Exhibit 99.1

OPC Energy Ltd.

Report of the Board of Directors

OPC ENERGY LTD.

Report of the Board of Directors regarding the Company’s Matters

for the Year Ended December 31, 2022

The Board of Directors of OPC Energy Ltd. (hereinafter – “the Company”) is pleased to present herein the Report of the Board of

Directors regarding the activities of the Company and its investee companies (hereinafter together – “the Group”), as at December 31, 2022 and for the year then ended (“the Period of the Report” or “the Year of the Report”).

It is emphasized that the description in this report contains “forward‑looking” information, as defined in the

Securities Law, 1968 (hereinafter – “the Securities Law”). “Forward‑looking” information, is uncertain information regarding the future, including forecasts, estimates, plans, assessments or other information relating to an event or matter the

outcome of which is uncertain and/or is not under the Company’s control. The “forward‑looking” information included in this report is based on information or estimates in the Company’s possession as at the publication date of this report and there is

no certainty regarding its realization or the manner of its ultimate realization, which could be different, even materially, from that stated in this report – this being as a result of, among other things, changes in market conditions, regulatory

factors, operating factors, risk factors applying to the Company’s activities and/or other items that are not under the Company’s control.

Except for the data audited in the Company’s consolidated financial statements as at December 31, 2022 (hereinafter – “the Financial

Statements”) that is included in this report below, the data appearing in the Report of the Board of Directors has not been audited or reviewed by the Company’s auditing CPAs.

OPC Energy Ltd.

Report of the Board of Directors

| 1. |

Executive Summary1

|

Highlights of the results

|

For the

|

||||||||||||||||||||||||

|

Year Ended

|

Three Months Ended

|

|||||||||||||||||||||||

|

December 31

|

December 31

|

|||||||||||||||||||||||

|

2022

|

2021

|

Change

|

2022

|

2021

|

Change

|

|||||||||||||||||||

|

Adjusted EBITDA – consolidated*

|

818

|

634

|

28

|

%

|

219

|

158

|

39

|

%

|

||||||||||||||||

|

Adjusted EBITDA – Israel*

|

367

|

352

|

4

|

%

|

101

|

90

|

12

|

%

|

||||||||||||||||

|

Adjusted EBITDA – U.S.*

|

477

|

303

|

57

|

%

|

126

|

75

|

68

|

%

|

||||||||||||||||

|

Adjusted EBITDA renewable energies

|

||||||||||||||||||||||||

|

– U.S.

|

26

|

29

|

(10

|

%)

|

4

|

9

|

(56

|

)%

|

||||||||||||||||

|

Adjusted EBITDA* energy transition –

|

||||||||||||||||||||||||

|

U.S.*

|

562

|

339

|

66

|

%

|

173

|

104

|

66

|

%

|

||||||||||||||||

|

Income (loss)

|

217

|

(303

|

)

|

+520

|

m

|

37

|

(94

|

)

|

+131

|

m

|

||||||||||||||

|

Adjusted income (loss)*

|

231

|

28

|

725

|

%

|

51

|

(16

|

)

|

+67

|

m

|

|||||||||||||||

| * |

Adjusted EBITDA and net income – for additional information regarding the definition and manner of the calculation – see Sections 4B, 4E and 5E below.

|

Main developments in 2022

|

Israel

|

Increase in the electricity

tariffs – an increase of about 16% in the generation component in 2022 compared with 2021.

There has been a decrease in the generation component and an update of the categories (brackets) of the demand hours commencing from the beginning of 2023.

Natural gas – first gas from the

Karish reservoir – annual savings estimated at about NIS 60 million.

Increase in Rotem’s results – increase of about 10% in the adjusted EBITDA compared with last year.

Hadera – completion of the maintenance work on the steam turbine.

Completion of the Veridis

transaction and structural change in Israel – investment of capital of about NIS 452 million in the beginning of 2023 for further growth in Israel.

Gat transaction – acquisition of a plant with a capacity of 75 megawatts, for a consideration of NIS 870 million, presently in the stages of completion of the preconditions.

Hearing on Rotem’s supply license

– intended to permit activities in the energy market in the same manner as other generation facilities in Israel that are authorized to execute bilateral transactions.

|

| 1 |

The Executive Summary below is presented solely for convenience and it is not a substitute for reading the full detail (including with reference to the matters referred to in the Summary) as stated in this report with all its parts

(including warnings relating to “forward‑looking” information, definitions or explanations with respect to the indices for measurement of the results). This Report of the Board of Directors is submitted on the assumption that all the parts of

the Periodic Report are known to the reader.

|

2

OPC Energy Ltd.

Report of the Board of Directors

| 1. |

Executive Summary (Cont.)

|

Main developments in 2022 (Cont.)

|

U.S.

|

Supportive business environment – high energy margins in 2022.

Decline in the energy margins

starting from the beginning of 2023 – against the background of the warm winter and high inventory levels of natural gas high seasonality.

Increase in the results of the CPV

Group – a jump of about 60% in the adjusted EBITDA compared with 2021.

Significant tax benefits for the CPV Group under the Inflation Reduction Act (IRA)

– Acceleration of development of two natural‑gas power plants for

generation of electricity with carbon capture (natural gas power plants with reduced carbon emissions – CCS).

– Economic improvement of the renewable energy projects, including

the Maple Hill and Stagecoach power plants.

Transaction for acquisition of

renewable energy power plants – acquisition of a portfolio of active wind farms with a capacity of 81.5 megawatts for a consideration of about $172

million2, presently in the stages of completion of the preconditions.

|

|

Headquarters

|

Successful raising of capital – in the amount of about NIS 830 million for the Company’s continued growth.

|

Portfolio of about 12.4 GW

(*) For additional information – see Section 6 below.

2 In this report, “dollar” means the U.S. dollar.

3

OPC Energy Ltd.

Report of the Board of Directors

| 2. |

Brief description of the Group’s area of activities

|

The Company is a public company the securities of which are listed for trade on the Tel Aviv Stock Exchange Ltd. (hereinafter – “the Stock Exchange”).

As at the date of the report the Group is engaged in generation and supply of electricity and energy in three activity segments (which constitute

reportable segments in its financial statements):

| (1) |

Israel – as part of this area of activities the Company is engaged in generation and supply of electricity and energy, mainly to private customers and to the System Operator, as well as in initiation, development, construction and

operation of power plants and facilities for generation of energy through use of natural gas and renewable energy in Israel. Upon completion of the Veridis transaction in January 2023 for investment and change of the structure in this area

of activities in Israel, as at the approval date of the report the Company manages its activities in Israel through OPC Holdings Israel Ltd. (“OPC Israel”).3 In addition, the Company acts through Gnrgy in the area of charging

electric vehicles and energy management in Israel. For additional details regarding completion of the Veridis transaction – see Note 29A to the financial statements;

|

| (2) |

Renewable energy in the United States – in this area of activities, the Company is engaged, through the CPV Group, in initiation, development, construction and holding of power plants using renewable energy (solar and wind) in the U.S.

and in supply of electricity from renewable sources;

|

| (3) |

Energy transition in the United States – in this area of activities, the Company is engaged, through the CPV Group, in development, construction and holding of power plants using conventional energy (natural gas), which efficiently and

reliably supply electricity in the U.S. The active power plants and the power plants under construction in this area of activities are held through associated companies (that are not consolidated in the Company’s financial statements).

|

In addition, the Company is engaged, through the CPV Group, in a number of business activities in the U.S., which as at the date of the report are not

material to the results of the Group’s operations (and that do not constitute reportable segments in the financial statements):

| (1) |

Initiation and development of projects for generation of electricity and energy (power plants operating using natural gas at high efficiency) with integration of carbon capture capabilities;

|

| (2) |

Provision of asset‑management and energy services to power plants that are partly owned by the CPV Group partly owned by third parties;

|

| (3) |

In the beginning of 2023, the CPV Group launched activities for “retail” sale to commercial customers that is intended to complement the electricity generation activities by the CPV Group. As activities at the very outset of the road in

the launch stages, in the upcoming years it is expected to show a loss and have negative cash flows that is are not significant to the Group.

|

For additional details regarding the Group’s activities in its activity areas as well as in other areas of activity – see Sections 2.2, 7 and 8 to Part A

(Description of the Company’s Business) and that stated in Note 27 to the financial statements4.

| 3 |

As at the date of the report, the Company holds 80% of the shares of OPC Israel, whereas the remaining 20% is held by Veridis Power Plants Ltd. (“Veridis”). In addition, OPC Israel holds 51% of the shares of Gnrgy Ltd. (“Gngry”), the

shares of which were acquired in 2021.

|

| 4 |

It is clarified that in some cases an additional description has been provided in order to present a comprehensive picture of the matter described or of the relevant business environment. References to reports included in this report

include the information included therein by means of reference.

|

4

OPC Energy Ltd.

Report of the Board of Directors

| 3. |

Main Developments in the Company’s Business Environment

|

| 3.1 |

General

|

| A. |

Changes in the macro‑economic environment (particularly changes in inflation and interest) –

in the period of the report, a macro‑economic trend is discernable, both in Israel and worldwide, which is characterized by a sharp increase in the rates of inflation and the price levels in the U.S. and in Israel, particularly the energy

and electricity prices, and corresponding to the significant increase in the interest rates. This is true, among other things against the background of geo‑political events, particularly the war in the Ukraine, the global energy crisis,

along with the long‑term impacts of the Coronavirus, especially the continuing disruptions in the supply chain.

|

These parameters have a significant impact on the macro‑economic environment in Israel and in the U.S. and the

business environment in which the Group companies operate, due to, among other things, the prices of energy, electricity and natural gas, tariffs in the Israeli electricity sector, the costs of executing construction projects, financing expenses, and

the like.

In this regard, in 2022 the CPI in Israel has risen by about 5.3%, and Bank of Israel raised the interest rate (a number of times) which as at the date of the report was 3.25%.

Subsequent to the date of the report, the CPI in Israel increased by an additional rate of 1.1% and the Bank of Israel interest rate rose (in several additional increments) to 4.25%.

In the United States, the CPI rose in 2022 by about 6.5% and the Federal Reserve Bank (the Fed) raised the dollar interest rate (a number of times) to the rate of 4.50%–4.75% as at

the approval date of the report. As at the approval date of the report, there is no certainty regarding a change in these trends. For additional details regarding changes in the macro‑economic environment – see Section 12 below.

In January 2023, the Government began advancement of a plan for making changes in Israel’s judicial system. Pursuant

to the publications in the media, the changes could impact the strength of the Israeli economy, and in particular they could lead to a reduction of the credit rating of the State of Israel, adversely impact investments in the Israeli economy and

trigger a removal of money and investments from Israel, increase the costs of the financing sources in Israel, drive up the exchange rate of the shekel against other currencies (including the dollar) and harm the activities of the business sector. To

the extent the above estimates materialize, wholly or partly, this could negatively impact the financial position and activities of the Company customers and suppliers and could also impact the availability and cost of the capital and financing

sources that are required by the Company for purposes of supporting its continued business growth.

| B. |

The Coronavirus and broad global impacts on raw‑material prices and the supply chain – in

March 2020, the World Health Organization declared the Coronavirus to be a worldwide pandemic. Despite taking preventative measures in order to reduce the risk of spread of the virus, the virus continued to spread, including different

variants that developed, and it caused significant business and economic uncertainty, particularly in 2020 and in the first half of 2021. Thereafter, the restrictions on movement (travel) and carrying on of business and trade in the

Company’s main areas of activity were lifted.

|

5

OPC Energy Ltd.

Report of the Board of Directors

| 3. |

Main Developments in the Company’s Business Environment (Cont.)

|

| 3.1 |

General (Cont.)

|

| B. |

(Cont.)

|

Nonetheless, the dynamic nature of the Coronavirus, particularly development of new strains (variations) and

imposition of specific restrictions in countries that are central to the global economy, such as, China, and the results of developing events that arose against the background of the Coronavirus, mainly an adverse impact on the supply chains,

including global delays of the equipment supply dates along with an increase in the prices of raw materials and equipment and transport costs, an impact is visible on the construction, equipment and maintenance costs, as well as on the timetables for

completion. In addition, an impact is discernible on the availability and prices of solar panels for renewable energy projects of the CPV Group that are in the development stage or under construction.

As at the approval date of the report, continuation of the broad global impacts of the trends that started against

the background of the Coronavirus crisis on the markets and factors relating to the Group’s business activities is possible, however at the present time, in the Company’s estimation, such impacts will probably be long‑term in nature (including in

connection with the costs and timing of completion of the construction projects).5

As at the approval date of the report, there is no certainty with respect to the continuation of the trends and the

scope of the impact thereof on the Group’s activities, if any at all.

| 3.2 |

Activities in Israel

|

| C. |

Update of tariffs during 2022, including the brackets of the demand hours – on February 1,

2022, the annual update of the electricity tariffs of the Electricity Authority for 2022 entered into effect, according to which the generation component, increased at the rate of about 13.6%, and stood at NIS 0.2869 per kilowatt hour

commencing from February 1, 2022.

|

On May 1, 2022, an additional update to the electricity tariff for the rest of 2022 entered into effect, as a result

of reduction of the excise tax on use of coal. The generation component after the reduction was NIS 0.2764 per kilowatt hour, a reduction of 3.7% from the tariff determined on February 1, 2022, as stated above.

On August 1, 2022, an additional update to the electricity tariff entered into effect for the remainder of 2022

whereby the generation component is NIS 0.314 per kilowatt hour, an increase of about 13.6% over the tariff determined in May 2022 and an increase of 9.4% of the tariff determined in February 2022. Update of the tariff was made against the background

of the sharp increase in the coal prices index due to the worldwide energy crisis along with the increase in the shekel/dollar exchange rate and the CPI.

On January 1, 2023, the annual update to the electricity tariff for 2023 entered into effect. Pursuant to the

impact, the generation component was NIS 0.312 per kilowatt hour – a decrease of 0.6% in the generation component that occurred in the final months of 2022.

| 5 |

The Company’s estimates regarding the impacts of the Coronavirus crisis and the global trends referred to constitute “forward‑looking” information,

regarding which there is no certainty they will ultimately materialize and that are impacted by factors that are not under the Company’s control and/or the existence of one or more of the risk factors the Company is exposed to, as stated in

Section 19 Part A (Description of the Company’s Business).

|

6

OPC Energy Ltd.

Report of the Board of Directors

| 3. |

Main Developments in the Company’s Business Environment (Cont.)

|

| 3.2 |

Activities in Israel (Cont.)

|

| C. |

(Cont.)

|

On February 1, 2023, a decision of the Electricity Authority entered into effect to update the costs recognized to

Israel Electricity Company (hereinafter – “the Electricity Company”) and Noga Electricity Systems Management Company (hereinafter – “Noga”) and the tariffs to the electricity consumers. Pursuant to the decision, an additional update to the generation

component for 2023 entered into effect whereby the generation component is NIS 0.3081 per kilowatt hour – a decrease of 1.2% compared with the tariff set on January 1, 2023 – this being due to extension of the Excise Tax on Fuel Order, which calls

for a decrease in the purchase tax and excise tax applicable to the coal.

In the beginning of March 2023, a hearing was published for update of the costs recognized for the Electric Company

and the tariffs for the electricity consumers – this being as a result of the decline in the price of coal by about 30% compared with the price the last tariff increase was based on, while on the other hand there was an increase in other indices that

impact the cost recognized. Entry into effect of the hearing, to the extent it is determined in a final decision, on April 1, 2023 the generation component will be brought for update, to the amount of NIS 0.3048 per kilowatt hour, a decline of

about 1% compared with the tariff update determined in February 2023.

Update of the brackets of the demand hours

In August 2022, the Electricity Authority published a decision to revise, the time of use (TOU) demand categories

(brackets) for purposes of adjusting the structure of the load and time tariffs (TOAZ) for a significant integration of solar energy and storage. Pursuant to that stated in the Authority’s publication, the update of the TOU demand categories is

expected to encourage steering consumption to the noon hours wherein there is higher generation of renewable energy as opposed to consumption in the peak evening demand hours – this being by means of, among other things, raising the tariff in the

demand hours and applying the following main updates: (a) moving the peak hours from the noon hours to the evening hours; (b) expanding the number of months wherein the peak hours apply in the summer season to 4 months in place of 2 months;

(c) increase of the gap between the peak hours and the low‑demand hours; and (d) definition of a maximum of two TOU categories for every day of the year (without an intermediate category – Geva). Change of the TOU categories in accordance with the

decision is expected to increase the tariffs paid by household consumers and reduce the tariffs paid by TOAZ consumers.

Based on the decision, the updated tariff structure will enter into effect upon update of the tariff to the consumer

for 2023. In addition, the decision provides that in light of the frequent sectorial changes and the need to express the correct sectorial cost, the TOU categories will be updated more frequently, based on the actual changes.

As result of the decision, the Group is taking actions to adjust the mix of its sales in Israel, to the extent

possible, to the structure of the updated demand‑hours categories. Update of the demand‑hours categories is expected to have a negative impact on the Group’s results, this being since, in general, the consumption profile of the Group’s customers,

which are mostly industrial and commercial customers, has low consumption volatility in the daytime hours compared with the consumption profile of households that is reflected as part of the tariffs and arrangements determined in the update with

reference to tariffs for low‑level and peak hours.6

| 6 |

For additional details – see Sections 7.2.4 and 7.10.2 of Part A (Description of the Company’s Business).

|

7

OPC Energy Ltd.

Report of the Board of Directors

| 3. |

Main Developments in the Company’s Business Environment (Cont.)

|

| 3.2 |

Activities in Israel (Cont.)

|

| C. |

(Cont.)

Regarding Hadera, the said decision to update the demand‑hours categories, in the framework of which the Geva “Mashav” was cancelled and the low‑level hours were expanded, could lead to a reduction of the

purchase requirement of the System Operator and, accordingly a negative impact on Hadera’s revenues. In addition, change of the demand‑hours categories changes the breakdown of the Company’s revenues and profits in Israel over the

quarters of the year in such a manner that it increases the third quarter (the summer months) at the expense of the other quarters, particularly the first quarter.

For additional details regarding the generation tariff and its impact on the Group’s activities in Israel – see Section 7.2.3 of Part A (Description of the Company’s

Business). It is noted that the results of the Group’s activities in Israel are materially impacted by changes in the electricity generation tariff, in such a manner that an increase in the electricity tariff has a positive impact on the

Group’s result, and vice‑versa.

|

| D. |

Market model for generation and storage facilities connected to or integrated into the

distribution network – in September 2022, a decision of the Electricity Authority was published that governs the activities of the generation and storage facilities in the distribution network and provides the possibility for them to

sell electricity directly to the suppliers, commencing from January 2024. In addition, as part of the decision the formula for acquisition of electricity through a virtual supplier was revised. As a practical matter, the decision permits

opening of the supply sector to competition while removing the quotas previously provided for this matter. In the Company’s estimation, in the short run the decision reduces the viability of the virtual supplier activities and in the long

run the decision encourages increased competition in the supply area while integrating generation facilities and storage facilities.

|

| E. |

Supply license for Rotem – in February 2023, the Electricity Authority published a proposed

decision that includes granting of a supplier license to Rotem with language (terms) similar to the existing suppliers along with imposition of covenants on Rotem, including covenants relating to a deviation from the consumption plans plus

arrangements and covenants relating to this. That stated is part of a process that is intended to create uniformity with respect to arrangements applicable to Rotem and the other bilateral generators, including, application of the market

model to Rotem and the manner of determination of the price for purchase of electricity for the consumers at a time of reduction of generation at the plant. As at the approval date of the report, there is no certainty regarding the final

language of the arrangements that will be determined (if ultimately determined) and the scope of their impact7. Based on the publication, the proposed decision creates uniformity regarding many aspects of the regulation

applicable to Rotem with that of the generation facilities that are authorized to execute bilateral transactions, and thus they should permit Rotem to operate in the energy market in a manner similar to that of the other generation

facilities that are authorized to execute bilateral transactions.

|

For additional details regarding developments of the Group’s activities in Israel – see Section 10 below and

Section 7 Part A (Description of the Company’s Business).

7 That stated above, including the arrangements in the above‑mentioned proposed decision, the impact thereof on Rotem and/or their advancement by the Electricity

Authority constitutes “forward‑looking” information as it is defined in the Securities Law, which is based on the information known to the Company as at the approval date of the report, and regarding which there is no certainty that it will

materialize – this being as a result of factors that are not under the Company’s control. Ultimately, the final terms of the supplementary arrangements, if determined, could be different than those set forth above. There is also no certainty

regarding the advancement and/or application of the decision. For additional details regarding the proposed decision and the matter of receipt of a supply license by Rotem and the consequences thereof – see Section 7.3.18.5 to Part A (Description

of the Company’s Business).

8

OPC Energy Ltd.

Report of the Board of Directors

| 3. |

Main Developments in the Company’s Business Environment (Cont.)

|

| 3.3 |

Activities in the U.S.

|

| F. |

Electricity and natural gas prices

|

The natural gas price is significant in determination of the price of the electricity in most

of the regions in which the power plants of the CPV Group operate that are powered by natural gas as part of the “Energy Transition” area of activities in the U.S.

In the estimation of the CPV Group, in general, in the existing production mix, over time, to

the extent the natural‑gas prices are higher, the marginal energy prices will also be higher, and will have a positive impact on the energy margins of the CPV Group due to the high efficiency of the power plants it owns (the impact could be different

between the projects taking into account their characteristics and the area (region) in which they are located). This impact could be offset, in whole or in part, by programs hedging electricity margins in the natural‑gas powered power plants of the

CPV Group, which are intended to reduce volatility in the CPV Group’s electricity margins due to changes in the commodity prices in the energy market (for additional details regarding agreements for hedging electricity margins in the CPV Group in the

period of the report and thereafter – see Section 4D(5) below).

Natural gas prices

The natural gas prices are impacted by a large number of variables, including demand in the

industrial, residential and electricity sectors, production and supply of natural gas, natural‑gas production costs, changes in the pipeline infrastructure, international trade and the financial profile and the hedging profile of the natural‑gas

customers and producers. The price for import of liquid natural gas impacts the natural gas and electricity prices, in the winter months in New England and New York, where high prices of liquid natural gas (LNG), in general, should have a positive

impact on the profits of the Fairview and Valley power plants during the winter season.

Set forth below are the average natural gas in each of the main markets in which the power

plants of the CPV Group operate (the prices are denominated in dollars per MMBtu)*:

|

For the

|

||||||||||||||||||||||||

|

Year Ended

|

Three Months Ended

|

|||||||||||||||||||||||

|

Region

|

December 31

|

December 31

|

||||||||||||||||||||||

|

(Project)

|

2022

|

2021

|

Change

|

2022

|

2021

|

Change

|

||||||||||||||||||

|

TETCO M3 (Shore, Valley)

|

6.80

|

3.40

|

100

|

%

|

6.59

|

4.23

|

56

|

%

|

||||||||||||||||

|

Transco Zone 5 North (Maryland)

|

8.55

|

3.91

|

119

|

%

|

8.97

|

4.95

|

81

|

%

|

||||||||||||||||

|

TETCO M2 (Fairview)

|

5.53

|

3.08

|

80

|

%

|

4.55

|

3.96

|

15

|

%

|

||||||||||||||||

|

Dominion South (Valley)

|

5.51

|

3.06

|

80

|

%

|

4.42

|

3.98

|

11

|

%

|

||||||||||||||||

|

Algonquin (Towantic)

|

9.15

|

4.51

|

103

|

%

|

8.24

|

6.23

|

32

|

%

|

||||||||||||||||

*Source: The Day‑Ahead prices at gas Midpoints as reported in Platt’s Gas Daily. It is clarified that

the actual gas prices of the power plants of the CPV Group could be significantly different.

9

OPC Energy Ltd.

Report of the Board of Directors

| 3. |

Main Developments in the Company’s Business Environment (Cont.)

|

| 3.3 |

Activities in the U.S. (Cont.)

|

| F. |

Electricity and natural gas prices (Cont.)

|

Natural

gas prices (Cont.)

As is shown by the above table, the natural gas prices in CPV’s activity markets increased

significantly in 2022 and in the fourth quarter of 2022, compared with the corresponding periods last year. In the estimation of the CPV Group, the said increase stems from, among other things, an increase in demand for electricity in the U.S., a

strengthening of the global demand for natural gas, inventory levels of natural gas that are lower than in the past, and a limited increase in production of natural gas.

From the beginning of 2023, there has been a significant decline in the natural gas prices,

mainly against the background of the warm winter in CPV’s activity markets along with high seasonal natural‑gas levels.

Electricity prices

The following table summarizes the average electricity prices in each of the main markets in

which power plants of the CPV Group are active (the prices are denominated in dollars per megawatt hour):

|

For the

|

||||||||||||||||||||||||

|

Year Ended

|

Three Months Ended

|

|||||||||||||||||||||||

|

Region

|

December 31

|

December 31

|

||||||||||||||||||||||

|

(Project)

|

2022

|

2021

|

Change

|

2022

|

2021

|

Change

|

||||||||||||||||||

|

PJM West (Shore and Maryland)

|

73.09

|

38.92

|

88

|

%

|

68.74

|

54.39

|

26

|

%

|

||||||||||||||||

|

PJM AD Hub (Fairview)

|

69.42

|

38.35

|

81

|

%

|

64.70

|

51.88

|

25

|

%

|

||||||||||||||||

|

NY‑ISO Zone G (Valley)

|

82.21

|

40.74

|

102

|

%

|

73.04

|

51.33

|

42

|

%

|

||||||||||||||||

|

ISO‑NE Mass Hub (Towantic)

|

85.56

|

45.92

|

86

|

%

|

76.92

|

59.88

|

28

|

%

|

||||||||||||||||

Based on Day‑Ahead prices as published by the relevant ISO. It is clarified that the actual gas prices

of the power plants of the CPV Group could be significantly different.

The increase in the electricity prices in 2022 and in the fourth quarter of 2022 compared with

the corresponding periods last year, as shown by the above table, stems mainly from the increase in the natural gas prices as detailed above, and this situation became more severe due to the premium on the natural gas price in the northwest region in

the market areas referred to.

From the beginning of 2023, there has been a significant decline in the natural gas prices –

present and future, as detailed above.

10

OPC Energy Ltd.

Report of the Board of Directors

| 3. |

Main Developments in the Company’s Business Environment (Cont.)

|

| 3.3 |

Activities in the U.S. (Cont.)

|

| G. |

Capacity payments

|

PJM market

In the PJM market, the capacity payments vary between the market’s sub‑regions, as a function of local supply and

demand and transmission capabilities.

Set forth below are the capacity tariffs in the sub‑regions that are relevant to CPV’s power plants and in the

general market (the prices are denominated in dollars per megawatt per day):

|

Sub-Region

|

CPV Plants8

|

2024/2025

|

2023/2024

|

2022/2023

|

2021/2022

|

2020/2021

|

|

PJM RTO

|

28.92

|

34.13

|

50

|

140

|

76.53

|

|

|

PJM COMED

|

Three Rivers

|

28.92

|

34.13

|

-

|

-

|

-

|

|

PJM MAAC

|

Fairview, Maryland, Maple Hill

|

49.49

|

49.49

|

95.79

|

140

|

86.04

|

|

PJM EMAAC

|

Shore

|

54.95

|

49.49

|

97.86

|

165.73

|

187.77

|

Source: PJM

8 The Three Rivers project, which is in the construction stages, will be entitled to capacity payments,

subject to completion of the construction, commencing from its commercial operation.

11

OPC Energy Ltd.

Report of the Board of Directors

| 3. |

Main Developments in the Company’s Business Environment (Cont.)

|

| 3.3 |

Activities in the U.S. (Cont.)

|

| G. |

Capacity payments (Cont.)

|

NYISO market

Similar to the PJM market, in the NYISO market capacity payments are made in the framework of a central mechanism

for acquisition of capacity. In the NYISO market, there are a number of submarkets, wherein there could be various capacity demands as a function of local supply and demand and transmission capability. NYISO makes seasonal tenders in every spring for

the upcoming summer (the months of May through October) and in the fall for the upcoming winter (the months of November through April). In addition, there are supplemental monthly tenders for the balance of the capacity not sold in the seasonal

tenders. The power plants are permitted to assure the capacity payments in the seasonal tender, the monthly tender or through bilateral sales.

Set forth below are the capacity prices determined in the seasonal tenders in NYISO market (the prices are

denominated in dollars per kilowatt per month):

|

Sub-Area

|

CPV

Plants

|

Winter

2022/2023

|

Summer

2022

|

Winter

2021/2022

|

Summer

2021

|

|

NYISO

Rest of the Market

|

–

|

1.18

|

3.40

|

1.00

|

4.09

|

|

Lower Hudson Valley

|

Valley

|

1.31

|

4.65

|

1.01

|

4.56

|

Source: NYISO

It is noted that the Valley power plant is located in Area G (Lower Hudson Valley) and the actual capacity prices

for the Valley power plants are impacted by the seasonal tenders, the monthly tenders and the SPOT prices, with variable capacity prices every month, as well as bilateral agreements with energy suppliers in the market.

ISO‑NE market

Similar to the PJM market, capacity payments in the ISO‑NE market are as part of a central mechanism for acquisition

of capacity. In the ISO‑NE market, there are a number of submarkets, wherein there could be various capacity demands as a function of local supply and demand and transmission capability. Forward capacity tenders are made three years in advance for

the capacity year. In addition, there are supplemental monthly and annual tenders for the balance of the capacity not sold in the Forward tenders.

12

OPC Energy Ltd.

Report of the Board of Directors

| 3. |

Main Developments in the Company’s Business Environment (Cont.)

|

| 3.3 |

Activities in the U.S. (Cont.)

|

| G. |

Capacity payments (Cont.)

|

ISO‑NE

market (Cont.)

The Towantic power plant participated for the first time in a capacity tender for 2018–2019 at a price of $9.55

KW/month and determination of the tariff for seven years in respect of 725 megawatts linked to the Utilities Inputs Index, which will apply up to May 2025. Set forth below are the capacity payments determined in the sub‑regions that are relevant to

the Towantic power plant (the prices are denominated in dollars per kilowatt per month):

|

Sub-Region

|

CPV Power Plants

|

2026/2027

|

2025/2026

|

|

ISO-NE

Rest of the Market

|

Towantic

|

2.59

|

2.59

|

It is noted that the actual capacity payments for the Towantic power plant are impacted by forward tenders,

supplemental annual tenders, monthly tenders with variable capacity prices in every month and bilateral agreements with the energy suppliers in the market.

| H. |

The Inflation Reduction Act (“the IRA Law”) – in August 2022, the Inflation Reduction Act of

2022 was signed by the President of the U.S. and it became law. Among other things, the said law grants significant tax credits for renewable energies and technologies for carbon capture, and one of the targets of the IRA is to lead to an

increase of the generation of renewable energies and the regulatory stability in the area.

|

Renewable energies

The IRA Law includes, a number of benefits for renewable energy projects: extension the Investment Tax Credit (ITC)

and the Production Tax Credit (PTC) in renewable energy projects the construction of which is started prior to January 1, 2025. Projects that meet certain requirements provided in the IRA Law, should be entitled to ITC of up to 30% or PTC of up to

1.5 cents per kilowatt (adjusted for inflation). In addition, it is possible to earn bonus credits, which increase the ITC or PTC by 10%, to the extent the project meets certain requirements, such as, local manufacture located in special designated

energy communities (such as, locations with unemployment in excess of the natural average or population regions located proximate to a coal mine or coal‑powered power plant. The said tax credits may be transferred to unrelated entities. For

additional details regarding benefits for renewable energy projects in the framework of the IRA – see Section 8.1.4(O) of Part A (Description of the Company’s Business).

In the estimation of the CPV Group, the IRA Law is expected to have a favorable impact on the renewable energy

initiation, development and construction projects, including Maple Hill and Stagecoach (for additional details regarding the projects and, among other things, an increase in the value of the tax credits that is expected to be received compared with

the situation prior to passage of the law.

As at the approval date of the report, the CPV Group estimates that it will choose tax benefits of the ITC type for

the Maple Hill project and that Maple Hill will comply with the conditions for the ITC at the rate of an additional 10% bonus (and in total 40%). Furthermore, the CPV Group is analyzing the impacts of the IRA on Stagecoach and Rogue’s Wind (for

additional details regarding the projects – see Section 6, below) – the economic feasibility that will derive from the choice of the ITC or the PTC benefit for each project along with the eligibility of the projects to additional tax bonus, all of

this taking into account the final arrangements.

13

OPC Energy Ltd.

Report of the Board of Directors

| 3. |

Main Developments in the Company’s Business Environment (Cont.)

|

| 3.3 |

Activities in the U.S. (Cont.)

|

| H. |

The Inflation Reduction Act (“the IRA Law”) – (Cont.)

|

Renewable energies

(Cont.)

In addition, in the estimation of the CPV Group, the possibility of selling the tax credits is expected to increase

the Group’s ability to realize part of the value of the tax credits of its renewable projects and to improve the investment conditions.9

Carbon capture projects

The IRA Law extends broadens the available PTC to capture and/or use of carbon dioxide. For electricity generation

facilities that install carbon capture technology with the capability of capturing 75% or more of the generation base of the carbon dioxide, the said generation tax credit for the first 12 years after commencement of activities if the relevant

electricity generation facility captures at leas 18,750 metric tons of carbon dioxide per year. The ceiling for the credit for separated carbon dioxide is $85 per metric ton and the ceiling for the EOR credit and other beneficial re‑uses (recycling)

is $60 per metric ton. In addition, the tax credit permits direct payment (as opposed to a credit against the tax paid) up to the first five years on carbon capture equipment that is placed into service after December 31, 2022. For additional details

regarding benefits for carbon capture projects as part of the IRA Law – see Section 8.1.4(O) of Part A (Description of the Company’s Business).

With reference to the projects of the CPV Group that are in the development stage, as stated in Section 6B(7) below

(backlog of projects), and that integrate technologies for carbon capture, in the estimation of the CPV Group the IRA Law is expected to have a positive impact in all that relating to the technological benefits for carbon capture provided in the Law.

As at the approval date of the report, the full impacts of the IRA Law have not yet been finally clarified, and they are expected to be clarified upon formulation of the detailed arrangements (regulations).10

For additional details regarding developments in the Company’s activities in the U.S. – see Sections 6 and 10 below

and Section 8 of Part A (Description of the Company’s Business).

9 That stated with respect to the main impacts of the IRA Law and its

application to projects of the CPV Group, particularly the estimates of the CPV Group regarding the impacts of the IRA on the Group’s projects (including Stagecoach, Maple Hill and Rogue’s Wind) and their eligibility for the benefits, constitutes

“forward‑looking” information as it is defined in the Securities Law, and is merely an estimate that is based on the information, estimates, forecasts and data in the possession of the CPV Group as at the approval date of the report, based on,

among other things, the language of the law published and the existing business plans. Ultimately, the impacts of the IRA could be impacted by, among other things, the detailed regulatory arrangements that will be determined, compliance with the

conditions for entitlement and advancement of the relevant project, legislative updates to the extent that will be determined in connection with the manner of implementation or allocation of the benefits. This information is conditional on the

existence of various factors, including factors that are not under the Company’s control, such as, the final arrangements that will be determined, realization of the development plans of the list of awaiting projects, compliance with entitlement

conditions, technological development, etc. Accordingly, information as stated above may not materialize and/or may materialize in a manner different than that described above.

| 10 |

That stated in connection with the main impacts of the IRA Law and its application to projects of the CPV Group, constitutes “forward‑looking” information, as it is defined in the Securities Law. For details –

footnote 9 above.

|

14

OPC Energy Ltd.

Report of the Board of Directors

| 4. |

Results of operations for the year ended December 31, 2022 (in millions of NIS)

|

The Group’s activities in Israel and the United States are subject to seasonal fluctuations

(for additional details regarding seasonal impacts – see Sections 7.10 and 8.7 to Part A (Description of the Company’s Business)).

In Israel, the TOAZ tariffs are supervised (controlled) and published by the Electricity Authority. In the year of the report, the said tariffs are broken down into three seasons –

summer (July and August), winter (January, February and December) and transition (March through June and September through November). The TOAZ tariff in the summer and the winter are higher than those in the transition seasons. For details

regarding a decision to update the hourly demand categories of the TOAZ (including the months of the year’s seasons and the categories of the daily hours) commencing from the tariff update for 2023 – see Section 3.2C above and Section 7.2.4 of

Part A (Description of the Company’s Business).

In the United States, the electricity tariffs are not supervised (controlled) and are impacted

by the demand for electricity, which is generally high in the summer and the winter compared with the average and as a function of the natural gas prices.

In light of the said seasonality, generally the preference is to concentrate, to the extent

possible, the maintenance work on the power plants during the transition periods, which are characterized, as stated, by relatively lower demand.

15

OPC Energy Ltd.

Report of the Board of Directors

| 4. |

Results of operations for the year ended December 31, 2022 (in millions of NIS) (Cont.)

|

| A. |

Statement of income11

|

|

Section

|

For the year ended December 31

|

Board’s explanations

|

|||||||

|

2022

|

2021

|

||||||||

|

Revenues from sale and provision of services (1)

|

1,927

|

1,575

|

For details – see this Section below.

|

||||||

|

Cost of sales and provision of services (without depreciation and amortization) (2)

|

1,404

|

1,086

|

For details – see this Section below.

|

||||||

|

Depreciation and amortization

|

191

|

171

|

|||||||

|

Gross profit

|

332

|

318

|

For details – see Sections C and D below.

|

||||||

|

Administrative and general expenses

|

239

|

177

|

For details – see Sections C and D below.

|

||||||

|

Share in earnings (losses) of associated companies12

|

286

|

(35

|

)

|

The increase stems mainly from an improvement of the results of the activities in the U.S. For details – see Section D below.

|

|||||

|

Transaction expenses in respect of acquisition of the CPV Group

|

–

|

2

|

|||||||

|

Business development expenses

|

50

|

5

|

Most of the increase, in the amount of about NIS 11 million, is in the renewable energy in the U.S. segment and in the Israel segment, in the amount of about NIS 5 million.

|

||||||

|

Ordinary income

|

329

|

77

|

|||||||

|

Financing expenses, net (3)

|

47

|

457

|

For additional details – see this Section below.

|

||||||

|

Income (loss) before taxes on income

|

282

|

(380

|

)

|

||||||

|

Taxes on income (tax benefit)

|

65

|

(77

|

)

|

The increase stems from better results in Israel and in the U.S.

|

|||||

|

Net income (loss) for the year (4A)

|

217

|

(303

|

)

|

For additional details – see this Section below.

|

|||||

|

Adjustments

|

14

|

331

|

For details – see Section E below.

|

||||||

|

Adjusted income for the year (4B)13

|

231

|

28

|

For additional details – see this Section below.

|

||||||

| 11 |

The results of the CPV Group are consolidated in the Company financial statements commencing from the completion date of the transaction for acquisition of the CPV Group on January 25, 2021. The results of the associated companies in the

U.S. are presented in the category “Company’s share in income of associated companies”.

|

12 The income of associated companies in the U.S. includes income or loss in respect of changes in the

fair value of derivative financial instruments not yet realized as at the date of the financial statements deriving from plans of the CPV Group that hedge electricity margins.

13 It is emphasized that “adjusted income or loss” as stated in this report is not a recognized data

item that is recognized under IFRS or under any other set of generally accepted accounting principles as an index for measuring financial performance and should not be considered as a substitute for income or loss or other terms provided in

accordance with IFRS. It is possible that the Company’s definitions of “adjusted income or loss” are different than those used by other companies. Nonetheless, the Company believes that the “adjusted income or loss” provides information that is

useful to management and investors by means of eliminating certain line items (categories) that do not constitute an indication of the Company’s ongoing business activities.

16

OPC Energy Ltd.

Report of the Board of Directors

| 4. |

Results of operations for the year ended December 31, 2022 (in millions of NIS) (Cont.)

|

| A. |

Statement of income (Cont.)

|

(1) Changes in revenues (in NIS millions):

|

Revenues

|

For the

|

Board’s Explanations

|

|||||||

|

Year Ended

|

|||||||||

|

December 31

|

|||||||||

|

2022

|

2021

|

||||||||

|

Revenues in Israel

|

|||||||||

|

Revenues from sale of energy to private customers

|

1,212

|

966

|

An increase, in the amount of about NIS 165 million, stemming from an increase in the generation component tariff (for details – see Section 3.2C, below) stemming from an increase in customer

consumption offset by a decrease in Rotem’s sales, in the amount of about NIS 81 million.

|

||||||

|

Revenues from private customers in respect of infrastructure services

|

315

|

298

|

|||||||

|

Revenues from sale of energy to the System Operator and to other suppliers

|

107

|

91

|

|||||||

|

Revenues from sale of steam

|

62

|

57

|

|||||||

|

Other revenues

|

39

|

–

|

Reflects revenues in respect of Gnrgy’s activities, which were initially consolidated on December 31, 2021.

|

||||||

|

Total revenues in Israel

|

1,735

|

1,412

|

|||||||

|

Revenues in the U.S.

|

|||||||||

|

Revenues from sale of electricity from renewable energy

|

87

|

82

|

|||||||

|

Revenues from provision of services (under others)

|

105

|

81

|

Mainly in respect of non‑recurring revenue under an asset‑management agreement that ended in the year of the report.

|

||||||

|

Total revenues in the U.S.

|

192

|

163

|

|||||||

|

Total revenues

|

1,927

|

1,575

|

|||||||

* For details regarding the components of the sales, generation and purchases of energy – see Section 4F below.

17

OPC Energy Ltd.

Report of the Board of Directors

| 4. |

Results of operations for the year ended December 31, 2022 (in millions of NIS) (Cont.)

|

| A. |

Statement of income (Cont.)

|

| (2) |

Changes in the cost of sales and provision of services (not including depreciation and amortization) (in NIS millions):

|

|

Cost of Sales and

Provision of Services

|

For the

|

Board’s Explanations

|

|||||||

|

Year Ended

|

|||||||||

|

December 31

|

|||||||||

|

2022

|

2021

|

||||||||

|

Cost of sales in Israel

|

|||||||||

|

Natural gas and diesel oil

|

526

|

495

|

An increase, in the amount of about NIS 60 million, stemming from an increase in the price of the natural gas as a result of an increase in the

generation component and the dollar/shekel exchange rate. In addition, there was an increase, in the amount of about NIS 16 million, stemming from revenue in respect of compensation from Energean in Rotem and Hadera last year (as detailed in

Section C1 below). On the other hand, there was a decrease in the expenses for the consumption of natural gas, in the amount of about NIS 37 million, due to maintenance work at the Rotem Power Plant that was performed mainly in the second

quarter of 2022 (as detailed in Section C3 below).

|

||||||

|

Expenses in respect of acquisition of energy

|

295

|

102

|

An increase in the amount of about NIS 129 million, in light of an increase in consumption by customers, and an increase, in the amount of about

NIS 68 million, deriving from maintenance work at the Rotem Power Plant that was performed mainly in the second quarter of 2022.

|

||||||

|

Expenses in respect of infrastructure services

|

315

|

298

|

|||||||

|

Cost of transmission of gas

|

32

|

32

|

|||||||

|

Operating expenses

|

86

|

80

|

|||||||

|

Other expenses

|

40

|

–

|

In 2022, represents the amount of about NIS 30 million, in respect the cost of sales of Gnrgy’s activities, which were initially consolidated on

December 31, 2021, and the amount of about NIS 10 million, in respect of activities relating to the commercial operation of the Zomet power plant in 2023.

|

||||||

|

Total cost of sales in Israel

|

1,294

|

1,007

|

|||||||

|

Cost of sales and services in the U.S.

|

|||||||||

|

Cost of sales in respect of sale of electricity from renewable energy

|

30

|

26

|

Reflects cost of sales in respect of Gnrgy’s activities, which were initially consolidated at the end of 2021.

|

||||||

|

Cost in respect provision of services (under others)

|

80

|

53

|

Mostly in respect of an increase in the expenses for wages, in the amount of about NIS 10 million, and an unusual expense relating to an

asset‑management agreement that ended in the year of the report.

|

||||||

|

Total cost of sales and provision of services in the U.S.

|

110

|

79

|

|||||||

|

Total cost of sales and provision of services

|

1,404

|

1,086

|

|||||||

* For details regarding the components of the sales, generation and purchases of energy – see Section 4F below.

18

OPC Energy Ltd.

Report of the Board of Directors

4. Results of operations for the

year ended December 31, 2022 (in millions of NIS) (Cont.)

| A. |

Statement of income (Cont.)

|

(3) Changes in the financing expenses, net

The decrease in the net financing expenses stems mainly from the following factors: (A) non‑recurring financing

expenses recorded in 2021 in respect of: (1) early repayment of financing in Rotem, in the amount of about NIS 244 million; (2) settlement of financial liabilities, net, in the amount of about NIS 28 million, as a result of early repayment of a loan

in Keenan (for additional details – see Note 21E to the financial statements); (3) a decrease in interest and linkage expenses relating to Rotem financing, in the amount of about NIS 55 million (including the results of a hedge of the CPI); (4) an

increase in the financing income, in the amount of about NIS 106 million, in respect of revaluation of intercompany shekel loans that were provided by the Company to the Group companies in the U.S. the functional currency of which is the dollar. It

is noted that commencing from October 1, 2022, the loans to the Group companies in the U.S. were reclassified as part of the net investment, and commencing from this date, exchange rate differences are recorded to a translation reserve (for

additional details – see Note 21E to the financial statements); and (5) an increase in the financing income, in the amount of about NIS 11 million, as a result of the impact of the changes in the shekel/dollar exchange rate.

On the other hand, there was an increase in interest and linkage expenses in respect of the Company’s debentures, in

the amount of about NIS 37 million.

(4) Attribution of the income (loss) for the year

| (A) |

Income for the period of about NIS 167 million in the year of the report and a loss of about NIS 219 million last year is attributable to the Company’s shareholders and the balance is attributable to the holders of the non-controlling

interests.

|

| (B) |

Adjusted income14 for the period of about NIS 179 million in the year of the report and about NIS 22 million last year is attributable to the Company’s shareholders and the balance is attributable to the holders of the

non-controlling interests.

|

| 14 |

See footnote 13 above.

|

19

OPC Energy Ltd.

Report of the Board of Directors

| 4. |

Results of operations for the year ended December 31, 2022 (in millions of NIS) (Cont.)

|

| B. |

EBITDA and Adjusted EBITDA

|

The Company defines “EBITDA” as earnings (losses) before depreciation and amortization,

financing expenses or income and taxes on income.

The Company defines “adjusted EBITDA” as EBITDA plus a proportionate consolidation of the

results of the associated companies based on the rate of holdings of the CPV Group therein, and after adjustments in respect of changes in fair value of derivative financial instruments and items not in the ordinary course of the Group’s business

and/or having a non‑recurring nature. For details regarding adjustments during the period – see Section E below.

EBITDA and adjusted EBITDA data are not recognized under IFRS or under any other generally

accepted accounting standards as an indicator for the measurement of financial performance and should not be considered a substitute for gross and operating profit or loss, cash flows from operating activities or other terms of operational

performance or liquidity prescribed under IFRS.

EBITDA and adjusted EBITDA are not intended to represent an approximate of the free cash from

the Group’s current operating activities, particularly against the background the provisions of the project financing agreements in some of the Group’s power plants, or to represent monies that are available for distribution of dividends or other

uses, since such monies may be used for servicing debt, capital expenditures, working capital and other liabilities. EBITDA is characterized by limitations that impair its use as an indicator of the Company’s profitability, since it does not take

into account certain costs and expenses deriving from the Company’s business, which could materially affect its income or loss, such as, depreciation and financing expenses or income and taxes on income.

The Company believes that the adjusted EBITDA data provides useful information in a transparent

manner that is helpful to investors in examining the Company’s operating performances and in comparing them against the operating performance of other companies in the same sector or in other sectors (industries) with different capital structures,

debt levels and/or income tax rates (it is noted that other companies might define EBITDA differently), as well as comparison of performances between periods. This data item is also used by Company management when examining the Company’s performance.

20

OPC Energy Ltd.

Report of the Board of Directors

| 4. |

Results of operations for the year ended December 31, 2022 (in millions of NIS) (Cont.)

|

| B. |

EBITDA and Adjusted EBITDA (Cont.)

|

Calculation

of the EBITDA and Adjusted EBITDA (in millions of NIS):

|

For the

|

||||||||

|

Year Ended

|

||||||||

|

December 31

|

||||||||

|

2022

|

2021

|

|||||||

|

Revenues from sales and provision of services

|

1,927

|

1,575

|

||||||

|

Cost of sales (without depreciation and amortization)

|

(1,404

|

)

|

(1,086

|

)

|

||||

|

Administrative and general expenses (without depreciation and

|

||||||||

|

amortization)

|

(229

|

)

|

(169

|

)

|

||||

|

Transaction expenses relating to acquisition of the CPV Group

|

–

|

(2

|

)

|

|||||

|

Business development expenses

|

(50

|

)

|

(27

|

)

|

||||

|

Consolidated EBITDA*

|

244

|

291

|

||||||

|

Share of Group in proportionate EBITDA of associated companies**

|

556

|

195

|

||||||

|

EBITDA (total consolidated and the proportionate amount of

|

||||||||

|

associated companies)

|

800

|

486

|

||||||

|

Adjustments – see detail in Section E below

|

18

|

148

|

||||||

|

Adjusted EBITDA

|

818

|

634

|

||||||

| * |

Presented on the basis of 100% of the companies the financial results of which are consolidated in the Company’s financial statements.

|

| ** |

Represents the EBITDA of the associated companies based on the rate of the holdings of the CPV Group therein.

|

21

OPC Energy Ltd.

Report of the Board of Directors

| 4. |

Results of operations for the year ended December 31, 2022 (in millions of NIS) (Cont.)

|

| B. |

EBITDA and Adjusted EBITDA (Cont.)

|

Set forth below is a breakdown of the adjusted EBITDA data broken down by the subsidiaries (on

a consolidated basis) and the associated companies (on a proportionate basis, based on the rate of the holdings of the CPV Group therein) (in NIS millions):

|

Basis of

|

|||||||||

|

presentation

|

|||||||||

|

in the

|

For the

|

||||||||

|

Company’s

|

Year Ended

|

||||||||

|

financial

|

December 31

|

||||||||

|

statements

|

2022

|

2021

|

|||||||

|

Rotem

|

Consolidated

|

343

|

310

|

||||||

|

Hadera

|

Consolidated

|

48

|

55

|

||||||

|

Zomet

|

Consolidated

|

(6

|

)

|

(3

|

)

|

||||

|

Business development costs, headquarters and others

|

Consolidated

|

(18

|

)

|

(10

|

)

|

||||

|

Total Israel

|

367

|

352

|

|||||||

|

Fairview

|

Associate

|

113

|

73

|

||||||

|

Towantic

|

Associate

|

96

|

92

|

||||||

|

Maryland

|

Associate

|

65

|

41

|

||||||

|

Shore

|

Associate

|

75

|

69

|

||||||

|

Valley

|

Associate

|

217

|

70

|

||||||

|

Other

|

Consolidated

|

(4

|

)

|

(6

|

)

|

||||

|

Total energy transition in the U.S.

|

562

|

339

|

|||||||

|

Keenan

|

Consolidated

|

55

|

54

|

||||||

|

Development costs of renewable energy

|

Consolidated

|

(29

|

)

|

(25

|

)

|

||||

|

Total renewable energy in the U.S.

|

26

|

29

|

|||||||

|

Total activities under another segment

|

Consolidated

|

–

|

8

|

||||||

|

Headquarters in the United States15

|

Consolidated

|

(111

|

)

|

(73

|

)

|

||||

|

Total United States

|

477

|

303

|

|||||||

|

Company headquarters (not allocated to the

|

|||||||||

|

segments)*

|

Consolidated

|

(26

|

)

|

(21

|

)

|

||||

|

Adjusted EBITDA

|

818

|

634

|

|||||||

| * |

Most of the increase stems from an increase in expenses for wages in the headquarters, in the amount of about NIS 1 million, and from an increase in business development expenses in the Company, in the amount of about NIS 2 million.

|

15 After elimination of management fees between the CPV Group and the Company, in the amounts of about

NIS 21 million and about NIS 16 million in the years ended December 31, 2022 and 2021, respectively.for the years ended December 31, 2022 and 2021, respectively.

22

OPC Energy Ltd.

Report of the Board of Directors

| 4. |

Results of operations for the year ended December 31, 2022 (in millions of NIS) (Cont.)

|

| C. |

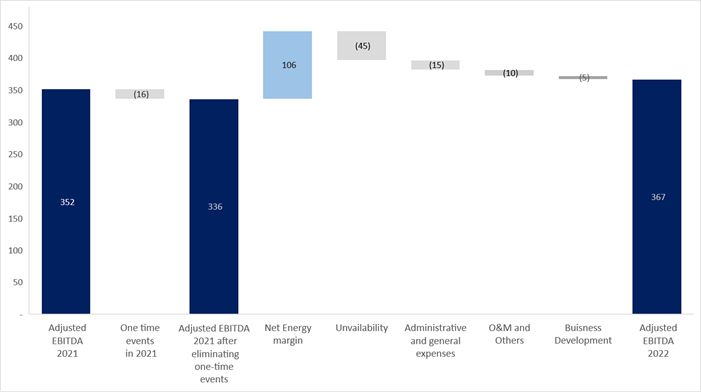

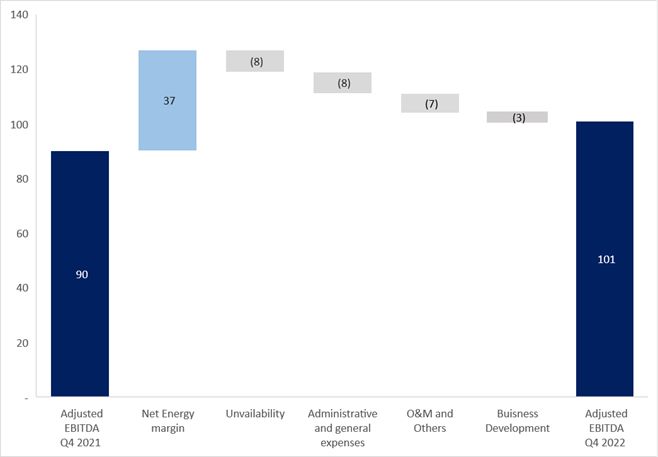

Analysis of the change in adjusted EBITDA – segment in Israel

|

Set forth below is an analysis of the change in adjusted EBITDA in Israel in 2022 compared with

last year (in NIS millions):

| 1. |

One-time events – in 2021, Rotem and Hadera recognized revenue, in the amount of about NIS 16

million, stemming from compensation due to the delay in the commercial operation of the Karish reservoir (for additional details – see Note 28C3 to the financial statements). For details regarding the start of the flow of the first gas from

the Karish reservoir in the fourth quarter of 2022 – see Section 10C below.

|

| 2. |

Energy margin – the increase in energy margin in the year of the report compared with last

year stems mainly from an increase in the generation component tariff offset by an increase in the natural gas prices. The natural gas prices were also impacted by an increase in the shekel/dollar exchange rate (which led to an increase of

about NIS11 million in the cost of the natural gas). For additional details – see Section 3.2C above.

|

23

OPC Energy Ltd.

Report of the Board of Directors

| 4. |

Results of operations for the year ended December 31, 2022 (in millions of NIS) (Cont.)

|

| C. |

Analysis of the change in adjusted EBITDA – segment in Israel (Cont.)

|

| 3. |

Unavailability due to maintenance work – during the year of the report, the Rotem and Hadera

power plants were shut down for different periods of time for purposes of maintenance work, which had a negative impact on their results in the year of the report, as well as compared with last year.

|

Rotem

– in March 2022, the activities of the Rotem Power Plant were shut down for a period of 12 days for purposes of performance of unplanned maintenance work to repair a malfunction, which was repaired; and further to the activities of the power plant

were shut down in April 2022 for purposes of performance of planned maintenance work which lasted 26 days, after which the power plant returned to regular activities. The next planned maintenance at the Rotem Power Plant is expected to take place

in the first half of 2024 for a period of about 15 days16.

| 16 |

That stated in this Section above, including with reference to the expected date of completion of the maintenance work, impact of the work on Rotem’s

results, period of the said work and/or the completion thereof, includes “forward‑looking” as it is defined in the Securities Law. The said information may not materialize, or it may materialize in a different manner, including as a result

of reasons that are not dependent on Rotem, such as, pressures the source of which is the maintenance contractor or the equipment supplier, manner of performance of the maintenance work, technical breakdowns or delays in arrival of the

equipment or teams to the site and/or other delays that could impact the performance of the power plant or the length of the shutdown. It is noted that early maintenance work might be needed, included unplanned work, due to changes in the

timetables and breakdowns. Partial activity or a shutdown of Rotem’s power plant for extended periods would have a negative impact on Rotem’s results.

|

24

OPC Energy Ltd.

Report of the Board of Directors

| 4. |

Results of operations for the year ended December 31, 2022 (in millions of NIS) (Cont.)

|

| C. |

Analysis of the change in adjusted EBITDA – segment in Israel (Cont.)

|

| 3. |

(Cont.)

|

Hadra – since the date of the commercial operation in 2020, the Hadera Power Plant perform maintenance work a number of times during which the

plant’s operations were partly or fully shut down. For additional details – see Section 7.11.1 to Part A (Description of the Company’s Business). In this connection, at the end of April 2022, the steam turbine of the Hadera Power Plant was shut

down for planned maintenance, where in the course of the work, repair work was also performed in the gas turbines. Repair of the gas turbines was completed, and the shutdown of the steam turbine was extended beyond that planned owing to

additional required repairs and the steam turbine had returned to service commencing from December 2022. During the period of time wherein the maintenance work was performed in the steam turbine, the Hadera Power Plant is being operated on a

partial basis. Shutdown of the Hadera Power Plant’s activities for purposes of performance of the maintenance work, as stated, had an unfavorable impact on Hadera’s results in 2022.

It is noted that, during the above‑mentioned maintenance, sale of the electricity to the

Company’s customers continued, where the Company purchased electricity from a third party in order to supply the full scope of the demand in the shutdown period.

For details regarding maintenance performed in the Tamar reservoir in the fourth quarter of

2022 and the impact thereof on the Company’s results in Israel – see Section 5C(2) below.

| 4. |

Administrative and general expenses – most of the increase stems from an increase in wages

and projects in Israel, in the amount of about NIS 10 million, and an increase in respect of non‑cash equity remuneration expenses, in the amount of about NIS 6 million, among other things, due to preparations for expansion of the

activities in Israel in 2023.

|

| 5. |

Operating and other expenses – most of the increase stems from an increase in the expenses

for wages of operational employees in the power plants in Israel, in the amount of about NIS 3 million and expenses in respect of the initial consolidation of Gnrgy, in the amount of about NIS 3 million.

|

25

OPC Energy Ltd.

Report of the Board of Directors

4. Results of operations for the

year ended December 31, 2022 (in millions of NIS) (Cont.)

| D. |

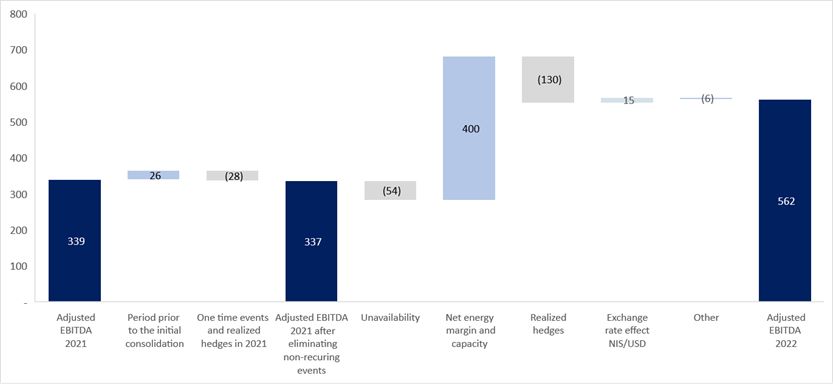

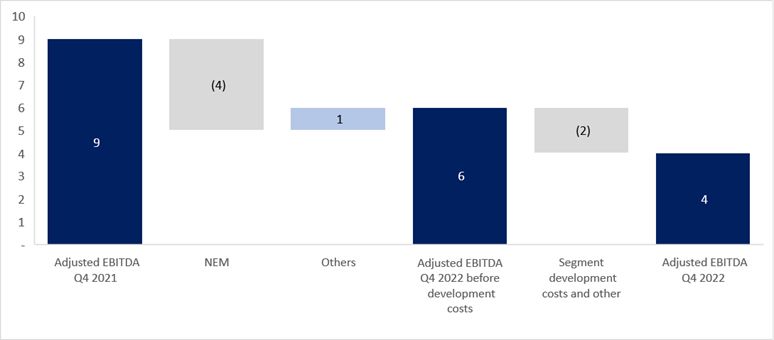

Analysis of the change in adjusted EBITDA – energy transition segment in the U.S.

|

Set forth below is an analysis of the change in the adjusted EBITDA in the energy transition

segment in the U.S. for 2022 compared with last year (in millions of NIS):17

| 1. |

Period prior to the initial consolidation – adjusted EBITDA in respect of the CPV Group from

January 1, 2021 and up to January 25, 2021 (the acquisition date).

|

| 2. |

One-time events and hedges – in addition to the regularly existing hedging program at the CPV

Group, in 2021 the CPV Group recognized revenue in respect of hedging agreements (an agreement hedging RPO in the Valley power plant and a hedging agreement of the HRCO type in the Shore power plant), which are not current and are not