UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

|

| |

☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2019

or

|

| |

☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number: 001-36638

(Exact name of registrant as specified in its charter)

|

| |

Delaware | 47-1130638 |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

280 Park Avenue, 6th Floor East

New York, New York 10017

(Address of principal executive offices)(Zip Code)

(212) 759-0777

(Registrant’s telephone number, including area code) Securities registered pursuant to Section 12 (b) of the Act:

|

| |

(Title of each class) | (Name of each exchange on which registered) |

Class A Common Stock, $0.01 par value per share | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act:

Indicate by check mark if the registrant is a well-known seasoned issuer as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer”, “smaller reporting company” and "emerging growth company" in Rule 12b-2 of the Exchange Act.

|

| | | |

Large accelerated filer | ☐ | Accelerated filer | ☐ |

Non-accelerated filer | ☒ | Smaller reporting company | ☒ |

| | Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

As of June 28, 2019, the aggregate market value of registrant's voting and non-voting common equity held by non-affiliates was approximately $14,148,678. The number of shares of the registrant’s Class A common stock, par value $0.01 per share, outstanding as of March 20, 2020 was 6,284,625. The number of shares of the registrant’s Class B common stock, par value $0.01 per share, outstanding as of March 20, 2020 was 100.

DOCUMENTS INCORPORATED BY REFERENCE

Items 10, 11, 12, 13 and 14 of Part III of this Annual Report on Form 10-K incorporate information by reference from the registrant's definitive proxy statement relating to its 2020 annual meeting of stockholders to be filed with the Securities and Exchange Commission within 120 days after the close of the registrant's fiscal year.

TABLE OF CONTENTS

|

| | |

| | Page |

Part I. | | |

| | |

Item 1. | | |

| | |

Item 1A. | | |

| | |

Item 1B. | | |

| | |

Item 2. | | |

| | |

Item 3. | | |

| | |

Item 3A. | | |

| | |

Item 4. | | |

| | |

Part II. | | |

| | |

Item 5. | | |

| | |

Item 6. | | |

| | |

Item 7. | | |

| | |

Item 7A. | | |

| | |

Item 8. | | |

| | |

Item 9. | | |

| | |

Item 9A. | | |

| | |

Part III | | |

| | |

Item 10. | | |

| | |

Item 11. | | |

| | |

Item 12. | | |

| | |

Item 13. | | |

| | |

Item 14. | | |

| | |

Part IV. | | |

| | |

Item 15. | | |

| | |

Item 16 | | |

| | |

Signatures | | |

FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K (“Form 10-K”) contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the "Securities Act"), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), that reflect our current views with respect to, among other things, our operations and financial performance. Forward-looking statements include all statements that are not historical facts. In some cases, you can identify these forward-looking statements by the use of words such as “outlook,” “believes,” “expects,” “potential,” “may,” “should,” “could,” “seeks,” “approximately,” “predicts,” “intends,” “plans,” “estimates,” “anticipates” or the negative version of these words or other comparable words. Such forward-looking statements are subject to various risks and uncertainties. Accordingly, there are or will be important factors that could cause actual outcomes or results to differ materially from those indicated in these statements. We believe these factors include, but are not limited to, those described under Part I, Item 1A. “Risk Factors,” which include, but are not limited to, the following:

| |

• | difficult market and political conditions may adversely affect our business in many ways, including by reducing the value or hampering the performance of the investments made by our funds, each of which could materially and adversely affect our business, results of operations and financial condition; |

| |

• | our business may be adversely affected by the recent coronavirus outbreak; |

| |

• | we derive a substantial portion of our revenues from funds managed pursuant to advisory agreements that may be terminated or fund partnership agreements that permit fund investors to remove us as the general partner; |

| |

• | we may not be able to maintain our current fee structure as a result of industry pressure from fund investors to reduce fees, which could have an adverse effect on our profit margins and results of operations; |

| |

• | a change of control of us could result in termination of our investment advisory agreements; |

| |

• | the historical returns attributable to our funds should not be considered as indicative of the future results of our funds or of our future results or of any returns expected on an investment in Medley Management Inc.'s Class A common stock ("Class A common stock"); |

| |

• | if we are unable to consummate or successfully integrate development opportunities, acquisitions or joint ventures, we may not be able to implement our growth strategy successfully; |

| |

• | we depend on third-party distribution sources to market our investment strategies; |

| |

• | an investment strategy focused primarily on privately held companies presents certain challenges, including the lack of available information about these companies; |

| |

• | our funds’ investments in investee companies may be risky, and our funds could lose all or part of their investments; |

| |

• | prepayments of debt investments by our investee companies could adversely impact our results of operations; |

| |

• | our funds’ investee companies may incur debt that ranks equally with, or senior to, our funds’ investments in such companies; |

| |

• | subordinated liens on collateral securing loans that our funds make to their investee companies may be subject to control by senior creditors with first priority liens and, if there is a default, the value of the collateral may not be sufficient to repay in full both the first priority creditors and our funds; |

| |

• | there may be circumstances where our funds’ debt investments could be subordinated to claims of other creditors or our funds could be subject to lender liability claims; |

| |

• | our funds may not have the resources or ability to make additional investments in our investee companies; |

| |

• | economic recessions or downturns could impair our investee companies and harm our operating results; |

| |

• | a covenant breach by our investee companies may harm our operating results; |

| |

• | the investment management business is competitive; |

| |

• | our funds operate in a competitive market for lending that has recently intensified, and competition may limit our funds’ ability to originate or acquire desirable loans and investments and could also affect the yields of these assets and have a material adverse effect on our business, results of operations and financial condition; |

| |

• | dependence on leverage by certain of our funds and by our funds’ investee companies subjects us to volatility and contractions in the debt financing markets and could adversely affect our ability to achieve attractive rates of return on those investments; |

| |

• | some of our funds may invest in companies that are highly leveraged, which may increase the risk of loss associated with those investments; |

| |

• | we generally do not control the business operations of our investee companies and, due to the illiquid nature of our investments, may not be able to dispose of such investments; |

| |

• | a substantial portion of our investments may be recorded at fair value as determined in good faith by or under the direction of our respective funds’ boards of directors or similar bodies and, as a result, there may be uncertainty regarding the value of our funds’ investments; |

| |

• | we may need to pay “clawback” obligations if and when they are triggered under the governing agreements with respect to certain of our funds and SMAs; |

| |

• | our funds may face risks relating to undiversified investments; |

| |

• | third-party investors in our private funds may not satisfy their contractual obligation to fund capital calls when requested, which could adversely affect a fund’s operations and performance; |

| |

• | our funds may be forced to dispose of investments at a disadvantageous time; |

| |

• | hedging strategies may adversely affect the returns on our funds’ investments; |

| |

• | our business depends in large part on our ability to raise capital from investors. If we were unable to raise such capital, we would be unable to collect management fees or deploy such capital into investments, which would materially and adversely affect our business, results of operations and financial condition; |

| |

• | we depend on our senior management team, senior investment professionals and other key personnel, and our ability to retain them and attract additional qualified personnel is critical to our success and our growth prospects; |

| |

• | our failure to appropriately address conflicts of interest could damage our reputation and adversely affect our business; |

| |

• | potential conflicts of interest may arise between our Class A common stockholders and our fund investors; |

| |

• | rapid growth of our business may be difficult to sustain and may place significant demands on our administrative, operational and financial resources; |

| |

• | we may enter into new lines of business and expand into new investment strategies, geographic markets and business, each of which may result in additional risks and uncertainties in our business; |

| |

• | extensive regulation affects our activities, increases the cost of doing business and creates the potential for significant liabilities and penalties that could adversely affect our business and results of operations; |

| |

• | failure to comply with “pay to play” regulations implemented by the SEC and certain states, and changes to the “pay to play” regulatory regimes, could adversely affect our business; |

| |

• | new or changed laws or regulations governing our funds’ operations and changes in the interpretation thereof could adversely affect our business; |

| |

• | present and future business development companies for which we serve as investment adviser are subject to regulatory complexities that limit the way in which they do business and may subject them to a higher level of regulatory scrutiny; |

| |

• | we are subject to risks in using custodians, counterparties, administrators and other agents; |

| |

• | a portion of our revenue and cash flow is variable, which may impact our ability to achieve steady earnings growth on a quarterly basis and may cause the price of our Class A common stock to decline; |

| |

• | we may be subject to litigation risks and may face liabilities and damage to our professional reputation as a result; |

| |

• | employee misconduct could harm us by impairing our ability to attract and retain investors and subjecting us to significant legal liability, regulatory scrutiny and reputational harm, and fraud and other deceptive practices or other misconduct at our investee companies could similarly subject us to liability and reputational damage and also harm our business; |

| |

• | our substantial indebtedness could adversely affect our financial condition, our ability to pay our debts or raise additional capital to fund our operations, our ability to operate our business and our ability to react to changes in the economy or our industry and could divert our cash flow from operations for debt payments; |

| |

• | servicing our indebtedness will require a significant amount of cash. Our ability to generate sufficient cash depends on many factors, some of which are not within our control; |

| |

• | despite our current level of indebtedness, we may be able to incur substantially more debt and enter into other transactions, which could further exacerbate the risks to our financial condition; |

| |

• | operational risks may disrupt our business, result in losses or limit our growth; |

| |

• | Medley Management Inc.’s only material asset is its interest in Medley LLC, and it is accordingly dependent upon distributions from Medley LLC to pay taxes, make payments under the tax receivable agreement or pay dividends; |

| |

• | Medley Management Inc. is controlled by our pre-IPO owners, whose interests may differ from those of our public stockholders; |

| |

• | Medley Management Inc. will be required to pay exchanging holders of LLC Units for most of the benefits relating to any additional tax depreciation or amortization deductions that we may claim as a result of the tax basis step-up we receive in connection with sales or exchanges of LLC Units and related transactions; |

| |

• | in certain cases, payments under the tax receivable agreement may be accelerated and/or significantly exceed the actual benefits Medley Management Inc. realizes in respect of the tax attributes subject to the tax receivable agreement; |

| |

• | anti-takeover provisions in our organizational documents and Delaware law might discourage or delay acquisition attempts for us that you might consider favorable; and |

| |

• | our ability to realize anticipated cost savings and efficiencies from consolidating our business activities to our New York office. |

This Form 10-K also includes “forward-looking” statements, including statements regarding the proposed transactions contemplated by the Amended MDLY Merger Agreement (as defined herein) and the Amended MCC Merger Agreement (as defined herein). Because forward-looking statements, such as the possibility that MDLY may receive competing proposals and the date that the parties expect the proposed transactions to be completed, include risks and uncertainties, actual results may differ materially from those expressed or implied and include, but are not limited to, those discussed in each of Sierra’s, MCC’s and the Company’s filings with the SEC, and (i) the satisfaction or waiver of closing conditions relating to the proposed transactions described herein, including, but not limited to, the requisite approvals of the stockholders of each of the Company, Sierra and MCC; Sierra successfully taking all actions reasonably required with respect to certain outstanding indebtedness of the Company and MCC to prevent any material adverse effect relating thereto; certain required approvals of the SEC (including necessary exemptive relief to consummate the merger transactions), the necessary consents of certain third-party advisory clients of the Company; and any applicable waiting period (and any extension thereof) applicable to the transactions under the Hart-Scott-Rodino Antitrust Improvements Act of 1976, as amended, shall have expired or been terminated; (ii) the parties’ ability to successfully consummate the proposed transactions, and the timing thereof; and (iii) the possibility that competing offers or acquisition proposals related to the proposed transactions will be made and, if made, could be successful. Additional risks and uncertainties specific to the Company include, but are not limited to, (i) the costs and expenses that the Company has, and may incur, in connection with the proposed transactions (whether or not they are consummated); (ii) the impact that any litigation relating to the proposed transactions may have on the Company; (iii) that projections with respect to distributions may prove to be incorrect; (iv) Sierra’s ability to invest its portfolio of cash in a timely manner following the closing of the proposed transactions; (v) the market performance of the combined portfolio; (vi) the ability of portfolio companies to pay interest and principal in the future; (vii) the ability of the Company to grow its fee earning assets under management; (viii) whether Sierra, as the surviving company, will trade with more volume and perform better than the Company prior to the proposed transactions; and (ix) negative effects of entering into the proposed transactions on the trading volume and market price of the Company’s common stock. There can be no assurance of the level of any distributions to be paid, if any, following consummation of the proposed transactions.

These factors should not be construed as exhaustive and should be read in conjunction with the other cautionary statements that are included in this Form 10-K and other reports we file with the Securities and Exchange Commission. Forward-looking statements speak as of the date on which they are made, and we undertake no obligation to publicly update or review any forward-looking statement, whether as a result of new information, future developments or otherwise, except as required by law.

Unless the context suggests otherwise, references herein to the “Company,” “Medley,” "MDLY," “we,” “us” and “our” refer to Medley Management Inc., Medley LLC, and their consolidated subsidiaries.

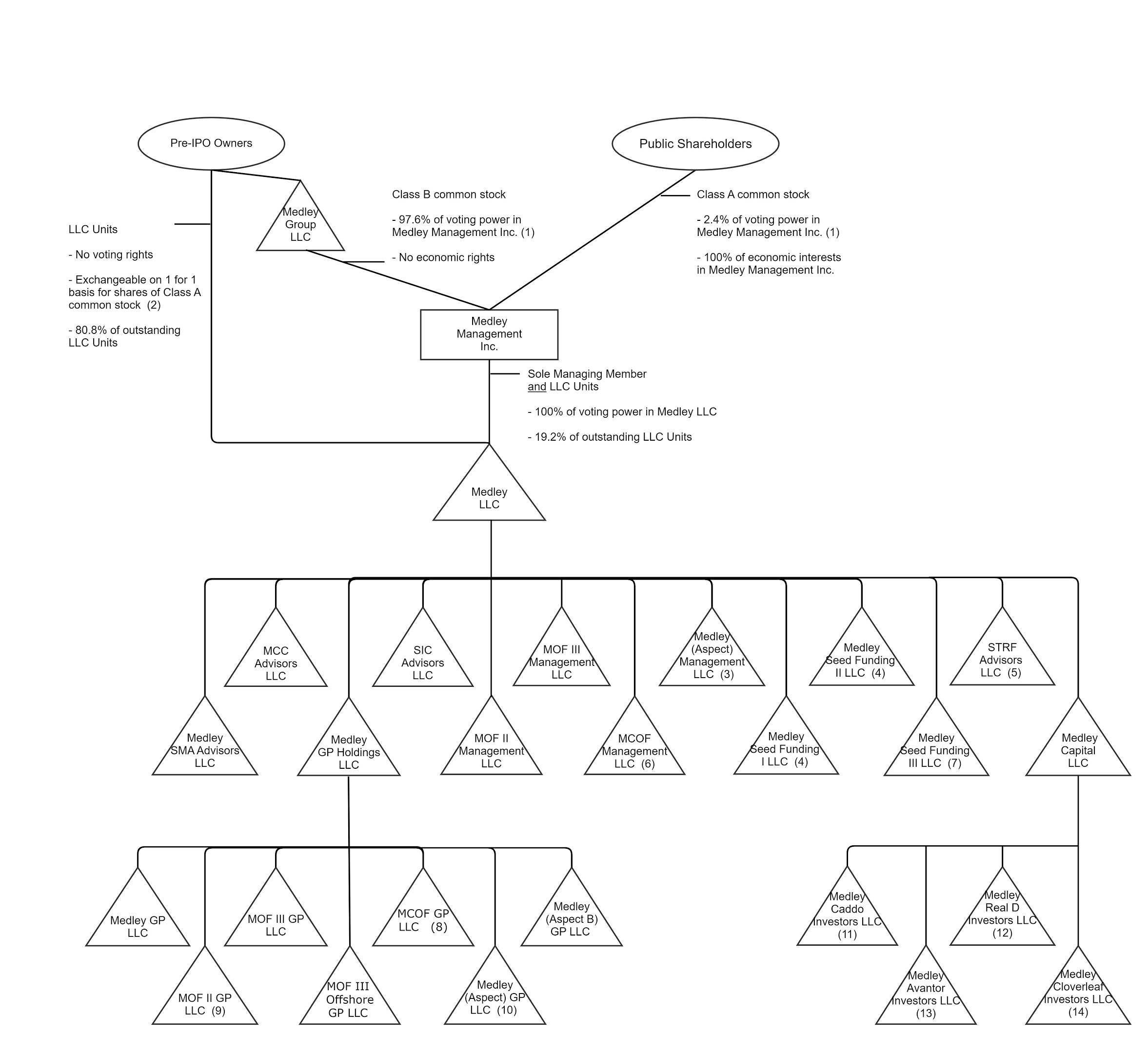

The “pre-IPO owners” refers to the senior professionals who were the owners of Medley LLC immediately prior to the Offering Transactions. The “Offering Transactions” refer to Medley Management Inc.’s purchase upon the consummation of its IPO of 6,000,000 newly issued limited liability company units (the “LLC Units”) from Medley LLC, which correspondingly diluted the ownership interests of the pre-IPO owners in Medley LLC and resulted in Medley Management Inc.’s holding a number of LLC Units in Medley LLC equal to the number of shares of Class A common stock it issued in its IPO.

Unless the context suggests otherwise, references herein to:

| |

• | “Aspect” refers to Aspect-Medley Investment Platform A LP; |

| |

• | “Aspect B” refers to Aspect-Medley Investment Platform B LP; |

| |

• | “AUM” refers to the assets of our funds, which represents the sum of the NAV of such funds, the drawn and undrawn debt (at the fund level, including amounts subject to restrictions) and uncalled committed capital (including commitments to funds that have yet to commence their investment periods); |

| |

• | “base management fees” refers to fees we earn for advisory services provided to our funds, which are generally based on a defined percentage of fee earning AUM or, in certain cases, a percentage of originated assets in the case of certain of our SMAs; |

| |

• | “BDC” refers to business development company; |

| |

• | “Consolidated Funds” refers to, with respect to periods after December 31, 2013 and before January 1, 2015, MOF II, with respect to periods prior to January 1, 2014, MOF I LP, MOF II and MOF III, subsequent to its formation; and, with respect to periods after May 31, 2017, Sierra Total Return Fund, subsequent to its formation. |

| |

• | “fee earning AUM” refers to the assets under management on which we directly earn base management fees; |

| |

• | “hurdle rates” refers to the rates above which we earn performance fees, as defined in the long-dated private funds’ and SMAs’ applicable investment management or partnership agreements; |

| |

• | “investee company” refers to a company to which one of our funds lends money or in which one of our funds otherwise makes an investment; |

| |

• | “long-dated private funds” refers to MOF II, MOF III, MOF III Offshore, MCOF, Aspect, Aspect B and any other private funds we may manage in the future; |

| |

• | “management fees” refers to base management fees, other management fees and Part I incentive fees; |

| |

• | “MCOF” refers to Medley Credit Opportunity Fund LP; |

| |

• | “MDLY” refers to Medley Management Inc.; |

| |

• | “Medley LLC” refers to Medley LLC and its consolidated subsidiaries; |

| |

• | “MOF II” refers to Medley Opportunity Fund II LP; |

| |

• | “MOF III” refers to Medley Opportunity Fund III LP; |

| |

• | "MOF III Offshore" refers to Medley Opportunity Fund Offshore III LP; |

| |

• | “our funds” refers to the funds, alternative asset companies and other entities and accounts that are managed or co-managed by us and our affiliates; |

| |

• | “our investors” refers to the investors in our permanent capital vehicles, our private funds and our SMAs; |

| |

• | “Part I incentive fees” refers to fees that we receive from our permanent capital vehicles, and since 2017, MCOF and Aspect, which are paid in cash quarterly and are driven primarily by net interest income on senior secured loans subject to hurdle rates. As it relates to Medley Capital Corporation (NYSE: MCC) (TASE:MCC) (“MCC”), these fees are subject to netting against realized and unrealized losses; |

| |

• | “Part II incentive fees” refers to fees related to realized capital gains in our permanent capital vehicles; |

| |

• | “performance fees” refers to incentive allocations in our long-dated private funds and incentive fees from our SMAs, which are typically 15% to 20% of the total return after a hurdle rate, accrued quarterly, but paid after the return of all invested capital and in an amount sufficient to achieve the hurdle rate; |

| |

• | “permanent capital” refers to capital of funds that do not have redemption provisions or a requirement to return capital to investors upon exiting the investments made with such capital, except as required by applicable law, which funds |

currently consist of MCC, Sierra Total Return Fund ("STRF") and Sierra Income Corporation (“SIC” or "Sierra"). Such funds may be required, or elect, to return all or a portion of capital gains and investment income. In certain circumstances, the investment adviser of such a fund may be removed;

| |

• | “SMA” refers to a separately managed account; and |

| |

• | "standalone" refers to our financial results without the consolidation of any fund(s). |

PART I.

Item 1. Business

Overview

We are an alternative asset management firm offering yield solutions to retail and institutional investors. We focus on credit-related investment strategies, primarily originating senior secured loans to private middle market companies in the United States that have revenues between $50 million and $1 billion. We generally hold these loans to maturity. Our national direct origination franchise provides capital to the middle market in the U.S. For over 18 years, we have provided capital to over 400 companies across 35 industries in North America.

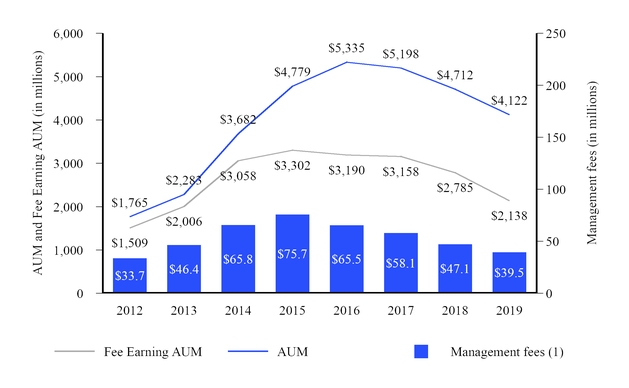

We manage three permanent capital vehicles, two of which are Business Development Companies "BDCs", and a credit interval fund, as well as long-dated private funds and Separately Managed Accounts ("SMAs"), with a primary focus on senior secured credit. As of December 31, 2019, we had $4.1 billion of AUM in two business development companies, MCC and SIC, as well as private investment vehicles. Our compounded annual AUM growth rate from December 31, 2010 through December 31, 2019 was 17%, and our compounded annual Fee Earning AUM growth rate was 10%, which have both been driven in large part by the growth in our permanent capital vehicles. Typically the investment periods of our institutional commitments range from 18 to 24 months and we expect our Fee Earning AUM to increase as capital commitments included in AUM are invested.

In general, our institutional investors do not have the right to withdraw capital commitments and to date we have not experienced any withdrawals of capital commitments. For a description of the risk factor associated with capital commitments, see “Risk Factors — Third-party investors in our private funds may not satisfy their contractual obligation to fund capital calls when requested, which could adversely affect a fund's operations and performance.”

The diagram below presents the historical correlation between growth in our AUM, fee earning AUM and management fees.

(1) Presented on a standalone basis

Direct origination, credit structuring and active monitoring of the loan portfolios we manage are important success factors in our business, which can be adversely affected by difficult market and political conditions, such as the turmoil in the global capital markets from 2007 to 2009 and the ongoing after-effects including market turbulence and volatility. Since our inception in 2006, we have adhered to a disciplined investment process that employs these principles with the goal of delivering strong risk-adjusted investment returns while protecting investor capital. Our focus on protecting investor capital is reflected in our investment strategy; at December 31, 2019, approximately 67% of the combined portfolios investments were in first lien positions. We believe that our ability to directly originate, structure and lead deals enables us to consistently lend at higher yields with better terms. In addition, the loans we manage generally have a contractual maturity between three and seven years and are typically floating rate

(at December 31, 2019, approximately 83% of the loans we manage, based on aggregate principal amount, bore interest at floating rates), which we believe positions our business well for rising interest rates.

Our senior management team has on average over 20 years of experience in credit, including originating, underwriting, principal investing and loan structuring. As of December 31, 2019, we had 65 employees, including 29 investment, origination and credit management professionals, and 36 operations, accounting, legal, compliance and marketing professionals, each with extensive experience in their respective disciplines.

Our Funds

We provide our credit-focused investment strategies through various funds and products that meet the needs of a wide range of retail and institutional investors.

Except as otherwise described herein with respect to our BDCs, our investment funds themselves do not register as investment companies under the Investment Company Act of 1940, as amended (the “Investment Company Act”), in reliance on Section 3(c)(1), Section 3(c)(7) or Section 7(d) thereof. Section 3(c)(7) of the Investment Company Act exempts from the Investment Company Act’s registration requirements investment funds privately placed in the United States whose securities are owned exclusively by persons who, at the time of acquisition of such securities, are “qualified purchasers” as defined under the Investment Company Act. Section 3(c)(1) of the Investment Company Act exempts from the Investment Company Act’s registration requirements privately placed investment funds whose securities are beneficially owned by not more than 100 persons. In addition, under certain current interpretations of the SEC, Section 7(d) of the Investment Company Act exempts from registration any non-U.S. investment fund all of whose outstanding securities are beneficially owned either by non-U.S. residents or by U.S. residents that are qualified purchasers and purchase their interests in a private placement. Certain subsidiaries of Medley LLC typically serve as an investment adviser for our funds and are registered under the Advisors Act. Our funds’ investment advisers or one of their affiliates are entitled to management fees, performance fees and/or incentive fees from each investment fund to which they serve as investment advisers. For a discussion of the fees to which our funds’ investment advisers are entitled across our various types of funds, please see “Business — Fee Structure.”

Medley Capital Corporation

We launched MCC (NYSE:MCC) (TASE:MCC), our first permanent capital vehicle, in 2011 as a BDC. MCC has grown to become a BDC with approximately $0.4 billion in AUM as of December 31, 2019. MCC has demonstrated an 8% compounded annual growth rate of AUM from inception through December 31, 2019.

Sierra Income Corporation

We launched SIC, our first public non-traded permanent capital vehicle, in 2012 as a BDC. As of December 31, 2019, AUM has grown to $1.1 billion, and has demonstrated an 86% compounded annual growth rate of AUM from inception through December 31, 2019.

Sierra Total Return Fund

We launched STRF (NASDAQ:SRNTX), our first interval fund, in January 2017. STRF is a continuously offered, non-diversified, closed-end investment management company that is operated as an interval fund. The fund commenced investment operations in June 2017.

Long-Dated Private Funds

We launched MOF I, our first long-dated private fund, in 2006, MOF II, our second long-dated private fund, in 2010, MOF III, our third long-dated private fund, in 2014, MCOF and Aspect, our fourth and fifth long-dated private funds, respectively, in 2016, and MOF III Offshore, our sixth long-dated private fund, in 2017. In 2018, we launched Aspect B. Our long-dated private funds are managed through partnership structures, in which limited partnerships organized by us accept commitments or funds for investment from institutional investors and high net worth individuals, and a general partner makes all policy and investment decisions, including selection of investment advisers. Affiliates of Medley LLC serve as the general partners and investment advisers to our long-dated private funds. The limited partners of our long-dated private funds take no part in the conduct or control of the business of such funds, have no right or authority to act for or bind such funds and have no influence on the voting or disposition of the securities or assets held by such funds, although limited partners often have the right to remove the general partner or cause an early liquidation by super-majority vote. As our long-dated private funds are closed-ended, once an investor makes an investment, the investor is generally not able to withdraw or redeem its interest, except in very limited circumstances.

Separately Managed Accounts (SMAs)

We launched our first SMA in 2010 and currently manage twelve SMAs. In the case of our SMAs, the investor, rather than us, dictates the risk tolerances and target returns of the account. We act as an investment adviser registered under the Advisers Act for these accounts. The accounts offer customized solutions for liability driven investors such as insurance companies and typically offer attractive returns on risk based capital.

Fee Structure

We earn management fees at an annual rate of 0.75% to 2.00% and may earn performance fees, which may be in the form of an incentive fee or carried interest, in the event that specified investment returns are achieved by the fund or SMA. Management fees are generally based on a defined percentage of (1) average or total gross assets, including assets acquired with leverage, (2) total commitments, (3) net invested capital (4) NAV, or (5) lower of cost or market value of a fund’s portfolio investments. Management fees are calculated quarterly and are paid in cash in advance or in arrears depending on each specific fund or SMA. We earn incentive fees on our permanent capital vehicles and earn incentive fees on certain of our long-dated private funds. In addition, we may earn additional carried interest performance fees on our long-dated private funds and SMAs that are typically 15% to 20% of the total return over a 6% to 8% annualized preferred return.

Medley Capital Corporation

Pursuant to the investment management agreement between MCC and our affiliate, MCC Advisors LLC, MCC Advisors LLC receives a base management fee and a two-part incentive fee. Effective January 1, 2016, pursuant to a fee waiver executed by MCC Advisors LLC on February 8, 2016, the base management fee is calculated at an annual rate of 1.75% of MCC’s gross assets up to $1.0 billion and 1.50% on MCC's gross assets over $1.0 billion, and is payable quarterly in arrears (the “Reduced Base Management Fee”). The Reduced Base Management Fee is calculated based on the average value of MCC’s gross assets at the end of the two most recently completed calendar quarters and will be appropriately pro-rated for any partial quarter. Prior to January 1, 2016, the MCC base management fee was calculated at an annual rate of 1.75% of MCC's gross assets. The base management fee was calculated based on the average value of MCC's gross assets at the end of the two most recently completed calendar quarters.

The two components of the MCC incentive fee are described below.

| |

• | The first component of the MCC incentive fee is the Part I incentive fee. Effective January 1, 2016, the incentive fee based on net investment income is reduced from 20.0% on pre-incentive fee net investment income over a fixed hurdle rate of 2.0% per quarter, to 17.5% on pre-incentive fee net investment income over a fixed hurdle rate of 1.5% per quarter. Moreover, the incentive fee based on net investment income is determined and paid quarterly in arrears at the end of each calendar quarter by reference to our aggregate net investment income, as adjusted, as described below (the “Reduced Incentive Fee on Net Investment Income”), from the calendar quarter then ending and the eleven preceding calendar quarters (or if shorter, the number of quarters that have occurred since January 1, 2016). We refer to such period as the “Trailing Twelve Quarters.” The hurdle amount for the Reduced Incentive Fee on Net Investment Income is determined on a quarterly basis, and is equal to 1.5% multiplied by MCC’s net assets at the beginning of each applicable calendar quarter comprising the relevant Trailing Twelve Quarters. The hurdle amount is calculated after making appropriate adjustments to MCC’s net assets, as determined as of the beginning of each applicable calendar quarter, in order to account for any capital raising or other capital actions as a result of any issuances by MCC of its common stock (including issuances pursuant to MCC’s dividend reinvestment plan), any repurchase by MCC of its own common stock, and any dividends paid by MCC, each as may have occurred during the relevant quarter. Any Reduced Incentive Fee on Net Investment Income is paid to MCC Advisors LLC on a quarterly basis, and is based on the amount by which (A) aggregate net investment income (“Ordinary Income”) in respect of the relevant Trailing Twelve Quarters exceeds (B) the hurdle amount for such Trailing Twelve Quarters. The amount of the excess of (A) over (B) described in this paragraph for such Trailing Twelve Quarters is referred to as the “Excess Income Amount.” For the avoidance of doubt, Ordinary Income is net of all fees and expenses, including the Reduced Base Management Fee but excluding any incentive fee on pre-incentive fee net investment income or on MCC’s capital gains. |

The Reduced Incentive Fee on Net Investment Income for each quarter is determined as follows:

| |

• | No incentive fee based on net investment income is payable to MCC Advisors LLC for any calendar quarter for which there is no Excess Income Amount; |

| |

• | 100% of the Ordinary Income, if any, that exceeds the hurdle amount, but is less than or equal to an amount, which we refer to as the “Catch-up Amount,” determined as the sum of 1.8182% multiplied by MCC’s net assets at the beginning of each applicable calendar quarter, as adjusted as noted above, comprising the relevant Trailing Twelve Quarters is included in the calculation of the Reduced Incentive Fee on Net Investment Income; and |

| |

• | 17.5% of the Ordinary Income that exceeds the Catch-up Amount is included in the calculation of the Reduced Incentive Fee on Net Investment Income. |

The amount of the Reduced Incentive Fee on Net Investment Income that is paid to MCC Advisors LLC for a particular quarter equals the excess of the incentive fee so calculated minus the aggregate incentive fees based on income that were paid in respect of the first eleven calendar quarters (or the portion thereof) included in the relevant Trailing Twelve Quarters but not in excess of the Incentive Fee Cap (as described below).

The Reduced Incentive Fee on Net Investment Income that is paid to MCC Advisors LLC for a particular quarter is subject to a cap (the “Incentive Fee Cap”). The Incentive Fee Cap for any quarter is an amount equal to (a) 17.5% of the Cumulative Net Return (as defined below) during the relevant Trailing Twelve Quarters minus (b) the aggregate incentive fees based on net investment income that was paid in respect of the first eleven calendar quarters (or a portion thereof) included in the relevant Trailing Twelve Quarters.

“Cumulative Net Return” means (X) the Ordinary Income in respect of the relevant Trailing Twelve Quarters minus (Y) any Net Capital Loss (as defined below), if any, in respect of the relevant Trailing Twelve Quarters. If, in any quarter, the Incentive Fee Cap is zero or a negative value, MCC pays no incentive fee based on net investment income to MCC Advisors for such quarter. If, in any quarter, the Incentive Fee Cap for such quarter is a positive value but is less than the Reduced Incentive Fee based on Net Investment Income that is payable to MCC Advisors for such quarter (before giving effect to the Incentive Fee Cap) calculated as described above, MCC pays a Reduced Incentive Fee on Net Investment Income to MCC Advisors equal to the Incentive Fee Cap for such quarter. If, in any quarter, the Incentive Fee Cap for such quarter is equal to or greater than the Reduced Incentive Fee on Net Investment Income that is payable to MCC Advisors for such quarter (before giving effect to the Incentive Fee Cap) calculated as described above, MCC pays a Reduced Incentive Fee on Net Investment Income to MCC Advisors, calculated as described above, for such quarter without regard to the Incentive Fee Cap.

“Net Capital Loss” in respect of a particular period means the difference, if positive, between (i) aggregate capital losses, whether realized or unrealized, and dilution to MCC’s net assets due to capital raising or capital actions, in such period and (ii) aggregate capital gains, whether realized or unrealized and accretion to MCC’s net assets due to capital raising or capital action, in such period.

Dilution to MCC’s net assets due to capital raising is calculated, in the case of issuances of common stock, as the amount by which the net asset value per share was adjusted over the transaction price per share, multiplied by the number of shares issued. Accretion to MCC’s net assets due to capital raising is calculated, in the case of issuances of common stock (including issuances pursuant to our dividend reinvestment plan), as the excess of the transaction price per share over the amount by which the net asset value per share was adjusted, multiplied by the number of shares issued. Accretion to MCC's net assets due to other capital action is calculated, in the case of repurchases by MCC of its own common stock, as the excess of the amount by which the net asset value per share was adjusted over the transaction price per share multiplied by the number of shares repurchased by MCC.

The purpose of changing the fee structure was to permanently reduce aggregate fees payable to MCC Advisors by MCC. Beginning January 1, 2016, in order to ensure that MCC pays MCC Advisors aggregate fees on a cumulative basis under the new fee structure that are less than the aggregate fees otherwise due under the management agreement, at the end of each quarter, MCC Advisors calculates aggregate base management fees and incentive fees on net investment income under both the new fee structure and the fee structure under the management agreement, and if, at any time after January 1, 2016, the aggregate fees on a cumulative basis under the new fee structure would be greater than the aggregate fees on a cumulative basis under the fee structure under the management agreement, MCC Advisors is only entitled to the lesser of those two amounts. Since the hurdle rate is fixed, if and as interest rates rise, it would be more likely that we would surpass the hurdle rate and receive an incentive fee based on net investment income.

Prior to January 1, 2016, the Part I incentive fee was payable quarterly in arrears and was 20.0% of MCC’s pre-incentive fee net investment income for the immediately preceding calendar quarter subject to a 2.0% (which was 8.0% annualized) hurdle rate and a “catch-up” provision measured as of the end of each calendar quarter. Under the hurdle rate and catch-up provisions, in any calendar quarter, we received no incentive fee until MCC’s net investment income equaled the hurdle rate of 2.0%, but then received, as a “catch-up,” 100% of MCC’s pre-incentive fee net investment income with respect to that portion of such pre-incentive fee net investment income, if any, that exceeded the hurdle rate but was less than 2.5%. The effect of this provision was that, if pre-incentive fee net investment income exceeded 2.5% in any calendar quarter, MCC Advisors LLC would receive 20.0% of MCC’s pre-incentive fee net investment income as if the hurdle rate did not apply. For this purpose, pre-incentive fee net investment income meant interest income, dividend income and any other income including any other fees (other than fees for providing managerial assistance), such as commitment, origination, structuring, due diligence and consulting fees or other fees that MCC received from portfolio companies accrued during the calendar quarter, minus MCC’s operating expenses for the quarter including the base management fee, expenses payable to MCC Advisors LLC, and any interest expense and any dividends paid on any issued

and outstanding preferred stock, but excluding the incentive fee. Pre-incentive fee net investment income included, in the case of investments with a deferred interest feature (such as original issue discount, debt instruments with payment-in-kind interest and zero coupon securities), accrued income that we had not yet received in cash.

| |

• | The second component of the MCC incentive fee, the Part II incentive fee, is determined and payable in arrears as of the end of each calendar year (or upon termination of the investment management agreement as of the termination date), and equals 20.0% of MCC’s cumulative aggregate realized capital gains less cumulative realized capital losses, unrealized capital depreciation (unrealized depreciation on a gross investment-by-investment basis at the end of each calendar year) and all capital gains upon which prior performance-based capital gains incentive fee payments were previously made to MCC Advisors LLC. |

Entities controlled by former employees held limited liability company interests in MCC Advisors LLC that entitled them to approximately 4.86% of the net incentive fee income through October 29, 2015 and an additional 5.75% of the net incentive fee income through August 20, 2016 from MCC Advisors LLC. Since August 20, 2016 and going forward, we are entitled to all of the management fees paid to MCC Advisors LLC. We may have similar arrangements with respect to the ownership of the entities that advise our BDCs in the future.

Sierra Income Corporation

Pursuant to the investment management agreement between SIC and our affiliate, SIC Advisors LLC, SIC Advisors LLC receives a base management fee and a two-part incentive fee. The SIC base management fee is calculated at an annual rate of 1.75% of SIC’s gross assets at the end of each completed calendar quarter and is payable quarterly in arrears.

The two components of the SIC incentive fee are as follows.

| |

• | The first, the Part I incentive fee (which is also referred to as a subordinated incentive fee), payable quarterly in arrears, is 20.0% of SIC’s pre-incentive fee net investment income for the immediately preceding calendar quarter subject to a 1.75% (which is 7.0% annualized) hurdle rate and a “catch-up” provision measured as of the end of each calendar quarter. Under the hurdle rate and catch-up provisions, in any calendar quarter, SIC Advisors LLC receives no incentive fee until SIC’s pre-incentive fee net investment income equals the hurdle rate of 1.75%, but then receives, as a “catch-up,” 100% of SIC’s pre-incentive fee net investment income with respect to that portion of such pre-incentive fee net investment income, if any, that exceeds the hurdle rate but is less than 2.1875%. The effect of this provision is that, if pre-incentive fee net investment income exceeds 2.1875% in any calendar quarter, SIC Advisors LLC will receive 20.0% of SIC’s pre-incentive fee net investment income as if the hurdle rate did not apply. For this purpose, pre-incentive fee net investment income means interest income, dividend income and any other income including any other fees (other than fees for providing managerial assistance), such as commitment, origination, structuring, due diligence and consulting fees or other fees that SIC receives from portfolio companies accrued during the calendar quarter, minus SIC’s operating expenses for the quarter including the base management fee, expenses payable to SIC Advisors LLC or to us, and any interest expense and any dividends paid on any issued and outstanding preferred stock, but excluding the incentive fee. Pre-incentive fee net investment income includes, in the case of investments with a deferred interest feature (such as original issue discount, debt instruments with payment-in-kind interest and zero coupon securities), accrued income that SIC has not yet received in cash. Since the hurdle rate is fixed, if interest rates rise, it will be easier for us to surpass the hurdle rate and receive an incentive fee based on pre-incentive fee net investment income. |

| |

• | The second, the Part II incentive fee, is determined and payable in arrears as of the end of each calendar year (or upon termination of the investment management agreement as of the termination date), and equals 20.0% of SIC’s cumulative aggregate realized capital gains less cumulative realized capital losses, unrealized capital depreciation (unrealized depreciation on a gross investment-by-investment basis at the end of each calendar year) and all capital gains upon which prior performance-based capital gains incentive fee payments were previously made to SIC Advisors LLC. |

Strategic Capital Advisory Services, LLC owned 20% of SIC Advisors LLC through July 31, 2018 and was entitled to receive distributions of up to 20% of the gross cash proceeds received by SIC Advisors LLC from the management and incentive fees paid by SIC to SIC Advisors LLC, net of certain expenses, as well as 20% of the returns of the investments held at SIC Advisors LLC. We may have similar arrangements with respect to the ownership of the entities that advise our BDCs in the future.

Sierra Total Return Fund

Pursuant to the investment management agreement between STRF and our affiliate, STRF Advisors LLC, STRF Advisors LLC is entitled to a base management fee and may earn an incentive fee. The STRF base management fee is calculated and payable monthly in arrears at an annual rate of 1.50% of STRF's average daily total assets during such period.

The incentive fee is calculated and payable quarterly in arrears in an amount equal to 15.0% of the Fund's pre-incentive fee net investment income for the immediately preceding quarter, and is subject to a hurdle rate, expressed as a rate of return on the Fund's adjusted capital, equal to 1.50% per quarter, subject to a “catch-up” feature, which will allow STRF Advisors LLC to recover foregone incentive fees that were previously limited by the hurdle rate. Under the hurdle rate and catch-up provisions, in any calendar quarter, STRF Advisors LLC will not receive any incentive fee until STRF's pre-incentive fee net investment income equals the hurdle rate of 1.50%, but then will receive, as a “catch-up,” 100% of STRF's pre-incentive fee net investment income with respect to that portion of such pre-incentive fee net investment income, if any, that exceeds the hurdle rate but is less than or equal to 1.76%. The effect of this provision is that, if pre-incentive fee net investment income exceeds 1.76% in any calendar quarter, STRF Advisors LLC will receive 15.0% of SIC's pre-incentive fee net investment income as if the hurdle rate did not apply. For this purpose, pre-incentive fee net investment income means interest income, dividend income and any other income accrued during the calendar quarter, minus STRF's operating expenses for the quarter (including the management fee, expenses reimbursed to STRF Advisors LLC and any interest expenses and distributions paid on any issued and outstanding preferred shares, but excluding the inventive fee). For this purpose, adjusted capital means the cumulative gross proceeds received by STRF from the sale of shares (including pursuant to STRF's distribution reinvestment plan), reduced by amounts paid in connection with purchases of shares pursuant to STRF's mandatory repurchases and discretionary repurchases. There is no accumulation of amounts on the hurdle rate from quarter to quarter, and accordingly there is no clawback of amounts previously paid to STRF Advisors LLC if subsequent quarters are below the quarterly hurdle rate, and there is no delay of payment to STRF Advisors LLC if prior quarters are below the quarterly hurdle rate.

Long-Dated Private Funds and SMAs

Pursuant to the respective underlying agreements of our long-dated private funds and SMAs, we receive an annual management fee and may earn incentive or performance fees. In general, management fees are calculated at an annual rate of 0.75% to 2.00% calculated on the value of the capital accounts or the value of the investments held by each limited partner, fund or account. We may also receive transaction and advisory fees from a funds' underlying portfolio investment. In certain circumstances, we are required to offset our management fees earned by 50% to 100% of transaction and advisory fees earned. In addition, we receive performance fees or carried interest in an amount equal to 15.0% to 20.0% of the realized cash derived from an investment, subject to a cumulative annualized preferred return to the investor of 6.0% to 8.0%, which is in turn subject to a 50% to 100% catch-up allocation to us.

For certain long-dated private funds, we may also earn a two-part incentive fee. The first, the Part I incentive fee, is calculated and payable quarterly in an amount equal to 15.0% to 20.0% of the net investment income, subject to a hurdle rate equal to 1.5% to 2.0% per quarter, which is in turn subject to a 50% to 100% catch-up provision measured as of the end of each calendar quarter. The second, the Part II incentive fee, is calculated and payable annually in an amount equal to 15.0% to 20.0% of cumulative realized capital gains.

In order to align the interests of our senior professionals and the other individuals who manage our long-dated private funds with our own interests and with those of the investors in such funds, such individuals may be allocated directly a portion of the performance fees in such funds. These interests entitle the holders to share the performance fees earned from MOF II. We may make similar arrangements with respect to allocation of performance or incentive fees with respect to MOF III, MCOF, Aspect or other long-dated private funds that we may advise in the future.

As noted above, in connection with raising new funds or securing additional investments in existing funds, we negotiate terms for such funds and investments with existing and potential investors. The outcome of such negotiations could result in our agreement to terms that are materially less favorable to us than for prior funds we have advised or funds advised by our competitors. See “Risk Factors — Risks Related to Our Business and Industry — We may not be able to maintain our current fee structure as a result of industry pressure from fund investors to reduce fees, which could have an adverse effect on our profit margins and results of operations.”

Investor Relations

Our fundraising efforts historically have been spread across distribution channels and have not been dependent on the success of any single channel. We distribute our investment products through two primary channels: (1) permanent capital vehicles and (2) long-dated private funds and SMAs. We believe that each of these channels offers unique advantages to investors and allows us to continue to raise and deploy capital opportunistically in varying market environments.

Permanent Capital Vehicles

We distribute our permanent capital vehicles through three sub-channels:

| |

• | MCC is our publicly traded vehicle. It offers retail and institutional investors liquid access to an otherwise illiquid asset class (middle market credit). In addition to equity capital, MCC also raises debt capital in the private and public markets which is an alternative source of capital in challenging operating environments. |

| |

• | SIC is our non-traded public vehicle. It offers retail and institutional investors access to an otherwise illiquid asset class (middle market credit) without exposure to public market trading volatility. It allows us to continue to raise capital continually during more challenging operating environments when publicly listed vehicles may be trading below net asset value (“NAV”), which we believe is valuable during times of market volatility. We believe this is a competitive advantage allowing us to make opportunistic investments, while peers may be more limited during times of market volatility. |

| |

• | STRF is our non-traded interval vehicle. It offers retail and institutional investors investments in the debt and equity of fixed-income and fixed-income related securities. STRF is a continuously offered, non-diversified, closed-end investment management company that is operated as an interval fund. |

Long-Dated Private Funds and SMAs

We distribute our long-dated private funds and SMAs through two sub-channels:

| |

• | Long-dated private funds: Our long-dated private funds offer institutional investors attractive risk-adjusted returns. We believe this channel is an important element of our capital raising efforts given institutional investors are more likely to remain engaged in higher yielding private credit assets during periods of market turbulence. |

| |

• | Separately managed accounts: Our SMAs provide investors with customized investment solutions. This is particularly attractive for liability driven investors such as insurance companies that invest over long time horizons. |

We believe that our deep and long-standing investor relationships, founded on our strong performance, disciplined management of our investors’ capital and diverse product offering, have facilitated the growth of our existing business and will assist us with the development of additional strategies and products, thereby increasing our fee earning AUM in the future. We have dedicated in-house capital markets, investor relations and marketing specialists. We have frequent discussions with our investors and are committed to providing them with the highest quality service. We believe our service levels, as well as our emphasis on transparency, inspire loyalty and support our efforts to continue to attract investors across our investment platform.

Investment Process

Direct Origination. We focus on lending directly to companies that are underserved by the traditional banking system and generally seek to avoid broadly marketed investment opportunities. We source investment opportunities primarily through financial sponsors, as well as through direct relationships with companies, financial intermediaries such as national, regional and local bankers, accountants, lawyers and consultants. Historically, as much as half of our annual origination volume has been derived from either repeat or referred borrowers or repeat sponsors. The other half of our annual origination volume has been sourced through a variety of channels including direct relationships with companies, financial intermediaries such as national, regional and local bankers, accountants, lawyers and consultants, as well as through other financial sponsors. Medley investments are well diversified across 27 of the 35 industries. As of December 31, 2019, our industry exposures in excess of 10% were 11.2% in business services, 10.7% in healthcare and pharmaceuticals and 10.6% in High Tech Industries. Medley has a highly selective, three step underwriting process that is governed by an investment committee. This comprehensive process narrows down the investment opportunities from generally over 1,000 a year to approximately 1% to 3% originated borrowers in a year. For the year ended December 31, 2019, we sourced 451 investment opportunities across 51 borrowers and approximately $200.0 million of invested capital. As of December 31, 2019, our funds had 266 investments across 169 borrowers.

Disciplined Underwriting. We perform thorough due diligence and focus on several key criteria in our underwriting process, including strong underlying business fundamentals, a meaningful equity cushion, experienced management, conservative valuation and the ability to deleverage through cash flows. We are often the agent for the loans we originate and accordingly influence the loan documentation and negotiation of covenants, which allows us to maintain consistent underwriting standards. We invest across a broad range of industries and our disciplined underwriting process often involves engagement of industry experts and third-party consultants. This disciplined underwriting process is essential, as our funds have historically invested primarily in privately held companies, for which public financial information may be unavailable. Since our inception, we have experienced annualized realized losses for 0.7% of that capital through December 31, 2019. We believe our disciplined underwriting culture is a key factor to our success and our ability to expand our product offerings.

Prior to making an investment, the investment team subjects each potential borrower to an extensive credit review process, which typically begins with an analysis of the market opportunity, business fundamentals, company operating metrics and historical and projected financial analysis. We also analyze liquidity, operating margin trends, leverage, free cash flow and fixed charge coverage ratios for potential investments. Areas of additional underwriting focus include management or sponsor (typically a private equity firm) experience, management compensation, competitive landscape, regulatory environment, pricing power, defensibility of market share and tangible asset values. Background checks may be conducted and tax compliance information may be requested on management teams and key employees. In addition, the investment team may contact customers, suppliers and competitors and/or perform on-site visits as part of a routine business due diligence process.

The investment team routinely uses third-party consultants and market studies to corroborate valuation and industry specific due diligence, as well as provide quality of earnings analysis. Experienced legal counsel is engaged to evaluate and mitigate regulatory, insurance, tax or other company-specific risks.

After the investment team completes its final due diligence, each proposed investment is presented to our investment committee and subjected to extensive discussion and follow-up analysis, if necessary. A formal memorandum for each investment opportunity typically includes the results of business due diligence, multi-scenario financial analysis, risk-management assessment, results of third-party consulting work, background checks (where applicable) and structuring proposals. Our investment committee requires a majority vote to approve any investment.

Active Credit Management. We employ active credit management. Our process includes frequent interaction with management, monthly or quarterly reviews of financial information and, typically, attendance at board of directors’ meetings as observers. Investment professionals with deep restructuring and workout experience support our credit management effort. The investment team also evaluates financial reporting packages provided by portfolio companies that detail operational and financial performance. Data is entered in Mariana Systems, an investment management software program. Mariana Systems creates a centralized, dynamic electronic repository for all of our portfolio company data and generates comprehensive, standardized reports and dashboards, which aggregate operational updates, portfolio company financial performance, asset valuations, macro trends, management call notes and account history.

Investment Operations and Information Technology

In addition to our investment team, we have a finance, accounting and operations team that supports our public and private vehicles team by providing infrastructure and administrative support in the areas of accounting/finance, valuation, capital markets and treasury functions, operations/information technology, strategy and business development, legal/compliance and human resources.

Regulatory and Compliance Matters

Our business, as well as the financial services industry generally, is subject to extensive regulation in the United States and elsewhere. The SEC and other regulators around the world have in recent years significantly increased their regulatory activities with respect to alternative asset management firms. Our business is subject to compliance with laws and regulations of United States federal and state governments, their respective agencies and/or various self-regulatory organizations or exchanges, and any failure to comply with these regulations could expose us to liability and/or reputational damage. Our business has been operated for a number of years within a legal framework that requires our being able to monitor and comply with a broad range of legal and regulatory developments that affect our activities. However, additional legislation, changes in rules promulgated by regulators or changes in the interpretation or enforcement of existing laws and rules, either in the United States or elsewhere, may directly affect our mode of operation and profitability.

Certain of our subsidiaries are registered as investment advisers with the SEC. Registered investment advisers are subject to the requirements and regulations of the Investment Advisers Act of 1940, as amended (the “Investment Advisers Act”). Such requirements relate to, among other things, fiduciary duties to advisory clients, maintaining an effective compliance program, solicitation agreements, conflicts of interest, recordkeeping and reporting requirements, disclosure requirements, limitations on agency cross and principal transactions between an advisor and advisory clients and general anti-fraud prohibitions. The SEC requires investment advisers registered or required to register with the SEC under the Investment Advisers Act that advise one or more private funds and have at least $150.0 million in private fund assets under management to periodically file reports on Form PF. We have filed, and will continue to file, quarterly reports on Form PF, which has resulted in increased administrative costs and requires a significant amount of attention and time to be spent by our personnel. In addition, our investment advisers are subject to routine periodic examinations by the staff of the SEC. Our investment advisers also have not been subject to any regulatory or disciplinary actions by the SEC.

MCC and SIC are BDCs. A BDC is a special category of investment company under the Investment Company Act that was added by Congress to facilitate the flow of capital to private companies and small public companies based in the United States

that do not have efficient or cost-effective access to public capital markets or other conventional forms of corporate financing. BDCs make investments in private or thinly traded public companies in the form of long-term debt and/or equity capital, with the goal of generating current income or capital growth.

BDCs are closed-end funds that elect to be regulated as BDCs under the Investment Company Act. As such, BDCs are subject to only certain provisions of the Investment Company Act, as well as the Securities Act and the Exchange Act. BDCs are provided greater flexibility under the Investment Company Act than are other investment companies that are registered under the Investment Company Act in dealing with their portfolio companies, issuing securities, and compensating their managers. BDCs can be internally or externally managed and may qualify to elect to be taxed as a regulated investment company (“RIC”) under Subchapter M of the Internal Revenue Code of 1986, as amended (the “Code”), and the regulations thereunder, for federal tax purposes. The Investment Company Act contains prohibitions and restrictions relating to transactions between BDCs and their affiliates, principal underwriters, and affiliates of those affiliates or underwriters. The Investment Company Act requires that a majority of a BDC’s directors be persons other than “interested persons,” as that term is defined in the Investment Company Act. In addition, the Investment Company Act provides that a BDC may not change the nature of its business so as to cease to be, or withdraw its election to be regulated as a BDC unless approved by a majority of its outstanding voting securities. The Investment Company Act defines “a majority of the outstanding voting securities” as the lesser of: (1) 67% or more of the voting securities present at a meeting if the holders of more than 50% of its outstanding voting securities are present or represented by proxy or (2) more than 50% of its voting securities.

Generally, BDCs are prohibited under the Investment Company Act from knowingly participating in certain transactions with their affiliates without the prior approval of their board of directors who are not interested persons and, in some cases, prior approval by the SEC. The SEC has interpreted the prohibition on transactions with affiliates broadly to prohibit “joint transactions” among entities that share a common investment adviser.

On November 25, 2013, we received an amended order from the SEC that expanded our ability to negotiate the terms of co-investment transactions among our BDCs and other funds managed by us (the “Exemptive Order”), subject to the conditions included therein. In situations where co-investment with other funds managed by us is not permitted or appropriate, such as when there is an opportunity to invest in different securities of the same issuer or where the different investments could be expected to result in a conflict between our interests and those of our other clients, we will need to decide which client will proceed with the investment. We will make these determinations based on our policies and procedures, which generally require that such opportunities be offered to eligible accounts on an alternating basis that will be fair and equitable over time. Moreover, except in certain circumstances, our BDCs will be unable to invest in any issuer in which another of our funds holds an existing investment. Similar restrictions limit our BDCs’ ability to transact business with our officers or directors or their affiliates.

Under the terms of the Exemptive Order, a “required majority” (as defined in Section 57(o) of the Investment Company Act) of the independent directors of our BDCs must make certain conclusions in connection with a co-investment transaction, including that (1) the terms of the proposed transaction are reasonable and fair to the applicable BDC and such BDC’s stockholders and do not involve overreaching of such BDC or its stockholders on the part of any person concerned and (2) the transaction is consistent with the interests of the BDC’s stockholders and is consistent with its investment strategies and policies.

Our BDCs have elected to be treated as RICs under Subchapter M of the Code. As RICs, the BDCs generally do not have to pay corporate-level federal income taxes on any income that is distributed to its stockholders from its tax earnings and profits. To maintain qualification as a RIC, our BDCs must, among other things, meet certain source-of-income and asset diversification requirements (as described below). In addition, in order to obtain and maintain RIC tax treatment, the BDCs must distribute to their stockholders, for each taxable year, at least 90% of their “investment company taxable income,” which is generally its net ordinary income plus the excess, if any, of realized net short-term capital gains over realized net long-term capital losses.

In July 2010, President Obama signed into law the Dodd-Frank Act. The Dodd-Frank Act, among other things, imposes significant regulations on nearly every aspect of the U.S. financial services industry, including oversight and regulation of systemic market risk (including the power to liquidate certain institutions); authorizing the Federal Reserve to regulate nonbank institutions that are deemed systemically important; generally prohibiting insured banks or thrifts, any bank holding company or savings and loan holding company, any non-U.S. bank with a U.S. branch, agency or commercial lending company and any subsidiaries and affiliates of any of these types of entities, regardless of geographic location, from conducting proprietary trading or investing in or sponsoring a “covered fund,” which includes private equity funds and hedge funds (i.e., the Volcker Rule); and imposing new registration, recordkeeping and reporting requirements on private fund investment advisers. Importantly, while several key aspects of the Dodd-Frank Act have been defined through final rules, some aspects still remain to be implemented by various regulatory bodies.

The Dodd-Frank Act requires the CFTC, the SEC and other regulatory authorities to promulgate certain rules relating to the regulation of the derivatives market. Such rules require or will require the registration of certain market participants, the clearing

of certain derivatives contracts through central counterparties, the execution of certain derivatives contracts on electronic platforms, as well as reporting and recordkeeping of derivatives transactions. Certain of our funds may from time to time, directly or indirectly, invest in instruments that meet the definition of a “swap” under the Commodity Exchange Act and the CFTC’s rules promulgated thereunder. As a result, such funds may qualify as commodity pools, and the operators of such funds may need to register as commodity pool operators (“CPOs”) unless an exemption applies. Additionally, pursuant to a rule finalized by the CFTC in December 2012, certain classes of interest rate swaps and certain classes of index credit default swaps have also been subject to mandatory clearing, unless an exemption applies. Since February 2014, many of these interest rate swaps and index credit default swaps have also been subject to mandatory trading on designated contract markets or swap execution facilities. The Dodd-Frank Act also provides expanded enforcement authority to the CFTC and SEC. While certain rules have been promulgated and are already in effect, the rulemaking and implementation process is still ongoing. In particular, the CFTC has finalized most of its rules under the Dodd-Frank Act, and the SEC has proposed several rules regarding security-based swaps but has only finalized a small number of these rules.

Competition

The investment management industry is intensely competitive, and we expect it to remain so. We face competition both in the pursuit of outside investors for our funds and in acquiring investments in attractive investee companies and making other investments. We compete for outside investors based on a variety of factors, including:

| |

• | investor perception of investment managers’ drive, focus and alignment of interest; |

| |

• | quality of service provided to and duration of relationship with investors; |

| |

• | business reputation; and |

| |

• | the level of fees and expenses charged for services. |

We face competition in our lending and other investment activities primarily from other credit-focused funds, specialized funds, BDCs, real estate funds, hedge fund sponsors, other financial institutions and other parties. Many of these competitors in some of our business are substantially larger and have considerably greater financial, technical and marketing resources than are available to us. Many of these competitors have similar investment objectives to us, which may create additional competition for investment opportunities. Some of these competitors may also have a lower cost of capital and access to funding sources that are not available to us, which may create competitive disadvantages for us with respect to investment opportunities. In addition, some of these competitors may have higher risk tolerances, different risk assessments or lower return thresholds, which could allow them to consider a wider variety of investments and to bid more aggressively than us for investments that we want to make. Lastly, institutional and individual investors are allocating increasing amounts of capital to alternative investment strategies. Several large institutional investors have announced a desire to consolidate their investments in a more limited number of managers. We expect that this will cause competition in our industry to intensify and could lead to a reduction in the size and duration of pricing inefficiencies.

Competition is also intense for the attraction and retention of qualified employees. Our ability to continue to compete effectively in our business will depend upon our ability to attract new employees and retain and motivate our existing employees.

For additional information concerning the competitive risks that we face, see “Risk Factors — Risks Related to Our Business and Industry — The investment management business is competitive.”

Employees

As of December 31, 2019, we employed 65 individuals, including 29 investment, origination and credit management professionals, located in our New York office.

Agreements and Plans of Merger

On August 9, 2018, the Company entered into the Agreement and Plan of Merger (the “MDLY Merger Agreement”), dated as of August 9, 2018, by and among the Company, Sierra and Sierra Management, Inc., a wholly owned subsidiary of Sierra ("Merger Sub"), pursuant to which the Company would, on the terms and subject to the conditions set forth in the MDLY Merger Agreement, merge with and into Merger Sub, with Merger Sub as the surviving company in the merger (the “MDLY Merger”). In the MDLY Merger, each share of our Class A common stock, issued and outstanding immediately prior to the MDLY Merger effective time (other than Dissenting Shares (as defined in the MDLY Merger Agreement) and shares of our Class A common stock held by the Company, Sierra or their respective wholly owned subsidiaries) would be converted into the right to receive (i) 0.3836 shares of Sierra’s common stock; plus (ii) cash in an amount equal to $3.44 per share. In addition, our stockholders would have the right to receive certain dividends and/or other payments. Simultaneously, pursuant to the Agreement and Plan of Merger, dated

as of August 9, 2018, by and between Medley Capital Corporation (“MCC”) and Sierra (the “MCC Merger Agreement”), MCC would, on the terms and subject to the conditions set forth in the MCC Merger Agreement, merge with and into Sierra, with Sierra as the surviving company in the merger (the “MCC Merger” together with the MDLY Merger, the “Mergers”). In the MCC Merger, each share of MCC’s common stock issued and outstanding immediately prior to the MCC Merger effective time (other than shares of MCC’s common stock held by MCC, Sierra or their respective wholly owned subsidiaries) would be converted into the right to receive 0.8050 shares of Sierra’s common stock.