UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO SECTION 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of November,

Commission File Number: 001-36815

(Exact Name of Registrant as Specified in Its Charter)

Tuborg Boulevard 12

DK-2900 Hellerup

Denmark

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F ☒ Form 40-F ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ☐

INCORPORATION BY REFERENCE

This report on Form 6-K shall be deemed to be incorporated by reference into the registration statements on Form S-8 (Registration Numbers 333-228576, 333-203040, 333-210810, 333-211512, 333-213412, 333-214843, 333-216883, 333-254101, 333-261550 and 333-270088) and Form F-3 (Registration Numbers 333-209336, 333-211511, 333-216882, 333-223134, 333-225284, and 333-256571) of Ascendis Pharma A/S (the “Company”) (including any prospectuses forming a part of such registration statements) and to be a part thereof from the date on which this report is filed, to the extent not superseded by documents or reports subsequently filed or furnished.

Information Contained in this Form 6-K Report

Financial Statements

This report contains the Company’s Unaudited Condensed Consolidated Interim Financial Statements as of and for the period ended September 30, 2023, including Management’s Discussion and Analysis of Financial Condition and Results of Operations for the period presented therein.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

Ascendis Pharma A/S |

|

|

|

|

|

Date: November 7, 2023 |

|

By: |

/s/ Michael Wolff Jensen |

|

|

|

Michael Wolff Jensen |

|

|

|

Executive Vice President, Chief Legal Officer |

TABLE OF CONTENTS

1. |

Unaudited Condensed Consolidated Interim Financial Statements – September 30, 2023 |

F-1 |

2. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

1 |

ASCENDIS PHARMA A/S

INDEX TO UNAUDITED CONDENSED CONSOLIDATED INTERIM FINANCIAL STATEMENTS

|

Page |

F-2 |

|

F-3 |

|

F-4 |

|

F-5 |

|

Notes to the Unaudited Condensed Consolidated Interim Financial Statements |

F-6 |

F-1

Unaudited Condensed Consolidated Interim Statements of Profit or Loss

and Comprehensive Income / (Loss) for the Three and Nine Months Ended September 30, 2023 and 2022

|

|

|

|

Three Months Ended |

|

|

Nine Months Ended |

|

||||||||||

|

|

Notes |

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

||||

|

|

|

|

(EUR’000) |

|

|

(EUR’000) |

|

||||||||||

Consolidated Statement of Profit or Loss |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Revenue |

|

5 |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Cost of sales |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Gross profit |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Research and development costs |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Selling, general and administrative expenses |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Operating profit / (loss) |

|

|

|

|

( |

) |

|

|

( |

) |

|

|

( |

) |

|

|

( |

) |

Share of profit / (loss) of associate |

|

|

|

|

( |

) |

|

|

( |

) |

|

|

( |

) |

|

|

( |

) |

Finance income |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Finance expenses |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Profit / (loss) before tax |

|

|

|

|

( |

) |

|

|

( |

) |

|

|

( |

) |

|

|

( |

) |

Income taxes (expenses) |

|

|

|

|

( |

) |

|

|

|

|

|

( |

) |

|

|

( |

) |

|

Net profit / (loss) for the period |

|

|

|

|

( |

) |

|

|

( |

) |

|

|

( |

) |

|

|

( |

) |

Attributable to owners of the Company |

|

|

|

|

( |

) |

|

|

( |

) |

|

|

( |

) |

|

|

( |

) |

Basic and diluted earnings / (loss) per share |

|

|

|

€ |

( |

) |

|

€ |

( |

) |

|

€ |

( |

) |

|

€ |

( |

) |

Number of shares used for calculation (basic and diluted) (1) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

(EUR’000) |

|

|

(EUR’000) |

|

||||||||||

Statement of Comprehensive Income |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Net profit / (loss) for the period |

|

|

|

|

( |

) |

|

|

( |

) |

|

|

( |

) |

|

|

( |

) |

Other comprehensive income / (loss) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Items that may be reclassified subsequently to profit or loss: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Exchange differences on translating foreign operations |

|

|

|

|

|

|

|

( |

) |

|

|

( |

) |

|

|

( |

) |

|

Other comprehensive income / (loss) for the period, net of tax |

|

|

|

|

|

|

|

( |

) |

|

|

( |

) |

|

|

( |

) |

|

Total comprehensive income / (loss) for the period, net of tax |

|

|

|

|

( |

) |

|

|

( |

) |

|

|

( |

) |

|

|

( |

) |

Attributable to owners of the Company |

|

|

|

|

( |

) |

|

|

( |

) |

|

|

( |

) |

|

|

( |

) |

F-2

Unaudited Condensed Consolidated Interim Statements of Financial Position

|

|

Notes |

|

September 30, |

|

|

December 31, |

|

||

|

|

|

|

(EUR’000) |

|

|||||

Assets |

|

|

|

|

|

|

|

|

||

Non-current assets |

|

|

|

|

|

|

|

|

||

Intangible assets |

|

|

|

|

|

|

|

|

||

Property, plant and equipment |

|

|

|

|

|

|

|

|

||

Investment in associate |

|

|

|

|

|

|

|

|

||

Other receivables |

|

10 |

|

|

|

|

|

|

||

Marketable securities |

|

10 |

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

||

Current assets |

|

|

|

|

|

|

|

|

||

Inventories |

|

|

|

|

|

|

|

|

||

Trade receivables |

|

10 |

|

|

|

|

|

|

||

Income tax receivables |

|

|

|

|

|

|

|

|

||

Other receivables |

|

10 |

|

|

|

|

|

|

||

Prepayments |

|

|

|

|

|

|

|

|

||

Marketable securities |

|

10 |

|

|

|

|

|

|

||

Cash and cash equivalents |

|

10 |

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

||

Total assets |

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

||

Equity and liabilities |

|

|

|

|

|

|

|

|

||

Equity |

|

|

|

|

|

|

|

|

||

Share capital |

|

8 |

|

|

|

|

|

|

||

Distributable equity |

|

|

|

|

( |

) |

|

|

|

|

Total equity |

|

4 |

|

|

( |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Non-current liabilities |

|

|

|

|

|

|

|

|

||

Borrowings |

|

10 |

|

|

|

|

|

|

||

Lease liabilities |

|

10 |

|

|

|

|

|

|

||

Derivative liabilities |

|

10 |

|

|

|

|

|

|

||

Contract liabilities |

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

||

Current liabilities |

|

|

|

|

|

|

|

|

||

Borrowings |

|

10 |

|

|

|

|

|

|

||

Lease liabilities |

|

10 |

|

|

|

|

|

|

||

Contract liabilities |

|

|

|

|

|

|

|

|

||

Trade payables and accrued expenses |

|

10 |

|

|

|

|

|

|

||

Other liabilities |

|

|

|

|

|

|

|

|

||

Income tax payables |

|

|

|

|

|

|

|

|

||

Provisions |

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

||

Total liabilities |

|

|

|

|

|

|

|

|

||

Total equity and liabilities |

|

|

|

|

|

|

|

|

||

F-3

Unaudited Condensed Consolidated Interim Statements of Changes in Equity

|

|

|

|

|

Distributable Equity |

|

|

|

|

|||||||||||||||

|

|

Share |

|

|

Share |

|

|

Treasury |

|

|

Foreign |

|

|

Accumulated |

|

|

Total |

|

||||||

|

|

(EUR’000) |

|

|||||||||||||||||||||

Equity at January 1, 2023 |

|

|

|

|

|

|

|

|

( |

) |

|

|

|

|

|

( |

) |

|

|

|

||||

Net profit / (loss) for the period |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

( |

) |

|

|

( |

) |

Other comprehensive income / (loss), net of tax |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

( |

) |

|

|

— |

|

|

|

( |

) |

Total comprehensive income / (loss) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

( |

) |

|

|

( |

) |

|

|

( |

) |

Transactions with Owners |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

Share-based payment (Note 7) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

|

|

|

|

||

Capital increase |

|

|

|

|

|

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

|

|||

Equity at September 30, 2023 |

|

|

|

|

|

|

|

|

( |

) |

|

|

|

|

|

( |

) |

|

|

( |

) |

|||

|

|

|

|

|

Distributable Equity |

|

|

|

|

|||||||||||||||

|

|

Share |

|

|

Share |

|

|

Treasury |

|

|

Foreign |

|

|

Accumulated |

|

|

Total |

|

||||||

|

|

(EUR’000) |

|

|||||||||||||||||||||

Equity at January 1, 2022 |

|

|

|

|

|

|

|

|

( |

) |

|

|

|

|

|

( |

) |

|

|

|

||||

Net profit / (loss) for the period |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

( |

) |

|

|

( |

) |

Other comprehensive income / (loss), net of tax |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

( |

) |

|

|

— |

|

|

|

( |

) |

Total comprehensive income / (loss) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

( |

) |

|

|

( |

) |

|

|

( |

) |

Transactions with Owners |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

Share-based payment (Note 7) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

|

|

|

|

||

Acquisition of treasury shares (Note 9) |

|

|

— |

|

|

|

— |

|

|

|

( |

) |

|

|

— |

|

|

|

( |

) |

|

|

( |

) |

Capital increase |

|

|

|

|

|

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

|

|||

Equity at September 30, 2022 |

|

|

|

|

|

|

|

|

( |

) |

|

|

|

|

|

( |

) |

|

|

|

||||

F-4

Unaudited Condensed Consolidated Interim Cash Flow Statements for the

Nine Months Ended September 30, 2023 and 2022

|

|

Nine Months Ended |

|

|||||

|

|

2023 |

|

|

2022 |

|

||

|

|

(EUR’000) |

|

|||||

Operating activities |

|

|

|

|

|

|

||

Net profit / (loss) for the period |

|

|

( |

) |

|

|

( |

) |

Reversal of finance income |

|

|

( |

) |

|

|

( |

) |

Reversal of finance expenses |

|

|

|

|

|

|

||

Reversal of gain and loss on disposal of property, plant and equipment |

|

|

|

|

|

|

||

Reversal of income taxes (expenses) |

|

|

|

|

|

|

||

Increase / (decrease) in provisions |

|

|

|

|

|

|

||

Adjustments for non-cash items: |

|

|

|

|

|

|

||

Non-cash consideration relating to revenue |

|

|

( |

) |

|

|

( |

) |

Share of profit / (loss) of associate |

|

|

|

|

|

|

||

Share-based payment |

|

|

|

|

|

|

||

Depreciation |

|

|

|

|

|

|

||

Amortization |

|

|

|

|

|

|

||

Changes in working capital: |

|

|

|

|

|

|

||

Inventories |

|

|

( |

) |

|

|

( |

) |

Receivables |

|

|

( |

) |

|

|

( |

) |

Prepayments |

|

|

( |

) |

|

|

( |

) |

Contract liabilities (deferred income) |

|

|

( |

) |

|

|

|

|

Trade payables, accrued expenses and other payables |

|

|

|

|

|

|

||

Cash flows generated from / (used in) operations |

|

|

( |

) |

|

|

( |

) |

Finance income received |

|

|

|

|

|

|

||

Finance expenses paid |

|

|

( |

) |

|

|

( |

) |

Income taxes received / (paid) |

|

|

( |

) |

|

|

( |

) |

Cash flows from / (used in) operating activities |

|

|

( |

) |

|

|

( |

) |

Investing activities |

|

|

|

|

|

|

||

Acquisition of property, plant and equipment |

|

|

( |

) |

|

|

( |

) |

Proceeds from disposal of property, plant and equipment |

|

|

|

|

|

|

||

Reimbursement from acquisition of property, plant and equipment |

|

|

|

|

|

|

||

Purchase of marketable securities |

|

|

|

|

|

( |

) |

|

Settlement of marketable securities |

|

|

|

|

|

|

||

Cash flows from / (used in) investing activities |

|

|

|

|

|

|

||

Financing activities |

|

|

|

|

|

|

||

Payment of principal portion of lease liabilities |

|

|

( |

) |

|

|

( |

) |

Net proceeds from borrowings |

|

|

|

|

|

|

||

Proceeds from exercise of warrants |

|

|

|

|

|

|

||

Acquisition of treasury shares, net of transaction costs |

|

|

|

|

|

( |

) |

|

Cash flows from / (used in) financing activities |

|

|

|

|

|

|

||

Increase / (decrease) in cash and cash equivalents |

|

|

( |

) |

|

|

|

|

Cash and cash equivalents at January 1 |

|

|

|

|

|

|

||

Effect of exchange rate changes on balances held in foreign currencies |

|

|

|

|

|

|

||

Cash and cash equivalents at September 30 |

|

|

|

|

|

|

||

Cash and cash equivalents include: |

|

|

|

|

|

|

||

Bank deposits |

|

|

|

|

|

|

||

Short-term marketable securities |

|

|

|

|

|

|

||

Cash and cash equivalents at September 30 |

|

|

|

|

|

|

||

F-5

Notes to the Unaudited Condensed Consolidated Interim Financial Statements

Note 1—General Information

Ascendis Pharma A/S, together with its subsidiaries, is applying its innovative TransCon technologies to build a leading, fully integrated, global, biopharma company. Ascendis Pharma A/S was incorporated in 2006 and is headquartered in Hellerup, Denmark. Unless the context otherwise requires, references to the “Company,” “we,” “us,” and “our,” refer to Ascendis Pharma A/S and its subsidiaries.

The address of the Company’s registered office is Tuborg Boulevard 12, DK-2900, Hellerup, Denmark.

On February 2, 2015, the Company completed an initial public offering which resulted in the listing of American Depositary Shares (“ADSs”), representing the Company’s ordinary shares, under the symbol “ASND” in the United States on The Nasdaq Global Select Market.

The Company’s Board of Directors (the “Board”) approved these unaudited condensed consolidated interim financial statements on November 7, 2023.

Note 2—Summary of Significant Accounting Policies

Basis of Preparation

The unaudited condensed consolidated interim financial statements of the Company are prepared in accordance with International Accounting Standard 34, “Interim Financial Reporting”. Certain information and disclosures normally included in the annual consolidated financial statements prepared in accordance with International Financial Reporting Standards (“IFRS”) have been condensed or omitted. Accordingly, these unaudited condensed consolidated interim financial statements should be read in conjunction with the Company’s audited annual consolidated financial statements for the year ended December 31, 2022, and accompanying notes, which have been prepared in accordance with IFRS as issued by the International Accounting Standards Board (the “IASB”) and as adopted by the European Union (the “EU”).

The accounting policies applied are consistent with those of the previous financial year. A description of the accounting policies is provided in the Accounting Policies section of the audited consolidated financial statements as of and for the year ended December 31, 2022. In addition, the accounting policy for royalty funding liabilities, applied for the first time in this reporting period, is described below.

The preparation of financial statements in conformity with IFRS requires the use of certain significant accounting estimates and requires management to exercise its judgement in the process of applying the Company’s accounting policies. The areas involving a higher degree of judgement or complexity, or areas where assumptions and estimates are significant to the unaudited condensed consolidated interim financial statements are disclosed in Note 3, “Significant Accounting Judgements and Estimates”.

Royalty Funding Liabilities

Royalty funding liabilities relate to the Company’s contractual obligations to pay a predetermined percentage of future commercial revenue until reaching a predetermined multiple of proceeds received, according to the detailed provisions of the synthetic royalty funding agreement (the “Agreement”).

Where relevant, royalty funding liabilities are separated into a financial liability and embedded derivative components based on the terms and conditions of the Agreement. Embedded derivative components are accounted for separately, unless these are deemed closely related to the financial liability. The Agreement includes a buy-out option where the value is dependent on non-financial variables that are specific to the Company. Accordingly, the buy-out option is not accounted for separately as a derivative.

The financial liability is recognized when the Company becomes party to the contractual provisions of the Agreement and measured at amortized cost until it is extinguished upon exercising a buy-out option or upon achieving the predetermined multiple of proceeds received. The effective interest rate is estimated at initial recognition and takes into account incremental transaction costs and anticipated amount and timing of future cash flows, which further depends on future commercial revenue forecasts and the probability of exercising the buy-out option. The amortized cost is remeasured prospectively when there is a material change in expectations to amount and timing of future cash flows, which will increase or decrease future interest expenses. Remeasurement gain or losses are recognized through the profit or loss as finance income or expenses, respectively.

The financial liability is presented as part of borrowings in the statement of financial position.

F-6

Change to Presentation of Borrowings

At December 31, 2022, lease liabilities were presented as part of borrowings in the consolidated statements of financial position. At December 31, 2022, carrying amount of lease liabilities was €

In connection with entering additional borrowing activities in September 2023, lease liabilities are from September 30, 2023, presented separately in the consolidated statements of financial position. Comparative amounts have been reclassified to reflect the change in presentation. Accordingly, at September 30, 2023 and December 31, 2022, borrowings comprise convertible senior notes and royalty funding liabilities, and convertible senior notes.

The change to presentation had no other impact on the unaudited condensed consolidated financial statements.

New International Financial Reporting Standards Not Yet Effective

The IASB has issued a number of new or amended standards, which have not yet become effective or have not yet been adopted by the EU. Therefore, these new standards have not been incorporated in these unaudited condensed consolidated interim financial statements.

Amendments to IAS 1, “Classification of Liabilities as Current or Non-current”

In January 2020, the IASB issued amendments to paragraphs 69 to 76 of IAS 1, “Presentation of Financial Statements”, to specify the requirements for classifying liabilities as current or non-current. The amendments clarify:

If approved by the EU, the amendments are effective for annual reporting periods beginning on or after January 1, 2024, and must be applied retrospectively. The amendments are expected to require the convertible senior notes (“convertible notes”) (presented as part of borrowings in the statement of financial position) and derivative liabilities, both presented as non-current liabilities at September 30, 2023, to be presented as current liabilities.

On September 30, 2023, the carrying amount of convertible notes and derivative liabilities were €

The consolidated financial statements are not expected to be affected by other new or amended standards.

F-7

Note 3—Significant Accounting Judgements and Estimates

In the application of the Company’s accounting policies, management is required to make judgements, estimates and assumptions about the carrying amounts of assets and liabilities that are not readily apparent from other sources. Judgements, estimates and assumptions applied are based on historical experience and other factors that are relevant, and which are available at the reporting date. Uncertainty concerning estimates and assumptions could result in outcomes that require a material adjustment to assets and liabilities in future periods.

The unaudited condensed consolidated interim financial statements do not include all disclosures for significant accounting judgements, estimates and assumptions, that are required in the annual consolidated financial statements, and therefore should be read in conjunction with the Company’s audited consolidated financial statements as of and for the year ended December 31, 2022.

Estimates and underlying assumptions are reviewed on an ongoing basis. Revisions to accounting estimates are recognized prospectively. While the application of critical accounting estimates is subject to material estimation uncertainties, management’s ongoing revisions of critical accounting estimates and underlying assumptions have not revealed any material impact in any of the periods presented in the unaudited condensed consolidated interim financial statements.

Other than as set out below, there have been no other changes to the application of significant accounting judgements, or estimation uncertainties regarding accounting estimates compared to December 31, 2022.

Measurement of Royalty Funding Liabilities

The carrying amount of royalty funding liabilities is measured according to anticipated future cash flows, which further depends on the amount and timing of future commercial revenue. Assumptions that impact amount and timing of future commercial revenue are subject to estimation uncertainties, and subject to a number of factors which are not within the Company's control.

The Company will periodically revisit anticipated amount and timing of future commercial revenue and to the extent such amount or timing is materially different from the current estimates, a remeasurement gain or loss is recognized through the profit or loss as finance income or expenses, respectively, which would further increase or decrease future interest expenses. Further details are provided in Note 10, “Financial Assets and Liabilities”.

F-8

Note 4—Significant Events in the Reporting Period

Global Banking Situation

In March 2023, the Federal Deposit Insurance Corporation (the “FDIC”) announced that Silicon Valley Bank (“SVB”) had been closed by the California Department of Financial Protection and Innovation, which appointed the FDIC as receiver. The Company did not hold deposits or securities or maintain any accounts at SVB. Following the closure of SVB and subsequent developments in the global banking sector, the Company considered the risk of expected credit loss on bank deposits and marketable securities, including the hypothetical impact arising from the probability of default, which is considered in conjunction with the expected loss caused by default by banks or securities with similar credit-ratings and attributes.

In line with previous periods, this assessment did not reveal a material impairment loss, and accordingly no provision for expected credit loss has been recognized.

Conflict in the Region Surrounding Ukraine and Russia

The ongoing conflict in the region surrounding Ukraine and Russia has impacted the Company's ability to continue clinical trial activities in those countries. The conflict did not have a direct material impact on the unaudited condensed consolidated interim financial statements.

Royalty Funding Liabilities

In September 2023, the Company entered into a $

Equity Development

As of September 30, 2023, the unaudited condensed consolidated interim statements of financial position presented a negative balance of equity of €

Based on its current operating plan, the Company believes that the existing capital resources as of September 30, 2023, will be sufficient to meet projected cash requirements for at least twelve months from the date of this report. However, the Company's operating plan may change as a result of many factors that are currently unknown, and the Company may need to seek additional funds sooner than planned. Further details regarding lease liabilities and borrowings including maturity analysis are provided in Note 10, “Financial Assets and Liabilities”.

F-9

Note 5—Revenue

Revenue from commercial sale of products relates to sale of SKYTROFA® (lonapegsomatropin-tcgd), primarily in the U.S. market, which is sold to specialty pharmacies and specialty distributors. In addition, the Company began shipping products to wholesalers in Germany in the third quarter of 2023. Customer payment terms are typically

Other revenue is generated primarily from three license agreements, which were entered into in 2018.

|

|

Three Months Ended |

|

|

Nine Months Ended |

|

||||||||||

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

||||

|

|

(EUR’000) |

|

|

(EUR’000) |

|

||||||||||

Revenue from external customers |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Commercial sale of products |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Rendering of services |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Sale of clinical supply |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Licenses |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Total revenue from external customers |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Attributable to |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Commercial customers |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Collaboration partners and license agreements |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Total revenue from external customers |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Specified by timing of recognition |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Recognized over time |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Recognized at a point in time |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Total revenue from external customers |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Revenue by geographical location |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Europe |

|

|

|

|

|

|

|

|

|

|

|

|

||||

North America |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Asia |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Total revenue from external customers |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Note 6—Segment Information

The Company is managed and operated as

Note 7—Share-based Payment

As an incentive to the senior management and the Executive Board, other employees, members of the Board and select consultants, Ascendis Pharma A/S has established warrant programs, a Restricted Stock Unit (“RSU”) program adopted in December 2021, and a Performance Stock Unit (“PSU”) program adopted in February 2023, which are all classified as equity-settled share-based payment transactions.

Share-based Compensation Costs

Share-based compensation costs are determined using the grant date fair value and are recognized over the vesting period as research and development costs, selling, general and administrative expenses, or cost of sales. For the three and nine months ended September 30, 2023 and 2022, share-based compensation costs recognized in the unaudited condensed consolidated interim statement of profit or loss were €

Restricted Stock Unit Program

RSUs are granted by the Board to certain members of senior management and the Executive Board, certain other employees and certain members of the Board (the “RSU-holders”). In addition, RSUs may be granted to select consultants.

One RSU represents a right for the RSU-holder to receive one ADS of Ascendis Pharma A/S upon vesting, if the vesting conditions are met. RSUs granted vest over three years with 1/3 of the RSUs vesting on each anniversary date from the date of grant, and require RSU-holders to be employed, or provide a specified period of service (the “service conditions”).

F-10

Performance Stock Unit Program

PSUs are granted by the Board to certain members of senior management and the Executive Board (the “PSU-holders”). In addition, PSUs may be granted to other employees, select consultants and members of the Board. PSUs were granted for the first time in March 2023.

One PSU represents a right for the PSU-holder to receive one ADS of Ascendis Pharma A/S upon vesting. PSUs vest in a manner similar to the service conditions of the RSUs; however, vesting is also contingent upon achievement of performance targets as determined by the Board, provided that no more than 10% of each tranche may be directly attributable to accomplishment of financial results achieved in the financial year prior to the vesting date. Exceeding performance targets will not result in granting of additional ADSs.

RSUs and PSUs generally cease to vest from the date of termination of employment or board membership, as applicable, whereas unvested RSUs or PSUs will forfeit. The Board may at its discretion and on an individual basis decide to deviate from the vesting conditions, including deciding to accelerate vesting in the event of termination of employment or board membership, as applicable.

All RSUs and PSUs are settled at the time of vesting by treasury shares that are ADSs repurchased in the market. The Company may at its sole discretion choose to make a cash settlement instead of delivering ADSs.

RSU and PSU Activity

The following table specifies the number of RSUs and PSUs granted and outstanding at September 30, 2023:

|

|

Restricted Stock Units |

|

|

Performance Stock Units |

|

|

Total |

|

|||

Outstanding |

|

(Number) |

|

|||||||||

January 1, 2023 |

|

|

|

|

|

|

|

|

|

|||

Granted during the period |

|

|

|

|

|

|

|

|

|

|||

Forfeited during the period |

|

|

( |

) |

|

|

( |

) |

|

|

( |

) |

September 30, 2023 |

|

|

|

|

|

|

|

|

|

|||

Specified by vesting year |

|

|

|

|

|

|

|

|

|

|||

2023 |

|

|

|

|

|

|

|

|

|

|||

2024 |

|

|

|

|

|

|

|

|

|

|||

2025 |

|

|

|

|

|

|

|

|

|

|||

2026 |

|

|

|

|

|

|

|

|

|

|||

September 30, 2023 |

|

|

|

|

|

|

|

|

|

|||

Warrant Program

Warrants are granted by the Board in accordance with authorizations given to it by the shareholders of Ascendis Pharma A/S to all employees, members of the Board and select consultants. Each warrant carries the right to subscribe for one ordinary share of a nominal value of DKK

Warrant Activity

The following table specifies the warrant activity for the nine months ended September 30, 2023:

|

|

Total |

|

|

Weighted |

|

||

|

|

(Number) |

|

|

(EUR) |

|

||

Outstanding |

|

|

|

|

|

|

||

January 1, 2023 |

|

|

|

|

|

|

||

Granted during the period |

|

|

|

|

|

|

||

Exercised during the period |

|

|

( |

) |

|

|

|

|

Forfeited during the period |

|

|

( |

) |

|

|

|

|

September 30, 2023 |

|

|

|

|

|

|

||

Vested at September 30, 2023 |

|

|

|

|

|

|

||

F-11

The exercise prices of outstanding warrants under the Company’s warrant programs range from €

Note 8—Share Capital

The share capital of Ascendis Pharma A/S consists of

Note 9—Treasury Shares

The holding of treasury shares is as follows:

|

|

Nominal |

|

|

Holding |

|

|

Holding in |

|

|||

|

|

(EUR’000) |

|

|

(Number) |

|

|

|

|

|||

Treasury shares |

|

|

|

|

|

|

|

|

|

|||

January 1, 2023 |

|

|

|

|

|

|

|

|

% |

|||

September 30, 2023 |

|

|

|

|

|

|

|

|

% |

|||

Note 10—Financial Assets and Liabilities

Financial assets comprise marketable securities, cash and cash equivalents, and receivables. Financial liabilities comprise convertible notes and royalty funding liabilities, presented as borrowings in the statement of financial position, lease liabilities, derivative liabilities, and trade payables and accrued expenses.

Derivative liabilities are measured at fair value. All other financial assets and liabilities are measured at amortized cost.

F-12

Marketable Securities

The following table specifies the marketable securities portfolio:

|

|

September 30, |

|

|

December 31, |

|

||

|

|

(EUR’000) |

|

|||||

Marketable securities |

|

|

|

|

|

|

||

U.S. Treasury bills |

|

|

|

|

|

|

||

U.S. Government bonds |

|

|

|

|

|

|

||

Corporate bonds |

|

|

|

|

|

|

||

Agency bonds |

|

|

|

|

|

|

||

Total marketable securities |

|

|

|

|

|

|

||

Classified based on maturity profiles |

|

|

|

|

|

|

||

Non-current assets |

|

|

|

|

|

|

||

Current assets |

|

|

|

|

|

|

||

Total marketable securities |

|

|

|

|

|

|

||

Specified by rate structure |

|

|

|

|

|

|

||

Fixed rate |

|

|

|

|

|

|

||

Floating rate |

|

|

|

|

|

|

||

Zero-coupon |

|

|

|

|

|

|

||

Total marketable securities |

|

|

|

|

|

|

||

Specified by investment grade credit rating |

|

|

|

|

|

|

||

High grade |

|

|

|

|

|

|

||

Upper medium grade |

|

|

|

|

|

|

||

Total marketable securities |

|

|

|

|

|

|

||

The portfolio of marketable securities is all denominated in U.S. Dollars. At September 30, 2023 and December 31, 2022, the portfolio had a weighted average duration of

F-13

Royalty Funding Liabilities

In September 2023, the Company entered into a $

Under the terms of the Royalty Pharma Agreement, the Company received an upfront payment of $

The Royalty Pharma Agreement includes a buy-out option, which provides the Company with the right to settle all outstanding liabilities at any time by paying a buy-out amount equal to

On September 30, 2023, the carrying amount of the royalty funding liabilities was €

Convertible Senior Notes

In March 2022, the Company issued an aggregate principal amount of $

The convertible notes accrue interest at a rate of

The convertible notes will be optionally redeemable, in whole or in part (subject to certain limitations), at the Company’s option at any time, and from time to time, on or after

On September 30, 2023, the carrying amount of the convertible notes was €

Derivative Liabilities

Derivative liabilities relate to the foreign currency conversion option embedded in the convertible notes.

Fair value cannot be measured based on quoted prices in active markets or other observable inputs, and accordingly, derivative liabilities are measured by using the Black-Scholes option pricing model. Fair value of the option is calculated, applying the following assumptions: (1) conversion price; (2) the Company’s share price; (3) maturity of the option; (4) a risk-free interest rate equaling the effective interest rate on a U.S. government bond with the same lifetime as the maturity of the option; (5) no payment of dividends; and (6) an expected volatility using the Company’s share price (

For additional description of fair values, refer to the following section “Fair Value Measurement”.

F-14

Sensitivity Analysis

On September 30, 2023, all other inputs and assumptions held constant, a

Similarly, on September 30, 2023, all other inputs and assumptions held constant, a

Fair Value Measurement

Because of the short-term maturity for cash and cash equivalents, receivables and trade payables, their fair value approximate carrying amount. Fair value of lease liabilities are not disclosed. Fair value compared to carrying amount of marketable securities, convertible notes, royalty funding liabilities and derivative liabilities, and their level in the fair value hierarchy is summarized in the following table, where:

Level 1 is quoted prices (unadjusted) in active markets for identical assets or liabilities that the entity can access at the measurement date;

Level 2 is based on valuation techniques for which the lowest level input that is significant to the fair value measurement is directly or indirectly observable;

Level 3 is based on valuation techniques for which the lowest level input that is significant to the fair value measurement is unobservable.

|

|

September 30, 2023 |

|

December 31, 2022 |

|

|

||||

|

|

Carrying |

|

Fair value |

|

Carrying |

|

Fair value |

|

Fair value level |

|

|

(EUR’000) |

|

(1-3) |

||||||

Financial assets |

|

|

|

|

|

|

|

|

|

|

Marketable securities |

|

|

|

|

|

1 |

||||

Financial assets measured at amortized cost |

|

|

|

|

|

|

||||

Financial liabilities |

|

|

|

|

|

|

|

|

|

|

Borrowings |

|

|

|

|

|

|

|

|

|

|

Convertible senior notes |

|

|

|

|

|

3 |

||||

Royalty funding liabilities |

|

|

|

|

|

3 |

||||

Financial liabilities measured at amortized cost |

|

|

|

|

|

|

||||

Derivative liabilities |

|

|

|

|

|

3 |

||||

Financial liabilities measured at fair value through profit or loss |

|

|

|

|

|

|

||||

|

|

2023 |

|

|

2022 |

|

||

|

|

(EUR’000) |

|

|||||

Derivative liabilities |

|

|

|

|

|

|

||

January 1 |

|

|

|

|

|

|

||

Additions |

|

|

|

|

|

|

||

Remeasurement recognized in financial (income) or expense |

|

|

( |

) |

|

|

( |

) |

September 30 |

|

|

|

|

|

|

||

F-15

Maturity Analysis

The following table summarizes maturity analysis (on an undiscounted basis) for non-derivative financial liabilities recognized in the unaudited condensed consolidated statements of financial position at September 30, 2023:

|

|

< 1 year |

|

|

1-5 years |

|

|

>5 years |

|

|

Total |

|

|

Carrying |

|

|||||

|

|

(EUR’000) |

|

|||||||||||||||||

Financial liabilities |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

September 30, 2023 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

Borrowings |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

Lease liabilities |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

Trade payables and accrued expenses |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

Total financial liabilities |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

F-16

Note 11—Subsequent Events

No events have occurred after the balance sheet date that would influence the evaluation of these unaudited condensed consolidated interim financial statements.

F-17

ASCENDIS PHARMA A/S

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND

RESULTS OF OPERATIONS

You should read the following discussion and analysis of our financial condition and results of operations in conjunction with our unaudited condensed consolidated interim financial statements, including the notes thereto, included with this report and the section contained in our Annual Report on Form 20-F for the year ended December 31, 2022 – “Item 5. Operating and Financial Review and Prospects.” The following discussion is based on our financial information prepared in accordance with International Accounting Standard 34, “Interim Financial Reporting.” Certain information and disclosures normally included in the consolidated financial statements prepared in accordance with International Financial Reporting Standards (“IFRS”) have been condensed or omitted. IFRS as issued by the International Accounting Standards Board, and as adopted by the European Union, might differ in material respects from generally accepted accounting principles in other jurisdictions.

Special Note Regarding Forward-Looking Statements

This report contains forward-looking statements concerning our business, operations and financial performance and condition, as well as our plans, objectives and expectations for our business operations and financial performance and condition. Any statements contained herein that are not statements of historical facts may be deemed to be forward-looking statements. In some cases, you can identify forward-looking statements by terminology such as “aim,” “anticipate,” “assume,” “believe,” “contemplate,” “continue,” “could,” “due,” “estimate,” “expect,” “goal,” “intend,” “may,” “objective,” “plan,” “predict,” “potential,” “positioned,” “seek,” “should,” “target,” “will,” “would,” and other similar expressions that are predictions or indicate future events and future trends, or the negative of these terms or other comparable terminology. These forward-looking statements include, but are not limited to, statements about:

1

These forward-looking statements are based on senior management’s current expectations, estimates, forecasts and projections about our business and the industry in which we operate and involve known and unknown risks, uncertainties and other factors that are in some cases beyond our control. As a result, any or all of our forward-looking statements in this report may turn out to be inaccurate. Factors that may cause actual results to differ materially from current expectations include, among other things, those listed under the section in our Annual Report on Form 20-F for the year ended December 31, 2022 — “Item 3.D. Risk Factors.” You are urged to consider these factors carefully in evaluating the forward-looking statements. These forward-looking statements speak only as of the date of this report. Except as required by law, we assume no obligation to update or revise these forward-looking statements for any reason, even if new information becomes available in the future. Given these risks and uncertainties, you are cautioned not to rely on such forward-looking statements as predictions of future events.

You should read this report and the documents that we reference in this report and have filed as exhibits to this report completely and with the understanding that our actual future results may be materially different from what we expect. You should also review the factors and risks we describe in the reports we will file or submit from time to time with the Securities and Exchange Commission after the date of this report. We qualify all of our forward-looking statements by these cautionary statements.

Overview

We are applying our innovative TransCon technology platform to build a leading, fully integrated, global biopharma company focused on making a meaningful difference in patients’ lives. Guided by our core values of patients, science, and passion, we use our TransCon technologies to create new and potentially best-in-class therapies.

Our Vision

In January 2019, we announced Vision 3x3, our strategic roadmap through 2025 to build a leading fully integrated, global, biopharma company and achieve sustainable growth through multiple approaches:

2

We have applied our TransCon technology platform in combination with clinically validated parent drugs or pathways using our algorithm for product innovation, with the goal of creating product candidates with the potential for best-in-class safety, efficacy, tolerability, and convenience in our therapeutic areas of Endocrinology Rare Disease, Oncology, and Ophthalmology. We plan to apply this algorithm for product innovation in additional therapeutic areas. We believe our approach to product innovation may reduce the risks associated with traditional drug development, and that our TransCon technology platform has been validated by non-clinical and clinical programs completed to date.

Ascendis Algorithm for Product Innovation

When we apply our TransCon technology platform to clinically validated parent drugs or pathways, we may benefit from established clinical safety and efficacy data, which we believe increases the probability of success compared to traditional drug development. As presented in the graphic below, our algorithm for product innovation focuses on identifying indications that have an unmet medical need, have a clinically validated parent drug or pathway, are suitable to our TransCon technologies, have potential for creating a clearly differentiated product, have a potential established development pathway, and have the potential to address a large market.

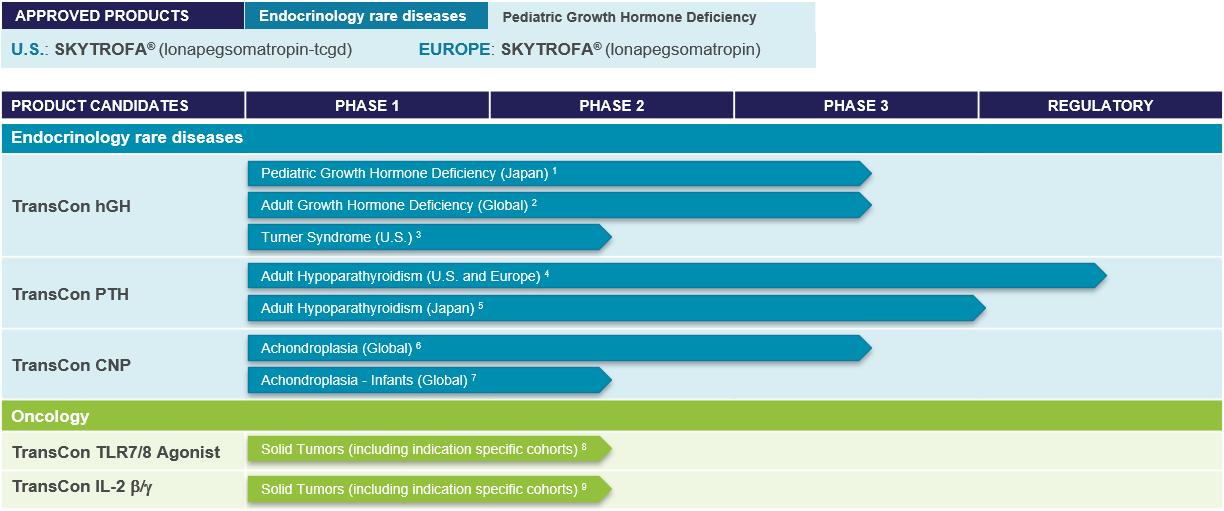

TransCon Products and Product Candidates Pipeline

We currently have one marketed product and a diversified portfolio of product candidates in clinical development in the areas of Endocrinology Rare Disease and Oncology. We are also working to apply our TransCon technology platform in additional therapeutic areas, including Ophthalmology.

3

4

Global Commercialization Strategy

We are establishing a global presence to commercialize approved TransCon Endocrinology Rare Disease products. In the U.S., we have established a multi-faceted organization to support the ongoing commercialization of SKYTROFA. This organization will also serve as the foundation for future Endocrinology Rare Disease product launches in the U.S. We are expanding our presence in Europe by building integrated organizations in select countries, beginning with the launch of SKYTROFA in Germany, and through established distribution channels in other countries. In other markets, we plan to establish a commercial presence through partners with local expertise and infrastructure.

In therapeutic areas outside of Endocrinology Rare Disease, we plan to create value through strategic partnerships, collaborations, or other business models.

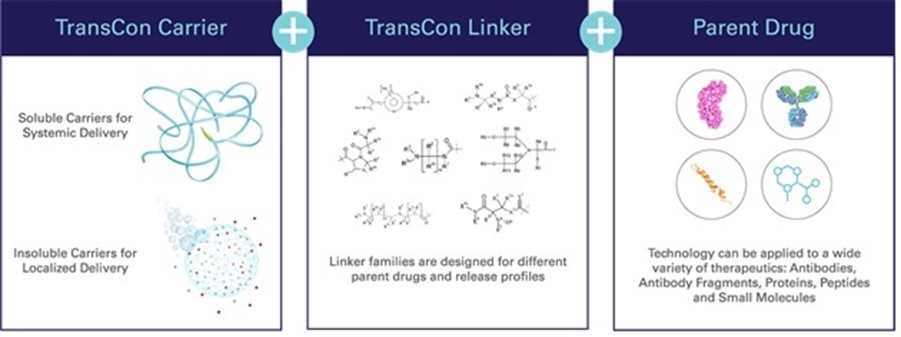

TransCon Technology Platform

Our TransCon technology platform is designed to combine the benefits of conventional prodrug and sustained release technologies to solve the fundamental limitations seen in other approaches to extending duration of a drug’s action in the body, with the goal of developing product candidates that are highly differentiated based on efficacy, safety, tolerability and convenience. In addition to retaining the original mode of action of the parent drug and potentially supporting dosing frequency from daily up to six months or more, we believe that predictable release over time can improve treatment efficacy, increase the likelihood of clinical development success, and provide intellectual property benefits.

TransCon molecules have three components: a parent drug, an inert carrier that protects it, and a linker that temporarily binds the two. When bound, the carrier inactivates and shields the parent drug from clearance. When injected into the body, physiologic pH and temperature conditions initiate the release of the active, unmodified parent drug in a predictable release manner. Depending upon the type of TransCon carrier we employ, we can design our TransCon prodrugs for sustained localized or systemic delivery.

On September 5, 2023, we announced a new TransCon technology carrier platform with the potential to unlock large market opportunities, where high volume and low-cost manufacturing is required, and demonstrated proof-of-principle for GLP-1 analogs (semaglutide), with data supporting potential best-in-class weekly and monthly administration profiles.

TransCon Products – Endocrinology Rare Disease

TransCon Growth Hormone (hGH) for Pediatric Growth Hormone Deficiency

TransCon hGH is a prodrug of somatropin, administered once weekly, composed of unmodified somatropin that is transiently bound to a carrier and proprietary linker. TransCon hGH is designed to maintain the same mode of action as daily therapies by releasing the same recombinant growth hormone molecule, somatropin, as daily hGH therapy.

5

On September 23, 2023, we announced results from enliGHten, an open-label extension trial evaluating the long-term safety and efficacy of TransCon hGH as a once-weekly treatment for children and adolescents with growth hormone deficiency. The enliGHten trial enrolled 298 participants (mean age 10.3 years) from the Phase 3 heiGHt Trial of treatment-naïve pediatric GHD patients and the Phase 3 fliGHt Trial of pediatric GHD patients switching from daily somatropin treatment. Patients in these trials received a total of up to 6 years of treatment with TransCon hGH. At the time of the enliGHten Trial closure, 81 participants were designated as treatment completers, based on their physician’s determination that treatment for pediatric GHD was no longer required. Of these treatment completers, 59% met or exceeded their average parental height standard deviation score (“SDS”), with mean TransCon hGH treatment duration of 3.2 years.

In March 2023, we enrolled our first patient in SkybriGHt, a Phase 4 U.S. multi-center, non-interventional, observational cohort study of subjects treated with SKYTROFA in the post-marketing setting.

In January 2022, the EC granted marketing authorization for SKYTROFA (developed under the name TransCon hGH) as a once-weekly subcutaneous injection for the treatment of children and adolescents ages 3 to 18 years with growth failure due to insufficient secretion of endogenous growth hormone.

In August 2021, the FDA approved TransCon hGH, known by its brand name SKYTROFA, for the treatment of pediatric patients one year and older who weigh at least 11.5 kg and have growth failure due to inadequate secretion of endogenous growth hormone, also known as GHD. SKYTROFA is the first FDA approved product that delivers somatropin, or growth hormone, by sustained release over one week.

TransCon Product Candidates – Endocrinology Rare Diseases

TransCon Growth Hormone (hGH) for Other Indications

Clinical Development in Adults

We are currently conducting foresiGHt, a global Phase 3 trial investigating the metabolic benefits of TransCon hGH in adults with GHD. Patients in the trial are randomized in a 1:1:1 ratio into the three arms of the study—treatment with once-weekly TransCon hGH, once-weekly placebo, or daily hGH. The primary endpoint of the trial is a change from baseline in percentage trunk fat at 38 weeks. Following the 38-week main trial period, all patients will be eligible to receive once-weekly TransCon hGH during the 52-week open-label extension. During the fourth quarter of 2022, we completed recruitment into this trial, and topline results are expected in the fourth quarter of 2023.

Other Development Plans

In June 2022, we submitted a trial protocol to the FDA for New InsiGHTS, a Phase 2 trial to evaluate TransCon hGH in Turner Syndrome. Based on the nature of Turner Syndrome, in this trial we are evaluating higher doses of TransCon hGH and daily hGH compared to doses studied for pediatric GHD. In addition, we are also considering other potential indications for TransCon hGH where we believe a long-acting hGH therapy may offer benefits to patients.

TransCon PTH

TransCon PTH (palopegteriparatide) is an investigational prodrug of parathyroid hormone (“PTH”) composed of PTH(1-34) transiently conjugated to an inert carrier via a TransCon linker that is designed to be administered once-daily to achieve and maintain a steady concentration of PTH in the bloodstream, thereby more fully addressing all aspects of the disease including normalizing serum and urinary calcium and serum phosphate levels and reducing the burden of conventional therapy. Pharmacokinetic data from our multiple ascending dose cohorts in our Phase 1 trial of TransCon PTH in healthy subjects demonstrated a half-life of approximately 60 hours, supporting an infusion-like profile with daily administration. We believe TransCon PTH can address the fundamental limitations of short-acting PTH molecules and become a highly differentiated therapy for hypoparathyroidism.

Clinical Development of TransCon PTH for Adult Hypoparathyroidism

Our Phase 3 PaTHway Trial, Phase 3 PaTHway Japan Trial, and Phase 2 PaTH Forward Trial evaluated TransCon PTH in adult patients with hypoparathyroidism. Following the primary outcome period, all three trials continue in the extension portion to collect long term data.

6

On September 14, 2023, we announced that the European Medicines Agency’s Committee for Medicinal Products for Human Use (“CHMP”) adopted a positive opinion and recommended the approval of TransCon PTH as a PTH replacement therapy indicated for the treatment of adults with chronic hypoparathyroidism. The EC’s final decision on our Marketing Authorisation Application is expected within 67 days after the positive opinion. If approved, the first EU launch of TransCon PTH is planned in Germany in early 2024.

On September 5, 2023, we announced new post hoc analysis showing adults with hypoparathyroidism treated with TransCon PTH demonstrated substantial improvement in estimated glomerular filtration rate (“eGFR”), suggesting improved kidney function. In the Phase 3 PaTHway Trial, mean baseline eGFR was 67.3 and 72.7 mL/min/1.73m2 for subjects randomized to TransCon PTH and placebo, respectively. At Week 26, patients treated with TransCon PTH experienced a mean increase in eGFR of 7.9 mL/min/1.73m2 compared to baseline (p<0.0001) while those on placebo experienced a mean decrease in eGFR of -1.9 mL/min/1.73m2 compared to baseline (p=0.3468). By Week 52, patients treated with TransCon PTH, including those crossing over from placebo, experienced a mean increase in eGFR of 8.9 mL/min/1.73m2 compared to baseline (p<0.0001). The improvement at Week 52 was even greater, for patients with eGFR <60 at baseline, the threshold for impaired kidney function, experiencing a mean increase in eGFR of 11.5 mL/min/1.73m2.

PaTHway: eGFR Change from Baseline by eGFR Group |

|||||

|

Baseline |

Week 26 |

Week 52 |

||

Study Arm |

eGFR (mL/min/1.73m2) |

N |

Mean (p value) |

N |

Mean (p value) |

TransCon PTH / TransCon PTH |

eGFR < 60 |

19 |

+11.4 (p=0.0002) |

19 |

+11.5 (p=0.0003) |

eGFR ≥ 60 |

41 |

+6.3 (p=0.0002) |

40 |

+8.2 (p <0.0001) |

|

All |

60 |

+7.9 (p< 0.0001) |

59 |

+9.3 (p<0.0001) |

|

Placebo (first 26 weeks) / TransCon PTH* |

eGFR < 60 |

4 |

+0.05 (p=0.9877) |

4 |

+11.7 (p=0.0018) |

eGFR ≥ 60 |

15 |

-2.4 (p=0.3280) |

15 |

+6.5 (p=0.0199) |

|

All |

19 |

-1.9 (p=0.3468) |

19 |

+7.6 (p=0.0014) |

|

eGFR (an assessment of kidney filtering capacity) was calculated by the trial’s central lab using the Modification of Diet in Renal Disease Study Group (MDRD) equation (Levey, Ann Intern Med 2006).

*Patients in the placebo arm switched to TransCon PTH following the Week 26 visit.

Among subjects with baseline eGFR < 60 mL/min/1.73m2 (considered the threshold for impaired kidney function), approximately 50% were able to improve their eGFR to > 60 mL/min/1.73m2 with TransCon PTH therapy.

|

|

Number of Responders* |

Number of Responders* |

|

eGFR < 60 |

(n, %) |

(n, %) |

|

at Baseline (n) |

Week 26 |

Week 52 |

TransCon PTH / TransCon PTH |

n=19 |

n=12 |

n=10 |

63% |

53% |

||

Placebo (first 26 weeks) / TransCon PTH** |

n=4 |

n=0 |

n=3 |

0% |

75% |

||

Total PaTHway Trial |

n=23 |

n=12 |

n=13 |

52% |

57% |

eGFR based on central lab data using the MDRD Study Group formula.

* Responders defined as moving from eGFR < 60 to eGFR ≥ 60. Units in (mL/min/1.73m2).

** Patients in the placebo arm switched to TransCon PTH following the Week 26 visit.

7

In late August 2023, a Type A meeting was held with FDA following the FDA's issuance of a complete response letter for the TransCon PTH (palopegteriparatide) NDA for the treatment of adults with hypoparathyroidism, in May 2023. In the complete response letter, the FDA cited concerns related to the manufacturing control strategy for variability of delivered dose in the TransCon PTH drug/device combination product. The FDA did not express concern in the complete response letter about the clinical data submitted as part of the NDA package and no new preclinical studies, or Phase 3 clinical trials to evaluate safety or efficacy, were requested in the letter. We plan to resubmit the NDA before mid-November 2023.

On June 17, 2023, we announced one-year (Week 52) data from the open-label extension (“OLE”) portion of the Phase 3 PaTHway Trial of TransCon PTH in adults with hypoparathyroidism. PaTHway is a Phase 3 trial of TransCon PTH with a placebo ("PBO")-controlled 26-week blinded portion and a 156-week OLE portion, designed to evaluate the long-term efficacy and safety of TransCon PTH as a potential hormone therapy for adult patients diagnosed with hypoparathyroidism. Of the 82 study participants dosed, 79 completed blinded treatment and entered the OLE, and 78 (59 TransCon PTH/TransCon PTH, 19 PBO/TransCon PTH) completed Week 52. The data showed that treatment with TransCon PTH resulted in sustained improvements through Week 52, as well as safety and tolerability similar to that reported for the initial 26-week blinded portion of the trial.

As of September 30, 2023, 76 out of 79 patients have exceeded two years of follow-up in the PaTHway Trial.

On June 5, 2023, we announced that we started enrollment for a Compassionate Use Program (“CUP”) in Germany for TransCon PTH (palopegteriparatide). The CUP was approved by Germany’s Federal Institute for Drugs & Medical Devices (Bundesinstitut für Arzneimittel & Medizinprodukte). Through the CUP, treating physicians can request TransCon PTH (palopegteriparatide) for eligible adult patients with hypoparathyroidism whose clinical condition, in the opinion of the treating physician, requires PTH treatment with palopegteriparatide, and who cannot be adequately treated with currently approved products or participate in a palopegteriparatide clinical trial.

On January 8, 2023, we announced topline data from PaTHway Japan, a single-arm Phase 3 trial to evaluate the safety, tolerability, and efficacy of TransCon PTH in adults with hypoparathyroidism. The study achieved its primary objective, with topline results consistent with our trials in North America and the EU. Twelve out of thirteen patients met the primary composite endpoint, which was defined as serum calcium levels in the normal range (8.3–10.6 mg/dL) and independence from conventional therapy (active vitamin D and >600 mg/day of calcium supplements). In this trial, TransCon PTH was generally well-tolerated, with no discontinuations related to study drug. As of September 30, 2023, 12 patients continue in the ongoing 3-year extension portion of the PaTHway Japan Trial.

In December 2022, the FDA allowed Ascendis to initiate a U.S. expanded access program (“EAP”) for TransCon PTH for eligible adult patients with hypoparathyroidism with prior PTH treatment experience. This EAP is open for enrollment, allowing U.S. physicians to request access to investigational TransCon PTH for their eligible patients.

In September 2022, we announced new Week 110 data from the Phase 2 PaTH Forward Trial showing that long-term therapy with TransCon PTH provided a durable response in adult patients with hypoparathyroidism, as evidenced by continued normalization of mean serum calcium levels and 93% of patients achieving independence from conventional therapy with active vitamin D and therapeutic levels of calcium. As of September 30, 2023, 57 out of the 59 patients continued in the OLE portion of the trial, where they receive an individualized maintenance dose of TransCon PTH. In addition, all 57 subjects have exceeded three years of follow-up in the PaTH Forward Trial. Two patients withdrew from the trial for reasons unrelated to safety or efficacy of the study drug.

In March 2022, we announced that topline data from the randomized, double-blind, placebo-controlled portion of our Phase 3 PaTHway Trial of TransCon PTH in adults with hypoparathyroidism demonstrated statistically significant improvement with TransCon PTH compared to control on the primary composite endpoint and all key secondary endpoints.

TransCon CNP

TransCon CNP is an investigational long-acting prodrug of C-type natriuretic peptide designed to provide continuous CNP exposure at therapeutic levels with a well-tolerated and convenient once-weekly dose. It is being developed for the treatment of children with ACH. TransCon CNP is designed to provide effective shielding of CNP from neutral endopeptidase degradation in subcutaneous tissue and the blood compartment, minimize binding of CNP to the NPR-C receptor to decrease clearance, reduce binding of CNP to the NPR-B receptor in the cardiovascular system to avoid hypotension, and release unmodified CNP, which is small enough in size to allow effective penetration into growth plates. Shorter-acting CNP and CNP analogs in development have resulted in high Cmax levels that may cause adverse cardiovascular events. We believe the therapeutically sustained release of TransCon CNP offers advantages that may mitigate this issue, leading to more constant CNP exposure at lower Cmax to correlate with better therapeutic outcomes.

8

Clinical Development of TransCon CNP for Achondroplasia

Our ongoing pivotal, Phase 3 ApproaCH Trial and Phase 2 ACcomplisH trial, as well as our long-term extension trial AttaCH, are evaluating the safety and efficacy of TransCon CNP in children with ACH.

During the third quarter of 2023, we filed an IND amendment with the FDA to initiate reACHin, a Phase 2, multicenter, double-blind, randomized, placebo-controlled trial, designed to evaluate the safety, tolerability, and efficacy of 100 μg CNP/kg of TransCon CNP once-weekly for 52 weeks in infants with ACH, aged 0 to < 2 years at the time of randomization. We also plan to submit an IND or similar application in the fourth quarter of 2023 for the evaluation of TransCon CNP in combination with TransCon hGH.

On September 5, 2023, we announced completion of enrollment in ApproaCH with a total of 84 subjects randomized. U.S. and EU regulatory agencies have endorsed ApproaCH, a global randomized, double-blind, placebo-controlled trial in children ages 2–11 years with achondroplasia, as a pivotal Phase 3 trial. The primary endpoint of the trial is annualized growth velocity at 52 weeks with additional endpoints analyzing achondroplasia-related co-morbidities and quality of life. Topline results from the ApproaCH trial are expected in the second half of 2024.

In November 2022, we announced topline results from ACcomplisH, a Phase 2 randomized, double-blind, placebo-controlled, dose-escalation trial evaluating the safety and efficacy of once-weekly TransCon CNP compared to placebo.