xhr-2021123100016160002021FYfalseP3Mhttp://fasb.org/us-gaap/2021-01-31#OtherAssetshttp://fasb.org/us-gaap/2021-01-31#OtherLiabilities00016160002021-01-012021-12-3100016160002021-06-30iso4217:USD00016160002022-02-28xbrli:shares00016160002021-12-3100016160002020-12-31iso4217:USDxbrli:shares0001616000us-gaap:OccupancyMember2021-01-012021-12-310001616000us-gaap:OccupancyMember2020-01-012020-12-310001616000us-gaap:OccupancyMember2019-01-012019-12-310001616000us-gaap:FoodAndBeverageMember2021-01-012021-12-310001616000us-gaap:FoodAndBeverageMember2020-01-012020-12-310001616000us-gaap:FoodAndBeverageMember2019-01-012019-12-310001616000us-gaap:HotelOtherMember2021-01-012021-12-310001616000us-gaap:HotelOtherMember2020-01-012020-12-310001616000us-gaap:HotelOtherMember2019-01-012019-12-3100016160002020-01-012020-12-3100016160002019-01-012019-12-310001616000xhr:HotelOtherDirectMember2021-01-012021-12-310001616000xhr:HotelOtherDirectMember2020-01-012020-12-310001616000xhr:HotelOtherDirectMember2019-01-012019-12-310001616000xhr:HotelOtherIndirectMember2021-01-012021-12-310001616000xhr:HotelOtherIndirectMember2020-01-012020-12-310001616000xhr:HotelOtherIndirectMember2019-01-012019-12-310001616000us-gaap:ManagementServiceMember2021-01-012021-12-310001616000us-gaap:ManagementServiceMember2020-01-012020-12-310001616000us-gaap:ManagementServiceMember2019-01-012019-12-310001616000us-gaap:CommonStockMember2018-12-310001616000us-gaap:AdditionalPaidInCapitalMember2018-12-310001616000us-gaap:AociIncludingPortionAttributableToNoncontrollingInterestMember2018-12-310001616000us-gaap:RetainedEarningsMember2018-12-310001616000xhr:OperatingPartnershipMember2018-12-3100016160002018-12-310001616000us-gaap:RetainedEarningsMember2019-01-012019-12-310001616000xhr:OperatingPartnershipMember2019-01-012019-12-310001616000us-gaap:CommonStockMember2019-01-012019-12-310001616000us-gaap:AdditionalPaidInCapitalMember2019-01-012019-12-310001616000us-gaap:AociIncludingPortionAttributableToNoncontrollingInterestMember2019-01-012019-12-310001616000us-gaap:CommonStockMember2019-12-310001616000us-gaap:AdditionalPaidInCapitalMember2019-12-310001616000us-gaap:AociIncludingPortionAttributableToNoncontrollingInterestMember2019-12-310001616000us-gaap:RetainedEarningsMember2019-12-310001616000xhr:OperatingPartnershipMember2019-12-3100016160002019-12-310001616000us-gaap:RetainedEarningsMember2020-01-012020-12-310001616000xhr:OperatingPartnershipMember2020-01-012020-12-310001616000us-gaap:CommonStockMember2020-01-012020-12-310001616000us-gaap:AdditionalPaidInCapitalMember2020-01-012020-12-310001616000us-gaap:AociIncludingPortionAttributableToNoncontrollingInterestMember2020-01-012020-12-310001616000us-gaap:CommonStockMember2020-12-310001616000us-gaap:AdditionalPaidInCapitalMember2020-12-310001616000us-gaap:AociIncludingPortionAttributableToNoncontrollingInterestMember2020-12-310001616000us-gaap:RetainedEarningsMember2020-12-310001616000xhr:OperatingPartnershipMember2020-12-310001616000us-gaap:RetainedEarningsMember2021-01-012021-12-310001616000xhr:OperatingPartnershipMember2021-01-012021-12-310001616000us-gaap:CommonStockMember2021-01-012021-12-310001616000us-gaap:AdditionalPaidInCapitalMember2021-01-012021-12-310001616000us-gaap:AociIncludingPortionAttributableToNoncontrollingInterestMember2021-01-012021-12-310001616000us-gaap:CommonStockMember2021-12-310001616000us-gaap:AdditionalPaidInCapitalMember2021-12-310001616000us-gaap:AociIncludingPortionAttributableToNoncontrollingInterestMember2021-12-310001616000us-gaap:RetainedEarningsMember2021-12-310001616000xhr:OperatingPartnershipMember2021-12-31xhr:market0001616000xhr:XHRLPOperatingPartnershipMember2021-12-31xbrli:purexhr:propertyxhr:room0001616000us-gaap:SalesRevenueNetMemberxhr:SanDiegoCaliforniaMembersrt:MinimumMemberus-gaap:GeographicConcentrationRiskMember2021-01-012021-12-310001616000us-gaap:SalesRevenueNetMembersrt:MinimumMemberxhr:PhoenixArizonaMemberus-gaap:GeographicConcentrationRiskMember2021-01-012021-12-310001616000us-gaap:SalesRevenueNetMemberxhr:OrlandoFloridaMembersrt:MinimumMemberus-gaap:GeographicConcentrationRiskMember2021-01-012021-12-310001616000us-gaap:SalesRevenueNetMembersrt:MinimumMemberxhr:HoustonTexasMemberus-gaap:GeographicConcentrationRiskMember2021-01-012021-12-310001616000us-gaap:SalesRevenueNetMemberxhr:OrlandoFloridaMembersrt:MinimumMemberus-gaap:GeographicConcentrationRiskMember2020-01-012020-12-310001616000us-gaap:SalesRevenueNetMembersrt:MinimumMemberxhr:PhoenixArizonaMemberus-gaap:GeographicConcentrationRiskMember2020-01-012020-12-310001616000us-gaap:SalesRevenueNetMemberxhr:OrlandoFloridaMembersrt:MinimumMemberus-gaap:GeographicConcentrationRiskMember2019-01-012019-12-310001616000us-gaap:SalesRevenueNetMemberus-gaap:ProductConcentrationRiskMemberxhr:FiveLargestHotelsMember2020-01-012020-12-310001616000us-gaap:SalesRevenueNetMemberus-gaap:ProductConcentrationRiskMemberxhr:FiveLargestHotelsMember2021-01-012021-12-310001616000us-gaap:SalesRevenueNetMemberus-gaap:ProductConcentrationRiskMemberxhr:FiveLargestHotelsMember2019-01-012019-12-310001616000us-gaap:SalesRevenueNetMemberstpr:TXus-gaap:GeographicConcentrationRiskMember2021-01-012021-12-310001616000us-gaap:SalesRevenueNetMemberstpr:CAus-gaap:GeographicConcentrationRiskMember2021-01-012021-12-310001616000us-gaap:SalesRevenueNetMemberstpr:FLus-gaap:GeographicConcentrationRiskMember2021-01-012021-12-310001616000xhr:HotelFurnitureFixturesandEquipmentReservesMember2021-12-310001616000us-gaap:BuildingAndBuildingImprovementsMember2021-01-012021-12-310001616000us-gaap:FurnitureAndFixturesMembersrt:MinimumMember2021-01-012021-12-310001616000us-gaap:LandImprovementsMembersrt:MinimumMember2021-01-012021-12-310001616000us-gaap:FurnitureAndFixturesMembersrt:MaximumMember2021-01-012021-12-310001616000us-gaap:LandImprovementsMembersrt:MaximumMember2021-01-012021-12-310001616000us-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMemberxhr:MarriottCharlestonTownCenterCharlestonWVMember2021-01-012021-12-310001616000xhr:KimptonHotelMonacoChicagoILMemberus-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMember2021-11-300001616000xhr:KimptonHotelMonacoChicagoILMemberus-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMember2021-01-012021-12-310001616000xhr:ParkHyattAviaraResortGolfClubAndSpaMember2021-01-012021-12-310001616000us-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMemberxhr:RenaissanceAustinHotelAustinTXMember2020-01-012020-12-310001616000xhr:MarriottChicagoAtMedicalDistrictUICChicagoILMember2019-01-012019-12-310001616000us-gaap:HurricaneMember2021-08-012021-08-310001616000us-gaap:HurricaneMember2021-07-012021-09-300001616000us-gaap:HurricaneMember2021-01-012021-09-300001616000us-gaap:HurricaneMember2021-10-012021-12-310001616000us-gaap:HurricaneMember2021-01-012021-12-310001616000us-gaap:HurricaneMember2021-12-310001616000xhr:COVID19PandemicMember2020-01-012020-12-310001616000xhr:WinterStormsInTexasMember2021-01-012021-12-310001616000us-gaap:HurricaneMemberxhr:HyattCentricKeyWestResortAndSpaKeyWestFLMember2019-01-012019-12-310001616000us-gaap:HurricaneMemberxhr:HyattCentricKeyWestResortAndSpaKeyWestFLMember2021-01-012021-12-31xhr:segment00016160002021-07-012021-07-31xhr:mortgage_loan0001616000xhr:OrlandoFloridaMember2021-01-012021-12-310001616000xhr:PhoenixArizonaMember2021-01-012021-12-310001616000xhr:SanDiegoCaliforniaMember2021-01-012021-12-310001616000xhr:HoustonTexasMember2021-01-012021-12-310001616000xhr:AtlantaGeorgiaMember2021-01-012021-12-310001616000xhr:DenverColoradoMember2021-01-012021-12-310001616000xhr:DallasTexasMember2021-01-012021-12-310001616000xhr:WashingtonDCMarylandVirginiaMember2021-01-012021-12-310001616000xhr:FloridaKeysMember2021-01-012021-12-310001616000xhr:SanFranciscoSanMateoCaliforniaMember2021-01-012021-12-310001616000xhr:OtherGeographicAreasMember2021-01-012021-12-310001616000xhr:OrlandoFloridaMember2020-01-012020-12-310001616000xhr:PhoenixArizonaMember2020-01-012020-12-310001616000xhr:HoustonTexasMember2020-01-012020-12-310001616000xhr:SanDiegoCaliforniaMember2020-01-012020-12-310001616000xhr:AtlantaGeorgiaMember2020-01-012020-12-310001616000xhr:DallasTexasMember2020-01-012020-12-310001616000xhr:SanFranciscoSanMateoCaliforniaMember2020-01-012020-12-310001616000xhr:DenverColoradoMember2020-01-012020-12-310001616000xhr:WashingtonDCMarylandVirginiaMember2020-01-012020-12-310001616000xhr:CaliforniaNorthMember2020-01-012020-12-310001616000xhr:OtherGeographicAreasMember2020-01-012020-12-310001616000xhr:OrlandoFloridaMember2019-01-012019-12-310001616000xhr:HoustonTexasMember2019-01-012019-12-310001616000xhr:PhoenixArizonaMember2019-01-012019-12-310001616000xhr:SanDiegoCaliforniaMember2019-01-012019-12-310001616000xhr:DallasTexasMember2019-01-012019-12-310001616000xhr:SanFranciscoSanMateoCaliforniaMember2019-01-012019-12-310001616000xhr:AtlantaGeorgiaMember2019-01-012019-12-310001616000xhr:SanJoseSantaCruzCaliforniaMember2019-01-012019-12-310001616000xhr:DenverColoradoMember2019-01-012019-12-310001616000xhr:WashingtonDCMarylandVirginiaMember2019-01-012019-12-310001616000xhr:OtherGeographicAreasMember2019-01-012019-12-310001616000xhr:HyattRegencyPortlandOregonConventionCenterMember2019-12-310001616000xhr:HyattRegencyPortlandOregonConventionCenterMember2019-12-012019-12-310001616000xhr:HyattRegencyPortlandOregonConventionCenterMembersrt:MaximumMember2019-12-310001616000xhr:HyattRegencyPortlandOregonConventionCenterMemberus-gaap:LandMember2019-01-012019-12-310001616000us-gaap:BuildingAndBuildingImprovementsMemberxhr:HyattRegencyPortlandOregonConventionCenterMember2019-01-012019-12-310001616000xhr:HyattRegencyPortlandOregonConventionCenterMemberus-gaap:FurnitureAndFixturesMember2019-01-012019-12-310001616000xhr:HyattRegencyPortlandOregonConventionCenterMember2019-01-012019-12-310001616000xhr:HyattRegencyPortlandOregonConventionCenterMemberus-gaap:CustomerContractsMember2019-01-012019-12-310001616000xhr:MarriottCharlestonTownCenterMemberus-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMember2021-08-310001616000xhr:MarriottCharlestonTownCenterMemberus-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMember2021-11-012021-11-300001616000xhr:RenaissanceAtlantaWaverlyHotelConventionCenterAtlantaGAMemberus-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMember2020-01-310001616000xhr:RenaissanceAtlantaWaverlyHotelConventionCenterAtlantaGAMemberus-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMember2020-08-012020-08-310001616000us-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMemberxhr:RenaissanceAustinHotelAustinTXMember2020-02-290001616000us-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMemberxhr:RenaissanceAustinHotelAustinTXMember2020-04-012020-04-300001616000xhr:KimptonPortfolioMemberus-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMember2020-03-310001616000xhr:KimptonPortfolioMemberxhr:HotelFurnitureFixturesandEquipmentReservesMemberus-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMember2020-03-310001616000xhr:KimptonPortfolioMemberus-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMember2020-04-300001616000xhr:KimptonPortfolioMemberus-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMember2020-07-310001616000xhr:ResidenceInnBostonCambridgeCambridgeMAMemberus-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMember2020-08-310001616000xhr:ResidenceInnBostonCambridgeCambridgeMAMemberus-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMember2020-10-012020-10-010001616000xhr:MarriottNapaValleyHotelSpaNapaValleyCAMemberus-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMember2020-08-310001616000xhr:MarriottNapaValleyHotelSpaNapaValleyCAMemberus-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMember2020-10-222020-10-220001616000us-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMemberxhr:RenaissanceAustinHotelAustinTXMember2020-09-300001616000us-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMemberxhr:RenaissanceAustinHotelAustinTXMember2020-11-242020-11-240001616000us-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMemberxhr:HotelCommonwealthMember2020-10-310001616000us-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMemberxhr:HotelCommonwealthMember2020-11-012020-11-300001616000xhr:MarriottCharlestonTownCenterMemberus-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMember2021-11-300001616000us-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMemberxhr:DisposedOfBySale2021Member2021-12-310001616000us-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMemberxhr:DisposedOfBySale2021Member2021-01-012021-12-310001616000xhr:ResidenceInnBostonCambridgeCambridgeMAMemberus-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMember2020-10-310001616000xhr:ResidenceInnBostonCambridgeCambridgeMAMemberus-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMember2020-10-012020-10-310001616000xhr:MarriottNapaValleyHotelSpaNapaValleyCAMemberus-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMember2020-10-310001616000xhr:MarriottNapaValleyHotelSpaNapaValleyCAMemberus-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMember2020-10-012020-10-310001616000us-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMemberxhr:HotelCommonwealthMember2020-11-300001616000us-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMemberxhr:RenaissanceAustinHotelAustinTXMember2020-11-300001616000us-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMemberxhr:RenaissanceAustinHotelAustinTXMember2020-11-012020-11-300001616000xhr:DisposedOfBySale2020Memberus-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMember2020-12-310001616000xhr:DisposedOfBySale2020Memberus-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMember2020-01-012020-12-310001616000xhr:MarriottChicagoAtMedicalDistrictUICChicagoILMemberus-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMember2019-12-310001616000xhr:MarriottChicagoAtMedicalDistrictUICChicagoILMemberus-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMember2019-12-012019-12-310001616000us-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMemberxhr:MarriottGriffinGateResortSpaLexingtonKYMember2019-12-310001616000us-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMemberxhr:MarriottGriffinGateResortSpaLexingtonKYMember2019-12-012019-12-310001616000us-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMemberxhr:DisposedOfBySale2019Member2019-12-310001616000us-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMemberxhr:DisposedOfBySale2019Member2019-01-012019-12-310001616000xhr:DisposedOfBySale2018Memberus-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMember2019-01-012019-12-310001616000xhr:KimptonHotelMonacoChicagoILMemberus-gaap:DisposalGroupHeldforsaleNotDiscontinuedOperationsMember2021-11-300001616000xhr:KimptonHotelMonacoChicagoILMemberus-gaap:DisposalGroupHeldforsaleNotDiscontinuedOperationsMember2021-01-012021-12-310001616000xhr:MarriottCharlestonTownCenterMemberus-gaap:DisposalGroupHeldforsaleNotDiscontinuedOperationsMember2021-12-310001616000us-gaap:LeasesAcquiredInPlaceMember2021-12-310001616000us-gaap:LeasesAcquiredInPlaceMember2020-12-310001616000us-gaap:CustomerContractsMember2021-12-310001616000us-gaap:CustomerContractsMember2020-12-310001616000us-gaap:LeasesAcquiredInPlaceMember2021-01-012021-12-310001616000us-gaap:LeasesAcquiredInPlaceMember2020-01-012020-12-310001616000us-gaap:CustomerContractsMember2021-01-012021-12-310001616000us-gaap:CustomerContractsMember2020-01-012020-12-310001616000xhr:HotelPalomarPhiladelphiaPhiladelphiaPAMemberus-gaap:MortgagesMember2021-12-310001616000xhr:HotelPalomarPhiladelphiaPhiladelphiaPAMemberus-gaap:MortgagesMember2020-12-310001616000us-gaap:MortgagesMemberxhr:RenaissanceAtlantaWaverlyHotelConventionCenterAtlantaGAMember2021-12-310001616000us-gaap:MortgagesMemberxhr:RenaissanceAtlantaWaverlyHotelConventionCenterAtlantaGAMember2020-12-310001616000us-gaap:MortgagesMemberxhr:AndazNapaMember2021-12-310001616000us-gaap:MortgagesMemberxhr:AndazNapaMember2020-12-310001616000us-gaap:MortgagesMemberxhr:RitzCarltonPentagonCityArlingtonVirginiaMember2021-12-310001616000us-gaap:MortgagesMemberxhr:RitzCarltonPentagonCityArlingtonVirginiaMember2020-12-310001616000xhr:GrandBohemianHotelOrlandoanAutographCollectionHotelOrlandoFLMemberus-gaap:MortgagesMember2021-12-310001616000xhr:GrandBohemianHotelOrlandoanAutographCollectionHotelOrlandoFLMemberus-gaap:MortgagesMember2020-12-310001616000us-gaap:MortgagesMemberxhr:MarriottSanFranciscoAirportWaterfrontSanFranciscoCAMember2021-12-310001616000us-gaap:MortgagesMemberxhr:MarriottSanFranciscoAirportWaterfrontSanFranciscoCAMember2020-12-310001616000us-gaap:MortgagesMember2021-12-310001616000us-gaap:MortgagesMember2020-12-310001616000xhr:TermLoan150MMaturityAugustTwentyTwentyThreeMemberus-gaap:NotesPayableToBanksMember2021-12-310001616000xhr:TermLoan150MMaturityAugustTwentyTwentyThreeMemberus-gaap:NotesPayableToBanksMember2020-12-310001616000xhr:TermLoan125MMaturitySeptemberTwentyTwentyFourMemberus-gaap:NotesPayableToBanksMember2021-12-310001616000xhr:TermLoan125MMaturitySeptemberTwentyTwentyFourMemberus-gaap:NotesPayableToBanksMember2020-12-310001616000us-gaap:LineOfCreditMemberus-gaap:RevolvingCreditFacilityMember2021-12-310001616000us-gaap:LineOfCreditMemberus-gaap:RevolvingCreditFacilityMember2020-12-310001616000xhr:CorporateCreditFacilitiesMember2021-12-310001616000xhr:CorporateCreditFacilitiesMember2020-12-310001616000us-gaap:SecuredDebtMemberxhr:SeniorSecuredNotes500MDue2025Member2021-12-310001616000us-gaap:SecuredDebtMemberxhr:SeniorSecuredNotes500MDue2025Member2020-12-310001616000xhr:SeniorSecuredNotes500MDue2029Memberus-gaap:SecuredDebtMember2021-12-310001616000xhr:SeniorSecuredNotes500MDue2029Memberus-gaap:SecuredDebtMember2020-12-310001616000us-gaap:LondonInterbankOfferedRateLIBORMemberus-gaap:MortgagesMember2021-01-012021-12-31xhr:loan0001616000us-gaap:MortgagesMemberus-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMember2021-01-012021-12-310001616000us-gaap:SubsequentEventMember2022-01-012022-01-31xhr:derivative_instrument0001616000srt:ScenarioForecastMemberus-gaap:LineOfCreditMemberus-gaap:RevolvingCreditFacilityMember2022-03-010001616000us-gaap:MortgagesMembersrt:MinimumMember2020-01-012020-12-310001616000us-gaap:MortgagesMembersrt:MaximumMember2020-01-012020-12-31xhr:fiscal_quarter0001616000us-gaap:MortgagesMember2020-01-012020-12-310001616000us-gaap:MortgagesMemberus-gaap:RecourseMember2021-12-310001616000us-gaap:MortgagesMember2021-06-300001616000us-gaap:LineOfCreditMemberus-gaap:RevolvingCreditFacilityMember2018-01-310001616000us-gaap:LineOfCreditMemberus-gaap:RevolvingCreditFacilityMember2018-01-012018-01-310001616000us-gaap:LondonInterbankOfferedRateLIBORMemberus-gaap:LineOfCreditMemberus-gaap:RevolvingCreditFacilityMembersrt:MinimumMember2018-01-012018-01-310001616000us-gaap:LondonInterbankOfferedRateLIBORMemberus-gaap:LineOfCreditMemberus-gaap:RevolvingCreditFacilityMembersrt:MaximumMember2018-01-012018-01-310001616000us-gaap:LineOfCreditMemberus-gaap:RevolvingCreditFacilityMembersrt:MinimumMember2018-01-012018-01-310001616000us-gaap:LineOfCreditMemberus-gaap:RevolvingCreditFacilityMembersrt:MaximumMember2018-01-012018-01-310001616000xhr:TermLoan175MMaturityFebruaryTwentyTwentyTwoMemberus-gaap:NotesPayableToBanksMember2020-06-300001616000xhr:CorporateCreditFacilitiesMemberus-gaap:EurodollarMember2020-06-302020-06-300001616000xhr:SeniorSecuredNotes300MDue2025Memberus-gaap:SecuredDebtMember2020-08-310001616000xhr:CorporateCreditFacilitiesMember2020-08-310001616000us-gaap:LineOfCreditMemberus-gaap:RevolvingCreditFacilityMember2020-10-310001616000us-gaap:LineOfCreditMemberus-gaap:RevolvingCreditFacilityMember2020-10-012020-10-310001616000xhr:CorporateCreditFacilitiesMember2020-10-300001616000xhr:TermLoan125MMaturitySeptemberTwentyTwentyFourMemberus-gaap:NotesPayableToBanksMember2021-05-012021-05-310001616000xhr:CorporateCreditFacilitiesMember2021-01-012021-04-300001616000srt:ScenarioForecastMemberxhr:CorporateCreditFacilitiesMember2021-05-012022-06-300001616000us-gaap:LineOfCreditMemberus-gaap:RevolvingCreditFacilityMember2021-01-012021-12-310001616000us-gaap:LineOfCreditMemberus-gaap:RevolvingCreditFacilityMember2020-01-012020-12-310001616000us-gaap:LineOfCreditMemberus-gaap:RevolvingCreditFacilityMember2019-01-012019-12-310001616000xhr:SeniorSecuredNotes500MDue2029Memberus-gaap:SecuredDebtMember2021-05-310001616000xhr:SeniorSecuredNotes500MDue2029Memberus-gaap:SecuredDebtMember2021-05-012021-05-310001616000xhr:LoanAmendmentsMember2021-01-012021-12-310001616000xhr:LoanAmendmentsMember2020-01-012020-12-310001616000xhr:LoanAmendmentsMemberus-gaap:GeneralAndAdministrativeExpenseMember2020-01-012020-12-310001616000us-gaap:InterestRateSwapMember2021-01-012021-12-310001616000us-gaap:InterestRateSwapMember2020-01-012020-12-310001616000xhr:MortgageDebtHedgedOneMemberus-gaap:InterestRateSwapMemberus-gaap:CashFlowHedgingMember2021-12-310001616000xhr:MortgageDebtHedgedOneMemberus-gaap:InterestRateSwapMemberus-gaap:CashFlowHedgingMember2020-12-310001616000xhr:MortgageDebtHedgedTwoMemberus-gaap:InterestRateSwapMemberus-gaap:CashFlowHedgingMember2021-12-310001616000xhr:MortgageDebtHedgedTwoMemberus-gaap:InterestRateSwapMemberus-gaap:CashFlowHedgingMember2020-12-310001616000xhr:MortgageDebtHedgedThreeMemberus-gaap:InterestRateSwapMemberus-gaap:CashFlowHedgingMember2021-12-310001616000xhr:MortgageDebtHedgedThreeMemberus-gaap:InterestRateSwapMemberus-gaap:CashFlowHedgingMember2020-12-310001616000us-gaap:InterestRateSwapMemberus-gaap:CashFlowHedgingMemberxhr:MortgageDebtHedgedFourMember2021-12-310001616000us-gaap:InterestRateSwapMemberus-gaap:CashFlowHedgingMemberxhr:MortgageDebtHedgedFourMember2020-12-310001616000xhr:MortgageDebtHedgedFiveMemberus-gaap:InterestRateSwapMemberus-gaap:CashFlowHedgingMember2021-12-310001616000xhr:MortgageDebtHedgedFiveMemberus-gaap:InterestRateSwapMemberus-gaap:CashFlowHedgingMember2020-12-310001616000us-gaap:InterestRateSwapMemberxhr:MortgageDebtHedgedSixMemberus-gaap:CashFlowHedgingMember2021-12-310001616000us-gaap:InterestRateSwapMemberxhr:MortgageDebtHedgedSixMemberus-gaap:CashFlowHedgingMember2020-12-310001616000us-gaap:InterestRateSwapMemberxhr:MortgageDebtHedgedSevenMemberus-gaap:CashFlowHedgingMember2021-12-310001616000us-gaap:InterestRateSwapMemberxhr:MortgageDebtHedgedSevenMemberus-gaap:CashFlowHedgingMember2020-12-310001616000xhr:MortgageDebtHedgedEightMemberus-gaap:InterestRateSwapMemberus-gaap:CashFlowHedgingMember2021-12-310001616000xhr:MortgageDebtHedgedEightMemberus-gaap:InterestRateSwapMemberus-gaap:CashFlowHedgingMember2020-12-310001616000us-gaap:InterestRateSwapMemberxhr:A125TermLoanHedgedOneMemberus-gaap:CashFlowHedgingMember2021-12-310001616000us-gaap:InterestRateSwapMemberxhr:A125TermLoanHedgedOneMemberus-gaap:CashFlowHedgingMember2020-12-310001616000xhr:A125TermLoanHedgedTwoMemberus-gaap:InterestRateSwapMemberus-gaap:CashFlowHedgingMember2021-12-310001616000xhr:A125TermLoanHedgedTwoMemberus-gaap:InterestRateSwapMemberus-gaap:CashFlowHedgingMember2020-12-310001616000us-gaap:InterestRateSwapMemberxhr:A125TermLoanHedgedThreeMemberus-gaap:CashFlowHedgingMember2021-12-310001616000us-gaap:InterestRateSwapMemberxhr:A125TermLoanHedgedThreeMemberus-gaap:CashFlowHedgingMember2020-12-310001616000us-gaap:InterestRateSwapMemberxhr:A125TermLoanHedgedFourMemberus-gaap:CashFlowHedgingMember2021-12-310001616000us-gaap:InterestRateSwapMemberxhr:A125TermLoanHedgedFourMemberus-gaap:CashFlowHedgingMember2020-12-310001616000us-gaap:InterestRateSwapMemberxhr:MortgageDebtHedgedNineMemberus-gaap:CashFlowHedgingMember2021-12-310001616000us-gaap:InterestRateSwapMemberxhr:MortgageDebtHedgedNineMemberus-gaap:CashFlowHedgingMember2020-12-310001616000us-gaap:InterestRateSwapMemberus-gaap:CashFlowHedgingMemberxhr:MortgageDebtHedgedTenMember2021-12-310001616000us-gaap:InterestRateSwapMemberus-gaap:CashFlowHedgingMemberxhr:MortgageDebtHedgedTenMember2020-12-310001616000us-gaap:InterestRateSwapMemberus-gaap:CashFlowHedgingMember2021-12-310001616000us-gaap:InterestRateSwapMemberus-gaap:CashFlowHedgingMember2020-12-310001616000us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:InterestRateSwapMember2021-12-310001616000us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Memberus-gaap:InterestRateSwapMember2021-12-310001616000us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:InterestRateSwapMember2020-12-310001616000us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Memberus-gaap:InterestRateSwapMember2020-12-310001616000us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsNonrecurringMember2021-12-310001616000us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsNonrecurringMember2021-12-310001616000us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsNonrecurringMember2020-12-310001616000us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsNonrecurringMember2020-12-310001616000us-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMemberxhr:MarriottCharlestonTownCenterCharlestonWVMember2021-12-3100016160002020-03-310001616000xhr:AndazSavannahSavannahGAMember2020-01-012020-03-310001616000xhr:BohemianHotelCelebrationanAutographCollectionHotelSavannahGAMember2020-01-012020-03-310001616000xhr:BohemianHotelCelebrationanAutographCollectionHotelSavannahGAMember2020-04-012020-06-300001616000us-gaap:CarryingReportedAmountFairValueDisclosureMember2021-12-310001616000us-gaap:EstimateOfFairValueFairValueDisclosureMember2021-12-310001616000us-gaap:CarryingReportedAmountFairValueDisclosureMember2020-12-310001616000us-gaap:EstimateOfFairValueFairValueDisclosureMember2020-12-310001616000us-gaap:MeasurementInputDiscountRateMemberus-gaap:FairValueInputsLevel2Member2021-12-310001616000us-gaap:MeasurementInputDiscountRateMemberus-gaap:FairValueInputsLevel2Member2020-12-310001616000us-gaap:DomesticCountryMember2021-12-310001616000us-gaap:DomesticCountryMember2020-12-310001616000us-gaap:StateAndLocalJurisdictionMember2021-12-310001616000us-gaap:StateAndLocalJurisdictionMember2020-12-310001616000xhr:RepurchaseProgramMember2021-12-310001616000xhr:TimeBasedLTIPUnitsandClassALTIPUnitsMember2021-01-012021-12-310001616000xhr:TimeBasedLTIPUnitsandClassALTIPUnitsMember2021-12-310001616000xhr:TimeBasedLTIPUnitsandClassALTIPUnitsMember2020-01-012020-12-310001616000xhr:TimeBasedLTIPUnitsandClassALTIPUnitsMember2020-12-310001616000xhr:XHRLPOperatingPartnershipMember2020-12-3100016160002020-05-012020-05-310001616000xhr:RestrictedStockUnitsRSUTimeBasedMember2019-02-012019-02-280001616000xhr:RestrictedStockUnitsRSUPerformanceBasedMember2019-02-012019-02-280001616000us-gaap:RestrictedStockUnitsRSUMember2019-02-012019-02-280001616000xhr:RestrictedStockUnitsRSUTimeBasedMember2020-03-012020-03-310001616000xhr:RestrictedStockUnitsRSUPerformanceBasedMember2020-03-012020-03-310001616000us-gaap:RestrictedStockUnitsRSUMember2020-03-012020-03-310001616000xhr:RestrictedStockUnitsRSUTimeBasedMember2020-06-012020-06-300001616000xhr:RestrictedStockUnitsRSUPerformanceBasedMember2020-06-012020-06-300001616000us-gaap:RestrictedStockUnitsRSUMember2020-06-012020-06-300001616000xhr:RestrictedStockUnitsRSUTimeBasedMember2020-12-012020-12-310001616000xhr:RestrictedStockUnitsRSUPerformanceBasedMember2020-12-012020-12-310001616000us-gaap:RestrictedStockUnitsRSUMember2020-12-012020-12-310001616000xhr:RestrictedStockUnitsRSUTimeBasedMember2021-03-012021-03-310001616000xhr:RestrictedStockUnitsRSUPerformanceBasedMember2021-03-012021-03-310001616000us-gaap:RestrictedStockUnitsRSUMember2021-03-012021-03-310001616000xhr:March2020Memberxhr:RestrictedStockUnitsRSUTimeBasedMemberus-gaap:ShareBasedCompensationAwardTrancheOneMember2021-01-012021-12-310001616000xhr:RestrictedStockUnitsRSUTimeBasedMemberxhr:February2018Memberus-gaap:ShareBasedCompensationAwardTrancheOneMember2021-01-012021-12-310001616000xhr:February2019Memberxhr:RestrictedStockUnitsRSUTimeBasedMemberus-gaap:ShareBasedCompensationAwardTrancheOneMember2021-01-012021-12-310001616000us-gaap:ShareBasedCompensationAwardTrancheTwoMemberxhr:March2020Memberxhr:RestrictedStockUnitsRSUTimeBasedMember2021-01-012021-12-310001616000xhr:February2019Memberus-gaap:ShareBasedCompensationAwardTrancheTwoMemberxhr:RestrictedStockUnitsRSUTimeBasedMember2021-01-012021-12-310001616000us-gaap:ShareBasedCompensationAwardTrancheTwoMemberxhr:RestrictedStockUnitsRSUTimeBasedMemberxhr:February2018Member2021-01-012021-12-310001616000us-gaap:ShareBasedCompensationAwardTrancheThreeMemberxhr:RestrictedStockUnitsRSUTimeBasedMemberxhr:February2018Member2021-01-012021-12-310001616000xhr:February2019Memberus-gaap:ShareBasedCompensationAwardTrancheThreeMemberxhr:RestrictedStockUnitsRSUTimeBasedMember2021-01-012021-12-310001616000us-gaap:ShareBasedCompensationAwardTrancheThreeMemberxhr:March2020Memberxhr:RestrictedStockUnitsRSUTimeBasedMember2021-01-012021-12-310001616000xhr:February2019Memberxhr:AbsoluteTSRRSUsMember2021-01-012021-12-310001616000xhr:AbsoluteTSRRSUsMemberxhr:February2018Member2021-01-012021-12-310001616000xhr:February2018Memberxhr:RelativeTSRRSUsMember2021-01-012021-12-310001616000xhr:February2019Memberxhr:RelativeTSRRSUsMember2021-01-012021-12-310001616000xhr:AbsoluteTSRRSUsMember2021-01-012021-12-310001616000xhr:RelativeTSRRSUsMember2021-01-012021-12-310001616000srt:DirectorMemberxhr:RestrictedStockUnitsRSUFullyVestedMember2021-05-012021-05-31xhr:director0001616000xhr:RestrictedStockUnitsRSUFullyVestedMember2021-05-012021-05-310001616000xhr:TimeBasedLTIPUnitsMember2021-12-310001616000xhr:TimeBasedLTIPUnitsMember2019-02-012019-02-280001616000xhr:ClassALTIPUnitsMember2019-02-012019-02-280001616000xhr:TimeBasedLTIPUnitsandClassALTIPUnitsMember2019-02-012019-02-280001616000xhr:TimeBasedLTIPUnitsMember2020-03-012020-03-310001616000xhr:ClassALTIPUnitsMember2020-03-012020-03-310001616000xhr:TimeBasedLTIPUnitsandClassALTIPUnitsMember2020-03-012020-03-310001616000xhr:TimeBasedLTIPUnitsMember2020-06-012020-06-300001616000xhr:ClassALTIPUnitsMember2020-06-012020-06-300001616000xhr:TimeBasedLTIPUnitsandClassALTIPUnitsMember2020-06-012020-06-300001616000xhr:TimeBasedLTIPUnitsMember2021-03-012021-03-310001616000xhr:ClassALTIPUnitsMember2021-03-012021-03-310001616000xhr:TimeBasedLTIPUnitsandClassALTIPUnitsMember2021-03-012021-03-310001616000xhr:February2018Memberxhr:TimeBasedLTIPUnitsMemberus-gaap:ShareBasedCompensationAwardTrancheOneMember2021-01-012021-12-310001616000xhr:February2019Memberxhr:TimeBasedLTIPUnitsMemberus-gaap:ShareBasedCompensationAwardTrancheOneMember2021-01-012021-12-310001616000xhr:March2020Memberxhr:TimeBasedLTIPUnitsMemberus-gaap:ShareBasedCompensationAwardTrancheOneMember2021-01-012021-12-310001616000us-gaap:ShareBasedCompensationAwardTrancheTwoMemberxhr:March2020Memberxhr:TimeBasedLTIPUnitsMember2021-01-012021-12-310001616000xhr:February2019Memberus-gaap:ShareBasedCompensationAwardTrancheTwoMemberxhr:TimeBasedLTIPUnitsMember2021-01-012021-12-310001616000us-gaap:ShareBasedCompensationAwardTrancheTwoMemberxhr:February2018Memberxhr:TimeBasedLTIPUnitsMember2021-01-012021-12-310001616000xhr:February2019Memberus-gaap:ShareBasedCompensationAwardTrancheThreeMemberxhr:TimeBasedLTIPUnitsMember2021-01-012021-12-310001616000us-gaap:ShareBasedCompensationAwardTrancheThreeMemberxhr:March2020Memberxhr:TimeBasedLTIPUnitsMember2021-01-012021-12-310001616000us-gaap:ShareBasedCompensationAwardTrancheThreeMemberxhr:February2018Memberxhr:TimeBasedLTIPUnitsMember2021-01-012021-12-310001616000xhr:AbsoluteTSRClassALTIPsMemberxhr:February2018Member2021-01-012021-12-310001616000xhr:February2019Memberxhr:AbsoluteTSRClassALTIPsMember2021-01-012021-12-310001616000xhr:February2018Memberxhr:RelativeTSRClassALTIPsMember2021-01-012021-12-310001616000xhr:February2019Memberxhr:RelativeTSRClassALTIPsMember2021-01-012021-12-310001616000srt:DirectorMemberxhr:FullyVestedLTIPUnitsMember2018-05-012018-05-310001616000srt:DirectorMemberxhr:FullyVestedLTIPUnitsMember2019-05-012019-05-310001616000srt:DirectorMemberxhr:FullyVestedLTIPUnitsMember2020-05-012020-05-310001616000srt:DirectorMemberxhr:FullyVestedLTIPUnitsMember2021-05-012021-05-310001616000xhr:ClassALTIPUnitsMember2021-01-012021-12-310001616000xhr:TwoThousandandFifteenIncentiveAwardPlanMemberus-gaap:RestrictedStockUnitsRSUMember2019-12-310001616000xhr:TimeBasedLTIPUnitsandClassALTIPUnitsMemberxhr:TwoThousandandFifteenIncentiveAwardPlanMember2019-12-310001616000xhr:TwoThousandandFifteenIncentiveAwardPlanMemberus-gaap:RestrictedStockUnitsRSUMember2020-01-012020-12-310001616000xhr:TimeBasedLTIPUnitsandClassALTIPUnitsMemberxhr:TwoThousandandFifteenIncentiveAwardPlanMember2020-01-012020-12-310001616000xhr:TwoThousandandFifteenIncentiveAwardPlanMemberus-gaap:RestrictedStockUnitsRSUMember2020-12-310001616000xhr:TimeBasedLTIPUnitsandClassALTIPUnitsMemberxhr:TwoThousandandFifteenIncentiveAwardPlanMember2020-12-310001616000xhr:TwoThousandandFifteenIncentiveAwardPlanMemberus-gaap:RestrictedStockUnitsRSUMember2021-01-012021-12-310001616000xhr:TimeBasedLTIPUnitsandClassALTIPUnitsMemberxhr:TwoThousandandFifteenIncentiveAwardPlanMember2021-01-012021-12-310001616000xhr:TwoThousandandFifteenIncentiveAwardPlanMemberus-gaap:RestrictedStockUnitsRSUMember2021-12-310001616000xhr:TimeBasedLTIPUnitsandClassALTIPUnitsMemberxhr:TwoThousandandFifteenIncentiveAwardPlanMember2021-12-310001616000xhr:AbsoluteTSRRSUsMember2019-02-192019-02-190001616000xhr:AbsoluteTSRRSUsMember2019-02-190001616000xhr:RelativeTSRRSUsMember2019-02-192019-02-190001616000xhr:RelativeTSRRSUsMember2019-02-190001616000xhr:AbsoluteTSRClassALTIPsMember2019-02-192019-02-190001616000xhr:AbsoluteTSRClassALTIPsMember2019-02-190001616000xhr:RelativeTSRClassALTIPsMember2019-02-192019-02-190001616000xhr:RelativeTSRClassALTIPsMember2019-02-190001616000xhr:AbsoluteTSRRestrictedStockUnitsTypeIMember2020-03-022020-03-020001616000xhr:AbsoluteTSRRestrictedStockUnitsTypeIMember2020-03-020001616000xhr:RelativeTSRRestrictedStockUnitsTypeIMember2020-03-022020-03-020001616000xhr:RelativeTSRRestrictedStockUnitsTypeIMember2020-03-020001616000xhr:AbsoluteTSRRestrictedStockUnitsTypeIIMember2020-03-022020-03-020001616000xhr:AbsoluteTSRRestrictedStockUnitsTypeIIMember2020-03-020001616000xhr:RelativeTSRRestrictedStockUnitsTypeIIMember2020-03-022020-03-020001616000xhr:RelativeTSRRestrictedStockUnitsTypeIIMember2020-03-020001616000xhr:AbsoluteTSRClassALTIPsMember2020-03-022020-03-020001616000xhr:AbsoluteTSRClassALTIPsMember2020-03-020001616000xhr:RelativeTSRClassALTIPsMember2020-03-022020-03-020001616000xhr:RelativeTSRClassALTIPsMember2020-03-020001616000xhr:AbsoluteTSRRSUsMember2021-03-012021-03-010001616000xhr:AbsoluteTSRRSUsMember2021-03-010001616000xhr:RelativeTSRRSUsMember2021-03-012021-03-010001616000xhr:RelativeTSRRSUsMember2021-03-010001616000xhr:AbsoluteTSRClassALTIPsMember2021-03-012021-03-010001616000xhr:AbsoluteTSRClassALTIPsMember2021-03-010001616000xhr:RelativeTSRClassALTIPsMember2021-03-012021-03-010001616000xhr:RelativeTSRClassALTIPsMember2021-03-010001616000xhr:ExecutiveOfficersandManagementMemberxhr:RestrictedStockUnitsAndLTIPUnitsMember2021-01-012021-12-310001616000srt:DirectorMemberxhr:FullyVestedLTIPUnitsMember2021-01-012021-12-310001616000srt:ManagementMemberus-gaap:RestrictedStockUnitsRSUMember2021-01-012021-12-310001616000xhr:ExecutiveOfficersandManagementMemberxhr:RestrictedStockUnitsAndLTIPUnitsMember2020-01-012020-12-310001616000srt:DirectorMemberxhr:FullyVestedLTIPUnitsMember2020-01-012020-12-310001616000srt:ManagementMemberus-gaap:RestrictedStockUnitsRSUMember2020-01-012020-12-310001616000xhr:ExecutiveOfficersandManagementMemberxhr:RestrictedStockUnitsAndLTIPUnitsMember2019-01-012019-12-310001616000srt:DirectorMemberxhr:FullyVestedLTIPUnitsMember2019-01-012019-12-310001616000srt:ManagementMemberus-gaap:RestrictedStockUnitsRSUMember2019-01-012019-12-310001616000srt:MinimumMemberxhr:HotelManagementAgreementBrandManagedHotelsMember2021-01-012021-12-310001616000srt:MaximumMemberxhr:HotelManagementAgreementBrandManagedHotelsMember2021-01-012021-12-310001616000srt:MinimumMemberxhr:HotelManagementAgreementBrandManagedHotelsMember2021-12-31xhr:renewal_period0001616000xhr:HotelManagementAgreementBrandManagedHotelsMember2021-01-012021-12-310001616000srt:MinimumMemberxhr:HotelManagementAgreementFranchisedHotelsMember2021-01-012021-12-310001616000xhr:HotelManagementAgreementFranchisedHotelsMembersrt:MaximumMember2021-01-012021-12-310001616000xhr:HotelManagementAgreementFranchisedHotelsMember2021-01-012021-12-310001616000xhr:FranchiseAgreementMembersrt:MinimumMember2021-01-012021-12-310001616000xhr:FranchiseAgreementMembersrt:MaximumMember2021-01-012021-12-310001616000xhr:FranchiseAgreementMember2021-01-012021-12-310001616000xhr:HotelFurnitureFixturesandEquipmentReservesMember2021-12-310001616000xhr:HotelFurnitureFixturesandEquipmentReservesMember2020-12-310001616000xhr:HotelPropertyRenovationThirdPartyMember2021-12-310001616000xhr:KimptonHotelMonacoChicagoILMember2021-01-142021-01-140001616000us-gaap:MortgagesMemberus-gaap:SubsequentEventMemberxhr:RitzCarltonPentagonCityArlingtonVirginiaMember2022-01-012022-01-310001616000us-gaap:SubsequentEventMemberus-gaap:InterestRateSwapMember2022-01-31xhr:interest_rate0001616000us-gaap:SubsequentEventMemberus-gaap:InterestRateSwapMember2022-01-012022-01-310001616000us-gaap:SubsequentEventMemberxhr:MarriottWHotelNashvilleTNMember2022-02-280001616000srt:HotelMemberxhr:AndazNapaValleyNapaCAMember2021-12-310001616000srt:HotelMemberxhr:AndazNapaValleyNapaCAMembersrt:MinimumMember2021-01-012021-12-310001616000srt:HotelMemberxhr:AndazNapaValleyNapaCAMembersrt:MaximumMember2021-01-012021-12-310001616000srt:HotelMemberxhr:AndazSanDiegoSanDiegoCAMember2021-12-310001616000srt:HotelMemberxhr:AndazSanDiegoSanDiegoCAMembersrt:MinimumMember2021-01-012021-12-310001616000srt:HotelMemberxhr:AndazSanDiegoSanDiegoCAMembersrt:MaximumMember2021-01-012021-12-310001616000srt:HotelMemberxhr:AndazSavannahSavannahGAMember2021-12-310001616000srt:HotelMemberxhr:AndazSavannahSavannahGAMembersrt:MinimumMember2021-01-012021-12-310001616000srt:HotelMemberxhr:AndazSavannahSavannahGAMembersrt:MaximumMember2021-01-012021-12-310001616000srt:HotelMemberxhr:BohemianHotelCelebrationanAutographCollectionHotelCelebrationFLMember2021-12-310001616000srt:HotelMembersrt:MinimumMemberxhr:BohemianHotelCelebrationanAutographCollectionHotelCelebrationFLMember2021-01-012021-12-310001616000srt:HotelMemberxhr:BohemianHotelCelebrationanAutographCollectionHotelCelebrationFLMembersrt:MaximumMember2021-01-012021-12-310001616000srt:HotelMemberxhr:BohemianHotelCelebrationanAutographCollectionHotelSavannahGAMember2021-12-310001616000srt:HotelMemberxhr:BohemianHotelCelebrationanAutographCollectionHotelSavannahGAMembersrt:MinimumMember2021-01-012021-12-310001616000srt:HotelMemberxhr:BohemianHotelCelebrationanAutographCollectionHotelSavannahGAMembersrt:MaximumMember2021-01-012021-12-310001616000srt:HotelMemberxhr:BuckheadAtlantaRestaurantAtlantaGAMember2021-12-310001616000srt:HotelMemberxhr:BuckheadAtlantaRestaurantAtlantaGAMembersrt:MinimumMember2021-01-012021-12-310001616000srt:HotelMemberxhr:BuckheadAtlantaRestaurantAtlantaGAMembersrt:MaximumMember2021-01-012021-12-310001616000srt:HotelMemberxhr:FairmontDallasDallasTXMember2021-12-310001616000srt:HotelMemberxhr:FairmontDallasDallasTXMembersrt:MinimumMember2021-01-012021-12-310001616000srt:HotelMemberxhr:FairmontDallasDallasTXMembersrt:MaximumMember2021-01-012021-12-310001616000srt:HotelMemberxhr:FairmontPittsburghPennsylvaniaMember2021-12-310001616000srt:HotelMemberxhr:FairmontPittsburghPennsylvaniaMembersrt:MinimumMember2021-01-012021-12-310001616000srt:HotelMemberxhr:FairmontPittsburghPennsylvaniaMembersrt:MaximumMember2021-01-012021-12-310001616000xhr:GrandBohemianHotelCharlestonMembersrt:HotelMember2021-12-310001616000xhr:GrandBohemianHotelCharlestonMembersrt:HotelMembersrt:MinimumMember2021-01-012021-12-310001616000xhr:GrandBohemianHotelCharlestonMembersrt:HotelMembersrt:MaximumMember2021-01-012021-12-310001616000srt:HotelMemberxhr:GrandBohemianMountainHotelBrookMember2021-12-310001616000srt:HotelMembersrt:MinimumMemberxhr:GrandBohemianMountainHotelBrookMember2021-01-012021-12-310001616000srt:HotelMembersrt:MaximumMemberxhr:GrandBohemianMountainHotelBrookMember2021-01-012021-12-310001616000srt:HotelMemberxhr:GrandBohemianHotelOrlandoanAutographCollectionHotelOrlandoFLMember2021-12-310001616000srt:HotelMemberxhr:GrandBohemianHotelOrlandoanAutographCollectionHotelOrlandoFLMembersrt:MinimumMember2021-01-012021-12-310001616000srt:HotelMemberxhr:GrandBohemianHotelOrlandoanAutographCollectionHotelOrlandoFLMembersrt:MaximumMember2021-01-012021-12-310001616000srt:HotelMemberxhr:HyattKeyWestResortSpaKeyWestFLMember2021-12-310001616000srt:HotelMemberxhr:HyattKeyWestResortSpaKeyWestFLMembersrt:MinimumMember2021-01-012021-12-310001616000srt:HotelMemberxhr:HyattKeyWestResortSpaKeyWestFLMembersrt:MaximumMember2021-01-012021-12-310001616000xhr:HyattRegencyGrandCypressMembersrt:HotelMember2021-12-310001616000xhr:HyattRegencyGrandCypressMembersrt:HotelMembersrt:MinimumMember2021-01-012021-12-310001616000xhr:HyattRegencyGrandCypressMembersrt:HotelMembersrt:MaximumMember2021-01-012021-12-310001616000srt:HotelMemberxhr:HyattRegencyPortlandOregonConventionCenterMember2021-12-310001616000srt:HotelMemberxhr:HyattRegencyPortlandOregonConventionCenterMembersrt:MinimumMember2021-01-012021-12-310001616000srt:HotelMemberxhr:HyattRegencyPortlandOregonConventionCenterMembersrt:MaximumMember2021-01-012021-12-310001616000xhr:HyattRegencySantaClaraSantaClaraCAMembersrt:HotelMember2021-12-310001616000xhr:HyattRegencySantaClaraSantaClaraCAMembersrt:HotelMembersrt:MinimumMember2021-01-012021-12-310001616000xhr:HyattRegencySantaClaraSantaClaraCAMembersrt:HotelMembersrt:MaximumMember2021-01-012021-12-310001616000srt:HotelMemberxhr:HyattRegencyScottsdaleResortAndSpaGaineyRanchAZMember2021-12-310001616000srt:HotelMemberxhr:HyattRegencyScottsdaleResortAndSpaGaineyRanchAZMembersrt:MinimumMember2021-01-012021-12-310001616000srt:HotelMemberxhr:HyattRegencyScottsdaleResortAndSpaGaineyRanchAZMembersrt:MaximumMember2021-01-012021-12-310001616000xhr:KeyWestBottlingCourtRetailCenterKeyWestFLMembersrt:HotelMember2021-12-310001616000xhr:KeyWestBottlingCourtRetailCenterKeyWestFLMembersrt:HotelMembersrt:MinimumMember2021-01-012021-12-310001616000xhr:KeyWestBottlingCourtRetailCenterKeyWestFLMembersrt:HotelMembersrt:MaximumMember2021-01-012021-12-310001616000srt:HotelMemberxhr:KimptonCanarySantaBarbaraCAHotelMember2021-12-310001616000srt:HotelMemberxhr:KimptonCanarySantaBarbaraCAHotelMembersrt:MinimumMember2021-01-012021-12-310001616000srt:HotelMemberxhr:KimptonCanarySantaBarbaraCAHotelMembersrt:MaximumMember2021-01-012021-12-310001616000srt:HotelMemberxhr:KimptonHotelMonacoDenverCOMember2021-12-310001616000srt:HotelMemberxhr:KimptonHotelMonacoDenverCOMembersrt:MinimumMember2021-01-012021-12-310001616000srt:HotelMemberxhr:KimptonHotelMonacoDenverCOMembersrt:MaximumMember2021-01-012021-12-310001616000xhr:KimptonHotelMonacoSaltLakeCityUTMembersrt:HotelMember2021-12-310001616000xhr:KimptonHotelMonacoSaltLakeCityUTMembersrt:HotelMembersrt:MinimumMember2021-01-012021-12-310001616000xhr:KimptonHotelMonacoSaltLakeCityUTMembersrt:HotelMembersrt:MaximumMember2021-01-012021-12-310001616000srt:HotelMemberxhr:KimptonHotelPalomarPhiladelphiaPAMember2021-12-310001616000srt:HotelMembersrt:MinimumMemberxhr:KimptonHotelPalomarPhiladelphiaPAMember2021-01-012021-12-310001616000srt:HotelMemberxhr:KimptonHotelPalomarPhiladelphiaPAMembersrt:MaximumMember2021-01-012021-12-310001616000srt:HotelMemberxhr:KimptonLorienHotelAndSpaAlexandriaVAMember2021-12-310001616000srt:HotelMemberxhr:KimptonLorienHotelAndSpaAlexandriaVAMembersrt:MinimumMember2021-01-012021-12-310001616000srt:HotelMemberxhr:KimptonLorienHotelAndSpaAlexandriaVAMembersrt:MaximumMember2021-01-012021-12-310001616000srt:HotelMemberxhr:KimptonRiverPlaceHotelPortlandORMember2021-12-310001616000srt:HotelMemberxhr:KimptonRiverPlaceHotelPortlandORMembersrt:MinimumMember2021-01-012021-12-310001616000srt:HotelMemberxhr:KimptonRiverPlaceHotelPortlandORMembersrt:MaximumMember2021-01-012021-12-310001616000srt:HotelMemberxhr:LoewsNewOrleansNewOrleansLAMember2021-12-310001616000srt:HotelMembersrt:MinimumMemberxhr:LoewsNewOrleansNewOrleansLAMember2021-01-012021-12-310001616000srt:HotelMembersrt:MaximumMemberxhr:LoewsNewOrleansNewOrleansLAMember2021-01-012021-12-310001616000srt:HotelMemberxhr:MarriottDallasCityCenterDallasTXMember2021-12-310001616000srt:HotelMemberxhr:MarriottDallasCityCenterDallasTXMembersrt:MinimumMember2021-01-012021-12-310001616000srt:HotelMemberxhr:MarriottDallasCityCenterDallasTXMembersrt:MaximumMember2021-01-012021-12-310001616000srt:HotelMemberxhr:MarriottSanFranciscoAirportWaterfrontSanFranciscoCAMember2021-12-310001616000srt:HotelMemberxhr:MarriottSanFranciscoAirportWaterfrontSanFranciscoCAMembersrt:MinimumMember2021-01-012021-12-310001616000srt:HotelMemberxhr:MarriottSanFranciscoAirportWaterfrontSanFranciscoCAMembersrt:MaximumMember2021-01-012021-12-310001616000srt:HotelMemberxhr:MarriottWoodlandsWaterwayHotelConventionCenterWoodlandsTXMember2021-12-310001616000srt:HotelMemberxhr:MarriottWoodlandsWaterwayHotelConventionCenterWoodlandsTXMembersrt:MinimumMember2021-01-012021-12-310001616000srt:HotelMemberxhr:MarriottWoodlandsWaterwayHotelConventionCenterWoodlandsTXMembersrt:MaximumMember2021-01-012021-12-310001616000srt:HotelMemberxhr:ParkHyattAviaraResortGolfClubAndSpaMember2021-12-310001616000srt:HotelMembersrt:MinimumMemberxhr:ParkHyattAviaraResortGolfClubAndSpaMember2021-01-012021-12-310001616000srt:HotelMemberxhr:ParkHyattAviaraResortGolfClubAndSpaMembersrt:MaximumMember2021-01-012021-12-310001616000srt:HotelMemberxhr:RenaissanceAtlantaWaverlyHotelConventionCenterAtlantaGAMember2021-12-310001616000srt:HotelMemberxhr:RenaissanceAtlantaWaverlyHotelConventionCenterAtlantaGAMembersrt:MinimumMember2021-01-012021-12-310001616000srt:HotelMemberxhr:RenaissanceAtlantaWaverlyHotelConventionCenterAtlantaGAMembersrt:MaximumMember2021-01-012021-12-310001616000srt:HotelMemberxhr:RoyalPalmsResortAndSpaHyattUnboundCollectionMember2021-12-310001616000srt:HotelMemberxhr:RoyalPalmsResortAndSpaHyattUnboundCollectionMembersrt:MinimumMember2021-01-012021-12-310001616000srt:HotelMemberxhr:RoyalPalmsResortAndSpaHyattUnboundCollectionMembersrt:MaximumMember2021-01-012021-12-310001616000srt:HotelMemberxhr:RitzCarltonDenverColoradoMember2021-12-310001616000srt:HotelMemberxhr:RitzCarltonDenverColoradoMembersrt:MinimumMember2021-01-012021-12-310001616000srt:HotelMemberxhr:RitzCarltonDenverColoradoMembersrt:MaximumMember2021-01-012021-12-310001616000srt:HotelMemberxhr:RitzCarltonPentagonCityArlingtonVirginiaMember2021-12-310001616000srt:HotelMemberxhr:RitzCarltonPentagonCityArlingtonVirginiaMembersrt:MinimumMember2021-01-012021-12-310001616000srt:HotelMemberxhr:RitzCarltonPentagonCityArlingtonVirginiaMembersrt:MaximumMember2021-01-012021-12-310001616000srt:HotelMemberxhr:WaldorfAstoriaAtlantaBuckheadMember2021-12-310001616000srt:HotelMemberxhr:WaldorfAstoriaAtlantaBuckheadMembersrt:MinimumMember2021-01-012021-12-310001616000srt:HotelMemberxhr:WaldorfAstoriaAtlantaBuckheadMembersrt:MaximumMember2021-01-012021-12-310001616000srt:HotelMemberxhr:WestinGalleriaHoustonHoustonTXMember2021-12-310001616000srt:HotelMemberxhr:WestinGalleriaHoustonHoustonTXMembersrt:MinimumMember2021-01-012021-12-310001616000srt:HotelMemberxhr:WestinGalleriaHoustonHoustonTXMembersrt:MaximumMember2021-01-012021-12-310001616000srt:HotelMemberxhr:WestinOaksHoustonattheGalleriaHoustonTXMember2021-12-310001616000srt:HotelMemberxhr:WestinOaksHoustonattheGalleriaHoustonTXMembersrt:MinimumMember2021-01-012021-12-310001616000srt:HotelMemberxhr:WestinOaksHoustonattheGalleriaHoustonTXMembersrt:MaximumMember2021-01-012021-12-310001616000srt:HotelMember2021-12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

☑ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2021

or

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period ended _____ to _____

Commission file number 001-36594

___________________________________

Xenia Hotels & Resorts, Inc.

(Exact name of registrant as specified in its charter)

___________________________________

| | | | | | | | |

| | |

Maryland | | 20-0141677 |

(State of Incorporation) | | (I.R.S. Employer Identification No.) |

| | |

200 S. Orange Avenue | | |

Suite 2700, Orlando, Florida | | 32801 |

(Address of Principal Executive Offices) | | (Zip Code) |

Registrant’s telephone number, including area code: (407) 246-8100

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

Title of each class | | Trading Symbol | | Name of each exchange on which registered |

Common Stock, $0.01 par value per share | | XHR | | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. ☑ Yes ☐ No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. ☐ Yes ☑ No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to the filing requirements for the past 90 days. ☑ Yes ☐ No

Indicate by check mark whether the Registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). ☑ Yes ☐ No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer”, “smaller reporting company”, and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | | | | | | | |

Large accelerated filer | ☑ | | | Accelerated filer | ☐ |

| Non-accelerated filer | ☐ | | | Smaller reporting company | ☐ |

| | | | Emerging growth company | ☐ |

| If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. | ☐ |

| Indicate by check mark whether the registrant has filed a report on and attestation to its management's assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. | ☑ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). ☐ Yes ☑ No

The aggregate market value of the 113,128,642 shares of common stock held by non-affiliates of the registrant was approximately $2.12 billion based on the closing price of the New York Stock Exchange for such common stock as of June 30, 2021.

As of February 28, 2022, there were 114,320,592 shares of the registrant's common stock, $0.01 par value per share, outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

The registrant incorporates by reference portions of its Definitive Proxy Statement for the 2022 Annual Meeting of Stockholders, which is expected to be held on May 17, 2022, into Part III of this Form 10-K to the extent stated herein.

XENIA HOTELS & RESORTS, INC.

2021 FORM 10-K ANNUAL REPORT

| | | | | | | | | | | | | | |

Item No. | | Part I | | Page |

| | Special Note Regarding Forward-Looking Statements | | |

| | Market and Industry Data | | |

| | Trademarks, Service Marks, and Tradenames | | |

| | Disclaimer | | |

| | Certain Defined Terms | | |

Item 1. | | Business | | |

Item 1A. | | Risk Factors | | |

Item 1B. | | Unresolved Staff Comments | | |

Item 2. | | Properties | | |

Item 3. | | Legal Proceedings | | |

Item 4. | | Mine Safety Disclosures | | |

| | | | |

| | Part II | | |

Item 5. | | Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities | | |

Item 6. | | [Reserved] | | |

Item 7. | | Management's Discussion and Analysis of Financial Condition and Results of Operations | | |

Item 7A. | | Quantitative and Qualitative Disclosures About Market Risk | | |

Item 8. | | Financial Statements and Supplementary Data | | |

Item 9. | | Changes in and Disagreements with Accountants on Accounting and Financial Disclosure | | |

Item 9A. | | Controls and Procedures | | |

Item 9B. | | Other Information | | |

| | | | |

| | Part III | | |

Item 10. | | Directors, Executive Officers and Corporate Governance | | |

Item 11. | | Executive Compensation | | |

Item 12. | | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | | |

Item 13. | | Certain Relationships and Related Transactions | | |

Item 14. | | Principal Accounting Fees and Services | | |

| | | | |

| | Part IV | | |

| Item 15. | | Exhibits and Financial Statements Schedules | | |

Item 16. | | Form 10-K Summary | | |

| | Signatures | | |

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

Certain statements in this Annual Report on Form 10-K ("Annual Report"), other than purely historical information, are "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933, as amended, (the "Securities Act") and Section 21E of the Securities Exchange Act of 1934, as amended (the "Exchange Act"). These statements include statements about Xenia Hotels & Resorts, Inc.’s ("Xenia") plans, objectives, strategies, financial performance and outlook, trends, the short- and longer-term effects of the COVID-19 pandemic, the amount and timing of future cash distributions, prospects or future events and involve known and unknown risks that are difficult to predict. As a result, our actual financial results, performance, achievements or prospects may differ materially from those expressed or implied by these forward-looking statements. In some cases, you can identify forward-looking statements by the use of words such as "may," "could," "expect," "intend," "plan," "seek," "anticipate," "believe," "estimate," "guidance," "predict," "potential," "continue," "likely," "will," "would," "illustrative" and variations of these terms and similar expressions, or the negative of these terms or similar expressions. Such forward-looking statements are necessarily based upon estimates and assumptions that, while considered reasonable by Xenia and its management based on their knowledge and understanding of the business and industry, are inherently uncertain. These statements are not guarantees of future performance, and stockholders should not place undue reliance on forward-looking statements. There are a number of risks, uncertainties and other important factors, many of which are beyond our control, that could cause our actual results to differ materially from the forward-looking statements contained in this Annual Report. Such risks, uncertainties and other important factors, include, among others, the risks, uncertainties and factors set forth under "Part I-Item 1A. Risk Factors" and "Part II-Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations," and the risks and uncertainties related to the following:

•the short- and longer-term effects of the COVID-19 pandemic and variants of COVID-19, including decreased demand for travel, transient and group business, and levels of consumer confidence;

•actions that governments, businesses, and individuals take in response to the COVID-19 pandemic and variants of COVID-19, including limiting or banning travel, limiting the number of attendees at events, and social distancing requirements;

•the impact of and actions taken in response to the COVID-19 pandemic and variants of COVID-19 or any future resurgence on global and regional economies, travel, and economic activity, including the duration and magnitude of its impact on unemployment rates and consumer discretionary spending;

•the ability of third-party managers or other partners to successfully navigate the impacts of the COVID-19 pandemic or variants of COVID-19, including the ability to provide adequate staffing levels required to effectively operate our hotels and meet customer needs;

•the impact of supply chain disruptions on our ability to source furniture, fixtures, and equipment required to comply with brand standards and guest expectations and the ability of our third-party managers to source supplies and other items required for operations;

•the pace of economic and travel industry recovery following the COVID-19 pandemic and variants of COVID-19;

•our ability to successfully negotiate amendments and covenant waivers under our secured and unsecured indebtedness;

•our ability to comply with contractual covenants;

•business, financial and operating risks inherent to real estate investments and the lodging industry;

•seasonal and cyclical volatility in the lodging industry;

•adverse changes in specialized industries, such as the energy, technology and/or tourism industries, that result in a sustained downturn of related businesses and corporate spending that may negatively impact our revenues and results of operations;

•macroeconomic and other factors beyond our control that can adversely affect and reduce demand for hotel rooms, food and beverage services, and/or meeting facilities;

•contraction in the U.S. or global economy or low levels of economic growth;

•inflation which increases our labor and other costs of providing services to guests and meeting hotel brand standards, as well as costs related to construction and other capital expenditures, property and other taxes, and insurance which could result in reduced operating profit margins;

•levels of spending in transient or group business and leisure segments as well as consumer confidence;

•declines in occupancy ("OCC") and average daily rate ("ADR");

•decreased business travel for in-person meetings due to technological advancements in virtual meetings and/or changes in guest and consumer preferences, including consideration of the impact of travel on the environment;

•fluctuations in the supply of hotels due to hotel construction and/or renovation and expansion of existing hotels and demand for hotel rooms;

•changes in the competitive environment in the lodging industry, including due to consolidation of management companies, franchisors, and online travel agencies and changes in the markets where we own hotels;

•events beyond our control, such as war, terrorist or cyber-attacks, mass casualty events, government shutdowns and closures, travel-related health concerns, and natural disasters;

•cyber incidents and information technology failures, including unauthorized access to our computer systems and/or our vendors' computer systems, and our third-party management companies' or franchisors' computer systems and/or their vendors' computer systems;

•our inability to directly operate our properties and reliance on third-party hotel management companies to operate and manage our hotels;

•our ability to maintain good relationships with our third-party hotel management companies and franchisors;

•our failure to maintain and/or comply with required brand operating standards;

•our ability to maintain our brand licenses at our hotels;

•relationships with labor unions and changes in labor laws, including increases to minimum wages;

•retention and attraction of our senior management team or key personnel;

•our ability to identify and consummate additional acquisitions and dispositions of hotels;

•our ability to integrate and successfully operate any hotel properties that we acquire in the future and the risks associated with these hotel properties;

•the impact of hotel renovations, repositionings, redevelopments and re-branding activities;

•our ability to access capital for renovations, acquisitions and general operating needs on terms and at times that are acceptable to us;

•the fixed cost nature of hotel ownership;

•our ability to service, restructure or refinance our debt;

•changes in interest rates and operating costs, including labor and service related costs;

•compliance with regulatory regimes and local laws;

•uninsured or underinsured losses, including those relating to natural disasters, civil unrest, terrorism or cyber-attacks and the physical effects of climate change;

•changes in distribution channels, such as through internet travel intermediaries or websites that facilitate the short-term rental of homes and apartments from owners;

•the amount of debt that we currently have or may incur in the future;

•provisions in our debt agreements that may restrict the operation of our business;

•our organizational and governance structure;

•our status as a real estate investment trust ("REIT");

•our taxable REIT subsidiary ("TRS") lessee structure;

•the cost of compliance with and liabilities under environmental, health and safety laws;

•adverse litigation judgments or settlements;

•changes in real estate and zoning laws;

•increases in real property tax valuations or rates;

•increases in insurance costs or other fixed costs;

•changes in federal, state or local tax law, including legislative, administrative, regulatory or other actions affecting REITs;

•changes in governmental regulations or interpretations thereof; and

•estimates relating to our ability to make distributions to our stockholders in the future.

These factors are not necessarily all of the important factors that could cause our actual financial results, performance, achievements or prospects to differ materially from those expressed in or implied by any of our forward-looking statements. Other unknown or unpredictable factors also could harm our results. All forward-looking statements attributable to us or persons acting on our behalf are expressly qualified in their entirety by the cautionary statements set forth above. Forward-looking statements speak only as of the date they are made, and we do not undertake or assume any obligation to update publicly any of these forward-looking statements to reflect actual results, new information or future events, changes in assumptions or changes in other factors affecting forward-looking statements, except to the extent required by applicable laws. If we update one or more forward-looking statements, no inference should be drawn that we will make additional updates with respect to those or other forward-looking statements.

The "Company," "Xenia," "we," "our" or "us" means Xenia Hotels & Resorts, Inc. and one or more of its subsidiaries (including XHR LP (the "Operating Partnership") and XHR Holding, Inc. (together with its wholly-owned subsidiaries, "XHR Holding")), or, as the context may require, Xenia Hotels & Resorts, Inc. only, the Operating Partnership only or XHR Holding only.

MARKET AND INDUSTRY DATA

The market data and certain other statistical information used throughout this Annual Report are based on independent industry publications, government publications or other published independent sources. These sources generally state that the information they provide has been obtained from sources believed to be reliable, but that the accuracy and completeness of the information are not guaranteed. The forecasts and projections are based on industry surveys and the preparers’ experience in the industry, and there is no assurance that any of the projected amounts will be achieved. We believe that the surveys and market research others have performed are reliable, but we have not independently verified this information. STR Inc. ("STR") is the primary source for third-party market data and industry statistics and forecasts. STR does not guarantee the performance of any company about which it collects and provides data. The reproduction of STR’s data without their written permission is strictly prohibited. Nothing in the STR data should be construed as advice. Some data is also based on our good faith estimates.

TRADEMARKS, SERVICE MARKS AND TRADENAMES

Xenia Hotels & Resorts® and related trademarks, trade names and service marks of Xenia appearing in this Annual Report are the property of Xenia. Unless otherwise noted, all other trademarks, trade names or service marks appearing in this Annual Report are the property of their respective owners, including Marriott International, Inc., Hyatt Corporation, Kimpton Hotel & Restaurant Group, LLC, Fairmont Hotels & Resorts, Loews Hotels, Inc., and Hilton Worldwide Inc. or their respective parents, subsidiaries or affiliates ("Brand Companies"). In the event that any of our management agreements or franchise agreements with the Brand Companies are terminated for any reason, the use of all applicable trademarks and service marks owned by the Brand Companies will cease at the hotel where the management agreement or franchise agreement was terminated; all signs and materials bearing the marks and other indicia connecting the hotel to the Brand Companies will be removed at our expense.

DISCLAIMER

None of the Brand Companies or their respective directors, officers, agents or employees are issuers of the shares described herein or had responsibility for the creation or contents of this Annual Report. None of the Brand Companies or their respective

directors, officers, agents or employees make any representation or warranty as to the accuracy, adequacy or completeness of any of the following information, including any financial information and any projections of future performance. The Brand Companies do not have an exclusive relationship with us and will continue to be engaged in other business ventures, including the acquisition, development, construction, ownership or operation of lodging, residential and vacation ownership properties, which are or may become competitive with the properties held by us.

CERTAIN DEFINED TERMS

Except where the context suggests otherwise, we define certain terms in this Annual Report as follows:

•"ADR" or "average daily rate" means rooms revenues divided by total number of rooms sold in a given period;

•"occupancy" means the total number of rooms sold in a given period divided by the total number of rooms available, regardless of operational status, at a hotel or group of hotels;

•"RevPAR" or "revenue per available room" means rooms revenues divided by room nights available, regardless of operational status, in a given period, and does not include non-rooms revenues such as food and beverage revenues or other operating revenues;

•"Top 25 lodging markets" refers to the top 25 U.S. lodging markets as defined by STR;

•an "upper upscale" hotel refers to an upper upscale hotel as defined by STR;

•a "luxury" hotel refers to a luxury hotel as defined by STR;

•"Fairmont," "Hilton," "Hyatt," "Kimpton," "Loews," and "Marriott" mean Fairmont Hotels & Resorts, Hilton Worldwide Inc., Hyatt Corporation, Kimpton Hotel & Restaurant Group, LLC, Loews Hotels, Inc. and Marriott International, Inc., respectively, as well as their respective parents, subsidiaries or affiliates.

PART I

Item 1. Business

General

Xenia Hotels & Resorts, Inc. is a Maryland corporation that primarily invests in uniquely positioned luxury and upper upscale hotels and resorts with a focus on the Top 25 lodging markets as well as key leisure destinations in the United States ("U.S.").

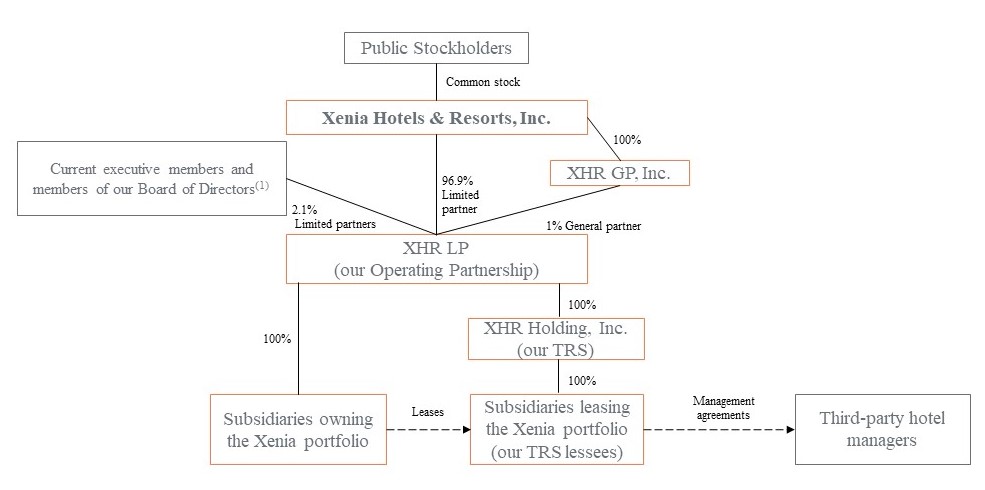

Substantially all of the Company's assets are held by, and all the operations are conducted through XHR LP (the "Operating Partnership"). XHR GP, Inc. is the sole general partner of the Operating Partnership and is wholly-owned by the Company. As of December 31, 2021, the Company collectively owned 97.9% of the common limited partnership units issued by the Operating Partnership ("Operating Partnership Units"). The remaining 2.1% of the Operating Partnership Units are owned by the other limited partners comprised of certain of our current executive officers and members of our Board of Directors and includes vested and unvested long-term incentive plan ("LTIP") partnership units. LTIP partnership units may or may not vest based on the passage of time and meeting certain market-based performance objectives.

Xenia operates as a real estate investment trust ("REIT") for U.S. federal income tax purposes. To qualify as a REIT, the Company cannot operate or manage its hotels. Therefore, the Operating Partnership and its subsidiaries lease the hotel properties to XHR Holding, Inc. and its subsidiaries (collectively with its subsidiaries, "XHR Holding"), the Company's taxable REIT subsidiary ("TRS"), which engages third-party eligible independent contractors to manage the hotels. The third-party hotel operators manage each hotel pursuant to a management agreement, the terms of which are discussed in more detail under "Part I-Item 2. Properties - Our Principal Agreements."

The Company's consolidated financial statements include the accounts of the Company, the Operating Partnership, and XHR Holding and each of their wholly-owned subsidiaries. The Company's subsidiaries generally consist of limited liability companies ("LLCs"), limited partnerships ("LPs") and our TRS. The effects of all inter-company transactions are eliminated.

As of December 31, 2021, the Company owned 34 lodging properties with a total of 9,659 rooms.

The Company’s principal executive offices are located at 200 S. Orange Avenue, Suite 2700, Orlando, Florida, 32801, and our telephone number is (407) 246-8100. The Company’s website is www.xeniareit.com. The information contained on our website, or that can be accessed through our website, neither constitutes part of this Annual Report on Form 10-K nor is incorporated by reference herein.

The following chart shows our structure as of December 31, 2021:

(1)Ownership percentages include vested and unvested LTIP partnership units which may or may not vest based on the passage of time and meeting certain market-based performance objectives.

Impact of COVID-19 on our Business

The onset and global spread of the COVID-19 pandemic led federal, state and local governments in the United States to impose measures intended to control its spread, including restrictions on freedom of movement and business operations such as travel bans, border closings, business closures, school closures, quarantines, shelter-in-place orders and social distancing requirements, and also to implement phased, multi-step policies of re-opening regions of the country. The effects of the COVID-19 pandemic on the hotel industry have been significant and unprecedented with global demand for lodging drastically reduced and occupancy levels reaching historic lows in 2020 and continuing into 2021. As a result of the COVID-19 pandemic, the majority of our hotels and resorts temporarily suspended operations for certain periods of time during 2020. All of our lodging properties had resumed operations by the end of May 2021.

Leisure demand gradually improved during the second half of 2020, a trend that accelerated during the first seven months of 2021. We also began to see increasing levels of demand for both business transient and group business during the second quarter and into July 2021. In August and September 2021, however, we began to experience a softening in demand due to the impact of the Delta variant and a seasonal decline in leisure demand. Occupancy rebounded in October and November 2021 before declining again in December 2021 as COVID-19 case counts, positivity ratios and hospitalizations began to increase in many parts of the U.S. Additionally, many companies delayed their office re-openings and return to work timelines and, during the fourth quarter, we began to experience group business cancellations for meetings held in early 2022. We have estimated the impact of these cancellations, net of cancellation and attrition revenue and events that have been rebooked, to be approximately $5.0 million. There remains significant uncertainty regarding the pace of recovery and whether and when business travel and larger group meetings will return to pre-pandemic levels. We may be impacted by, among other things, the distribution and acceptance of COVID-19 vaccines and boosters, breakthrough cases, and new variants of COVID-19, as well as the ongoing local and national response to the virus including indoor mask mandates, group size limitations and other restrictions. As the recovery continues, we expect that the pace will vary from market to market and may be uneven in nature.

Business Objectives and Growth Strategies

As a result of the COVID-19 pandemic and the ongoing recovery, it was necessary during 2021 to continue to focus primarily on our balance sheet flexibility and liquidity and on the safe and efficient operation of our properties.

In May 2021, we issued $500 million of 4.875% Senior Notes due in 2029 and used the net proceeds to repay in full the borrowings under our revolving credit facility, prepay in full our corporate credit facility term loan maturing in August 2023 and repay the mortgage loan collateralized by Kimpton Hotel Palomar Philadelphia. As of December 31, 2021, we do not have any debt maturities until 2024.

We also worked with our lenders to complete amendments to our revolving credit facility and our one remaining corporate credit facility term loan. These amendments have provided flexibility as we move through the pandemic toward eventual recovery, however, as further described in this Annual Report, they also resulted in certain restrictions during the covenant waiver period.

We continued to be prudent with the use of our cash liquidity through capital expenditures below our historical averages prior to the onset of COVID-19 and continued suspension of our dividend through 2021.

Looking Forward

Over the long-term, we intend to turn our focus back to our primary objective and growth strategy of allocating capital in a high-quality diversified portfolio of uniquely positioned luxury and upper upscale hotels and resorts with a focus on the Top 25 lodging markets as well as key leisure destinations in the U.S. We invest at valuation levels that we believe will generate attractive risk-adjusted returns. We pursue this objective through the following investment and growth strategies:

•Follow a Differentiated Investment Strategy Across Targeted Markets. We use our management team’s network of relationships in the lodging industry, real estate brokers and our relationships with multiple hotel brands and management companies, among others, to source acquisition opportunities. When evaluating opportunities, we use a multi-pronged approach to investing that we believe provides us the flexibility to pursue attractive opportunities in a variety of markets across any point in the economic cycle. We consider the following characteristics when making investment decisions:

- Market Characteristics. We seek opportunities across a range of urban and dense suburban areas, primarily in the Top 25 lodging markets as well as key leisure destinations in the U.S. We believe this strategy provides us with a broader range of opportunities and allows us to target markets and sub-markets with particular positive characteristics, such as multiple demand generators, favorable supply and demand dynamics and attractive long-term projected RevPAR growth. We believe assets in the Top 25 lodging markets and key

leisure destinations in the U.S. present attractive investment opportunities considering the favorable supply and demand dynamics, RevPAR growth trends, attractive valuations and better opportunities for diversification.

- Asset Characteristics. We generally pursue uniquely positioned hotels in the luxury and upper upscale segments that are affiliated with leading brands as we believe these segments yield attractive risk-adjusted returns. Within these segments, we seek hotels that will provide guests with a distinctive lodging experience, often tailored to reflect local market environments, which draws demand from both business and leisure transient and group business segments. We seek properties with desirable locations within their markets, exceptional facilities, and other competitive advantages that are hard to replicate. We also favor properties that can be purchased below estimated replacement cost. We believe our focus on uniquely positioned luxury and upper upscale hotel assets allows us to seek appropriate investments that are well-suited for specific markets.

- Operational and Structural Characteristics. We pursue both new or recently constructed assets that require limited capital investment, as well as more mature and complex properties with opportunities for our dedicated asset and project management teams to create value through more active operational oversight and targeted capital expenditures.

•Drive Growth Through Aggressive Asset Management, In-House Project Management and Strategic Capital Investment. We believe that investing in our properties and employing a proactive asset management approach designed to identify investment strategies will optimize internal growth opportunities. Our management team’s extensive industry experience across multiple brands and management companies coupled with our integrated asset management and project management teams enable us to identify and implement value-add strategies and to prudently invest capital in our assets to optimize operating results while leveraging best practices across our portfolio.