[Letterhead of Sullivan & Cromwell LLP]

September 25, 2014

Michael R. Clampitt

Division of Corporation Finance,

Securities and Exchange Commission,

100 F Street, NE,

Washington, DC 20549.

| Re: | Great Western Bancorp, Inc. |

| Registration Statement on Form S-1 |

| Filed August 28, 2014 |

| File No. 333-198458 |

Dear Mr. Clampitt:

On behalf of our client, Great Western Bancorp, Inc. (the “Company”), enclosed please find a copy of Amendment No. 1 (“Amendment No. 1”) to the Registration Statement on Form S-1 (the “Registration Statement”), as filed on EDGAR with the Securities Exchange Commission (the “Commission”) on the date hereof, marked to show changes from the Registration Statement filed with the Commission on August 28, 2014.

The changes reflected in Amendment No. 1 include those made in response to the comments of the staff of the Commission (the “Staff”) set forth in the Staff’s letter of September 15, 2014 (the “Comment Letter”). Amendment No. 1 also includes other changes that are intended to update, clarify and render more complete the information contained therein.

The numbered responses that follow relate to the questions set forth in the Comment Letter, which are reproduced below in bold print. The responses of the Company follow each reproduced comment. All references to page numbers and captions (other than those in the Staff’s comments) correspond to the page numbers and captions in Amendment No. 1.

Securities and Exchange Commission

September 25, 2014

- 2 -

Outside Front Cover Page of Prospectus

| 1. | We acknowledge your response to comment 2 of our letter to you dated August 14, 2014. As we requested, please disclose the information required by Item 501 and Instruction 1 to paragraph 501(b)(3) including the amount of securities to be sold by the selling shareholder and a range for the offering price. Revise pages 13 and 181 accordingly. |

The Company acknowledges the Staff’s comment and will provide all information required by Item 501 and Instruction 1 to paragraph 501(b)(3) in an amendment or amendments to the Registration Statement at the time such information is known.

Prospectus Summary, Our Business page 1

| 2. | Please revise to add a section at the front summarizing the magnitude and nature of your material weaknesses in both the design and the operation of your internal controls over financial reporting and your efforts to remediate such failures. Please disclose line items affected by the material weakness and the extent of the impact on those items before they were corrected. Please tell us the extent to which the material weakness in the design and operation of your internal controls over financial reporting may be attributable in part to the fact that NAB, Great Western and their respective financial and accounting staff have been using International Financial Reporting Standards under the laws applicable in Australia instead of U.S. GAAP for financial reporting. Please also tell us the education, training and experience in U.S. GAAP of the accounting and financial staff of Great Western. |

The Company has revised the disclosure on pages 16, 42–43 and 117–118 of Amendment No. 1 in response to the Staff’s comment.

The Company concluded that a material weakness existed in connection with the preparation and review of its consolidated financial statements satisfying the heightened financial reporting standards applicable to public companies under GAAP and Commission rules. A detailed discussion of the material weakness and the steps taken to remediate it are included below. Notwithstanding this material weakness, the Company’s reported net income and stockholder’s equity for all periods in its consolidated financial statements were unaffected, and its total assets and total liabilities changed immaterially (less than 0.1%) due to a change in the treatment of an intercompany amount that should have been eliminated. Further, reported amounts in the Company’s consolidated statements of comprehensive income were not affected (other than a typographical presentation error noted in noninterest expense line items contained in the consolidated statement of comprehensive income for the six months ended March 31, 2014 and 2013). All identified errors related principally to the consolidated statements of cash flows and disclosures in the notes to the Company’s consolidated financial statements, and all such inaccuracies were satisfactorily resolved prior to the confidential submission of the

Securities and Exchange Commission

September 25, 2014

- 3 -

Company’s consolidated financial statements to the Commission as part of the draft registration statement on July 18, 2014 (the “Draft Registration Statement”). Due to the remedial measures undertaken by the Company, including the enhanced controls and procedures discussed below implemented prior to the period-end close of its subsequent quarterly reporting period, no material differences, either individually or in the aggregate, were identified in connection with the review of the Company’s unaudited interim consolidated financial statements at and for the third fiscal quarter of 2014 (the “Third Quarter Financial Statements”) included in the Registration Statement.

For the reasons described, the material weakness identified in the Company’s design and operation of its internal controls over financial reporting resulted primarily from the Company’s failure to (1) commit sufficient resources and personnel to the preparation and review of its consolidated financial statements for inclusion in the Draft Registration Statement and (2) maintain formal controls and procedures with respect to its internal review of the accuracy and completeness of its application of Commission rules to the Company’s consolidated financial statements for inclusion in the Draft Registration Statement. In an effort to maintain the confidentiality of the offering process, only a subset of the Company’s accounting and financial reporting staff were involved in the Company’s preparation of the consolidated financial statements for inclusion in the Draft Registration Statement. As a result, not all accounting and financial reporting personnel typically involved in the preparation of the Company’s consolidated financial statements were involved, and the level of review the Company would ordinarily undertake in the preparation of its consolidated financial statements was not fully undertaken. The Company also had not implemented a control framework sufficient to ensure a complete and independent review of the additional disclosures required of public companies contained in the Company’s consolidated financial statements. This resulted in a greater than ordinary number of identified inaccuracies in the Company’s draft consolidated financial statements.

The Company advises the Staff that it does not believe the material weakness identified was attributable to the Company’s reporting of its financial results under International Financial Reporting Standards (“IFRS”) applicable to it as a wholly owned subsidiary of National Australia Bank Limited (“NAB”). The Company has also reported its financial results under U.S. GAAP to U.S. federal bank regulators as required by the financial reporting regulatory regime applicable to financial institutions and their holding companies in the U.S. As a result, since its acquisition by NAB, the Company has reported financial information to NAB under IFRS and, for an extended period of time, to U.S. federal bank regulators under U.S. GAAP. As discussed above, the material weakness was identified in connection with the preparation and review of the Company’s consolidated financial statements satisfying the heightened financial reporting standards applicable to public companies under U.S. GAAP and Commission rules, standards that the Company had not been required to comply with prior to this offering.

Securities and Exchange Commission

September 25, 2014

- 4 -

The material weakness disclosed was initially brought to the Company’s attention by the Company’s independent auditor in connection with their review of the Company’s consolidated financial statements to be included in the Draft Registration Statement. The number of differences observed indicated that a deficiency in the Company’s internal control environment existed. After assessing the deficiency, management of the Company and the Company’s independent auditor concluded that a material weakness existed.

Following identification of the material weakness, the Company implemented a number of controls and procedures designed to improve its control environment. In particular, the Company included additional members of its accounting and financial reporting staff in the preparation and review of the Third Quarter Financial Statements included in the Registration Statement and implemented a more formal preparation and review hierarchy designed to identify and resolve potential errors on a timely basis. In addition, the Company retained two independent consulting firms to perform independent reviews of the Third Quarter Financial Statements and assist the Company in identifying potential errors on a timely basis. As a result of these additional controls and procedures, no differences were identified in connection with the review of the Third Quarter Financial Statements that were, individually or in the aggregate, material to the consolidated financial statements. Despite this improvement in the Company’s control environment, management of the Company believes that further reporting periods, including the fiscal year end 2014 reporting cycle, are required to confirm the remediation of the disclosed material weakness and the ongoing effectiveness of the Company’s revised control environment. During the fiscal year end 2014 reporting cycle and going forward, the Company’s full accounting and financial reporting team will be included in the preparation of the Company’s consolidated financial statements, and the Company expects that its enhanced control environment will be fully implemented. The Company will continue to monitor the effectiveness of its financial reporting system, recognizing that such monitoring involves a continuous effort that requires the Company to anticipate and react to changes in its business and the economic and regulatory environments.

The Company believes that its current accounting and financial reporting staff, supplemented by the two independent consulting firms, has sufficient qualifications and appropriate experience for the accurate recording, reporting and disclosure of the Company’s financial information. The Company’s accounting and financial reporting staff has extensive experience with U.S. GAAP reporting and in auditing public companies. In particular, the Company’s Chief Financial Officer has over 20 years of accounting and financial reporting related experience, both with an external accounting firm and with NAB, including experience as the Head of Financial Control for NAB where he was responsible for all NAB’s external financial reporting and internal management reporting. A more detailed description of the qualifications and experience of the Company’s accounting and financial reporting staff is included in Annex A. The

Securities and Exchange Commission

September 25, 2014

- 5 -

Company continues to assess the qualifications and experience of its accounting and financial reporting staff. Although the Company believes its current accounting and financial staff are highly qualified, the Company is in the process of hiring two individuals to supplement its current capabilities and reduce its reliance on third parties for review of financial information.

In light of the foregoing, the Company respectfully submits that greater prominence of this matter in the Prospectus Summary beyond identifying it as one of the significant risks facing the Company is inappropriate. In particular, the Company believes that disproportionate disclosure of this risk, relative to other risks facing the Company, would suggest this risk is more significant to the Company’s ongoing business than other risks identified, which is inconsistent with how management views the Company and its risk profile. Detailed disclosure regarding the material weakness, the steps the Company has taken to remediate it and the risks related thereto are presented in “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Internal Control Over Financial Reporting” and “Risk Factors—Risks Relating to Our Business—We may not be able to report our future financial results accurately and timely as a publicly listed company if we fail to maintain an effective system of disclosure controls and procedures and internal control over financial reporting, or if we fail to remediate the material weakness identified relating to the design and operation of our internal control over financial reporting.”

| 3. | We acknowledge your response to comment 5 of our letter to you dated August 14, 2014 regarding your claim in the first paragraph on page 1 and elsewhere where you claim to have “an efficiency ratio superior to our peer median.” However, we note that your claim is based upon your comparison of your efficiency ratio which you compute one way with that of your peers that compute their efficiency ratio another way using the more traditional computation. Please revise your claim on page 1 and elsewhere (including the table on page 7) by disclosing your efficiency ratio using the same method of computing efficiency ratio as your peers. |

The Company has revised the disclosure on pages 7, 21-22 and 134 of Amendment No. 1 in response to the Staff’s comment and has presented its efficiency ratio calculated in the same manner as its peer group.

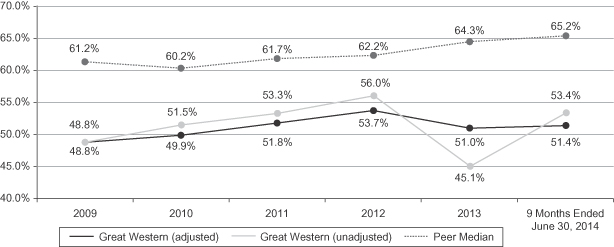

The Company notes that its efficiency ratio calculated in this manner remains superior to the peer group’s median. As demonstrated in the table below, the Company’s efficiency ratio, without adjusting for changes in fair value related to the effects of fluctuations in interest rates on the Company’s long-term fixed-rate loans and related interest rate swaps, was 12.3 percentage points, 8.6 percentage points, 8.4 percentage points, 6.1 percentage points, 19.1 percentage points and 11.8 percentage points lower than the peer group’s median for fiscal 2009, 2010, 2011, 2012 and 2013 and for the nine months ended June 30, 2014, respectively. As disclosed on page 7 of Amendment No. 1, the Company

Securities and Exchange Commission

September 25, 2014

- 6 -

believes that its efficiency ratio calculated on an unadjusted basis does not accurately reflect its operating efficiency due to the inclusion of offsetting changes in fair value related to the effects of fluctuations in interest rates on the Company’s long-term fixed-rate loans and related interest rate swaps. Because the fair value fluctuations associated with these instruments are completely offset in the Company’s results of operations and therefore have no effect on net income or profitability, the Company believes that the unadjusted presentation of its efficiency ratio, which highlights these fair value changes, does not accurately reflect the Company’s operating efficiency. For example, for fiscal 2013, the Company’s efficiency ratio, calculated on an unadjusted basis, was 19.1 percentage points lower than the peer group’s median and, calculated on an adjusted basis (i.e., excluding the fair value adjustments), was 13.3 percentage points lower than the peer median, reflecting a 5.9 percentage point overstatement of the Company’s true operational efficiency relative to the peer median. Further, the unadjusted efficiency ratio distorts the trends and suggests a significant decline of 10.9 percentage points in the Company’s efficiency ratio from fiscal 2012 to 2013 and a significant increase of 8.3 percentage points to the next fiscal period (from fiscal 2013 to the nine months ended June 30, 2014), 75% and 96% of which changes, respectively, are due to fair value adjustments that have no impact on the Company’s operational efficiency or its results of operations. Adjusting for the changes in fair value described above, the Company’s efficiency ratio reflects the true trends in its operational efficiency between these periods – its operational efficiency improved as its adjusted efficiency ratio declined by 2.7 percentage points from fiscal 2012 to 2013 (compared to the 10.9 percentage point decline on an unadjusted basis) and increased in the next fiscal period by 0.4 percentage points (compared to the 8.3 percentage point increase on an unadjusted basis). For periods prior to fiscal 2013, the difference in the calculation of the efficiency ratio is relatively modest, as demonstrated in the table below, due to more modest fluctuations in interest rates and, therefore, in the fair value of these instruments. Accordingly, the Company respectfully submits that the presentation of only its unadjusted efficiency ratio would materially distort its operational efficiency and the trends related thereto. The Company has revised the graph depicting its efficiency ratio as set forth below to include a line depicting the Company’s unadjusted efficiency ratio.

| Nine Months Ended June 30, 2014 |

Fiscal Year Ended September 30, | |||||||||||||||||||||||

| 2013 | 2012 | 2011 | 2010 | 2009 | ||||||||||||||||||||

| Peer group median |

65.2 | % | 64.3 | % | 62.2 | % | 61.7 | % | 60.2 | % | 61.2 | % | ||||||||||||

| Company efficiency ratio (unadjusted) |

53.4 | % | 45.1 | % | 56.0 | % | 53.3 | % | 51.5 | % | 48.8 | % | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Percentage points below peer group median* |

11.8 | 19.1 | 6.1 | 8.4 | 8.6 | 12.3 | ||||||||||||||||||

| Difference as percent of peer group median* |

18.1 | % | 29.8 | % | 9.9 | % | 13.6 | % | 14.4 | % | 20.2 | % | ||||||||||||

| Company efficiency ratio (adjusted) |

51.4 | % | 51.0 | % | 53.7 | % | 51.8 | % | 49.9 | % | 48.8 | % | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Percentage points below peer group median* |

13.9 | 13.3 | 8.5 | 9.9 | 10.3 | 12.3 | ||||||||||||||||||

| Difference as percent of peer group median* |

21.2 | % | 20.6 | % | 13.6 | % | 16.1 | % | 17.1 | % | 20.2 | % | ||||||||||||

| * | Differences and quotients may not foot due to rounding. |

Securities and Exchange Commission

September 25, 2014

- 7 -

Prospectus Summary, Our Structure, page 11

| 4. | We acknowledge your response to comment 12 of our letter to you dated August 14, 2014 regarding each company. Please revise your descriptions on page 11 to disclose any operations in the United States conducted directly or indirectly by NAB other than Great Western. |

The Company has revised the disclosure on page 11 of Amendment No. 1 in response to the Staff’s comment.

Prospectus Summary, Separation from NAB, page 12

| 5. | We note your revisions to this section. Please revise to disclose that according to its August 29 press release, NAB intends to divest but that it will do so “over time, subject to market conditions” and that “the timing of subsequent sales of GWB shares is unknown.” |

The Company has revised the disclosure on pages 12–13 and 53 of Amendment No. 1 in response to the Staff’s comment.

Securities and Exchange Commission

September 25, 2014

- 8 -

Prospectus Summary, Relationship with NAB, page 13

| 6. | We acknowledge your response to comment 13 of our letter to you dated August 14, 2014 regarding your relationship with NAB. Please revise the subsections as follows: |

| • | revise the second paragraph to explain why you have delayed entering into agreements with your parent NAB and disclose when these agreements will be final; |

| • | revise the second paragraph to identify any other agreements you have or intend to enter into with NAB; |

| • | revise the summary of the Stockholder Agreement to clarify that the “consent rights” give NAB a veto over your actions, describe the “various other corporate actions” to which you refer and explain the reasons your Board gave NAB such veto rights; |

| • | revise the summary of the Stockholder Agreement to explain the benefits to NAB of exchanging voting stock for nonvoting stock; and |

| • | revise the summary of the Transitional Services Agreement to disclose the termination date of the Agreement. |

The Company has revised the disclosure on pages 13–15 of Amendment No. 1 in response to the Staff’s comment. The Company believes the consent rights granted to NAB as part of the Stockholder Agreement are consistent with consent rights granted to controlling stockholders as a means of permitting oversight of the Company’s business. Given the regulatory responsibilities NAB has as a controlling person of the Company, the Company believes these rights balance the Company’s interest in continuing its ordinary course business operations while granting NAB the right to consent to actions the Company may undertake outside the ordinary course. In addition, the Company believes the rights granted to NAB are appropriate in connection with NAB’s continuing control of the Company for U.S. bank regulatory purposes following completion of this offering.

Prospectus Summary, The Offering, page 16

| 7. | We note your revisions to this section including new disclosure regarding your plan to implement a stock split before completion of the offering. Please disclose the terms of the stock split and revise the share information throughout the document accordingly. Please summarize the purpose and effect of the stock split. |

The Company has revised the disclosure on pages 18 and 98 of Amendment No. 1 in response to the Staff’s comment. The Company will disclose the terms of the stock split and revise the share information at the time the terms of the stock split are known.

Securities and Exchange Commission

September 25, 2014

- 9 -

Risk Factors, page 20

| 8. | Please consider adding a risk factor addressing the risks associated with your legal agreement to provide NAB with access to all of your internal information which may result in NAB having material nonpublic information regarding Great Western before other shareholders have such information. |

The Company has revised the disclosure on page 52 of Amendment No. 1 in response to the Staff’s comment.

| 9. | We note the revisions to the risk factor on pages 41 and 42 relating to your material weakness in the design and operation of your internal controls over financial reporting. Please revise the second paragraph on page 42 to clarify that the risk applies not only to your future financial statements once you are a public company but also includes, if true, the risk that the material weakness resulted in material inaccuracies in the financial statements and disclosure contained in the prospectus. Revise the caption accordingly. |

As discussed in greater detail in response to Comment #2 above, the Company does not believe the identified material weakness results in any risk of material inaccuracies in the consolidated financial statements and disclosure included in the Registration Statement.

Management, page 160

| 10. | As required by Item 401(e)(1), please revise your description of the business experience of Peter Chapman, your CFO, on page 163, to disclose “information relating to the level of his or her professional competence” as follows: |

| • | disclose his professional qualifications; |

| • | identify his “roles within NAB” to which you refer; and |

| • | revise your reference to his being “with” Ernst & Young, to disclose his respective position(s), identify the country or countries in which he worked and identify his specific practice areas or expertise. |

The Company has revised the disclosure on page 166 of Amendment No. 1 in response to the Staff’s comment.

Securities and Exchange Commission

September 25, 2014

- 10 -

Internal Control Over Financial Reporting, page 116

| 11. | We note your revisions to this section. Please revise your disclosure to provide more detail as to the nature and extent of the material weakness. Supplementally tell us how and when you discovered the material weaknesses and who discovered them. |

The Company has revised the disclosure on pages 42–43 and 117–118 of Amendment No. 1 in response to the Staff’s comment. The Company’s response to Comment #2 above includes a discussion of how, when and by whom the disclosed material weakness was discovered.

Exhibits

| 12. | We acknowledge your response to comment 45 of our letter to you dated August 14, 2014 regarding exhibits. We note that you still have not filed several of the exhibits required by Item 601 of Regulation S-K including various agreements with your parent company NAB. Please file all exhibits with your next amendment. Once you file all of the exhibits, please adjust your schedule to allow the staff adequate time to review and comment upon your disclosure relating to the exhibits. |

The Company acknowledges the Staff’s comment and has included several of the remaining exhibits with Amendment No. 1. The Company undertakes to provide any remaining exhibits required as soon as such exhibits are available. In addition, the Company has refiled its forms of Stockholder Agreement, Transitional Services Agreement and Registration Rights Agreement. The form of Stockholder Agreement has been revised to include a settlement and dispute resolution mechanism substantially similar to the one currently contained in the form of Transitional Services Agreement. The form of Transitional Services Agreement has been revised to clarify the insurance reimbursement arrangements between the Company and NAB. The form of Registration Rights Agreement filed with Amendment No. 1 is identical to the version submitted to the Commission on a confidential basis on August 25, 2014. A non-final draft of the Registration Rights Agreement was inadvertently filed with the Registration Statement on August 28, 2014. The version of the Registration Rights Agreement filed with Amendment No. 1 is consistent with the disclosure in the Registration Statement.

* * *

Securities and Exchange Commission

September 25, 2014

- 11 -

The Company acknowledges that:

| • | should the Commission or the Staff, acting pursuant to delegated authority, declare the filing effective, it does not foreclose the Commission from taking any action with respect to the filing; |

| • | the action of the Commission or the Staff, acting pursuant to delegated authority, in declaring the filing effective, does not relieve the Company from its full responsibility for the adequacy and accuracy of the disclosure in the filing; and |

| • | the Company may not assert Staff comments and the declaration of effectiveness as a defense in any proceeding initiated by the Commission or any person under the federal securities laws of the United States. |

Any questions or comments with respect to the Registration Statement may be communicated to the undersigned at (212) 558-4175 or by email (clarkinc@sullcrom.com) or to Zachary L. Cochran at (212) 558-4735 or by email (cochranz@sullcrom.com). Please send copies of any correspondence relating to this filing to Catherine M. Clarkin by email and facsimile, at (212) 291-9025, with the original by mail to Sullivan & Cromwell LLP, 125 Broad Street, New York, New York 10004.

| Yours truly, |

| /s/ Catherine M. Clarkin |

|

|

| Catherine M. Clarkin |

(Enclosure)

| cc: | Jonathan E. Gottlieb |

| Gustavo Rodriguez |

| Marc Thomas |

| (Securities and Exchange Commission) |

| Kenneth Karels |

| Peter Chapman |

| Donald J. Straka |

| (Great Western Bancorp, Inc.) |

| Mark J. Menting |

| Zachary L. Cochran |

| (Sullivan & Cromwell LLP) |

Securities and Exchange Commission

September 25, 2014

- 12 -

Annex A – Qualifications and Experience of Accounting and Financial Reporting Staff

Peter Chapman (Chief Financial Officer)

| • | Mr. Chapman has served as Great Western Bancorporation, Inc.’s Chief Financial Officer and Executive Vice President and on its board of directors since January 2013. Mr. Chapman is also the Chief Financial Officer and Executive Vice President of Great Western Bank. |

| • | From 2010 until he was appointed as our Chief Financial Officer in November 2012, Mr. Chapman served as the General Manager, Finance Performance Management & Non Traded Businesses for NAB’s Wholesale Banking business, where was responsible for coordinating the planning, forecasting and financial control for Wholesale Banking globally. |

| • | Mr. Chapman served as Head of Financial Control at NAB from 2007 through 2010 and was responsible for oversight and delivery of NAB’s external financial reporting and internal management reporting. Mr. Chapman’s responsibilities also included direct oversight of the team preparing Guide 3 information to support NAB’s Rule 144A debt program and to prepare U.S. regulatory filings with respect to Great Western Bank, Great Western Bancorporation, Inc. and National Americas Investments, Inc. |

| • | From 2004 to 2007, Mr. Chapman served as Manager, and then Senior Manager, in the Group Accounting Policy team at NAB, where he was responsible for interpreting international financial reporting standards and U.S. GAAP accounting guidance. Mr. Chapman was also directly responsible for overseeing U.S. GAAP financial instrument disclosures in NAB’s Annual Report during that time and for providing U.S. GAAP specific accounting advice on a number of structured finance transactions. |

| • | Prior to joining NAB, Mr. Chapman was held various roles with E&Y’s Financial Services Audit Division from 1995 to 2004, including a secondment to Ernst & Young’s New York Financial Services Audit practice from 1998 to 2000. During his time at E&Y, Mr. Chapman advised numerous clients that were required to report financial information consistent with U.S. GAAP. |

| • | Mr. Chapman has been a Chartered Accountant with the Institute of Chartered Accountants Australia since 1998 and is currently a Fellow of the Institute. |

Securities and Exchange Commission

September 25, 2014

- 13 -

David Hinderaker (Head of Business Performance)

| • | Mr. Hinderaker began working at Great Western Bank in July 2010. |

| • | Mr. Hinderaker has approximately eight years’ experience in various financial management roles with private companies, primarily in the financial services industry, and has been in his current role overseeing planning, reporting and strategy as Head of Business Performance at Great Western Bank for nearly four years. |

| • | Prior to joining Great Western Bank, Mr. Hinderaker was employed by Deloitte & Touche LLP (“Deloitte”) in the firm’s audit practice for approximately four years. During his time at Deloitte, Mr. Hinderaker advised a variety of clients in several industries, including both public and private companies, and supported multiple public offerings and other transactions. Mr. Hinderaker also assisted a number of publicly traded clients with their initial implementation of Sarbanes-Oxley Act (“SOX”) Section 404 compliance programs in 2003 and 2004. |

| • | Mr. Hinderaker is an active certified public accountant in the State of South Dakota and completes numerous continuing professional education courses on an annual basis. |

Kristin Hoff (Controller)

| • | Ms. Hoff began serving as Controller of Great Western Bank in 2011, where she has led the financial close and reporting process as well as various other duties. |

| • | Prior to joining Great Western Bank, Ms. Hoff was employed by KPMG LLP (“KPMG”) for approximately five years where she advised a variety of public and private company clients. In particular, during her time with KPMG, Ms. Hoff worked for four years on the audit team for a public company in the banking industry, which included advising on the company’s implementation of SOX Section 404 compliance in 2004. In addition, for two and a half years after leaving KPMG, Ms. Hoff led the SOX compliance audit and engagement for another public company, outside the banking industry, and reviewed all of their public filings with the Commission. |

| • | Ms. Hoff is an active certified public accountant in the State of South Dakota and completes numerous continuing professional education courses on an annual basis. |

Securities and Exchange Commission

September 25, 2014

- 14 -

Michelle Gustin (Manager Tax & Loss Share Accounting)

| • | Ms. Gustin has been part of the accounting staff at Great Western Bank for six years and actively participated in the preparation of financial statements and the completion and integration of five acquisitions, including managing impaired loan accounting in connection with those acquisitions. |

| • | Ms. Gustin is a certified public accountant in the State of South Dakota with over twelve years of total public accounting experience, encompassing work for both public and private companies. |

| • | Ms. Gustin is an active certified public accountant in the State of South Dakota and completes numerous continuing professional education courses on an annual basis. |

Jennifer Warren (Head of Internal Audit)

| • | Ms. Warren began working at Great Western Bank in 2010. She has worked in various financial reporting roles at Great Western Bank and currently heads its Internal Audit department. |

| • | For over five years prior to joining Great Western Bank, Ms. Warren was employed by KPMG, where she advised public companies, including a large public, global property and casualty insurer. Ms. Warren was involved in, among other things, performing and managing the review of filings with the Commission and the completion of comfort letter processes in connection with her work for this client. |

| • | Ms. Warren is a certified public accountant in the State of South Dakota with knowledge and experience applying and interpreting the requirements of U.S. GAAP, U.S. GAAS, PCAOB auditing standards, insurance statutory standards, SOX requirements and filings with the Commission. Ms. Warren has completed several hundred hours of continuing professional education, much of which was dedicated to topics and updates applicable to public companies and public filings with the Commission. |

Corey Weeg (Accounting Manager)

| • | Mr. Weeg has been with Great Western Bank for approximately four years, serving in various capacities in reporting and accounting roles and most recently overseeing regulatory reporting and general ledger reconciliation. Prior to joining Great Western Bank, Mr. Weeg was a senior accountant for a public bank and a public energy company in Sioux Falls, South Dakota. |