UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

☒ | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended March 31, 2017

or

☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number: 001-36638

(Exact name of registrant as specified in its charter)

Delaware | 47-1130638 |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

280 Park Avenue, 6th Floor East

New York, New York 10017

(Address of principal executive offices)(Zip Code)

(212) 759-0777

(Registrant’s telephone number, including area code)

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer”, “smaller reporting company” and "emerging growth company" in Rule 12b-2 of the Exchange Act.

Large accelerated filer | ☐ | Accelerated filer | ☐ |

Non-accelerated filer | ☐ (Do not check if a smaller reporting company) | Smaller reporting company | ☒ |

Emerging growth company | ☒ | ||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☒

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

The number of shares of the registrant’s Class A common stock, par value $0.01 per share, outstanding as of May 11, 2017 was 5,638,891. The number of shares of the registrant’s Class B common stock, par value $0.01 per share, outstanding as of May 11, 2017 was 100.

TABLE OF CONTENTS

Page | ||

Part I. | ||

Item 1. | ||

Item 2. | ||

Item 3. | ||

Item 4. | ||

Part II. | ||

Item 1. | ||

Item 1A. | ||

Item 2. | ||

Item 3. | ||

Item 4. | ||

Item 5. | ||

Item 6. | ||

FORWARD-LOOKING STATEMENTS

This Quarterly Report on Form 10-Q (“Form 10-Q”) contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the "Securities Act"), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) that reflect our current views with respect to, among other things, our operations and financial performance. Forward-looking statements include all statements that are not historical facts. In some cases, you can identify these forward-looking statements by the use of words such as “outlook,” “believes,” “expects,” “potential,” “may,” “should,” “could,” “seeks,” “approximately,” “predicts,” “intends,” “plans,” “estimates,” “anticipates” or the negative version of these words or other comparable words. Such forward-looking statements are subject to various risks and uncertainties. Accordingly, there are or will be important factors that could cause actual outcomes or results to differ materially from those indicated in these statements. We believe these factors include, but are not limited to, those described under Part I, Item 1A. “Risk Factors,” in our Annual Report on Form 10-K for the fiscal year ended December 31, 2016 (the "Annual Report on Form 10-K") available on the SEC's website at www.sec.gov, which include, but are not limited to, the following:

• | difficult market and political conditions may adversely affect our business in many ways, including by reducing the value or hampering the performance of the investments made by our funds, each of which could materially and adversely affect our business, results of operations and financial condition; |

• | we derive a substantial portion of our revenues from funds managed pursuant to advisory agreements that may be terminated or fund partnership agreements that permit fund investors to remove us as the general partner; |

• | we may not be able to maintain our current fee structure as a result of industry pressure from fund investors to reduce fees, which could have an adverse effect on our profit margins and results of operations; |

• | a change of control of us could result in termination of our investment advisory agreements; |

• | the historical returns attributable to our funds should not be considered as indicative of the future results of our funds or of our future results or of any returns expected on an investment in our Class A common stock; |

• | if we are unable to consummate or successfully integrate development opportunities, acquisitions or joint ventures, we may not be able to implement our growth strategy successfully; |

• | we depend on third-party distribution sources to market our investment strategies; |

• | an investment strategy focused primarily on privately held companies presents certain challenges, including the lack of available information about these companies; |

• | our funds’ investments in investee companies may be risky, and our funds could lose all or part of their investments; |

• | prepayments of debt investments by our investee companies could adversely impact our results of operations; |

• | our funds’ investee companies may incur debt that ranks equally with, or senior to, our funds’ investments in such companies; |

• | subordinated liens on collateral securing loans that our funds make to their investee companies may be subject to control by senior creditors with first priority liens and, if there is a default, the value of the collateral may not be sufficient to repay in full both the first priority creditors and our funds; |

• | there may be circumstances where our funds’ debt investments could be subordinated to claims of other creditors or our funds could be subject to lender liability claims; |

• | our funds may not have the resources or ability to make additional investments in our investee companies; |

• | economic recessions or downturns could impair our investee companies and harm our operating results; |

• | a covenant breach by our investee companies may harm our operating results; |

• | the investment management business is competitive; |

• | our funds operate in a competitive market for lending that has recently intensified, and competition may limit our funds’ ability to originate or acquire desirable loans and investments and could also affect the yields of these assets and have a material adverse effect on our business, results of operations and financial condition; |

i

• | dependence on leverage by certain of our funds and by our funds’ investee companies subjects us to volatility and contractions in the debt financing markets and could adversely affect our ability to achieve attractive rates of return on those investments; |

• | some of our funds may invest in companies that are highly leveraged, which may increase the risk of loss associated with those investments; |

• | we generally do not control the business operations of our investee companies and, due to the illiquid nature of our investments, may not be able to dispose of such investments; |

• | a substantial portion of our investments may be recorded at fair value as determined in good faith by or under the direction of our respective funds’ boards of directors or similar bodies and, as a result, there may be uncertainty regarding the value of our funds’ investments; |

• | we may need to pay “clawback” obligations if and when they are triggered under the governing agreements with respect to certain of our funds and SMAs; |

• | our funds may face risks relating to undiversified investments; |

• | third-party investors in our private funds may not satisfy their contractual obligation to fund capital calls when requested, which could adversely affect a fund’s operations and performance; |

• | our funds may be forced to dispose of investments at a disadvantageous time; |

• | hedging strategies may adversely affect the returns on our funds’ investments; |

• | our business depends in large part on our ability to raise capital from investors. If we were unable to raise such capital, we would be unable to collect management fees or deploy such capital into investments, which would materially and adversely affect our business, results of operations and financial condition; |

• | we depend on our senior management team, senior investment professionals and other key personnel, and our ability to retain them and attract additional qualified personnel is critical to our success and our growth prospects; |

• | our failure to appropriately address conflicts of interest could damage our reputation and adversely affect our business; |

• | potential conflicts of interest may arise between our Class A common stockholders and our fund investors; |

• | rapid growth of our business may be difficult to sustain and may place significant demands on our administrative, operational and financial resources; |

• | we may enter into new lines of business and expand into new investment strategies, geographic markets and business, each of which may result in additional risks and uncertainties in our business; |

• | extensive regulation affects our activities, increases the cost of doing business and creates the potential for significant liabilities and penalties that could adversely affect our business and results of operations; |

• | failure to comply with “pay to play” regulations implemented by the SEC and certain states, and changes to the “pay to play” regulatory regimes, could adversely affect our business; |

• | new or changed laws or regulations governing our funds’ operations and changes in the interpretation thereof could adversely affect our business; |

• | present and future business development companies for which we serve as investment adviser are subject to regulatory complexities that limit the way in which they do business and may subject them to a higher level of regulatory scrutiny; |

• | we are subject to risks in using custodians, counterparties, administrators and other agents; |

• | a portion of our revenue and cash flow is variable, which may impact our ability to achieve steady earnings growth on a quarterly basis and may cause the price of our Class A common stock to decline; |

• | we may be subject to litigation risks and may face liabilities and damage to our professional reputation as a result; |

• | employee misconduct could harm us by impairing our ability to attract and retain investors and subjecting us to significant legal liability, regulatory scrutiny and reputational harm, and fraud and other deceptive practices or other misconduct at our investee companies could similarly subject us to liability and reputational damage and also harm our business; |

ii

• | our substantial indebtedness could adversely affect our financial condition, our ability to pay our debts or raise additional capital to fund our operations, our ability to operate our business and our ability to react to changes in the economy or our industry and could divert our cash flow from operations for debt payments; |

• | our Revolving Credit Facility imposes significant operating and financial restrictions on us and our subsidiaries, which may prevent us from capitalizing on business opportunities; |

• | servicing our indebtedness will require a significant amount of cash. Our ability to generate sufficient cash depends on many factors, some of which are not within our control; |

• | despite our current level of indebtedness, we may be able to incur substantially more debt and enter into other transactions, which could further exacerbate the risks to our financial condition; |

• | operational risks may disrupt our business, result in losses or limit our growth; |

• | Medley Management Inc.’s only material asset is its interest in Medley LLC, and it is accordingly dependent upon distributions from Medley LLC to pay taxes, make payments under the tax receivable agreement or pay dividends; |

• | Medley Management Inc. is controlled by our pre-IPO owners, whose interests may differ from those of our public stockholders; |

• | Medley Management Inc. will be required to pay exchanging holders of LLC Units for most of the benefits relating to any additional tax depreciation or amortization deductions that we may claim as a result of the tax basis step-up we receive in connection with sales or exchanges of LLC Units and related transactions; |

• | in certain cases, payments under the tax receivable agreement may be accelerated and/or significantly exceed the actual benefits Medley Management Inc. realizes in respect of the tax attributes subject to the tax receivable agreement; and |

• | anti-takeover provisions in our organizational documents and Delaware law might discourage or delay acquisition attempts for us that you might consider favorable. |

These factors should not be construed as exhaustive and should be read in conjunction with the other cautionary statements that are included in this Form 10-Q. Forward-looking statements speak as of the date on which they are made, and we undertake no obligation to publicly update or review any forward-looking statement, whether as a result of new information, future developments or otherwise, except as required by law.

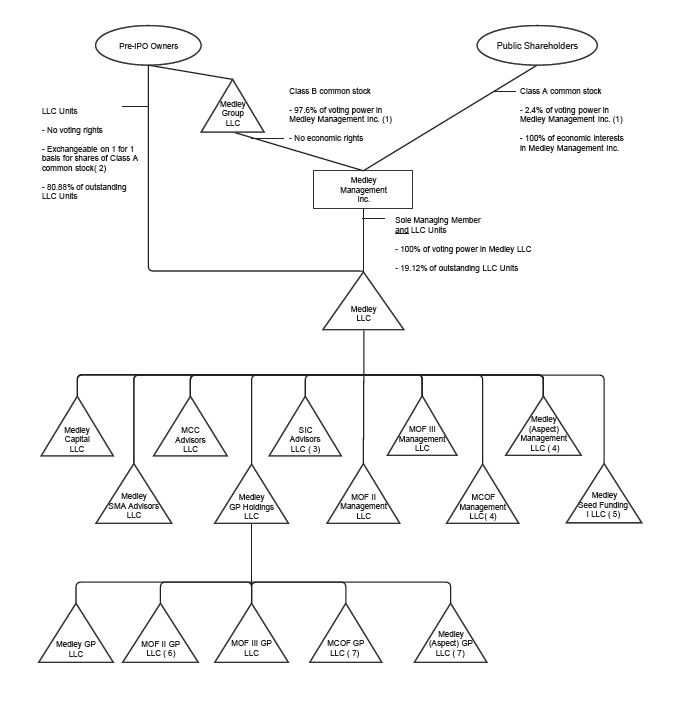

Medley Management Inc. was incorporated as a Delaware corporation on June 13, 2014, and its sole asset is a controlling equity interest in Medley LLC. Pursuant to a reorganization into a holding corporation structure (the “Reorganization”) consummated in connection with Medley Management Inc.’s initial public offering (“IPO”), Medley Management Inc. became a holding corporation and the sole managing member of Medley LLC, operating and controlling all of the business and affairs of Medley LLC and, through Medley LLC and its subsidiaries, conducts its business.

Unless the context suggests otherwise, references herein to the “Company,” “Medley,” “we,” “us” and “our” refer to Medley Management Inc., Medley LLC, and their consolidated subsidiaries.

The “pre-IPO owners” refers to the senior professionals who were the owners of Medley LLC immediately prior to the Offering Transactions. The “Offering Transactions” refer to Medley Management Inc.’s purchase upon the consummation of its IPO of 6,000,000 newly issued limited liability company units (the “LLC Units”) from Medley LLC, which correspondingly diluted the ownership interests of the pre-IPO owners in Medley LLC and resulted in Medley Management Inc.’s holding a number of LLC Units in Medley LLC equal to the number of shares of Class A common stock it issued in its IPO.

Unless the context suggests otherwise, references herein to:

• | “Aspect” refers to Aspect-Medley Investment Platform A LP; |

• | “AUM” refers to the assets of our funds, which represents the sum of the NAV of such funds, the drawn and undrawn debt (at the fund level, including amounts subject to restrictions) and uncalled committed capital (including commitments to funds that have yet to commence their investment periods); |

• | “base management fees” refers to fees we earn for advisory services provided to our funds, which are generally based on a defined percentage of fee earning AUM or, in certain cases, a percentage of originated assets in the case of certain of our SMAs; |

iii

• | “BDC” refers to business development company; |

• | “fee earning AUM” refers to the assets under management on which we directly earn base management fees; |

• | “hurdle rates” refers to the rates above which we earn performance fees, as defined in the long-dated private funds’ and SMAs’ applicable investment management or partnership agreements; |

• | “investee company” refers to a company to which one of our funds lends money or in which one of our funds otherwise makes an investment; |

• | “long-dated private funds” refers to MOF II, MOF III, MCOF, Aspect and any other private funds we may manage in the future; |

• | “management fees” refers to base management fees and Part I incentive fees; |

• | “MCOF” refers to Medley Credit Opportunity Fund LP; |

• | “Medley LLC” refers to Medley LLC and its consolidated subsidiaries; |

• | “MOF II” refers to Medley Opportunity Fund II LP; |

• | “MOF III” refers to Medley Opportunity Fund III LP; |

• | “our funds” refers to the funds, alternative asset companies and other entities and accounts that are managed or co-managed by us and our affiliates; |

• | “our investors” refers to the investors in our permanent capital vehicles, our private funds and our SMAs; |

• | “Part I incentive fees” refers to fees that we receive from our permanent capital vehicles, which are paid in cash quarterly and are driven primarily by net interest income on senior secured loans subject to hurdle rates. As it relates to Medley Capital Corporation (NYSE: MCC) (“MCC”), these fees are subject to netting against realized and unrealized losses; |

• | “Part II incentive fees” refers to fees related to realized capital gains in our permanent capital vehicles; |

• | “performance fees” refers to incentive allocations in our long-dated private funds and incentive fees from our SMAs, which are typically 15% to 20% of the total return after a hurdle rate, accrued quarterly, but paid after the return of all invested capital and in an amount sufficient to achieve the hurdle rate; |

• | “permanent capital” refers to capital of funds that do not have redemption provisions or a requirement to return capital to investors upon exiting the investments made with such capital, except as required by applicable law, which funds currently consist of MCC and Sierra Income Corporation (“SIC”). Such funds may be required, or elect, to return all or a portion of capital gains and investment income. In certain circumstances, the investment adviser of such a fund may be removed; |

• | “SMA” refers to a separately managed account; and |

• | “STRF” refers to Sierra Total Return Fund. |

iv

PART I.

Item 1. Financial Statements

Medley Management Inc.

Condensed Consolidated Balance Sheets

(Amounts in thousands, except share and per share amounts)

As of March 31, 2017 (unaudited) | As of December 31, 2016 | ||||||

Assets | |||||||

Cash and cash equivalents | $ | 63,245 | $ | 49,666 | |||

Restricted cash equivalents | 7,554 | 4,897 | |||||

Investments, at fair value | 36,311 | 31,904 | |||||

Management fees receivable | 11,226 | 12,630 | |||||

Performance fees receivable | 2,744 | 4,961 | |||||

Other assets | 17,393 | 18,311 | |||||

Total assets | $ | 138,473 | $ | 122,369 | |||

Liabilities and Equity | |||||||

Senior unsecured debt | $ | 116,480 | $ | 49,793 | |||

Loans payable | 8,736 | 52,178 | |||||

Accounts payable, accrued expenses and other liabilities | 27,723 | 37,255 | |||||

Total liabilities | 152,939 | 139,226 | |||||

Commitments and contingencies (Note 9) | |||||||

Redeemable Non-controlling Interests | 36,041 | 30,805 | |||||

Equity | |||||||

Class A common stock, $0.01 par value, 3,000,000,000 shares authorized; 6,046,842 and 6,042,050 issued as of March 31, 2017 and December 31, 2016, respectively; 5,764,722 and 5,809,130 outstanding as of March 31, 2017 and December 31, 2016, respectively | 58 | 58 | |||||

Class B common stock, $0.01 par value, 1,000,000 shares authorized; 100 shares issued and outstanding | — | — | |||||

Additional paid in capital | 3,911 | 3,310 | |||||

Accumulated other comprehensive income | 65 | 33 | |||||

Accumulated deficit | (6,164 | ) | (5,254 | ) | |||

Total stockholders' deficit, Medley Management Inc. | (2,130 | ) | (1,853 | ) | |||

Non-controlling interests in consolidated subsidiaries | (1,714 | ) | (1,717 | ) | |||

Non-controlling interests in Medley LLC | (46,663 | ) | (44,092 | ) | |||

Total deficit | (50,507 | ) | (47,662 | ) | |||

Total liabilities, redeemable non-controlling interests and equity | $ | 138,473 | $ | 122,369 | |||

See accompanying notes to unaudited condensed consolidated financial statements

F- 1

Medley Management Inc.

Condensed Consolidated Statements of Operations (unaudited)

(Amounts in thousands, except share and per share amounts)

For the Three Months Ended March 31, | ||||||||

2017 | 2016 | |||||||

Revenues | ||||||||

Management fees (includes Part I incentive fees of $544 and $3,369, respectively) | $ | 13,895 | $ | 16,263 | ||||

Performance fees | (2,219 | ) | (591 | ) | ||||

Other revenues and fees | 2,320 | 1,899 | ||||||

Total revenues | 13,996 | 17,571 | ||||||

Expenses | ||||||||

Compensation and benefits | 5,794 | 5,868 | ||||||

Performance fee compensation | (881 | ) | (71 | ) | ||||

General, administrative and other expenses | 2,668 | 7,979 | ||||||

Total expenses | 7,581 | 13,776 | ||||||

Other income (expense) | ||||||||

Dividend income | 735 | 222 | ||||||

Interest expense | (3,647 | ) | (2,118 | ) | ||||

Other income (expense), net | 1,560 | (751 | ) | |||||

Total other expense, net | (1,352 | ) | (2,647 | ) | ||||

Income before income taxes | 5,063 | 1,148 | ||||||

Provision for income taxes | 413 | 112 | ||||||

Net income | 4,650 | 1,036 | ||||||

Net income attributable to redeemable non-controlling interests and non-controlling interests in consolidated subsidiaries | 1,488 | 263 | ||||||

Net income attributable to non-controlling interests in Medley LLC | 2,768 | 679 | ||||||

Net income attributable to Medley Management Inc. | $ | 394 | $ | 94 | ||||

Dividends declared per Class A common stock | $ | 0.20 | $ | 0.20 | ||||

Net income (loss) per Class A common stock: | ||||||||

Basic (Note 11) | $ | 0.06 | $ | (0.01 | ) | |||

Diluted (Note 11) | $ | 0.06 | $ | (0.01 | ) | |||

Weighted average shares outstanding - Basic and Diluted | 5,808,626 | 5,851,129 | ||||||

See accompanying notes to unaudited condensed consolidated financial statements

F- 2

Medley Management Inc.

Condensed Consolidated Statements of Comprehensive Income (unaudited)

(Amounts in thousands)

For the Three Months Ended March 31, | ||||||||

2017 | 2016 | |||||||

Net income | $ | 4,650 | $ | 1,036 | ||||

Other comprehensive income: | ||||||||

Change in fair value of available-for-sale securities | 485 | — | ||||||

Total comprehensive income | 5,135 | 1,036 | ||||||

Comprehensive income attributable to redeemable non-controlling interests and non-controlling interests in consolidated subsidiaries | 1,812 | 263 | ||||||

Comprehensive income attributable to Medley LLC | 2,897 | 679 | ||||||

Comprehensive income attributable to Medley Management Inc. | $ | 426 | $ | 94 | ||||

See accompanying notes to unaudited condensed consolidated financial statements

F- 3

Medley Management Inc.

Condensed Consolidated Statement of Changes in Equity and Redeemable Non-controlling Interests (unaudited)

(Amounts in thousands, except share and per share amounts)

Class A Common Stock | Class B Common Stock | Additional Paid in Capital | Accumulated Other Comprehensive Income | Accumulated Deficit | Non- controlling Interests in Consolidated Subsidiaries | Non- controlling Interests in Medley LLC | Total Deficit | Redeemable Non- controlling Interests | ||||||||||||||||||||||||||||||||||

Shares | Dollars | Shares | Dollars | |||||||||||||||||||||||||||||||||||||||

Balance at December 31, 2016 | 5,809,130 | $ | 58 | 100 | $ | — | $ | 3,310 | $ | 33 | $ | (5,254 | ) | $ | (1,717 | ) | $ | (44,092 | ) | $ | (47,662 | ) | $ | 30,805 | ||||||||||||||||||

Cumulative effect of accounting change due to the adoption of ASU 2016-09 | — | — | — | — | 1,039 | — | (120 | ) | — | (801 | ) | 118 | — | |||||||||||||||||||||||||||||

Net income | — | — | — | — | — | — | 394 | 3 | 2,768 | 3,165 | 1,485 | |||||||||||||||||||||||||||||||

Change in fair value of available-for-sale securities | — | — | — | — | — | 32 | — | — | 129 | 161 | 324 | |||||||||||||||||||||||||||||||

Stock-based compensation | — | — | — | — | (37 | ) | — | — | — | — | (37 | ) | — | |||||||||||||||||||||||||||||

Dividends on Class A common stock ($0.20 per share) | — | — | — | — | — | — | (1,600 | ) | — | — | (1,600 | ) | — | |||||||||||||||||||||||||||||

Reclass of cumulative dividends on forfeited RSUs | — | — | — | — | — | — | 416 | — | — | 416 | — | |||||||||||||||||||||||||||||||

Issuance of Class A common stock related to vesting of restricted stock units | 4,792 | — | — | — | — | — | — | — | — | — | — | |||||||||||||||||||||||||||||||

Repurchases of Class A common stock | (49,200 | ) | — | — | — | (401 | ) | — | — | — | — | (401 | ) | — | ||||||||||||||||||||||||||||

Contributions | — | — | — | — | — | — | — | — | — | — | 5,000 | |||||||||||||||||||||||||||||||

Distributions | — | — | — | — | — | — | — | — | (4,667 | ) | (4,667 | ) | (1,573 | ) | ||||||||||||||||||||||||||||

Balance at March 31, 2017 | 5,764,722 | $ | 58 | 100 | $ | — | $ | 3,911 | $ | 65 | $ | (6,164 | ) | $ | (1,714 | ) | $ | (46,663 | ) | $ | (50,507 | ) | $ | 36,041 | ||||||||||||||||||

See accompanying notes to unaudited condensed consolidated financial statements

F- 4

Medley Management Inc.

Condensed Consolidated Statements of Cash Flows (unaudited) (Amounts in thousands) | |||||||

For the Three Months Ended March 31, | |||||||

2017 | 2016 | ||||||

Cash flows from operating activities | |||||||

Net income | $ | 4,650 | $ | 1,036 | |||

Adjustments to reconcile net income to net cash provided by (used in) operating activities: | |||||||

Stock-based compensation | (37 | ) | 836 | ||||

Amortization of debt issuance costs | 979 | 135 | |||||

Accretion of debt discount | 552 | 198 | |||||

Provision for (benefit from) deferred taxes | 82 | (66 | ) | ||||

Depreciation and amortization | 235 | 188 | |||||

Net change in unrealized depreciation on investments | 72 | 110 | |||||

Income from equity method investments | (69 | ) | (12 | ) | |||

Reclassification of cumulative dividends paid on forfeited restricted stock units | 416 | — | |||||

Other non-cash amounts | — | 27 | |||||

Changes in operating assets and liabilities: | |||||||

Management fees receivable | 1,404 | 3,144 | |||||

Performance fees receivable | 2,217 | 574 | |||||

Other assets | 715 | 872 | |||||

Accounts payable, accrued expenses and other liabilities | (9,519 | ) | (3,201 | ) | |||

Net cash provided by operating activities | 1,697 | 3,841 | |||||

Cash flows from investing activities | |||||||

Purchases of fixed assets | (18 | ) | (1,867 | ) | |||

Distributions received from equity method investments | 17 | 810 | |||||

Purchases of available-for-sale securities | (3,728 | ) | — | ||||

Net cash used in investing activities | (3,729 | ) | (1,057 | ) | |||

Cash flows from financing activities | |||||||

Repayment of loans payable | (44,800 | ) | (312 | ) | |||

Proceeds from issuance of senior unsecured debt | 69,108 | — | |||||

Capital contributions from redeemable non-controlling interests | 5,000 | — | |||||

Distributions to members and redeemable non-controlling interests | (6,240 | ) | (6,214 | ) | |||

Debt issuance costs | (2,585 | ) | — | ||||

Dividends paid | (1,600 | ) | (1,314 | ) | |||

Repurchases of Class A common stock | (401 | ) | (1,198 | ) | |||

Capital contributions to equity method investments | (214 | ) | (53 | ) | |||

Net cash provided by (used in) financing activities | 18,268 | (9,091 | ) | ||||

Net increase (decrease) in cash, cash equivalents and restricted cash equivalents | 16,236 | (6,307 | ) | ||||

Cash, cash equivalents and restricted cash equivalents, beginning of period | 54,563 | 71,688 | |||||

Cash, cash equivalents and restricted cash equivalents, end of period | $ | 70,799 | $ | 65,381 | |||

See accompanying notes to unaudited condensed consolidated financial statements

F- 5

Medley Management Inc.

Condensed Consolidated Statements of Cash Flows (unaudited) (Amounts in thousands) | |||||||

For the Three Months Ended March 31, | |||||||

2017 | 2016 | ||||||

Reconciliation of cash, cash equivalents, and restricted cash equivalents reported on the condensed consolidated balance sheets to the total of such amounts reported on the condensed consolidated statements of cash flows | |||||||

Cash and cash equivalents | $ | 63,245 | $ | 65,381 | |||

Restricted cash equivalents | 7,554 | — | |||||

Total cash, cash equivalents and restricted cash equivalents | $ | 70,799 | $ | 65,381 | |||

Supplemental disclosure of non-cash investing and financing activities | |||||||

Deferred tax asset impact on cumulative effect of accounting change due to the adoption of ASU 2016-09 | $ | 118 | $ | — | |||

Fixed assets | — | 2,293 | |||||

Reclassification of redeemable non-controlling interest | — | 12,155 | |||||

See accompanying notes to unaudited condensed consolidated financial statements

F- 6

Medley Management Inc.

Notes to Condensed Consolidated Financial Statements (unaudited)

1. ORGANIZATION AND BASIS OF PRESENTATION

Medley Management Inc. is an asset management firm offering yield solutions to retail and institutional investors. The Company's national direct origination franchise provides capital to the middle market in the U.S. Medley Management Inc., through its consolidated subsidiary, Medley LLC, provides investment management services to permanent capital vehicles, long-dated private funds and separately managed accounts and serves as the general partner to the private funds, which are generally organized as pass-through entities. Medley LLC is headquartered in New York City and has an office in San Francisco.

The Company’s business is currently comprised of only one reportable segment, the investment management segment, and substantially all of the Company operations are conducted through this segment. The investment management segment provides investment management services to permanent capital vehicles, long-dated private funds and separately managed accounts. The Company conducts its investment management business in the U.S., where substantially all its revenues are generated.

Initial Public Offering of Medley Management Inc.

Medley Management Inc. was incorporated on June 13, 2014 and commenced operations on September 29, 2014 upon the completion of its initial public offering (“IPO”) of its Class A common stock. Medley Management Inc. raised $100.4 million, net of underwriting discount, through the issuance of 6,000,000 shares of Class A common stock at an offering price to the public of $18.00 per share. Medley Management Inc. used the offering proceeds to purchase 6,000,000 newly issued LLC Units (defined below) from Medley LLC. Prior to the IPO, Medley Management Inc. had not engaged in any business or other activities except in connection with its formation and IPO.

In connection with the IPO, Medley Management Inc. issued 100 shares of Class B common stock to Medley Group LLC (“Medley Group”), an entity wholly owned by the pre-IPO members of Medley LLC. For as long as the pre-IPO members and then-current Medley personnel hold at least 10% of the aggregate number of shares of Class A common stock and LLC Units (defined below) (excluding those LLC Units held by Medley Management Inc.) then outstanding, the Class B common stock entitles Medley Group to a number of votes that is equal to 10 times the aggregate number of LLC Units held by all non-managing members of Medley LLC that do not themselves hold shares of Class B common stock and entitle each other holder of Class B common stock, without regard to the number of shares of Class B common stock held by such other holder, to a number of votes that is equal to 10 times the number of membership units held by such holder. The Class B common stock does not participate in dividends and does not have any liquidation rights.

Medley LLC Reorganization

In connection with the IPO, Medley LLC amended and restated its limited liability agreement to modify its capital structure by reclassifying the 23,333,333 interests held by the pre-IPO members into a single new class of units (“LLC Units”). The pre-IPO members also entered into an exchange agreement under which they (or certain permitted transferees thereof) have the right, subject to the terms of an exchange agreement, to exchange their LLC Units for shares of Medley Management Inc.’s Class A common stock on a one-for-one basis, subject to customary conversion rate adjustments for stock splits, stock dividends and reclassifications. In addition, pursuant to the amended and restated limited liability agreement, Medley Management Inc. became the sole managing member of Medley LLC.

The pre-IPO owners are, subject to limited exceptions, prohibited from transferring any LLC Units held by them or any shares of Class A common stock received upon exchange of such LLC Units, until the third anniversary of the date of the closing of the IPO without the Company’s consent. Thereafter and prior to the fourth and fifth anniversaries of the closing of the IPO, such holders may not transfer more than 33 1/3% and 66 2/3%, respectively, of the number of LLC Units held by them, together with the number of any shares of Class A common stock received by them upon exchange therefor, without the Company’s consent.

Basis of Presentation

The accompanying condensed consolidated financial statements have been prepared on the accrual basis of accounting in conformity with U.S. generally accepted accounting principles (“GAAP”) and include the accounts of Medley Management Inc., Medley LLC and its consolidated subsidiaries (collectively, “Medley” or the “Company”). Additionally, the accompanying condensed consolidated financial statements of the Company and related financial information have been prepared pursuant to the requirements for reporting on Form 10-Q and Article 10 of Regulation S-X. Accordingly, certain disclosures accompanying annual financial statements prepared in accordance with U.S. GAAP may be omitted. In the opinion of management, the unaudited condensed consolidated financial results included herein contain all adjustments, consisting solely of normal recurring accruals,

F- 7

Medley Management Inc.

Notes to Condensed Consolidated Financial Statements (unaudited)

considered necessary for the fair presentation of financial statements for the interim periods included herein. Therefore, this Form 10-Q should be read in conjunction with the Company's Annual Report on Form 10-K for the fiscal year ended December 31, 2016. The current period's results of operations will not necessarily be indicative of results that ultimately may be achieved for the full year ending December 31, 2017.

2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Principles of Consolidation

In accordance with Accounting Standards Codification (“ASC”) 810, Consolidation, the Company consolidates those entities where it has a direct and indirect controlling financial interest based on either a variable interest model or voting interest model. As such, the Company consolidates entities that the Company concludes are variable interest entities (“VIEs”), for which the Company is deemed to be the primary beneficiary and entities in which it holds a majority voting interest or has majority ownership and control over the operational, financial and investing decisions of that entity.

For legal entities evaluated for consolidation, the Company must determine whether the interests that it holds and fees paid to it qualify as a variable interest in an entity. This includes an evaluation of the management fees and performance fees paid to the Company when acting as a decision maker or service provider to the entity being evaluated. If fees received by the Company are customary and commensurate with the level of services provided, and the Company does not hold other economic interests in the entity that would absorb more than an insignificant amount of the expected losses or returns of the entity, the interest that the Company holds would not be considered a variable interest. The Company factors in all economic interests including proportionate interests through related parties, to determine if fees are considered a variable interest.

An entity in which the Company holds a variable interest is a VIE if any one of the following conditions exist: (a) the total equity investment at risk is not sufficient to permit the legal entity to finance its activities without additional subordinated financial support, (b) the holders of equity investment at risk have the right to direct the activities of the entity that most significantly impact the legal entity’s economic performance, (c) the voting rights of some investors are disproportionate to their obligation to absorb losses or rights to receive returns from a legal entity. For limited partnerships and other similar entities, non-controlling investors must have substantive rights to either dissolve the fund or remove the general partner (“kick-out rights”) in order to not qualify as a VIE.

For those entities that qualify as a VIE, the primary beneficiary is generally defined as the party who has a controlling financial interest in the VIE. The Company is generally deemed to have a controlling financial interest if it has the power to direct the activities of a VIE that most significantly impact the VIE’s economic performance, and the obligation to absorb losses or receive benefits from the VIE that could potentially be significant to the VIE. The Company determines whether it is the primary beneficiary of a VIE at the time it becomes initially involved with the VIE and reconsiders that conclusion continuously. The primary beneficiary evaluation is generally performed qualitatively on the basis of all facts and circumstances. However, quantitative information may also be considered in the analysis, as appropriate. These assessments require judgments. Each entity is assessed for consolidation on a case-by-case basis.

For those entities evaluated under the voting interest model, the Company consolidates the entity if it has a controlling financial interest. The Company has a controlling financial interest in a voting interest entity (“VOE”) if it owns a majority voting interest in the entity.

Consolidated Variable Interest Entities

Medley Management Inc. is the sole managing member of Medley LLC and, as such, it operates and controls all of the business and affairs of Medley LLC and, through Medley LLC, conducts its business. Under ASC 810, Medley LLC meets the definition of a VIE because the equity of Medley LLC is not sufficient to permit activities without additional subordinated financial support. Medley Management Inc. has the obligation to absorb expected losses that could be significant to Medley LLC and holds 100% of the voting power, therefore Medley Management Inc. is considered to be the primary beneficiary of Medley LLC.

As a result, Medley Management Inc. consolidates the financial results of Medley LLC and its subsidiaries and records a non-controlling interest for the economic interest in Medley LLC held by the non-managing members. Medley Management Inc.’s and the non-managing members’ economic interests in Medley LLC are 19.5% and 80.5%, respectively, as of March 31, 2017 and 19.9% and 80.1%, respectively, as of December 31, 2016. Net income attributable to the non-controlling interests in Medley LLC on the consolidated statements of operations represents the portion of earnings attributable to the economic interest

F- 8

Medley Management Inc.

Notes to Condensed Consolidated Financial Statements (unaudited)

in Medley LLC held by its non-managing members. Non-controlling interests in Medley LLC on the consolidated balance sheets represents the portion of net assets of Medley LLC attributable to the non-managing members based on total LLC Units of Medley LLC owned by such non-managing members.

As of March 31, 2017 and December 31, 2016, Medley LLC has three majority owned subsidiaries, SIC Advisors LLC, Medley Seed Funding I LLC and STRF Advisors LLC, which are consolidated VIEs. Each of these entities were organized as a limited liability company and was legally formed to either manage a designated fund or strategically invest capital as well as isolate business risk. As of March 31, 2017, total assets and total liabilities, after eliminating entries, of these VIEs reflected in the condensed consolidated balance sheets were $54.7 million and $20.1 million, respectively. As of December 31, 2016, total assets and total liabilities, after eliminating entries, of these VIEs reflected in the condensed consolidated balance sheets were $51.7 million and $22.8 million, respectively. Except to the extent of the assets of these VIEs that are consolidated, the holders of the consolidated VIEs’ liabilities generally do not have recourse to the Company.

Seed Investments

The Company accounts for seed investments through the application of the voting interest model under ASC 810-10-25-1 through 25-14 and consolidates a seed investment when the investment advisor holds a controlling interest, which is, in general, 50% or more of the equity in such investment. For seed investments in which the Company does not hold a controlling interest, the Company accounts for such seed investment under the equity method of accounting, at its ownership percentage of such seed investment’s net asset value.

Non-Consolidated Variable Interest Entities

The Company holds interests in certain VIEs that are not consolidated because the Company is not deemed the primary beneficiary. The Company's interest in these entities is in the form of insignificant equity interests and fee arrangements. The maximum exposure to loss represents the potential loss of assets by the Company relating to these non-consolidated entities.

As of March 31, 2017, the Company recorded investments, at fair value, attributed to these non-consolidated VIEs of $5.4 million, receivables of $2.0 million included as a component of other assets and a clawback obligation of $7.1 million included as a component of accounts payable, accrued expenses and other liabilities on the Company’s condensed consolidated balance sheets. The clawback obligation assumes a hypothetical liquidation of a fund’s investments, at their then current fair values and a portion of tax distributions relating to performance fees which would need to be returned. As of December 31, 2016, the Company recorded investments, at fair value of $5.1 million, receivables of $1.9 million included as a component of other assets and a clawback obligation of $7.1 million included as a component of accounts payable, accrued expenses and other liabilities on the Company’s condensed consolidated balance sheets. As of March 31, 2017, the Company’s maximum exposure to losses from these entities is $7.4 million.

Use of Estimates

The preparation of financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosures of contingent assets and liabilities at the date of the financial statements and the reported amounts of income and expenses during the reporting period. Management’s estimates are based on historical experience and other factors, including expectations of future events that management believes to be reasonable under the circumstances. These assumptions and estimates also require management to exercise judgment in the process of applying the Company’s accounting policies. Significant estimates and assumptions by management affect the carrying value of investments, performance compensation payable and certain accrued liabilities. Actual results could differ from these estimates, and such differences could be material.

Indemnification

In the normal course of business, the Company enters into contractual agreements that provide general indemnifications against losses, costs, claims and liabilities arising from the performance of individual obligations under such agreements. The Company has not experienced any prior claims or payments pursuant to such agreements. The Company’s individual maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Company that have not yet occurred. However, based on management’s experience, the Company expects the risk of loss to be remote.

F- 9

Medley Management Inc.

Notes to Condensed Consolidated Financial Statements (unaudited)

Non-Controlling Interests in Consolidated Subsidiaries

Non-controlling interests in consolidated subsidiaries represent the component of equity in such consolidated entities held by third-parties. These interests are adjusted for contributions to and distributions from Medley entities and are allocated income from Medley entities based on their ownership percentages.

Redeemable Non-Controlling Interests

Redeemable non-controlling interests represents interests of certain third parties that are not mandatorily redeemable but redeemable for cash or other assets at a fixed or determinable price or a fixed or determinable date, at the option of the holder or upon the occurrence of an event that is not solely within the control of the issuer. These interests are classified in temporary equity.

Class A Earnings per Share

The Company computes and presents earnings per share using the two-class method. Under the two-class method, the Company allocates earnings between common stock and participating securities. The two-class method includes an earnings allocation formula that determines earnings per share for each class of common stock according to dividends declared and undistributed earnings for the period. For purposes of calculating earnings per share, the Company reduces its reported net earnings by the amount allocated to participating securities to arrive at the earnings allocated to Class A common stockholders. Earnings are then divided by the weighted average number of Class A common stock outstanding to arrive at basic earnings per share. Diluted earnings per share reflects the potential dilution beyond shares for basic earnings per share that could occur if securities or other contracts to issue common stock were exercised, converted into common stock, or resulted in the issuance of common stock that would have shared in our earnings. Participating securities consist of the Company's unvested restricted stock units that contain non-forfeitable rights to dividends or dividend equivalents, whether paid or unpaid, in the number of shares outstanding in its basic and diluted calculations.

Investments

Investments include equity method investments that are not consolidated but over which the Company exerts significant influence. The Company measures the carrying value of its public non-traded equity method investment at NAV per share. The Company measures the carrying value of its privately-held equity method investments by recording its share of the underlying income or loss of these entities.

Unrealized appreciation (depreciation) resulting from changes in fair value of the equity method investments is reflected as a component of other income (expense), net in the condensed consolidated statements of operations. The Company evaluates its equity method investments for impairment whenever events or changes in circumstances indicate that the carrying amounts of such investments may not be recoverable.

The carrying amounts of equity method investments are reflected in investments in the consolidated statements of financial condition. As the underlying entities that the Company manages and invests in are, for U.S. GAAP purposes, primarily investment companies which reflect their investments at estimated fair value, the carrying value of the Company’s equity method investments in such entities approximates fair value. The Company evaluates its equity-method investments for impairment whenever events or changes in circumstances indicate that the carrying amounts of such investments may not be recoverable.

Investments also include available-for-sale securities which consist of an investment in publicly traded common stock. The Company measures the carrying value of its publicly traded investment in available-for-sale securities at the quoted market price on the primary market or exchange on which they trade. Unrealized appreciation (depreciation) resulting from changes in fair value of available-for-sale securities is recorded in accumulated other comprehensive income, redeemable non-controlling interests and non-controlling interests in Medley LLC. Realized gains (losses) and declines in value determined to be other than temporary, if any, are reported in other income (expenses), net. The Company evaluates its investment in available-for-sale securities for impairment whenever events or changes in circumstances indicate that the carrying amounts of such investment may not be recoverable.

F- 10

Medley Management Inc.

Notes to Condensed Consolidated Financial Statements (unaudited)

Debt Issuance Costs

Debt issuance costs represent direct costs incurred in obtaining financing and are amortized over the term of the underlying debt using the effective interest method. Debt issuance costs, and the related amortization expense, are adjusted when any prepayments of principal are made to the related outstanding debt. Amortization of debt issuance costs is included as a component of interest expense in the Company's consolidated statement of operations.

Revenues

Management Fees

Medley provides investment management services to both public and private investment vehicles. Management fees include base management fees, other management fees, and Part I incentive fees, as described below.

Base management fees are calculated based on either (i) the average or ending gross assets balance for the relevant period, (ii) limited partners’ capital commitments to the funds, (iii) invested capital, (iv) NAV or (v) lower of cost or market value of a fund’s portfolio investments. Depending upon the contracted terms of the investment management agreement, management fees are paid either quarterly in advance or quarterly in arrears, and are recognized as earned over the period the services are provided.

Certain management agreements provide for Medley to receive other management fee revenue derived from up front origination fees paid by the funds' and/or separately managed accounts' underlying portfolio companies. These fees are recognized when Medley becomes entitled to such fees.

Certain management agreements also provide for Medley to receive Part I incentive fee revenue derived from net interest income (excluding gains and losses) above a hurdle rate. As it relates to Medley Capital Corporation (“MCC”), these fees are subject to netting against realized and unrealized losses. Part I incentive fees are paid quarterly and are recognized as earned over the period the services are provided.

Performance Fees

Performance fees consist principally of the allocation of profits from certain funds and separately managed accounts, to which Medley provides management services. Medley is generally entitled to an allocation of income as a performance fee after returning the invested capital plus a specified preferred return as set forth in each respective agreement. Medley recognizes revenues attributable to performance fees based upon the amount that would be due pursuant to the respective agreement at each period end as if the funds were terminated at that date. Accordingly, the amount recognized in the Company's condensed consolidated financial statements reflects Medley’s share of the gains and losses of the associated funds’ underlying investments measured at their current fair values. Performance fee revenue may include reversals of previously recognized performance fees due to a decrease in the net income of a particular fund that results in a decrease of cumulative performance fees earned to date. Since fund return hurdles are cumulative, previously recognized performance fees also may be reversed in a period of appreciation that is lower than the particular fund’s hurdle rate. During the three months ended March 31, 2017 and 2016, the Company reversed $2.6 million and $0.7 million, respectively, of previously recognized performance fees. As of March 31, 2017, the Company recognized cumulative performance fees of $4.8 million.

Performance fees received in prior periods may be required to be returned by Medley in future periods if the funds’ investment performance declines below certain levels. Each fund is considered separately in this regard and, for a given fund, performance fees can never be negative over the life of a fund. If upon a hypothetical liquidation of a fund’s investments, at their then current fair values, previously recognized and distributed performance fees would be required to be returned, a liability is established for the potential clawback obligation. As of March 31, 2017, the Company had not received any performance fee distributions, except for tax distributions related to the Company’s allocation of net income, which included an allocation of performance fees. Pursuant to the organizational documents of each respective fund, a portion of these tax distributions may be subject to clawback. As of March 31, 2017, the Company had accrued $7.1 million for clawback obligations that would need to be paid if the funds were liquidated at fair value as of the end of the reporting period. The Company’s actual obligation, however, would not become payable or realized until the end of a fund’s life.

F- 11

Medley Management Inc.

Notes to Condensed Consolidated Financial Statements (unaudited)

Other Revenues and Fees

Medley provides administrative services to certain affiliated funds and is reimbursed for direct and allocated expenses incurred in providing such administrative services, as set forth in the respective underlying agreements. These fees are recognized as revenue in the period administrative services are rendered.

Performance Fee Compensation

Medley has issued profit interests in certain subsidiaries to select employees. These profit-sharing arrangements are accounted for under ASC 710, Compensation — General, which requires compensation expense to be measured at fair value at the grant date and expensed over the vesting period, which is usually the period over which the service is provided. The fair value of the profit interests are re-measured at each balance sheet date and adjusted for changes in estimates of cash flows and vesting percentages. The impact of such changes is recorded in the condensed consolidated statements of operations as an increase or decrease to performance fee compensation.

Stock-based Compensation

The Company accounts for stock-based compensation in accordance with ASC 718, Compensation – Stock Compensation. Stock-based compensation cost is measured at the grant date based on the fair value of the award and is recognized as expense over the requisite service period.

Prior to January 1, 2017, the fair value of the awards were amortized on a straight line basis over the requisite service period as stock based compensation expenses and was reduced for the impact of estimated forfeitures. The Company estimated forfeitures based on its historical experience and revised its estimate if actual forfeitures differed from its initial estimates. Effective January 1, 2017, the Company adopted a change in accounting policy as a result of the adoption of ASU 2016-09 to account for forfeitures as they occur. As such, stock based compensation expense relating to equity based awards are measured at fair value as of the grant date, reduced for actual forfeitures in the period they occur, and expensed over the requisite service period on a straight-line basis as a component of compensation and benefits on the Company's condensed consolidated statements of operations.

Income Taxes

The Company accounts for income taxes using the asset and liability approach, which requires the recognition of tax benefits or expenses for temporary differences between the financial reporting and tax basis of assets and liabilities. A valuation allowance is established when necessary to reduce deferred tax assets to the amounts expected to be realized. The Company also recognizes a tax benefit from uncertain tax positions only if it is “more likely than not” that the position is sustainable based on its technical merits. The Company’s policy is to recognize interest and penalties on uncertain tax positions and other tax matters as a component of income tax expense. For interim periods, the Company accounts for income taxes based on its estimate of the effective tax rate for the year. Discrete items and changes in its estimate of the annual effective tax rate are recorded in the period they occur.

Medley Management Inc. is subject to U.S. federal, state and local corporate income taxes on its allocable portion of the income of Medley LLC at prevailing corporate tax rates. Medley LLC and its subsidiaries are not subject to federal, state and local corporate income taxes since all income, gains and losses are passed through to its members. However, a portion of taxable income from Medley LLC and its subsidiaries are subject to New York City’s unincorporated business tax, which is included in the Company’s provision for income taxes.

The Company analyzes its tax filing positions in all of the U.S. federal, state and local tax jurisdictions where it is required to file income tax returns, as well as for all open tax years in these jurisdictions. If, based on this analysis, the Company determines that uncertainties in tax positions exist, a liability is established.

Recently Issued Accounting Pronouncements Adopted as of January 1, 2017

In March 2016, the FASB issued ASU 2016-09, Improvements to Employee Share-Based Payment Accounting, which simplifies and improves several aspects of the accounting for share-based payment transactions, including the income tax consequences, classification of awards as either equity or liabilities and classification on the statement of cash flows. The Company adopted ASU 2016-09 effective January 1, 2017.

F- 12

Medley Management Inc.

Notes to Condensed Consolidated Financial Statements (unaudited)

Under the new guidance, all excess tax benefits and tax deficiencies related to employee stock compensation will be recognized within income tax expense. Under prior guidance, excess tax benefits were recognized to additional paid-in capital and tax deficiencies were only recognized to the extent they exceeded the pool of excess tax benefits. In addition, excess tax benefits will be classified as cash flows from operating activities, and cash withheld by the Company for employees' withholding taxes will be classified as cash flows from financing activities on the Company's consolidated statements of cash flows. In connection with the adoption of ASU 2016-09, the Company elected to account for forfeitures as they occur, instead of utilizing an estimated forfeiture rate assumption. The change in accounting for forfeitures was applied on a modified retrospective basis by means of a cumulative-effect adjustment to equity. As of January 1, 2017, retained earnings and non-controlling interests in Medley LLC decreased by $0.1 million and $0.8 million, respectively, additional paid in capital increased by $1.0 million and a deferred tax asset was recorded in the amount of $0.1 million to reflect the change in accounting principle.

Recently Issued Accounting Pronouncements Not Yet Adopted

In May 2014, the FASB issued ASU 2014-09, Revenue from Contracts with Customers (Topic 606), which provides that an entity should recognize revenue to depict the transfer of promised goods or services to customers in an amount that reflects the consideration to which the entity expects to be entitled in exchange for such goods or services. To achieve this core principle, an entity should apply the following steps: (1) identify the contracts with a customer, (2) identify the performance obligations in the contracts, (3) determine the transaction prices, (4) allocate the transaction prices to the performance obligations in the contracts, and (5) recognize revenue when, or as, the entity satisfies a performance obligation. The guidance also requires advanced disclosures regarding the nature, amount, timing and uncertainty of revenue and cash flows arising from an entity’s contracts with customers. In March 2016, the FASB issued ASU 2016-08, Revenue from Contracts with Customers (Topic 606): Principal versus Agent Considerations (Reporting Revenue Gross versus Net), which clarified the implementation guidance on principal versus agent considerations. In April 2016, the FASB issued ASU 2016-10, Revenue from Contracts with Customers (Topic 606): Identifying Performance Obligations and Licensing, which clarified the implementation guidance regarding performance obligations and licensing arrangements. The new standard will become effective for the Company on January 1, 2018. The Company is evaluating the effect that ASU 2014-09 will have on its consolidated financial statements and related disclosures. However, the adoption of this guidance is expected to impact the timing of performance fee revenue recognition. The Company has not yet selected a transition method nor has it determined the effect of the standard on its ongoing financial reporting.

In January 2016, the FASB issued ASU 2016-01, Financial Instruments – Overall: Recognition and Measurement of Financial Assets and Financial Liabilities, which requires that all equity investments (except those accounted for under the equity method of accounting) be measured at fair value with changes in fair value recognized in net income. This guidance eliminates the available-for-sale classification for equity securities with readily determinable fair values. However, companies may elect to measure equity investments that do not have readily determinable fair values at cost minus impairment, if any, plus or minus changes resulting from observable price changes in orderly transactions for an identical or similar investment of the same issuer. This new guidance will become effective for the Company on January 1, 2018. Under this new guidance, changes in the fair value of available-for-sale securities will no longer be classified in the Company's condensed consolidated statements of comprehensive income but rather as a component of other income in its condensed consolidated statements of operations.

In February 2016, the FASB issued ASU 2016-02, Leases (Topic 842). This guidance requires an entity to recognize assets and liabilities arising from a lease for both financing and operating leases, along with additional qualitative and quantitative disclosures. This new guidance will become effective for the Company on January 1, 2019, with early adoption permitted. The Company is currently evaluating the impact of adopting this standard on its consolidated financial statements. However, the adoption of this guidance is expected to result in a significant increase in total assets and total liabilities, but is not expected to have a significant impact on the consolidated statement of operations.

The Company does not believe any other recently issued, but not yet effective, revisions to authoritative guidance will have a material effect on its consolidated balance sheets, results of operations or cash flows.

F- 13

Medley Management Inc.

Notes to Condensed Consolidated Financial Statements (unaudited)

3. INVESTMENTS

The components of investments are as follows:

As of March 31, 2017 (unaudited) | As of December 31, 2016 | ||||||

(Amounts in thousands) | |||||||

Equity method investments, at fair value | $ | 15,088 | $ | 14,895 | |||

Available-for-sale securities | 21,223 | 17,009 | |||||

Total investments, at fair value | $ | 36,311 | $ | 31,904 | |||

Equity Method Investments

Medley measures the carrying value of its public non-traded equity method investments at NAV per share. Unrealized appreciation (depreciation) resulting from changes in NAV per share is reflected as a component of other income (expense) in the condensed consolidated statements of operations. The carrying value of the Company’s privately-held equity method investments is determined based on the amounts invested by the Company plus the equity in earnings or losses of the investee allocated based on the respective underlying agreements, less distributions received.

The Company evaluates its equity method investments for impairment whenever events or changes in circumstances indicate that the carrying amounts of such investments may not be recoverable. There were no impairment losses recorded during the three months ended March 31, 2017 and 2016.

As of March 31, 2017 and December 31, 2016, the Company’s carrying value of its equity method investments was $15.1 million and $14.9 million, respectively. Included in this balance was $9.0 million as of March 31, 2017 and December 31, 2016 from the Company’s investment in publicly-held Sierra Income Corporation (“SIC”). The remaining balance as of March 31, 2017 and December 31, 2016 relates primarily to the Company’s investments in Medley Opportunity Fund II, LP ("MOF II"), Medley Opportunity Fund III LP (“MOF III”) and CK Pearl Fund, LP.

Available-For-Sale Securities

As of March 31, 2017 and December 31, 2016, the Company’s carrying value of its available-for-sale securities was $21.2 million and $17.0 million, respectively, and consisted of 2,759,748 and 2,264,892 shares of MCC, respectively. The Company measures the carrying value of its investment in MCC at fair value based on the quoted market price on the exchange on which its shares trade. As of March 31, 2017, cumulative unrealized gains in redeemable non-controlling interests, non-controlling interests in Medley LLC and accumulated other comprehensive income on the Company's consolidated balance sheets was $0.3 million, $0.3 million, and $0.1 million respectively. There were no impairment charges recorded related to the Company’s investments in available-for-sale securities during the three months ended March 31, 2017 and 2016.

4. FAIR VALUE MEASUREMENTS

The Company follows the guidance set forth in ASC 820 for measuring the fair value of investments in available-for-sale securities. Fair value is the price that would be received from the sale of an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. Where available, fair value is based on observable market prices or parameters, or derived from such prices or parameters. Where observable prices or inputs are not available, valuation models are applied. These valuation models involve some level of management estimation and judgment, the degree of which is dependent on the price transparency for the instruments or market and the instruments’ complexity. Financial instruments recorded at fair value in the consolidated financial statements are categorized for disclosure purposes based upon the level of judgment associated with the inputs to the valuation of the investment as of the measurement date.

F- 14

Medley Management Inc.

Notes to Condensed Consolidated Financial Statements (unaudited)

The three levels are defined as follows:

• | Level I – Valuations based on quoted prices in active markets for identical assets or liabilities at the measurement date. |

• | Level II – Valuations based on inputs other than quoted prices in active markets included in Level I, which are either directly or indirectly observable at the measurement date. This category includes quoted prices for similar assets or liabilities in non-active markets including bids from third parties for privately held assets or liabilities, and observable inputs other than quoted prices such as yield curves and forward currency rates that are entered directly into valuation models to determine the value of derivatives or other assets or liabilities. |

• | Level III – Valuations based on inputs that are unobservable and where there is little, if any, market activity at the measurement date. The inputs for the determination of fair value may require significant management judgment or estimation and is based upon management’s assessment of the assumptions that market participants would use in pricing the assets and liabilities. These investments include debt and equity investments in private companies or assets valued using the market or income approach and may involve pricing models whose inputs require significant judgment or estimation because of the absence of any meaningful current market data for identical or similar investments. The inputs in these valuations may include, but are not limited to, capitalization and discount rates, beta and EBITDA multiples. The information may also include pricing information or broker quotes that include a disclaimer that the broker would not be held to such a price in an actual transaction. The non-binding nature of consensus pricing and/or quotes accompanied by disclaimer would result in classification as Level III information, assuming no additional corroborating evidence. |

When determining the fair value of publicly traded equity securities, the Company uses the quoted market price as of the valuation date on the primary market or exchange on which they trade. The Company’s investments in available-for-sale securities are categorized as Level I. As of March 31, 2017 and December 31, 2016, there were no financial instruments classified as Level II or Level III.

Our equity method investments for which fair value is measured at NAV per share, or its equivalent, using the practical expedient, are not categorized in the fair value hierarchy.

A review of the fair value hierarchy classifications is conducted on a quarterly basis. Changes in the observability of valuation inputs may result in a reclassification for certain financial assets or liabilities. Reclassifications impacting all levels of the fair value hierarchy are reported as transfers in or out of Level I, II or III category as of the beginning of the quarter during which the reclassifications occur. There were no transfers between levels in the fair value hierarchy during the three months ended March 31, 2017 and 2016.

5. OTHER ASSETS

The components of other assets are as follows:

As of March 31, 2017 (unaudited) | As of December 31, 2016 | ||||||

(Amounts in thousands) | |||||||

Fixed assets, net of accumulated depreciation of $2,053 and $1,816, respectively | $ | 4,781 | $ | 4,998 | |||

Security deposits | 1,975 | 1,975 | |||||

Administrative fees receivable (Note 10) | 2,113 | 2,068 | |||||

Deferred tax assets (Note 12) | 1,906 | 2,001 | |||||

Due from affiliates (Note 10) | 1,893 | 2,133 | |||||

Prepaid expenses and taxes | 2,464 | 3,078 | |||||

Other | 2,261 | 2,058 | |||||

Total other assets | $ | 17,393 | $ | 18,311 | |||

F- 15

Medley Management Inc.

Notes to Condensed Consolidated Financial Statements (unaudited)

6. LOANS PAYABLE

The Company's loans payable consist of the following:

As of March 31, 2017 (unaudited) | As of December 31, 2016 | ||||||

(Amounts in thousands) | |||||||

Term loans under the Credit Suisse Term Loan Facility, net of unamortized discount and debt issuance costs of $1,207 at December 31, 2016 | $ | — | $ | 43,593 | |||

Non-recourse promissory notes, net of unamortized discount of $1,264 and $1,415, respectively | 8,736 | 8,585 | |||||

Total loans payable | $ | 8,736 | $ | 52,178 | |||

Credit Suisse Term Loan Facility

On August 14, 2014, the Company entered into a $110.0 million senior secured term loan credit facility (as amended, “Term Loan Facility”) with Credit Suisse AG, Cayman Islands Branch, as administrative agent and collateral agent thereunder, Credit Suisse Securities (USA) LLC, as bookrunner and lead arranger, and the lenders from time-to-time party thereto, which had an original maturity date of June 15, 2019. In February 2017, borrowings under this facility were paid off using the proceeds from the issuance of senior unsecured debt and the Term Loan Facility was terminated.

Borrowings under the Term Loan Facility, bore interest, at the borrower’s option, at a rate equal to either a Eurodollar margin over an adjusted LIBOR (with a “floor” of 1.0%) or a base rate margin over an adjusted base rate determined by reference to the highest of (i) the term loan administrative agent’s prime rate; (ii) the federal funds effective rate in effect on such day plus 0.5%; and (iii) an adjusted LIBOR plus 1.0%. The applicable margins for the Term Loan Facility was 5.5%, in the case of Eurodollar loans and 4.5%, in the case of adjusted base rate loans. Outstanding borrowings under the Term Loan Facility bore interest at a rate of 6.5% as of December 31, 2016. Borrowings were collateralized by substantially all of the equity interests in Medley LLC’s wholly owned subsidiaries. Total interest expense under the Term Loan Facility, including accretion of the note discount and amortization of debt issuance costs, was $1.5 million and $1.8 million for the three months ended March 31, 2017 and 2016, respectively.

CNB Credit Agreement

On August 19, 2014, the Company entered into a $15.0 million senior secured revolving credit facility with City National Bank (as amended, the “Revolving Credit Facility”). The Company intends to use any proceeds from borrowings under the Revolving Credit Facility for general corporate purposes, including funding of its working capital needs. Borrowings under the Revolving Credit Facility bear interest at the option of the Company, either (i) at an Alternate Base Rate, as defined, plus an applicable margin not to exceed 3.25% or (ii) at an Adjusted LIBOR plus an applicable margin not to exceed 4.0%. As of and during the three months ended March 31, 2017 and 2016, there were no amounts drawn under the Revolving Credit Facility.

The Revolving Credit Facility also contains a financial covenant that requires the Company to maintain a Maximum Net Leverage Ratio of not greater than 3.5 to 1.0, with which the Company is compliant. This ratio is calculated on a trailing twelve months basis and is the ratio of Total Net Debt, as defined, to Core EBITDA, as defined, and is calculated using the Company’s financial results and includes adjustments made to calculate Core EBITDA. Non-compliance with any of the financial or non-financial covenants without cure or waiver would constitute an event of default under the Revolving Credit Facility. The Revolving Credit Facility also contains other customary events of default, including defaults based on events of bankruptcy and insolvency, dissolution, nonpayment of principal, interest or fees when due, breach of specified covenants, change in control and material inaccuracy of representations and warranties. There were no events of default under the Revolving Credit Facility as of March 31, 2017.

F- 16

Medley Management Inc.

Notes to Condensed Consolidated Financial Statements (unaudited)

Non-Recourse Promissory Notes

In April 2012, the Company borrowed $10.0 million under two non-recourse promissory notes. Proceeds from the borrowings were used to purchase 1,108,033 shares of common stock of SIC, which were pledged as collateral for the obligations. Interest on the notes is paid monthly and is equal to the dividends received by the Company related to the pledged shares. The Company may prepay the notes in whole or in part at any time without penalty and the lenders may call the notes if certain conditions are met. The notes are scheduled to mature in March 2019. The proceeds from the notes were recorded net of issuance costs of $3.8 million and are being accreted, using the effective interest method, over the term of the non-recourse promissory notes. Total interest expense under these non-recourse promissory notes, including accretion of the note discount, was $0.3 million and $0.4 million for the three months ended March 31, 2017 and 2016, respectively. The fair value of the outstanding balance of the notes was $10.2 million as of March 31, 2017 and December 31, 2016.

Contractual Maturities of Loans Payable

As of March 31, 2017, $10.0 million of future principal payments will be due, relating to loans payable, during the year ended December 31, 2019.

7. SENIOR UNSECURED DEBT

The Company’s senior unsecured debt consist of the following:

As of March 31, 2017 (unaudited) | As of December 31, 2016 | ||||||

(Amounts in thousands) | |||||||

2026 Notes, net of unamortized discount and debt issuance costs of $3,549 at March 31, 2017 and $3,802 at December 31, 2016 | $ | 50,046 | $ | 49,793 | |||