mdt-2023072800016131034/26falseQ12024D02 XH0200016131032023-04-292023-07-280001613103us-gaap:CommonStockMember2023-04-292023-07-280001613103mdt:SeniorNotes2019Due2025Member2023-04-292023-07-280001613103mdt:SeniorNotes2020Due2025Member2023-04-292023-07-280001613103mdt:SeniorNotes2022Due2025Member2023-04-292023-07-280001613103mdt:SeniorNotes2019Due20271125PercentMember2023-04-292023-07-280001613103mdt:SeniorNotes2020Due2028Member2023-04-292023-07-280001613103mdt:SeniorNotes2022Due2028Member2023-04-292023-07-280001613103mdt:SeniorNotes2019Due20311625PercentMember2023-04-292023-07-280001613103mdt:SeniorNotes2019Due20311.00PercentMember2023-04-292023-07-280001613103mdt:SeniorNotes2022Due2031Member2023-04-292023-07-280001613103mdt:SeniorNotes2020Due2032Member2023-04-292023-07-280001613103mdt:SeniorNotes2022Due2034Member2023-04-292023-07-280001613103mdt:SeniorNotes2019Due20394500PercentMember2023-04-292023-07-280001613103mdt:SeniorNotes2019Due20391.50PercentMember2023-04-292023-07-280001613103mdt:SeniorNotes2020Due2040Member2023-04-292023-07-280001613103mdt:SeniorNotes2019Due2049Member2023-04-292023-07-280001613103mdt:SeniorNotes2020Due2050Member2023-04-292023-07-2800016131032023-08-25xbrli:sharesiso4217:USD00016131032022-04-302022-07-29iso4217:USDxbrli:shares00016131032023-07-2800016131032023-04-280001613103us-gaap:CommonStockMember2023-04-280001613103us-gaap:AdditionalPaidInCapitalMember2023-04-280001613103us-gaap:RetainedEarningsMember2023-04-280001613103us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-04-280001613103us-gaap:ParentMember2023-04-280001613103us-gaap:NoncontrollingInterestMember2023-04-280001613103us-gaap:RetainedEarningsMember2023-04-292023-07-280001613103us-gaap:ParentMember2023-04-292023-07-280001613103us-gaap:NoncontrollingInterestMember2023-04-292023-07-280001613103us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-04-292023-07-280001613103us-gaap:CommonStockMember2023-04-292023-07-280001613103us-gaap:AdditionalPaidInCapitalMember2023-04-292023-07-280001613103us-gaap:CommonStockMember2023-07-280001613103us-gaap:AdditionalPaidInCapitalMember2023-07-280001613103us-gaap:RetainedEarningsMember2023-07-280001613103us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-07-280001613103us-gaap:ParentMember2023-07-280001613103us-gaap:NoncontrollingInterestMember2023-07-280001613103us-gaap:CommonStockMember2022-04-290001613103us-gaap:AdditionalPaidInCapitalMember2022-04-290001613103us-gaap:RetainedEarningsMember2022-04-290001613103us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-04-290001613103us-gaap:ParentMember2022-04-290001613103us-gaap:NoncontrollingInterestMember2022-04-2900016131032022-04-290001613103us-gaap:RetainedEarningsMember2022-04-302022-07-290001613103us-gaap:ParentMember2022-04-302022-07-290001613103us-gaap:NoncontrollingInterestMember2022-04-302022-07-290001613103us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-04-302022-07-290001613103us-gaap:CommonStockMember2022-04-302022-07-290001613103us-gaap:AdditionalPaidInCapitalMember2022-04-302022-07-290001613103us-gaap:CommonStockMember2022-07-290001613103us-gaap:AdditionalPaidInCapitalMember2022-07-290001613103us-gaap:RetainedEarningsMember2022-07-290001613103us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-07-290001613103us-gaap:ParentMember2022-07-290001613103us-gaap:NoncontrollingInterestMember2022-07-2900016131032022-07-290001613103mdt:CardiacRhythmandHeartFailureDivisionMembermdt:CardiovascularMember2023-04-292023-07-280001613103mdt:CardiacRhythmandHeartFailureDivisionMembermdt:CardiovascularMember2022-04-302022-07-290001613103mdt:StructuralHeartAndAorticDivisionMembermdt:CardiovascularMember2023-04-292023-07-280001613103mdt:StructuralHeartAndAorticDivisionMembermdt:CardiovascularMember2022-04-302022-07-290001613103mdt:CoronaryAndPeripheralVascularDivisionMembermdt:CardiovascularMember2023-04-292023-07-280001613103mdt:CoronaryAndPeripheralVascularDivisionMembermdt:CardiovascularMember2022-04-302022-07-290001613103mdt:CardiovascularMember2023-04-292023-07-280001613103mdt:CardiovascularMember2022-04-302022-07-290001613103mdt:NeuroscienceGroupMembermdt:CranialAndSpinalTechnologiesDivisionMember2023-04-292023-07-280001613103mdt:NeuroscienceGroupMembermdt:CranialAndSpinalTechnologiesDivisionMember2022-04-302022-07-290001613103mdt:NeuroscienceGroupMembermdt:SpecialtyTherapiesDivisionMember2023-04-292023-07-280001613103mdt:NeuroscienceGroupMembermdt:SpecialtyTherapiesDivisionMember2022-04-302022-07-290001613103mdt:NeuroscienceGroupMembermdt:NeuromodulationDivisionMember2023-04-292023-07-280001613103mdt:NeuroscienceGroupMembermdt:NeuromodulationDivisionMember2022-04-302022-07-290001613103mdt:NeuroscienceGroupMember2023-04-292023-07-280001613103mdt:NeuroscienceGroupMember2022-04-302022-07-290001613103mdt:SurgicalEndoscopyMembermdt:MedicalSurgicalMember2023-04-292023-07-280001613103mdt:SurgicalEndoscopyMembermdt:MedicalSurgicalMember2022-04-302022-07-290001613103mdt:PatientMonitoringAndRespiratoryInterventionsMembermdt:MedicalSurgicalMember2023-04-292023-07-280001613103mdt:PatientMonitoringAndRespiratoryInterventionsMembermdt:MedicalSurgicalMember2022-04-302022-07-290001613103mdt:MedicalSurgicalMember2023-04-292023-07-280001613103mdt:MedicalSurgicalMember2022-04-302022-07-290001613103mdt:DiabetesGroupMember2023-04-292023-07-280001613103mdt:DiabetesGroupMember2022-04-302022-07-290001613103mdt:OtherMember2023-04-292023-07-280001613103mdt:OtherMember2022-04-302022-07-290001613103country:USmdt:CardiovascularMember2023-04-292023-07-280001613103country:USmdt:CardiovascularMember2022-04-302022-07-290001613103mdt:JapanAustraliaNewZealandKoreaCanadaandWesternEuropeMembermdt:CardiovascularMember2023-04-292023-07-280001613103mdt:JapanAustraliaNewZealandKoreaCanadaandWesternEuropeMembermdt:CardiovascularMember2022-04-302022-07-290001613103mdt:CardiovascularMembermdt:MiddleEastAfricaLatinAmericaEasternEuropeandAsiaExcludingJapanandKoreaMember2023-04-292023-07-280001613103mdt:CardiovascularMembermdt:MiddleEastAfricaLatinAmericaEasternEuropeandAsiaExcludingJapanandKoreaMember2022-04-302022-07-290001613103mdt:NeuroscienceGroupMembercountry:US2023-04-292023-07-280001613103mdt:NeuroscienceGroupMembercountry:US2022-04-302022-07-290001613103mdt:NeuroscienceGroupMembermdt:JapanAustraliaNewZealandKoreaCanadaandWesternEuropeMember2023-04-292023-07-280001613103mdt:NeuroscienceGroupMembermdt:JapanAustraliaNewZealandKoreaCanadaandWesternEuropeMember2022-04-302022-07-290001613103mdt:NeuroscienceGroupMembermdt:MiddleEastAfricaLatinAmericaEasternEuropeandAsiaExcludingJapanandKoreaMember2023-04-292023-07-280001613103mdt:NeuroscienceGroupMembermdt:MiddleEastAfricaLatinAmericaEasternEuropeandAsiaExcludingJapanandKoreaMember2022-04-302022-07-290001613103country:USmdt:MedicalSurgicalMember2023-04-292023-07-280001613103country:USmdt:MedicalSurgicalMember2022-04-302022-07-290001613103mdt:JapanAustraliaNewZealandKoreaCanadaandWesternEuropeMembermdt:MedicalSurgicalMember2023-04-292023-07-280001613103mdt:JapanAustraliaNewZealandKoreaCanadaandWesternEuropeMembermdt:MedicalSurgicalMember2022-04-302022-07-290001613103mdt:MedicalSurgicalMembermdt:MiddleEastAfricaLatinAmericaEasternEuropeandAsiaExcludingJapanandKoreaMember2023-04-292023-07-280001613103mdt:MedicalSurgicalMembermdt:MiddleEastAfricaLatinAmericaEasternEuropeandAsiaExcludingJapanandKoreaMember2022-04-302022-07-290001613103country:USmdt:DiabetesGroupMember2023-04-292023-07-280001613103country:USmdt:DiabetesGroupMember2022-04-302022-07-290001613103mdt:DiabetesGroupMembermdt:JapanAustraliaNewZealandKoreaCanadaandWesternEuropeMember2023-04-292023-07-280001613103mdt:DiabetesGroupMembermdt:JapanAustraliaNewZealandKoreaCanadaandWesternEuropeMember2022-04-302022-07-290001613103mdt:DiabetesGroupMembermdt:MiddleEastAfricaLatinAmericaEasternEuropeandAsiaExcludingJapanandKoreaMember2023-04-292023-07-280001613103mdt:DiabetesGroupMembermdt:MiddleEastAfricaLatinAmericaEasternEuropeandAsiaExcludingJapanandKoreaMember2022-04-302022-07-290001613103country:USmdt:OtherMember2023-04-292023-07-280001613103country:USmdt:OtherMember2022-04-302022-07-290001613103mdt:JapanAustraliaNewZealandKoreaCanadaandWesternEuropeMembermdt:OtherMember2023-04-292023-07-280001613103mdt:JapanAustraliaNewZealandKoreaCanadaandWesternEuropeMembermdt:OtherMember2022-04-302022-07-290001613103mdt:OtherMembermdt:MiddleEastAfricaLatinAmericaEasternEuropeandAsiaExcludingJapanandKoreaMember2023-04-292023-07-280001613103mdt:OtherMembermdt:MiddleEastAfricaLatinAmericaEasternEuropeandAsiaExcludingJapanandKoreaMember2022-04-302022-07-290001613103country:US2023-04-292023-07-280001613103country:US2022-04-302022-07-290001613103mdt:JapanAustraliaNewZealandKoreaCanadaandWesternEuropeMember2023-04-292023-07-280001613103mdt:JapanAustraliaNewZealandKoreaCanadaandWesternEuropeMember2022-04-302022-07-290001613103mdt:MiddleEastAfricaLatinAmericaEasternEuropeandAsiaExcludingJapanandKoreaMember2023-04-292023-07-280001613103mdt:MiddleEastAfricaLatinAmericaEasternEuropeandAsiaExcludingJapanandKoreaMember2022-04-302022-07-290001613103mdt:OtherAccruedExpensesMember2023-07-280001613103us-gaap:AccountsReceivableMember2023-07-280001613103mdt:OtherAccruedExpensesMember2023-04-280001613103us-gaap:AccountsReceivableMember2023-04-280001613103us-gaap:OtherLiabilitiesMember2023-07-280001613103us-gaap:OtherLiabilitiesMember2023-04-280001613103mdt:IntersectENTMember2022-05-132022-05-130001613103mdt:IntersectENTMember2022-05-130001613103mdt:IntersectENTMemberus-gaap:TechnologyBasedIntangibleAssetsMember2022-05-130001613103mdt:IntersectENTMemberus-gaap:CustomerRelatedIntangibleAssetsMember2022-05-130001613103mdt:IntersectENTMemberus-gaap:TradeNamesMember2022-05-130001613103mdt:OtherAcquisitionsMember2022-07-290001613103us-gaap:TechnologyBasedIntangibleAssetsMembermdt:OtherAcquisitionsMember2022-07-290001613103mdt:OtherAcquisitionsMember2022-04-302022-07-290001613103us-gaap:FairValueMeasurementsRecurringMembermdt:RevenueMilestoneMemberus-gaap:FairValueInputsLevel3Member2023-07-280001613103us-gaap:FairValueMeasurementsRecurringMemberus-gaap:MeasurementInputDiscountRateMembersrt:MinimumMembermdt:RevenueMilestoneMemberus-gaap:FairValueInputsLevel3Member2023-07-28xbrli:pure0001613103us-gaap:FairValueMeasurementsRecurringMemberus-gaap:MeasurementInputDiscountRateMembermdt:RevenueMilestoneMemberus-gaap:FairValueInputsLevel3Membersrt:MaximumMember2023-07-280001613103srt:WeightedAverageMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:MeasurementInputDiscountRateMembermdt:RevenueMilestoneMemberus-gaap:FairValueInputsLevel3Member2023-07-280001613103us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Membermdt:ProductDevelopmentMilestoneMember2023-07-280001613103us-gaap:FairValueMeasurementsRecurringMemberus-gaap:MeasurementInputDiscountRateMembersrt:MinimumMemberus-gaap:FairValueInputsLevel3Membermdt:ProductDevelopmentMilestoneMember2023-07-280001613103us-gaap:FairValueMeasurementsRecurringMemberus-gaap:MeasurementInputDiscountRateMemberus-gaap:FairValueInputsLevel3Membermdt:ProductDevelopmentMilestoneMembersrt:MaximumMember2023-07-280001613103srt:WeightedAverageMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:MeasurementInputDiscountRateMemberus-gaap:FairValueInputsLevel3Membermdt:ProductDevelopmentMilestoneMember2023-07-280001613103us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Member2023-04-280001613103us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Member2023-04-292023-07-280001613103us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Member2023-07-280001613103mdt:MozarcMembermdt:RenalCareSolutionsMemberus-gaap:DisposalGroupNotDiscontinuedOperationsMember2023-04-012023-04-010001613103mdt:MozarcMembermdt:RenalCareSolutionsMemberus-gaap:DisposalGroupNotDiscontinuedOperationsMember2023-04-010001613103mdt:MozarcMember2023-04-010001613103mdt:MozarcMember2023-04-010001613103mdt:MozarcMembermdt:RenalCareSolutionsMembersrt:MaximumMember2023-04-010001613103us-gaap:OtherOperatingIncomeExpenseMembermdt:RenalCareSolutionsMember2022-04-302022-07-290001613103mdt:MozarcMember2023-07-280001613103us-gaap:EmployeeSeveranceMember2023-04-292023-07-280001613103mdt:EnterpriseExcellenceMember2023-07-280001613103mdt:SimplificationRestructuringProgramMember2023-07-280001613103us-gaap:CostOfSalesMember2023-04-292023-07-280001613103us-gaap:CostOfSalesMember2022-04-302022-07-290001613103us-gaap:SellingGeneralAndAdministrativeExpensesMember2023-04-292023-07-280001613103us-gaap:SellingGeneralAndAdministrativeExpensesMember2022-04-302022-07-290001613103us-gaap:RestructuringChargesMember2023-04-292023-07-280001613103us-gaap:RestructuringChargesMember2022-04-302022-07-290001613103mdt:EnterpriseExcellenceAndSimplificationMemberus-gaap:EmployeeSeveranceMember2023-04-280001613103mdt:EnterpriseExcellenceAndSimplificationMembermdt:AssociatedCostsMember2023-04-280001613103mdt:EnterpriseExcellenceAndSimplificationMemberus-gaap:OtherRestructuringMember2023-04-280001613103mdt:EnterpriseExcellenceAndSimplificationMember2023-04-280001613103mdt:EnterpriseExcellenceAndSimplificationMemberus-gaap:EmployeeSeveranceMember2023-04-292023-07-280001613103mdt:EnterpriseExcellenceAndSimplificationMembermdt:AssociatedCostsMember2023-04-292023-07-280001613103mdt:EnterpriseExcellenceAndSimplificationMemberus-gaap:OtherRestructuringMember2023-04-292023-07-280001613103mdt:EnterpriseExcellenceAndSimplificationMember2023-04-292023-07-280001613103mdt:EnterpriseExcellenceAndSimplificationMemberus-gaap:EmployeeSeveranceMember2023-07-280001613103mdt:EnterpriseExcellenceAndSimplificationMembermdt:AssociatedCostsMember2023-07-280001613103mdt:EnterpriseExcellenceAndSimplificationMemberus-gaap:OtherRestructuringMember2023-07-280001613103mdt:EnterpriseExcellenceAndSimplificationMember2023-07-280001613103us-gaap:USGovernmentAgenciesDebtSecuritiesMemberus-gaap:FairValueInputsLevel1Member2023-07-280001613103us-gaap:InvestmentsMemberus-gaap:USGovernmentAgenciesDebtSecuritiesMemberus-gaap:FairValueInputsLevel1Member2023-07-280001613103us-gaap:USGovernmentAgenciesDebtSecuritiesMemberus-gaap:FairValueInputsLevel1Memberus-gaap:OtherAssetsMember2023-07-280001613103us-gaap:FairValueInputsLevel2Memberus-gaap:CorporateDebtSecuritiesMember2023-07-280001613103us-gaap:InvestmentsMemberus-gaap:FairValueInputsLevel2Memberus-gaap:CorporateDebtSecuritiesMember2023-07-280001613103us-gaap:FairValueInputsLevel2Memberus-gaap:OtherAssetsMemberus-gaap:CorporateDebtSecuritiesMember2023-07-280001613103us-gaap:FairValueInputsLevel2Memberus-gaap:USGovernmentAgenciesDebtSecuritiesMember2023-07-280001613103us-gaap:InvestmentsMemberus-gaap:FairValueInputsLevel2Memberus-gaap:USGovernmentAgenciesDebtSecuritiesMember2023-07-280001613103us-gaap:FairValueInputsLevel2Memberus-gaap:USGovernmentAgenciesDebtSecuritiesMemberus-gaap:OtherAssetsMember2023-07-280001613103us-gaap:FairValueInputsLevel2Memberus-gaap:MortgageBackedSecuritiesMember2023-07-280001613103us-gaap:InvestmentsMemberus-gaap:FairValueInputsLevel2Memberus-gaap:MortgageBackedSecuritiesMember2023-07-280001613103us-gaap:FairValueInputsLevel2Memberus-gaap:OtherAssetsMemberus-gaap:MortgageBackedSecuritiesMember2023-07-280001613103us-gaap:FairValueInputsLevel2Memberus-gaap:ForeignGovernmentDebtSecuritiesMember2023-07-280001613103us-gaap:InvestmentsMemberus-gaap:FairValueInputsLevel2Memberus-gaap:ForeignGovernmentDebtSecuritiesMember2023-07-280001613103us-gaap:FairValueInputsLevel2Memberus-gaap:OtherAssetsMemberus-gaap:ForeignGovernmentDebtSecuritiesMember2023-07-280001613103us-gaap:FairValueInputsLevel2Memberus-gaap:AssetBackedSecuritiesMember2023-07-280001613103us-gaap:InvestmentsMemberus-gaap:FairValueInputsLevel2Memberus-gaap:AssetBackedSecuritiesMember2023-07-280001613103us-gaap:FairValueInputsLevel2Memberus-gaap:AssetBackedSecuritiesMemberus-gaap:OtherAssetsMember2023-07-280001613103us-gaap:FairValueInputsLevel2Member2023-07-280001613103us-gaap:InvestmentsMemberus-gaap:FairValueInputsLevel2Member2023-07-280001613103us-gaap:FairValueInputsLevel2Memberus-gaap:OtherAssetsMember2023-07-280001613103us-gaap:FairValueInputsLevel3Memberus-gaap:AuctionRateSecuritiesMember2023-07-280001613103us-gaap:InvestmentsMemberus-gaap:FairValueInputsLevel3Memberus-gaap:AuctionRateSecuritiesMember2023-07-280001613103us-gaap:FairValueInputsLevel3Memberus-gaap:OtherAssetsMemberus-gaap:AuctionRateSecuritiesMember2023-07-280001613103us-gaap:InvestmentsMember2023-07-280001613103us-gaap:OtherAssetsMember2023-07-280001613103us-gaap:USGovernmentAgenciesDebtSecuritiesMemberus-gaap:FairValueInputsLevel1Member2023-04-280001613103us-gaap:InvestmentsMemberus-gaap:USGovernmentAgenciesDebtSecuritiesMemberus-gaap:FairValueInputsLevel1Member2023-04-280001613103us-gaap:USGovernmentAgenciesDebtSecuritiesMemberus-gaap:FairValueInputsLevel1Memberus-gaap:OtherAssetsMember2023-04-280001613103us-gaap:FairValueInputsLevel2Memberus-gaap:CorporateDebtSecuritiesMember2023-04-280001613103us-gaap:InvestmentsMemberus-gaap:FairValueInputsLevel2Memberus-gaap:CorporateDebtSecuritiesMember2023-04-280001613103us-gaap:FairValueInputsLevel2Memberus-gaap:OtherAssetsMemberus-gaap:CorporateDebtSecuritiesMember2023-04-280001613103us-gaap:FairValueInputsLevel2Memberus-gaap:USGovernmentAgenciesDebtSecuritiesMember2023-04-280001613103us-gaap:InvestmentsMemberus-gaap:FairValueInputsLevel2Memberus-gaap:USGovernmentAgenciesDebtSecuritiesMember2023-04-280001613103us-gaap:FairValueInputsLevel2Memberus-gaap:USGovernmentAgenciesDebtSecuritiesMemberus-gaap:OtherAssetsMember2023-04-280001613103us-gaap:FairValueInputsLevel2Memberus-gaap:MortgageBackedSecuritiesMember2023-04-280001613103us-gaap:InvestmentsMemberus-gaap:FairValueInputsLevel2Memberus-gaap:MortgageBackedSecuritiesMember2023-04-280001613103us-gaap:FairValueInputsLevel2Memberus-gaap:OtherAssetsMemberus-gaap:MortgageBackedSecuritiesMember2023-04-280001613103us-gaap:FairValueInputsLevel2Memberus-gaap:ForeignGovernmentDebtSecuritiesMember2023-04-280001613103us-gaap:InvestmentsMemberus-gaap:FairValueInputsLevel2Memberus-gaap:ForeignGovernmentDebtSecuritiesMember2023-04-280001613103us-gaap:FairValueInputsLevel2Memberus-gaap:OtherAssetsMemberus-gaap:ForeignGovernmentDebtSecuritiesMember2023-04-280001613103us-gaap:FairValueInputsLevel2Memberus-gaap:CertificatesOfDepositMember2023-04-280001613103us-gaap:InvestmentsMemberus-gaap:FairValueInputsLevel2Memberus-gaap:CertificatesOfDepositMember2023-04-280001613103us-gaap:FairValueInputsLevel2Memberus-gaap:CertificatesOfDepositMemberus-gaap:OtherAssetsMember2023-04-280001613103us-gaap:FairValueInputsLevel2Memberus-gaap:AssetBackedSecuritiesMember2023-04-280001613103us-gaap:InvestmentsMemberus-gaap:FairValueInputsLevel2Memberus-gaap:AssetBackedSecuritiesMember2023-04-280001613103us-gaap:FairValueInputsLevel2Memberus-gaap:AssetBackedSecuritiesMemberus-gaap:OtherAssetsMember2023-04-280001613103us-gaap:FairValueInputsLevel2Member2023-04-280001613103us-gaap:InvestmentsMemberus-gaap:FairValueInputsLevel2Member2023-04-280001613103us-gaap:FairValueInputsLevel2Memberus-gaap:OtherAssetsMember2023-04-280001613103us-gaap:FairValueInputsLevel3Memberus-gaap:AuctionRateSecuritiesMember2023-04-280001613103us-gaap:InvestmentsMemberus-gaap:FairValueInputsLevel3Memberus-gaap:AuctionRateSecuritiesMember2023-04-280001613103us-gaap:FairValueInputsLevel3Memberus-gaap:OtherAssetsMemberus-gaap:AuctionRateSecuritiesMember2023-04-280001613103us-gaap:InvestmentsMember2023-04-280001613103us-gaap:OtherAssetsMember2023-04-280001613103us-gaap:CorporateDebtSecuritiesMember2023-07-280001613103us-gaap:USGovernmentAgenciesDebtSecuritiesMember2023-07-280001613103us-gaap:MortgageBackedSecuritiesMember2023-07-280001613103us-gaap:AssetBackedSecuritiesMember2023-07-280001613103us-gaap:AuctionRateSecuritiesMember2023-07-280001613103us-gaap:CorporateDebtSecuritiesMember2023-04-280001613103us-gaap:USGovernmentAgenciesDebtSecuritiesMember2023-04-280001613103us-gaap:MortgageBackedSecuritiesMember2023-04-280001613103us-gaap:AssetBackedSecuritiesMember2023-04-280001613103us-gaap:AuctionRateSecuritiesMember2023-04-280001613103mdt:EquityInvestmentsMember2023-04-292023-07-280001613103mdt:EquityInvestmentsMember2022-04-302022-07-290001613103us-gaap:CommercialPaperMembermdt:A2015CommercialPaperProgramMember2023-07-280001613103us-gaap:CommercialPaperMember2023-07-280001613103us-gaap:CommercialPaperMember2023-04-292023-07-280001613103us-gaap:CommercialPaperMember2023-04-280001613103us-gaap:LineOfCreditMembermdt:AmendedandRestatedRevolvingCreditAgreementMember2023-07-280001613103us-gaap:LineOfCreditMembermdt:AmendedandRestatedRevolvingCreditAgreementMember2023-04-292023-07-280001613103us-gaap:LineOfCreditMembermdt:AmendedandRestatedRevolvingCreditAgreementMember2023-04-280001613103mdt:SeniorNotes2019Due20260250PercentMember2023-07-280001613103mdt:SeniorNotes2019Due20260250PercentMember2023-04-292023-07-280001613103us-gaap:SeniorNotesMembermdt:SeniorNotes2019Due20260250PercentMember2023-07-280001613103us-gaap:SeniorNotesMembermdt:SeniorNotes2019Due20260250PercentMember2023-04-280001613103mdt:A2265PercentThreeYear2022SeniorNotesMember2023-07-280001613103mdt:A2265PercentThreeYear2022SeniorNotesMember2023-04-292023-07-280001613103mdt:A2265PercentThreeYear2022SeniorNotesMemberus-gaap:SeniorNotesMember2023-07-280001613103mdt:A2265PercentThreeYear2022SeniorNotesMemberus-gaap:SeniorNotesMember2023-04-280001613103mdt:SeniorNotes2020Due20260000PercentMember2023-07-280001613103mdt:SeniorNotes2020Due20260000PercentMember2023-04-292023-07-280001613103mdt:SeniorNotes2020Due20260000PercentMemberus-gaap:SeniorNotesMember2023-07-280001613103mdt:SeniorNotes2020Due20260000PercentMemberus-gaap:SeniorNotesMember2023-04-280001613103mdt:SeniorNotes2019Due20271125PercentMember2023-07-280001613103mdt:SeniorNotes2019Due20271125PercentMember2023-04-292023-07-280001613103mdt:SeniorNotes2019Due20271125PercentMemberus-gaap:SeniorNotesMember2023-07-280001613103mdt:SeniorNotes2019Due20271125PercentMemberus-gaap:SeniorNotesMember2023-04-280001613103mdt:A4250PercentFiveYear2023SeniorNotesMember2023-07-280001613103mdt:A4250PercentFiveYear2023SeniorNotesMember2023-04-292023-07-280001613103mdt:A4250PercentFiveYear2023SeniorNotesMemberus-gaap:SeniorNotesMember2023-07-280001613103mdt:A4250PercentFiveYear2023SeniorNotesMemberus-gaap:SeniorNotesMember2023-04-280001613103mdt:A3000PercentSixYear2022SeniorNotesMember2023-07-280001613103mdt:A3000PercentSixYear2022SeniorNotesMember2023-04-292023-07-280001613103us-gaap:SeniorNotesMembermdt:A3000PercentSixYear2022SeniorNotesMember2023-07-280001613103us-gaap:SeniorNotesMembermdt:A3000PercentSixYear2022SeniorNotesMember2023-04-280001613103mdt:SeniorNotes2020Due20290375PercentMember2023-07-280001613103mdt:SeniorNotes2020Due20290375PercentMember2023-04-292023-07-280001613103us-gaap:SeniorNotesMembermdt:SeniorNotes2020Due20290375PercentMember2023-07-280001613103us-gaap:SeniorNotesMembermdt:SeniorNotes2020Due20290375PercentMember2023-04-280001613103mdt:SeniorNotes2019Due20311625PercentMember2023-07-280001613103mdt:SeniorNotes2019Due20311625PercentMember2023-04-292023-07-280001613103us-gaap:SeniorNotesMembermdt:SeniorNotes2019Due20311625PercentMember2023-07-280001613103us-gaap:SeniorNotesMembermdt:SeniorNotes2019Due20311625PercentMember2023-04-280001613103mdt:SeniorNotes2019Due20321000PercentMember2023-07-280001613103mdt:SeniorNotes2019Due20321000PercentMember2023-04-292023-07-280001613103mdt:SeniorNotes2019Due20321000PercentMemberus-gaap:SeniorNotesMember2023-07-280001613103mdt:SeniorNotes2019Due20321000PercentMemberus-gaap:SeniorNotesMember2023-04-280001613103mdt:A3125PercentNineYear2022SeniorNotesMember2023-07-280001613103mdt:A3125PercentNineYear2022SeniorNotesMember2023-04-292023-07-280001613103us-gaap:SeniorNotesMembermdt:A3125PercentNineYear2022SeniorNotesMember2023-07-280001613103us-gaap:SeniorNotesMembermdt:A3125PercentNineYear2022SeniorNotesMember2023-04-280001613103mdt:SeniorNotes2020Due20330750PercentMember2023-07-280001613103mdt:SeniorNotes2020Due20330750PercentMember2023-04-292023-07-280001613103us-gaap:SeniorNotesMembermdt:SeniorNotes2020Due20330750PercentMember2023-07-280001613103us-gaap:SeniorNotesMembermdt:SeniorNotes2020Due20330750PercentMember2023-04-280001613103mdt:A4500PercentTenYear2023SeniorNotesMember2023-07-280001613103mdt:A4500PercentTenYear2023SeniorNotesMember2023-04-292023-07-280001613103mdt:A4500PercentTenYear2023SeniorNotesMemberus-gaap:SeniorNotesMember2023-07-280001613103mdt:A4500PercentTenYear2023SeniorNotesMemberus-gaap:SeniorNotesMember2023-04-280001613103mdt:A3375PercentTwelveYear2022SeniorNotesMember2023-07-280001613103mdt:A3375PercentTwelveYear2022SeniorNotesMember2023-04-292023-07-280001613103mdt:A3375PercentTwelveYear2022SeniorNotesMemberus-gaap:SeniorNotesMember2023-07-280001613103mdt:A3375PercentTwelveYear2022SeniorNotesMemberus-gaap:SeniorNotesMember2023-04-280001613103mdt:SeniorNotes2020Due20354375PercentMember2023-07-280001613103mdt:SeniorNotes2020Due20354375PercentMember2023-04-292023-07-280001613103us-gaap:SeniorNotesMembermdt:SeniorNotes2020Due20354375PercentMember2023-07-280001613103us-gaap:SeniorNotesMembermdt:SeniorNotes2020Due20354375PercentMember2023-04-280001613103mdt:A2007CIFSASeniorNotesDue20386550PercentMember2023-07-280001613103mdt:A2007CIFSASeniorNotesDue20386550PercentMember2023-04-292023-07-280001613103us-gaap:SeniorNotesMembermdt:A2007CIFSASeniorNotesDue20386550PercentMember2023-07-280001613103us-gaap:SeniorNotesMembermdt:A2007CIFSASeniorNotesDue20386550PercentMember2023-04-280001613103mdt:SeniorNotes2019Due20392250PercentMember2023-07-280001613103mdt:SeniorNotes2019Due20392250PercentMember2023-04-292023-07-280001613103us-gaap:SeniorNotesMembermdt:SeniorNotes2019Due20392250PercentMember2023-07-280001613103us-gaap:SeniorNotesMembermdt:SeniorNotes2019Due20392250PercentMember2023-04-280001613103mdt:SeniorNotes2009Due20396500PercentMember2023-07-280001613103mdt:SeniorNotes2009Due20396500PercentMember2023-04-292023-07-280001613103mdt:SeniorNotes2009Due20396500PercentMemberus-gaap:SeniorNotesMember2023-07-280001613103mdt:SeniorNotes2009Due20396500PercentMemberus-gaap:SeniorNotesMember2023-04-280001613103mdt:SeniorNotes2019Due20401500PercentMember2023-07-280001613103mdt:SeniorNotes2019Due20401500PercentMember2023-04-292023-07-280001613103us-gaap:SeniorNotesMembermdt:SeniorNotes2019Due20401500PercentMember2023-07-280001613103us-gaap:SeniorNotesMembermdt:SeniorNotes2019Due20401500PercentMember2023-04-280001613103mdt:SeniorNotes2010Due20405550PercentMember2023-07-280001613103mdt:SeniorNotes2010Due20405550PercentMember2023-04-292023-07-280001613103us-gaap:SeniorNotesMembermdt:SeniorNotes2010Due20405550PercentMember2023-07-280001613103us-gaap:SeniorNotesMembermdt:SeniorNotes2010Due20405550PercentMember2023-04-280001613103mdt:SeniorNotes2020Due20411375PercentMember2023-07-280001613103mdt:SeniorNotes2020Due20411375PercentMember2023-04-292023-07-280001613103mdt:SeniorNotes2020Due20411375PercentMemberus-gaap:SeniorNotesMember2023-07-280001613103mdt:SeniorNotes2020Due20411375PercentMemberus-gaap:SeniorNotesMember2023-04-280001613103mdt:SeniorNotes2012Due20424500PercentMember2023-07-280001613103mdt:SeniorNotes2012Due20424500PercentMember2023-04-292023-07-280001613103us-gaap:SeniorNotesMembermdt:SeniorNotes2012Due20424500PercentMember2023-07-280001613103us-gaap:SeniorNotesMembermdt:SeniorNotes2012Due20424500PercentMember2023-04-280001613103mdt:SeniorNotes2013Due20434000PercentMember2023-07-280001613103mdt:SeniorNotes2013Due20434000PercentMember2023-04-292023-07-280001613103us-gaap:SeniorNotesMembermdt:SeniorNotes2013Due20434000PercentMember2023-07-280001613103us-gaap:SeniorNotesMembermdt:SeniorNotes2013Due20434000PercentMember2023-04-280001613103mdt:SeniorNotes2014Due20444625PercentMember2023-07-280001613103mdt:SeniorNotes2014Due20444625PercentMember2023-04-292023-07-280001613103mdt:SeniorNotes2014Due20444625PercentMemberus-gaap:SeniorNotesMember2023-07-280001613103mdt:SeniorNotes2014Due20444625PercentMemberus-gaap:SeniorNotesMember2023-04-280001613103mdt:SeniorNotes2015Due20454625PercentMember2023-07-280001613103mdt:SeniorNotes2015Due20454625PercentMember2023-04-292023-07-280001613103us-gaap:SeniorNotesMembermdt:SeniorNotes2015Due20454625PercentMember2023-07-280001613103us-gaap:SeniorNotesMembermdt:SeniorNotes2015Due20454625PercentMember2023-04-280001613103mdt:SeniorNotes2019Due20501750PercentMember2023-07-280001613103mdt:SeniorNotes2019Due20501750PercentMember2023-04-292023-07-280001613103us-gaap:SeniorNotesMembermdt:SeniorNotes2019Due20501750PercentMember2023-07-280001613103us-gaap:SeniorNotesMembermdt:SeniorNotes2019Due20501750PercentMember2023-04-280001613103mdt:SeniorNotes2020Due20511625PercentMember2023-07-280001613103mdt:SeniorNotes2020Due20511625PercentMember2023-04-292023-07-280001613103mdt:SeniorNotes2020Due20511625PercentMemberus-gaap:SeniorNotesMember2023-07-280001613103mdt:SeniorNotes2020Due20511625PercentMemberus-gaap:SeniorNotesMember2023-04-280001613103mdt:MedtronicLuxcoMemberus-gaap:SeniorNotesMembermdt:MedtronicLuxcoSeniorNotesMember2022-09-30mdt:tranche0001613103us-gaap:SeniorNotesMembermdt:MedtronicLuxcoSeniorNotesMember2022-09-30iso4217:EUR0001613103us-gaap:SeniorNotesMembermdt:MedtronicLuxcoSeniorNotesMember2022-09-012022-09-300001613103us-gaap:SeniorNotesMembermdt:MedtronicLuxcoSeniorNotesMember2022-12-012022-12-310001613103us-gaap:SeniorNotesMembermdt:MedtronicLuxcoSeniorNotesMember2023-03-310001613103us-gaap:SeniorNotesMembermdt:MedtronicLuxcoSeniorNotesMember2023-03-012023-03-310001613103mdt:MedtronicLuxcoMemberus-gaap:SeniorNotesMembermdt:MedtronicLuxcoSeniorNotesMember2023-03-31iso4217:JPY0001613103mdt:MedtronicLuxcoMemberus-gaap:SeniorNotesMembermdt:MedtronicLuxcoSeniorNotesMember2023-03-312023-03-310001613103mdt:MedtronicLuxcoMemberus-gaap:LoansPayableMember2022-05-310001613103mdt:MedtronicLuxcoMemberus-gaap:LoansPayableMember2022-05-012022-05-310001613103mdt:MedtronicLuxcoMemberus-gaap:LoansPayableMembermdt:TokyoInterBankOfferedRateTIBORMember2022-05-012022-05-310001613103mdt:SeniorNotes2015Due20253500PercentMemberus-gaap:SeniorNotesMember2022-05-310001613103mdt:SeniorNotes2015Due20253500PercentMember2022-05-310001613103mdt:SeniorNotes2015Due20253500PercentMemberus-gaap:SeniorNotesMember2022-05-012022-05-310001613103mdt:SeniorNotes2017Due20273350PercentMemberus-gaap:SeniorNotesMember2022-05-310001613103mdt:SeniorNotes2017Due20273350PercentMember2022-05-310001613103mdt:SeniorNotes2017Due20273350PercentMemberus-gaap:SeniorNotesMember2022-05-012022-05-310001613103mdt:MedtronicLuxcoMemberus-gaap:LoansPayableMember2022-04-302022-07-290001613103us-gaap:SeniorNotesMember2023-07-280001613103us-gaap:SeniorNotesMember2023-04-280001613103us-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:CashFlowHedgingMemberus-gaap:ForeignExchangeContractMember2023-04-292023-07-280001613103us-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:CashFlowHedgingMemberus-gaap:ForeignExchangeContractMember2023-07-280001613103us-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:CashFlowHedgingMemberus-gaap:ForeignExchangeContractMember2023-04-280001613103us-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:NetInvestmentHedgingMemberus-gaap:ForeignExchangeContractMember2023-07-280001613103us-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:NetInvestmentHedgingMemberus-gaap:ForeignExchangeContractMember2023-04-280001613103us-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:NetInvestmentHedgingMembermdt:ForeignCurrencyDenominatedDebtMember2023-07-280001613103us-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:NetInvestmentHedgingMembermdt:ForeignCurrencyDenominatedDebtMember2023-04-280001613103us-gaap:NondesignatedMemberus-gaap:ForeignExchangeContractMember2023-07-280001613103us-gaap:NondesignatedMemberus-gaap:ForeignExchangeContractMember2023-04-280001613103us-gaap:DesignatedAsHedgingInstrumentMembersrt:EuropeMemberus-gaap:ForeignExchangeContractMember2023-07-280001613103country:JPus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:ForeignExchangeContractMember2023-07-280001613103us-gaap:OtherOperatingIncomeExpenseMemberus-gaap:ForeignExchangeContractMember2023-04-292023-07-280001613103us-gaap:OtherOperatingIncomeExpenseMemberus-gaap:ForeignExchangeContractMember2022-04-302022-07-290001613103us-gaap:CostOfSalesMemberus-gaap:ForeignExchangeContractMember2023-04-292023-07-280001613103us-gaap:CostOfSalesMemberus-gaap:ForeignExchangeContractMember2022-04-302022-07-290001613103mdt:ForeignCurrencyDenominatedDebtMember2023-04-292023-07-280001613103mdt:ForeignCurrencyDenominatedDebtMember2022-04-302022-07-290001613103us-gaap:ForeignExchangeContractMember2023-04-292023-07-280001613103us-gaap:ForeignExchangeContractMember2022-04-302022-07-290001613103us-gaap:OtherOperatingIncomeExpenseMemberus-gaap:TotalReturnSwapMember2023-04-292023-07-280001613103us-gaap:OtherOperatingIncomeExpenseMemberus-gaap:TotalReturnSwapMember2022-04-302022-07-290001613103us-gaap:PrepaidExpensesAndOtherCurrentAssetsMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:ForeignExchangeContractMember2023-07-280001613103us-gaap:PrepaidExpensesAndOtherCurrentAssetsMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:ForeignExchangeContractMember2023-04-280001613103mdt:OtherAccruedExpensesMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:ForeignExchangeContractMember2023-07-280001613103mdt:OtherAccruedExpensesMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:ForeignExchangeContractMember2023-04-280001613103us-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:OtherAssetsMemberus-gaap:ForeignExchangeContractMember2023-07-280001613103us-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:OtherAssetsMemberus-gaap:ForeignExchangeContractMember2023-04-280001613103us-gaap:OtherLiabilitiesMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:ForeignExchangeContractMember2023-07-280001613103us-gaap:OtherLiabilitiesMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:ForeignExchangeContractMember2023-04-280001613103us-gaap:DesignatedAsHedgingInstrumentMember2023-07-280001613103us-gaap:DesignatedAsHedgingInstrumentMember2023-04-280001613103us-gaap:PrepaidExpensesAndOtherCurrentAssetsMemberus-gaap:NondesignatedMemberus-gaap:ForeignExchangeContractMember2023-07-280001613103us-gaap:PrepaidExpensesAndOtherCurrentAssetsMemberus-gaap:NondesignatedMemberus-gaap:ForeignExchangeContractMember2023-04-280001613103mdt:OtherAccruedExpensesMemberus-gaap:NondesignatedMemberus-gaap:ForeignExchangeContractMember2023-07-280001613103mdt:OtherAccruedExpensesMemberus-gaap:NondesignatedMemberus-gaap:ForeignExchangeContractMember2023-04-280001613103us-gaap:PrepaidExpensesAndOtherCurrentAssetsMemberus-gaap:NondesignatedMemberus-gaap:TotalReturnSwapMember2023-07-280001613103us-gaap:PrepaidExpensesAndOtherCurrentAssetsMemberus-gaap:NondesignatedMemberus-gaap:TotalReturnSwapMember2023-04-280001613103mdt:OtherAccruedExpensesMemberus-gaap:NondesignatedMemberus-gaap:TotalReturnSwapMember2023-07-280001613103mdt:OtherAccruedExpensesMemberus-gaap:NondesignatedMemberus-gaap:TotalReturnSwapMember2023-04-280001613103us-gaap:NondesignatedMember2023-07-280001613103us-gaap:NondesignatedMember2023-04-280001613103us-gaap:FairValueInputsLevel1Member2023-07-280001613103us-gaap:FairValueInputsLevel1Member2023-04-280001613103us-gaap:ForeignExchangeContractMember2023-07-280001613103us-gaap:TotalReturnSwapMember2023-07-280001613103us-gaap:ForeignExchangeContractMember2023-04-280001613103mdt:CardiovascularMember2023-04-280001613103mdt:MedicalSurgicalMember2023-04-280001613103mdt:NeuroscienceGroupMember2023-04-280001613103mdt:DiabetesGroupMember2023-04-280001613103mdt:CardiovascularMember2023-07-280001613103mdt:MedicalSurgicalMember2023-07-280001613103mdt:NeuroscienceGroupMember2023-07-280001613103mdt:DiabetesGroupMember2023-07-280001613103mdt:PatientMonitoringAndRespiratoryInterventionsMembermdt:MedicalSurgicalMember2023-07-280001613103mdt:MedicalSurgicalMembermdt:RenalCareBusinessRCSMember2022-07-290001613103mdt:MedicalSurgicalMembermdt:RenalCareBusinessRCSMember2022-04-302022-07-290001613103us-gaap:CustomerRelatedIntangibleAssetsMember2023-07-280001613103us-gaap:CustomerRelatedIntangibleAssetsMember2023-04-280001613103mdt:PurchasedTechnologyAndPatentsMember2023-07-280001613103mdt:PurchasedTechnologyAndPatentsMember2023-04-280001613103us-gaap:TrademarksAndTradeNamesMember2023-07-280001613103us-gaap:TrademarksAndTradeNamesMember2023-04-280001613103us-gaap:OtherIntangibleAssetsMember2023-07-280001613103us-gaap:OtherIntangibleAssetsMember2023-04-280001613103us-gaap:InProcessResearchAndDevelopmentMember2023-07-280001613103us-gaap:InProcessResearchAndDevelopmentMember2023-04-280001613103us-gaap:ForeignCountryMember2023-04-292023-07-280001613103us-gaap:EmployeeStockOptionMember2023-04-292023-07-280001613103us-gaap:EmployeeStockOptionMember2022-04-302022-07-290001613103us-gaap:RestrictedStockUnitsRSUMember2023-04-292023-07-280001613103us-gaap:RestrictedStockUnitsRSUMember2022-04-302022-07-290001613103us-gaap:PerformanceSharesMember2023-04-292023-07-280001613103us-gaap:PerformanceSharesMember2022-04-302022-07-290001613103us-gaap:EmployeeStockOptionMember2023-04-292023-07-280001613103us-gaap:EmployeeStockOptionMember2022-04-302022-07-290001613103mdt:EmployeesStockPurchasePlanMember2023-04-292023-07-280001613103mdt:EmployeesStockPurchasePlanMember2022-04-302022-07-290001613103us-gaap:ResearchAndDevelopmentExpenseMember2023-04-292023-07-280001613103us-gaap:ResearchAndDevelopmentExpenseMember2022-04-302022-07-290001613103us-gaap:PensionPlansDefinedBenefitMembercountry:US2023-04-292023-07-280001613103us-gaap:PensionPlansDefinedBenefitMembercountry:US2022-04-302022-07-290001613103us-gaap:ForeignPlanMemberus-gaap:PensionPlansDefinedBenefitMember2023-04-292023-07-280001613103us-gaap:ForeignPlanMemberus-gaap:PensionPlansDefinedBenefitMember2022-04-302022-07-290001613103us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2023-04-280001613103us-gaap:AccumulatedTranslationAdjustmentMember2023-04-280001613103us-gaap:AociDerivativeQualifyingAsHedgeExcludedComponentParentMember2023-04-280001613103us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2023-04-280001613103us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2023-04-280001613103us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2023-04-292023-07-280001613103us-gaap:AccumulatedTranslationAdjustmentMember2023-04-292023-07-280001613103us-gaap:AociDerivativeQualifyingAsHedgeExcludedComponentParentMember2023-04-292023-07-280001613103us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2023-04-292023-07-280001613103us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2023-04-292023-07-280001613103us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2023-07-280001613103us-gaap:AccumulatedTranslationAdjustmentMember2023-07-280001613103us-gaap:AociDerivativeQualifyingAsHedgeExcludedComponentParentMember2023-07-280001613103us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2023-07-280001613103us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2023-07-280001613103us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2022-04-290001613103us-gaap:AccumulatedTranslationAdjustmentMember2022-04-290001613103us-gaap:AociDerivativeQualifyingAsHedgeExcludedComponentParentMember2022-04-290001613103us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2022-04-290001613103us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2022-04-290001613103us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2022-04-302022-07-290001613103us-gaap:AccumulatedTranslationAdjustmentMember2022-04-302022-07-290001613103us-gaap:AociDerivativeQualifyingAsHedgeExcludedComponentParentMember2022-04-302022-07-290001613103us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2022-04-302022-07-290001613103us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2022-04-302022-07-290001613103us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2022-07-290001613103us-gaap:AccumulatedTranslationAdjustmentMember2022-07-290001613103us-gaap:AociDerivativeQualifyingAsHedgeExcludedComponentParentMember2022-07-290001613103us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2022-07-290001613103us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2022-07-290001613103mdt:ColibriMember2023-02-082023-02-080001613103us-gaap:DamagesFromProductDefectsMembermdt:PelvicMeshLitigationMember2023-04-292023-07-28mdt:subsidiarymdt:manufacturer0001613103us-gaap:DamagesFromProductDefectsMembermdt:PelvicMeshLitigationMember2015-04-252016-04-29mdt:claim0001613103us-gaap:DamagesFromProductDefectsMembermdt:PelvicMeshLitigationMember2017-05-012017-05-310001613103us-gaap:DamagesFromProductDefectsMembermdt:PelvicMeshLitigationMember2023-07-28mdt:claimant0001613103us-gaap:DamagesFromProductDefectsMembermdt:PelvicMeshLitigationMemberus-gaap:SubsequentEventMember2023-08-022023-08-020001613103mdt:HerniaMeshLitigationMemberus-gaap:SubsequentEventMemberus-gaap:PendingLitigationMember2023-08-022023-08-02mdt:plantiff0001613103stpr:MAmdt:HerniaMeshLitigationMemberus-gaap:SubsequentEventMemberus-gaap:PendingLitigationMember2023-08-022023-08-020001613103stpr:MNmdt:HerniaMeshLitigationMemberus-gaap:SubsequentEventMemberus-gaap:PendingLitigationMember2023-08-022023-08-020001613103mdt:HerniaMeshLitigationMemberus-gaap:SubsequentEventMemberus-gaap:PendingLitigationMember2023-08-020001613103mdt:DiabetesPumpRetainerRingLitigationMemberstpr:CAus-gaap:SubsequentEventMember2023-08-032023-08-03mdt:segment0001613103mdt:MedicalSurgicalMember2023-04-292023-07-280001613103us-gaap:OperatingSegmentsMembermdt:CardiovascularMember2023-04-292023-07-280001613103us-gaap:OperatingSegmentsMembermdt:CardiovascularMember2022-04-302022-07-290001613103mdt:NeuroscienceGroupMemberus-gaap:OperatingSegmentsMember2023-04-292023-07-280001613103mdt:NeuroscienceGroupMemberus-gaap:OperatingSegmentsMember2022-04-302022-07-290001613103us-gaap:OperatingSegmentsMembermdt:MedicalSurgicalMember2023-04-292023-07-280001613103us-gaap:OperatingSegmentsMembermdt:MedicalSurgicalMember2022-04-302022-07-290001613103us-gaap:OperatingSegmentsMembermdt:DiabetesGroupMember2023-04-292023-07-280001613103us-gaap:OperatingSegmentsMembermdt:DiabetesGroupMember2022-04-302022-07-290001613103us-gaap:OperatingSegmentsMembermdt:OtherSegmentMember2023-04-292023-07-280001613103us-gaap:OperatingSegmentsMembermdt:OtherSegmentMember2022-04-302022-07-290001613103us-gaap:OperatingSegmentsMember2023-04-292023-07-280001613103us-gaap:OperatingSegmentsMember2022-04-302022-07-290001613103us-gaap:MaterialReconcilingItemsMember2023-04-292023-07-280001613103us-gaap:MaterialReconcilingItemsMember2022-04-302022-07-290001613103country:IE2023-04-292023-07-280001613103country:IE2022-04-302022-07-290001613103mdt:TotalOtherCountriesExcludingUnitedStatesandIrelandMember2023-04-292023-07-280001613103mdt:TotalOtherCountriesExcludingUnitedStatesandIrelandMember2022-04-302022-07-290001613103mdt:TotalOtherCountriesExcludingIrelandMember2023-04-292023-07-280001613103mdt:TotalOtherCountriesExcludingIrelandMember2022-04-302022-07-290001613103mdt:KarenLParkhillMember2023-04-292023-07-280001613103mdt:KarenLParkhillMember2023-07-28

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 10-Q | | | | | | | | |

| ☒ | QUARTERLY REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| For the quarterly period ended | July 28, 2023 |

| | |

| ☐ | Transition report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934.

For the transition period from __________ to __________ |

Commission File Number 001-36820

®

® | | | | | |

| Medtronic plc |

| (Exact name of registrant as specified in its charter) |

| | |

| Ireland | 98-1183488 |

| (State of incorporation) | (I.R.S. Employer

Identification No.) |

20 On Hatch, Lower Hatch Street

Dublin 2, Ireland

(Address of principal executive offices) (Zip Code)

+353 1 438-1700

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | |

| Title of each class | Trading Symbol | Name of each exchange on which registered |

| Ordinary shares, par value $0.0001 per share | MDT | New York Stock Exchange |

| 0.250% Senior Notes due 2025 | MDT/25 | New York Stock Exchange |

| 0.000% Senior Notes due 2025 | MDT/25A | New York Stock Exchange |

| 2.625% Senior Notes due 2025 | MDT/25B | New York Stock Exchange |

| 1.125% Senior Notes due 2027 | MDT/27 | New York Stock Exchange |

| 0.375% Senior Notes due 2028 | MDT/28 | New York Stock Exchange |

| 3.000% Senior Notes due 2028 | MDT/28A | New York Stock Exchange |

| 1.625% Senior Notes due 2031 | MDT/31 | New York Stock Exchange |

| 1.000% Senior Notes due 2031 | MDT/31A | New York Stock Exchange |

| 3.125% Senior Notes due 2031 | MDT/31B | New York Stock Exchange |

| 0.750% Senior Notes due 2032 | MDT/32 | New York Stock Exchange |

| 3.375% Senior Notes due 2034 | MDT/34 | New York Stock Exchange |

| 2.250% Senior Notes due 2039 | MDT/39A | New York Stock Exchange |

| 1.500% Senior Notes due 2039 | MDT/39B | New York Stock Exchange |

| 1.375% Senior Notes due 2040 | MDT/40A | New York Stock Exchange |

| 1.750% Senior Notes due 2049 | MDT/49 | New York Stock Exchange |

| 1.625% Senior Notes due 2050 | MDT/50 | New York Stock Exchange |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer”, “smaller reporting company,” and "emerging growth company" in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | | | | | | | |

| Large accelerated filer | ☒ | Accelerated filer | ☐ | Emerging growth company | ☐ |

| Non-accelerated filer | ☐ | Smaller Reporting Company | ☐ | | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 1(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes ☐ No ☒

As of August 25, 2023, 1,330,533,713 ordinary shares, par value $0.0001, of the registrant were outstanding.

TABLE OF CONTENTS | | | | | | | | | | | | | | |

| Item | | Description | | Page |

| | | | | |

| | | | | |

| 1. | | | | |

| 2. | | | | |

| 3. | | | | |

| 4. | | | | |

| | | | | |

| 1. | | | | |

| 2. | | | | |

| 5. | | | | |

| 6. | | | | |

| | | | |

PART I — FINANCIAL INFORMATION

Item 1. Financial Statements

Medtronic plc

Consolidated Statements of Income

(Unaudited) | | | | | | | | | | | | | | | |

| | Three months ended | | |

| (in millions, except per share data) | July 28, 2023 | | July 29, 2022 | | | | |

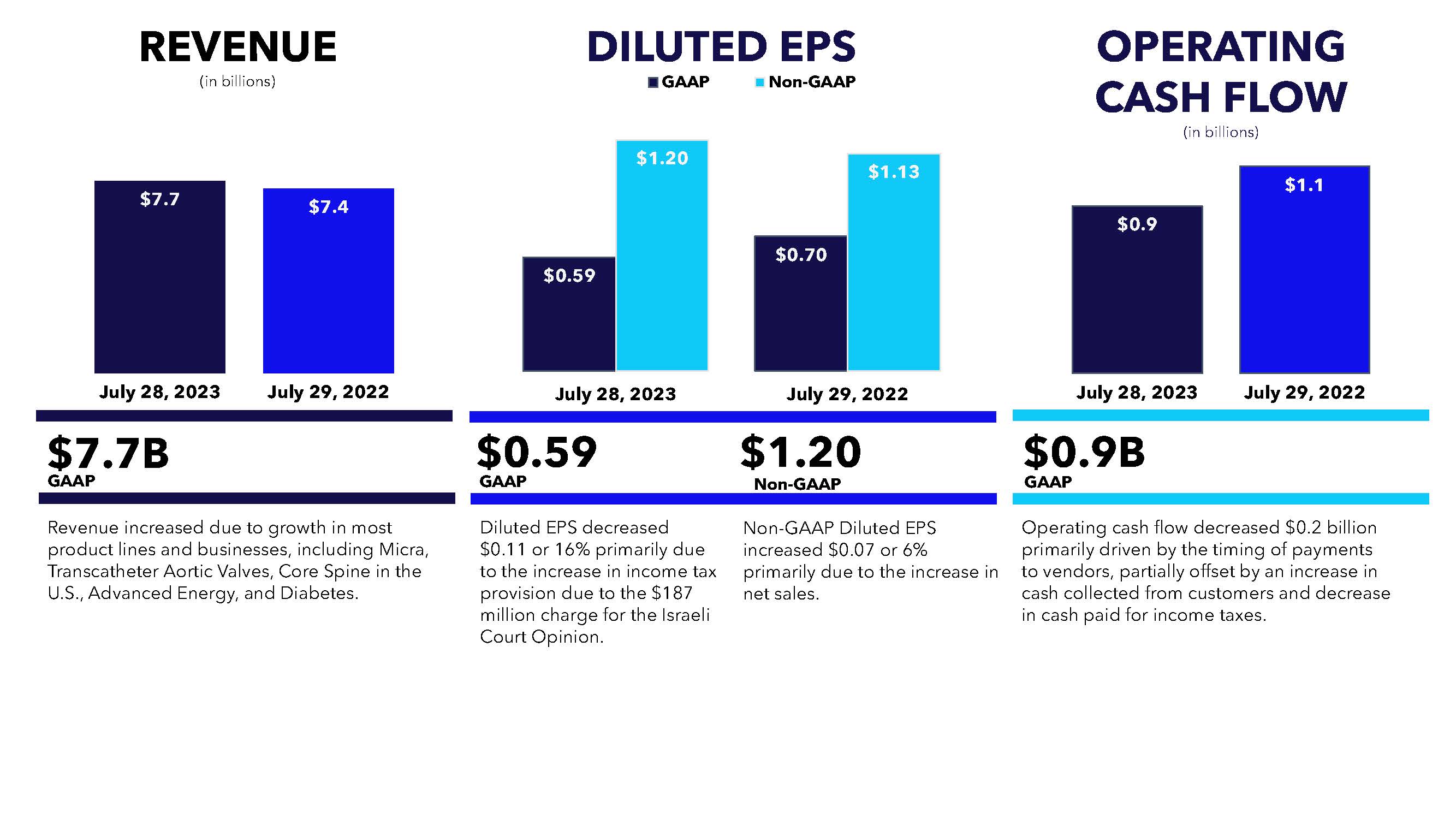

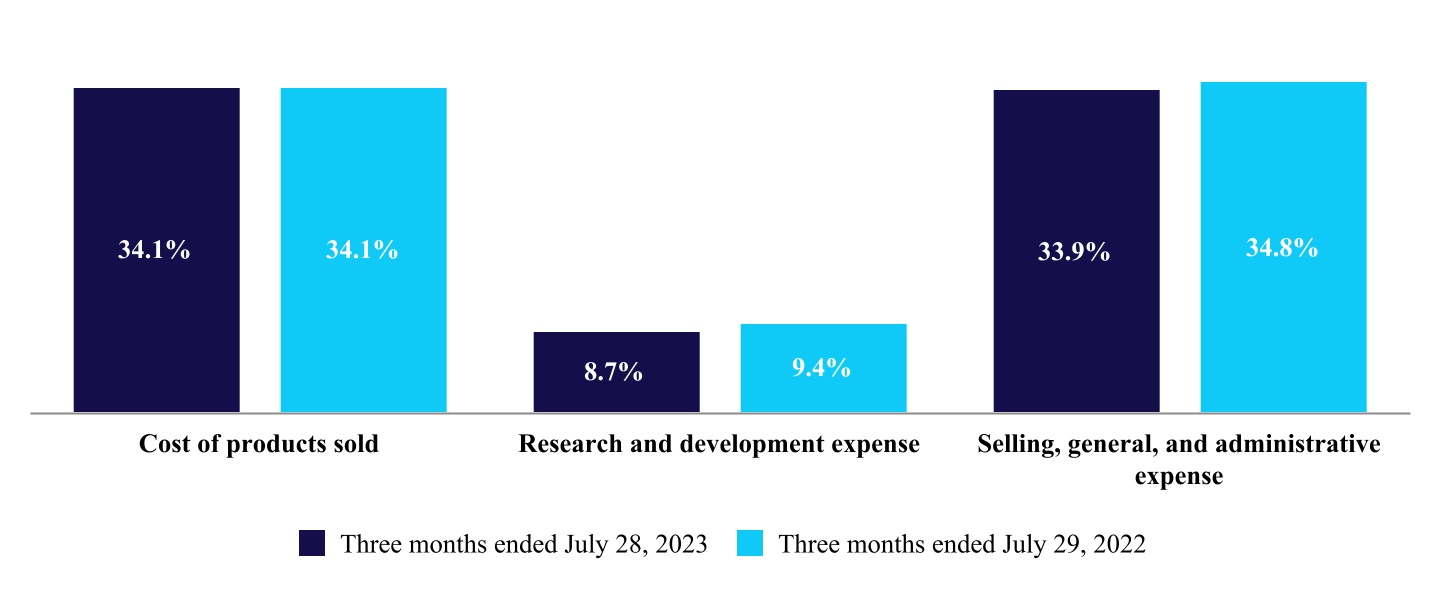

| Net sales | $ | 7,702 | | | $ | 7,371 | | | | | |

| Costs and expenses: | | | | | | | |

| Cost of products sold, excluding amortization of intangible assets | 2,628 | | | 2,516 | | | | | |

| Research and development expense | 668 | | | 692 | | | | | |

| Selling, general, and administrative expense | 2,613 | | | 2,567 | | | | | |

| Amortization of intangible assets | 429 | | | 423 | | | | | |

| Restructuring charges, net | 54 | | | 14 | | | | | |

| Certain litigation charges | 40 | | | — | | | | | |

| Other operating expense, net | 1 | | | 35 | | | | | |

| Operating profit | 1,268 | | | 1,125 | | | | | |

| Other non-operating income, net | (76) | | | (83) | | | | | |

| Interest expense, net | 148 | | | 164 | | | | | |

| Income before income taxes | 1,196 | | | 1,044 | | | | | |

| Income tax provision | 400 | | | 112 | | | | | |

| Net income | 797 | | | 931 | | | | | |

| Net income attributable to noncontrolling interests | (6) | | | (2) | | | | | |

| Net income attributable to Medtronic | $ | 791 | | | $ | 929 | | | | | |

| Basic earnings per share | $ | 0.59 | | | $ | 0.70 | | | | | |

| Diluted earnings per share | $ | 0.59 | | | $ | 0.70 | | | | | |

| Basic weighted average shares outstanding | 1,330.5 | | | 1,329.4 | | | | | |

| Diluted weighted average shares outstanding | 1,333.8 | | | 1,334.5 | | | | | |

The accompanying notes are an integral part of these consolidated financial statements.

Medtronic plc

Consolidated Statements of Comprehensive Income

(Unaudited) | | | | | | | | | | | | | | | |

| | Three months ended | | |

| (in millions) | July 28, 2023 | | July 29, 2022 | | | | |

| Net income | $ | 797 | | | $ | 931 | | | | | |

| Other comprehensive (loss) income, net of tax: | | | | | | | |

| Unrealized loss on investment securities | (19) | | | (16) | | | | | |

| Translation adjustment | 14 | | | (884) | | | | | |

| Net investment hedge | (143) | | | 1,002 | | | | | |

| Net change in retirement obligations | 3 | | | 1 | | | | | |

| Unrealized (loss) gain on cash flow hedges | (30) | | | 220 | | | | | |

| Other comprehensive (loss) income | (175) | | | 324 | | | | | |

| Comprehensive income including noncontrolling interests | 622 | | | 1,255 | | | | | |

| Comprehensive income attributable to noncontrolling interests | (6) | | | — | | | | | |

| Comprehensive income attributable to Medtronic | $ | 616 | | | $ | 1,255 | | | | | |

The accompanying notes are an integral part of these consolidated financial statements.

Medtronic plc

Consolidated Balance Sheets

(Unaudited) | | | | | | | | | | | |

| (in millions) | July 28, 2023 | | April 28, 2023 |

| ASSETS | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 1,339 | | | $ | 1,543 | |

| Investments | 6,537 | | | 6,416 | |

Accounts receivable, less allowances and credit losses of $190 and $176, respectively | 5,806 | | | 5,998 | |

| Inventories, net | 5,668 | | | 5,293 | |

| Other current assets | 2,518 | | | 2,425 | |

| Total current assets | 21,869 | | | 21,675 | |

| Property, plant, and equipment, net | 5,665 | | | 5,569 | |

| Goodwill | 41,436 | | | 41,425 | |

| Other intangible assets, net | 14,434 | | | 14,844 | |

| Tax assets | 3,461 | | | 3,477 | |

| Other assets | 3,912 | | | 3,959 | |

| Total assets | $ | 90,776 | | | $ | 90,948 | |

| LIABILITIES AND EQUITY | | | |

| Current liabilities: | | | |

| Current debt obligations | $ | 519 | | | $ | 20 | |

| Accounts payable | 2,239 | | | 2,662 | |

| Accrued compensation | 1,695 | | | 1,949 | |

| Accrued income taxes | 1,013 | | | 840 | |

| Other accrued expenses | 3,581 | | | 3,581 | |

| Total current liabilities | 9,047 | | | 9,051 | |

| Long-term debt | 24,463 | | | 24,344 | |

| Accrued compensation and retirement benefits | 1,092 | | | 1,093 | |

| Accrued income taxes | 2,407 | | | 2,360 | |

| Deferred tax liabilities | 687 | | | 708 | |

| Other liabilities | 1,715 | | | 1,727 | |

| Total liabilities | 39,410 | | | 39,283 | |

| Commitments and contingencies (Note 16) | | | |

| Shareholders’ equity: | | | |

Ordinary shares— par value $0.0001, 2.6 billion shares authorized, 1,330,498,304 and 1,330,809,036 shares issued and outstanding, respectively | — | | | — | |

| Additional paid-in capital | 24,587 | | | 24,590 | |

| Retained earnings | 30,265 | | | 30,392 | |

| Accumulated other comprehensive loss | (3,674) | | | (3,499) | |

| Total shareholders’ equity | 51,178 | | | 51,483 | |

| Noncontrolling interests | 188 | | | 182 | |

| Total equity | 51,366 | | | 51,665 | |

| Total liabilities and equity | $ | 90,776 | | | $ | 90,948 | |

The accompanying notes are an integral part of these consolidated financial statements.

Medtronic plc

Consolidated Statements of Equity

(Unaudited) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Ordinary Shares | | Additional Paid-in Capital | | Retained

Earnings | | Accumulated

Other

Comprehensive

Loss | | Total

Shareholders’

Equity | | Noncontrolling Interests | | Total Equity |

| (in millions) | | Number | | Par Value | | | | | | |

| April 28, 2023 | | 1,331 | | | $ | — | | | $ | 24,590 | | | $ | 30,392 | | | $ | (3,499) | | | $ | 51,483 | | | $ | 182 | | | $ | 51,665 | |

| Net income | | — | | | — | | | — | | | 791 | | | — | | | 791 | | | 6 | | | 797 | |

| Other comprehensive loss | | — | | | — | | | — | | | — | | | (175) | | | (175) | | | — | | | (175) | |

Dividends to shareholders ($0.69 per ordinary share) | | — | | | — | | | — | | | (918) | | | — | | | (918) | | | — | | | (918) | |

| Issuance of shares under stock purchase and award plans | | 1 | | | — | | | 73 | | | — | | | — | | | 73 | | | — | | | 73 | |

| Repurchase of ordinary shares | | (2) | | | — | | | (148) | | | — | | | — | | | (148) | | | — | | | (148) | |

| Stock-based compensation | | — | | | — | | | 73 | | | — | | | — | | | 73 | | | — | | | 73 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| July 28, 2023 | | 1,330 | | | $ | — | | | $ | 24,587 | | | $ | 30,265 | | | $ | (3,674) | | | $ | 51,178 | | | $ | 188 | | | $ | 51,366 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Ordinary Shares | | Additional Paid-in Capital | | Retained

Earnings | | Accumulated

Other

Comprehensive

Loss | | Total

Shareholders’

Equity | | Noncontrolling Interests | | Total Equity |

| (in millions) | | Number | | Par Value | | | | | | |

| April 29, 2022 | | 1,331 | | | $ | — | | | $ | 24,566 | | | $ | 30,250 | | | $ | (2,265) | | | $ | 52,551 | | | $ | 171 | | | $ | 52,722 | |

| Net income | | — | | | — | | | — | | | 929 | | | — | | | 929 | | | 2 | | | 931 | |

| Other comprehensive income (loss) | | — | | | — | | | — | | | — | | | 326 | | | 326 | | | (2) | | | 324 | |

Dividends to shareholders ($0.68 per ordinary share) | | — | | | — | | | — | | | (903) | | | — | | | (903) | | | — | | | (903) | |

| Issuance of shares under stock purchase and award plans | | 2 | | | — | | | 41 | | | — | | | — | | | 41 | | | — | | | 41 | |

| Repurchase of ordinary shares | | (3) | | | — | | | (333) | | | — | | | — | | | (333) | | | — | | | (333) | |

| Stock-based compensation | | — | | | — | | | 62 | | | — | | | — | | | 62 | | | — | | | 62 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| July 29, 2022 | | 1,329 | | | $ | — | | | $ | 24,335 | | | $ | 30,276 | | | $ | (1,939) | | | $ | 52,672 | | | $ | 170 | | | $ | 52,843 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

The accompanying notes are an integral part of these consolidated financial statements.

Medtronic plc

Consolidated Statements of Cash Flows

(Unaudited) | | | | | | | | | | | |

| | Three months ended |

| (in millions) | July 28, 2023 | | July 29, 2022 |

| Operating Activities: | | | |

| Net income | $ | 797 | | | $ | 931 | |

| Adjustments to reconcile net income to net cash provided by operating activities: | | | |

| Depreciation and amortization | 672 | | | 668 | |

| Provision for credit losses | 21 | | | 15 | |

| Deferred income taxes | — | | | (18) | |

| Stock-based compensation | 73 | | | 62 | |

| Loss on debt extinguishment | — | | | 53 | |

| | | |

| | | |

| | | |

| Other, net | 135 | | | 121 | |

| Change in operating assets and liabilities, net of acquisitions and divestitures: | | | |

| Accounts receivable, net | 164 | | | 89 | |

| Inventories, net | (410) | | | (380) | |

| Accounts payable and accrued liabilities | (673) | | | (147) | |

| Other operating assets and liabilities | 96 | | | (311) | |

| | | |

| | | |

| Net cash provided by operating activities | 875 | | | 1,083 | |

| Investing Activities: | | | |

| Acquisitions, net of cash acquired | — | | | (1,191) | |

| | | |

| Additions to property, plant, and equipment | (354) | | | (426) | |

| Purchases of investments | (1,916) | | | (1,884) | |

| Sales and maturities of investments | 1,748 | | | 1,886 | |

| Other investing activities, net | (17) | | | 30 | |

| Net cash used in investing activities | (539) | | | (1,585) | |

| Financing Activities: | | | |

| Change in current debt obligations, net | 500 | | | — | |

| | | |

| Proceeds from short-term borrowings (maturities greater than 90 days) | — | | | 2,284 | |

| | | |

| Payments on long-term debt | — | | | (2,311) | |

| Dividends to shareholders | (918) | | | (903) | |

| Issuance of ordinary shares | 77 | | | 43 | |

| Repurchase of ordinary shares | (152) | | | (336) | |

| Other financing activities | (8) | | | 273 | |

| Net cash used in financing activities | (501) | | | (950) | |

| Effect of exchange rate changes on cash and cash equivalents | (39) | | | (122) | |

| Net change in cash and cash equivalents | (204) | | | (1,574) | |

| Cash and cash equivalents at beginning of period | 1,543 | | | 3,714 | |

| Cash and cash equivalents at end of period | $ | 1,339 | | | $ | 2,140 | |

| | | |

| Supplemental Cash Flow Information | | | |

| Cash paid for: | | | |

| Income taxes | $ | 117 | | | $ | 260 | |

| Interest | 84 | | | 68 | |

|

The accompanying notes are an integral part of these consolidated financial statements.

Medtronic plc

Notes to Consolidated Financial Statements

(Unaudited)

1. Basis of Presentation

The accompanying unaudited consolidated financial statements of Medtronic plc and its subsidiaries (Medtronic plc, Medtronic, or the Company) have been prepared in accordance with accounting principles generally accepted in the United States of America (U.S.) (U.S. GAAP) for interim financial information and with the instructions to Form 10-Q and Article 10 of Regulation S-X. In the opinion of management, the consolidated financial statements include all the adjustments necessary for a fair statement in conformity with U.S. GAAP. Certain reclassifications have been made to prior year financial statements to conform to classifications used in the current year.

Operating results for interim periods are not necessarily indicative of results that may be expected for the fiscal year as a whole. The preparation of the financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect the reported amounts of assets, liabilities, revenues, expenses, and the related disclosures at the date of the financial statements and during the reporting period. Actual results could materially differ from these estimates.

The accompanying unaudited consolidated financial statements include the accounts of Medtronic plc, its wholly-owned subsidiaries, entities for which the Company has a controlling financial interest, and variable interest entities for which the Company is the primary beneficiary. Intercompany transactions and balances have been eliminated in consolidation. Amounts reported in millions within this quarterly report are computed based on the amounts in thousands, and therefore, the sum of the components may not equal the total amount reported in millions due to rounding. Additionally, certain columns and rows within tables may not sum due to rounding.

The accompanying unaudited consolidated financial statements and related notes should be read in conjunction with the audited consolidated financial statements of the Company and related notes included in the Company’s Annual Report on Form 10-K for the fiscal year ended April 28, 2023. The Company’s fiscal years 2024, 2023, and 2022 will end or ended on April 26, 2024, April 28, 2023, and April 29, 2022, respectively.

2. New Accounting Pronouncements

Recently Adopted

Supplier Finance Programs

In September 2022, the Financial Accounting Standards Board (FASB) issued Accounting Standards Update (ASU) 2022-04, Liabilities— Supplier Finance Programs (Subtopic 405-50), which requires that a buyer in a supplier finance program disclose sufficient information about the program to allow a user of financial statements to understand the program’s nature, activity during the period, changes from period to period, and potential magnitude. The Company adopted this guidance on April 29, 2023. The adoption of this standard does not have a material impact on the Company’s Consolidated Financial Statements.

As of July 28, 2023, there are no recently issued but not yet adopted accounting pronouncements that are expected to materially impact our consolidated financial statements.

3. Revenue

The Company's revenues are principally derived from device-based medical therapies and services related to cardiac rhythm disorders, cardiovascular disease, neurological disorders and diseases, spinal conditions and musculoskeletal trauma, chronic pain, urological and digestive disorders, ear, nose, and throat conditions, and diabetes conditions as well as advanced and general surgical care products, respiratory and monitoring solutions, and neurological surgery technologies. The Company's primary customers include healthcare systems, clinics, third-party healthcare providers, distributors, and other institutions, including governmental healthcare programs and group purchasing organizations. Prior period revenue has been recast to reflect the new reporting structure, which primarily includes allocating certain prior Medical Surgical businesses to the Other line. Refer to Note 17 to the consolidated financial statements for additional information regarding the Company's new reporting structure.

Medtronic plc

Notes to Consolidated Financial Statements

(Unaudited)

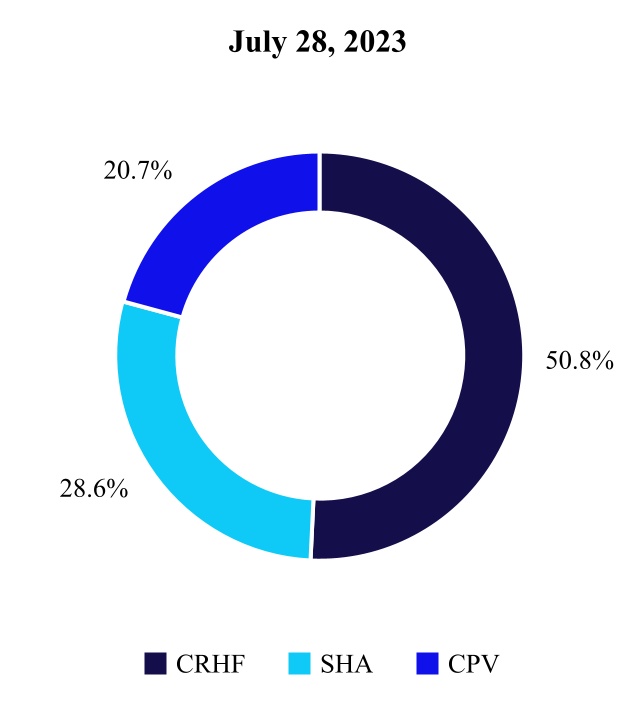

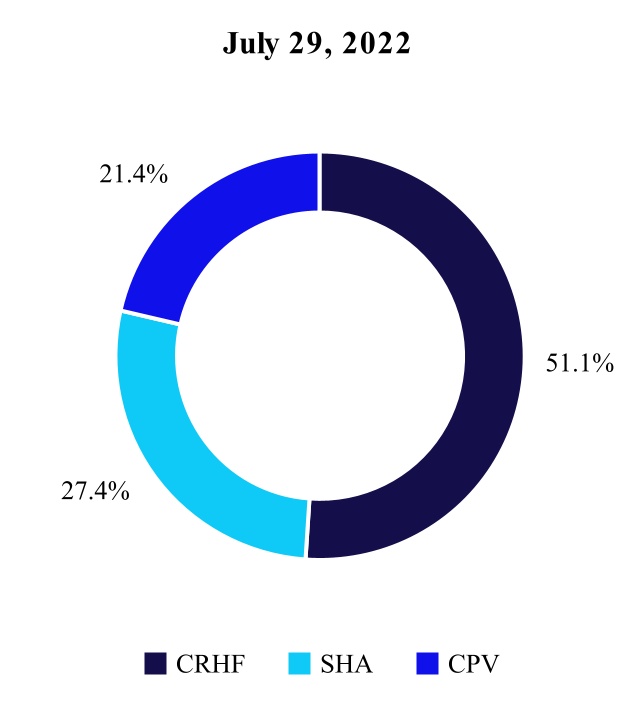

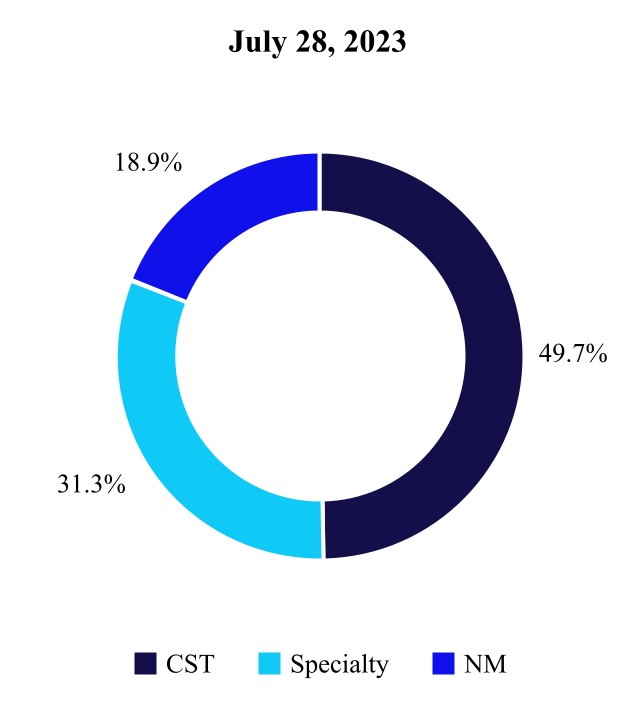

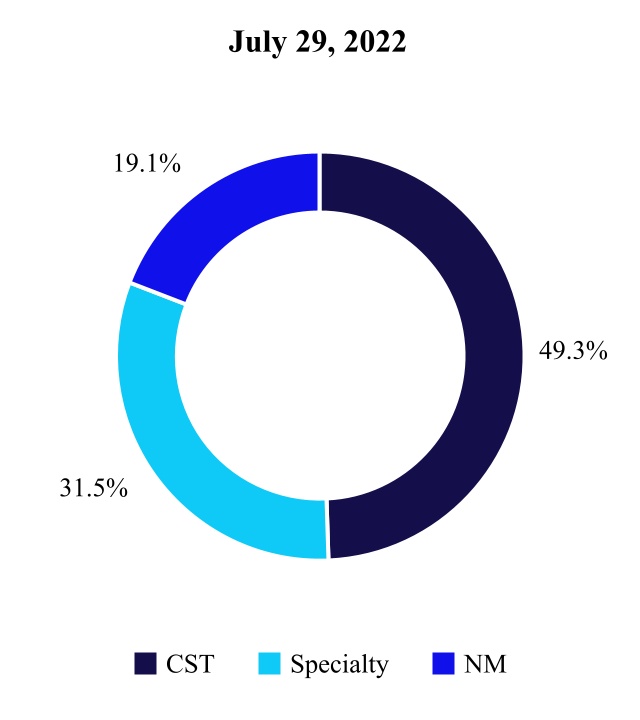

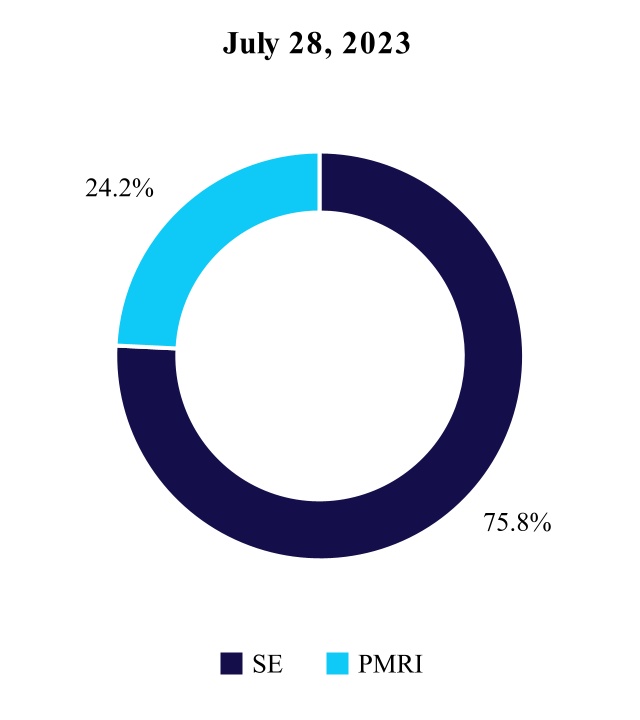

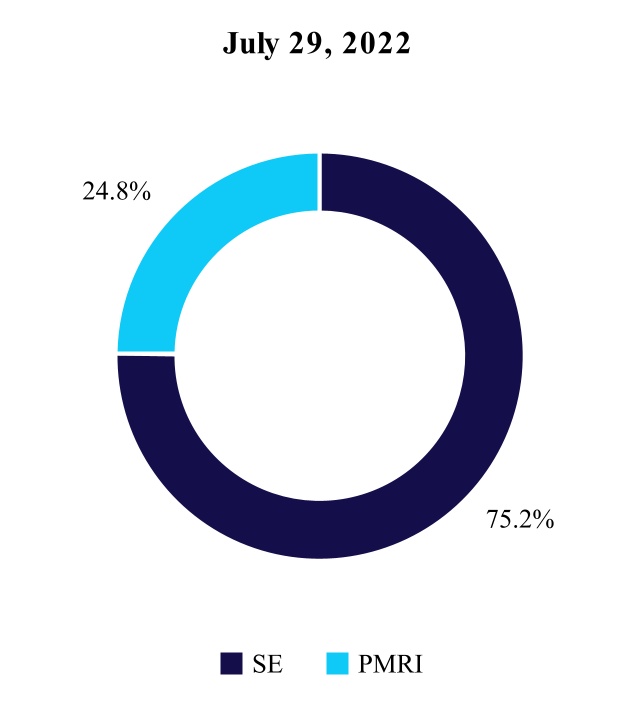

The table below illustrates net sales by segment and division for the three months ended July 28, 2023 and July 29, 2022:

| | | | | | | | | | | | | | | |

| | Three months ended | | |

| (in millions) | July 28, 2023 | | July 29, 2022 | | | | |

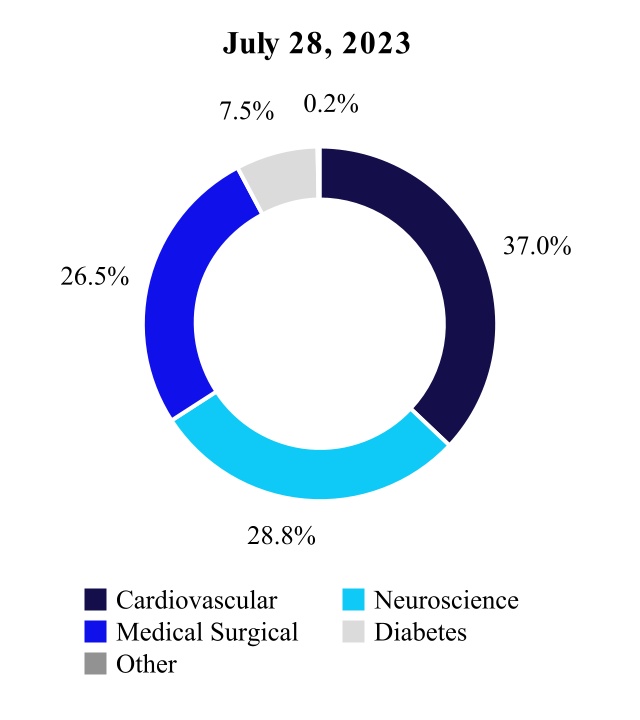

| Cardiac Rhythm & Heart Failure | $ | 1,446 | | | $ | 1,381 | | | | | |

| Structural Heart & Aortic | 814 | | | 741 | | | | | |

| Coronary & Peripheral Vascular | 589 | | | 579 | | | | | |

| Cardiovascular | 2,850 | | | 2,701 | | | | | |

| Cranial & Spinal Technologies | 1,103 | | | 1,043 | | | | | |

| Specialty Therapies | 695 | | | 667 | | | | | |

| Neuromodulation | 420 | | | 405 | | | | | |

| Neuroscience | 2,219 | | | 2,115 | | | | | |

| Surgical & Endoscopy | 1,546 | | | 1,455 | | | | | |

| Patient Monitoring & Respiratory Interventions | 493 | | | 479 | | | | | |

| Medical Surgical | 2,039 | | | 1,933 | | | | | |

| Diabetes | 578 | | | 541 | | | | | |

Other(1) | 16 | | | 81 | | | | | |

| Total | $ | 7,702 | | | $ | 7,371 | | | | | |

(1) Includes revenue from the divested Renal Care Solutions business and Transition Manufacturing Agreements from previously divested businesses.

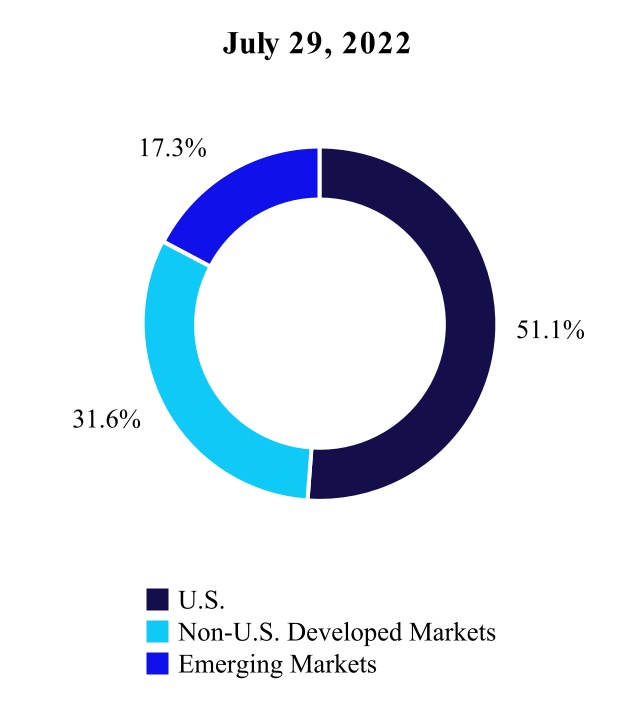

The table below illustrates net sales by market geography for each segment for the three months ended July 28, 2023 and July 29, 2022:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | U.S.(1) | | Non-U.S. Developed Markets(2) | | Emerging Markets(3) |

| Three months ended | | Three months ended | | Three months ended |

| (in millions) | July 28, 2023 | | July 29, 2022 | | July 28, 2023 | | July 29, 2022 | | July 28, 2023 | | July 29, 2022 |

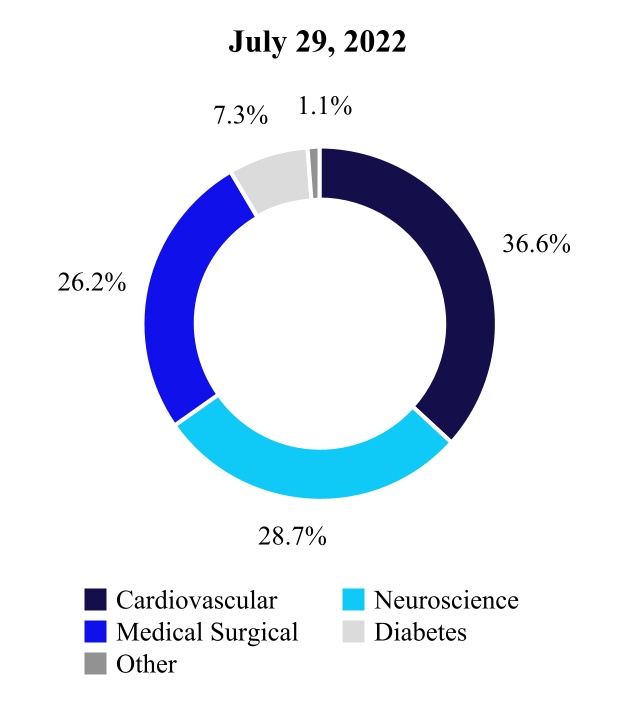

| Cardiovascular | $ | 1,350 | | | $ | 1,286 | | | $ | 956 | | | $ | 892 | | | $ | 544 | | | $ | 523 | |

| Neuroscience | 1,497 | | | 1,419 | | | 416 | | | 407 | | | 306 | | | 290 | |

| Medical Surgical | 881 | | | 831 | | | 772 | | | 735 | | | 386 | | | 368 | |

| Diabetes | 188 | | | 206 | | | 315 | | | 264 | | | 75 | | | 72 | |

Other(4) | 8 | | | 25 | | | 5 | | | 32 | | | 3 | | | 24 | |

| Total | $ | 3,924 | | | $ | 3,766 | | | $ | 2,463 | | | $ | 2,328 | | | $ | 1,314 | | | $ | 1,276 | |

| | | | | | | | | | | |

| | | | | |

| | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

(1)U.S. includes the United States and U.S. territories.

(2)Non-U.S. developed markets include Japan, Australia, New Zealand, Korea, Canada, and the countries within Western Europe.

(3)Emerging markets include the countries of the Middle East, Africa, Latin America, Eastern Europe, and the countries of Asia that are not included in the non-U.S. developed markets, as defined above.

(4)Includes revenue from the divested Renal Care Solutions (RCS) business and Transition Manufacturing Agreements from previously divested businesses.

The amount of revenue recognized is reduced by sales rebates and returns. Adjustments to rebates and returns reserves are recorded as increases or decreases to revenue. At July 28, 2023, $1.1 billion of rebates were classified as other accrued expenses, and $602 million of rebates were classified as a reduction of accounts receivable in the consolidated balance sheet. At April 28, 2023, $1.1 billion of rebates were classified as other accrued expenses, and $555 million of rebates were classified as a reduction of accounts receivable in the consolidated balance sheet.

Deferred Revenue and Remaining Performance Obligations

Deferred revenue at July 28, 2023 and April 28, 2023 was $425 million and $405 million, respectively. At July 28, 2023 and April 28, 2023, $334 million and $314 million was included in other accrued expenses, respectively, and $90 million and $91 million was included in other liabilities, respectively. During the three months ended July 28, 2023, the Company recognized $124 million of revenue that was included in deferred revenue as of April 28, 2023.

Medtronic plc

Notes to Consolidated Financial Statements

(Unaudited)

Remaining performance obligations include goods and services that have not yet been delivered or provided under existing, noncancellable contracts with minimum purchase commitments. At July 28, 2023, the estimated revenue expected to be recognized in future periods related to unsatisfied performance obligations for executed contracts with an original duration of one year or more was approximately $0.6 billion. The Company expects to recognize revenue on the majority of these remaining performance obligations over the next three years.

4. Acquisitions and Dispositions

Fiscal Year 2024

The Company had no acquisitions that were accounted for as business combinations during the three months ended July 28, 2023. For the three months ended July 28, 2023, purchase price allocation adjustments were not significant.

Fiscal Year 2023

The Company had acquisitions that were accounted for as business combinations during the three months ended July 29, 2022. The assets and liabilities of the businesses acquired were recorded and consolidated on the acquisition date at their respective fair values. Goodwill resulting from business combinations is largely attributable to future, yet to be defined technologies, new customer relationships, existing workforce of the acquired businesses, and synergies expected to arise after the Company's acquisition of these businesses. The pro forma impact of these acquisitions was not significant, either individually or in the aggregate, to the consolidated results of the Company for the three months ended July 29, 2022. The results of operations of acquired businesses have been included in the Company's consolidated statements of income since the date each business was acquired. For the three months ended July 29, 2022, purchase price allocation adjustments were not significant.

Intersect ENT

On May 13, 2022, the Company acquired Intersect ENT, a global ear, nose, and throat (ENT) medical technology leader which offers a broad suite of solutions to assist surgeons treating patients who suffer from chronic rhinosinusitis (CRS). Total consideration, net of cash acquired, for the transaction, was $1.2 billion consisting of $1.1 billion of cash and $98 million previously held investments in Intersect ENT. The Company acquired $615 million of goodwill, $635 million of technology-based intangible assets, $35 million of customer-related intangible assets, and $13 million of tradenames with estimated useful lives of 20 years. The goodwill is not deductible for tax purposes.

Revenue and net loss attributable to Intersect ENT since the date of acquisition as well as costs incurred in connection with the acquisition included in the consolidated statements of income were not significant for the three months ended July 29, 2022.

The acquisition date fair values of the assets acquired and liabilities assumed were as follows:

| | | | | |

| (in millions) | Intersect ENT |

| Cash and cash equivalents | $ | 39 | |

| Inventory | 32 | |

| Goodwill | 615 | |

| Other intangible assets | 683 | |

| Other assets | 40 | |

| Total assets acquired | 1,408 | |

| | |

| Current liabilities | 63 | |

| Deferred tax liabilities | 51 | |

| Other liabilities | 18 | |

| Total liabilities assumed | 131 | |

| Net assets acquired | $ | 1,277 | |

Medtronic plc

Notes to Consolidated Financial Statements

(Unaudited)

Other acquisitions

For acquisitions, other than Intersect ENT, the acquisition date fair value of net assets acquired during the three months ended July 29, 2022, was $123 million. Assets acquired were primarily comprised of $66 million of goodwill and $57 million of technology-based intangible assets, with estimated useful lives of 16 years. The goodwill is deductible for tax purposes. The Company recognized $73 million of non-cash contingent consideration liabilities in connection with these acquisitions, which are comprised of revenue and product development milestone-based payments.

Acquired In-Process Research & Development (IPR&D)

IPR&D with no alternative future use acquired outside of a business combination is expensed immediately. During the three months ended July 28, 2023, the Company did not acquire any IPR&D in connection with asset acquisitions of technology not yet approved. During the three months ended July 29, 2022, IPR&D acquired in connection with asset acquisitions of technology not yet approved by regulators was not significant.

Contingent Consideration

Certain of the Company’s business combinations involve potential payment of future consideration that is contingent upon the achievement of certain product development milestones and/or contingent on the acquired business reaching certain performance milestones. A liability is recorded for the estimated fair value of the contingent consideration on the acquisition date. The fair value of the contingent consideration is remeasured at each reporting period, and the change in fair value is recognized within other operating expense, net in the consolidated statements of income.

The fair value of contingent consideration liabilities at July 28, 2023 and April 28, 2023 was $206 million. At July 28, 2023, $33 million was recorded in other accrued expenses, and $173 million was recorded in other liabilities in the consolidated balance sheet. At April 28, 2023, $34 million was recorded in other accrued expenses, and $171 million was recorded in other liabilities in the consolidated balance sheet.

The following table provides a reconciliation of the beginning and ending balances of contingent consideration liabilities:

| | | | | | | | | | | | | | | |

| | Three months ended | | |

| (in millions) | July 28, 2023 | | July 29, 2022 | | | | |

| Beginning balance | $ | 206 | | | $ | 119 | | | | | |

| Purchase price contingent consideration | — | | | 73 | | | | | |

| | | | | | | |

| Payments | (3) | | | — | | | | | |

| Change in fair value | 3 | | | 2 | | | | | |

| Ending balance | $ | 206 | | | $ | 193 | | | | | |

The recurring Level 3 fair value measurements of contingent consideration for which a liability is recorded include the following significant unobservable inputs:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Fair Value at | | | | | | | | |

| (in millions) | | July 28, 2023 | | | | Unobservable Input | | Range | | Weighted Average (1) |

| Revenue and other performance-based payments | | $81 | | | | Discount rate | | 11.2% - 27.2% | | 17.3% |

| | | | Projected fiscal year of payment | | 2024 - 2027 | | 2025 |

| Product development and other milestone-based payments | | $125 | | | | Discount rate | | 3.9% - 5.5% | | 4.1% |

| | | | Projected fiscal year of payment | | 2024 - 2027 | | 2026 |

(1) Unobservable inputs were weighted by the relative fair value of the contingent consideration liability. For projected fiscal year of payment, the amount represents the median of the inputs and is not a weighted average.

Medtronic plc

Notes to Consolidated Financial Statements

(Unaudited)

On April 1, 2023, the Company and DaVita Inc. (“DaVita”) completed the transaction for the Company to sell half of its Renal Care Solutions (RCS) business. In connection with the sale, the Company may be entitled to receive additional consideration based on the achievement of certain revenue, regulatory, and profitability milestones, with potential payouts starting in fiscal year 2025 through 2029. The fair value of the contingent consideration receivable at July 28, 2023 and April 28, 2023 was $152 million and $195 million, respectively, and was recorded in other assets in the consolidated balance sheet.

The following table provides a reconciliation of the beginning and ending balances of the Level 3 measurement of contingent consideration receivable:

| | | | | |

| (in millions) | July 28, 2023 |

| Beginning balance | $ | 195 | |

| Change in fair value | (43) | |

| Ending balance | $ | 152 | |

Renal Care Solutions disposition

This sale is part of an agreement between Medtronic and DaVita to form a new, independent kidney care-focused medical device company (“Mozarc Medical” or "Mozarc") with equal equity ownership. RCS was part of the Company’s Medical Surgical portfolio. At closing, the Company received $45 million cash consideration, recorded non-cash contingent consideration receivables valued at $195 million, made an additional cash investment of $224 million, and retained a 50% non-controlling equity interest in Mozarc valued at $307 million. For the contingent consideration receivables, the maximum consideration the Company could receive in the future is $300 million based on the achievement of the aforementioned milestones. The Company recorded a non-cash pre-tax impairment of $67 million in the three months ended July 29, 2022, primarily related to goodwill, recognized in other operating expense, net in the consolidated statements of income. Refer to Note 10 to the consolidated financial statements for additional information on the goodwill impairment. Refer to Note 6 to the consolidated financial statements for additional information on the Company’s retained 50% equity investment in Mozarc as a result of this transaction.

The Company determined that the sale of the RCS business did not meet the criteria to be classified as discontinued operations.

5. Restructuring and Other Costs

For the three months ended July 28, 2023, the Company incurred $91 million of restructuring and associated costs related to employee termination benefits and facility consolidations to support cost reduction initiatives. For the three months ended July 29, 2022, restructuring charges primarily related to the Enterprise Excellence and Simplification restructuring programs, both of which were substantially completed as of the end of fiscal year 2023. Enterprise Excellence was designed to leverage the Company’s global size and scale to focus on global operations, and functional and commercial optimization, and had total pre-tax charges of $1.8 billion. Simplification was designed to focus the organization on accelerating innovation, enhancing customer experience, driving revenue growth and winning market share, and had total pre-tax charges of $0.5 billion.

Employee-related costs primarily consist of termination benefits provided to employees who have been involuntarily terminated and voluntary early retirement benefits. Associated costs primarily include salaries and wages of employees that are fully-dedicated to restructuring programs and consulting expenses.

Medtronic plc

Notes to Consolidated Financial Statements

(Unaudited)