UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO SECTION

13a-16

OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of August,

Commission File Number:

001-36815

(Exact Name of Registrant as Specified in Its Charter)

Tuborg Boulevard 12

DK-2900

Hellerup Denmark

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of

Form 20-F

or Form 40-F.

Form 20-F ☒ Form

40-F ☐

Indicate by check mark if the registrant is submitting the

Form 6-K

in paper as permitted by Regulation S-T

Rule 101(b)(1): ☐ Indicate by check mark if the registrant is submitting the

Form 6-K

in paper as permitted by Regulation S-T

Rule 101(b)(7): ☐ INCORPORATION BY REFERENCE

This report on

Form 6-K

shall be deemed to be incorporated by reference into the registration statements on Form S-8

(Registration Numbers 333-228576,

333-203040,

333-210810,

333-211512,

333-213412,

333-214843,

333-216883,

333-254101,

and 333-261550)

and Form F-3

(Registration Numbers 333-209336,

333-211511,

333-216882,

333-223134,

333-225284,

and 333-256571)

of Ascendis Pharma A/S (the “Company”) (including any prospectuses forming a part of such registration statements) and to be a part thereof from the date on which this report is filed, to the extent not superseded by documents or reports subsequently filed or furnished. Information Contained in this Form

6-K

Report Financial Statements

This report contains the Company’s Unaudited Condensed Consolidated Interim Financial Statements as of June 30, 2022, including Management’s Discussion and Analysis of Financial Condition and Results of Operations for the period presented therein.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Ascendis Pharma A/S | ||||||

Date: August 10, 2022 |

By: |

/s/ Michael Wolff Jensen | ||||

Michael Wolff Jensen | ||||||

Senior Vice President, Chief Legal Officer | ||||||

ASCENDIS PHARMA A/S

INDEX TO UNAUDITED CONDENSED CONSOLIDATED INTERIM FINANCIAL STATEMENTS

Page |

||||

F-2 |

||||

F-3 |

||||

F-4 |

||||

F-5 |

||||

F-6 |

||||

F-1

Unaudited Condensed Consolidated Interim Statements of Profit or Loss

and Comprehensive Income / (Loss) for Three and Six Months Ended June 30

Three Months Ended June 30 |

Six Months Ended June 30 |

|||||||||||||||||||

Notes |

2022 |

2021 |

2022 |

2021 |

||||||||||||||||

(EUR’000) |

(EUR’000) |

|||||||||||||||||||

Statement of Profit or Loss |

||||||||||||||||||||

Revenue |

5 |

|||||||||||||||||||

Cost of sales |

||||||||||||||||||||

Gross profit / (loss) |

||||||||||||||||||||

Research and development costs |

||||||||||||||||||||

Selling, general and administrative expenses |

||||||||||||||||||||

Operating profit / (loss) |

( |

) |

( |

) |

( |

) |

( |

) | ||||||||||||

Share of profit / (loss) of associate |

( |

) | ( |

) | ( |

) | ||||||||||||||

Finance income |

||||||||||||||||||||

Finance expenses |

||||||||||||||||||||

Profit / (loss) before tax |

( |

) |

( |

) |

( |

) |

( |

) | ||||||||||||

Tax on profit / (loss) for the period |

( |

) | ||||||||||||||||||

Net profit / (loss) for the period |

( |

) |

( |

) |

( |

) |

( |

) | ||||||||||||

Attributable to owners of the Company |

( |

) | ( |

) | ( |

) | ( |

) | ||||||||||||

Basic and diluted earnings / (loss) per share |

€( |

) | €( |

) | €( |

) | €( |

) | ||||||||||||

Number of shares used for calculation (basic and diluted) (1) |

||||||||||||||||||||

(EUR’000) |

(EUR’000) |

|||||||||||||||||||

Statement of Comprehensive Income |

||||||||||||||||||||

Net profit / (loss) for the period |

( |

) |

( |

) |

( |

) |

( |

) | ||||||||||||

Other comprehensive income / (loss) |

||||||||||||||||||||

Items that may be reclassified subsequently to profit or loss: |

||||||||||||||||||||

Exchange differences on translating foreign operations |

( |

) | ( |

) | ||||||||||||||||

Other comprehensive income / (loss) for the period, net of tax |

( |

) |

( |

) |

||||||||||||||||

Total comprehensive income / (loss) for the period, net of tax |

( |

) |

( |

) |

( |

) |

( |

) | ||||||||||||

Attributable to owners of the Company |

( |

) | ( |

) | ( |

) | ( |

) | ||||||||||||

(1) |

As of June 30, 2022, a total of warrants outstanding, each carrying the right to subscribe for one ordinary share, and convertible senior notes which can potentially be converted into ordinary shares, can potentially dilute earnings per share in the future but have not been included in the calculation of diluted earnings per share because they are antidilutive for the periods presented. Similarly, a total of warrants outstanding as of June 30, 2021, are also considered antidilutive for the periods presented and have not been included in the calculation. The weighted average number of shares takes into account the weighted average effect of changes in treasury shares during the period. |

F-2

Unaudited Condensed Consolidated Interim Statements of Financial Position

Notes |

June 30, 2022 |

December 31, 2021 |

||||||||||

(EUR’000) |

||||||||||||

| Assets |

||||||||||||

| Non-current assets |

||||||||||||

| Intangible assets |

||||||||||||

| Property, plant and equipment |

||||||||||||

| Investment in associate |

||||||||||||

| Other receivables |

10 |

|||||||||||

| Marketable securities |

10 |

|||||||||||

| |

|

|

|

|||||||||

| |

|

|

|

|||||||||

| Current assets |

||||||||||||

| Inventories |

||||||||||||

| Trade receivables |

10 |

|||||||||||

| Income tax receivables |

||||||||||||

| Other receivables |

10 |

|||||||||||

| Prepayments |

||||||||||||

| Marketable securities |

10 |

|||||||||||

| Cash and cash equivalents |

10 |

|||||||||||

| |

|

|

|

|||||||||

| |

|

|

|

|||||||||

| Total assets |

||||||||||||

| |

|

|

|

|||||||||

| Equity and liabilities |

||||||||||||

| Equity |

||||||||||||

| Share capital |

8 |

|||||||||||

| Distributable equity |

||||||||||||

| |

|

|

|

|||||||||

| |

|

|

|

|||||||||

| Non-current liabilities |

||||||||||||

| Borrowings |

10 |

|||||||||||

| Derivative liabilities |

10 |

|||||||||||

| Contract liabilities |

||||||||||||

| |

|

|

|

|||||||||

| |

|

|

|

|||||||||

| Current liabilities |

||||||||||||

| Borrowings |

10 |

|||||||||||

| Contract liabilities |

||||||||||||

| Trade payables and accrued expenses |

10 |

|||||||||||

| Other liabilities |

||||||||||||

| Income taxes payable |

||||||||||||

| Provisions |

||||||||||||

| |

|

|

|

|||||||||

| |

|

|

|

|||||||||

| Total liabilities |

||||||||||||

| |

|

|

|

|||||||||

| Total equity and liabilities |

||||||||||||

| |

|

|

|

|||||||||

F-3

Unaudited Condensed Consolidated Interim Statements of Changes in Equity

Distributable Equity |

||||||||||||||||||||||||||||

Share Capital |

Share Premium |

Treasury Shares |

Foreign Currency Translation Reserve |

Share-based Payment Reserve |

Accumulated Deficit |

Total |

||||||||||||||||||||||

(EUR’000) |

||||||||||||||||||||||||||||

| Equity at January 1, 2022 |

( |

) |

( |

) |

||||||||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Net profit / (loss) for the period |

— |

— |

— |

— |

— |

( |

) |

( |

) | |||||||||||||||||||

| Other comprehensive income / (loss), net of tax |

— |

— |

— |

( |

) |

— |

— |

( |

) | |||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Total comprehensive income / (loss) |

— |

— |

— |

( |

) |

— |

( |

) |

( |

) | ||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Transactions with Owners |

||||||||||||||||||||||||||||

| Share-based payment (Note 7) |

— |

— |

— |

— |

— |

|||||||||||||||||||||||

| Acquisition of treasury shares (Note 9) |

— |

— |

( |

) |

— |

— |

— |

( |

) | |||||||||||||||||||

| Capital increase |

— |

— |

— |

— |

||||||||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Equity at June 30, 2022 |

( |

) |

( |

) |

||||||||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

Distributable Equity |

||||||||||||||||||||||||||||

Share Capital |

Share Premium |

Treasury Shares |

Foreign Currency Translation Reserve |

Share-based Payment Reserve |

Accumulated Deficit |

Total |

||||||||||||||||||||||

(EUR’000) |

||||||||||||||||||||||||||||

| Equity at January 1, 2021 |

( |

) |

( |

) |

||||||||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Net profit / (loss) for the period |

— |

— |

— |

— |

— |

( |

) |

( |

) | |||||||||||||||||||

| Other comprehensive income / (loss), net of tax |

— |

— |

— |

— |

— |

|||||||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Total comprehensive income / (loss) |

— |

— |

— |

( |

) |

( |

) | |||||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Transactions with Owners |

— |

|||||||||||||||||||||||||||

| Share-based payment (Note 7) |

— |

— |

— |

— |

— |

|||||||||||||||||||||||

| Capital increase |

— |

— |

— |

— |

||||||||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Equity at June 30, 2021 |

( |

) |

||||||||||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

F-

4

Unaudited Condensed Consolidated Interim Cash Flow Statements for the

Six Months Ended June 30

Six Months Ended June 30, |

||||||||

2022 |

2021 |

|||||||

(EUR’000) |

||||||||

| Operating activities |

||||||||

| Net profit / (loss) for the period |

( |

) |

( |

) | ||||

| Reversal of finance income |

( |

) |

( |

) | ||||

| Reversal of finance expenses |

||||||||

| Reversal of gain and loss on disposal of property, plant and equipment |

||||||||

| Reversal of tax charge |

( |

) | ||||||

| Increase / (decrease) in provisions |

||||||||

| Adjustments for non-cash items: |

||||||||

| Non-cash consideration relating to revenue |

( |

) |

( |

) | ||||

| Share of profit / (loss) of associate |

( |

) | ||||||

| Share-based payment |

||||||||

| Depreciation |

||||||||

| Amortization |

||||||||

| Changes in working capital: |

||||||||

| Inventories |

( |

) |

||||||

| Receivables |

( |

) |

( |

) | ||||

| Prepayments |

( |

) |

( |

) | ||||

| Contract liabilities (deferred income) |

( |

) |

( |

) | ||||

| Trade payables, accrued expenses and other payables |

||||||||

| |

|

|

|

|||||

| Cash flows generated from / (used in) operations |

( |

) |

( |

) | ||||

| Finance income received |

||||||||

| Finance expenses paid |

( |

) |

( |

) | ||||

| Income taxes received / (paid) |

( |

) |

( |

) | ||||

| |

|

|

|

|||||

| Cash flows from / (used in) operating activities |

( |

) |

( |

) | ||||

| |

|

|

|

|||||

| Investing activities |

||||||||

| Investment in associate |

( |

) | ||||||

| Acquisition of property, plant and equipment |

( |

) |

( |

) | ||||

| Reimbursement from acquisition of property, plant and equipment |

||||||||

| Development expenditures (software) |

( |

) | ||||||

| Purchase of marketable securities |

( |

) |

( |

) | ||||

| Settlement of marketable securities |

||||||||

| |

|

|

|

|||||

| Cash flows from / (used in) investing activities |

( |

) | ||||||

| |

|

|

|

|||||

| Financing activities |

||||||||

| Payment of principal portion of lease liabilities |

( |

) |

( |

) | ||||

| Net proceeds from convertible senior notes |

||||||||

| Proceeds from exercise of warrants |

||||||||

| Acquisition of treasury shares, net of transaction costs |

( |

) |

||||||

| |

|

|

|

|||||

| Cash flows from / (used in) financing activities |

||||||||

| |

|

|

|

|||||

| Increase / (decrease) in cash and cash equivalents |

( |

) | ||||||

| |

|

|

|

|||||

| Cash and cash equivalents at January 1 |

||||||||

| Effect of exchange rate changes on balances held in foreign currencies |

||||||||

| |

|

|

|

|||||

| Cash and cash equivalents at June 30 |

||||||||

| |

|

|

|

|||||

| Cash and cash equivalents include: |

||||||||

| Bank deposits |

||||||||

| Short-term marketable securities |

||||||||

| |

|

|

|

|||||

| Cash and cash equivalents at June 30 |

||||||||

| |

|

|

|

|||||

F-

5

Notes to the Unaudited Condensed Consolidated Interim Financial Statements

Note 1—General Information

Ascendis Pharma A/S, together with its subsidiaries, is applying its innovative TransCon technologies to build a leading, fully integrated, global biopharmaceutical company. Ascendis Pharma A/S was incorporated in 2006 and is headquartered in Hellerup, Denmark. Unless the context otherwise requires, references to the “Company,” “we,” “us,” and “our”, refer to Ascendis Pharma A/S and its subsidiaries.

The address of the Company’s registered office is Tuborg Boulevard 12,

DK-2900,

Hellerup, Denmark. On February 2, 2015, the Company completed an initial public offering which resulted in the listing of American Depositary Shares (“ADSs”), representing the Company’s ordinary shares, under the symbol “ASND” in the United States on The Nasdaq Global Select Market.

The Company’s Board of Directors approved these unaudited condensed consolidated interim financial statements on August 10, 2022.

Note 2—Summary of Significant Accounting Policies

Basis of Preparation

The unaudited condensed consolidated interim financial statements of the Company are prepared in accordance with International Accounting Standard 34, “Interim Financial Reporting.” Certain information and disclosures normally included in the annual consolidated financial statements prepared in accordance with International Financial Reporting Standards (“IFRS”) have been condensed or omitted. Accordingly, these unaudited condensed consolidated interim financial statements should be read in conjunction with the Company’s audited annual consolidated financial statements for the year ended December 31, 2021, and accompanying notes, which have been prepared in accordance with IFRS as issued by the International Accounting Standards Board (the “IASB”) and as adopted by the European Union (the “EU”).

The accounting policies applied are consistent with those of the previous financial year. A description of

the

accounting policies is provided in the Accounting Policies section of the audited consolidated financial statements as of and for the year ended December 31, 2021. In addition, the accounting policy for convertible senior notes and derivative liabilities, applied for the first time in this reporting period, is described below. The preparation of financial statements in conformity with IFRS requires the use of certain significant accounting estimates and requires management to exercise its judgement in the process of applying the Company’s accounting policies. The areas involving a higher degree of judgement or complexity, or areas where assumptions and estimates are significant to the unaudited condensed consolidated interim financial statements are disclosed in Note 3, “Significant Accounting Judgements and Estimates”.

Convertible Senior Notes and Derivative Liabilities

Convertible senior notes (“convertible notes”) are separated into a financial liability and an embedded derivative component based on the terms and conditions of the contract. The embedded derivative component is accounted for separately if this is not deemed closely related to the financial liability.

The convertible notes include an embedded equity conversion option which is not deemed closely related to the financial liability, and is therefore initially recognized and measured separately at fair value as a derivative liability based on the stated terms upon issuance of the convertible notes. The conversion option is classified as a foreign currency conversion option which is not convertible into a fixed number of shares for a fixed amount of cash. Accordingly, the conversion option is recognized and measured as a derivative liability at fair value through profit or loss, with any subsequent remeasurement gains or losses recognized as part of financial income or expenses.

In addition, the convertible notes include a redemption option, which entitle the Company to redeem the notes at a cash amount equal to the principal amount of the convertible notes, plus accrued and unpaid interest. The redemption option is closely related to the financial liability, and therefore is not separately accounted for. The initial carrying amount of the financial liability component including the redemption option is the residual amount of the proceeds, net of allocated transaction costs, after separating the derivative component.

Transaction costs are apportioned between the financial liability and derivative component based on the allocation of proceeds when the instrument is initially recognized. Transaction costs apportioned to the financial liability component form part of the effective interest and are amortized over the expected lifetime of the liability. Transaction costs allocated to the derivative component are expensed as incurred.

The financial liability is subsequently measured at amortized cost until it is extinguished on conversion, optional redemption or upon repayment at maturity. The financial liability is presented as part of borrowings on the statement of financial position.

F-

6

Notes to the Unaudited Condensed Consolidated Interim Financial Statements

New International Financial Reporting Standards Not Yet Effective

The IASB has issued a number of new or amended standards, which have not yet become effective or have not yet been adopted by the EU. Therefore, these new standards have not been incorporated in these unaudited condensed consolidated interim financial statements.

Amendments to IAS 1, “Classification of Liabilities as Current or

Non-current”

In January 2020, the IASB issued amendments to paragraphs 69 to 76 of IAS 1, “Presentation of Financial Statements”, to specify the requirements for classifying liabilities as current or

non-current.

The amendments clarify: | • | What is meant by a right to defer settlement; |

| • | That a right to defer must exist at the end of the reporting period; |

| • | That classification is unaffected by the likelihood that an entity will exercise its deferral right; and |

| • | That only if an embedded derivative in a convertible liability is itself an equity instrument would the terms of a liability not impact its classification. |

If approved by the EU, the amendments are effective for annual reporting periods beginning on or after January 1, 202399.0 million and €102.0 million, respectively.

3

, and must be applied retrospectively. The amendments are expected to require the convertible notes (presented as part of borrowings on the statement of financial position) and derivative liabilities, both

presented as non-current

liabilities at June 30, 2022, to be presented as current liabilities. On June 30, 2022, the carrying amount of convertible notes and derivative liabilities were €The consolidated financial statements are not expected to be affected by other new or amended standards.

Note 3—Significant Accounting Judgements and Estimates

In the application of the Company’s accounting policies, management is required to make judgements, estimates and assumptions about the carrying amounts of assets and liabilities that are not readily apparent from other sources. Judgements, estimates and assumptions applied are based on historical experience and other factors that are relevant, and which are available at the reporting date. Uncertainty concerning estimates and assumptions could result in outcomes, that require a material adjustment to assets and liabilities in future periods.

The unaudited condensed consolidated interim financial statements do not include all disclosures for significant accounting judgements, estimates and assumptions, that are required in the annual consolidated financial statements, and therefore, should be read in conjunction with the Company’s audited consolidated financial statements as of and for the year ended December 31, 2021.

Estimates and underlying assumptions are reviewed on an ongoing basis. Revisions to accounting estimates are recognized prospectively. While the application of critical accounting estimates is subject to material estimation uncertainties, management’s ongoing revisions of critical accounting estimates and underlying assumptions have not revealed any material impact in any of the periods presented in the unaudited condensed consolidated interim financial statements.

Other than as set out below, there have been no other changes to the application of significant accounting judgements, or estimation uncertainties regarding accounting estimates compared to December 31, 2021.

Valuation of Embedded Derivatives

The foreign currency conversion option, embedded in the convertible notes, is accounted for separately as a derivative liability at fair value through profit or loss.

Fair value cannot be measured based on quoted prices in active markets or other observable inputs, and accordingly, derivative liabilities are measured by using the Black-Scholes option pricing model. Subjective judgements and assumptions, which are subject to estimation uncertainties, need to be exercised in determining the appropriate unobservable input to the valuation model (Level 3 in the fair value hierarchy). These inputs include volatility of the Company’s share price for a historic period, reflecting the assumption that the historical volatility is indicative of a period similar to the expected lifetime of the option.

Changes in assumptions relating to these factors could affect the reported fair value of derivative liabilities.

F-

7

Notes to the Unaudited Condensed Consolidated Interim Financial Statements

Note 4—Significant Events in the Reporting Period

COVID-19

Pandemic The

COVID-19

pandemic has affected countries where we are operating, where we have planned or have ongoing clinical trials, and where we rely on third-parties to manufacture preclinical, clinical and commercial supply. COVID-19

did not have a direct material impact on the unaudited condensed consolidated interim financial statements. Conflict in the Region Surrounding Ukraine and Russia

The ongoing conflict in the region surrounding Ukraine and Russia has impacted our ability to continue clinical trial activities in those countries. The conflict did not have a direct material impact on the unaudited condensed consolidated interim financial statements.

Leases

In February 2022, the Company entered into a facility lease in Germany with an enforceable lease term of 15 years , which is expected to commence in 2025. Subject to changes in terms and conditions and development in interest rates, an initial lease liability and corresponding asset of €55.2 million is expected to be recognized at the commencement date.

right-of-use

Convertible Senior Notes Offering

In March 2022, the Company issued an aggregate principal amount of $575.0 million of fixed rate 2.25 % convertible notes. The net proceeds from the offering were $557.9 million (€503.3 million), after deducting the initial purchasers’ discounts and commissions and offering expenses.

Further details are disclosed in Note 10, “Financial Assets and Financial Liabilities”.

Acquisition of Treasury Shares

The Company used $116.7 million (€105.3 million) of the net proceeds from the offering of the convertible notes to repurchase 1,000,000 ADSs representing the Company’s ordinary shares. Total holding of treasury shares is disclosed in Note 9, “Treasury Shares”.

F-

8

Notes to the Unaudited Condensed Consolidated Interim Financial Statements

Note 5—Revenue

Revenue from commercial sale of products relates to sale of SKYTROFA30 days from the transaction date. SKYTROFA (lonapegsomatropin-tcgd) was approved by the U.S. Food and Drug Administration in August 2021, and the Company began shipping products to commercial customers in the fourth quarter of 2021.

®

(lonapegsomatropin-tcgd) on the U.S. market, which is sold to specialty pharmacies and specialty distributors (“commercial customers”). Customer payment terms are typically Other revenue is generated primarily from three license agreements, which were entered into in 2018. The licenses grant VISEN Pharmaceuticals exclusive rights to develop and commercialize TransCon hGH, TransCon PTH and TransCon CNP in Greater China.

Three Months Ended June 30, |

Six Months Ended June 30, |

|||||||||||||||

2022 |

2021 |

2022 |

2021 |

|||||||||||||

(EUR’000) |

(EUR’000) |

|||||||||||||||

| Revenue from external customers |

||||||||||||||||

| Commercial sale of products |

||||||||||||||||

| Rendering of services |

||||||||||||||||

| Sale of clinical supply |

||||||||||||||||

| Licenses |

||||||||||||||||

| |

|

|

|

|

|

|

|

|||||||||

| Total revenue from external customers |

||||||||||||||||

| |

|

|

|

|

|

|

|

|||||||||

| Attributable to |

||||||||||||||||

| Commercial customers |

||||||||||||||||

| Collaboration partners and license agreements (1) |

||||||||||||||||

| |

|

|

|

|

|

|

|

|||||||||

| Total revenue from external customers |

||||||||||||||||

| |

|

|

|

|

|

|

|

|||||||||

| Specified by timing of recognition |

||||||||||||||||

| Recognized over time |

||||||||||||||||

| Recognized at a point in time |

||||||||||||||||

| |

|

|

|

|

|

|

|

|||||||||

| Total revenue from external customers |

||||||||||||||||

| |

|

|

|

|

|

|

|

|||||||||

| Revenue by geographical location |

||||||||||||||||

| Europe |

||||||||||||||||

| North America |

||||||||||||||||

| China |

||||||||||||||||

| |

|

|

|

|

|

|

|

|||||||||

| Total revenue from external customers |

||||||||||||||||

| |

|

|

|

|

|

|

|

|||||||||

(1) |

For the three months ended June 30, 2022 and 2021, and for the six month ended June 30, 2022 and 2021, “Total revenue” includes recognition of previously deferred revenue/internal profit from associate of € million and € million, and of € million and € million respectively. |

F-

9

Notes to the Unaudited Condensed Consolidated Interim Financial Statements

Note 6—Segment Information

The Company is managed and operated as one business unit. No separate business areas or separate business units have been identified in relation to product candidates or geographical markets. Accordingly, no additional information on business segments or geographical areas is disclosed.

Note 7—Share-based Payment

As an incentive to the Executive Board, employees, members of the Board of Directors and select consultants, Ascendis Pharma A/S has established warrant programs and, since December 2021, a Restricted Stock Unit program (“RSU program”), which are equity-settled share-based payment transactions.

Share-based Compensation Costs

Share-based compensation costs are determined using the grant date fair value of warrants and Restricted Stock Units (“RSUs”) granted and are recognized over the vesting period as research and development costs, selling, general and administrative expenses, or cost of sales. For the three and six months ended June 30, 2022 and 2021, share-based compensation costs recognized in the unaudited condensed consolidated interim statement of profit or loss were €16.8 million and €16.3 million, respectively, and €36.8 million and €39.4 million, respectively.

Restricted Stock Unit Program

RSUs are granted by the Board of Directors in accordance with authorizations given to it by the shareholders of Ascendis Pharma A/S to the Executive Board, select employees and members of the Board of Directors

(“RSU-holders”)

in accordance with the Company’s RSU program adopted in December 2021. In addition, RSUs may be granted to select consultants. One RSU represents a right for the RSU-holder

to receive one ADS of Ascendis Pharma A/S upon vesting if the vesting conditions are met, or waived by the Board of Directors at its discretion. All RSUs are hedged by treasury shares that have been repurchased in the market. Upon vesting, the Company may at its sole discretion choose to make a cash settlement instead of delivering ADSs.

RSU Activity

The following table specifies the number of RSUs granted, and outstanding RSUs at June 30, 2022:

Total RSUs |

||||

| Outstanding at January 1, 2022 |

||||

| |

|

|||

| Granted during the period |

||||

| Settled during the period |

||||

| Transferred during the period |

||||

| Forfeited during the period |

( |

) | ||

| |

|

|||

| Outstanding at June 30, 2022 |

||||

| |

|

|||

| Specified by vesting date |

||||

| December, 2022 |

||||

| December, 2023 |

||||

| December, 2024 |

||||

| |

|

|||

| Outstanding at June 30, 2022 |

||||

| |

|

|||

The fair value of RSUs at the date of grant was €123.46 for the year ended December 31, 2021, which was the first date of granting RSUs.

Warrant program

Warrants are granted by the Board of Directors in accordance with authorizations given to it by the shareholders of Ascendis Pharma A/S to all employees, members of the Board of Directors and select consultants (“warrantholders”). Each warrant carries the right to subscribe for one ordinary share of a nominal value of DKK 1 . The exercise price is fixed at the fair market value of the Company’s ordinary shares at the time of grant as determined by the Board of Directors. Vested warrants may be exercised in two or four annual exercise periods.

F-

10

Notes to the Unaudited Condensed Consolidated Interim Financial Statements

Warrant Activity

The following table specifies the warrant activity during the six months ended June 30, 2022:

Total Warrants |

Weighted Average Exercise Price EUR |

|||||||

| Outstanding at January 1, 2022 |

||||||||

| |

|

|

|

|||||

| Granted during the period |

||||||||

| Exercised during the period |

( |

) |

||||||

| Forfeited during the period |

( |

) |

||||||

| |

|

|

|

|||||

| Outstanding at June 30, 2022 |

||||||||

| |

|

|

|

|||||

| Vested at June 30, 2022 |

||||||||

| |

|

|

|

|||||

The exercise prices of outstanding warrants under the Company’s warrant programs range from €6.48 to €145.5 depending on the grant dates.

Note 8—Share Capital

The share capital of Ascendis Pharma A/S consists of 56,965,058 fully paid shares at a nominal value of DKK 1 , all in the same share class.

Note 9—Treasury Shares

The holding of treasury shares is specified below:

Nominal values |

Holding |

Holding in % of total outstanding shares |

||||||||||

(EUR’000) |

(Number) |

|||||||||||

| Treasury shares |

||||||||||||

| At January 1, 2022 |

% | |||||||||||

| Acquired from third-parties |

||||||||||||

| |

|

|

|

|

|

|||||||

| At June 30, 2022 |

% | |||||||||||

| |

|

|

|

|

|

|||||||

F-

11

Notes to the Unaudited Condensed Consolidated Interim Financial Statements

Note 10—Financial Assets and Financial Liabilities

Financial assets and liabilities comprise the following:

June 30, 2022 |

December 31, 2021 |

|||||||

(EUR’000) |

||||||||

| Financial assets by category |

||||||||

| Trade receivables |

||||||||

| Other receivables (excluding VAT receivables) |

||||||||

| Marketable securities |

||||||||

| Cash and cash equivalents |

||||||||

| |

|

|

|

|||||

| Financial assets measured at amortized cost |

||||||||

| |

|

|

|

|||||

| Total financial assets |

||||||||

| |

|

|

|

|||||

| Classified in the statement of financial position |

||||||||

| Non-current assets |

||||||||

| Current assets |

||||||||

| |

|

|

|

|||||

| Total financial assets |

||||||||

| |

|

|

|

|||||

June 30, 2022 |

December 31, 2021 |

|||||||

(EUR’000) |

||||||||

| Financial liabilities by category |

||||||||

| Borrowings |

||||||||

| Convertible senior notes |

||||||||

| Lease liabilities |

||||||||

| Trade payables and accrued expenses |

||||||||

| |

|

|

|

|||||

| Financial liabilities measured at amortized cost |

||||||||

| |

|

|

|

|||||

| Derivative liabilities |

||||||||

| |

|

|

|

|||||

| Financial liabilities measured at fair value through profit or loss |

||||||||

| |

|

|

|

|||||

| Total financial liabilities |

||||||||

| |

|

|

|

|||||

| Classified in the statement of financial position |

||||||||

| Non-current liabilities |

||||||||

| Current liabilities |

||||||||

| |

|

|

|

|||||

| Total financial liabilities |

||||||||

| |

|

|

|

|||||

F-12

Notes to the Unaudited Condensed Consolidated Interim Financial Statements

Marketable Securities

Marketable securities are measured at amortized cost, and fair values are determined based on quoted market prices. (Level 1 in the fair value hierarchy).

The composition of the portfolio is specified in the following table:

June 30, 2022 |

December 31, 2021 |

|||||||||||||||

Carrying amount |

Fair value |

Carrying amount |

Fair value |

|||||||||||||

(EUR’000) |

||||||||||||||||

| Marketable securities |

||||||||||||||||

| U.S. Government bonds |

||||||||||||||||

| Commercial papers |

||||||||||||||||

| Corporate bonds |

||||||||||||||||

| Agency bonds |

||||||||||||||||

| |

|

|

|

|

|

|

|

|||||||||

| Total marketable securities |

||||||||||||||||

| |

|

|

|

|

|

|

|

|||||||||

| Classified based on maturity profiles |

||||||||||||||||

| Non-current assets |

||||||||||||||||

| Current assets |

||||||||||||||||

| |

|

|

|

|

|

|

|

|||||||||

| Total marketable securities |

||||||||||||||||

| |

|

|

|

|

|

|

|

|||||||||

| Specified by rate structure |

||||||||||||||||

| Fixed rate |

||||||||||||||||

| Floating rate |

||||||||||||||||

| Zero-coupon |

||||||||||||||||

| |

|

|

|

|

|

|

|

|||||||||

| Total marketable securities |

||||||||||||||||

| |

|

|

|

|

|

|

|

|||||||||

| Specified by investment grade credit rating |

||||||||||||||||

| High grade |

||||||||||||||||

| Upper medium grade |

||||||||||||||||

| Lower medium grade |

||||||||||||||||

| |

|

|

|

|

|

|

|

|||||||||

| Total marketable securities |

||||||||||||||||

| |

|

|

|

|

|

|

|

|||||||||

The Company’s marketable securities are all denominated in U.S. Dollars. At June 30, 2022 and December 31, 2021, the portfolio had a weighted average duration of 6.1 and 6.6 months for current positions, and 15.2 and 17.5 months for 7.2 months and 10.4 months, respectively.

non-current

positions, respectively. At June 30, 2022 and December 31, 2021, the entire portfolio had a weighted average duration of All marketable securities have investment grade ratings and accordingly, the risk from probability of default is low. The risk of expected credit loss over marketable securities has been considered, including the hypothetical impact arising from the probability of default which is considered in conjunction with the expected loss given default from securities with similar credit ratings and attributes. This assessment did not reveal a material expected credit loss and accordingly, no provision for expected credit loss has been recognized.

Convertible Senior Notes

In March 2022, the Company issued an aggregate principal amount of $575.0 million of fixed rate 2.25 % convertible notes. The net proceeds from the offering of the convertible notes were $557.9 million (€503.3 million), after deducting the initial purchasers’ discounts and commissions, and offering expenses. The convertible notes rank equally in right of payment with all future senior unsecured indebtedness. Unless earlier converted or redeemed, the convertible notes will mature on April 1, 2028 .

F-1

3

Notes to the Unaudited Condensed Consolidated Interim Financial Statements

The convertible notes accrue interest at a rate of 2.25 % per annum, payable semi-annually in arrears on April 1 and October 1 of each year, beginning on October 1, 2022 . At any time before the close of business on the second scheduled trading day immediately before the maturity date, noteholders may convert their convertible notes at their option into the Company’s ordinary shares represented by ADSs, together, if applicable, with cash in lieu of any fractional ADS, at the then-applicable conversion rate. The initial conversion rate is 6.0118 ADSs per $1,000 principal amount of convertible notes, which represents an initial conversion price of $166.34 per ADS. The conversion rate and conversion price will be subject to customary adjustments upon the occurrence of certain events.

The convertible notes will be optionally redeemable, in whole or in part (subject to certain limitations), at the Company’s option at any time, and from time to time, on or after April 7, 2025 , but only if the last reported sale price per ADS exceeds 130 % of the conversion price on (i) each of at least 20 trading days, whether or not consecutive, during the 30 consecutive trading days ending on, and including, the trading day immediately before the date the Company sends the related optional redemption notice; and (ii) the trading day immediately before the date the Company sends such notice.

On June 30, 2022, the carrying amount of the convertible notes was €399.0 million, and the fair value was approximately €400.8 million. Fair value cannot be measured based on quoted prices in active markets, or other observable input, and accordingly the fair value was estimated by using an estimated market rate for an equivalent

non-convertible

instrument, and by excluding transaction costs (Level 3 in the fair value hierarchy). Derivative Liabilities

Derivative liabilities relate to the foreign currency conversion option embedded in the convertible notes.

Fair value cannot be measured based on quoted prices in active markets or other observable

(inputs

, and accordingly, derivative liabilities are measured by using the Black-Scholes option pricing

model (Level 3 in the fair value hierarchy). Fair value of the option is calculated, applying the following assumptions: (1) conversion price; (2) the Company’s share price; (3) maturity of the option

; (4) a risk-free interest rate equaling the effective interest rate on a U.S. government bond with the same lifetime as the maturity of the option

; (5) no payment of dividends; and (6) an expected volatility using the Company’s share priceDerivative liabilities were recognized in March, 2022, at the initial fair value of €142.5 million. For the three and six months ended June 30, 2022, remeasurement gains recognized in the unaudited condensed consolidated interim statement of profit or loss were €39.3 million and €40.4 million

,

respectively. Sensitivity Analysis

On June 30, 2022, all other inputs and assumptions held constant, a 10 % increase in volatility, will increase the fair value of derivative liabilities by approximately €13.8 million and indicates a decrease in profit or loss and equity before tax. Similarly, a 10 % decrease in volatility indicates the opposite impact.

Similarly, on June 30, 2022, all other inputs and assumptions held constant, a 10 % increase in the share price, will increase the fair value of derivative liabilities by approximately €18.8 million and indicates a decrease in profit or loss and equity before tax. Similarly, a 10 % decrease in the share price indicates the opposite impact.

F-1

4

Notes to the Unaudited Condensed Consolidated Interim Financial Statements

Maturity Analysis

Maturity analysis (on an undiscounted basis) for

non-derivative

financial liabilities recognized in the unaudited condensed consolidated statements of financial position at June 30, 2022, is specified below. < 1 year |

1-5 years |

>5 years |

Total contractual cash-flows |

Carrying amount |

||||||||||||||||

(EUR’000) |

||||||||||||||||||||

| June 30, 2022 |

||||||||||||||||||||

| Borrowings |

||||||||||||||||||||

| Convertible senior notes |

||||||||||||||||||||

| Lease liabilities |

||||||||||||||||||||

| Trade payables and accrued expenses |

||||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|||||||||||

| Total financial liabilities |

||||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|||||||||||

Note 11—Subsequent Events

No events have occurred after the reporting date that would influence the evaluation of these unaudited condensed consolidated interim financial statements.

F-15

ASCENDIS PHARMA A/S

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND

RESULTS OF OPERATIONS

You should read the following discussion and analysis of our financial condition and results of operations in conjunction with our unaudited condensed consolidated interim financial statements, including the notes thereto, included with this report and the section contained in our Annual Report on

Form 20-F

for the year ended December 31, 2021 – “Item 5. Operating and Financial Review and Prospects”. The following discussion is based on our financial information prepared in accordance with International Accounting Standard 34, “Interim Financial Reporting.” Certain information and disclosures normally included in the consolidated financial statements prepared in accordance with International Financial Reporting Standards (“IFRS”) have been condensed or omitted. IFRS as issued by the International Accounting Standards Board, and as adopted by the European Union, might differ in material respects from generally accepted accounting principles in other jurisdictions. Special Note Regarding Forward-Looking Statements

This report contains forward-looking statements concerning our business, operations and financial performance and condition, as well as our plans, objectives and expectations for our business operations and financial performance and condition. Any statements contained herein that are not statements of historical facts may be deemed to be forward-looking statements. In some cases, you can identify forward-looking statements by terminology such as “aim,” “anticipate,” “assume,” “believe,” “contemplate,” “continue,” “could,” “due,” “estimate,” “expect,” “goal,” “intend,” “may,” “objective,” “plan,” “predict,” “potential,” “positioned,” “seek,” “should,” “target,” “will,” “would,” and other similar expressions that are predictions or indicate future events and future trends, or the negative of these terms or other comparable terminology. These forward-looking statements include, but are not limited to, statements about:

| • | the timing or likelihood of regulatory filings and approvals for our product candidates; |

| • | our expectations regarding the commercial availability of TransCon Growth Hormone, or TransCon hGH, and related patient support services; |

| • | the commercialization of TransCon hGH and our other product candidates, if approved; |

| • | our commercialization, marketing and manufacturing capabilities of TransCon hGH and our other product candidates and associated devices; |

| • | the scope, progress, results and costs of developing our product candidates or any other future product candidates, and conducting preclinical studies and clinical trials; |

| • | our pursuit of oncology as our second of three independent therapeutic areas of focus, and our development of a pipeline of product candidates related to oncology; |

| • | our expectations regarding the potential market size and the size of the patient populations for TransCon hGH and our other product candidates, if approved for commercial use; |

| • | our expectations regarding the potential advantages of TransCon hGH and our other product candidates over existing therapies; |

| • | our ability to enter into new collaborations; |

| • | our expectations with regard to the ability to develop additional product candidates using our TransCon technologies and file Investigational New Drug Applications (“INDs”), or similar for such product candidates; |

| • | our expectations with regard to the ability to seek expedited regulatory approval pathways for our product candidates, including the potential ability to rely on the parent drug’s clinical and safety data with regard to our product candidates; |

1

| • | our expectations with regard to our current and future collaboration partners to pursue the development of our product candidates and file INDs or similar for such product candidates; |

| • | our development plans with respect to TransCon hGH and our other product candidates; |

| • | our pursuit of additional indications for TransCon hGH; |

| • | our ability to develop, acquire and advance product candidates into, and successfully complete, clinical trials; |

| • | the implementation of our business model and strategic plans for our business, TransCon hGH and our other product candidates and technologies, including global commercialization strategies; |

| • | the scope of protection we are able to establish and maintain for intellectual property rights covering TransCon hGH and our other product candidates; |

| • | our expectations regarding our ability to apply our technology platform and algorithm for product innovation to develop highly differentiated product candidates to address unmet medical needs; |

| • | our ability to apply our platform technology to build a leading, fully integrated biopharmaceutical company; |

| • | our use of our TransCon technologies to create new and potentially best-in-class |

| • | estimates of our expenses, future revenue, capital requirements, our needs for additional financing and our ability to obtain additional capital; |

| • | our financial performance; |

| • | developments and projections relating to our market conditions, competitors and industry; and |

| • | the potential effects on our business of the worldwide COVID-19 pandemic and the ongoing conflict in the region surrounding Ukraine and Russia. |

These forward-looking statements are based on senior management’s current expectations, estimates, forecasts and projections about our business and the industry in which we operate and involve known and unknown risks, uncertainties and other factors that are in some cases beyond our control. As a result, any or all of our forward-looking statements in this report may turn out to be inaccurate. Factors that may cause actual results to differ materially from current expectations include, among other things, those listed under the section in our Annual Report on Form

20-F

for the year ended December 31, 2021 — “Item 3.D. Risk Factors”. You are urged to consider these factors carefully in evaluating the forward-looking statements. These forward-looking statements speak only as of the date of this report. Except as required by law, we assume no obligation to update or revise these forward-looking statements for any reason, even if new information becomes available in the future. Given these risks and uncertainties, you are cautioned not to rely on such forward-looking statements as predictions of future events. You should read this report and the documents that we reference in this report and have filed as exhibits to this report completely and with the understanding that our actual future results may be materially different from what we expect. You should also review the factors and risks we describe in the reports we will file or submit from time to time with the Securities and Exchange Commission after the date of this report. We qualify all of our forward-looking statements by these cautionary statements.

Overview

Ascendis Pharma is applying its innovative TransCon technology platform to build a leading, fully integrated biopharma company focused on making a meaningful difference in patients’ lives. Guided by our core values of patients, science and passion, we use our TransCon technologies to create new and potentially best-in-class therapies. Ascendis is headquartered in Copenhagen, Denmark, and has additional facilities in Heidelberg and Berlin, Germany; Palo Alto and Redwood City, California; and Princeton, New Jersey.

We have applied these TransCon technologies in combination with a clinically-validated parent drug or pathway using our algorithm for product innovation with the goal of creating product candidates with the potential to be in endocrinology rare diseases and oncology. In addition, we plan to apply this algorithm for product innovation and selection in new therapeutic areas. We believe our approach to product innovation may reduce the risks associated with traditional drug development, and that our TransCon technologies have been validated by

best-in-class

non-clinical

and clinical programs completed to date. 2

Ascendis Algorithm for Product Innovation

Through our approach, we may benefit from established clinical safety and efficacy data, which we believe increases the probability of success. As presented above, our algorithm for product innovation focuses on identifying indications that have an unmet medical need, have a clinically-validated parent drug or pathway, are suitable to our TransCon technologies, have potential for creating a clearly differentiated product, have an established development pathway and have a large potentially addressable market.

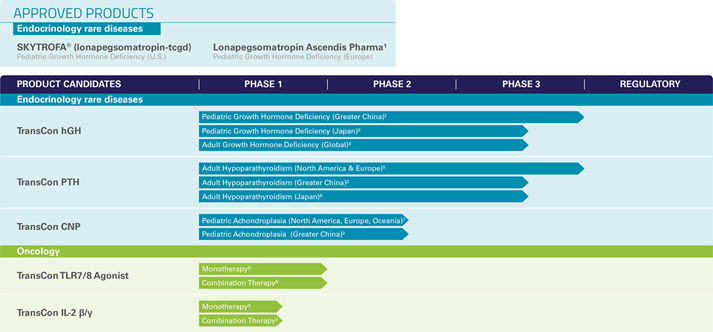

We currently have one marketed product and a diversified portfolio of five product candidates in clinical development in the areas of endocrinology rare diseases and oncology. We are also evaluating additional therapeutic areas and indications.

| • | First Approved Product – Our first marketed product is SKYTROFA ® (lonapegsomatropin-tcgd), developed as TransCon Growth Hormone (“TransCon hGH”), which has received regulatory approval in the United States (“U.S.”) for the treatment of pediatric patients one year and older who weigh at least 11.5 kg and have growth failure due to inadequate secretion of endogenous growth hormone, also known as growth hormone deficiency (“GHD”) and which is now commercially available for prescription in the U.S. TransCon hGH is also approved in the European Union (“EU”) under the name Lonapegsomatropin Ascendis Pharma for the treatment of children and adolescents aged from 3 years up to 18 years with growth failure due to insufficient endogenous growth hormone secretion. |

| • | Endocrinology Rare Disease Pipeline – We are developing three product candidates in our endocrinology rare disease portfolio spanning seven different clinical programs. These include TransCon hGH for pediatric GHD in Japan; TransCon hGH for adults with GHD; TransCon PTH for adults with hypoparathyroidism; the last classical hormone deficiency for which complete hormone replacement has been elusive; and TransCon CNP for achondroplasia, the most common form of dwarfism. VISEN Pharmaceuticals (“VISEN”), to which we have licensed rights to TransCon hGH, TransCon PTH, and TransCon CNP, and under certain conditions, has a First Right of Negotiation for other Endocrine product candidates for the Chinese market in case Ascendis decides to out-license such territory, is developing TransCon hGH, TransCon PTH and TransCon CNP in China. In addition, we are planning new trials in other endocrinology rare disease indications, including TransCon hGH for Turner Syndrome; TransCon PTH for children with hypoparathyroidism; and TransCon CNP for infants (age 0-2 years) with achondroplasia. |

| • | Oncology Pipeline – In oncology, we are leveraging our TransCon technologies in effort to enhance anti-tumor effects of clinically-validated parent drugs and pathways and to provide sustained modulation of tumor microenvironments and activate cytotoxic immune cells. We have initiated clinical development of two product candidates: TransCon TLR7/8 Agonist, an investigational, long-acting prodrug of resiquimod, a small molecule agonist of Toll like receptors (“TLR”) 7 and 8 for intratumoral delivery and TransCon IL-2 ß/g for systemic delivery, which is designed for prolonged exposure to an IL-2 variant that selectively activates the IL-2Rß/ g , with minimal binding to IL-2Rα. Our clinical development program for these product candidates also includes evaluation of them as a potential combination therapy. |

3

TransCon Product and Product Candidate Pipeline

1 |

Developed under the name TransCon hGH |

2 |

In development in Greater China through strategic investment in VISEN Pharmaceuticals. |

3 |

Japanese riGHt Trial. |

4 |

Global foresiGHt Trial. |

5 |

Top-line results from the North American and European PaTHway Trial were reported on March 13, 2022. |

6 |

Japanese PaTHway Japan Trial. |

7 |

North America, Europe, and Oceania ACcomplisH Trial. |

8 |

transcendIT-101 Trial. |

9 |

IL-ßelie g e Trial. |

TransCon Technologies

Our TransCon technologies are designed to combine the benefits of conventional prodrug and sustained release technologies to solve the fundamental limitations seen in other approaches to extending duration of a drug’s action in the body with the goal of developing highly differentiated product candidates based on potential safety and efficacy. In addition to retaining the original mode of action of the parent drug and potentially supporting dosing frequency from daily up to six months or more, we believe that predictable release over time can improve treatment efficacy, increase the likelihood of clinical development success, and provide intellectual property benefits.

TransCon molecules have three components: a parent drug, an inert carrier that protects it, and a linker that temporarily binds the two. When bound, the carrier inactivates and shields the parent drug from clearance. When injected into the body, the unmodified parent drug is released in a predictable manner. Depending upon the type of TransCon carrier we employ, we can design our TransCon prodrugs for sustained localized or systemic delivery.

4

TransCon Products Candidates – Endocrinology

TransCon Growth Hormone

TransCon hGH is a long-acting prodrug of somatropin (“hGH”) composed of an unmodified somatropin that is transiently bound to a carrier and proprietary linker. TransCon hGH is designed to maintain the same mode of action as daily therapies by releasing the same recombinant growth hormone molecule, somatropin, as used in extensively proven daily hGH therapy which is the current standard of care for growth hormone deficiency.

In May 2022, VISEN Pharmaceuticals announced results from its Phase 3 trial of once-weekly TransCon hGH in children with GHD in China. The trial demonstrated results that were consistent with our Phase 3 heiGHt Trial. VISEN Pharmaceuticals’ Phase 3 trial achieved its primary endpoint, with pediatric GHD patients treated with once-weekly TransCon hGH demonstrating greater annualized height velocity at

52-weeks

compared to patients treated with daily growth hormone. In January 2022, the European Commission granted marketing authorization for Lonapegsomatropin Ascendis Pharma (developed under the name TransCon hGH) as a once-weekly subcutaneous injection for the treatment of children and adolescents ages 3 to 18 years with growth failure due to insufficient secretion of endogenous growth hormone.

In August 2021, the U.S. Food and Drug Administration (“FDA”), approved TransCon hGH, known by its brand name SKYTROFA (lonapegsomatropin-tcgd), for the treatment of pediatric patients one year and older who weigh at least 11.5 kg and have growth failure due to inadequate secretion of endogenous growth hormone, also known as GHD. Once-weekly SKYTROFA (lonapegsomatropin-tcgd) is the first FDA approved product that delivers somatropin, or growth hormone, by sustained release over one week.

The FDA approval of SKYTROFA (lonapegsomatropin-tcgd) was based on results from the Phase 3 heiGHt Trial, a

52-week,

global, randomized, open-label, active-controlled, parallel-group trial that compared once-weekly TransCon hGH to daily somatropin (Genotropin®

) in 161 treatment-naïve

children with GHD. The primary endpoint was annualized height velocity (“AHV”) at 52 weeks for weekly SKYTROFA (lonapegsomatropin-tcgd) and the daily hGH treatment groups. Other endpoints included adverse events, injection-site reactions, incidence of anti-hGH

antibodies, annualized height velocity, change in height standard deviation score (“SDS”), proportion of subjects with IGF-1

SDS (0.0 to +2.0), PK/PD in subjects > 3 years, and preference for and satisfaction with SKYTROFA (lonapegsomatropin-tcgd). We believe once-weekly SKYTROFA (lonapegsomatropin-tcgd) offers patients benefits compared to daily growth hormone:

| • | A national study has shown 66%, or 2/3 of patients miss more than one injection per week. We believe reducing injection frequency is associated with better adherence and thus may improve height velocity. |

| • | In a Phase 3 clinical study, TransCon hGH demonstrated higher AHV compared to daily somatropin with similar safety profile in treatment-naïve children with GHD. |

| • | With a weekly injection, patients switching from daily injections can experience up to 86% fewer injection days per year. |

| • | After first removed from a refrigerator, SKYTROFA (lonapegsomatropin-tcgd) can be stored at room temperature for up to six months. |

In September 2020, we filed a Clinical Trial Notification (“CTN”), with the Pharmaceuticals and Medical Devices Agency (“PMDA”), in Japan, to initiate our Phase 3 riGHt Trial of lonapegsomatropin for the treatment of pediatric GHD. The primary objective of the riGHt Trial is to evaluate and compare the AHV of 40 Japanese prepubertal treatment naïve children with GHD treated with weekly lonapegsomatropin to that of a commercially available daily somatropin formulation at 52 weeks. We anticipate completing enrollment in the riGHt Trial by the end of 2022.

5

In October 2019, we received Orphan Designation (“OD”) from the European Commission for TransCon hGH for GHD. OD is granted to therapies aimed at the treatment, prevention or diagnosis of a disease that is life-threatening or chronically debilitating, affects no more than five in 10,000 persons in the EU, or the product, without the benefits derived from orphan status, would not generate sufficient return in the EU to justify investment and for which no satisfactory method of diagnosis, prevention, or treatment has been authorized (or if such a method exists, the product would provide significant additional benefit over existing therapies). We received Orphan Drug Designation (“ODD”) from the FDA for TransCon hGH as a treatment for GHD in April 2020.

Commercialization Strategy

We have developed a multi-faceted commercial organization and strategy to optimize U.S. market adoption of SKYTROFA (lonapegsomatropin-tcgd).

| • | Sales Force: In the U.S., the sales team covers approximately 1,400 prescribers who represent approximately 80% of the prescription volume. |

| • | Medical Affairs: Our Medical Affairs organization is educating stakeholders and broadening SKYTROFA (lonapegsomatropin-tcgd) awareness. |

| • | Market Access: Our Market Access organization engages payors and pharmacy benefit managers in an effort to garner reimbursement for SKYTROFA (lonapegsomatropin-tcgd). |

As of December 31, 2021, the cumulative number of new patient prescriptions for SKYTROFA (lonapegsomatropin-tcgd) totaled 369 which were written by 139 prescribers. In addition, 42% of the prescribers had written prescriptions for more than one patient. As of June 30, 2022, the cumulative number of new patient prescriptions for SKYTROFA (lonapegsomatropin-tcgd) increased to 1,707 which were written by 505 prescribers. In addition, 53% of the prescribers had written prescriptions for more than one patient.

We plan to commercially launch TransCon hGH in Europe during 2023.

TransCon Growth Hormone (hGH) for Other Indications

We continue to enroll patients in the foresiGHt Trial, a global Phase 3 study with the aim to demonstrate the metabolic benefits of lonapegsomatropin in adults. The ongoing conflict in the region surrounding Ukraine and Russia has impacted our ability to continue clinical trial activities in those countries. As a result, we are now targeting completion of enrollment in the foresiGHt Trial in the fourth quarter of 2022.

In the second quarter of 2022, we submitted a protocol to the FDA to evaluate TransCon hGH for Turner Syndrome. In addition, we are also considering other potential indications for TransCon hGH where a long-acting hGH therapy may offer a best-in-class option for patients with rare growth disorders.

TransCon Parathyroid Hormone

TransCon Parathyroid Hormone (“PTH”) is an investigational long-acting prodrug of PTH that is designed as a novel replacement therapy for PTH dosed once-daily to achieve and maintain a steady concentration of PTH in the bloodstream within the normal range, at levels similar to those observed in healthy individuals. TransCon PTH is designed to restore physiologic levels of PTH, 24 hours per day, thereby more fully addressing all aspects of hypoparathyroidism (HP) including normalizing serum and urinary calcium and serum phosphate levels.

HP is a rare endocrine disease characterized by deficient or absent PTH. The most common cause in approximately 75% of cases is inadvertent removal or damage to the parathyroid tissue during neck surgery. Patients with HP cannot adequately regulate calcium and phosphate metabolism and suffer from low calcium and elevated phosphate levels in the blood. The condition results in a diverse range of physical, cognitive and emotional symptoms, as well as a decrease in quality of life. Short term symptoms include weakness, severe muscle cramps (tetany), abnormal sensations such as tingling, burning and numbness (paresthesia), memory loss, impaired judgement and headache. Over the long term, treatment with the current conventional therapy can increase risk of major complications, such as extraskeletal calcium depositions occurring within the brain, lens of the eye, and kidneys, which can lead to impaired renal function. Patients often experience decreased quality of life.

Pharmacokinetic data from multiple ascending dose cohorts in our Phase 1 trial of TransCon PTH in healthy subjects demonstrated a continuous infusion-like profile of free PTH. By providing steady levels of PTH in the physiological range, we believe TransCon PTH can address the fundamental limitations of short-acting PTH molecules and become a highly differentiated therapy for HP

.

Current conventional therapy for HP patients primarily consists of active vitamin D and oral calcium supplementation. However, since PTH is not present at the kidney to facilitate calcium reabsorption from the urine, the goal of conventional therapy is to maintain serum calcium (“sCa”) levels just below or within the lower part of the normal range and thereby limit as much as possible the damage from excess urinary calcium excretion. Nonetheless, conventional therapy frequently leads to significant sCa fluctuations accompanied by symptomatic hyper- or hypocalcemia. In addition, conventional therapy with active vitamin D and calcium have been shown to contribute to the risk of renal disease.

HP also poses a high burden on the healthcare system despite current conventional therapy. For example, one survey of 374 patients showed that 72% experienced more than ten symptoms in the preceding twelve months, with symptoms experienced for a mean of 13 ± 9 hours a day. Other studies showed that 79% of HP cases require hospitalizations and that patients with the disease results have a four-fold increase in the risk of renal disease compared to healthy controls. Patients often experience decreased quality of life. We

6

conducted a survey of 42 patients which found that 100% of subjects reported negative psychological impacts, interference with daily life and impact on physical functioning from HP, and that 76% were either no longer able to work or experienced interference with work productivity.

In March 2022, we announced that

top-line

data from the randomized, double-blind, placebo-controlled portion of its Phase 3 PaTHway Trial of TransCon PTH in adults with hypoparathyroidism demonstrated statistically significant improvement with TransCon PTH compared to control on the primary composite endpoint and all key secondary endpoints. The primary endpoint – defined as serum calcium levels in the normal range (8.3– 10.6 mg/dL) and independence from conventional therapy (active vitamin D and >600 mg/day of calcium supplements) with no increase in prescribed study drug within the 4 weeks prior to the Week 26 visit – was achieved by 78.7% of TransCon PTH-treated

patients (48 of 61), compared to 4.8% for patients (1 of 21) in control group (p-value

<0.0001). In addition, all key pre-specified secondary endpoints were met with statistical significance. TransCon PTH was generally well tolerated, with no discontinuations related to study drug. Three patients discontinued during the treatment period – 2 from the placebo arm and 1 from the TransCon PTH arm. TransCon PTH-treated

patients showed a mean decrease in 24-hour

urine calcium excretion into the normal range. Following an initial blinded study period of 26 weeks all 79 patients completing the blinded period opted to receive treatment with TransCon PTH in the ongoing open-label extension portion of the study for up to 3 years (156 weeks). As of June 30, 2022, 78 out of 79 patients continued in the open label extension portion of the PaTHway Trial.

7

In November 2021, we announced week 84

top-line

data from the Phase 2 PaTH Forward Trial. Week 84 results from the PaTH Forward OLE demonstrated: | • | Mean serum calcium levels remained stable and in the normal range. |

| • | All study subjects discontinued active vitamin D supplements in the earliest weeks of the trial and have remained off it since then. In addition, 93% of subjects were taking calcium supplements <600 mg per day. |

| • | Mean urinary calcium excretion remained stable and in the normal range. |

| • | TransCon PTH was well-tolerated at all doses administered. No treatment-related serious or severe adverse events occurred, and no treatment-emergent adverse events (“TEAEs”) led to discontinuation of study drug. |

| • | Injections were well-tolerated using pen injector planned for commercial presentation. |

At week 58, and bone mineral density data were collected. The data demonstrated:

quality-of-life

| • | All mean summary and subdomain SF-36 Health Survey scores continued normalization between week 26 and week 58 despite all mean scores starting below norms at baseline. |

| • | Bone mineral density Z-scores trended towards normalization and stabilization over 58 weeks in PaTH Forward. |

As of June 30, 2022, 57 out of the 59 patients continued in the open-label extension portion of the trial, where they receive an individualized maintenance dose of TransCon PTH (6 to 30 µg per day). In addition, all 57 subjects have exceeded two years of

follow-up

in the PaTH Forward Trial. Two patients withdrew from the trial for reasons unrelated to safety or efficacy of the study drug. In the second quarter of 2021, we submitted a CTN to the MHLW for PaTHway Japan Trial, a Phase 3 trial to evaluate the safety, tolerability, and efficacy of TransCon PTH. In July 2021, the Japanese Pharmaceuticals and Medical Devices Agency accepted the CTN for the PaTHway Japan Trial, a

single-arm,

Phase 3 trial of TransCon PTH in a minimum of 12 Japanese subjects with HP. Subjects will start with an 18 µg dose of TransCon PTH and be followed over a 26-week

period during which they will be titrated to an optimal dose. The minimum enrollment target of 12 patients was achieved in April 2022. In October 2020, the EC granted orphan designation to TransCon PTH for the treatment of HP.

In June 2018, we were granted orphan drug designation by the FDA for TransCon PTH for the treatment of hypoparathyroidism.

TransCon

C-Type

Natriuretic Peptide TransCon

C-Type

Natriuretic Peptide (“CNP”) is an investigational long-acting prodrug of C-type

natriuretic peptide designed to provide continuous CNP exposure at therapeutic levels with a well-tolerated and convenient once-weekly dose. It is being developed for the treatment of children with achondroplasia. Achondroplasia is the most common form of dwarfism, occurring in about one in 10,000 to 30,000 newborns or approximately 250,000 worldwide. Achondroplasia results in severe skeletal complications and comorbidities, including spinal stenosis due to premature fusion of the foramen magnum, sleep apnea, and chronic ear infections. Achondroplasia is caused by an autosomal dominant activating mutation in fibroblast growth factor receptor 3 (“FGFR3”) that leads to an imbalance in the effects of the FGFR3 and C-type natriuretic peptide (CNP) signaling pathways. TransCon CNP is designed to provide effective shielding of CNP from neutral endopeptidase degradation in subcutaneous tissue and the blood compartment, minimize binding of CNP to the

NPR-C

receptor to decrease clearance, reduce binding of CNP to the NPR-B

receptor in the cardiovascular system to avoid hypotension, and release unmodified CNP, which is small enough in size to allow effective penetration into growth plates. We believe TransCon CNP offers advantages over shorter-acting CNP and CNP analogs in development that result in high Cmax levels which may cause adverse cardiovascular events. In addition, we expect a more constant CNP exposure at lower Cmax to correlate with better therapeutic outcomes. In July 2019, we initiated the Phase 2 ACcomplisH Trial, a randomized, double-blind, placebo-controlled, sequential rising dose trial to evaluate the safety and efficacy of TransCon CNP in approximately 60 children with achondroplasia (ages two to ten years). Subjects are randomized to receive either TransCon CNP or placebo in a 3:1 ratio. The primary efficacy endpoint is annualized height

8

velocity at twelve months. Key secondary and additional endpoints include body proportionality and change in BMI, both evaluated after twelve months of weekly TransCon CNP treatment, and patient reported outcome measures. In December 2021, we announced that enrollment in ACcomplisH Trial was completed. All patients in the open-label extension portion of the ACcomplisH Trial continue on drug at the 100 microgram per kilogram dose.