1

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For The Fiscal Year Ended

☐

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ____________ to ____________

Commission file number:

(Exact name of registrant as specified in its charter)

(State or other Jurisdiction of Incorporation or Organization)

(I.R.S. Employer Identification No.)

,

,

(Address of principal executive offices) (Zip Code)

(

)

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12 (b) of the Act:

Title of each class:

Trading Symbol(s)

Name of each exchange on which registered:

The

Securities registered pursuant to Section 12 (g) of the Act: NONE

Indicate by check mark if the registrant is a well-known seasoned issuer as defined in Rule 405 of the Securities Act.

☑

No

☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes

☐

☑

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act

of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject

to such filing requirements for the past 90 days.

☑

No

☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule

405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to

submit such files).

☑

No

☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting

company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer”, “smaller reporting company”,

and "emerging growth company" in Rule 12b-2 of the Exchange Act.

☑

Accelerated filer

☐

Non-accelerated filer

☐

Smaller reporting company

☐

Emerging growth company

☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act

☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management's assessment of the effectiveness of its

internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting

firm that prepared or issued its audit report.

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes

☐

No

☑

The aggregate market value, as reported by The NASDAQ Global Select Market, of the registrant’s Common Stock, $0.01 par value, held by

non-affiliates at November 25, 2022, which was the date of the last business day of the registrant’s most recently completed second fiscal

quarter, was $

.

As of July 25, 2023,

Common Stock, $0.01 par value, were outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

The information called for by Part III of this Form 10-K is incorporated herein by reference from the registrant’s Definitive Proxy Statement

for its 2023 annual meeting of stockholders which will be filed pursuant to Regulation 14A not later than 120 days after the end of the fiscal

year covered by this report.

2

TABLE OF CONTENTS

Item

Page

Number

1.

1A.

1B.

2.

3.

4.

5.

6.

7.

7A.

8.

9.

9A.

9B.

9C.

10.

11.

12.

13.

14.

15.

16.

3

PART I.

FORWARD -LOOKING STATEMENTS

This report contains numerous forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 (the

“Securities Act”) and Section 21E of the Securities Exchange Act of 1934 (the “Exchange Act”) relating to our shell egg business,

including estimated future production data, expected construction schedules, projected construction costs, potential future supply

of and demand for our products, potential future corn and soybean price trends, potential future impact on our business of inflation

and rising interest rates, potential future impact on our business of new legislation, rules or policies, potential outcomes of legal

proceedings, and other projected operating data, including anticipated results of operations and financial condition. Such forward-

looking statements are identified by the use of words such as “believes,” “intends,” “expects,” “hopes,” “may,” “should,” “plans,”

“projected,” “contemplates,” “anticipates,” or similar words. Actual outcomes or results could differ materially from those

projected in the forward-looking statements. The forward-looking statements are based on management’s current intent, belief,

expectations, estimates, and projections regarding the Company and its industry. These statements are not guarantees of future

performance and involve risks, uncertainties, assumptions, and other factors that are difficult to predict and may be beyond our

control. The factors that could cause actual results to differ materially from those projected in the forward-looking statements

include, among others, (i) the risk factors set forth in Item 1A Risk Factors and elsewhere in this report as well as those included

in other reports we file from time to time with the Securities and Exchange Commission (the “SEC”) (including our Quarterly

Reports on Form 10-Q and Current Reports on Form 8-K), (ii) the risks and hazards inherent in the shell egg business (including

disease, pests, weather conditions, and potential for product recall), including but not limited to the current outbreak of highly

pathogenic avian influenza (“HPAI”) affecting poultry in the United States (“U.S.”), Canada and other countries that was first

detected in commercial flocks in the U.S. in February 2022, (iii) changes in the demand for and market prices of shell eggs and

feed costs, (iv) our ability to predict and meet demand for cage-free and other specialty eggs, (v) risks, changes, or obligations

that could result from our future acquisition of new flocks or businesses and risks or changes that may cause conditions to

completing a pending acquisition not to be met, (vi) risks relating to increased costs, rising inflation and rising interest rates,

which began in response to market conditions caused in part by the COVID-19 pandemic and which generally have been

exacerbated by the Russia-Ukraine War that began in February 2022, (vii) our ability to retain existing customers, acquire new

customers and grow our product mix and (viii) adverse results in pending litigation matters. Readers are cautioned not to place

undue reliance on forward-looking statements because, while we believe the assumptions on which the forward-looking

statements are based are reasonable, there can be no assurance that these forward-looking statements will prove to be accurate.

Further, forward-looking statements included herein are only made as of the respective dates thereof, or if no date is stated, as of

the date hereof. Except as otherwise required by law, we disclaim any intent or obligation to update publicly these forward-

looking statements, whether because of new information, future events, or otherwise.

ITEM 1. BUSINESS

Our Business

We are the largest producer and distributor of shell eggs in the United States. Our mission is to be the most sustainable producer

and reliable supplier of consistent, high quality fresh shell eggs and egg products in the country, demonstrating a "Culture of

Sustainability" in everything we do, and creating value for our shareholders, customers, team members and communities. We sell

most of our shell eggs in the southwestern, southeastern, mid-western and mid-Atlantic regions of the U.S. and aim to maintain

efficient, state-of-the-art operations located close to our customers. We were founded in 1957 by the late Fred R. Adams, Jr. and

are headquartered in Ridgeland, Mississippi.

The Company has one reportable operating segment, which is the production, grading, packaging, marketing and distribution of

shell eggs. Our integrated operations consist of hatching chicks, growing and maintaining flocks of pullets, layers and breeders,

manufacturing feed, and producing, processing, packaging, and distributing shell eggs. Layers are mature female chickens, pullets

are female chickens usually less than 18 weeks of age, and breeders are male and female chickens used to produce fertile eggs to

be hatched for egg production flocks. Our total flock as of June 3, 2023 consisted of approximately 41.2 million layers and 10.8

million pullets and breeders.

Many of our customers rely on us to provide most of their shell egg needs, including specialty and conventional eggs. Specialty

eggs encompass a broad range of products. We classify cage-free, organic, brown, free-range, pasture-raised and nutritionally

enhanced as specialty eggs for accounting and reporting purposes. We classify all other shell eggs as conventional products.

While we report separate sales information for these egg types, there are many cost factors that are not specifically available for

conventional or specialty eggs due to the nature of egg production. We manage our operations and allocate resources to these

types of eggs on a consolidated basis based on the demands of our customers.

4

We believe that an important competitive advantage for Cal-Maine Foods is our ability to meet our customers’ evolving needs

with a favorable product mix of conventional and specialty eggs, including cage-free, organic and other specialty offerings, as

well as egg products. We have also enhanced our efforts to provide free-range and pasture -raised eggs that meet consumers’

evolving choice preferences. While a small part of our current business, the free-range and pasture-raised eggs we produce and

sell represent attractive offerings to a subset of consumers, and therefore our customers, and help us continue to serve as the

trusted provider of quality food choices.

Throughout the Company’s history, we have acquired other companies in our industry. Since 1989 through our fiscal year ended

June 3, 2023, we have completed 23 acquisitions ranging in size from 160 thousand layers to 7.5 million layers. Most recently,

effective on May 30, 2021, the Company acquired the remaining 50% membership interest in Red River Valley Egg Farm, LLC

(“Red River”), which owns and operates a specialty shell egg production complex that includes 1.7 million cage-free hens. For a

further description of this transaction, refer to Part II. Item 8. Notes to the Consolidated Financial Statements,

. We are also focused on additional ways to enhance our product mix and support new opportunities in the restaurant,

institutional and commercial food preparation area. Beginning in fiscal 2022, we have invested approximately $32.3 million in

Meadowcreek Foods, LLC (“Meadowcreek”), an egg products operation focused on offering hard-cooked eggs. In addition to

growth through acquisitions, we have also grown by making substantial investments in our business, primarily to increase our

cage-free production capacity.

When we use “we,” “us,” “our,” or the “Company” in this report, we mean Cal-Maine Foods, Inc. and our consolidated

subsidiaries, unless otherwise indicated or the context otherwise requires. The Company’s fiscal year-end is on the Saturday

closest to May 31. Our fiscal year 2023 and fourth quarter ended June 3, 2023, included 53 weeks and 14 weeks, respectively.

The first three fiscal quarters of fiscal 2023 ended August 27, 2022, November 26, 2022, and February 25, 2023, all included 13

weeks. All references herein to a fiscal year means our fiscal year and all references to a year mean a calendar year.

Industry Background

According to the U.S. Department of Agriculture (“USDA”) Agricultural Marketing Service, in 2022 approximately 71% of table

eggs produced in the U.S. were sold as shell eggs, with 56.6% sold through food at home outlets such as grocery and convenience

stores, 12.4% sold to food-away-from home channels such as restaurants and 1.7% exported. The USDA estimated that in 2022

approximately 29.6% of eggs produced in the U.S. were sold as egg products (shell eggs broken and sold in liquid, frozen, or

dried form) to institutions (e.g. companies producing baked goods). For information about egg producers in the U.S., see

“Competition” below.

Our industry has been greatly impacted by the outbreaks of highly pathogenic avian influenza (“HPAI”), first detected in

commercial flocks in the U.S. in February 2022 and continuing during our fiscal 2023. For additional information regarding HPAI

and its impact on our industry and business, see

Given historical consumption trends, we believe that general demand for eggs in the U.S. increases basically in line with the

overall U.S. population growth; however, specific events can impact egg supply and consumption in a particular period, as

occurred with the 2015 HPAI outbreak, the COVID-19 pandemic (particularly during 2020), and the most recent HPAI outbreak

starting in early 2022. According to the USDA’s Economic Research Service, estimated annual per capita consumption in the

United States between 2018 and 2022 varied, ranging from 279 to 292 eggs. In calendar year 2022, per capita U.S. consumption

was estimated to be 279 eggs, or approximately 5.4 eggs per person per week. According to the USDA, the decline in consumption

was primarily due to limited availability caused by the outbreak of HPAI. As of July 18, 2023, the USDA projects that the per

capita consumption will increase in calendar year 2023 and 2024 to 282.6 and 292.7, respectively. The USDA calculates per

capita consumption by dividing total shell egg disappearance in the U.S. by the U.S. population.

Prices for Shell Eggs

Wholesale shell egg sales prices are a critical component of revenue for the Company. Wholesale shell egg prices are volatile,

cyclical, and impacted by a number of factors, including consumer demand, seasonal fluctuations, the number and productivity

of laying hens in the U.S. and outbreaks of agricultural diseases such as HPAI. While we use several different pricing mechanisms

in pricing agreements with our customers, we believe the majority of conventional shell eggs sold in the U.S. in the retail and

foodservice channels are sold at prices that take into account, in varying ways, independently quoted wholesale market prices,

such as those published by Urner Barry Publications, Inc. (“UB”) for shell eggs, however, grain-based and cost plus arrangements

are being utilized in the food service channel and some western markets. We sell the majority of our conventional shell eggs

based on formulas that take into account, in varying ways, independently quoted regional wholesale market prices for shell eggs

5

or formulas related to our costs of production, which include the cost of corn and soybean meal. We do not sell eggs directly to

consumers or set the prices at which eggs are sold to consumers.

The weekly average price for the southeast region for large white conventional shell eggs as quoted by UB is shown below for

the past three fiscal years along with the five-year average price. As further discussed in

, conventional shell egg prices rose during the fourth quarter of fiscal 2022 and first three

quarters of fiscal 2023, due to the reduced supply related to the HPAI outbreak first detected in commercial flocks in February

2022, steady shell egg demand and higher production costs. Conventional shell egg prices continued to rise into the fourth quarter

of fiscal 2023 followed by a substantial decline, as demand for shell eggs began to decrease in line with typical seasonal variance

and as supply increased due to the repopulating of HPAI -affected layer flocks. The actual prices that we realize on any given

transaction will not necessarily equal quoted market prices because of the individualized terms that we negotiate with individual

customers which are influenced by many factors. Depending on market conditions, input costs and individualized contract terms,

the price we receive per dozen eggs in any given transaction may be more than or less than our farm production and other costs

per dozen.

Specialty eggs are typically sold at prices and terms negotiated directly with customers. Historically, prices for specialty eggs

have experienced less volatility than prices for conventional shell eggs and have generally been higher due to customer and

consumer willingness to pay more for specialty eggs. However, throughout most of fiscal 2023 conventional egg prices exceeded

specialty egg prices. Conventional egg prices generally respond more quickly to market conditions because we sell the majority

of our conventional shell eggs based on formulas that adjust periodically and take into account, in varying ways, independently

quoted regional wholesale market prices for shell eggs or formulas related to our costs of production. Because the majority of our

specialty eggs are typically sold at prices and terms negotiated directly with customers, specialty egg prices do not fluctuate as

much as conventional pricing.

Feed Costs for Shell Egg Production

Feed is a primary cost component in the production of shell eggs and represented 63.1% of our fiscal 2023 farm production costs.

We routinely fill our storage bins during harvest season when prices for feed ingredients, primarily corn and to a lesser extent

soybean meal, are generally lower. To ensure continued availability of feed ingredients, we may enter into contracts for future

purchases of corn and soybean meal, and as part of these contracts, we may lock-in the basis portion of our grain purchases

several months in advance. Basis is the difference between the local cash price for grain and the applicable futures price. A basis

6

contract is a common transaction in the grain market that allows us to lock-in a basis level for a specific delivery period and wait

to set the futures price at a later date. Furthermore, due to the more limited supply for organic ingredients, we may commit to

purchase organic ingredients in advance to help assure supply. Ordinarily, we do not enter into long-term contracts beyond a year

to purchase corn and soybean meal or hedge against increases in the prices of corn and soybean meal. As the quality and

composition of feed is a critical factor in the nutritional value of shell eggs and health of our chickens, we formulate and produce

the vast majority of our own feed at our feed mills located near our production plants. Our annual feed requirements for fiscal

2023 were 2.0 million tons of finished feed, of which we manufactured 1.9 million tons. We currently have the capacity to store

182 thousand tons of corn and soybean meal, and we replenish these stores as needed throughout the year.

Our primary feed ingredients, corn and soybean meal, are commodities subject to volatile price changes due to weather, various

supply and demand factors, transportation and storage costs, speculators and agricultural, energy and trade policies in the U.S.

and internationally and most recently the Russia-Ukraine War. While we do not import corn or soy directly from the region, the

Russia-Ukraine War has had a negative impact on the worldwide supply of grain, including corn, putting upward pressure on

prices. We purchase the vast majority of our corn and soybean meal from U.S sources but may be forced to purchase

internationally when U.S. supplies are not readily available. Feed grains are currently available from an adequate number of

sources in the U.S. As a point of reference, a multi-year comparison of the average of daily closing prices per Chicago Board of

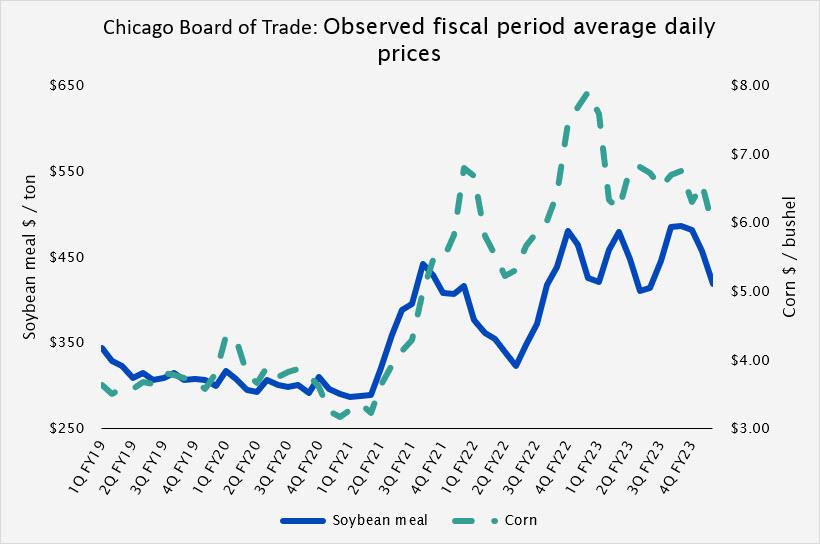

Trade for each period in our fiscal calendar are shown below for corn and soybean meal:

Shell Egg Production

Our percentage of dozens produced to sold was 92.3% of our total shell eggs sold in fiscal 2023, with 91.8% of such production

coming from company-owned facilities, and 8.2% from contract producers. Under a typical arrangement with a contract producer,

we own the flock, furnish all feed and critical supplies, own the shell eggs produced and assume market risks. The contract

producers own and operate their facilities and are paid a fee based on production with incentives for performance.

The commercial production of shell eggs requires a source of baby chicks for laying flock replacement. We hatch the majority of

our chicks in our own breeder farms and hatcheries in a computer-controlled environment and obtain the balance from commercial

sources. The chicks are grown in our own pullet farms and are placed into the laying flock once they reach maturity.

7

After eggs are produced, they are cleaned, graded and packaged. Substantially all our farms have modern “in-line” facilities which

mechanically gather, clean, grade and package the eggs at the location where they are laid. The in-line facilities generate

significant efficiencies and cost savings compared to the cost of eggs produced from non-in-line facilities, which process eggs

that have been laid at another location and transported to the processing facility. The in-line facilities also produce a higher

percentage of USDA Grade A eggs, which sell at higher prices. Eggs produced on farms owned by contractors are brought to our

processing plants to be graded and packaged. Because shell eggs are perishable, we do not maintain large egg inventories. Our

egg inventory averaged six days of sales during fiscal 2023. We believe our constant focus on production efficiencies and

automation throughout the supply chain enable us to be a low-cost supplier in our markets.

We are proud to have created and upheld what we believe is a leading poultry Animal Welfare Program (“AWP”). We have

aligned our AWP with regulatory, veterinary and our third-party certifying bodies’ guidance to govern welfare of animals in our

direct care, our contract farmers’ care and our farmer-suppliers’ care. We continually review our program to monitor and evolve

standards that guide how we hatch chicks, rear pullets and nurture breeder and layer hens. At each stage of our animals’ lives, we

are dedicated to providing welfare conditions aligned to our commitment to the principles of the internationally recognized

Five

Freedoms of Animal Welfare

. Our standards apply to our enterprise and are tailored for our owned and contract grower operations

with oversights and approvals from senior members of our compliance team.

We do not use artificial hormones in the production of our eggs. Hormone use in the poultry and egg production industry has

been effectively banned in the U.S. since the 1950s. We have an extensive written protocol that allows the use of medically

important antibiotics only when animal health is at risk, consistent with guidance from the United States Food and Drug

Administration (“FDA”) and the Guidance for Judicious Therapeutic Use of Antimicrobials in Poultry, developed by the

American Association of Avian Pathologists. When antibiotics are medically necessary, a licensed veterinary doctor will approve

and administer approved doses for a restricted period. Our programs are designed to ensure antibiotics are ordered and used only

when necessary and records of their usage – when and where – are maintained to monitor compliance with our protocols. We do

not use antibiotics for growth promotion or performance enhancement.

Specialty Eggs

We are one of the largest producers and marketers of value-added specialty shell eggs in the U.S., which continues to be a

significant and growing segment of the market. We classify cage-free, organic, brown, free-range, pasture-raised and nutritionally

enhanced as specialty eggs for accounting and reporting purposes. Specialty eggs are intended to meet the demands of consumers

sensitive to environmental, health and/or animal welfare issues and to comply with state requirements for cage-free eggs.

As defined by the USDA, eggs packed in USDA grade marked consumer packages labeled as cage-free are laid by hens that are

able to roam vertically and horizontally in indoor houses and have access to fresh food and water. Cage-free systems must allow

hens to exhibit natural behaviors and include enrichments such as scratch areas, perches and nests. Hens must have access to

litter, protection from predators and be able to move in a barn in a manner that promotes bird welfare.

Ten states have passed legislation or regulations mandating minimum space or cage-free requirements for egg production or

mandated the sale of only cage-free eggs and egg products in their states, with implementation of these laws ranging from January

2022 to January 2026. These states represent approximately 27% of the U.S. total population according to the 2020 U.S. Census.

California, Massachusetts, and Colorado, which collectively represent approximately 16% of the total estimated U.S. population

have cage-free legislation in effect currently. In May 2023, the U.S. Supreme Court upheld as constitutional California’s law that

requires the sale of only cage-free eggs in that state and regardless of the state in which the eggs are produced. Although we do

not sell the majority of our eggs in these ten states, these state laws have impacted egg production practices nationally.

A significant number of our customers previously announced goals to offer cage-free eggs exclusively on or before 2026, subject

in most cases to availability of supply, affordability and consumer demand, among other contingencies. Some of these customers

have recently changed those goals to offer 70% cage-free eggs by the end of 2030. Our customers typically do not commit to

long-term purchases of specific quantities or types of eggs with us, and as a result, it is difficult to accurately predict customer

requirements for cage-free eggs. We are focused on adjusting our cage-free production capacity with a goal of meeting the future

needs of our customers in light of changing state requirements and our customer’s goals. As always, we strive to offer a product

mix that aligns with current and anticipated customer purchase decisions. We are engaging with our customers to help them meet

their announced goals and needs. We have invested significant capital in recent years to acquire and construct cage-free facilities,

and we expect our focus for future expansion will continue to include cage-free facilities. Our volume of cage-free egg sales has

continued to increase and account for a larger share of our product mix. Cage-free sales represented approximately 20.1% of our

total net shell sales for fiscal year 2023. At the same time, we understand the importance of our continued ability to provide

conventional eggs in order to provide our customers with a variety of egg choices and to address hunger in our communities.

8

We are a member of the Eggland’s Best, Inc. cooperative (“EB”) and produce, market, distribute and sell

Egg-Land’s Best®

Land O’ Lakes®

Land O’ Lakes®

produced by hens that are fed a whole-grain vegetarian diet. Our

Farmhouse Eggs

® brand eggs are produced at our facilities by

cage-free hens that are provided with a vegetarian diet. We market organic, vegetarian and omega-3 eggs under our

4-Grain®

brand, which consists of conventional and cage-free eggs. We also produce, market and distribute private label specialty shell

eggs to several customers.

Egg Products

Egg products are shell eggs broken and sold in liquid, frozen, or dried form. We sell liquid and frozen egg products primarily to

the institutional, foodservice and food manufacturing sectors in the U.S. Our egg products are primarily sold through our wholly

owned subsidiaries American Egg Products, LLC located in Georgia and Texas Egg Products, LLC located in Texas.

During March 2023, MeadowCreek Food, LLC (“Meadowcreek”), a majority-owned subsidiary, began operations with a focus

on being a leading provider of hard-cooked eggs. We serve as the preferred provider to supply specialty and conventional eggs

that MeadowCreek needs to manufacture egg products. MeadowCreek’s marketing plan is designed to extend our reach in the

foodservice and retail marketplace and bring new opportunities in the restaurant, institutional and industrial food products arenas.

Summary of Conventional and Specialty Shell Egg and Egg Product Sales

The following table sets forth the contribution as a percentage of revenue and volumes of dozens sold of conventional and

specialty shell egg and egg product sales for the following fiscal years:

2023

2022

2021

Revenue

Volume

Revenue

Volume

Revenue

Volume

Conventional Eggs

65.2

%

65.3

%

59.8

%

69.0

%

56.8

%

73.2

%

Specialty Eggs

Egg-Land’s Best®

14.7

%

16.6

%

19.2

%

15.9

%

20.9

%

13.5

%

Other Specialty Eggs

15.7

%

18.1

%

17.3

%

15.1

%

19.1

%

13.3

%

Total Specialty Eggs

30.4

%

34.7

%

36.5

%

31.0

%

40.0

%

26.8

%

Egg Products

3.9

%

3.4

%

2.7

%

Marketing and Distribution

In fiscal 2023, we sold our shell eggs in 38 states through the southwestern, southeastern, mid-western and mid-Atlantic regions

of the U.S. through our extensive distribution network to a diverse group of customers, including national and regional grocery

store chains, club stores, companies servicing independent supermarkets in the U.S., foodservice distributors and egg product

consumers. Some of our sales are completed through co-pack agreements – a common practice in the industry whereby production

and processing of certain products are outsourced to another producer. Although we face intense competition from numerous

other companies, we believe that we have the largest market share for the sale of shell eggs in the grocery segment, including

large U.S. food retailers.

The majority of eggs sold are based on the daily or short-term needs of our customers. Most sales to established accounts are on

payment terms ranging from seven to 30 days. Although we have established long-term relationships with many of our customers,

most of them are free to acquire shell eggs from other sources.

The shell eggs we sell are either delivered to our customers’ warehouse or retail stores, by our own fleet or contracted refrigerated

delivery trucks, or are picked up by our customers at our processing facilities.

We are a member of the Eggland’s Best, Inc. cooperative and produce, market, distribute and sell

Egg-Land’s Best®

Land

O’ Lakes®

exclusive license agreements in Alabama, Arizona, Florida, Georgia, Louisiana, Mississippi and Texas, and in portions of

Arkansas, California, Nevada, North Carolina, Oklahoma and South Carolina. We also have an exclusive license in New York

City in addition to exclusivity in select New York metropolitan areas, including areas within New Jersey and Pennsylvania. As

discussed above under “Specialty Eggs,” we also sell our own Farmhouse Eggs® and 4Grain® branded eggs.

9

During 2022, the Company joined in the formation of a new egg farmer cooperative in the western United States. ProEgg,

Inc.(“ProEgg”) is comprised of leading egg production companies, including Cal-Maine Foods, servicing retail and foodservice

shell egg customers in 13 western states. ProEgg is a producer-owned cooperative organized under the Capper-Volstead Act.

The Company’s top priority in joining as a member of ProEgg is serving our valued customers in this important market region.

Our membership in ProEgg is expected to provide benefits for its customers, including supply chain stability and enhanced

reliability. Initially, Cal-Maine Foods’ customer relationships and customer support are expected to remain the same. We expect

that starting January 1, 2024, each producer member will sell through ProEgg the shell eggs it produces for sale in the western

states covered by the cooperative. Customers will have a single point of contact for their shell egg purchases, as ProEgg will have

a dedicated team to market and sell the members’ combined egg production in the region.

Customers

Our top three customers accounted for an aggregate of 50.1%, 45.9% and 48.6% of net sales dollars for fiscal 2023 , 2022, and

2021, respectively. Our largest customer, Walmart Inc. (including Sam's Club), accounted for 34.2%, 29.5% and 29.8% of net

sales dollars for fiscal 2023, 2022 and 2021, respectively.

In fiscal 2023, approximately 85.3% of our revenue related to sales to retail customers, 10.8% to sales to foodservice providers

and 3.9% to egg products sales. Retail customers include primarily national and regional grocery store chains, club stores, and

companies servicing independent supermarkets in the U.S. Foodservice customers include primarily companies that sell food

products and related items to restaurants, healthcare and education facilities and hotels.

Competition

The production, processing, and distribution of shell eggs is an intensely competitive business, which has traditionally attracted

large numbers of producers in the United States. Shell egg competition is generally based on price, service and product quality.

The shell egg production industry remains highly fragmented. According to

Egg Industry Magazine

, the ten largest producers

owned approximately 53% of industry table egg layer hens at year-end 2022 and 2021. We believe industry consolidation may

continue, and we plan to capitalize on opportunities as they arise. We believe further concentration could result in reduced

cyclicality of shell egg prices, but no assurance can be given in that regard.

Seasonality

Retail sales of shell eggs historically have been highest during the fall and winter months and lowest during the summer months.

Prices for shell eggs fluctuate in response to seasonal demand factors and a natural increase in egg production during the spring

and early summer. Historically, shell egg prices tend to increase with the start of the school year and tend to be highest prior to

holiday periods, particularly Thanksgiving, Christmas and Easter. Consequently, and all other things being equal, we would

expect to experience lower selling prices, sales volumes and net income (and may incur net losses) in our first and fourth fiscal

quarters ending in August/September and May/June, respectively. Accordingly, we generally expect our need for working capital

to be highest during those quarters.

Growth Strategy

Our growth strategy is focused on remaining a low-cost provider of shell eggs located near our customers, offering our customers

choices that meet their requirements for eggs and egg products and continuing to grow our focus on specialty eggs and egg

products. For example, our recent investment in MeadowCreek, discussed under the heading “Egg Products” above, is intended

to extend our reach in the foodservice and retail marketplace and bring new opportunities in the restaurant, institutional and

industrial food products arenas.

In light of the growing customer demand and increased legal requirements for cage-free eggs, we intend to continue to closely

evaluate the need to expand through selective acquisitions, with a priority on those that will facilitate our ability to expand our

cage-free shell egg production capabilities in key locations and markets. We will also continue to closely evaluate the need to

continue to expand and convert our own facilities to increase production of cage-free eggs based on a timeline designed to meet

the anticipated needs of our customers and comply with evolving legal requirements. As the ongoing production of cage-free

eggs is more costly than the production of conventional eggs, aligning our cage-free production capabilities with changing

demand for cage-free eggs is important to the success of our business.

10

Trademarks and License Agreements

We own the trademarks

Farmhouse Eggs®

,

Sunups®

,

Sunny Meadow®

4Grain®

. We produce and market

Egg-Land's Best

®

and

Land O’ Lakes

® branded eggs under license agreements with EB. We believe these trademarks and license agreements are

important to our business.

Government Regulation

Our facilities and operations are subject to regulation by various federal, state, and local agencies, including, but not limited to,

the FDA, USDA, Environmental Protection Agency (“EPA ”), Occupational Safety and Health Administration ("OSHA") and

corresponding state agencies or laws. The applicable regulations relate to grading, quality control, labeling, sanitary control and

reuse or disposal of waste. Our shell egg facilities are subject to periodic USDA, FDA, EPA and OSHA inspections. Our feed

production facilities are subject to FDA, EPA and OSHA regulation and inspections. We maintain our own inspection program

to monitor compliance with our own standards and customer specifications. It is possible that we will be required to incur

significant costs for compliance with such statutes and regulations. In the future, additional rules could be proposed that, if

adopted, could increase our costs.

Ten states have passed legislation or regulations mandating minimum space or cage-free requirements for egg production or

mandated the sale of only cage-free eggs and egg products in their states, with implementation of these laws ranging from January

2022 to January 2026. These states represent approximately 27% of the U.S. total population according to the 2020 U.S. Census.

California, Massachusetts, and Colorado, which collectively represent approximately 16% of the total estimated U.S. population

have cage-free legislation in effect currently. In May 2023, the U.S. Supreme Court upheld as constitutional California’s law that

requires the sale of only cage-free eggs in that state and regardless of the state in which the eggs are produced.

Environmental Regulation

Our operations and facilities are subject to various federal, state, and local environmental, health and safety laws and regulations

governing, among other things, the generation, storage, handling, use, transportation, disposal, and remediation of hazardous

materials. Under these laws and regulations, we must obtain permits from governmental authorities, including, but not limited to,

wastewater discharge permits. We have made, and will continue to make, capital and other expenditures relating to compliance

with existing environmental, health and safety laws and regulations and permits. We are not currently aware of any major capital

expenditures necessary to comply with such laws and regulations; however, as environmental, health and safety laws and

regulations are becoming increasingly more stringent, including those relating to animal wastes and wastewater discharges, it is

possible that we will have to incur significant costs for compliance with such laws and regulations in the future.

Human Capital Resources

As of June 3, 2023, we had 2,976 employees, of whom 2,305 worked in egg production, processing, and marketing, 207 worked

in feed mill operations and 464, including our executive officers, were administrative employees. Approximately 5.4% of our

personnel are part-time, and we utilize temporary employment agencies and independent contractors to augment our

staffing needs when necessary. For fiscal 2023, the average monthly full-time equivalent for contingent workers was 1,349. None

of our employees are covered by a collective bargaining agreement. We consider our relations with employees to be good.

Culture and Values

We are proud to be contributing corporate citizens where we live and work and to help create healthy, prosperous

communities. Our colleagues help us continue to enhance our community contributions, which are driven by

our longstanding culture that strives to promote an environment that upholds integrity and respect and provides opportunities for

each colleague to realize full potential. These commitments are encapsulated in the

Cal-Maine Foods Code of Ethics and Business

Conduct

Human Rights Statement

.

Health and Safety

Our top priority is the health and safety of our employees, who continue to produce high-quality, affordable egg choices for our

customers and contribute to a stable food supply. Our enterprise safety committee comprises two corporate safety managers, eight

area compliance managers (three specifically for worker health and safety), 55 local site compliance managers, feed mill managers

and general managers. The committee that oversees health and safety regularly reviews our written policies and changes to OSHA

regulation standards and shares information as it relates to outcomes from incidents in order to improve future performance. The

11

committee’s goals include working to help ensure that our engagements with our consumers, customers, and regulators

evidence our strong commitment to our workers’ health and safety.

Our commitment to our colleagues’ health includes a strong commitment to on-site worker safety, including a focus on accident

prevention and life safety. Our Safety and Health Program is designed to promote best practices that help prevent and minimize

workplace accidents and illnesses. The scope of our Safety and Health Program applies to all enterprise colleagues. Additionally,

to help protect the health and well-being of our colleagues and people in our value chain, we require that any contractors or

vendors acknowledge and agree to comply with the guidelines governed by our Safety and Health Program. At each of our

locations, our general managers are expected to uphold and implement our Safety and Health Program in alignment with OSHA

requirements. We believe that this program, which is reviewed annually by our senior management team, contributes to strong

safety outcomes. As part of our Safety and Health Program, we conduct multi-lingual training that covers topics such as slip-and-

fall avoidance, respiratory protection, prevention of hazardous communication of chemicals, the proper use of personal protective

equipment, hearing conservation, emergency response, lockout and tagout of equipment and forklift safety, among others. We

have also installed dry hydrogen peroxide biodefense systems in our processing facilities to help protect our colleagues’

respiratory health. To help drive our focus on colleague safety, we developed safety committees at each of our sites with employee

representation from each department.

We review the success of our safety programs on a monthly basis to monitor their effectiveness and the development of any

trends that need to be addressed. During fiscal year 2023 our recordable incident rates decreased by 29% compared to fiscal 2022.

Diversity, Equity and Inclusion

Our culture seeks to embrace the diversity and inclusion of all our team members. This culture is driven by our board and

executive management team. Our board comprises seven members, four of whom are independent. Women comprise 29% of our

board and 14% of our board members identify as a racial or ethnic minority. As of June 3, 2023, our total workforce comprised

29% women and 53% of colleagues who identify as racial or ethnic minorities. Our Policy against Harassment, Discrimination,

Unlawful or Unethical Conduct and Retaliation; Reporting Procedure affirms our commitment to supporting our employees

regardless of race, color, religion, sex, national origin or any other basis protected by applicable law.

Cal-Maine Foods strives to ensure that our colleagues are treated equitably. We are an Equal Opportunity Employer that prohibits,

by policy and practice, any violation of applicable federal, state, or local law regarding employment. Discrimination because of

race, color, religion, sex, pregnancy, age, national origin, citizenship status, veteran status, physical or mental disability, genetic

information, or any other basis protected by applicable law is prohibited. We value diversity in our workplaces or in work-related

situations. We maintain strong protocols to help our colleagues perform their jobs free from harassment and discrimination. Our

focus on equitable treatment extends to recruitment, employment applications, hiring, placement, job assignments, career

development, training, remuneration, benefits, discharge and other matters tied to terms and conditions of employment. We are

committed to offering our colleagues opportunities commensurate with our operational needs, their experiences, goals and

contributions.

Recruitment, Development and Retention

We believe in compensating our colleagues with fair and competitive wages, in addition to offering

competitive benefits. Approximately 76% of our employees are paid at hourly rates, which are all paid at rates above the federal

minimum wage requirement. We offer our full-time eligible employees a range of benefits, including company-paid life

insurance. The Company provides a comprehensive self-insured health plan and pays approximately 84% of the costs of the plan

for participating employees and their families as of December 31, 2022. Recent benchmarking of our health plan

indicates comparable benefits, at lower employee contributions, when compared to an applicable Agriculture and

Food Manufacturing sector grouping, as well as peer group data. In addition, we offer employees the opportunity to purchase an

extensive range of other group plan benefits, such as dental, vision, accident, critical illness, disability and voluntary life. After

one year of employment, full-time employees who meet eligibility requirements may elect to participate in our

KSOP retirement plan, which offers a range of investment alternatives and includes many positive features, such as

automatic enrollment with scheduled automatic contribution increases and loan provisions. Regardless of the

employees’ elections to contribute to the KSOP, the Company contributes shares of Company stock or cash equivalent to 3%

of participants’ eligible compensation for each pay period that hours are worked.

We

provide extensive training and development related to safety, regulatory compliance, and task training.

We

invest in

developing our future leaders through our Management Intern, Management Trainee and informal mentoring programs.

12

Sustainability

We understand that climate, and the potential consequences of climate change, freshwater availability and preservation of global

biodiversity, in addition to responsible management of our flocks, are vital to the production of high-quality eggs and egg products

and to the success of our Company. We have engaged in agricultural production for more than 60 years. Our agricultural practices

continue to evolve as we continue to strive to meet the need for nutritious, affordable foods to feed a growing population even as

we exercise responsible natural resource stewardship. We plan to publish our most recent sustainability report on or around early

August 2023, which will be available on our website. Information contained on our website is not a part of this report on Form

10-K.

Our Corporate Information

We maintain a website at www.calmainefoods.com where general information about our business and corporate governance

matters is available. The information contained in our website is not a part of this report. Our Annual Reports on Form 10-K,

Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, proxy statements, and all amendments to those reports filed or

furnished pursuant to Section 13(a) or 15(d) of the Exchange Act are available, free of charge, through our website as soon as

reasonably practicable after we file them with, or furnish them to, the SEC. In addition, the SEC maintains a website at

www.sec.gov that contains reports, proxy and information statements, and other information regarding issuers that file

electronically with the SEC. Cal-Maine Foods, Inc. is a Delaware corporation, incorporated in 1969.

ITEM 1A. RISK FACTORS

Our business and results of operations are subject to numerous risks and uncertainties, many of which are beyond our

control. The following is a description of the known factors that may materially affect our business, financial condition or results

of operations. They should be considered carefully, in addition to the information set forth elsewhere in this Annual Report on

Form 10-K, including under Part II. Item 7. Management’s Discussion and Analysis of Financial Condition and Results of

Operations, in making any investment decisions with respect to our securities. Additional risks or uncertainties that are not

currently known to us, or that we are aware of but currently deem to be immaterial or that could apply to any company could

also materially adversely affect our business, financial condition or results of operations.

INDUSTRY RISK FACTORS

Market prices of wholesale shell eggs are volatile, and decreases in these prices can adversely impact our revenues and

profits.

Our operating results are significantly affected by wholesale shell egg market prices, which fluctuate widely and are outside our

control. As a result, our prior performance should not be presumed to be an accurate indication of future performance. Under

certain circumstances, small increases in production, or small decreases in demand, within the industry might have a large adverse

effect on shell egg prices. Low shell egg prices adversely affect our revenues and profits.

Market prices for wholesale shell eggs have been volatile and cyclical. Shell egg prices have risen in the past during periods of

high demand such as the initial outbreak of the COVID-19 pandemic and periods when high protein diets are popular. Shell egg

prices have also risen during periods of constrained supply, such as the latest highly pathogenic avian influenza (“HPAI”)

outbreak that was first detected in domestic commercial flocks in February 2022. During times when prices are high, the egg

industry has typically geared up to produce more eggs, primarily by increasing the number of layers, which historically has

ultimately resulted in an oversupply of eggs, leading to a period of lower prices.

As discussed above in

, seasonal fluctuations impact shell egg prices. Therefore, comparisons

of our sales and operating results between different quarters within a single fiscal year are not necessarily meaningful

comparisons.

A decline in consumer demand for shell eggs can negatively impact our business.

We believe the increase in meals prepared at home due to concerns and restrictions during the initial outbreak of the COVID-19

pandemic, high-protein diet trends, industry advertising campaigns and the improved nutritional reputation of eggs have all

contributed at one time or another to increased shell egg demand. However, it is possible that the demand for shell eggs will

decline in the future. Adverse publicity relating to health or safety concerns and changes in the perception of the nutritional value

of shell eggs, changes in consumer views regarding consumption of animal-based products, as well as movement away from high

protein diets, could adversely affect demand for shell eggs, which would have a material adverse effect on our future results of

operations and financial condition.

13

Feed costs are volatile and increases in these costs can adversely impact our results of operations.

Feed costs are the largest element of our shell egg (farm) production cost, ranging from 55% to 63% of total farm production cost

in the last five fiscal years.

Although feed ingredients, primarily corn and soybean meal, are available from a number of sources, we do not have control over

the prices of the ingredients we purchase, which are affected by weather, various global and U.S. supply and demand factors,

transportation and storage costs, speculators, and agricultural, energy and trade policies in the U.S. and internationally. More

recently, the Russia-Ukraine War has had a negative impact on the worldwide supply of grain, including corn, putting upward

pressure on prices. We saw increasing prices for corn and soybean meal for fiscal years 2022 and 2023 as a result of weather-

related shortfalls in production and yields, ongoing supply chain disruptions and the Russia-Ukraine War and its impact on the

export markets. Our costs for corn and soybean meal are also affected by local basis prices. Factors that can affect basis levels

include transportation and storage costs. We saw basis levels increase in our areas of operation during fiscal 2023 as a result of

higher transportation and storage costs, resulting in higher farm production costs during the year.

Increases in feed costs unaccompanied by increases in the selling price of eggs can have a material adverse effect on the results

of our operations and cash flow. Alternatively, low feed costs can encourage industry overproduction, possibly resulting in lower

egg prices and lower revenue.

Agricultural risks, including outbreaks of avian disease, could harm our business.

Our shell egg production activities are subject to a variety of agricultural risks. Unusual or extreme weather conditions, disease

and pests can materially and adversely affect the quality and quantity of shell eggs we produce and distribute. Outbreaks of avian

influenza among poultry occur periodically worldwide and have occurred sporadically in the U.S. Most recently, an outbreak of

HPAI, which was first detected in February 2022, has impacted the industry. Prior to 2022, there was another significant HPAI

outbreak in the U.S. impacting poultry during 2015. There have been no positive tests for HPAI at any Cal-Maine Foods’ owned

or contracted facility as of July 25, 2023. The Company maintains controls and procedures designed to reduce the risk of exposing

our flocks to harmful diseases; however, despite these efforts, outbreaks of avian disease can and do still occur and may adversely

impact the health of our flocks. An outbreak of avian disease could have a material adverse impact on our financial results by

increasing government restrictions on the sale and distribution of our products and requiring us to euthanize the affected

layers. Negative publicity from an outbreak within our industry can negatively impact customer perception, even if the outbreak

does not directly impact our flocks. If a substantial portion of our layers or production facilities are affected by any of these

factors in any given quarter or year, our business, financial condition, and results of operations could be materially and adversely

affected.

Shell eggs and shell egg products are susceptible to microbial contamination, and we may be required to, or we may

voluntarily, recall contaminated products.

Shell eggs and shell egg products are vulnerable to contamination by pathogens such as Salmonella. The Company maintains

policies and procedures designed to comply with the complex rules and regulations governing egg production, such as The Final

Egg Rule issued by the FDA “Prevention of Salmonella Enteritidis in Shell Eggs During Production, Storage, and

Transportation,” and the FDA’s Food Safety Modernization Act. Shipment of contaminated products, even if inadvertent, could

result in a violation of law and lead to increased risk of exposure to product liability claims, product recalls and scrutiny by federal

and state regulatory agencies. We have little, if any, control over proper handling once the product has been shipped or

delivered. In addition, products purchased from other producers could contain contaminants that might be inadvertently

redistributed by us. As such, we might decide or be required to recall a product if we, our customers or regulators believe it poses

a potential health risk. Any product recall could result in a loss of consumer confidence in our products, adversely affect our

reputation with existing and potential customers and have a material adverse effect on our business, results of operations and

financial condition. We currently maintain insurance with respect to certain of these risks, including product liability insurance,

business interruption insurance and general liability insurance, but in many cases such insurance is expensive, difficult to obtain

and no assurance can be given that such insurance can be maintained in the future on acceptable terms, or in sufficient amounts

to protect us against losses due to any such events, or at all.

Our profitability may be adversely impacted by increases in other input costs such as packaging materials and delivery

expenses, including as a result of inflation.

In addition to feed ingredient costs, other significant input costs include costs of packaging materials and delivery expenses. Our

costs of packing materials increased during fiscal 2023 and 2022 due to rising inflation and labor costs, and during 2022 also as

a result of supply chain constraints initially caused by the pandemic, and these costs may continue to increase. We also

14

experienced increases in delivery expenses during fiscal 2023 and 2022 due to increases in fuel and labor costs for both our fleet

and contract trucking, and these costs may continue to increase. Increases in these costs are largely outside of our control and

have an adverse effect on our profitability and cash flow.

BUSINESS AND OPERATIONAL RISK FACTORS

Global or regional health crises including pandemics or epidemics could have an adverse impact on our business and

operations.

The effects of global or regional pandemics or epidemics can significantly impact our operations. Although demand for our

products could increase as a result of restrictions such as travel bans and restrictions, quarantines, shelter-in-place orders, and

business and government shutdowns, which can prompt more consumers to eat at home, these restrictions could also significantly

increase our cost of doing business due to labor shortages, supply-chain disruptions, increased costs and decreased availability of

packaging supplies, and increased medical and other costs. We experienced these impacts as a result of the COVID-19 pandemic,

primarily during our fiscal years 2020 and 2021. The pandemic recovery also contributed to increasing inflation and interest rates,

which persist and may continue to persist. The impacts of health crises are difficult to predict and depend on numerous factors

including the severity, length and geographic scope of the outbreak, resurgences of the disease and variants, availability and

acceptance of vaccines, and governmental, business and individuals’ responses. A resurgence of COVID-19 and/or variants, or

any future major public health crisis, would disrupt our business and could have a material adverse effect on our financial results.

Our acquisition growth strategy subjects us to various risks.

As discussed in

, we plan to pursue a growth strategy that includes selective acquisitions

of other companies engaged in the production and sale of shell eggs, with a priority on those that will facilitate our ability to

expand our cage-free shell egg production capabilities in key locations and markets. We may over-estimate or under-estimate the

demand for cage-free eggs, which could cause our acquisition strategy to be less-than-optimal for our future growth and

profitability. The number of existing companies with cage-free capacity that we may be able to purchase is limited, as most

production of shell eggs by other companies in our markets currently does not meet customer demands or legal requirements to

be designated as cage-free. Conversely, if we acquire cage-free production capacity, which is more expensive to purchase and

operate, and customer demands or legal requirements for cage-free eggs were to change, the resulting lack of demand for cage-

free eggs may result in higher costs and lower profitability.

Acquisitions require capital resources and can divert management’s attention from our existing business. Acquisitions also entail

an inherent risk that we could become subject to contingent or other liabilities, including liabilities arising from events or conduct

prior to our acquisition of a business that were unknown to us at the time of acquisition. We could incur significantly greater

expenditures in integrating an acquired business than we anticipated at the time of its purchase.

We cannot assure you that we:

●

will identify suitable acquisition candidates;

●

can consummate acquisitions on acceptable terms;

●

can successfully integrate an acquired business into our operations; or

●

can successfully manage the operations of an acquired business.

No assurance can be given that companies we acquire in the future will contribute positively to our results of operations or

financial condition. In addition, federal antitrust laws require regulatory approval of acquisitions that exceed certain threshold

levels of significance, and we cannot guarantee that such approvals would be obtained.

The consideration we pay in connection with any acquisition affects our financial results. If we pay cash, we could be required

to use a portion of our available cash or credit facility to consummate the acquisition. To the extent we issue shares of our

Common Stock, existing stockholders may be diluted. In addition, acquisitions may result in additional debt. Our ability to access

any additional capital that may be needed for an acquisition may be adversely impacted by higher interest rates and economic

uncertainty.

Our largest customers have accounted for a significant portion of our net sales volume. Accordingly, our business may be

adversely affected by the loss of, or reduced purchases by, one or more of our large customers.

Our customers, such as supermarkets, warehouse clubs and food distributors, have continued to consolidate and consolidation is

expected to continue. These consolidations have produced larger customers and potential customers with increased buying power

who are more capable of operating with reduced inventories, opposing price increases, and demanding lower pricing, increased

15

promotional programs and specifically tailored products. Because of these trends, our volume growth could slow or we may need

to lower prices or increase promotional spending for our products, any of which could adversely affect our financial results.

Our top three customers accounted for an aggregate of 50.1%, 45.9% and 48.6% of net sales dollars for fiscal 202 3, 2022, and

2021, respectively. Our largest customer, Walmart Inc. (including Sam's Club), accounted for 34.2%, 29.5% and 29.8% of net

sales dollars for fiscal 2023, 2022, and 2021, respectively. Although we have established long-term relationships with most of

our customers who continue to purchase from us based on our ability to service their needs, they are generally free to acquire

shell eggs from other sources. If, for any reason, one or more of our large customers were to purchase significantly less of our

shell eggs in the future or terminate their purchases from us, and we were not able to sell our shell eggs to new customers at

comparable levels, it would have a material adverse effect on our business, financial condition, and results of operations.

Our business is highly competitive.

The production and sale of fresh shell eggs, which accounted for virtually all of our net sales in recent years, is intensely

competitive. We compete with a large number of competitors that may prove to be more successful than we are in producing,

marketing and selling shell eggs. We cannot provide assurance that we will be able to compete successfully with any or all of

these companies. Increased competition could result in price reductions, greater cyclicality, reduced margins and loss of market

share, which would negatively affect our business, results of operations, and financial condition.

We are dependent on our management team, and the loss of any key member of this team may adversely affect the

implementation of our business plan in a timely manner.

Our success depends largely upon the continued service of our senior management team. The loss or interruption of service of

one or more of our key executive officers could adversely affect our ability to manage our operations effectively and/or pursue

our growth strategy. We have not entered into any employment or non-compete agreements with any of our executive officers.

Competition could cause us to lose talented employees, and unplanned turnover could deplete institutional knowledge and result

in increased costs due to increased competition for employees.

Our business is dependent on our information technology systems and software, and failure to protect against or

effectively respond to cyber-attacks, security breaches, or other incidents involving those systems, could adversely affect

day-to-day operations and decision making processes and have an adverse effect on our performance and reputation.

The efficient operation of our business depends on our information technology systems, which we rely on to effectively manage

our business data, communications, logistics, accounting, regulatory and other business processes. If we do not allocate and

effectively manage the resources necessary to build and sustain an appropriate technology environment, our business,

reputation, or financial results could be negatively impacted. In addition, our information technology systems may be

vulnerable to damage or interruption from circumstances beyond our control, including systems failures, natural disasters,

terrorist attacks, viruses, ransomware, security breaches or cyber incidents. Cyber-attacks are becoming more sophisticated and

are increasing in the number of attempts and frequency by groups and individuals with a wide range of motives. We have

experienced and expect to continue to experience attempted cyber-attacks of our information technology systems or networks.

A security breach of sensitive information could result in damage to our reputation and our relations with our customers or

employees. Any such damage or interruption could have a material adverse effect on our business.

Technology and business and regulatory requirements continue to change rapidly. Failure to update or replace legacy systems to

address these changes could result in increased costs, including remediation costs, system downtime, third party litigation,

regulatory actions or cyber security vulnerabilities which could have a material adverse effect on our business.

Labor shortages or increases in labor costs could adversely impact our business and results of operations.

Labor is a primary component of our farm production costs. Our success is dependent upon recruiting, motivating, and retaining

staff to operate our farms. Approximately 76% of our employees are paid at hourly rates, often in entry-level positions. While all

our employees are paid at rates above the federal minimum wage requirements, any significant increase in local, state or federal

minimum wage requirements could increase our labor costs. In addition, any regulatory changes requiring us to provide additional

employee benefits or mandating increases in other employee-related costs, such as unemployment insurance or workers

compensation, would increase our costs. A shortage in the labor pool, which may be caused by competition from other employers,

the remote locations of many of our farms, decreased labor participation rates or changes in government-provided support or

immigration laws, particularly in times of lower unemployment, could adversely affect our business and results of operations.

A

shortage of labor available to us could cause our farms to operate with reduced staff, which could negatively impact our production

capacity and efficiencies. In fiscal 2021 and 2022, our labor costs increased primarily due to the pandemic and its effects, which

16

caused us to increase wages in response to labor shortages. In fiscal 2023, labor wages continued to rise due to increasing inflation

and low unemployment. Accordingly, any significant labor shortages or increases in our labor costs could have a material adverse

effect on our results of operations.

We are controlled by the family of our late founder, Fred R. Adams, Jr., and Adolphus B. Baker, Chairman of our Board

of Directors, controls the vote of 100% of our outstanding Class A Common Stock.

Fred R. Adams, Jr., our Founder and Chairman Emeritus died on March 29, 2020. Mr. Adams’ son-in-law, Adolphus B. Baker,

Chairman of our board of directors, Mr. Baker’s spouse and her three sisters (Mr. Adams’ four daughters) (collectively, the

“Family”) beneficially own, directly or indirectly through related entities, 100% of our outstanding Class A Common Stock

(which has 10 votes per share), controlling approximately 52.1% of our total voting power. Such persons also have additional

voting power due to beneficial ownership of our Common Stock (which has one vote per share), directly or indirectly through

related entities, resulting in family voting control of approximately 53.8% of our total voting power. Mr. Baker controls the vote

of 100% of our outstanding Class A Common Stock.

We understand that the Family intends to retain ownership of a sufficient amount of our Common Stock and our Class A Common

Stock to assure continued ownership of more than 50% of the voting power of our outstanding shares of capital stock. As a result

of this ownership, the Family has the ability to exert substantial influence over matters requiring action by our stockholders,

including amendments to our certificate of incorporation and by-laws, the election and removal of directors, and any merger,

consolidation, or sale of all or substantially all of our assets, or other corporate transactions. Delaware law provides that the

holders of a majority of the voting power of shares entitled to vote must approve certain fundamental corporate transactions such

as a merger, consolidation and sale of all or substantially all of a corporation’s assets; accordingly, such a transaction involving

us and requiring stockholder approval cannot be effected without the approval of the Family. Such ownership will make an

unsolicited acquisition of our Company more difficult and discourage certain types of transactions involving a change of control

of our Company, including transactions in which the holders of our Common Stock might otherwise receive a premium for their

shares over then current market prices. The Family’s controlling ownership of our capital stock may adversely affect the market

price of our Common Stock.

The price of our Common Stock may be affected by the availability of shares for sale in the market, and you may

experience significant dilution as a result of future issuances of our securities, which could materially and adversely affect

the market price of our Common Stock.

The sale or availability for sale of substantial amounts of our Common Stock could adversely impact its price. The Family holds

approximately 1.4 million shares of Common Stock (the “Subject Shares”) that are subject to an Agreement Regarding Common

Stock (the “Agreement”) filed as an exhibit to this report. The Subject Shares remain subject to potential sale under the

Agreement. The Agreement generally provides that if a holder of Subject Shares intends to sell any of the Subject Shares, such

party must give the Company a right of first refusal to purchase all or any of such shares. The price payable by the Company to

purchase shares pursuant to the exercise of the right of first refusal will reflect a 6% discount to the then-current market price

based on the 20 business-day volume-weighted average price. If the Company does not exercise its right of first refusal and

purchase the shares offered, such party will, subject to the approval of a special committee of independent directors of the Board

of Directors, be permitted to sell the shares not purchased by the Company pursuant to a Company registration statement, Rule

144 under the Securities Act of 1933, or another manner of sale agreed to by the Company. Although pursuant to the Agreement

the Company will have a right of first refusal to purchase all or any of those shares, the Company may elect not to exercise its

rights of first refusal, and if so such shares would be eligible for sale pursuant to the registration rights in the Agreement or

pursuant to Rule 144 under the Securities Act of 1933. Sales, or the availability for sale, of a large number of shares of our

Common Stock could result in a decline in the market price of our Common Stock.

In addition, our articles of incorporation authorize us to issue 120,000,000 shares of our Common Stock. As of June 3, 2023,

there were 44,184,048 shares of our Common Stock outstanding. Accordingly, a substantial number of shares of our Common

Stock are outstanding and are, or could become, available for sale in the market. In addition, we may be obligated to issue

additional shares of our Common Stock in connection with employee benefit plans (including equity incentive plans).

In the future, we may decide to raise capital through offerings of our Common Stock, additional securities convertible into or

exchangeable for Common Stock, or rights to acquire these securities or our Common Stock. The issuance of additional shares

of our Common Stock or additional securities convertible into or exchangeable for our Common Stock could result in dilution of

existing stockholders’ equity interests in us. Issuances of substantial amounts of our Common Stock, or the perception that such

issuances could occur, may adversely affect prevailing market prices for our Common Stock, and we cannot predict the effect

this dilution may have on the price of our Common Stock.

17

LEGAL AND REGULATORY RISK FACTORS

Pressure from animal rights groups regarding the treatment of animals may subject us to additional costs to conform our

practices to comply with developing standards or subject us to marketing costs to defend challenges to our current

practices and protect our image with our customers. In particular, changes in customer preferences and new legislation

have accelerated an increase in demand for cage-free eggs, which increases uncertainty in our business and increases our

costs.

We and many of our customers face pressure from animal rights groups, such as People for the Ethical Treatment of Animals and

the Humane Society of the United States, to require companies that supply food products to operate their business in a manner

that treats animals in conformity with certain standards developed or approved by these groups. In general, we may incur

additional costs to conform our practices to address these standards or to defend our existing practices and protect our image with

our customers. The standards promoted by these groups change over time, but typically require minimum cage space for hens,