Trillium Therapeutics Inc. - Exhibit 99.2 - Filed by newsfilecorp.com

MANAGEMENT’S DISCUSSION AND ANALYSIS

FOR THE YEARS ENDED

DECEMBER 31, 2018 AND 2017

Dated: March 7, 2019

2488 Dunwin Drive

Mississauga, Ontario, L5L 1J9

www.trilliumtherapeutics.com

| TRILLIUM THERAPEUTICS INC.

|

| Management’s

Discussion and Analysis |

ABOUT THIS MANAGEMENT’S DISCUSSION AND ANALYSIS

All references in this management’s discussion and analysis, or

MD&A to “the Company”, “Trillium”, “we”, “us”, or “our” refer to Trillium

Therapeutics Inc. and the subsidiaries through which it conducts its business,

unless otherwise indicated or the context requires otherwise.

The following MD&A is prepared as of March 8, 2019 for

Trillium Therapeutics Inc. for the years ended December 31, 2018 and 2017, and

should be read in conjunction with the audited consolidated financial statements

for the years ended December 31, 2018 and 2017, which have been prepared by

management in accordance with International Financial Reporting Standards, or

IFRS as issued by the International Accounting Standards Board, or IASB. Our

IFRS accounting policies are set out in note 3 of the annual audited

consolidated financial statements for the years ended December 31, 2018 and

2017. All amounts are in thousands of Canadian dollars, except per share amounts

and unless otherwise indicated. References to “U.S. $” are to United States

dollars.

CAUTIONARY STATEMENT ABOUT FORWARD-LOOKING STATEMENTS

This MD&A contains forward-looking statements within the

meaning of applicable securities laws. All statements contained herein that are

not clearly historical in nature are forward-looking, and the words

“anticipate”, “believe”, “expect”, “estimate”, “may”, “will”, “could”,

“leading”, “intend”, “contemplate”, “shall” and similar expressions are

generally intended to identify forward-looking statements. Forward-looking

statements in this MD&A include, but are not limited to, statements with

respect to:

- our expected future loss and accumulated deficit levels;

- our projected financial position and estimated cash burn rate;

- our requirements for, and the ability to obtain, future funding on

favorable terms or at all;

- our projections for the SIRPαFc development plans and progress of each of

our products and technologies, particularly with respect to the timely and

successful completion of studies and trials and availability of results from

such studies and trials;

- our plans to focus development of TTI-621 on patients with cutaneous

T-cell lymphoma based on our early clinical results;

- our expectations about our products’ safety and efficacy;

- our expectations regarding our ability to arrange for and scale up the

manufacturing of our products and technologies;

- our expectations regarding the progress, and the successful and timely

completion, of the various stages of the regulatory approval process;

- our expectations about the timing of achieving milestones and the cost of

our development programs;

- our observations and expectations regarding the relative low binding of

SIRPαFc to red blood cells, or RBCs, compared to anti-CD47 monoclonal

antibodies and proprietary CD47-blocking agents and the potential benefits to

patients;

- our ability to intensify the dose of TTI-621 with the goal of achieving

increased blockade of CD47;

- our expectation that we will achieve levels of TTI-622 in patients

sufficient to obtain sustained CD47 blockade;

- our expectation that TTI-622 is likely to be more effective in combination

with agents that provide additional “eat” signals to macrophages or other

forms of immune activation;

- our plans to market, sell and distribute our products and technologies;

- our expectations regarding the acceptance of our products and technologies

by the market;

- our ability to retain and access appropriate staff, management and expert

advisers;

- our expectations about the differentiated nature and discovery research

capabilities of Fluorinov Pharma Inc., or Fluorinov;

- our ability to generate future product development programs with improved

pharmacological properties and acceptable safety profiles using Fluorinov

technology;

- 1 -

| TRILLIUM THERAPEUTICS INC.

|

| Management’s

Discussion and Analysis |

- our expectations about whether various clinical and regulatory milestones

with an existing Fluorinov compound will be achieved;

- our expectations of the final quantum and form of any future contingent

milestone payments related to the Fluorinov acquisition;

- our expectations of the ability to secure the requisite approvals

(including approvals from the Toronto Stock Exchange, or TSX, and the NASDAQ

Stock Market, or NASDAQ) with respect to the issuance of any common shares in

satisfaction of future milestone payments;

- our ability to secure strategic partnerships with larger pharmaceutical

and biotechnology companies;

- our strategy to acquire and develop new products and technologies and to

enhance the safety and efficacy of existing products and technologies;

- our expectations with respect to existing and future corporate alliances

and licensing transactions with third parties, and the receipt and timing of

any payments to be made by us or to us in respect of such arrangements; and

- our strategy with respect to the protection of our intellectual property.

All forward-looking statements reflect our beliefs and

assumptions based on information available at the time the assumption was made.

These forward-looking statements are not based on historical facts but rather on

management’s expectations regarding future activities, results of operations,

performance, future capital and other expenditures (including the amount, nature

and sources of funding thereof), competitive advantages, business prospects and

opportunities.

By its nature, forward-looking information involves numerous

assumptions, inherent risks and uncertainties, both general and specific, known

and unknown, that contribute to the possibility that the predictions, forecasts,

projections or other forward-looking statements will not occur. In evaluating

forward-looking statements, readers should specifically consider various

factors, including the risks outlined under the heading “Risk Factors” in this

MD&A. Some of these risks and assumptions include, among others:

- substantial fluctuation of losses from quarter to quarter and year to year

due to numerous external risk factors, and anticipation that we will continue

to incur significant losses in the future;

- uncertainty as to our ability to raise additional funding to support

operations;

- our ability to generate product revenue to maintain our operations without

additional funding;

- the risks associated with the development of our product candidates which

are at early stages of development;

- positive results from preclinical and early clinical research are not

necessarily predictive of the results of later-stage clinical trials;

- reliance on third parties to plan, conduct and monitor our preclinical

studies and clinical trials;

- our product candidates may fail to demonstrate safety and efficacy to the

satisfaction of regulatory authorities or may not otherwise produce positive

results;

- risks related to filing Investigational New Drug applications, or INDs, to

commence clinical trials and to continue clinical trials if approved;

- the risks of delays and inability to complete clinical trials due to

difficulties enrolling patients;

- competition from other biotechnology and pharmaceutical companies;

- our reliance on the capabilities and experience of our key executives and

scientists and the resulting loss of any of these individuals;

- our ability to fully realize the benefits of acquisitions;

- our ability to adequately protect our intellectual property and trade

secrets;

- our ability to source and maintain licenses from third-party owners;

- the risk of patent-related litigation; and

- our expectations regarding our status as a passive foreign investment

company, or PFIC,

all as further and more fully described under the heading “Risk

Factors” in this MD&A.

- 2 -

| TRILLIUM THERAPEUTICS INC.

|

| Management’s

Discussion and Analysis |

Although the forward-looking statements contained in this

MD&A are based upon what our management believes to be reasonable

assumptions, we cannot assure readers that actual results will be consistent

with these forward-looking statements.

Any forward-looking statements represent our estimates only as

of the date of this MD&A and should not be relied upon as representing our

estimates as of any subsequent date. We undertake no obligation to update any

forward-looking statement or statements to reflect events or circumstances after

the date on which such statement is made or to reflect the occurrence of

unanticipated events, except as may be required by securities legislation.

BUSINESS

Overview

We are a clinical stage immuno-oncology company developing

innovative therapies for the treatment of cancer. Our lead program, TTI-621, is

a SIRPαFc fusion protein that consists of the extracellular CD47-binding domain

of human signal regulatory protein alpha, or SIRPα, linked to the Fc region of a

human immunoglobulin G1, or IgG1. It is designed to act as a soluble decoy

receptor, preventing CD47 from delivering its inhibitory (“do not eat”) signal.

Neutralization of the inhibitory CD47 signal enables the activation of

macrophage anti-tumor effects by pro-phagocytic (“eat”) signals. The IgG1 Fc

region of TTI-621 may also assist in the activation of macrophages by engaging

Fc receptors. Two phase 1 clinical trials evaluating TTI-621 are ongoing. In

these trials, TTI-621 has shown single agent activity by both local and/or

systemic delivery in multiple B- and T-cell lymphoma indications and has been

well tolerated in over 200 patients to date.

We are also developing a second SIRPαFc fusion protein,

TTI-622. TTI-622 consists of the extracellular CD47-binding domain of human

SIRPα linked to a human immunoglobulin G4, or IgG4 Fc region, which has a

decreased ability to engage Fc receptors than an IgG1 Fc. We initiated a phase 1

clinical trial for TTI-622 in June 2018. Both SIRPαFc fusion proteins enable

CD47 blockade with different levels of Fc receptor engagement on macrophages and

thus may find unique applications.

We also have a medicinal chemistry platform that uses

proprietary fluorine-based chemistry to yield new chemical entities. Our most

advanced preclinical program stemming from this platform is an epidermal growth

factor receptor, or EGFR antagonist with increased uptake and retention in the

brain. In addition, a number of compounds directed at undisclosed

immuno-oncology targets are currently in the discovery phase.

Our Strategy

Our goal is to become a leading innovator in the field of

oncology by targeting immune-regulatory pathways that tumor cells exploit to

evade the host immune system. We believe we have the most differentiated and

comprehensive approach to targeting CD47, with the development of two SIRPαFc

fusion proteins, monotherapy and combination therapy approaches, and both

intravenous and intratumoral administration. We intend to:

-

Rapidly advance the clinical development of TTI-621. Because

CD47 is highly expressed by multiple liquid and solid tumors, and high

expression is correlated with worse clinical outcomes, we believe SIRPαFc has

potential to be effective in a variety of cancers. In our clinical trials to

date, we have enrolled over 200 patients with multiple tumor types where

TTI-621 may provide clinical benefit to find specific malignancies of interest

for further development.

-

Focus our TTI-621 clinical program on promising cancer indications.

From our broad clinical approach, we found a number of cancers where

we saw positive responses in patients. We are particularly interested in our

initial results treating mycosis fungoides, a predominant form of cutaneous

T-cell lymphoma, or CTCL, and we are focusing our near-term efforts on

patients with T-cell malignancies broadly to include both CTCL and peripheral

T-cell lymphoma, or PTCL, patients.

- 3 -

| TRILLIUM THERAPEUTICS INC.

|

| Management’s

Discussion and Analysis |

-

Expand our portfolio of SIRPαFc

constructs through advancement of TTI-622. Our expertise in designing

fusion proteins allows us to explore alternative approaches to blocking CD47

that may be advantageous for certain applications. We began testing TTI-622 in

a phase 1 clinical trial in June 2018 as a second and differentiated approach

to block CD47. We expect TTI-622 may be of particular interest when used in

combination with other anti-cancer drugs, including immunomodulatory agents.

-

Build a pipeline of novel oncology products using our proprietary

medicinal chemistry platform. We have several preclinical and

discovery stage assets developed using our proprietary fluorine chemistry

platform. We plan to advance these novel oncology products for internal

development or out-license.

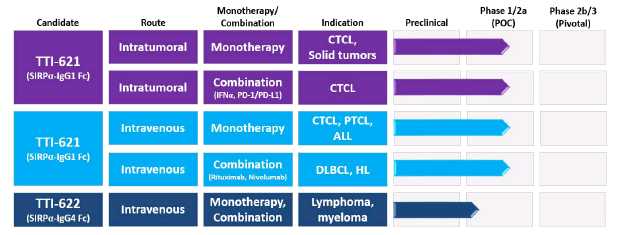

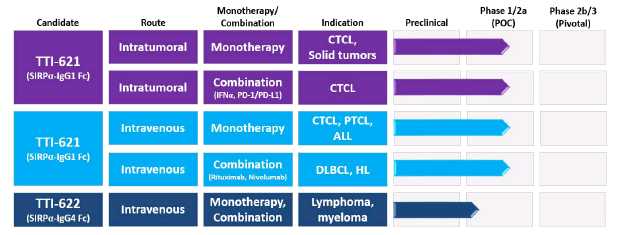

Our CD47 Clinical Pipeline

SIRPαFc

Blocking the CD47 “do not eat” signal using a

SIRPαFc decoy receptor

The immune system is the body’s mechanism to identify and

eliminate pathogens, and can be divided into the innate immune system and the

adaptive immune system. The innate immune system is the body’s first line of

defense to identify and eliminate pathogens and consists of proteins and cells,

such as macrophages, that identify and provide an immediate response to

pathogens. The adaptive immune system is activated by, and adapts to, pathogens,

creating a targeted and durable response. Cancer cells often have the ability to

reduce the immune system’s ability to recognize and destroy them.

Macrophages are a type of white blood cell that can ingest and

destroy (phagocytose) other cells. Macrophage activity is controlled by both

positive “eat” and negative “do not eat” signals. Recently, a role for

macrophages in the control of tumors has been described. Tumor cells may express

“eat” signals (e.g., calreticulin) that make themselves visible to macrophages.

To counterbalance this increased visibility the tumor cells often express high

levels of CD47, which transmits a “do not eat” signal by binding SIRPα on the

surface of macrophages. Elevated expression of CD47 has been observed across a

range of hematological and solid tumors. In many cases, high CD47 expression was

shown to have negative clinical consequences, correlating with more aggressive

disease and poor survival.

Our lead program, TTI-621, is a novel SIRPαFc fusion protein

that harnesses the innate immune system by blocking the activity of CD47.

TTI-621 is a protein that consists of the CD47-binding domain of human SIRPα

linked to the Fc region of IgG1. It is designed to act as a soluble decoy

receptor, preventing CD47 from delivering its inhibitory signal. Neutralization

of the inhibitory CD47 signal enables the activation of macrophage anti-tumor

effects by the pro-phagocytic “eat” signals. The IgG1 Fc region of TTI-621 may

also assist in the activation of macrophages by engaging Fc receptors. A second

SIRPαFc fusion protein, TTI-622, entered phase 1 testing in June 2018. TTI-622

consists of the same CD47-binding domain of human SIRPα and is linked to the Fc

region of IgG4. The IgG4 Fc region of TTI-622 is expected to have a decreased ability to

engage activating Fc receptors compared to an IgG1 Fc, and thus provide a more

modest “eat” signal to macrophages, allowing for greater tolerability and higher

CD47 blockade but lower potency. TTI-622 will allow us to assess how higher CD47

blockade with an IgG4-based agent in patients compares to lower CD47 blockade

with an IgG1-based drug (TTI-621).

- 4 -

| TRILLIUM THERAPEUTICS INC.

|

| Management’s

Discussion and Analysis |

In preclinical studies, TTI-621 and TTI-622 frequently

triggered significant macrophage-mediated tumor cell phagocytosis in vitro

compared to control treatment. In vivo, both fusion proteins exhibited

anti-tumor activity in human xenograft models.

In addition to their direct anti-tumor activity, macrophages

can also function as antigen-presenting cells and stimulate antigen-specific

T-cells. Thus, it is possible that increasing tumor cell phagocytosis after

SIRPαFc exposure may result in enhanced adaptive immunity. In support of this,

CD47 antibody blockade has been recently shown to augment antigen presentation

and prime an anti-tumor cytotoxic T-cell response in immune-competent mice. In

2016, we presented data demonstrating that TTI-621 can augment antigen-specific

T-cell responses in vitro. CD47 blockade has also been reported to promote

tumor-specific T-cell responses through a dendritic cell-based mechanism,

although the effect of SIRPαFc on dendritic cells is currently unknown.

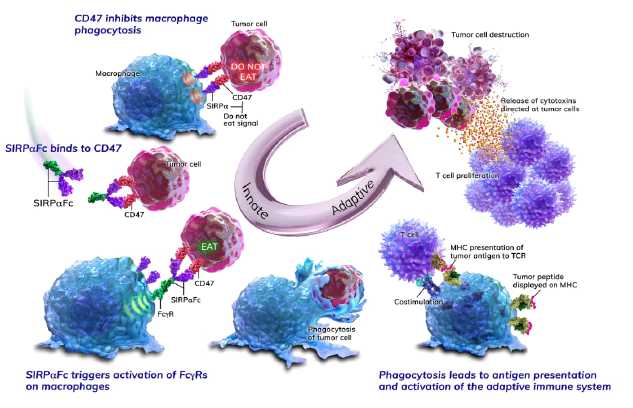

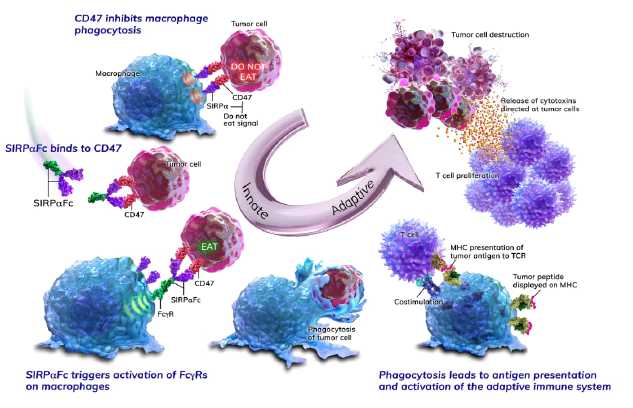

The figure below illustrates how SIRPαFc blocks the CD47 “do

not eat” signal and engages activating Fc receptors on macrophages, leading to

tumor cell phagocytosis, increased antigen presentation and enhanced T-cell

responses.

By inhibiting the CD47 “do not eat” signal, we believe SIRPαFc

has the ability to promote the macrophage-mediated killing of tumor cells in a

broad variety of cancers both as a monotherapy and in combination with other

immune therapies. Both SIRPαFc fusion proteins enable CD47 blockade with

different levels of Fc receptor engagement on macrophages and thus may find

unique applications.

- 5 -

| TRILLIUM THERAPEUTICS INC.

|

| Management’s

Discussion and Analysis |

Combination Therapy

We believe that SIRPαFc enhancement of macrophage activity, and

possibly T-cell responses, could be synergistic with other immune-mediated

therapies. Since many cancer antibodies work at least in part by activating

cells of the innate immune system, it may be possible to enhance the potency of

these agents by blocking the negative “do not eat” CD47 signal that tumor cells

deliver to macrophages. In fact, we have observed anti-tumor activity when

combining SIRPαFc with rituximab in both preclinical studies and in B lymphoma

patients. We hypothesize that SIRPαFc may act synergistically with other

immunological agents, including T-cell checkpoint inhibitors (e.g. pembrolizumab

and nivolumab), cancer vaccines, oncolytic viruses or chimeric antigen receptor,

or CAR T-cells.

SIRPαFc Clinical Development

– TTI-621

We are recruiting patients in two ongoing phase 1 clinical

trials; one with intratumoral injection and one with intravenous infusion. These

trials were designed to establish a safe dosing level, characterize safety,

pharmacokinetics, and pharmacodynamics and treat a broad range of malignancies

searching for evidence of antitumor activity.

Intratumoral administration – TTI-621

In a multi-center, open-label phase 1 trial, TTI-621 is being

delivered by intratumoral injection in patients with relapsed and refractory,

percutaneously-accessible cancers. In the escalation phase, patients were

enrolled in sequential dose cohorts to receive intratumoral injections of

TTI-621 that increased in dose and dosing frequency to characterize safety,

pharmacokinetics, pharmacodynamics and preliminary evidence of antitumor

activity. In addition, detailed evaluation of serial, on-treatment tumor

biopsies of both injected and non-injected cancer lesions is being performed to

help characterize the tumor microenvironment. The most recent data from the

ongoing study were reported at the American Society of Hematology

60th Annual Meeting in December 2018. Local delivery of TTI-621 was

well tolerated, with no treatment-related > Grade 3 adverse events or

dose-limiting toxicity observed in 27 mycosis fungoides patients. Among 22

evaluable patients, reductions in Composite Assessment of Index Lesion Severity,

or CAILS, scores, which measure local lesion responses, were observed in 91% of

patients, with 41% exhibiting reductions of 50% or greater. These responses

occurred rapidly within the 2-week induction period. Similar CAILS scores

changes were seen in adjacent non-injected lesions, suggesting locoregional

effects that were not confined to the site of injection. Evidence of a systemic

effect was observed in 1 of 2 patients receiving continuation monotherapy beyond

the 2-week induction therapy. In addition, data suggest a combination effect

with pegylated IFN-alpha-2a. Collectively, the data demonstrate that CTCL

appears biologically responsive to intratumoral injections of TTI-621.

We have amended the protocol for this trial to focus on

recruiting additional patients with T-cell malignancies, and specifically CTCL,

to determine if the preliminary results will be seen in a larger patient

population. Patients are currently being enrolled in the expansion phase of the

trial in which they receive 10 mg of TTI-621 three times per week for two weeks

followed by weekly dosing, to further characterize safety and efficacy. In

addition, patients may receive intratumoral TTI-621 in combination with other

anti-cancer therapies (anti-PD-1 or anti-PD-L1, pegylated interferon α2a,

talimogene laherparepvec or radiation). We have modified this trial to allow for

the increase in the size of each cohort from 12 to 40 patients based on early

signs of clinical benefit.

- 6 -

| TRILLIUM THERAPEUTICS INC.

|

| Management’s

Discussion and Analysis |

Intravenous administration – TTI-621

We are enrolling patients with advanced hematologic

malignancies in a phase 1b clinical trial with intravenous administration of

TTI-621. The most recent data from the ongoing expansion phase were reported at

the

T-Cell Lymphoma Forum in January 2019. Based on an expanded data set of 179

patients, weekly infusions of TTI-621 were shown to be well tolerated.

Thrombocytopenia was the most frequent grade 3 or higher treatment-emergent

adverse event, occurring in 18% of patients. Platelet reductions, however, were

shown to be transient and pre-dose platelet levels remained steady during the

course of the study. Notably, the reversible thrombocytopenia did not lead to an

increased risk of bleeding and had no impact on drug delivery, nor was there a

significant impact of TTI-621 on hemoglobin levels. Monotherapy efficacy was

observed in patients with mycosis fungoides (17% overall response rate, or ORR,

n=24), peripheral T-cell lymphoma, or PTCL (18% ORR, n=11), Sézary Syndrome (20%

ORR, n=5). As reported at the 16th Annual Discovery on Target conference in

September 2018, monotherapy efficacy was also observed in diffuse large B-cell

lymphoma, or DLBCL patients (25% ORR, n=8), and in DLBCL patients when combined

with rituximab (25% ORR, n=24). This clinical activity was observed in patients

receiving relatively low doses of drug (0.2 mg/kg for monotherapy or 0.1 mg/kg

in combination with rituximab). Dose intensification beyond 0.2 mg/kg is

currently ongoing, and doses of 0.5 mg/kg have been well tolerated for up to 27

weeks.

We are focusing our near-term efforts on patients with CTCL and

PTCL, following the early signals of efficacy observed in the intratumoral

trial. These patients are being enrolled in separate cohorts that will be

evaluated using a Simon 2-stage design where we must achieve predefined target

responses in the first stage (18 patients) to continue recruiting patients for a

second stage of 17 patients. We also introduced a standardized intra-subject dose

intensification schedule for all newly enrolled subjects to increase drug

exposure.

- 7 -

| TRILLIUM THERAPEUTICS INC.

|

| Management’s

Discussion and Analysis |

TTI-621 has recently been granted an Orphan Drug Designation by

the U.S. Food and Drug Administration, or FDA for the treatment of cutaneous

T-cell lymphoma. Orphan Drug Designation qualifies the sponsor of the drug

candidate for various development incentives, which may include tax credits for

qualified clinical testing, an exemption from fees under the Prescription Drug

User Fee Act, and a seven-year marketing exclusivity period following approval.

SIRPαFc Clinical Development

– TTI-622

A second SIRPαFc fusion protein, TTI-622, is in clinical

development. A two-part, multicenter, open-label, phase 1a/1b study of TTI-622

in patients with advanced relapsed or refractory lymphoma or multiple myeloma

was initiated in June 2018. In the phase 1a dose-escalation part, patients will

be enrolled in sequential dose cohorts to receive TTI-622 once weekly to

characterize safety, tolerability, pharmacokinetics, and to determine the

maximum tolerated dose. In the phase 1b part, patients will be treated with

TTI-622 in combination with rituximab, a proteasome inhibitor-containing

regimen, or a PD-1 inhibitor. Rituximab and proteasome inhibitors may provide

additional “eat” signals that could enhance the efficacy of TTI-622. A PD-1

inhibitor may help amplify any anti-tumor T-cell response generated by TTI-622.

TTI-622 consists of the same extracellular CD47-binding domain

of human SIRPα as TTI-621 but has a different Fc region (IgG4 Fc instead of IgG1

Fc), which provides a more modest “eat” signal than IgG1 due to more limited

interactions with activating Fc receptors. Preclinical studies suggest that

IgG4-based SIRPαFc fusion proteins have greater tolerability but lower potency

than IgG1-based fusion proteins. We therefore expect to achieve higher levels of

TTI-622 in patients compared to TTI-621, leading to greater and more sustained

CD47 blockade. Thus, TTI-622 will allow us to assess how higher CD47 blockade

with an IgG4-based agent in patients compares to lower CD47 blockade with the

IgG1-based TTI-621. Due to the lower potency of the IgG4 Fc, we expect that

TTI-622 is likely to be more effective in combination with agents that provide

additional “eat” signals to macrophages or other forms of immune activation.

Preclinical TTI-622 data were reported at the 2018 Annual

Meeting of the American Association for Cancer Research. The data demonstrate

that TTI-622 induces the phagocytosis of a broad panel of tumor cells derived

from patients with both hematological and solid tumors. As a monotherapy,

TTI-622 treatment resulted in decreased tumor growth and improved survival in a

B cell lymphoma xenograft model, and enhanced the efficacy of cetuximab

(anti-EGFR) and daratumumab (anti-CD38) antibodies in solid and hematological

xenograft models, respectively. Unlike CD47-blocking antibodies, TTI-622 bound

minimally to RBCs and did not induce hemagglutination in vitro. We believe that

this property could give TTI-622 best-in-class status among IgG4-based blocking

agents currently in clinical development.

- 8 -

| TRILLIUM THERAPEUTICS INC.

|

| Management’s

Discussion and Analysis |

SIRPαFc Key Takeaways

-

Multiple clinical approaches. We believe we have the most

systematic and comprehensive approach to CD47 with two decoy receptors in

development with different Fc functions, monotherapy and combination therapy

approaches, and intravenous and intratumoral delivery modalities.

-

Demonstrated clear signals of activity. TTI-621 monotherapy

has produced positive signals of activity in CTCL, PTCL and DLBCL patients. A

signal of activity was also seen in DLBCL patients when combined with

rituximab.

-

Tolerability and safety. TTI-621 has been well tolerated in

over 180 patients to date.

-

Clear paths forward. We are focusing our development on

intratumoral monotherapy and combination therapy in CTCL; intravenous

monotherapy in both CTCL and PTCL; and intravenous combination therapy in

B-cell lymphoma.

SIRPαFc

Competition

There are a number of companies developing blocking agents to

the CD47-SIRPα axis, which can be broadly classified into six groups which

include, but are not limited to:

- CD47-specific antibodies: Forty Seven Inc (phase 2); Celgene

Corporation, Surface Oncology, Innovent Biologics (Suzhou) Co. (phase 1); Arch

Oncology, I-Mab Biopharma, Phanes Therapeutics, ImmuneOncia (preclinical)

- CD47 bispecific antibodies: Novimmune SA, Hummingbird

BioSciences, Pharmabcine (preclinical)

- Mutated high affinity SIRPαFc:

ALX Oncology (phase 1)

- SIRPα-specific antibody: Celgene

(phase 1), OSE Immunotherapeutics (preclinical), Forty Seven Inc (preclinical)

- SIRPαFc-agonist fusion protein:

Shattuck Labs (preclinical)

- Small molecule inhibitor: Aurigene Discovery Technologies

(preclinical)

We believe that TTI-621 has advantages over other CD47 blocking

agents. TTI-621’s IgG1 Fc maximizes potency by delivering an activating signal

to macrophages through Fc receptors. With this higher potency, we believe that

TTI-621 has a higher likelihood of monotherapy activity and therefore is not

dependent upon a combination with another IgG1 antibody. TTI-621 could also have

the potential to be used to treat tumors where no anti-cancer antibody is

available.

- 9 -

| TRILLIUM THERAPEUTICS INC.

|

| Management’s

Discussion and Analysis |

We have also demonstrated that our SIRPαFc fusion proteins

exhibit minimal binding to RBCs in contrast to CD47-specific antibodies and a

mutated high affinity SIRPαFc. We believe that this property confers several

possible advantages including avoidance of drug-induced anemia, avoidance of the

“antigen sink effect” (i.e. removal of drug from circulation by RBCs) and

non-interference with laboratory blood typing tests. It should be noted that

TTI-622 shares the same CD47-binding domain as TTI-621 and preclinical studies

have shown that it also exhibits minimal binding to human RBCs. Thus, we

anticipate that TTI-622, like TTI-621, will not induce anemia in patients.

Fluorine Chemistry Platform

Our medicinal chemistry platform uses proprietary

fluorine-based chemistry yield new chemical entities. We believe the potency

and/or safety of both existing pharmacophores and historically inaccessible

chemical structures may be enhanced using our technology. This chemistry

platform has been utilized to establish several preclinical programs including

an EGFR inhibitor, and a number of compounds directed at undisclosed

immuno-oncology targets are currently in the discovery phase.

Plan of Operations

We are advancing our intratumoral and intravenous clinical

trials of TTI-621 with a focus on CTCL and PTCL and our TTI-622 phase 1 trial

has been initiated. We also continue to advance our small molecule program in

internal development and pursue partnering activities.

Legal Proceedings

To our knowledge, there have not been any legal or arbitration

proceedings, including those relating to bankruptcy, receivership or similar

proceedings, those involving any third party, and governmental proceedings

pending or known to be contemplated, which may have, or have had in the recent

past, significant effect on our financial position or profitability.

Also, to our knowledge, there have been no material proceedings

in which any director, any member of senior management, or any of our affiliates

is either a party adverse to us or any of our subsidiaries or has a material

interest adverse to us or any of our subsidiaries.

- 10 -

| TRILLIUM THERAPEUTICS INC.

|

| Management’s

Discussion and Analysis |

RESULTS OF OPERATIONS

For the three months and years ended December 31, 2018 and

2017

Overview

Since inception, we have incurred losses while advancing the

research and development of our products. Net loss for the year ended December

31, 2018 of $42,486 was lower than the loss of $45,088 for the year ended

December 31, 2017. The net loss was lower due mainly to a net foreign currency

gain of $3,489 for the current year compared to a net foreign currency loss of

$4,742 in the prior year, and lower manufacturing costs, partially offset by

higher clinical trial expenses and an amendment to the SIRPαFc license

agreement, where the sublicense revenue sharing provisions were removed in

return for a payment to the licensors of $3,000 in the form of 369,621 common

shares.

Net loss for the three months ended December 31, 2018 of $8,553

was lower than the loss of $10,658 for the three months ended December 31, 2017

mainly due to a higher net foreign currency gain of $2,005 compared to $167 in

the prior year, partially offset by higher research and development expenses of

$10,611 with two active phase 1 trials for TTI-621, and the initiation of a

phase 1 trial for TTI-622.

Research and Development

Research and development expenses by program for the three

months and years ended December 31, 2018 and 2017 were as follows:

| |

|

Three months |

|

|

Three months |

|

|

|

|

|

|

|

| |

|

ended |

|

|

ended |

|

|

Year ended |

|

|

Year ended |

|

| |

|

December 31, |

|

|

December 31, |

|

|

December 31, |

|

|

December 31, |

|

| |

|

2018 |

|

|

2017 |

|

|

2018 |

|

|

2017 |

|

| |

|

$ |

|

|

$ |

|

|

$ |

|

|

$ |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| SIRPαFc |

|

10,128 |

|

|

9,003 |

|

|

39,748 |

|

|

31,052 |

|

| Small molecule programs |

|

483 |

|

|

805 |

|

|

3,653 |

|

|

6,041 |

|

| Other |

|

- |

|

|

3 |

|

|

25 |

|

|

42 |

|

| Total(1) |

|

10,611 |

|

|

9,811 |

|

|

43,426 |

|

|

37,135 |

|

|

Note: |

|

| (1) |

Research and development expenditures in the above table

include all direct and indirect costs for the programs, personnel costs,

intellectual property, amortization, share-based compensation and research

and development overhead, and is net of government assistance. Research

and development overhead costs have been allocated to the programs based

mainly on personnel time spent on the programs. |

During 2018 and 2017, most of our resources were focused on the

development of our SIRPαFc program. For the year ended December 31, 2018,

SIRPαFc research and development costs were higher than the prior year due to

higher clinical trial expenses with three active phase 1 clinical trials and the

amendment to the SIRPαFc license agreement, partially offset by lower SIRPαFc

manufacturing and reduced activity relating to academic research

collaborations.

Small molecule program expenses were lower than the prior year

as we completed most of our targeted preclinical development studies for the

bromodomain and EGFR inhibitors in 2017, while 2018 activities were focused on

our immuno-oncology discovery programs.

- 11 -

| TRILLIUM THERAPEUTICS INC.

|

| Management’s

Discussion and Analysis |

Components of research and development expenses for the three

months ended December 31, 2018 and 2017 were as follows:

| |

|

2018 |

|

|

2017 |

|

| |

|

$ |

|

|

$ |

|

| |

|

|

|

|

|

|

| Research and development programs excluding

the below items |

|

7,643 |

|

|

6,241 |

|

| Salaries, fees and short-term benefits |

|

2,114 |

|

|

2,675 |

|

| Share-based compensation |

|

755 |

|

|

713 |

|

| Amortization of intangible assets |

|

584 |

|

|

965 |

|

| Change in fair value of contingent

consideration |

|

(674 |

) |

|

(1,012 |

) |

| Depreciation of property and equipment |

|

202 |

|

|

243 |

|

| Tax credits |

|

(13 |

) |

|

(14 |

) |

| |

|

10,611 |

|

|

9,811

|

|

Components of research and development expenses for the years

ended December 31, 2018 and 2017 were as follows:

| |

|

2018 |

|

|

2017 |

|

| |

|

$ |

|

|

$ |

|

| |

|

|

|

|

|

|

| Research and development programs excluding

the below items |

|

27,493 |

|

|

22,831 |

|

| Salaries, fees and short-term benefits |

|

8,510 |

|

|

7,969 |

|

| License agreement amendment |

|

3,000 |

|

|

- |

|

| Share-based compensation |

|

2,148 |

|

|

2,911 |

|

| Amortization of intangible assets |

|

2,338 |

|

|

3,860 |

|

| Change in fair value of contingent consideration |

|

(674 |

) |

|

(1,158 |

) |

| Depreciation of property and equipment |

|

808 |

|

|

849 |

|

| Tax credits |

|

(197 |

) |

|

(127 |

) |

| |

|

43,426 |

|

|

37,135 |

|

The increase in research and development program expenses for

the three months ended December 31, 2018 compared to the same period last year

was due mainly to higher SIRPαFc clinical trial expenses by $744 and higher

manufacturing costs by $860. Salaries, fees and short-term benefits decreased in

the three months ended December 31, 2018 due to lower incentive compensation

expenses compared to the same period in 2017. Share-based compensation costs

were comparable to the same period in the prior year. Amortization of intangible

assets decreased as we extended our estimate of the life of our small molecule

platform intangible asset. The change in fair value of contingent consideration

reflected an increase in the time estimate and increased risk of reaching the

potential milestones. Depreciation of property and equipment and tax credits

were comparable to the prior year period.

The increase in research and development program expenses for

the year ended December 31, 2018 over the prior year was due mainly to an

increase in SIRPαFc clinical trial expenses of $6,432, partially offset by a

decrease in SIRPαFc manufacturing costs of $178 and lower activity related to

academic research collaborations. Salaries, fees, and short-term benefits

increased in the year ended December 31, 2018 due to higher staffing and

salaries compared to 2017. For the year ended December 31, 2018, we incurred an

expense of $3,000 relating to the SIRPαFc license agreement amendment.

Share-based compensation costs decreased mainly due to an increase in stock

option forfeitures and in the expected forfeiture rate. Amortization of

intangible assets decreased as we extended our estimate of the life of our small

molecule platform intangible asset. The change in fair value of contingent

consideration reflected an increase in the time estimate and lowered the

likelihood of

reaching the potential milestones.

- 12 -

| TRILLIUM THERAPEUTICS INC.

|

| Management’s

Discussion and Analysis |

Depreciation of property and equipment was comparable to the

prior year. Tax credits increased compared to the prior year due to an increase

in eligible expenses.

General and Administrative

Components of general and administrative expenses for the three

months ended December 31, 2018 and 2017 were as follows:

| |

|

2018 |

|

|

2017 |

|

| |

|

$ |

|

|

$ |

|

| |

|

|

|

|

|

|

| General and administrative expenses

excluding the below items |

|

470 |

|

|

407 |

|

| Salaries, fees and short-term benefits |

|

829 |

|

|

603 |

|

| Change in fair value of deferred share

units |

|

(1,197 |

) |

|

154 |

|

| Share-based

compensation |

|

104 |

|

|

90

|

|

| |

|

206 |

|

|

1,254 |

|

Components of general and administrative expenses for the years

ended December 31, 2018 and 2017 were as follows:

| |

|

2018 |

|

|

2017 |

|

| |

|

$ |

|

|

$ |

|

| |

|

|

|

|

|

|

| General and administrative expenses

excluding the below items |

|

1,905 |

|

|

1,469 |

|

| Salaries, fees and short-term benefits |

|

2,716 |

|

|

2,038 |

|

| Change in fair value of deferred share

units |

|

(1,401 |

) |

|

10 |

|

| Share-based

compensation |

|

362 |

|

|

344

|

|

| |

|

3,582 |

|

|

3,861 |

|

General and administrative expenses for the three months ended

December 31, 2018 of $470 were higher than the prior year comparable period

mainly due to higher professional fees incurred. Salaries, fees and short-term

benefits increased mainly due to higher staffing levels and higher

director-related fees. The change in the fair value of deferred share units was

a result of fluctuations in our share price during the respective periods.

Share-based compensation expense was comparable to the prior year period.

General and administrative expenses for the year ended December

31, 2018 of $1,905 were higher than the prior year mainly due to higher

professional fees and listing fees incurred related to a prospectus supplement

filing and the 2018 Stock Option Plan. Salaries, fees and short-term benefits

increased mainly due to higher staffing levels and the issuance of director

DSUs. The change in the fair value of deferred share units was a result of

fluctuations in our share price during the respective periods. Share-based

compensation expense was comparable to the prior year.

Finance income and costs, foreign exchange gains and

losses, and income taxes

Finance income for the three months and year ended December 31,

2018 of $270 and $1,084, respectively, were higher than the prior year

comparable period amounts of $254 and $722 due mainly to higher interest rates.

Finance costs for the three months and year ended December 31,

2018 were comparable to the prior year periods.

- 13 -

| TRILLIUM THERAPEUTICS INC.

|

| Management’s

Discussion and Analysis |

During the three months ended December 31, 2018, we recorded a

net foreign currency gain of $2,005, compared to $167 for the comparative period

in 2017. The net foreign currency gain in the current period reflected a

strengthening of the U.S. dollar versus the Canadian dollar while holding net

U.S. dollar denominated assets. During the year ended December 31, 2018, we

recorded a net foreign currency gain of $3,489, compared to a net foreign

currency loss of $4,742 for the year ended December 31, 2017.

Liquidity and Capital Resources

Cash, working capital, and debt

Since inception, we have financed our operations primarily from

sales of equity, proceeds from the exercise of warrants and stock options and

from interest income on funds available for investment. Our primary capital

needs are for funds to support our scientific research and development

activities including staffing, facilities, manufacturing, preclinical studies,

clinical trials, administrative costs and for working capital.

We have experienced operating losses and cash outflows from

operations since incorporation, will require ongoing financing in order to

continue our research and development activities and we have not earned

significant revenue or reached successful commercialization of our products. Our

future operations are dependent upon our ability to finance our cash

requirements which will allow us to continue our research and development

activities and the commercialization of our products. There can be no assurance

that we will be successful in continuing to finance our operations.

In June 2017, we completed an underwritten public offering of

common shares and non-voting convertible preferred shares in the United States.

In the offering, we sold 2,949,674 common shares and 3,250,000 Series II

Non-Voting Convertible First Preferred Shares at a price of U.S. $5.00 per

share. The gross proceeds from this offering were $41,847 (U.S. $30,998) before

deducting offering expenses of $2,856.

The Series II Non-Voting Convertible First Preferred Shares

sold in the offering are non-voting and are convertible into common shares, on a

one-for-one basis (subject to adjustment), at any time at the option of the

holder, subject to certain restrictions on conversion. Holders may not convert

Series II Non-Voting Convertible First Preferred Shares into common shares if,

after giving effect to the exercise of conversion, the holder and its joint

actors would have beneficial ownership or direction or control over common

shares in excess of 4.99% of the then outstanding common shares. This limit may

be raised at the option of the holder on 61 days’ prior written notice: (i) up

to 9.99%, (ii) up to 19.99%, subject to clearance of a personal information form

submitted by the holder to the TSX, and (iii) above 19.99%, subject to approval

by the TSX and shareholder approval.

In connection with the acquisition of Series II First Preferred

Shares in this offering at the public offering price by an existing

institutional shareholder, we entered into an investment agreement with such

shareholder. The investment agreement provides this shareholder the right, but

not the obligation, for so long as it beneficially owns at least 10% of the

adjusted share capital of the Company, calculated on a fully-diluted basis, to

nominate one person for election to our board of directors, subject to meeting

applicable legal and stock exchange requirements and we have the obligation to

appoint such director, whose term will run until the next annual meeting of

shareholders. Thereafter, we are required to nominate such director to be a

director at any meeting of shareholders called for the purposes of electing

directors and to use commercially reasonable efforts to ensure that such

director is elected to the board of directors, including soliciting proxies in

support of his or her election and taking the same actions taken by us to ensure

the election of the other nominees selected by the board of directors for

election to the board of directors. In addition, until such time as the existing

shareholder exercises its right to nominate a member of our board of directors,

and so long as the existing shareholder’s nominee is not an employee, officer,

director or limited partner of such shareholder, then such shareholder shall

have the right, but not the obligation, to appoint an observer to our board of

directors, who must be an employee, officer or director of such shareholder. The

observer will have the right to receive notice of and attend the meetings of the

board of directors, and will have the right to address the board of directors at

any of its meetings, but will not have any right to vote at any meeting of the

board of directors. In addition, we have agreed to provide this existing

shareholder with certain registration rights in the event that such shareholder

and its joint actors are deemed to be “affiliates” for purposes of applicable

U.S. securities laws.

- 14 -

| TRILLIUM THERAPEUTICS INC.

|

| Management’s

Discussion and Analysis |

In December 2017, we completed a non-brokered private placement

financing and sold 1,950,000 common shares and 400,000 Series II Non-Voting

Convertible Preferred Shares at a price of U.S. $8.50 per share yielding gross

proceeds of $25,338 (U.S. $19,975) before deducting offering expenses of

$1,784.

On January 5, 2018, we filed a base shelf prospectus with the

British Columbia, Alberta, Manitoba, Ontario and Nova Scotia securities

commissions in Canada and a Form F-10 registration statement with the United

States Securities and Exchange Commission, or SEC, that provides that we may

sell under the prospectus from time to time over the following 25 months up to

U.S. $150 million, in one or more offerings, of common shares, First Preferred

shares, warrants to purchase common shares, subscription receipts, or units

comprising a combination of common shares, First Preferred shares and/or

warrants.

On June 19, 2018 we filed a prospectus supplement to the base

prospectus included in our U.S. registration statement on Form F-10 declared

effective on January 8, 2018. We also entered into a sales agreement with Cowen

and Company, LLC, or the Agent, pursuant to which we may, at our discretion and

from time to time during the term of the sales agreement, sell, through the

Agent, acting as agent and/or principal, such number of common shares of

Trillium as would result in aggregate gross proceeds to us of up to U.S. $25

million. Sales of common shares through the Agent, acting as agent, will be made

through “at the market” issuances on NASDAQ at the market price prevailing at

the time of each sale, and, as a result, sale prices may vary. No common shares

will be offered or sold on the TSX or any other trading markets in Canada.

Our cash and cash equivalents and marketable securities, and

working capital at December 31, 2018 were $45,409 and $34,185, respectively

compared to $81,791 and $68,900, respectively at December 31, 2017. The decrease

in cash and cash equivalents and marketable securities was due mainly to cash

used in operations of $39,295, net of an unrealized foreign exchange gain of

$3,108. The decrease in working capital was due mainly to cash used in

operations and a decrease to accounts payable and accrued liabilities due to

timing of clinical trial related payments.

We are indebted to the Federal

Economic Development Agency for Southern Ontario, or FedDev, under a

non-interest bearing contribution agreement and are making monthly repayments of

$10 through November 2019. As at December 31, 2018 and 2017, the balances

repayable were $96 and $211 respectively. The loan payable was discounted using

an estimated market interest rate of 15%. Interest expense accretes on the

discounted loan amount until it reaches its face value at maturity.

As at December 31, 2018 and 2017, we had a deferred lease

inducement of $375 and $407, respectively, for our facility lease. The

inducement benefit is being recognized over the expected term of the lease.

As at December 31, 2018 and 2017, we had a long-term liability

of $127 and $801, respectively, related to contingent consideration on the

acquisition of Fluorinov. For the year ended December 31, 2018, the

remeasurement of the fair value of the contingent consideration recognized an

increase in the time estimate and increased risk of reaching the potential

milestones, resulting in an expense reduction of $674 which is included in

research and development expenses.

Cash flows from operating activities

Cash used in operating activities increased to $39,295 for the

year ended December 31, 2018, compared to $27,038 for the year ended December

31, 2017, due mainly to higher research and development costs, a decrease in

accounts payable and accrued liabilities of $1,196 compared to an increase of

$8,165 in the prior year, and by an unrealized foreign exchange gain of $3,108

compared to an unrealized loss of $3,748 in the prior year.

Cash flows from investing activities

Cash provided from investing activities totaled $30,632 for the

year ended December 31, 2018, compared to cash used of $57,465 for the year

ended December 31, 2017. The change was due to the maturities of marketable

securities in the year ended December 31, 2018 compared to purchases of

marketable securities in the prior year.

- 15 -

| TRILLIUM THERAPEUTICS INC.

|

| Management’s

Discussion and Analysis |

Cash flows from financing activities

Cash used in financing activities totaled $115 for the year

ended December 31, 2018, compared to cash provided by financing activities of

$62,575 for the year ended December 31, 2017. The decrease was due to an

underwritten public offering of common shares and non-voting convertible

preferred shares in June 2017 and financing activity in December 2017.

Contractual Obligations and Contingencies

We enter into research, development and license agreements in

the ordinary course of business where we receive research services and rights to

proprietary technologies. Milestone and royalty payments that may become due

under various agreements are dependent on, among other factors, clinical trials,

regulatory approvals and ultimately the successful development of a new drug,

the outcome and timing of which is uncertain.

Under the license agreement for SIRPαFc, we have future

contingent milestones payable of $25 related to successful patent grants, $200

and $300 on the first patient dosed in phase 2 and 3 clinical trials

respectively, and regulatory milestones on their first achievement totaling

$5,000, and low single digit royalties payable on net sales.

Under two agreements with Catalent pursuant to which we

acquired the right to use a proprietary expression system for the manufacture of

two SIRPαFc constructs, we have future contingent milestones on pre-marketing

approval of up to U.S. $875 and aggregate sales milestone payments of up to U.S.

$28,750 for each agreement.

In connection with our acquisition of all the outstanding

shares of Fluorinov, we are obligated to pay up to $35,000 of additional future

payments that are contingent on us achieving certain clinical and regulatory

milestones with an existing Fluorinov compound. We will also have an obligation

to pay royalty payments on future sales of such compounds.

We periodically enter into research and license agreements with

third parties that include indemnification provisions customary in the industry.

These guarantees generally require us to compensate the other party for certain

damages and costs incurred as a result of claims arising from research and

development activities undertaken by or on our behalf. In some cases, the

maximum potential amount of future payments that could be required under these

indemnification provisions could be unlimited. These indemnification provisions

generally survive termination of the underlying agreement. The nature of the

indemnification obligations prevents us from making a reasonable estimate of the

maximum potential amount we could be required to pay. Historically, we have not

made any indemnification payments under such agreements and no amount has been

accrued in our consolidated financial statements with respect to these

indemnification obligations.

Other than as disclosed below, we did not have any contractual

obligations relating to long-term debt obligations, capital (finance) lease

obligations, operating lease obligations, purchase obligations or other

long-term liabilities reflected on our balance sheet as at December 31, 2018:

| |

|

|

Payment due by period |

|

| |

|

|

|

|

|

Less than |

|

|

1 to 3 |

|

|

3 to 5 |

|

|

More than |

|

| Contractual Obligations(1)(2) |

|

|

Total |

|

|

1

year |

|

|

years |

|

|

years |

|

|

5

years |

|

| Long-Term Debt

Obligations(3) |

|

$ |

105 |

|

$ |

105 |

|

$ |

- |

|

$ |

- |

|

$ |

- |

|

| Operating Lease Obligations(4) |

|

|

1,982 |

|

|

398 |

|

|

830 |

|

|

708 |

|

|

46 |

|

| Purchase

Obligations(5) |

|

|

30,694 |

|

|

23,308 |

|

|

7,290 |

|

|

96 |

|

|

- |

|

| Other Long-Term Liabilities Reflected on our

Balance Sheet(6) |

|

|

467 |

|

|

340 |

|

|

- |

|

|

- |

|

|

127 |

|

| |

|

$ |

33,248 |

|

$ |

24,151 |

|

$ |

8,120 |

|

$ |

804 |

|

$ |

173 |

|

- 16 -

| TRILLIUM THERAPEUTICS INC.

|

| Management’s

Discussion and Analysis |

|

|

|

|

|

|

|

|

|

Notes: |

|

|

| |

(1) |

Contractual obligations in the above table do not include

amounts in accounts payable and accrued liabilities on our balance sheet

as at December 31, 2018. |

| |

(2) |

Contingent milestones under the SIRPαFc license agreement

and the Catalent expression system agreements are not included in the

above table. |

| |

(3) |

Amounts due to FedDev repayable in equal monthly

installments of $10 through November 2019. |

| |

(4) |

Includes operating lease obligations for laboratory and

office facilities. |

| |

(5) |

Purchase obligations include all non-cancellable

contracts, and all cancellable contracts with $100 or greater remaining

committed at the period end including agreements related to the conduct of

our clinical trials, preclinical studies and manufacturing

activities. |

| |

(6) |

Includes $127 of contingent consideration related to

potential future payments of up to $35,000 based on the achievement of

clinical and regulatory milestones with an existing Fluorinov

compound. |

Description of Share Capital

The continuity of the number of our issued and outstanding

common and preferred shares from December 31, 2017 to the date of this MD&A

is presented below:

|

|

|

Number

of Series I |

|

|

Number

of Series II |

|

|

Number

of |

|

| |

|

Preferred Shares(1 |

) |

|

Preferred Shares(2 |

) |

|

Common Shares |

|

| |

|

|

|

|

|

|

|

|

|

| Balance at December 31, 2017

|

|

52,325,827 |

|

|

4,368,403 |

|

|

13,147,404 |

|

| Issued to amend SIRPαFc license |

|

- |

|

|

- |

|

|

369,621 |

|

| Preferred share conversion |

|

(35,154,286 |

) |

|

- |

|

|

1,171,806 |

|

| Balance at December 31, 2018 |

|

17,171,541 |

|

|

4,368,403 |

|

|

14,688,831 |

|

| Public offering |

|

- |

|

|

12,200,000 |

|

|

6,550,000 |

|

| Balance at the date of this MD&A |

|

17,171,541 |

|

|

16,568,403 |

|

|

21,238,831 |

|

|

Notes: |

|

|

| |

(1) |

Convertible at a ratio of 30 Series I Preferred Shares

for one common share. |

| |

(2) |

Convertible at a ratio of one Series II Preferred Share

for one common share. |

Share capital issued – issued subsequent to the year

ended December 31, 2018

In February 2019, we completed an underwritten public offering

for gross proceeds of U.S. $15 million comprised of 6,550,000 common share units

and 12,200,000 Series II Non-Voting Convertible First Preferred Share units,

each issued at U.S. $0.80 per unit. Each common share unit is comprised of one

common share of the Company and one common share purchase warrant. Each common

share purchase warrant will be exercisable for one common share at a price of

U.S. $0.96 per common share purchase warrant for sixty months. Each preferred

share unit is comprised of one Series II First Preferred Share of the Company

and one Series II First Preferred Share purchase warrant. Each Series II First

Preferred Share purchase warrant will be exercisable for one Series II First

Preferred Share at a price of U.S. $0.96 per Series II First Preferred Share

purchase warrant for sixty months.

Share capital issued – for the year ended December 31,

2018

During the year ended December 31, 2018, 369,621 common shares

were issued on the renegotiation of the SIRPαFc license agreement, and 1,171,806

common shares were issued on the conversion of preferred shares.

- 17 -

| TRILLIUM THERAPEUTICS INC.

|

| Management’s

Discussion and Analysis |

Share capital issued – for the year ended December 31,

2017

In June 2017, we completed an underwritten public offering of

common shares and non-voting convertible preferred shares in the United States.

In the offering, we sold 2,949,674 common shares and 3,250,000 Series II

Non-Voting Convertible First Preferred Shares at a price of U.S. $5.00 per

share. The gross proceeds from this offering were $41,847 (U.S. $30,998) before

deducting offering expenses of $2,856.

In December 2017, the Company completed a non-brokered private

placement financing and sold 1,950,000 common shares and 400,000 Series II

Non-Voting Convertible Preferred Shares at a price of U.S. $8.50 per share

yielding gross proceeds of $25,338 (U.S. $19,975) before deducting offering

expenses of $1,784.

During the year ended December 31, 2017, 13,332 common shares

were issued on the exercise of 399,980 warrants for proceeds of $159; 900,364

Series I First Preferred Shares were converted into 30,012 common shares; and

359,202 Series II First Preferred Shares were converted into 359,202 common

shares.

Warrants

The continuity of the number of issued and outstanding warrants

for the years ended December 31, 2017 and 2018, and to the date of this MD&A

is presented below:

| |

|

Preferred |

|

|

Common

Share |

|

| |

|

Warrants |

|

|

Warrants |

|

| |

|

|

|

|

|

|

| Balance at December 31, 2017 |

|

1,190,476 |

(1) |

|

69,073,031 |

(2)

|

| Expired |

|

(1,190,476 |

) |

|

(69,073,031 |

) |

| Balance at December 31, 2018 |

|

- |

|

|

- |

|

| Issued in public

offering |

|

12,200,000 |

(3) |

|

6,550,000 |

(4) |

| Balance at the date of this MD&A |

|

12,200,000 |

|

|

6,550,000 |

|

|

Notes: |

|

|

| |

(1) |

These Preferred Warrants were exercisable at $8.40 per

warrant for one common share or one Series II Preferred Share. |

| |

(2) |

These warrants were exercisable at a ratio of 30 warrants

for one common share. |

| |

(3) |

Each preferred share warrant is exercisable for one

Series II First Preferred Share at an exercise price of U.S. $0.96 per

Series II First Preferred Share. |

| |

(4) |

Each common share warrant is exercisable for one common

share at an exercise price of U.S. $0.96 per common

share. |

Stock Options

The 2018 Stock Option Plan was approved by our shareholders at

the annual meeting held on June 1, 2018. Stock options granted are

equity-settled, have a vesting period of four years and have a maximum term of

ten years. The total number of common shares available for issuance under the

2018 Stock Option Plan is 3,894,501. As at December 31, 2018, we were entitled

to issue an additional 1,195,296 stock options under the 2018 Stock Option Plan.

- 18 -

| TRILLIUM THERAPEUTICS INC.

|

| Management’s

Discussion and Analysis |

The continuity of the number of issued and outstanding stock

options from December 31, 2017 to the date of this MD&A is presented below:

|

|

|

Number

of |

|

|

Weighted

Average |

|

| |

|

Options |

|

|

Exercise Price |

|

| |

|

|

|

|

|

|

| Balance at December 31, 2017

|

|

1,746,982 |

|

|

$12.87 |

|

| Granted |

|

1,082,600 |

|

|

4.95 |

|

| Forfeited |

|

(128,356 |

) |

|

12.98 |

|

| Expired |

|

(2,021 |

) |

|

14.08

|

|

| Balance at December 31, 2018

|

|

2,699,205 |

|

|

9.69 |

|

| Expired |

|

(116,309 |

) |

|

20.26

|

|

| Balance at the date of this MD&A |

|

2,582,896 |

|

|

9.21 |

|

Deferred Share Unit Plan

The board of directors approved a Cash-Settled DSU Plan on

November 9, 2016. For the years ended December 31, 2018 and 2017, there were

189,393 and 46,187 DSUs issued, respectively. The fair value of DSUs as at

December 31, 2018 and 2017 was $806 and $1,349, respectively. The number of DSUs

outstanding as at December 31, 2018 and 2017 were 334,982 and 145,589,

respectively.

Fully Diluted Share Capital

The number of issued and outstanding common shares, Series I

First Preferred Shares, Series II First Preferred Shares, and stock options on a

fully converted basis as at December 31, 2018 was as follows:

| |

|

Number of Common |

|

| |

|

Share Equivalents |

|

| |

|

|

|

| Common shares |

|

14,688,831 |

|

| Series I First Preferred Shares |

|

572,385 |

|

| Series II First Preferred Shares |

|

4,368,403 |

|

| Stock options |

|

2,699,205 |

|

| Total |

|

22,328,824 |

|

Trend Information

Historical patterns of expenditures cannot be taken as an

indication of future expenditures. The amount and timing of expenditures and

therefore liquidity and capital resources vary substantially from period to

period depending on the number of research and development programs being

undertaken at any one time, the stage of the development programs, the timing of

significant expenditures for manufacturing, toxicology and pharmacology studies

and clinical trials, and the availability of funding from investors and

prospective commercial partners.

- 19 -

| TRILLIUM THERAPEUTICS INC.

|

| Management’s

Discussion and Analysis |

Selected Annual Financial Information

|

2018

$ |

2017

$ |

2016

$ |

Revenue

|

-

|

-

|

-

|

| Net loss and comprehensive loss |

42,486 |

45,088 |

31,733 |

| Fully diluted net loss per common share |

3.06 |

4.61 |

4.06 |

Total long-term liabilities

|

502

|

1,306

|

2,588

|

| Total assets |

55,459 |

94,403 |

66,623 |

Net loss for the year ended December 31, 2017 was higher than

the net loss of 2016 due mainly to higher clinical development expenses with two

active TTI-621 phase I trials and manufacturing expenses for TTI-622, the

recognition of a deferred tax recovery in the year ended December 31, 2016

related to the acquisition of Fluorinov of $3,690, and a higher net foreign

currency loss of $2,715 in 2017. Total long term liabilities decreased from

December 31, 2016 to December 31, 2018 due mainly to the reduction in the

contingent consideration related to the Fluorinov acquisition. Total assets

increased in 2017 over 2016 due mainly to two financings completed in 2017, net

of cash used in operations. In 2018, total assets decreased due mainly to the

use of cash in operations for the year.

Selected Quarterly Financial Information

2018 |

Q4-2018

$ |

Q3-2018

$ |

Q2-2018

$ |

Q1-2018

$ |

| Revenue |

- |

- |

- |

- |

| Research and development expenses |

10,611 |

10,752 |

12,722 |

9,341 |

| General and administrative expenses |

206 |

1,100 |

1,247 |

1,029 |

| Net loss for the period |

8,553 |

13,052 |

12,316 |

8,565 |

| Basic and diluted net loss per share |

0.56 |

0.91 |

0.92 |

0.65 |

| Cash and cash equivalents and marketable

securities |

45,409 |

52,095 |

64,698 |

73,920 |

2017 |

Q4-2017

$ |

Q3-2017

$ |

Q2-2017

$ |

Q1-2017

$ |

| Revenue |

- |

- |

- |

- |

| Research and development expenses |

9,811 |

8,275 |

8,851 |

10,199 |

| General and administrative expenses |

1,254 |

969 |

684 |

954 |

| Net loss for the period |

10,658 |

11,337 |

11,642 |

11,451 |

| Basic and diluted net loss per share |

0.91 |

1.05 |

1.33 |

1.46 |

| Cash and cash equivalents and marketable

securities |

81,791 |

64,297 |

72,618 |

41,347 |

- 20 -

| TRILLIUM THERAPEUTICS INC.

|

| Management’s

Discussion and Analysis |

The net losses for the first and second quarters of 2017 were

higher due to higher personnel costs, SIRPαFc clinical trial costs, and

preclinical work on the bromodomain inhibitor and EGFR inhibitor programs. The

net loss for the third and fourth quarters of 2017 reflected continued focus on

the SIRPαFc development program, and lower small molecule expenses relative to

the first and second quarters of 2017. The decrease in net loss in the first

quarter of 2018 reflected a higher net foreign currency gain. The increase in

net loss in the second quarter of 2018 reflected higher clinical development

expenses and the license agreement amendment payment, partially offset by a net

foreign currency gain. The increase in net loss in the third quarter of 2018

reflected higher clinical development costs. The decrease in net loss in the

fourth quarter of 2018 was mainly due to a net foreign currency gain and change

in fair value of deferred share units.

Off-Balance Sheet Arrangements

We do not have any off-balance sheet arrangements that have, or

are reasonably likely to have, a current or future effect on our financial

condition, revenues or expenses, results of operations, liquidity, capital

expenditures or capital resources that are material to investors.

Implications of Being an Emerging Growth Company

We are an “emerging growth company” under the U.S. Jumpstart

Our Business Startups Act of 2012, or the JOBS Act, and will continue to qualify

as an “emerging growth company” until the earliest to occur of: (a) the last day

of the fiscal year during which we have total annual gross revenues of $1.07

billion (as such amount is indexed for inflation every 5 years by the SEC) or

more; (b) the last day of our fiscal year following the fifth anniversary of the

date of the first sale of our common shares pursuant to an effective

registration statement under the U.S. Securities Act of 1933 which is December

31, 2019; (c) the date on which we have, during the previous 3-year period,

issued more than $1.0 billion in non-convertible debt; or (d) the date on which

we are deemed to be a “large accelerated filer”, as defined in Rule 12b–2 of the

U.S. Securities Exchange Act of 1934, or the Exchange Act.

Generally, a company that registers any class of its securities

under Section 12 of the Exchange Act is required to include in the second and

all subsequent annual reports filed by it under the Exchange Act, a management

report on internal control over financial reporting and, subject to an exemption

available to companies that meet the definition of a “smaller reporting company”

in Rule 12b-2 under the Exchange Act, an auditor attestation report on

management’s assessment of the company’s internal control over financial

reporting. However, for so long as we continue to qualify as an emerging growth

company, we will be exempt from the requirement to include an auditor

attestation report in our annual reports filed under the Exchange Act, even if

we do not qualify as a “smaller reporting company”. In addition, Section

103(a)(3) of the Sarbanes-Oxley Act of 2002, or the Sarbanes-Oxley Act, has been

amended by the JOBS Act to provide that, among other things, auditors of an

emerging growth company are exempt from any rules of the Public Company

Accounting Oversight Board requiring mandatory audit firm rotation or a

supplement to the auditor’s report in which the auditor would be required to