UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

| ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |||||

For the fiscal year ended December 31 , 2023

OR

| TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |||||

For the transition period from to

Commission File Number 001-40406

(Exact name of registrant as specified in its charter)

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification Number) | |||||||

ZipRecruiter, Inc.

(Address of principal executive office, including zip code)

(877 ) 252-1062

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol | Name of each exchange on which registered | ||||||

Securities Registered Pursuant to Section 12(g) of the Act: None.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☒ No ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| ☒ | Accelerated filer | ☐ | |||||||||||||||

| Non-accelerated filer | ☐ | Smaller reporting company | |||||||||||||||

| Emerging growth company | |||||||||||||||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C.7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☒

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

1

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act): Yes ☐ No ☒

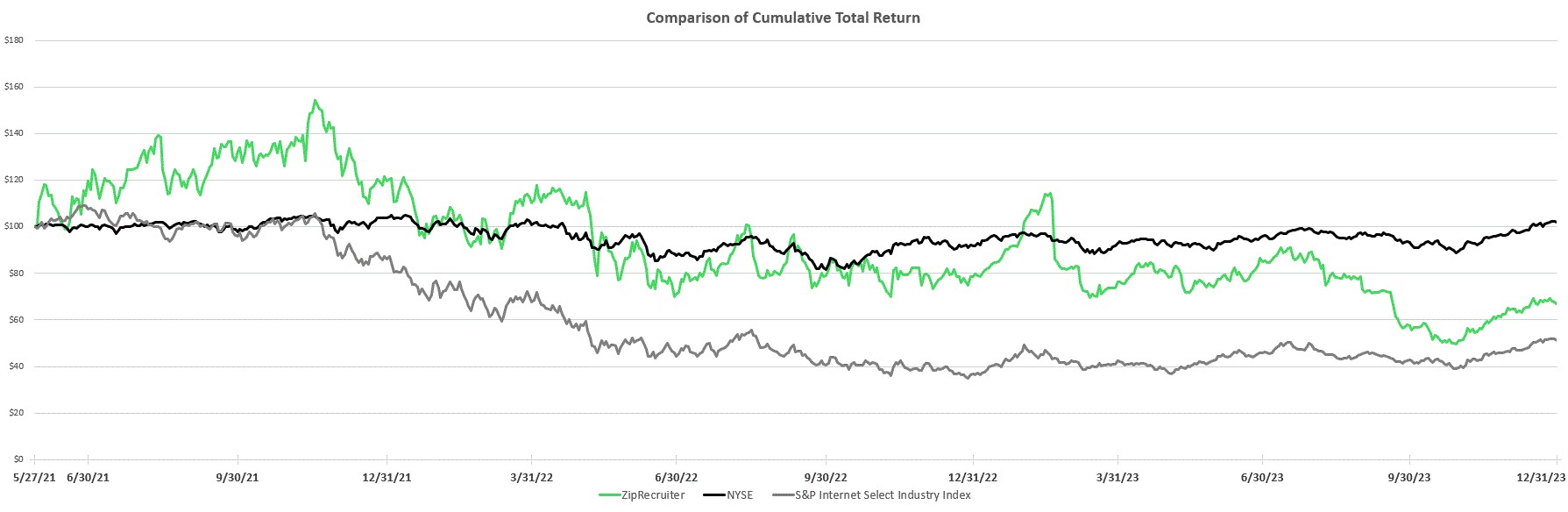

The aggregate market value of voting stock held by non-affiliates of the registrant, as of June 30, 2023, the last day of the registrant’s most recently completed second fiscal quarter, was $1.2 billion (based on the closing price for the shares of the registrant’s common stock as reported by the New York Stock Exchange on June 30, 2023). Shares of common stock held by each executive officer, director, and holder of 5% or more of the outstanding common stock have been excluded in that such persons may be deemed to be affiliates. This determination of affiliate status is not necessarily a conclusive determination for other purposes.

The registrant had 76,440,263 shares of Class A common stock outstanding and 22,633,316 shares of Class B common stock outstanding as of February 16, 2024.

DOCUMENTS INCORPORATED BY REFERENCE

Information required in response to Part III of Form 10-K (Items 10, 11, 12, 13 and 14) is hereby incorporated by reference to portions of the Registrant’s Proxy Statement for the Annual Meeting of Stockholders to be held in 2024. The Proxy Statement will be filed by the Registrant with the Securities and Exchange Commission no later than 120 days after the end of the Registrant’s fiscal year ended December 31, 2023.

TABLE OF CONTENTS

Signatures | |||||

3

NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K contains forward-looking statements. All statements contained in this Annual Report on Form 10-K other than statements of historical fact, including statements regarding our future operating results and financial position, our business strategy and plans, market growth, and our objectives for future operations, are forward-looking statements. The words “believe,” “may,” “will,” “estimate,” “potential,” “continue,” “anticipate,” “intend,” “expect,” “could,” “would,” “project,” “plan,” “target,” and similar expressions are intended to identify forward-looking statements.

Forward-looking statements contained in this Annual Report on Form 10-K include, but are not limited to, statements about:

•our future financial performance, including our expectations regarding our revenue, cost of revenue, gross profit, operating expenses including changes in research and development, sales and marketing, and general and administrative expenses (including any components of the foregoing), and our ability to achieve and/or maintain future profitability;

•effects of a variety of global business and macroeconomic factors that affect our business, the employment market, and the economy in general, including inflationary pressures, a volatile interest rate environment, increasing borrowing costs, actual or perceived instability in the global banking industry and the impacts, cybersecurity incidents, uncertainty with respect to the federal debt ceiling and budget and potential government shutdowns related thereto, and the impacts of the war in Ukraine and the Israel-Hamas war;

•our business plan and our ability to effectively manage our growth;

•our ability to compete with well-established competitors and new entrants;

•our ability to enhance our marketplace and introduce new and improved offerings;

•our ability to increase the number of employers and job seekers in our marketplace;

•our ability to strengthen our technology that underpins our marketplace;

•our ability to attract and retain qualified employees and key personnel;

•our ability to execute our strategy;

•beliefs and objectives for future operations;

•the effects of seasonal trends on our results of operations;

•our ability to expand to new markets;

•our ability to maintain, protect, and enhance our brand and intellectual property;

•our ability to stay in compliance with laws and regulations that currently apply or become applicable to our business;

•economic and industry trends, projected growth, or trend analysis; and

•increased expenses associated with being a public company.

We caution you that the foregoing list may not contain all of the forward-looking statements made in this Annual Report on Form 10-K.

We have based these forward-looking statements largely on our current expectations and projections about future events and trends that we believe may affect our financial condition, results of operations, business strategy, short and long-term business operations and objectives, and financial needs. These

4

forward-looking statements are subject to a number of risks, uncertainties, and assumptions, including those described in the section titled “Risk Factors.” Moreover, we operate in a very competitive and rapidly changing environment. New risks emerge from time to time. It is not possible for our management to predict all risks, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements we may make. In light of these risks, uncertainties, and assumptions, the future events and trends discussed in this Annual Report on Form 10-K may not occur and actual results could differ materially and adversely from those anticipated or implied in the forward-looking statements.

You should not rely upon forward-looking statements as predictions of future events. The events and circumstances reflected in the forward-looking statements may not be achieved or occur. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, performance, or achievements. We undertake no obligation to update any of these forward-looking statements for any reason after the date of this Annual Report on Form 10-K or to conform these statements to actual results or revised expectations, except as required by law.

You should read this Annual Report on Form 10-K with the understanding that our actual future results, performance, and events and circumstances may be materially different from what we expect.

As used herein, “ZipRecruiter,” “the Company,” “we,” “us,” “our,” and similar terms include ZipRecruiter, Inc. and its subsidiaries, unless the context indicates otherwise.

SUMMARY OF RISK FACTORS

Our business is subject to numerous risks and uncertainties, including those highlighted in the section titled “Risk Factors” later in this Annual Report on Form 10-K. These risks include, but are not limited to, the following:

•Our business is significantly affected by fluctuations in general economic conditions. There is risk that any economic recovery may be delayed, short-lived and/or uneven, and may not result in increased demand for our services.

•We face intense competition and could lose market share to our competitors, which could adversely affect our business, operating results, and financial condition.

•Our marketplace functions on software that is highly technical and complex and if it fails to perform properly, our reputation could be adversely affected, our market share could decline and we could be subject to liability claims.

•Our future success depends in part on employers purchasing and renewing or upgrading subscriptions and performance-based services from us. Any decline in our user renewals or upgrades or performance-based services could harm our future operating results.

•If we fail to scale our business effectively, our business, operating results, and financial condition could be adversely affected.

•Significant segments of the market for job advertisement services may have hiring needs and service preferences that are subject to greater volatility than the overall economy.

•Our efforts and ability to sell to a broad mix of businesses could adversely affect our operating results in a given period.

•Our business depends largely on our ability to attract and retain talented employees, including senior management and key personnel. If we lose the services of Ian Siegel, our Chief Executive Officer, or other members of our senior management team, we may not be able to execute on our business strategy.

5

•If internet search engines’ methodologies or other channels that we use to direct traffic to our website are modified to our disadvantage, or our search result page rankings decline for other reasons, our user growth could decline.

•Our quarterly results may fluctuate significantly and may not fully reflect the underlying performance of our business, which makes our future results difficult to predict.

•Our success depends on our ability to maintain the value and reputation of the ZipRecruiter brand.

•Our indebtedness could adversely affect our liquidity and financial condition.

•Market volatility may affect the value of an investment in our Class A common stock and could subject us to litigation.

•The dual class structure of our common stock concentrates voting control with those stockholders who held our capital stock prior to our listing, including our directors, executive officers, and 5% stockholders. This ownership will limit or preclude your ability to influence corporate matters, including the election of directors and the approval of any change of control transaction.

6

Part I

Item 1. Business

Overview

The job market remains painfully inefficient. Job seekers are required to navigate on their own in order to find the right jobs to apply to, usually across multiple sites and without effective tools for monitoring new opportunities. Employers in turn are overwhelmed by the complexity of modern recruiting given the abundance of job boards, search engines, and social networks to source talent from. Neither side is an expert at their role. Neither side enjoys the process.

ZipRecruiter is a two-sided marketplace for work that simplifies the job market for both job seekers and employers. Unlike traditional online job sites, ZipRecruiter works like a matchmaker curating job opportunities for job seekers, and candidates for employers.

Our Mission. To actively connect people to their next great opportunity.

Creating Value for Job Seekers. For job seekers across all industries and levels of seniority, we operate like a dedicated recruiter. That means presenting strong fit job opportunities, proactively pitching strong fit potential candidates to employers and providing job seekers with updates on the status of their applications and guidance on how to get more attention from potential employers. This makes job seekers feel supported while searching for work.

Creating Value for Employers. For employers, we focus on building technology to rapidly deliver quality candidates to companies of all sizes and across all industries. Our algorithms alert strong-fit job seekers in our marketplace when a job is posted. We also present high-quality candidates to employers whom we believe will be a Great Match for their jobs, and allow these employers to invite those candidates to apply.

Unique Data and Artificial Intelligence Provide Better Outcomes for Employers and Job Seekers. With a relevant data pipeline created from billions of interactions between job seekers and employers, we are uniquely positioned to harness that data to fuel the advanced artificial intelligence, or AI, behind our matching, recommendation and marketplace optimization capabilities. Through our deep learning-based natural language processing, we understand job seekers’ and employers’ nuanced needs. We analyze clicks, applications, hiring signals and numerous other interactions to improve outcomes for all participants in our marketplace. Our advanced technology stack processes the data generated by our highly engaged user base to continuously improve our matching.

Accelerating Network Effects. Increasing the number of jobs in our marketplace attracts more job seekers. A greater number of job seekers attracts more employers who in turn post more job opportunities in our marketplace. These natural, self-perpetuating network effects increase our data and thereby accelerate the rate at which our matching technology gets smarter over time.

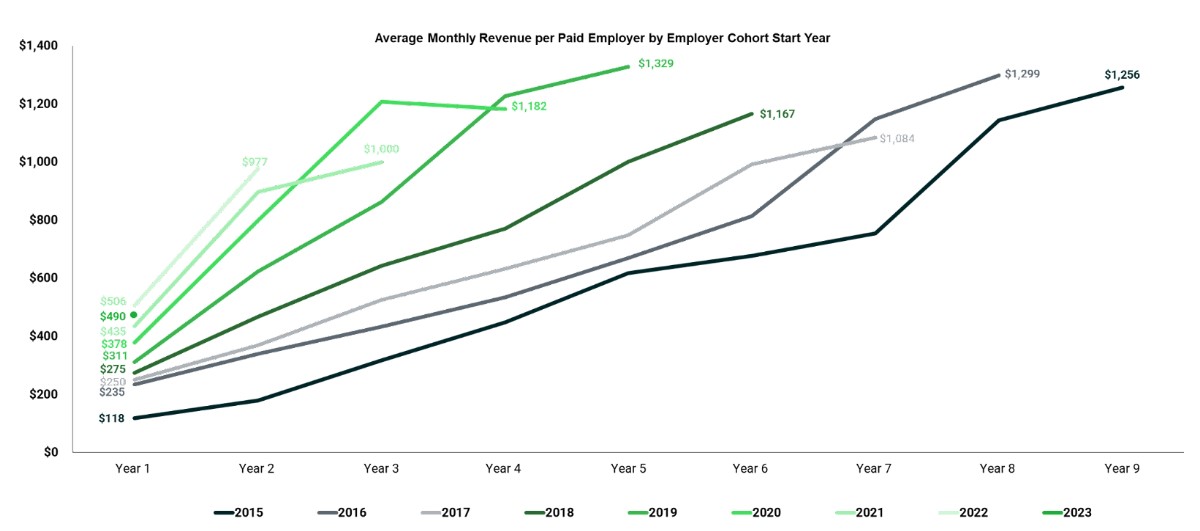

Compelling Financial Results. The combination of the scale on both sides of our marketplace, our efficient and highly flexible go-to-market strategy and intelligent use of technology has resulted in compelling financial results. For the year ended December 31, 2023, our revenue was $645.7 million and we generated net income of $49.1 million and Adjusted EBITDA of $175.3 million. For the year ended December 31, 2022, our revenue was $904.6 million and we generated net income of $61.5 million and Adjusted EBITDA of $184.9 million. Adjusted EBITDA is a financial measure not presented in accordance with generally accepted accounting principles, or GAAP. For a definition of Adjusted EBITDA, an explanation of our management’s use of this measure, and a reconciliation of net income to Adjusted EBITDA, see “Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations—Key Operating Metrics and Non-GAAP Financial Measures.”

7

What We Do

We enable work by connecting job seekers and employers in our marketplace.

How We Work for Employers

Our technology delivers high-quality matches to our employers immediately after a job goes live and provides tools to streamline the candidate selection process.

Quality Candidates Fast

•Instant alerts to qualified potential candidates. When employers post a job, ZipRecruiter’s matching technology immediately identifies and sends an alert to strong-fit job seekers in our marketplace.

•Direct recruitment messages from the employer. Immediately after a job is posted, ZipRecruiter’s matching technology presents the employer with a list of the best potential candidates in the market. The employer can then, with a single click, personally invite the most qualified potential candidates to apply. These recruitment messages directly from the employer drive the highest rated candidates ever delivered through ZipRecruiter.

•Matching that learns. When an employer gives an applicant a “thumbs up” rating, our technology searches for other job seekers with similar profiles to that candidate and proactively encourages them to apply. Our matching will continue to improve over time as we collect more data and our technology applies the learnings embedded in the data.

•Job distribution. Our employers’ jobs are posted not only across ZipRecruiter’s online sites and mobile apps but are also distributed to well over 1,000 sites managed by our Job Distribution Partners. Job Distribution Partners are third-party sites who have a relationship with us and advertise jobs from our marketplace, and include job boards, newspaper classifieds, search engines, social networks, talent communities and resume services. The diversity and depth of our partner network enables employers to reach an especially broad job seeker audience.

•Access to an expansive database of job seekers. We provide employers the ability to search through our database of job seekers who have broad skill sets and a range of experiences.

Efficient Candidate Vetting

•All the applicants in one place. For employers who do not already have an established process to manage hiring, job applicants are captured inside the ZipRecruiter Applicant Tracking System, or ATS. Our ATS centralizes and simplifies the decision-making process. Inside this system, hiring teams can review, rate, manage the status of, and ultimately decide which candidate to hire. For employers already using certain third-party ATSs, we seamlessly populate candidates into their existing workflow.

•Great Matches. Our technology labels candidates identified as a Great Match to help hiring managers avoid missing high-quality candidates.

•In-demand candidate alerts. We apply an “Act Fast!” label to notify employers when their candidates have received interest from other employers, encouraging them to reach out quickly. In a tight, competitive market for top-quality talent, these notifications prompt hiring managers to move quickly to avoid losing out on a potentially great hire.

Flexible Pricing

•Flexible pricing based on customer needs. We provide a variety of pricing plans to best suit an employer’s specific needs, including flat rate pricing on terms typically ranging from a day to a

8

year, as well as performance-based pricing for employers that run sophisticated recruitment marketing campaigns.

How We Work for Job Seekers

For job seekers, we make finding work easier.

Process Efficiency

•Search millions of jobs in one place. ZipRecruiter provides job seekers with access to millions of jobs from all over the internet. Job seekers can filter this vast array of opportunities by using numerous criteria to find the handful of best potential matches on our website or in our mobile app.

•Simple, one-click applications. On ZipRecruiter, job seekers create a profile and can then apply for certain opportunities with a single click. Our one-click application technology works across both our marketplace and certain Job Distribution Partners to remove barriers between a job seeker and their next opportunity. This is particularly useful for job seekers on mobile devices where a resume can’t be easily created or uploaded.

•Job application tracking. Job seekers typically apply to numerous opportunities throughout the course of their search. Our simple, user-friendly dashboard aggregates their application history so job seekers can track opportunities they have reviewed or applied to.

Personalized Recruiter Assistance

•“Phil,” your (automated) career advisor. Our automated career advisor “Phil” welcomes job seekers to our marketplace and engages with them throughout their onboarding and job seeking journeys. Through Phil, job seekers are presented with curated opportunities for which they might be a Great Match. Phil provides positive, personalized messages to candidates, inviting them to apply for new open positions. Through repeated interaction throughout the ZipRecruiter job seeker experience, Phil learns about each job seeker and is able to deliver better matches and recommendations.

•Pitched to employers as a potential candidate. After a new job is posted, ZipRecruiter’s matching technology immediately presents strong-fit in-market job seekers to the employer for consideration. Employers can then directly invite the job seekers they like best to apply. Candidates receive inbound requests from interested employers before applying or even actively searching. While job seekers typically do not like the process of applying to jobs, the feeling of affirmation from being recruited to a particular job drives greater engagement.

•Job alerts. ZipRecruiter delivers a digest of relevant new opportunities from across the web on a frequent basis, enabling job seekers to monitor the full breadth of our marketplace offerings.

•Application updates. Our technology notifies job seekers when an employer either views their application or gives them a “thumbs up” rating. This addresses the #1 complaint we hear from job seekers: applying to a job and then hearing nothing back.

9

Our Strengths

Our core competitive advantages that have been critical to our success include:

•Large and proprietary data set. We capture billions of user interactions facilitated by our marketplace. Going far beyond the resume, job description and job search history, we observe how job seekers interact with every job and how employers engage with every job seeker in our marketplace.

•Leading edge AI-powered matching technology. Our purpose-built technology captures insights from our proprietary data set, driving meaningful increases in match quality over time.

•Powerful network effects. More jobs, more job seekers and better matching technology over time create more high-velocity hiring activity in our marketplace, fueling a self-perpetuating cycle of network effects.

•Best products for job seekers. Job seekers love our #1 rated job search app1. Phil, our AI-powered career advisor, gets to know each individual job seeker, helping them discover new opportunities and stand out to employers.

•Our brand. Since our founding, we have invested to build the ZipRecruiter brand to 80% aided brand awareness among U.S. employers and job seekers.

•Flexible business model. Our sales and marketing spend is highly variable, allowing us to quickly align investment with a changing macroeconomic backdrop. We respond to employer and job seeker acquisition opportunities quickly, taking advantage where we see great returns on investment.

•Designed for simplicity and speed. We thrive on taking unnecessarily complex processes and simplifying them. This product design philosophy permeates our entire company. We focus on continually making ZipRecruiter faster and simpler for employers and job seekers to use.

•Metrics-driven culture. We are a metrics and data-driven company. We are disciplined about setting quantitative operating goals and then finding innovative ways to achieve those goals.

Our Competition

Hiring is a vast, competitive, and highly fragmented market. We compete in varying degrees with other online job sites including CareerBuilder, Craigslist, Glassdoor, Indeed, LinkedIn, Monster and hundreds of others.

Competition for Employers

Employers have a range of options when posting job opportunities. We compete to attract and retain employers to advertise their jobs in our marketplace. We compete for employers based on several factors including the pricing and features of our offerings, the speed of receiving great candidates, the size of our job seeker community, the simplicity of our user experience, and our trusted brand. We believe that our employers are able to cost-effectively attract the right job seekers in our marketplace compared to other online recruiting sites and traditional “offline” recruiting service providers due to the combination of the strength of our job seeker community and our proven matching technology that continues to get smarter over time.

Competition for Job Seekers

Job seekers have a variety of choices when searching for their next great job opportunity. We compete for job seekers on many fronts, including our ability to surface unique and attractive jobs, our

1 Based on job seeker app ratings, as of January 2024 from AppFollow for ZipRecruiter, CareerBuilder, Glassdoor, Indeed, LinkedIn, and Monster.

10

ability to simplify the search process, the transparent feedback job seekers receive on the status of their applications, and our trusted brand. Our marketplace is free to job seekers. We believe our offering to job seekers compares favorably to alternatives due to the combination of our large and unique pool of job opportunities, and the personalized job seeker experience facilitated by our AI-powered career advisor named Phil.

Our Employees and Human Capital Resources

As of December 31, 2023, we employed over 1,000 individuals across the United States, the United Kingdom, Canada and Israel. We also engage independent contractors and consultants. We have efficiently operated and adapted as a remote and hybrid workforce since the beginning of 2020; however, we maintain office spaces for in-person work in Santa Monica, California, Palo Alto, California, Phoenix, Arizona, London, the United Kingdom, and Tel Aviv, Israel. Collectively, we view our team as our greatest asset, and we take great pride in having been recognized by companies such as Comparably and Newsweek for various awards including “Best Company Culture”, “Best Place to Work,” and “Newsweek’s Top 100 Most Loved Workplaces” to name a few.

Several aspects of how we operate our business have been critical to building our team:

•We use ZipRecruiter. We utilize the power of the marketplace we have built to connect to our next great employees.

•We foster an entrepreneurial culture of safety and innovation. We believe a safe, professional environment empowers people to take risks and be their best selves. Our employees are encouraged to champion great ideas, embrace innovative approaches and use data to advocate for their point of view.

•We embrace diversity, equity and inclusion, or DE&I: We believe our company is strengthened by a culture that embraces diversity and inclusion. We create a safe space for all employees to feel heard, included and like they belong. Our employee-led and executive-sponsored Employee Resource Groups are highly active and create communities for employees to engage in. Our commitment to DE&I is aligned with our mission to actively connect people from all backgrounds to their next great opportunity.

•We reward high performance. We focus on attracting and retaining results-oriented employees who are passionate about our mission. We use a variety of compensation tools to recruit, retain and reward employees whose achievements exceed our high expectations.

•We are committed to our employees’ career development. We invest in our people so that ZipRecruiter is not just a great place to work, but also a great place to advance and grow a rewarding career. Over half of our leadership positions are held by people who grew internally at ZipRecruiter, demonstrating our dedication to fostering a culture of professional growth and development.

On May 31, 2023, we announced a plan to reduce our global headcount by approximately 270 employees, which represents approximately 20% of our total number of employees prior to the reduction. Approximately 50% of the impacted employees were from our sales and customer support teams. This action was taken in response to current market conditions and after reducing other discretionary expenses, with a view toward driving long-term efficiency. By streamlining our organization and optimizing our cost structure, we believe we can execute faster with increased focus on our top priorities and long-term strategic growth objectives, including continued development of its technology roadmap.

Our Technology

Our research and development efforts are focused on delivering great products through data driven systems, machine learning technology, and robust infrastructure to ensure that our marketplace is sophisticated, low latency, resilient, and available to our users at all times.

11

Our research and development organization is built around small, cross-functional development teams. These development teams foster greater agility, which enables us to develop new, innovative product features as well as iterate quickly on new capabilities and optimizations. Our development teams design, build and continue to expand our ATS, mobile apps, data processing and analysis pipelines, marketplace functionality, search and matching, email and messaging, and third-party product integrations as well as the software infrastructure that supports best practices such as high frequency deployment, orchestrating containers, and leveraging open-source technologies. Our systems are currently operated entirely on cloud services.

We have engineers, product managers and data scientists all over the United States and in Tel Aviv, Israel. We intend to continue to invest in our technology capabilities as we further build out a category-defining marketplace for job seekers and employers.

Regulatory Matters

We are subject to many varying laws and regulations in the United States, Canada, the European Union, the United Kingdom and throughout the world, including those related to privacy, data protection, content regulation, intellectual property, consumer protection, e-commerce, marketing, advertising, messaging, rights of publicity, health and safety, employment and labor, product liability, accessibility, competition, and taxation. These laws and regulations are constantly evolving and may be interpreted, applied, created, or amended in a manner that could harm or require us to change our current or future business and operations. In addition, it is possible that certain governments may seek to block or limit our products and services or otherwise impose other restrictions that may affect the accessibility or usability of any or all of our products and services for an extended period of time or indefinitely.

Data Privacy and Security Laws

We are subject to various federal, state and international laws and regulations relating to the privacy and security of consumer, customer and employee personal information. These laws often require companies to implement specific information security controls to protect certain types of data (such as personal data, “special categories of personal data” or health data), and/or impose specific requirements relating to the collection or processing of such data.

In the United States, the Federal Trade Commission, or the FTC, the Department of Commerce, and various states continue to call for greater regulation of the collection of personal data, as well as restrictions for certain targeted advertising practices. Section 5(a) of the FTC Act empowers the agency to enforce against “unfair or deceptive acts or practices in or affecting commerce,” and the FTC has used this authority extensively to hold businesses to fair and transparent privacy and security standards. Numerous states have also enacted or are proposing legislation to enact state-level data privacy laws and regulations governing the collection, use, and processing of state residents’ personal information. For example, the California Consumer Privacy Act, or CCPA, came into force in California in 2020. The CCPA established a new privacy framework for covered businesses such as ours, created new privacy rights for consumers residing in the state, and required us to modify our data processing practices and policies and incur compliance related costs and expenses. The California Privacy Rights and Enforcement Act of 2020, or CPRA, which took effect January 1, 2023, further expanded the CCPA with additional data privacy compliance requirements and rights for California consumers, and established a new regulatory agency dedicated to enforcing those requirements. Similar comprehensive privacy legislation has also been enacted in at least ten other U.S. states and imposes similar compliance obligations. These laws create new privacy rights for consumers residing in those states and new obligations for businesses operating in those states, including obligations relating to data minimization, processing of sensitive information, and targeted advertising practices. In the United States, several data privacy proposals (including proposed comprehensive legislation) are pending before federal and state legislative and regulatory bodies, which may impose additional obligations and restrictions.

In Canada, the federal Personal Information Protection and Electronic Documents Act, or PIPEDA, sets forth ten principles that are designed to protect the personal information of individuals in Canada,

12

and places obligations on companies that process personal information. PIPEDA applies to organizations that collect, use or disclose personal information in the course of commercial activities, where such activities take place within a Canadian province that does not otherwise have “substantially similar” legislation. Alberta, British Columbia and Québec are the only provinces that have enacted comprehensive private sector privacy statutes that have each been deemed “substantially similar” to PIPEDA. As such, PIPEDA will not apply to commercial organizations operating within Alberta, British Columbia and Québec. Although these provincial laws are similar in principle to PIPEDA, there are important differences in the details. Moreover, Québec recently made substantial changes to its provincial privacy laws, including An Act respecting the protection of personal information in the private sector, as amended by Law 25 (aka Bill 64) (Quebec Privacy Act).

In the European Union, the General Data Protection Regulation, or the GDPR, became effective on May 25, 2018. The GDPR created a single legal framework in relation to the collection, control, processing, sharing, disclosure and other use of data relating to an identifiable living individual that applies across all EU member states. However, the GDPR allows for derogations where EU member states can deviate from the requirements in their own legislation, including for example, introducing measures that apply in specific situations and implementing rules regarding legal basis of processing. It is therefore likely that we will need to comply with these local regulations in addition to the GDPR, where we operate or provide services in those EU member state jurisdictions. Local supervisory authorities are able to impose fines for non-compliance and have the power to carry out audits, require companies to cease or change processing, request information, and obtain access to premises. The GDPR created more stringent operational requirements for processors and controllers of personal data, including, for example, granting new rights for data subjects as well as enhancing existing rights, requiring enhanced disclosures to data subjects about how personal data is processed (including information about the profiling of individuals and automated individual decision-making), records of processing activities, limiting retention periods of personal data, requiring mandatory data breach notification to data protection regulators or supervisory authorities (and in certain cases, to the affected individuals), and requiring additional policies and procedures to comply with the accountability principle under the GDPR.

In the United Kingdom, the UK Data Protection Act 2018, the UK’s implementation of the GDPR, became effective in May 2018 and was statutorily amended in 2019 and further supplemented by the U.K. General Data Protection Regulation, or the UK GDPR, which came into effect on January 1, 2021. From the beginning of 2021 (when the transitional period following the United Kingdom’s exit from the European Union expired), we have had to continue to comply with the GDPR as well as the U.K.’s Data Protection Act and the UK GDPR. The European Commission adopted a decision on the UK’s adequacy under the GDPR in June 2021, meaning that most data can continue to flow from the European Economic Area, or EEA, to the UK without the need for additional safeguards. In 2024, the UK government will likely continue its focus on data protection reform to make further modifications to the UK GDPR.

In any event, we are subject to laws, rules, and regulations regarding cross-border transfers of personal data, including laws relating to the transfer of personal data outside the EEA and the UK. On June 4, 2021 the European Commission finalized new versions of the Standard Contractual Clauses, with the Implementing Decision now in effect. The U.K. Information Commissioner’s Office of the Data Protection Authority published the U.K. version of the Standard Contractual Clauses, or the SCCS, and by March 2024, we will be required to use and honor these clauses for transfers of U.K. residents’ personal data to a foreign country that does not have adequate data protection. Effective July 10, 2023, the new EU-U.S. Data Privacy Framework, or DPF, has been recognized as adequate under EU law to allow transfers of personal data from the EU to certified companies in the U.S. We are currently an active participant in and comply with the EU-U.S. DPF, the UK Extension to the EU-U.S. DPF, and the Swiss-U.S. Data Privacy Framework as set forth by the U.S. Department of Commerce. However, the DPF is subject to further legal challenge which could cause the legal requirements for personal data transfers from the EU to the U.S. to become uncertain once again.

We are also subject to evolving privacy laws on cookies and e-marketing. In the EU and the UK, for example, regulators are increasingly focusing on compliance with requirements in the digital advertising

13

ecosystem. The GDPR also imposes conditions on obtaining valid consent, such as a prohibition on pre-checked consents and a requirement to ensure separate consents are sought for each type of cookie or similar technology.

Similarly, other jurisdictions are instituting privacy and data security laws, rules, and regulations, or may do so in the future, which could increase our risk and compliance costs.

In addition, the U.S. and foreign regulatory environment in which we operate is continuously evolving, with both existing and prospective regulations that implicate aspects of our corporate governance, risk management practices, public disclosures, environmental, social and governance related issues, AI and cybersecurity.

Seasonality

For a discussion of the seasonality of our business, see “Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations—Factors Affecting our Performance—Seasonality.”

Intellectual Property

We rely on a combination of trademarks and trade secrets, as well as contractual provisions and restrictions, to protect our intellectual property.

As of December 31, 2023, we owned three U.S. and 20 international trademark registrations for the mark ZIPRECRUITER. We also own numerous domain names, including www.ziprecruiter.com.

We rely primarily on trade secrets and confidential information to develop and maintain our competitive position. We seek to protect our trade secrets and confidential information through a variety of methods, including confidentiality agreements with employees, third parties, and others who may have access to our proprietary information. We also require employees to sign invention assignment agreements with respect to inventions arising from their employment, and strictly control access to our proprietary technology.

Corporate Information

We were incorporated in 2010 as ZipRecruiter, Inc., a Delaware corporation. Our website address is www.ziprecruiter.com. The information contained on, or that can be accessed through, our website is not incorporated by reference into, and is not a part of, this Annual Report on Form 10-K or any other report or document we file with the Securities and Exchange Commission, or SEC.

Available Information

Our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, and other filings with the SEC, and all amendments to these filings, can be obtained free of charge from our website at www.ziprecruiter-investors.com/financials/sec-filings. The SEC maintains an Internet site that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC at www.sec.gov. We also use our Investor Relations page on our website at www.ziprecruiter.com, press releases, public conference calls, public webcasts, X (formerly known as Twitter) feed (@ZipRecruiter), Facebook page, and LinkedIn page as means of disclosing material information and for complying with our disclosure obligations under Regulation FD. The information contained on, or that can be accessed through, any website reference herein is not incorporated by reference into, and is not a part of, this Annual Report on Form 10-K, and the inclusion of such website addresses is as inactive textual references only.

14

Item 1A. Risk Factors

Investing in our Class A common stock involves a high degree of risk. You should carefully consider the risks and uncertainties described below, together with all of the other information in this Annual Report on Form 10-K, before making a decision to invest in our Class A common stock. The risks and uncertainties described below are not the only ones we face. Additional risks and uncertainties that we are unaware of or that we deem immaterial may also become important factors that adversely affect our business. If any of the following risks occur, our business, financial condition, operating results, and future prospects could be materially and adversely affected. In that event, the price of our Class A common stock could decline, and you could lose part or all of your investment.

Risk Related to Our Business

Operational Risks

Our business is significantly affected by fluctuations in general economic conditions. There is risk that any economic recovery may be delayed, short-lived and/or uneven, and may not result in increased demand for our services.

Our business depends on the overall demand for labor and on the economic health of current and prospective employers and job seekers that use our marketplace. Demand for recruiting and hiring services is significantly affected by the general level of economic activity and employment in the United States and the other countries in which we operate. Any significant weakening of the economy in the United States or the global economy, increased unemployment, reduced credit availability, reduced business confidence and activity, decreased government spending, economic uncertainty, financial turmoil affecting the banking system or financial markets, including actual or perceived instability in the banking industry, trade wars and higher tariffs, volatility in interest rates, inflation in the cost of goods and services including labor, and other adverse economic or market conditions may adversely impact our business and operating results. Significant swings in, or periods of reduced, economic activity historically have had a disproportionately negative impact on hiring activity and related efforts to find candidates. We may also experience more pricing pressure during periods of economic downturn.

Economic recoveries are difficult to predict, and may be delayed, short-lived, and/or uneven, with some regions, or countries within a region, continuing to experience declines or weakness in economic activity while others improve. Differing economic conditions and patterns of economic growth or contraction in the geographical regions in which we operate may affect demand for our marketplace. We may not experience uniform, or any, increases in demand for our marketplace within the markets where our business is concentrated.

There has been volatility in financial markets as a result of a number of factors, including, but not limited to, banking instability, global conflict, including the war in Ukraine and the Israel-Hamas war, inflation, changes in interest rates, and volatile markets. There is a risk that as a result of these macroeconomic factors, we could continue to experience declines in all, or in portions, of our business. Economic uncertainty may cause some of our current or potential employers to curtail spending in our marketplace and may ultimately result in cost challenges to our operations. For example, our employers, including those of our employers that are banks, may be adversely affected by any bank failure or other event affecting financial institutions. Any resulting adverse effects to our employers’ liquidity or financial performance could reduce the demand for our services or affect our allowance for expected credit losses and collectability of accounts receivable. These adverse conditions could result in reductions in revenue, increased operating expenses, longer sales cycles, slower adoption of new technologies, and increased competition. We cannot predict the timing, strength, or duration of any economic slowdown or any subsequent recovery generally. There is also risk that when overall global economic conditions are positive, our business could be negatively impacted by decreased demand for job postings and our services. If general economic conditions significantly deviate from present levels, our business, financial condition, and operating results could be adversely affected.

15

Substantially all of our revenue is generated by our business operations in the United States. Prior to 2020, the United States had largely experienced positive economic and employment trends since our founding in 2010 and therefore we do not have a significant operating history in periods of weak economic environments and cannot predict how our business will perform in such periods. Any significant economic downturn in the United States or other countries in which we operate could have a material adverse effect on our business, financial condition and results of operations.

We face intense competition and could lose market share to our competitors, which could adversely affect our business, operating results, and financial condition.

We face intense competition from many well-established online job sites such as CareerBuilder, Craigslist, Glassdoor, Indeed, LinkedIn and Monster as well as from newer entrants such as Google or Facebook. Many of our existing and potential competitors are considerably larger or more established than we are and have larger workforces and more substantial marketing and financial resources. Price competition for job marketplaces such as ours is likely to remain high, which could limit our ability to maintain or increase our market share, subscriber base, revenue and/or profitability.

We also compete with companies that utilize emerging technologies and assets, such as large language models (LLMs), machine learning, and other types of artificial intelligence. These competitors may offer products and services that may, among other things, provide automated alternatives to the services that employers or job seekers would otherwise seek from ZipRecruiter, use machine learning algorithms to connect employers with job seekers more effectively than we do, or otherwise change the way that employers engage with job seekers or the way job seekers find work so as to make our marketplace less attractive. We may face increased competition from these competitors as they mature and expand their capabilities.

Many of our larger competitors have long-standing relationships or access to employers, including our Paid Employers2, as well as those whom we may wish to pursue. Some employers may be hesitant to use a new platform and prefer to upgrade products offered by these incumbent platforms for reasons that include price, quality, sophistication, familiarity, and global presence. These platforms could offer competing products on a standalone basis at a low price or bundled as part of a larger product sale.

Many of our competitors are able to devote greater resources to the development, promotion, sale, and support of their products and services. Furthermore, our current or potential competitors may be acquired by third parties with greater available resources and the ability to initiate or withstand substantial price competition. Our competitors may also establish cooperative relationships among themselves or with third parties to enhance their product offerings or resources. If our competitors’ products, platforms, services or technologies maintain or achieve greater market acceptance than ours, if they are successful in bringing their products or services to market earlier than ours, or if their products, platforms or services are more technologically capable than ours, then our revenue could be adversely affected. Also, some of our competitors may offer their products and services at a lower price. If we cannot optimize pricing, our operating results may be negatively affected. Pricing pressures and increased competition could result in reduced sales, reduced margins, losses or a failure to maintain or improve our competitive market position, any of which could adversely affect our business.

The number of employers distributing their job posting service purchases among a broader group of competitors may increase which may make it more difficult to retain or maintain our current share of business with existing Paid Employers. We also face the risk that employers may decide to provide similar services internally or reduce or redirect their efforts to recruit job seekers through online job advertisements. As a result, there can be no assurance that we will not encounter increased competition in the future.

2 “Paid Employer(s)” means any employer(s) (or entities acting on behalf of an employer) on a paying subscription plan or performance marketing campaign for at least one day. Paid Employer(s) excludes employers from our Job Distribution Partners or other indirect channels, employers who are not actively searching for candidates, but otherwise have access to previously posted jobs, and employers on free trial.

16

Our marketplace functions on software that is highly technical and complex and if it fails to perform properly, our reputation could be adversely affected, our market share could decline and we could be subject to liability claims.

Our marketplace functions on software that is highly technical and complex and may now or in the future contain undetected errors, bugs, or vulnerabilities. Some errors in our software code may be discovered only after the code has been deployed. Any errors, bugs, or vulnerabilities discovered in our code after deployment, inability to identify the cause or causes of performance problems within an acceptable period of time, or difficulty maintaining and improving the performance of our marketplace could result in damage to our reputation or brand, loss of employers and job seekers, loss of revenue, or liability for damages, any of which could adversely affect our business and results of operations.

As the usage of our marketplace grows, we will need an increasing amount of technical infrastructure, including network capacity and computing power, to continue to operate our marketplace. If we cannot continue to effectively scale and grow our technical infrastructure to accommodate these increased demands, it may adversely affect our user experience. We also rely on third-party software and infrastructure, including the infrastructure of the internet, to provide our marketplace. Any failure of or disruption to this software and infrastructure, whether intentional or malicious in nature or due to our activities or those of our vendors, could also make our marketplace unavailable to our users. If our marketplace is unavailable to our subscribers or job seekers for any period of time, our business could be adversely affected.

Our marketplace technology is constantly changing with new updates, which may contain undetected errors when first introduced or released. Any errors, defects, disruptions in service, or other performance or stability problems with our marketplace, or the insufficiency of our efforts to adequately prevent or timely remedy errors or defects, could result in negative publicity, loss of or delay in market acceptance of our marketplace, loss of competitive position, our inability to timely and accurately maintain our financial records, inaccurate or delayed invoicing of Paid Employers, delay of payment to us, claims by users for losses sustained by them, corrective action taken by gatekeepers of components integral to our marketplace, or investigation and corrective action taken by a regulatory agency. In such an event, we may be required, or may choose, for user relations or other reasons, to expend additional resources to help resolve the issue. Accordingly, any errors, defects, or disruptions in our marketplace could adversely impact our brand and reputation, revenue, and operating results.

Because of the large amount of data that our Paid Employers collect and manage by means of our services, it is possible that failures or errors in our systems could result in data loss or corruption, or cause the information that we or our Paid Employers collect to be incomplete or contain inaccuracies that our Paid Employers regard as significant. Furthermore, the availability or performance of our marketplace could be adversely affected by a number of factors, including users’ inability to access the internet or to send or receive email messages, the failure of our network or software systems, security breaches or variability in user traffic for our services. We may be required to issue credits or refunds for prepaid amounts related to unused services or otherwise be liable to our users for damages they may incur resulting from certain of these events. In addition to potential liability, if we experience interruptions in the availability of our marketplace, our reputation could be adversely affected and we could lose employers and job seekers.

Our errors and omissions insurance may be inadequate or may not be available in the future on acceptable terms, or at all. In addition, our policy may not cover all claims made against us and defending a suit, regardless of its merit, could be costly and divert management’s attention.

17

Our future success depends in part on employers purchasing and renewing or upgrading subscriptions and performance-based services from us. Any decline in our user renewals or upgrades or performance-based services could harm our future operating results.

Many of our Paid Employers pay for access to our marketplace on a per-job-per-day basis, rather than entering into new longer term paid time-based job posting plans, renewing their paid time-based job posting plans when such contract terms expire, or purchasing performance-based services from us. Employers who enter into paid plans have no obligation to renew their plans after the expiration of their contract period, which typically range from one day to 12 months. In addition, employers may renew for lower subscription amounts or for shorter contract lengths. Historically, some of our Paid Employers have elected not to renew their agreements with us and as we expand into new products and markets, we have a limited ability to reliably predict future renewal rates. Our future renewal rates for both existing and potential new products may be lower, possibly significantly lower, than historical trends.

Our future success also depends in part on our ability to sell upsell services to employers who use our marketplace. If employers do not purchase upsell services from us, our revenue may decline and our operating results may be harmed.

Our Paid Employer subscription renewals, performance-based services, and upsells may decline or fluctuate as a result of a number of factors, including user usage, user satisfaction with our services and user support, our prices, the prices of competing services, mergers and acquisitions affecting our user base, the effects of U.S. and global economic conditions, or reductions in our Paid Employers’ spending levels generally.

If we fail to scale our business effectively, our business, operating results, and financial condition could be adversely affected.

We have experienced a period of significant growth in recent years and expect to continue to invest strategically across our company to support measured growth, while also scaling back certain areas of our business in response to changing macroeconomic conditions. Although we have experienced rapid growth historically, we may not return to prior growth rates or sustain our growth rates, nor can we assure you that our investments to support our growth or to manage expenses by scaling back other areas of our business will be successful. The effective scaling of our business will place significant demands on our management as well as on our administrative, operational, and financial resources. To manage any future growth effectively, we must continue to improve our operational, financial, and management information systems; expand, motivate, and effectively manage and train our workforce; and effectively collaborate with our third-party partners. If we cannot manage any future growth successfully, our business, operating results, financial condition, and ability to successfully advertise our marketplace and serve our employers and job seekers could be adversely affected.

Over time, we expect to expand our operations and personnel significantly. However, from time to time, we realign our resources and talent to respond to macroeconomic changes and to streamline our organization and optimize our cost structure, including through furloughs, layoffs and reductions in force. For example, in May 2023, in response to current market conditions and after reducing other discretionary expenses, we reduced our workforce. If there are unforeseen expenses associated with such realignments in our business strategies, and we incur unanticipated charges or liabilities, then we may not be able to effectively realize the expected cost savings or other benefits of such actions. In addition, the loss of certain personnel, through such reduction in force or otherwise, presents significant risks including, among other things, failure to maintain adequate controls and procedures. Failure to manage any growth or any scaling back of our operations could have an adverse effect on our business, operating results, and financial condition.

In addition, our historical growth should not be considered indicative of our future performance. We have encountered in the past, and will encounter in the future, risks, challenges, and uncertainties frequently experienced by growing companies in rapidly changing industries. If our assumptions regarding

18

these risks, challenges, and uncertainties, which we use to plan and operate our business, are incorrect or change, or if we do not address these risks successfully, our financial condition and operating results could differ materially from our expectations, we may be unable to effectively scale our business, and our business would be adversely impacted.

Significant segments of the market for job advertisement services may have hiring needs and service preferences that are subject to greater volatility than the overall economy.

The employers in the United States’ private sector are diverse across a number of business characteristics, including company size, geography, and industry, among other factors. Hiring activity may vary significantly among businesses with different characteristics and accordingly, any concentration we may have among businesses with certain characteristics may subject us to high volatility in our financial results. Smaller businesses, for example, typically have less persistent hiring needs and may experience greater volatility in their need for job advertisement services and preferences among providers of such services. Along with a relatively shorter sales cycle, smaller businesses may be more likely to change platforms based on short-term differences in perceived price, value, service level, or other factors. Difficulty in acquiring and/or retaining these employers may adversely affect our operating results.

Our efforts and ability to sell to a broad mix of businesses could adversely affect our operating results in a given period.

Our ability to increase revenue and maintain profitability depends, in part, on widespread acceptance and utilization of our marketplace by businesses of all sizes and types. Because our customers reflect a wide variety of businesses, we face a variety of challenges, including but not limited to, pricing pressure, cost variances and marketing strategies that vary based on the business type and size, varying lengths of sales cycles, and less predictability in completing some of our sales. For example, some of our larger prospective customers may need us to provide greater levels of education regarding the use and benefits of our marketplace and services, because the prospective customer’s decision to use our marketplace and services may be a company-wide decision. We are in the early stages of developing the analytical tools that will allow us to determine how prospective customers can be most effectively directed within, and addressed by, our sales organizations. As a result, we may not always approach new opportunities in the most cost-effective manner or with the most appropriate resources. Developing and successfully implementing these tools will be important as we seek to efficiently capitalize on new and expanding market opportunities. In addition, because we are a relatively new company with a limited operating history when compared to some of our existing competitors, our target employers and job seekers may prefer to use offerings from more established competitors that are more tailored to their specific requirements.

Our business depends largely on our ability to attract and retain talented employees, including senior management and key personnel. If we lose the services of Ian Siegel, our Chief Executive Officer, or other members of our senior management team, we may not be able to execute on our business strategy.

Our future success depends in large part on the continued services of our senior management and other key personnel and our ability to retain and motivate them. In particular, we are dependent on the services of Ian Siegel, our Chief Executive Officer, and our technology, marketplace, future vision, and strategic direction could be compromised if he were to take another position, become ill or incapacitated, or otherwise become unable to serve as our Chief Executive Officer. We rely on our leadership team in the areas of marketing, sales, finance, support, product development, human resources, and technology. Our senior management and other key personnel are all employed on an at-will basis, which means that they could terminate their employment with us at any time, for any reason, and without notice. If we lose the services of senior management or other key personnel, or if we cannot attract, train, and retain the highly skilled personnel we need, our business, operating results, and financial condition could be adversely affected.

19

Our future success also depends on our continuing ability to attract, train, and retain highly skilled personnel, including software engineers and sales personnel. We face intense competition for qualified personnel from numerous software and other technology companies. This competition for highly skilled personnel is especially intense in the regions where we have significant operations, and we may incur significant costs to attract and retain them. We have, from time to time, experienced, and we expect to continue to experience, difficulty in hiring and retaining highly skilled employees with appropriate qualifications. We may incur significant costs to attract and retain highly skilled personnel, and we may lose new employees to our competitors or other technology companies before we realize the benefit of our investment in recruiting and training them. In addition, in a tight labor market, we may experience increased difficulty in hiring and retaining, or increased costs in attracting and retaining, highly skilled personnel, or we may lose new employees to our competitors or other technology companies at a greater rate. To the extent we move into new geographies, we would need to attract and recruit skilled personnel in those areas. Moreover, uncertainty arising from economy-wide shifts toward remote work could negatively impact our ability to recruit or retain talent, particularly in light of our workforce historically being concentrated largely in the Los Angeles and Phoenix metropolitan areas. In addition, job candidates and existing employees often consider the value of the equity awards they receive in connection with their employment. If the perceived value of our equity or equity awards declines, it may adversely affect our ability to retain highly skilled employees. If we cannot attract and retain suitably qualified individuals who are capable of meeting our growing technical, operational, and managerial requirements, on a timely basis or at all, our business may be adversely affected.

If internet search engines’ methodologies or other channels that we use to direct traffic to our website are modified to our disadvantage, or our search result page rankings decline for other reasons, our user growth could decline.

We depend in part on various internet search engines, such as Google, as well as other channels to direct a significant amount of traffic to our website. Our ability to maintain the number of visitors directed to our website is not entirely within our control. For example, our competitors’ search engine optimization and other efforts such as paid search may result in their websites receiving a higher search result page ranking than ours, internet search engines or other channels that we utilize to direct traffic to our website could revise their methodologies in a manner that adversely impacts traffic to our website, or we may make changes to our website that adversely impact our search engine optimization rankings and traffic. As a result, links to our website may not be prominent enough to drive sufficient traffic to our website, and we may not be able to influence the results.

Search engines and other channels that we use to drive employers and job seekers to our website periodically change their algorithms, policies, and technologies, sometimes in ways that cause traffic to our website to decline. These changes can also result in an interruption in their ability to access our website or a drop in our search ranking, or have other adverse impacts that negatively affect our ability to maintain and grow the number of employers and job seekers that visit our website. We may also be forced to significantly increase marketing expenditures in the event that market prices for online advertising and paid listings escalate or our organic ranking decreases. Any of these changes could have an adverse impact on our business, user acquisition, and operating results.

Our quarterly results may fluctuate significantly and may not fully reflect the underlying performance of our business, which makes our future results difficult to predict.

Our quarterly results of operations, including the levels of our revenue, gross margin, and profitability, may vary significantly in the future and period to period comparisons of our operating results may not be meaningful. Accordingly, the results of any one quarter should not be relied upon as an indication of future performance. We also have a limited operating history and make pricing and other changes from time to time, all of which make it difficult to forecast our future results. As a result, you should not rely upon our past quarterly operating results as indicators of future performance.

20

Factors that may cause fluctuations in our quarterly financial results include, without limitation, those listed below:

•our ability to attract new employers and job seekers;

•Paid Employer renewal rates;

•Paid Employers purchasing upsell services;

•the addition or loss of large Paid Employers, including through acquisitions or consolidations;

•the timing of recognition of revenue;

•the amount and timing of operating expenses related to the maintenance and expansion of our business, operations and infrastructure;

•network outages or security breaches;

•general economic, industry and market conditions, including inflationary pressures, a volatile interest rate environment, increasing borrowing costs, actual or perceived instability in the global banking industry and the impacts, cybersecurity incidents, uncertainty with respect to the federal debt ceiling and budget and potential government shutdowns related thereto and the impacts of the war in Ukraine and the Israel-Hamas war;

•changes in our pricing policies or those of our competitors;

•seasonal variations in sales of our products, which have historically been most pronounced in the fourth quarter of our fiscal year;

•the timing and success of new product or service introductions by us or our competitors or any other change in the competitive dynamics of our industry, including consolidation among competitors or strategic partners; and

•the timing of expenses related to the development or acquisition of technologies or businesses and potential future charges for impairment of goodwill from acquired companies.

Our success depends on our ability to maintain the value and reputation of the ZipRecruiter brand.

We believe that our brand is important to attracting and retaining both employers and job seekers. Maintaining, protecting, and enhancing our brand depends largely on the success of our marketing efforts, our ability to provide a compelling job marketplace, including services, features, content, and support related to our marketplace, and our ability to successfully secure, maintain, and defend our rights to use the “ZipRecruiter” mark, our logo, and other trademarks important to our brand. While we constantly measure the expected returns of specific sales and marketing initiatives and adjust spend levels up or down accordingly, it is not certain that these and any future investments have had or will have sufficient positive impact on our brand awareness, and any reduction in our levels of investments in brand awareness may harm our brand awareness. We believe that the importance of our brand will increase as competition further intensifies and brand promotion activities may require substantial expenditures. Our brand could be harmed if we cannot achieve these objectives or if our public image were to be tarnished by negative publicity. Unfavorable publicity about us could diminish confidence in our marketplace and services. Such negative publicity also could have an adverse effect on the volume, engagement and loyalty of our employers and job seekers and could have an adverse effect on our business.

If we are not able to provide successful enhancements, and new products, services, and features, our business could be adversely affected.

The market for job-posting marketplaces is characterized by frequent product and service introductions and enhancements, changing user demands, and rapid technological change. The

21

introduction of products and services embodying new technologies can quickly make existing products and services obsolete and unmarketable. The success of our business will depend, in part, on our ability to adapt and respond effectively and timely to these changes. We invest substantial resources in researching and developing new products and services and enhancing our marketplace by incorporating additional features, improving functionality, and adding other improvements to meet our employers’ and job seekers’ evolving demands in our highly competitive industry. If we cannot provide enhancements and new features or services that achieve market acceptance or that keep pace with rapid technological developments and the competitive landscape, our business could be adversely affected. The success of any enhancements or improvements to, or new features of, our marketplace or any new products and services depends on several factors, including timely completion, competitive pricing, adequate quality testing, integration with new and existing technologies in our marketplace and third-party partners’ technologies, overall market acceptance, and resulting user activity that is consistent with the intent of such products or services. We cannot be sure that we will succeed, either timely or cost effectively, in developing, marketing, and delivering enhancements or new features, products and services to our marketplace that respond to continued changes in the market for job placement services, nor can we be sure that any enhancements or new features to our existing or any new products and services will achieve market acceptance or produce the intended effect. In addition, if new technologies emerge that allow our competitors to deliver similar services at lower prices, more efficiently, more conveniently, or more securely, such technologies could adversely impact our ability to compete.

Additionally, because our marketplace operates on a variety of third-party systems and platforms, we will need to continuously modify and enhance our offerings to keep pace with changes in internet-related hardware, operating systems, cloud computing infrastructure, and other software, communication, browser and open source technologies. We may not be successful in either developing these modifications and enhancements or in bringing them to market timely. Furthermore, uncertainties about the timing and nature of new network platforms or technologies, or modifications to existing platforms or technologies, could increase our research and development expenses. Parts of the technology stack supporting our marketplace may also become difficult to maintain and service as there become fewer software engineers who are skilled with respect to the programming languages used to build such pieces of software. Any failure of our marketplace to operate effectively with future network systems and technologies could reduce the demand for our marketplace, result in user dissatisfaction and adversely affect our business.

Issues with the use of artificial intelligence (including machine learning) in our marketplace may result in reputational harm or liability, or could otherwise adversely affect our business.

Artificial intelligence, or AI, is enabled by or integrated into some of our marketplace and is a significant element of our business. As with many developing technologies, AI presents risks and challenges that could affect its further development, adoption, and use, and therefore our business. AI algorithms may be flawed. Datasets may be insufficient, of poor quality, or contain biased information. Inappropriate or controversial data practices by data scientists, engineers, and end-users of our systems or elsewhere (including the integration or use of third-party AI tools) could impair the acceptance of AI solutions and could result in burdensome new regulations that may limit our ability to use existing or new AI technologies. If the recommendations, forecasts, or analyses that AI applications assist in producing are deficient or inaccurate, we could be subject to competitive harm, potential legal liability, and brand or reputational harm. Some AI scenarios present ethical issues. If we enable or offer AI solutions that are controversial because of their purported or real impact on human rights, privacy, employment, or other social issues, we may experience brand or reputational harm. In addition, we expect that there will continue to be new laws or regulations concerning the use of AI. It is possible that certain governments may seek to regulate, limit, or block the use of AI in our products and services or otherwise impose other restrictions that may affect or impair the usability or efficiency of our products and services for an extended period of time or indefinitely.

22

The forecasts of growth of online recruitment may prove to be inaccurate, and even if the market in which we compete achieves the forecasted growth, we cannot assure you that our business will grow at a similar rate, if at all.