Table of Contents

As filed with the Securities and Exchange Commission on September 8, 2014

Registration No. 333-197660

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

AMENDMENT NO. 2 TO

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

VIRGIN AMERICA INC.

(Exact name of registrant as specified in its charter)

| Delaware | 4512 | 20-1585173 | ||

| (State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification Number) |

555 Airport Boulevard

Burlingame, California 94010

(650) 762-7000

(Address, including zip code, and telephone number, including

area code, of registrant’s principal executive offices)

C. David Cush

President and Chief Executive Officer

Virgin America Inc.

555 Airport Boulevard, Burlingame, California 94010

(650) 762-7000

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies To:

| Tad J. Freese Nathan C. Salha Latham & Watkins LLP 140 Scott Drive Menlo Park, California 94025 (650) 328-4600 |

John J. Varley Senior Vice President and General Counsel Virgin America Inc. 555 Airport Boulevard Burlingame, California 94010 (650) 762-7000 |

Alan F. Denenberg Davis Polk & Wardwell LLP 1600 El Camino Real Menlo Park, California 94025 (650) 752-2000 |

Approximate date of commencement of the proposed sale to the public:

As soon as practicable after this Registration Statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ¨

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ¨ | Accelerated filer ¨ | |||

| Non-accelerated filer x | (Do not check if a smaller reporting company) | Smaller reporting company ¨ |

CALCULATION OF REGISTRATION FEE

|

| ||||

| Title of Each Class of Securities to be Registered |

Proposed Maximum Aggregate Offering Price (1) |

Amount of Registration Fee | ||

| Common Stock, par value $0.01 per share |

$ 115,000,000 | $ 14,812 (2) | ||

|

| ||||

|

| ||||

| (1) | Estimated solely for the purpose of calculating the registration fee pursuant to Rule 457(o) under the Securities Act of 1933, as amended. |

| (2) | Previously paid. |

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

The information in this prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell nor does it seek an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

Subject to Completion, dated September 8, 2014.

PROSPECTUS

Shares

Virgin America Inc.

Common Stock

This is our initial public offering of shares of our common stock. We are offering shares. In addition, VX Employee Holdings, LLC, a Virgin America employee stock ownership vehicle that we consolidate for financial reporting purposes, is offering 1,745,395 issued and outstanding shares as a selling stockholder. We will not receive any proceeds from the shares sold by this selling stockholder.

No public market currently exists for our shares of common stock.

We intend to apply to list our shares of common stock on the NASDAQ Global Select Market under the symbol “VA.” We anticipate that the initial public offering price per share will be between $ and $ .

Investing in our common stock involves risks. See “Risk Factors” beginning on page 21 of this prospectus.

| Per Share | Total | |||||||

| Price to the Public |

$ | $ | ||||||

| Underwriting discounts and commissions (1) |

$ | $ | ||||||

| Proceeds to us (before expenses) |

$ | $ | ||||||

| Proceeds to selling stockholder (before expenses) |

$ | $ | ||||||

| (1) | We refer you to “Underwriting” beginning on page 152 of this prospectus for additional information regarding underwriting compensation. |

Our principal stockholders, funds affiliated with or related to Cyrus Capital Partners, L.P. (which we refer to in this prospectus collectively as “Cyrus Capital”) and affiliates of Virgin Group Holdings Limited (which we refer to in this prospectus collectively as the “Virgin Group”), as option selling stockholders, have granted the underwriters an option to purchase up to additional shares of common stock at the initial public offering price less the underwriting discount solely to cover overallotments. We will receive no proceeds from the sale of any shares sold by these option selling stockholders if the overallotment option is exercised.

Neither the Securities and Exchange Commission nor any state securities commission nor any other regulatory body has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The underwriters expect to deliver the shares to purchasers on or about , 2014.

| Barclays | Deutsche Bank Securities |

, 2014.

Table of Contents

Table of Contents

| Page | ||||

| 1 | ||||

| 18 | ||||

| 21 | ||||

| 36 | ||||

| 37 | ||||

| 40 | ||||

| 41 | ||||

| 42 | ||||

| 45 | ||||

| UNAUDITED PRO FORMA AS ADJUSTED CONSOLIDATED BALANCE SHEET AND STATEMENTS OF OPERATIONS |

48 | |||

| NOTES TO UNAUDITED PRO FORMA AS ADJUSTED CONSOLIDATED BALANCE SHEET AND STATEMENTS OF OPERATIONS |

53 | |||

| 56 | ||||

| MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

59 | |||

| 89 | ||||

| 91 | ||||

| 106 | ||||

| 114 | ||||

| 134 | ||||

| 138 | ||||

| 141 | ||||

| 146 | ||||

| MATERIAL U.S. FEDERAL INCOME TAX CONSEQUENCES TO NON-U.S. HOLDERS |

148 | |||

| 152 | ||||

| 158 | ||||

| 158 | ||||

| 158 | ||||

| F-1 | ||||

We are responsible for the information contained in this prospectus or contained in any free writing prospectus prepared by or on behalf of us to which we have referred you. Neither we, the selling stockholders nor the underwriters, have authorized anyone to provide you with additional information or information different from that contained in this prospectus or in any free writing prospectus filed with the Securities and Exchange Commission, and we take no responsibility for any other information that others may give you. We and the selling stockholders are offering to sell, and seeking offers to buy, shares of our common stock only in jurisdictions where offers and sales are permitted. The information contained in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or of any sale of our common stock. Our business, results of operations or financial condition may have changed since such date.

Until , 2014 (25 days after the date of this prospectus), all dealers that buy, sell or trade shares of our common stock, whether or not participating in this offering, may be required to deliver a prospectus. This delivery requirement is in addition to the dealer’s obligation to deliver a prospectus when acting as underwriters and with respect to their unsold allotments or subscriptions.

For investors outside the United States: Neither we, the selling stockholders nor any of the underwriters have taken any action that would permit this offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. You are required to inform yourselves about and to observe any restrictions relating to this offering and the distribution of this prospectus.

i

Table of Contents

This summary highlights selected information about us and the common stock being offered by us and the selling stockholders. It may not contain all of the information that is important to you. Before investing in our common stock, you should read this entire prospectus carefully for a more complete understanding of our business and this offering, including our financial statements and the accompanying notes and the sections entitled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations.”

Overview

Virgin America is a premium-branded, low-cost airline based in California that provides scheduled air travel in the continental United States and Mexico. We operate primarily from our focus cities of Los Angeles and San Francisco to other major business and leisure destinations in North America. We provide a distinctive offering for our passengers, whom we call guests, that is centered around our brand and our premium travel experience, while at the same time maintaining a low-cost structure through our point-to-point network and high utilization of our efficient, single fleet type. Our distinctive business model allows us to offer a product that is attractive to guests who historically favored legacy airlines but at a lower cost than that of legacy airlines. This business model also enables us to compete effectively with other low-cost carriers, or LCCs, by generating higher stage-length adjusted revenue per available seat mile, or RASM, but at a stage-length adjusted cost per available seat mile, or CASM, competitive with that of other LCCs and lower than that of legacy airlines. As of June 30, 2014, we provided service to 21 airports in the United States and Mexico with a fleet of 53 narrow-body aircraft.

Leveraging the reputation of the Virgin brand, a global brand founded by Sir Richard Branson, we target guests who value the experience associated with the Virgin brand and the high-quality product and service that we offer. Our employees, whom we call teammates, provide a personalized level of service to our guests that is a key component of our product. Other elements of our premium product available fleetwide include power outlets adjacent to every seat, inflight wireless internet access, distinctive on-board mood lighting, leather seats, high-quality food and beverage offerings and our industry-leading Red® inflight entertainment system featuring a nine-inch personal touch-screen interface with a variety of features available on-demand, including live television, movies, seat-to-seat text chat, games, interactive maps and music. We have won numerous awards for our product, including Best Domestic Airline in Travel + Leisure Magazine’s World’s Best Awards for the past seven consecutive years as well as each of Best Domestic Airline in Condé Nast Traveler Magazine’s Readers’ Choice Awards and Best U.S. Business/First Class Airline in Condé Nast Traveler Magazine’s Business Travel Poll for the past six consecutive years.

LCCs in the United States generally operate point-to-point networks with a single fleet type, a single class of service with a relatively high density seating configuration, high degree of outsourced operational services and high aircraft utilization. While we have many of these characteristics, we differentiate ourselves from other LCCs in the United States with additional attributes that business and high-end leisure travelers value. In contrast to most LCCs, we have three classes of service onboard our aircraft. In addition to our Main Cabin economy product, we offer our guests a First Class product and a premium economy class product called Main Cabin Select. We also provide a number of other amenities that are important to frequent travelers, including our Elevate® loyalty program with tiered benefits for our most loyal guests, lounge access in certain airports, including our own Virgin America Loft at Los Angeles International Airport (LAX), interline and codeshare partnerships with other airlines and a wide range of distribution channels and contractual travel discounts for over 175 major corporate customers. While these amenities result in a higher CASM than we could otherwise achieve with a more traditional LCC model, we believe that these amenities, along with our premium on-board features, enabled us to realize the highest average passenger revenue per available seat mile, or PRASM, in 2013 among U.S. LCCs within most of our markets.

1

Table of Contents

Our disciplined cost control is also core to our strategy, and we maintain the cost simplicity of other LCCs. We operate one of the youngest fleets among U.S. airlines, comprised entirely of fuel-efficient Airbus A320-family aircraft. Our single fleet type allows us to avoid the operational complexities and cost disadvantages of carriers with multiple and older fleet types. In addition, our long-haul, point-to-point network results in high aircraft utilization and efficient scheduling of our aircraft and crews. We believe that our teammates are productive and attentive to our guests, contributing to our cost advantage while maintaining our high-quality travel experience. We also outsource many non-core functions, such as certain ground handling activities, major airframe and engine maintenance and call center functions, leading to efficient, cost-competitive services and flexibility in these areas.

Executing our strategy of providing a premium travel experience within a disciplined, competitive cost structure has led to improved financial results. For 2013, we recorded operating revenues of $1.4 billion, operating income of $80.9 million and net income of $10.1 million. We increased our RASM in 2013 by 9.3% compared to 2012, the largest increase of any major U.S. airline. Furthermore, our CASM of 10.98 cents increased by only 0.7% from 2012. On a stage-length adjusted basis, our 2013 CASM was competitive with that of LCCs and below that of legacy airlines. We completed a recapitalization of a majority of our operating lease and debt obligations in May 2013, leading to a $34.7 million decline in aircraft rent expense and a $44.8 million decline in interest expense for 2013 compared to 2012. As a result of our RASM increase and the reduction in rent and interest expense, our financial performance improved from a net loss of $145.4 million in 2012 to net income of $10.1 million in 2013. In the first six months of 2014, we had net income of $14.6 million, compared to a net loss of $37.5 million in the first six months of 2013. Our RASM in the first six months of 2014 increased by 4.6% from the prior year period, while our CASM in the first six months of 2014 increased by only 1.5% from the prior year period.

Our business model relies on attracting guests who value the premium product that we provide. Because we provide a high level of amenities to our guests, it generally requires a longer period of time for us to reach profitability in each new market that we enter than it might require for a traditional LCC that does not provide this higher level of service. However, we believe that in the long term, our business model enables us to have financially successful routes as evidenced by our PRASM premium over other LCCs in our markets and in part by our recent history of operating profitability in 2013 after two years of rapid growth into new markets in 2011 and 2012.

Our Competitive Strengths

We believe the following strengths allow us to compete successfully in the U.S. airline industry:

Premium Travel Experience. We believe our premium guest experience, attractive amenities, customer-focused teammates and wide array of inflight entertainment options differentiate us from other airlines in the United States. A key component of our product strength is the consistency across our entire fleet. In contrast to airlines with multiple aircraft types, our product offering is identical on every Airbus 320-family aircraft, allowing for the same enhanced travel experience on every flight. We also differentiate ourselves from other LCCs by providing both First Class and Main Cabin Select products in addition to our Main Cabin economy product. With just eight seats on every aircraft—fewer than most first class cabins offered on competing airlines, our First Class cabin has an exclusive feel with a dedicated attendant providing a personal level of service. Unlike many other airlines, we do not provide complimentary upgrades to First Class, enhancing the exclusivity of this product. In addition to more leg room, which is a standard feature of most premium economy products, we offer additional features within Main Cabin Select, such as complimentary on-demand current-run movies, premium television programs, premium beverages and Main Cabin meals and snacks. We have differentiated our product in all three classes of service as compared to other domestic airlines, leading to a travel experience that can only be found on Virgin America.

2

Table of Contents

World-Class Virgin Brand. We believe that the Virgin brand is widely recognized in the United States and is known for being innovative, stylish, entrepreneurial and hip. We believe that the brand is recognized worldwide from the Virgin Group’s offerings in music, air travel, wireless service and a wide variety of other products. We capitalize on the strength of the Virgin brand to target guests who value an enhanced travel experience and association with the Virgin brand. We believe that the Virgin brand has helped us to establish ourselves as a premium airline in the domestic market in a short period of time. When we enter a new market, awareness of the Virgin brand generates interest from new guests. The power of the Virgin brand provides an opportunity for low-cost public relations events that generate extensive media coverage in new markets and has led to other cooperative marketing relationships for us with major companies. In addition to capitalizing on the Virgin brand strength, we are rapidly establishing Virgin America as a distinct and premium brand for air travel in the United States in its own right. We believe our guests associate the Virgin and Virgin America brands with a distinctive high-quality and high-value travel experience.

Low-Cost, Disciplined Operating Structure. A core component of our business model is our disciplined cost structure. In 2013, the average stage-length adjusted domestic CASM of the legacy airlines was 31% higher than ours. Key components of this low cost structure include our modern, fuel-efficient single-aircraft fleet, our high aircraft utilization, our point-to-point operations, our productive and engaged workforce, our outsourcing of non-core activities and our lean, scalable overhead structure. We are committed to maintaining this disciplined cost structure and believe we will continue to improve our competitive cost position as we grow and further leverage our existing infrastructure.

Established Presence in Los Angeles and San Francisco. We have built our network around the Los Angeles and San Francisco metropolitan areas, the second- and third-largest domestic air travel markets in the United States in 2013. We believe that these two markets, with a combined population of approximately 27 million people and strong economic bases in the technology, media and entertainment industries, serve as an excellent platform for long-term growth. Los Angeles and San Francisco both have large populations of technologically savvy, entrepreneurial and innovative individuals who we believe value our brand and premium guest experience. We have made significant investments in these key markets since 2010, and as of June 30, 2014 we provide service to 18 destinations from Los Angeles and 20 destinations from San Francisco. These destinations include eight of the top ten domestic destinations served from LAX and nine of the top ten domestic destinations served from San Francisco International Airport (SFO), based on passenger volume. This investment provides greater network coverage across North America for travelers from these two focus markets, and we expect that this investment will allow us to continue to grow by leveraging the loyal guest base that we have established in each market.

Our Team and Entrepreneurial Culture. Our teammates and culture are essential elements of our success because they contribute significantly to our premium travel experience. We start by hiring the right teammates through a rigorous process that includes numerous interviews, as well as pre-employment testing for our frontline teammates and our pilots. Key characteristics of Virgin America teammates include a friendly, personable nature, a willingness to think differently, a passionate approach to his or her work and intense pride in Virgin America and our product. We empower our teammates with a high level of authority to resolve guest issues throughout the travel experience, from making flight reservations to interactions at the airport and in flight. We strive to create an environment for our teammates where open communication is both encouraged and expected and where we celebrate our successes together. We believe our positive work environment has contributed to our having one of the highest customer satisfaction rankings in the airline industry.

3

Table of Contents

Our Growth Strategy

Our goal is to generate above-average RASM in each market we serve by providing the leading domestic air travel product through our brand and our premium guest experience, while at the same time maintaining our competitive cost structure through the efficient operations we have established. Key elements of our growth strategy include:

Leverage Our Recent Expansion. We have significantly expanded our fleet size and route network since 2010. We increased our operating fleet from 28 aircraft as of June 30, 2010 to 53 aircraft as of April 30, 2013, and we introduced service to 11 new airports during that period, doubling the number of destinations served. Airline routes tend to become more profitable as they mature because of increased demand as travelers become aware of the service and through repeat business. Our RASM in markets that we entered in 2011 and 2012 increased from 2012 to 2013 by 20.5% as compared to our overall RASM increase of 9.3%. In addition, as we continue to expand our network by increasing the number of markets served from Los Angeles and San Francisco, we expect our network to become more attractive to frequent travelers who prefer to concentrate their travel with one airline, increasing demand for service on our existing routes. We intend to leverage our recent expansion to drive higher RASM.

Expand Our Route Network. We currently serve only 15 of the 50 largest metropolitan areas in the United States and three leisure destinations in Mexico. We believe there are significant opportunities to expand our service from our focus cities of Los Angeles and San Francisco to other large markets throughout the United States, Canada and Mexico. We have firm commitments to take delivery of ten Airbus A320-family aircraft from July 2015 through June 2016, and we expect to continue to grow at a measured, disciplined pace beyond 2016. While we expect most of our expansion in the next several years will focus on the opportunities we have at Los Angeles and San Francisco, we also plan to grow our presence in Dallas, Texas. Through the use of recently acquired slots at New York LaGuardia Airport (LGA) and Ronald Reagan Washington National Airport (DCA), we will add service at Dallas Love Field (DAL) to these markets in October 2014. We will also move our existing service at Dallas/Fort Worth International Airport (DFW) to DAL. DAL is located in a growing, affluent section of the Dallas/Fort Worth metropolitan area and is the closest airport to downtown Dallas. In addition, the airline facilities at DAL are limited by federal law to only 20 gates, providing a structural barrier to entry. We believe this opportunity to provide service at DAL will further diversify our route network and allow us to provide service to LGA and DCA. In addition, we intend to expand our codeshare and interline relationships with other airlines that are complementary to our network, expanding travel destination options for our guests while adding new sources of revenue and more guests.

Maintain Competitive Unit Operating Costs. We are highly focused on maintaining competitive unit operating costs. We expect to realize economies of scale as we continue to grow by leveraging our distribution, marketing and technology costs across our platform and by better utilizing our facilities and ground assets across a larger network. Our fleet is 100% financed by operating leases, of which 26 leases will expire between 2015 and 2022. As our leases expire, we expect to have the opportunity to lower our costs by renewing at lower lease rates or by opportunistically replacing these aircraft with new Airbus A320-family aircraft with lower operating costs sourced in the open market. In addition, we expect our cost structure will continue to benefit from our highly productive and flexible workforce as we grow our fleet and network.

Continue to Grow Our Base of Frequent Travelers. We intend to continue to grow our share of business travelers, a focus that is uncommon among U.S. LCCs, because we believe this population of airline travelers allows us to achieve increased RASM. We target the business community by providing a premium travel service between our focus cities and many of the most important business destinations in North America, as well as key leisure destinations that we believe are important to business travelers when flying for leisure travel. We have already attracted a significant base of frequent business and premium leisure travelers who regularly fly with us and who we believe prefer our premium product attributes. We believe that these types of guests also value a

4

Table of Contents

larger route network and frequent flights within markets. As we grow our network from California and expand our interline and codeshare partnerships, we believe we will be well positioned to attract additional business and high-end leisure travelers. We consider guests who book within 14 days of departure as business travelers. Using this as a measure, we believe that approximately 30% of our guests in 2013 were business travelers, representing approximately 40% of our revenue in 2013.

Continue to Enhance Our Product and Guest Experience. We believe our guest experience is unique in the industry and revolves around our teammates’ focus on guest service, extensive entertainment options, compelling passenger comfort features and an association with our brand that would be difficult to replicate. We nevertheless are continually developing new enhancements to our product. For example, in early 2014, we further expanded our First Class food service on select flights to include enhanced gourmet food offerings and linen service. In the second quarter of 2014, we launched a redesigned version of the Virgin America website, enhancing the ease of use and functionality as well as providing a more customized experience for our guests. In 2015, we plan to upgrade the monitors within our inflight entertainment system to include a “swipe” touch capability, similar to that found on many modern personal electronic devices. This upgrade will include a redesign of the software behind our industry-leading Red inflight entertainment system, allowing for future software features. Additionally, we continually analyze new technologies for longer-term enhancements to our fleet, inflight product and airport experience.

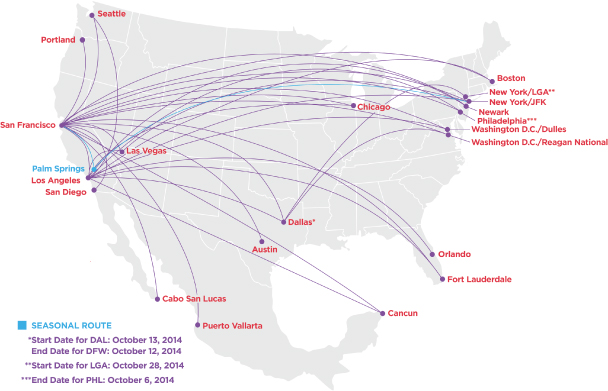

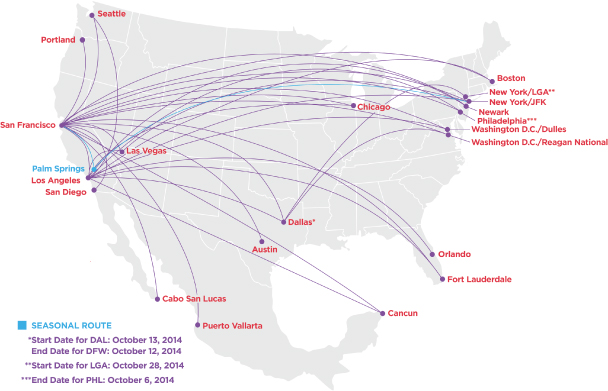

Route Network

We served 21 airports throughout North America as of June 30, 2014. The majority of our routes operate to and from our focus cities of Los Angeles and San Francisco. Our current network is a mix of long-haul, transcontinental service combined with short-haul West coast service and select Mexico leisure destinations. Below is a route map of our network.

5

Table of Contents

We use publicly available data related to existing traffic, fares and capacity in domestic markets to identify growth opportunities. To monitor the profitability of each route, we analyze monthly profitability reports as well as near-term forecasting. We routinely make adjustments to capacity and frequency of flights within our network based on the financial performance of our markets, and we discontinue service in markets where we determine that long-term profitability is not likely to meet our expectations.

Our future network plans include growing from our focus cities of Los Angeles and San Francisco to other major markets in North America. By continuing to add destinations in select markets from Los Angeles and San Francisco, we can leverage our existing base of loyal guests and grow our share of revenue within these focus cities while also expanding our customer base as we gain new guests in new markets. We also plan to add service from DAL to LGA and DCA. We believe this DAL opportunity will further diversify our route network and provide growth into strategic airports that are limited by regulation.

Fleet

We fly only Airbus A320-family aircraft and operate only CFM engines, which provide us significant operational and cost advantages compared to airlines that operate multiple fleet and engine types. Flight crews are entirely interchangeable across all of our aircraft, and maintenance, spare parts inventories and other operational support are highly simplified relative to more complex fleets. Due to this commonality among Airbus single-aisle aircraft, we retain the benefits of a fleet consisting of a single family of aircraft while still having flexibility to match the capacity and range of the aircraft to the demands of many routes.

We have a fleet of 53 Airbus single-aisle aircraft, consisting of ten Airbus A319s and 43 Airbus A320s. The average age of the fleet was approximately five years at June 30, 2014. Our Airbus A319 aircraft accommodate 119 guests, and our Airbus A320 aircraft accommodate 146-149 guests. All of the existing aircraft are financed under operating leases.

We plan to grow our fleet with additional Airbus A320-family aircraft, and we currently have an order with Airbus for ten Airbus A320 aircraft to be delivered between July 2015 and June 2016 and 30 Airbus A320 new engine option, or A320neo, aircraft to be delivered between 2020 and 2022. We have an option to cancel our Airbus A320neo positions up to two years in advance of delivery in groups of five aircraft, but we could incur a loss of deposits and credits as a cancellation fee. We may elect to supplement these deliveries by additional acquisitions from Airbus or in the open market if demand conditions merit. Twenty-six of our existing operating leases will expire between 2015 and 2022, and we believe there will be an opportunity to extend these leases at a reduced lease rate or to replace them with new or used Airbus A320-family aircraft. Although we expect to grow our fleet as we increase our flights on our existing route network and expand our route network to new markets, we are only committed to grow to 63 aircraft. As a result, our fleet plan provides significant flexibility.

Our Airbus A320 aircraft deliveries in 2015 and 2016 will be equipped with sharklets, a new wingtip device that we believe will create up to 3.0% additional fuel efficiency in our network. In addition to lowering our average fuel cost per flight, the sharklets provide increased range. This will reduce technical stops on our transcontinental flights that occasionally occur during specific weather patterns as well as allow for the possibility of operations to the state of Hawaii. Operating to Hawaii will require additional Federal Aviation Authority, or FAA, certification for extended twin-engine over-water operations, and we are currently evaluating these markets and the additional operational requirements.

6

Table of Contents

Risk Factors

Our business is subject to numerous risks and uncertainties, including those highlighted in the section entitled “Risk Factors” immediately following this prospectus summary, that represent potential challenges we face in connection with the successful implementation of our strategy and the growth of our business. We expect a number of factors to cause our results of operations to fluctuate on a quarterly and annual basis, which may make it difficult to predict our future performance. Such factors include:

| • | the price and availability of aircraft fuel; |

| • | our ability to compete in an extremely competitive industry; |

| • | the successful execution and implementation of our strategy; |

| • | security concerns resulting from any threatened or actual terrorist attacks or other hostilities; |

| • | our reliance upon technology and automated systems to operate our business; |

| • | our reputation and business being adversely affected in the event of an emergency, accident or similar incident; |

| • | changes in economic conditions; |

| • | our limited profitable operating history; |

| • | changes in governmental regulation; and |

| • | our ability to obtain financing or access capital markets. |

Corporate Information

We were incorporated in the state of Delaware in 2004 as Best Air Holdings, Inc. We changed our name to Virgin America Inc. in November 2005. Our principal executive offices are located at 555 Airport Boulevard, Burlingame, California 94010. Our general telephone number is (650) 762-7000, and our website address is www.virginamerica.com. We have not incorporated by reference into this prospectus any of the information on, or accessible through, our website, and you should not consider our website to be a part of this document. Our website address is included in this document for reference only.

Virgin America®, the Virgin America logo and the Virgin signature are trademarks of Virgin America Inc. in the United States and other countries by license from certain entities affiliated with the Virgin Group. This prospectus also contains trademarks and trade names of other companies.

2014 Recapitalization

As of June 30, 2014, we had a total of $666.4 million of contractual obligations for principal and accrued interest outstanding under certain secured related-party notes, which we refer to in this prospectus as the “Related-Party Notes.” As of June 30, 2014, the Virgin Group held approximately $410.6 million aggregate principal amount and accrued interest of the Related-Party Notes, and Cyrus Capital held approximately $255.8 million aggregate principal amount and accrued interest of the Related-Party Notes. The Virgin Group and Cyrus Capital also hold the majority of our outstanding warrants to purchase shares of our common stock, which we refer to in this prospectus as the “Related-Party Warrants.”

We intend to enter into a recapitalization agreement with the Virgin Group and Cyrus Capital, which we refer to in this prospectus as the “2014 Recapitalization Agreement.” The 2014 Recapitalization Agreement would provide that we would retain net proceeds in connection with this offering of $ million (after we pay underwriting discounts on the shares sold by us and the expenses in this offering payable by us) and that remaining net proceeds, which we

7

Table of Contents

estimate to be $ million (based on an assumed initial public offering price of $ per share, the midpoint of the price range set forth on the cover of this prospectus), would be used to repay a portion of the Related-Party Notes. Remaining principal and accrued interest under the Related-Party Notes would either be (1) exchanged for a new $50.0 million note bearing interest at a rate of 5.0% per annum, compounded annually, which we refer to as the “Post-IPO Note”; (2) repaid after the release to us of cash collateral held by our credit card processors in connection with a letter of credit facility arranged by the Virgin Group, which we refer to as the “Letter of Credit Facility”; or (3) exchanged for shares of our common stock, as described more fully in “2014 Recapitalization” elsewhere in this prospectus. In addition, Related-Party Warrants either would be exchanged without receipt of cash consideration for shares of our common stock in amounts agreed to in the 2014 Recapitalization Agreement, be exercised immediately prior to this offering, expire upon the closing of this offering or be cancelled in their entirety, as described more fully in “2014 Recapitalization” elsewhere in this prospectus.

We anticipate that, after consummation of the transactions contemplated by the 2014 Recapitalization Agreement, which we refer to in this prospectus as the “2014 Recapitalization,” and upon the closing of this offering, only the Post-IPO Note, and none of the Related-Party Notes or the Related-Party Warrants, would remain outstanding. We also anticipate that each issued and outstanding share of our Class A, Class A-1, Class B, Class C and Class G common stock and each issued and outstanding share of our convertible preferred stock would be converted into one share of common stock in accordance with our certificate of incorporation. Further, all of our remaining currently outstanding warrants that are not Related-Party Warrants will expire by their existing terms upon the closing of this offering unless the initial public offering price exceeds the applicable exercise price. Based on an assumed initial public offering price of $ per share (the midpoint of the price range set forth on the cover of this prospectus), we do not anticipate that any of our existing warrants to purchase common stock would remain outstanding upon the closing of this offering.

For more information, see “2014 Recapitalization” beginning on page 35 of this prospectus. The transactions contemplated by the 2014 Recapitalization Agreement, which we refer to in this prospectus as the “2014 Recapitalization,” would be contingent upon the consummation of this offering.

Immediately after this offering of shares of our common stock at an assumed initial public offering price of $ per share, the midpoint of the price range listed on the cover of this prospectus, after deducting underwriting discounts and estimated offering expenses payable by us and the application of such net proceeds as described under “Use of Proceeds” elsewhere in this prospectus, our principal stockholders, the Virgin Group and Cyrus Capital, will beneficially own approximately % and % of our outstanding voting common stock.

Following this offering, the Virgin Group will have the right to designate a member of our board of directors pursuant to amended and restated license agreements related to our use of the Virgin name and brand that we intend to enter into with the Virgin Group. Mr. Evan Lovell, a member of our board of directors since April 2013 and a partner of the Virgin Group, plans to remain on our board of directors following this offering as the Virgin Group’s designee.

8

Table of Contents

THE OFFERING

| Common stock offered by us |

shares. |

| Common stock offered by the selling stockholder |

1,745,395 shares. |

| Shares outstanding after the offering |

shares.(1) |

| Underwriters’ overallotment option to purchase additional shares |

Our principal stockholders, Cyrus Capital and the Virgin Group, as option selling stockholders, have granted the underwriters an option to purchase up to additional shares of common stock solely to cover overallotments. |

| Use of proceeds |

We estimate that we will receive net proceeds from this offering of approximately $ million, based on an assumed initial public offering price of $ per share (the midpoint of the price range set forth on the cover of this prospectus) and after deducting underwriting discounts and expenses of this offering payable by us. |

| VX Employee Holdings, LLC, a Virgin America employee ownership vehicle that we consolidate for financial reporting purposes will sell 1,745,395 issued and outstanding shares as a selling stockholder and will distribute the net proceeds, which we estimate to be $ , based on an assumed initial public offering price of $ (the midpoint of the price range set forth on the cover of this prospectus), to eligible teammates, which do not include our officers. We will not receive any proceeds from the sale of shares by the selling stockholder in this offering. |

From the shares of common stock we are selling in this offering, we will retain net proceeds of $ million for general corporate purposes, including working capital, sales and marketing activities, general and administrative matters and capital expenditures, including future flight equipment acquisitions, as well as for certain aircraft operating lease obligations.

| In connection with the 2014 Recapitalization, we intend to use the remaining net proceeds received by us from this offering, which we estimate will be $ million, based on an assumed initial offering price of $ per share (the midpoint of the price range on the cover of this prospectus), to repay principal and accrued interest on certain Related-Party Notes held by Cyrus Capital and the Virgin Group. For more information, see “2014 Recapitalization” and “Use of Proceeds” elsewhere in this prospectus. |

| If the overallotment option is exercised, Cyrus Capital and the Virgin Group, as option selling stockholders, will sell the shares of our common stock deliverable upon such exercise, and we will not receive any proceeds from the sale of such shares. See “Principal and Selling Stockholders” elsewhere in this prospectus. |

9

Table of Contents

| Risk factors |

See “Risk Factors” and the other information included elsewhere in this prospectus for a discussion of factors you should carefully consider before deciding to invest in our common stock. |

| Proposed NASDAQ Global Select Market symbol |

“VA” |

| (1) | The number of shares outstanding after the offering is based on the 14,719,426 shares of our common stock outstanding (on an as converted to common stock basis) as of June 30, 2014, and excludes: |

| • | an aggregate of 3,153,699 shares of common stock reserved for issuance under our 2005 Stock Incentive Plan; |

| • | 8,025,383 shares of common stock issuable upon the exercise of stock options outstanding as of June 30, 2014 at a weighted-average exercise price of $2.09 per share, of which 817,922 are vested; |

| • | 2,124,450 shares of common stock issuable upon the vesting of restricted stock units, or RSUs, outstanding as of June 30, 2014 under our 2005 Stock Incentive Plan; |

| • | 4,951,417 shares of common stock issuable upon the vesting of additional RSUs outstanding as of June 30, 2014; |

| • | 1,650,000 shares of common stock issuable upon the vesting of RSUs approved by our board of directors to be granted to certain executive officers and management contingent upon consummation of the transactions contemplated by the 2014 Recapitalization, all of which will vest immediately; |

| • | warrants to purchase an aggregate of 175,000 shares of common stock at an exercise price of $5.00 per share and an aggregate of 3,883,333 shares of common stock at an exercise price of $10.00 per share, all of which will expire, if unexercised, upon completion of this offering; |

| • | rights to purchase 1,150,709 shares of common stock at an exercise price of $3.61 per share outstanding as of June 30, 2014, which will expire, if unexercised, upon completion of this offering; |

| • | an aggregate of shares of common stock reserved for issuance under our 2014 Equity Incentive Award Plan; and |

| • | an aggregate of shares of common reserved for issuance under our 2014 Employee Stock Purchase Plan. |

Except as otherwise indicated, information in this prospectus (including the number of shares outstanding after this offering) reflects or assumes that the following will have taken place, which we refer to in this prospectus as the “Transactions”:

| • | that our amended and restated certificate of incorporation, which we will file in connection with the completion of this offering, is in effect; |

| • | that the 2014 Recapitalization has been completed, including that we have issued shares of common stock in connection therewith, based on an assumed initial offering price of $ per share (the midpoint of the price range on the cover of this prospectus); |

| • | that the holders of all issued and outstanding shares of our convertible preferred stock and our Class A, Class A-1, Class B, Class C and Class G common stock have caused each such share to be converted into one share of common stock in connection with the 2014 Recapitalization, which we refer to in this prospectus as “on an as converted to common stock basis”; and |

| • | that there has been no exercise of the underwriters’ overallotment option to purchase up to additional shares of our common stock from the option selling stockholders. |

10

Table of Contents

The information we present in this prospectus does not reflect a reverse split of our common stock that we may effect prior to the consummation of this offering.

The number of shares outstanding after the offering will depend primarily on the price per share at which our common stock is sold in this offering and the total size of this offering. In connection with this offering and pursuant to the 2014 Recapitalization:

| • | the principal and accrued interest outstanding pursuant to our Related-Party Notes either (i) would be repaid with a portion of the net proceeds from this offering and the proceeds from the release of credit card holdbacks in connection with the establishment of the Letter of Credit Facility, (ii) would be exchanged for the Post-IPO Note or (iii) would be exchanged for shares of our common stock based on the initial public offering price of this offering; |

| • | our currently outstanding warrants to purchase shares of our common stock, including our Related-Party Warrants, either (i) would be exchanged without receipt of cash consideration for shares of our common stock in amounts agreed to in the 2014 Recapitalization Agreement, which depend in part on the initial public offering price of this offering, (ii) would be exercised to the extent the exercise price per share provided for therein is less than the initial public offering price of this offering or (iii) would expire or otherwise be cancelled; and |

| • | each issued and outstanding share of our convertible preferred stock and our Class A, Class A-1, Class B, Class C and Class G common stock would be converted into one share of common stock. |

In this prospectus, in calculating the number of shares of common stock to be issued pursuant to the 2014 Recapitalization, we have assumed the application of the net proceeds to us as set forth in “Use of Proceeds” elsewhere in this prospectus an assumed initial public offering price of $ per share (the midpoint of the price range set forth on the cover of this prospectus) and an assumed initial public offering date of June 30, 2014 for purposes of calculating accrued interest on the Related-Party Notes. For more information, see “Use of Proceeds” and “2014 Recapitalization” elsewhere in this prospectus.

A change in the offering price and, accordingly, the amount of net proceeds received by us, would result in changes to the application of the net proceeds as set forth in “Use of Proceeds” elsewhere in this prospectus and in the following variables: (1) the amount of principal and accrued interest outstanding pursuant to our Related-Party Notes that are not repaid with net proceeds from this offering; (2) the number of shares of common stock that would be issued upon exchange of such Related-Party Notes; and (3) the number of shares of common stock that would be issued upon exchange of our Related-Party Warrants. The following table shows (in thousands, except per share data) the effects of various initial public offering prices on these variables based on the assumptions described above. The initial public offering prices shown below are hypothetical and illustrative only.

|

Assumed Initial |

Repayment of Related- Party Notes |

Shares of Common Stock Issued Upon Exchange for Related-Party Notes |

Shares of Common Stock Issued Upon Exchange for Related- Party Warrants |

Total Shares of Common Stock Outstanding after this Offering | ||||||

| $ |

$ | |||||||||

In each case, the total number of shares of common stock outstanding after this offering above is based on 14,719,426 shares of our common stock outstanding (on an as converted to common basis) as of June 30, 2014, subject to the same exclusions described above.

11

Table of Contents

Because the share amounts set forth above are based on the accrued interest outstanding pursuant to our Related-Party Notes as of June 30, 2014, such amounts do not take into account shares of common stock to be issued in the 2014 Recapitalization in exchange for unpaid interest on the Related-Party Notes accrued from June 30, 2014 through the closing date of this offering. Such interest contractually accrues at a rate of approximately $3.9 million per month in the aggregate.

For more information, see “2014 Recapitalization” elsewhere in this prospectus.

12

Table of Contents

SUMMARY CONSOLIDATED FINANCIAL AND OPERATING DATA

The following tables summarize the consolidated financial and operating data for our business for the periods presented. You should read this summary consolidated financial and operating data in conjunction with “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our consolidated financial statements and related notes, included elsewhere in this prospectus.

We derived the summary consolidated statements of operations data for the years ended December 31, 2011, 2012 and 2013 from our audited consolidated financial statements included in this prospectus. We derived the summary consolidated statement of operations data for the six months ended June 30, 2013 and 2014 and the consolidated balance sheet data as of June 30, 2014 from our unaudited consolidated financial statements included in this prospectus. The unaudited interim financial statements have been prepared on the same basis as the audited financial statements and include all adjustments, which consist of only normal recurring adjustments, necessary for the fair presentation of the financial information set forth in those statements. Our historical results are not necessarily indicative of the results to be expected in the future, and results for the six months ended June 30, 2014 are not indicative of the results expected for the full year.

| Year Ended December 31, | Six Months Ended June 30, | |||||||||||||||||||

| 2011 | 2012 | 2013 | 2013 | 2014 | ||||||||||||||||

| (in thousands, except per share data) | ||||||||||||||||||||

| (unaudited) | ||||||||||||||||||||

| Consolidated Statements of Operations Data: |

||||||||||||||||||||

| Operating revenues |

$ | 1,037,108 | $ | 1,332,837 | $ | 1,424,678 | $ | 677,406 | $ | 712,235 | ||||||||||

| Operating expenses |

1,064,504 | 1,364,570 | 1,343,797 | 664,510 | 678,240 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Operating income (loss) |

(27,396 | ) | (31,733 | ) | 80,881 | 12,896 | 33,995 | |||||||||||||

| Other expense |

(72,993 | ) | (113,640 | ) | (70,420 | ) | (50,435 | ) | (19,050 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net income (loss) before income tax |

(100,389 | ) | (145,373 | ) | 10,461 | (37,539 | ) | 14,945 | ||||||||||||

| Income tax expense |

14 | 15 | 317 | — | 316 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net income (loss) |

$ | (100,403 | ) | $ | (145,388 | ) | $ | 10,144 | $ | (37,539 | ) | $ | 14,629 | |||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net income (loss) per share: |

||||||||||||||||||||

| Basic (1) |

$ | (18.96 | ) | $ | (27.45 | ) | $ | 0.74 | $ | (7.09 | ) | $ | 1.07 | |||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Diluted (1) |

$ | (18.96 | ) | $ | (27.45 | ) | $ | 0.56 | $ | (7.09 | ) | $ | 0.74 | |||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Shares used in per share calculation: |

||||||||||||||||||||

| Basic (1) |

5,296,895 | 5,296,895 | 5,296,895 | 5,296,895 | 5,296,895 | |||||||||||||||

| Diluted (1) |

5,296,895 | 5,296,895 | 9,689,719 | 5,296,895 | 11,289,461 | |||||||||||||||

| Non-GAAP Financial Data (unaudited): |

||||||||||||||||||||

| EBITDA (2) |

$ | (17,241 | ) | $ | (20,473 | ) | $ | 94,844 | $ | 19,304 | $ | 40,748 | ||||||||

| EBITDAR (2) |

170,635 | 216,327 | 296,915 | 130,029 | 133,105 | |||||||||||||||

| (1) | See Note 14 to our consolidated financial statements included elsewhere in this prospectus for an explanation of the method used to calculate the basic and diluted earnings per share. |

| (2) | EBITDA is earnings before interest, income taxes, and depreciation and amortization. EBITDAR is earnings before interest, income taxes, depreciation and amortization and aircraft rent. EBITDA and EBITDAR are included as supplemental disclosure because we believe they are useful indicators of our operating performance. Derivations of EBITDA and EBITDAR are well recognized performance measurements in the airline industry that are frequently used by companies, investors, securities analysts and other interested parties in comparing the operating performance of companies in our industry. We also believe EBITDA is useful for evaluating performance of our senior management team. EBITDAR is useful in evaluating our operating performance compared to our competitors because its calculation isolates the effects of financing in general, the accounting effects of capital spending and acquisitions (primarily aircraft, |

13

Table of Contents

| which may be acquired directly, directly subject to acquisition debt, by capital lease or by operating lease, each of which is presented differently for accounting purposes) and income taxes, which may vary significantly between periods and for different companies for reasons unrelated to overall operating performance. However, because derivations of EBITDA and EBITDAR are not determined in accordance with GAAP, such measures are susceptible to varying calculations, and not all companies calculate the measures in the same manner. As a result, derivations of EBITDA and EBITDAR as presented may not be directly comparable to similarly titled measures presented by other companies. |

These non-GAAP financial measures have limitations as an analytical tool. Some of these limitations are: they do not reflect our cash expenditures or future requirements for capital expenditures or contractual commitments; they do not reflect changes in, or cash requirements for, our working capital needs; they do not reflect the significant interest expense, or the cash requirements necessary to service interest or principal payments, on our debt; although depreciation and amortization are non-cash charges, the assets being depreciated and amortized will often have to be replaced in the future, and these measures do not reflect any cash requirements for such replacements; and other companies in our industry may calculate EBITDA and EBITDAR differently than we do, limiting their usefulness as a comparative measure. Because of these limitations, EBITDA and EBITDAR should not be considered in isolation or as a substitute for performance measures calculated in accordance with GAAP.

The following table represents the reconciliation of net income (loss) to EBITDA and EBITDAR for the periods presented below:

| Year Ended December 31, | Six Months Ended June 30, | |||||||||||||||||||

| 2011 | 2012 | 2013 | 2013 | 2014 | ||||||||||||||||

| (in thousands) | ||||||||||||||||||||

| (unaudited) | ||||||||||||||||||||

| Reconciliation: |

||||||||||||||||||||

| Net income (loss) |

$ | (100,403 | ) | $ | (145,388 | ) | $ | 10,144 | $ | (37,539 | ) | $ | 14,629 | |||||||

| Interest expense |

75,577 | 116,110 | 71,293 | 50,628 | 20,424 | |||||||||||||||

| Capitalized interest |

(2,320 | ) | (2,176 | ) | (534 | ) | — | (1,116 | ) | |||||||||||

| Interest income |

(264 | ) | (294 | ) | (339 | ) | (193 | ) | (258 | ) | ||||||||||

| Income tax expense |

14 | 15 | 317 | — | 316 | |||||||||||||||

| Depreciation and amortization |

10,155 | 11,260 | 13,963 | 6,408 | 6,753 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| EBITDA |

(17,241 | ) | (20,473 | ) | 94,844 | 19,304 | 40,748 | |||||||||||||

| Aircraft rent |

187,876 | 236,800 | 202,071 | 110,725 | 92,357 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| EBITDAR |

$ | 170,635 | $ | 216,327 | $ | 296,915 | $ | 130,029 | $ | 133,105 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

The following table presents our historical consolidated balance sheet data as of June 30, 2014, on a pro forma as adjusted basis to give effect to the 2014 Recapitalization and to the receipt by us of the estimated net proceeds from the sale by us of shares at an assumed initial public offering price of $ per share (the midpoint of the price range set forth on the cover of this prospectus) after deducting underwriting discounts and estimated expenses payable by us and the application of such net proceeds as described in “Use of Proceeds” elsewhere in this prospectus.

| As of June 30, 2014 | ||||||

| Actual | Pro Forma as Adjusted (1) | |||||

| (in thousands) | ||||||

| Consolidated Balance Sheet Data: |

||||||

| Cash and cash equivalents |

$ | 179,980 | ||||

| Total assets |

871,172 | |||||

| Long-term debt, including current portion |

798,891 | |||||

| Convertible preferred stock |

21,406 | |||||

| Total stockholders’ equity (deficit) |

(369,912 | ) | ||||

| (1) | The unaudited pro forma as adjusted consolidated balance sheet has been adjusted to illustrate the effect of: (a) the repayment of $100.0 million of principal and accrued interest due under the Related-Party Notes with $100.0 million of |

14

Table of Contents

| cash released from cash collateral held by our credit card processors in connection with the establishment of the Letter of Credit Facility arranged by the Virgin Group; (b) the increase in the license rate associated with our amended and restated license agreements with the Virgin Group for use of the Virgin name and brand; (c) the issuance of the $50.0 million Post-IPO Note in exchange for cancellation of $50.0 million of certain Related-Party Notes held by the Virgin Group; (d) the repayment of $ million of principal and accrued interest due under certain Related-Party Notes with net proceeds from this offering; (e) the exchange of approximately $ million of principal and accrued interest due under the Related-Party Notes for shares of our common stock, assuming an initial public offering price of $ (the midpoint of the price range on the cover of this prospectus); (f) the issuance of shares of common stock in exchange for Related-Party Warrants to purchase shares of our common stock, assuming an initial public offering price of $ (the midpoint of the price range on the cover of this prospectus); (g) the conversion of each share of our convertible preferred stock and our Class A, Class A-1, Class B, Class C and Class G common stock into one share of our common stock; and (h) the presentation of net proceeds of $ received as a result of the 2014 Recapitalization and the offering as additional paid in capital. |

The number of shares outstanding after the offering will depend primarily on the price per share at which our common stock is sold in this offering and the total size of this offering. In connection with this offering and pursuant to the 2014 Recapitalization:

| • | principal and accrued interest outstanding pursuant to our Related-Party Notes would be either (i) repaid with a portion of the net proceeds from this offering and the proceeds from the release of credit card holdbacks in connection with the establishment of the Letter of Credit Facility, (ii) exchanged for the Post-IPO Note or (iii) exchanged for shares of our common stock based on the initial public offering price of this offering; |

| • | outstanding warrants to purchase shares of our common stock, including our Related-Party Warrants, either (i) would be exchanged without receipt of cash consideration for shares of our common stock in amounts agreed to in the 2014 Recapitalization Agreement, which depend in part on the initial public offering price of this offering, (ii) would be exercised to the extent the exercise price per share provided for therein is less than the initial public offering price of this offering or (iii) would expire or otherwise be cancelled; and |

| • | each issued and outstanding share of our convertible preferred stock and our Class A, Class A-1, Class B, Class C and Class G common stock would be converted into one share of common stock. |

In this prospectus, in calculating the number of shares of common stock to be issued pursuant to the 2014 Recapitalization, we have assumed the application of the net proceeds to us as set forth in “Use of Proceeds” elsewhere in this prospectus, an assumed initial public offering price of $ per share (the midpoint of the price range set forth on the cover of this prospectus) and an assumed initial public offering date of June 30, 2014 for purposes of calculating accrued interest on the Related-Party Notes. For more information, see “Use of Proceeds” and “2014 Recapitalization” elsewhere in this prospectus.

A change in the offering price and, accordingly, the amount of net proceeds received by us, would result in changes to the application of the net proceeds as set forth in “Use of Proceeds” elsewhere in this prospectus and in the following variables: (1) the amount of principal and accrued interest outstanding pursuant to our Related-Party Notes that are not repaid with net proceeds from this offering; (2) the number of shares of common stock that would be issued upon exchange of such Related-Party Notes; and (3) the number of shares of common stock

15

Table of Contents

that would be issued upon exchange of our Related-Party Warrants. The following table shows (in thousands, except per share data) the effects of various initial public offering prices on these variables based on the assumptions described above. The initial public offering prices shown below are hypothetical and illustrative only.

| Assumed Initial Offering Price |

Repayment of Related- Party Notes |

Shares of Common Stock Issued Upon Exchange for Related-Party Notes |

Shares of Common Stock Issued Upon Exchange for Related- Party Warrants |

Total Shares of Common Stock Outstanding after this Offering | ||||||

| $ |

$ | |||||||||

The above discussion is based on the 14,719,426 shares of our common stock outstanding (on an as converted to common stock basis) as of June 30, 2014, and excludes:

| • | an aggregate of 3,153,699 shares of common stock reserved for issuance under our 2005 Stock Incentive Plan; |

| • | 8,025,383 shares of common stock issuable upon the exercise of stock options outstanding as of June 30, 2014 at a weighted-average exercise price of $2.09 per share, of which 817,922 are vested; |

| • | 2,124,450 shares of common stock issuable upon the vesting of RSUs outstanding as of June 30, 2014 under our 2005 Stock Incentive Plan; |

| • | 4,951,417 shares of common stock issuable upon the vesting of additional RSUs outstanding as of June 30, 2014; |

| • | 1,650,000 shares of common stock issuable upon the vesting of RSUs approved by our board of directors to be granted to certain executive officers and management contingent upon consummation of the transactions contemplated by the 2014 Recapitalization, all of which will vest immediately; |

| • | rights to purchase 1,150,709 shares of common stock at an exercise price of $3.61 per share outstanding as of June 30, 2014 which will expire, if unexercised, upon completion of this offering; |

| • | warrants to purchase an aggregate of 175,000 shares of common stock at an exercise price of $5.00 per share and an aggregate of 3,883,333 shares of common stock at an exercise price of $10.00 per share, all of which will expire, if unexercised, upon the completion of this offering; |

| • | an aggregate of shares of common stock reserved for issuance under our 2014 Equity Incentive Award Plan; and |

| • | an aggregate of shares of common reserved for issuance under our 2014 Employee Stock Purchase Plan. |

Because the share amounts set forth above are based on the accrued interest outstanding pursuant to our Related-Party Notes as of June 30, 2014, such amounts do not take into account shares of common stock to be issued in the 2014 Recapitalization in exchange for unpaid interest on the Related-Party Notes accrued from June 30, 2014 through the closing date of this offering. Such interest contractually accrues at a rate of approximately $3.9 million per month in the aggregate.

For more information, see “2014 Recapitalization” elsewhere in this prospectus.

16

Table of Contents

OPERATING STATISTICS

| Year Ended December 31, | Six Months Ended June 30, | |||||||||||||||||||

| 2011 | 2012 | 2013 | 2013 | 2014 | ||||||||||||||||

| Operating Statistics: (1) |

||||||||||||||||||||

| Available seat miles—ASMs (millions) |

9,853 | 12,514 | 12,243 | 5,948 | 5,979 | |||||||||||||||

| Departures |

44,696 | 56,362 | 58,215 | 27,712 | 28,962 | |||||||||||||||

| Average stage length (statute miles) |

1,571 | 1,567 | 1,474 | 1,510 | 1,445 | |||||||||||||||

| Aircraft in service—end of period |

44 | 52 | 53 | 53 | 53 | |||||||||||||||

| Fleet utilization |

12.1 | 11.6 | 10.8 | 10.7 | 10.7 | |||||||||||||||

| Passengers (thousands) |

5,030 | 6,219 | 6,329 | 3,068 | 3,208 | |||||||||||||||

| Average fare |

$ | 189.05 | $ | 195.38 | $ | 203.70 | $ | 198.86 | $ | 197.55 | ||||||||||

| Yield per passenger mile (cents) |

11.82 | 12.26 | 13.14 | 12.70 | 12.89 | |||||||||||||||

| Revenue passenger miles—RPMs (millions) |

8,034 | 9,912 | 9,814 | 4,806 | 4,917 | |||||||||||||||

| Load factor |

81.5 | % | 79.2 | % | 80.2 | % | 80.8 | % | 82.2 | % | ||||||||||

| Passenger revenue per available seat mile—PRASM (cents) |

9.64 | 9.71 | 10.53 | 10.26 | 10.60 | |||||||||||||||

| Total revenue per available seat mile—RASM (cents) |

10.53 | 10.65 | 11.64 | 11.39 | 11.91 | |||||||||||||||

| Cost per available seat mile—CASM (cents) |

10.80 | 10.90 | 10.98 | 11.17 | 11.34 | |||||||||||||||

| CASM, excluding fuel (cents) |

6.56 | 6.61 | 6.83 | 6.97 | 7.21 | |||||||||||||||

| Fuel cost per gallon |

$ | 3.24 | $ | 3.32 | $ | 3.18 | $ | 3.23 | $ | 3.14 | ||||||||||

| Fuel gallons consumed (thousands) |

128,852 | 161,404 | 159,326 | 77,367 | 78,828 | |||||||||||||||

| Teammates (FTE) |

2,002 | 2,395 | 2,482 | 2,375 | 2,500 | |||||||||||||||

| (1) | See “Glossary of Airline Terms” beginning on the next page of this prospectus for definitions of terms used in this table. |

17

Table of Contents

Set forth below is a glossary of industry terms used in this prospectus:

Airbus A320-family includes A318, A319, A320 and A321 aircraft manufactured by the Airbus Group. The Airbus A320-family have common engine, airframe and cockpit design, leading to shared maintenance and flight operations procedures. We currently operate A319 and A320 aircraft.

Ancillary revenue means the amount of non-ticket revenue received from passengers, including baggage fees, change fees, seat selection fees and on-board sales.

Ancillary revenue per passenger means the total ancillary revenue divided by passengers.

ASMs, or “available seat miles,” refer to the number of seats available for passengers multiplied by the number of miles the seats are flown.

ATL, or “air traffic liability,” means the value of tickets sold in advance of travel.

Average fare means total passenger revenue divided by passengers.

Banks means the discrete periods during the day at a hub airport during which a large number of flights arrive and depart, allowing for connections.

Block hours means the hours during which the aircraft is in revenue service, measured from the time of gate departure before take-off until the time of gate arrival at the destination.

CASM, or “cost per available seat mile,” means the airline’s total operating costs divided by available seat miles.

CASM, excluding fuel, or “CASM ex-fuel,” means operating costs less aircraft fuel expense divided by ASMs.

Codeshare refers to a type of arrangement where two or more airlines share the same flight and where a seat can be purchased through one airline but actually operated by a cooperating airline under a different flight number or code.

DOT means the U.S. Department of Transportation, a federal Cabinet department of the U.S. government overseeing interstate and international transportation.

EPA means the U.S. Environmental Protection Agency, an agency of the federal government of the United States charged with protecting human health and the environment.

FAA means the U.S. Federal Aviation Administration, an agency of the U.S. Department of Transportation that has the authority to regulate and oversee civil aviation in the United States.

Fleet utilization, or “aircraft utilization,” means block hours in the period divided by average number of aircraft in our fleet divided by number of days in the period.

Flight equipment means all types of property and equipment used in the inflight operation of aircraft.

Flight hours means the total time an aircraft is in the air between an origin-destination airport pair, i.e. from wheels-up at the origin airport to wheels-down at the destination airport.

GDS means a Global Distribution System such as Amadeus, Sabre and Travelport, used by travel agencies and corporations to purchase tickets on participating airlines.

18

Table of Contents

Hub-and-spoke network refers to a method of organizing an airline network in which one major airport is used as a connecting point for passengers traveling to other destinations, including smaller local airports and international destinations.

Interline refers to a type of agreement among airline partners that allow guests to create itineraries connecting from one airline to another.

Length of haul adjusted RASM means RASM adjusted for passenger-weighted length of haul.

Load factor means the proportion of airline capacity (ASMs) that is actually consumed, calculated by dividing RPMs by ASMs.

Major airline, as defined by the U.S. Department of Transportation, means a U.S.-based air carrier with annual operating revenues in excess of one billion dollars during a fiscal year.

Passenger revenue means revenue received by the airline from the carriage of passengers in scheduled operations.

Passenger-weighted length of haul means the average distance flown, measured in statute miles, per passenger, calculated by dividing total RPMs by the number of total revenue passengers.

Passengers means the total number of passengers flown on all flight segments.

PDP means pre-delivery payments, which are payments required by aircraft manufacturers in advance of delivery of the aircraft; typically aircraft-specific payments begin 24 months prior to aircraft delivery.

Pitch, or “seat pitch,” means the measure of distance between seat rows on an aircraft, measured in inches from the middle of one seat to the middle of the seat directly in front of it.

Point-to-point network means a method of organizing an airline network in which flights travel directly to a destination rather than going through a central hub.

PRASM, or “passenger revenue per available seat mile,” refers to a measure of passenger unit revenue calculated by dividing passenger revenue by available seat miles, or ASMs.

RASM, “revenue per available seat mile” or “unit revenue” refers to a measure of unit revenue calculated by dividing the airline’s total revenue by available seat miles, or ASMs.

RPMs, or “revenue passenger miles,” means the number of miles flown by revenue passengers.

Seat-weighted stage length means the average distance flown, measured in statute miles, per seat, calculated by dividing total ASMs by the number of total seats flown.

Stage length means the average distance flown, measured in statute miles, per aircraft departure, calculated by dividing total aircraft miles flown by the number of total aircraft departures performed.

Stage length adjusted CASM means CASM adjusted for a seat-weighted stage length.

Stage-length adjustment refers to an adjustment to enable comparison of CASM and RASM across airlines. All other things being equal, the same airline will have lower CASM and RASM as stage length increases since fixed and departure related costs are spread over increasingly larger average flight lengths. Therefore, to properly compare these quantities across airlines (or even across the same airline for two different periods if the airline’s

19

Table of Contents

average stage length has changed significantly) requires settling on a common assumed stage length and then adjusting CASM and RASM appropriately. This requires some judgment and different observers may use different stage-length adjustment techniques. For comparisons in this prospectus in which CASM is stage-length adjusted, the stage-length being utilized is a seat-weighted distance, or the average of the distances flown by each seat divided by total seats flown. For comparisons where RASM is stage-length adjusted, the stage being utilized is the passenger-weighted distance, or the average of the individual distances flown by the airlines’ passengers.

TSA means the U.S. Transportation Security Administration, an agency of the U.S. Department of Homeland Security that exercises authority over the security of the traveling public in the United States.

U.S. citizen means a “citizen of the United States” as that term is defined in 49 U.S.C. §40102(a)(15).

Yield refers to a measure of average fare paid per mile per passenger, calculated by dividing passenger revenue by revenue passenger miles.

Virgin America Destinations:

AUS—Austin-Bergstrom International Airport (Austin, Texas).

BOS—General Edward Lawrence Logan International Airport (Boston, Massachusetts).

CUN—Cancún International Airport (Cancún, Mexico).

DAL—Dallas Love Field (Dallas, Texas).

DCA—Ronald Reagan Washington National Airport (Washington, D.C.).

DFW—Dallas/Fort Worth International Airport (Dallas, Texas).

EWR—Newark Liberty International Airport (Newark, New Jersey).

FLL—Fort Lauderdale-Hollywood International Airport (Fort Lauderdale, Florida).

IAD—Washington Dulles International Airport (Dulles, Virginia).

JFK—John F. Kennedy International Airport (Jamaica, New York).

LAS—McCarran International Airport (Las Vegas, Nevada).

LAX—Los Angeles International Airport (Los Angeles, California).

LGA—LaGuardia Airport (New York, New York).

MCO—Orlando International Airport (Orlando, Florida).

ORD—Chicago O’Hare International Airport (Chicago, Illinois).

PDX—Portland International Airport (Portland, Oregon).

PHL—Philadelphia International Airport (Philadelphia, Pennsylvania).

PSP—Palm Springs International Airport (Palm Springs, California).

PVR—Licenciado Gustavo Díaz Ordaz International Airport (Puerto Vallarta, Mexico).

SAN—San Diego International Airport (San Diego, California).

SEA—Seattle–Tacoma International Airport (Seattle, Washington).