BYLAWS

OF

FLIXCHIP

CORP.

ARTICLE

I - OFFICES

Section

1. The principal executive office of FlixChip Corp., a California corporation (the “Corporation”) shall be at such

place inside or outside the State of California as the Board (the “Board”) may determine from time to time.

Section

2. The Corporation may also have offices at such other places as the Board may from time to time designate, or as the

business of the Corporation may require.

ARTICLE

II - SHAREHOLDERS’ MEETINGS

Section

1. Annual Meetings. The annual meeting of the shareholders of the Corporation for the election of directors to succeed

those whose terms expire and for the transaction of such other business as may properly come before the meeting shall be held

at such place and at such time as may be fixed from time to time by the Board and stated in the notice of the meeting. If the

annual meeting of the shareholders be not held as herein prescribed, the election of directors may be held at any meeting thereafter

called pursuant to these Bylaws.

Section

2. Special Meetings. Special meetings of the shareholders, for any purpose whatsoever, unless otherwise prescribed by statute,

may be called at any time by the Chairman of the Board, the President, or by the Board, or by one or more shareholders holding

not less than ten percent of the voting power of the Corporation.

Section

3. Place. All meetings of the shareholders shall be at any place within or without the State of California designated by

the Board or by written consent of all the persons entitled to vote thereat, given either before or after the meeting. In the

absence of any such designation, shareholders’ meetings shall be held at the principal executive office of the Corporation.

Section

4. Notice. Notice of meetings of the shareholders of the Corporation shall be given in writing to each shareholder entitled

to vote, either personally, by electronic transmission by the Corporation, or by first-class mail unless the Corporation has 500

or more shareholders determined as provided by the California Corporations Code (the “Code”) on the record date for

the meeting, in which case notice may be sent by third-class mail or other means of written communication, charges prepaid, addressed

to the shareholder at his address appearing on the books of the Corporation or given by the shareholder to the Corporation for

the purpose of notice. Notice of any such meeting of shareholders shall be sent to each shareholder entitled thereto not less

than ten or, if sent by third-class mail, thirty nor more than sixty days before the meeting. Said notice shall state the place,

date and hour of the meeting, the means of electronic transmission by and to the Corporation, as defined in Sections 20 and 21

of the Code, or electronic video screen communication, if any, by which shareholders may participate in that meeting, subject

to the provisions of Section 600(e) of the Code, and, (1) in the case of special meetings, the general nature of the business

to be transacted, and no other business may be transacted, or (2) in the case of annual meetings, those matters which the Board,

at the time of the mailing of the notice, intends to present for action by the shareholders, but subject to Section 60l(f) of

the Code any proper matter may be presented at the meeting for shareholder action, and (3) in the case of any meeting at which

directors are to be elected, the names of the nominees intended at the time of the mailing of the notice to be presented by management

for election.

GoChip Inc. (formerly FlixChip Corp.) Bylaws - Page 1

Section

5. Adjourned Meetings. Any shareholders’ meeting may be adjourned from time to time by the vote of the holders of

a majority of the voting shares present at the meeting either in person or by proxy. Notice of any adjourned meeting need not

be given unless a meeting is adjourned for forty-five days or more from the date set for the original meeting or if after the

adjournment a new record date is fixed for the adjourned meeting.

Section

6. Quorum. A majority of the shares entitled to vote, represented in person or by proxy, shall constitute a quorum at a

meeting of the shareholders for the transaction of business. The shareholders present at a duly called or held meeting at which

a quorum is present may continue to do business until adjournment, notwithstanding the withdrawal of enough shareholders to leave

less than a quorum, if any action taken (other than adjournment) is approved by at least a majority of the shares required to

constitute a quorum.

In

the absence of a quorum, any meeting of shareholders may be adjourned from time to time by the vote of a majority of the shares,

the holders of which are either present in person or represented by proxy thereat, but no other business may be transacted, except

as provided above.

Section

7. Shareholder Action by Written Consent. Any action which may be taken at any meeting of shareholders may be taken without

a meeting and without prior notice, if a consent in writing, setting forth the action so taken, shall be signed by the holders

of outstanding shares having not less than the minimum number of votes that would be necessary to authorize or take such action

at a meeting at which all shares entitled to vote thereon were present and voted; provided, however, that (1) unless the consents

of all shareholders entitled to vote have been solicited in writing, notice of any shareholder approval without a meeting by less

than unanimous written consent shall be given as required by the Code, and (2) directors may not be elected by written consent

except by unanimous written consent of all shares entitled to vote for the election of directors or as allowed by the Code.

Any

written consent may be revoked by a writing received by the Secretary of the Corporation prior to the time that written consents

of the number of shares required to authorize the proposed action have been filed with the Secretary.

Section

8. Waiver of Notice. The transactions of any meeting of shareholders, however called and noticed, and whenever held, shall

be as valid as though had at a meeting duly held after regular call and notice, if a quorum be present either in person or by

proxy, and if, either before or after the meeting, each of the persons entitled to vote, not present in person or by proxy, signs

a written waiver of notice, or a consent to the holding of the meeting, or an approval of the minutes thereof. All such waivers,

consents, or approvals shall be filed with the corporate records or made a part of the minutes of the meeting.

GoChip Inc. (formerly FlixChip Corp.) Bylaws - Page 2

Attendance

of a person at a meeting shall constitute a waiver of notice of such meeting except when the person objects, at the beginning

of the meeting, to the transaction of any business because the meeting is not lawfully called or convened, and except that attendance

at a meeting is not a waiver of any right to object to the consideration of matters required by the Code to be included in the

notice but not so included, if the objection is expressly made at the meeting.

Section

9. Voting. The voting at all meetings of shareholders need not be by ballot, but any qualified shareholder before the voting

begins may demand a stock vote whereupon such stock vote shall be taken by ballot, each of which shall state the name of the shareholder

voting and the number of shares voted by such shareholder, and if such ballot be cast by a proxy, it shall also state the name

of such proxy.

At

any meeting of the shareholders, every shareholder having the right to vote shall be entitled to vote in person, or by proxy appointed

in a writing subscribed by such shareholder and bearing a date not more than eleven months prior to said meeting, unless the writing

states that it is irrevocable and satisfies Section 705(e) of the Code, in which event it is irrevocable for the period specified

in said writing and said Section 705(e).

Section

10. Record Dates. In the event the Board fixes a day for the determination of shareholders of record entitled to vote as

provided in Section 1 of Article V of these Bylaws, then, subject to the provisions of the Code, only persons in whose name shares

entitled to vote stand on the stock records of the Corporation at the close of business on such day shall be entitled to vote.

If

no record date is fixed:

The

record date for determining shareholders entitled to notice of or to vote at a meeting of shareholders shall be at the close of

business on the business day next preceding the day on which notice is given or, if notice is waived, at the close of business

on the business day next preceding the day on which the meeting is held;

The

record date for determining shareholders entitled to give consent to corporate action in writing without a meeting, when no prior

action by the Board is necessary, shall be the day on which the first written consent is given; and

The

record date for determining shareholders for any other purpose shall be at the close of business on the day on which the Board

adopts the resolution relating thereto, or the 60th day prior to the date of such other action, whichever is later.

A

determination of shareholders of record entitled to notice of or to vote at a meeting of shareholders shall apply to any adjournment

of the meeting unless the Board fixes a new record date for the adjourned meeting, but the Board shall fix a new record date if

the meeting is adjourned for more than 45 days from the date set for the original meeting.

GoChip Inc. (formerly FlixChip Corp.) Bylaws - Page 3

Section

11. Cumulative Voting for Election of Directors. Provided the candidate’s name has been placed in nomination prior

to the voting and one or more shareholders has given notice at the meeting prior to the voting of the shareholder’s intent

to cumulate the shareholder’s votes, every shareholder entitled to vote at any election for directors shall have the right

to cumulate such shareholder’s votes and give one candidate a number of votes equal to the number of directors to be elected

multiplied by the number of votes to which the shareholder’s shares are normally entitled, or distribute the shareholder’s

votes on the same principle among as many candidates as the shareholder shall think fit. The candidates receiving the highest

number of votes of the shares entitled to be voted for them up to the number of directors to be elected by such shares are elected.

ARTICLE

III - BOARD OF DIRECTORS

Section

1. Powers. Subject to any limitations in the Articles of Incorporation or these Bylaws and to any provision of the Code

requiring shareholder authorization or approval for a particular action, the business and affairs of the Corporation shall be

managed and all corporate powers shall be exercised by, or under the direction of, the Board. The Board may delegate the management

of the day-to-day operation of the business of the Corporation to a management company or other person provided that the business

and affairs of the Corporation shall be managed and all corporate powers shall be exercised under the ultimate direction of the

Board.

Section

2. Number, Tenure and Qualifications. The number of directors that shall constitute the whole board shall be not more than

three nor less than one. The exact number of directors may be fixed from time to time within such limit by a duly adopted resolution

of the Board or shareholders. The exact number of directors presently authorized shall. be three until changed within the limits

specified above by a duly adopted resolution of the Board or shareholders. Directors need not be shareholders.

Directors

shall hold office until the next annual meeting of shareholders and until their respective successors are elected. If any such

annual meeting is not held, or the directors are not elected thereat, the directors may be elected at any special meeting of shareholders

held for that purpose.

Section

3. Regular Meetings. A regular annual meeting of the Board shall be held without other notice than this Bylaw immediately

after, and at the same place as, the annual meeting of shareholders. The Board may provide for other regular meetings from time

to time by resolution.

Section

4. Special Meetings. Special meetings of the Board may be called at any time by the Chairman of the Board, or the President

or any Vice President, or the Secretary or any two directors. Written notice of the time and place of all special meetings of

the Board shall be delivered personally or by telephone, including a voice messaging system or by electronic transmission by the

Corporation to each director at least 48 hours before the meeting, or sent to each director by first-class mail, postage prepaid,

at least four days before the meeting. Such notice need not specify the purpose of the meeting. Notice of any meeting of the Board

need not be given to any director who signs a waiver of notice, whether before or after the meeting, or who attends the meeting

without protesting prior thereto or at its commencement, the lack of notice to such director.

GoChip Inc. (formerly FlixChip Corp.) Bylaws - Page 4

Section

5. Place of Meetings. Meetings of the Board may be held at any place within or without the State of California, which has

been designated in the notice, or if not stated in the notice or there is no notice, the principal executive office of the Corporation

or as designated by the resolution duly adopted by the Board.

Section

6. Participation by Telephone. Members of the Board may participate in a meeting through use of conference telephone, electronic

video screen communication, or electronic transmission by and to the corporation as permitted by Sections 20 and 21 of the Code.

Participation in a meeting through use of conference telephone or electronic video screen communication constitutes presence in

person at the meeting as long as all members participating in such meeting can hear one another. Participation in a meeting through

electronic transmission by and to the corporation (other than conference telephone and electronic video screen communication)

constitutes presence in person at that meeting if both of the following apply: (a) each member participating in the meeting can

communicate with all of the other members concurrently, and (b) each member is provided the means of participating in all matters

before the Board, including, without limitation, the capacity to propose, or to interpose an objection to, a specific action to

be taken by the Corporation.

Section

7. Quorum. A majority of the Board shall constitute a quorum at all meetings. In the absence of a quorum a majority of

the directors present may adjourn any meeting to another time and place. If a meeting is adjourned for more than 24 hours, notice

of any adjournment to another time or place shall be given prior to the time of the reconvened meeting to the directors who were

not present at the time of adjournment.

Section

8. Action at Meeting. Every act or decision done or made by a majority of the directors present at a meeting duly held

at which a quorum is present is the act of the Board. A meeting at which a quorum is initially present may continue to transact

business notwithstanding the withdrawal of directors, if any action taken is approved by at least a majority of the required quorum

for such meeting.

Section

9. Waiver of Notice. The transactions of any meeting of the Board, however called and noticed or wherever held, are as

valid as though had at a meeting duly held after regular call and notice if a quorum is present and if, either before or after

the meeting, each of the directors not present signs a written waiver of notice, a consent to holding the meeting, or an approval

of the minutes thereof. All such waivers, consents and approvals shall be filed with the corporate records or made a part of the

minutes of the meeting.

Section

10. Action Without Meeting. Any action required or permitted to be taken by the Board may be taken without a meeting, if

all members of the Board individually or collectively consent in writing to such action. Such written consent or consents shall

be filed with the minutes of the proceedings of the Board. Such action by written consent shall have the same force and effect

as a unanimous vote of such directors.

GoChip Inc. (formerly FlixChip Corp.) Bylaws - Page 5

Section

11. Removal. The entire Board or any individual director may be removed from office without cause by a vote of shareholders

holding a majority of the outstanding shares entitled to vote at an election of directors; provided, however, that unless the

entire Board is removed, no individual director may be removed when the votes cast against removal, or not consenting in writing

to such removal, would be sufficient to elect such director if voted cumulatively at an election at which the same total number

of votes cast were cast (or, if such action is taken by written consent, all shares entitled to vote were voted) and the entire

number of directors authorized at the time of the director’s most recent election were then being elected.

In

the event an office of a director is so declared vacant or in case the Board or any one or more directors be so removed, new directors

may be elected at the same meeting.

Section

12. Resignations. Any director may resign effective upon giving written notice to the Chairman of the Board, the President,

the Secretary or the Board of the Corporation, unless the notice specifies a later time for the effectiveness of such resignation.

If the resignation is effective at a future time, a successor may be elected to take office when the resignation becomes effective.

Section

13. Vacancies. Except for a vacancy created by the removal of a director, all vacancies in the Board, whether caused

by resignation, death or otherwise, may be filled by a majority of the remaining directors or, if the number of directors

then in office is less than a quorum, by (a) the unanimous written consent of the directors then in office, (b) the

affirmative vote of a majority of the directors then in office at a meeting held pursuant to notice or waivers of notice

complying with Section 307 of the Code, or (c) a sole remaining director, and each director so elected shall hold office

until his successor is elected at an annual, regular or special meeting of the shareholders. Vacancies created by the removal

of a director may be filled only by approval of the shareholders. The shareholders may elect a director at any time to fill

any vacancy not filled by the directors. Any such election by written consent requires the consent of a majority of the

outstanding shares entitled to vote.

Section

14. Compensation. No stated salary shall be paid directors, as such, for their services, but, by resolution of the Board,

a fixed sum and expenses of attendance, if any, may be allowed for attendance at each regular or special meeting of such Board;

provided that nothing herein contained shall be construed to preclude any director from serving the Corporation in any other capacity

and receiving compensation therefor. Members of special or standing committees may be allowed like compensation for attending

committee meetings.

Section

15. Committees. The Board may, by resolution adopted by a majority of the authorized number of directors, designate one

or more committees, each consisting of two or more directors, to serve at the pleasure of the Board. The Board may designate one

or more directors as alternate members of any committee, who may replace any absent member at any meeting of the committee. The

appointment of members or alternate members of a committee requires the vote of a majority of the authorized number of directors.

Any such committee, to the extent provided in the resolution of the Board, shall have all the authority of the Board in the management

of the business and affairs of the Corporation, except with respect to (a) the approval of any action requiring shareholders’

approval or approval of the outstanding shares; (b) the filling of vacancies on the Board or any committee; (c) the fixing of

compensation of directors for serving on the Board or in any committee; (d) the amendment or repeal of Bylaws or adoption of new

bylaws; (e) the amendment or repeal of any resolution of the Board which by its express terms is not so amendable or repeatable;

(f) a distribution to shareholders, except at a rate or in a periodic amount or within a price range determined by the Board;

and (g) the appointment of other committees of the Board or the members thereof.

GoChip Inc. (formerly FlixChip Corp.) Bylaws - Page 6

ARTICLE

IV - OFFICERS

Section

1. Number and Term. The officers of the Corporation shall be a Chairman of the Board, a President, one or more Vice Presidents,

a Secretary and a Chief Financial Officer, all of which shall be chosen by the Board. In addition, the Board may appoint such

other officers as may be deemed expedient for the proper conduct of the business of the Corporation, each of whom shall have such

authority and perform such duties as the Board may from time to time determine. The officers to be appointed by the Board shall

be chosen annually at the regular meeting of the Board held after the annual meeting of shareholders and shall serve at the pleasure

of the Board. If officers are not chosen at such meeting of the Board, they shall be chosen as soon thereafter as shall be convenient.

Each officer shall hold office until his successor shall have been duly chosen or until his removal or resignation.

Section

2. Inability to Act. In the case of absence or inability to act of any officer of the Corporation and of any person herein

authorized to act in his place, the Board may from time to time delegate the powers or duties of such officer to any other officer,

or any director or other person whom it may select.

Section

3. Removal and Resignation. Any officer chosen by the Board may be removed at any time, with or without cause, by the affirmative

vote of a majority of all the members of the Board.

Any

officer chosen by the Board may resign at any time by giving written notice of said resignation to the Corporation. Unless a different

time is specified therein, such resignation shall be effective upon its receipt by the Chairman of the Board, the President, the

Secretary or the Board.

Section

4. Vacancies. A vacancy in any office because of any cause may be filled by the Board for the unexpired portion of the

term.

Section

5. Chairman of the Board. The Chairman of the Board shall preside at all meetings of the Board.

Section

6. President. The President shall be the chief executive officer of the Corporation unless such title is assigned to another

officer of the Corporation; in the absence of a Chairman and Vice Chairman of the Board, the President shall preside as the chairman

of meetings of the shareholders and the Board; and the President shall have general and active management of the business of the

Corporation and shall see that all orders and resolutions of the Board are carried into effect. The President or any Vice President

shall execute bonds, mortgages and other contracts requiring a seal, under the seal of the Corporation (if the Corporation has

adopted a seal), except where required or permitted by law to be otherwise signed and executed and except where the signing and

execution thereof shall be expressly delegated by the Board to some other officer or agent of the Corporation.

GoChip Inc. (formerly FlixChip Corp.) Bylaws - Page 7

Section

7. Vice President. In the absence of the President, or in the event of such officer’s death, disability or refusal

to act, the Vice President, or in the event there be more than one Vice President, the Vice Presidents in the order designated

at the time of their selection, or in the absence of such designation, then in the order of their selection, shall perform the

duties of President, and when so acting, shall have all the powers and be subject to all restrictions upon the President. Each

Vice President shall have such powers and discharge such duties as may be assigned from time to time by the President or by the

Board.

Section

8. Secretary. The Secretary shall see that notices for all meetings are given in accordance with the provisions of these

Bylaws and as required by law, shall keep minutes of all meetings, shall have charge of the seal and the corporate books, and

shall make such reports and perform such other duties as are incident to such office, or as are properly required by the President

or by the Board.

The

Assistant Secretary or the Assistant Secretaries, in the order of their seniority, shall, in the absence or disability of the

Secretary, or in the event of such officer’s refusal to act, perform the duties and exercise the powers and discharge such

duties as may be assigned from time to time by the President or by the Board.

Section

9. Chief Financial Officer. The Chief Financial Officer may also be designated by the alternate title of “Treasurer.”

The Chief Financial Officer shall have the custody of all moneys and securities of the Corporation and shall keep regular books

of account. Such officer shall disburse funds of the Corporation in payment of the just demands against the Corporation, or as

may be ordered by the Board, taking proper vouchers for such disbursements, and shall render to the Board from time to time as

may be required of such officer, an account of all transactions as Chief Financial Officer and of the financial condition of the

Corporation. Such officer shall perform all duties incident to such office or that are properly required by the President or by

the Board. If required by the Board, the Chief Financial Officer shall give the corporation a bond (which shall be renewed every

six years) in such sum and with such surety or sureties as shall be satisfactory to the Board for the faithful performance of

the duties of such officer’s office and for the restoration to the corporation, in case of such officer’s death, resignation,

retirement or removal from office, of all books, papers, vouchers, money and other property of whatever kind in such officer’s

possession or control belonging to the corporation.

The

Assistant Treasurer or the Assistant Treasurers, in the order of their seniority, shall, in the absence or disability of the Chief

Financial Officer, or in the event of such officer’s refusal to act, perform the duties and exercise the powers of the Chief

Financial Officer, and shall have such powers and discharge such duties as may be assigned from time to time by the President

or by the Board.

Section

10. Salaries. The salaries of the officers shall be fixed from time to time by the Board and no officer shall be prevented

from receiving such salary by reason of the fact that such officer is also a director of the Corporation.

GoChip Inc. (formerly FlixChip Corp.) Bylaws - Page 8

Section

11. Officers Holding More Than One Office. Any two or more offices may be held by the same person, but no officer shall

execute, acknowledge or verify any instrument in more than one capacity.

Section

12. Approval of Loan to Officers. The Corporation may, upon the approval of the Board alone, make loans or money or property

to, or guarantee the obligations of, any officer of the Corporation or its parent or subsidiary, whether or not a director, or

adopt an employee benefit plan or plans authorizing such loans or guaranties provided that (i) the Board determines that such

a loan or guaranty or plan may reasonably be expected to benefit the Corporation, (ii) the Corporation has outstanding shares

held of record by 100 or more persons (determined as provided in Section 605 of the California Corporations Code) on the date

of approval by the Board, and (iii) the approval of the Board is by a vote sufficient without counting the vote of any interested

director or directors.

ARTICLE

V - MISCELLANEOUS

Section

1. Record Date and Closing of Stock Books. The Board may fix a time in the future as a record date for the determination

of the shareholders entitled to notice of and to vote at any meeting of shareholders or entitled to receive payment of any dividend

or distribution, or any allotment of rights, or to exercise rights in respect to any other lawful action. The record date so fixed

shall not be more than sixty nor less than ten days prior to the date of the meeting or event for the purposes of which it is

fixed. When a record date is so fixed, only shareholders of record at the close of business on that date are entitled to notice

of and to vote at the meeting or to receive the dividend, distribution, or allotment of rights, or to exercise the rights, as

the case may be, notwithstanding any transfer of any shares on the books of the Corporation after the record date.

The

Board may close the books of the Corporation against transfers of shares during the whole or any part of a period of not more

than sixty days prior to the date of a shareholders’ meeting, the date when the right to any dividend, distribution, or

allotment of rights vests, or the effective date of any change, conversion or exchange of shares.

Section

2. Certificates. Certificates of stock shall be issued in numerical order and each shareholder shall be entitled to a certificate

signed in the name of the Corporation by the Chairman of the Board or the President or a Vice President, and the Chief Financial

Officer or the Secretary or an Assistant Secretary, certifying to the number of shares owned by such shareholder. Any or all of

the signatures on the certificate may be facsimile. Prior to the due presentment for registration of transfer in the stock transfer

book of the Corporation, the registered owner shall be treated as the person exclusively entitled to vote, to receive notifications

and otherwise to exercise all the rights and powers of an owner, except as expressly provided otherwise by the laws of the State

of California.

Section

3. Fiscal Year. The fiscal year of the Corporation shall end on December 31 of each year.

GoChip Inc. (formerly FlixChip Corp.) Bylaws - Page 9

Section

4. Annual Reports. The Annual Report to shareholders, described in the Code, is expressly waived and dispensed with until

such time as the Corporation has more than I 00 shareholders.

Section

5. Amendments. Bylaws may be adopted, amended, or repealed by the vote or the written consent of shareholders entitled

to exercise a majority of the voting power of the Corporation. Subject to the right of shareholders to adopt, amend, or repeal

Bylaws, Bylaws may be adopted, amended, or repealed by the Board.

Section

6. Indemnification of Corporate Agents. The Corporation shall indemnify each of its agents against expenses, judgments,

fines, settlements and other amounts, actually and reasonably incurred by such person by reason of such person’s having

been made or having been threatened to be made a party to a proceeding to the fullest extent permissible under the Code and the

Corporation shall advance the expenses reasonably expected to be incurred by such agent in defending any such proceeding upon

receipt of the undertaking required by subdivision (f) of Section 317 of the Code. The terms “agent,” “proceeding”

and “expenses” made in this section shall have the same meaning as such terms in said Section 317.

GoChip Inc. (formerly FlixChip Corp.) Bylaws - Page 10

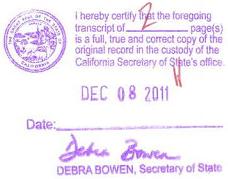

CERTIFICATE

OF SECRETARY OF

FLIXCIDP CORP.

The

undersigned, John Strisower, Secretary of FlixChip Corp. (the “Corporation”), a California corporation, hereby certifies

that the attached document is a true and complete copy of the Bylaws of the Corporation as in effect on the date hereof.

IN

WITNESS WHEREOF, the undersigned has executed this certificate as of this day of February 2012.

| |

/s/ John Strisower |

| |

John Strisower, Secretary |

GoChip Inc. (formerly FlixChip Corp.) Bylaws - Page 11