Table of Contents

As confidentially submitted to the Securities and Exchange Commission on August 13, 2014. This draft registration statement has not been publicly filed with the Securities and Exchange Commission and all information herein remains strictly confidential.

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No. 1

to

Form 20-F

| x | REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Or

| ¨ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended

Or

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Or

| ¨ | SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

KENON HOLDINGS LTD.

(Exact name of registrant as specified in its charter)

| Singapore | (Company Registration No. 201406588W) 4911 |

Not Applicable | ||

| (State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification No.) |

80 Raffles Place #26-01

UOB Plaza 1

Singapore 048624

(Address, including zip code, and telephone number, including area code,

of registrant’s principal executive offices)

Copies to:

Scott V. Simpson

James A. McDonald

Skadden, Arps, Slate, Meagher and Flom (UK) LLP

40 Bank Street

London E14 5DS

Telephone: +44 20 7519 7000

Facsimile: +44 20 7519 7070

Securities registered or to be registered pursuant to Section 12(b) of the Act:

| Title of Each Class | Name of Each Exchange on Which Registered | |||

| Ordinary Shares, no par value* |

Table of Contents

Securities registered or to be registered pursuant to Section 12(g) of the Act: None

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934. Yes ¨ No ¨

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such a shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ¨ No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ¨ No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer ¨ Accelerated filer ¨ Non-accelerated filer x

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

| U.S. GAAP ¨ | International Financial Reporting Standards as issued by the International Accounting Standards Board x |

Other ¨ |

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the Registrant has elected to follow:

Item 17 ¨ Item 18 ¨

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No ¨

(APPLICABLE ONLY TO ISSUERS INVOLVED IN BANKRUPTCY PROCEEDINGS DURING THE PAST FIVE YEARS)

Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Sections 12, 13 or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court. Yes ¨ No ¨

Table of Contents

| PART I | ||||||

| ITEM 1. | |

11 |

| |||

| 11 | ||||||

| 11 | ||||||

| 11 | ||||||

| ITEM 2. | 11 | |||||

| ITEM 3. | 11 | |||||

| 11 | ||||||

| 25 | ||||||

| 25 | ||||||

| 25 | ||||||

| ITEM 4. | 81 | |||||

| 81 | ||||||

| 85 | ||||||

| 160 | ||||||

| 160 | ||||||

| ITEM 4A. | 160 | |||||

| ITEM 5. | 161 | |||||

| 165 | ||||||

| 185 | ||||||

| 202 | ||||||

| 203 | ||||||

| 206 | ||||||

| 206 | ||||||

| 207 | ||||||

| ITEM 6. | 208 | |||||

| 208 | ||||||

| 209 | ||||||

| 209 | ||||||

| 212 | ||||||

| 213 | ||||||

| ITEM 7. | 213 | |||||

| 213 | ||||||

| 214 | ||||||

| 216 | ||||||

| ITEM 8. | 216 | |||||

| 216 | ||||||

| 216 | ||||||

| ITEM 9. | 216 | |||||

| 216 | ||||||

| 216 | ||||||

| 216 | ||||||

| 217 | ||||||

| 217 | ||||||

| 217 | ||||||

| ITEM 10. | 217 | |||||

| 217 | ||||||

| 217 | ||||||

| 231 | ||||||

| 231 | ||||||

| 231 | ||||||

| 238 | ||||||

| 238 | ||||||

| 238 | ||||||

| 239 | ||||||

| ITEM 11. | 239 | |||||

1

Table of Contents

| ITEM 12. | 239 | |||||

| 239 | ||||||

| 239 | ||||||

| 239 | ||||||

| 239 | ||||||

| PART II | ||||||

| ITEM 13. | 240 | |||||

| ITEM 14. | Material Modifications to the Rights of Security Holders and Use of Proceeds |

240 | ||||

| ITEM 15. | 240 | |||||

| ITEM 16. | 240 | |||||

| ITEM 16A. | 240 | |||||

| ITEM 16B. | 240 | |||||

| ITEM 16C. | 240 | |||||

| ITEM 16D. | 240 | |||||

| ITEM 16E. | Purchases of Equity Securities by the Issuer and Affiliated Purchasers |

240 | ||||

| ITEM 16F. | 240 | |||||

| ITEM 16G. | 240 | |||||

| ITEM 16H. | 240 | |||||

| PART III | ||||||

| ITEM 17. | 241 | |||||

| ITEM 18. | 241 | |||||

| ITEM 19. | 241 | |||||

INTRODUCTION AND USE OF CERTAIN TERMS

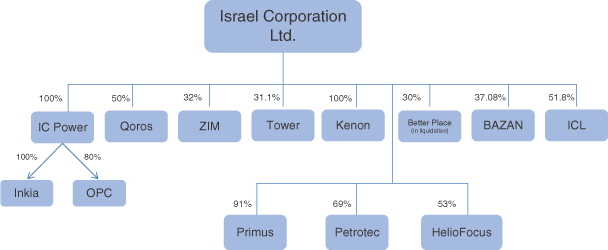

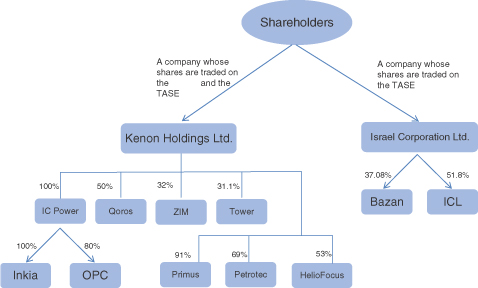

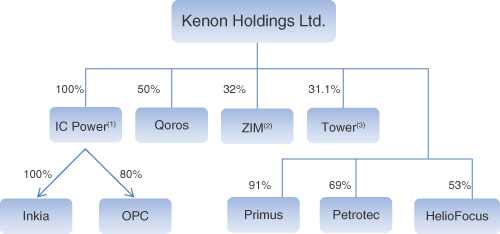

We have prepared this registration statement to register our shares under the Securities Exchange Act of 1934 in connection with the trading of our shares on . Kenon Holdings Ltd., or Kenon, was formed in the first quarter of 2014 in Singapore to serve as the holding company of businesses to be contributed to Kenon by its parent, Israel Corporation Ltd., or IC, in connection with a spin-off of the following businesses and associated companies that are currently held by IC:

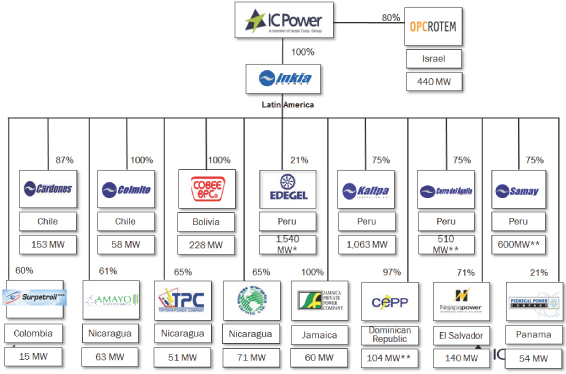

| • | a 100% interest in IC Power Ltd. (“IC Power”), a power generation company with operations in Latin America, the Caribbean and Israel; |

| • | a 50% interest in Qoros Automotive Co., Ltd. (“Qoros”), an automotive company based in China; |

| • | a 32% stake in ZIM Integrated Shipping Services, Ltd. (“ZIM”), a global container shipping company that recently completed a financial restructuring with its creditors, reducing IC’s equity interest from 99.7% to 32%; |

| • | a 31.1% interest in Tower Semiconductor Ltd. (“Tower”), a NASDAQ and Tel Aviv Stock Exchange, or TASE-listed semiconductor manufacturer; and |

| • | interests in three businesses in the renewable energy business, including Primus Green Energy, Inc. (“Primus”), an innovative developer of an alternative fuel technology. |

We have prepared this registration statement using a number of conventions, which you should consider when reading the information contained herein. In this registration statement, “we,” “us” and “our” shall refer to Kenon, or Kenon and each of our businesses collectively, as the context may require. Additionally, this registration statement uses the following conventions:

| • | HelioFocus Ltd., an Israeli company (“HelioFocus”), which is one of our renewable energy businesses; |

| • | IC Power and its operating companies and investments, as the context requires, include the following: |

| • | AEI Nicaragua Holdings Ltd., a Cayman Island corporation (“AEI Nicaragua”); |

2

Table of Contents

| • | Amayo S.A. a Nicaraguan corporation (“Amayo I”); |

| • | Central Cardones SA, a Chilean corporation (“Central Cardones”); |

| • | Cerro del Águila S.A., a Peruvian corporation (“CDA”); |

| • | Compañía Boliviana de Energía Eléctrica, a Canadian corporation (“COBEE”); |

| • | Compañía de Electricidad de Puerto Plata S.A., a Dominican Republic corporation (“CEPP”); |

| • | Consorcio Eolico Amayo (Fase II) S.A., a Nicaraguan corporation (“Amayo II”); |

| • | Edegel S.A.A., a Peruvian corporation listed on the Lima Stock Exchange (Bolsa de Valores de Lima) (“Edegel”); |

| • | Empresa Energetica Corinto Ltd., a Nicaraguan corporation (“Corinto”); |

| • | Generandes Peru S.A., a Peruvian corporation (“Generandes”); |

| • | IC Power Israel Ltd., an Israeli corporation (“ICPI”); |

| • | Inkia Energy Limited, a Bermudian corporation (“Inkia”); |

| • | Jamaica Private Power Company, a Jamaican corporation (“JPPC”); |

| • | Kallpa Generacion S.A., a Peruvian corporation (“Kallpa”); |

| • | Nejapa Power Company LLC, a Delaware corporation (“Nejapa”); |

| • | OPC Rotem Ltd., an Israeli corporation (“OPC”); |

| • | Pedregal Power Company S.de.R.L, a Panamanian corporation (“Pedregal”); |

| • | Southern Cone Power Peru S.A., a Peruvian corporation (“Southern Cone”); |

| • | Samay I S.A., a Peruvian corporation (“Samay I”); |

| • | Surpetroil S.A.S., a Colombian corporation (“Surpetroil”); |

| • | Termoeléctrica Colmito Ltda., a Chilean corporation (“Colmito”); |

| • | Tipitapa Power Company Ltd., a Nicaraguan corporation (“Tipitapa Power”); |

| • | Petrotec AG, a German company listed on the Frankfurt Stock Exchange (“Petrotec”), which is one of our renewable energy businesses; |

| • | Quantum (2007) LLC, a Delaware limited liability company (“Quantum”), which is the direct owner of our 50% interest in Qoros; |

| • | “renewable energy businesses” shall refer to each of Primus, Petrotec and HelioFocus; and |

| • | “spin-off” shall refer to (i) IC’s proposed contribution to Kenon of its interests in each of IC Power, Qoros, ZIM, Tower, Primus, Petrotec and HelioFocus, as well as other intermediate holding companies related to these entities, and (ii) the concurrent distribution of our issued and outstanding ordinary shares, via a dividend, to IC’s existing shareholders. |

Unless otherwise indicated or required by the context, in this registration statement, our disclosure assumes that the consummation of the spin-off has occurred. Although we will not acquire each of our businesses until shortly before the spin-off, the operating and other statistical information with respect to each of our businesses is presented as of December 31, 2013, as if we owned such businesses as of such date.

3

Table of Contents

FINANCIAL INFORMATION

Under this registration statement, we are applying to register our ordinary shares under the Securities Exchange Act of 1934 and to list our ordinary shares on . Concurrently with our listing on , we also expect to list our ordinary shares on the TASE. We produce financial statements in accordance with the International Financial Reporting Standards, or IFRS, issued by the International Accounting Standards Board, or IASB, and all financial information included in this registration statement is presented in accordance with IFRS, except as otherwise indicated. In particular, this registration statement contains certain non-IFRS financial measures which are defined under “Item 3A. Selected Financial Data” and “Item 4B. Business Overview – Our Businesses and Associated Companies – IC Power.” In addition, certain financial information relating to Tower, where indicated, has been prepared in accordance with U.S. GAAP.

Our financial statements presented in this registration statement are combined carve-out financial statements. The combined carve-out financial statements included in this registration statement comprise statements of income, statements of cash flows and statements of changes in parent company investment for the years ended December 31, 2013 and 2012 and balance sheet data as of December 31, 2013, December 31, 2012 and January 1, 2012. These financial statements represent our first publication of financial statements in accordance with IFRS. We present our combined carve-out financial statements in U.S. Dollars, the legal currency of the United States. All references in this registration statement to (i) “dollars”, “$” or “USD” are to U.S. Dollars; (ii) “Singapore Dollars” or “S$” are to the legal currency of Singapore; (iii) “EUR” or “Euro” are to the legal currency of participating member states for the purposes of the European Monetary Union; (iv) “NIS” or “New Israeli Shekel” are to the legal currency of the State of Israel, or Israel; (v) “Peruvian Nuevo Sol” are to the legal currency of Peru; (vi) “Bs” and “Bolivianos” are to the legal currency of Bolivia; (vii) “JPY” or “Japanese Yen” are to the legal currency of Japan; and (viii) “Yuan”, “RMB” or “Chinese Yuan” are to the legal currency of China. We have made rounding adjustments to reach some of the figures included in this registration statement. Consequently, numerical figures shown as totals in some tables may not be arithmetic aggregations of the figures that precede them. Solely for convenience, this registration statement contains conversions of certain RMB, Euro and New Israeli Shekel amounts into U.S. Dollars at rates of 6.1557:1 RMB/U.S. Dollar, 1.3412:1 U.S. Dollar/Euro and 3.4760:1 NIS/U.S. Dollar, respectively, as of August 8, 2014. These conversions are solely illustrative, and you should not expect that a RMB, Euro, or New Israeli Shekel amount actually represents a stated U.S. Dollar amount or that it could be converted into U.S. Dollars at the rate suggested.

In this registration statement, we also attach consolidated statements of profit or loss and other comprehensive income, consolidated statements of changes in equity, and consolidated statements of cash flows for Qoros for the years ended December 31, 2013 and 2012 and consolidated statements of financial position for Qoros as of December 31, 2013, December 31, 2012 and January 1, 2012, in accordance with Rule 3-09 of Regulation S-X.

NON-IFRS FINANCIAL INFORMATION

In this registration statement, we disclose non-IFRS financial measures, namely EBITDA, Proportionate EBITDA, Net Debt and Proportionate Net Debt, each as defined under “Item 3A. Selected Financial Data” and “Item 4B. Business Overview – Our Businesses and Associated Companies – IC Power.” Each of these measures are important measures used by us, and our subsidiaries and associated companies, to assess financial performance. We believe that the disclosure of EBITDA, Proportionate EBITDA, Net Debt and Proportionate Net Debt provides transparent and useful information to investors and financial analysts in their review of our, or our subsidiaries’ and associated companies’, operating performance and in the comparison of such operating performance to the operating performance of other companies in the same industry or in other industries that have different capital structures, debt levels and/or income tax rates.

4

Table of Contents

EXCHANGE RATE INFORMATION

The following tables set forth the historical period-end, average, high and low noon buying rates in New York City for cable transfers in foreign currencies as certified by the Federal Reserve Bank of New York for the U.S. Dollars, expressed in RMB per one U.S. Dollar, and Euro per one U.S. Dollar, as applicable, for the periods indicated:

| RMB/U.S. Dollar | ||||||||||||||||

| Year |

Period end |

Average rate1 |

High | Low | ||||||||||||

| 2009 |

6.8259 | 6.8295 | 6.8470 | 6.8176 | ||||||||||||

| 2010 |

6.6000 | 6.7603 | 6.8330 | 6.6000 | ||||||||||||

| 2011 |

6.2939 | 6.4475 | 6.6364 | 6.2939 | ||||||||||||

| 2012 |

6.2301 | 6.2990 | 6.3879 | 6.2221 | ||||||||||||

| 2013 |

6.0537 | 6.1412 | 6.2438 | 6.0537 | ||||||||||||

|

|

||||||||||||||||

| 1. | The average rate is based upon the exchange rate in effect on the last business day of each month. |

| RMB/U. S. Dollar | ||||||||

| Month |

High | Low | ||||||

| January 2014 |

6.0600 | 6.0402 | ||||||

| February 2014 |

6.1448 | 6.0591 | ||||||

| March 2014 |

6.2273 | 6.1183 | ||||||

| April 2014 |

6.2591 | 6.1966 | ||||||

| May 2014 |

6.2591 | 6.2255 | ||||||

| June 2014 |

6.2548 | 6.2036 | ||||||

| July 2014 |

6.2115 | 6.1712 | ||||||

| August 2014 (up to August 8, 2014) |

6.1793 | 6.1557 | ||||||

| U.S. Dollar/Euro | ||||||||||||||||

| Year |

Period end |

Average rate1 |

High | Low | ||||||||||||

| 2009 |

1.4332 | 1.3955 | 1.5100 | 1.2547 | ||||||||||||

| 2010 |

1.3269 | 1.3216 | 1.4536 | 1.1959 | ||||||||||||

| 2011 |

1.2973 | 1.4002 | 1.4875 | 1.2926 | ||||||||||||

| 2012 |

1.3186 | 1.2909 | 1.3463 | 1.2062 | ||||||||||||

| 2013 |

1.3779 | 1.3303 | 1.3816 | 1.2774 | ||||||||||||

|

|

||||||||||||||||

| 1. | The average rate is based upon the exchange rate in effect on the last business day of each month. |

| U. S. Dollar/Euro | ||||||||

| Month |

High | Low | ||||||

| January 2014 |

1.3680 | 1.3500 | ||||||

| February 2014 |

1.3806 | 1.3507 | ||||||

| March 2014 |

1.3927 | 1.3731 | ||||||

| April 2014 |

1.3898 | 1.3704 | ||||||

| May 2014 |

1.3924 | 1.3596 | ||||||

| June 2014 |

1.3690 | 1.3522 | ||||||

| July 2014 |

1.3681 | 1.3378 | ||||||

| August 2014 (up to August 8, 2014) |

1.3414 | 1.3355 | ||||||

5

Table of Contents

The following tables set forth the historical period-end, average, high and low rates, calculated using the daily representative rates, as reported by the Bank of Israel for the U.S. Dollars, expressed in NIS per one U.S. Dollar for the periods indicated:

| U.S. Dollar/New Israeli Shekel | ||||||||||||||||

| Year |

Period end |

Average rate1 |

High | Low | ||||||||||||

| 2009 |

3.775 | 3.927 | 4.256 | 3.690 | ||||||||||||

| 2010 |

3.549 | 3.732 | 3.894 | 3.549 | ||||||||||||

| 2011 |

3.821 | 3.582 | 3.821 | 3.363 | ||||||||||||

| 2012 |

3.733 | 3.844 | 4.084 | 3.700 | ||||||||||||

| 2013 |

3.471 | 3.360 | 3.791 | 3.471 | ||||||||||||

|

|

||||||||||||||||

| 1. | The average rate is based upon the exchange rate in effect on the last business day of each month. |

| U.S. Dollar/ New Israeli Shekel |

||||||||

| Month |

High | Low | ||||||

| January 2014 |

3.507 | 3.483 | ||||||

| February 2014 |

3.549 | 3.496 | ||||||

| March 2014 |

3.504 | 3.459 | ||||||

| April 2014 |

3.493 | 3.461 | ||||||

| May 2014 |

3.490 | 3.447 | ||||||

| June 2014 |

3.476 | 3.432 | ||||||

| July 2014 |

3.436 | 3.402 | ||||||

| August 2014 (up to August 8, 2014) |

3.476 | 3.415 | ||||||

6

Table of Contents

MARKET AND INDUSTRY DATA

Unless otherwise indicated, all sources for industry data and statistics are estimates or forecasts contained in or derived from internal or industry sources we believe to be reliable. Market data used throughout this registration statement was obtained from independent industry publications and other publicly available information. Such data, as well as internal surveys, industry forecasts and market research, while believed to be reliable, have not been independently verified. In addition, in certain cases we have made statements in this registration statement regarding the industries in which each of our businesses operate and their position in such industries based upon the experience of our businesses and their individual investigations of the market conditions affecting their respective operations.

Market data and statistics are inherently predictive and speculative and are not necessarily reflective of actual market conditions. Such statistics are based upon market research, which itself is based upon sampling and subjective judgments by both the researchers and the respondents. In addition, the value of comparisons of statistics for different markets is limited by many factors, including that (i) the markets are defined differently, (ii) the underlying information was gathered by different methods and (iii) different assumptions were applied in compiling the data. Accordingly, although we believe and operate as though all market and industry information presented in this Registration Statement is accurate, the market statistics included in this registration statement should be viewed with caution.

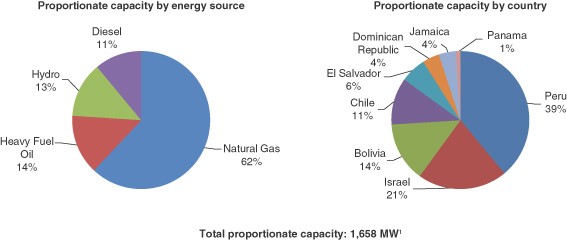

TECHNICAL TERMS

Unless otherwise indicated, statistics provided throughout this registration statement with respect to power generation units are expressed in MW, in the case of the capacity of such power generation units, and in GWh, in the case of the electricity production of such power generation units. One GWh is equal to 1,000 MWh, and one MWh is equal to 1,000 KWh. Statistics relating to aggregate annual electricity production are expressed in GWh and are based on a year of 8,760 hours. Unless otherwise indicated, the capacity and generation figures of IC Power provided in this registration statement reflect IC Power’s proportionate interests in each of its subsidiaries and associated companies. For information on IC Power’s ownership interest in each of its operating companies, see “Item 4B. – Business Overview – Our Businesses and Associated Companies – IC Power.”

INFORMATION REGARDING TOWER

Tower is subject to the reporting requirements of the SEC and, as a foreign private issuer, Tower is required to file with the SEC annual reports containing audited financial information, and to furnish to the SEC reports containing any material information that Tower provides to its local securities regulator, investors or stock exchange. Tower’s published financial statements are prepared according to US GAAP. Information related to Tower contained, or referred to, in this registration statement has been derived from Tower’s public filings with the SEC; financial information of Tower in accordance with IFRS has been derived a reconciliation of US GAAP information to IFRS. Although we have a significant equity interest in Tower, we do not control or manage Tower, participate in the preparation of Tower’s public reports or financial statements or have any specific information rights. Any information related to Tower contained, or referred to, in this registration statement is provided to satisfy our obligations under the Exchange Act of 1934. You are encouraged to review Tower’s publicly available filings, which can be found on the SEC’s website at www.sec.gov.

We have a 31.1% equity interest in Tower, as of June 30, 2014, assuming the full conversion of Tower’s approximately 7.9 million outstanding capital notes held by Bank Leumi Le-Israel B.M., or Bank Leumi, and Bank Hapoalim, which conversion would result in approximately 57.2 million shares outstanding. Kenon’s equity interest in Tower, based upon the approximately 49.3 million Tower shares currently outstanding, is 36.6%. Kenon may experience additional dilution of its equity interest in Tower if the holders of Tower’s outstanding convertible bonds, options and warrants convert their bonds and exercise their options or warrants, as applicable. Should all outstanding convertible bonds, options and warrants be converted and exercised, Kenon’s equity interest in Tower, which we refer to as Kenon’s fully-diluted equity interest, would decrease to 18.9%.

INFORMATION REGARDING EDEGEL

IC Power indirectly owns 21% of Edegel (IC Power has a 100% interest in Inkia, which has a 100% interest in Southern Cone, which has a 39% equity interest in Generandes, an entity that, in turn, has a 54% equity

7

Table of Contents

interest in the outstanding shares of Edegel). Edegel is the largest generator of electricity in Peru, and is listed on the Lima Stock Exchange (Bolsa de Valores de Lima). In April 2014, IC Power entered into an agreement to sell its 21% equity interest in Edegel to Enersis S.A., or Enersis, a subsidiary of Edegel’s indirect controlling shareholder, for $413 million. IC Power is entitled to receive its proportionate share of earnings generated by Edegel up to the closing of the transaction. The sale of IC Power’s equity interest in Edegel is subject to regulatory approval by INDECOPI, the Peruvian anti-trust regulator.

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This registration statement contains forward-looking statements reflecting our current expectations and views of the quality of our assets, our anticipated financial performance, our future growth prospects and the future growth prospects of our businesses and associated companies, the listing and liquidity of our ordinary shares, and other future events. Forward-looking statements relate to expectations, beliefs, projections, future plans and strategies, anticipated events or trends and similar expressions concerning matters that are not historical facts, and are principally contained in the sections entitled “Item 3. Key Information,” “Item 4. Information on the Company” and “Item 5. Operating and Financial Review and Prospects.” Some of these forward-looking statements can be identified by terms and phrases such as “anticipate,” “should,” “likely,” “foresee,” “believe,” “estimate,” “expect,” “intend,” “continue,” “could,” “may,” “plan,” “project,” “predict,” “will,” and similar expressions.

These forward-looking statements include statements relating to:

| • | our goals and strategies; |

| • | our capital commitments with respect to each of our businesses and associated companies; |

| • | the listing of our ordinary shares on each of the and the TASE; |

| • | our ability to implement, successfully or at all, our strategies for us and for each of our businesses following the spin-off; |

| • | tax and corporate benefits relating to our incorporation in Singapore; |

| • | our capital allocation principles, as set forth in “Item 4B. Business Overview – Our Strategy”; |

| • | the funding requirements, strategies, and business development plans of our businesses, including expectations that our businesses will be able to raise third party debt and/or equity financing to fund their operations as needed, including for the construction or expansion of their operations and/or respective facilities; |

| • | the potential listing, distribution or monetization of our businesses and the anticipated timing thereof; |

| • | expected trends in the industries in which each of our businesses operate, including trends relating to the growth of a particular market; |

| • | fluctuations in the availability and prices of commodities purchased by, or in competition with, our businesses; |

| • | resolutions of particular litigation and/or regulatory proceedings; |

| • | with respect to IC Power: |

| • | the sale of Edegel; |

| • | the cost and expected timing of completion of existing construction projects and the anticipated business results of such projects; |

| • | the ability to finance existing, and to source and finance new, development and acquisition projects; |

| • | its ability to source and enter into long-term power purchase agreements, or PPAs and turnkey agreements and the amounts to be paid under such agreements; |

| • | expected increased demand in the Peruvian power generation industry and other markets where we currently operate or may operate in the future; and |

| • | the potential nationalization of operating assets; |

8

Table of Contents

| • | with respect to Qoros: |

| • | the acceptance of Qoros’ vehicle models by its targeted Chinese consumers; |

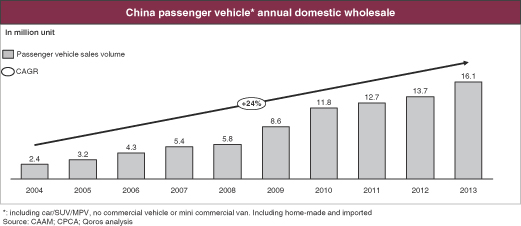

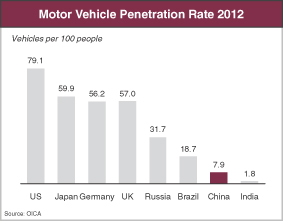

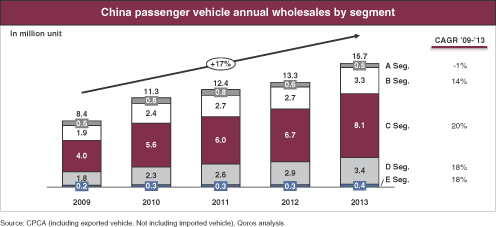

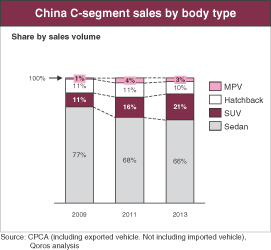

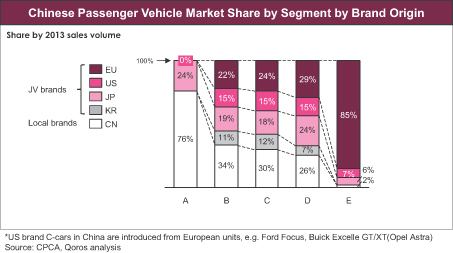

| • | growth in the Chinese passenger vehicle market, particularly within the C-segment market; |

| • | development of a competitive vehicle platform; |

| • | continued development of an effective dealer network; |

| • | Qoros’ ability to expand its commercial operation, including with respect to its development of aftersales and customer services; |

| • | Qoros’ ability to secure third-party debt financing to support its operational expansion and development; |

| • | Qoros’ ability to increase its production capacity and expected costs; |

| • | Qoros’ ability to efficiently launch new models, using its existing platform to the extent that demand for its vehicles increases; and |

| • | Qoros’ ability to secure the necessary government approvals and permits required for its continued manufacturing and/or facility expansions; |

| • | with respect to ZIM: |

| • | the assumptions used in its impairment analysis, including with respect to expected fuel price, freight rates, and WAC trends; |

| • | modifications with respect to its operating fleet and lines, including the leasing of larger vessels within certain trade zones; |

| • | completion of the expansion of the Panama canal; |

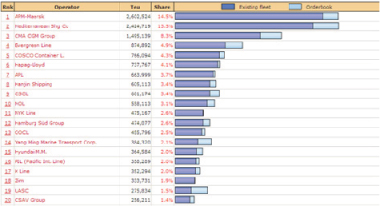

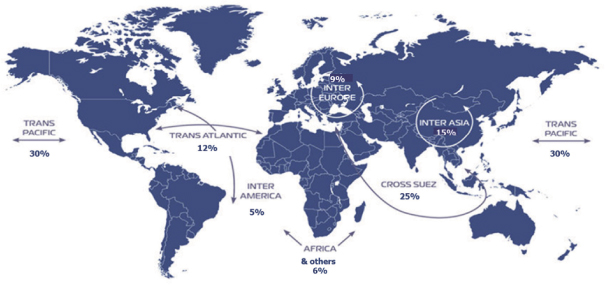

| • | expected growth in the container shipping industry, generally, and in certain trade zones, in particular; |

| • | ability to enter into, and benefit from, cooperative operational agreements and alliances with other liners companies; and |

| • | trends related to the global container shipping industry, including with respect to fluctuations in container supply, demand, and charter/freights rates; |

| • | with respect to Tower: |

| • | Tower’s ability to promote and fund its growth plan and the ramp-up of its businesses; |

| • | Tower’s ability to maintain its technological and manufacturing capacity and capabilities; |

| • | the maintenance of high utilization rates in each of its manufacturing facilities; |

| • | fulfillment of its debt obligations and other liabilities; and |

| • | Tower’s ability to finance its operations via cash flow from operations and/or financing transactions; |

| • | with respect to our renewable energy businesses: |

| • | the increased acceptance of alternative fuels and renewable energy technologies and processes; |

| • | the continued relatively low pricing of material alternative fuel inputs (e.g., natural gas, used cooking oil and other types of waste oils and fats) as compared to material traditional fuel inputs (e.g., petroleum, crude oil, or diesel); |

| • | their individual ability to effectively respond to changes in applicable government regulations and standards; |

| • | the continued relatively low price of alternative fuels (e.g., high-octane gasoline or biodiesel) as compared to traditional fuels (e.g., petroleum-derived gasoline, jet fuel, or petrodiesel); |

| • | subsidies provided by national and local governments to incentivize the production and/or sale of renewable energy products; |

| • | their ability to source third party financing to support their operational expansions and development efforts; and |

| • | their ability to continue to develop technologies and processes for commercialization. |

9

Table of Contents

The preceding list is not intended to be an exhaustive list of each of our forward-looking statements. The forward-looking statements are based on our beliefs, assumptions and expectations of future performance, taking into account the information currently available to us and are only predictions based upon our current expectations and projections about future events. There are important factors that could cause our actual results, level of activity, performance or achievements to differ materially from the results, level of activity, performance or achievements expressed or implied by these forward-looking statements which are set forth in “Item 3D. Risk Factors.” Given these risks and uncertainties, you should not place undue reliance on forward-looking statements as a prediction of actual results.

Except as required by law, we undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. The foregoing factors that could cause our actual results to differ materially from those contemplated in any forward-looking statement included in this registration statement should not be construed as exhaustive. You should read this registration statement, and each of the documents filed as exhibits to the registration statement, completely, with this cautionary note in mind, and with the understanding that our actual future results may be materially different from what we expect.

10

Table of Contents

PART I

ITEM 1. Identity of Directors, Senior Management and Advisers

| A. | Directors and Senior Management |

For information on our directors and senior management, see “Item 6A. Directors and Senior Management.”

| B. | Advisers |

Not applicable.

| C. | Auditors |

For information on our auditors, see “Item 10G. Statement by Experts.”

ITEM 2. Offer Statistics and Expected Timetable

Not applicable.

| A. | Selected Financial Data |

The following tables set forth our selected combined carve-out financial and other data. This information should be read in conjunction with our combined carve-out financial statements, and the notes thereto, as of December 31, 2013 and 2012 and January 1, 2012 and for the years ended December 31, 2013 and 2012, included elsewhere in this registration statement, the information contained in “Item 5. Operating and Financial Review and Prospects” and “Item 3D. Risk Factors.” The historical financial and other data included here and elsewhere in this registration statement should not be assumed to be indicative of our future financial condition or results of operations.

Our financial statements presented in this registration statement are combined carve-out financial statements and have been prepared in accordance with IFRS as issued by the IASB. The assumptions used in the preparation of the selected financial data for 2009, 2010 and 2011 set forth below are the same as those used in the preparation of the audited financial statements for 2012 and 2013 as described in Note 1 to the combined carve-out financial statements included elsewhere in this registration statement.

11

Table of Contents

The financial information below also includes certain non-IFRS measures used by us to evaluate our economic and financial performance. These measures are not identified as accounting measures under IFRS and therefore should not be considered as an alternative measure to evaluate our performance.

| Year Ended December 31, | ||||||||||||||||||||

| 2013 | 2012 | 2011 | 20101 | 20091 | ||||||||||||||||

| (in millions of USD) | ||||||||||||||||||||

| Consolidated Statements of Income |

||||||||||||||||||||

| Revenues |

$ | 4,812 | $ | 4,751 | $ | 4,507 | $ | 4,139 | $ | 2,776 | ||||||||||

| Cost of sales and services |

4,385 | 4,360 | 4,324 | 3,622 | 3,081 | |||||||||||||||

| Depreciation |

218 | 208 | 205 | 179 | 155 | |||||||||||||||

| Derecognition of payment on account of vessels |

72 | 133 | — | — | — | |||||||||||||||

| Gross profit (loss) |

$ | 137 | $ | 50 | $ | (22 | ) | $ | 338 | $ | (460 | ) | ||||||||

| Selling, general and administrative expenses |

235 | 221 | 225 | 197 | 198 | |||||||||||||||

| Other expenses |

38 | 6 | 15 | 27 | 58 | |||||||||||||||

| Other income |

(84 | ) | (52 | ) | (93 | ) | (181 | ) | (98 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Operating income (loss) |

$ | (52 | ) | $ | (125 | ) | $ | (169 | ) | $ | 295 | $ | (618 | ) | ||||||

| Financing expenses |

384 | 238 | 203 | 200 | 141 | |||||||||||||||

| Financing income |

(7 | ) | (6 | ) | (47 | ) | (52 | ) | (301 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Financing expenses, net |

$ | 377 | $ | 232 | $ | 156 | $ | 148 | $ | (160 | ) | |||||||||

| Share in income (loss) from associates, net of tax |

(117 | ) | (43 | ) | (27 | ) | (15 | ) | (37 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Profit (loss) before taxes on income |

$ | (546 | ) | $ | (400 | ) | $ | (352 | ) | $ | 132 | $ | (495 | ) | ||||||

| Tax (expenses) benefit |

(63 | ) | (40 | ) | (37 | ) | (38 | ) | 62 | |||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Income/Loss for the year |

$ | (609 | ) | $ | (440 | ) | $ | (389 | ) | $ | 94 | $ | (433 | ) | ||||||

| Attributable to: |

||||||||||||||||||||

| Kenon’s shareholders |

$ | (626 | ) | $ | (452 | ) | $ | (407 | ) | $ | 77 | $ | (436 | ) | ||||||

| Non-controlling interests |

17 | 12 | 18 | 17 | 3 | |||||||||||||||

| Contributions to Kenon’s Income (Loss) for the Year2 |

||||||||||||||||||||

| IC Power |

$ | 66 | $ | 57 | $ | 60 | 3 | $ | 43 | $ | 59 | 4 | ||||||||

| Qoros |

(127 | ) | (54 | ) | (54 | ) | (39 | ) | (6 | ) | ||||||||||

| ZIM |

(533 | ) | (432 | ) | (395 | ) | 54 | (428 | ) | |||||||||||

| Tower |

(27 | ) | (21 | ) | (8 | ) | (15 | ) | (45 | ) | ||||||||||

| Other5 |

(5 | ) | (2 | ) | (10 | ) | 34 | (16 | ) | |||||||||||

| Combined Balance Sheet Data |

||||||||||||||||||||

| Cash and cash equivalents |

$ | 671 | $ | 414 | $ | 439 | $ | 614 | $ | 220 | ||||||||||

| Short-term investments and deposits |

30 | 89 | 175 | 144 | 50 | |||||||||||||||

| Trade receivables |

358 | 323 | 286 | 318 | 229 | |||||||||||||||

| Other receivables and debt balances |

98 | 83 | 93 | 76 | 123 | |||||||||||||||

| Income tax receivable |

7 | 15 | 8 | 15 | — | |||||||||||||||

| Inventories |

150 | 174 | 161 | 128 | 127 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total current assets |

$ | 1,314 | $ | 1,098 | $ | 1,162 | $ | 1,295 | $ | 749 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total long-term assets |

4,670 | 4,880 | 4,839 | 4,381 | 3,983 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total assets |

$ | 5,984 | $ | 5,978 | $ | 6,001 | $ | 5,676 | $ | 4,732 | ||||||||||

| Total current liabilities |

$ | 2,920 | $ | 1,173 | $ | 2,666 | $ | 950 | $ | 734 | ||||||||||

| Total non-current liabilities |

$ | 2,112 | $ | 3,357 | $ | 1,756 | $ | 2,903 | $ | 2,575 | ||||||||||

| Parent company investment |

714 | 1,213 | 1,401 | 1,666 | $ | 1,239 | ||||||||||||||

| Total parent company investment and non-controlling interests |

$ | 952 | $ | 1,448 | $ | 1,579 | $ | 1,823 | $ | 1,423 | ||||||||||

| Total liabilities and parent company investment and non-controlling interests |

$ | 5,984 | $ | 5,978 | $ | 6,001 | $ | 5,676 | $ | 4,732 | ||||||||||

| Combined Cash Flow Data |

||||||||||||||||||||

| Cash flows from operating activities |

$ | 257 | $ | 169 | $ | 130 | $ | 446 | $ | (374 | ) | |||||||||

| Cash flows from investing activities |

(278 | ) | (318 | ) | (575 | ) | (338 | ) | (46 | ) | ||||||||||

| Cash flows from financing activities |

282 | 119 | 269 | 322 | 345 | |||||||||||||||

| Net change in cash in period |

261 | (30 | ) | (176 | ) | 430 | (75 | ) | ||||||||||||

|

|

||||||||||||||||||||

| 1. | IC Power was organized in March 2010. IC Power’s primary main subsidiaries are Inkia, the holding company for IC Power’s operations in Latin America and the Caribbean, and OPC, IC Power’s operating company in Israel. Financial data for 2009 and 2010, up to the date of formation of IC Power, are results of Inkia. |

| 2. | Net income attributable to Kenon shareholders for each segment and associated company set forth in the table. |

12

Table of Contents

| 3. | Includes $24 million of pre-tax recognition of negative goodwill. |

| 4. | Includes recognition of capital gains of $35 million pre-tax. |

| 5. | Includes intercompany finance income, Kenon’s general and administrative expenses, as well as the results of Primus and Petrotec. |

Information on Business Segments

Kenon is a holding company of (i) IC Power, (ii) certain renewable energy businesses (Primus, Petrotec and HelioFocus), (iii) a 50% interest in Qoros, (iv) a 32% interest in ZIM and (v) a 31.1% stake in Tower. Kenon’s segments are IC Power, ZIM, Qoros and Other, which includes the consolidated results of Primus and Petrotec. The results of Qoros, Tower, HelioFocus and certain non-controlling interests held by IC Power are reflected in our statement of income as share in income (loss) from associates. The following table sets forth selected financial data for Kenon’s reportable segments for the periods presented:

| Year Ended December 31, 2013(1) | ||||||||||||||||||||||||

| IC Power | ZIM | Qoros | Other2 | Adjustments3 | Combined Carve-Out Results |

|||||||||||||||||||

| (in millions of USD, unless otherwise indicated) | ||||||||||||||||||||||||

| Revenue |

$ | 866 | $ | 3,682 | $ | 2 | $ | 257 | $ | 5 | $ | 4,812 | ||||||||||||

| Depreciation and amortization |

(75 | ) | (238 | )4 | 7 | (5 | ) | 7 | (318 | ) | ||||||||||||||

| Financing income |

5 | 3 | (3 | ) | 31 | (35 | ) | 7 | ||||||||||||||||

| Financing expenses |

(86 | ) | (330 | ) | 5 | — | (37 | ) | (384 | ) | ||||||||||||||

| Share in income (loss) from associated companies |

32 | 10 | — | (159 | ) | — | (117 | ) | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Income (loss) before taxes |

$ | 123 | $ | (507 | ) | (255 | ) | $ | (162 | ) | $ | 255 | $ | (546 | ) | |||||||||

| Tax expense (benefit) on income |

42 | 23 | — | (2 | ) | — | $ | 63 | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Income (loss) for the year |

$ | 81 | $ | (530 | ) | $ | (255 | ) | $ | (160 | ) | $ | 255 | $ | (609 | ) | ||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Attributable to: |

||||||||||||||||||||||||

| Kenon’s shareholders |

66 | (535 | ) | — | (157 | ) | — | (626 | ) | |||||||||||||||

| Non-controlling interests |

15 | 5 | — | (3 | ) | — | 17 | |||||||||||||||||

| Segment assets5 |

$ | 2,749 | $ | 2,591 | $ | 1,531 | $ | 1,240 | $ | (2,667 | ) | $ | 5,444 | |||||||||||

| Investments in associated companies |

286 | 11 | — | 243 | — | 540 | ||||||||||||||||||

| Segment liabilities |

2,237 | 3,180 | 1,127 | 751 | (2,263 | ) | 5,032 | |||||||||||||||||

| Capital expenditure |

351 | 20 | 692 | — | (692 | ) | 371 | |||||||||||||||||

| EBITDA |

$ | 247 | 6 | $ | 48 | 7 | $ | (246 | )(8) | $ | (29 | )9 | $ | 246 | $ | 266 | ||||||||

| Percentage of combined revenues |

18 | % | 77 | % | — | 5 | % | — | 100 | % | ||||||||||||||

| Percentage of combined assets |

51 | % | 43 | % | — | 6 | % | — | 100 | % | ||||||||||||||

| Percentage of combined assets excluding associated companies |

51 | % | 48 | % | — | 1 | % | — | 100 | % | ||||||||||||||

| Percentage of combined EBITDA |

93 | % | 18 | % | — | (11 | )% | — | 100 | % | ||||||||||||||

|

|

||||||||||||||||||||||||

| 1. | Includes ZIM’s consolidated results as a result of IC’s previous 99.7% interest in ZIM. In future periods, however, as a result of IC’s reduced equity interest in ZIM to 32% in July 2014, we will no longer consolidate ZIM’s results of operations and, instead, will present ZIM’s results as a share in income (loss) from associates. |

| 2. | Includes financing income from parent company loans to Kenon’s subsidiaries, holding company general and administrative expenses, as well as the results of Primus and Petrotec. |

| 3. | “Adjustments” includes inter-segment sales and the consolidation entries. For the purposes of calculating the “percentage of combined assets” and the “percentage of combined assets excluding associated companies,” “Adjustments” has been combined with “Other.” |

| 4. | In the case of ZIM, includes the derecognition of payments on account of vessels of $72 million. |

| 5. | Excludes investment in associates. |

| 6. | For IC Power’s definition of EBITDA and a reconciliation of IC Power’s net income to its EBITDA, see “– Information on Business Segments – IC Power.” |

| 7. | For ZIM’s definition of EBITDA and a reconciliation of ZIM’s net income to its EBITDA, see “– Information on Business Segments – ZIM.” |

| 8. | With respect to Qoros, Kenon defines “EBITDA” for each period as income (loss) for the year before finance expenses (net), depreciation and amortization, and income tax expense, excluding share in income (loss) of associated companies. EBITDA is not recognized under IFRS or any other generally accepted accounting principles as a measure of financial performance and should not be considered as a substitute for net income or loss, cash flow from operations or other measures of operating performance or liquidity determined in accordance with IFRS. EBITDA is not intended to represent funds available for dividends or other discretionary uses by us because those funds are required for debt service, capital expenditures, working capital and other commitments and contingencies. EBITDA presents limitations that impair its use as a measure of our profitability since it does not take into consideration certain costs and expenses that result from our business that could have a significant effect on our net income, such as financial expenses, taxes, depreciation, capital expenses and other related charges. The following table sets forth a reconciliation of Qoros’ income (loss) to its EBITDA for the periods presented. Other companies may calculate EBITDA differently, and therefore this presentation of EBITDA may not be comparable to other similarly titled measures used by other companies. |

13

Table of Contents

| For the Year Ended December 31, |

||||||||

| 2013 | 2012 | |||||||

| (in millions of USD) | ||||||||

| Income (loss) for the year |

$ | (255 | ) | $ | (108 | ) | ||

| Finance expenses (net) |

2 | (6 | ) | |||||

| Depreciation and amortization |

7 | 3 | ||||||

| Income tax expense |

— | — | ||||||

| Share in (income) loss from associated companies |

— | — | ||||||

| EBITDA |

$(246) | $ | (111 | ) | ||||

|

|

|

|

|

|||||

| 9. | With respect to its “Other” reporting segment, Kenon defines “EBITDA” for each period as income (loss) for the year before finance expenses (net), depreciation and amortization, and income tax expense, excluding share in income (loss) of associated companies. EBITDA is not recognized under IFRS or any other generally accepted accounting principles as a measure of financial performance and should not be considered as a substitute for net income or loss, cash flow from operations or other measures of operating performance or liquidity determined in accordance with IFRS. EBITDA is not intended to represent funds available for dividends or other discretionary uses by us because those funds are required for debt service, capital expenditures, working capital and other commitments and contingencies. EBITDA presents limitations that impair its use as a measure of our profitability since it does not take into consideration certain costs and expenses that result from our business that could have a significant effect on our net income, such as financial expenses, taxes, depreciation, capital expenses and other related charges. The following table sets forth a reconciliation of our “Other” reporting segment’s income (loss) to its EBITDA for the periods presented. Other companies may calculate EBITDA differently, and therefore this presentation of EBITDA may not be comparable to other similarly titled measures used by other companies. |

| Year Ended December 31, | ||||||||

| 2013 | 2012 | |||||||

| (in millions of USD) | ||||||||

| Income (loss) for the year |

$ | (160 | ) | $ | (79 | ) | ||

| Finance expenses (net) |

(31 | ) | (24 | ) | ||||

| Depreciation and amortization |

5 | 4 | ||||||

| Income tax expense |

(2 | ) | — | |||||

| Share in (income) loss from associates |

159 | 85 | ||||||

|

|

|

|

|

|||||

| EBITDA |

$ | (29 | ) | $ | (14 | ) | ||

|

|

|

|

|

|||||

| Year Ended December 31, 20121 | ||||||||||||||||||||||||

| IC Power | ZIM | Qoros | Other2 | Adjustments3 | Combined Carve-Out Results |

|||||||||||||||||||

| (in millions of USD) | ||||||||||||||||||||||||

| Revenue |

$ | 576 | $ | 3,960 | — | $ | 215 | — | $ | 4,751 | ||||||||||||||

| Depreciation and amortization |

(55 | ) | (314 | )4 | 3 | (4 | ) | (3 | ) | (373 | ) | |||||||||||||

| Financing income |

5 | 3 | (6 | ) | 24 | 32 | 6 | |||||||||||||||||

| Financing expenses |

(50 | ) | (214 | ) | — | — | (26 | ) | (238 | ) | ||||||||||||||

| Share in income (loss) from associated companies |

33 | 9 | — | (85 | ) | — | (43 | ) | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Income (loss) before taxes |

$ | 87 | $ | (408 | ) | $ | (108 | ) | $ | (79 | ) | $ | 108 | $ | (400 | ) | ||||||||

| Tax expenses (benefit) on income |

21 | 19 | — | — | — | 40 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Income (loss) for the year |

$ | 66 | $ | (427 | ) | $ | (108 | ) | $ | (79 | ) | $ | 108 | $ | (440 | ) | ||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Attributable to: |

||||||||||||||||||||||||

| Kenon’s shareholders |

57 | (433 | ) | — | (76 | ) | — | (452 | ) | |||||||||||||||

| Non-controlling interests |

9 | 6 | — | (3 | ) | — | 12 | |||||||||||||||||

| Segment assets5 |

$ | 2,145 | $ | 3,142 | $ | 786 | $ | 1,073 | $ | (1,745 | ) | $ | 5,401 | |||||||||||

| Investments in associated companies |

312 | 18 | — | 247 | — | 577 | ||||||||||||||||||

| Segment liabilities |

1,709 | 3,186 | 420 | 594 | (1,379 | ) | 4,530 | |||||||||||||||||

| Capital expenditures |

391 | 42 | 350 | — | 359 | 433 | ||||||||||||||||||

| EBITDA |

$ | 154 | 6 | $ | 108 | 7 | $ | (111 | )8 | $ | (14 | )9 | $ | 111 | $ | 248 | ||||||||

| Percentage of Combined Revenues |

13 | % | 82 | % | — | 6 | % | — | 100 | % | ||||||||||||||

| Percentage of Combined Assets |

41 | % | 53 | % | — | 6 | % | — | 100 | % | ||||||||||||||

| Percentage of combined assets excluding associated companies |

40 | % | 58 | % | — | 2 | % | — | 100 | % | ||||||||||||||

| Percentage of Combined EBITDA |

62 | % | 44 | % | — | (6 | )% | — | 100 | % | ||||||||||||||

|

|

||||||||||||||||||||||||

| 1. | Includes ZIM’s consolidated results as a result of IC’s previous 99.7% interest in ZIM. In future periods, however as a result of IC’s reduced equity interest in ZIM to 32% in July 2014, we will no longer consolidate ZIM’s results of operations and, instead, will present ZIM’s results as a share in income (loss) from associates. |

14

Table of Contents

| 2. | Includes financing income from parent company loans to Kenon’s subsidiaries, holding company general and administrative expenses, as well as the results of Primus and Petrotec. |

| 3. | “Adjustments” includes the consolidation entries. For the purposes of calculating the “percentage of combined assets” and the “percentage of combined assets excluding associated companies,” “Adjustments” has been combined with “Other.” |

| 4. | In the case of ZIM, includes the derecognition of payments on account of vessels of $133 million. |

| 5. | Excludes investment in associates. |

| 6. | For a reconciliation of IC Power’s net income to its EBITDA, see “– Information on Business Segments – IC Power.” |

| 7. | For a reconciliation of ZIM’s net income to its EBITDA, see “– Information on Business Segments – ZIM.” |

| 8. | For a reconciliation of Qoros’ income (loss) to its EBITDA, see the footnote to the preceding table. |

| 9. | For a reconciliation of our “Other” reporting segment’s income (loss) to its EBITDA, see the footnote to the preceding table. |

The following tables set forth other financial and key operating data for IC Power and ZIM for the periods presented:

IC Power

| Year Ended December 31, | ||||||||

| 2013 | 2012 | |||||||

| (in millions of USD, except as indicated) | ||||||||

| EBITDA1 |

$ | 247 | $ | 154 | ||||

| Proportionate EBITDA1 |

265 | 192 | ||||||

| Net Debt2 |

1,143 | 1,001 | ||||||

| Proportionate Net Debt2 |

1,004 | 886 | ||||||

| Effective proportionate capacity of operating companies and associated companies at end of year (MW), including proportionate capacity of Edegel3 |

1,984 | 1,574 | ||||||

| Effective proportionate capacity of operating companies and associated companies at end of year (MW) excluding proportionate capacity of Edegel3 |

1,658 | 1,248 | ||||||

| Weighted average availability during the period (%) |

95 | % | 93 | % | ||||

|

|

||||||||

| 1. | IC Power defines “EBITDA” for each period as income (loss) for the year before finance income and expenses, depreciation and amortization and income tax expense of IC Power and its consolidated subsidiaries, excluding share in profit of associated companies. |

IC Power defines “Proportionate EBITDA” for each period as EBITDA, adjusted to exclude income recognized from recognition of negative goodwill and capital gains, minus proportionate share in EBITDA attributable to minority interests held by third parties in IC Power’s consolidated subsidiaries plus proportionate share in EBITDA from any associated companies in which IC Power owns a minority interest.

15

Table of Contents

EBITDA and Proportionate EBITDA are not recognized under IFRS or any other generally accepted accounting principles as measures of financial performance and should not be considered as a substitute for net income or loss, cash flow from operations or other measures of operating performance or liquidity determined in accordance with IFRS. EBITDA and Proportionate EBITDA are not intended to represent funds available for dividends or other discretionary uses by IC Power because those funds are required for debt service, capital expenditures, working capital and other commitments and contingencies. EBITDA and Proportionate EBITDA present limitations that impair their use as a measure of IC Power’s profitability since they do not take into consideration certain costs and expenses that result from IC Power’s business that could have a significant effect on IC Power’s net income, such as financial expenses, taxes, depreciation, capital expenses and other related charges. The following table sets forth a reconciliation of IC Power’s income to its EBITDA and its Proportionate EBITDA for the periods presented. Other companies may calculate EBITDA and Proportionate EBITDA differently, and therefore this presentation of EBITDA and Proportionate EBITDA may not be comparable to other similarly titled measures used by other companies:

| Year Ended December 31, | ||||||||||||||||||||||||

| 2013 | 2012 | 2011 | 2010(1) | 2009(1) | 2008(1) | |||||||||||||||||||

| (in millions of USD, unless otherwise indicated) | ||||||||||||||||||||||||

| Income for the year |

$ | 81 | $ | 66 | $ | 73 | $ | 56 | $ | 66 | $ | (4) | ||||||||||||

| Depreciation and amortization |

75 | 55 | 41 | 35 | 26 | 20 | ||||||||||||||||||

| Finance expenses (net) |

81 | 45 | 37 | 29 | 20 | 29 | ||||||||||||||||||

| Income tax expense |

42 | 21 | 18 | 13 | 9 | 8 | ||||||||||||||||||

| Share in income from associates |

(32 | ) | (33 | ) | (25 | ) | (20) | (21) | (12) | |||||||||||||||

| EBITDA |

$ | 247 | $ | 154 | $ | 144 | $ | 113 | $ | 100 | $ | 41 | ||||||||||||

| minus recognized negative goodwill |

(1 | ) | — | (24 | ) | — | — | — | ||||||||||||||||

| minus capital gains |

— | — | — | — | (35) | — | ||||||||||||||||||

| minus share in EBITDA attributable to minority interests held by third parties in IC Power subsidiaries |

(50 | ) | (28 | ) | (22) | (20) | (6) | (3) | ||||||||||||||||

| plus proportionate share in EBITDA from associated companies in which IC Power owns a minority interest(2) |

69 | 66 | 62 | 38 | 33 | 29 | ||||||||||||||||||

| Proportionate EBITDA |

265 | 192 | 160 | 131 | 92 | 67 | ||||||||||||||||||

|

|

||||||||||||||||||||||||

| (1) IC Power was organized in March 2010. Results for 2008, 2009 and 2010, are the results of Inkia. (2) Includes pro rata share of depreciation, interest expense and tax provision adjustments for unconsolidated entities in which IC Power owns a minority interest.

We are presenting a reconciliation of income to EBITDA for IC Power for 2008 through 2013 as we present elsewhere in this registration statement the CAGR in our EBITDA from 2008 through 2013. |

| |||||||||||||||||||||||

| 2. | Proportionate net debt is calculated as total debt, excluding debt from parent, minus cash, minus debt attributable to minority interests held by third parties in IC Power’s subsidiaries (i.e., net debt of each such subsidiary multiplied by the percentage owned by third parties in such subsidiary) plus IC Power’s proportionate share of debt of associated companies in which IC Power owns a minority interest (i.e., net debt of associated companies multiplied by IC Power’s ownership interest). Net debt and proportionate net debt are not measures recognized under IFRS. The table below sets forth a reconciliation of total debt to net debt and proportionate net debt. |

| Year Ended December 31, | ||||||||

| 2013 | 2012 | |||||||

| (in millions of USD, except as indicated) | ||||||||

| Total debt(1) |

$ | 1,669 | $ | 1,266 | ||||

| Cash(2) |

526 | 265 | ||||||

| Net debt |

1,143 | 1,001 | ||||||

| minus net Debt attributable to minority interests held by third parties in IC Power subsidiaries |

(188 | ) | (169 | ) | ||||

| plus IC Power’s proportionate share of net debt of associated companies in which it owns a minority interest |

49 | 54 | ||||||

| Proportionate net debt |

$ | 1,004 | $ | 886 | ||||

|

|

||||||||

| (1) Total debt comprises loans from banks and debentures from third parties and includes long term and short term debt. (2) Includes short-term deposits and restricted cash of $9 and $81 million at December 31, 2013 and 2012, respectively. |

| |||||||

| 3. | IC Power has entered into an agreement to sell its 21% indirect equity interest in Edegel. The transaction has not yet been completed and is subject to regulatory approval. |

16

Table of Contents

ZIM

| Year Ended December 31, | ||||||||

| 2013 | 2012 | |||||||

| (in millions of USD, except as indicated) | ||||||||

| Other Financial Data |

||||||||

| EBITDA1 |

$ | 48 | $ | 108 | ||||

| Key Operating Data |

||||||||

| Number of vessels owned (including partially-owned) or chartered |

89 | 92 | ||||||

| Aggregate carrying capacity (in TEU) |

346,311 | 361,263 | ||||||

| Aggregate TEUs shipped |

2,519 | 2,407 | ||||||

| Average freight rate/TEU |

$ | 1,227 | $ | 1,342 | ||||

|

|

||||||||

| 1. ZIM defines “EBITDA” for each period as income (loss) for the year before finance expense, net, depreciation, amortization and loss due to derecognition of payments on account of vessels, and income tax expense, excluding share in profit of associated companies. EBITDA is not recognized under IFRS or any other generally accepted accounting principles as a measure of financial performance and should not be considered as a substitute for net income or loss, cash flow from operations or other measures of operating performance or liquidity determined in accordance with IFRS. EBITDA is not intended to represent funds available for dividends or other discretionary uses by ZIM because those funds are required for debt service, capital expenditures, working capital and other commitments and contingencies. EBITDA presents limitations that impair its use as a measure of ZIM’s profitability since it does not take into consideration certain costs and expenses that result from ZIM’s business that could have a significant effect on ZIM’s net income, such as financial expenses, taxes, depreciation, capital expenses and other related charges. The following table sets forth a reconciliation of ZIM’s income (loss) to its EBITDA for the periods presented. Other companies may calculate EBITDA differently, and therefore this presentation of EBITDA may not be comparable to other similarly titled measures used by other companies: |

| |||||||

| Year Ended December 31, | ||||||||

| 2013 | 2012 | |||||||

| (in millions of USD, unless otherwise indicated) |

||||||||

| Loss for the year |

$ | (530 | ) | $ | (427 | ) | ||

| Depreciation and amortization |

238 | 314 | ||||||

| Finance expense (net) |

327 | 211 | ||||||

| Income tax expense |

23 | 19 | ||||||

| Share in (income) loss from associates |

(10 | ) | (9 | ) | ||||

| EBITDA |

$ | 48 | $ | 108 | ||||

17

Table of Contents

Unaudited Pro Forma Financial Information

On July 16, 2014, ZIM completed its financial restructuring, reducing ZIM’s outstanding indebtedness and liabilities (face value, including future off-balance sheet commitments such as operational leases) from approximately $3.4 billion to a remaining balance of approximately $2 billion. As a result, ZIM is not in default under any of its loans or outstanding liabilities and the lenders under ZIM’s loans no longer have the right to demand ZIM’s immediate repayment of such indebtedness. Additionally, as of July 31, 2014, ZIM was in compliance with its minimum liquidity covenant of $125 million. In connection with the completion of ZIM’s restructuring plan, ZIM also postponed certain of its maturity dates and reduced certain of its charter rates. As part of ZIM’s restructuring, IC invested $200 million in ZIM’s capital structure and ICs’ ownership of ZIM (which will be contributed to Kenon) was reduced to 32% of ZIM’s outstanding shares. In addition, IC waived all of ZIM’s current debts owed to it, which were subordinated debts of approximately $240 million, and IC undertook to provide a credit line to ZIM in the amount of $50 million, bearing market interest rate for a period of two years from the date of the completion of the restructuring. For further information on the terms of ZIM’s restructuring plan, see “Item 5B. Liquidity and Capital Resources – ZIM’s Liquidity and Capital Resources – ZIM’s Restructuring Plan.”

The following unaudited pro forma condensed combined carve-out financial statements are presented to illustrate the effects of ZIM’s restructuring. The unaudited pro forma statement of financial position as of December 31, 2013 illustrates the estimated effects of the restructuring on Kenon’s condensed consolidated statements of financial position, as if the restructuring had occurred on December 31, 2013. The unaudited pro forma income statements for the years ended December 31, 2013 and December 31, 2012 set forth the estimated effects of the restructuring on Kenon’s condensed combined carve-out statements of income, as if the restructuring had occurred in its entirety on January 1, 2012.

The unaudited pro forma financial statements are presented for informational purposes only and do not purport to present what Kenon’s actual results would have been had the restructuring occurred on the dates assumed, or to project Kenon’s results of operations or financial position for any future period. The pro forma financial statements include assumptions that are believed to be reasonable and represent all material information that is necessary to fairly present pro forma financial statements.

The unaudited pro forma financial statements, including the notes thereto, should be read in conjunction with Kenon’s audited combined carve-out financial statements, and the notes thereto, as of December 31, 2013 and 2012 and January 1, 2012 and for the years ended December 31, 2013 and 2012, included elsewhere in this registration statement, the information contained in “Item 5. Operating and Financial Review and Prospects” and “Item 3D. Risk Factors.”

18

Table of Contents

Kenon Holdings, Carve-out

Unaudited Pro Forma Condensed Combined Carve-out Statement of Financial Position

| December 31, 2013 | ||||||||||||||

| As Reported |

Pro Forma Adjustments |

Pro Forma |

||||||||||||

| Note |

(In millions of $) | |||||||||||||

| Current assets |

||||||||||||||

| Cash and cash equivalents |

(a) | 671 | (123 | ) | 548 | |||||||||

| Short-term investments and deposits |

(a) | 30 | (19 | ) | 11 | |||||||||

| Trade receivables |

(a) | 358 | (209 | ) | 149 | |||||||||

| Other receivables and debit balances |

(a) | 98 | (61 | ) | 37 | |||||||||

| Income tax receivable |

(a) | 7 | (7 | ) | — | |||||||||

| Inventories |

(a) | 150 | (101 | ) | 49 | |||||||||

|

|

|

|

|

|

|

|||||||||

| Total current assets |

1,314 | (520 | ) | 794 | ||||||||||

|

|

|

|

|

|

|

|||||||||

| Non-current assets |

||||||||||||||

| Investments in associated companies |

(a),(b) | 540 | 189 | 729 | ||||||||||

| Deposits, loans and other debit balances, including financial instruments |

(a) | 80 | (40 | ) | 40 | |||||||||

| Deferred taxes, net |

(a) | 28 | (1 | ) | 27 | |||||||||

| Property, plant and equipment |

(a) | 3,860 | (1,968 | ) | 1,892 | |||||||||

| Intangible assets |

(a) | 162 | (63 | ) | 99 | |||||||||

|

|

|

|

|

|

|

|||||||||

| Total non-current assets |

4,670 | (1,883 | ) | 2,787 | ||||||||||

|

|

|

|

|

|

|

|||||||||

| Total assets |

5,984 | (2,403 | ) | 3,581 | ||||||||||

|

|

|

|

|

|

|

|||||||||

19

Table of Contents

Kenon Holdings, Carve-out

Unaudited Pro Forma Condensed Combined Carve-out Statement of Financial Position

| December 31, 2013 | ||||||||||||||

| As Reported |

Pro Forma Adjustments |

Pro Forma |

||||||||||||

| Note |

(In millions of $) | |||||||||||||

| Current liabilities |

||||||||||||||

| Credit from banks and others |

(a) | 620 | (367 | ) | 253 | |||||||||

| Long-term liabilities reclassified to short-term |

(a) | 1,505 | (1,505 | ) | – | |||||||||

| Trade payables |

(a) | 532 | (407 | ) | 125 | |||||||||

| Provisions |

(a) | 29 | (29 | ) | – | |||||||||

| Other payables and credit balances, including financial derivatives |

(a) | 219 | (138 | ) | 81 | |||||||||

| Income tax payable |

15 | – | 15 | |||||||||||

|

|

|

|

|

|

|

|||||||||

| Total current liabilities |

2,920 | (2,446 | ) | 474 | ||||||||||

|

|

|

|

|

|

|

|||||||||

| Non-current liabilities |

||||||||||||||

| Loans from banks and others |

(a) | 1,288 | (463 | ) | 825 | |||||||||

| Debentures |

637 | – | 637 | |||||||||||

| Derivative instruments |

10 | – | 10 | |||||||||||

| Provisions |

6 | – | 6 | |||||||||||

| Deferred taxes, net |

(a) | 80 | (1 | ) | 79 | |||||||||

| Employee benefits |

(a) | 91 | (86 | ) | 5 | |||||||||

|

|

|

|

|

|

|

|||||||||

| Total non-current liabilities |

2,112 | (550 | ) | 1,562 | ||||||||||

|

|

|

|

|

|

|

|||||||||

| Total liabilities |

5,032 | (2,966 | ) | 2,036 | ||||||||||

|

|

|

|

|

|

|

|||||||||

| Parent company investment |

(a) |

714 | 671 | 1,385 | ||||||||||

| Non-controlling interests |

(a) | 238 | (78 | ) | 160 | |||||||||

|

|

|

|

|

|

|

|||||||||

| Total parent company investment and non-controlling interests |

952 | 593 | 1,545 | |||||||||||

|

|

|

|

|

|

|

|||||||||

| Total liabilities and parent company investment and non-controlling interests |

5,984 | (2,403 | ) | 3,581 | ||||||||||

|

|

|

|

|

|

|

|||||||||

20

Table of Contents

Kenon Holdings, Carve-out

Unaudited Pro Forma Condensed Combined Carve-out Statements of Income

| Year Ended December 31, 2013 | ||||||||||||||

| As Reported |

Pro Forma Adjustments |

Pro Forma |

||||||||||||

| Note |

(In millions of $) | |||||||||||||

| Revenues |

(a) | 4,812 | (3,682 | ) | 1,130 | |||||||||

| Cost of sales and services |

(a) | 4,385 | (3,556 | ) | 829 | |||||||||

| Depreciation |

(a) | 218 | (143 | ) | 75 | |||||||||

| Derecognition of payments on account of vessels |

(a) | 72 | (72 | ) | — | |||||||||

|

|

|

|

|

|

|

|||||||||

| Gross profit |

137 | 89 | 226 | |||||||||||

| Selling, general and administrative expenses |

(a) | 235 | (152 | ) | 83 | |||||||||

| Other expenses |

(a) | 38 | (32 | ) | 6 | |||||||||

| Other income |

(a) | (84 | ) | 78 | (6 | ) | ||||||||

|

|

|

|

|

|

|

|||||||||

| Operating income (loss) |

(52 | ) | 195 | 143 | ||||||||||

|

|

|

|

|

|

|

|||||||||

| Financing expenses |

(a) | 384 | (313 | ) | 71 | |||||||||

| Financing income |

(7 | ) | — | (7 | ) | |||||||||

|

|

|

|

|

|

|

|||||||||

| Financing expenses, net |

377 | (313 | ) | 64 | ||||||||||

|

|

|

|

|

|

|

|||||||||

| Share in income (losses) of associated companies, net of tax |

(d) |

(117 | ) | (130 | ) | (247 | ) | |||||||

|

|

|

|

|

|

|

|||||||||

| Loss before income taxes |

(546 | ) | 378 | (168 | ) | |||||||||

| Tax expenses |

(a) | (63 | ) | 23 | (40 | ) | ||||||||

|

|

|

|

|

|

|

|||||||||

| Loss for the year |

(609 | ) | 401 | (208 | ) | |||||||||

|

|

|

|

|

|

|

|||||||||

| Attributable to: |

||||||||||||||

| Kenon’s shareholders |

(626 | ) | 403 | (223 | ) | |||||||||

| Non-controlling interests |

17 | (2 | ) | 15 | ||||||||||

|

|

|

|

|

|

|

|||||||||

| Loss for the year |

(609 | ) | 401 | (208 | ) | |||||||||

|

|

|

|

|

|

|

|||||||||

21

Table of Contents

Kenon Holdings, Carve-out

Unaudited Pro Forma Condensed Combined Carve-out Statements of Income

| Year Ended December 31, 2012 | ||||||||||||||

| As Reported |

Pro Forma Adjustments |

Pro Forma |

||||||||||||

| Note |

(In millions of $) | |||||||||||||

| Revenues |

(a) | 4,751 | (3,960 | ) | 791 | |||||||||

| Cost of sales and services |

(a) | 4,360 | (3,767 | ) | 593 | |||||||||

| Depreciation |

(a) | 208 | (153 | ) | 55 | |||||||||

| Derecognition of payments on account of vessels |

(a) | 133 | (133 | ) | — | |||||||||

|

|

|

|

|

|

|

|||||||||

| Gross profit |

50 | 93 | 143 | |||||||||||

| Selling, general and administrative expenses |

(a) | 221 | (142 | ) | 79 | |||||||||

| Other expenses |

(a) | 6 | (5 | ) | 1 | |||||||||

| Other income |

(a) | (52 | ) | 34 | (18 | ) | ||||||||

|

|

|

|

|

|

|

|||||||||

| Operating income (loss) |

(125 | ) | 206 | 81 | ||||||||||

|

|

|

|

|

|

|

|||||||||

| Financing expenses |

(a) | 238 | (195 | ) | 43 | |||||||||

| Financing income |

(6 | ) | — | (6 | ) | |||||||||

|

|

|

|

|

|

|

|||||||||

| Financing expenses, net |

232 | (195 | ) | 37 | ||||||||||

|

|

|

|

|

|

|

|||||||||

| Share in income (losses) of associated companies, net of tax |

(d) |

(43 | ) | (99 | ) | (142 | ) | |||||||

|

|

|

|

|

|

|

|||||||||

| Loss before income taxes |

(400 | ) | 302 | (98 | ) | |||||||||

| Tax expenses |

(a) | (40 | ) | 19 | (21 | ) | ||||||||

|

|

|

|

|

|

|

|||||||||

| Loss for the year |

(440 | ) | 321 | (119 | ) | |||||||||

|

|

|

|

|

|

|

|||||||||

| Attributable to: |

||||||||||||||

| Kenon’s shareholders |

(452 | ) | 325 | (127 | ) | |||||||||

| Non-controlling interests |

12 | (4 | ) | 8 | ||||||||||

|

|

|

|

|

|

|

|||||||||

| Loss for the year |

(440 | ) | 321 | (119 | ) | |||||||||

|

|

|

|

|

|

|

|||||||||

22

Table of Contents

Kenon Holdings, Carve-out

Notes to Pro Forma Condensed Combined Carve-out Financial Statements

(Unaudited)

Note 1 – Basis of Presentation

On July 16, 2014, ZIM completed its financial restructuring.

Set forth below is a description of the transaction:

| A. | IC invested in ZIM’s capital an amount of $200 million. Upon the completion of the restructuring, IC now holds 32% of ZIM’s issued share capital. This investment will be transferred to Kenon as a parent company investment. |

| B. | IC waived all of ZIM’s debts to it, which were subordinated debts, in a total amount of $240 million (nominal face value). |

| C. | IC undertook to provide a credit line to ZIM in the amount of $50 million bearing market interest rate for a period of two years from the date of completion of the restructuring, against the debts of ZIM’s customers with a coverage ratio of 2:1, and, to the extent necessary, to guarantee payments to the entity which shall provide the credit line. This obligation to provide the credit line will not be transferred to Kenon. |

Upon the completion of the restructuring on July 16, 2014, IC ceased to control ZIM. IC’s derecognition of the investment in ZIM as a subsidiary and IC’s subsequent account of ZIM as an associated company will result in a gain being recorded.

As of December 31, 2013 the negative balance of IC’s investment in subsidiary (net of intercompany loans) was $471 million.

The unaudited pro forma income statements do not reflect any of the following:

1) One time gain of IC from its loss of control over ZIM and the presentation of its investment in ZIM as an associated company based upon its fair value, which is derived from the amount of IC’s investment in ZIM.