Exhibit 99.2

December 23, 2019

To whom it may concern:

| Company name | SoftBank Corp. | |||||

| Name of Representative | Representative Director, President & CEO | Ken Miyauchi | ||||

| (Securities Code: 9434, Tokyo Stock Exchange First Section) | ||||||

| Inquiries | Executive Officer, General Manager of Finance & Accounting Division | Takashi Naito | ||||

| (TEL. 03-6889-2000) | ||||||

| Company name | NAVER Corporation | |||||

| Name of Representative | CEO | Han Seong Sook | ||||

| Inquiries | IR Leader | Kim Min | ||||

| (E-Mail: dl_IR@navercorp.com) | ||||||

Notice Concerning Entry into a Definitive Agreement Relating to the Business Integration of Z Holdings Corporation (Securities Code: 4689) and LINE Corporation (Securities Code: 3938)

SoftBank Corp. (hereinafter “SoftBank”), NAVER Corporation (hereinafter “NAVER”, and SoftBank and NAVER are collectively referred to as the “Proposing Parties”), Z Holdings Corporation (Securities Code: 4689, listed on the first section of the Tokyo Stock Exchange, Inc. (hereinafter, the “TSE”)), a consolidated subsidiary of SoftBank (hereinafter “ZHD”), and LINE Corporation (Securities Code: 3938, listed on the first section of the TSE), a consolidated subsidiary of NAVER (hereinafter “LINE”), have, since November 18, 2019, been discussing and evaluating a business integration between ZHD and its subsidiaries (hereinafter, the “ZHD Group”) and LINE and its subsidiaries (hereinafter, the “LINE Group”) (hereinafter, the “Business Integration”) based on the Memorandum of Understanding regarding the Business Integration on an equal basis that was entered into between the four companies on November 18, 2019 (hereinafter, the “Integration MOU”), and in accordance with the resolutions of the Board of Directors of each of NAVER, ZHD and LINE at a meeting held today, and in accordance with the decision of Ken Miyauchi, Representative Director, President & CEO, who has been authorized in accordance with the resolution of the Board of Directors of SoftBank at a meeting held today, the four companies have today entered into a business integration agreement, which is the definitive and legally-binding agreement regarding the Business Integration (hereinafter, the “Definitive Integration Agreement”), and in accordance with the resolutions of the Board of Directors of NAVER at a meeting held today, and in accordance with the decision of Ken Miyauchi, Representative Director, President & CEO, who has been authorized in accordance with the resolution of the Board of Directors of SoftBank at a meeting held today, the Proposing Parties have entered into a legally-binding transaction agreement today regarding the Definitive Integration Agreement and joint venture agreement (hereinafter, the “Joint Venture Agreement”).

In addition, as announced by the Proposing Parties in the “Notice Concerning the Planned Commencement of the Joint Tender Offer for Shares of LINE Corporation (Securities Code: 3938)” dated today (hereinafter, the “Press Release for the Tender Offer”), as one step in the series of transactions to realize the Business Integration, by resolution of the Board of Directors of NAVER at a meeting held today, and by the decision of Ken Miyauchi, Representative Director, President & CEO, who has been authorized in accordance with the resolution of the Board of Directors of SoftBank at a meeting held today, the Proposing Parties have decided to jointly conduct a tender offer in Japan and the United States (hereinafter, the “Joint Tender Offer”).

According to the announcement from LINE today, “Announcement of Opinion Regarding the Planned Commencement of the Joint Tender Offer for the Shares of LINE Corporation by SoftBank Corp. and NAVER Corporation, the Controlling Shareholder of LINE Corporation,” it has been resolved by the Board of Directors of LINE at a meeting held today that in the event that the Joint Tender Offer commences, LINE will express its opinion in support of the Joint Tender Offer and, at the same time, recommend that holders of LINE common shares and American Depositary Receipts tender into the Joint Tender Offer for common shares of LINE (“LINE Shares”), and leave to the discretion of the owners of share options and convertible bonds the decision of whether or not to tender into the Joint Tender Offer.

1

ZHD, the publicly listed integrated company following the Business Integration (hereinafter, the “Combined Company”), is expected to be a consolidated subsidiary of SoftBank. The Business Integration is conditioned on the receipt of required competition law and foreign exchange law approvals and other clearances and permits required by applicable law and regulation.

| 1. | Purpose and Significance of the Business Integration |

| (1) | Background |

Social and industrial conditions surrounding us are changing drastically and daily on a global basis. Particularly in the Internet market, overseas companies, especially those based in the United States and China, are overwhelmingly dominant, and even when comparing the size of operations, there is currently a big difference between such overseas companies and those in Japan and other Asian countries, other than China.

Furthermore, in Japan, which is working to increase the declining productivity that comes along with a shrinking workforce and to respond rapidly to natural disasters, the use of AI (Note 1) and technology in these fields has great potential.

(Note 1) “AI” stands for “Artificial Intelligence.”

In these circumstances, under SoftBank’s “Beyond Carrier” strategy, through collaboration between SoftBank group companies and leading companies that they invest in, SoftBank goes beyond being a telecommunications carrier and aims to develop new businesses that use the world’s most advanced technologies, including AI and IoT (Note 2). At the same time, NAVER aims to transform and innovate the world’s most advanced technologies in order to provide services going beyond being the biggest search portal engine in the Republic of Korea. The Business Integration aims to bring together the business resources of the ZHD Group, which provides various services in Japan and has a firm user base (averaging 67.43 million monthly users and 140 million MAU in total for apps) and abundant assets (total consolidated assets: 2,795,895 million yen), and the LINE Group, which has a rich range of services and a user base with 82 million monthly active users in Japan and 104 million monthly active users overseas, to provide a convenient experience to users in Japan and bring Japanese society and industry up-to-date through strengthening existing business areas and investing in expansion into new business areas. Through further expanding this innovative model globally, SoftBank aims to be a leading company that is a driving force across Japan, Asia, and worldwide. The Business Integration envisions business cooperation between SoftBank, NAVER, ZHD, and LINE in a variety of areas and industries, including among others, AI, internet searches, telecommunications, advertisement, payment settlement, communication, etc., and is positioned to be instrumental in increasing the corporate value of SoftBank and NAVER: in the case of SoftBank, by generating further growth at ZHD, a crucial component to SoftBank’s “Beyond Carrier” strategy, and creating new business opportunities in the 5G era; and in the case of NAVER, by supporting its efforts to establish itself as a leading AI technology-based IT company and accelerating the growth of its Fintech (Note 3) services using the most advanced technologies.

(Note 2) IoT stands for “Internet of Things,” and it refers to the communication between objects via the Internet.

(Note 3) Fintech is a word made up of “finance” and “technology,” and it refers to activities to attempt to resolve inefficiencies in existing financial services and to innovate financial services through the utilization of smart devices including smartphones and tablets and technologies that utilize big data.

| (2) | Basic Principles of the Business Integration |

The Business Integration will be conducted on an equal basis by ZHD and LINE with the aim of forming a business group that can overcome fierce domestic and global competition through the ZHD Group and the LINE Group bringing together their business resources and through the Combined Company group, following the Business Integration, pursuing synergies in their respective business areas as well as implementing business investment targeting growth in the areas of AI, commerce, Fintech, advertising, and O2O (Note 4) and other new business areas.

(Note 4) O2O stands for “Online to Offline,” and it refers to measures for online (internet)-based information to influence offline (real world) purchasing activities.

2

| (3) | Vision and Management Philosophy for the Combined Company |

Through the Business Integration, the ZHD Group and the LINE Group will combine their business resources, and by crossing the ZHD Group slogan of “Make our users’ lives convenient to a surprising (!) extent” and the “wow” value standard of the LINE Group, will create and offer a more abundant and convenient lifestyle for users by providing AI and Internet technology.

First, by bringing Japanese society and industry up-to-date by providing the best user experience in Japan, and expanding from there to Asia and then beyond globally, the aim is to become the “AI tech leader of the world from Japan/Asia”.

| 2. | Summary of the Business Integration |

| (1) | Method of Business Integration |

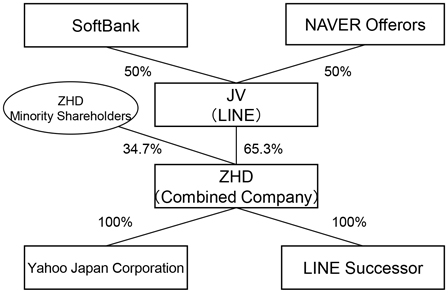

In the Definitive Integration Agreement, SoftBank, NAVER, ZHD, and LINE agreed broadly on the following method of Business Integration. Please also refer to “Attachment 1 Schematic Diagram of the Business Integration” for the method of Business Integration.

| ① | SoftBank and NAVER or its wholly owned subsidiary (a Japanese entity) (NAVER and such wholly owned subsidiary, the “NAVER Offerors”) will implement the Joint Tender Offer for the purpose of taking LINE private. |

| ② | In the event that, following the completion of the Joint Tender Offer, a portion of the Target Shares (defined in the Press Release for the Tender Offer) have not been tendered and acquired, SoftBank and the NAVER Offerors will implement squeeze-out procedures (with the intended result that post-squeeze out, SoftBank and the NAVER Offerors shall be the only shareholders of LINE) using a reverse share split or other methods permitted by law to take LINE private (hereinafter, the “Squeeze-out”, and together with the Joint Tender Offer, hereinafter, the “Transaction to Take LINE Private”), and deliver consideration for the Squeeze-out in the same amount as the tender offer price to LINE shareholders in the Joint Tender Offer. |

| ③ | LINE will make a tender offer for ZHD shares (hereinafter, the “Tender Offer for ZHD Shares”) (Note 1) for the purpose of acquiring all of ZHD shares (hereinafter, the “Shares to be Tendered”) held by Shiodome Z Holdings Corporation (hereinafter “Shiodome Z Holdings”), which is a consolidated subsidiary of SoftBank (Note 2). |

| ④ | Prior to the settlement of the Tender Offer for ZHD Shares, LINE will issue a corporate bond with SoftBank as the underwriter for the underwriting amount equivalent to the aggregate amount of the purchase price for the Tender Offer for ZHD Shares in order to secure the purchase funds for Tender Offer for ZHD Shares (hereinafter, the “Bond Issuance”). |

| ⑤ | After completion of the settlement for the Tender Offer for ZHD shares, an absorption-type merger (hereinafter, the “Merger”) will be conducted between Shiodome Z Holdings as the company ceasing to exist in the Merger and LINE as the surviving company. Assuming the total number of issued and outstanding LINE Shares and shares of ZHD are those of September 30, 2019 (excluding treasury shares), 180,882,293 new LINE Shares will be issued in consideration of the Merger (Note 3), all of which will be allocated to SoftBank, which is the parent of Shiodome Z Holdings. |

| ⑥ | By the day before the date of commencement of settlement for the Tender Offer for ZHD shares, SoftBank and the NAVER Offerors will undertake a shareholding adjustment transaction in order to make the ratio of voting rights in LINE held by SoftBank and the NAVER Offerors 50:50 immediately after the Merger becomes effective, which transaction shall take the form of a transfer of a portion of LINE Shares held by SoftBank from SoftBank to the NAVER Offerors (hereinafter, the “JV Conversion Transaction”). Through the Merger and the JV Conversion Transaction, LINE will become a consolidated subsidiary of SoftBank. |

| ⑦ | At the same time as the Merger becomes effective, LINE will contribute all of its business (except for its shares in ZHD and the status, rights, and obligations in connection with the contracts entered into by LINE with respect to the Business Integration and any other rights and obligations specified in the absorption-type demerger agreement) to a newly formed wholly owned subsidiary (hereinafter, the “LINE Successor”) in an absorption-type demerger (hereinafter, the “Corporate Demerger”). |

| ⑧ | After the Corporate Demerger becomes effective, a share exchange will be conducted with ZHD shares as consideration whereby ZHD becomes the wholly owning parent company and the LINE Successor becomes the wholly owned subsidiary company (hereinafter, the “Share Exchange”). |

3

The Business Integration is subject to receipt of required competition law and foreign exchange law and other clearances and permits required by applicable law and regulation in each country as well as the satisfaction of the other preconditions specified in the Definitive Integration Agreement.

(Note 1) As disclosed in the announcement dated November 18, 2019, by SoftBank titled “Announcement of Transfer of Shares of Z Holdings Corporation through Secondary Distribution to Shiodome Z Holdings Co., Ltd.”, in connection with the Business Integration, SoftBank transferred its shares in ZHD to its wholly owned consolidated subsidiary Shiodome Z Holdings, with an execution date of December 18, 2019.

(Note 2) Because the Tender Offer for ZHD Shares is scheduled to be conducted approximately nine months after today and will be conducted in accordance with an agreement between SoftBank and NAVER to transfer the Shares to be Tendered from Shiodome Z Holdings to LINE, the method and terms of the transfer of the Shares to be Tendered from Shiodome Z Holdings to LINE may change to the extent permitted by applicable law and regulation. In addition, the Tender Offer for ZHD Shares will not be conducted, directly or indirectly, in the United States, and will not be extended to, or for the benefit of, shareholders in the United States, who are definitively excluded from the Tender Offer for ZHD Shares.

(Note 3) However, based on the result of the Squeeze-out or if there is any other reason that requires reasonable adjustment, SoftBank and NAVER intend to make appropriate adjustments according to such result or reason through a separate agreement.

| (2) | Business Integration Schedule |

| Signing of the Integration MOU

|

November 18, 2019

| |

| Signing of the Definitive Integration Agreement (Signed Today)

|

December 23, 2019

| |

| Signing of the Absorption-Type Demerger Agreement for the Corporate Demerger (Planned)

|

January 2020

| |

| Signing of the Share Exchange Agreement for the Share Exchange (Planned)

|

January 2020

| |

| Shareholder Meeting for the Approval of the Share Exchange Agreement for the Share Exchange (Planned) (Note 1)

|

March 2020

| |

| Commencement of the Joint Tender Offer (Planned)

|

May–June 2020

| |

| Commencement of the Tender Offer for ZHD Shares (Planned)

|

September 2020

| |

| Shareholder Meeting for the Approval of the Absorption-Type Merger Agreement for the Merger (Planned) (Notes 1 and 2)

|

September 2020

| |

| Shareholder Meeting for the Approval of the Absorption-Type Demerger Agreement for the Corporate Demerger (Planned) (Notes 1 and 2)

|

September 2020

| |

| Effective Date of the Merger (Planned)

|

October 2020

| |

| Effective Date of the Corporate Demerger (Planned)

|

October 2020

| |

| Effective Date of the Share Exchange (Planned)

|

October 2020

|

| (Note 1) | The “Shareholder Meeting for the Approval of the Share Exchange Agreement for the Share Exchange (Planned)” means a shareholder meeting to be held by ZHD, the “Shareholder Meeting for the Approval of the Absorption-Type Merger Agreement for the Merger (Planned)” means shareholder meetings to be held by LINE and Shiodome Z Holdings, and the “Shareholder Meeting for the Approval of the Absorption-Type Demerger Agreement for the Corporate Demerger (Planned)” mean a shareholder meeting to be held by LINE. |

| (Note 2) | A shareholder meeting held by LINE for approving the absorption-type merger agreement for the Merger and a shareholder meeting held by LINE for approving the absorption-type demerger agreement for the Corporate Demerger will each be held after the completion of the Squeeze-out when SoftBank and the NAVER Offerors are the only shareholders of LINE. |

4

| (3) | Making LINE a subsidiary of SoftBank |

SoftBank plans to acquire LINE Shares by conducting the Transaction to Take LINE Private, including the Joint Tender Offer and the Merger as a part of a series of the transactions to realize the Business Integration, and LINE will become a subsidiary of SoftBank upon completion of the Transaction to Take LINE Private and effectiveness of the Merger and through the organization and operational structure of LINE based on the Joint Venture Agreement. In parallel with the Tender Offer for ZHD Shares and the Merger, SoftBank and the NAVER Offerors will undertake the JV Conversion Transaction in order to make the ratio of voting rights in LINE held by SoftBank and the NAVER Offerors 50:50 immediately after the Merger becomes effective. Please refer to “(2) Details of the Joint Venture Agreement” in “4. Outline of the Business Alliance with Capital Alliance by ZHD and LINE” for details of the contents of the Joint Venture Agreement.

| ① | Reasons for acquisition of shares |

The Transaction to Take LINE Private, including the Joint Tender Offer, the Merger and the JV Conversion Transaction, will be conducted as a series of steps in the transactions to realize the Business Integration. Please refer to “1. Purpose and Significance of the Business Integration” for the purpose of the Business Integration.

| ② | Method of acquisition of shares |

SoftBank and the NAVER Offerors will conduct the Transaction to Take LINE Private, including the Joint Tender Offer to acquire LINE Shares for the purpose of taking LINE private. The number of shares to be purchased in the Joint Tender Offer is 83,606,486 shares, and SoftBank is expected to purchase the number of shares corresponding to 50% of the number of shares for each type of shares, etc. tendered in the Joint Tender Offer and the NAVER Offerors are expected to purchase the number of shares corresponding to the remaining 50%. If not all of the Target Shares are acquired in the Joint Tender Offer, SoftBank and the NAVER Offerors are expected to acquire LINE Shares in the Squeeze-Out. Please refer to the Press Release for the Tender Offer for details of the Joint Tender Offer and the Squeeze-out.

After completion of the settlement for the Tender Offer for ZHD Shares, assuming the total number of issued and outstanding LINE Shares and shares of ZHD are those of September 30, 2019 (excluding treasury shares), 180,882,293 new LINE Shares will be issued in consideration of the Merger (Note), all of which will be allocated to SoftBank, which is the parent of Shiodome Z Holdings.

(Note) However, based on the result of the Squeeze-out or if there is any other reason that requires reasonable adjustment, SoftBank and NAVER intend to make appropriate adjustments according to such result or reason through a separate agreement.

In the JV Conversion Transaction, SoftBank and the NAVER Offerors will transfer the LINE shares from SoftBank to NAVER so that LINE voting rights held by SoftBank and the NAVER Offerors will be 50:50 immediately after the Merger becomes effective.

| ③ | Outline of subsidiary subject to change |

Please refer to “(1) Parties involved in making LINE a subsidiary of SoftBank” in “5. Outline of the Parties” below for an overview of the subsidiaries subject to change.

| ④ | Outline of the counterparty to share acquisition |

Please refer to the Press Release for the Tender Offer for details of the Transaction to Take LINE Private, including the Joint Tender Offer.

For an overview of LINE, which will be the surviving company of the Merger, please refer to “(1) Parties involved in making LINE a subsidiary of SoftBank” in “5. Outline of the Parties” below.

5

| ⑤ | Number of shares to be acquired, acquisition price, and the status of shareholding before and after acquisition |

|

①

|

Number of shares held before change

|

Zero.

| ||||||

|

② |

Number of shares to be acquired | Number corresponding to 50% of the total number of issued and outstanding LINE Shares (excluding treasury shares) immediately after the completion of the Tender Offer for ZHD Shares (Note)

| ||||||

|

③ |

Acquisition price | Please refer to the Press Release for the Tender Offer for terms and conditions of the Transaction to Take LINE Private, including the acquisition price for the Joint Tender Offer. Please refer to “(4) The Merger” in “2. Overview of the Business Integration” for details on the Merger.

| ||||||

|

④ |

Number of shares held after acquisition | Number corresponding to 50% of the total number of issued and outstanding LINE Shares (excluding treasury shares) immediately after the completion of the Tender Offer for ZHD Shares (Holding ratio 50.0%) (Note)

| ||||||

(Note) The specific number of shares to be acquired may vary depending on the results of the Joint Tender Offer and the Squeeze-out and will be announced as soon as they are finalized.

| ⑥ | Change schedule |

We are aiming to commence the Transaction to Take LINE Private, including the Joint Tender Offer, from May to June 2020. The detailed schedule for the Joint Tender Offer will be announced as soon as it is finalized. Please refer to the Press Release for the Tender Offer for details of the Transaction to Take LINE Private, including the Joint Tender Offer.

The effective date of the Merger will be the same day as the settlement start date of the Tender Offer for ZHD Shares. The detailed schedule for the Tender Offer for ZHD Shares will be announced as soon as it is finalized. For other details of the Tender Offer for ZHD Shares, please refer to “Hikoukaikago no tousha ni yoru Z Hourudingusu Kabushiki Gaisha (Shouken Koudo: 4689) kabushiki ni taisuru koukai kaitsuke no kaishi yotei ni kansuru oshirase” (非公開化後の当社によるZホールディングス株式会社(証券コード:4689)株式に対する公開買付けの開始予定に関するお知らせ) announced by LINE today.

The JV Conversion Transaction is expected to be concluded by one day prior to the settlement start date of the Tender Offer for ZHD Shares.

| (4) | The Merger |

| ① | Purpose of the Merger |

As one step in a series of transactions to realize the Business Integration, LINE Shares will be allocated and issued to SoftBank as consideration for the Merger in order to make LINE a consolidated subsidiary of SoftBank and a joint venture company in which SoftBank and the NAVER Offerors will hold 50:50 voting rights.

| ② | Overview of the Merger |

| a) | Schedule of the Merger |

Please refer to “(2) Business Integration Schedule” in “2. Summary of the Business Integration” above for the Merger schedule.

| b) | Method of the Merger |

It will be an absorption-type merger with Shiodome Z Holdings as the company that will cease to exist and LINE as the surviving company in the Merger.

| c) | Details of allotment pertaining to the Merger |

Upon the Merger, LINE will issue 180,882,293 new common shares (Note) in consideration of the Merger, all of which will be allocated and issued to SoftBank.

(Note) However, based on the result of the Squeeze-out or if there is any other reason that requires reasonable adjustment, SoftBank and NAVER intend to make appropriate adjustments according to such result or reason through a separate agreement.

6

| d) | Treatment of share options and convertible bonds in connection with the Merger |

Not applicable.

| ③ | Outline of the parties to the Merger and the surviving company after the Merger |

Please refer to “(2) Parties to the Merger” in “5. Outline of the Parties.”

| (5) | The Corporate Demerger |

| ① | Method of the Corporate Demerger |

Absorption-type demerger with the demerger of LINE into the LINE Successor.

| ② | Allocation related to the Corporate Demerger |

LINE will not be given shares or other properties for the Corporate Demerger.

| ③ | Treatment of share options and convertible bonds in connection with the Corporate Demerger |

The LINE Successor does not plan to issue any share options or convertible bonds prior to the time when the Corporate Demerger becomes effective.

| ④ | Capital that will increase/decrease in connection with the Corporate Demerger |

The capital of LINE will not increase or decrease in connection with the Corporate Demerger.

| ⑤ | Rights and obligations succeeded to by the LINE Successor |

All rights and obligations of LINE in connection with its business (except for its shares in ZHD and the status, rights, and obligations in connection with the contracts entered into by LINE with respect to the Business Integration and any other rights and obligations specified in the absorption-type demerger agreement) will be succeeded to by the LINE Successor.

The succession of obligations shall be based on the method of assumption of obligations without any liabilities remaining with LINE.

| ⑥ | Expectation of fulfilling financial obligations |

The obligations of the LINE Successor before and after the Corporate Demerger are expected to be able to be fulfilled.

| (6) | The Share Exchange |

| ① | Purpose of the Share Exchange |

The Share Exchange will be conducted as one step in the series of the transactions to realize the Business Integration. Please refer to “1. Purpose and Significance of the Business Integration” for the purpose of the Business Integration.

| ② | Overview of the Share Exchange |

| a) | Schedule of the Share Exchange |

Please refer to “(2) Business Integration Schedule” in “2. Summary of the Business Integration” above for the schedule of the Share Exchange.

| b) | Method of the Share Exchange |

The Share Exchange will result in ZHD becoming the wholly owning parent company and the LINE Successor becoming the wholly owned subsidiary company.

7

c) Allotment for the Share Exchange

| (i) | The Exchange Ratio (allotted ratio of ZHD Shares to be exchanged for one share of the LINE Successor) |

| ZHD (Share Exchange wholly owning parent company)

|

LINE Successor (Share Exchange wholly

owned

| |||

| Exchange Ratio

|

1

|

11.75

|

(Note 1) The allotted ratio is calculated on the assumption that the total number of issued and outstanding shares (excluding treasury shares) of the LINE Successor immediately before the Share Exchange becomes effective will be the same as the total number of issued and outstanding LINE Shares (excluding treasury shares) as of September 30, 2019, which is 240,960,343 shares.

(Note 2) Based on the Exchange Ratio, the number of ZHD shares to be delivered through the Share Exchange will be 2,831,284,030 shares. (The number of ZHD treasury shares to be included in the quantity of ZHD shares to be delivered through the Share Exchange is yet to be finalized.) In addition, 11.75 shares of ZHD for each share of the LINE Successor will be allocated and delivered to LINE, the wholly owned parent company of the LINE Successor.

| d) | The Treatment of share options and convertible bonds in connection with the Share Exchange |

The LINE Successor does not plan to issue any share options or convertible bonds prior to the time when the Share Exchange becomes effective.

For the basis of the share exchange ratio for the Share Exchange, please refer to “Attachment 2 ‘Announcement Regarding Definitive Agreement on Business Integration’ Announced Today by ZHD and LINE”. In addition, the basis of the exchange ratio for the Share Exchange has not been materially changed from the basis described in the press release of November 18, 2019 titled “Entry into a Memorandum of Understanding Regarding the Business Integration’’ that was announced by ZHD and LINE.

| ③ | Outline of the parties in the Share Exchange and the wholly owning parent company after the Share Exchange |

Please refer to “(3) Parties to the Share Exchange” in “5. Outline of the Parties.”

| 3. | Outline of the Joint Tender Offer |

Please refer to the Press Release for the Tender Offer for details of the Joint Tender Offer.

| 4. | Outline of the business alliance with capital alliance by ZHD and LINE |

| (1) | Details of the business alliance with capital alliance by ZHD and LINE |

The Business Integration will be conducted as a business alliance with capital alliance on an equal basis by ZHD and LINE with the aim of forming a business group that can overcome fierce domestic and global competition through the ZHD Group and the LINE Group bringing together their business resources, and through the Combined Company group following the Business Integration pursuing synergies in their respective business areas as well as implementing business investment targeting growth in the areas of AI, commerce, Fintech, advertising, and O2O and other new business areas. For details of the business alliance involving the capital alliance between ZHD and LINE, including the details of the capital alliance agreement signed by ZHD and LINE today (hereinafter, the “Capital Alliance Agreement”), please refer to “Attachment 2 ’Announcement Regarding Definitive Agreement on Business Integration’ Announced Today by ZHD and LINE”.

8

| (2) | Details of the Joint Venture Agreement |

SoftBank and NAVER have entered into the Joint Venture Agreement today with respect to the Business Integration, and have broadly agreed on the organization and operation of LINE (hereinafter, the “JV”), which will be a joint venture company, whose only shareholders will be SoftBank and the NAVER Offerors, for the purpose of holding ZHD shares as outlined below.

| ① | Organizational design |

The JV shall be a company with a board of directors.

| ② | Directors |

There will be five (5) directors for the JV, of which three (3) will be appointed by SoftBank and the remaining two (2) will be appointed by NAVER. There shall be two (2) representative directors for the JV, of which SoftBank and NAVER will each appoint one (1). Immediately after the Business Integration, the board of directors of the JV will be composed of Ken Miyauchi and Kazuhiko Fujihara, each appointed by SoftBank, Hae Jin Lee and In Joon Hwang, each appointed by NAVER, and one more person to be separately appointed by SoftBank. Of these directors, Ken Miyauchi will assume the position of Representative Director and President of the JV and Hae Jin Lee will assume the position of Representative Director and Chairperson of the Board of the JV.

| ③ | Statutory auditor |

The JV will have 2 statutory auditors, with SoftBank and NAVER each appointing one.

| ④ | Agreement on consolidation of the JV |

NAVER agrees that SoftBank will consolidate the JV, subject to SoftBank’s voting rights in the JV being 50% or more (on a fully diluted basis).

| ⑤ | Agreement regarding the exercise of the right held by the JV to appoint ZHD directors based on the Capital Alliance Agreement |

SoftBank and NAVER will each appoint 3 of the 6 ZHD internal directors that the JV has the right to appoint under the Capital Alliance Agreement.

| ⑥ | Agreement regarding matters requiring consent of the JV as stipulated in the Capital Alliance Agreement |

In the event that ZHD intends to act on any of the following matters, the JV shall require prior written consent from SoftBank and NAVER before granting consent under the Capital Alliance Agreement.

| • | Changes to the articles of incorporation of ZHD (excluding minor changes); |

| • | Any action of ZHD involving an issuance of new shares, share options, or convertible bonds (including disposal of treasury shares or treasury share options) or granting or issuance of rights to convert to or acquire ZHD shares which renders the voting rights of the JV in ZHD to be 50% or less on a fully diluted basis; and |

| • | Transfers, assignments, successions, provisions of collateral or any other disposals (hereinafter, the “Transfer, Etc.”) of shares or other assets or businesses owned by ZHD or its consolidated subsidiaries that account for more than one-fifth of ZHD’s consolidated book value assets (excluding transfer of shares of listed companies held by ZHD or its consolidated subsidiaries) to a third party outside the ZHD Group. |

| ⑦ | Handling of the JV shares |

Except as otherwise provided for in the Joint Venture Agreement, neither SoftBank nor NAVER may undertake any Transfer, Etc. of the JV shares it holds without prior written consent of the other party.

9

| 5. | Outline of the Parties |

| (1) | Parties involved in making LINE a subsidiary of SoftBank |

| ① | Outline of subsidiary subject to change |

|

①

|

Name

|

LINE Corporation

| ||||||

|

② |

Address | 4-1-6 Shinjuku, Shinjuku-ku, Tokyo

| ||||||

|

③ |

Name and title of representative

|

Mr. Takeshi Idezawa, Representative Director and President

| ||||||

|

④ |

Nature of business | Advertising service based on the mobile messenger application “LINE,” core businesses including the sales of stamp and game service, and strategic businesses including Fintech, AI, and commerce service.

| ||||||

|

⑤

|

Share capital

|

JPY 96,535 million (as of September 30, 2019)

| ||||||

|

⑥

|

Founded

|

September 4, 2000

| ||||||

|

⑦ |

Equity attributable to the shareholders of the Company

|

JPY 164,844 million (as of September 30, 2019) | ||||||

|

⑧

|

Total assets

|

JPY 530,442 million (as of September 30, 2019)

| ||||||

|

⑨ |

Major shareholders and shareholding ratios (as of June 30, 2019)

|

NAVER | 72.64% | |||||

| MOXLEY & CO LLC | 3.64% | |||||||

| JAPAN TRUSTEE SERVICES BANK, LTD.

|

2.11%

| |||||||

|

⑩ |

Relationship with SoftBank

| |||||||

| Capital relationship | Not applicable.

| |||||||

| Personnel relationship | Not applicable.

| |||||||

| Business relationship | There are business relationships with respect to use of communication services, etc.

| |||||||

| Situations applicable to affiliated parties

|

It is not an affiliated party. | |||||||

|

⑪ |

Results of operation and financial position for the in the most recent three-year period (consolidated)

| |||||||

|

Fiscal year end

|

Year ended on December 31, 2016

|

Year ended on December 31, 2017

|

Year ended on December 31, 2018

| |||||

|

Revenues

|

JPY 140,704 m

|

JPY 167,147 m

|

JPY 207,182 m

| |||||

|

Operating income

|

JPY 19,897 m

|

JPY 25,078 m

|

JPY 16,110 m | |||||

| Profit (loss) before tax from continuing operations

|

JPY 17,990 m | JPY 18,145 m | JPY 3,354 m | |||||

| Profit (loss) attributable to the shareholders of the

LINE

|

JPY 6,763 m | JPY 8,078 m | JPY (3,718 m) | |||||

| Earnings per share: basic profit (loss) for the period attributable to the shareholders of

LINE

|

JPY 34.84 | JPY 36.56 | JPY (15.62) | |||||

10

| (2) | Parties to the Merger |

| ① | Company ceasing to exist in the Merger |

|

①

|

Name

|

Shiodome Z Holdings Co., Ltd.

| ||||||

|

②

|

Address

|

1-9-1, Higashi-Shinbashi, Minato-ku, Tokyo

| ||||||

|

③

|

Name and title of representative

|

Kazuhiko Fujihara, Representative Director

| ||||||

|

④

|

Nature of business

|

Business preparation company

| ||||||

|

⑤

|

Share capital

|

JPY 10 million (As of March 31, 2019)

| ||||||

|

⑥

|

Founded

|

June 1, 2016

| ||||||

|

⑦

|

Net assets

|

JPY 20 million (As of March 31, 2019)

| ||||||

|

⑧

|

Total assets

|

JPY 20 million (As of March 31, 2019)

| ||||||

| ⑨ | Major shareholders and shareholding ratios (as of September 30, 2019)

|

SoftBank Corp. 100% |

||||||

|

⑩ |

Relationships with the Other Parties

| |||||||

| Capital relationship | Not applicable.

| |||||||

| Personnel relationship | Not applicable.

| |||||||

| Business relationship | Not applicable.

| |||||||

| Situations applicable to affiliated parties

|

It is not an affiliated party. | |||||||

| ② | Surviving company in the Merger |

For an overview of LINE, which will be the surviving company in the Merger, please refer to “① Outline of subsidiary subject to change” in “(1) Parties involved in making LINE a subsidiary of SoftBank” under “5. Outline of the Parties.”

| ③ | Status of the surviving company after the Merger |

|

①

|

Name

|

LINE Corporation

| ||

|

②

|

Address

|

4-1-6 Shinjuku, Shinjuku-ku, Tokyo

| ||

|

③

|

Name and title of representative

|

Mr. Takeshi Idezawa, Representative Director and President

| ||

|

④

|

Nature of business

|

Advertising service based on the mobile messenger application “LINE,” core businesses including the sales of stamp and game service, and strategic businesses including Fintech, AI, and commerce service.

| ||

|

⑤

|

Share capital

|

JPY 96,535 million (as of September 30, 2019)

| ||

|

⑥

|

Fiscal year end

|

December 31

|

(Note) The status prior to the Corporate Demerger becoming effective is shown. LINE plans to transfer all of its business to the LINE Successor through the Corporate Demerger, and after the Corporate Demerger becomes effective, LINE (the JV) will hold ZHD (the Combined Company) shares in order to run the business that controls and manages ZHD business activities and to run associated operations. In addition, the name of LINE (the JV) will be changed after the Corporate Demerger becomes effective, but the name after the change has not yet been decided. For an overview of the Corporate Demerger, please refer to “(5) The Corporate Demerger” in “2. Summary of the Business Integration” above. For the organization and operation of LINE (the JV) after the Business Integration, please refer to “(2) Details of the Joint Venture Agreement” in “4. Outline of the Business Alliance with Capital Alliance by ZHD and LINE.”

11

| (3) | Parties to the Share Exchange |

| ① | Wholly owning parent company in the Share Exchange and the wholly owned subsidiary in the Share Exchange |

| Wholly owning parent company in Share Exchange | Wholly owned subsidiary company in Share Exchange | |||||||||||||

| ① | Name |

Z Holdings Corporation |

Preparatory corporation for demerger of LINE | |||||||||||

| ② | Address | Tokyo Garden Terrace Kioi-cho Kioi Tower, 1-3, Kioicho, Chiyoda-ku, Tokyo | 4-1-6 Shinjuku Shinjuku-ku, Tokyo | |||||||||||

| ③ | Name and title of representative | Kentaro Kawabe, Representative Director, President and CEO |

Takeshi Idezawa, Representative Director | |||||||||||

| ④ | Nature of business | Management of group companies and related operations | Company for preparation of operations | |||||||||||

| ⑤ | Share capital | JPY 237,404 million (as of September 30, 2019) | 1.50 million yen (as of the founding date of December 13, 2019) | |||||||||||

| ⑥ | Founded | January 31, 1996 | December 13, 2019 | |||||||||||

| ⑦ | Number of outstanding shares | 4,822,417,565 | 300 | |||||||||||

| ⑧ | Fiscal year end | March 31 | March 31 | |||||||||||

| ⑨ | Number of employees | 12,874 (As of March 31, 2019) | Not applicable (as of the founding date of December 13, 2019) | |||||||||||

| ⑩ | Major business relationships | General customers, corporations | Not applicable | |||||||||||

| ⑪ | Main banking relationships | Mizuho Bank, Ltd. Sumitomo Mitsui Banking Corporation MUFG Bank, Ltd. The Japan Net Bank, Limited. Crédit Agricole Corporate and Investment Bank Sumitomo Mitsui Trust Bank, Limited |

Not applicable | |||||||||||

| ⑫ | Major shareholders and shareholding ratios (Note 1) (as of September 30, 2019) |

SoftBank Corp. |

44.6% |

LINE Corporation |

100% | |||||||||

| STATE STREET BANK AND TRUST COMPANY 505325 | 3.0% | |||||||||||||

| SSBTC CLIENT OMNIBUS ACCOUNT | 1.9% | |||||||||||||

| JAPAN TRUSTEE SERVICES BANK, LTD. (Trust account) |

1.8% | |||||||||||||

| The Master Trust Bank of Japan, Ltd. (Trust account) |

1.8% | |||||||||||||

| GOLDMAN, SACHS & CO. REG | 1.7% | |||||||||||||

| J.P. MORGAN BANK LUXEMBOURG S. A. 1300000 | 1.5% | |||||||||||||

| JP MORGAN CHASE BANK 385632 | 1.2% | |||||||||||||

| BBH FOR FIDELITY LOW-PRICED STOCK FUND (PRINCIPAL ALL SECTOR SUBPORTFOLIO) | 1.1% | |||||||||||||

| JAPAN TRUSTEE SERVICES BANK, LTD. (Trust account 9) |

1.0% | |||||||||||||

| ⑬ | Relationships with the Other Parties | |||||||||||||

| Capital relationship | LINE will hold 100% of the shares in the LINE Successor immediately prior to the effective date of the Corporate Demerger, but on the day after the effective date of the Corporate Demerger, along with the Share Exchange, ZHD will hold 100% of the shares in the LINE Successor. | |||||||||||||

| Personnel relationship | Not applicable. | |||||||||||||

| Business relationship | Not applicable. | |||||||||||||

| Situations applicable to affiliated parties | Not applicable. | |||||||||||||

| ⑭ |

Results of operation and financial position in the most recent three-year period | |||||||||||||

| Fiscal year end |

ZHD (Consolidated) |

LINE Successor (Consolidated) (Note 2) | ||||||||||||

| Fiscal year ended March 31, 2017 |

Fiscal year ended March 31, 2018 |

Fiscal year ended March 31, 2019 |

Fiscal year ended December 31, 2016 |

Fiscal year ended December 31, 2017 |

Fiscal year ended December 31, 2018 | |||||||||

| Total capital | JPY 998,709 m | JPY 1,121,887 m | JPY 910,523 m | JPY 161,023 m | JPY 189,977 m | JPY 208,514 m | ||||||||

| Total assets | JPY 1,534,212 m | JPY 2,516,633 m | JPY 2,429,601 m | JPY 256,089 m | JPY 303,439 m | JPY 486,587 m | ||||||||

| Equity attributable to owners of parent per share | JPY 163.51 | JPY 177.97 | JPY 160.96 | JPY 738.53 | JPY 779.30 | JPY 833.87 | ||||||||

| Revenues | JPY 853,730 m | JPY 897,185 m | JPY 954,714 m | JPY 140,704 m | JPY 167,147 m | JPY 207,182 m | ||||||||

| Operating income | JPY 192,049 m | JPY 185,810 m | JPY 140,528 m | JPY 19,897 m | JPY 25,078 m | JPY 16,110 m | ||||||||

| Net profit before income taxes | JPY 193,475 m | JPY 193,177 m | JPY 123,370 m | JPY 17,990 m | JPY 18,145 m | JPY 3,354 m | ||||||||

| Income attributable to owners of the parent company | JPY 136,589 m | JPY 131,153 m | JPY 78,677 m | JPY 6,763 m | JPY 8,078 m | JPY (3,718 m) | ||||||||

| Earnings per share: basic profit (loss) for the period | JPY 23.99 | JPY 23.04 | JPY 14.74 | JPY 34.84 | JPY 36.56 | JPY (15.62) | ||||||||

|

Dividends per share |

JPY 8.86 | JPY 8.86 | JPY 8.86 | — | — | — | ||||||||

(Note 1) ZHD is also holding 60,021,000 treasury shares in addition to the above.

(Note 2) For the operating performance and financial conditions of the LINE Successor, those of LINE are shown.

12

| ② | Outline of the wholly owning parent company in share exchange after the Share Exchange |

| ① | Name | Z Holdings Corporation | ||

| ② | Address | Tokyo Garden Terrace Kioi-cho Kioi Tower, 1-3, Kioicho, Chiyoda-ku, Tokyo | ||

| ③ | Name and title of representative | Takeshi Idezawa, Representative Director and Co-CEO Kentaro Kawabe, Representative Director, President and Co-CEO | ||

| ④ | Nature of business | Management of group companies and related operations | ||

| ⑤ | Share capital | Not yet finalized. | ||

| ⑥ | Fiscal year end | March 31 | ||

| ⑦ | Net assets | Not yet finalized. | ||

| ⑧ | Total assets | Not yet finalized. |

| 6. | Advisors |

SoftBank retained Mizuho Securities Co., Ltd. and Nomura Securities Co., Ltd. to act as its financial advisor, and NAVER retained Deutsche Bank to act as its financial advisor. SoftBank’s legal advisors are Nagashima Ohno & Tsunematsu and Simpson Thacher & Bartlett LLP, and NAVER’s legal advisors are Nishimura & Asahi, Kim & Chang and Cleary Gottlieb Steen & Hamilton LLP.

| 7. | Other Matters |

Any impact on the results of our business and operations due to the Joint Tender Offer and the Business Integration will be disclosed if and when they become known.

End

13

This press release contains “forward-looking statements” as defined in Article 27A of the U.S. Securities Act of 1933, as amended, and Article 21E of the U.S. Securities Exchange Act of 1934, as amended (the “Exchange Act”). Actual results might be materially different from the express or implied predictions, including the “forward-looking statements” contained herein due to known or unknown risks, uncertainties, or any other factors. Neither SoftBank, the NAVER Offerors (together with SoftBank, hereinafter, the “Tender Offerors”), LINE (hereinafter, the “Target Company”), nor their respective affiliates assure that such express or implied predictions, including the “forward-looking statements” contained herein, will be achieved. The “forward-looking statements” contained in this press release have been prepared based on the information possessed by the Tender Offerors and the Target Company as of the date hereof, and unless otherwise required under applicable laws and regulations, neither the Tender Offerors, the Target Company, nor any of their affiliates assume any obligation to update or revise such statements to reflect any future events or circumstances.

The respective financial advisors of the Tender Offerors or the Target Company as well as the tender offer agent(s) (including their affiliates) may, in the ordinary course of their business, engage in the purchase of the common shares or other securities of the Target Company, or act in preparation for such purchase, for their own account or for their customers’ account before or during the purchase period for the Joint Tender Offer in accordance with the requirements of Rule 14e-5(b) under the Exchange Act and to the extent permitted under Japanese financial instruments and exchange regulations and other applicable laws and ordinances. If any information concerning such purchase is disclosed in Japan, the relevant financial adviser or tender offer agent who conducted such purchase will disclose such information on its English website (or by any other means of public disclosure).

The Joint Tender Offer described in this press release has not yet commenced. This press release is provided for informational purposes only and does not constitute an offer to purchase or the solicitation of an offer to sell any common stock (including any American Depositary Share representing any common stock) or other securities of LINE. If and at the time a tender offer is commenced, the Tender Offerors (and/or its affiliates, if applicable) intend to file with the U.S. SEC a Tender Offer Statement on Schedule TO containing an offer to purchase, a form of letter of transmittal and other documents relating to the tender offer, and the Target Company will file with the U.S. SEC a Solicitation/Recommendation Statement on Schedule 14D-9 with respect to the tender offer. The Tender Offerors intend to mail these documents to the Target Company shareholders. INVESTORS AND SHAREHOLDERS ARE URGED TO READ THOSE DOCUMENTS CAREFULLY BEFORE MAKING A DECISION CONCERNING THE TENDER OFFER AS THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE TENDER OFFER. Those documents and other documents filed by the Tender Offerors and the Target Company may be obtained without charge after they have been filed at the U.S. SEC’s website at www.sec.gov. The offer to purchase and related materials may also be obtained (when available) for free by contacting the information agent for the tender offer.

14

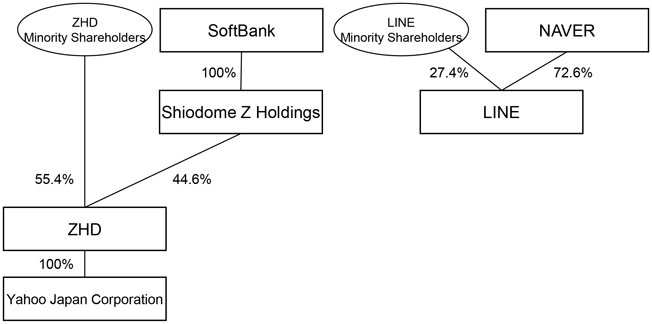

<Attachment 1 Schematic Diagram of the Business Integration>

|

Current status (As of today) |

| |||

|

①

② |

The

Joint

And

The Squeeze-out |

| ||

|

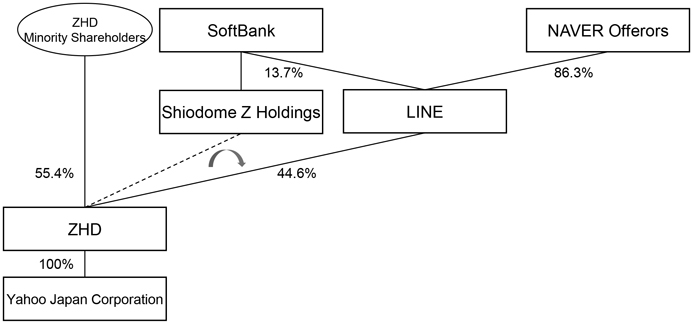

① SoftBank and the NAVER Offerors will jointly conduct the Joint Tender Offer for the purpose of taking LINE private. The commencement of the Joint Tender Offer is targeted to occur during the period from May to June 2020, and the Tender Offer Period is intended to be at least 30 business days, but it is difficult to accurately predict the amount of time required for procedures, etc. with the competition authorities in Japan and abroad, and therefore the detailed schedule of the Joint Tender Offer will be announced as soon as it is finalized. The aggregate amount of the purchase price is expected to be approximately 372.0 billion yen, with SoftBank and the NAVER Offerors each purchasing 50%.

② In the event that the Joint Tender Offer is completed and all of the Target Shares have not been acquired in the Joint Tender Offer, the Squeeze-out using a reverse share split or other methods will be deployed to take LINE private and to make SoftBank and the NAVER Offerors the only shareholders of LINE, and will provide LINE shareholders with the same amount as the Tender Offer Price in the Joint Tender Offer.

|

15

|

③

④ |

The Tender Offer for ZHD Shares

And

The Bond Issuance (Issuance of corporate bond by LINE) |

| ||

|

③ LINE will conduct the Tender Offer for ZHD Shares for the purpose of acquiring all ZHD shares held by Shiodome Z Holdings. The commencement of the Tender Offer for ZHD Shares is targeted to occur in early September 2020, but it is difficult to accurately predict the amount of time required for procedures, etc. with the competition authorities in Japan and abroad, and therefore, the detailed schedule of the Tender Offer for ZHD Shares will be announced as soon as it is finalized. In addition, the aggregate amount of the purchase price will be the number of shares to be purchased (2,125,366,950 shares) multiplied by the tender offer price pertaining to the Tender Offer for ZHD Shares (348 yen (or, if the lesser of (i) the closing price of ZHD shares on the First Section of the Tokyo Stock Exchange on the business day before the date of commencement of the Tender Offer for ZHD Shares and (ii) the simple average closing price over the past one month to the same date, discounted by 5% (rounded down to the nearest yen), is below 348 yen, then such amount); however, the specific amount is still to be finalized.

④ Prior to the settlement of the Tender Offer for ZHD Shares, LINE will issue bonds with SoftBank as the underwriter in order to secure the purchase funds for the Tender Offer for ZHD Shares. SoftBank and NAVER have agreed that the amount to be paid for the Bond Issuance will be equivalent to the aggregate amount of the purchase price in the Tender Offer for ZHD Shares.

| ||||

|

⑤

⑥ |

The Merger (Merger of Shiodome Z Holdings and LINE)

And

The JV Conversion Transaction (Transaction to adjust the voting rights ratio in LINE held by SoftBank and the NAVER Offerors to 50:50) |

| ||

|

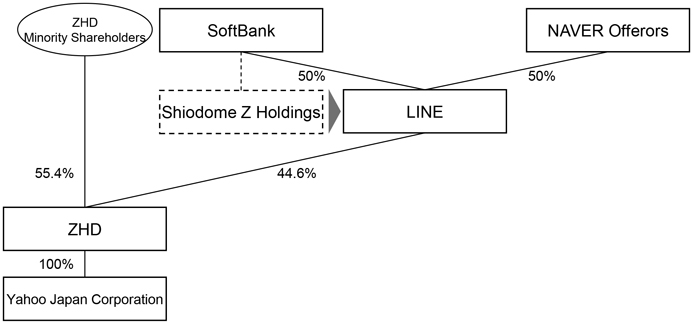

⑤ After completion of the settlement of the Tender Offer for ZHD Shares, the Merger will be conducted with Shiodome Z Holdings as the company ceasing to exist in the Merger and LINE as the surviving company. Assuming the total number of issued and outstanding LINE Shares and shares of ZHD is that of September 30 2019 (excluding treasury shares), 180,882,293 new LINE Shares will be issued in consideration of the Merger, all of which will be allocated to SoftBank, which is the parent of Shiodome Z Holdings. The Merger is scheduled to be effective in October 2020.

⑥ By the day before the settlement start date of the Tender Offer for ZHD Shares, SoftBank and the NAVER Offerors will undertake a shareholding adjustment transaction in order to make the ratio of voting rights in LINE held by SoftBank and the NAVER Offerors 50:50 immediately after the Merger becomes effective, which transaction shall take the form of a transfer by SoftBank of a portion of the LINE Shares held by SoftBank to the NAVER Offerors immediately after the Merger becomes effective. Through the Tender Offer for ZHD Shares and the JV Conversion Transaction, LINE will become a consolidated subsidiary of SoftBank.

|

16

|

⑦ |

The Corporate Demerger (Demerger by LINE of all of its business to the LINE Successor) |

| ||

|

⑦ At the same time as the Merger becomes effective, LINE will contribute all of its business (except for its shares in ZHD and the status, rights, and obligations in connection with the contracts entered into by LINE with respect to the Business Integration and any other rights and obligations specified in the absorption-type demerger agreement) to the LINE Successor to be newly established by LINE in the Merger. The Corporate Demerger is scheduled to be effective in October 2020.

| ||||

|

⑧ |

The Share Exchange (Share exchange between ZHD and LINE) |

| ||

|

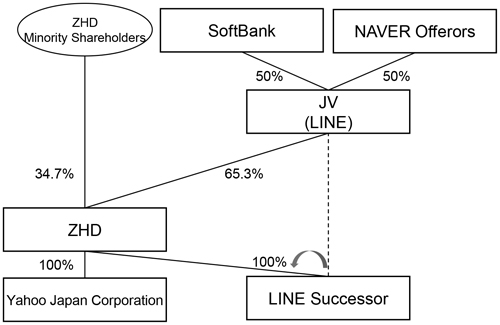

⑧ After the Corporate Demerger becomes effective, a share exchange will be conducted with ZHD shares as consideration whereby ZHD becomes the wholly owning parent company and the LINE Successor becomes the wholly owned subsidiary company. The exchange ratio for the Share Exchange (allotted ratio of ZHD Shares to be exchanged for one share of the LINE Successor) is 11.75, and the Share Exchange is scheduled to be effective in October 2020.

| ||||

|

After the Business Integration |

|

17