Shares tendered, including circumstances where the Master Fund limits the number of its shares purchased under the Corresponding Offer. See Section 3 below. |

4

Is there any reason Shares tendered would not be accepted?

• | In addition to those circumstances, described in Section 3, under which the Company is not required to accept tendered Shares, the Company has reserved the right to reject any and all tenders determined by it not to be in appropriate form. For example, a tender will be rejected if it does not include original signature(s) or the original of any required signature guarantee(s). |

How will tendered Shares be accepted for payment?

• | Properly tendered Shares will be accepted for payment by the Company promptly following the expiration of the Offer. See Section 6 below. |

What action need I take if I decide not to tender my Shares?

• | None. |

Does management encourage Shareholders to participate in the Offer, and will they participate in the Offer?

• | None of the Company, the Board, the Master Fund, the Advisors or the Dealer Manager is making any recommendation to tender, or not to tender, Shares in the Offer. Based upon information provided or available to us, none of our trustees, officers or affiliates intends to tender Shares pursuant to the Offer. The Offer does not, however, restrict the purchase of Shares pursuant to the Offer from any such person. See Section 9 below. |

How do I obtain information?

• | Questions and requests for assistance or requests for additional copies of the Offer to Purchase, the Letter of Transmittal and all other Offer documents should be directed to the Company or the DST Systems, Inc., our transfer agent (the “Transfer Agent”), as follows: |

Our website: | www.careycredit.com/2016T |

Our toll-free phone number: | 1-800-WP CAREY |

U.S. mail: | Carey Credit Income Fund 2016 T c/o DST Systems, Inc. 430 W. 7th Street, Suite 219145 Kansas City, Missouri 64105-1407 |

If you do not own Shares directly, you should obtain this information and the documents from your broker, dealer, commercial bank, trust company or other nominee, as appropriate. Shareholders may also contact their broker, dealer, commercial bank, trust company or nominee for assistance concerning the Offer.

The properly completed Letter of Transmittal should be sent to the Company at the following address:

Carey Credit Income Fund 2016 T

c/o DST Systems, Inc.

430 W. 7th Street, Suite 219145

Kansas City, Missouri 64105-1407

Phone 1-800-WP CAREY

430 W. 7th Street, Suite 219145

Kansas City, Missouri 64105-1407

Phone 1-800-WP CAREY

5

1. Purchase Price; Number of Shares; Expiration Date.

We are offering to purchase 71,951 Shares. The purpose of the Offer is to provide Shareholders with limited interim liquidity because there is otherwise no public market for the Shares. See Section 2 below. The Offer is for cash at a price per share equal to our NAV for the quarter ended September 30, 2016, or $9.13 per share, and is made upon the terms and subject to the conditions set forth in this Offer to Purchase and the accompanying Letter of Transmittal. You will not receive interest on the Purchase Price under any circumstances, and you will not be entitled to any distributions on declared distribution record dates that occur on or after the date that Company has accepted your Shares for purchase.

The Company’s Offer is being made at the same time as, and in parallel with, a corresponding offer by the Master Fund, which is offering to purchase Master Fund shares in an amount up to 2.5% of the Master Fund's weighted average number of outstanding shares for the trailing four quarters. Participation by the Company (a Master Fund shareholder) in the Master Fund’s offer is subject to the Master Fund’s 2.5% limitation on shares tendered.

Subject to the Master Fund’s tender offer, as discussed below, if the number of Shares duly tendered pursuant to the Offer (and not withdrawn, as provided in Section 5 below) is greater than the number of Shares we are repurchasing in the Offer, we will repurchase Shares on a pro rata basis, in accordance with the number of Shares duly tendered by or on behalf of each Shareholder (and not withdrawn). As a result, we may repurchase less than the full amount of Shares that you want us to repurchase. If Master Fund shares in excess of 2.5% of the Master Fund's weighted average number of outstanding shares for the trailing four quarters are duly tendered to the Master Fund before the Expiration Date and are not withdrawn before the Expiration Date as part of the Master Fund’s corresponding tender offer, the Master Fund, in its sole discretion, may do any of the following: (a) accept the additional Master Fund shares permitted to be accepted pursuant to Rule 13e-4(f)(3) under the Securities Exchange Act of 1934, as amended (the “Exchange Act”); (b) extend the Master Fund’s corresponding offer, if necessary, and increase the amount of Master Fund shares which the Master Fund is offering to purchase to an amount it believes sufficient to accommodate the excess Master Fund shares tendered as well as any Master Fund shares tendered on or before the specified expiration date in such extension of the Master Fund’s corresponding offer; and (c) accept Master Fund shares tendered before the expiration date and not withdrawn before the expiration date for payment on a pro rata basis based on the aggregate net asset value of tendered Master Fund shares. The Company will take the same action with respect to this Offer as the Master Fund, in its discretion, takes with respect to the Master Fund’s corresponding offer. Additionally, the Offer may be extended, amended or canceled in various other circumstances as described in Section 3 below.

As of September 30, 2016, there were 10,087,622 Shares issued and outstanding, and there were 1,820 holders of record of Shares. Certain of these holders of record were brokers, dealers, commercial banks, trust companies and other institutions that held Shares in nominee name on behalf of multiple beneficial owners.

The Offer will remain open until 5:00 p.m., Central Time, on December 19, 2016, unless and until we, in our discretion, extend the period of time during which the Offer will remain open. If we extend the period of time during which the Offer remains open, the term “Expiration Date” will refer to the latest time and date at which the Offer expires. See Section 14 below, for a description of our rights to extend, delay, terminate and/or amend the Offer.

We will publish a notice to all Shareholders by means of a public press release or some other public announcement, if we decide to extend, terminate, supplement or amend the terms of the Offer. If the Offer is scheduled to expire within ten (10) business days from the date we notify you of a significant amendment to the Offer, we also intend to extend the Offer, if necessary, to ensure that the Offer remains open for at least ten (10) business days after the date we publish notice of the amendment.

A “business day” means any day other than a Saturday, Sunday or federal holiday and consists of the time period from 12:01 a.m., through midnight, Eastern Time.

In the judgment of the Board, including the independent trustees, the Offer is in the best interests of our Shareholders and does not violate applicable law. Pursuant to our declaration of trust, subject to certain limited exceptions, we generally may not make a distribution to shareholders, including pursuant to our share repurchase program, if, either prior to or after giving effect to the distribution, the capital of the Company is or would be impaired.

The Board also considered the following factors, among others, in making its determination regarding whether to cause us to offer to repurchase Shares and under what terms:

• | the effect of such repurchases on our qualification as a regulated investment company, or RIC (including the consequences of any necessary asset sales); |

• | the liquidity of our assets (including fees and costs associated with disposing of assets); |

• | our investment plans and working capital requirements; |

• | the relative economies of scale with respect to our size; |

6

• | our history in repurchasing Shares or portions thereof; and |

• | the condition of the securities markets. |

The Board has approved the Offer. The Board recognizes that the decision to accept or reject the Offer is an individual one that should be based on a variety of factors; and Shareholders should consult with their personal advisors if they have questions about their financial and/or tax situations. Accordingly, we are not expressing any opinion as to whether a Shareholder should accept or reject the Offer.

2. Purpose of the Offer; Plans or Proposals of the Company.

The purpose of the Offer is to provide limited interim liquidity to our Shareholders, because there is no public market for the Shares. Under our Share Repurchase Program, we plan to conduct quarterly tender offers for approximately 2.5% per quarter of our weighted average number of outstanding Shares for the trailing four quarters. We will repurchase tendered Shares to allow our Shareholders to receive a price based upon our NAV as of the end of our most recent fiscal quarter prior to the date of repurchase. Our Share Repurchase Program recognizes that our Shares are not listed on a national securities exchange and have limited liquidity prior to the occurrence of a “liquidity event.” A liquidity event could include: (i) the purchase by the Master Fund for cash of all our Master Fund shares at net asset value and the distribution of that cash to our Shareholders on a pro rata basis in connection with our complete liquidation and dissolution; or (ii) subject to the approval of the shareholders of each feeder fund, a listing of the shares of the Master Fund on a national securities exchange and the liquidation and dissolution of each feeder fund, including the Company, at which point all shareholders of each feeder fund would become direct shareholders of the Master Fund. We do not know at this time what circumstances will exist in the future and therefore we do not know what factors our Board will consider in determining whether to pursue a liquidity event.

At the sole discretion of our Board, we may use cash on hand, cash available from borrowings and cash from liquidation of investments as of the end of the applicable period to repurchase Shares.

We do not have any present plans or proposals and are not engaged in any negotiations that relate to or would result in (i) any extraordinary transaction, such as a merger, reorganization or liquidation, involving the Company or any of its subsidiaries; (ii) any purchase, sale or transfer of a material amount of assets of the Company or any of its subsidiaries, other than in connection with transactions in the ordinary course of the Company’s operations and for purposes of funding the Offer; (iii) any material change in the Company’s present dividend rate or policy, or indebtedness or capitalization of the Company; (iv) any change in the present Board or management of the Company, including, but not limited to, any plans or proposals to change the number or the term of trustees or to fill any existing vacancies on the Board or any material change to the Advisory Agreement; (v) any other material change in the Company’s corporate structure or business, including any plans or proposals to make any changes in the Company’s investment policy for which a vote would be required by Section 13 of the Investment Company Act of 1940, as amended; (vi) any class of equity securities of the Company becoming eligible for termination of registration pursuant to Section 12(g)(4) of the Exchange Act; (vii) the suspension of the Company’s obligation to file reports pursuant to Section 15(d) of the Exchange Act; (viii) the acquisition by any person of additional securities of the Company, or the disposition of securities of the Company, other than in connection with transactions in the ordinary course of the Company’s operations, including the Company’s continuous offering of up to 104,712,041 Common Shares, and the registration of up to $1,000,000,000 of the Company’s Common Shares, which the Company may offer from time to time in one or more offerings; or (ix) any changes in the Company’s declaration of trust, bylaws or other governing instruments or other actions that could impede the acquisition of control of the Company.

3. Certain Conditions of the Offer.

Notwithstanding any other provision of the Offer, we will not be required to purchase any Shares tendered pursuant to the Offer if such purchase will cause us to be in violation of the securities, commodities or other laws of the United States or any other relevant jurisdiction. Further, we will not be required to purchase any Shares tendered in the Offer if there is any (i) material legal action or proceeding instituted or threatened which, in the Board’s judgment, challenges the Offer or otherwise materially adversely affects the Company, (ii) declaration of a banking moratorium by federal, state or foreign authorities or any suspension of payment by banks in the United States, New York State or in a foreign country which is material to the Company, (iii) limitation which affects the Company or the issuers of its portfolio securities imposed by federal, state or foreign authorities on the extension of credit by lending institutions or on the exchange of foreign currencies, (iv) commencement of war, armed hostilities or other international or national calamity directly or indirectly involving the United States or any foreign country that is material to the Company, (v) the Master Fund has not repurchased a sufficient number of its shares from us, or (vi) other event or condition that, in the Board’s judgment, would have a material adverse effect on the Company or its Shareholders if Shares tendered pursuant to the Offer were purchased.

The foregoing conditions are for our sole benefit and may be asserted by us regardless of the circumstances giving rise to any such condition, and any such condition may be waived by us, in whole or in part, at any time and from time to time in our judgment. Our failure at any time to exercise any of the foregoing rights shall not be deemed a waiver of any such right; the waiver of any such right with respect to particular facts and circumstances shall not be deemed a waiver with respect to any

7

other facts or circumstances; and each such right shall be deemed an ongoing right which may be asserted at any time and from time to time, provided that any such waiver shall apply to all tenders of Shares. Any determination by us concerning the events described in this Section 2 shall be final and binding. We reserve the right, at any time during the pendency of the Offer, to amend, extend or terminate the Offer in any respect. See Section 14 below.

4. Procedures for Tendering Shares.

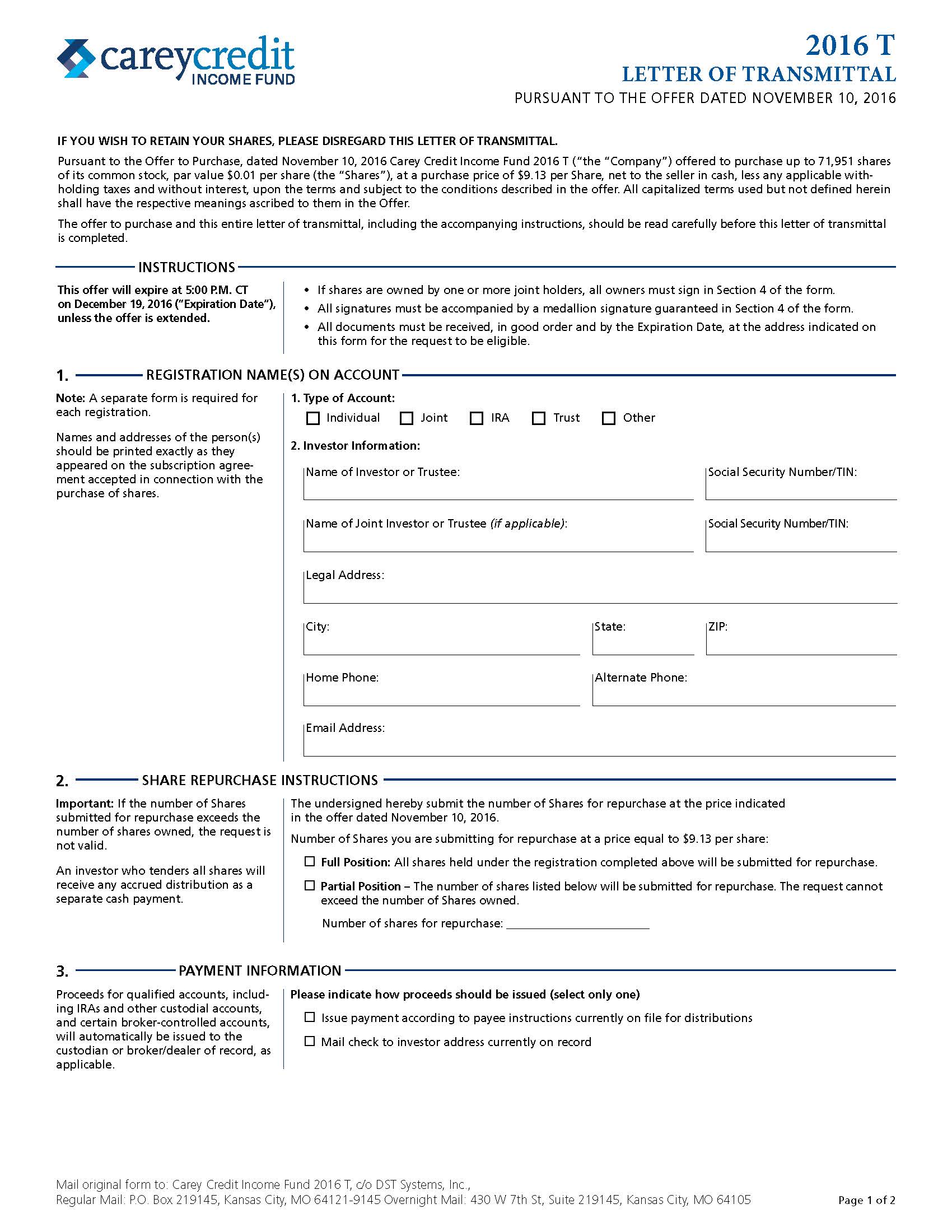

Participation in the Offer is voluntary. If you elect not to participate in the Offer, your Shares will remain outstanding. To participate in the Offer, you must complete and deliver the accompanying Letter of Transmittal to us at:

Carey Credit Income Fund 2016 T

c/o DST Systems, Inc.

430 W. 7th Street, Suite 219145

Kansas City, Missouri 64105-1407

Phone 1-800-WP CAREY

c/o DST Systems, Inc.

430 W. 7th Street, Suite 219145

Kansas City, Missouri 64105-1407

Phone 1-800-WP CAREY

The Letter of Transmittal must be received by us at the address above, before 5:00 p.m., Central Time, on the Expiration Date.

a. Proper Tender of Shares and Method of Delivery. For Shares to be properly tendered pursuant to the Offer, a properly completed and duly executed Letter of Transmittal bearing original signature(s) for all Shares to be tendered and any other documents required by the Letter of Transmittal must be physically received by us at the address listed above, before 5:00 p.m., Central Time, on the Expiration Date. These materials may be sent via mail, courier or personal delivery. Shareholders who desire to tender Shares registered in the name of a broker, dealer, commercial bank, trust company or other nominee must contact that firm to effect a tender on their behalf.

THE METHOD OF DELIVERY OF THE LETTER OF TRANSMITTAL AND ANY OTHER REQUIRED DOCUMENTS IS AT THE OPTION AND SOLE RISK OF THE TENDERING SHAREHOLDER. IF DOCUMENTS ARE SENT BY MAIL, REGISTERED MAIL WITH RETURN RECEIPT REQUESTED, PROPERLY INSURED, IS RECOMMENDED.

Shareholders have the responsibility to cause their Shares to be tendered, the Letter of Transmittal properly completed and bearing original signature(s) and the original of any required signature guarantee(s), and any other documents required by the Letter of Transmittal, to be timely delivered. Timely delivery is a condition precedent to acceptance of Shares for purchase pursuant to the Offer and to payment of the purchase amount.

b. Determination of Validity. All questions as to the validity, form, eligibility (including time of receipt) and acceptance of tenders will be determined by us, in our sole discretion, which determination shall be final and binding. We reserve the absolute right to reject any or all tenders determined not to be in appropriate form or to refuse to accept for payment, purchase, or pay for, any Shares if accepting, purchasing or paying for such Shares would be unlawful. We also reserve the absolute right to waive any of the conditions of the Offer or any defect in any tender, whether generally or with respect to any particular Share(s) or Shareholder(s). Our interpretations, in consultation with our counsel, of the terms and conditions of the Offer shall be final and binding.

W. P. CAREY, AS ADMINISTRATOR FOR THE COMPANY, WILL NOT BE OBLIGATED TO GIVE ANY NOTICE OF ANY DEFECT OR IRREGULARITY IN ANY TENDER, AND WILL NOT INCUR ANY LIABILITY FOR FAILURE TO GIVE ANY SUCH NOTICE.

c. United States Federal Income Tax Withholding. To prevent the potential imposition of U.S. federal backup withholding tax on the gross payments made pursuant to the Offer, prior to receiving such payments, each Shareholder accepting the Offer who has not previously submitted to the Company a correct, completed and signed Internal Revenue Service (“IRS”) Form W‑9 (“Form W‑9”) or substituted Form W-9 (included with the original subscription) (for U.S. Shareholders) or IRS Form W‑8BEN (“Form W‑8BEN”), IRS Form W‑8IMY (“Form W‑8IMY”), IRS Form W‑8ECI (“Form W‑8ECI”), or other applicable form (for Non-U.S. Shareholders), or otherwise established an exemption from such withholding, must submit the appropriate form to the Company. See Section 13 below.

For this purpose, a “U.S. Shareholder” is, in general, a Shareholder that is (i) a citizen or resident of the United States, (ii) a corporation, partnership or other entity created or organized in or under the laws of the United States or any political subdivision thereof, (iii) an estate the income of which is subject to United States federal income taxation regardless of the source of such income or (iv) a trust if (A) a court within the United States is able to exercise primary supervision over the administration of the trust and (B) one or more U.S. persons have the authority to control all substantial decisions of the trust. A “Non-U.S. Shareholder” is any Shareholder other than a U.S. Shareholder.

8

5. Withdrawal Rights.

At any time prior to 5:00 p.m., Central Time, on the Expiration Date, and, if the Shares have not by then been accepted for payment by us, at any time after January 18, 2017 (which is 40 business days after the commencement of the Offer), any Shareholder may withdraw all or any number of the Shares that the Shareholder has tendered. To be effective, a written notice of withdrawal must be timely received by us, via mail, courier, facsimile or personal delivery, at the address listed in Section 4 of this Offer to Purchase. Any notice of withdrawal must include submitting a letter of instruction to the Company at the address listed in Section 4 of this Offer to Purchase, and specify the name(s) of the person having tendered the Shares to be withdrawn, and the number of Shares to be withdrawn.

All questions as to the validity, form and eligibility (including time of receipt) of notices of withdrawal will be determined by us in our sole discretion, which determination shall be final and binding. Shares properly withdrawn will not thereafter be deemed to be tendered for purposes of the Offer. Withdrawn Shares, however, may be re-tendered by following the procedures described in Section 4, above, prior to 5:00 p.m., Central Time, on the Expiration Date.

6. Payment for Shares.

Our acceptance of your Shares will form a binding agreement between you and the Company on the terms and subject to the conditions of the Offer. We will have accepted for payment Shares validly submitted for purchase and not withdrawn, when we give oral or written notice to the Transfer Agent, of our acceptance for payment of such Shares pursuant to the Offer. The Purchase Price will be equal to $9.13 per share. You will not receive interest on the Purchase Price under any circumstances.

In all cases, payment for Shares purchased pursuant to the Offer will be made only after timely receipt by us of: (i) a Letter of Transmittal properly completed and bearing original signature(s) and any required signature guarantee(s) and (ii) any other documents required by the Letter of Transmittal. Shareholders may be charged a fee by a broker, dealer or other institution for processing the tender requested. We may not be obligated to purchase Shares pursuant to the Offer under certain conditions. See Section 3, above.

Any tendering Shareholder or other payee who has not previously submitted a correct, completed and signed Form W‑9, Form W‑8BEN, Form W‑8IMY, Form W‑8ECI or other appropriate form, as necessary, and who fails to complete fully, and sign either the Substitute Form W-9 in the Letter of Transmittal or other appropriate form (e.g., Form W‑8BEN, Form W‑8IMY or Form W‑8ECI) and provide such properly completed form to us may be subject to federal backup withholding tax on the gross proceeds paid to such Shareholder or other payee pursuant to the Offer. See Section 13 regarding this tax as well as possible withholding on the gross proceeds payable to tendering Non-U.S. Shareholders.

7. Source and Amount of Funds.

The total cost to us of purchasing a maximum of 71,951 of our issued and outstanding Shares pursuant to the Offer, at the Purchase Price of $9.13 per Share, would be $656,913. As discussed in Section 1, we are limiting the aggregate number of Shares to be repurchased to 71,951 Shares. We intend to purchase Shares validly tendered and not withdrawn in the Offer from (a) cash on hand, (b) proceeds from the issuance and sale of the Company's Shares and/or (c) proceeds from the parallel Corresponding Offer of the Master Fund.

8. Financial Statements.

Financial statements have not been included herein because the consideration offered to Shareholders consists solely of cash; neither the Offer nor the Corresponding Offer is subject to any financing condition; and the Company and the Master Fund are public reporting companies under Section 13(a) of the Exchange Act and file their reports electronically on the EDGAR system.

Information about the Company and the Master Fund's reports filed with the United States Securities and Exchange Commission (the “SEC”) can be viewed and copied at the SEC’s Public Reference Room in Washington, DC. Information about the Reference Room’s operations may be obtained by calling the SEC at (202) 551‑8090. Reports and other information about the Company and the Master Fund are available on the EDGAR Database on the SEC’s website (www.sec.gov); and copies of this information may be obtained, after paying a duplicating fee, by electronic request at the following e-mail address: publicinfo@sec.gov, or by writing the Public Reference Section of the SEC, 100 F Street, N.E., Washington, DC 20549.

9. | Interest of Trustees, Executive Officers and Certain Related Persons; Transactions and Arrangements Concerning the Shares. |

As of November 8, 2016, there are no persons that are beneficial owners of 5% or more of our outstanding Shares, as determined in accordance with Rule 13d-3 under the Exchange Act.

9

Summary of Ownership by Officers and Directors

The trustees and executive officers of the Company and the aggregate number and percentage of the Shares each of them beneficially owned as of September 30, 2016, are set forth in the table below. The address of each of them is c/o Carey Credit Income Fund 2016 T, 50 Rockefeller Plaza, New York, New York 10020.

Name | Number of Shares | % Of Class(1) | ||

Trustees and Executive Officers: | ||||

Interested Trustees: | ||||

Mark J. DeCesaris | — | — | ||

Jeffrey B. Abrams | — | — | ||

Independent Trustees: | ||||

Marc S. Goodman | — | — | ||

Eric Rosenblatt | — | — | ||

Peter E. Roth | — | — | ||

Executive Officers: | ||||

Mark J. DeCesaris | — | — | ||

Mark M. Goldberg | — | — | ||

Paul S. Saint-Pierre | — | — | ||

Robert F. Amweg | — | — | ||

Kamal Jafarnia | — | — | ||

John V. Palmer | — | — | ||

% All trustees and officers as a group (10 persons) | — | —% | ||

(1) Based on a total of 10,087,622 Shares issued and outstanding as of September 30, 2016.

Except for transactions pursuant to the distribution reinvestment plan, based upon our records and upon information provided to us, there have not been any other transactions in Shares that were effected during such period by any of our trustees or executive officers, any person controlling the Company, any director, trustee or executive officer of any corporation or other person ultimately in control of the Company, any associate or minority-owned subsidiary of the Company or any executive officer, trustee or director of any subsidiary of the Company. Except as set forth in the Offer or the Corresponding Offer, neither we nor, to the best of our knowledge, any of the above-mentioned persons, is a party to any contract, arrangement, understanding or relationship with any other person relating, directly or indirectly, to the Offer with respect to any of our securities (including, but not limited to, any contract, arrangement, understanding or relationship concerning the transfer or the voting of any such securities, joint ventures, loan or option arrangements, puts or calls, guaranties of loans, guaranties against loss or the giving or withholding of proxies, consents or authorizations). Based upon information provided or available to us, none of our trustees, officers or affiliates intends to tender Shares pursuant to the Offer. The Offer does not, however, restrict the purchase of Shares pursuant to the Offer from any such person.

10. Certain Effects of the Offer and the Corresponding Offer.

The purchase of Shares pursuant to the Offer and the Corresponding Offer will have the effect of i) increasing the proportionate interest in the Company of Shareholders who do not tender Shares and ii) increasing the Company's proportionate interest in the Master Fund to the extent it tenders less common shares than other shareholders of the Master Fund. All Shareholders remaining after the Offer will be subject to any increased risks associated with the reduction in the number of outstanding Shares and the reduction in the Company’s assets resulting from payment for the tendered Shares. See Section 7, above. Similarly, the Company will be subject to any increased risks associated with the reduction in the number of outstanding common shares and the reduction in the Master Fund's assets resulting from payment for the tendered Master Fund's common shares. All Shares and common shares purchased by the Company and the Master Fund pursuant to the Offer and the Corresponding Offer will be retired and thereafter will be authorized and unissued Shares and authorized and unissued common shares, respectively.

11. Certain Information about the Company.

We are a non-diversified closed-end management investment company that has elected to be treated as a business development company under the 1940 Act. Formed as a Delaware statutory trust on September 5, 2014, we are externally managed by the Advisors. The Advisors are collectively responsible for sourcing potential investments, conducting due diligence on prospective investments, analyzing investment opportunities, structuring investments and monitoring our portfolio on an ongoing basis.

10

Both of the Advisors are registered as investment advisers with the SEC. We intend to elect to be treated for federal income tax purposes, and intend to qualify annually, as a regulated investment company, or a RIC, under the Internal Revenue Code of 1986, as amended, or the Code.

Our investment objective is to provide our Shareholders with current income capital preservation, and, to a lesser extent, long-term capital appreciation. We intend to meet our investment objective investing primarily in large, privately-negotiated loans to private middle market U.S. companies. We will seek to achieve our investment objectives by investing all or substantially all of our assets in the Master Fund, an externally managed, non-diversified, closed-end management investment company that has elected to be treated as a BDC under the 1940 Act. Thus, our investment results will be directly dependent on investment results of the Master Fund. The Master Fund has the same investment objectives as us. The Master Fund is managed by the Advisors and it intends to elect to be treated for federal income tax purposes, and intends to qualify annually, as a RIC under the Code. All portfolio company investments will be made at the Master Fund level. The Master Fund will invest primarily in large, privately-negotiated loans to private middle market U.S. companies, but may also invest in other debt investments, options, or other forms of equity participation. There is no minimum or maximum percentage of the Master Fund's assets that may be invested in any of the investment categories identified above.

Our investment strategy leverages our Advisors' deep research teams with a relative value perspective across all corporate credit asset types and industries, creating a larger, proprietary opportunity set that lends itself to generating best ideas. This strategy focuses on investing primarily in large, privately-negotiated loans to private middle market U.S. companies. We seek to invest in businesses that have a strong reason to exist and have demonstrated competitive and strategic advantages. These companies generally possess distinguishing business characteristics, such as a leading competitive position in a well-defined market niche, unique brands, sustainable profitability and cash flow, and experienced management.

Our address is Carey Credit Income Fund 2016 T, 50 Rockefeller Plaza, New York, New York 10020.

12. Additional Information.

Information concerning our business, including our background, strategy, business, investment portfolio, competition and personnel, as well as our financial information, is included in:

• | our Annual Report on Form 10-K for the fiscal year ended December 31, 2015, as filed with the SEC; |

• | our Quarterly Report on Form 10-Q for the quarterly periods ended March 31, 2016, June 30, 2016 and September 30, 2016, as filed with the SEC; |

• | our Current Reports on Form 8-K (excluding any information furnished therein), as filed with the SEC since December 31, 2015; and |

• | our Issuer Tender Offer Statement on Schedule TO, as filed with the SEC on November 10, 2016. |

Each of the foregoing documents is incorporated by reference herein. We also hereby incorporate by reference additional documents that we may file with the SEC prior to the Expiration Date. You may inspect and copy these reports and other information at the Public Reference Room of the SEC at 100 F Street, N.E., Washington, D.C. 20549. You may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. The SEC maintains an Internet site that contains reports and information statements and other information filed electronically by us with the SEC, which are available on the SEC’s website at www.sec.gov. Copies of these reports and information statements and other information may be obtained, after paying a duplicating fee, by electronic request at the following e-mail address: publicinfo@sec.gov, or by writing the SEC’s Public Reference Section, 100 F Street, N.E., Washington, D.C. 20549.

13. Certain United States Federal Income Tax Consequences.

The following discussion is a general summary of the federal income tax consequences of a sale of Shares pursuant to the Offer. This summary is based upon the Code, applicable Treasury regulations promulgated thereunder, rulings and administrative pronouncements and judicial decisions, changes in which could affect the tax consequences described herein and could occur on a retroactive basis. This summary addresses only Shares held as capital assets. This summary does not address all of the tax consequences that may be relevant to Shareholders in light of their particular circumstances. In addition, this summary does not address (i) any state, local or foreign tax considerations that may be relevant to a Shareholder’s decision to tender Shares pursuant to the Offer; or (ii) any tax consequences to any corporation, partnership, estate, trust or other entity created or organized in or under the laws of the United States or any political subdivision thereof for U.S. federal tax purposes (or their partners, members, etc.) tendering Shares pursuant to the Offer. Shareholders should consult their own tax advisors regarding the tax consequences of a sale of Shares pursuant to the Offer, as well as the effects of state and local tax laws. See Section 4.c. “Procedures for Tendering Shares—United States Federal Income Tax Withholding,” above. The Company has no liability to determine the tax treatment of Shares tendered under this Offer for individual Shareholders.

a. U.S. Shareholders. The sale of Shares pursuant to the Offer will generally be a sale or exchange for federal income tax purposes or under certain circumstances, as a “dividend.” Under Section 302(b) of the Code, a sale of Shares pursuant to the

11

Offer generally will be treated as a “sale or exchange” if the receipt of cash: (i) results in a “complete termination” of the Shareholder’s interest in the Company, (ii) is “substantially disproportionate” with respect to the Shareholder or (iii) is ”not essentially equivalent to a dividend” with respect to the Shareholder. In determining whether any of these tests has been met, Shares actually owned, as well as Shares considered to be owned by the Shareholder by reason of certain constructive ownership rules set forth in Section 318 of the Code, generally must be taken into account. If any of these three tests for “sale or exchange” treatment is met, a Shareholder will recognize gain or loss equal to the difference between the amount of cash received pursuant to the Offer and the adjusted tax basis of the Shares sold. The gain or loss will be a capital gain or loss. In general, capital gain or loss with respect to Shares sold will be long-term capital gain or loss if the holding period for such Shares is more than one year. The ability to deduct capital losses is limited. Under the ”wash sale” rules of the Code, recognition of a capital loss on Shares sold pursuant to the Offer will ordinarily be disallowed to the extent a Shareholder acquires substantially identical Shares, including Shares purchased pursuant to the Company’s Distribution Reinvestment Plan, within 30 days before or after the date the Shares are purchased by the Company pursuant to the Offer. In that event, the tax basis and holding period of the Shares acquired by the Shareholder will be adjusted to reflect the disallowed capital loss. Additionally, any capital loss realized upon a taxable disposition of Shares held for six months or less will be treated as a long-term capital loss to the extent of any capital gains dividends received by the Shareholder (or amounts credited to the Shareholder as undistributed capital gains) with respect to such Shares.

If none of the tests set forth in Section 302(b) of the Code is met, amounts received by a Shareholder who sells Shares pursuant to the Offer will be taxable to the Shareholder as a “dividend” to the extent of such Shareholder’s allocable share of the Company’s current or accumulated earnings and profits, and the excess of such amounts received over the portion that is taxable as a dividend will constitute a non-taxable return of capital (to the extent of the Shareholder’s tax basis in the Shares sold pursuant to the Offer). Any amounts received in excess of the Shareholder’s tax basis in such case will constitute taxable gain. If the amounts received by a tendering Shareholder are treated as a “dividend,” the tax basis (after an adjustment for non-taxable return of capital discussed above) in the Shares tendered to the Company will be transferred to any remaining Shares held by such Shareholder.

In addition, if a tender of Shares is treated as a “dividend” to a tendering Shareholder, the IRS may take the position that a constructive distribution under Section 305(c) of the Code may result to a Shareholder whose proportionate interest in the earnings and assets of the Company has been increased by such tender. Shareholders are urged to consult their own tax advisors regarding the possibility of deemed distributions resulting from the sale of Shares pursuant to the Offer.

We cannot predict whether or the extent to which the Offer will be oversubscribed. If the Offer is oversubscribed, proration of tenders pursuant to the Offer will cause us to accept fewer Shares than are tendered. Therefore, a U.S. Shareholder can be given no assurance that a sufficient number of such U.S. Shareholder’s sShares will be purchased pursuant to the Offer to ensure that such purchase will be treated as a sale or exchange, rather than as a dividend, for U.S. federal income tax purposes pursuant to the rules discussed above.

The Company may be required to withhold 28% of the gross proceeds paid to a U.S. Shareholder or other payee pursuant to the Offer unless the U.S. Shareholder has completed and submitted to the Company a Form W-9 (or Substitute Form W 9), providing the U.S. Shareholder’s Employer Identification Number or Social Security number as applicable, and certifying under penalties of perjury that: (a) such number is correct; (b) either (i) the U.S. Shareholder is exempt from backup withholding, (ii) the U.S. Shareholder has not been notified by the IRS that the U.S. Shareholder is subject to backup withholding as a result of an under-reporting of interest or dividends, or (iii) the IRS has notified the U.S. Shareholder that the U.S. Shareholder is no longer subject to backup withholding; or (c) an exception applies under applicable law. Even though the Company may have received a completed W-9 from a U.S. Shareholder, the Company may nevertheless be required to backup withhold if it receives a notice from the IRS to that effect.

b. Non-U.S. Shareholders. The U.S. federal income taxation of a Non-U.S. Shareholder on a sale of Shares pursuant to the Offer depends on whether this transaction is “effectively connected” with a trade or business carried on in the United States by the Non-U.S. Shareholder (and if an income tax treaty applies, on whether the Non-U.S. Shareholder maintains a United States permanent establishment) as well as the tax characterization of the transaction as either a sale of the Shares or a dividend distribution by the Company, as discussed above, for U.S. Shareholders. If the sale of Shares pursuant to the Offer is not so effectively connected (or, if an income tax treaty applies, the Non-U.S. Shareholder does not maintain a United States permanent establishment) and if, as anticipated for U.S. Shareholders, it gives rise to gain or loss rather than dividend treatment, any gain realized by a Non-U.S. Shareholder upon the tender of Shares pursuant to the Offer will not be subject to U.S. federal income tax or to any U.S. tax withholding; provided, however, that such a gain will be subject to U.S. federal income tax at the rate of 30% (or such lower rate as may be applicable under an income tax treaty) if the Non-U.S. Shareholder is a non-resident alien individual who is physically present in the United States for more than 182 days during the taxable year of the sale. If, however, Non-U.S. Shareholders are deemed, for the reasons described above, in respect of U.S. Shareholders, to receive a dividend distribution from the Company with respect to Shares they tender, the portion of the distribution treated as a dividend (which may not include the portion of such dividend attributable to certain interest income and certain capital gain

12

income) to the Non-U.S. Shareholder would be subject to a U.S. withholding tax at the rate of 30% (or such lower rate as may be applicable under a tax treaty) if the dividend is not effectively connected with the conduct of a trade or business in the United States by the Non-U.S. Shareholder (or, if an income tax treaty applies, the Non-U.S. Shareholder does not maintain a United States permanent establishment).

If the amount realized on the tender of Shares by a Non-U.S. Shareholder is effectively connected with the conduct of a trade or business in the United States by the Non-U.S. Shareholder (and, if an income tax treaty applies, the Non-U.S. Shareholder maintains a U.S. permanent establishment), regardless of whether the tender is characterized as a sale or as giving rise to a dividend distribution from the Company for U.S. federal income tax purposes, the transaction will be treated and taxed in the same manner as if the Shares involved were tendered by a U.S. Shareholder.

Any dividends received by a corporate Non-U.S. Shareholder that are effectively connected with a U.S. trade or business in which the corporate Shareholder is engaged (and if an income tax treaty applies, are attributable to a permanent establishment maintained by the corporate Non-U.S. Shareholder) also may be subject to an additional branch profits tax at a 30% rate, or lower applicable treaty rate.

Non-U.S. Shareholders should provide the Company with a properly completed Form W-8BEN, Form W-8IMY, Form W 8ECI or other applicable form in order to avoid 28% backup withholding on the cash they receive from the Company regardless of how they are taxed with respect to their tender of the Shares involved.

United States Internal Revenue Service Circular 230 Notice: To ensure compliance with Internal Revenue Service Circular 230, Shareholders are hereby notified that: (a) any discussion of U.S. federal tax issues contained or referred to in this Offer to Purchase or any document referred to herein is not intended or written to be used, and cannot be used by Shareholders for the purpose of avoiding penalties that may be imposed on them under the Code; (b) such discussion is written for use in connection with the promotion or marketing of the transactions or matters addressed herein; and (c) Shareholders should seek advice based on their particular circumstances from an independent tax advisor.

The tax discussion set forth above is included for general information only. Each Shareholder is urged to consult such Shareholder’s own tax advisor to determine the particular tax consequences to him or her of the Offer, including the applicability and effect of state, local and foreign tax laws.

14. Amendments; Extension of Tender Period; Termination.

We reserve the right, at any time during the pendency of the Offer, to amend, supplement, extend or terminate the Offer in any respect. Without limiting the manner in which we may choose to make a public announcement of such an amendment, supplement, extension or termination, we shall have no obligation to publish, advertise or otherwise communicate any such public announcement, except as provided by applicable law (including Rule 14e-1(d) and Rule 13e-4(e)(3) promulgated under the Exchange Act).

We may extend the period of time the Offer will be open by issuing a press release or making some other public announcement by no later than 9:00 a.m., Eastern Time, on the next business day after the Offer would have otherwise expired. Except to the extent required by applicable law (including Rule 13e-4(f)(1) promulgated under the Exchange Act), we will have no obligation to extend the Offer.

15. Forward Looking Statements; Miscellaneous.

The Offer may include forward-looking statements. Words like “anticipate,” “believe,” “expect” and “intend” indicate a forward-looking statement, although not all forward-looking statements include these words. Although we believe that the expectations reflected in such forward-looking statements are based upon reasonable assumptions, our actual results could differ materially from those set forth in the forward-looking statements. Some factors that might cause such a difference include the following: the current global economic downturn, increased direct competition, changes in government regulations or accounting rules, changes in local, national and global capital market conditions, our ability to obtain or maintain credit lines or credit facilities on satisfactory terms, changes in interest rates, availability of proceeds from our offering, our ability to identify suitable investments, our ability to close on identified investments, inaccuracies of our accounting estimates, our ability to locate suitable borrowers for our loans and the ability of such borrowers to make payments under their respective loans.

Our actual results could differ materially from those implied or expressed in the forward-looking statements for any reason.

We have based the forward-looking statements included in the Offer on information available to us on the date of the Offer, and we assume no obligation to update any such forward-looking statements. Except as required by the federal securities laws, we undertake no obligation to revise or update any forward-looking statements, whether as a result of new information, future events or otherwise. You are advised to consult any additional disclosures that we may make directly to you or through reports that we may file in the future with the SEC, including annual reports on Form 10-K, quarterly reports on Form 10-Q and current reports on Form 8-K. The forward-looking statements and projections contained in the Offer are excluded from the safe harbor protection provided by Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Exchange Act.

13

The Offer is not being made to, nor will we accept tenders from or on behalf of, owners of Shares in any jurisdiction in which the making of the Offer or its acceptance would not comply with the securities or “blue sky” laws of that jurisdiction. We are not aware of any jurisdiction in which the making of the Offer or the acceptance of tenders of, purchase of, or payment for, Shares in accordance with the Offer would not be in compliance with the laws of such jurisdiction. We, however, reserve the right to exclude Shareholders in any jurisdiction in which it is asserted that the Offer cannot lawfully be made or tendered Shares cannot lawfully be accepted, purchased or paid for. So long as we make a good-faith effort to comply with any state law deemed applicable to the Offer, we believe that the exclusion of holders residing in any such jurisdiction is permitted under Rule 13e-4(f)(9) promulgated under the Exchange Act. In any jurisdiction where the securities, blue sky or other laws require the Offer to be made by a licensed broker or dealer, the Offer shall be deemed to be made on our behalf by one or more brokers or dealers licensed under the laws of such jurisdiction.

November 10, 2016 CAREY CREDIT INCOME FUND 2016 T

14