Use these links to rapidly review the document

TABLE OF CONTENTS

INDEX TO CONSOLIDATED FINANCIAL STATEMENTS

As filed with the Securities and Exchange Commission on April 22, 2016.

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Performance Health Holdings Corp.

(Exact name of registrant as specified in its charter)

| Delaware (State or other jurisdiction of incorporation or organization) |

5190 (Primary standard industrial classification code number) |

80-0856022 (I.R.S. employer identification number) |

1245 Home Ave.

Akron, OH 44310

Telephone: (330) 633-8460

(Address, including zip code, and telephone number, including area code, of registrant's principal executive offices)

Marshall Dahneke

Chief Executive Officer

1245 Home Ave.

Akron, OH 44310

Telephone: (330) 633-8460

(Name, address, including zip code, and telephone number, including area code, of agent for service)

| Copies to: | ||

Christopher D. Comeau, Esq. Ropes & Gray LLP Prudential Tower 800 Boylston Street Boston, MA 02199 (617) 951-7000 |

Kris F. Heinzelman, Esq. Craig F. Arcella, Esq. Cravath, Swaine & Moore LLP Worldwide Plaza 825 Eighth Avenue New York, NY 10019 (212) 474-1000 |

|

Approximate date of commencement of proposed sale to the public:

As soon as practicable after this registration statement becomes effective.

If any of the securities being registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. o

If this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act. (Check one).

| Large accelerated Filer o | Accelerated filer o | Non-accelerated filer ý (Do not check if a smaller reporting company) |

Smaller reporting company o |

CALCULATION OF REGISTRATION FEE

|

||||

| Title of Each Class of Securities to be Registered |

Proposed Maximum Aggregate Offering Price(1)(2) |

Amount of Registration Fee(3) |

||

|---|---|---|---|---|

Common Stock, $0.0001 par value per share |

$100,000,000 | $10,070 | ||

|

||||

- (1)

- Estimated

solely for the purpose of calculating the registration fee in accordance with Rule 457(o) of the Securities Act of 1933, as amended (the

"Securities Act").

- (2)

- Includes

the aggregate offering price of additional shares that the underwriters have the option to purchase to cover over-allotments, if any.

- (3)

- Calculated pursuant to Rule 457(o) of the Securities Act.

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Commission acting pursuant to said Section 8(a), may determine.

The information in this preliminary prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell nor does it seek an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

Preliminary Prospectus

Subject to Completion. Dated April 22, 2016.

Shares

Performance Health Holdings Corp.

Common Stock

This is our initial public offering. We are offering shares of common stock.

Prior to this offering, there has been no public market for our common stock. It is currently estimated that the initial public offering price per share will be between $ and $ . We intend to list our common stock on the NASDAQ Global Market under the symbol "PHC."

The underwriters have an option to purchase up to additional shares from us at the initial public offering price per share to cover any over-allotment of shares.

We are an "emerging growth company" under federal securities laws and are subject to reduced public company disclosure standards.

Investing in our common stock involves risks. See "Risk Factors" beginning on page 18.

| |

Price to Public |

Underwriting Discounts and Commissions(1) |

Proceeds to Company |

|||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Per Share | $ | $ | $ | |||||||

| Total | $ | $ | $ | |||||||

- (1)

- We have agreed to reimburse the underwriters for certain expenses in connection with this offering. See "Underwriting."

Delivery of the shares of common stock will be made on or about , 2016.

Neither the Securities and Exchange Commission nor any other regulatory body has approved or disapproved of these securities or passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

| Credit Suisse Baird William Blair |

Jefferies UBS Investment Bank SunTrust Robinson Humphrey |

Prospectus dated , 2016.

TABLE OF CONTENTS

Until , all dealers that effect transactions in these securities, whether or not participating in this offering, may be required to deliver a prospectus. This is in addition to a dealer's obligation to deliver a prospectus when acting as an underwriter and with respect to unsold allotments or subscriptions.

You should rely only on the information contained in this document or to which we have referred you. We have not authorized anyone to provide any information that is different. This document may only be used where it is legal to sell these securities. The information in this document may only be accurate on the date of this document.

i

Market and Other Industry Data

Market data and certain industry forecasts used throughout this prospectus were obtained from market research, consultant surveys, publicly available information, industry publications and surveys conducted by independent third parties, including Strategic Data Marketing and Euromonitor International Ltd. Such research, surveys, information and publications generally state that the information contained therein has been obtained from sources believed to be reliable, but that the accuracy and completeness of such information is not guaranteed. We have not independently verified any of the data from such third-party sources nor have we ascertained the underlying economic assumptions relied upon therein.

When we refer in this prospectus to Euromonitor International data, with respect to the global consumer health and wellness market, such market consists of the following categories (as defined by Euromonitor in the Euromonitor International—Consumer Health 2016 edition, Health and Wellness 2016 edition, Apparel and Footwear 2015 edition and Consumer Electronics 2016 edition): analgesics, sports nutrition, vitamins and dietary supplements, weight management, Health and Wellness bone and joint health, Health and Wellness endurance, Health and Wellness energy boosting, sports apparel, sports footwear and passive and autonomous wearables. In addition, when we refer to the projected compound annual growth rate ("CAGR") of the global consumer health and wellness market, such estimates are based on the estimated size of the above referenced categories in real terms (to adjust for inflation) using a constant U.S. dollar currency exchange rate (based on either 2014 or 2015 exchange rates). The data from which these estimates are derived was accessed from Euromonitor's database on November 9, 2015.

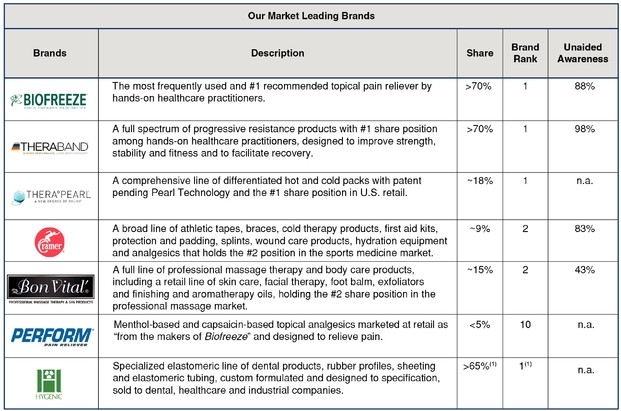

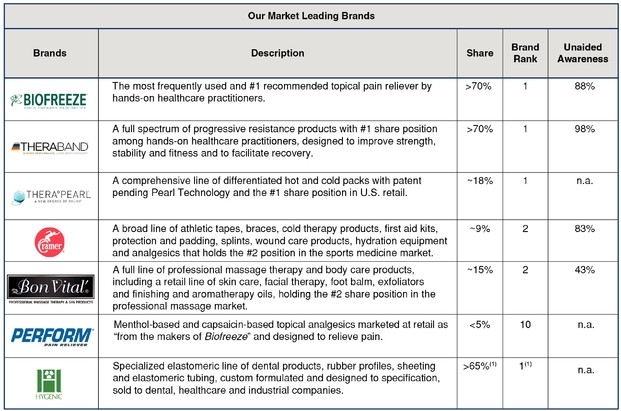

Throughout this prospectus we have used market data about our brands and industry obtained from an October 2014 report by the Newton Strategy Group, a management consulting firm focused on providing market diligence to private equity firms, who we retained and compensated to perform the study (the "Newton Report"). We believe the report to be reliable based upon our management's knowledge of the industry, but we have not independently verified the report's findings. The Newton Report defines the "Share," "Brand Rank" and "Unaided Awareness" of our brands. The "Share" of each brand is defined as the market share of the relevant brand within its core product category on a revenue basis, except for Bon Vital, whose market share is determined by the percentage of massages in which the brand is used based on a survey of 904 massage therapists asking which brand of massage lubricants they primarily used. The "Brand Rank," or "Rank," of each brand is defined as the brand's rank by Share within its core product category. A brand's "Unaided Awareness" is defined as the percentage of surveyed hands-on healthcare practitioners who could name the brand, unassisted, when asked to name brands in a particular product category. To determine the "Share" and Brand Rank" of our brands (other than Bon Vital, as described above), the Newton Strategy Group conducted primary and secondary research to estimate the size of the existing market for each brand and used company sales data to calculate the percentage share of each brand in its respective core product category, as indicated in the column entitled "Core Product Category" in the table below. The Biofreeze, TheraBand, Cramer and Bon Vital brands' Share and Brand Rank are based on the Newton Strategy Group's estimates of the category market size within the U.S. clinical channel. To calculate Unaided Awareness of the brands, the Newton Strategy Group conducted telephone surveys in which; (i) 113 U.S. clinical healthcare practitioners were asked to list the top brands of topical analgesics of which they were aware, (ii) 132 U.S. clinical healthcare practitioners were asked to list the top brands of therapy bands of which they were aware; (iii) 322 U.S. athletic trainers were asked to list the top five brands for sports medicine supplies of which they were aware; and (iv) 904 U.S. massage therapists were asked to

ii

list the top three massage lubricant brands of which they were aware. The core product category of each brand and the types of healthcare practitioners surveyed about each brand are as follows:

Brand

|

Core Product Category | Surveyed Practitioners | ||

|---|---|---|---|---|

| Biofreeze | Topical analgesics | Clinical healthcare practitioners* | ||

| TheraBand | Resistance bands and tubes | Clinical healthcare practitioners* | ||

| TheraPearl | Hybrid cold/heat packs | N/A | ||

| Cramer | Sports medicine | Athletic trainers | ||

| Bon Vital | Massage lubricant | Massage therapists | ||

| Perform | Retail topical analgesics | N/A |

- *

- Clinical healthcare practitioners, which we refer to throughout this prospectus as "hands-on healthcare practitioners," include physical therapists, occupational therapists, chiropractors, massage therapists, athletic trainers and podiatrists.

While we are not aware of any misstatements regarding any market, industry or similar data presented herein, whether in the Newton Report or otherwise, such data involves risks and uncertainties, including the extent to which the data is derived from a statistically significant segment of the market or industry, and is subject to change based on various factors, including those discussed in "Cautionary Note Regarding Forward-Looking Statements" and "Risk Factors" in this prospectus.

This prospectus includes our trademarks such as, but not limited to, Biofreeze, TheraBand, Perform, Cramer, Bon Vital, TheraPearl and Hygenic which are protected under applicable intellectual property laws and are owned by Performance Health Holdings Corp. through its subsidiaries. Solely for convenience, trademarks and trade names referred to in this prospectus may appear without the ® or ™ symbols, but such references are not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, our rights or the right of the applicable licensor to these trademarks, service marks, trade names and copyrights.

References in this prospectus to fiscal years are to our fiscal years, which end on April 30. We refer to the fiscal year ended April 30, 2014 as fiscal 2014, the fiscal year ended April 30, 2015 as fiscal 2015 and the fiscal year ended April 30, 2016 as fiscal 2016.

iii

This prospectus summary highlights information appearing elsewhere in this prospectus. This summary is not complete and does not contain all of the information that you should consider before investing in our common stock and is qualified by and should be read in conjunction with the more detailed information appearing elsewhere in this prospectus. You should carefully read the entire prospectus, including the financial data and related notes and "Risk Factors" before deciding whether to invest in our common stock. Unless otherwise indicated or the context otherwise requires, references in this prospectus to the "Company," "Performance Health," "we," "us" and "our" refer to Performance Health Holdings Corp. and its consolidated subsidiaries. All information in this prospectus assumes no exercise of the underwriters' option to purchase additional shares, unless otherwise noted.

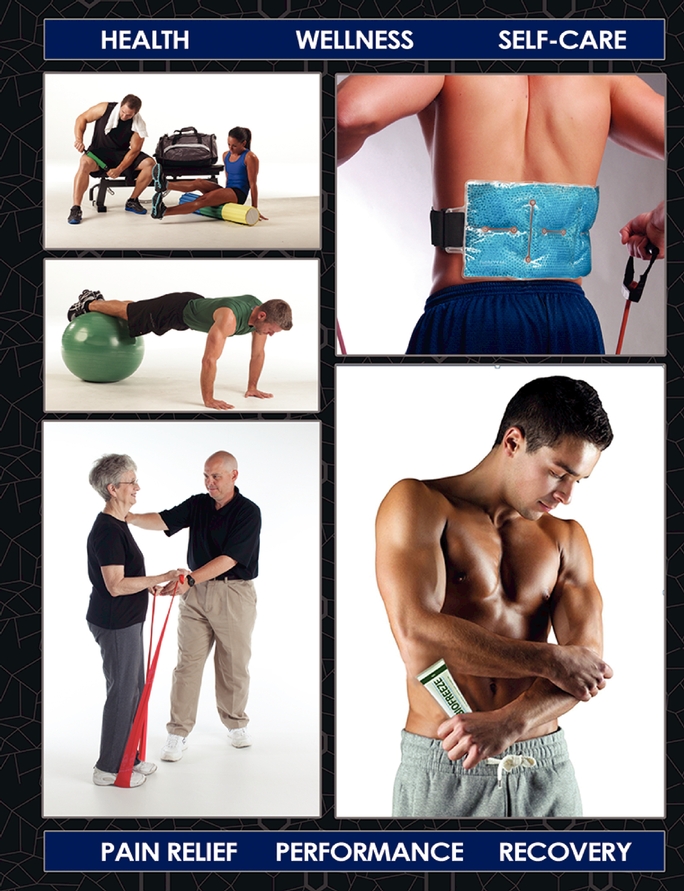

Our Company

Performance Health is a fast-growing, highly profitable, global consumer branded health, wellness and self-care company. Our products, distributed through clinical and retail channels both in the U.S. and internationally, help consumers accelerate recovery, relieve pain, increase strength, improve performance and enhance their quality of life. Hands-on healthcare practitioners trust and embrace our brands, as demonstrated by high in-clinic usage and recommendations to their patients and clients who in turn can purchase our products directly from their practitioner or at retail. This practitioner recommendation enhances our brands' visibility, credibility and loyalty among consumers and is an important competitive advantage that also drives retail demand. We believe the demand for our market leading brands, as well as the growth of our business, will continue to be supported by secular shifts in consumers' increasingly active lifestyles, an aging population and lower-cost self-care.

Source: Newton Report and, only with respect to information related to The Hygenic Corporation, Strategic Data Marketing.

(1) The market share data and brand rank for The Hygenic Corporation is specific to U.S. sales of its dental dam product.

Our brands address common health, wellness and self-care needs through a suite of practical products with nearly 100 years of heritage and protocols which are proven to deliver positive outcomes.

1

The breadth of our product offering is a competitive advantage, not only in scope, but also because our products are complementary to one another and commonly promoted and used in tandem to address specific health, wellness and self-care needs. We expect that practitioner preference and the interconnectedness of our products and market leading brands will continue to drive growth. We also expect to capitalize on the secular shift by consumers to preventative healthcare and lower-cost in-home care driven by an aging population that wants to maintain an active, healthy and independent lifestyle in the face of growing chronic conditions.

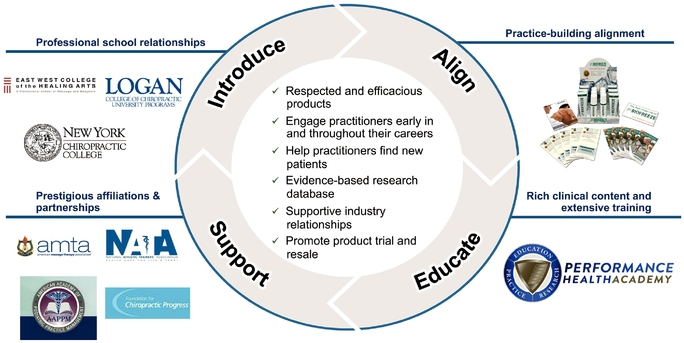

Our business centers on our unique engagement with the clinical community and the resulting preference for, and endorsement of, our brands and health, wellness and self-care solutions by hands-on healthcare practitioners. We engage with these practitioners by approaching them while they are students and provide them with career-long support such as practice-building tools, continuing education and the latest research. Consequently, we develop unique, symbiotic relationships that effectively align our brand building efforts with practitioners' focus on finding and retaining patients. They use our products in their practices, often endorsing them directly, and resell or dispense them to their patients, typically in tandem with a prescribed home regimen. Our strategic alignment with these hands-on healthcare practitioners serves as a true differentiator and creates a significant competitive advantage extending across our channels.

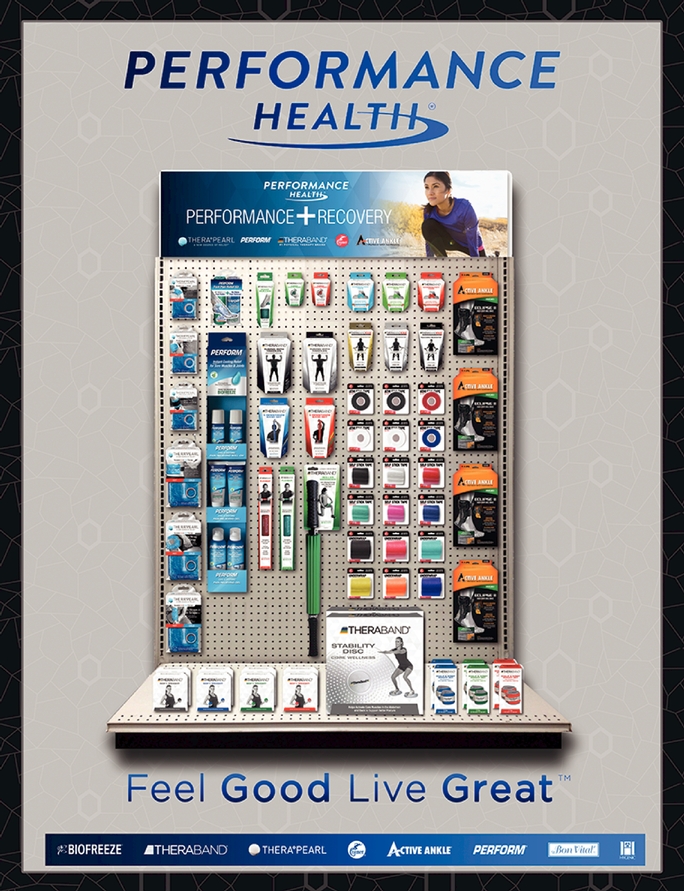

Consumers are frequently introduced to our brands and solutions in the course of treatment by hands-on healthcare practitioners and will use our products during and after treatment, frequently becoming advocates themselves. Consumers are also increasingly self-diagnosing and self-treating with respect to their health and wellness needs. As a result, our clinical brands enjoy growing consumer demand in retail channels because they are effective, affordable and practitioner recommended. Further, in the U.S. and internationally, our products also experience meaningful retail channel demand pull, as retailers are motivated to stock recognizable brands that are requested by consumers. Our retail strategies have developed as natural extensions of our strong position in the clinical channel, both in the U.S. and internationally. Currently, we distribute our products in over 53,000 North American retail locations both on an individual product basis and by offering brands together through multi-product packages and multi-brand in-store displays, as well as in 105 countries outside of the United States with significant room for further penetration. We expect to increase our U.S. retail and international market penetration through the introduction of additional brands and products into currently served channels and markets and entry into new channels and markets.

Within our specialty products offering that features the Hygenic brand, we leverage our competency with elastomeric formulation and processing to develop innovative custom solutions for leading dental, healthcare and industrial companies and believe that we have a leading market share in this business-to-business channel. The technological improvements that we develop within the specialty products offering continue as our intellectual property and are often applicable to new product development elsewhere in our platform.

We have a proven history of acquiring innovative consumer branded health, wellness and self-care businesses that complement our existing suite of products, protocols and solutions and integrating them into the Performance Health platform. We also leverage nearly a century of developing elastomeric and topical products to address needs not currently met in the market. We intend to continue developing, acquiring and delivering appropriate health, wellness and self-care products and solutions that can be synergistically combined with our existing solutions-based offerings and distributed through our U.S. clinical, U.S. retail, international and specialty products channels.

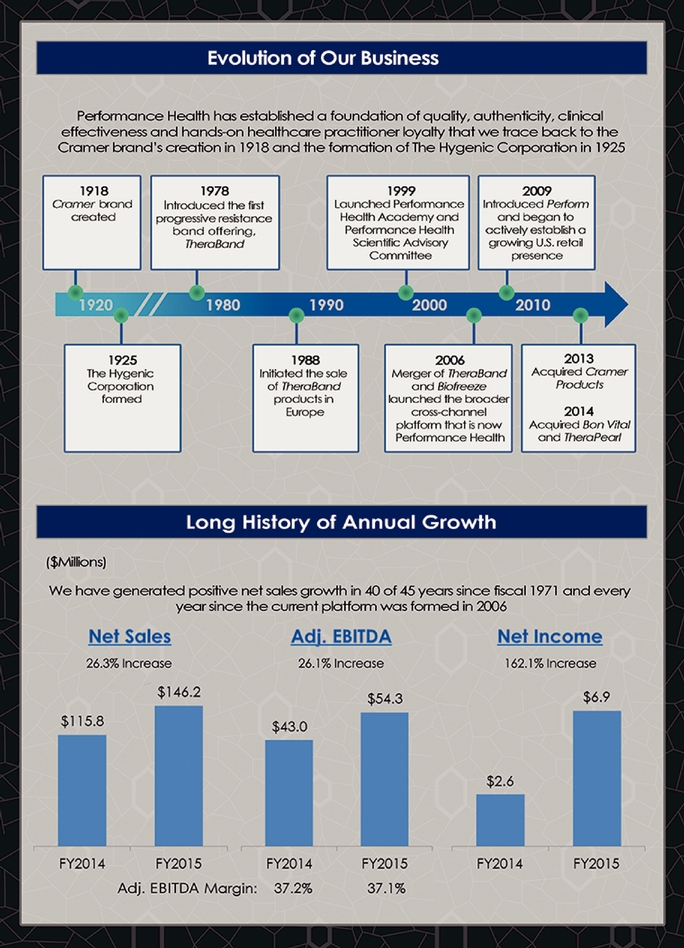

We have delivered strong financial results:

- •

- During fiscal 2015, we generated total net sales of $146.2 million, up from $115.8 million in fiscal 2014, representing a growth rate of 26.3% during the period. Net sales from acquisitions completed in fiscal 2015 and fiscal 2014 accounted for $22.0 million of the increase in net sales.

2

- •

- During fiscal 2015, we generated Adjusted EBITDA of $54.3 million, up from $43.0 million in fiscal 2014, representing a

growth rate of 26.1%, and we generated net income of $6.9 million, up from $2.6 million in fiscal 2014. During the first nine months of fiscal 2016, we generated Adjusted EBITDA of

$43.9 million, up from $42.1 million in the first nine months of fiscal 2015, representing a growth rate of 4.3%, and we generated net income of $5.7 million in the first nine

months of fiscal 2016, down from $8.6 million in the first nine months of fiscal 2015. Our net income during each of these periods was impacted by significant non-cash amortization and interest

expenses as a result of acquisitions and financings.

- •

- Our Adjusted EBITDA margins were 37.1% and 37.2% in fiscal 2015 and fiscal 2014, respectively. Our Adjusted EBITDA margins were 37.3%

and 38.3% in the first nine months of fiscal 2016 and first nine months of fiscal 2015, respectively.

- •

- During fiscal 2015, we generated Adjusted Net Income of $18.6 million, up from $10.6 million in fiscal 2014,

representing a growth rate of 74.8%. During the first nine months of fiscal 2016, we generated Adjusted Net Income of $12.8 million, down from $15.6 million in the first nine months of

fiscal 2015, representing a decrease of 18.0%.

- •

- We generated strong free cash flow conversion of 96.0% in fiscal 2015 and 97.5% in fiscal 2014. We generated strong free cash flow

conversion of 95.6% in the first nine months of fiscal 2016 and 96.0% in the first nine months of fiscal 2015.

- •

- We generated positive net sales growth in 40 of 45 years since fiscal 1971 and every year since the current platform was formed in 2006 following the acquisition of Biofreeze.

During the first nine months of fiscal 2016, we generated total net sales of $117.7 million, up from $109.9 million in the first nine months of fiscal 2015, representing a growth rate of 7.1% during the period. Net sales from acquisitions completed in fiscal 2015 accounted for $1.8 million of the increase in net sales.

Continuing net sales growth and strong Adjusted EBITDA margins and free cash flow conversion provide us with the flexibility to direct capital towards brand and business reinvestment, organic growth, acquisitions and deleveraging. We consider free cash flow conversion to be Adjusted EBITDA minus purchases of property, plant and equipment, divided by Adjusted EBITDA.

Industry Overview

We compete in segments of the global consumer health and wellness market that represent $472 billion of the total market, based on data from Euromonitor International. We believe that our portfolio of leading brands and innovative solutions is well-positioned to capture rising consumer demand for health and wellness products, driven by an increase in active lifestyles, an aging population base, increases in chronic conditions, the emergence of the middle class around the globe and evolving consumer preferences with respect to health and wellness.

- •

- Increasingly active lifestyles—Consumers of all ages are increasingly

adopting active lifestyles that promote long-term health and wellness. The percentage of adults meeting weekly aerobic activity target guidelines in the U.S. increased from 40% in 1998 to 52% in 2014,

according to data from the U.S. Centers for Disease Control and Prevention.

- •

- An aging population base—There is a continuing shift toward older

populations in developed markets worldwide. According to the U.S. Census, the population aged 65 and older in the U.S. alone is expected to increase from 43 million in 2012 to 73 million

by 2030.

- •

- Increases in chronic conditions—The aging population suffers a higher incidence of chronic conditions associated with recurring physical pain and constraints that require continual attention and management. As of 2015, an estimated 39% of Americans over the age of 65, as well as

3

- •

- Emergence of the middle class in developing nations—The rise in global

spending power has given consumers worldwide increased access to high-quality products and more leisure time. The Organisation for Economic Co-operation and Development ("OECD") predicts that the

global middle class will double between 2010 and 2020 and roughly triple by 2030, which we believe will drive growth of the consumer health and wellness category.

- •

- Evolving consumer preferences—Consumer demand for products that positively affect health and wellness is on the rise globally, as evidenced by the acceleration in growth of the consumer health and wellness category.

32% of Americans between the pages of 45 and 54, suffer from chronic conditions, according to a 2014 report from Kantar Health.

Driven by these secular trends, the growth rate of the global consumer health and wellness market is projected to accelerate from a 2010 - 2015 CAGR of 3.8% to a 2015 - 2019 CAGR of 5.0%, based on estimates of Euromonitor International. Our integrated platform has a broad suite of complementary products and solutions that are well positioned to capitalize on this growth.

Within the consumer health and wellness market, we operate in clinical and retail channels. In many of our product categories, both clinical and retail product markets remain fragmented, presenting attractive opportunities for an established platform to achieve continued organic and inorganic growth. Overall, we are less penetrated in the U.S. retail channel as compared to the clinical channel and thus have significant opportunities to leverage our brands' clinical positioning and preference to increase U.S. retail market share and grow our business. In the U.S. retail channel, we distribute our brands through retailers including food, drug and mass retailers ("FDM"), sporting goods retailers and specialty retailers. We expect the U.S. retail market for our products to continue steady growth, driven by the demographic trends described above.

Internationally, we have expanded our global footprint with presence in 105 countries outside of the United States, 45 of which we have entered since May 1, 2013, and we believe we have further opportunity to penetrate and grow. According to Euromonitor International, the international market for consumer health and wellness products has grown and is projected to grow at a faster rate than the U.S. market.

The U.S. clinical market is our most developed channel and consists of topical analgesic, therapy, sports medicine and professional massage therapy products, often marketed together, to hands-on healthcare practitioners and where we command high market shares. Our leading brands in the clinical channel expose our products and the Performance Health master brand to millions of consumers who trust the recommendations of their hands-on healthcare practitioners, use our products and subsequently drive demand in the retail channel. For instance, approximately 34 million U.S. adults seek chiropractic care each year with a similar number of individuals seeing massage therapists, according to reports from the Gallup-Palmer College of Chiropractic and the American Massage Therapy Association. Other types of practitioners, such as physical therapists, also treat a significant number of individuals that are exposed to our products. Consequently, our leading brands in the clinical channel continuously reinforce retail channel growth while creating a significant competitive advantage.

Evolution of Our Business

Performance Health has established a foundation of quality, authenticity, clinical effectiveness and hands-on healthcare practitioner loyalty that we trace back to the Cramer brand's creation in 1918 and the formation of The Hygenic Corporation, a dental rubber manufacturing enterprise that produced hard rubber used in the dental industry, in 1925.

4

- •

- In 1978, we introduced the first progressive resistance band offering, TheraBand,

pioneering the category and beginning our shift toward health, wellness and self-care products.

- •

- In 1988, we initiated the sale of TheraBand products in Europe through our first

international distributors. In 2009, we transitioned this formerly opportunistic initiative into a proactive, higher-growth and regionally-managed channel.

- •

- In 1999, we launched Performance Health Academy and Performance Health Scientific Advisory Committee to strengthen our position as a

leader in evidence-based research, outcomes and education.

- •

- In 2006, the merger of TheraBand and Biofreeze launched the broader cross-channel

platform that is now Performance Health.

- •

- In 2009, we introduced Perform and began to actively establish a growing U.S. retail

presence.

- •

- To further leverage the strengths of our synergistic health, wellness and self-care platform, we acquired Cramer Products in 2013 and Bon Vital and TheraPearl in 2014 to complement the ongoing organic innovation and channel reach of our brands.

Today, we have a portfolio of leading, complementary brands that are synonymous with the markets they serve and enjoy hands-on healthcare practitioner loyalty fostered by years of evidence-based research, education, protocols and practice-building support. Our strong foundation with a broad base of practitioners translates into clinical and retail growth, both in the U.S. and internationally, driven by consumer demand generated through practitioner preference and endorsement and retailers' desire to stock clinically proven products. We believe that our long-term commitment to investments in advancing patient care and supporting practitioners will continue to yield market leading applications, category-defining products, significant practitioner loyalty and brand adoption that will underpin our continued growth.

Our Competitive Strengths

We believe that the following strengths differentiate us from our competitors and will drive continued sales and profit growth:

Strong Practitioner Loyalty for our Leading Brands

Our widely recognized and established portfolio of complementary, market leading brands has years of proven clinical effectiveness, supported by deep loyalty among hands-on healthcare practitioners and consumers. For example, Biofreeze and TheraBand are both number one brands in their respective categories, each with over 70% Share and Unaided Awareness of 88% and 98%, respectively. Likewise, Bon Vital and Cramer each has the number two Share in their respective categories. Our leading market positions are the result of decades of practitioner engagement, which differentiates our brands from those of our competitors. In addition, we commonly promote multiple brands, as well as solution sets comprised of multiple brands, that address specific ailments to hands-on healthcare practitioners, further differentiating ourselves from mono-branded competitors. Moreover, the base of practitioner awareness and preference for our brands, combined with the proven efficacy of our products, creates a self-reinforcing cycle of product awareness, trial and referral by hands-on healthcare practitioners, who advocate for us while providing proven treatments. This practitioner validation promotes brand awareness and elevates trust among consumers, also generating demand pull from retailers in both international and domestic markets.

5

Product Alignment with Growing Consumer Needs

We are uniquely positioned at the intersection of branded consumer products and science-based health, with solutions that capitalize on significant long-term demographic and economic trends while addressing the full spectrum of lifestyle care across all ages, including exercise, performance, recovery, pain relief, rehabilitation and wellness. In the U.S., the population is increasingly focused on preventative healthcare and maintaining an active lifestyle. The natural aging process increases the incidence of chronic conditions such as back pain and arthritis, which are frequently accompanied by physical pain and lifestyle constraints. Such conditions require continual personal attention and management, generating demand among sufferers for convenient, cost-effective and proven solutions. Our products are "healthcare-lite" in that they capitalize on a growing consumer preference to satisfy healthcare needs without resorting to invasive surgical procedures or costly prescription medications, both of which can carry undesirable side effects.

Unique Multi-Channel Strategy

Our differentiated positioning, core clinical competency and preferred status among a growing population of domestic and international consumers enable us to bring our brands to market through multiple channels:

- •

- U.S. clinical—Our commercial and brand-building focus centers on the U.S.

clinical channel, where a large number of hands-on healthcare practitioners embrace and endorse our products through use in the course of treatments complemented by prescribed home regimens. Our

position in this market is enhanced by our in-house clinical marketing and education teams that engage practitioners by reaching them first while they are students and providing them with ongoing

support throughout their careers, including practice-building tools and the latest research. Consequently, this practitioner base has long tenured loyalty and enthusiasm for our brands that extends to

our consumers.

- •

- U.S. retail—Our strong position in the U.S. clinical channel generates

consumer awareness, trust and latent demand that drive growth in our U.S. retail channels, such as FDM, sporting goods and specialty retail. The extensive use of our products by hands-on healthcare

practitioners instills confidence in patients, who are also consumers, in the quality and clinical effectiveness of our products and generates retailer demand pull because our products are directly

requested by consumers. This dynamic creates an opportunity to drive our clinical brands throughout retail channels and has the added benefit of turning more consumers into brand advocates.

- •

- International—We have expanded into international retail and professional

markets through a growing global network of distributors as a result of the reputation of our brands as leading practitioner-recommended products in the U.S. We typically enter a new country with a

smaller number of products from a single brand, opening the opportunity for introduction of additional brands and products over time. Since May 1, 2013, we have entered 45 of the 105 countries

outside of the United States where we currently distribute. We believe we have significant room for further penetration across international markets as we continue to expand and deepen our

relationships in each of these countries, in part because our entire brand portfolio is not sold in every international market where we have a presence with one or several of our brands.

- •

- Specialty Products—Specialty Products is a business-to-business channel providing customized solutions for leading dental, healthcare and industrial companies that have been our customers for decades and shares common products and distributors within our U.S. clinical channel.

6

Proven Innovation Capabilities

Our product development capabilities have enabled our success in innovating into new and adjacent products, channels and end-user markets. Due to our unique engagement with hands-on healthcare practitioners and consumers, we gain insights that help us develop relevant new products. Our product development function is organized to find and address new and adjacent needs and to continuously improve upon our existing products. The engineering requirements and formulations necessary to develop and produce many of our products are highly-specialized and cannot be easily replicated by our competitors. Our contributions to the field of health, wellness and self-care include category-defining products under the Biofreeze, TheraBand, TheraPearl, Cramer and Hygenic brands. As of January 31, 2016, our patent portfolio consisted of 103 secured and 55 pending patents.

Efficient Manufacturer Supported by a Flexible Global Supply Chain

Leveraging over 90 years of manufacturing experience, Performance Health has developed efficient, low-cost manufacturing processes. We are a market leader in the custom manufacturing of highly engineered natural rubber, latex, polyisoprene and thermoplastic elastomeric components and have developed a core competency around manufacturing custom-formulated products with strict technical and quality specifications. When a product requires significant technical expertise to produce, such as specialty products and TheraBand, we are able to rely on our robust in-house capabilities. We optimize our cost structure by balancing in-house manufacturing with high quality, low cost third-party manufacturers based on volume, material inputs and technological complexity. Our flexible, asset-lite supply chain translates into a global, lean operational footprint that generates strong free cash flow conversion.

Consistent History of Strong Financial Performance and Free Cash Flow Conversion

We have delivered consistent sales growth and a highly-visible sales stream with approximately 90% of our net sales in fiscal 2015 attributable to single-use or single-consumer-use products, based on management's estimates. Our attractive Adjusted EBITDA margins (37.1% in fiscal 2015) are achieved through strong brands that often yield premium pricing and the ability to deliver annual price increases. Our Adjusted EBITDA margins, sales growth and low capital expenditures result in significant annual free cash flow conversion. In fiscal 2015, we achieved free cash flow conversion of 96.0%. This substantial free cash flow generation enables us to make meaningful investments in brands, personnel and product development to drive future growth and margin enhancement, acquire attractive businesses and pay down debt.

Experienced Management Team with Demonstrated Track Record

Our management team, led by Marshall Dahneke, our Chief Executive Officer, Rocco Mango, our President and Chief Operating Officer, and Scott Emerick, our Chief Financial Officer, has significant experience leading businesses in the health, wellness and self-care and manufacturing industries. Messrs. Dahneke, Mango and Emerick have a combined 80 years of relevant industry experience, and Messrs. Dahneke and Mango have helped build our strategy and platform, which has resulted in strong financial results and a significant global growth opportunity.

Our Growth Strategy

We believe significant incremental growth potential exists in cross-selling complementary brands across multiple sales channels, creating system solutions from our multi-brand offering and leveraging our competitive strengths. In addition, we see attractive opportunities to grow through new product offerings, international expansion and strategic acquisitions.

7

Cross-Sell Leading Brands through Multi-channel Capabilities

We believe we can significantly grow our business by cross-selling our current product platform through multiple channels. We have developed deep relationships with hands-on healthcare practitioners and our brands' Shares and Unaided Awareness reflect our investment in these relationships. The brand loyalty that our consumers develop creates demand for our products at retail. To capitalize on this latent demand, we have built a strong U.S. retail channel team and meaningfully expanded our distribution within this channel. Our products are currently available in over 53,000 North American retail locations. We believe that our retail sales will continue to grow as we introduce and actively drive our full product portfolio into this channel, emphasizing multi-brand in-store displays and multi-product packages under the Performance Health master brand, while continuing to add new retail customers. We have similarly invested in building a strong international distributor management team and have expanded our global footprint with distributors in 105 countries outside of the United States, 45 of which we have entered since May 1, 2013 and where we believe we have further opportunity to grow. Similar to our U.S. retail channel, we believe we enjoy attractive growth potential internationally as we introduce and cross-sell our entire brand portfolio across this network, especially in those countries we recently entered. Further, we expect the success of these cross-selling strategies will continue to be bolstered by the ongoing strength and growth of our U.S. clinical channel.

Expand Our Solutions-based Approach

We promote a solutions-based approach, focused on leveraging our products with clear usage protocols backed by evidence-based research to address specific, common health, wellness and self-care needs. We have historically done so as a mono-brand and then a duo-brand company. With the recent additions of Cramer, Bon Vital and TheraPearl, we are now pursuing opportunities to elevate the effectiveness of our solutions by using multiple brands in concert to achieve more holistic, broader, system solutions. As we continue to develop and expand our platform, we expect to more fully address common needs by offering additional multi-brand solution sets. We intend to leverage our clinical competencies of education and evidence-based research to give practitioners the protocols necessary to implement broader system solutions involving multiple Performance Health brands. This strategy further strengthens practitioner and consumer satisfaction with our products, increases awareness and drives growth across the entire portfolio. This growth strategy also strengthens and unites a platform that can readily integrate additional brands, further differentiating us from our mono-branded competitors.

One multi-brand, system-solution approach can be illustrated by examining how a range of our products combined with protocols can be used to more comprehensively treat low back pain. Back pain is the second most frequent medical complaint in the U.S. with lifetime prevalence of 80% and a one-year prevalence rate of 15% - 20%, which is predominantly comprised of low back pain.

8

Illustrative example: low back pain system solution

A typical consumer will not achieve their desired outcome without clear and easily accessible protocols. We are developing these system offerings and protocols to support a multi-brand solutions-based approach, delivered to consumers via practitioners, web apps, videos and booklets.

Accelerate Growth through Continued Innovation

We have an established history of driving growth through pioneering new categories and next generation products, capitalizing on new trends and introducing innovative product extensions under our brands. Our product development organization has enabled us to innovate into new and adjacent products and end-user markets. To fulfill its mandate of identifying and addressing needs that are not sufficiently satisfied in the market today, our product development team oversees a multi-stage screening process that assesses and prioritizes new ideas, whether originating inside or outside of the company. Then the team interviews customers and users, reviews the competitive landscape, develops prototypes and solicits additional feedback prior to commercialization. We will continue to leverage our product development capabilities to develop and expand our product offerings and categories in ways that provide next-generation solutions addressing unmet needs of consumers.

Expand Global Footprint to Grow Internationally

We believe that expanding and deepening our international footprint will continue to be a growth engine, both through expansion into new countries and further penetrating established and recently entered markets. The credibility of our clinical brands enables international expansion, as overseas professionals want to use, and retailers seek to stock, the leading U.S. clinically endorsed brands. The accelerating pace of our international expansion is indicative of our brands' powerful draw. Since May 1, 2013, we have entered 45 of the 105 countries outside of the United States where we currently sell our products. We have likewise grown and strengthened our international sales team that effectively drives growth through our international distributors. In our existing international markets, there is significant opportunity to introduce additional brands and begin implementing both solutions-based and multi-channel strategies.

Pursue Strategic Acquisitions

We have a proven track record of acquiring and integrating new synergistic brands into our offering platform. Having acquired Cramer, Bon Vital and TheraPearl in the last two years, we are now more frequently approached as a potential acquirer of businesses and products in the health, wellness

9

and self-care industry, and we maintain a robust pipeline of future acquisition opportunities. Our acquisition focus remains on companies in adjacent product categories that can benefit from the strength of our multi-channel network. We have historically used our cash flow to fund the opportunities we source. Given the number of available opportunities, we approach acquisitions selectively, seeking out companies with strong brand recognition and clear alignment with our platform, yielding attractive cross-selling potential. Management has built a replicable acquisition strategy by accelerating product roll-out through our existing clinical practitioners, retail channels and international and specialty products network that we believe will continue to support growth in the future.

Risk Factors

An investment in our common stock involves risk. Any of the factors set forth under "Risk Factors" may limit our ability to successfully execute our business strategy. You should carefully consider all of the information set forth in this prospectus and, in particular, you should evaluate the specific factors set forth under "Risk Factors" in deciding whether to invest in our common stock. Among these important risks are the following:

- •

- We may not be successful in implementing or maintaining our business strategies;

- •

- We may fail to maintain our brands and relationships with hands-on healthcare practitioners, who are not contractually obligated to

use or endorse our products and therefore are under no continuing obligation to do so, or fail to cultivate new relationships with new hands-on healthcare practitioners;

- •

- We are exposed to commodity price volatility, particularly with respect to the price of latex, menthol and polyisoprene;

- •

- We may not be successful in developing and marketing new products or product enhancements or finding new applications for our existing

products, which could impair our growth plans;

- •

- We depend on arrangements with independent third-party distributors from which we derive a substantial portion of our net sales, and

in certain circumstances, the loss of such an arrangement could adversely affect our net sales and our ability to have our products delivered to hands-on healthcare practitioners;

- •

- We have identified control deficiencies that constitute a material weakness in our internal control over financial reporting;

- •

- Due to our high level of indebtedness, we may have difficulty satisfying our obligations, which may place us at a competitive

disadvantage;

- •

- We are subject to risks of doing business internationally;

- •

- Our Sponsor owns a substantial portion of our outstanding equity and its interests may not always coincide with the interests of our

other stockholders; and

- •

- Our business plan relies on assumptions concerning demographic and other trends, which if incorrect could adversely affect our business plan and results of operations.

Our Sponsor

Gridiron Capital, LLC ("Gridiron Capital," "Gridiron" or our "Sponsor") is a private equity firm focused on investing in and growing leading companies that have significant opportunities for market expansion. The firm's principals combine a long track record of investing with executive and operating management experience and a personal history of working in family-owned and -operated businesses. Utilizing this experience, Gridiron focuses on creating long-term sustainable value in each of its companies by working in collaboration with its companies' management teams to establish a shared

10

vision and execute on specific strategies. With more than a dozen investment professionals, Gridiron manages over a billion dollars of committed capital. Gridiron Capital seeks to make control investments in consumer products, services and niche manufacturing companies. Gridiron Capital is based in New Canaan, Connecticut. Immediately following the completion of this offering, PHW Equity Investors, L.P., whose voting and investment decisions are controlled by entities affiliated with our Sponsor, will own approximately % of our outstanding common stock, or % if the underwriters' option to purchase additional shares of common stock is exercised in full. Three of our directors, Messrs. Burger, Jr., Conese, Jr. and Jackson are affiliated with our Sponsor.

Corporate Information

We are a Delaware corporation that was incorporated in October 2012 in connection with our Sponsor's acquisition of our business. Our principal executive offices are located at 1245 Home Ave., Akron, Ohio 44310. Our telephone number is (330) 633-8460 and our website can be found at http://www.performancehealth.com. The information on, or that can be accessed through, our website is not part of this prospectus, and you should not rely on any such information in making the decision whether to purchase our common stock.

Implications of Being an Emerging Growth Company

As a company with less than $1.0 billion in revenue during our most recently completed fiscal year, we qualify as an "emerging growth company" as defined in Section 2(a) of the Securities Act of 1933, as amended (the "Securities Act"), as modified by the Jumpstart Our Business Startups Act of 2012 (the "JOBS Act"). As an emerging growth company, we may take advantage of exemptions from disclosure and other requirements that are otherwise applicable generally to public companies that are not emerging growth companies. These provisions include:

- •

- Reduced disclosure about our executive compensation arrangements;

- •

- Presentation of only two years of audited financial statements, in addition to any required unaudited interim financial statements,

with correspondingly reduced "Management's Discussion and Analysis of Financial Condition and Results of Operations" disclosure in this prospectus;

- •

- No non-binding shareholder advisory votes on executive compensation or golden parachute arrangements; and

- •

- Exemption from the auditor attestation requirement in the assessment of our internal control over financial reporting.

We may take advantage of these exemptions for up to five years or such earlier time that we are no longer an emerging growth company. We would cease to be an emerging growth company if we (1) have more than $1.0 billion in annual revenues as of the end of our fiscal year, (2) are a large accelerated filer and have more than $700.0 million in market value of our stock held by non-affiliates as of the end of our second fiscal quarter or (3) issue more than $1.0 billion of non-convertible debt over a three-year period. We may choose to take advantage of some but not all of these reduced disclosure obligations. We have taken advantage of reduced disclosure regarding executive compensation arrangements in this prospectus, and we may choose to take advantage of some but not all of these reduced disclosure obligations in future filings. If we do, the information that we provide stockholders may be different than you might get from other public companies in which you hold stock.

The JOBS Act permits an emerging growth company such as us to take advantage of an extended transition period to comply with new or revised accounting standards applicable to public companies. We are choosing to "opt out" of this provision and, as a result, we will comply with new or revised accounting standards as required when they are adopted. This decision to opt out of the extended transition period under the JOBS Act is irrevocable.

11

Common stock offered by us |

shares (or shares if the underwriters exercise their option to purchase additional shares in full). | |

Common stock to be outstanding immediately after completion of this offering |

shares (or shares if the underwriters exercise their option to purchase additional shares in full). |

|

Underwriters' option to purchase additional shares |

We have granted the underwriters a 30-day option to purchase an additional shares. |

|

Use of proceeds |

We expect to receive net proceeds, after deducting estimated offering expenses and underwriting discounts and commissions, of approximately $ million, based on an assumed offering price of $ per share (the midpoint of the range set forth on the cover of this prospectus). We intend to use the net proceeds from this offering to repay some or all of the outstanding principal on the term loan under our Second Lien Credit Facility, plus accrued interest thereon. See "Use of Proceeds." |

|

Dividend policy |

Our board of directors does not currently intend to pay regular dividends on our common stock. See "Dividend Policy." |

|

Listing |

We have applied to have our common stock listed on the NASDAQ Global Market under the symbol "PHC." |

|

Risk factors |

You should read carefully the "Risk Factors" section of this prospectus for a discussion of factors that you should consider before deciding to invest in shares of our common stock. |

References in this section to number of shares of common stock to be issued and outstanding after this offering is based on shares issued and outstanding as of , 2016, and excludes:

- •

- shares of common stock issuable upon the exercise of outstanding stock options at a weighted average

exercise price of

$ per share (of which shares are issuable upon the exercise

of vested stock options) as of , 2016; and

- •

- shares of common stock reserved for issuance, and not subject to outstanding options, under the 2012 Option Plan and the 2016 Omnibus Incentive Plan as of , 2016.

Except as otherwise indicated, all information in this prospectus:

- •

- assumes the automatic conversion of our all of our non-voting common stock into an equal number of shares of voting common stock in

connection with the completion of this offering;

- •

- assumes no exercise of the underwriters' option to purchase additional shares; and

- •

- assumes an initial public offering price of $ per share (the midpoint of the range set forth on the cover of this prospectus).

12

Summary Consolidated Financial Information and Other Data

The following table sets forth our summary historical financial information and other data as of the dates and for the periods indicated. The summary historical financial information as of and for the years ended April 30, 2015 and 2014 presented in this table have been derived from our audited consolidated financial statements included elsewhere in this prospectus, and the summary historical financial information as of and for the nine months ended January 31, 2016 and January 31, 2015 are derived from our unaudited condensed consolidated financial statements appearing elsewhere in this prospectus. Historical results are not necessarily indicative of the results to be expected for future periods and operating results for the nine months ended January 31, 2016 are not necessarily indicative of the results that may be expected for the fiscal year ending April 30, 2016.

This summary consolidated financial information and other data should be read in conjunction with the disclosures in "Capitalization" and "Management's Discussion and Analysis of Financial Condition and Results of Operations" and the audited consolidated financial statements and the related notes thereto appearing elsewhere in this prospectus.

| |

For the nine months ended January 31, |

For the year ended April 30, |

|||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

2016 | 2015 | 2015 | 2014 | |||||||||

| |

(dollars in thousands, except per share data) |

||||||||||||

Consolidated Statements of Operations Data |

|||||||||||||

Net sales |

$ | 117,675 | $ | 109,878 | $ | 146,194 | $ | 115,762 | |||||

Cost of products sold |

46,763 | 45,662 | 61,269 | 49,773 | |||||||||

| | | | | | | | | | | | | | |

Gross profit |

70,912 | 64,216 | 84,925 | 65,989 | |||||||||

Selling, general and administrative expenses |

39,675 |

35,270 |

50,733 |

39,578 |

|||||||||

| | | | | | | | | | | | | | |

Income from operations |

31,237 | 28,946 | 34,192 | 26,411 | |||||||||

Other income (expense): |

|||||||||||||

Interest expense, net |

(22,382 | ) | (14,373 | ) | (20,739 | ) | (20,179 | ) | |||||

Extinguishment of long-term debt |

— | — | (1,034 | ) | (1,664 | ) | |||||||

Bargain purchase gain |

— | — | — | 2,315 | |||||||||

Other, net |

27 | — | (170 | ) | (708 | ) | |||||||

| | | | | | | | | | | | | | |

Total other income (expense) |

(22,355 | ) | (14,373 | ) | (21,943 | ) | (20,236 | ) | |||||

| | | | | | | | | | | | | | |

Income before income taxes |

8,882 | 14,573 | 12,249 | 6,175 | |||||||||

Provision for income taxes |

3,191 |

5,930 |

5,359 |

3,546 |

|||||||||

| | | | | | | | | | | | | | |

Net income |

$ | 5,691 | $ | 8,643 | $ | 6,890 | $ | 2,629 | |||||

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

Per share information: |

|||||||||||||

Net income per share: |

|||||||||||||

Basic |

$ | 4.23 | $ | 6.43 | $ | 5.12 | $ | 1.97 | |||||

Diluted |

$ | 4.18 | $ | 6.41 | $ | 5.10 | $ | 1.97 | |||||

Weighted average shares outstanding: |

|||||||||||||

Basic |

1,345,058 | 1,344,621 | 1,344,749 | 1,337,220 | |||||||||

Diluted |

1,362,602 | 1,347,733 | 1,351,572 | 1,337,220 | |||||||||

Pro forma net income per share unaudited:(1) |

|||||||||||||

Basic |

$ | $ | $ | $ | |||||||||

Diluted |

$ | $ | $ | $ | |||||||||

Pro forma weighted average shares outstanding unaudited:(1) |

|||||||||||||

Basic |

|||||||||||||

Diluted |

|||||||||||||

13

| |

For the nine months ended January 31, |

For the year ended April 30, |

|||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

2016 | 2015 | 2015 | 2014 | |||||||||

| |

(dollars in thousands) |

||||||||||||

Other financial data: |

|||||||||||||

Cash flows from: |

|||||||||||||

Operating activities |

$ | 10,245 | $ | 18,424 | $ | 21,535 | $ | 15,399 | |||||

Investing activities |

(3,181 | ) | (19,817 | ) | (20,601 | ) | (22,269 | ) | |||||

Financing activities |

(2,911 | ) | 6,673 | 1,065 | 5,657 | ||||||||

Depreciation and amortization |

8,977 | 9,647 | 12,868 | 11,861 | |||||||||

Capital expenditures(2) |

1,946 | 1,696 | 2,151 | 1,070 | |||||||||

EBITDA(3) |

$ |

40,241 |

$ |

38,593 |

$ |

45,856 |

$ |

38,215 |

|||||

Adjusted EBITDA(3) |

$ | 43,882 | $ | 42,077 | $ | 54,255 | $ | 43,029 | |||||

Adjusted Net Income(3) |

$ | 12,820 | $ | 15,635 | $ | 18,576 | $ | 10,628 | |||||

| |

|

As of April 30, | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| |

As of January 31, 2016 |

|||||||||

| |

2015 | 2014 | ||||||||

| |

(dollars in thousands) |

|||||||||

Consolidated balance sheet data: |

||||||||||

Cash and cash equivalents |

$ | 8,525 | $ | 4,524 | $ | 2,764 | ||||

Net working capital(4) |

40,392 | 35,003 | 31,188 | |||||||

Goodwill and intangible assets |

371,220 | 377,750 | 369,831 | |||||||

Property, plant and equipment, net |

12,151 | 11,663 | 12,604 | |||||||

Total assets |

448,577 | 443,194 | 428,894 | |||||||

Total debt |

382,265 | 383,542 | 243,964 | |||||||

Total stockholders' equity and redeemable common stock |

8,417 | 4,094 | 130,447 | |||||||

- (1)

- In

accordance with SEC Staff Accounting Bulletin Topic 1.B.3, pro forma weighted average share and

per share data are presented to give effect to the pro forma earnings per share impact of the distribution in February 2015, which was in excess of our net income for fiscal 2015.

- (2)

- Capital

expenditures exclude purchases of software and other capitalized expenses related to our ERP implementation of $1.4 million and

$0.7 million in fiscal 2015 and fiscal 2014, respectively, and $1.2 million for the nine months ended January 31, 2016.

- (3)

- EBITDA

represents net income before interest expense, provision for income taxes, depreciation and amortization. Adjusted EBITDA represents net income

before interest expense, provision for income taxes, depreciation, amortization and certain items that we do not consider representative of our ongoing operating performance. Adjusted Net Income

represents net income adjusted for certain items, which may be recurring, that we do not consider representative of our ongoing operating performance.

EBITDA, Adjusted EBITDA and Adjusted Net Income as presented in this prospectus are supplemental measures of our performance that are neither required by, nor presented in accordance with generally accepted accounting principles ("GAAP"). EBITDA, Adjusted EBITDA and Adjusted Net Income are not measurements of our financial performance under GAAP and should not be considered as alternatives to net income or any other performance measures derived in accordance with GAAP or as alternatives to cash flow from operating activities as a measure of our liquidity. In addition, in evaluating EBITDA, Adjusted EBITDA and Adjusted Net Income, you should be aware that in the future we will incur expenses or charges such as those added back to calculate EBITDA, Adjusted EBITDA and Adjusted Net Income. Our presentation of EBITDA,

14

Adjusted EBITDA and Adjusted Net Income should not be construed as an inference that our future results will be unaffected by these or other unusual or nonrecurring items.

EBITDA, Adjusted EBITDA and Adjusted Net Income have limitations as analytical tools, and you should not consider them in isolation, or as substitutes for analysis of our results as reported under GAAP, in particular, in the case of EBITDA and Adjusted EBITDA (i) they do not reflect our capital expenditures, future requirements for capital expenditures or contractual commitments, (ii) they do not reflect changes in, or cash requirements for, our working capital needs, (iii) they do not reflect the interest expense, or the cash requirements necessary to service interest or principal payments, on our debt, (iv) although depreciation and amortization are non-cash charges, the assets being depreciated and amortized will often have to be replaced in the future, and EBITDA and Adjusted EBITDA do not reflect any cash requirements for such replacements, (v) they do not adjust for all non-cash income or expense items that are reflected in our statements of cash flows, (vi) they do not reflect the impact of earnings or charges resulting from matters we consider not to be indicative of our ongoing operations and (vii) other companies in our industry may calculate these measures differently than we do, limiting their usefulness as comparative measures. In the case of Adjusted Net Income, this measure does not give effect to certain costs that we believe are not representative of our ongoing operating performance, but which may be recurring.

We compensate for these limitations by providing specific information regarding the GAAP amounts excluded from such non-GAAP financial measures. We further compensate for the limitations in our use of non-GAAP financial measures by presenting comparable GAAP measures prominently.

We believe EBITDA, Adjusted EBITDA and Adjusted Net Income facilitate operating performance comparisons from period to period by isolating the effects of some items that vary from period to period without any correlation to core operating performance or that vary widely among similar companies. Specifically, our senior secured credit facilities contain financial ratio conditions that use Adjusted EBITDA as a measure of our financial health. We also present EBITDA, Adjusted EBITDA and Adjusted Net Income because (i) we believe these measures are frequently used by securities analysts, investors and other interested parties to evaluate companies in our industry and (ii) we use EBITDA, Adjusted EBITDA and Adjusted Net Income internally as benchmarks to evaluate our operating performance or compare our performance to that of our competitors.

In the tables below, we have provided a reconciliation of EBITDA, Adjusted EBITDA and Adjusted Net Income to our net income, the most directly comparable financial measure calculated and presented in accordance with GAAP. EBITDA, Adjusted EBITDA and Adjusted Net Income should not be considered as an alternative to net income or any other measure of financial performance calculated and presented in accordance with GAAP. Our EBITDA, Adjusted EBITDA and Adjusted Net Income may not be comparable to similarly titled measures of other organizations because other organizations may not calculate EBITDA, Adjusted EBITDA and Adjusted Net Income in the same manner as we do.

15

The following table provides a reconciliation of EBITDA and Adjusted EBITDA to our net income for the periods presented.

| |

For the nine months ended January 31, |

For the year ended April 30, |

|||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

2016 | 2015 | 2015 | 2014 | |||||||||

| |

(dollars in thousands) |

||||||||||||

Net income |

$ | 5,691 | $ | 8,643 | $ | 6,890 | $ | 2,629 | |||||

Depreciation and amortization |

8,977 | 9,647 | 12,868 | 11,861 | |||||||||

Interest expense, net |

22,382 | 14,373 | 20,739 | 20,179 | |||||||||

Income taxes |

3,191 | 5,930 | 5,359 | 3,546 | |||||||||

| | | | | | | | | | | | | | |

EBITDA |

40,241 | 38,593 | 45,856 | 38,215 | |||||||||

Acquisition related costs(a) |

68 |

2,150 |

2,177 |

2,573 |

|||||||||

Costs associated with proposed initial public offering(b) |

2,042 | 198 | 585 | — | |||||||||

Bargain purchase gain(c) |

— | — | — | (2,315 | ) | ||||||||

Debt refinancing(d) |

— | — | 2,941 | 1,835 | |||||||||

Stock-based compensation(e) |

514 | 118 | 1,341 | 356 | |||||||||

Management fee and reimbursed expenses(f) |

823 | 864 | 1,119 | 1,052 | |||||||||

Other(g) |

194 | 154 | 236 | 1,313 | |||||||||

| | | | | | | | | | | | | | |

Adjusted EBITDA |

$ | 43,882 | $ | 42,077 | $ | 54,255 | $ | 43,029 | |||||

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

- (a)

- In

connection with our acquisitions, we incurred acquisition-related costs consisting of: investment banking, legal and other professional services costs;

the recording of non-cash fair value adjustments associated with acquisition accounting; the disposal of property, plant and equipment and associated disposal costs; and costs associated with the

write-off of non-operating assets.

- (b)

- Represents

costs associated with this offering. These consisted mainly of legal, accounting and other professional advisory services costs.

- (c)

- During

fiscal 2014, we recognized a bargain purchase gain of $2.3 million related to our acquisition of Cramer Products, Inc.

- (d)

- Includes

expenses associated with our debt refinancings and modifications during fiscal 2015 and fiscal 2014, including our loss upon the extinguishment of

debt of $1.0 million and $1.7 million during the respective periods.

- (e)

- Represents

the non-cash charge attributable to our stock-based compensation expense.

- (f)

- Pursuant

to our management agreement with Gridiron Capital, LLC for advisory, transaction and oversight services, we are required to pay an annual

advisory fee and reimburse Gridiron Capital, LLC for its out-of-pocket expenses. In addition, we are obligated to pay a transaction fee related to the consummation of a material financing or

business acquisition. This agreement will terminate upon the completion of this offering.

- (g)

- Represents certain non-recurring and unusual or non-operational losses primarily related to non-consummated acquisition costs, costs associated with the ongoing liquidation of a German subsidiary, facility reorganization and software write-off.

16

The following table provides a reconciliation of Adjusted Net Income to our net income for the periods presented.

| |

For the nine months ended January 31, |

For the year ended April 30, |

|||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

2016 | 2015 | 2015 | 2014 | |||||||||

| |

(dollars in thousands) |

||||||||||||

Net income |

$ | 5,691 | $ | 8,643 | $ | 6,890 | $ | 2,629 | |||||

Acquisition related costs(a) |

68 | 2,150 | 2,177 | 2,573 | |||||||||

Costs associated with proposed initial public offering(b) |

2,042 | 198 | 585 | — | |||||||||

Bargain purchase gain(c) |

— | — | — | (2,315 | ) | ||||||||

Debt refinancing(d) |

— | — | 2,941 | 1,835 | |||||||||

Stock-based compensation(e) |

514 | 118 | 1,341 | 356 | |||||||||

Management fee and reimbursed expenses(f) |

823 | 864 | 1,119 | 1,052 | |||||||||

Amortization expense(g) |

7,765 | 7,703 | 10,297 | 9,373 | |||||||||

Other(h) |

194 | 154 | 236 | 1,313 | |||||||||

Tax impact of adjustments to net income(i) |

(4,277 | ) | (4,195 | ) | (7,010 | ) | (6,188 | ) | |||||

| | | | | | | | | | | | | | |

Adjusted Net Income |

$ | 12,820 | $ | 15,635 | $ | 18,576 | $ | 10,628 | |||||

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

- (a)

- In

connection with our acquisitions, we incurred acquisition-related costs consisting of: investment banking, legal and other professional services costs;

the recording of non-cash fair value adjustments associated with acquisition accounting; the disposal of property, plant and equipment and associated disposal costs; and costs associated with the

write-off of non-operating assets.

- (b)

- Represents

costs associated with this offering. These consisted mainly of legal, accounting and other professional advisory services costs.

- (c)

- During

fiscal 2014, we recognized a bargain purchase gain of $2.3 million related to our acquisition of Cramer Products, Inc.

- (d)

- Includes

expenses associated with our debt refinancings and modifications during fiscal 2015 and fiscal 2014, including our loss upon the extinguishment of

debt of $1.0 million and $1.7 million during the respective periods.

- (e)

- Represents

the non-cash charge attributable to our stock-based compensation expense.

- (f)

- Pursuant

to our management agreement with Gridiron Capital, LLC for advisory, transaction and oversight services, we are required to pay an annual

advisory fee and reimburse Gridiron Capital, LLC for its out-of-pocket expenses. In addition, we are obligated to pay a transaction fee related to the consummation of a material financing or

business acquisition. This agreement will terminate upon the completion of this offering.

- (g)

- Represents

non-cash amortization charges primarily related to finite-lived intangible assets from our acquisitions.

- (h)

- Represents

certain non-recurring and unusual or non-operational losses primarily related to non-consummated acquisition costs, costs associated with the

ongoing liquidation of a German subsidiary, facility reorganization and software write-off.

- (i)

- Represents the tax impact on adjustments to net income using a tax rate of 37.5%, as applicable.

- (4)

- Net working capital is calculated as current assets (other than cash and cash equivalents) minus current liabilities (other than debt).

17

An investment in our common stock involves various risks. You should carefully consider the following risks and all of the other information contained in this prospectus before investing in our common stock. The risks described below are those which we believe are the material risks that we face. Additional risks not presently known to us or which we currently consider immaterial may also adversely affect our company. Our results of operations, cash flows, financial condition and liquidity could be materially adversely affected by any of these risks. The market or trading price of our common stock could decline due to any of these risks, and you may lose part or all of your investment in our common stock.

Risks Related to Our Business and Industry

If we cannot successfully implement or maintain our business strategies, our business and results of operations will be adversely affected.

We may not be able to successfully implement our business strategies. Our business strategies involve many components including increasing our net sales by introducing new products, finding new applications for our existing products, educating hands-on healthcare practitioners about the clinical benefits of our products and the manner in which they may be used and thereby increasing the number of hands-on healthcare practitioners that use and recommend our products during the course of treatment and expanding the number of retail locations in which our products are sold. We may not be able to successfully implement or maintain any of these strategies. A significant turnover in our existing sales force, our inability to recruit and train additional qualified members of our sales force, or our inability to find dependable third-party distributors for our products would severely impair our ability to implement these strategies. Moreover, even if we successfully implement our business strategies, our operating results may not improve. Also, we may decide to alter or discontinue aspects of our business strategy and may adopt different strategies due to business or competitive factors or factors not currently foreseen, such as the introduction of new products by our competitors or new technologies that would make our products less marketable or even obsolete. Any such failure may adversely affect our business and results of operations.

We rely heavily on our brands and relationships with hands-on healthcare practitioners who use our products in clinics and recommend them to their patients, and our failure to maintain these brands and relationships and cultivate new relationships with new practitioners could adversely affect our business.

We have developed and maintain close relationships with a number of hands-on healthcare practitioners, and we believe that net sales of our products depend significantly on their use and recommendation of our products in the course of providing treatment. Any failure to maintain these relationships or to develop similar relationships with other hands-on healthcare practitioners, such as through engagement with students or providing marketing tools, could result in a decrease in the use and recommendation of our products, particularly because hands-on healthcare practitioners are not contractually obligated to use or endorse our products and are therefore under no continuing obligation to do so.

Developing and maintaining our brands, including our Performance Health master brand, is critical to our success. Because consumers and hands-on healthcare practitioners are under no obligation to purchase our products, our success is directly dependent on the perception of our Performance Health master brand and our individual brands by consumers and hands-on health-care practitioners, and this is likely to become of even greater importance as competitors offer more products similar to ours.

The success of our brands may suffer if our marketing plans or product initiatives do not have the desired impact on our brands' image or its ability to attract customers. Further, the value of our brands could diminish significantly due to a number of factors, including perceptions by consumers and hands-on healthcare practitioners that we have acted in an irresponsible manner, adverse publicity

18