Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

| ☒ | Quarterly report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

for the quarterly period ended March 31, 2019

| ☐ | Transition report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

for the transition period from to

Commission file number: 001-37996

WORLD GOLD TRUST

(SPONSORED BY WGC USA ASSET MANAGEMENT COMPANY, LLC)

(Exact Name of Registrant as Specified in Its Charter)

| Delaware | 36-7650517 | |

| (State or Other Jurisdiction of Incorporation or Organization) |

(I.R.S. Employer Identification No.) |

c/o WGC USA Asset Management Company, LLC

685 Third Avenue 27th Floor

New York, New York 10017

(Address of Principal Executive Offices)

(212) 317-3800

(Registrant’s Telephone Number, Including Area Code)

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer |

☐ |

Accelerated filer |

☐ | |||

| Non-accelerated filer |

☐ |

Smaller reporting company |

☒ | |||

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☒

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

Securities registered pursuant to Section 12(b) of the Securities Exchange Act of 1934:

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered | ||

|

SPDR® Long Dollar Gold Trust |

GLDW | NYSE Arca | ||

|

SPDR® Gold MiniSharesSM Trust |

GLDM | NYSE Arca |

As of May 6, 2019, SPDR® Long Dollar Gold Trust had 230,000 shares outstanding, and SPDR® Gold MiniSharesSM Trust had 49,500,000 shares outstanding.

Table of Contents

WORLD GOLD TRUST

| Page | ||||||

| 1 | ||||||

| Item 1. | 1 | |||||

| Item 2. | Management’s Discussion and Analysis of Financial Condition and Results of Operations |

40 | ||||

| Item 3. | 46 | |||||

| Item 4. | 46 | |||||

| 47 | ||||||

| Item 1. | 47 | |||||

| Item 1A. | 47 | |||||

| Item 2. | 47 | |||||

| Item 3. | 47 | |||||

| Item 4. | 47 | |||||

| Item 5. | 48 | |||||

| Item 6. | 48 | |||||

| 50 | ||||||

Table of Contents

Table of Contents

World Gold Trust

Combined Statements of Financial Condition

at March 31, 2019 (unaudited) and September 30, 2018

| (Amounts in 000’s of US$) | Mar-31, 2019 | Sep-30, 2018 | ||||||

| (unaudited) | ||||||||

| ASSETS |

||||||||

| Investment in Gold, at fair value (cost $656,378 and $254,337 at March 31, 2019 and September 30, 2018, respectively) |

$ | 676,417 | $ | 246,784 | ||||

| Gold Delivery Agreement receivable |

149 | 276 | ||||||

| Gold receivable |

— | 8,307 | ||||||

|

|

|

|

|

|||||

| Total Assets |

$ | 676,566 | $ | 255,367 | ||||

|

|

|

|

|

|||||

| LIABILITIES |

| |||||||

| Accounts payable to Sponsor |

$ | 107 | $ | 29 | ||||

| Gold Delivery Agreement payable |

— | 1 | ||||||

|

|

|

|

|

|||||

| Total Liabilities |

$ | 107 | $ | 30 | ||||

|

|

|

|

|

|||||

| Net Assets |

$ | 676,459 | $ | 255,337 | ||||

|

|

|

|

|

|||||

See notes to the unaudited combined financial statements.

2

Table of Contents

World Gold Trust

Combined Schedules of Investments

(All balances in 000’s except for percentages)

| March 31, 2019 |

Ounces of gold |

Cost | Fair Value |

% of Net Assets |

||||||||||||

| (unaudited) | ||||||||||||||||

| Investment in Gold |

522.3 | $ | 656,378 | $ | 676,417 | 99.99 | % | |||||||||

| Gold Delivery Agreement |

— | — | — | 0.00 | % | |||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total Investments |

522.3 | $ | 656,378 | $ | 676,417 | 99.99 | % | |||||||||

| Assets in excess of liabilities |

42 | 0.01 | % | |||||||||||||

|

|

|

|

|

|||||||||||||

| Net Assets |

$ | 676,459 | 100.00 | % | ||||||||||||

|

|

|

|

|

|||||||||||||

Derivatives Contract

at March 31, 2019 (unaudited)

| Underlying Instrument |

Counter-Party | Notional Value |

Expiration Date |

Unrealized Appreciation/(Depreciation) | ||||||||||||

| Gold Delivery Agreement |

Merrill Lynch International | $ | 29,508 | 6/30/22 | $— | |||||||||||

(All balances in 000’s except for percentages)

| September 30, 2018 |

Ounces of gold |

Cost | Fair Value |

% of Net Assets |

||||||||||||

| Investment in Gold |

207.9 | $ | 254,337 | $ | 246,784 | 96.65 | % | |||||||||

| Gold Delivery Agreement |

— | — | — | 0.00 | % | |||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total Investments |

207.9 | $ | 254,337 | $ | 246,784 | 96.65 | % | |||||||||

| Assets in excess of liabilities |

8,553 | 3.35 | % | |||||||||||||

|

|

|

|

|

|||||||||||||

| Net Assets |

$ | 255,337 | 100.00 | % | ||||||||||||

|

|

|

|

|

|||||||||||||

Derivatives Contract

at September 30, 2018

| Underlying Instrument |

Counter-Party | Notional Value |

Expiration Date |

Unrealized Appreciation/(Depreciation) | ||||||||||||

| Gold Delivery Agreement |

Merrill Lynch International | $ | 26,042 | 6/30/22 | $— | |||||||||||

See notes to the unaudited combined financial statements.

3

Table of Contents

World Gold Trust

Unaudited Combined Statements of Operations

For the three and six months ended March 31, 2019 and 2018

| (Amounts in 000’s of US$) | Three Months Ended Mar-31, 2019 |

Three Months Ended Mar-31, 2018 |

Six Months Ended Mar-31, 2019 |

Six Months Ended Mar-31, 2018 |

||||||||||||

| (unaudited) | (unaudited) | (unaudited) | (unaudited) | |||||||||||||

| EXPENSES |

||||||||||||||||

| Sponsor fees |

$ | 274 | $ | 15 | $ | 431 | $ | 30 | ||||||||

| Gold Delivery Provider fees |

12 | 8 | 24 | 15 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total expenses |

286 | 23 | 455 | 45 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net investment loss |

(286 | ) | (23 | ) | (455 | ) | (45 | ) | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net realized and change in unrealized gain/(loss) on investment in gold and Gold Delivery Agreement |

||||||||||||||||

| Net realized gain/(loss) from investment in gold sold to pay Sponsor fees |

11 | 1 | 10 | 2 | ||||||||||||

| Net realized gain/(loss) on Gold Delivery Agreement |

452 | (415 | ) | 975 | (533 | ) | ||||||||||

| Net realized gain/(loss) on gold transferred to cover Gold Delivery Agreement and Gold Delivery Provider fees |

91 | 168 | 70 | 229 | ||||||||||||

| Net realized gain/(loss) from gold distributed for the redemption of shares |

— | 149 | — | 149 | ||||||||||||

| Net change in unrealized appreciation/(depreciation) on investment in gold |

2,852 | 98 | 27,592 | 235 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net realized and change in unrealized gain/(loss) on investment in gold and Gold Delivery Agreement |

3,406 | 1 | 28,647 | 82 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net Income/(Loss) |

$ | 3,120 | $ | (22 | ) | $ | 28,192 | $ | 37 | |||||||

|

|

|

|

|

|

|

|

|

|||||||||

See notes to the unaudited combined financial statements.

4

Table of Contents

World Gold Trust

Unaudited Combined Statements of Cash Flows

For the three and six months ended March 31, 2019 and 2018

| (Amounts in 000’s of US$) | Three Months Ended Mar-31, 2019 |

Three Months Ended Mar-31, 2018 |

Six Months Ended Mar-31, 2019 |

Six Months Ended Mar-31, 2018 |

||||||||||||

| (unaudited) | (unaudited) | (unaudited) | (unaudited) | |||||||||||||

| INCREASE/DECREASE IN CASH FROM OPERATIONS: |

||||||||||||||||

| Cash proceeds received from sales of gold |

$ | 226 | $ | 15 | $ | 353 | $ | 29 | ||||||||

| Cash expenses paid |

(226 | ) | (15 | ) | (353 | ) | (29 | ) | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Increase/(Decrease) in cash resulting from operations |

— | — | — | — | ||||||||||||

| INCREASE/DECREASE IN CASH FLOWS FROM FINANCING ACTIVITIES: |

||||||||||||||||

| Cash proceeds from issuance of shares |

— | — | — | — | ||||||||||||

| Cash paid for repurchase of shares |

— | — | — | — | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Increase/(Decrease) in cash resulting from financing activities |

— | — | — | — | ||||||||||||

| Cash and cash equivalents at beginning of period |

— | — | — | — | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Cash and cash equivalents at end of period |

$ | — | $ | — | $ | — | $ | — | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| SUPPLEMENTAL DISCLOSURE OF NON-CASH FINANCING ACTIVITIES: |

||||||||||||||||

| Value of gold received for creation of shares - net of gold receivable |

$ | 271,715 | $ | — | $ | 392,930 | $ | 4,814 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Value of gold distributed for redemption of shares - net of gold payable |

$ | — | $ | (2,393 | ) | $ | — | $ | (2,393 | ) | ||||||

|

|

|

|

|

|

|

|

|

|||||||||

| SUPPLEMENTAL DISCLOSURE OF NON-CASH OPERATING ACTIVITIES: |

||||||||||||||||

| Value of Gold Delivery Agreement inflows - net of Gold Delivery Agreement receivable |

$ | 2,148 | $ | 1,645 | $ | 4,779 | $ | 3,005 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Value of Gold Delivery Agreement outflows - net of Gold Delivery Agreement payable |

$ | (1,957 | ) | $ | (2,365) | $ | (3,954) | $ | (3,710) | |||||||

|

|

|

|

|

|

|

|

|

|||||||||

| (Amounts in 000’s of US$) | Three Months Ended Mar-31, 2019 |

Three Months Ended Mar-31, 2018 |

Six Months Ended Mar-31, 2019 |

Six Months Ended Mar-31, 2018 |

||||||||||||

| (unaudited) | (unaudited) | (unaudited) | (unaudited) | |||||||||||||

| RECONCILIATION OF NET INCOME/(LOSS) TO NET CASH PROVIDED BY OPERATING ACTIVITIES |

||||||||||||||||

| Net Income/(Loss) |

$ | 3,120 | $ | (22 | ) | $ | 28,192 | $ | 37 | |||||||

| Adjustments to reconcile net income/(loss) to net cash provided by operating activities: |

||||||||||||||||

| Gold paid for Gold Delivery Provider fees |

12 | 8 | 24 | 15 | ||||||||||||

| Proceeds from sales of gold to pay expenses |

226 | 15 | 353 | 29 | ||||||||||||

| Net realized (gain)/loss from investment in gold sold to pay Sponsor fees |

(11 | ) | (1 | ) | (10 | ) | (2 | ) | ||||||||

| Net realized (gain)/loss on Gold Delivery Agreement |

(452 | ) | 415 | (975 | ) | 533 | ||||||||||

| Net realized (gain)/loss on gold transferred to cover Gold Delivery Agreement and Gold Delivery Provider fees |

(91 | ) | (168 | ) | (70 | ) | (229 | ) | ||||||||

| Net realized (gain)/loss from gold distributed for the redemption of shares |

— | (149 | ) | — | (149 | ) | ||||||||||

| Net change in unrealized (appreciation)/depreciation on investment in gold |

(2,852 | ) | (98 | ) | (27,592 | ) | (235 | ) | ||||||||

| Increase/(Decrease) in accounts payable to Sponsor |

48 | — | 78 | 1 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net cash provided by operating activities |

$ | — | $ | — | $ | — | $ | — | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

See notes to the unaudited combined financial statements.

5

Table of Contents

World Gold Trust

Unaudited Combined Statements of Changes in Net Assets

For the three and six months ended March 31, 2019 and 2018

| (Amounts in 000’s of US$) | Three Months Ended Mar-31, 2019 |

Three Months Ended Mar-31, 2018 |

Six Months Ended Mar-31, 2019 |

Six Months Ended Mar-31, 2018 |

||||||||||||

| (unaudited) | (unaudited) | (unaudited) | (unaudited) | |||||||||||||

| Net Assets - Opening Balance |

$ | 425,953 | $ | 19,246 | $ | 255,337 | $ | 14,373 | ||||||||

| Creations |

247,386 | — | 392,930 | 4,814 | ||||||||||||

| Redemptions |

— | (2,393 | ) | — | (2,393 | ) | ||||||||||

| Net investment loss |

(286 | ) | (23 | ) | (455 | ) | (45 | ) | ||||||||

| Net realized gain/(loss) from investment in gold sold to pay Sponsor fees |

11 | 1 | 10 | 2 | ||||||||||||

| Net realized gain/(loss) on Gold Delivery Agreement |

452 | (415 | ) | 975 | (533 | ) | ||||||||||

| Net realized gain/(loss) on gold transferred to cover Gold Delivery Agreement and Gold Delivery Provider fees |

91 | 168 | 70 | 229 | ||||||||||||

| Net realized gain/(loss) from gold distributed for the redemption of shares |

— | 149 | — | 149 | ||||||||||||

| Net change in unrealized appreciation/(depreciation) on investment in gold |

2,852 | 98 | 27,592 | 235 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net Assets - Closing Balance |

$ | 676,459 | $ | 16,831 | $ | 676,459 | $ | 16,831 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

See notes to the unaudited combined financial statements.

6

Table of Contents

WORLD GOLD TRUST

Notes to the Unaudited Combined Financial Statements

| 1. | Organization |

World Gold Trust (the “Trust”), formerly known as “World Currency Gold Trust,” was organized as a Delaware statutory trust on August 27, 2014 and is governed by the Fourth Amended and Restated Agreement and Declaration of Trust (“Declaration of Trust”), dated as of April 16, 2018, between WGC USA Asset Management Company, LLC (the “Sponsor”) and the Delaware Trust Company (the “Trustee”). The Trust is authorized to issue an unlimited number of shares of beneficial interest (“Shares”). The beneficial interest in the Trust may be divided into one or more series. The Trust has established six separate series of which two were operational as of March 31, 2019. All of the series of the Trust are collectively referred to as the “Funds” and each individually as a “Series.” The accompanying financial statements relate to the Trust, SPDR® Long Dollar Gold Trust (“GLDW”) and SPDR® Gold MiniSharesSM Trust (“GLDM”). GLDW commenced operations on January 27, 2017, and GLDM commenced operations on June 26, 2018. The fiscal year-end of both the Trust and the Funds is September 30.

BNY Mellon Asset Servicing, a division of The Bank of New York Mellon (“BNYM”), is the Administrator and Transfer Agent of the Funds. BNYM also serves as the custodian of the Funds’ cash, if any. State Street Global Advisors Funds Distributors, LLC is the Marketing Agent of the Funds.

The Combined Statement of Financial Condition and Schedule of Investments at March 31, 2019, and the Combined Statements of Operations, Changes in Net Assets and Cash Flows for the three and six months ended March 31, 2019 and 2018 have been prepared on behalf of the Trust and the Funds without audit. In the opinion of management of the Sponsor, all adjustments (which include normal recurring adjustments) necessary to present fairly the financial position, results of operations and cash flows as of and for the three and six months ended March 31, 2019 and for all periods presented have been made. These combined financial statements should be read in conjunction with the financial statements and notes thereto included in the Trust’s Annual Report on Form 10-K for the fiscal year ended September 30, 2018. The results of operations for the three and six months ended March 31, 2019 are not necessarily indicative of the operating results for the full fiscal year.

Capitalized terms used but not defined herein have the meaning as set forth in the Declaration of Trust.

The Trust had no operations with respect to the Funds’ Shares prior to January 27, 2017 other than matters relating to its organization and the registration of the offer and sale of the Funds’ Shares under the Securities Act of 1933, as amended.

| 2. | Significant Accounting Policies |

The preparation of financial statements in accordance with accounting principles generally accepted in the United States of America (“U.S. GAAP”) requires those responsible for preparing financial statements to make estimates and assumptions that affect the reported amounts and disclosures. Actual results could differ from those estimates. The following is a summary of significant accounting policies followed by the Funds and the Trust.

| 2.1 | Basis of Accounting |

The Funds are investment companies within the scope of Financial Accounting Standards Board Accounting Standards Codification (“ASC”) 946, Financial Services—Investment Companies, and therefore apply the specialized accounting and reporting guidance therein. The Funds are not registered as investment companies under the Investment Company Act of 1940, as amended.

These financial statements present the financial condition, results of operations and cash flows of the Funds and the Trust combined. For the periods presented, there were no balances or activity for the Trust and all balances and activity related to the Funds, and the footnotes accordingly relate to the Funds, unless stated otherwise.

7

Table of Contents

| 2.2 | Basis of Presentation |

The financial statements are presented for the Trust, as the SEC registrant, combined with the Funds and for each of GLDW and GLDM individually. The debts, liabilities, obligations and expenses incurred, contracted for or otherwise existing with respect to each Series shall be enforceable only against the assets of that Series and not against the Trust generally or any other Series that the Trust may establish in the future.

| 2.3 | Cash and Cash Equivalents |

Cash and cash equivalents include highly liquid investments of sufficient credit quality with original maturity of three months or less.

| 2.4 | Solactive GLD® Long USD Gold Index—Gold Delivery Agreement |

Pursuant to the terms of the Gold Delivery Agreement, GLDW has entered into a transaction to deliver gold bullion to, or receive gold bullion from, Merrill Lynch International, as Gold Delivery Provider, each Business Day. The amount of gold bullion transferred essentially will be equivalent to GLDW’s profit or loss as if it had exchanged the Reference Currencies comprising the Index (“FX Basket”), in the proportion in which they are reflected in the Index, for USDs in an amount equal to its holdings of gold bullion on such day. In general, if there is a currency gain (i.e., the value of the USD against the Reference Currencies comprising the FX Basket increases), GLDW will receive gold bullion. In general, if there is a currency loss (i.e., the value of the USD against the Reference Currencies comprising the FX Basket decreases), it will deliver gold bullion. In this manner, the amount of gold bullion held will be adjusted to reflect the daily change in the value of the Reference Currencies comprising the FX Basket against the USD. The Gold Delivery Agreement requires gold bullion ounces, calculated pursuant to formulas contained in the Gold Delivery Agreement, to be delivered to the custody account of GLDW or the Gold Delivery Provider, as applicable. The fee that GLDW pays the Gold Delivery Provider for its services under the Gold Delivery Agreement is accrued daily and reflected in the calculation of the amount of gold bullion to be delivered pursuant to the Gold Delivery Agreement. The realized gain/loss from the Gold Delivery Agreement is disclosed on the Combined Statements of Operations and the Combined Statements of Changes in Net Assets.

The Index is designed to represent the daily performance of a long position in physical gold, as represented by the LBMA Gold Price AM, and a short position in the basket of Reference Currencies with weightings determined by the FX Basket. The Reference Currencies and their respective weightings in the Index are as follows: Euro (EUR/USD) (57.6%), Japanese Yen (JPY/USD) (13.6%), British Pound Sterling (USD/GBP) (11.9%), Canadian Dollar (USD/CAD) (9.1%), Swedish Krona (USD/SEK) (4.2%), and Swiss Franc (USD/CHF) (3.6%).

| 2.5 | Fair Value Measurement |

U.S. GAAP defines fair value as the price the Funds would receive to sell an asset or pay to transfer a liability in an orderly transaction between market participants at the measurement date. The Funds’ policy is to value their investments at fair value.

Various inputs are used in determining the fair value of the Funds’ assets or liabilities. Inputs may be based on independent market data (“observable inputs”) or they may be internally developed (“unobservable inputs”). These inputs are categorized into a disclosure hierarchy consisting of three broad levels for financial reporting purposes. The level of a value determined for an asset or liability within the fair value hierarchy is based on the lowest level of any input that is significant to the fair value measurement in its entirety. The three levels of the fair value hierarchy are:

Level 1 – Unadjusted quoted prices in active markets for identical assets or liabilities;

Level 2 – Inputs other than quoted prices included within Level 1 that are observable for the asset or liability either directly or indirectly, including quoted prices for similar assets or liabilities in active markets,

8

Table of Contents

quoted prices for identical or similar assets or liabilities in markets that are not considered to be active, inputs other than quoted prices that are observable for the asset or liability and inputs that are derived principally from or corroborated by observable market data by correlation or other means; and

Level 3 – Inputs that are unobservable for the asset and liability, including the Funds’ assumptions (if any) used in determining the fair value of investments.

The following table summarizes the Funds’ investments at fair value:

| (Amounts in 000’s of US$) March 31, 2019 |

Level 1 | Level 2 | Level 3 | |||||||||

| Investment in Gold |

$ | 676,417 | $ | — | $ | — | ||||||

| Gold Delivery Agreement |

— | — | — | |||||||||

|

|

|

|

|

|

|

|||||||

| Total |

$ | 676,417 | $ | — | $ | — | ||||||

|

|

|

|

|

|

|

|||||||

| (Amounts in 000’s of US$) September 30, 2018 |

Level 1 | Level 2 | Level 3 | |||||||||

| Investment in Gold |

$ | 246,784 | $ | — | $ | — | ||||||

| Gold Delivery Agreement |

— | — | — | |||||||||

|

|

|

|

|

|

|

|||||||

| Total |

$ | 246,784 | $ | — | $ | — | ||||||

|

|

|

|

|

|

|

|||||||

There were no transfers between Level 1 and other Levels for the period ended March 31, 2019 or for the fiscal year ended September 30, 2018.

The Administrator values the gold held by the Funds on the basis of the price of an ounce of gold as determined by ICE Benchmark Administration Limited (“IBA”), a benchmark administrator, which provides an independently administered auction process, as well as the overall administration and governance for the LBMA Gold Price. In determining the net asset value (“NAV”) of the Funds, the Administrator values the gold held by the Funds on the basis of the price of an ounce of gold determined by the IBA auction process, which is an electronic auction, with the imbalance calculated and the price adjusted in rounds (30 seconds in duration). The auction runs twice daily at 10:30 AM and 3:00 PM London time. The Administrator calculates the NAV of the Funds on each day the NYSE Arca is open for regular trading. If no gold price is made on a particular evaluation day, the next most recent gold price is used in the determination of the NAV of the Funds, unless the Administrator, in consultation with the Sponsor, determines that such price is inappropriate to use as the basis for such determination.

| 2.6 | Custody of Gold |

Gold bullion is held by HSBC Bank plc on behalf of GLDW, and by ICBC Standard Bank Plc on behalf of GLDM, each individually referred to as the “Custodian.”

| 2.7 | Gold Receivable/Payable |

Gold receivable/payable represents the quantity of gold covered by contractually binding orders for the creation/redemption of Shares where the gold has not yet been transferred into/out of the Series’ account. Generally, ownership of the gold is transferred within two business days of the trade date.

| Mar-31, 2019 |

Sep-30, 2018 |

|||||||

| (Amounts in 000’s of US$) | ||||||||

| Gold receivable |

$ | — | $ | 8,307 | ||||

9

Table of Contents

| Mar-31, 2019 |

Sep-30, 2018 |

|||||||

| (Amounts in 000’s of US$) | ||||||||

| Gold payable |

$ | — | $ | — | ||||

| 2.8 | Gold Delivery Agreement Receivable |

Gold Delivery Agreement receivable represents the quantity of gold due to be received under the Gold Delivery Agreement. The gold is transferred to GLDW’s allocated gold bullion account at the Custodian two business days after the valuation date.

| Mar-31, 2019 |

Sep-30, 2018 |

|||||||

| (Amounts in 000’s of US$) | ||||||||

| Gold Delivery Agreement receivable |

$ | 149 | $ | 276 | ||||

| 2.9 | Gold Delivery Agreement Payable |

Gold Delivery Agreement payable represents the quantity of gold due to be delivered under the Gold Delivery Agreement. The gold is transferred from GLDW’s allocated gold bullion account at the Custodian two business days after the valuation date.

| Mar-31, 2019 |

Sep-30, 2018 |

|||||||

| (Amounts in 000’s of US$) | ||||||||

| Gold Delivery Agreement payable |

$ | — | $ | 1 | ||||

| 2.10 | Creations and Redemptions of Shares |

The Funds create and redeem Shares from time to time, but only in one or more Creation Units (a Creation Unit equals a block of 10,000 GLDW Shares or a block of 100,000 GLDM Shares). The Funds issue Shares in Creation Units to certain authorized participants (“Authorized Participants”) on an ongoing basis. The creation and redemption of Creation Units is only made in exchange for the delivery to the Funds or the distribution by the Funds of the amount of gold and any cash represented by the Creation Units being created or redeemed, the amount of which will be based on the net asset value of the number of Shares included in the Creation Units being created or redeemed determined on the day the order to create or redeem Creation Units is properly received.

As the Shares of the Funds are redeemable in Creation Units at the option of the Authorized Participants, the Funds have classified the Shares as Net Assets for financial reporting purposes. Changes in the Shares for the six months ended March 31, 2019 and March 31, 2018 were:

| Six Months Ended Mar-31, 2019 |

Six Months Ended Mar-31, 2018 |

|||||||

| (Amounts in 000’s) | ||||||||

| Activity in Number of Shares Created and Redeemed: |

||||||||

| Creations |

30,700 | 40 | ||||||

| Redemptions |

(— | ) | (20 | ) | ||||

|

|

|

|

|

|||||

| Net change in Number of Shares Created and Redeemed |

30,700 | 20 | ||||||

|

|

|

|

|

|||||

10

Table of Contents

| Six Months Ended Mar-31, 2019 |

Six Months Ended Mar-31, 2018 |

|||||||

| (Amounts in 000’s of US$) | ||||||||

| Activity in Value of Shares Created and Redeemed: |

||||||||

| Creations |

$ | 392,930 | $ | 4,814 | ||||

| Redemptions |

(— | ) | (2,393 | ) | ||||

|

|

|

|

|

|||||

| Net change in Value of Shares Created and Redeemed |

$ | 392,930 | $ | 2,421 | ||||

|

|

|

|

|

|||||

| 2.11 | Income and Expense (Amounts in 000’s of US$) |

The Administrator will, at the direction of the Sponsor, sell the Funds’ gold as necessary to pay the Funds’ expenses. When selling gold to pay expenses, the Administrator will endeavor to sell the smallest amount of gold needed to pay expenses in order to minimize the Funds’ holdings of assets other than gold. Unless otherwise directed by the Sponsor, to meet expenses the Administrator will give a sell order and sell gold to the Custodian following the sell order. A gain or loss is recognized based on the difference between the selling price and the average cost of the gold sold, and such amounts are reported as net realized gain/(loss) from investment in gold sold to pay Sponsor fees on the Combined Statements of Operations.

The Funds’ net realized and change in unrealized gain on investment in gold and Gold Delivery Agreement for the six-month period ended March 31, 2019 of $28,647 is made up of a realized gain of $10 from the sale of gold to pay Sponsor fees, a realized gain of $975 from the Gold Delivery Agreement, a realized gain of $70 from gold transferred to cover Gold Delivery Agreement and Gold Delivery Provider fees, and a change in unrealized appreciation of $27,592 on investment in gold.

The Funds’ net realized and change in unrealized gain on investment in gold and Gold Delivery Agreement for the six-month period ended March 31, 2018 of $82 is made up of a realized gain of $2 from the sale of gold to pay Sponsor fees, a realized loss of $533 from the Gold Delivery Agreement, a realized gain of $229 from gold transferred to cover Gold Delivery Agreement and Gold Delivery Provider fees, a realized gain of $149 from gold distributed for the redemption of shares, and a change in unrealized appreciation of $235 on investment in gold.

| 2.12 | Income Taxes |

The Funds are classified as “grantor trusts” for U.S. federal income tax purposes. As a result, the Funds are not subject to U.S. federal income tax. Instead, the Funds’ income and expenses “flow through” to the shareholders, and the Administrator will report the Funds’ proceeds, income, deductions, gains and losses to the Internal Revenue Service on that basis

The Sponsor has evaluated whether there are uncertain tax positions that require financial statement recognition and has determined that no reserves for uncertain tax positions are required as of March 31, 2019 or September 30, 2018. As of March 31, 2019, the 2018 and 2017 tax years remain open for examination. There were no examinations in progress at period end.

| 2.13 | New Accounting Pronouncements |

In August 2018, the FASB issued Accounting Standards Update 2018-13, Fair Value Measurement (Topic 820): Disclosure Framework—Changes to the Disclosure Requirements for Fair Value Measurement (“ASU 2018-13”). The update provides guidance that eliminates, adds and modifies certain disclosure requirements for fair value measurements. ASU 2018-13 will be effective for annual periods beginning after December 15, 2019. Early adoption is permitted. Management of the Sponsor does not currently expect these changes to have a material impact to future financial statements.

11

Table of Contents

| 3. | Fund Expenses |

For GLDW, the only ordinary recurring operating expenses are expected to be the Gold Delivery Provider’s annual fee as well as the Sponsor’s annual fee. For GLDM, the only ordinary recurring operating expense is expected to be the Sponsor’s annual fee. Further detail can be found in the respective Series’ Financial Statements.

Expenses, which accrue daily, and are payable by the Funds, will reduce the NAV of the Funds.

| 4. | Foreign Currency Risk |

GLDW does not hold foreign currency, but is exposed to foreign currency risk as a result of its transactions under the Gold Delivery Agreement. Foreign currency exchange rates may fluctuate significantly over short periods of time and can be unpredictably affected by political developments or government intervention. The value of the Reference Currencies included in the FX Basket may be affected by several factors, including: monetary policies of central banks within the relevant foreign countries or markets; global or regional economic, political or financial events; inflation or interest rates of the relevant foreign countries and investor expectations concerning inflation or interest rates; and debt levels and trade deficits of the relevant foreign countries.

Currency exchange rates are influenced by the factors identified above and may also be influenced by, among other things: changing supply and demand for a particular currency; monetary policies of governments (including exchange control programs, restrictions on local exchanges or markets and limitations on foreign investment in a country or on investment by residents of a country in other countries); changes in balances of payments and trade; trade restrictions; and currency devaluations and revaluations. Also, governments from time to time intervene in the currency markets, including by regulation, in order to influence rates directly. These events and actions are unpredictable. The resulting volatility in the Reference Currency exchange rates relative to the USD could materially and adversely affect the value of the Shares.

| 5. | Counterparty Risk |

If the Gold Delivery Provider fails to deliver gold pursuant to its obligations under the Gold Delivery Agreement, such failure would have an adverse effect on GLDW in meeting its investment objective. Moreover, to the extent that the Gold Delivery Provider is unable to honor its obligations under the Gold Delivery Agreement, such as due to bankruptcy or default under the Gold Delivery Agreement or for any other reason, GLDW would need to find a new entity to act in the same capacity as the Gold Delivery Provider. If it could not quickly find a new entity to act in that capacity, it may not be able to meet its investment objective. The transactions under the Gold Delivery Agreement will terminate on June 30, 2022, unless the parties agree on extension terms. If the parties cannot agree on extension terms and GLDW is unable to find a new entity to act as Gold Delivery Provider, GLDW may not be able to meet its investment objective.

| 6. | Concentration of Risk |

The primary business activities for GLDW are the investment in gold bullion, the transactions under the Gold Delivery Agreement, and the issuance and sale of GLDW Shares.

For GLDM, the primary business activities are the investment in gold bullion and the issuance and sale of GLDM Shares.

Various factors could affect the price of gold including: (i) global gold supply and demand, which is influenced by such factors as forward selling by gold producers, purchases made by gold producers to unwind gold hedge positions, central bank purchases and sales, and production and cost levels in major gold-producing countries such as China, Australia, South Africa and the United States; (ii) investors’ expectations with respect to the rate

12

Table of Contents

of inflation; (iii) currency exchange rates; (iv) interest rates; (v) investment and trading activities of hedge funds and commodity funds; and (vi) global or regional political, economic or financial events and situations. In addition, there is no assurance that gold will maintain its long-term value in terms of purchasing power in the future. In the event that the price of gold declines, the Sponsor expects the value of an investment in the Shares of a Series to decline proportionately. Each of these events could have a material effect on the Funds’ financial position and results of operations.

| 7. | Derivative Contract Information |

For the three and six months ended March 31, 2019 and 2018, the effect of GLDW’s derivative contracts on the Combined Statements of Operations was as follows:

| Risk exposure derivative type |

Location of Gain or Loss on Derivatives Recognized in Income |

Three Months Ended Mar-31, 2019 |

Three Months Ended Mar-31, 2018 |

Six Months Ended Mar-31, 2019 |

Six Months Ended Mar-31, 2018 |

|||||||||||||

| (Amounts in 000’s of US$) | ||||||||||||||||||

| Currency Risk |

Net Realized gain/(loss) on Gold Delivery Agreement | $ | 452 | $ | (415 | ) | $ | 975 | $ | (533 | ) | |||||||

The table below summarizes the average daily notional value of derivative contracts outstanding during the periods:

| Six Months Ended Mar-31, 2019 |

Six Months Ended Mar-31, 2018 |

|||||||

| (Amounts in 000’s of US$) | ||||||||

| Average notional |

$ | 28,687 | $ | 17,888 | ||||

The notional value of the contract varies daily based on the amount of gold held at the Custodian.

At March 31, 2019 and September 30, 2018, GLDW’s over-the-counter (“OTC”) derivative assets and liabilities were as follows:

| Gross Amounts of Assets and Liabilities Presented in the Combined Statements of Financial Condition |

||||||||

| Assetsa | Liabilitiesa | |||||||

| Derivatives |

||||||||

| Gold Delivery Agreement |

$ | — | $ | — | ||||

|

|

|

|

|

|||||

| a | Absent an event of default or early termination, OTC derivative assets and liabilities are presented gross and not offset on the Combined Statements of Financial Condition. |

At March 31, 2019 and September 30, 2018, GLDW’s OTC derivative assets, which may offset against its OTC derivative liabilities and collateral received from the counterparty, were as follows:

| Amounts Not Offset in the Combined Statements of Financial Condition |

||||||||||||||||||||

| Gross Amounts of Assets Presented in the Combined Statements of Financial Condition |

Financial Instruments Available for Offset |

Financial Instruments Collateral Received |

Cash Collateral Received |

Net Amount |

||||||||||||||||

| Counterparty |

||||||||||||||||||||

| Merrill Lynch International |

$ | — | $ | — | $ | — | $ | — | $ | — | ||||||||||

13

Table of Contents

At March 31, 2019 and September 30, 2018, GLDW’s OTC derivative liabilities, which may offset against its OTC derivative assets and collateral pledged from the counterparty, were as follows:

| Amounts Not Offset in the Combined Statements of Financial Condition |

||||||||||||||||||||

| Gross Amounts of Liabilities Presented in the Combined Statements of Financial Condition |

Financial Instruments Available for Offset |

Financial Instruments Collateral Pledged |

Cash Collateral Pledged |

Net Amount |

||||||||||||||||

| Counterparty |

||||||||||||||||||||

| Merrill Lynch International |

$ | — | $ | — | $ | — | $ | — | $ | — | ||||||||||

| 8. | Indemnification |

The Sponsor and each of its shareholders, members, directors, officers, employees, affiliates and subsidiaries will be indemnified by the Trust and held harmless against any losses, liabilities or expenses incurred in the performance of its duties under the Declaration of Trust without gross negligence, bad faith or willful misconduct. The Sponsor shall in no event be deemed to have assumed or incurred any liability, duty, or obligation to any shareholder or to the Trustee other than as expressly provided for in the Declaration of Trust. Such indemnity includes payment from the Trust of the costs and expenses incurred in defending against any indemnified claim or liability under the Declaration of Trust.

The Trustee and each of its officers, affiliates, directors, employees, and agents will be indemnified by the Trust from and against any losses, claims, taxes, damages, reasonable expenses, and liabilities incurred with respect to the creation, operation or termination of the Trust, the execution, delivery or performance of the Declaration of Trust or the transactions contemplated thereby; provided that the indemnified party acted without willful misconduct, bad faith or gross negligence. The Sponsor will not be liable to the Trust, the Trustee or any shareholder for any action taken or for refraining from taking any action in good faith, or for errors in judgment or for depreciation or loss incurred by reason of the sale of any gold bullion or other assets held in trust under Declaration of Trust. However, the preceding liability exclusion will not protect the Sponsor against any liability resulting from its own gross negligence, bad faith, or willful misconduct.

| 9. | Financial Highlights |

Management of the Sponsor does not believe including Financial Highlights in a combined evaluation is meaningful. Refer to GLDW’s and GLDM’s Notes to the Financial Statements for respective Financial Highlight calculations.

14

Table of Contents

SPDR® Long Dollar Gold Trust

Statements of Financial Condition

at March 31, 2019 (unaudited) and September 30, 2018

| (Amounts in 000’s of US$ except for share and per share data) | Mar-31, 2019 | Sep-30, 2018 | ||||||

| (unaudited) | ||||||||

| ASSETS |

| |||||||

| Investment in Gold, at fair value (cost $28,482 and $27,380 at March 31, 2019 and September 30, 2018, respectively) |

$ | 29,508 | $ | 26,042 | ||||

| Gold Delivery Agreement receivable |

149 | 276 | ||||||

|

|

|

|

|

|||||

| Total Assets |

$ | 29,657 | $ | 26,318 | ||||

|

|

|

|

|

|||||

| LIABILITIES |

| |||||||

| Accounts payable to Sponsor |

$ | 9 | $ | 8 | ||||

| Gold Delivery Agreement payable |

— | 1 | ||||||

|

|

|

|

|

|||||

| Total Liabilities |

$ | 9 | $ | 9 | ||||

|

|

|

|

|

|||||

| Net Assets |

$ | 29,648 | $ | 26,309 | ||||

|

|

|

|

|

|||||

| Shares issued and outstanding(1) |

230,000 | 230,000 | ||||||

| Net asset value per Share |

$ | 128.91 | $ | 114.39 | ||||

| (1) | Authorized share capital is unlimited and the par value of the Shares is $0.00. |

See notes to the unaudited financial statements.

15

Table of Contents

SPDR® Long Dollar Gold Trust

Schedules of Investments

(All balances in 000’s except for percentages)

| March 31, 2019 |

Ounces of gold |

Cost | Fair Value |

% of Net Assets |

||||||||||||

| (unaudited) | ||||||||||||||||

| Investment in Gold |

22.9 | $ | 28,482 | $ | 29,508 | 99.53 | % | |||||||||

| Gold Delivery Agreement |

— | — | — | 0.00 | % | |||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total Investments |

22.9 | $ | 28,482 | $ | 29,508 | 99.53 | % | |||||||||

| Assets in excess of liabilities |

140 | 0.47 | % | |||||||||||||

|

|

|

|

|

|||||||||||||

| Net Assets |

$ | 29,648 | 100.00 | % | ||||||||||||

|

|

|

|

|

|||||||||||||

Derivatives Contract

at March 31, 2019 (unaudited)

| Underlying Instrument |

Counter-Party |

Notional Value |

Expiration Date | Unrealized Appreciation/ (Depreciation) |

||||||||||

| Gold Delivery Agreement |

Merrill Lynch International | $ | 29,508 | 6/30/22 | $ | — | ||||||||

(All balances in 000’s except for percentages)

| September 30, 2018 |

Ounces of gold |

Cost | Fair Value |

% of Net Assets |

||||||||||||

| Investment in Gold |

22.0 | $ | 27,380 | $ | 26,042 | 98.99 | % | |||||||||

| Gold Delivery Agreement |

— | — | — | 0.00 | % | |||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total Investments |

22.0 | $ | 27,380 | $ | 26,042 | 98.99 | % | |||||||||

| Assets in excess of liabilities |

267 | 1.01 | % | |||||||||||||

|

|

|

|

|

|||||||||||||

| Net Assets |

$ | 26,309 | 100.00 | % | ||||||||||||

|

|

|

|

|

|||||||||||||

Derivatives Contract

at September 30, 2018

| Underlying Instrument |

Counter-Party |

Notional Value |

Expiration Date | Unrealized Appreciation/ (Depreciation) |

||||||||||

| Gold Delivery Agreement |

Merrill Lynch International | $ | 26,042 | 6/30/22 | $ | — | ||||||||

See notes to the unaudited financial statements.

16

Table of Contents

SPDR® Long Dollar Gold Trust

Unaudited Statements of Operations

For the three and six months ended March 31, 2019 and 2018

| (Amounts in 000’s of US$) | Three Months Ended Mar-31, 2019 |

Three Months Ended Mar-31, 2018 |

Six Months Ended Mar-31, 2019 |

Six Months Ended Mar-31, 2018 |

||||||||||||

| (unaudited) | (unaudited) | (unaudited) | (unaudited) | |||||||||||||

| EXPENSES |

||||||||||||||||

| Sponsor fees |

$ | 24 | $ | 15 | $ | 47 | $ | 30 | ||||||||

| Gold Delivery Provider fees |

12 | 8 | 24 | 15 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total expenses |

36 | 23 | 71 | 45 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net investment loss |

(36 | ) | (23 | ) | (71 | ) | (45 | ) | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net realized and change in unrealized gain/(loss) on investment in gold and Gold Delivery Agreement |

||||||||||||||||

| Net realized gain/(loss) from investment in gold sold to pay Sponsor fees |

2 | 1 | 1 | 2 | ||||||||||||

| Net realized gain/(loss) on Gold Delivery Agreement |

452 | (415 | ) | 975 | (533 | ) | ||||||||||

| Net realized gain/(loss) on gold transferred to cover Gold Delivery Agreement and Gold Delivery Provider fees |

91 | 168 | 70 | 229 | ||||||||||||

| Net realized gain/(loss) from gold distributed for the redemption of shares |

— | 149 | — | 149 | ||||||||||||

| Net change in unrealized appreciation/(depreciation) on investment in gold |

128 | 98 | 2,364 | 235 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net realized and change in unrealized gain/(loss) on investment in gold and Gold Delivery Agreement |

673 | 1 | 3,410 | 82 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net Income/(Loss) |

$ | 637 | $ | (22 | ) | $ | 3,339 | $ | 37 | |||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net income/(loss) per share |

$ | 2.77 | $ | (0.15 | ) | $ | 14.52 | $ | 0.25 | |||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Weighted average number of shares (in 000’s) |

230 | 150 | 230 | 149 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

See notes to the unaudited financial statements.

17

Table of Contents

SPDR® Long Dollar Gold Trust

Unaudited Statements of Cash Flows

For the three and six months ended March 31, 2019 and 2018

| (Amounts in 000’s of US$) | Three Months Ended Mar-31, 2019 |

Three Months Ended Mar-31, 2018 |

Six Months Ended Mar-31, 2019 |

Six Months Ended Mar-31, 2018 |

||||||||||||

| (unaudited) | (unaudited) | (unaudited) | (unaudited) | |||||||||||||

| INCREASE/DECREASE IN CASH FROM OPERATIONS: |

||||||||||||||||

| Cash proceeds received from sales of gold |

$ | 23 | $ | 15 | $ | 46 | $ | 29 | ||||||||

| Cash expenses paid |

(23 | ) | (15 | ) | (46 | ) | (29 | ) | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Increase/(Decrease) in cash resulting from operations |

— | — | — | — | ||||||||||||

| INCREASE/DECREASE IN CASH FLOWS FROM FINANCING ACTIVITIES: |

||||||||||||||||

| Cash proceeds from issuance of shares |

— | — | — | — | ||||||||||||

| Cash paid for repurchase of shares |

— | — | — | — | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Increase/(Decrease) in cash resulting from financing activities |

— | — | — | — | ||||||||||||

| Cash and cash equivalents at beginning of period |

— | — | — | — | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Cash and cash equivalents at end of period |

$ | — | $ | — | $ | — | $ | — | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| SUPPLEMENTAL DISCLOSURE OF NON-CASH FINANCING ACTIVITIES: |

||||||||||||||||

| Value of gold received for creation of shares - net of gold receivable |

$ | — | $ | — | $ | — | $ | 4,814 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Value of gold distributed for redemption of shares - net of gold payable |

$ | — | $ | (2,393 | ) | $ | — | $ | (2,393 | ) | ||||||

|

|

|

|

|

|

|

|

|

|||||||||

| SUPPLEMENTAL DISCLOSURE OF NON-CASH OPERATING ACTIVITIES: |

||||||||||||||||

| Value of Gold Delivery Agreement inflows - net of Gold Delivery Agreement receivable |

$ | 2,148 | $ | 1,645 | $ | 4,779 | $ | 3,005 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Value of Gold Delivery Agreement outflows - net of Gold Delivery Agreement payable |

$ | (1,957 | ) | $ | (2,365 | ) | $ | (3,954 | ) | $ | (3,710 | ) | ||||

|

|

|

|

|

|

|

|

|

|||||||||

| (Amounts in 000’s of US$) | Three Months Ended Mar-31, 2019 |

Three Months Ended Mar-31, 2018 |

Six Months Ended Mar-31, 2019 |

Six Months Ended Mar-31, 2018 |

||||||||||||

| (unaudited) | (unaudited) | (unaudited) | (unaudited) | |||||||||||||

| RECONCILIATION OF NET INCOME/(LOSS) TO NET CASH PROVIDED BY OPERATING ACTIVITIES |

||||||||||||||||

| Net Income/(Loss) |

$ | 637 | $ | (22 | ) | $ | 3,339 | $ | 37 | |||||||

| Adjustments to reconcile net income/(loss) to net cash provided by operating activities: |

||||||||||||||||

| Gold paid for Gold Delivery Provider fees |

12 | 8 | 24 | 15 | ||||||||||||

| Proceeds from sales of gold to pay expenses |

23 | 15 | 46 | 29 | ||||||||||||

| Net realized (gain)/loss from investment in gold sold to pay Sponsor fees |

(2 | ) | (1 | ) | (1 | ) | (2 | ) | ||||||||

| Net realized (gain)/loss on Gold Delivery Agreement |

(452 | ) | 415 | (975 | ) | 533 | ||||||||||

| Net realized (gain)/loss on gold transferred to cover Gold Delivery Agreement and Gold Delivery Provider fees |

(91 | ) | (168 | ) | (70 | ) | (229 | ) | ||||||||

| Net realized (gain)/loss from gold distributed for the redemption of shares |

— | (149 | ) | — | (149 | ) | ||||||||||

| Net change in unrealized (appreciation)/depreciation on investment in gold |

(128 | ) | (98 | ) | (2,364 | ) | (235 | ) | ||||||||

| Increase/(Decrease) in accounts payable to Sponsor |

1 | — | 1 | 1 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net cash provided by operating activities |

$ | — | $ | — | $ | — | $ | — | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

See notes to the unaudited financial statements.

18

Table of Contents

SPDR® Long Dollar Gold Trust

Unaudited Statements of Changes in Net Assets

For the three and six months ended March 31, 2019 and 2018

| (Amounts in 000’s of US$) | Three Months Ended Mar-31, 2019 |

Three Months Ended Mar-31, 2018 |

Six Months Ended Mar-31, 2019 |

Six Months Ended Mar-31, 2018 |

||||||||||||

| (unaudited) | (unaudited) | (unaudited) | (unaudited) | |||||||||||||

| Net Assets - Opening Balance |

$ | 29,011 | $ | 19,246 | $ | 26,309 | $ | 14,373 | ||||||||

| Creations |

— | — | — | 4,814 | ||||||||||||

| Redemptions |

— | (2,393 | ) | — | (2,393 | ) | ||||||||||

| Net investment loss |

(36 | ) | (23 | ) | (71 | ) | (45 | ) | ||||||||

| Net realized gain/(loss) from investment in gold sold to pay Sponsor fees |

2 | 1 | 1 | 2 | ||||||||||||

| Net realized gain/(loss) on Gold Delivery Agreement |

452 | (415 | ) | 975 | (533 | ) | ||||||||||

| Net realized gain/(loss) on gold transferred to cover Gold Delivery Agreement and Gold Delivery Provider fees |

91 | 168 | 70 | 229 | ||||||||||||

| Net realized gain/(loss) from gold distributed for the redemption of shares |

— | 149 | — | 149 | ||||||||||||

| Net change in unrealized appreciation/(depreciation) on investment in gold |

128 | 98 | 2,364 | 235 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net Assets - Closing Balance |

$ | 29,648 | $ | 16,831 | $ | 29,648 | $ | 16,831 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

See notes to the unaudited financial statements.

19

Table of Contents

SPDR® Long Dollar Gold Trust

Notes to the Unaudited Financial Statements

| 1. | Organization |

World Gold Trust (the “Trust”), formerly known as “World Currency Gold Trust,” was organized as a Delaware statutory trust on August 27, 2014 and is governed by the Fourth Amended and Restated Agreement and Declaration of Trust (“Declaration of Trust”), dated as of April 16, 2018, between WGC USA Asset Management Company, LLC (the “Sponsor”) and the Delaware Trust Company (the “Trustee”). The Trust is authorized to issue an unlimited number of shares of beneficial interest (“Shares”). The beneficial interest in the Trust may be divided into one or more series. The Trust has established six separate series, two of which were operational as of March 31, 2019. The accompanying financial statements relate to the series SPDR® Long Dollar Gold Trust (“GLDW”), which commenced operations on January 27, 2017. The fiscal year-end of GLDW is September 30.

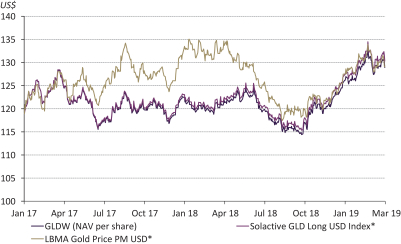

The investment objective of GLDW is to track the performance of the Solactive GLD® Long USD Gold Index (the “Index”), less GLDW’s expenses. The Index seeks to track the daily performance of a long position in physical gold, as represented by the London Bullion Market Association (“LBMA”) Gold Price AM, and a short position in a basket of specific non-U.S. currencies (i.e., a long U.S. dollar “USD” exposure versus the basket). Those non-U.S. currencies, which are weighted according to the Index, consist of the Euro, Japanese Yen, British Pound Sterling, Canadian Dollar, Swedish Krona, and Swiss Franc (each, a “Reference Currency” and together, the “Reference Currencies”).

BNY Mellon Asset Servicing, a division of The Bank of New York Mellon (“BNYM”), is the Administrator and Transfer Agent. BNYM also serves as the custodian of GLDW’s cash, if any. HSBC Bank plc (the “Custodian”) is responsible for custody of GLDW’s gold bullion. Merrill Lynch International is the Gold Delivery Provider. State Street Global Advisors Funds Distributors, LLC is the Marketing Agent. Solactive AG (the “Index Provider”) has licensed the Index to the Sponsor for use with GLDW.

The Statement of Financial Condition and Schedule of Investments at March 31, 2019, and the Statements of Operations, Changes in Net Assets and Cash Flows for the three and six months ended March 31, 2019 and 2018 have been prepared on behalf of GLDW without audit. In the opinion of management of the Sponsor, all adjustments (which include normal recurring adjustments) necessary to present fairly the financial position, results of operations and cash flows as of and for the three and six months ended March 31, 2019 and for all periods presented have been made. These financial statements should be read in conjunction with the financial statements and notes thereto included in the Annual Report on Form 10-K for the fiscal year ended September 30, 2018. The results of operations for the three and six months ended March 31, 2019 are not necessarily indicative of the operating results for the full fiscal year.

Capitalized terms used but not defined herein have the meaning as set forth in the Declaration of Trust.

The Trust had no operations with respect to GLDW’s Shares prior to January 27, 2017 other than matters relating to its organization, the registration of the offer and sale of Shares under the Securities Act of 1933, as amended, and the sale and issuance by GLDW to WGC (US) Holdings, Inc. of 10 Shares for an aggregate purchase price of $1,000.

| 2. | Significant Accounting Policies |

The preparation of financial statements in accordance with accounting principles generally accepted in the United States of America (“U.S. GAAP”) requires those responsible for preparing financial statements to make estimates and assumptions that affect the reported amounts and disclosures. Actual results could differ from those estimates. The following is a summary of significant accounting policies followed by GLDW.

20

Table of Contents

| 2.1 | Basis of Accounting |

GLDW is an investment company within the scope of Financial Accounting Standards Board Accounting Standards Codification (“ASC”) 946, Financial Services—Investment Companies, and therefore applies the specialized accounting and reporting guidance therein. It is not registered as an investment company under the Investment Company Act of 1940, as amended.

| 2.2 | Basis of Presentation |

The financial statements are presented for GLDW individually. The debts, liabilities, obligations and expenses incurred, contracted for or otherwise existing with respect to GLDW shall be enforceable only against its assets and not against the assets of the Trust generally or any other series that the Trust may establish.

| 2.3 | Cash and Cash Equivalents |

Cash and cash equivalents include highly liquid investments of sufficient credit quality with original maturity of three months or less.

| 2.4 | Solactive GLD® Long USD Gold Index—Gold Delivery Agreement |

Pursuant to the terms of the Gold Delivery Agreement, GLDW has entered into a transaction to deliver gold bullion to, or receive gold bullion from, Merrill Lynch International, as Gold Delivery Provider, each Business Day. The amount of gold bullion transferred essentially will be equivalent to GLDW’s profit or loss as if it had exchanged the Reference Currencies comprising the Index (“FX Basket”), in the proportion in which they are reflected in the Index, for USDs in an amount equal to its holdings of gold bullion on such day. In general, if there is a currency gain (i.e., the value of the USD against the Reference Currencies comprising the FX Basket increases), GLDW will receive gold bullion. In general, if there is a currency loss (i.e., the value of the USD against the Reference Currencies comprising the FX Basket decreases), GLDW will deliver gold bullion. In this manner, the amount of gold bullion held will be adjusted to reflect the daily change in the value of the Reference Currencies comprising the FX Basket against the USD. The Gold Delivery Agreement requires gold bullion ounces, calculated pursuant to formulas contained in the Gold Delivery Agreement, to be delivered to the custody account of GLDW or the Gold Delivery Provider, as applicable. The fee that GLDW pays the Gold Delivery Provider for its services under the Gold Delivery Agreement is accrued daily and reflected in the calculation of the amount of gold bullion to be delivered pursuant to the Gold Delivery Agreement. The realized gain/loss from the Gold Delivery Agreement is disclosed on the Statements of Operations and the Statements of Changes in Net Assets.

The Index is designed to represent the daily performance of a long position in physical gold, as represented by the LBMA Gold Price AM, and a short position in the basket of Reference Currencies with weightings determined by the FX Basket. The Reference Currencies and their respective weightings in the Index are as follows: Euro (EUR/USD) (57.6%), Japanese Yen (USD/JPY) (13.6%), British Pound Sterling (GBP/USD) (11.9%), Canadian Dollar (USD/CAD) (9.1%), Swedish Krona (USD/SEK) (4.2%), and Swiss Franc (USD/CHF) (3.6%).

| 2.5 | Fair Value Measurement |

U.S. GAAP defines fair value as the price a fund would receive to sell an asset or pay to transfer a liability in an orderly transaction between market participants at the measurement date. GLDW’s policy is to value its investments at fair value.

Various inputs are used in determining the fair value of GLDW’s assets or liabilities. Inputs may be based on independent market data (“observable inputs”) or they may be internally developed (“unobservable inputs”).

21

Table of Contents

These inputs are categorized into a disclosure hierarchy consisting of three broad levels for financial reporting purposes. The level of a value determined for an asset or liability within the fair value hierarchy is based on the lowest level of any input that is significant to the fair value measurement in its entirety. The three levels of the fair value hierarchy are as follows:

Level 1 – Unadjusted quoted prices in active markets for identical assets or liabilities;

Level 2 – Inputs other than quoted prices included within Level 1 that are observable for the asset or liability either directly or indirectly, including quoted prices for similar assets or liabilities in active markets, quoted prices for identical or similar assets or liabilities in markets that are not considered to be active, inputs other than quoted prices that are observable for the asset or liability and inputs that are derived principally from or corroborated by observable market data by correlation or other means; and

Level 3 – Inputs that are unobservable for the asset and liability, including a fund’s assumptions (if any) used in determining the fair value of investments.

The following table summarizes GLDW’s investments at fair value:

| (Amounts in 000’s of US$) March 31, 2019 |

Level 1 | Level 2 | Level 3 | |||||||||

| Investment in Gold |

$ | 29,508 | $ | — | $ | — | ||||||

| Gold Delivery Agreement |

— | — | — | |||||||||

|

|

|

|

|

|

|

|||||||

| Total |

$ | 29,508 | $ | — | $ | — | ||||||

|

|

|

|

|

|

|

|||||||

| (Amounts in 000’s of US$) September 30, 2018 |

Level 1 | Level 2 | Level 3 | |||||||||

| Investment in Gold |

$ | 26,042 | $ | — | $ | — | ||||||

| Gold Delivery Agreement |

— | — | — | |||||||||

|

|

|

|

|

|

|

|||||||

| Total |

$ | 26,042 | $ | — | $ | — | ||||||

|

|

|

|

|

|

|

|||||||

There were no transfers between Level 1 and other Levels for the period ended March 31, 2019 or for the fiscal year ended September 30, 2018.

The Administrator values the gold held by GLDW on the basis of the price of an ounce of gold as determined by ICE Benchmark Administration Limited (“IBA”), a benchmark administrator, which provides an independently administered auction process, as well as the overall administration and governance for the LBMA Gold Price. In determining the net asset value (“NAV”) of GLDW, the Administrator values the gold held on the basis of the price of an ounce of gold determined by the IBA 10:30 AM auction process (“LBMA Gold Price AM”), which is an electronic auction, with the imbalance calculated and the price adjusted in rounds (30 seconds in duration). The auction runs twice daily at 10:30 AM and 3:00 PM London time. The Administrator calculates the NAV of GLDW on each day the NYSE Arca is open for regular trading, generally as of 12:00 PM New York time. If no LBMA Gold Price AM is made on a particular evaluation day or if the LBMA Gold Price PM has not been announced by 12:00 PM New York time on a particular evaluation day, the next most recent LBMA Gold Price AM is used in the determination of the NAV of GLDW, unless the Administrator, in consultation with the Sponsor, determines that such price is inappropriate to use as the basis for such determination.

| 2.6 | Custody of Gold |

Gold bullion is held by HSBC Bank plc on behalf of GLDW. During the six months ended March 31, 2019 and the fiscal year ended September 30, 2018, no gold was held by a subcustodian.

22

Table of Contents

| 2.7 | Gold Delivery Agreement Receivable and Gold Receivable |

Gold Delivery Agreement receivable represents the quantity of gold due to be received under the Gold Delivery Agreement. The gold is transferred to GLDW’s allocated gold bullion account at the Custodian two business days after the valuation date.

Gold receivable represents the quantity of gold covered by contractually binding orders for the creation of Shares where the gold has not yet been transferred to GLDW’s account. Generally, ownership of the gold is transferred within two business days of the trade date.

| Mar-31, | Sep-30, | |||||||

| (Amounts in 000’s of US$) | 2019 | 2018 | ||||||

| Gold Delivery Agreement receivable |

$ | 149 | $ | 276 | ||||

| Gold Receivable |

— | — | ||||||

| 2.8 | Gold Delivery Agreement Payable and Gold Payable |

Gold Delivery Agreement payable represents the quantity of gold due to be delivered under the Gold Delivery Agreement. The gold is transferred from GLDW’s allocated gold bullion account at the Custodian two business days after the valuation date.

Gold payable represents the quantity of gold covered by contractually binding orders for the redemption of Shares where the gold has not yet been transferred out of GLDW’s account. Generally, ownership of the gold is transferred within two business days of the trade date.

| Mar-31, | Sep-30, | |||||||

| (Amounts in 000’s of US$) | 2019 | 2018 | ||||||

| Gold Delivery Agreement payable |

$ | — | $ | 1 | ||||

| Gold Payable |

— | — | ||||||

| 2.9 | Creations and Redemptions of Shares |

GLDW creates and redeems Shares from time to time, but only in one or more Creation Units (a Creation Unit equals a block of 10,000 Shares). It issues Shares in Creation Units to certain authorized participants (“Authorized Participants”) on an ongoing basis. The creation and redemption of Creation Units is only made in exchange for the delivery to or by the distribution from GLDW in the amount of gold and any cash represented by the Creation Units being created or redeemed. This amount will be based on the combined net asset value of the number of Shares included in the Creation Units being created or redeemed determined on the day the order to create or redeem Creation Units is properly received.

GLDW Shares commenced trading in January 2017. As the Shares are redeemable in Creation Units at the option of the Authorized Participants, GLDW has classified the Shares as Net Assets for financial reporting purposes. Changes in the Shares for the six months ended March 31, 2019 and March 31, 2018 were:

| (Amounts in 000’s) | Six Months Ended Mar-31, 2019 |

Six Months Ended Mar-31, 2018 |

||||||

| Activity in Number of Shares Created and Redeemed: |

||||||||

| Creations |

— | 40 | ||||||

| Redemptions |

(— | ) | (20 | ) | ||||

|

|

|

|

|

|||||

| Net change in Number of Shares Created and Redeemed |

— | 20 | ||||||

|

|

|

|

|

|||||

23

Table of Contents

| (Amounts in 000’s of US$) | Six Months Ended Mar-31, 2019 |

Six Months Ended Mar-31, 2018 |

||||||

| Activity in Value of Shares Created and Redeemed: |

||||||||

| Creations |

$ | — | $ | 4,814 | ||||

| Redemptions |

(— | ) | (2,393 | ) | ||||

|

|

|

|

|

|||||

| Net change in Value of Shares Created and Redeemed |

$ | — | $ | 2,421 | ||||

|

|

|

|

|

|||||

| 2.10 | Income and Expense (Amounts in 000’s of US$) |

The Administrator will, at the direction of the Sponsor, sell GLDW’s gold as necessary to pay its expenses. When selling gold to pay expenses, the Administrator will endeavor to sell the smallest amount of gold needed to pay expenses in order to minimize GLDW’s holdings of assets other than gold. Unless otherwise directed by the Sponsor, to meet expenses the Administrator will give a sell order and sell gold to the Custodian at the next LBMA Gold Price AM following the sell order. A gain or loss is recognized based on the difference between the selling price and the average cost of the gold sold, and such amounts are reported as net realized gain/(loss) from investment in gold sold to pay Sponsor fees on the Statements of Operations.

GLDW’s net realized and change in unrealized gain on investment in gold and Gold Delivery Agreement for the six-month period ended March 31, 2019 of $3,410 is made up of a realized gain of $1 from the sale of gold to pay Sponsor fees, a realized gain of $975 from the Gold Delivery Agreement, a realized gain of $70 from gold transferred to cover Gold Delivery Agreement and Gold Delivery Provider fees, and a change in unrealized appreciation of $2,364 on investment in gold.

GLDW’s net realized and change in unrealized gain on investment in gold and Gold Delivery Agreement for the six-month period ended March 31, 2018 of $82 is made up of a realized gain of $2 from the sale of gold to pay Sponsor fees, a realized loss of $533 from the Gold Delivery Agreement, a realized gain of $229 from gold transferred to cover Gold Delivery Agreement and Gold Delivery Provider fees, a realized gain of $149 from gold distributed for the redemption of shares, and a change in unrealized appreciation of $235 on investment in gold.

| 2.11 | Income Taxes |

GLDW is classified as a “grantor trust” for U.S. federal income tax purposes. As a result, it is not subject to U.S. federal income tax. Instead, its income and expenses “flow through” to the shareholders, and the Administrator will report GLDW’s proceeds, income, deductions, gains and losses to the Internal Revenue Service on that basis.

The Sponsor has evaluated whether there are uncertain tax positions that require financial statement recognition and has determined that no reserves for uncertain tax positions are required as of March 31, 2019 or September 30, 2018. As of March 31, 2019, the 2018 and 2017 tax years remain open for examination. There were no examinations in progress at period end.

| 2.12 | New Accounting Pronouncements |

In August 2018, the FASB issued Accounting Standards Update 2018-13, Fair Value Measurement (Topic 820): Disclosure Framework—Changes to the Disclosure Requirements for Fair Value Measurement (“ASU 2018-13”). The update provides guidance that eliminates, adds and modifies certain disclosure requirements for fair value measurements. ASU 2018-13 will be effective for annual periods beginning after December 15, 2019. Early adoption is permitted. Management of the Sponsor does not currently expect these changes to have a material impact to future financial statements.

24

Table of Contents

| 3. | Related Parties—Sponsor |

The Sponsor receives an annual fee equal to 0.33% of the NAV of GLDW, calculated on a daily basis.

The Sponsor is responsible for the payment of all ordinary fees and expenses of GLDW, including but not limited to the following: fees charged by its Administrator, Custodian, Index Provider, Marketing Agent and Trustee; exchange listing fees; typical maintenance and transaction fees of The Depository Trust Company; SEC registration fees; printing and mailing costs; audit fees and expenses; and legal fees not in excess of $100,000 per annum and expenses and applicable license fees. The Sponsor is not, however, required to pay any extraordinary expenses incurred in the ordinary course of GLDW’s business as outlined in the Amended and Restated Sponsor Agreement between the Sponsor and the Trust.

| 4. | Fund Expenses |

GLDW’s only ordinary recurring operating expenses are expected to be the Sponsor’s annual fee of 0.33% of the NAV of GLDW and the Gold Delivery Provider’s annual fee of 0.17% of the NAV of GLDW, each of which accrue daily. The Sponsor’s fee is payable by GLDW monthly in arrears, while the Gold Delivery Provider’s fee is paid daily with gold bullion in-kind, so that GLDW’s total annual expense ratio is expected to equal 0.50% of daily net assets. Expenses payable by GLDW will reduce the NAV of GLDW.

| 5. | Concentration of Risk |

GLDW’s primary business activities are the investment in gold bullion, the transactions under the Gold Delivery Agreement, and the issuance and sale of Shares. Various factors could affect the price of gold including: (i) global gold supply and demand, which is influenced by such factors as forward selling by gold producers, purchases made by gold producers to unwind gold hedge positions, central bank purchases and sales, and production and cost levels in major gold-producing countries such as China, Australia, and the United States; (ii) investors’ expectations with respect to the rate of inflation; (iii) currency exchange rates; (iv) interest rates; (v) investment and trading activities of hedge funds and commodity funds; and (vi) global or regional political, economic or financial events and situations. In addition, there is no assurance that gold will maintain its long-term value in terms of purchasing power in the future. In the event that the price of gold declines, the Sponsor expects the value of an investment in the Shares to decline proportionately. Each of these events could have a material effect on GLDW’s financial position and results of operations.

| 6. | Foreign Currency Risk |