0001616000DEF 14AFALSE00016160002023-01-012023-12-31iso4217:USDiso4217:USDxbrli:shares00016160002022-01-012022-12-3100016160002021-01-012021-12-3100016160002020-01-012020-12-310001616000xhr:DeductionForAmountsReportedUnderTheStockAwardsAndOptionAwardsColumnsInTheSummaryCompensationForApplicableFYMemberecd:PeoMember2020-01-012020-12-310001616000xhr:DeductionForAmountsReportedUnderTheStockAwardsAndOptionAwardsColumnsInTheSummaryCompensationForApplicableFYMemberecd:NonPeoNeoMember2020-01-012020-12-310001616000xhr:DeductionForAmountsReportedUnderTheStockAwardsAndOptionAwardsColumnsInTheSummaryCompensationForApplicableFYMemberecd:PeoMember2021-01-012021-12-310001616000xhr:DeductionForAmountsReportedUnderTheStockAwardsAndOptionAwardsColumnsInTheSummaryCompensationForApplicableFYMemberecd:NonPeoNeoMember2021-01-012021-12-310001616000xhr:DeductionForAmountsReportedUnderTheStockAwardsAndOptionAwardsColumnsInTheSummaryCompensationForApplicableFYMemberecd:PeoMember2022-01-012022-12-310001616000xhr:DeductionForAmountsReportedUnderTheStockAwardsAndOptionAwardsColumnsInTheSummaryCompensationForApplicableFYMemberecd:NonPeoNeoMember2022-01-012022-12-310001616000xhr:DeductionForAmountsReportedUnderTheStockAwardsAndOptionAwardsColumnsInTheSummaryCompensationForApplicableFYMemberecd:PeoMember2023-01-012023-12-310001616000xhr:DeductionForAmountsReportedUnderTheStockAwardsAndOptionAwardsColumnsInTheSummaryCompensationForApplicableFYMemberecd:NonPeoNeoMember2023-01-012023-12-310001616000xhr:IncreaseBasedOnASC718FairValueOfAwardsGrantedDuringApplicableFYThatRemainUnvestedAsOfApplicableFYEndDeterminedAsOfApplicableFYEndMemberecd:PeoMember2020-01-012020-12-310001616000ecd:NonPeoNeoMemberxhr:IncreaseBasedOnASC718FairValueOfAwardsGrantedDuringApplicableFYThatRemainUnvestedAsOfApplicableFYEndDeterminedAsOfApplicableFYEndMember2020-01-012020-12-310001616000xhr:IncreaseBasedOnASC718FairValueOfAwardsGrantedDuringApplicableFYThatRemainUnvestedAsOfApplicableFYEndDeterminedAsOfApplicableFYEndMemberecd:PeoMember2021-01-012021-12-310001616000ecd:NonPeoNeoMemberxhr:IncreaseBasedOnASC718FairValueOfAwardsGrantedDuringApplicableFYThatRemainUnvestedAsOfApplicableFYEndDeterminedAsOfApplicableFYEndMember2021-01-012021-12-310001616000xhr:IncreaseBasedOnASC718FairValueOfAwardsGrantedDuringApplicableFYThatRemainUnvestedAsOfApplicableFYEndDeterminedAsOfApplicableFYEndMemberecd:PeoMember2022-01-012022-12-310001616000ecd:NonPeoNeoMemberxhr:IncreaseBasedOnASC718FairValueOfAwardsGrantedDuringApplicableFYThatRemainUnvestedAsOfApplicableFYEndDeterminedAsOfApplicableFYEndMember2022-01-012022-12-310001616000xhr:IncreaseBasedOnASC718FairValueOfAwardsGrantedDuringApplicableFYThatRemainUnvestedAsOfApplicableFYEndDeterminedAsOfApplicableFYEndMemberecd:PeoMember2023-01-012023-12-310001616000ecd:NonPeoNeoMemberxhr:IncreaseBasedOnASC718FairValueOfAwardsGrantedDuringApplicableFYThatRemainUnvestedAsOfApplicableFYEndDeterminedAsOfApplicableFYEndMember2023-01-012023-12-310001616000xhr:IncreaseBasedOnASC718FairValueOfAwardsGrantedDuringApplicableFYThatVestedDuringApplicableFYDeterminedAsOfVestingDateMemberecd:PeoMember2020-01-012020-12-310001616000xhr:IncreaseBasedOnASC718FairValueOfAwardsGrantedDuringApplicableFYThatVestedDuringApplicableFYDeterminedAsOfVestingDateMemberecd:NonPeoNeoMember2020-01-012020-12-310001616000xhr:IncreaseBasedOnASC718FairValueOfAwardsGrantedDuringApplicableFYThatVestedDuringApplicableFYDeterminedAsOfVestingDateMemberecd:PeoMember2021-01-012021-12-310001616000xhr:IncreaseBasedOnASC718FairValueOfAwardsGrantedDuringApplicableFYThatVestedDuringApplicableFYDeterminedAsOfVestingDateMemberecd:NonPeoNeoMember2021-01-012021-12-310001616000xhr:IncreaseBasedOnASC718FairValueOfAwardsGrantedDuringApplicableFYThatVestedDuringApplicableFYDeterminedAsOfVestingDateMemberecd:PeoMember2022-01-012022-12-310001616000xhr:IncreaseBasedOnASC718FairValueOfAwardsGrantedDuringApplicableFYThatVestedDuringApplicableFYDeterminedAsOfVestingDateMemberecd:NonPeoNeoMember2022-01-012022-12-310001616000xhr:IncreaseBasedOnASC718FairValueOfAwardsGrantedDuringApplicableFYThatVestedDuringApplicableFYDeterminedAsOfVestingDateMemberecd:PeoMember2023-01-012023-12-310001616000xhr:IncreaseBasedOnASC718FairValueOfAwardsGrantedDuringApplicableFYThatVestedDuringApplicableFYDeterminedAsOfVestingDateMemberecd:NonPeoNeoMember2023-01-012023-12-310001616000xhr:IncreasedeductionForAwardsGrantedDuringPriorFYThatVestedDuringApplicableFYDeterminedBasedOnChangeInASC718FairValueFromPriorFYEndToVestingDateMemberecd:PeoMember2020-01-012020-12-310001616000ecd:NonPeoNeoMemberxhr:IncreasedeductionForAwardsGrantedDuringPriorFYThatVestedDuringApplicableFYDeterminedBasedOnChangeInASC718FairValueFromPriorFYEndToVestingDateMember2020-01-012020-12-310001616000xhr:IncreasedeductionForAwardsGrantedDuringPriorFYThatVestedDuringApplicableFYDeterminedBasedOnChangeInASC718FairValueFromPriorFYEndToVestingDateMemberecd:PeoMember2021-01-012021-12-310001616000ecd:NonPeoNeoMemberxhr:IncreasedeductionForAwardsGrantedDuringPriorFYThatVestedDuringApplicableFYDeterminedBasedOnChangeInASC718FairValueFromPriorFYEndToVestingDateMember2021-01-012021-12-310001616000xhr:IncreasedeductionForAwardsGrantedDuringPriorFYThatVestedDuringApplicableFYDeterminedBasedOnChangeInASC718FairValueFromPriorFYEndToVestingDateMemberecd:PeoMember2022-01-012022-12-310001616000ecd:NonPeoNeoMemberxhr:IncreasedeductionForAwardsGrantedDuringPriorFYThatVestedDuringApplicableFYDeterminedBasedOnChangeInASC718FairValueFromPriorFYEndToVestingDateMember2022-01-012022-12-310001616000xhr:IncreasedeductionForAwardsGrantedDuringPriorFYThatVestedDuringApplicableFYDeterminedBasedOnChangeInASC718FairValueFromPriorFYEndToVestingDateMemberecd:PeoMember2023-01-012023-12-310001616000ecd:NonPeoNeoMemberxhr:IncreasedeductionForAwardsGrantedDuringPriorFYThatVestedDuringApplicableFYDeterminedBasedOnChangeInASC718FairValueFromPriorFYEndToVestingDateMember2023-01-012023-12-310001616000xhr:IncreasedeductionAwardsGrantedDuringPriorFYThatWereOutstandingAndUnvestedAsOfApplicableFYEndDeterminedBasedOnChangeInASC718FairValueFromPriorFYEndToApplicableFYEndMemberecd:PeoMember2020-01-012020-12-310001616000ecd:NonPeoNeoMemberxhr:IncreasedeductionAwardsGrantedDuringPriorFYThatWereOutstandingAndUnvestedAsOfApplicableFYEndDeterminedBasedOnChangeInASC718FairValueFromPriorFYEndToApplicableFYEndMember2020-01-012020-12-310001616000xhr:IncreasedeductionAwardsGrantedDuringPriorFYThatWereOutstandingAndUnvestedAsOfApplicableFYEndDeterminedBasedOnChangeInASC718FairValueFromPriorFYEndToApplicableFYEndMemberecd:PeoMember2021-01-012021-12-310001616000ecd:NonPeoNeoMemberxhr:IncreasedeductionAwardsGrantedDuringPriorFYThatWereOutstandingAndUnvestedAsOfApplicableFYEndDeterminedBasedOnChangeInASC718FairValueFromPriorFYEndToApplicableFYEndMember2021-01-012021-12-310001616000xhr:IncreasedeductionAwardsGrantedDuringPriorFYThatWereOutstandingAndUnvestedAsOfApplicableFYEndDeterminedBasedOnChangeInASC718FairValueFromPriorFYEndToApplicableFYEndMemberecd:PeoMember2022-01-012022-12-310001616000ecd:NonPeoNeoMemberxhr:IncreasedeductionAwardsGrantedDuringPriorFYThatWereOutstandingAndUnvestedAsOfApplicableFYEndDeterminedBasedOnChangeInASC718FairValueFromPriorFYEndToApplicableFYEndMember2022-01-012022-12-310001616000xhr:IncreasedeductionAwardsGrantedDuringPriorFYThatWereOutstandingAndUnvestedAsOfApplicableFYEndDeterminedBasedOnChangeInASC718FairValueFromPriorFYEndToApplicableFYEndMemberecd:PeoMember2023-01-012023-12-310001616000ecd:NonPeoNeoMemberxhr:IncreasedeductionAwardsGrantedDuringPriorFYThatWereOutstandingAndUnvestedAsOfApplicableFYEndDeterminedBasedOnChangeInASC718FairValueFromPriorFYEndToApplicableFYEndMember2023-01-012023-12-310001616000xhr:IncreaseBasedOnDividendsOrOtherEarningsPaidDuringApplicableFYPriorToVestingDateMemberecd:PeoMember2020-01-012020-12-310001616000xhr:IncreaseBasedOnDividendsOrOtherEarningsPaidDuringApplicableFYPriorToVestingDateMemberecd:NonPeoNeoMember2020-01-012020-12-310001616000xhr:IncreaseBasedOnDividendsOrOtherEarningsPaidDuringApplicableFYPriorToVestingDateMemberecd:PeoMember2021-01-012021-12-310001616000xhr:IncreaseBasedOnDividendsOrOtherEarningsPaidDuringApplicableFYPriorToVestingDateMemberecd:NonPeoNeoMember2021-01-012021-12-310001616000xhr:IncreaseBasedOnDividendsOrOtherEarningsPaidDuringApplicableFYPriorToVestingDateMemberecd:PeoMember2022-01-012022-12-310001616000xhr:IncreaseBasedOnDividendsOrOtherEarningsPaidDuringApplicableFYPriorToVestingDateMemberecd:NonPeoNeoMember2022-01-012022-12-310001616000xhr:IncreaseBasedOnDividendsOrOtherEarningsPaidDuringApplicableFYPriorToVestingDateMemberecd:PeoMember2023-01-012023-12-310001616000xhr:IncreaseBasedOnDividendsOrOtherEarningsPaidDuringApplicableFYPriorToVestingDateMemberecd:NonPeoNeoMember2023-01-012023-12-31000161600032023-01-012023-12-31000161600012023-01-012023-12-31000161600022023-01-012023-12-31000161600042023-01-012023-12-31000161600052023-01-012023-12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. ) | | | | | | | | |

Filed by the Registrant x | | Filed by a Party other than the Registrant ¨ |

Check the appropriate box: | | |

¨ | Preliminary Proxy Statement |

¨ | Confidential, For Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

x | Definitive Proxy Statement |

¨ | Definitive Additional Materials |

¨ | Soliciting Material Pursuant to §240.14a-12 |

Xenia Hotels & Resorts, Inc.

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

| | | | | | | | | | | |

Payment of Filing Fee (Check the appropriate box): | |

x | No fee required. | |

| | |

¨ | Fee paid previously with preliminary materials | |

| | | |

¨ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i) (1) and 0-11 | |

| | | |

April 1, 2024

Dear Stockholder:

You are cordially invited to attend the 2024 Annual Meeting of Stockholders (the “Annual Meeting”) of Xenia Hotels & Resorts, Inc. (“Xenia”) to be held at Hyatt Regency Grand Cypress Resort, One Grand Cypress Blvd, Orlando, Florida 32836, on Tuesday, May 14, 2024, at 8:00 a.m., local time.

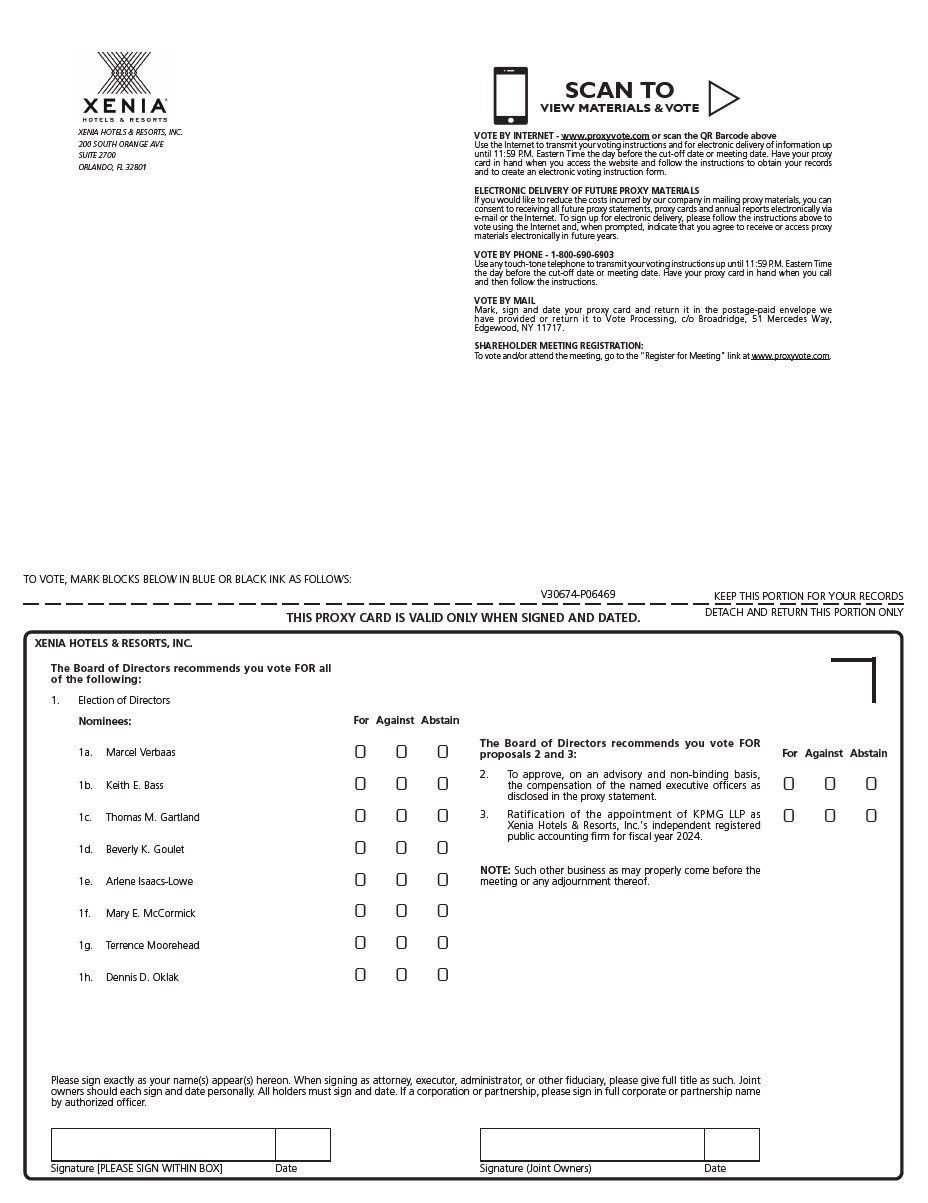

At the Annual Meeting you will be asked to (a) elect eight directors to our Board of Directors, (b) approve, on an advisory and non-binding basis, the compensation of our named executive officers as described in our proxy materials (“say-on-pay”), (c) ratify the appointment of KPMG LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2024 and (d) transact any other business as properly may come before the Annual Meeting or any postponement or adjournment thereof.

It is important that your shares be represented and voted whether or not you plan to attend the Annual Meeting in person. You may submit your proxy or voting instructions via the internet or by telephone, which will ensure your shares are represented at the Annual Meeting. If you received your proxy materials by mail, you may submit your proxy or voting instructions on the internet or by telephone, or you may submit your proxy by completing and mailing the enclosed proxy card/voting instruction form. If you do attend the Annual Meeting, you may revoke your proxy should you wish to vote in person.

Important Note: If you plan to attend the Annual Meeting, you must obtain an admission ticket by registering no later than Friday, May 10, 2024. To register, follow the instructions provided in "Article IX: Attending the Annual Meeting" of the proxy statement. You must bring your admission ticket and a valid, government-issued photo identification in order to gain access to the Annual Meeting.

We thank you for your continued support and look forward to seeing you at the Annual Meeting. | | |

| Sincerely, |

|

Marcel Verbaas Chair and Chief Executive Officer |

XENIA HOTELS & RESORTS, INC.

200 S. Orange Avenue, Suite 2700

Orlando, Florida 32801

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Be Held on May 14, 2024

NOTICE IS HEREBY GIVEN that the 2024 Annual Meeting of Stockholders (the “Annual Meeting”) of Xenia Hotels & Resorts, Inc., a Maryland corporation (“Xenia”), will be held at Hyatt Regency Grand Cypress Resort, One Grand Cypress Blvd, Orlando, Florida 32836, on Tuesday, May 14, 2024, at 8:00 a.m., local time, for the following purposes:

1.To consider and vote upon the election of eight directors who will each hold office until the 2025 annual meeting of stockholders and until his or her successor is duly elected and qualifies;

2.To consider and vote, on an advisory and non-binding basis, upon a resolution approving the compensation of Xenia's named executive officers as described in our proxy materials (“say-on-pay”);

3.To consider and vote upon the ratification of the appointment of KPMG LLP as Xenia’s independent registered public accounting firm for the fiscal year ending December 31, 2024; and

4.To transact any other business as properly may come before the Annual Meeting or any postponement or adjournment thereof.

Stockholders of record at the close of business on March 21, 2024 are entitled to receive notice of and to vote at the Annual Meeting and any postponement or adjournment thereof.

In seeking to conserve natural resources and reduce costs, we are primarily furnishing proxy materials to our stockholders electronically as permitted by the U.S. Securities and Exchange Commission. Unless an election has been affirmatively made to receive printed paper copies of the materials by mail, stockholders will receive a Notice of Internet Availability of Proxy Materials with instructions for accessing the proxy materials free of charge over the internet.

| | | | | |

| By Order of the Board of Directors |

| |

| Taylor C. Kessel Corporate Secretary |

Orlando, Florida

April 1, 2024

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE STOCKHOLDER MEETING TO BE HELD ON MAY 14, 2024:

The proxy statement for the Annual Meeting and the Annual Report

for the fiscal year ended December 31, 2023 are available free of charge at www.proxyvote.com.

The Board of Directors urges you to authorize proxies to vote your shares by telephone or via the internet prior to the Annual Meeting or to obtain an admission ticket and vote in person at the Annual Meeting. If you received your proxy materials by mail, you may submit your proxy or voting instructions on the internet or by telephone, or you may submit your proxy by completing and mailing the enclosed proxy card/voting instruction form.

| | | | | |

TABLE OF CONTENTS |

PROXY SUMMARY | |

PROXY STATEMENT | |

ARTICLE I: PROXY MATERIALS AND ANNUAL MEETING | |

QUESTIONS AND ANSWERS ABOUT THE PROXY MATERIALS AND THE ANNUAL MEETING | |

ARTICLE II: CORPORATE GOVERNANCE | |

PROPOSAL 1 - ELECTION OF DIRECTORS | |

OUR BOARD OF DIRECTORS | |

Directors Standing for Re-Election | |

Family Relationships | |

Corporate Governance Profile and Board Leadership Structure | |

Director Retirement Policy | |

Stockholder Engagement and Investor Outreach Program | |

Corporate Governance Developments | |

Stock Ownership Guidelines | |

Anti-Hedging and Anti-Pledging Policies | |

Clawback Policy | |

Corporate Responsibility | |

Corporate Citizenship, Community Impact and Diversity and Inclusion | |

| Board Refreshment | |

Director Onboarding and Continuing Education | |

Succession Planning | |

Role of our Board of Directors in Risk Oversight | |

Board Committees | |

Director Independence | |

Corporate Governance Guidelines | |

Code of Ethics and Business Conduct | |

Stockholder Communications with our Board of Directors | |

Compensation Committee Interlocks and Insider Participation | |

Compensation of Directors | |

ARTICLE III: EXECUTIVE OFFICERS | |

ARTICLE IV: EXECUTIVE COMPENSATION | |

COMPENSATION DISCUSSION AND ANALYSIS | |

Executive Summary | |

Overview of Executive Compensation Program | |

Determination of Compensation | |

Elements of Executive Compensation Program | |

Accounting Considerations | |

| COMPENSATION COMMITTEE REPORT | |

Summary Compensation Table | |

Grants of Plan-Based Awards | |

Narrative Disclosure to Compensation Tables | |

Outstanding Equity Awards as of December 31, 2023 | |

Option Exercises and Stock Vested for the Year Ended December 31, 2023 | |

Potential Payments Upon Termination or Change in Control | |

PAY VERSUS PERFORMANCE | |

CEO PAY RATIO | |

| COMPENSATION RISK ASSESSMENT | |

PROPOSAL 2 – NON-BINDING ADVISORY VOTE TO APPROVE NAMED EXECUTIVE OFFICER COMPENSATION (“SAY-ON-PAY”) | |

| | | | | |

ARTICLE V: INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM | |

PROPOSAL 3 - RATIFICATION OF APPOINTMENT OF THE INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM | |

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM’S FEES | |

ARTICLE VI: REPORT OF THE AUDIT COMMITTEE OF THE BOARD OF DIRECTORS | |

ARTICLE VII: STOCK | |

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT | |

ARTICLE VIII: CERTAIN RELATIONSHIPS AND RELATED PARTY TRANSACTIONS | |

STATEMENT OF POLICY REGARDING TRANSACTIONS WITH RELATED PERSONS | |

ARTICLE IX: ATTENDING THE ANNUAL MEETING | |

ARTICLE X: MISCELLANEOUS | |

AVAILABILITY OF ANNUAL REPORT ON FORM 10-K | |

HOUSEHOLDING | |

FORWARD-LOOKING STATEMENTS | |

OTHER MATTERS THAT MAY COME BEFORE THE ANNUAL MEETING | |

PROXY SUMMARY

This summary highlights some of the topics discussed in this proxy statement. It does not cover all of the information you should consider before voting, and you are encouraged to read the entire proxy statement before casting your vote.

GENERAL INFORMATION

| | | | | | | | | | | | | | |

| Meeting: | Annual Meeting of Stockholders | | Stock Symbol: | XHR |

| Date: | Tuesday, May 14, 2024 | | Exchange: | New York Stock Exchange |

| Time: | 8:00 a.m. | | Common Stock Outstanding: | 101,963,677 |

| Location: | Hyatt Regency Grand Cypress Resort | | State of Incorporation: | Maryland |

| One Grand Cypress Blvd | | Exchange Listed Public Company Since: | 2015 |

| Orlando, Florida 32836 | | Corporate Website: | www.xeniareit.com |

| Record Date: | March 21, 2024 | | Investor Relations Website: | investors.xeniareit.com |

The information found on, or otherwise accessible through, including other documents mentioned in this proxy and included on our website (but not otherwise filed with the SEC), our website is not incorporated by reference into, nor does it form a part of, this proxy statement.

VOTING ITEMS AND BOARD RECOMMENDATIONS

| | | | | | | | | | | | | | | | | | | | |

| Proposal | | Proposal Summary | | Board Recommendation | | Page |

| Proposal 1 | | Election of Directors | | FOR each Director Nominee | | |

| Proposal 2 | | Non-binding advisory vote to approve named executive officer compensation (“say-on-pay”) | | FOR | | |

| Proposal 3 | | Ratification of the appointment of KPMG LLP as our independent registered public accounting firm for 2024 | | FOR | | |

Beginning on or about April 1, 2024, we mailed a Notice of Internet Availability of Proxy Materials to our stockholders, which contained instructions on how to access and review proxy materials. On or about April 1, 2024, we also began mailing a full set of proxy materials to certain stockholders, including those who previously requested a paper copy of the proxy materials.

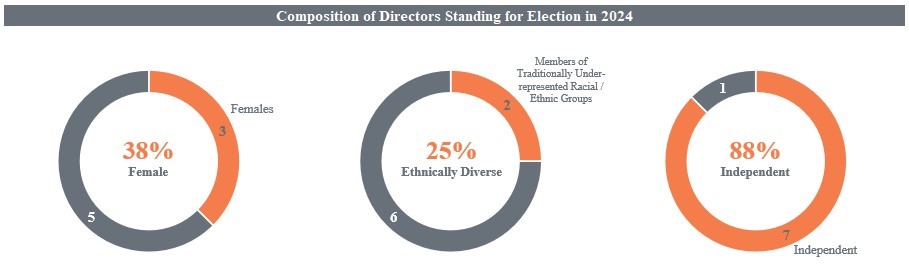

Our Directors

We believe our Board membership is both balanced and diverse in experience, professional background, areas of expertise and perspectives (shown below). For more information about our Board, please see “Article II: Corporate Governance - Our Board of Directors.” | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | Committee Membership*** |

| Name | | Age | | Years on Board | | Independent | | Audit | | Compensation | | Nominating and Corporate Governance | | Executive |

| Marcel Verbaas * | | 54 | | 9 | | | | | | | | | | C |

| Dennis D. Oklak** | | 70 | | 9 | | ü | | | | | | M | | M |

| Keith E. Bass | | 59 | | 9 | | ü | | | | M | | | | |

| | | | | | | | | | | | | | |

| Thomas M. Gartland | | 66 | | 9 | | ü | | | | C | | | | M |

| Beverly K. Goulet | | 69 | | 9 | | ü | | C | | | | | | M |

| Arlene Isaacs-Lowe | | 64 | | 2 | | ü | | M | | | | M | | |

| Mary E. McCormick | | 66 | | 9 | | ü | | M | | | | C | | M |

| Terrence Moorehead | | 61 | | 3 | | ü | | M | | M | | | | |

* = Chair of the Board

** = Lead Director

*** = Committee membership as of the date of this proxy statement

C = Committee Chair

M = Committee Member

We believe our Board has diversity of experience, qualifications, attributes and skills, as reflected in the summary below. For more information about the qualifications and experience of each of our directors standing for election at the 2024 Annual Meeting, please see “Article II: Corporate Governance — Directors Standing for Re-Election."

Board of Directors Experience

Our Board brings extensive experience and a diverse skill set to the Company, including the following:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Keith E. Bass | Thomas M. Gartland | Beverly K. Goulet | Arlene Isaacs-Lowe | Mary E. McCormick | Terrence Moorehead | Dennis D. Oklak | Marcel Verbaas |

Knowledge, Skills

and Experience | | | | | | | | |

| Public Company Board Experience | ü | ü | ü | ü | ü | ü | ü | ü |

Financial/Capital Allocation/

Corporate Finance | ü | ü | ü | ü | ü | ü | ü | ü |

| Risk Management Experience | ü | ü | ü | ü | ü | | ü | ü |

| Accounting Experience | | | ü | ü | | ü | ü | ü |

| Corporate Governance/Ethics | ü | ü | ü | | ü | | ü | ü |

Legal/Regulatory/

Public Policy Experience | ü | | ü | | | | | ü |

| HR/Compensation Experience | ü | ü | ü | | | ü | ü | ü |

| Real Estate and/or REIT Experience | ü | | | ü | ü | | ü | ü |

| Executive Leadership Experience | ü | ü | ü | ü | | ü | ü | ü |

| Operational Experience | ü | ü | ü | ü | | ü | ü | ü |

| Travel and Lodging Experience | | ü | ü | | | | | ü |

| Strategic Planning/Oversight | ü | ü | ü | ü | ü | ü | ü | ü |

| Mergers and Acquisitions | ü | ü | ü | | | ü | ü | ü |

| Academia/Education | | | | | ü | | | |

| Capital Markets | ü | | ü | ü | ü | | ü | ü |

Shareholder Advocacy/

Engagement Experience | ü | ü | | | | ü | ü | ü |

| | | | | | | | |

| Consumer Products | | | | | | ü | | |

| Marketing/Sales/Business Development Experience | | ü | | ü | | ü | | |

| | | | | | | | |

Environmental Sustainability

and Climate Risk | | | | ü | | ü | | ü |

| | | | | | | | |

| Demographics | | | | | | | | |

African American

or Black | | | | ü | | ü | | |

| White/Caucasian | ü | ü | ü | | ü | | ü | ü |

| | | | | | | | |

| Gender | | | | | | | | |

| Male | ü | ü | | | | ü | ü | ü |

| Female | | | ü | ü | ü | | | |

As a corporate governance best practice, our Nominating and Corporate Governance Committee annually considers the composition of our Board and standing Board committees to ensure an appropriate balance and a diversity of perspectives, which includes skill sets, background, gender, race, ethnicity and experience. See “Article II: Corporate Governance — Board Committees” for additional details.

Governance Highlights

Strong Corporate Governance Practices

We are committed to maintaining strong corporate governance practices. Since our listing in 2015, we have implemented corporate governance best practices and improvements as highlighted below and we continue to seek feedback from all stakeholders as we evolve our governance profile.

| | | | | | | | | | | | | | |

| ü | Adopted proxy access | | ü | Stockholders have the right to amend the Company's bylaws |

| | | | |

| ü | Majority voting standard for director elections | | ü | Common stock is the only class of voting security outstanding |

| | | | |

| ü | All of our directors stand for election each year | | ü | Anti-hedging and anti-pledging policies |

| | | | |

| ü | 7 of 8 directors standing for re-election are independent | | ü | Executive and director stock ownership guidelines |

| | | | |

| ü | Executive sessions of independent directors held at each regularly scheduled board meeting and chaired by the Lead Director | | ü | Opted out of all provisions of the Maryland Unsolicited Takeover Act (“MUTA”) |

| | | | |

| ü | All Audit Committee members are financial experts | | ü | Robust succession planning for senior management |

| | | | |

| ü | Annual Board and committee self-evaluations | | ü | Clawback policy in compliance with SEC rules and NYSE listing standards |

| | | | |

| ü | Oversight of risk by the Board and select committees | | ü | No poison pill |

| | | | |

| ü | The Audit, Compensation and Nominating and Corporate Governance committees include only independent directors | | ü | We publish an annual Corporate Responsibility Report available on our website at www.xeniareit.com/corporate-responsibility |

Strategy and Our Board

We believe it is important to the success of our Company that our Board review the Company’s strategic framework and direction. Our Board regularly meets with members of the senior management team to consider our current and future strategies to meet our corporate objectives designed to maximize long-term stockholder value. In 2023, our Board met seven times and discussed both short- and long-term strategies.

Investor Outreach

We regularly engage with our investors on a variety of matters, which we believe is a strong corporate governance practice. In 2023 and early 2024, we reached out to, met with or engaged with institutional investors holding over 65% of our common stock as of December 31, 2023, and we continue to engage with additional stockholders on an ongoing basis.

Corporate Responsibility

We are committed to supporting the communities in which our properties are located. We also enable our employees to support the communities in which they live through our charitable organization spotlight program. We encourage our employees to give back to their communities in various ways, including regular team building events that benefit charities and through serving on charitable organization boards. Each year we invite several charitable organizations to visit our Company headquarters in order to share their purpose and needs with our employees. This program highlights altruistic opportunities in which our employees can and do participate. In 2019, we published our first Corporate Responsibility Report and in early 2020 we adopted and published our Enterprise Environmental Policy, Human Rights and Labor Rights Policy, and Supplier/Vendor Code of Conduct. In 2021, we published two updated Corporate Responsibility Reports disclosing key environmental sustainability metrics and other notable items, including our first Task Force on Climate-Related Financial Disclosures (“TCFD”) report to more specifically address climate-related risks to our business. In 2022, we set and published our intensity metric reduction targets for achievement by 2030. Our 2023 Corporate Responsibility Report which contains our interim progress towards our intensity metric reduction goals can be found on our website at www.xeniareit.com/corporate-responsibility. Neither our 2023 Corporate Responsibility Report nor our TCFD report is incorporated into this proxy statement, nor does either form a part of this proxy statement.

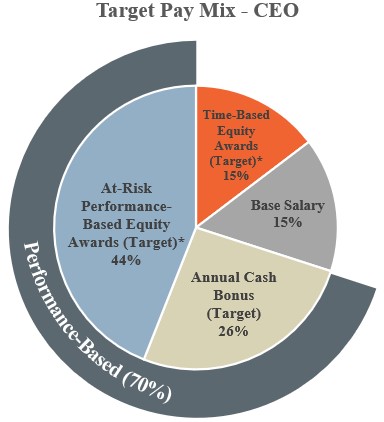

Compensation Highlights

Our executive compensation program is designed to attract, retain and motivate experienced and talented executives who can help the Company to maximize stockholder value. We believe that we maintain a competitive compensation program that incorporates strong governance practices.

The Company’s compensation guiding principles are as follows:

ü We pay for performance. We utilize multiple performance measures across various performance periods. In order to earn any of the outstanding performance-based equity awards that are measured by absolute total stockholder return ("TSR"), we must achieve at least a six percent annualized total stockholder return.

ü We balance short-term and long-term incentives. Annual cash bonuses and long-term equity awards comprise a significant portion of our named executive officers' ("NEOs") overall target compensation.

ü We align our NEOs' compensation with stockholders' interests. Our NEOs' compensation aligns with stockholders' interests, which means the granting of performance-based equity awards that are tied to total stockholder return on both a relative and absolute basis.

ü We maintain a clawback policy. Our clawback policy allows for the recovery of amounts inappropriately paid in the event of a restatement of our financial statements.

ü Payments pursuant to our NEOs' severance agreements are subject to a "double trigger." Any change in control cash payments pursuant to severance agreements with our NEO's are subject to a "double trigger."

ü We do not have tax gross-ups. We do not provide tax gross-ups on any severance, change-in-control or other payments.

As a result of our rigorous pay for performance program, the Company received a say-on-pay approval rate of over 97% for the 2022 compensation program, consistent with an average say-on-pay approval rate of 96% for all other years, excluding the 2020 program.

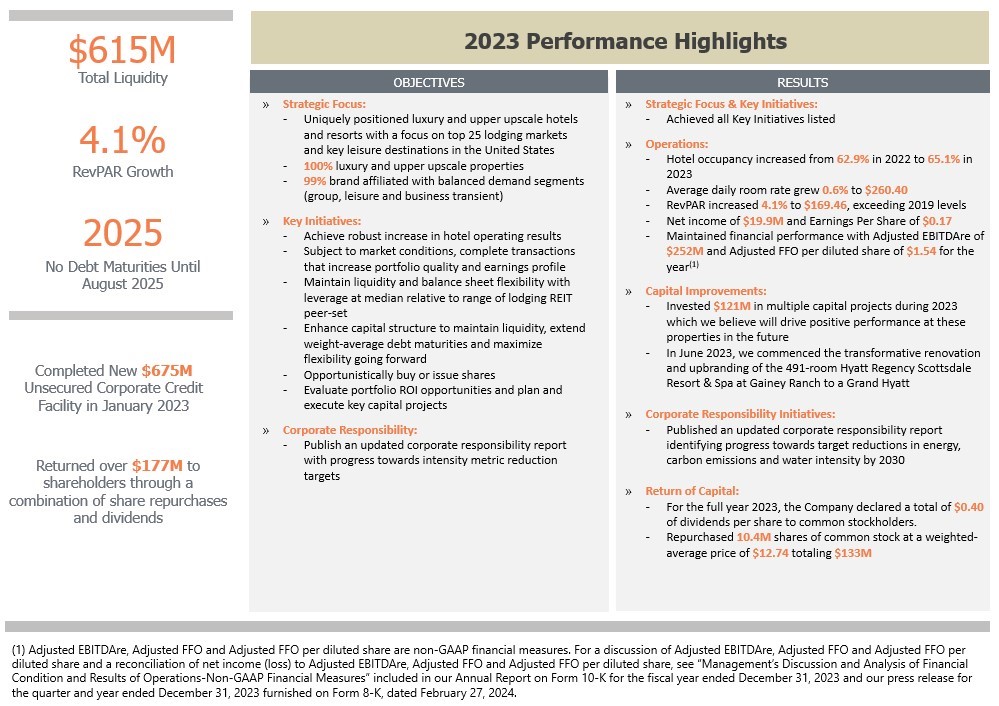

2023 Performance Highlights

In 2023, the Company continued to place a significant focus on maximizing hotel revenue growth and controlling expenses while also returning value to shareholders through share repurchases and dividends and investing in portfolio improvements. During 2023, our hotel occupancy increased to 65.1% from 62.9% in 2022 and our average daily rate ("ADR") increased 0.6% to $260.40. The combined growth in occupancy and ADR resulted in an increase in revenue per available room ("RevPAR") of 4.1% to $169.46 during 2023. Hotel operating income decreased 1.1% from $325.3 million in 2022 to $321.7 million in 2023 due in part to higher labor and benefits costs at our hotels.

We also continued to focus on maximizing liquidity and balance sheet flexibility to remain in a position to capitalize on future opportunities. In January 2023, we entered into a new $675 million senior unsecured credit facility and amended an existing mortgage loan. Proceeds from these loans were used to repay an existing $125 million corporate credit facility term loan and a $95 million mortgage loan. As a result of these actions, the Company does not have any debt maturities until August 2025. Further, we balanced capital allocation priorities by returning over $177 million to shareholders through a combination of share repurchases and dividends.

As of December 31, 2023, we had $164.7 million in cash and full availability on our $450 million revolving credit facility resulting in total liquidity of approximately $615 million. Additionally, we held $58.4 million of restricted cash and escrows primarily set aside to maintain our hotels.

During the year, we invested $120.9 million in portfolio improvements, completing several important capital projects, including comprehensive renovations at Kimpton Canary Hotel Santa Barbara, Kimpton Hotel Monaco Salt Lake City and Grand Bohemian Hotel Orlando and made substantial progress on our largest and most impactful renovation project, the transformative renovation and upbranding of Hyatt Regency Scottsdale.

XENIA HOTELS & RESORTS, INC.

200 S. Orange Avenue, Suite 2700

PROXY STATEMENT

FOR THE ANNUAL MEETING OF STOCKHOLDERS

To Be Held on May 14, 2024 The board of directors (the “Board of Directors” or the “Board”) of Xenia Hotels & Resorts, Inc., a Maryland corporation (referred to herein as “Xenia,” “we,” “us” or the “Company”), solicits your proxy to vote at the 2024 Annual Meeting of Stockholders (the “Annual Meeting”) to be held on Tuesday, May 14, 2024, beginning at 8:00 a.m., local time, at Hyatt Regency Grand Cypress Resort, One Grand Cypress Blvd, Orlando, Florida 32836, and at any adjournments or postponements thereof.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS

Pursuant to the rules and regulations of the U.S. Securities and Exchange Commission (the “SEC”), we are primarily furnishing proxy materials to our stockholders via the internet, rather than mailing paper copies of the materials. Internet distribution of the proxy materials is designed to expedite receipt by stockholders, lower costs and reduce the environmental impact of the Annual Meeting.

This proxy statement for the Annual Meeting and the Annual Report

for the fiscal year ended December 31, 2023 are available free of charge at www.proxyvote.com.

Beginning on or about April 1, 2024, we mailed a Notice of Internet Availability of Proxy Materials (the “Notice”) to our stockholders as of the close of business on March 21, 2024, which contained instructions on how to access and review proxy materials, including our proxy statement and our Annual Report for the fiscal year ended December 31, 2023, and how to submit proxies or voting instructions via the internet. On or about April 1, 2024, we also began mailing a full set of proxy materials to certain stockholders, including those who previously requested a paper copy of the proxy materials.

ARTICLE I: PROXY MATERIALS AND ANNUAL MEETING

QUESTIONS AND ANSWERS ABOUT THE PROXY MATERIALS AND THE ANNUAL MEETING

1. Q: Why did I receive a notice in the mail regarding the internet availability of the proxy materials?

A: The Board of Directors is delivering or providing access to proxy materials to its stockholders in connection with its solicitation of proxies to vote at the Annual Meeting and at any postponement or adjournment thereof. The SEC has adopted rules permitting the electronic delivery of proxy materials. In accordance with those rules, we have elected to provide access to our proxy materials, which include this proxy statement and our Annual Report for the fiscal year ended December 31, 2023 at www.proxyvote.com. We sent the Notice to our stockholders as of the close of business on March 21, 2024, the record date, directing them to a website where they can access the proxy materials and view instructions on how to authorize proxies to vote their shares over the internet or by telephone. Stockholders who previously indicated a preference for paper copies of our proxy materials received paper copies. If you received a Notice but would like to request paper copies of our proxy materials going forward, you may still do so by following the instructions described in the Notice.

Choosing to receive your proxy materials over the internet will help conserve natural resources and reduce the costs associated with the printing and mailing of the proxy materials to you. Unless you affirmatively elect to receive paper copies of our proxy materials in the future by following the instructions included in the Notice, you will continue to receive a Notice directing you to a website for electronic access to our proxy materials.

2. Q: When and where is the Annual Meeting?

A: The Annual Meeting will be held at Hyatt Regency Grand Cypress Resort, One Grand Cypress Blvd, Orlando, Florida 32836 on Tuesday, May 14, 2024 at 8:00 a.m., local time.

3. Q: What is the purpose of the Annual Meeting?

A: At our Annual Meeting, stockholders will consider and vote upon the matters outlined in this proxy statement and in the Notice of Annual Meeting of Stockholders included with this proxy statement: the election of directors, the approval of a non-binding advisory resolution on the compensation of our named executive officers (“say-on-pay”), the ratification of KPMG LLP as our independent registered public accounting firm and the transaction of any other business as properly may come before the Annual Meeting or any postponement or adjournment thereof.

4. Q: How can I attend the Annual Meeting?

A: Only stockholders of record and beneficial owners of Xenia common stock as of the close of business on March 21, 2024, the record date, or their duly authorized proxies, will be entitled to attend the Annual Meeting. To gain admittance, stockholders (or their proxies) must first obtain an admission ticket by registering no later than Friday, May 10, 2024. To register, follow the instructions provided in "Article X: Attending the Annual Meeting" of this proxy statement. You must bring your admission ticket and a valid, government-issued photo identification (such as a valid driver’s license or passport) in order to gain access to the Annual Meeting. If you are a beneficial owner of Xenia common stock (as described in Question 6 below), you will need to obtain a legal proxy from your broker or other nominee in order to vote at the Annual Meeting (as described in Question 7 below).

For directions to the meeting location, please contact us at 407-246-8100.

Stockholders may be required to enter through a security check point before being granted access to the meeting. No cameras, recording devices, other electronic devices or large packages will be permitted at the Annual Meeting. Photographs and videos taken at the Annual Meeting by or at the request of Xenia may be used by Xenia, and by attending the Annual Meeting, you waive any claim or rights with respect to those photographs and their use.

5. Q: What should I do if I receive more than one Notice or set of proxy materials?

A: You may receive more than one Notice or set of proxy materials. For example, if you hold your shares in more than one brokerage account, or if you are a stockholder of record and your shares are registered in more than one name, you will receive more than one Notice or set of proxy materials. Please be sure to submit your proxy or voting instructions for each account in which you hold shares.

6. Q: What is the difference between holding shares as a record holder versus a beneficial owner?

A: Many Xenia stockholders hold their shares through a broker or other nominee rather than directly in their own name. There are some distinctions between shares held of record and those owned beneficially:

Record Holders: If your shares are registered directly in your name with our transfer agent, Computershare, Inc., you are considered, with respect to those shares, the stockholder of record or record holder. As the stockholder of record as of the record date, you have the right to authorize a proxy to vote your shares or to vote in person at the Annual Meeting.

Beneficial Owners: If your shares are held in a brokerage account or by another nominee, you are considered the beneficial owner of shares held in street name, and the Notice (or in some cases as described above, a full set of proxy materials) is being forwarded to you automatically, along with instructions from your broker, bank or other nominee. As a beneficial owner, you have the right to direct your broker, bank or other nominee how to vote and are also invited to attend the Annual Meeting. Since a beneficial owner is not the stockholder of record, you may not vote these shares in person at the meeting unless you obtain a legal proxy from the broker, bank or other nominee that holds your shares, giving you the right to vote the shares at the meeting. Your broker, bank or other nominee has provided voting instructions for you to use in directing how to vote your shares. If you do not provide specific voting instructions by the deadline set forth in the materials you receive from your broker, bank or other nominee, your broker, bank or other nominee can vote your shares with respect to discretionary items but not with respect to non-discretionary items. See Question 10 below for more information about broker non-votes.

7. Q: Who can vote and how do I vote?

A: Only stockholders as of the close of business on March 21, 2024, the record date, will be entitled to notice of and to vote at the Annual Meeting. To ensure that your vote is recorded promptly, please authorize a proxy to vote your shares as soon as possible, even if you plan to attend the Annual Meeting in person.

If you are a record holder, you may submit your proxy via the internet or by telephone, which will ensure your shares are represented at the Annual Meeting. If you received your proxy materials by mail, you may submit your proxy on the internet or by telephone, or you may submit your proxy by completing and mailing the enclosed proxy card/voting instruction form. If you attend the Annual Meeting, you may revoke your proxy by voting in person, and any previous votes that you submitted will be superseded by the vote that you cast at the Annual Meeting. Your attendance at the Annual Meeting is not sufficient in and of itself to revoke your proxy.

Beneficial owners may submit voting instructions by telephone or internet if their bank, broker or other nominee makes those methods available, in which case the bank, broker or other nominee will provide instructions for doing so. Beneficial owners who wish to vote at the Annual Meeting must first obtain a legal proxy from their broker, bank or other nominee, giving the beneficial owner the right to vote the shares at the meeting and present such legal proxy at the Annual Meeting.

To attend and vote at the Annual Meeting, all stockholders must also register by Friday, May 10, 2024, as described in "Article X: Attending the Annual Meeting" of this proxy statement.

For further instructions on voting, see the Notice or proxy card. If you authorize a proxy or submit voting instructions by telephone, via the internet or by returning your proxy card/voting instructions, the shares represented by the proxy will be voted in accordance with your instructions.

8. Q: What are my voting choices and how many votes are required for approval or election?

A: In the vote on the election of director nominees identified in this proxy statement to serve until the 2025 annual meeting of stockholders and until their respective successors have been duly elected and qualify, stockholders may (1) vote for specific nominees; (2) vote against specific nominees; or (3) abstain from voting for any specific nominees. Under our bylaws, to be elected in an uncontested election, director nominees must receive the affirmative vote of a majority of the votes cast, which means that the number of shares voted for a nominee must exceed the number of shares voted against that nominee. Shares of common stock not voted (whether by abstention, broker non-vote or otherwise) will not be counted as a vote cast for or against a nominee’s election and will have no effect on the result of the vote. If an incumbent director were to fail to be re-elected by a majority of votes cast, that director would be required under our Corporate Governance Guidelines to offer to tender his or her resignation to the Board. The Nominating and Corporate Governance Committee will make a recommendation to the Board on whether to accept or reject the resignation, or whether other action is recommended. The Board is required to act on

the offer to resign within 90 days after the election results are certified and promptly and publicly disclose its decision and rationale. The Board of Directors unanimously recommends a vote FOR each of the nominees.

In the say-on-pay advisory vote, stockholders may (1) vote to approve the resolution; (2) vote against the resolution; or (3) abstain from voting on the resolution. The affirmative vote of a majority of all of the votes cast at the Annual Meeting is required to approve the non-binding advisory resolution on the compensation of our named executive officers. For purposes of this vote, shares of common stock not voted (whether by abstention, broker non-vote or otherwise) will not be counted as a vote cast and will have no effect on the result of the vote. Although the advisory vote on Proposal 2 is non-binding, as provided by law, the Board of Directors and the Compensation Committee will review the results of the vote and will take it into account in making future determinations concerning executive compensation. The Board of Directors unanimously recommends a vote FOR the approval of the compensation of the Company's named executive officers.

In the vote on the ratification of the appointment of KPMG LLP as Xenia’s independent registered public accounting firm for fiscal year 2024, stockholders may (1) vote for the ratification; (2) vote against the ratification; or (3) abstain from voting on the ratification. Ratification of the appointment of KPMG LLP as our independent registered public accounting firm for fiscal year 2024 will require the affirmative vote of a majority of the votes cast at the Annual Meeting; however, stockholder ratification is not required to authorize the appointment of KPMG LLP as our independent registered public accounting firm. For purposes of this vote, shares of common stock not voted (whether by abstention, broker non-vote or otherwise) will not be counted as a vote cast and will have no effect on the result of the vote. The Board of Directors unanimously recommends a vote FOR the ratification of the appointment of KPMG LLP as our independent registered public accounting firm for fiscal year 2024.

9. Q: What is the effect of an “abstain” vote on the proposals to be voted on at the Annual Meeting?

A: Because a majority of all the votes cast at the Annual Meeting is required to elect a director, an “abstain” vote will have no effect on the outcome of the election of directors. Because an “abstain” vote is not considered a vote “cast” and the affirmative vote of a majority of the votes cast at the Annual Meeting will be required for the stockholders to approve the say-on-pay advisory vote and the ratification of KPMG LLP as Xenia's independent registered public accounting firm for the fiscal year 2024. An “abstain” vote will not have any impact on the outcome of those proposals. Both abstentions and broker non-votes will be considered present for the purpose of determining the presence of a quorum.

10. Q: What is the effect of a “broker non-vote” on the proposals to be voted on at the Annual Meeting?

A: A “broker non-vote” will occur with respect to any proposal that is a non-discretionary item if you are the beneficial owner of shares held by a broker or other custodian and you do not provide the broker or custodian with voting instructions with respect to such proposal. This is because under applicable New York Stock Exchange (“NYSE”) rules, a broker or custodian may not vote on these matters without instruction from the underlying beneficial owner. Because the ratification of auditors is considered a discretionary item for which a broker or other custodian may vote shares that are held in the name of a broker, bank or other nominee and which are not voted by the applicable beneficial owners, we do not expect to receive any broker non-votes with respect to this proposal. Except for the ratification of auditors, all of the proposals described in this proxy statement are non-discretionary items. A "broker non-vote" is not considered a vote "cast" and will not have any effect on the outcome of the election of directors, the say-on-pay advisory vote and the ratification of KPMG LLP as Xenia's independent registered public accounting firm for fiscal year 2024.

11. Q: Who counts the votes?

A: Broadridge Financial Solutions, Inc. will count the votes. The Board of Directors has appointed Broadridge Financial Solutions, Inc., or an authorized third-party engaged by Broadridge Financial Solutions, Inc., to serve as the inspector of elections.

12. Q: Revocation of proxy: May I change my vote after I return my proxy?

A: Yes, you may revoke your proxy if you are a record holder by filing written notice of revocation with Xenia’s corporate secretary at our principal executive offices at 200 S. Orange Avenue, Suite 2700, Orlando, Florida 32801 by submitting a later dated proxy or by voting in person at the Annual Meeting.

If your shares are held in street name through a broker, bank, or other nominee, you need to contact the record holder of your shares regarding how to revoke your proxy.

13. Q: What if I submit a proxy but do not specify a choice for a matter?

A: Unless you indicate otherwise, the persons named as proxies will vote your shares FOR all of the nominees for director named in this proxy statement, FOR the say-on-pay proposal and FOR the ratification of KPMG LLP as our independent registered public accounting firm for fiscal year 2024.

14. Q: What constitutes a quorum?

A: Presence at the Annual Meeting in person or by proxy of stockholders entitled to cast a majority of all the votes entitled to be cast at the Annual Meeting shall constitute a quorum, permitting the Annual Meeting to proceed and business to be conducted. Proxies received with matters marked with abstentions, or that contain broker non-votes, will be included in the calculation of the number of votes considered to be present at the meeting for purposes of determining whether a quorum is present.

15. Q: Where can I find the voting results of the Annual Meeting?

A: We will publish final results on a Current Report on Form 8-K within four business days after the Annual Meeting.

16. Q: Who will pay the costs of soliciting these proxies?

A: We will bear the entire cost of solicitation of proxies, including costs incurred in connection with preparation, assembly, printing and mailing of the Notice, this proxy statement and any additional information furnished to stockholders. Copies of solicitation materials will be furnished to banks, brokerage houses, fiduciaries and custodians holding shares of Xenia common stock beneficially owned by others to forward to such beneficial owners. We may reimburse persons representing beneficial owners of Xenia common stock for their reasonable costs of forwarding solicitation materials to such beneficial owners. Original solicitation of proxies may be supplemented by electronic means, mail, facsimile, telephone or personal solicitation by our directors, officers or other employees. No additional compensation will be paid to our directors, officers or other employees for such services.

We have hired Georgeson Inc. to assist in the solicitation of proxies at a base fee of $8,250, plus additional amounts, which will vary depending upon the extent of services actually performed by Georgeson Inc., plus reimbursement for reasonable out-of-pocket expenses.

17. Q: What happens if additional matters are presented at the Annual Meeting?

A: Other than the three proposals described in this proxy statement, we are not aware of any other properly submitted business to be acted upon at the Annual Meeting. If you grant a proxy, the persons named as proxy holders, Marcel Verbaas and Barry A.N. Bloom, will have the discretion to vote your shares on any additional matters properly presented for a vote at the Annual Meeting. If any of our nominees for director are unavailable, or are unable to serve or for good cause will not serve, the persons named as proxy holders will vote your proxy for such other candidate or candidates as may be nominated by the Board of Directors.

18. Q: How many shares of common stock are outstanding? How many votes do I have?

A: As of the close of business on March 21, 2024, the record date for the Annual Meeting, there were 101,963,677 shares of our common stock outstanding and entitled to vote. Each stockholder will be entitled to one vote for each share of Xenia common stock held as of the record date.

19. Q: What is the deadline under Rule 14a-8 under the Securities Exchange Act of 1934, as amended, for stockholders to propose actions to be included in our proxy statement relating to our 2025 annual meeting of stockholders and identified in our form of proxy relating to the 2025 annual meeting?

A: The deadline for stockholders to submit proposals to be included in our proxy statement and identified in our form of proxy under Rule 14a-8 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), is December 2, 2024. Proposals by stockholders must comply with all requirements of applicable rules of the SEC, including Rule 14a-8, and be mailed to our corporate secretary at our principal executive offices at 200 S. Orange Avenue, Suite 2700, Orlando, Florida 32801. We reserve the right to reject, rule out of order, or take other appropriate action with respect to any proposal that does not comply with Rule 14a-8 and other applicable requirements.

20. Q: What is the deadline under our current bylaws for stockholders to nominate persons for election to the Board of Directors or propose other matters to be considered at our 2025 annual meeting of stockholders?

A: Our proxy access bylaw permits an eligible stockholder (or group of up to 20 stockholders) owning 3% or more of our outstanding common stock continuously for at least three years to nominate and include in the Company’s proxy materials director candidates constituting the greater of two director nominees or director nominees constituting up to 20% of the total number of directors then serving on the Board of Directors, if the nominating stockholder(s) and nominee(s) satisfy the requirements specified in the bylaws.

Stockholders who wish to nominate persons for election to our Board of Directors or propose other matters to be considered at our 2025 annual meeting of stockholders must provide us advance notice of the director nomination or stockholder proposal, as well as the information specified in our current bylaws, no earlier than November 2, 2024 and no later than 5:00 p.m., Eastern Time, on December 2, 2024. Stockholders are advised to review our bylaws, which contain the requirements for advance notice of director nominations and stockholder proposals. Notice of director nominations and stockholder proposals must be mailed to our corporate secretary at our principal executive offices at 200 S. Orange Avenue, Suite 2700, Orlando, Florida 32801. The requirements for advance notice of stockholder proposals under our bylaws do not apply to proposals properly submitted under Rule 14a-8 under the Exchange Act, as those stockholder proposals are governed by Rule 14a-8.

In addition to satisfying the foregoing requirements under our bylaws, to comply with the universal proxy rules, stockholders who intend to solicit proxies in support of director nominees other than the Company’s nominees must comply with the additional requirements of Rule 14a-19 under the Exchange Act. We reserve the right to reject, rule out of order, or take other appropriate action with respect to any director nomination or stockholder proposal that does not comply with our bylaws and other applicable requirements.

21. Q: How do I submit a potential director nominee for consideration by the Board of Directors for nomination?

A: You may submit names of potential director nominees for consideration by the Nominating and Corporate Governance Committee for nomination by our Board of Directors at the 2025 annual meeting of stockholders. Your submission should be mailed to our corporate secretary at our principal executive offices at 200 S. Orange Avenue, Suite 2700, Orlando, Florida 32801. See "Article II: Corporate Governance — Board Committees — Nominating and Corporate Governance Committee” for information on the nomination process used by our Nominating and Corporate Governance Committee and our Board of Directors. The deadline has passed to submit a potential director nominee to be considered for nomination by our Board of Directors at the 2024 Annual Meeting. The deadline to submit a potential director nominee for consideration by our Board of Directors for nomination at the 2025 annual meeting of stockholders is 5:00 p.m., Eastern Time, on December 2, 2024.

The Company intends to file a proxy statement and a WHITE proxy card with the SEC in connection with its solicitation of proxies for our 2024 Annual Meeting of Stockholders. Stockholders may obtain our proxy statement (and any amendments and supplements thereto) and other documents as and when filed by the Company without charge from the SEC’s website at www.sec.gov.

ARTICLE II: CORPORATE GOVERNANCE

PROPOSAL 1 - ELECTION OF DIRECTORS

Xenia’s charter and bylaws provide that the Board of Directors may establish, increase or decrease the number of directors, but the number of directors shall never be less than the minimum number required by the Maryland General Corporation Law (“MGCL”) nor more than fifteen. At present, the number of members of the Board of Directors is fixed at eight.

In accordance with the recommendation of the Nominating and Corporate Governance Committee, the Board of Directors has unanimously nominated Marcel Verbaas, Dennis D. Oklak, Keith E. Bass, Thomas M. Gartland, Beverly K. Goulet, Arlene Isaacs-Lowe, Mary E. McCormick and Terrence Moorehead to stand for re-election to the Board of Directors. Each of the foregoing has been nominated to hold office until the 2025 annual meeting of stockholders and until their respective successors have been duly elected and qualify. Unless otherwise instructed by the stockholder, the proxy holders will vote the shares represented by such proxy for the election of the nominees named in this proxy statement.

Each of the nominees has consented to serve as a director if elected. If any of the nominees should be unavailable to serve for any reason, the Board of Directors may designate a substitute nominee or substitute nominees (in which event proxy holders will vote for the election of such substitute nominee or nominees). Alternatively, the Board of Directors may reduce the size of the Board of Directors or allow the vacancy or vacancies to remain open until a suitable candidate or candidates are identified by the Board of Directors.

Vote Required

Approval of the election of a director requires the affirmative “FOR” vote of the holders of a majority of the votes cast on the election of such director.

| | | | | | | | |

| ü | | The Board of Directors unanimously recommends that the stockholders vote “FOR” each of Marcel Verbaas, Dennis D. Oklak, Keith E. Bass, Thomas M. Gartland, Beverly K. Goulet, Arlene Isaacs-Lowe, Mary E. McCormick, and Terrence Moorehead as directors to serve and hold office until the 2025 annual meeting of stockholders and until their respective successors have been duly elected and qualify. |

OUR BOARD OF DIRECTORS

Set forth below is information regarding the business experience of each of our directors who are standing for election at the 2024 Annual Meeting that has been furnished to us by each respective director. Each director has been principally engaged in the employment indicated for the last five years unless otherwise stated. Also set forth below for each director is a discussion of the experience, qualifications, attributes or skills that led the Board to conclude that the director is qualified and should serve as a director of Xenia.

Directors Standing for Re-Election

Marcel Verbaas (age 54) is our Chair and Chief Executive Officer. Previous to this role, Mr. Verbaas served as President and Chief Executive Officer with Xenia or its affiliated entities from 2007 until November 2017. Mr. Verbaas has also served on the Board since our listing on the NYSE in February 2015 and was elected Chair in November 2017. From December 2004 until the successful sale of the company in April 2007, Mr. Verbaas was Senior Vice President and Chief Investment Officer for CNL Hotels & Resorts, Inc., a real estate investment trust ("REIT"). In that capacity, he was responsible for the company’s investment activities, acquisitions and dispositions. Mr. Verbaas served as Senior Vice President and Chief Investment Officer for CNL Retirement Corporation from June 2003 to December 2004, during which time he oversaw more than $2.5 billion in acquisitions in the senior housing and medical office segments. From 2000 to 2003, Mr. Verbaas held the positions of Vice President of Real Estate Finance and Senior Vice President of Project Finance with CNL Hospitality Corporation, the former advisor to CNL Hotels and Resorts, Inc. Prior to joining CNL in 2000, Mr. Verbaas served as Director of Corporate Finance for Stormont Trice Development Corporation, a private hotel development company. Mr. Verbaas also held positions in real estate finance with GE Capital Corporation and Ocwen Financial Corporation where he primarily focused on the financing of lodging properties. Mr. Verbaas received his Master’s Degree in Business Economics from Erasmus University of Rotterdam, The Netherlands.

Mr. Verbaas’ qualifications to serve on our Board of Directors include his more than 25 years of experience in the lodging industry and his general expertise in real estate operations and finance. Further, the Board of Directors also values his executive leadership as

Chair of our Board and the way his additional role as our Chief Executive Officer brings management's perspective to Board deliberations providing valuable information about the status of our day-to-day operations.

Dennis D. Oklak (age 70) has served on the Board since our listing on the NYSE in February 2015 and currently serves as Lead Director. Mr. Oklak served as Chief Executive Officer of Duke Realty Corporation, a publicly traded REIT focused on industrial and office properties, from April 2004 through December 2015, and served as Director from April 2004 and Chairman of the board of directors of Duke Realty Corporation from 2005 until April 2017. Mr. Oklak serves as a Director of Tutor Perini Corporation, a publicly traded commercial contractor, where he has served since May 2017. He also serves as the Non-Executive Chair of the Board of Managers of ITR Concession Company LLC, lessee of the Indiana Toll Road. Mr. Oklak serves as Chair of the Board of Directors of the Eskenazi Health Foundation. He holds a Bachelor’s degree from Ball State University.

Mr. Oklak contributes to the Board of Directors real estate industry, consulting, operations, development and executive leadership expertise, as well as finance, accounting and auditing expertise from his nine years as an accountant at Deloitte & Touche LLP prior to joining Duke Realty. The Board of Directors also values his experience as a chief executive officer and a public company director.

Keith E. Bass (age 59) has served on the Board since our listing on the NYSE in February 2015. Mr. Bass currently serves as the Chief Executive Officer of Mattamy Homes US, one of the largest privately owned home-builders in North America. Mr. Bass served as President and Chief Executive Officer of WCI Communities, Inc., a lifestyle community developer and luxury homebuilder of single-and multi-family homes in Florida, from December 2012 until February 2017 and as a member of its board of directors since March 2012 until February 2017. Mr. Bass serves as a Director of Rayonier, Inc., where he has served since December 2017. From 2011 to November 2012, Mr. Bass was President of Pinnacle Land Advisors. From 2003 to 2011, Mr. Bass was an executive with The Ryland Group, and most recently, from 2008 to 2011, served as Senior Vice President of The Ryland Group and President of the South U.S. Region. From 2003 to 2008, Mr. Bass held the various titles at The Ryland Group of SE U.S. Region President, Orlando Division President and Vice President, Land Resources—SE U.S. Region. Prior to Ryland, Mr. Bass was President of the Florida Region of Taylor Woodrow from 1997 to 2003. He received a Bachelor’s degree in Business Administration from North Carolina Wesleyan College.

Mr. Bass brings to the Board of Directors significant executive management experience, including his extensive experience in the real estate industry. The Board of Directors also values Mr. Bass’s experience as a chief executive officer and a public company director.

Thomas M. Gartland (age 66) has served on the Board since our listing on the NYSE in February 2015. Mr. Gartland currently serves as the Chairman and CEO of Monway Auto Transport, a privately-held North American transport company. Mr. Gartland also serves as director and chair of the governance committee and a member of the compensation committee of ABM Industries, Inc., a publicly traded provider of facility solutions, where he has served since October 2015. Mr. Gartland was President, North America for Avis Budget Group, a provider of vehicle rental services, from October 2011 until December 31, 2014. Mr. Gartland served as Executive Vice President of Sales, Marketing & Customer Care at Avis Budget Group, Inc. from April 2008 through October 2011, as a senior executive of JohnsonDiversey, Inc.’s from 1994 to 2008, including most recently as President of the North American Region from 2002 to 2008, and at Ecolab, Inc. from 1980 to 1994, most recently as Vice President and Director of National Accounts. He received a Bachelor’s degree in Business Administration/Marketing from the University of St. Thomas in St. Paul, Minnesota.

Mr. Gartland brings to our Board of Directors a strong background in sales and significant senior executive and operations experience at major, multi-national companies, including a major company in the travel industry.

Beverly K. Goulet (age 69) has served on the Board since our listing on the NYSE in February 2015. Ms. Goulet served as Senior Vice President and Chief Integration Officer of American Airlines Group Inc. from February 2013 through November 2015 and Executive Vice President and Chief Integration Officer from December 2015 until her retirement from American Airlines in June 2017. Ms. Goulet serves as a Director of Rolls Royce PLC, where she has served since July 2017. Ms. Goulet previously served as a Director of Atlas Air Worldwide from May 2021 to March 2023. Ms. Goulet served as Chief Restructuring Officer of American Airlines from 2011 to 2013, and as Vice President—Corporate Development and Treasurer from 2002 to 2013. Prior to joining American Airlines, Ms. Goulet practiced corporate and securities law for 13 years. She received a Bachelor’s degree and a Juris Doctor from the University of Michigan.

Ms. Goulet brings to the Board of Directors significant executive management and financial experience at a major company in the travel industry. The Board of Directors also values Ms. Goulet’s legal experience.

Arlene Isaacs-Lowe (age 64) has served on the Board since March 2022. Ms. Isaacs-Lowe retired from Moody’s Corporation (“Moody’s”) on June 30, 2022 after 24 years with the company. During this tenure, she served as Special Advisor to the executive leadership team of Moody’s, Global Head of Corporate Social Responsibility, and as President of the Moody’s Foundation. Ms. Isaacs-Lowe additionally served as leader of the relationship management team responsible for Europe, the Middle East, and Africa and led business development and account management efforts for US Financial Institutions, Public, and Project and Infrastructure Finance for Moody’s Commercial Group. Before joining Moody’s Commercial Group, Ms. Isaacs-Lowe served as Senior Vice President and lead credit analyst in the Financial Institutions Group. Prior to her work with Moody’s, Ms. Isaacs-Lowe held positions

with Equinox Realty Advisors, LLC, MetLife, and West World Holding, Inc. Ms. Isaacs-Lowe currently serves as a non-executive director on the board of Compass PLC, a FTSE100 company and the leading provider of food and support services globally. Ms. Isaacs-Lowe also serves as a independent director on the board of Equitable Holdings, a financial services holding company comprised of two complementary and well-established principal franchises, Equitable and AllianceBernstein. She is a member of the New York State Society of CPAs, the New York State Society of Security Analysts and the CFA Institute. She received a Bachelor’s degree from Howard University and an MBA from Fordham University.

Ms. Isaacs-Lowe contributes to our Board of Directors through her extensive experience in credit markets, risk management, commercial real estate, and environmental, social strategy. The Board of Directors values her executive leadership and corporate social responsibility experience.

Mary E. McCormick (age 66) has served on the Board since our listing on the NYSE in February 2015. Ms. McCormick has extensive experience in real estate, capital markets and corporate governance and brings that expertise to Board discussions. From 2017 until May 2022, Ms. McCormick served as the Executive Director for the Center for Real Estate at The Fisher School of Business at The Ohio State University. From 2010 to 2016, Ms. McCormick was a Senior Advisor with Almanac Realty Investors, LLC. She served the Ohio Public Employees Retirement System from 1989 through 2005, where she was most recently responsible for directing the then $64 billion fund’s real estate investments. Ms. McCormick has held a number of leadership positions for a variety of national and regional real estate associations, including Chair of the Pension Real Estate Association. Ms. McCormick has served as a Director of EastGroup Properties, an industrial REIT, since 2005, as a Director of Broadstone Net Lease, a private REIT, from 2013 to 2016, and as a Director of Mid America Apartment Communities from 2006 to 2010. Ms. McCormick is a member of the Urban Land Institute, NAIOP, and the Pension Real Estate Association. She received a Bachelor’s degree and an MBA from The Ohio State University.

Ms. McCormick contributes to our Board of Directors through her extensive experience in real estate, capital markets and board governance. The Board of Directors values her leadership and public company director experience.

Terrence Moorehead (age 61) has served on the Board since May 2021. Mr. Moorehead currently serves as President and Chief Executive Officer and as a Director of Nature’s Sunshine Products, Inc. (“Nature’s Sunshine”), a publicly traded leading natural health and wellness company. Prior to joining Nature’s Sunshine in 2018, Mr. Moorehead held the role of Chief Executive Officer at Carlisle Etcetera LLC, from 2015 through 2018, and at Dana Beauty, Inc., from 2013 to 2015. From 1991 to 2013 he served in various leadership capacities at Avon Products, Inc., including, among other positions, as VP, Strategy and Digital- North America, President and Chairman of Avon Japan, President of Avon Canada, and General Manager of Avon Italy. Mr. Moorehead received his Masters of Business Administration from Columbia University and a Bachelor of Arts in Economics from Boston College.

Mr. Moorehead contributes to the Board of Directors operational, consumer products, and executive leadership expertise. The Board of Directors also values his experience as a chief executive officer and a public company director.

Family Relationships

There are no family relationships among any of our directors or executive officers.

Corporate Governance Profile and Board Leadership Structure

We have structured our corporate governance in a manner we believe closely aligns our interests with those of our stockholders. Notable features of our corporate governance structure include the following:

•our Board of Directors is not classified, so each of our directors is subject to election annually;

•director elections are subject to a majority voting standard;

•any director nominee who receives more votes "against" than votes "for" must submit his or her written resignation offer to the Board;

•of the eight persons standing for re-election to our Board, our Board has determined that seven, or 87.5%, satisfy the listing standards for independence of the NYSE;

•our Board has determined that all members of the Audit Committee qualify as an “audit committee financial expert” as defined by the SEC;

•all members of the Audit, Compensation, and Nominating and Corporate Governance committees of the Board are independent of the Company and our officers and employees;

•we have opted out of the business combination provisions (provided that the business combination has been approved by the Board) and control share acquisition provisions of the MGCL;

•we have opted out of all provisions of the Maryland Unsolicited Takeover Act (“MUTA”);

•we have adopted a proxy access right for stockholders;

•stockholders have the right to amend our bylaws; and

•we do not have a stockholder rights plan.

Our Corporate Governance Guidelines provide that our Board of Directors shall select its chair and the Company’s chief executive officer in any way it considers to be in the best interests of the Company. Therefore, the Board does not have a policy on whether the role of the chair and chief executive officer should be separate or combined. The Board and the Nominating and Corporate Governance Committee review this structure each year and has determined that it is in our best interest not to separate these positions. Mr. Verbaas, our Chief Executive Officer, was appointed Chair of the Board and assumed the role effective November 2017. Mr. Verbaas possesses a detailed knowledge of our industry, as well as an understanding of both the opportunities and challenges we face. The Board thus believes that Mr. Verbaas is best positioned to develop agendas that ensure that the Board’s time and attention are focused on the most important matters facing the Company. The Board also believes that Mr. Verbaas’ combined role ensures clear accountability, enhances our ability to articulate our strategy and message to our employees, stockholders and business partners and enables decisive overall leadership.

To promote the independence of the Board and appropriate oversight of management and to demonstrate our commitment to strong corporate governance, the independent directors have designated an independent, non-employee director to serve as our Lead Director. The Lead Director helps to facilitate free and open discussion and communication among the independent, non-employee directors. While we do not have a formal attendance policy regarding the Lead Director's attendance at all committee meetings, our Lead Director makes every effort to attend each committee meeting. We believe that regular meetings of independent directors, without management present, and permitting all directors to add items to the agenda of meetings of the Board and its committees mitigates the risk that having our Chief Executive Officer serve as our Chair may cause management to have undue influence on the Board. The responsibilities of the Lead Director are set forth in our Corporate Governance Guidelines. Mr. Oklak was appointed Lead Director and assumed the role effective May 2021. The Board believes this current leadership structure best serves the objectives of the Board’s oversight of management, the Board’s ability to carry out its roles and responsibilities on behalf of the stockholders and the Company’s overall corporate governance. The Nominating and Corporate Governance Committee and the Board will periodically review the leadership structure to determine whether it continues to best serve the Company and its stockholders.

During the fiscal year ended December 31, 2023, our Board of Directors held seven meetings (and took action four times by unanimous written consent). The Audit Committee held five meetings, the Compensation Committee held five meetings, the Nominating and Corporate Governance Committee held five meetings and the Executive Committee did not meet. No incumbent director attended fewer than 75% of the total number of meetings of the Board of Directors and committees on which such director served that were held during the period the director served in 2023. Additionally, all directors in the aggregate attended over 99% of the total Board and committee meetings held in 2023 and all directors elected or appointed at the time attended our 2023 annual meeting of the stockholders.

Our non-management directors meet regularly in executive sessions of the Board and each committee without the presence of any members of management, with our Lead Director or the chair of the respective committee presiding over such sessions. Our directors are expected to make every effort to attend all meetings of the Board of Directors, meetings of the committees of which they are members and any meeting of stockholders.

Director Retirement Policy

Our Corporate Governance Guidelines include a director retirement policy, which requires any director upon attaining the age of seventy-five (75), and annually thereafter, to tender a letter of proposed retirement from the Board to the chair of the Board with such effective date of retirement to be at the first annual meeting of the stockholders held thereafter. The Board shall review the director’s continuation on the Board, and in light of all the circumstances, the Board shall accept such proposed retirement or request that the director continue to serve. A majority of the disinterested directors on the Board shall determine the acceptance of the proposed retirement or election to request that the director continue to serve.

Stockholder Engagement and Investor Outreach Program

Our Board is deeply engaged in the Company's strategic direction and performance. To that end, building and maintaining long-term relationships with our stockholders is a core goal of the Company and there is no higher priority than earning and keeping the trust of our stockholders as we build value for the long-term. Additionally, both management and the Board believe that engaging with our stockholders is a year-round priority. Furthermore, both management and the Board are committed to both proactive and reactive engagement; and we are determined to solicit feedback from our stockholders while also listening to any suggestions they might have to strengthen the long-term prospects of the Company. Thus, the Company regularly contacts representatives of large stockholders to