|

Filed by the Registrant ☒

|

Filed by a Party other than the Registrant ☐

|

|

☐

|

Preliminary Proxy Statement

|

|

☐

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

| ☒ |

Definitive Proxy Statement

|

| ☐ |

Definitive Additional Materials

|

|

☐

|

Soliciting Material Pursuant to §240.14a-12

|

| |

| (Name of Registrant as Specified In Its Charter) |

| |

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

|

☒

|

No fee required.

|

|

☐

|

Fee paid previously with preliminary materials.

|

|

☐

|

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i) and 0-11

|

Notice of

Annual Meeting

and

Proxy Statement

October 4, 2024

Table of Contents

NOTICE OF ANNUAL MEETING

October 4, 2024

TO THE STOCKHOLDERS:

The Annual Meeting of Stockholders of Cal-Maine Foods, Inc. (the “Company”) will be held at the corporate offices of Cal-Maine Foods, Inc. at 1052 Highland Colony Parkway, Suite 200, Ridgeland, Mississippi 39157, at 10:00 a.m., Central Time, on Friday, October 4, 2024, for the following purposes:

| 1. |

To elect seven directors to serve for the ensuing year;

|

| 2. |

To ratify the selection of Frost, PLLC, as our independent registered public accounting firm for fiscal year 2025; |

| 3. |

To amend our certificate of incorporation to add officer exculpation; and |

| 4. |

To consider and act upon such other matters as may properly come before the Annual Meeting or any adjournments thereof. |

August 9, 2024 has been fixed as the record date for determination of stockholders entitled to vote at the Annual Meeting and to receive notice thereof. The accompanying proxy statement describes the matters being voted on and contains other information relating to the Company.

Whether or not you plan to attend the meeting in person, it is important that your shares be represented and voted. So that we may be sure your vote will be included, please promptly submit your proxy and voting instructions via the internet, or sign, date and return a proxy card (if received by mail). Stockholders are encouraged to submit proxies as early as possible to avoid any possible delays.

| FOR THE BOARD OF DIRECTORS | |

|

|

| MAX P. BOWMAN, SECRETARY |

Dated: August 22, 2024

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR ANNUAL MEETING OF STOCKHOLDERS TO BE HELD OCTOBER 4, 2024.

The proxy statement and the Company’s 2024 annual report to stockholders are available at

www.ProxyVote.com

CAL-MAINE FOODS, INC.

1052 Highland Colony Parkway, Suite 200

Ridgeland, Mississippi 39157

PROXY STATEMENT FOR ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD OCTOBER 4, 2024

The information set forth in this proxy statement is furnished by our Board of Directors in connection with the Annual Meeting of Stockholders of Cal-Maine Foods, Inc. (the “Company”) to be held on October 4, 2024, at 10:00 a.m., central time, at our principal executive offices, 1052 Highland Colony Parkway, Suite 200, Ridgeland, Mississippi 39157 (the “Annual Meeting”). Our telephone number is (601) 948-6813. The terms “we,” “us” and “our” used in this proxy statement refer to the Company.

GENERAL MATTERS

In accordance with the rules of the Securities and Exchange Commission (“SEC”), we are permitted to furnish proxy materials, including this proxy statement and our Annual Report to Stockholders for the fiscal year ended June 1, 2024 (the “Annual Report”), to stockholders by providing access to these documents on the internet instead of mailing printed copies. Most stockholders will not receive printed copies of the proxy materials unless requested. Instead, the notice of internet availability of proxy materials provides instructions on how to access and review the proxy materials on the internet. The notice also provides instructions on how to submit your proxy and voting instructions via the internet. If you would like to receive a printed or email copy of our proxy materials, please follow the instructions provided in the notice to request the materials. A list of the stockholders of record as of the record date will be available for inspection by stockholders of the Company for any purpose germane to the meeting at the Company’s corporate offices for 10 days preceding the date of the Annual Meeting during ordinary business hours.

The following proxy materials are being made available to holders of record on August 9, 2024, on or about August 22, 2024, free of charge at our website, www.calmainefoods.com/annual-meeting-and-proxy-material or www.proxyvote.com:

| • | The Notice of Annual Meeting and Proxy Statement for the 2024 Annual Meeting of Stockholders; |

| • | The Annual Report; and |

| • | The form of proxy card being distributed to stockholders in connection with the 2024 Annual Meeting of Stockholders. |

We have adopted a procedure approved by the SEC called “householding.” Under this procedure, we will deliver only one copy of our notice of internet availability of proxy materials to stockholders who have the same address and last name unless one or more of these stockholders notifies us that they wish to receive individual copies. This procedure reduces our printing costs and postage fees. Although only one copy of our notice of internet availability of proxy materials will be delivered to each address, each stockholder sharing that address will continue to be able to access the proxy materials and submit his or her individual voting instructions. If you want to receive separate copies of our notice of internet availability of proxy materials, or if you do not wish to participate in householding in the future, or if any shareholders sharing an address are receiving multiple copies of our notice of internet availability of proxy materials and would like to request delivery of a single copy, you can make these requests through the following sources:

Stockholders of record should contact the Company’s Secretary in writing or by telephone at Cal-Maine Foods, Inc., ATTN: Max P. Bowman, Secretary, Post Office Box 2960, Jackson, Mississippi 39207, telephone number (601) 948-6813.

Stockholders who are beneficial owners should contact their bank, broker or other nominee record holder.

Our Board of Directors is soliciting your proxy to vote your shares on all matters scheduled to come before the Annual Meeting. The proxy may be revoked by a stockholder at any time before it is voted by filing with our Secretary a written revocation of such proxy or a duly executed proxy bearing a later date. The proxy also may be revoked by a stockholder attending the meeting by withdrawing the proxy and voting in person.

The Company is not using a proxy solicitor. All expenses incurred in connection with the solicitation of proxies will be paid by us. Our directors, officers, and regular employees may solicit proxies in person, by telephone, mail, email, telecopy or employee communications. We will not pay such persons additional compensation for their proxy solicitation efforts. We will, upon request, reimburse banks,, brokerage houses and other institutions, and fiduciaries for their expenses in forwarding proxy materials to their principals.

VOTING SHARES

Stockholders of record at the close of business on August 9, 2024, are eligible to vote at the Annual Meeting in person or by proxy. As of the record date, 44,236,582 shares of our common stock were outstanding (including 274,215 shares of unvested restricted common stock issued under our Amended and Restated 2012 Omnibus Long-Term Incentive Plan that have voting rights), and 4,800,000 shares of our Class A common stock were outstanding.

Each share of common stock is entitled to one vote on each matter to be considered at the Annual Meeting. Each share of Class A common stock is entitled to 10 votes on each such matter. The holders of shares of our common stock and/or Class A common stock representing a majority of the voting interest of all the outstanding shares of our common stock and Class A common stock, considered together as a group and entitled to vote at the meeting, in person or by proxy, will constitute a quorum for purposes of the 2024 Annual Meeting of Stockholders.

If a quorum is not present in person or by proxy, the holders of shares representing a majority of the voting interest of all such shares present may, without notice other than announcement at the meeting, adjourn the meeting from time to time, until a quorum is present, and at any such adjourned meeting at which a quorum is present, any business may be transacted which might have been transacted at the original meeting.

If your shares are held in a stock brokerage account by a bank, broker or other nominee, you are considered the beneficial owner of shares held in “street name” and these proxy materials are being made available to you by your bank, broker or other nominee that is considered the stockholder of record of those shares. As the beneficial owner, you have the right to direct your bank, broker or other nominee on how to vote your shares and your bank, broker or other nominee will send you instructions on how to submit your voting instructions.

If you are a stockholder of record and you do not return a proxy, your shares will not be voted. If you are a stockholder of record and you make no specifications on your proxy card, your shares of our common stock will be voted in accordance with the recommendations of our Board of Directors, as provided below. If you are a beneficial owner and you do not provide voting instructions to your bank, broker or other nominee holding shares for you, your shares will not be voted with respect to any proposal for which the stockholder of record does not have discretionary authority to vote. Rules of the New York Stock Exchange (“NYSE”) governing brokers (regardless of the exchange on which the company is listed) determine whether proposals presented at stockholder meetings are “discretionary” or “non-discretionary.” If a proposal is determined to be discretionary, your bank, broker or other nominee is permitted under NYSE rules to vote on the proposal without receiving voting instructions from you. If a proposal is determined to be non-discretionary, NYSE rules prohibit your bank, broker or other nominee from voting on the proposal without receiving voting instructions from you. A “broker non-vote” occurs when a bank, broker or other nominee holding shares for a beneficial owner returns a valid proxy, but does not vote on a particular proposal because it does not have discretionary authority to vote on the matter and has not received voting instructions from the stockholder for whom it is holding shares.

Under the NYSE rules, the proposals relating to the election of directors and to amend our certificate of incorporation to add officer exculpation are considered non-routine matters and non-discretionary proposals and the proposal relating to the ratification of the appointment of our independent registered public accounting firm is a discretionary proposal. As such, if you are a beneficial owner and you do not provide voting instructions to your bank, broker or other nominee holding shares for you, your shares will not be voted with respect to the election of directors or the proposal to amend our certificate of incorporation to add officer exculpation, and your shares may be voted with respect to the ratification of the appointment of our independent registered public accounting firm.

Abstentions occur when stockholders are present at the Annual Meeting but fail to vote or voluntarily withhold their vote for any of the matters upon which the stockholders are voting. Abstentions are counted for purposes of determining whether a quorum is present and will have the same effect as a vote against proposals other than the election of directors.

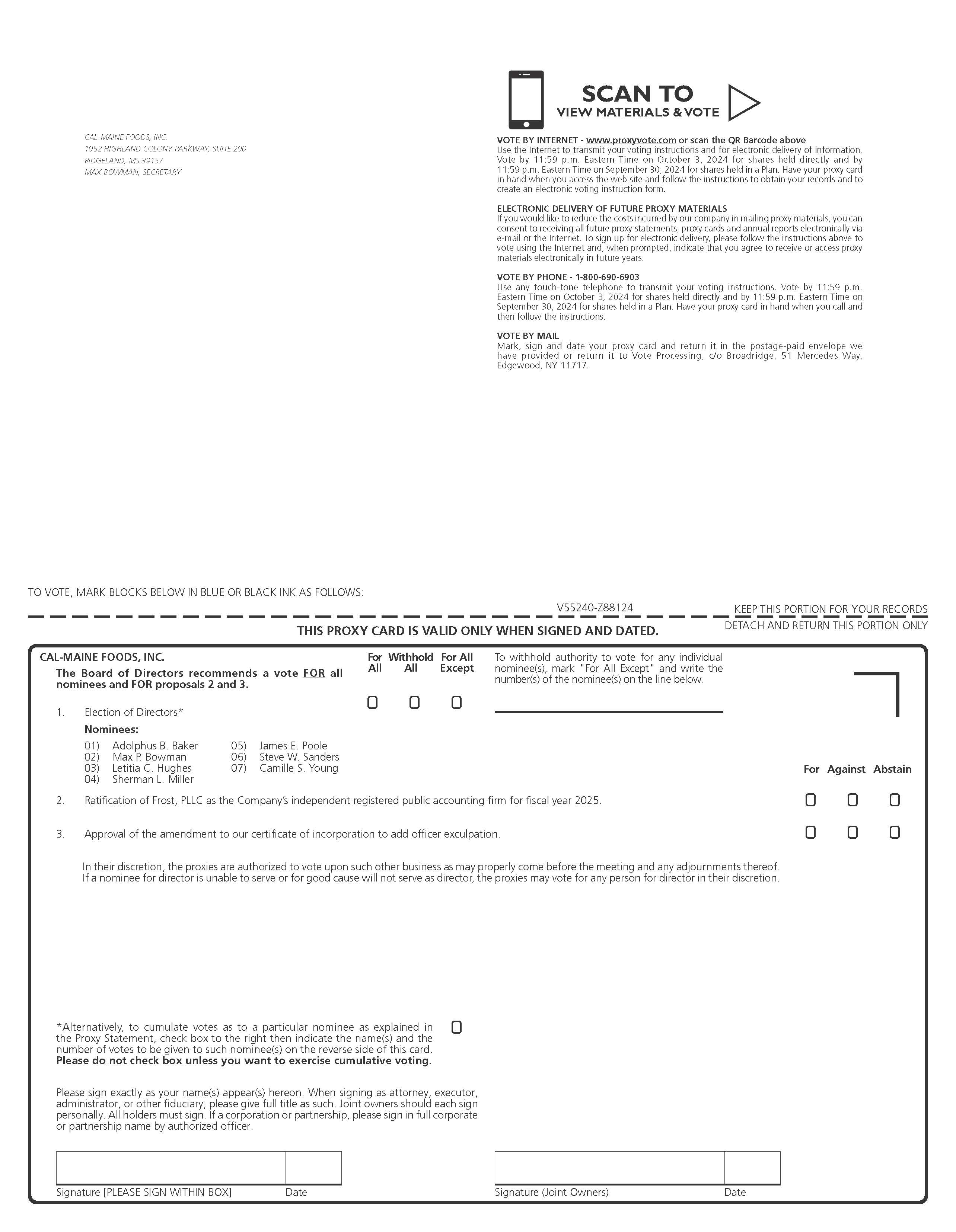

Election of Directors. Both the shares of common stock and the shares of Class A common stock have the right of cumulative voting in the election of directors. Cumulative voting means that each stockholder is entitled to cast as many votes as he or she has the right to cast (before cumulating votes), multiplied by the number of directors to be elected. All such votes may be cast for a single nominee or may be distributed among the nominees to be voted for as the stockholder sees fit. To exercise cumulative voting rights by proxy, a stockholder must clearly designate the number of votes to be cast for any given nominee. Under Delaware law, votes withheld from a director’s election will be counted toward a quorum but will not affect the outcome of the vote on the election of a director. Broker non-votes will not be taken into account in determining the outcome of the election. The election of directors requires a plurality of the votes cast, which means the candidates receiving the highest number of “FOR” votes will be elected.

Voting Requirements. The following table summarizes the votes required for passage of each proposal and the effect of abstentions and uninstructed shares held by brokers.

| Proposal | Voting Options |

Votes Required To Adopt Proposal |

Effect of Abstentions |

Effect of Broker Non-Votes |

| No. 1: Election of directors | For or withhold on all nominees, or allocate votes among the nominees | Plurality of votes cast | N/A | No effect |

| No. 2: Ratification of selection of independent registered public accounting firm | For, against, or abstain | Majority of voting interest having voting power present in person or by proxy | Treated as votes against | N/A |

| No. 3: Approval of the amendment to our certificate of incorporation to add officer exculpation | For, against, or abstain | The approval of a majority in voting interest of the shares of Common Stock and Class A Common Stock issued and outstanding, voting together as a group | Treated as votes against | Treated as votes against |

Our Board recommends that you vote:

| • | FOR the election of the seven nominees named in this proxy statement to serve as directors of the Company; |

| • | FOR the ratification of our selection of Frost, PLLC as independent registered public accounting firm of the Company for fiscal year 2025; and |

| • | FOR the approval of the amendment to our certificate of incorporation to add officer exculpation. |

We do not expect any matters to be presented for action at our Annual Meeting other than the matters described in the proxy statement. However, by completing, dating, signing and returning a proxy card, or by submitting your proxy and voting instructions via the internet, you will give to the persons named as proxies discretionary voting authority with respect to any other matter that may properly come before the Annual Meeting, and they intend to vote on any such other matter in accordance with their best judgment.

In accordance with Delaware law, the Company will appoint two inspectors of election. The inspectors will take charge of and will count the votes and ballots cast at the Annual Meeting and will make a written report on their determination.

OWNERSHIP OF VOTING SECURITIES BY CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth information as to the beneficial ownership of our common stock and Class A common stock as of August 9, 2024, unless otherwise indicated, by:

| • | each person known by us to beneficially own more than 5% of either class outstanding, and |

| • | each director of the Company, each nominee to serve as a director, each executive officer named in the Summary Compensation Table (each a “named executive officer”) and by all directors and executive officers as a group. |

| Name of Beneficial Owner (1) | Common Stock and Class A Common Stock | Percentage of Total Voting Power (3) | ||||||

| Number of Shares Beneficially Owned (2) | Percentage of Class Outstanding | |||||||

| Common | Class A | Common | Class A | |||||

| DLNL (4) | 1,031,361 | 2,400,000 | 2.3 | % | 50.0 | % | 27.1 | % |

| Adolphus B. Baker (5) | 591,893 | 2,400,000 | 1.3 | % | 50.0 | % | 26.7 | % |

| Max P. Bowman (6) | 15,498 | — | * | — | % | * | ||

| Robert L. Holladay, Jr. (7) | 23,801 | — | * | — | % | * | ||

| Letitia C. Hughes (8) | 43,570 | — | * | — | % | * | ||

| Sherman L. Miller (9) | 29,696 | — | * | — | % | * | ||

| James E. Poole (10) | 10,170 | — | * | — | % | * | ||

| Steve W. Sanders (11) | 26,170 | — | * | — | % | * | ||

| Michael T. Walters (12) | 11,923 | — | * | — | % | * | ||

| Camille S. Young (13) | 8,548 | — | * | — | % | * | ||

| BlackRock, Inc. (14) | 6,714,394 | — | 15.2 | % | — | % | 7.3 | % |

| The Vanguard Group (15) | 4,771,655 | — | 10.8 | % | — | % | 5.2 | % |

| Dimensional Fund Advisors LP (16) | 2,438,372 | — | 5.5 | % | — | % | 2.6 | % |

| Cal-Maine Foods, Inc. KSOP | 1,917,587 | — | 4.3 | % | — | % | 2.1 | % |

|

All directors and executive officers as a group

(10 persons) (17)

|

1,797,479 |

4,800,000 |

4.1 |

% |

100.0 |

% |

54.0 |

% |

* Less than 1%

| (1) | Unless otherwise set forth in the footnotes below, the mailing address of each beneficial owner is Cal-Maine Foods, Inc., Post Office Box 2960, Jackson, MS 39207. |

| (2) | The information as to beneficial ownership is based on information known to us or statements furnished to us by the beneficial owners. As used in this table, “beneficial ownership” has the meaning given in Rule 13d-3 under the Securities Exchange Act of 1934 (the “Exchange Act”), i.e., the sole or shared power to vote or to direct the voting of a security, or the sole or shared investment power with respect to a security (the power to dispose of or to direct the disposition of a security). For purposes of this table, a person is deemed as of any date to have “beneficial ownership” of any security that such person has the right to acquire within 60 days of such date. |

| (3) | Percentage of total voting power represents voting power with respect to all shares of our common stock and Class A common stock, voting together as a single class. Each share of common stock is entitled to one vote and each share of Class A common stock is entitled to ten votes. Shares of Class A common stock are automatically converted into common stock on a share per share basis in the event the beneficial or record ownership of any such share of Class A common stock is transferred to any person or entity other than the “Immediate Family Members” of our late founder and Chairman Emeritus, Mr. Fred R. Adams, Jr. or “Permitted Transferees,” as defined in our Second Amended and Restated Certificate of Incorporation filed July 20, 2018. Each share of Class A common stock is convertible, at the option of its holder, into one share of common stock at any time. |

| (4) | Such shares are held of record by DLNL, LLC, a Delaware limited liability company (“Daughters’ LLC”). The members of the Daughters’ LLC are Mr. Baker, his spouse Dinnette Baker, and her three sisters (Mr. Adams’ four daughters). The Daughters’ LLC also holds the 1,309,245 shares of Class A Common Stock attributed by the Daughters’ LLC to Mr. Baker and the 1,090,755 shares of Class A Common Stock and 56,595 shares of common stock attributed by the Daughters’ LLC to Mr. Baker’s spouse, and these shares are reflected in Mr. Baker’s information in the table. |

| (5) | Mr. Baker is Chairman of the Board, a director and a director nominee. The 586,731 shares of common stock includes (i) 287,683 shares of common stock, owned by Mr. Baker’s spouse separately as to which Mr. Baker disclaims beneficial ownership, (ii) 5,618 shares of common stock accumulated under his spouse’s KSOP account as to which Mr. Baker disclaims beneficial ownership, (iii) 147,385 shares of common stock accumulated under Mr. Baker’s KSOP account, (iv) 11,194 shares of unvested restricted common stock, and (v) 56,595 shares of common stock attributed by Daughter’s LLC to Mr. Baker’s spouse. The 2,400,000 shares of Class A common stock are held by the Daughters’ LLC. As sole managing member of the Daughters’ LLC, Mr. Baker controls the vote of 100% of our outstanding Class A Common Stock, except that certain extraordinary matters requiring the vote of the Company’s stockholders such as a merger or amendment of the Company’s Second Amended and Restated Certificate of Incorporation require joint approval of Mr. Baker and members of the Daughters’ LLC holding a majority of its voting interests. Mr. Baker’s aggregate percentage of total voting power is 53.8%. |

| (6) | Mr. Bowman is a director, a director nominee, and is our Vice President – Chief Financial Officer, Treasurer, and Secretary. Includes 1,323 shares of common stock accumulated under his KSOP account and 7,020 shares of unvested restricted common stock. |

| (7) | Mr. Holladay is our Vice President – General Counsel. Includes 5,547 shares of common stock accumulated under his KSOP account and 6,463 shares of unvested restricted common stock. |

| (8) | Ms. Hughes is a director and a director nominee. Includes 6,248 shares of unvested restricted common stock. Ms. Hughes has pledged an account that holds 37,322 shares of common stock as well as other assets to secure a line of credit. Ms. Hughes has established that she has the financial capacity, including the other assets in the account, to repay the line of credit without resorting to the pledged shares. |

| (9) | Mr. Miller is a director, a director nominee, and is President and Chief Executive Officer. Includes 1,341 shares of common stock accumulated under his spouse’s KSOP account as to which Mr. Miller disclaims beneficial ownership, 5,152 shares of common stock accumulated under Mr. Miller’s KSOP account, and 8,227 shares of unvested restricted common stock. |

| (10) | Mr. Poole is a director and a director nominee. Includes 311 shares of common stock owned through Mr. Poole’s individual retirement account and 6,248 shares of unvested restricted common stock. |

| (11) | Mr. Sanders is a director and a director nominee. Includes 6,248 shares of unvested restricted common stock. |

| (12) | Mr. Walters is Vice President – Operations and Chief Operating Officer. Includes 6,613 shares of common stock accumulated under Mr. Walters’ KSOP account, and 4,294 shares of unvested restricted common stock. |

| (13) | Ms. Camille S. Young is a director and a director nominee. Includes 6,248 shares of unvested restricted common stock. |

| (14) | This information is based solely on a Schedule 13G/A filed with the SEC on January 22, 2024, by BlackRock, Inc. (“BlackRock”). The Schedule 13G/A reports that BlackRock has sole voting power over 6,597,908 of such shares and sole dispositive power over 6,714,394 of such shares. BlackRock’s address is 50 Hudson Yards, New York, NY 10001. |

| (15) | This information is based solely on a Schedule 13G/A filed with the SEC on February 13, 2024, by The Vanguard Group (“Vanguard”). The Schedule 13G/A reports that Vanguard has shared voting power over 74,163 of such shares, sole dispositive power over 4,654,752 of such shares, and shared dispositive power over 116,903 of such shares. Vanguard’s address is 100 Vanguard Blvd., Malvern, PA 19355. |

| (16) | This information is based solely on a Schedule 13G filed with the SEC on February 9, 2024 by Dimensional Fund Advisors LP (“Dimensional”). The Schedule 13G reports that Dimensional has sole voting power over 2,384,126 shares and sole dispositive power over 2,438,372 shares. Dimensional’s address is 6300 Bee Cave Road, Building One, Austin, TX 78746. |

| (17) | Includes shares of common stock accumulated under the KSOP. Also includes shares of common stock as to which Messrs. Baker and Miller disclaim beneficial ownership, as described in Notes (5) and (9) above. A total of 173,618 shares of common stock accumulated in the KSOP for the benefit of the directors and executive officers named above and their spouses are included in the 1,936,761 shares shown in the table as owned by the KSOP. |

PROPOSAL NO. 1: ELECTION OF DIRECTORS

Our bylaws provide that the number of directors shall be fixed by resolution of the Board of Directors and that the number may not be less than three nor more than 12. The Board of Directors has fixed the number of directors at seven as of the date of the Annual Meeting. Unless otherwise specified, proxies will be voted FOR the election of the seven nominees named below to serve until the next annual meeting of stockholders and until their successors are elected and qualified. If, at the time of the Annual Meeting, any of the nominees named below is unable to serve or for good cause will not serve, the proxies will be voted for the election of such other person or persons as the Board of Directors may designate in their discretion, unless otherwise directed.

The Board of Directors, upon the recommendation of the Nominating Committee, has designated Adolphus B. Baker, Max P. Bowman, Letitia C. Hughes, Sherman L. Miller, James E. Poole, Steve W. Sanders and Camille S. Young as nominees for election as directors of the Company at the Annual Meeting (each a “Nominee”). Each Nominee is currently a director of the Company and all Nominees have consented to being named as a nominee in this proxy statement and to serve as a director if elected. However, if any Nominee is unable or unwilling to take office at the Annual Meeting, your proxy may be voted in favor of another person or other persons nominated by the Board of Directors. If elected, each Nominee will serve until the expiration of his/her term at the next annual meeting of stockholders and until his/her successor is elected and qualified or until his/her earlier death, resignation or removal from office.

Under our bylaws, our directors are elected by a plurality of votes cast. For more information on the voting requirements, see “Voting Shares—Election of Directors” above.

The Board unanimously recommends a vote “FOR” the seven Nominees.

DIRECTOR NOMINEES

Below is biographical information about each of our Nominees, including information regarding tenure as a

director, business experience and qualifications, education and other company directorships. In addition to the qualifications referred to below, see Corporate Governance – Skills Matrix for information regarding the specific skills of each of our

Nominees.

|

Adolphus B. Baker Chairman, Cal-Maine Foods, Inc. |

|||

| Age |

Director Since

|

Committees | Other Public Company Directorships | |

|

67 |

1991 |

• Executive (Chair) • Nominating (Chair)

|

Trustmark Corporation and Trustmark National Bank | |

| Business Experience, Qualifications, Attributes and Skills |

|

Adolphus B. Baker serves as Company Chairman of the Board. He was elected as chairman of the board in 2012. Previously, Mr. Baker served as Company Chief Executive Officer from 2010 to September 30, 2022, President from 2010 to 2018, and as Chief Operations Officer from 1997 to 2010. Mr. Baker served as Company Vice President and Director of Marketing from 1987 to 2010 after earning his promotion from his prior position as Company Assistant to the President in 1987. Mr. Baker joined Cal-Maine Foods in 1986.

Mr. Baker has guided Cal-Maine Foods’ emergence as the largest producer and distributor of fresh shell eggs and egg products in the United States. During his tenure, the Company has identified, acquired and successfully integrated 25 companies that have driven enterprise growth. Mr. Baker was also instrumental in delivering the Company’s 1996 initial public offering and Nasdaq listing (Nasdaq: CALM). Mr. Baker’s focus on prudential growth helped drive net sales of $293 million in fiscal 1997 to the Company’s highest net sales of $3.1 billion in fiscal 2023. He helped the Company align enterprise production, sales and distribution capabilities to generate annual sales volumes in excess of one billion dozen shell eggs, which represent about 21% of current United States domestic shell egg consumption. Mr. Baker has helped expand the Company’s total addressable market through our growth strategies. Notably, Mr. Baker has supervised the installation of an asset base that helps the Company provide a spectrum of food choices across product categories.

As Chairman of the Board, Mr. Baker remains actively involved in managing the Company, with a focus on strategy, capital allocation, advising the senior management team and leading the Board. Mr. Baker also leverages his deep experience and diverse skillset to advise the Company on its engagement with stakeholders.

Mr. Baker currently serves on the Board of Directors of Eggland’s Best, Inc., and the board of managers of Eggland’s Best, LLC. He previously served as Chairman of the American Egg Board, United Egg Producers, Egg Clearinghouse, Inc. and the Mississippi Poultry Association. He has also previously served as a Director of United Egg Producers. He currently serves on the Board of Directors of Trustmark Corporation and its subsidiary, Trustmark National Bank.

Mr. Baker earned a Bachelor of Business Administration from Mississippi State University in 1980. He is the son-in-law of the late Fred R. Adams, Jr., the Company’s founder. The Board believes that Mr. Baker’s highly informed view of Company operations, his depth and breadth of experience and his continued poultry industry engagement qualify him to serve on the Board.

|

|

Max P. Bowman Vice President, Chief Financial Officer, Cal-Maine Foods, Inc. |

|||

| Age | Director Since | Committees | Other Public Company Directorships | |

|

64 |

2018 |

• Executive

|

None | |

| Business Experience, Qualifications, Attributes and Skills |

|

Mr. Bowman has served as Company Vice President and Chief Financial Officer since October 5, 2018, when he was elected to the Board. Mr. Bowman also serves as treasurer and secretary. He joined the Company in June 2018 as Vice President, Finance. Mr. Bowman is a Certified Public Accountant who has extensive experience leading corporate finance and accounting, financial reporting, risk management and merger and acquisition efforts. Mr. Bowman is responsible for the Company’s business line finance group, accounting and financial reporting, corporate development, financial planning and analysis, human capital, information technology, investor relations, risk management and sustainability functions.

Prior to joining the Company, Mr. Bowman served as Chief Financial Officer of Southern States Utility Trailer Sales and H&P Leasing from 2014 to 2018. In 2003, Mr. Bowman co-founded Tenax, LLC, a holding company for Tenax Aerospace, a special-mission aircraft-leasing company. At Tenax, Mr. Bowman served as chief executive officer, chief financial officer and president. From 1985 to 2002, Mr. Bowman served in progressive roles of responsibility at ChemFirst, Inc. (NYSE: CEM), a diversified global agricultural, intermediate and fine chemical manufacturer and provider of electronic materials and chemicals to the semiconductor industry that was previously listed on the New York Stock Exchange. Mr. Bowman was appointed as Chief Financial Officer of ChemFirst in 1997 and served in this role until ChemFirst was sold to DuPont Co in December 2002. Previously, Mr. Bowman began working at Arthur Andersen & Company in 1982 and was serving as a Senior Auditor when he left the firm in 1985.

Mr. Bowman’s earlier board service includes Tenax and WGS Systems. He earned a Bachelor of Accountancy Degree from Mississippi State University. The Board believes that Mr. Bowman’s extensive experience in managing the finance divisions of public and private companies and successful dealmaking track record qualify him to serve on the Board.

|

|

Letitia C. Hughes Retired Senior Vice President, Trustmark National Bank |

|||

| Age | Director Since | Committees | Other Public Company Directorships | |

|

72

|

2001 |

• Audit (Chair) • Compensation • Long-Term Incentive Plan • Nominating

|

None | |

| Business Experience, Qualifications, Attributes and Skills |

|

Letitia C. Hughes was elected to the Board as an independent director in 2001. Ms. Hughes retired as Senior Vice President and Manager of Private Banking at Trustmark National Bank in Jackson, Mississippi, in 2014 after more than forty years of service as a private wealth management expert, industry vertical banker and credit analyst. During her career, Ms. Hughes earned progressively more senior roles tied to financial services, human capital management and technology management, among other capabilities. She served as a subject matter expert for customer privacy, bank secrecy and anti-money laundering governance initiatives. Ms. Hughes also helped the bank develop standards for measuring progress against key legal, compliance and performance objectives.

Ms. Hughes most recently served as Senior Vice President at Trustmark. She focused her career on private banking from 1995 until her retirement. Ms. Hughes helped high net-worth individuals and their families meet their financial goals by providing holistic wealth planning capabilities, including financial analysis, real estate and portfolio management solutions and insurance, tax and trust-planning services. Between 1980 and 1995, Ms. Hughes served as a relationship manager for small- and medium-size corporate clients and offered merger and acquisition advisory services in addition to loan-origination capabilities across industry verticals, including manufacturing, food processing and heavy equipment leasing and finance, among others. In 1975, Ms. Hughes was promoted to a generalist credit analyst role dedicated to support the bank’s risk management efforts. She began her career with Trustmark in 1974 as a management trainee. During her career, Ms. Hughes maintained active Series 6, Series 7 and Series 63 licenses.

Ms. Hughes continues to contribute to community organizations, including serving in a number of leadership and advisory roles in the Jackson, Mississippi, area. Notably, she previously served as President of the Junior League of Jackson, Mississippi. Ms. Hughes has served on the Board of Trustees of Methodist Rehabilitation Center (“MRC”) in Jackson since 2007. Since 2012, she has also supported the MRC’s Wilson Research Foundation, which is devoted to build a research and education program to advance the clinical practice of neurorehabilitation, with board service and Investment Committee participation and oversight.

Ms. Hughes earned her B.S. in Math from Vanderbilt University in 1974. The Board believes that Ms. Hughes’ broad audit, finance and banking experience, in addition to her general knowledge of the Company’s operating environment, qualify her to serve on the Board.

|

|

Sherman L. Miller President and Chief Executive Officer, Cal-Maine Foods, Inc. |

|||

| Age | Director Since | Committees | Other Public Company Directorships | |

|

49 |

2012 |

• Executive

|

None | |

| Business Experience, Qualifications, Attributes and Skills |

|

Mr. Miller was elected to the Board in 2012. He has served as Company President since 2018 and was elected as Chief Executive Officer (“CEO”) on September 30, 2022. Mr. Miller previously served as Chief Operating Officer from 2011 to March 24, 2023. Mr. Miller has devoted his professional career to the Company since joining in 1996, including by serving in various positions of increasing responsibility in operations prior to his promotion to Company Vice President, Operations, in 2007. Mr. Miller is a widely recognized animal protein industry expert. He brings extensive experience in attracting and retaining the talent base necessary to support the Company’s strategy of growing by acquisition and integration, in addition to organic growth.

Since 2011, Mr. Miller has maintained primary responsibility for commodity sourcing and procurement as well as operational logistics that support distribution. Mr. Miller brings a deep understanding of the regulatory landscape that governs how safe, quality food is produced, processed and brought to market. He is primarily responsible for upholding Company risk policies tied to food safety, environmental management and animal welfare.

Mr. Miller’s current and prior board service includes contributions to the United Egg Producers, the U.S. Poultry and Egg Association and the Mississippi State University Poultry Science Advisory Board, among others. He earned his B.S. in Poultry Science from Mississippi State University, where he currently serves as the Distinguished Fellow for the Department of Poultry Science.

As CEO, Mr. Miller is a proven leader in managing our business through the various market cycles that are characteristic of our industry. He leverages his operational experience with a strategic vision to focus on effective operations and execution of the Company’s growth strategy.

The Board believes that Mr. Miller’s recognized and substantial industry experience, track record of innovation and successful execution of the Company’s strategies for the benefit of its customers qualify him to serve on the Board.

|

|

James E. Poole Retired Founder and Managing Partner, GranthamPoole |

|||

| Age | Director Since | Committees | Other Public Company Directorships | |

|

75 |

2004 |

• Audit • Compensation (Chair) • Long-Term Incentive Plan (Chair) • Nominating

|

None | |

| Business Experience, Qualifications, Attributes and Skills |

|

James E. Poole was elected to the Board as an independent director in 2004. Mr. Poole is a Certified Public Accountant who retired in 2013 as a Principal of GranthamPoole, a public accounting firm he co-founded in 1999. GranthamPoole grew into one of the southeastern United States’ largest regional accounting firms, driven largely by the firm’s recognized expertise designing audit, ethics and governance programs for clients. Mr. Poole’s service to the firm included Management Committee membership and senior partner and principal roles. Mr. Poole’s practice focused on identifying clients’ key business risks and helping them integrate liability management and insurance strategies into growth-focused operating cultures. He also supervised the expansion of the firm’s merger and acquisitions and tax-consulting practices.

Prior to co-founding GranthamPoole, Mr. Poole founded James E. Poole, CPA, a public accounting firm, in 1985. Under his leadership, the firm quickly scaled its valuation and merger and advisory practices on behalf of corporate clients pursuing growth, among other specialty areas. Previously, Mr. Poole co-founded Mississippi Mortgage Company, a company focused on low-income housing mortgage origination and syndication. He also built other businesses, including a real estate company focused on residential development in the Florida panhandle in addition to a business dedicated to oil and gas exploration.

A native of Oxford, Mississippi, Mr. Poole earned a Bachelor of Business Administration with a major in Accounting from University of Mississippi in 1972. He is very well-known for his contributions to the Ole Miss football team as a standout player. Mr. Poole is also active in the community. He previously volunteered for Kairos Prison Ministries, an organization devoted to serve incarcerated men, women and youth and assist those who have been impacted by incarceration. He previously served on the ministry’s Central Mississippi Board of Directors.

The Board believes that Mr. Poole’s extensive audit and financial experience, risk management expertise, successful track record of business development and broad knowledge of the general business climate where the Company operates qualify him for service on the Board.

|

|

Steve W. Sanders Retired Managing Partner Ernst & Young |

|||

| Age | Director Since | Committees | Other Public Company Directorships | |

|

78 |

2009 |

• Audit • Compensation • Long-Term Incentive Plan • Nominating

|

None | |

| Business Experience, Qualifications, Attributes and Skills |

|

Steve W. Sanders was elected to the Board as an independent director in 2009. Mr. Sanders is a Certified Public Accountant who retired as Managing Partner of the Ernst & Young LLP, Jackson, Mississippi, office after more than 30 years of service. Mr. Sanders has extensive audit, merger and acquisition accounting and valuation-advisory experience. In his practice, Mr. Sanders advised private companies searching for bolt-on acquisitions and engaging in initial public offerings. Mr. Sanders also has broad experience providing industry verticals with audit services and various acquisition audits and related services.

Mr. Sanders was promoted to partner at Ernst & Young in 1986. During his tenure, Mr. Sanders was increasingly responsible for human capital management, including hiring, retention and client-side staffing for the Jackson, Mississippi, office. He also supervised the Jackson, Mississippi, office’s ethics, legal and regulatory compliance prior to his retirement in 2002 as Managing Partner. Mr. Sanders’ early career included experience working part-time at a poultry company, which gave him insight into the poultry industry’s operating needs.

Mr. Sanders served as a Lecturer at the Richard C. Adkerson School of Accountancy at Mississippi State University, where he taught accounting and auditing courses from 2003 until his retirement in 2017. His previous board service includes a directorship of Valley Services, Inc., a privately held national contract food services manager, from 2002 until Elior North America acquired the business in 2012. Mr. Sanders’ community activities include service as Chairman of the Finance Committee of the Broadmoor Baptist Church in Madison, Mississippi.

Mr. Sanders earned his B.S. of Accountancy at Mississippi State University in 1968 and Masters in Business Administration in 1969. The Board believes that Mr. Sanders’ extensive audit, accounting and finance experience, in addition to his human capital management and leadership record, qualify him to serve on the Board.

|

|

Camille S. Young Principal and Director, Cornerstone Government Affairs |

|||

| Age | Director Since | Committees | Other Public Company Directorships | |

|

51 |

2021 |

• Audit • Compensation • Long-Term Incentive Plan • Nominating

|

Mississippi Power Company | |

| Business Experience, Qualifications, Attributes and Skills |

|

Camille S. Young was elected to the Board as an independent director in 2021. Ms. Young brings more than twenty years of government affairs experience with Mississippi’s elected state and local government officials. Ms. Young maintains deep relationships with business leaders and community influencers nationally and across the state of Mississippi. She deploys her issue expertise and relationships to help clients navigate policies, create and drive effective advocacy campaigns, utilize business and development opportunities and craft successful public affairs efforts. In her practice, Ms. Young also helps clients pursue mergers and acquisitions, navigate supply chain complexities and manage value chain risks.

Ms. Young currently serves as Principal and Director of Cornerstone Government Affairs, a full-service, bipartisan consulting firm specializing in federal and state government relations, public affairs and strategic communications and advisory services. At Cornerstone, Mr. Young co-chairs the firm’s Diversity and Inclusion Working Group. Ms. Young joined the firm in 2011.

Previously, Ms. Young served as a government affairs representative with one of Mississippi’s leading law firms, Watkins Ludlam Winter & Stennis, from 2001 to 2011, where she was a member of the Government Affairs practice group. She was responsible for managing clients’ legislative advocacy, public affairs and community relations efforts. Prior to joining Watkins Ludlam, Ms. Young served the Mississippi Farm Bureau Federation for five years in various roles as a communications specialist, director of media relations and a government relations specialist. She also held a position with the United States Department of Agriculture as an outreach and public affairs specialist.

Ms. Young serves as a member of the inaugural Diversity and Inclusion Committee of the Madison County Business League and Foundation in Mississippi. She previously served as President of the Mississippi State University National Alumni Association, where, during her tenure, she helped drive increased participation by diverse members of the alumni base. Ms. Young has contributed to community activities such as the Greater Jackson Chamber Partnership Board of Directors, the Junior League of Jackson Sustainers Board of Directors, Alpha Kappa Alpha Sorority, Incorporated, and the Mississippi 4-H Foundation. Ms. Young’s public board service includes Mississippi Power Company, a subsidiary of Southern Company. She also serves on the board of privately-held BankFirst Financial Services.

Ms. Young earned her B.A. in Communication and M.S. in Agriculture & Extension Education from Mississippi State University. The Board believes that Ms. Young’s extensive human capital, government and regulatory relations, risk management and strategic planning experience qualify her to serve on the Board.

|

EXECUTIVE OFFICERS OF THE COMPANY

The following information sets forth the name, age, principal occupation and business experience during the last five years of each of the current executive officers of the Company. The executive officers serve at the pleasure of the Board.

ADOLPHUS B. BAKER, age 67, is Chairman of the Board. See previous description under “Director Nominees.”

SHERMAN L. MILLER, age 49, is President, Chief Executive Officer and a director. See previous description under “Director Nominees.”

MAX P. BOWMAN, age 64, is Vice President, Chief Financial Officer, Treasurer and Secretary and a director. See previous description under “Director Nominees.”

ROBERT L. HOLLADAY, JR., age 48, is Vice President – General Counsel. Mr. Holladay joined the Company and was appointed to this position in 2011.

MICHAEL T. WALTERS, age 53, is Vice President – Operations and Chief Operating Officer. Mr. Walters has served as a Vice President since July 11, 2011. He was appointed as Chief Operating Officer by the Board on March 24, 2023.

SCOTT D. HULL, age 37, is Vice President – Sales. Mr. Hull assumed the executive officer role on April 4, 2024 and has served as Vice President - Sales since October 1, 2021. Prior to that time, Mr. Hull served as National Sales Manager from September 2016. Mr. Hull previously served as a general manager at the Company’s Louisburg, North Carolina, location before joining the sales team in 2014. He has been with the Company since 2009.

CORPORATE GOVERNANCE

Meetings and Attendance

Our Board of Directors holds regularly scheduled quarterly meetings and may hold special meetings each year. Normally, committee meetings occur the day of the Board meeting. At each quarterly Board meeting, time is set aside for the independent directors to meet without management present. Our Board held four regularly scheduled quarterly meetings, six special meetings, and took action by written consent twice during fiscal year 2024. All of our directors attended at least 75% of the aggregate of all Board of Directors meetings and meetings of the committees on which they served during their tenure in office in the last fiscal year. Directors are encouraged to attend the Annual Meeting of Stockholders, and all directors then in office attended the 2023 Annual Meeting.

Board Committees

Our Board has five standing committees: an Audit Committee, a Compensation Committee, an Executive Committee, a Long-Term Incentive Plan Committee (“LTIP Committee”) and a Nominating Committee. In addition, under our bylaws our Board may designate additional committees as it deems appropriate. In select instances, the Board and its committees may take action through written consent. The Audit and Compensation Committees have written charters which are available on the “Investor Relations – Corporate Governance” page of our website at www.calmainefoods.com. The Executive, Long-Term Incentive Plan, and Nominating Committees do not have charters. The table below provides the current composition for each of the Board’s standing committees.

| Director | Audit | Compensation | Executive | Long-Term Incentive Plan | Nominating |

| Adolphus B. Baker | Chair | Chair | |||

| Max P. Bowman | Member | ||||

| Letitia C. Hughes | Chair | Member | Member | Member | |

| Sherman L. Miller | Member | ||||

| James E. Poole | Member | Chair | Chair | Member | |

| Steve W. Sanders | Member | Member | Member | Member | |

| Camille S. Young | Member | Member | Member | Member |

Audit Committee: The Audit Committee, which is composed of four directors who are independent in accordance with applicable Nasdaq listing standards and SEC rules, including the enhanced criteria with respect to audit committee members, meets with management, internal auditors, and the Company’s independent registered public accounting firm to oversee the adequacy of internal controls, recommends a registered public accounting firm for the Company to select, evaluates and oversees an internal auditor for the Company, reviews annual audited and quarterly financial statements and recommends whether such statements should be included in the Company’s annual reports on Form 10-K and quarterly reports on Form 10-Q, and oversees financial matters. The Audit Committee held four regular scheduled meetings in fiscal year 2024.

Compensation Committee: The Compensation Committee is also composed of four directors who are independent in accordance with applicable Nasdaq listing standards and SEC rules. The Compensation Committee discharges the responsibilities of the Board of Directors relating to compensation of the Company’s executive officers by establishing goals and reviewing general policy matters relating to compensation and benefits of employees of the Company, including the issuance of equity awards to the Company’s officers, employees and directors. It reviews and approves the compensation and benefits of officers who are members of the Executive Committee and makes recommendations to the Board of Directors and members of the LTIP Committee with respect to the Company’s incentive compensation plans and equity-based plans. For more information on the Compensation Committee processes and procedures, see “Compensation Discussion and Analysis” below. The Compensation Committee held two regular scheduled quarterly meetings in fiscal year 2024.

Executive Committee: The Executive Committee may exercise all of the powers of the full Board of Directors, except for certain major actions, such as the adoption of an agreement of merger or consolidation, the recommendation to stockholders of the disposition of substantially all of the Company’s assets or a dissolution of the Company, and the declaration of a dividend or authorization of an issuance of stock. It may not authorize single capital expenditure projects in excess of $10 million. The Executive Committee did not hold any formal meetings in fiscal year 2024, but worked closely together and took action by written consent seven times.

Long-Term Incentive Plan Committee: The LTIP Committee, which is composed of four independent directors, administers the Amended and Restated Cal-Maine Foods, Inc. 2012 Omnibus Long-Term Incentive Plan, which includes selection of the persons to whom awards may be made, determining the types of awards, determining the times at which awards will be made and other terms and conditions relating to awards, all in accordance with plan documents. The LTIP Committee held two meetings in fiscal year 2024.

Nominating Committee: The Nominating Committee considers potential director nominees proposed by committee members, other members of the Board of Directors, management or our stockholders. Any stockholder desiring to submit a director candidate for consideration should submit the candidate’s name, address and detailed background information to the Secretary of the Company at the Company’s address shown above under “General Matters.” The Secretary will forward such information to the Nominating Committee for its consideration. The Nominating Committee held one meeting in fiscal year 2024.

Consideration of Director Nominees

In recommending nominees for the Board, the Nominating Committee considers any specific criteria the Board may request from time to time and such other factors as it deems appropriate. These factors may include any special training or skill, experience with businesses and other organizations of comparable size and type, experience or knowledge with businesses that are particularly relevant to the Company’s current or future business plans, financial expertise, the interplay of the candidate’s experience with the experience of the other directors, sufficient time to devote to the responsibilities of a director, freedom from conflicts of interest or legal issues and the extent to which, in the Nominating Committee’s opinion, the candidate would be a desirable addition to the Board. Diversity is taken into account when determining how the candidates’ qualities and attributes would complement the other directors’ backgrounds. Type of advanced studies and certification, type of industry experience, area of corporate experience, race, ethnicity, and gender, among other factors, are taken into consideration. The Nominating Committee believes that the different business and educational backgrounds of the directors of the Board contribute to the overall insight necessary to evaluate matters coming before the Board.

Each candidate brought to the attention of the

Nominating Committee, regardless of who recommended such candidate, will be considered on the basis of the criteria set forth above.

Skills and Experience

The following table notes the breadth and variety of business experience that each of Nominees brings to the Company and which enable the Board to provide insightful leadership to the Company We believe that our directors have suitable and diverse skill sets that align with our industry and business strategy. Our Nominating Committee will review these skill areas periodically to help ensure they represent the current and anticipated future needs of our business.

| CAL-MAINE FOODS BOARD OF DIRECTORS CHARACTERISTICS | |||||||

| BAKER | BOWMAN | HUGHES | MILLER | POOLE | SANDERS | YOUNG | |

| SKILLS AND EXPERIENCE | |||||||

| Audit & risk management | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | |

| Financial reporting | ✓ | ✓ | ✓ | ✓ | ✓ | ||

| Governance & ethics oversight | ✓ | ✓ | ✓ | ✓ | |||

| Human capital management | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ |

| Industry experience | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ |

| Information & cyber security | ✓ | ✓ | |||||

| Legal compliance & regulatory relations | ✓ | ✓ | ✓ | ✓ | ✓ | ||

| Mergers & acquisitions | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ |

| Product quality & innovation | ✓ | ✓ | ✓ | ||||

| Strategy & planning | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ |

| Supply chain & procurement | ✓ | ✓ | ✓ | ✓ | ✓ | ||

| Sustainability governance | ✓ | ✓ | ✓ | ✓ | |||

| BOARD INDEPENDENCE AND DEMOGRAPHICS | |||||||

| Independent | N | N | Y | N | Y | Y | Y |

| Age | 67 | 64 | 72 | 49 | 75 | 78 | 51 |

| Gender | M | M | F | M | M | M | F |

| Race | White | White | White | White | White | White | Black |

Board Diversity

The table below provides certain highlights of the composition of our Nominees. Each of the categories listed in the below table has the meaning as it is used in Nasdaq Rule 5605(f).

| BOARD DIVERSITY MATRIX AS OF AUGUST 22, 2024 | ||||

| Total Number of Directors | 7 | |||

|

Did Not Disclose |

||||

| Female | Male | Non-Binary | ||

| Part I: Gender Identity | ||||

| Directors | 2 | 5 | ||

| Part II: Demographic Background | ||||

| African American or Black | 1 | |||

| Alaskan Native or Native American | ||||

| Asian | ||||

| Hispanic or Latinx | ||||

| Native Hawaiian or Pacific Islander | ||||

| White | 1 | 5 | ||

| Two or More Races or Ethnicities | ||||

| LGBTQ+ | ||||

| Did Not Disclose Demographic Background | ||||

Stockholder Communications

Stockholders may send communications to the Board by directing them to the Secretary in the manner described above under “General Matters.” The Secretary will forward to all members of the Board any such communications he receives which, in his reasonable judgment, he deems to be not spurious and to be sent in good faith.

Strategy Oversight

The Board is responsible for oversight of strategic planning of the Company. The Board plays an integral role in development of Company strategy and coordination with management of the execution of that strategy. The Board also identifies and oversees the management of the Company’s long-term goals.

Risk Oversight

The Board takes its oversight role in the Company’s risk management very seriously. The Board does not have a standing risk management committee, but rather administers this oversight function directly through the Board as a whole, as well as through various Board standing committees that address risks inherent in their respective areas of oversight.

The Company’s Executive Committee is primarily responsible for managing the day-to-day risks of the Company’s business and is best equipped to assess and manage those risks. The Audit Committee also plays a prominent role in assessing and addressing risks faced by the Company with respect to financial and accounting controls, internal audit functions, pending or threatened legal matters, insurance coverage and the Company’s “whistleblower” hotline policy, among other matters. The Board and the Audit Committee receive reports on the Company’s exposure to risk and its risk management practices from members of the Executive Committee as well as other members of the Company’s management and legal counsel, including reports on the Company’s information technology standards and safeguards, financial and accounting controls and security measures, environmental compliance, bio-security and animal health, food safety, human resources, litigation and other legal matters, grain purchasing strategies, and customer concentration and product mix, among other things. For additional information about the Company’s processes for managing risks from cybersecurity threats and the Board’s oversight of such risks, see our Annual Report on Form 10-K for fiscal 2024, Part I. Item 1C. Cybersecurity. The Board regularly receives updates about and reassesses the management of the Company’s risks throughout the year. The Board and the Audit Committee also review the Company’s risk disclosures in its draft periodic reports before they are filed and have the opportunity to question management and outside advisers about the risks presented. In addition, the Compensation Committee assesses whether the Company’s incentive compensation arrangements encourage unnecessary or excessive risk-taking and evaluate compensation policies and practices that could mitigate any such risk.

The Board’s role in risk oversight of the Company is consistent with the Company’s leadership structure, with the Chief Executive Officer and other members of senior management having responsibility for assessing and managing the Company’s risk exposure on a day-to-day basis, and the Board and its committees providing oversight in connection with those efforts.

The Board’s oversight of risks affecting the Company has not specifically affected the Board’s leadership structure. The Board believes that its current leadership structure is conducive to and appropriate for its risk oversight function. If in the future the Board believes that a change in its leadership structure is required to, or potentially could, improve the Board’s risk oversight function, it may make any change it deems appropriate.

Sustainability

Our Board oversees our sustainability efforts, including topics that we believe are of interest to our stakeholders. You can read more about our sustainability efforts and standards in our most recent Sustainability Report, available in the “Investor Relations – Sustainability – Reports” section of our website at www.calmainefoods.com. Information contained on our website is not a part of this proxy statement.

Stock Ownership Guidelines

The Board has adopted stock ownership guidelines applicable to the Company’s non-employee directors. Under the guidelines, each non-employee director is encouraged to maintain ownership of Company stock valued at two times his or her annual retainer, which is currently $45,000. Under the stock ownership guidelines, new directors are expected to comply with the stock ownership target within five years of appointment. All of our non-employee directors are currently in compliance with the guidelines.

Board Independence and Impact of “Controlled Company” Status

Nasdaq’s qualitative listing standards require that a majority of a listed company’s directors be independent and that a compensation committee and nominating committee of the Board composed solely of independent directors be established. These standards are not applicable to any company where more than 50% of the voting power for the election of directors is held by one individual or group. Fred R. Adams, Jr., our Founder and Chairman Emeritus, died on March 29, 2020. A limited liability company (the “Daughters’ LLC”), owned by Mr. Adams’ son-in-law, Mr. Baker, Mr. Baker’s spouse and her three sisters (Mr. Adams’ four daughters) (collectively, the “Family”), owns 100% of our outstanding Class A Common Stock (which has 10 votes per share), controlling approximately 52.0% of our total voting power. As sole managing member of the Daughters’ LLC, Mr. Baker controls the vote of 100% of our outstanding Class A Common Stock, except that certain extraordinary matters requiring the vote of the Company’s stockholders such as a merger or amendment of the Company’s Second Amended and Restated Certificate of Incorporation require joint approval of Mr. Baker and members of the Daughters’ LLC holding a majority of its voting interests. Family members also have additional voting power due to beneficial ownership of our Common Stock (which has one vote per share), directly or indirectly through the Daughter’s LLC and other entities, resulting in family voting control of approximately 53.8% of our total voting power. Accordingly, the Company is a “controlled company” and thus exempt from those Nasdaq listing standards.

As executive officers of the Company, Messrs. Baker, Bowman and Miller do not qualify as independent pursuant to the Nasdaq listing standards, if elected. Additionally, Mr. Baker serves as chair of the Nominating Committee. Our Board determined that, under the Nasdaq listing standards, the following director nominees are independent: Ms. Hughes, Mr. Poole, Mr. Sanders and Ms. Young.

Notwithstanding the Company’s status as a controlled company and although not required, a majority of the directors on our Board are independent in accordance with the Nasdaq listing standards applicable to non-controlled companies and the governance policies of certain institutional investors and advisory groups, and our Compensation Committee includes only independent directors.

The Company is, however, subject to the Nasdaq listing standards requiring that the Audit Committee (i) be composed solely of independent directors; (ii) be directly responsible for the appointment, compensation, retention and oversight of the independent registered public accounting firm, which must report directly to the audit committee; (iii) establish procedures to receive, retain, and treat complaints regarding accounting, internal accounting controls and auditing matters, and for employees’ confidential, anonymous submissions of concerns regarding questionable accounting or auditing matters; (iv) have the authority to engage independent counsel and other advisors when the committee determines such outside advice is necessary; and (v) be adequately funded by the Company. Our Audit Committee is in compliance with these standards. In addition, our Board has determined that all of the members of the Audit Committee satisfy Nasdaq’s enhanced independence and other criteria applicable to audit committee members and that each of Ms. Hughes and Messrs. Poole and Sanders qualifies as an “audit committee financial expert,” as such term is defined by the rules of the SEC.

Executive Sessions

The Company is also subject to Nasdaq’s listing standards that require the independent directors of the Board to have regularly scheduled meetings at which only independent directors are present. Such meetings were held following each regular meeting of the Board during fiscal year 2024.

Code of Ethics and Business Conduct

Nasdaq qualitative listing standards require companies to adopt a code of business conduct and ethics applicable to all directors, officers and employees that is in compliance with certain provisions of the Sarbanes-Oxley Act of 2002 and related SEC rules. Our Code of Ethics and Business Conduct is posted on the “Investor Relations—Corporate Governance” page of our website at www.calmainefoods.com.

Board Leadership Structure

Mr. Baker, who previously served also as our Chief Executive Officer, serves as Chairman of the Board. On September 30, 2022, Mr. Miller was named our Chief Executive Officer. The Board recognizes that the leadership structure and the decision to combine or separate the roles of the Chief Executive Officer and Chairman of the Board are prompted by the Company’s needs at any point in time. The Company’s leadership structure has varied over time and has included combining and separating these roles. As a result, the Board has not established a firm policy requiring combination or separation of these leadership roles and the Company’s governing documents do not mandate a particular structure. This provides the Board with flexibility to establish the most appropriate structure for the Company at any given time. However, the Board has determined that the Company benefits from Mr. Miller serving as Chief Executive Officer while Mr. Baker continues to serve as Chairman of the Board. Mr. Miller has a great understanding of the Company through his operational experience and the Board recognized the value of his expertise and strategic vision to the Company. Mr. Baker’s service as Chairman of the Board aids the Board’s decision-making process because he has firsthand knowledge of the Company’s operations and the major issues facing the Company, and he chairs the Board meetings where the Board discusses strategic and business issues.

The Board also considers the above structure appropriate due to the Company’s status as a “controlled company.” Further, due to the relatively small size of the Board and the fact that a majority of the members of the Board are independent directors, the Board has not felt it necessary to designate a lead independent director.

Related-Party Transactions

We are the largest producer and distributor of shell eggs in the United States. We spend hundreds of millions of dollars for third-party goods and services annually, with the authority to purchase such goods and services dispersed among many different officers and managers across the United States. Consequently, there may be transactions and business arrangements with businesses and other organizations in which one of our directors or nominees, executive officers, or their immediate families, or a greater than 5% owner of either class of our capital stock, may also be a director, executive officer, or investor, or have some other direct or indirect material interest. We may refer to these relationships generally as related-party transactions.

Related-party transactions have the potential to create actual or perceived conflicts of interest between the Company and its directors and executive officers or their immediate family members. The Company’s Code of Ethics and Business Conduct prohibits directors, officers and employees of the Company from engaging in transactions which may create or appear to create a conflict of interest without disclosing all relevant facts and circumstances to, and obtaining the prior written approval of, the Company’s Chief Executive Officer and General Counsel. The General Counsel reports at least annually to the Audit Committee concerning any such disclosures. The Nasdaq listing standards require that related-party transactions be reviewed for potential conflicts of interest on an ongoing basis by the Company’s Audit Committee or another independent committee of the Board of Directors. The Audit Committee usually reviews and approves such transactions. While the Audit Committee has no specific written policy and procedures for review and approval of related-party transactions, in the past if a related-party transaction involved a director, executive officer, or their immediate family members, in evaluating such transaction the Audit Committee has considered, among other factors:

| • | the goods or services provided by or to the related party, |

| • | the nature of the transaction and the costs to be incurred by the Company or payments to the Company, | |

| • | the benefits associated with the proposed transaction and whether alternative goods or services are available from unrelated parties, |

| • | the advantages the Company would gain by engaging in the transaction, |

| • | whether the terms of the transaction are fair to the Company and arms-length in nature, |

| • | the materiality of the transaction to the Company and to the related party, and |

| • | management’s determination that the transaction is in the best interests of the Company. |

No reportable related-party transactions have taken place since the beginning of fiscal year 2024, and none are currently proposed.

Delinquent Section 16(a) Reports

Section 16(a) of the Exchange Act requires our officers and directors, and persons who beneficially own more than 10% of the outstanding shares of our common stock, to file reports of ownership and changes in ownership concerning their shares of our common stock with the SEC and to furnish us with copies of all Section 16(a) forms they file. We are required to disclose delinquent filings of reports by such persons.

Based solely upon a review of Forms 3, Forms 4, and Forms 5 furnished to us pursuant to Rule 16a-3 under the Exchange Act, we believe that all such forms required to be filed pursuant to Section 16(a) of the Exchange Act during fiscal 2024 were timely filed by the officers, directors, and security holders required to file such forms except that Mr. Baker filed one late Form 4 on January 16, 2024 with respect to stock donations that occurred on December 7, 2023.

COMPENSATION DISCUSSION AND ANALYSIS

This compensation discussion and analysis describes and analyzes our executive compensation philosophy and program in the context of the compensation paid during the last fiscal year to our named executive officers. Our named executive officers for fiscal year 2024 are listed below:

| • | Adolphus B. Baker, Chairman of the Board; |

| • | Sherman L. Miller, President and Chief Executive Officer; |

| • | Max P. Bowman, Vice President – Chief Financial Officer, Treasurer, and Secretary; |

| • | Robert L. Holladay, Jr., Vice President – General Counsel; and |

| • | Michael T. Walters, Vice President – Operations and Chief Operating Officer. |

Compensation Philosophy and Process

We believe we are one of only two publicly held companies in the United States whose primary business is the commercial production, processing and sale of shell eggs. Accordingly, there is little public information available regarding the compensation paid by our competitors. It is our intent to compensate our employees at a level that will appropriately reward them for their performance, minimize the number of employees leaving our employment because of inadequate compensation, and enable us to attract sufficient talent as our business expands.

We are a controlled company as defined in Rule 5615(c)(1) of the Nasdaq listing rules. Although not required, our Compensation Committee is composed solely of independent directors. We divide our executive officers into two categories for compensation purposes. The first are members of the Executive Committee of our Board of Directors, which during fiscal year 2024 was composed of Messrs. Baker, Bowman, and Miller, and also includes our General Counsel, Mr. Holladay. The compensation of the members of the Executive Committee and Mr. Holladay is approved by the Compensation Committee, after recommendation by the Executive Committee. The compensation for other executive officers is determined by the Executive Committee based on the overall compensation goals and guidance established by the Compensation Committee. Finally, equity awards for all executive officers are approved by the LTIP Committee, which is composed entirely of independent directors.

Compensation Practices and Risks

We do not believe any risks arise from the Company’s compensation policies and practices that are likely to have a material adverse effect on the Company.

Elements of Compensation

During fiscal 2024, our executive compensation program had the following primary components: base salary, an annual cash bonus and equity compensation in the form of restricted share awards (“RSAs”). Our named executive officers received certain perquisites and certain of our named executive officers participate in our deferred compensation plan. The tables that follow give details as to the compensation of each of our named executive officers for fiscal year 2024.

Base Salary

We believe that base salaries, which provide fixed compensation, should meet the objective of attracting and retaining the executive officers needed to manage our business successfully. Base salary adjustments, if any, are approved in December of each year and become effective January 1st of the following calendar year. After consideration of the review of peer company compensation prepared in 2022 by Mercer (US) Inc. (“Mercer”), a compensation consulting firm engaged by our Compensation Committee, which review indicated that the base salaries of our executive officers lagged behind the 25th percentile of our peer group, the Compensation Committee approved base salary increases effective January 1, 2024 for the members of the Executive Committee as follows: Mr. Baker – no increase, Mr. Miller – 7%, Mr. Bowman – 4% and Mr. Holladay – 4%. In connection with his promotion to Chief Operations Officer in March 2023, the Executive Committee approved a base salary increase for Mr. Walters of 20%. Following these increases, the base salaries of our named executive officers continue to remain below the 25th percentile of our peer group based on Mercer’s most recent peer company compensation reviews. See “Benchmarking of Compensation” below for information regarding recent updates to the Mercer report.

Annual Cash Bonus

Executive Committee Members and General Counsel Bonus Programs

For members of our Executive Committee and Mr. Holladay, the annual bonus program is a variable, at-risk component of compensation designed to reward these officers for maximizing annual Company performance. The Executive Committee recommends bonuses for its members and Mr. Holladay, and the Compensation Committee reviews these recommendations and makes the final determination as to bonus awards. Although these bonus awards are not based on objective metrics or goals, our Company’s profitability has historically been the most significant item in determining bonus amounts for the Executive Committee members and Mr. Holladay. Mr. Walters participates in the general bonus program applicable to our other officers and employees. For 2024, the Compensation Committee considered the Company’s profitability for 2024 compared to 2023 and each individual’s workload and job performance in determining bonuses for the Executive Committee and Mr. Holladay for 2024. As reflected in the Summary Compensation Table on page 27, annual cash bonuses for 2024 were lower than the 2023 bonus awards given our record earnings and profitability in 2023.

General Bonus Program

Participants in our general bonus program are eligible to earn a bonus equal to 50% of the sum of the officer’s base salary plus such officer’s prior year’s bonus. This program is designed to reward both Company and individual performance during the year.