UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

for

the fiscal year ended

or

for the transition period from to .

Commission

file number:

(Exact name of registrant as specified in its charter)

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

(Address of principal executive offices) (Zip code)

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| Title of Each Class | Trading Symbol(s) | Name Of Each Exchange On Which Registered | ||

Shipping ETF |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate

by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. ☐ Yes ☒

Indicate

by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. ☐ Yes ☒

Indicate

by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange

Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2)

has been subject to such filing requirements for the past 90 days. ☒

Indicate

by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule

405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant

was required to submit such files). ☒

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ☐ | Accelerated filer ☐ |

| Smaller reporting company | |

| Emerging Growth Company |

If an emerging growth company, indicate by check mark if the registrant has elected to not use the extend transition period for complying with any new or revised financial reporting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate

by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). ☐ Yes ☒

The

aggregate market value of the registrant’s shares held by non-affiliates of the registrant as of December 31, 2020 was:

$

The

registrant had

ETF Managers Group Commodity Trust I

Table of Contents

i

Part I

Item 1. Business

The Trust and the Funds

ETF Managers Group Commodity Trust I (the “Trust”) was organized as a Delaware statutory trust on July 23, 2014. The Trust is a series trust formed pursuant to the Delaware Statutory Trust Act and currently includes one series: Breakwave Dry Bulk Shipping ETF (“BDRY,” or the “Fund”) is a commodity pool that continuously issues shares of beneficial interest that may be purchased and sold on the NYSE Arca. SIT Rising Rate ETF (“RISE”) also operated as a series of the Trust, but was liquidated on November 18, 2020 at its final net asset value as of that date.

BDRY commenced investment operations on March 22, 2018. BDRY commenced trading on the NYSE Arca on March 22, 2018 and trades under the symbol “BDRY.”

The principal office of the Trust and the Fund is located at 30 Maple Street, Suite 2, Summit, NJ 07901. The telephone number is (844) 383-6477.

The Sponsor

The Fund is managed and controlled by ETF Managers Capital LLC (the “Sponsor”), a single member limited liability company that was formed in the state of Delaware on June 12, 2014. The Fund pays the Sponsor a management fee. The Sponsor maintains its main business office at 30 Maple Street, Suite 2, Summit, NJ 07901. The Sponsor’s telephone number is (844) 383-6477.

The Fund is a “commodity pool” as defined by the Commodity Exchange Act (“CEA”). Consequently, the Sponsor has registered as a commodity pool operator (“CPO”) with the Commodity Futures Trading Commission (“CFTC”) and is a member of the National Futures Association (“NFA”).

The Sponsor is a wholly-owned subsidiary of Exchange Traded Managers Group LLC (“ETFMG”), a limited liability company domiciled and headquartered in New Jersey.

1

Breakwave Dry Bulk Shipping ETF

BDRY Investment Objective

BDRY’s investment objective is to provide investors with exposure to the daily change in the price of dry bulk freight futures by tracking the performance of a portfolio (the “BDRY Benchmark Portfolio” ) consisting of exchange-cleared futures contracts on the cost of shipping dry bulk freight (“Freight Futures”). BDRY seeks to achieve its investment objective by investing substantially all of its assets in the Freight Futures currently constituting the BDRY Benchmark Portfolio.

The BDRY Benchmark Portfolio is maintained by Breakwave Advisors LLC (“Breakwave”), which also serves as BDRY’s Commodity Trading Advisor (“CTA”). The BDRY Benchmark Portfolio is maintained by Breakwave and will be rebalanced annually.

BDRY Commodity Trading Advisor

Breakwave serves as BDRY’s CTA. Breakwave is a Delaware limited liability company.

Breakwave is registered as a CTA with the CFTC and is a member of the NFA.

Breakwave provides its services to BDRY under a Services Agreement with the Sponsor. Under this agreement, Breakwave has agreed to compose and maintain the BDRY Benchmark Portfolio and license to the Sponsor the use of the BDRY Benchmark Portfolio.

BDRY Investing Strategy

BDRY seeks to achieve its investment objective by investing substantially all of its assets in the Freight Futures currently constituting the BDRY Benchmark Portfolio. The BDRY Benchmark Portfolio will include all existing positions to maturity and settle them in cash. During any given calendar quarter, the BDRY Benchmark Portfolio will progressively increase its position to the next calendar quarter three-month strip, thus maintaining constant exposure to the Freight Futures market as positions mature.

The BDRY Benchmark Portfolio will maintain long-only positions in Freight Futures. The BDRY Benchmark Portfolio will include a combination of Capesize, Panamax and Supramax Freight Futures. More specifically, the BDRY Benchmark Portfolio will include 50% exposure in Capesize Freight Futures contracts, 40% exposure in Panamax Freight Futures contracts and 10% exposure in Supramax Freight Futures contracts. The BDRY Benchmark Portfolio will not include and BDRY will not invest in swaps, non-cleared dry bulk freight forwards or other over-the-counter derivative instruments that are not cleared through exchanges or clearing houses. BDRY may hold exchange-traded options on Freight Futures. The BDRY Benchmark Portfolio is maintained by Breakwave and will be rebalanced annually. The Freight Futures currently constituting the BDRY Benchmark Portfolio, as well as the daily holdings of BDRY will be available on BDRY’s website at www.drybulketf.com.

When establishing positions in Freight Futures, BDRY will be required to deposit initial margin with a value of approximately 10% to 40% of the notional value of each Freight Futures position at the time it is established. These margin requirements are established and subject to change from time to time by the relevant exchanges, clearing houses or BDRY’s futures commission merchant (“FCM”). On a daily basis, BDRY will be obligated to pay, or entitled to receive, variation margin in an amount equal to the change in the daily settlement level of its Freight Futures positions. Any assets not required to be posted as margin with BDRY’s FCM will generally be held at BDRY’s custodian in cash or cash equivalents, as discussed below.

BDRY will hold cash or cash equivalents such as U.S. Treasuries or other high credit quality, short-term fixed-income or similar securities for direct investment or as collateral for the U.S. Treasuries and for other liquidity purposes and to meet redemptions that may be necessary on an ongoing basis. BDRY may also realize interest income from its holdings in U.S. Treasuries or other market rate instruments.

2

BDRY Benchmark Portfolio

The BDRY Benchmark Portfolio is maintained by Breakwave, which also serves as BDRY’s CTA. The BDRY Benchmark Portfolio consists of the Freight Futures, which are a three-month strip of the nearest calendar quarter of futures contracts on specified indexes (each a “Reference Index”) that measure rates for shipping dry bulk freight. Each Reference Index is published each United Kingdom business day by the London-based Baltic Exchange Ltd. (the “Baltic Exchange”) and measures the charter rate for shipping dry bulk freight in a specific size category of cargo ship – Capesize, Panamax or Supramax. The three Reference Indexes are as follows:

| ● | Capesize: the Capesize 5TC Index; |

| ● | Panamax: the Panamax 4TC Index; and |

| ● | Supramax: the Supramax 10TC Index. |

The Freight Futures currently constituting the BDRY Benchmark Portfolio as of June 30, 2021 include:

| Name | Ticker | Market Value USD |

||||

| BALTIC EXCHANGE PANAMAX T/C AVERAGE SHIPPING ROUTE INDEX - JUL 21 | BFFAP N21 Index | $ | 16,372,965 | |||

| BALTIC EXCHANGE PANAMAX T/C AVERAGE SHIPPING ROUTE INDEX - AUG 21 | BFFAP Q21 Index | 16,231,590 | ||||

| BALTIC EXCHANGE PANAMAX T/C AVERAGE SHIPPING ROUTE INDEX - SEP 21 | BFFAP U21 Index | 15,374,205 | ||||

| BALTIC EXCHANGE SUPRAMAX T/C AVERAGE SHIPPING ROUTE INDEX - JUL 21 | S58FM N21 Index | 3,621,450 | ||||

| BALTIC EXCHANGE SUPRAMAX T/C AVERAGE SHIPPING ROUTE INDEX - AUG 21 | S58FM Q21 | 3,683,610 | ||||

| BALTIC EXCHANGE SUPRAMAX T/C AVERAGE SHIPPING ROUTE INDEX - SEP 21 | S58FM U21 | 3,427,200 | ||||

| BALTIC CAPESIZE TIME CHARTER - JUL 21 | BFFATC N21 Index | 15,947,020 | ||||

| BALTIC CAPESIZE TIME CHARTER - AUG 21 | BFFATC Q21 Index | 17,744,375 | ||||

| BALTIC CAPESIZE TIME CHARTER - SEP 21 | BFFATC U21 Index | 17,442,220 | ||||

The value of the Capesize 5TC Index is disseminated at 11:00 a.m., London Time and the value of the Panamax 4TC Index and the Supramax 10TC Index are each disseminated at 1:00 p.m., London Time. The Reference Index information disseminated by the Baltic Exchange also includes the components and value of each component in each Reference Index. Such Reference Index information also is widely disseminated by Reuters and/or other major market data vendors.

BDRY Trading Policies

Liquidity

BDRY invests principally in exchange cleared futures that, in the opinion of the Sponsor, are traded in sufficient volume to permit the ready taking of orders in these financial interests.

Leverage

The Sponsor endeavors to have the value of the Fund’s Treasury Securities, cash and cash equivalents, whether held by the Fund or posted as margin or collateral, at all times approximate the aggregate market value of its obligations under the Fund’s Freight Futures interests, adjusted for the proportion of the current month’s Freight Futures contracts whose value has already been assessed.

Borrowings

BDRY does not intend to or foresee the need to borrow money or establish lines of credit.

3

Pyramiding

BDRY does not and will not employ the technique, commonly known as pyramiding, in which the speculator uses unrealized profits on existing positions as variation margin for the purchase of additional positions in the same commodity interest.

No Distributions

The Sponsor has discretionary authority over all distributions made by BDRY. In view of BDRY’s objective of seeking significant capital appreciation, the Sponsor currently does not intend to cause BDRY to make any distributions, but, has the sole discretion to do so from time to time.

Margin Requirements and Marking-to-Market Futures Positions

“Initial margin” is an amount of funds that must be deposited by a commodity trader with the trader’s broker to initiate an open position in futures contracts. A margin deposit is like a cash performance bond. It helps assure the trader’s performance of the futures contracts that he or she purchases or sells. Futures contracts are customarily bought and sold on initial margin that represents a small percentage of the aggregate purchase or sales price of the contract. The amount of margin required in connection with a particular futures contract is set by the exchange on which the contract is traded. Brokerage firms, such as BDRY’s clearing broker, carrying accounts for traders in commodity interest contracts may require higher amounts of margin as a matter of policy to further protect themselves.

Futures contracts are marked to market at the end of each trading day and the margin required with respect to such contracts is adjusted accordingly. This process of marking-to-market is designed to prevent losses from accumulating in any futures account. Therefore, if BDRY’s futures positions have declined in value, BDRY may be required to post “variation margin” to cover this decline. Alternatively, if BDRY’s futures positions have increased in value, this increase will be credited to BDRY’s account.

Futures Contracts

The Fund enters into futures contracts to gain exposure to changes in the value of the Benchmark Portfolio. A futures contract obligates the seller to deliver (and the purchaser to accept) the future cash settlement of a specified quantity and type of a treasury futures contract at a specified time and place. The contractual obligations of a buyer or seller of a treasury futures contract may generally be satisfied by making an offsetting sale or purchase of an identical futures contract on the same or linked exchange before the designated date of delivery.

Upon entering into a futures contract, the Fund is required to deposit and maintain as collateral at least such initial margin as required by the exchange on which the transaction is affected. The initial margin is segregated as cash held by broker, as disclosed in the Statements of Assets and Liabilities, and is restricted as to its use. Pursuant to the futures contract, the Fund agrees to receive from or pay to the broker an amount of cash equal to the daily fluctuation in value of the futures contract. Such receipts or payments are known as variation margin and are recorded by the Fund as unrealized gains or losses. The Fund will realize a gain or loss upon closing a futures transaction.

Futures contracts involve, to varying degrees, elements of market risk (specifically treasury price risk) and exposure to loss in excess of the amount of variation margin. The face or contract amounts reflect the extent of the total exposure the Fund has in the particular classes of instruments. Additional risks associated with the use of futures contracts include imperfect correlation between movements in the price of the futures contracts and the market value of the underlying securities and the possibility of an illiquid market for a futures contract. With futures contracts, there is minimal counterparty risk to the Fund since futures contracts are exchange-traded and the exchange’s clearinghouse, as counterparty to all exchange-traded futures contracts, guarantees the futures contracts against default.

The Fund’s Service Providers

Administrator, Custodian, Fund Accountant, and Transfer Agent

The Fund has appointed U.S. Bank, a national banking association, with its principal office in Milwaukee, Wisconsin, as the custodian (the “Custodian”). Its affiliate, U.S. Bancorp Fund Services, is the Fund accountant (the “Fund Accountant”) of the Fund, transfer agent (the “Transfer Agent”) for the Fund’s shares and administrator for the Fund (the “Administrator”). It performs certain administrative and accounting services for the Fund and prepares certain SEC, NFA and CFTC reports on behalf of the Fund. (U.S. Bank and U.S. Bancorp Fund Services are referred to collectively hereinafter as “U.S. Bank”).

Distributor

ETFMG Financial LLC, a wholly-owned subsidiary of ETFMG (the “Distributor”), has provided statutory and wholesaling distribution services to BDRY since it commenced trading on the NYSE Arca on March 22, 2018.

4

The Fund pays the Distributor an annual fee for statutory and wholesaling distribution services and related administrative services equal to the greater of $15,000 or 0.02% of the Fund’s average daily net assets, payable monthly. Pursuant to the Marketing Agent Agreement between the Sponsor, the Fund and the Distributor, the Distributor assists the Sponsor and the Fund with certain functions and duties relating to distribution and marketing services to the Fund, including reviewing and approving marketing materials and certain regulatory compliance matters. The Distributor also assists with the processing of creation and redemption orders.

In no event will the aggregate compensation paid to the Distributor and any affiliate of the Sponsor for distribution-related services in connection with the offering of shares exceed ten percent (10%) of the gross proceeds of the offering. The Distributor’s principal business address is 30 Maple Street, Suite 2, Summit, New Jersey, 07901.

Trustee

Under the respective Amended and Restated Declaration of Trust and Trust Agreement (each, a “Trust Agreement”) for the Fund, Wilmington Trust Company, the Trustee of the Fund (the “Trustee”) serves as the sole trustee of the Fund in the State of Delaware. The Trustee will accept service of legal process on the Fund in the State of Delaware and will make certain filings under the Delaware Statutory Trust Act. Under the Trust Agreement for the Fund, the Sponsor has the exclusive management and control of all aspects of the business of the Fund. The Trustee does not owe any other duties to the Fund, the Sponsor or the Shareholders of the Fund. The Trustee has no duty or liability to supervise or monitor the performance of the Sponsor, nor does the Trustee have any liability for the acts or omissions of the Sponsor.

BDRY Futures Commission Merchant

ED&F Man Capital Inc., (“ED&F Man”) a Delaware limited liability company, serves as BDRY’s clearing broker (the “Commodity Broker”). In its capacity as clearing broker, the Commodity Broker executes and clear BDRY’s futures transactions and performs certain administrative services for the Fund. Prior to November 6, 2020, Macquarie Futures USA LLC served as BDRY’s clearing broker. ED&F Man is a futures commission merchant registered with the CFTC. BDRY pays 0.10% of nominal value in brokerage commissions and approximately $12 per lot in clearing and exchange related fees (excluding the impact on the Fund of creation and/or redemption activity).

ED&F Man’s head office is at 140 East 45th Street, #18, New York, NY 10017.

There have been no material administrative, civil or criminal actions brought, pending or concluded against ED&F Man or its principals in the past five years.

Neither ED&F Man nor any affiliate, officer, director or employee thereof have passed on the merits of the prospectus or offering, or give any guarantee as to the performance or any other aspect of BDRY.

ED & F Man is not affiliated with either BDRY or the Sponsor. Therefore, the Sponsor and BDRY do not believe that BDRY has any conflicts of interest with ED&F Man or its trading principals arising from their acting as BDRY’s FCM.

5

Legal Counsel

Sullivan & Worcester LLP serves as legal counsel to the Trust and the Fund.

Fees of the Funds

Management and CTA Fees

BDRY pays the Sponsor a management fee (the “Sponsor Fee”) in consideration of the Sponsor’s advisory services to the Fund. Additionally, BDRY pays its commodity trading advisor a license and service fee (the “CTA Fee”).

BDRY pays the Sponsor Fee, monthly in arrears, in an amount equal to the greater of 0.15% per year of BDRY’s average daily net assets, or $125,000. BDRY’s Sponsor Fee is paid in consideration of the Sponsor’s management services to BDRY. BDRY also pays Breakwave the CTA Fee monthly in arrears, for the use of BDRY’s Benchmark Portfolio in an amount equal to 1.45% per annum of BDRY’s average daily net assets.

Breakwave has agreed to waive its CTA Fee and the Sponsor has agreed to correspondingly assume the remaining expenses of BDRY so that BDRY’s expenses do not exceed an annual rate of 3.50%, excluding brokerage commissions, interest expense, and extraordinary expenses, of the value of BDRY’s average daily net assets (the “BDRY Expense Cap”). The assumption of expenses and waiver of BDRY’s CTA Fee are contractual on the part of the Sponsor and Breakwave, respectively, through September 30, 2022. If after that date, the Sponsor and/or Breakwave no longer assumed expenses or waived the CTA Fee, respectively, BDRY could be adversely impacted, including in its ability to achieve its investment objective.

The assumption of expenses by the Sponsor for BDRY, pursuant to the BDRY Expense Cap, amounted to $-0- and $284,850 for the year ended June 30, 2021 and 2020, respectively, as disclosed in the Combined Statements of Operations. The waiver of Breakwave’s CTA fees, pursuant to the undertaking, amounted to $39,184 and $60,769 for the year ended June 30, 2021 and 2020, respectively, as disclosed in the Combined Statements of Operations. BDRY currently accrues its daily expenses based upon established individual expense category amounts or the BDRY Expense Cap, whichever aggregate amount is less. At the end of each month, the accrued amount is remitted to the Sponsor as the Sponsor is responsible for the payment of the routine operational, administrative and other ordinary expenses of the Fund. BDRY’s total expenses amounted to $1,888,152 and $847,729 for the year ended June 30, 2021 and 2020, respectively.

Prior to its liquidation, RISE paid the sponsor $25,068 and $74,999 for the year ended June 30, 2021 and 2020, respectively, as disclosed in the Combined Statements of Operations.

Prior to its liquidation, RISE paid CTA fees in the amount of $3,042 and $12,445 for the year ended June 30, 2021 and 2020, respectively, as disclosed in the Combined Statements of Operations.

6

Administrator, Custodian, Fund Accountant, and Transfer Agent Fees

BDRY has agreed to pay U.S. Bank 0.05% of AUM, with a $45,000 minimum annual fee payable for its administrative, accounting and transfer agent services and 0.01% of AUM, with an annual minimum of $4,800 for custody services. BDRY paid U.S. Bank $63,796 and $61,854 for the years ended June 30, 2021 and 2020, respectively, as disclosed in the Combined Statements of Operations.

Prior to its liquidation, RISE paid U.S. Bank $19,486 and $57,601 for the year ended June 30, 2021 and 2020, respectively, as disclosed in the Combined Statements of Operations.

Distribution Fees

BDRY pays the Distributor an annual fee for statutory and wholesaling distribution services and related administrative services equal to the greater of $15,000 or 0.02% of the Fund’s average daily net assets, payable monthly. Pursuant to the Marketing Agent Agreement between the Sponsor, the Fund and the Distributor, the Distributor assists the Sponsor and the Fund with certain functions and duties relating to distribution and marketing services to the Fund, including reviewing and approving marketing materials and certain regulatory compliance matters. The Distributor also assists with the processing of creation and redemption orders. BDRY incurred $15,821 and $16,497 in distribution and related administrative services for the year ended June 30, 2021 and 2020, respectively, as disclosed in the Combined Statements of Operations.

BDRY pays the Sponsor for wholesale support services at an annual rate of $25,000 plus 0.12% of BDRY’s average daily net assets, payable monthly. The Fund incurred $78,874 and $35,622 in wholesale support fees for the year ended June 30, 2021 and 2020, respectively, as disclosed in the Combined Statements of Operations.

Prior to its liquidation, RISE paid the Distributor $5,116 and $15,539 in distribution and related administrative services for the year ended June 30, 2021 and 2020, respectively, as disclosed in the Combined Statements of Operations.

Prior to its liquidation, RISE also paid the Sponsor $1,522 and $6,223 in wholesale support fees for the year ended June 30, 2021 and 2020, respectively, as disclosed in the Combined Statements of Operations.

Futures Commission Merchant Fees

BDRY pays brokerage commissions, including applicable exchange fees, NFA fees, give–up fees, pit brokerage fees and other transaction related fees and expenses charged in connection with trading activities in CFTC regulated investments. Brokerage commissions on futures contracts are recognized on a half-turn basis.

The Sponsor does not expect brokerage commissions and fees, on an annual basis, to exceed 0.40% (excluding the impact on the Fund of creation and/or redemption activity) of the NAV of the Fund and for execution and clearing services to exceed $12 per lot on behalf of the Fund, although the actual amount of brokerage commissions and fees in any year or any part of any year may be greater. The effects of trading spreads, financing costs associated with financial instruments, and costs relating to the purchase of freight futures, Treasury Instruments or similar high credit quality short-term fixed-income or similar securities are not included in the foregoing analysis. BDRY incurred $518,616 and $208,650 in brokerage commissions and fees for the year ended June 30, 2021 and 2020, respectively, as disclosed in the Combined Statements of Operations.

Prior to its liquidation, RISE incurred $1,424 and $4,961 in brokerage commissions and fees for the year ended June 30, 2021 and 2020, respectively, as disclosed in the Combined Statements of Operations.

Other Fees

The Fund is responsible for certain other expenses, including professional services (e.g., outside auditor’s fees and legal fees and expenses), shareholder Form K-1’s, tax return preparation, regulatory compliance, and other services provided by affiliated and non-affiliated service providers. The fees for Principal Financial Officer, Chief Compliance Officer, and regulatory reporting services provided to the Fund by the Sponsor each amount to $25,000 per annum.

Extraordinary fees

The Fund pays all of its extraordinary fees and expenses, if any. Extraordinary fees and expenses are fees and expenses which are non-recurring and unusual in nature, such as legal claims and liabilities, litigation costs or indemnification or other unanticipated expenses. Such extraordinary fees and expenses, by their nature, are unpredictable in terms of timing and amount.

Form of Shares

Registered Form

Shares of the Fund are issued in registered form in accordance with the Trust Agreement for the Fund. U.S. Bank has been appointed registrar and transfer agent for the purpose of transferring shares in certificated form. U.S. Bank keeps a record of all limited partners and holders of the shares in certificated form in the registry (the “Register”). The Sponsor recognizes transfers of shares in certificated form only if done in accordance with the respective Trust Agreement for the Fund. The beneficial interests in such shares are held in book-entry form through participants and/or accountholders in the Depository Trust Company (“DTC”).

7

Book Entry

Individual certificates are not issued for the shares. Instead, shares are represented by one or more global certificates, which are deposited by the Administrator with, or on behalf of, DTC and registered in the name of Cede & Co., as nominee for DTC. The global certificates evidence all of the shares outstanding at any time. Shareholders are limited to (1) participants in DTC such as banks, brokers, dealers and trust companies (“DTC Participants”), (2) banks, brokers, dealers and trust companies who maintain, either directly or indirectly, a custodial relationship with, or clear through, a DTC Participant (“Indirect Participants”), and (3) persons holding interests in the shares through DTC Participants or Indirect Participants, in each case who satisfy the requirements for transfers of shares.

Shareholders will be shown on, and the transfer of Shares will be effected only through, in the case of DTC Participants, the records maintained by the Depository and, in the case of Indirect Participants and Shareholders holding through a DTC Participant or an Indirect participant, through those records or the records of the relevant DTC Participants or Indirect participants. Shareholders are expected to receive, from or through which the Shareholder has purchased Shares, a written confirmation relating to their purchase of Shares.

DTC

DTC is a limited purpose trust company organized under the laws of the State of New York and is a member of the Federal Reserve System, a “clearing corporation” within the meaning of the New York Uniform Commercial Code and a “clearing agency” registered pursuant to the provisions of Section 17A of the Exchange Act. DTC holds securities for DTC Participants and facilitates the clearance and settlement of transactions between DTC Participants through electronic book-entry changes in accounts of DTC Participants.

Calculating NAV

The Fund’s NAV is calculated by:

| ● | Taking the current market value of its total assets; |

| ● | Subtracting any liabilities; and |

| ● | Dividing that total by the total number of outstanding shares. |

The Administrator calculates the NAV of the Fund once each NYSE Arca trading day. The NAV for a particular trading day is released after 4:00 p.m. E.T. Regular trading on the NYSE Arca typically closes at 4:00 p.m. E.T. The Administrator uses the Baltic Exchange settlement price for the Freight Futures and option contracts. The Administrator calculates or determines the value of all other Fund investments using market quotations, if available, or other information customarily used to determine the fair value of such investments as of the close of the NYSE Arca (normally 4:00 p.m. E.T.), in accordance with the current Administrative Agency Agreement among U.S. Bancorp Fund Services, the Fund and the Sponsor.

In addition, in order to provide updated information relating to the Fund for use by investors and market professionals, an updated indicative fund value (“IFV”) is made available through on-line information services throughout the core trading hours of 9:30 a.m. E.T. to 4:00 p.m. E.T. on each trading day. The IFV is calculated by using the prior day’s closing NAV per share of the Fund as a base and updating that value throughout the trading day to reflect changes in the most recently reported trade price for the futures and/or options held by the Fund. Certain Freight Futures brokers provide real time pricing information to the general public either through their websites or through data vendors such as Bloomberg or Reuters. The IFV disseminated during NYSE Arca core trading hours should not be viewed as an actual real time update of the NAV, because the NAV is calculated only once at the end of each trading day based upon the relevant end of day values of the Fund’s investments.

The IFV is disseminated on a per share basis every 15 seconds during regular NYSE Arca core trading session hours. The customary trading hours of the Freight Futures trading are 3:00 a.m. E.T. to 12:00 p.m. E.T. This means that there is a gap in time at the beginning and/or the end of each day during which the Fund’s shares are traded on the NYSE Arca, but real-time trading prices for contracts are not available. During such gaps in time the IFV will be calculated based on the end of day price of such contracts from the Baltic Exchange immediately preceding the trading session. In addition, other investments held by the Fund will be valued by the Administrator, using rates and points received from client-approved third party vendors (such as Reuters and WM Company) and advisor or broker-dealer quotes. These investments will not be included in the IFV.

The NYSE Arca disseminates the IFV through the facilities of CTA/CQ High Speed Lines. In addition, the IFV is published on the NYSE Arca’s website and is available through on-line information services such as Bloomberg and Reuters.

Dissemination of the IFV provides additional information that is not otherwise available to the public and is useful to investors and market professionals in connection with the trading of the Fund’s shares on the NYSE Arca. Investors and market professionals are able throughout the trading day to compare the market price of the Fund’s shares and the IFV. If the market price of the Fund’s shares diverges significantly from the IFV, market professionals will have an incentive to execute arbitrage trades. For example, if the Fund’s shares appear to be trading at a discount compared to the IFV, a market professional could the Fund’s shares on the NYSE Arca and take the opposite position in Freight Futures. Such arbitrage trades can tighten the tracking between the market price of the Fund’s shares and the IFV and thus can be beneficial to all market participants.

8

Creation and Redemption of Shares

The Fund creates and redeems shares from time to time, but only in one or more Creation Baskets or Redemption Baskets. The creation and redemption of baskets are only made in exchange for delivery to the Fund or the distribution by the Fund of the amount of cash represented by the baskets being created or redeemed, the amount of which is based on the combined NAV of the number of shares included in the baskets being created or redeemed determined as of 4:00 p.m. E.T. on the day the order to create or redeem baskets is properly received.

Authorized Participants are the only persons that may place orders to create and redeem baskets. Authorized Participants must be (1) registered broker-dealers or other securities market participants, such as banks and other financial institutions, that are not required to register as broker-dealers to engage in securities transactions described below, and (2) DTC Participants. To become an Authorized Participant, a person must enter into an Authorized Participant Agreement with the Sponsor. The Authorized Participant Agreement provides the procedures for the creation and redemption of baskets and for the delivery of the U.S. Treasuries and any cash required for such creation and redemptions. The Authorized Participant Agreement and the related procedures attached thereto may be amended by the Fund, without the consent of any limited partner or shareholder or Authorized Participant. Authorized Participants will pay a transaction fee of $500 to the Custodian for each order they place to create or redeem one or more baskets. Authorized Participants who make deposits with the Fund in exchange for baskets receive no fees, commissions or other form of compensation or inducement of any kind from either the Fund or the Sponsor, and no such person will have any obligation or responsibility to the Sponsor or the Fund to effect any sale or resale of shares.

Each Authorized Participant is required to be registered as a broker-dealer under the Exchange Act and be a member in good standing with FINRA, or exempt from being or otherwise not required to be registered as a broker-dealer or a member of FINRA, and qualified to act as a broker or dealer in the states or other jurisdictions where the nature of its business so requires. Certain Authorized Participants may also be regulated under federal and state banking laws and regulations. Each Authorized Participant has its own set of rules and procedures, internal controls and information barriers as it determines is appropriate in light of its own regulatory regime.

Under the Authorized Participant Agreements, the Sponsor has agreed to indemnify the Authorized Participants against certain liabilities, including liabilities under the 1933 Act, and to contribute to the payments the Authorized Participants may be required to make in respect of those liabilities.

Creation Procedures

On any business day, an Authorized Participant may place an order with the Transfer Agent, and accepted by the Distributor, to create one or more baskets. For purposes of processing purchase and redemption orders, a “business day” means any day other than a day when any of the NYSE Arca, the New York Stock Exchange or the Baltic Exchange is closed for regular trading. Purchase orders must be placed by 12:00 p.m. E.T. or the close of the NYSE Arca core trading session, whichever is earlier. The day on which a valid purchase order is received in accordance with the terms of the “Authorized Participant Agreement” is referred to as the purchase order date. Purchase orders are irrevocable. Prior to the delivery of baskets for a purchase order, the Authorized Participant will be charged a non-refundable transaction fee due for the purchase order.

The manner by which creations are made is dictated by the terms of the Authorized Participant Agreement.

9

Determination of Required Payment

The Creation Basket Deposit for the Fund is the NAV of 25,000 shares on the purchase order date, but only if the required payment is timely received. To calculate the NAV, the Administrator will use the Baltic Exchange settlement price (typically determined after 2:00 p.m. E.T.) for the Freight Futures.

Because orders to purchase Creation Baskets must be placed no later than 12:00 p.m. E.T., but the total payment required to create a Creation Basket typically will not be determined until after 2:00 p.m. E.T., on the date the purchase order is received, Authorized Participants will not know the total amount of the payment required to create a Creation Basket at the time they submit an irrevocable purchase order. The NAV and the total amount of the payment required to create a Creation Basket could rise or fall substantially between the time an irrevocable purchase order is submitted and the time the amount of the purchase price in respect thereof is determined.

Delivery of Required Payment

An Authorized Participant who places a purchase order shall transfer to the Administrator the required amount of cash, by the end of the next business day following the purchase order date. Upon receipt of the deposit amount, the Administrator will direct DTC to credit the number of Creation Baskets ordered to the Authorized Participant’s DTC account on the next business day following the purchase order date.

Suspension of Purchase Orders

The Sponsor acting by itself or through the Administrator or the Distributor may suspend the right of purchase, or postpone the purchase settlement date, for any period during which the NYSE Arca or other exchange on which the shares are listed is closed, other than for customary holidays or weekends, or when trading is restricted or suspended. None of the Sponsor, the Marketing Agent or the Administrator will be liable to any person or in any way for any loss or damages that may result from any such suspension or postponement.

Rejection of Purchase Orders

The Sponsor acting by itself or through the Distributor shall have the absolute right but no obligation to reject a purchase order or a Creation Basket Deposit if:

| ● | it determines that the purchase order or the Creation Basket Deposit is not in proper form; |

| ● | the acceptance or receipt of the purchase order or Creation Basket Deposit would, in the opinion of counsel to the Sponsor, be unlawful; or |

| ● | circumstances outside the control of the Sponsor, Distributor or Custodian make it, for all practical purposes, not feasible to process creations of baskets. |

None of the Sponsor, Distributor or Custodian will be liable for the rejection of any purchase order or Creation Basket Deposit.

Redemption Procedures

The procedures by which an Authorized Participant can redeem one or more baskets mirror the procedures for the creation of baskets. On any business day, an Authorized Participant may place an order with the Distributor to redeem one or more baskets. Redemption orders must be placed by 12:00 p.m. E.T. or the close of the core trading session on the NYSE Arca, whichever is earlier. A redemption order so received will be effective on the date it is received in satisfactory form by the Distributor. The redemption procedures allow Authorized Participants to redeem baskets and do not entitle an individual shareholder to redeem any shares in an amount less than a Redemption Basket, or to redeem baskets other than through an Authorized Participant. Redemption orders are irrevocable.

10

The manner by which redemptions are made is dictated by the terms of the Authorized Participant Agreement. By placing an order for Redemption Baskets of BDRY, an Authorized Participant agrees to deliver the Redemption Baskets to be redeemed through DTC’s book-entry system to the Fund not later than 12:00 p.m. E.T., on the next business day immediately following the redemption order date. Prior to the delivery of redemption distribution or proceeds, the Authorized Participant will be charged a non-refundable transaction fee due for the redemption order.

Determination of Redemption Proceeds

The redemption proceeds from the Fund consist of a cash redemption amount equal to the NAV of the number of Baskets requested in the Authorized Participant’s redemption order on the redemption order date. To calculate the NAV, the Administrator will use the Baltic Exchange settlement price (typically determined after 2:00 p.m. E.T.) for the Freight Futures.

Because orders to redeem baskets must be placed no later than 12:00 p.m. E.T., but the total amount of redemption proceeds typically will not be determined until after 2:00 p.m. E.T., on the date the redemption order is received, Authorized Participants will not know the total amount of the redemption proceeds at the time they submit an irrevocable redemption order. The NAV and the total amount of redemption proceeds could rise or fall substantially between the time an irrevocable redemption order is submitted and the time the amount of redemption proceeds in respect thereof is determined.

Delivery of Redemption Proceeds

The redemption proceeds due from the Fund will be delivered to the Authorized Participant at 1:00 p.m. E.T., on the next business day immediately following the redemption order date if, by such time, the Fund’s DTC account has been credited with the baskets to be redeemed. If the Fund’s DTC account has not been credited with all of the baskets to be redeemed by such time, the redemption distribution is delivered to the extent of whole baskets received. Any remainder of the redemption distribution is delivered on the next business day to the extent of remaining whole baskets received if the Fund receives the fee applicable to the extension of the redemption distribution date which the Sponsor may, from time to time, determine and the remaining baskets to be redeemed are credited to the Fund’s DTC account by 1:00 p.m. E.T., on such next business day. Any further outstanding amount of the redemption order shall be cancelled. The Sponsor may cause the redemption distribution to be delivered notwithstanding that the baskets to be redeemed are not credited to the Fund’s DTC account by 12:00 p.m. E.T., on the next business day immediately following the redemption order date if the Authorized Participant has collateralized its obligation to deliver the Baskets through DTC’s book entry system on such terms as the Sponsor may from time to time determine.

11

Suspension or Rejection of Redemption Orders

The Sponsor may, in its discretion, suspend the right of redemption, or postpone the redemption settlement date, (1) for any period during which the NYSE Arca, or the Baltic Exchange is closed other than customary weekend or holiday closings, or trading on the NYSE Arca, or the Baltic Exchange, is suspended or restricted, (2) for any period during which an emergency exists as a result of which delivery, disposal or evaluation of the redemption distribution or redemption proceeds, as applicable, is not reasonably practicable, or (3) for such other period as the Sponsor determines to be necessary for the protection of the limited partners or shareholders. For example, the Sponsor may determine that it is necessary to suspend redemptions to allow for the orderly liquidation of the Fund’s assets at an appropriate value to fund a redemption. If the Sponsor has difficulty liquidating its positions, e.g., because of a market disruption event in the futures markets or a suspension of trading by the exchange where the futures contracts are listed, it may be appropriate to suspend redemptions until such time as such circumstances are rectified. None of the Sponsor, the Distributor, the Transfer Agent, the Administrator, or the Custodian will be liable to any person or in any way for any loss or damages that may result from any such suspension or postponement.

Redemption orders must be made in whole baskets. The Sponsor will reject a redemption order if the order is not in proper form as described in the applicable Authorized Participant Agreement or if the fulfillment of the order, in the opinion of its counsel, might be unlawful. The Sponsor may also reject a redemption order if the number of shares being redeemed would reduce the remaining outstanding shares to 50,000 shares (minimum NYSE Arca maintenance listing requirement) or less, unless the Sponsor has reason to believe that the placer of the redemption order does in fact possess all the outstanding shares and can deliver them.

Creation and Redemption Transaction Fee

To compensate the Funds for their expenses in connection with the creation and redemption of baskets, an Authorized Participant is required to pay a transaction fee to the Custodian of $500 per order to create or redeem baskets, regardless of the number of baskets in such order. An order may include multiple baskets. The transaction fee may be reduced, increased or otherwise changed by the Sponsor. The Sponsor will notify DTC of any change in the transaction fee and will not implement any increase in the fee for the redemption of baskets until 30 days after the date of the notice.

Tax Responsibility

Authorized Participants are responsible for any transfer tax, sales or use tax, stamp tax, recording tax, value added tax or similar tax or governmental charge applicable to the creation or redemption of baskets, regardless of whether or not such tax or charge is imposed directly on the Authorized Participant, and agree to indemnify the Sponsor and the Fund if they are required by law to pay any such tax, together with any applicable penalties, additions to tax and interest thereon.

Secondary Market Transactions

As noted, the Fund creates and redeems shares from time to time, but only in one or more Creation Baskets or Redemption Baskets. The creation and redemption of baskets are only made in exchange for delivery to the Fund or the distribution by the Fund of the amount of cash, represented by the baskets being created or redeemed, the amount of which will be based on the aggregate NAV of the number of shares included in the baskets being created or redeemed determined on the day the order to create or redeem baskets is properly received.

As discussed above, Authorized Participants are the only persons that may place orders to create and redeem baskets. Authorized Participants must be registered broker-dealers or other securities market participants, such as banks and other financial institutions that are not required to register as broker-dealers to engage in securities transactions. An Authorized Participant is under no obligation to create or redeem baskets, and an Authorized Participant is under no obligation to offer to the public shares of any baskets it does create. Authorized Participants that do offer to the public shares from the baskets they create will do so at per share offering prices that are expected to reflect, among other factors, the trading price of the shares on the NYSE Arca, the NAV of the Fund at the time the Authorized Participant purchased the Creation Baskets and the NAV of the shares at the time of the offer of the shares to the public, the supply of and demand for shares at the time of sale, and the liquidity of the futures contract market and the market for Treasury Instruments or U.S. Treasuries, as applicable. The prices of shares offered by Authorized Participants are expected to fall between the Fund’s NAV and the trading price of the shares on the NYSE Arca at the time of sale.

Shares initially comprising the same basket but offered by Authorized Participants to the public at different times may have different offering prices. An order for one or more baskets may be placed by an Authorized Participant on behalf of multiple clients. Authorized Participants that make deposits with the Fund in exchange for baskets receive no fees, commissions or other form of compensation or inducement of any kind from either the Fund or the Sponsor, and no such person has any obligation or responsibility to the Sponsor or the Fund to effect any sale or resale of shares.

Shares trade in the secondary market on the NYSE Arca. Shares may trade in the secondary market at prices that are lower or higher relative to their NAV per share. The amount of the discount or premium in the trading price relative to the NAV per share may be influenced by various factors, including the number of investors who seek to purchase or sell shares in the secondary market and the liquidity of the futures contracts market. While the shares trade during regular trading hours on the NYSE Arca until 4:00 p.m. E.T., liquidity in the market for Freight Futures, may be reduced after the close of the Freight Futures market at approximately 12:00 p.m. E.T. As a result, during this time, trading spreads, and the resulting premium or discount, on the shares may widen.

12

There are a minimum number of specified baskets and associated shares. Once the minimum number of baskets is reached, there can be no more basket redemptions until there has been a Creation Basket. In such case, market makers may be less willing to purchase shares from investors in the secondary market, which may in turn limit the ability of shareholders of the Fund to sell their shares in the secondary market. As of the date of this annual report the minimum level for BDRY is 25,000 shares, representing one basket.

All proceeds from the sale of Creation Baskets will be invested as quickly as practicable in the investments described in the prospectus. BDRY’s cash and investments are held through the Custodian, in accounts with BDRY’s commodity futures brokers or in demand deposits with highly-rated financial institutions. There is no stated maximum time period for BDRY’s operations and BDRY will continue its operations until all shares are redeemed or BDRY is liquidated pursuant to the terms of BDRY’s Trust Agreement.

There is no specified limit on the maximum number of Creation Baskets that can be sold, although the Fund may not sell shares in Creation Baskets if such shares have not been registered with the SEC under an effective registration statement.

Regulatory Environment

The regulation of futures markets, futures contracts, and futures exchanges has historically been comprehensive. The CFTC and the exchanges are authorized to take extraordinary actions in the event of a market emergency including, for example, the retroactive implementation of speculative position limits, increased margin requirements, the establishment of daily price limits and the suspension of trading.

The regulation of commodity interest transactions in the United States is an evolving area of law and is subject to ongoing modification by governmental and judicial action. Considerable regulatory attention has been focused on non-traditional investment pools that are publicly distributed in the United States. There is a possibility of future regulatory changes within the United States altering, perhaps to a material extent, the nature of an investment in the Fund, or the ability of the Fund to continue to implement its investment strategy. In addition, various national governments outside of the United States have expressed concern regarding the disruptive effects of speculative trading in the commodities markets and the need to regulate the derivatives markets in general. The effect of any future regulatory change on the Fund is impossible to predict but could be substantial and adverse.

The CFTC possesses exclusive jurisdiction to regulate the activities of commodity pool operators and commodity trading advisors with respect to “commodity interests,” such as futures, swaps and options, and has adopted regulations with respect to the activities of those persons and/or entities. Under the CEA, a registered CPO, such as the Sponsor, is required to make annual filings with the CFTC and NFA describing its organization, capital structure, management and controlling persons. In addition, the CEA authorizes the CFTC to require and review books and records of, and documents prepared by, registered CPOs. Pursuant to this authority, the CFTC requires CPOs to keep accurate, current and orderly records for each pool that they operate. The CFTC may suspend the registration of a commodity pool operator (1) if the CFTC finds that the operator’s trading practices tend to disrupt orderly market conditions, (2) if any controlling person of the operator is subject to an order of the CFTC denying such person trading privileges on any exchange, and (3) in certain other circumstances. Suspension, restriction or termination of the Sponsor’s registration as a commodity pool operator would prevent it, until that registration were to be reinstated, from managing the Fund, and might result in the termination of the Fund if a successor sponsor is not elected pursuant to the Trust Agreement.

The Fund’s investors are afforded prescribed rights for reparations under the CEA. Investors may also be able to maintain a private right of action for violations of the CEA. The CFTC has adopted rules implementing the reparation provisions of the CEA, which provide that any person may file a complaint for a reparations award with the CFTC for violation of the CEA against a floor broker or an FCM, introducing broker, commodity trading advisor, CPO, and their respective associated persons.

Pursuant to authority in the CEA, the NFA has been formed and registered with the CFTC as a registered futures association. At the present time, the NFA is the only self-regulatory organization for commodity interest professionals, other than futures exchanges. The CFTC has delegated to the NFA responsibility for the registration of CPOs and FCMs and their respective associated persons. The Sponsor and the Fund’s clearing broker are members of the NFA. As such, they will be subject to NFA standards relating to fair trade practices, financial condition and consumer protection. The NFA also arbitrates disputes between members and their customers and conducts registration and fitness screening of applicants for membership and audits of its existing members. Neither the Trust nor the Fund are required to become a member of the NFA.

The regulations of the CFTC and the NFA prohibit any representation by a person registered with the CFTC or by any member of the NFA, that registration with the CFTC, or membership in the NFA, in any respect indicates that the CFTC or the NFA has approved or endorsed that person or that person’s trading program or objectives. The registrations and memberships of the parties described in this summary must not be considered as constituting any such approval or endorsement. Likewise, no futures exchange has given or will give any similar approval or endorsement.

Futures exchanges in the United States are subject to varying degrees of regulation under the CEA depending on whether such exchange is a designated contract market, exempt board of trade or electronic trading facility. Clearing organizations are also subject to the CEA and the rules and regulations adopted thereunder as administered by the CFTC. The CFTC’s function is to implement the CEA’s objectives of preventing price manipulation and excessive speculation and promoting orderly and efficient commodity interest markets. In addition, the various exchanges and clearing organizations themselves exercise regulatory and supervisory authority over their member firms.

The Dodd-Frank Wall Street Reform and Consumer Protection Act (the “Dodd-Frank Act”) was enacted in response to the economic crisis of 2008 and 2009 and it significantly altered the regulatory regime to which the securities and commodities markets are subject. To date, the CFTC has issued proposed or final versions of almost all of the rules it is required to promulgate under the Dodd-Frank Act. The provisions of the new law include the requirement that position limits be established on a wide range of commodity interests, including agricultural, energy, and metal-based commodity futures contracts, options on such futures contracts and cleared and uncleared swaps that are economically equivalent to such futures contracts and options; new registration and recordkeeping requirements for swap market participants; capital and margin requirements for “swap dealers” and “major swap participants,” as determined by the new law and applicable regulations; reporting of all swap transactions to swap data repositories; and the mandatory use of clearinghouse mechanisms for sufficiently standardized swap transactions that were historically entered into in the over-the-counter market, but are now designated as subject to the clearing requirement; and margin requirements for over-the-counter swaps that are not subject to the clearing requirements.

13

The Dodd-Frank Act was intended to reduce systemic risks that may have contributed to the 2008/2009 financial crisis. Since the first draft of what became the Dodd-Frank Act, supporters and opponents have debated the scope of the legislation. As the administrations of the U.S. change, the interpretation and implementation will change along with them. Nevertheless, regulatory reform of any kind may have a significant impact on U.S. regulated entities.

Current rules and regulations under the Dodd-Frank Act require enhanced customer protections, risk management programs, internal monitoring and controls, capital and liquidity standards, customer disclosures and auditing and examination programs for FCMs. The rules are intended to afford greater assurances to market participants that customer segregated funds and secured amounts are protected, customers are provided with appropriate notice of the risks of futures trading and of the FCMs with which they may choose to do business, FCMs are monitoring and managing risks in a robust manner, the capital and liquidity of FCMs are strengthened to safeguard the continued operations and the auditing and examination programs of the CFTC and the self-regulatory organizations are monitoring the activities of FCMs in a thorough manner.

Regulatory bodies outside the U.S. have also passed or proposed, or may propose in the future, legislation similar to that proposed by the Dodd-Frank Act or other legislation containing other restrictions that could adversely impact the liquidity of and increase costs of participating in the commodities markets. For example, the European Union Markets in Financial Instruments Directive (Directive 2014/65/EU) and Markets in Financial Instruments Regulation (Regulation (EU) No 600/2014) (together “MiFID II”), which has applied since January 3, 2018, governs the provision of investment services and activities in relation to, as well as the organized trading of, financial instruments such as shares, bonds, units in collective investment schemes and derivatives. In particular, MiFID II requires EU Member States to apply position limits to the size of a net position which a person can hold at any time in commodity derivatives traded on EU trading venues and in “economically equivalent” over-the-counter (“OTC”) contracts. By way of further example, the European Market Infrastructure Regulation (Regulation (EU) No 648/2012, as amended) (“EMIR”) introduced certain requirements in respect of OTC derivatives including: (i) the mandatory clearing of OTC derivative contracts declared subject to the clearing obligation; (ii) risk mitigation techniques in respect of un-cleared OTC derivative contracts, including the mandatory margining of un-cleared OTC derivative contracts; and (iii) reporting and recordkeeping requirements in respect of all derivatives contracts. In the event that the requirements under EMIR and MiFID II apply, these are expected to increase the cost of transacting derivatives.

In addition, considerable regulatory attention has been focused on non-traditional publicly distributed investment pools such as the Fund. Furthermore, various national governments have expressed concern regarding the disruptive effects of speculative trading in certain commodity markets and the need to regulate the derivatives markets in general. The effect of any future regulatory change on the Funds is impossible to predict, but could be substantial and adverse.

Management believes that as of June 30, 2021, it had fulfilled in a timely manner all Dodd-Frank or other regulatory requirements to which it is subject.

SEC Reports

The Fund makes available, free of charge, on its website (www.drybulketf.com.), its annual reports on Form 10-K, its quarterly reports on Form 10-Q, its current reports on Form 8-K and amendments to these reports filed or furnished pursuant to Section 13(a) or 15(d) of the Exchange Act as soon as reasonably practicable after these forms are filed with, or furnished to, the SEC. These reports are also available from the SEC though its website at: www.sec.gov.

CFTC Reports

The Trust also makes available, on its website, its monthly reports and its annual reports required to be prepared and filed with the NFA under the CFTC regulations.

Item 1A. Risk Factors

Not required for smaller reporting companies.

Item 1B. Unresolved Staff Comments.

Not applicable.

Item 2. Properties.

Not applicable.

Item 3. Legal Proceedings

Although the Fund may, from time to time, be involved in litigation arising out of its operations in the normal course of business or otherwise, the Fund is currently a party to any pending material legal proceedings.

Item 4. Mine Safety Disclosures.

Not applicable.

14

Part II

Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities.

Shares of BDRY have traded on the NYSE Arca under the symbol “BDRY” since March 22, 2018.

As of June 30, 2021, BDRY had approximately 7,673 holders of its shares.

Dividends

The Fund has not made and does not currently intend to make cash distributions to its shareholders.

Issuer Purchases of Equity Securities

The Fund does not purchase shares directly from its shareholders.

Authorized Participant redemption activity for the Fund during the period from April 1, 2021 through June 30, 2021 and the period from April 1, 2020 through June 30, 2020 was as follows:

| BDRY | ||||||||

| Period of Redemption | Total Number of Shares Redeemed |

Average Price Paid per Share |

||||||

| Period from April 1, 2021 through June 30, 2021 | 1,675,000 | $ | 13.52 | |||||

| Period from April 1, 2020 through June 30, 2020 | 200,000 | $ | 7.63 | |||||

15

Item 6. Selected Financial Data.

Not required for small reporting companies.

Item 7 . Management’s Discussion and Analysis of Financial Condition and Results of Operations.

The following discussion should be read in conjunction with the financial statements and the notes thereto of the Trust and the Fund included elsewhere in this annual report on Form 10-K.

This information should be read in conjunction with the financial statements and notes included in Item 8 of this Annual Report (the “Report”). The discussion and analysis which follows may contain trend analysis and other forward-looking statements within the meaning of Section 21E of the Securities Exchange Act of 1934 which reflect our current views with respect to future events and financial results. Words such as “anticipate,” “expect,” “intend,” “plan,” “believe,” “seek,” “outlook” and “estimate,” as well as similar words and phrases, signify forward-looking statements. ETF Managers Group Commodity Trust I’s forward-looking statements are not guarantees of future results and conditions, and important factors, risks and uncertainties may cause our actual results to differ materially from those expressed in our forward-looking statements.

You should not place undue reliance on any forward-looking statements. Except as expressly required by the Federal securities laws, ETF Managers Capital, LLC undertakes no obligation to publicly update or revise any forward-looking statements or the risks, uncertainties or other factors described in this Report, as a result of new information, future events or changed circumstances or for any other reason after the date of this Report.

Overview

The Trust is a Delaware statutory trust formed on July 23, 2014. The Trust is a series trust currently consisting of one publicly listed series: Breakwave Dry Bulk Shipping ETF (“BDRY” or the “Fund”). The Fund issues common units, called the “Shares,” representing fractional undivided beneficial interests in the Fund. The Trust and the Fund operate pursuant to the Trust’s Amended and Restated Declaration of Trust and Trust Agreement (the “Trust Agreement”).

The Sponsor has the power and authority to establish and designate one or more series and to issue shares thereof, from time to time as it deems necessary or desirable. The Sponsor has exclusive power to fix and determine the relative rights and preferences as between the shares of any series as to the right of redemption, special and relative rights as to dividends and other distributions and on liquidation, conversion rights, and conditions under which the series shall have separate voting rights or no voting rights. The term for which the Trust is to exist commenced on the date of the filing of the Certificate of Trust, and the Trust, the Fund, and any additional series created in the future will exist in perpetuity, unless earlier terminated in accordance with the provisions of the Trust Agreement. Separate and distinct records shall be maintained for each Fund and the assets associated with a Fund shall be held in such separate and distinct records (directly or indirectly, including a nominee or otherwise) and accounted for in such separate and distinct records separately from the assets of any other series. The Fund and each future series will be separate from all such series in respect of the assets and liabilities allocated to a Fund and each separate series and will represent a separate investment portfolio of the Trust.

The sole Trustee of the Trust is Wilmington Trust, N.A. (the “Trustee”), and the Trustee serves as the Trust’s corporate trustee as required under the Delaware Statutory Trust Act (“DSTA”). The Trustee’s principal offices are located at 1100 North Market Street, Wilmington, Delaware 19890. The Trustee is unaffiliated with the Sponsor. The rights and duties of the Trustee and the Sponsor with respect to the offering of the Shares and Fund management and the shareholders are governed by the provisions of the DSTA and by the Trust Agreement.

16

On March 9, 2018, the initial Form S-1 for BDRY was declared effective by the SEC. On March 21, 2018, two Creation Baskets were issued for the Fund, representing 100,000 shares and $2,500,000. The Fund began trading on the New York Stock Exchange (“NYSE”) Arca on March 22, 2018.

The Fund is designed and managed to track the performance of a portfolio (a “Benchmark Portfolio”) consisting of futures contracts (the “Benchmark Component Instruments”).

Results of Operations

BDRY commenced investment operations on March 22, 2018 at $25.00 per Share. The Shares have been trading on the NYSE Arca since March 22, 2018 under the symbol “BDRY.”

The Fund seeks to track the daily return of the Benchmark Portfolio, over time, plus the excess, if any, of the Fund’s interest income from its holdings over the expenses of the Fund.

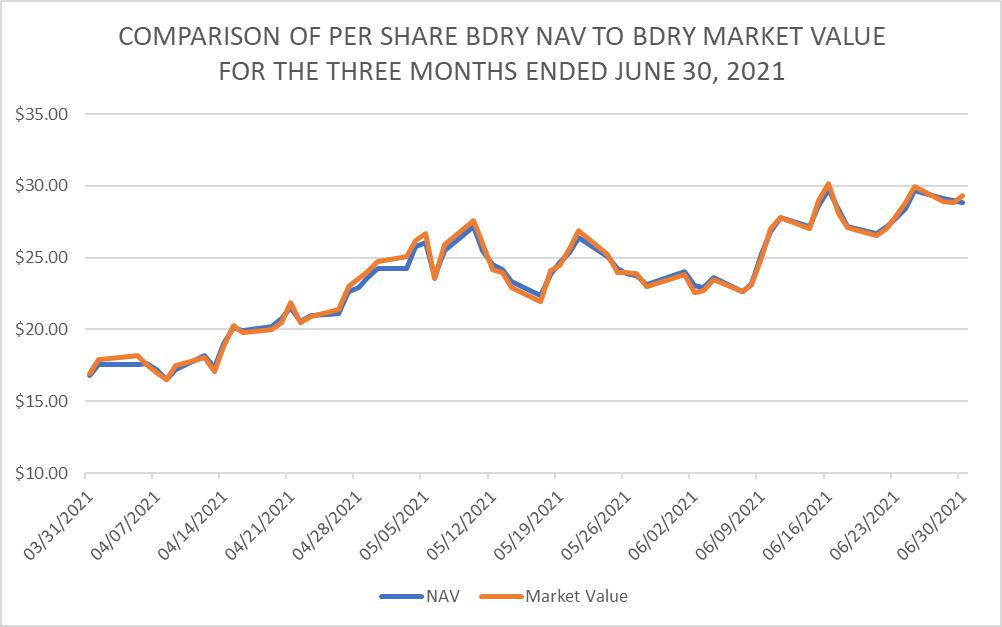

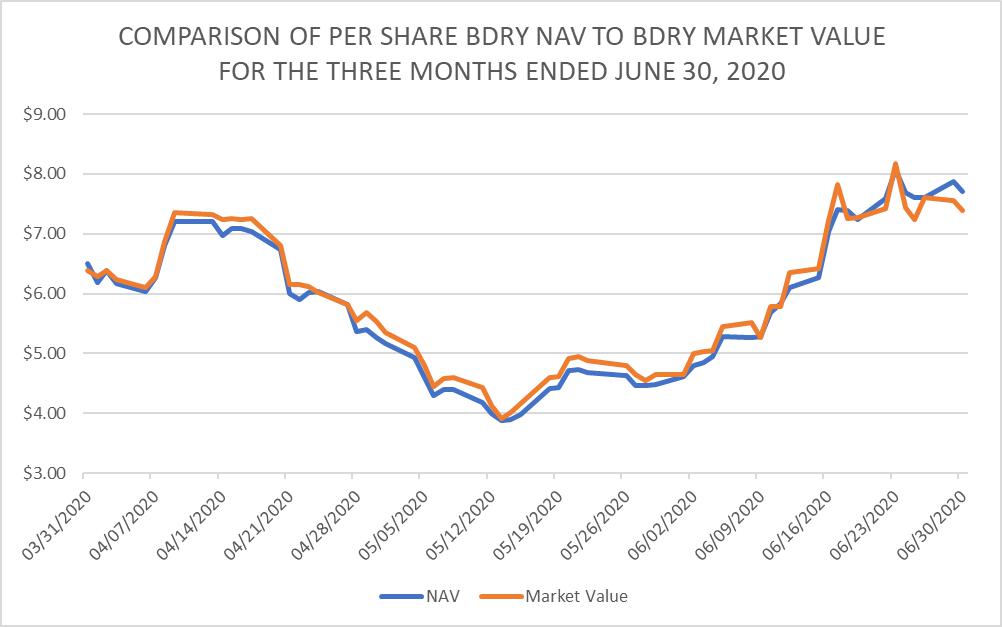

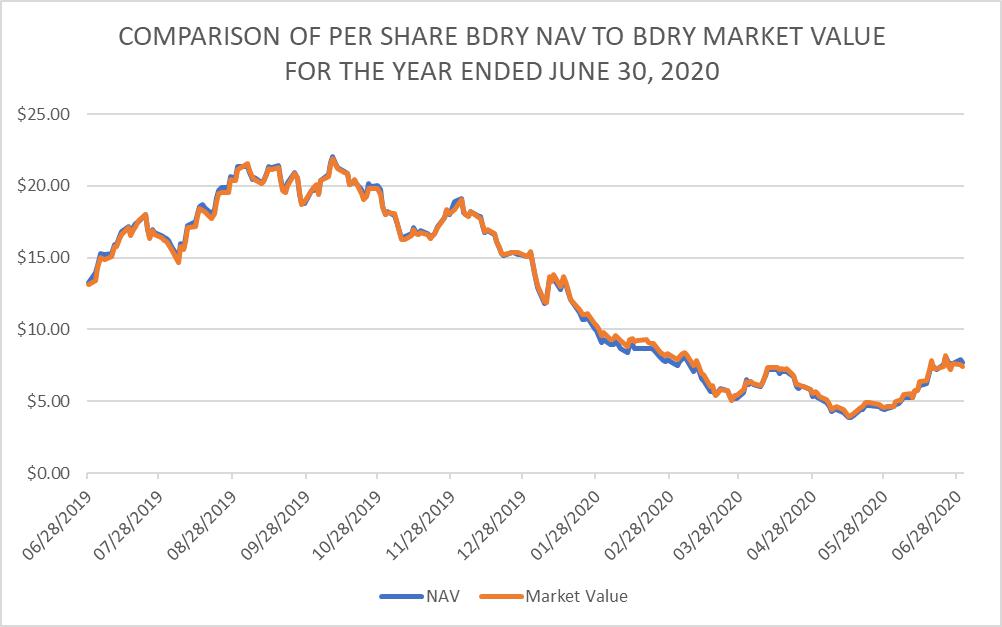

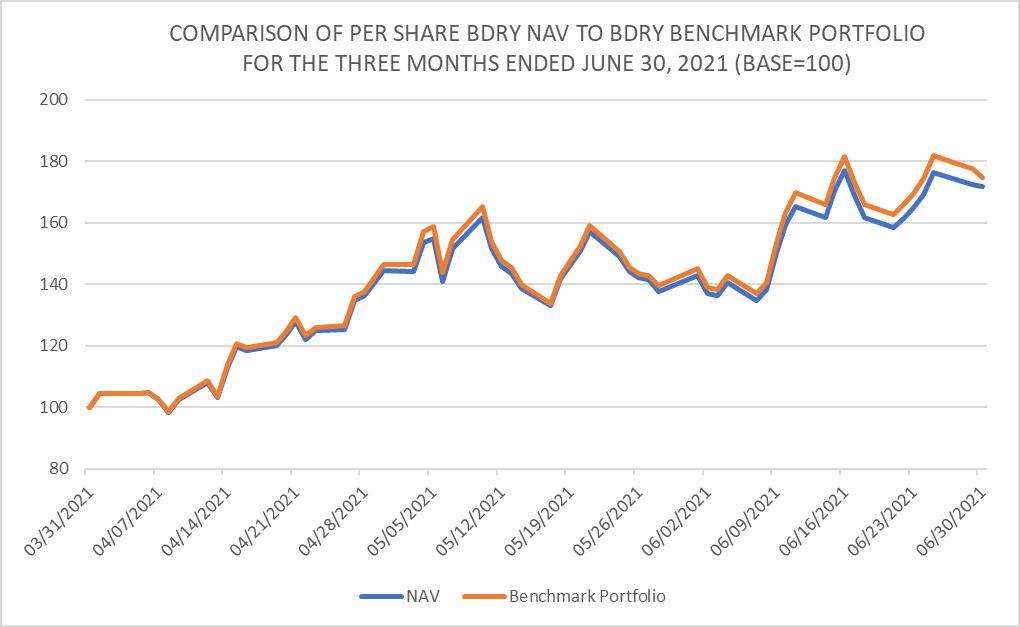

The following graphs illustrate changes in (i) the price of the Fund’s Shares (reflected, as applicable, by the graphs “Comparison of Per Share BDRY NAV to BDRY Market Value for the Three Months Ended June 30, 2021 and 2020” and “Comparison of Per Share BDRY NAV to BDRY Market Value for the Year Ended June 30, 2021 and 2020 and (ii) the Fund’s NAV (as reflected by the graphs “Comparison of BDRY NAV to Benchmark Index for the Three Months Ended June 30, 2021 and 2020” and “Comparison of BDRY NAV to Benchmark Index for the Year Ended June 30, 2021 and 2020”).

The Benchmark Portfolio is frictionless, in that it does not take into account fees or expenses associated with investing in the Fund. The performance of the Fund involves friction, in that fees and expenses impose a drag on performance.

17

Breakwave Dry Bulk Shipping ETF

During the year ended June 30, 2021, dry bulk spot rates increased substantially, with the benchmark Baltic Dry Index reaching 10-year highs towards the end of the period. A surge in demand for commodity transportation resulting from the partial reopening of global economies combined with considerable vessel delays and inefficiencies due to the ongoing COVID-19 pandemic were the main reasons for such a strong performance.

Freight rates enjoyed a strong summer and autumn of 2020 due to strong transportation demand for most bulk commodities, initially from China and later from other regions as well, reflecting strong industrial demand, increased manufacturing activity and some inventory rebuilding following the slow economic activity during the COVID-19 lockdown periods. In early 2021, considerable port delays due to COVID-19 crew screening procedures tightened the availability of vessels causing port congestion around the globe, thus leading to one of the strongest starts of the year in at least 10 years. As the first half of the year came to an end, freight rates across the dry bulk spectrum remained strong as economic activity accelerated.

An ongoing economic recovery and considerable stimulus efforts and infrastructure spending by the major economies around the globe because of COVID-19 should continue to benefit the shipping markets, which was also evident by strong realized freight rates during the summer of 2021. Although the global economic recovery seems strong, it is also highly fragile as the persistence of the COVID-19 virus remains a major risk globally. If the global economy remains on the path of growth, then shipping should benefit as trade flows should continue to increase. In addition, the upcoming shipping regulations related to reduction efforts in greenhouse gas emissions, could potentially lead to a reduction in the average fleet speed, further tightening the dry bulk supply and demand balance and thus supporting strong freight rates for longer.

Differences in the benchmark return and BDRY net asset value per share are due primarily to the following factors:

| ● | Benchmark portfolio uses settlement prices of freight futures vs. BDRY closing share price for BDRY. |

| ● | Benchmark portfolio roll methodology assumes rolls that happen evenly at fractions of lots vs. BDRY that transacts at real minimum lot size available pursuant to market practice (5 lots minimum) |

| ● | Benchmark portfolio assumes rolls that are happening at daily settlement prices vs. BDRY that transacts at prevailing prices during the day that might or might not be equal to settlement prices. |

| ● | Benchmark portfolio assumes no trading commissions vs. BDRY that pays 10bps of nominal value in commissions per transaction. |

| ● | Benchmark portfolio assumes no clearing fees vs BDRY that pays approximately $12 per lot in clearing fees per transaction. |

| ● | Benchmark portfolio assumes no management fees vs. BDRY fee structure. |

| ● | Creations and redemptions that lead to transactions in the freight futures market might occur at prices that might be different versus the settlement prices of that day. |

There are no known competitors. BDRY is the only freight futures ETF globally.

18

NEITHER THE PAST PERFORMANCE OF THE FUND NOR THE PRIOR INDEX LEVELS AND CHANGES, POSITIVE OR NEGATIVE, SHOULD BE TAKEN AS AN INDICATION OF THE FUND’S FUTURE PERFORMANCE.

The per Share market value of BDRY and its NAV tracked closely for the three months ended June 30, 2021.

NEITHER THE PAST PERFORMANCE OF THE FUND NOR THE PRIOR INDEX LEVELS AND CHANGES, POSITIVE OR NEGATIVE, SHOULD BE TAKEN AS AN INDICATION OF THE FUND’S FUTURE PERFORMANCE.

The per Share market value of BDRY and its NAV tracked closely for the year ended June 30, 2021.

19

NEITHER THE PAST PERFORMANCE OF THE FUND NOR THE PRIOR INDEX LEVELS AND CHANGES, POSITIVE OR NEGATIVE, SHOULD BE TAKEN AS AN INDICATION OF THE FUND’S FUTURE PERFORMANCE.

The per Share market value of BDRY and its NAV tracked closely for the three months ended June 30, 2020.

NEITHER THE PAST PERFORMANCE OF THE FUND NOR THE PRIOR INDEX LEVELS AND CHANGES, POSITIVE OR NEGATIVE, SHOULD BE TAKEN AS AN INDICATION OF THE FUND’S FUTURE PERFORMANCE.

The per Share market value of BDRY and its NAV tracked closely for the year ended June 30, 2020.

20

NEITHER THE PAST PERFORMANCE OF THE FUND NOR THE PRIOR BENCHMARK PORTFOLIO LEVELS AND CHANGES, POSITIVE OR NEGATIVE, SHOULD BE TAKEN AS AN INDICATION OF THE FUND’S FUTURE PERFORMANCE.

The graph above compares the return of BDRY with the benchmark portfolio returns for the three months ended June 30, 2021. The difference in the NAV price and the benchmark value often results in the appearance of a NAV premium or discount to the benchmark. The difference is related to the cumulative impact on NAV of the Fund’s income and expenses during the period presented in the chart above.

NEITHER THE PAST PERFORMANCE OF THE FUND NOR THE PRIOR BENCHMARK PORTFOLIO LEVELS AND CHANGES, POSITIVE OR NEGATIVE, SHOULD BE TAKEN AS AN INDICATION OF THE FUND’S FUTURE PERFORMANCE.

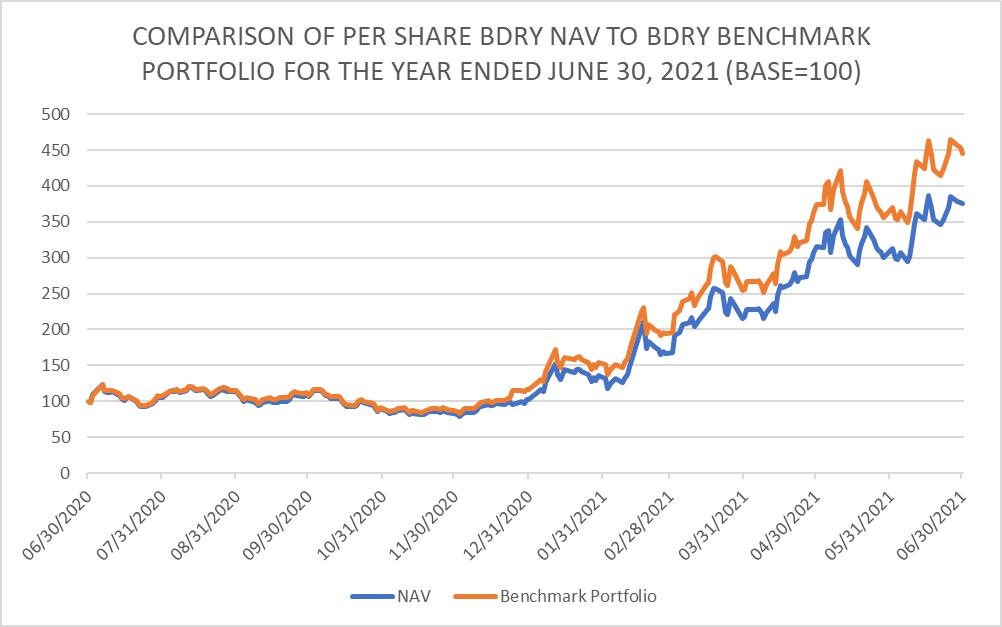

The graph above compares the return of BDRY with the benchmark portfolio returns for the year ended June 30, 2021. The difference in the NAV price and the benchmark value often results in the appearance of a NAV discount to the benchmark. The difference is related to the cumulative impact on NAV of the Fund’s expenses during the period presented in the chart above.

21

NEITHER THE PAST PERFORMANCE OF THE FUND NOR THE PRIOR BENCHMARK PORTFOLIO LEVELS AND CHANGES, POSITIVE OR NEGATIVE, SHOULD BE TAKEN AS AN INDICATION OF THE FUND’S FUTURE PERFORMANCE.

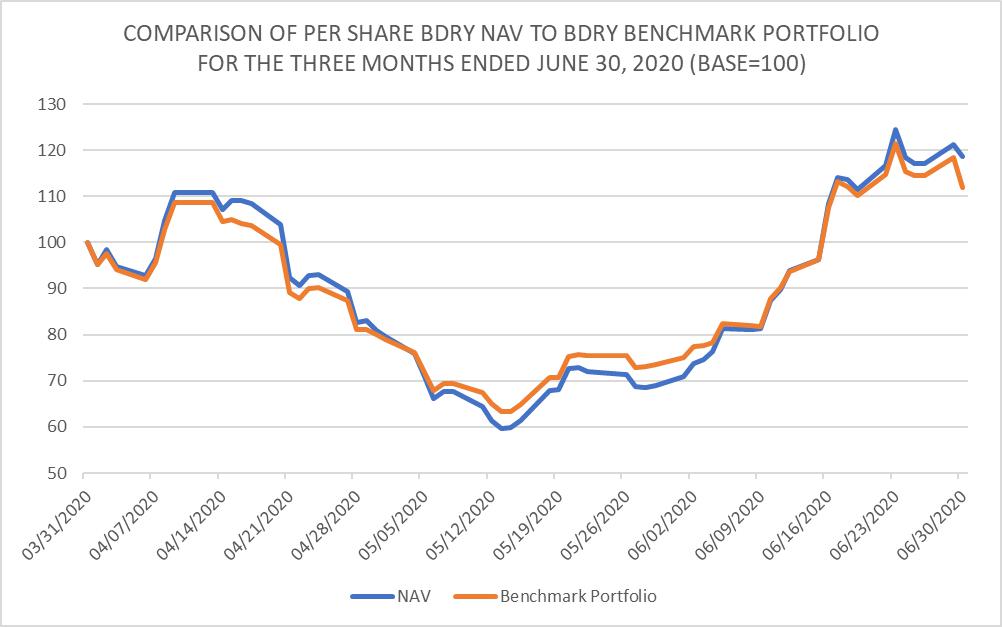

The graph above compares the return of BDRY with the benchmark portfolio returns for the three months ended June 30, 2020. The difference in the NAV price and the benchmark value often results in the appearance of a NAV premium or discount to the benchmark. The difference is related to the cumulative impact on NAV of the Fund’s income and expenses during the period presented in the chart above.

NEITHER THE PAST PERFORMANCE OF THE FUND NOR THE PRIOR BENCHMARK PORTFOLIO LEVELS AND CHANGES, POSITIVE OR NEGATIVE, SHOULD BE TAKEN AS AN INDICATION OF THE FUND’S FUTURE PERFORMANCE.

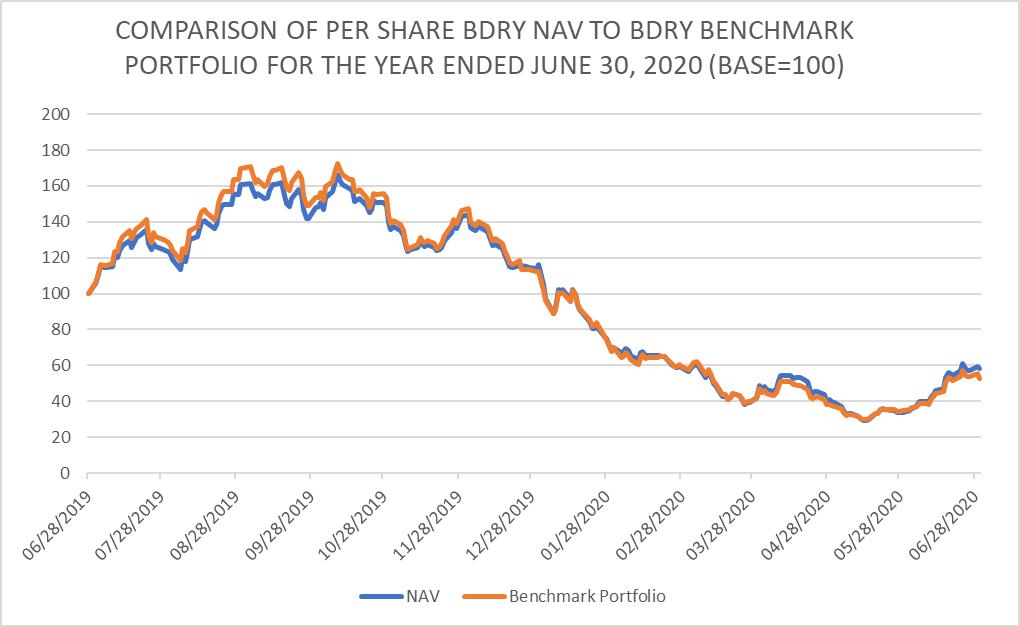

The graph above compares the return of BDRY with the benchmark portfolio returns for the year ended June 30, 2020. The difference in the NAV price and the benchmark value often results in the appearance of a NAV premium or discount to the benchmark. The difference is related to the cumulative impact on NAV of the Fund’s income and expenses during the period presented in the chart above.

22

FOR THE YEAR ENDED JUNE 30, 2021

Fund Share Price Performance

During the year ended June 30, 2021, the NYSE Arca market value of each share increased (+297.16%) from $7.39 per share, representing the closing price on June 30, 2020, to $29.35 per share, representing the closing price on June 30, 2021. The share price high and low for the year ended June 30, 2021 and related change from the closing share price on June 30, 2020 was as follows: shares traded from a high of $30.20 per share (+308.66%) on June 16, 2021 to a low of $6.10 per share (-17.46%) on December 3, 2020.

Fund Share Net Asset Value Performance

For the year ended June 30, 2021, the net asset value of each share increased (+275.06%) from $7.70 per share to $28.88 per share. Net gains in the futures contracts more than offset Fund expenses resulting in the overall increase in the NAV per share during the year ended June 30, 2021.

Net income for the year ended June 30, 2021, was $59,411,309, resulting from net realized gains on investments and futures contracts of $48,115,213, net unrealized gains on investments and futures contracts of $13,142,015, and the net investment loss of $1,845,919.

FOR THE YEAR ENDED JUNE 30, 2020

Fund Share Price Performance

During the year ended June 30, 2020, the NYSE Arca market value of each share decreased (-43.80%) from $13.15 per share, representing the closing price on June 28, 2019, to $7.39 per share, representing the closing price on June 30, 2020. The share price high and low for the year ended June 30, 2020 and related change from the closing share price on June 28, 2019 was as follows: shares traded from a high of $22.19 per share (+68.75%) on October 9, 2019 to a low of $3.75 per share (-71.48%) on May 13, 2020.

Fund Share Net Asset Value Performance

For the year ended June 30, 2020, the net asset value of each share decreased (-41.89%) from $13.25 per share to $7.70 per share. Net gains in the futures contracts, the impact of the timing of Fund share purchases in the fourth quarter of the year, and Fund expenses resulted in the overall decrease in the NAV per share during the year ended June 30, 2020.