0001615219FALSE00016152192025-01-102025-01-10

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): January 10, 2025

SALARIUS PHARMACEUTICALS, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Delaware | | 001-36812 | | 46-5087339 |

| (State or other jurisdiction of incorporation) | | (Commission File Number) | | (IRS Employer Identification Number) |

| | | | | |

2450 Holcombe Blvd.

Suite X

Houston, TX | | 77021 | |

| (Address of principal executive offices) | | (Zip Code) | |

(713) 913-5608

(Registrant’s telephone number, including area code)

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| | |

| Securities registered pursuant to Section 12(b) of the Act: |

| | | | | | | | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, par value $0.0001 | SLRX | The Nasdaq Capital Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.☐

EXPLANATORY NOTE

This Current Report on Form 8-K (the “Report”) is being filed in connection with the execution of the Merger Agreement (as defined below) between Salarius Pharmaceuticals, Inc. (“Salarius” or the “Company”) and Decoy Therapeutics Inc. (“Decoy”) pursuant to which Decoy’s business will combine with the business of the Company. A description of the material terms of the Merger Agreement is set forth in Item 1.01 of this Current Report.

The purpose of this Report, in addition to disclosures with respect to Merger Agreement (as defined below) is to provide stockholders with specified additional information about Decoy and its business.

FORWARD-LOOKING STATEMENTS

This Current Report on Form 8-K contains forward-looking statements regarding Salarius, Decoy, the proposed Merger (as defined below), pre-merger financing and other matters, including without limitation, statements relating to the satisfaction of the conditions to and consummation of the Merger, the expected timing of the closing (the “Closing”), the expected ownership percentages of the combined company and Salarius’ estimates of its expected net cash at Closing. These statements may discuss goals, intentions and expectations as to future plans, trends, events, results of operations or financial condition, or otherwise, based on current beliefs of the management of Salarius, as well as assumptions made by, and information currently available to, management. Forward-looking statements generally include statements that are predictive in nature and depend upon or refer to future events or conditions, and include words such as “may,” “will,” “should,” “would,” “expect,” “anticipate,” “plan,” “likely,” “believe,” “estimate,” “project,” “intend,” and other similar expressions. Statements that are not historical facts are forward-looking statements. Forward-looking statements are based on current beliefs and assumptions that are subject to risks and uncertainties and are not guarantees of future performance. Actual results could differ materially from those contained in any forward-looking statement as a result of various factors, including, without limitation: the risk that the conditions to the Closing are not satisfied, including uncertainties as to the timing of the consummation of the proposed Merger and the ability of each of Salarius and Decoy to consummate the Merger, including completing a Qualified Financing (as defined below); and risks related to Salarius’ ability to correctly estimate its expected net cash at Closing and estimate and manage its operating expenses and its expenses associated with the proposed Merger pending Closing. Readers are urged to carefully review and consider the various disclosures made by us in our reports filed with the SEC which attempt to advise interested parties of the risks and factors that may affect our business, financial condition, results of operation and cash flows. If one or more of these risks or uncertainties materialize, or if the underlying assumptions prove incorrect, our actual results may vary materially from those expected or projected.

In this Report, unless otherwise specified, all dollar amounts are expressed in United States dollars. Except as otherwise indicated herein, references in this report to “Company”, “Salarius”, “we”, “us” and “our” are references to Salarius Pharmaceuticals, Inc.

Item 1.01. Entry into a Material Definitive Agreement

Merger Agreement

On January 10, 2025, we entered into an Agreement and Plan of Merger (the “Merger Agreement”) with Decoy Therapeutics MergerSub I, Inc., a Delaware corporation and a wholly owned subsidiary of the Company (“First Merger Sub”), Decoy Therapeutics MergerSub II, LLC, a Delaware limited liability company and wholly owned subsidiary of the Company (“Second Merger Sub”), and Decoy. Pursuant to the Merger Agreement, the Company will combine with Decoy (the “Merger”) by causing First Merger Sub to be merged with and into Decoy, with Decoy surviving the merger as a wholly owned subsidiary of the Company (the “First Merger”). Immediately following the First Merger, Decoy will merge with and into Second Merger Sub, with Second Merger Sub being the surviving entity and continuing under the name “Decoy Therapeutics, LLC” as a wholly-owned subsidiary of the Company.

The Merger is structured as a stock-for-stock transaction pursuant to which all of Decoy’s outstanding equity interests will be exchanged based on an exchange ratio for consideration of a combination of (a) shares of the Company’s common stock par value $0.0001 (the “Common Stock”) in an amount up to (i) 19.9% of the Company’s total shares outstanding as of January 10, 2025 minus (ii) any shares of Salarius' Common Stock issued in any private placement between January 10, 2025 and the effective time of the First Merger (the "First Effective Time"), and (b) shares of Series A Preferred Stock, which is a newly designated series of preferred stock (“Preferred Stock”) that is intended to have economic rights equivalent to the Common Stock, but with only limited voting rights, in addition to the assumption of outstanding and unexercised stock options to purchase shares of Common Stock from the Decoy Therapeutics Inc. 2020 Equity Incentive Plan. The number of shares of common stock to be issued at the Closing and the number of shares of common stock underlying the Series A Preferred Stock to be issued at Closing is based on an exchange ratio which assumes a base value of $28.0 million for Decoy and $4.6 million for Salarius, subject in each case to adjustment based on the balance sheet cash available to each Salarius and Decoy at Closing (excluding any proceeds raised in in the Qualified Financing, as defined below). Based on these relative values, before taking into account the dilutive effects of the Qualified Financing, Salarius’ legacy stockholders would retain approximately 14.1% of Salarius on an as-converted-to-common basis and, after giving effect to the exchange ratio and the conversion of the Series A Preferred Stock, Decoy stockholders would own approximately 85.9% of Salarius.

The rights of the Series A Preferred Stock will be set forth in a Certificate of Designation of Preferences, Rights and Limitations that we will file with the Secretary of State of the State of Delaware (the “Certificate of Designation”). The Certificate of Designation provides that the preferred stock will be convertible into shares of Common stock on a 1-for-1000 basis, subject to stockholder approval. Please see “Description of Series A Preferred Stock” for a complete description of the Certificate of Designation and the rights of the Series A Preferred Stock. The Merger was approved by our Board of Directors and the board of directors of Decoy. In addition, following the consummation of the Merger, the Company has agreed to call a special stockholder meeting to approve (i) the conversion of the preferred stock to be issued at the Closing into shares of Common Stock (the “Conversion Proposal”), (ii) a new equity incentive plan in form reasonably agreed to by the parties (the “Equity Plan Proposal”), and (iii) if necessary and advisable, a reverse stock split in a ratio to be approved by our Board of Directors (the “Reverse Stock Split Proposal” and together with the Conversion Proposal and the Equity Plan Proposal, the “Company Stockholder Matters”).

The Merger Agreement contains customary representations and warranties by each of the Company and Decoy, as well as covenants relating to operating each respective business in the ordinary course prior to closing. The closing is conditioned upon, among other things, minimum proceeds from future offerings of at least $6.0 million (collectively, the “Qualified Financing”) and the continued listing of our Common Stock on Nasdaq.

In connection with the execution of the Merger Agreement, the Company entered into stockholder support agreements (the “Salarius Support Agreements”) with certain of our officers and directors, who collectively own an aggregate of approximately 1.38% of the outstanding shares of the Common Stock. The Salarius Support Agreements provide that, among other things, each of the parties thereto has agreed to vote or cause to be voted all of the shares of Common Stock owned by such stockholder in favor of the Company Stockholder Matters at a special or annual meeting of our stockholders to be held in connection therewith. The form of Salarius Support Agreement is attached hereto as Exhibit 10.1 and incorporated herein by reference. In addition, Decoy officers and directors, in their capacities as stockholders of Decoy, entered into stockholder support agreements (the “Decoy Support Agreements”) with Decoy. The Decoy Support Agreements provide that, among other things, each of the parties thereto has agreed to vote or cause to be voted all of the shares of Common Stock owned by such stockholder in favor of the proposed Merger. A Form of Decoy Support Agreement is attached hereto as Exhibit 10.2 and incorporated herein by reference.

Concurrently and in connection with the execution of the Merger Agreement, certain Decoy officers and directors, and certain of our directors and officers entered into lock-up agreements with us and Decoy, pursuant to which each such stockholder will be subject to a 180-day lockup on the sale or transfer of shares of Common Stock held by each such stockholder at the closing of the Merger, including those shares received by Decoy stockholders in the Merger. The form of lock-up agreement is attached hereto as Exhibit 10.3 and incorporated by reference.

As disclosed elsewhere in this Report, subject to the conditions set forth in the Merger Agreement, the businesses of Salarius and Decoy will combine upon the consummation of the Merger. Given the significance of Decoy’s operations to the future of the combined company, Salarius is providing certain information regarding Decoy and its business.

Unless the context otherwise requires, the information provided below relates to the combined company after the acquisition of Decoy.

Warrant Cancellation Agreement

On January 10, 2025, Salarius Pharmaceuticals, Inc. (the “Company”) entered into a Warrant Cancellation Agreement (the “Agreement”) with an accredited investor (“Investor”). The Company previously issued to the Investor a Series A-1 Common Stock Purchase Warrant to purchase 454,546 shares (on a post-reverse stock split basis) of its common stock, par value $0.0001 per share (the “Common Stock”) pursuant to the offering described in the Company’s Current Report on Form 8-K filed with the Securities and Exchange Commission (“SEC”) on May 16, 2023 (the “Warrant”). Pursuant to the Agreement, on January 10, 2025, the Company paid the Investor an aggregate amount in cash of $350,000 in exchange for the surrender and cancellation of the Warrant.

The above summary of the Agreement does not purport to be complete and is qualified in its entirety to the full text of the Agreement, which is filed as Exhibit 10.4 to this Current Report on Form 8-K and is qualified herein by this reference.

Item 3.02. Unregistered Sales of Equity Securities

To the extent required by Item 3.02 of Form 8-K, the information contained in Item 1.01 of this Report is incorporated herein by reference. The Common Stock and Preferred Stock to be issued at the Closing are intended to be exempt from registration pursuant to Section 4(a)(2) of the Securities Act of 1933, as amended (the “Securities Act”) and Regulation D promulgated thereunder.

Item 7.01. Regulation FD Disclosure

In connection with the execution of the Merger Agreement, the Company and Decoy issued the press release attached as Exhibit 99.4 hereto and incorporated by reference herein.

The information set forth in this Item 7.01 and in the press release attached hereto as Exhibit 99.4, is deemed to be “furnished” and shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that Section. The information set forth in this Item 7.01, including Exhibit 99.4, shall not be deemed incorporated by reference into any filing under the Exchange Act or the Securities Act of 1933, as amended, except to the extent that the Company specifically incorporates it by reference.

Item 8.01. Other Events

DESCRIPTION OF BUSINESS OF DECOY THERAPEUTICS INC.

Overview of Decoy’s and the Combined Company’s Proposed Business

Decoy’s proprietary IMP3ACTTM platform (Immediate Peptide/PPMO/P-PROTAC Alpha-helical Conjugate Technology) represents a paradigm shift in peptide conjugate drug discovery and manufacturing, leveraging machine learning (ML) and artificial intelligence (AI) tools alongside high- speed synthesis techniques to rapidly engineer, optimize and manufacture peptide conjugates that target serious unmet medical needs. Peptide conjugates are emerging as a major therapeutic drug modality, with the potential to transform multiple therapeutic areas. This innovative class of drugs, exemplified by successful diabetes and weight loss treatments like Ozempic, Wegovy, Mounjaro and ZepBound, combines small a-helical peptides with functional moieties to enhance solubility and extend the duration of action. By decreasing the complexity of peptide conjugate development, Decoy aims to establish itself as a leader in this advancing drug class. Decoy’s goal is to build a robust portfolio of novel peptide conjugate therapeutics, initially focusing on infectious diseases and oncology. Through this approach, Decoy intends to revolutionize the design, development, and commercialization of peptide conjugate therapeutics, becoming a fully integrated biopharmaceutical company at the forefront of this exciting field.

The peptide conjugate drug class is extremely modular and flexible, making it applicable to a wide range of human disease states and medical indications. Decoy expects that its drug candidates may be used both chronically, like current diabetes or weight loss drugs, or acutely, as is typical of antiviral treatments. Decoy is planning to engineer its peptide conjugates to be delivered via a variety of routes that can be optimally matched to the targeted disease state, including intranasal and pulmonary inhalation, extended-release dermal patches, oral, subcutaneous (SC) injection, and IV. Peptide drug conjugates (PDCs) can also be designed to deliver payloads, including radionucleotides or approved small molecule or biological drugs, to a specific target or tissue of interest, such as cancerous tumors, to achieve highly precise delivery with increased tissue penetration and lower cost compared to antibody-drug conjugates (ADCs). As with ADCs, the goal of this strategy is to widen the “therapeutic window” by

increasing efficacy while reducing the overall dose and consequent side-effects of the payload. Decoy believes the peptide conjugate modality is ideally suited to this strategy. Finally, Decoy believes its integration with Salarius expands the combined company’s opportunities to create an additional novel class of peptide conjugates, specifically, peptide-based proteolysis targeting chimeras, or P-PROTACs, utilizing the Salarius compound SP-3164 as an important building block in these peptide conjugate drugs.

New Program Development in the Merged Company

The combined company intends to leverage Salarius’ proprietary compound SP-3164, which specifically binds to the E3 ligase complex CRLCBRN, together with Decoy’s peptide engineering platform to engineer peptides to target a variety of disease relevant intracellular proteins, creating ‘peptide based-Proteolysis Targeting Chimeras,’ or PROTACs (P-PROTACS).

PROTACs are typically a bifunctional molecule; one side of the molecule binds to a targeted protein, while the other side of the molecule binds to an E3 ligase, with a linker between the two. When both the targeted protein and the E3 ligase are brought together the targeted protein is ubiquitinated, or “tagged” by the E3 ligase, and is marked for destruction via proteasomal protein degradation. SP-3164, a novel and proprietary immunomodulatory drug molecule, has many advantageous properties including potent cereblon binding, low molecular weight, high oral bioavailability, and clear and well characterized binding mechanisms. Using the IMP3ACT platform engineered peptides instead of small molecules to target disease causing proteins has many advantages: peptides can be precisely engineered to bind specifically to one protein, or to a pre-determined set of proteins (for example, across mutated ras proteins). In contrast, small molecules typically bind to many “off-target” proteins, decreasing selectivity and increasing toxicity. Peptides can bind to the active enzymatic site of a protein but can also be engineered to bind to other sites on the protein which may be under much lower selective mutational pressure, lowering the likelihood of resistance mechanisms and avoiding competition with the natural ligand. Finally, Decoy believes using peptides instead of existing small molecules vastly expands the protein targeting opportunities, and dramatically shortens the timelines to engineering P-PROTAC candidates.

The PROTAC mechanism of action can be described as “event-driven” in which one PROTAC molecule can induce the degradation of multiple copies of the protein target. Even small concentrations of the PROTAC can be highly advantageous, such that toxicity due to high drug concentrations may be avoided. Additionally, by degrading rather than inhibiting the protein target, both enzymatic and any other functions of the protein are disrupted, and these effects will last for as long as it takes the cell to synthesize new proteins, which can dramatically expand the duration of action of even a small concentration of a PROTAC. Thus, the combined company’s P-PROTACs may be ideal peptide drug conjugate payloads, targeting a potentially wide range of intracellular biologically relevant targets, including those thought to be “undruggable”, and representing a major addition to Decoy’s IMP3ACT platform. Upon consummation of the Merger, this is expected to become a major focus of exploratory research at the combined company, with an initial focus on creating P-PROTACs for metastatic colorectal cancer to complement Decoy’s colorectal cancer GPCR-based peptide conjugate program.

Decoy’s Drug Development Programs

Decoy is developing peptide conjugates, PDCs, and peptide-PROTACs with an initial focus on the treatment of viral infections and colorectal cancer. Decoy has demonstrated multi-virus in vitro activity with direct acting peptide conjugate antivirals by targeting the highly conserved fusion mechanism found across enveloped virus families. Next, Decoy intends to apply the same peptide design Machine Learning/Artificial Intelligence

(ML/AI) tools to create peptide binders to select overexpressed G protein-coupled receptor (GPCR) colorectal cancer targets for novel precision medicine peptide drug conjugates. Decoy intends to explore the use of the Salarius compound SP-3164, a molecular glue degrader that binds to cereblon, as a building block in a P-PROTAC in which the combined company plans to engineer a peptide targeting a protein of interest in colorectal cancer. This P-PROTAC may be suitable as a novel and proprietary payload for Decoy’s colorectal targeting peptide conjugate.

Through Decoy’s IMP3ACT Platform the combined company would aim to create a diverse and growing development portfolio of peptide conjugate, PDC and P-PROTAC programs as summarized in the figure below.

•COV: Pan-Coronavirus Prophylactic for Immunocompromised Patients. Decoy’s lead program, a nasally inhaled pan-Coronavirus prophylactic, has demonstrated activity in vitro against all human infecting Coronaviruses tested, including representatives of all variant strains of concern of COVID-19 that have emerged as of the date of this Report. This program has primarily been funded by grants from the Bill & Melinda Gates Foundation, BARDA’s Blue Knight Program, and with additional support from the IMI Care Consortium, Google and NVIDIA computing programs. Decoy plans to file an IND for this program in the first half of 2026. Decoy intends to continue to pursue non-dilutive funding and a development partner for this program’s clinical development.

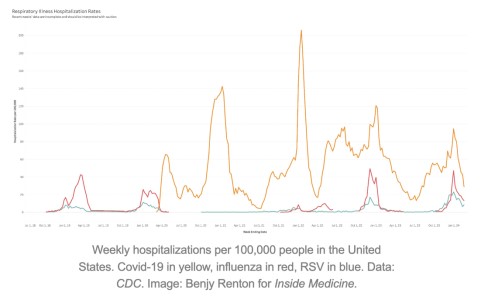

•TRI: Broad Respiratory Antiviral (Flu/COVID/Respiratory syncytial virus). Decoy’s goal is to exploit structural similarities across these viruses and their viral families to create a peptide conjugate antiviral that will be broadly applicable to most Influenza-like-illnesses (ILI), which drive an estimated 15 to 20 million medical visits every year in the United States alone. Building on work that Decoy has already done to create peptide conjugate antivirals with very broad activity in the Coronavirus and Paramyxovirus (RSV) viral families, Decoy believes this program could represent a fundamental shift in the treatment of respiratory viruses.

•cGPCR: GPCR-Targeted Conjugate for Colorectal (CRC) and other GI Tumors. There is an urgent need for the identification of new cell membrane targets to create multiple precision treatment options for many colon cancer patients, including those with late stage metastatic and drug resistant tumors. Decoy aims to investigate an under-utilized cell membrane molecule class, the G-protein coupled receptors (GPCRs) as new precision medicine targets for Decoy’s peptide engineering platform, ultimately creating novel peptide drug conjugates as new biomarker driven CRC therapeutics.

The Combined Company’s Exploratory Stage Program

•P-TAC: Exploratory P-PROTAC Conjugates: The combined company would aim to explore the use of SP-3164 as the E3 ligase binding component in peptide based PROTACs, using engineered peptides to target intracellular proteins involved in colorectal cancer cell function and dysregulation.

Legacy Small Molecule Program resulting from the Merger

•SP-2577: SP-2577 is a legacy small molecule LSD-1 inhibitor program from Salarius not using Decoy technology. The combined company would intend to continue supporting MD Anderson Cancer Center (MDACC) in MDACC’s sponsored investigator-initiated clinical trial evaluating seclidemstat (SP-2577) in combination with azacytidine in adult patients with myelodysplastic syndromes and chronic myelomonocytic leukemia. The trial remains on partial clinical hold following a serious and unexpected grade 4 adverse event while MDACC works with the FDA to resolve the partial clinical hold. The combined company would intend to conduct a thorough review of this small molecule program in early 2025.

Strategy

Decoy’s strategy is to leverage its IMP3ACT platform to rapidly design, develop and commercialize novel and transformative peptide conjugate therapeutics that improve the lives of patients with serious diseases. Decoy’s initial focus is on 3 types of peptide conjugates: fusion inhibitor peptide conjugates for viral diseases, GPCR-based peptide drug conjugates, and peptide-PROTACs. These areas were chosen as Decoy’s starting points for the following reasons:

•The fusion inhibition machinery is highly conserved across all enveloped viruses, and peptide conjugate inhibitors offer a new antiviral modality in a therapeutic area with high medical need and low competition.

•G-Protein Coupled Receptors (GPCRs) are a very rich target space that are simultaneously implicated in multiple serious disease states and have been underexploited in cancer. Peptide drug conjugates offer the potential for significant benefits including high tumor penetration, tissue selectivity with an improved toxicity profile, and are highly amenable to manufacturing modularity in payload type.

•PROTACs are an emerging drug class that suffers from two things: limitations due to what small molecules are available to target proteins of interest, and toxicity due to lack of selective tissue targeting. Peptide conjugate peptide-PROTACs can address both issues, dramatically expanding the range of the proteins of interest targeted for degradation and selectively targeting tissues for improved safety and efficacy.

Decoy selects peptide conjugate targets based on the following criteria:

•Potential for a therapeutic that can address multiple disease indications with one drug.

•The presence of a natural “starting peptide” that Decoy’s platform can rapidly optimize into a promising therapeutic.

•Potential to create a peptide conjugate therapeutic with a novel and differentiated value proposition that meets a significant unmet medical need.

Decoy believes that this target selection strategy will maximize the return on investment from the IMP3ACT platform by allowing Decoy to efficiently advance paradigm creating therapeutics across its peptide conjugate, peptide drug conjugate and peptide-PROTAC molecules.

Decoy’s goal is to become a fully integrated biopharmaceutical company with a pipeline of novel therapeutics with targets selected as outlined above. Decoy intends to achieve this goal by pursuing the following strategic objectives:

•Achieve clinical proof-of-concept for Decoy’s platform by bringing its lead pan-Coronavirus antiviral forward through a Phase 2 human challenge clinical trial. Even though COVID-19 has largely moved into an endemic phase, Decoy believes there is still a significant global unmet medical need among immune-suppressed people that this program can fill, giving it meaningful economic value. To date, this program has been largely supported by non-dilutive funds and this funding source continues to be the mechanism through which Decoy is validating many of the technologies in its platform. Decoy believes it will continue to attract such funds to advance this program in the clinic.

•Bring forward 1 additional transformative program to IND-enabling status within two years. Decoy aims to leverage the speed and efficiency of its peptide conjugate design and development platform to bring forward additional potentially transformative peptide conjugate therapeutics that meet the target selection criteria outlined above to the IND-enabling stage of development with 24 months. Decoy expects that this program could have the potential to deliver a novel value proposition that is not currently available to patients and healthcare providers.

•Thorough review of SP-2577 to drive a decision on whether to continue development internally or position this asset for out-licensing.

•Build a platform manufacturing capability: Decoy intends to pursue platform manufacturing designation from the FDA, allowing it to rapidly scale-up the manufacturing of novel peptide-conjugate drug candidates for pre-clinical and clinical studies in a repeatable and cost-effective manner. Decoy believes this would significantly enhance its ability to quickly advance novel and economically valuable therapeutic programs.

•Continue to access non-dilutive funding. To date, Decoy has been able to attract significant non-dilutive funding to support its programs and platform from organizations such as The Bill & Melinda Gates Foundation (BMGF), BARDA, Google, and the IMI-Care Consortium. Decoy expects to continue seeking such funds in the future.

•Pursue value-enhancing partnerships. Decoy believes it can rapidly create and validate novel therapeutic assets. Consequently, Decoy aims to attract capital and relevant capabilities in later-stage development and commercialization to these programs by selectively seeking partnerships for these assets that Decoy believes will be value enhancing to its company.

•Maintain Pandemic Readiness: Preserve the Pandemic “Call-Option” Embedded with the IMP3ACT Platform. Based on our goals, Decoy’s platform is well-positioned to rapidly advance antiviral therapeutics in response to the emergence of novel and dangerous viral pathogens, especially in several of the viral families that are often considered to be the most likely sources of such a pathogen, for example, avian influenza. Decoy will continue to actively work with governmental agencies and NGOs globally to provide funding to further develop peptide drug conjugates against developing global threats. Given the financial returns to their sponsors from therapeutic assets such as the mRNA vaccines and Paxlovid during the COVID-19 pandemic, Decoy considers this capability to be a valuable ‘call option’ on the next epidemic or pandemic.

Decoy’s Management and Management of the Proposed Combined Company

Decoy’s management, co-founders and scientific advisor board include highly experienced senior scientists, clinicians, biotechnology and pharmaceutical executives, and a renowned professor of peptide chemistry from the Massachusetts Institute of Technology:

•Rick Pierce, Chief Executive Officer and Director, a serial biotech entrepreneur who has helped build a number of biotech companies over the last 25 years, including Javelin Pharmaceuticals, which was sold to Pfizer, which now markets its lead drug, Dyloject.

•Barbara Hibner Ph.D., Chief Scientific Officer and Director, 25+ years of experience in pharmacology and drug discovery and development in pharma and biotech companies resulting in contributions to 2 oncology drugs sorafenib and ixazomib.

•Peter Marschel, MS MBA, Chief Business Officer & Director with over fifteen years of experience in business development, financial and commercial roles at large pharma and biotech, including leading market analytics for the cystic fibrosis franchise at Vertex Pharmaceuticals.

•Michael Lipp, Ph.D. Chief Technology Officer with over two decades of experience in pharmaceutical development and drug delivery technologies ranging from the preclinical stage through commercial approval.

•Bradley L. Pentelute, Ph.D., Professor of Chemistry at MIT and co-founder, whose lab invented the world’s fastest peptide synthesizer and has advised large pharmaceutical and biotech companies on advancing their peptide drug discovery and manufacturing efforts.

•Shahin Gharakhanian, MD, SAB chair and acting-Chief Medical Officer, is a Physician-Executive with expertise in pharmaceutical medicine, leadership and management, and an international track record and former VP within the Medicines Development Group, Global R&D at Vertex Pharmaceuticals with 2 antiviral drugs taken successfully to commercialization.

In addition, Mark Rosenblum, Chief Financial Officer of Salarius, is expected to serve as Chief Financial Officer of the combined company.

Decoy currently has 10 full time employees and 7 dedicated consultants, responsible for preclinical, toxicology, clinical development, prescriber, payor, market access and pricing strategy, CMC, quality, and regulatory strategy and execution, finance strategy and business development.

Decoy’s Scientific Advisory Board

Decoy also has 4 members of its Scientific Advisory Board chaired by Dr. Shahin Gharakhanian:

•Dr. Shahin Gharakhanian, SAB chair.

•Dr. Mark Garnick is an internationally renowned expert in medical oncology and urologic cancer and has served as an FDA ODAC panel member for 15 years. A clinical professor of medicine at Harvard Medical School, he also maintains an active clinical practice at Beth Israel Deaconess Medical Center.

•Dr. Daniel Kuritzkes, Chief of Infectious Disease at Brigham and Women’s Hospital and Professor of Medicine at Harvard Medical School.

•Yonatan Grad, Epidemiologist and Professor of Immunology and Infectious Disease at Harvard T.H. Chan School of Public Health.

Decoy’s employees and advisors have significant industry experience and have been involved in the discovery, development, regulatory approvals, and commercial launches of several successful drugs.

Financing Model

Decoy’s financing model has historically consisted of partnerships with industry entities, domestic and foreign government agencies, and non-governmental organization funding. This approach has been highly efficient and allowed Decoy to operate with relatively low annual cash burn rate and dilution compared to many of its peers.

Decoy has garnered substantial non-dilutive funding, support, and ML/AI computation credits equal to or greater than what Decoy has raised from institutional investors. Decoy has received significant grants from The Bill and Melinda Gates Foundation and the U.S. government’s Blue Knight Program, and support from the European Union’s IMI-CARE Consortium, the Canadian government’s National Research Council, GOOGLE’s AI Startup Program, and NVIDIA’s Inception Program.

Market Opportunity for Decoy’s Current Drug Development Programs

Decoy sees opportunities in each of the four main areas of its drug discovery program efforts:

COV: Pan-Coronavirus Inhibitor for Immunocompromised Patients

According to the most recent December 2024 WHO publication on COVID-19, while there are periodic waves of COVID-19 in some countries, SARS-CoV-2, the virus that causes COVID-19, largely circulates without

clear seasonality, and continues to infect, cause severe acute disease and post COVID-19 condition (long COVID).1 Currently, the primary tools to combat the virus involve mRNA vaccines and medications like Paxlovid, which are effective at avoiding severe outcomes in patients at high risk for progression to severe COVID-19. However, Paxlovid cannot be used prophylactically, either before or after exposure and has a significant Drug-Drug Interaction2 (DDI) profile, leaving a large treatment gap and negative outcomes for patients who are immune-suppressed or who have high-risk comorbidities and do not respond significantly to vaccines. Early in the pandemic, long-acting antibody-based prophylactics like Evusheld were prescribed for immune-suppressed patients. These antibody therapeutics quickly became obsolete due to the rapid and continued evolution of the SARS-CoV-2 virus. More recently the antibody Pemgarda was approved under an Emergency Use Authorization (EUA) for pre-exposure prophylaxis of COVID-19 in certain high-risk individuals. As with other antibodies, Pemgarda is at risk of losing efficacy as the virus continues to mutate; the most recent SARS-CoV-2 viral variants have ~ 150 mutations compared to the original viral sample, with no indication that viral evolution is slowing.

Decoy commissioned market research in 20223 that indicated important medical unmet needs in the treatment and prevention of COVID-19, including:

•Prophylaxis for current and future variants in high-risk patients: Health care providers, or HCPs, are concerned about preventing and minimizing severe cases in patients at risk. This is considered particularly critical if or when new variants arise.

•Easy-to-use route of administration: Key opinion leaders noted the need for non-injectable preventative products to enable broad availability by reducing infrastructure requirements. This type of treatment also avoids the need for high-risk patients to visit healthcare facilities for administration.

•Effective treatments with better Drug-Drug Interaction, or DDI, profile: DDIs, such as those seen with Paxlovid, are a concern for HCPs, especially when considering that high risk patients tend to have other comorbidities and are most probably already on other treatments.

This market research, which included both health care provider and payer studies across the United States and the European Union, indicated that there are 20 million or more patients in the US and Europe that many health care providers consider to be at ‘highest risk’ from COVID and other respiratory viral infections, and a favorable outlook for reimbursement for therapeutics that can fill treatment gaps for these patients.

Decoy’s lead program is a broad-acting antiviral nasal spray to prevent or mitigate COVID-19 infections in high-risk, immunocompromised populations for whom there are limited treatment options. This agent has been shown to be active in vitro against all human infecting Coronaviruses, including all COVID-19 variants that have emerged to date, would be conveniently self-administered, and is expected to provide 8-24 hours of antiviral activity. Decoy also believes that it will be able to manufacture this nasal spray with a low cost of goods..

Decoy expects multiple potential attractive development and commercialization options for an inhaled pan-Coronavirus fusion inhibitor, including:

1 https://www.who.int/publications/m/item/covid-19-epidemiological-update---24-december-2024

2 https://paxlovid.pfizerpro.com/drug-interactions

3 Primary market research performed by Bionest Partners in Oct/Nov 2022: 13 HCPs, 13 Payers in US, DE, FR, IT, UK

•Pre- and Post-Exposure Prophylaxis (PrEP/PEP) for highly immunocompromised populations that face elevated risks due to severe immune deficiencies associated with conditions such as hematological malignancies and immunosuppressive medical treatments in the context of Hematopoietic stem cell transplantation and solid organ transplants, with the potential for label expansion to other immunocompromised and at high-risk populations. The market research mentioned above suggests there may be 5M+ such patients in the US and EU, and that an estimated net price of up to $500 per 30-day supply in the US is feasible.

•Post-infection treatment as an alternative to Paxlovid, with a superior DDI profile. Morningstar research projects full year 2024 revenues exceeding $5 B4 for Pfizer’s Paxlovid, despite Paxlovid’s notable DDIs with widely prescribed drugs such as statins (prescribed to over 90 million Americans) and calcium channel blockers (prescribed to more than 20 million Americans), which underscore the critical need for a safer alternative. Many of these patients have serious pre-existing conditions that put them at significant risk from COVID infection, but there have been emerging concerns that Paxlovid is under-prescribed to high-risk patients because of DDI concerns. As of October 18, 2023, Paxlovid’s list price in the US was $1,390 for a 5-day course5.

Decoy also believes there may be additional opportunities for a pan-Coronavirus fusion inhibitor to generate revenue from public health authority stockpiling of drug for pandemic preparedness and military readiness purposes.

Decoy’s plan is to initially develop this agent as a Pre- and Post-Exposure Prophylactic for a targeted subset of the immunocompromised, such as patients with hematological malignancies and post-transplant patients, that have both a very high unmet medical need and can be accessed in the US by a small, specialized sales force focusing on a small number of cancer treatment and transplant centers. Decoy then plans to expand from there to additional indications, including potentially novel dose regimens and inhalation routes optimized to new indications.

Decoy recognizes the rapid evolution of the COVID landscape and will continue to strive to conduct key opinion leader, health care provider, payer, and patient market research and potentially adjust its plans based on those findings.

TRI: Broad Respiratory Antiviral (Flu/COVID/RSV)

Decoy is engineering a groundbreaking approach to combat Flu/COVID/respiratory syncytial virus (RSV) infections with a single peptide conjugate antiviral that is potentially effective against all three major respiratory viruses, including activity against pandemic flu strains if possible.

By addressing the tripledemic with a single therapy, Decoy aims to revolutionize the management and treatment of respiratory illnesses caused by these viruses. Respiratory tract infections represent an important unmet medical need, exerting a significant toll on patients and public health systems worldwide. The seasonal convergence of influenza, RSV, and COVID-19, often referred to as the “tripledemic,” has intensified the burden of these infections, which are often vectors to dangerous and expensive lower respiratory infections. Despite the availability of vaccines targeting these viruses, and with decreasing vaccine uptake, hospitalizations, ICU admissions, and fatalities attributed to respiratory viruses continue to strain healthcare resources underscoring the need for effective therapeutic interventions.

Decoy’s single therapy approach potentially offers several key advantages:

4 https://www.morningstar.com/news/business-wire/20241029363831/pfizer-reports-strong-third-quarter-2024-results-and-raises-2024-guidance

5 https://www.reuters.com/business/healthcare-pharmaceuticals/pfizer-price-covid-19-drug-paxlovid-1400-five-day-course-wsj-2023-10-18/

•A single therapy with proven efficacy against all three viruses could potentially eliminate the need for multiple treatments, streamlining patient care and reducing complexity for healthcare providers.

•Decoy’s therapy is expected to be self-administered, offering convenience and autonomy to patients.

•Peptide conjugates to date have a favorable safety and tolerability profile.

Given the ease of use and safety of the envisioned product profile, Decoy intends to work towards a commercialization approach that will make this product, if approved, broadly accessible to symptomatic patients, leveraging emerging channels such as telehealth, digital patient engagement and at-home delivery.

In the United States, the combined impact of influenza, RSV, and COVID-19 results in an estimated 15 to 20 million medical visits annually among patients aged 18 and older. This significant healthcare utilization underscores the burden of respiratory tract infections on the healthcare system.

Expanding the market to include individuals with symptomatic illness who may not physically visit a doctor's office approximately doubles the number of eligible adult patients. With the increasing adoption of telehealth services and the advancement of wearables signaling very early respiratory infections, there is a tangible opportunity to expand the market for respiratory tract infection, or RTI, treatments beyond patients who traditionally seek in-person medical care.

Given these factors, Decoy believes its ‘tripledemic’ antiviral program could represent the cornerstone of a significant global franchise.

cGPCR: GPCR-Targeted Conjugate for CRC/GI Tumors

Decoy aims to investigate an under-utilized cell membrane molecule class, G-protein coupled receptors (GPCRs), as oncology precision medicine targets.

Decoy's IMP3ACT peptide discovery platform optimizes natural GPCR a-helical peptide ligands for improved drug properties. Decoy’s Design-Build-Test-Learn (DBT-L) Cycle integrates AI-driven and physics-based design, rapid peptide synthesis, and experimental testing. This iterative process builds a proprietary database, potentially enhancing Decoy’s AI's predictive capabilities for GPCR peptide ligands.

The identification of one or more novel colon tumor overexpressed GPCR biomarkers and the subsequent design and synthesis of an engineered peptide ligand has the potential to create a new paradigm for personalized medicine for colon cancer. GPCR-based novel peptide drug conjugates or radionuclide therapies can transform cancer treatment with high therapeutic window medicines so desperately needed for drug resistant and metastatic colon cancer patients.

Colon cancer therapies have changed little over the last decades, with mainstay therapies continuing to revolve around Fluorouracil (5-FU), platinum, and irinotecan combinations, typically with the addition of an anti-VEGF treatment. Only a small percentage of colon cancer patients have a biomarker that allows the incorporation of a ‘precision medicine’ where characteristics of the patient tumor drive selection of a specific therapy (for example, the 3-5% of CRC patients with amplified HER2 become eligible for the ADC trastuzumab deruxtecan). There is a high need for the identification of new cell membrane and internal protein targets to create multiple options for

precision treatments for the majority of colon cancer patients, including late stage metastatic and drug resistant tumors.

According to the most recent American Cancer Society (ACS) report released in January 2024, is the ACS estimated 152,810 new cases of colorectal cancer diagnosed in the US in 2024, with approximately 20% of these diagnosed at a late stage. The incidence rate of colorectal cancer continues to rise between 1% and 2% each year in people under the age of 55, an alarming trend since the mid-1990s.6 The mortality rate in young people is also increasing about 1% each year since the mid-2000s. Colorectal cancer has now become the leading cause of cancer death in men under 50 and the second leading cause in women of the same age group. Young people are often diagnosed with more advanced cancers due to delays in detection. Overall, CRC is the second leading cause of all cancer-related deaths in the U.S., with an estimated 53,010 deaths in 2024.

GPCRs have a high potential to target peptide drug conjugates or peptide receptor radionuclide therapy (PRRT), as exemplified by multiple approvals of somatostatin theranostics to diagnose and treat GI neuroendocrine tumors (NETs).7 The structure of GPCRs is well conserved, with a defined architecture, and the ligand binding sites are on the outer cell membrane. Over 100 GPCRs have endogenous peptide ligands, and many GPCR peptides display a regular a-helical structure in solution8, a structure that provides an excellent natural starting point for Decoy’s innovative IMP3ACT design platform. While not classic driver mutations, several GPCRs with natural a-helical peptide ligands have been reported to be overexpressed in colon tumors compared to normal tissue, in some cases in resistant and metastatic tumors.9 Typically, antagonists of GPCRs will lead to internalization, necessary for PDCs to deliver a payload inside the cell. Decoy hypothesizes that by using state of the art AI tool- boosted immunohistochemistry (IHC) to quantify GPCR cell membrane expression at the protein level, Decoy may identify one or more new colon tumor biomarkers suitable for further exploration in PDC or PRRT therapies.

Decoy’s IMP3ACT Platform

Overview of Peptides and Peptide Conjugate Therapeutics

A key proposed advantage of the peptide-conjugate modality as exemplified by product candidates engineered and synthesized by Decoy’s IMP3ACT Platform is the opportunity for ‘polypharmacology’, in which a single molecule can activate or inhibit multiple targets/receptors in an additive or synergistic manner to achieve superior or multi-indication efficacy.

The success of multi-targeting peptide conjugates is due to careful peptide design based on the structural similarity between the two GPCRs or viruses and is an exciting advantage of peptide-conjugates that is difficult to match with other therapeutic modalities, and contrasts with the often unpredictable off-target effects of small molecules.

An FDA approved example of polypharmacology is the newest obesity drug, Eli Lilly’s blockbuster ZepBoundTM, in which a single peptide conjugate demonstrates agonism of two different GPCRs: glucagon-like peptide 1 receptor (GLP-1R), and gastric inhibitory peptide receptor (GIPR). A second example is Decoy’s lead

6 https://colorectalcancer.org/article/acs-releases-colorectal-cancer-estimates-2024

7 Susini, C. & Buscail, L. Rationale for the use of somatostatin analogs as antitumor agents. Ann. Oncol. 17: 1733–1742 (2006).

8 Kaiser, A and Irene Coin. Capturing Peptide-GPCR Interactions and Their Dynamics. Molecules 25, 4724 (2020).

9 Insel, PA et. al. GPCRomics: GPCR Expression in Cancer Cells and Tumors Identifies New, Potential Biomarkers and Therapeutic Targets. Front Pharmacol. 9:431 (2018).

program, a peptide-conjugate antiviral therapeutic, that has demonstrated activity against multiple related viral pathogens.

Peptides are short chains of amino acids linked together by peptide (amide) bonds, typically less than 50 amino acids long, which play a vital role in a wide range of biological processes. Secondary atomic interactions between amino acids cause peptides to fold into complex 3-dimensional structures, one of the most common of which is an -helical coil. -helical peptides and proteins are ubiquitous in human biology, and -helices often interact chemically with other -helices driving protein-protein and protein-nucleic acid interactions, so peptides with -helical structures can often be the basis for effective therapeutics.

Peptides have important innate advantages when compared to small molecules and antibody-based therapeutics10:

•High potency and specificity: Peptides bind a larger surface area of the target than small molecules, and therefore are highly selective with very tight binding.

•Excellent safety profile with predictable metabolism: Because they easily diffuse across cell membranes small molecules often have off target toxicities that can limit or nullify their therapeutic potential. Peptides typically do not passively diffuse, and they are usually readily metabolized into non-toxic compounds.

•High tissue penetration vs. antibodies: Antibody-based therapeutics are very large molecules (~30x the size of peptides) and thus have difficulty diffusing deep into tissues from blood vessels.

•Simpler manufacturing, lower cost of goods: Peptides are manufactured using synthetic chemistry, whereas antibody-based therapeutics require complex and intensively regulated biological processes.

Small peptides as drugs, however, have an intrinsic limitation; they are subject to rapid enzymatic digestion and clearance from the GI tract or in the bloodstream, limiting their half-life and oral bioavailability.

Peptide conjugates solve this problem by chemically linking a peptide, typically via a polyethylene glycol (PEG) structure, to one or more additional molecules, often another biological molecule such as another peptide, nucleic acid, or a fatty acid, which enhance the drug-like properties of the conjugate by improving enzymatic stability, half-life in the bloodstream or at the target, and bioavailability, while also maintaining low immunogenicity.

The IMP3ACT Platform

The Immediate Peptide/PPMO/P-PROTAC Alpha-helical Conjugate Technology (IMP3ACT) platform leverages peptide ‘coiled-coils’ chemistry and physics to design -helical peptides through computational and machine learning tools. Starting from naturally existing peptide ligands, Decoy optimizes their structure and transform them into multimeric conjugates by chemically linking multiple copies to lipids and other suitable anchor moieties, enhancing their drug-like properties and dosing flexibility with extended pharmacokinetics. Notably, Decoy’s technology has produced single peptide conjugates that are active against multiple human coronaviruses, including all the SARS-CoV-2 major variants of concern to date, and a second conjugate that is active against RSV A, RSV B, and hPIV3. By integrating machine learning algorithms in peptide design and synthesis, Decoy’s

10 PLoS ONE 17(3): e0255753. https://doi.org/10.1371/journal. pone.0255753

platform accelerates the creation of lead molecules for preclinical evaluations, simultaneously optimizing peptide conjugates for enhanced affinity, binding specificity, resistance to proteases, pharmacokinetic properties, and manufacturability at early commercial scale.

The efficiency of Decoy’s IMP3ACT platform may enable Decoy to achieve peptide conjugate manufacturing readiness faster than conventional drug development processes, leading to reduced manufacturing costs and accelerated delivery of broad-spectrum drug candidates to IND. The modular nature of these drugs and processes also means that each new drug candidate improves the overall platform, and the likelihood of success should grow as the experience base teaches the ML/AI models. By employing solid phase peptide synthesis (SPPS) in an “All-in-One” manufacturing approach, Decoy optimizes the assembly of complex peptide-linker-functionalized compounds, enhancing the speed, efficiency, and predictive value of the IMP3ACT platform.

The Design-Build-Test-Learn Engine

Decoy has integrated advancements in data science, peptide conjugate chemistry, and manufacturing processes, underpinned by strong foundational research, to create its IMP3ACT platform. The core of this innovation is the Design-Build-Test-Learn Cycle: the Design component utilizes artificial intelligence (AI) in silico approaches to analyze existing protein and genomics datasets and make structure-function predictions, the Build cycle component implements fast flow synthesizers that can generate peptide candidates faster than industry standard synthetic practices, and the Test cycle incorporates experimental testing of peptide physiochemical properties and activity via reliable assays to characterize peptide-candidates. The Learn cycle capitalizes on the experimental data to redesign new and improved in silico candidates.

This integrated, multiparameter approach is designed to streamline the drug discovery process, making it faster, more efficient and with greater attention to drug-like and commercialization properties. Additionally, Decoy believes that continuing to iterate on its Design-Build-Test-Learn loop will generate valuable proprietary data that can drive its in-silico models to generate design solutions that would otherwise not be available from computational approaches. Decoy’s hypothesis is that the key to value-creation in ML/AI driven drug design is well-structured, useful, and proprietary data and the knowledge on which tools to use when, not on the computational models themselves. Decoy’s platform strategy will help Decoy become the leaders in designing and developing -helical peptide-conjugate therapeutics in its chosen target areas.

Figure 1: The major components of Decoy’s Design-Build-Test-Learn iterative loop.

Figure 1. Flow schematic of Decoy’s engine for rapid drug discovery. (A) The design stage capitalizes on metagenomics data to create structure-function predictions and further optimize peptide ligand sequences based on in silico readouts. (B) Decoy’s build stage uses fast flow synthesis to create select candidates that pass in silico criteria. (C) At the test stage, biophysical assays check peptide candidates for a variety of readouts. (D) Through the learn stage, experimental data is used to guide new and improved in silico designs.

Starting from Existing Peptide Ligands

A key element of Decoy’s platform strategy is to start from naturally existing peptides, leveraging ‘Nature’s starting points’ to improve drug development program timelines and risk. Typically, Decoy can rapidly synthesize a peptide conjugate that incorporates a naturally existing peptide sequence, and which is immediately active against the target in question. Decoy believes this is an excellent starting point for the Design-Build-Test-Learn loop because it significantly decreases the size of the peptide conjugate design space, making it computationally tractable to immediately begin optimizing for drug-like properties.

Additionally, Decoy’s in-silico engine uses machine learning, AI, and physics-based computational tools to identify helical motifs within metagenomics data that are shared across targets. This enables Decoy, especially when starting from existing peptide ligands, to rapidly design polypharmacologic peptide conjugates in which one drug can potentially interact with multiple targets, unlocking the potential for very broad activity across several indications from a single peptide conjugate. For example, these ML-driven a-helical drug candidates have the potential to inhibit a wide range of viruses by targeting the viral fusion machinery, a critical component utilized by enveloped viruses for viral entry and subsequent replication in the host cells. Similarly, Decoy will leverage the virally trained a-helical database to train the engine to target one or more GPCRs with innovatively designed a-helical ligand agonists or antagonists.

Multiparameter Optimization of Drug Properties

The IMP3ACT Platform acts as an iterative feedback loop and incorporates data from multiple in vitro experiments to improve the design parameters of the candidate peptides. The real power of this approach lies in optimizing against multiple parameters at the same time. In the past, the drug-development industry has typically relied on ‘one step at a time’ optimization that often leads to a highly restricted chemical design space in which important downstream attributes, like pharmacokinetic behavior, cannot easily be enhanced. By using all the experimental data relevant to making a drug to train the ML engine as computational guides, more drug-like peptide conjugates with optimized functionality against one or more targets and with optimized commercialization potential (pharmacology, formulation, manufacturability) may be designed. This multiparameter optimization approach not only reduces the costs associated with combinatorial research investigations but will also significantly decrease the probability of pre-clinical or clinical failures by avoiding ‘dead end’ development paths.

Rapid synthesis

Decoy is using a fast-flow automated process coupled with a proprietary “All-in-One” method (patent pending) to synthesize multiple peptide-conjugates on lab-based machines. The yield (5-100 mg depending on desired scale) and purity is sufficient for conducting multiple in vitro tests including physicochemical properties and biological function. This innovation dramatically decreases the cycle time to learn the structure-activity relationships for different peptide designs and enables Decoy’s construction of a multiparameter structure-activity-drug-like proprietary database on a-helical peptides.

Compared to standard industrial solid phase synthesis, fast flow synthesis leverages the use of a heated reactor to accelerate synthetic speed, allowing amide bond formation creation in just 7 seconds per amino acid, compared to around 1 hour per cycle in traditional methods. In addition, fast flow synthesis can be automated to eliminate human intervention and errors, and work in a high throughput fashion. Mijalis et al tested the speed of synthesis of a GHRH peptide hormone, showing that the fast flow machines can generate the peptide 45x faster than standard batch synthesis, in 40 minutes versus 30 hours11. The crude peptide output and yields are better than standard batch synthesis. This automated approach enables rapid peptide conjugate production while maintaining high quality, making it suitable for applications like drug discovery that require synthesizing multiple peptide conjugates rapidly, thus shortening the overall time to optimize a clinical drug candidate.

By innovative design, Decoy has invented a multi-arm linker which is compatible with solid phase peptide synthesis (SPPS) methods and can be used to build complex biomacromolecules containing branched peptides and other functionalities in one synthetic run. These complex molecules can be differentially functionalized in such a way so that non-peptide functionality can be attached to them while the whole molecule is still attached to the solid phase resin; Decoy’s proprietary “All-In-One” manufacturing. When the desired molecule has been built, the intact, desired compound can be cleaved from the resin, purified by suitable means, and isolated for formulation and administration.

Using fast-flow synthesis technology coupled with the above process, the research scale synthesis of a peptide conjugate is reduced from several months, typical at a standard CDMO, to days or even hours. Decoy’s IMP3ACT platform is a unique lead optimization engine that can rapidly design from natural peptide ligands and

11 Mijalis AJ, et. al. A fully automated flow-based approach for accelerated peptide synthesis. Nat Chem Biol. 13(5):464-466 (2017).

identify optimized drug-like lead molecules. Additionally, Decoy is currently evaluating the use of its All-In-One process at commercial scale, which would enable further time savings in the transition from preclinical to GLP and cGMP scale up.

Testing

Decoy is focused on using in silico and empirical assays that have predictive value. In the Design Engine the in-silico tools have been validated against the actual data (e.g., binding affinity, solubility, protease resistance, manufacturability etc.) to ensure reliability of the computational predictions. The screening cascade for each program will rely on predictive assays to streamline the work and decision making. Where possible, human organoid and epithelial tissue models are incorporated to improve predictive power, as rodent efficacy models have moderate predictive value and it can be difficult to translate the pharmacokinetics to human tissues, especially for local peptide conjugate exposure in the nose or lungs as needed for an intranasal or inhaled program. Rodent noses are substantially different to human, and it is difficult to control compound delivery and tissue analysis in intranasal and inhaled studies. Organoid models are also significantly less expensive, and easier to scale-up, than animal models.

The human airway epithelial (HAE) model is a cell culture system that is grown at an air-liquid interface (ALI). This in vitro culture system is designed to mimic the conditions of the human airway epithelium more closely than traditional submerged cell cultures. In the ALI setup, the basal surface of the human airway (nasal, bronchial, or alveolar) cells is in contact with a liquid culture medium, while the apical surface is exposed to air. This configuration promotes the differentiation of the cells into a mucociliary phenotype, which is characteristic of the pseudostratified epithelium found in the human respiratory tract, including the presence of ciliated and mucus-secreting cells. The ALI culture system is physiologically relevant and is used for various research applications, including studying the cell biology of the respiratory epithelium, modeling respiratory diseases, studying respiratory epithelium infections and effects of drugs on the respiratory epithelium.

SARS-CoV-2 HAE-ALI experiments have demonstrated that this model recapitulates human data: SARS-CoV-2 infection kinetics have been studied, and the peak of viremia occurs between days 4 and 8 in HAE-ALI culture. Human SARS-CoV-2 viral kinetics peak in the nasal epithelium between days 4 and 8 as delineated in a human challenge trial.12 Additionally, multiple coronaviruses have been tested in the HAE-ALI culture and their growth kinetics and cellular effects correlate to human experience across the seasonal (‘cold-causing’) vs. pandemic viruses. Both Influenza and RSV have been modeled in HAE and used to test the infectivity of new strains as well as therapeutic efficacy.

Beyond use in respiratory viruses, human organoid models are gaining widespread acceptance as a predictive tool for cancer drug development. Recently, an analysis of drug responses in patients and in their matched cancer organoids led to the conclusion that responses to the drugs are highly similar in the two settings. A drug with no antitumor activity in the tumor organoids did not demonstrate efficacy in the matched patient, and drugs that showed an effect in the organoid cultures were matched by a patient response in close to 90% of cases. This study has been corroborated by several studies with larger cohorts. Human organoids may be highly predictive in vitro models for candidate drug screening that could improve the clinical success rate for a variety of therapeutics.

12 Lindeboom, R.G.H., Worlock, K.B., Dratva, L.M. et al. Human SARS-CoV-2 challenge uncovers local and systemic response dynamics. Nature 631, 189–198 (2024). https://doi.org/10.1038/s41586-024-07575-x

Additional pre-clinical work will include quantitative pharmacology and model- based approaches in conjunction with toxicology information in both human model systems and animal studies to project the human starting dose for phase 1 studies with appropriate modeling consideration for any delivery device.

Scale-Up Manufacturing

Decoy is working internally as well as in collaboration with multiple Contract Manufacturing Organizations (CMOs) to develop and scale-up proprietary and GMP-compatible manufacturing processes to produce peptide conjugates generated from its IMP3ACT platform. As described earlier above, the efficiency of Decoy’s IMP3ACT platform enables Decoy to achieve peptide conjugate manufacturing readiness faster than conventional drug development processes, leading to reduced manufacturing costs and accelerated delivery of broad-spectrum drug candidates.

By employing solid phase peptide synthesis (SPPS) in an “All-in-One” manufacturing approach, Decoy optimizes the assembly of complex peptide-linker-functionalized compounds, enhancing the speed, efficiency, and predictive value of the IMP3ACT platform. Decoy is currently working with a major peptide manufacturer to scale the “All-in-One” manufacturing process to quantities useful for pre-clinical development potentially through early-stage clinical trials at minimum; Decoy anticipates new intellectual property will be an outcome of this collaboration. Decoy’s goal is pre-clinical manufacturing readiness within significantly shorter timelines compared to traditional drug development processes, aiming to eventually meet or exceed the100-day goal for vaccine manufacturing; in other words, moving from an initial natural peptide ligand to drug lead in a single quarter.

Formulation Flexibility

Traditionally peptides as drugs have suffered from very low bioavailability, limiting their delivery to intravenous (IV) or subcutaneous (SC) routes. Decoy is exploring multiple routes of administration, with an emphasis on self-administered methods including:

•Intranasal, including nose-to-brain delivery.

•Inhaled/pulmonary delivery (local and systemic applications)

•Subcutaneous patches for extended systemic release.

•Oral

Decoy is engineering its peptide conjugates to possess the required physicochemical and pharmaceutical properties to enable each of these routes of delivery, including solubility, chemical stability, resistance to proteolytic degradation and compatibility with a range of pharmaceutically acceptable excipients. Results to date indicate that Decoy’s peptide conjugates can be formulated into both liquid and dry powder-based dosage forms that are room temperature stable and suitable for administration via a range of delivery devices such as liquid and dry powder-based nasal and pulmonary inhalation devices and syringes.

Competitive Strengths of the IMP3ACT Platform

Decoy believes the IMP3ACT platform has several key advantages compared to other drug-discovery approaches:

•Proprietary Data: Continuing to run Decoy’s Design-Build-Test-Learn loop results in an expanding proprietary data set that should give the IMP3ACT platform a differentiated and difficult to duplicate capability to design novel and promising therapeutic candidates against -helical targets, for example as found in viruses and GPCRs.

•Faster & Lower Cost Discovery: Decoy’s ML/AI engine is applying computational tools to model structures, energy costs, binding affinities and specificity, protease resistance and manufacturability to design lead quality molecules in a fraction of the time, and by making significantly fewer candidate molecules, than required in traditional drug discovery methods.

•Streamlined & Repeatable Manufacturing: Decoy is currently working to scale-up the “All-in-one” manufacturing process such that it will repeatably utilize the same chemistry, manufacturing, and controls (CMC) processes for each new drug candidate Decoy brings forward. Given this, Decoy has applied for the FDA Emerging Technology program based on the Food and Drug Omnibus Reform Act of 2022 (“FDORA”). Decoy’s goal to be able to manufacture 30g of active pharmaceutical ingredient (API) of a new therapeutic candidate, typically enough material to take a new therapeutic candidate at least through pre-clinical activities, in 30 days (“30 in 30”).

•Low Commercial Cost of Goods: Decoy’s manufacturing process is fully chemically synthetic and can be run on standard peptide synthesis machinery, thus avoiding the bioprocess and regulatory complexities of recombinant biological processes. Given this and based on examples from currently marketed peptide conjugate therapeutics, Decoy expects to have very low cost-of-goods-sold (COGS) at commercial scale. For example, Decoy is aiming for total COGS of less than $1/dose in its lead pan-coronavirus inhibitor program.

•Flexible Formulation: Decoy intends to formulate its peptide-conjugate therapeutic candidates in a variety of formats for self-administered routes of administration, including nasal and oral inhalation and extended-release dermal patches. This will allow Decoy to optimize the route of delivery for the indication and market in question.

•Increased Probability of Success: Multi-parameter optimization of drug properties from the beginning of the design and discovery process should help Decoy avoid “dead-ends” which can result in expensive and time-consuming drug development failures.

Drug Development Programs

Through Decoy’s IMP3ACT platform Decoy aims to create a diverse and expanding development portfolio of antiviral and GPCR-targeted peptide conjugates. Decoy’s initial programs are outlined below.

Pan-Coronavirus Prophylactic for Immunocompromised Patients

Decoy is developing this program for the prophylactic prevention of SARS-CoV-2 infection in immunocompromised patients. Decoy has evaluated multiple peptide-conjugate molecules and are currently in late lead optimization stage. This program is supported to IND by grants from the Bill & Melinda Gates Foundation and the Blue Knight Program totaling $6.5M. It is Decoy’s intention to seek additional non-dilutive funding through Phase 2a proof-of-concept (antiviral challenge) studies and a development partner for this program.

The SARS-CoV-2 pandemic demonstrated that vaccines and antiviral therapeutics are complementary tools in the response to viruses. The rapid development of the COVID-19 vaccines saved millions of lives. However, the continued evolution of SARS-CoV-2 immune escape variants, growing ‘vaccine hesitancy’ among the population at large, and the presence of immune-suppressed sub-groups that are at risk regardless of vaccination status are treatment gaps that can only be filled by antiviral therapeutics.

Decoy’s Target Product Profile (TPP) for this program, developed in conjunction with the Bill & Melinda Gates Foundation, is:

•Prevention of infection by all SARS-CoV-2 variants and other human infecting coronaviruses including MERS-CoV

•Convenient self-administration via intranasal spray

•8+ hours of protection from a single dose

•Cost of goods of less than $1 per dose

Decoy has demonstrated through in vitro pseudotype, live virus, human airway epithelium (HAE) assays and in vivo Syrian hamster models that multiple Decoy peptide conjugates inhibit viral infection and demonstrate a multifold decrease in viral infectious particles when delivered either before (pre-exposure prophylaxis, or PrEP) or after (post-exposure prophylaxis but before symptoms, PEP) viral challenge. DCOY101 and its analogs have also demonstrated infection inhibition in cell based assays against all major SARS-CoV-2 variants of concern and other human infecting coronaviruses, including SARS-CoV-1, Middle Eastern Respiratory Syndrome (MERS), and the “cold-causing” coronaviruses OC43 and NL63, as expected due to the strong similarity of the fusion region structure across coronaviruses.

The initial indication for the pan-Coronavirus inhibitor will be pre- and post-exposure prevention of COVID-19 in immunocompromised patients. Decoy intends to submit an IND to the FDA within the first half of 2026, and subsequently, if approved, to initiate a Phase I clinical trial in adult healthy volunteers to be followed quickly by a proof-of-concept Phase 2a human “challenge” study in which healthy volunteers are infected with SARS-Cov-2 under controlled conditions13. Decoy expects to partner this program after demonstration of human proof-of-concept in the challenge study.

Immunocompromised Populations

The SARS-CoV-2 virus initially infects ciliated cells in the nasopharynx; most people have a mild to moderate illness with viral replication restricted to the upper airways, resolving over 1-2 weeks. In some cases, however, Covid-19 can progress to life-threatening pneumonia with further complications. People that get severe infections often have predispositions, or co-morbidities, including hypertension, heart failure, cardiac arrhythmia, diabetes, kidney failure, chronic pulmonary disease, old age, and/or a compromised immune system. In such cases, infection in the lower respiratory tract can reach the alveoli causing inflammation and limiting gas exchange. Severe illness typically begins 1 week after symptoms start, with shortness of breath and decreased blood oxygen levels, with pneumonia evident as opaque regions on lung X-rays. Patients may meet the definition of ARDS, a form of

13 Nature Medicine (2022) 28:1031-1041

lung injury with inflammation, pulmonary vascular leakage, and hypoxic respiratory failure. Severe Covid-19 may also lead to disease beyond the respiratory tract, including gastrointestinal, acute cardiac, kidney and liver injury, cardiac arrhythmias, rhabdomyolysis, coagulopathy, and shock. COVID-19 infection can also lead to Long COVID, also known as Post COVID Condition, (PCC), a multisystemic condition that can persist for weeks, months or even years after an infection and vary widely in severity, from mild to debilitating. The risk of contracting Long COVID increases with each time an individual is infected; available data from multiple countries suggests that approximately 6% of symptomatic SARS-CoV-2 infections resulted in PCC despite vaccination14.

Immunocompromised patients face several distinct challenges:

•Patients post- hematopoietic stem cell transplants or CAR-T therapy are at higher risk of severe Covid-19 within 100 days of treatment, even with rigorous infection control and social avoidance practices.

•Patients with cancer have an impaired immune response to COVID-19 vaccination and are thus at significant risk from SARS-CoV-2 infection.

•Prolonged SARS-CoV-2 infection has been observed in patients with lymphoid or hematological malignancies.

•COVID-19 infections may lead to disruptions of care, for example an interruption in cancer treatment or a delay in a transplant procedure, that can have significant life-altering consequences for patients.

Chronic, persistent SARS-CoV-2 infections in immunocompromised patients are also of public health concern, as the continued evolution of the virus within these patients may be a key source of novel SARS-CoV-2 variants of concern, highlighting an important societal need to prevent infections in this population.

SARS-CoV-2 Burden of Disease Post-Pandemic

SARS-CoV-2 continues to cause significant morbidity and mortality. Between September 2023 and March 2024, approximately 561,000 people were hospitalized in the United States from Covid-19, resulting in approximately 42,000 deaths.15 By comparison, during the 2023-2024 Flu season, a similar timeframe, there were 470,000influenza-associated hospitalizations and 28,000 deaths. Decoy believes this data strongly suggests that COVID-19 prevalence may be equal to or higher than that of Influenza for the foreseeable future.

Current Treatment Landscape and Opportunity