As filed with the Securities and Exchange Commission on September 17, 2020

Registration No. 333-234292

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No. 9 to

FORM F-1

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

BRIACELL THERAPEUTICS CORP.

(Exact name of Registrant as specified in its charter)

| British Columbia | 2834 | 47-1099599 | ||

| (State or other jurisdiction of | (Primary Standard Industrial | (I.R.S. Employer | ||

| incorporation or organization) | Classification Code Number) | Identification Number) |

Suite 300 – 235 15th Street

West Vancouver, BC V7T 2X1

Telephone: (604) 921-1810

(Address, including zip code, and telephone number, including area code, of Registrant’s principal executive offices)

Paracorp Incorporated

2804 Gateway Oaks Drive #100,

Sacramento, CA 95833

Telephone: (888) 280-6563

(Name, address, including zip code, and telephone number, including area code, of agent of service)

Copies to:

Gregory Sichenzia, Esq. Avital Perlman, Esq. Sichenzia Ross Ference LLP 1185 Avenue of Americas 37th Floor New York, NY 10036 Telephone: (212) 930-9700 Facsimile: (212) 930-9725 |

Aaron Sonshine Bennett Jones LLP 3400 One First Canadian Place P.O. Box 130, Toronto, ON M5X 1A4 Telephone: (416) 777-6448 Facsimile: (416) 863-1716 |

Virgil Z. Hlus Clark Wilson LLP Suite 900-885 West Georgia Street Vancouver, BC,V6C 3H1 Telephone: (604) 687-5700 Facsimile: (604) 687-6314 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after this Registration Statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. [X]

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. [ ]

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. [ ]

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. [ ]

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933. Emerging growth company [X]

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided pursuant to Section 7(a)(2)(B) of the Securities Act. [ ]

† The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.

CALCULATION OF REGISTRATION FEE

Proposed

Maximum |

Amount

of |

|||||||

| Common Units (3) | $ | 15,755,000.00 | (2)(4)(5) | $ | 2,045.00 | |||

| Common shares, no par value, included in the Common Units | (6) | |||||||

| Warrants included in the Common Units (7) | (6) | |||||||

| Pre-funded Units (8) | (5)(9) | |||||||

| Pre-funded Warrants included in the Pre-funded Units (10) | (11) | |||||||

| Warrants included in the Pre-funded Units (7) | (11) | |||||||

| Common shares underlying the Pre-funded warrants included in the Pre-funded Units | ||||||||

| Common shares underlying the warrants included in the Common Units and the Pre-funded Units | $ | 19,693,750.00 | (2) | $ | 2,556.25 | |||

| Warrants to be issued to the Underwriters | (12) | |||||||

| Common shares underlying warrants to be issued to the Underwriters | $ | 984,687.50 | (2)(13) | $ | 127.81 | |||

| Common shares offered by the Selling Shareholder | $ | 238,000.00 |

(14) | $ | 30.89 |

|||

| Total | $ | 36,671,437.50 |

$ | 4,759.95 |

(15) | |||

| 1) | Pursuant to Rule 416, the securities being registered hereunder include such indeterminate number of additional securities as may be issued after the date hereof as a result of stock splits, stock dividends or similar transactions. | |

| 2) | Calculated pursuant to Rule 457(o) on the basis of the maximum aggregate offering price of all of the securities to be registered. | |

| 3) | Each Common Unit consists of one common share and one warrant, each whole warrant exercisable for one common share. | |

| 4) | Includes common shares and/or warrants representing 15% of the number of common shares and warrants included in the Common Units offered to the public that the underwriters have the option to purchase to cover over-allotments, if any. | |

| 5) | The proposed maximum aggregate offering price of Common Units proposed to be sold in the offering will be reduced on a dollar-for-dollar basis based on the offering price of any Pre-funded Units offered and sold in the offering, and the proposed maximum aggregate offering price of the Pre-funded Units to be sold in the offering will be reduced on a dollar-for-dollar basis based on the offering price of any Common Units sold in the offering. Accordingly, the proposed maximum aggregate offering price of the Common Units and Pre-funded Units (including the common shares issuable upon exercise of the Pre-funded warrants included in the Pre-funded Units), if any, is $15,755,000.00 | |

| 6) | Included in the price of the Common Units. No separate registration fee required pursuant to Rule 457(g) under the Securities Act of 1933, as amended. | |

| 7) | The warrants are exercisable at a price per common share equal to 125% of the Common Unit offering price. | |

| 8) | Each Pre-funded Unit consists of one Pre-funded warrant to purchase one common share and one warrant to purchase one common share. | |

| 9 ) | Includes Pre-funded warrants and/or warrants representing 15% of the number of Pre-funded warrants and warrants included in the Pre-funded Units offered to the public that the underwriters have the option to purchase to cover over-allotments, if any | |

| 10 ) | The Pre-funded warrants are exercisable at an exercise price of $0.01 per share. | |

| 11 ) | Included in the price of the Pre-funded Units. No separate registration fee required pursuant to Rule 457(g) under the Securities Act of 1933, as amended. | |

| 12 ) | No fee pursuant to Rule 457(g) under the Securities Act of 1933, as amended | |

| 13 ) | Estimated solely for the purpose of calculating the registration fee pursuant to Rule 457(g) under the Securities Act of 1933, as amended. We have agreed to issue to the underwriters warrants to purchase a number of common shares equal to 5% of the aggregate number of Common Units and Pre-funded Units sold in the offering (including the Common Units and Pre-funded Units issuable upon exercise of the over-allotment option). The warrants are exercisable at a per share exercise price equal to 125% of the per Common Unit public offering price for five years after the effective date of this registration statement. | |

| 14) | Estimated in accordance with Rule 457(c) under the Securities Act of 1933, as amended, solely for the purpose of calculating the registration fee, based on the average of the high and low prices of the registrant’s common shares, as reported on the OTCQB on September 15, 2020. | |

| 15) | $4,729.06 previously paid. |

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

EXPLANATORY NOTE

This Registration Statement contains two forms of prospectuses: one to be used in connection with the initial public offering of up to 2,952,587 common units and pre-funded units through the underwriters named on the cover page of this prospectus (the “IPO Prospectus”) and one to be used in connection with the potential resale by a selling shareholder of up to 50,000 common shares (the “Selling Shareholder Prospectus”). The IPO Prospectus and the Selling Shareholder Prospectus will be identical in all respects except for the alternate pages for the Selling Shareholder Prospectus included herein which are labeled “Alternate Pages for Selling Shareholder Prospectus.”

The Selling Shareholder Prospectus is substantively identical to the IPO Prospectus, except for the following principal points:

| ● | they contain different outside and inside front covers; | |

| ● | they contain different Offering sections in the Prospectus Summary section; | |

| ● | they contain different Use of Proceeds sections; | |

| ● | the Capitalization section is deleted from the Selling Shareholder Prospectus; | |

| ● | the Dilution section is deleted from the Selling Shareholder Prospectus; | |

| ● | a Selling shareholder section is included in the Selling Shareholder Prospectus; | |

| ● | the Underwriting section from the IPO Prospectus is deleted from the Selling Shareholder Prospectus and a Plan of Distribution is inserted in its place; and | |

| ● | the Legal Matters section in the Selling Shareholder Prospectus deletes the reference to counsel for the underwriters. |

We have included in this Registration Statement, after the financial statements, a set of alternate pages to reflect the foregoing differences of the Selling Shareholder Prospectus as compared to the IPO Prospectus.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

| PRELIMINARY PROSPECTUS | SUBJECT TO COMPLETION | DATED SEPTEMBER 17, 2020 |

Up to 2,952,587 Common Units, Each Consisting of a Common Share and a Warrant to Purchase One Common Share

Up to 2,952,587 Pre-funded Units, Each Consisting of a Pre-funded Warrant to Purchase One Common Share and a Warrant to Purchase One Common Share

BriaCell Therapeutics Corp.

We are offering up to 2,952,587 common units (each, a “Common Unit”), each Common Unit consisting of one common share, no par value per share, and one warrant (each a “Warrant”), in a firm commitment underwritten offering at an assumed price of US $4.64 per Common Unit. Each Warrant will entitle the holder to purchase one common share at an exercise price of US$________, equal to 125% of the public offering price of one Common Unit, and expire five years from the date of issuance.

We are also offering to those purchasers, if any, whose purchase of Common Units in this offering would otherwise result in the purchaser, together with its affiliates and certain related parties, beneficially owning more than 4.99% (or, at the election of the purchaser, 9.99%) of our outstanding common shares immediately following the consummation of this offering, the opportunity to purchase, if the purchaser so chooses, pre-funded units (each a “Pre-funded Unit”) in lieu of Common Units that would otherwise result in the purchaser’s beneficial ownership exceeding 4.99% (or, at the election of the purchaser, 9.99%) of our outstanding common shares. We are offering a maximum of Pre-funded Units. Each Pre-funded Unit will consist of a pre-funded warrant to purchase one common share at an exercise price of US$0. 01 per share (each a “Pre-funded Warrant”) and a Warrant. The purchase price of each Pre-funded Unit is equal to the price per Common Unit being sold to the public in this offering, minus US$0. 01 . The Pre-funded Warrants will be immediately exercisable and may be exercised at any time until all of the Pre-funded Warrants are exercised in full.

For each Pre-funded Unit we sell, the number of Common Units we are offering will be decreased on a one-for-one basis. Common Units and Pre-funded Units will not be certificated. The common shares or Pre-funded Warrants, as the case may be, and the Warrants included in the Common Units or the Pre-funded Units, can only be purchased together in this offering, but the securities contained in the Common Units or Pre-funded Units are immediately separable and will be issued separately.

The offering also includes the common shares issuable from time to time upon exercise of the Pre-Funded Warrants and Warrants. It is currently estimated that the initial public offering price per Common Unit will be between US $4.13 and US $5.13 and per Pre-funded Unit will be between US $4.12 and US $5.12.

In addition, we have registered an aggregate of 50,000 common shares for resale by a certain shareholder by means of separate prospectus (the “Selling Shareholder Prospectus”).

Our common shares are currently quoted on the U.S. OTCQB marketplace of OTC Markets Group, or OTCQB, under the symbol “BCTXF”, on the TSX Venture Exchange, or TSXV, under the symbol “BCT” and on the Frankfurt Stock Exchange under the Symbol “8BTA”. We are in the process of applying to list our common shares and our Warrants on the Nasdaq Capital Market under the symbols “BCTX” and “BCTXW”, respectively. No assurance can be given that our application will be approved. If Nasdaq does not approve the listing of our common shares and Warrants, we will not proceed with this offering.

On January 2, 2020, we implemented a 1-for-300 consolidation, or reverse split, of our issued and outstanding common shares prior to the date that we price this offering. Except where otherwise indicated, all share and per share data in this prospectus have been retroactively restated to reflect the reverse stock split.

On September 16, 2020, the closing price of our common shares was US $4.84 per share, as reported on the OTCQB. We have assumed a public offering price of US $4.64 per Common Unit. The actual public offering price per Common Unit and Pre-funded Unit, as the case may be, will not be determined by any particular formula but will rather be determined through negotiations between us and the underwriter at the time of pricing . Therefore, the assumed public offering prices used throughout this prospectus may not be indicative of the final offering price.

We are an “emerging growth company” as that term is used in the Jumpstart Our Business Start-ups Act of 2012 and, as such, have elected to comply with certain reduced public company reporting requirements for this prospectus and future filings.

Neither the Securities and Exchange Commission nor any other regulatory body has approved or disapproved of these securities or passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

Investing in our securities involves a high degree of risk. See “Risk Factors” on page 19 to read about factors you should consider before buying our securities.

Per Common Unit |

Per Pre-Funded Unit |

Total | ||||||||||

| Public offering price | US$ | US$ | US$ | |||||||||

| Underwriting discounts and commissions(1) | US$ | US$ | US$ | |||||||||

| Proceeds to BriaCell Therapeutics Corp., before expenses | US$ | US$ | US$ | |||||||||

| (1) | Underwriting discounts and commissions do not include a non-accountable expense allowance equal to 1% of the initial public offering price per Common Unit and Pre-Funded Unit, as applicable, payable to the underwriters. We refer you to “ Underwriting ” beginning on page 123 for additional information regarding underwriters’ compensation. |

We have granted a 45-day option to the underwriters to purchase up to additional common shares and/or Pre-funded Warrants, representing 15% of the common shares and Pre-funded Warrants sold in the offering and/or up to additional Warrants, representing 15% of the Warrants sold in the offering, solely to cover over-allotments, if any.

Sole Book-Running Manager

ThinkEquity

a division of Fordham Financial Management, Inc.

Co-Manager

Aegis Capital Corp.

The underwriters expect to deliver the securities to investors on or about , 2020.

The date of this prospectus is , 2020

TABLE OF CONTENTS

| 3 |

You should rely only on the information contained in this prospectus, any amendment or supplement to this prospectus or any free writing prospectus prepared by or on our behalf. Neither we, nor the Underwriters, have authorized any other person to provide you with different or additional information. Neither we, nor the Underwriters , take responsibility for, nor can we provide assurance as to the reliability of, any other information that others may provide. The Underwriters are not making an offer to sell these securities in any jurisdiction where the offer or sale is not permitted. The information contained in this prospectus is accurate only as of the date of this prospectus or such other date stated in this prospectus, and our business, financial condition, results of operations and/or prospects may have changed since those dates.

The selling shareholder is offering to sell and seeking offers to buy our common shares only in jurisdictions where offers and sales are permitted.

Except as otherwise set forth in this prospectus, neither we nor the Underwriters have taken any action to permit a public offering of these securities outside the United States and Canada or to permit the possession or distribution of this prospectus outside the United States. Persons outside the United States who come into possession of this prospectus must inform themselves about and observe any restrictions relating to the offering of these securities and the distribution of this prospectus outside the United States.

Unless the context otherwise requires, in this prospectus, the term(s) “we”, “us”, “our”, “Company”, “our company”, “BriaCell,” and “our business” refer to BriaCell Therapeutics Corp. and our subsidiaries.

MARKET, INDUSTRY AND OTHER DATA

This prospectus contains estimates, projections and other information concerning our industry, our business, and the markets for our products. Information that is based on estimates, forecasts, projections, market research or similar methodologies is inherently subject to uncertainties, and actual events or circumstances may differ materially from events and circumstances that are assumed in this information. Unless otherwise expressly stated, we obtained this industry, business, market and other data from our own internal estimates and research as well as from reports, research surveys, studies and similar data prepared by market research firms and other third parties, industry, medical and general publications, government data, and similar sources.

In addition, assumptions and estimates of our and our industry’s future performance are necessarily subject to a high degree of uncertainty and risk due to a variety of factors, including those described in “Risk Factors.” These and other factors could cause our future performance to differ materially from our assumptions and estimates. See “Cautionary Statement Regarding Forward-Looking Statements.”

CURRENCY AND EXCHANGE RATES

All dollar amounts in this prospectus are expressed in Canadian dollars unless otherwise indicated. The Company’s accounts are maintained in Canadian dollars and the Company’s financial statements are prepared in accordance with International Financial Reporting Standards as issued by the International Accounting Standards Board. All reference to “U.S. dollars”, “USD”, or to “US$” are to United States dollars.

The following table sets forth the rate of exchange for the Canadian dollar, expressed in United States dollars in effect at the end of the periods indicated, the average of exchange rates in effect during such periods, and the high and low exchange rates during such periods based on the noon rate of exchange as reported by the Bank of Canada for conversion of Canadian dollars into United States dollars.

On September 16, 2020, the exchange rate was US$1.00 = CAD$1.3168.

| Canada Dollar per U.S. Dollar Noon Buying Rate | ||||||||||||||||

| Average | High | Low | Period-End | |||||||||||||

| Year ended July, 31, | ||||||||||||||||

| 2020 | 1.3462 | 1.4496 | 1.2970 | 1.3404 | ||||||||||||

| 2019 | 1.3234 | 1.3642 | 1.2803 | 1.3148 | ||||||||||||

| Most recent six months | ||||||||||||||||

| March 2020 | 1.3953 | 1.4496 | 1.3356 | 1.4187 | ||||||||||||

| April 2020 | 1.4058 | 1.4217 | 1.3904 | 1.3910 | ||||||||||||

| May 2020 | 1.3970 | 1.4124 | 1.3764 | 1.3787 | ||||||||||||

| June 2020 | 1.3550 | 1.3682 | 1.3383 | 1.3628 | ||||||||||||

| July 2020 | 1.3499 | 1.3616 | 1.3360 | 1.3404 | ||||||||||||

| August 2020 | 1.3222 | 1.3377 | 1.3042 | 1.3042 | ||||||||||||

| 4 |

This summary highlights selected information contained elsewhere in this prospectus and does not contain all of the information that you should consider in making your investment decision. Before deciding to invest in our common shares, you should read this entire prospectus carefully, including the sections of this prospectus entitled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our consolidated financial statements and the related notes included elsewhere in this prospectus. All share and per share data in this prospectus reflects a 1-for-300 reverse stock split of our common shares issued and outstanding (including adjustments for fractional shares), which will be effected prior to the date we price this offering.

Overview of the Company

BriaCell is an immuno-oncology focused biotechnology company developing targeted and safe approaches for the management of cancer, with a focus on advanced breast cancer. BriaCell has completed positive proof-of-concept studies of Bria-IMT™, a whole cell targeted immunotherapy, in patients with advanced breast cancer.

BriaCell has been conducting a Phase I/IIa clinical trial of Bria-IMT™, BriaCell’s lead candidate, in a Combination Study with immune checkpoint inhibitors and has initiated combination therapy with the Incyte drugs INCMGA00012 (an anti-PD-1 antibody) and epacadostat, an orally bioavailable small-molecule inhibitor of indoleamine 2,3-dioxygenase 1 (IDO1).

BriaCell and Incyte Corporation have formed a non-exclusive clinical trial collaboration to evaluate the effects of combinations of novel clinical candidates. Under the agreement, Incyte and BriaCell will be evaluating novel combinations of compounds from Incyte’s development portfolio with Bria-IMT™ in advanced breast cancer patients.

Pending consummation of the offering, Bria-IMT™ will also be evaluated in an investigator-initiated Phase I/IIa study in combination with pembrolizumab (Keytruda) by Dr. Saveri Bhattacharya, Principal Investigator, in women with advanced breast cancer at Thomas Jefferson University. Dr. Bhattacharya has been selected to receive a grant from the Merck Investigator Studies Program for this study. Merck will provide Keytruda to Thomas Jefferson University and Dr. Bhattacharya for use in the combination study. The Company does not have an agreement with Merck for the supply of Keytruda. The Company has entered into a study agreement with Thomas Jefferson University providing for the investigator-initiated Phase I/IIa study by Dr. Bhattacharya and the Company’s supply of Bria-IMT™ to Thomas Jefferson University and Dr. Bhattacharya (the “Study Agreement”). Pursuant to the Study Agreement, the Company shall pay Thomas Jefferson University a total budget of $3,049,322.50. The FDA and Thomas Jefferson University’s internal review board have approved the clinical protocol. Patients with advanced breast cancer who have at least one human leukocyte antigen (“HLA”) that matches with Bria-IMT™ will be eligible for the trial. Pending consummation of the offering, the study is expected to commence in the fourth quarter of 2020 with safety and efficacy data to be released during 2021 and 2022.

BriaCell is also developing Bria-OTS™, an off-the-shelf personalized immunotherapy, for advanced breast cancer. Bria-OTS™ immunotherapy treatments are personalized to match the patient without the need for personalized manufacturing. Bria-OTS™ are a set of biologic drugs similar to Bria-IMT™, differing by a set of HLAs. The Bria-OTS™ cell lines will be pre-manufactured and stored frozen and ready to ship once a patient’s HLA type is known, making them “off-the-shelf.” HLA molecules are polymorphic in that they are different in some people and shared by some people with the different HLA molecules referred to as “HLA alleles” or “HLA types”. Patients will be treated with the Bria-OTS™ drugs most closely matching their HLA type, making their treatment “personalized”. Bria-OTS™, which is expected to cover over 99 percent of the patient population, is designed to produce a potent and selective immune response against the cancer of each patient while eliminating the time, expense and complex manufacturing logistics associated with other personalized immunotherapies.

BriaCell’s pipeline also includes other immunotherapy cell lines in development for other cancers (including lung, prostate and melanoma), the development of other immunotherapy approaches for cancer and infectious diseases, including multi-specific binding reagents similar to Bi-specific T-cell engagers, and small molecule inhibitors of protein kinase C delta which are postulated to be effective in cancers caused by mutations in the RAS oncogene.

Products/Pipeline

Bria-IMT™

Bria-IMT™, BriaCell’s lead candidate, is a whole-cell immunotherapy undergoing clinical testing in patients with metastatic breast cancer who have failed at least two prior lines of therapy. BriaCell has been conducting a Phase I/IIa clinical trial of Bria-IMT™ in combination with immune checkpoint inhibitors. The combination study is being conducted at 3 clinical sites: St. Joseph Heritage Healthcare, Santa Rosa, California, United States; University of Miami/Sylvester at Plantation, Plantation, Florida, USA; Cancer Center of Kansas (CCK), Wichita, Kansas, USA; Subsequent to the establishment of a collaboration with Incyte Corporation, this study has been modified to evaluate the combination of Bria-IMT™ with INCMGA00012 (a PD-1 inhibitor) and epacadostat (an indoleamine dioxygenase (IDO) inhibitor).

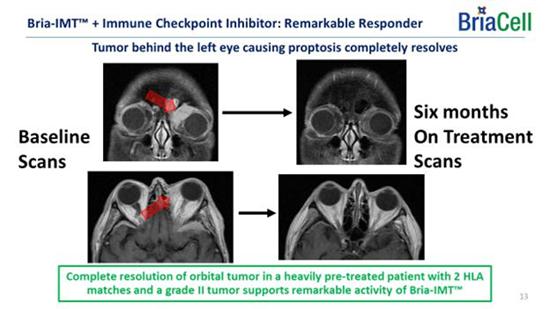

BriaCell has achieved proof of concept based on data from a Phase I/IIa study of Bria-IMT™ in advanced breast cancer patients. In essence, BriaCell obtained evidence that patients with certain HLA molecules also present in Bria-IMT™ have a higher likelihood of responding to the Bria-IMT™ regimen with tumor shrinkage, which is consistent with results from a molecular analysis of Bria-IMT™ conducted by BriaCell. BriaCell has also obtained evidence that patients with well-differentiated (grade I) or moderately differentiated (grade II) tumors are more likely to respond. Our proof of concept data is preliminary and we will need to complete the Phase I/IIa study and additional clinical studies before the Food and Drug Administration, or FDA, assesses the efficacy, safety and tolerability of this product candidate and determines whether it will be approved for commercial sale. Specifically, BriaCell plans to continue the Phase I/IIa study of the combination of Bria-IMT™ with INCMGA00012 and epacadostat. Once sufficient data is available from this study (anticipated to include data on at least 30 patients), BriaCell will determine the design of a Phase II registration study. BriaCell will negotiate with the FDA to obtain a “Special Protocol Assessment” (SPA) of the registration study. Under the SPA, the FDA would agree with the design and endpoints of the registration study and if these endpoints are met, would agree to grant marketing approval of the drug. Completion of the Phase II registration study will permit BriaCell to submit a Biologics License Application for Bria-IMT.

About Bria-IMT™

Developed and characterized by a team of dedicated scientists and clinicians, Bria-IMT™ (SV-BR-1-GM) is a targeted immunotherapy being developed for the treatment of breast cancer. Bria-IMT™ is a genetically engineered human breast cancer cell line with features of immune cells and clinically applied as a targeted immunotherapy.

In short, Bria-IMT™ immunotherapy is a genetically engineered human breast cancer cell line which activates the immune system to attack and destroy breast cancer tumors.

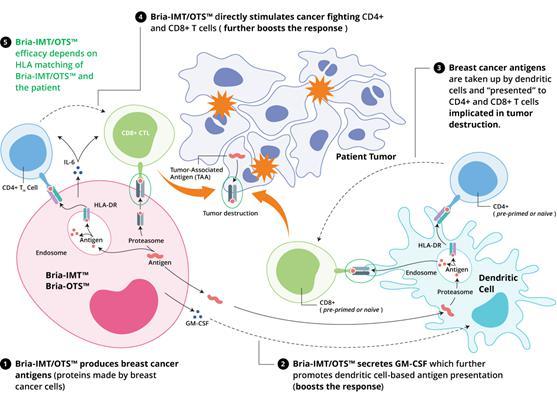

Mechanism of Action of Bria-IMT™: The mechanism of action of Bria-IMT™ is currently under investigation. It is likely that the expression of certain breast cancer antigens (proteins expressed in breast cancer cells) in Bria-IMT™ generates strong T cell and potentially antibody responses resulting in recognition and destruction of cancerous cells.

| 5 |

Bria-IMT™ is designed to secrete granulocyte/macrophage-colony stimulating factor (GM-CSF), a factor that stimulates components of the immune system. Specifically, GM-CSF activates dendritic cells, the cells that start immune responses. These activated dendritic cells then activate T cells, a key component of the immune system, to recognize the tumor cells as foreign, and eliminate them. To amplify this action, we have combined Bria-IMT™ with other immune system activators including cyclophosphamide (used in low doses to reduce immune suppression), and interferon-α, a cytokine. We believe this approach of simultaneous activation of the immune system via different pathways will improve the immune system response to attack and destroy cancer cells.

Using BriaCell’s novel technology platform and our strong R&D capabilities, we plan to develop Bria-OTS™, a personalized off-the-shelf immunotherapy for breast cancer, and similar immunotherapy cell lines for other cancer indications.

| ● | Bria-OTS™ is under development as an off-the-shelf personalized immunotherapy for advanced breast cancer. |

| ● | The concept for Bria-OTS™ comes from BriaCell’s work with Bria-IMT™, where we noted that if a patient “matches” Bria-IMT™ in their HLA type, they were more likely to respond. |

| ● | HLA molecules are the molecules that start immune responses but are polymorphic – i.e. they are different in different people, although some people will share the same HLA molecules (referred to as “HLA alleles” or “HLA types”). |

| ● | Bria-OTS™ is made from cell lines that are genetically engineered to expresses the immune boosters GM-CSF and interferon-α, as well as specific HLA types (a.k.a. alleles). |

| ● | Different cell lines are being pre-manufactured to express 15 different HLA types matching >99% of the overall breast cancer patient population (the methodology in determining that Bria-OTS would match 99% of the breast cancer population is discussed on pages 58 and 59 herein). |

| ● | Using the BriaDx™, a companion diagnostic test performed via buccal swabs inside the patient’s mouth, the suitable personalized treatment will be selected for each patient for administration. |

| ● | This approach allows personalized treatment without the need for personalized manufacturing. Additionally, it saves time and skips expensive and complicated manufacturing procedures associated with other personalized treatments. |

| ● | Bria-OTS™ cell lines are being engineered with the goal of transferring them to production in 2020 and commencing clinical evaluation in 2021 (expected authorization by FDA and expected first patient to be dosed in 2021) with safety and efficacy data expected to be released during 2021 and 2022. |

BriaDx™

BriaDx™ is a diagnostic test that BriaCell is developing to identify the patients most likely to respond to Bria-IMT™. Currently, BriaDx™ includes HLA typing of the patients as patients having HLA alleles also present in Bria-IMT™ appear to have a higher likelihood of responding to the Bria-IMT™ regimen with tumor regression (“shrinkage”). Additional markers of potential diagnostic use are being explored based on the expression of specific biomarkers in the responder (i.e. biomarkers which identify the patients for which Bria-IMT™ immunotherapy appears more effective) vs the non-responder patients from clinical studies of Bria-IMT™ in advanced breast cancer patients.

| 6 |

Blood including circulating tumor cells from the patients is analyzed using cutting-edge technologies including gene expression analysis and assessment of the levels of antibodies predicted to bind to Bria-IMTTM.

The insights gained from biomarker studies conducted to date have provided us with a solid basis for the development of Bria-OTS™, an off-the-shelf personalized immunotherapy which would match over 99% of patients with advanced breast cancer.

BriaDx™ is being developed to help understand which patients are most likely to respond to Bria-IMT™ targeted immunotherapy. Based on the proposed mechanism of action of Bria-IMT™ (see Figure below) HLA molecules play a key role inducing cellular immune responses to Bria-IMT™ which boosts the patient’s immune response to their cancer.

HLA molecules are polymorphic, in that they are different in different individuals but shared by some individuals (similar to eye color). Based on our clinical data to date we hypothesize that patients with HLA alleles also present in Bria-IMT™ have a higher likelihood of responding to the Bria-IMT™ regimen with tumor regression (“shrinkage”). Therefore, BriaDx™, a companion diagnostic test, determines the patients’ HLA types.

| 7 |

Available Clinical Data for Treatment with the Bria-IMT™ Regimen

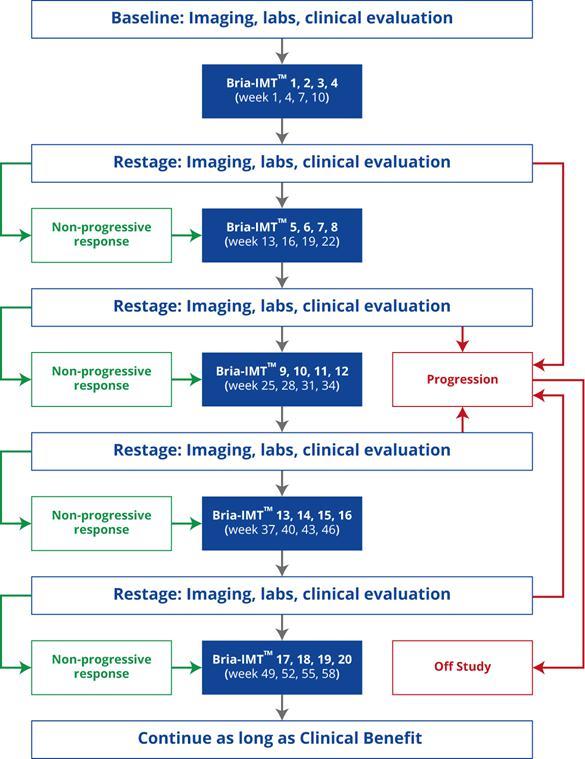

BriaCell conducted three Proof of Concept clinical trials, one using parental SV-BR-1 cells and the other two using Bria-IMT™ (i.e., genetically engineered SV-BR-1 cells – producing GM-CSF also called SV-BR-1-GM), in metastatic (i.e., Stage IV) breast cancer patients who had failed prior treatments. The patients were treated with the Bria-IMT™ regimen according to the following schedule, and the results are summarized starting on page 55 herein.

Mechanism of Action of BRIA-IMT™ and BRIA-OTS™

The mechanism of action of Bria-IMT™/Bria-OTS™ is currently under investigation.

We believe that Bria-IMT™/Bria-OTS™ activates the patient’s immune system to recognize tumor cells and destroy them. We hypothesize that Bria-IMT™/Bria-OTS™ exerts its action via the patient’s antigen-presentation system {i.e. the system that presents antigen material on the surface of cells for recognition by the T cells of the immune system as either self (i.e., safe) or foreign (i.e., to be destroyed)}. Specifically, Bria-IMT™/Bria-OTS™ is thought to stimulate dendritic cells, a key component of the antigen-presenting system, to display certain immunogenic (i.e., immune response-generating) protein fragments to T cells, which activates the T cells to destroy the tumor cells either directly, or indirectly by inducing a humoral (antibody-generating) immune response. In addition, we also have shown that Bria-IMT™ is capable of directly stimulating T cells thereby potentially adding additional therapeutic benefits. The latter property of Bria-IMT™ is the basis of the Bria-OTS™ project as it requires HLA matching between the therapeutic cells and the patient.

Our preliminary analyses have shown several up-regulated genes in Bria-IMT™ that encode proteins known to be immunogenic (i.e. immune response-generating), suggesting that Bria-IMT™ can stimulate the immune system against the cancer cells.

| 8 |

Bria-IMT™ is a human breast cancer cell line which expresses Her2/neu (a protein well known for its overexpression in breast cancer but also associated other epithelial malignancies including ovarian, pancreatic, colon, bladder and prostate cancers). Bria-IMT™ has been engineered to produce and secrete granulocyte/macrophage-colony stimulating factor (GM-CSF), a protein that promotes dendritic cell function, a key component of the immune system, and hence activates the immune system.

BRIA-IMT™ & BRIA-OTS™

Potential Mechanisms of Specific Immune Activation in Advanced Breast Cancer

| 1. | Bria-IMT/OTS™ produces breast cancer antigens (proteins made by breast cancer cells) |

| 2. | Bria-IMT/OTS™ secretes GM-CSF which further promotes dendritic cell-based antigen presentation (boosts the response) |

| 3. | Breast cancer antigens are taken up by dendritic cells and “presented” to CD4+ and CD8+ T cells implicated in tumor destruction. |

| 4. | Bria-IMT/OTS™ directly stimulates cancer fighting CD4+ and CD8+ T cells (further boosts the response) |

| 5. | Bria-IMT/OTS™ biological activity depends on HLA matching of Bria-IMT/OTS™ and the patient |

| 6. | Based on these observations, BriaCell is extending this technology to other types of cancer by developing additional immunotherapy cell lines. These include Prostate Cancer (novel immunotherapy cell line 1 or NICL1), non-small cell lung cancer (NICL2) and melanoma (NICL3). Production of these NICLs is anticipated to commence in 2020 and IND filings for these NICLs are anticipated starting in 2021 (NICL1 and NICL2) and 2022 (NICL3). Each of these IND filings is expected to require an additional ~US$1,000,000. |

| 9 |

Clinical Trials

Phase I/IIA Combination Study of BRIA-IMT™ with Immune Checkpoint Inhibitors in Advanced Breast Cancer

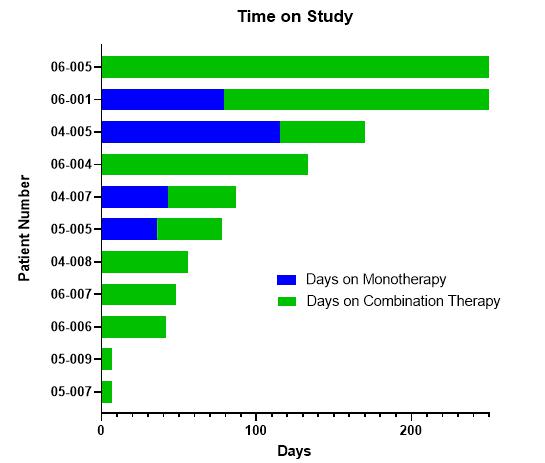

The FDA approved the combination study of Bria-IMT™ with immune checkpoint inhibitors. The initial study used pembrolizumab (Keytruda, purchased by the Company as the Company does not have an agreement with Merck for the supply of Keytruda). The Company dosed 11 patients with this combination and no dose limiting toxicities were observed. Additionally, evidence of additive or synergistic activity was observed.

The combination with Keytruda was discontinued and the study was subsequently modified to use a combination of Bria-IMT with the Incyte PD-1 inhibitor (INCMGA00012) and epacadostat. The Company anticipates additional safety and efficacy data for the combination of Bria-IMT™ with INCMGA00012 and epacadostat to be released between the fourth quarter of 2020 and throughout 2021 and 2022.

Rationale for the Combination Study of BRIA-IMT™ with Immune Checkpoint Inhibitors

The immune checkpoint inhibitors such as anti-PD-1 antibodies have come to the forefront in the fight against cancer with substantial benefits for some patients. Most recently, the significance of immune checkpoint inhibitors was recognized by the Nobel committee by awarding Dr. Tasuku Honjo and Dr. James P. Allison with the 2018 Nobel Prize in Physiology or Medicine (Scientists behind game-changing cancer immunotherapies win Nobel medicine prize), validating the Company’s decision to initiate a combination therapy with the immune checkpoint inhibitors.

Drs. Alison and Honjo independently, using different strategies, showed a new approach of treating patients by awakening certain cells of the immune system (T cells) to attack tumors. This new approach of treating patients with immune checkpoint inhibitors (such as anti-PD-1 antibodies), designed to overcome immune suppression in cancer patients, is revolutionizing the fight against cancer.

In 2010 an important pre-clinical study by Dr. Allison’s group showed that combination with anti-PD-1 antibodies potentiated the tumor-destroying effect of melanoma cells engineered to produce granulocyte-macrophage colony-stimulating factor (GM-CSF), a substance that activates the immune system, compared to the treatment with the GM-CSF producing cells alone. Bria-IMT™ similarly uses a breast cancer cell line which produces GM-CSF. Bria-IMT™ has also been shown to indirectly and directly stimulate T cells, and hence boost the immune system. BriaCell has published these findings in a leading immunology journal. It is important to note that PD-1 inhibitors have not been shown to work on their own in breast cancer.

| 10 |

BriaCell & Incyte Collaboration and Supply Agreement

Non-exclusive clinical trial collaboration to evaluate the effects of combinations of novel clinical candidates

| ● | The clinical study will focus on (but not limited to) BriaCell’s lead candidate, Bria-IMT™, in combination with Incyte’s selected compounds for advanced breast cancer. |

| ● | Incyte to provide compounds from its development portfolio, including INCMGA0012, an anti-PD-1 monoclonal antibody, and epacadostat, an IDO1 inhibitor, for use in combination studies with BriaCell’s lead candidate, Bria-IMT™. |

| ● | Incyte is a global biopharmaceutical company focused on discovering and developing novel therapeutics in oncology and other serious diseases. |

| ● | Incyte has a deep and rich pipeline in immuno-oncology with numerous molecular targets including PD-1, IDO, GITR, OX40, TIM-3, LAG-3, ARG, AXL/MER and PD-L1xCD137 |

| ● | The first 6 patients will receive the Bria-IMT™ regimen in combination with INCMGA00012. Once safety of the combination has been established, subsequent cohorts will receive a triple combination of the Bria-IMT™ regimen with INCMGA00012 and epacadostat. |

| ● | The design of the clinical study is shown below. Dosing of the novel combinations commenced in the fourth quarter of 2019. |

| ● | The Company anticipates additional safety and efficacy data to be released between the fourth quarter of 2020 and throughout 2021 and 2022. |

| ● | Pending discussions with the Food and Drug Administration (FDA), a registration study focused on, but not limited to, Bria-IMT™, in combination with Incyte’s selected compounds for advanced breast cancer is planned to commence in late 2021 with the Bria-OTS™ program following by approximately 6 quarters. |

| 11 |

Bria-IMT™ - Keytruda® Combination Study at Thomas Jefferson University

Pending consummation of the offering, Bria-IMT™ will be evaluated in an investigator-initiated Phase I/IIa study in combination with pembrolizumab (Keytruda) by Dr. Saveri Bhattacharya, Principal Investigator, in women with advanced breast cancer at Thomas Jefferson University. Dr. Bhattacharya has been selected to receive a grant from the Merck Investigator Studies Program for this study. Merck will provide Keytruda to Thomas Jefferson University and Dr. Bhattacharya for use in the combination study. The Company does not have an agreement with Merck for the supply of Keytruda. The Company has entered into the Study Agreement with Thomas Jefferson University providing for the investigator-initiated Phase I/IIa study by Dr. Bhattacharya and the Company’s supply of Bria-IMT™ to Thomas Jefferson University and Dr. Bhattacharya. As consideration, the Company shall pay Thomas Jefferson University a total budget of $3,049,322.50. The FDA and Thomas Jefferson University’s internal review board have approved the clinical protocol. Patients with advanced breast cancer who have at least HLA that matches with Bria-IMT™ will be eligible for the trial. Pending consummation of the offering the study is expected to commence in the fourth quarter of 2020 with safety and efficacy data to be released during 2021 and 2022.

Market

It is estimated that in 2019, approximately 268,600 women will be diagnosed with breast cancer in the United States. According to the National Breast Cancer Foundation, on every two minutes an American woman is diagnosed with breast cancer and more than 40,500 die each year. Although about 100 times less common than in women, breast cancer also affects men. It is estimated that the lifetime risk of men getting breast cancer is about 1 in 1,000, and the ACS estimates that approximately 2,670 new cases of invasive male breast cancer will be diagnosed and approximately 500 men will die from breast cancer in 2019.

| 12 |

According to the May 2019 “Global Oncology Trends 2019” report by the IQVIA Institute, the global market for cancer drugs (including immunotherapy drugs) is expected to reach nearly US$240 billion by the end of 2023, growing at a compound annual growth rate, or CAGR of 9-12% between 2019 and 2023.

Marketing and Sales Strategy

The product will initially be marketed to oncologists who are well versed in the use of immunotherapy for cancer. Partnering with other pharma companies in order to market combinations with a number of drugs is also an option that we intend to pursue. This study will utilize a frozen formulation which consists of irradiated SV-BR-1-GM cells in viable freezing media. This formulation will permit stockpiling of the immunotherapy so that it can be sent on demand to clinical sites. The eventual goal is to reach all oncologists who treat late stage breast cancer either by direct outreach or by partnering with another company that has an established presence in the oncology space.

Other Commercial Considerations

There is a high unmet medical need in late stage breast cancer, providing potential for accelerated approval of Bria-IMT™. The FDA is interested in facilitating the availability of novel therapies of patients with unmet medical needs, especially those that can target the population most likely to respond. In addition, Bria-IMT™ may fit the description of an orphan drug, especially if HLA matching and/or limitation to grade I/II tumors is required. These two facts may help facilitate accelerated approval of Bria-IMT™.

Production and Marketing Plan

Bria-IMT™ cells grow in simple tissue culture media and are irradiated prior to inoculation. Bria-IMT™ manufacturing will be performed by Contract Manufacturing Organizations (CMOs). Recently we have been working with KBI Biopharma, Inc. who have developed a frozen formulation, where the cells are grown, harvested and irradiated followed by cryopreservation in a viable state. The cells are stockpiled and shipped directly to clinical sites for inoculation. Each lot of Bria-IMT™ is tested for potency (GM-CSF production), identity (HER2+ and ER/PR-) and adventitious agents to assure that each patient receives a safe and effective treatment. To date, there have been no issues with these tests. Additional manufacturing facilities have been evaluated and may be enlisted as demand grows.

Earlier Phase Programs

BriaCell has recently filed provisional patent applications describing:

| ● | Coronavirus Immunotherapy | |

| ● | Antibody-Based Treatment of Infectious Diseases | |

| ● | Novel Therapeutics for Cancer | |

| ● | Novel Immune Therapies for Multiple Disease Indications | |

| ● | Novel Treatment and Diagnosis of Coronavirus Disease |

The Coronavirus Immunotherapy patent application, filed on April 10, 2020, entitled, “INDUCING IMMUNE RESPONSES BY TRANSFORMING CANCER CELLS INTO ANTIGEN-PRESENTING CELLS”, is based on molecular analyses of the Company’s lead anti-tumor product candidate. Antigen-presenting cells are the cells that typically start immune responses. BriaCell’s whole-cell immunotherapies are designed to stimulate the immune system to recognize and destroy the patient’s tumors by acting as antigen-presenting cells that stimulate the patient’s cancer-cell-recognizing immune cells. The new patent application by BriaCell scientists expands on this paradigm by proposing additional cellular therapeutics designed to activate immune cells recognizing SARS-CoV-2 (the coronavirus causing COVID-19) antigens. The patent application seeks protection for, among others, new whole-cell therapeutics and methods for their use. These are designated “Novel Immunotherapy Cell Lines (NICL-CoV-2)”. An IND filing for this treatment is anticipated to be made in 2021 and requires an additional ~US$1,000,000.

The Antibody-Based Treatment of Infectious Diseases patent application, filed on April 20, 2020, entitled, “COMPUTER-GUIDED DESIGN OF ANTIBODIES INCLUDING NEUTRALIZING SARS-CoV-2 BINDING AGENTS”, outlines compositions and methods for generating antibodies to neutralize SARS-CoV-2 (the coronavirus causing COVID-19) using computer-based simulation technology. Such antibodies are envisioned to prevent and treat the life-threatening symptoms of COVID-19. The use of computer simulation creates highly targeted antibodies by improving pre-existing antibodies. The improvements include, but are not limited to, creating higher affinity and/or specificity antibodies to the SARS-CoV-2 Spike protein (the protein which the virus uses to infect cells) versus the unmodified antibody. The resulting therapeutic antibodies are expected to quickly and specifically recognize the SARS-CoV-2 virus, bind to it, and neutralize it. The patent application also provides compositions and methods, using similar technologies, for cancer-directed antibodies. The patent application seeks protection for the design of new therapeutic antibodies and methods for their use. These are designated “Antibodies for SARS-CoV-2”. An IND filing for this treatment is anticipated to be made in 2021 and requires an additional ~US$1,000,000.

The patent application for Novel Immune Therapies for Multiple Disease Indications, filed on May 15, 2020, entitled, “MULTI-VALENT IMMUNOSTIMULATORS FOR INFECTIOUS DISEASES, AUTOIMMUNE DISEASES, ALLERGIC DISEASES AND CANCER”, describes a platform to generate multi-valent reagents carrying an antigen (such as an antigen from SARS-CoV-2) and delivering it to immune cells such as dendritic cells, a type of antigen-presenting cell crucial for the induction and modulation of immune responses. The expected effect is a targeted therapy envisioned to selectively destroy infectious agents or cancer cells with minimal negative effect on normal cells. This may mean less severe side effects for the treated patients compared to other therapies. The technology also has uses for autoimmune diseases and allergic diseases. The Company cautions that these novel therapeutics are still under early-stage research and development and is not making any express or implied claims as to their success in cancer treatment or commercial viability. The patent application seeks protection for, among others, the design of new therapeutics and methods for their use. These are designated “Novel ImmunoStimulators (NIS-CoV-2)”. An IND filing for this treatment is anticipated to be made in 2021 and requires an additional ~US$1,000,000.

| 13 |

The Company cautions that COVID-19 therapeutic development is still under early-stage research and development and is not making any express or implied claims that it has the ability to treat, prevent or eliminate the COVID-19 virus at this time.

The patent application for Novel Therapeutics for Cancer, filed on April 23, 2020, is entitled, “METHODS FOR INDUCING AND ENHANCING ANTI-CANCER IMMUNE RESPONSES USING NOVEL MOLECULAR CONSTRUCTS”. It outlines the development and use of multi-specific binding reagents that simultaneously bind to an immune cell and a cancer cell, or just to a cancer cell, and activate the immune system against the cancer cells. The novel binding reagents are designed to act, among others, as potent immune cell activators/immune checkpoint inhibitors without the toxicity of current checkpoint inhibitors. The expected effect is a highly targeted therapy envisioned to selectively destroy cancer cells without affecting normal (non-cancerous) cells. This may mean less severe side effects for the treated cancer patients compared to alternative therapies. The Company cautions that these novel therapeutics are still under early-stage research and development and is not making any express or implied claims as to their success in cancer treatment or commercial viability. The patent application seeks protection for, among others, the design of new therapeutics and methods for their use. These are designated “Bria-TILs-Rx”. IND filings for Bria-TILs-Rx for the treatment of prostate cancer and epithelial and glandular cancer, respectively, are anticipated to be made in 2022 and require an additional ~US$1,000,000 each.

The patent application for Novel Treatment and Diagnosis of Coronavirus Disease, filed on June 22, 2020, entitled “MULTI-VALENT DECOY RECEPTORS FOR DIAGNOSIS AND/OR TREATMENT OF CORONAVIRUS INFECTION”, describes a platform to generate multi-valent molecular constructs (decoy receptors) that have the potential to prevent coronaviruses including the SARS-CoV-2 virus (the virus that causes Coronavirus Disease 2019 (COVID-19)) from entering (infecting) healthy host cells. Multi-valent constructs described in the patent application are believed to have both therapeutic and diagnostic potential, the latter in the context of determining whether a patient has developed coronavirus-specific antibodies. The Company cautions that these novel therapeutics are still under early-stage research and development and is not making any express or implied claims as to their success in treatment or commercial viability. The patent application seeks protection for, among others, the design of new therapeutics and diagnostics and methods for their use.

Risks Related to our Business and this Offering

Our business and this offering are subject to numerous risks, as more fully described in the section entitled “Risk Factors” immediately following this prospectus summary. You should read these risks before you invest in our securities. In particular, our risks include, but are not limited to, the following:

| ● | We have a history of losses, may incur future losses and may not achieve profitability; | |

| ● | We are an early stage development company; | |

| ● | We have an unproven market for our product candidates; | |

| ● | We are heavily reliant on third-parties to carry out a large portion of our business; | |

| ● | Pre-clinical studies and initial clinical trials are not necessarily predictive of future results; | |

| ● | We must obtain additional capital to continue our operations; | |

| ● | We are highly dependent on our key personnel; | |

| ● | The report of our independent registered public accounting firm expresses substantial doubt about our ability to continue as a going concern; | |

| ● | We may not succeed in completing the development of our products, commercializing our products or generating significant revenues; | |

| ● | We may not successfully develop, maintain and protect our proprietary products and technologies; | |

| ● | Changes in legislation and regulations may affect our revenue and profitability; | |

| ● | If we or our licensees are unable to obtain U.S., Canadian and/or foreign regulatory approval for our product candidates, we will be unable to commercialize our therapeutic candidates; | |

| ● | Clinical trials involve a lengthy and expensive process with an uncertain outcome, and results of earlier studies and trials may not be predictive of future trial results; | |

| ● | An active trading market for our common shares may not develop on Nasdaq and our securityholders may not be able to resell their common shares or Warrants; | |

| ● | The Warrants may not have any value; | |

| ● | Without an active trading market, the liquidity of the Pre-funded Warrants and Warrants will be very limited and the Warrants and Pre-Funded Warrants may not have any value; | |

| ● | The Pre-Funded Warrants are not listed or quoted on any trading market or exchange; | |

| ● | Future issuance of our common shares could dilute the interests of existing shareholders; | |

| ● | We have a significant number of options and warrants outstanding, and while these options and warrants are outstanding, it may be more difficult to raise additional equity capital; | |

| ● | We are a foreign private issuer and, as a result, we are not subject to U.S. proxy rules and are subject to reporting obligations that, to some extent, are more lenient and less frequent than those applicable to a U.S. issuer; | |

| ● | If you purchase our common shares in this offering, you will incur immediate and substantial dilution in the book value of your shares; and | |

| ● | Our management will have broad discretion in the use of the net proceeds from this offering and may allocate the net proceeds from this offering in ways that you and other shareholders may not approve. |

Corporate Background

We were incorporated in the province of British Columbia on July 26, 2006. Our common shares have been quoted on the OTCQB under the symbol BCTXF, on the TSX Venture Exchange under the symbol “BCT.V” and on the Frankfurt Stock Exchange under the symbol “8BTA”.

Our principal executive office is located at Suite 300 – 235 15th Street, West Vancouver, British Columbia, V7T 2X1 and our telephone number in Canada is (604) 921-1810. Our web address is https://briacell.com/. The information contained on our website or available through our website is not incorporated by reference into and should not be considered a part of this prospectus, and the reference to our website in this prospectus is an inactive textual reference only. Any website references (URL’s) in this prospectus are inactive textual references only and are not active hyperlinks. The contents of our website is not part of this prospectus, and you should not consider the contents of our website in making an investment decision with respect to our common shares. Paracorp Incorporated is our agent in the United States, and its address is 2804 Gateway Oaks Drive #100, Sacramento, CA 95833, Tel: (888) 280-6563, Fax: (800) 603-5868; Attn: Katelyn Bean (kbean@myparacorp.com).

The Company’s corporate offices in the United States are located at 820 Heinz Avenue, Berkley, California 94710. The Company’s two wholly owned subsidiaries BriaCell Therapeutics Corp., a Delaware corporation, and Sapientia Pharmaceuticals Inc., a Delaware corporation, were formed on April 3, 2014 and September 20, 2012 respectively.

In February and March 2019, the Company’s Board of Directors was substantially restructured with the appointment of Jamieson Bondarenko, Dr. Rebecca Taub and Vaughn C. Embro-Pantalony to replace three resigning directors. Additionally, on August 12, 2019, Richard Berman was appointed to our Board of Directors. After these restructuring events, the current Board of Directors consists of:

| ● | Dr. William V. Williams, Director and Chief Executive Officer; | |

| ● | Jamieson Bondarenko, Director and Chairman of the Board; | |

| ● | Dr. Charles Wiseman, Director; | |

| ● | Dr. Rebecca Taub, Director | |

| ● | Vaughn C. Embro-Pantalony, Director; and | |

| ● | Richard Berman, Director |

| 14 |

Implications of Being an “Emerging Growth Company” and a Foreign Private Issuer

As a company with less than US$1.07 billion in revenue during our last fiscal year, we qualify as an “emerging growth company” as defined in the Jumpstart Our Business Startups Act of 2012, or the JOBS Act. An emerging growth company may take advantage of specified reduced reporting and other burdens that are otherwise applicable generally to public companies. These provisions include:

| ● | reduced executive compensation disclosure; | |

| ● | exemptions from the requirement to hold a non-binding advisory vote on executive compensation, including golden parachute compensation; and | |

| ● | an exemption from the auditor attestation requirement in the assessment of our internal control over financial reporting pursuant to the Sarbanes-Oxley Act of 2002. |

We may take advantage of these provisions until we are no longer an emerging growth company. We would cease to be an emerging growth company upon the earlier to occur of: (1) the last day of our fiscal year following the fifth anniversary of the completion of this offering; (2) the last day of the fiscal year in which we have total annual gross revenue of US$1.07 billion or more; (3) the date on which we have issued more than US$1.0 billion in nonconvertible debt during the previous three years; or (4) the date on which we are deemed to be a large accelerated filer under the rules of the Securities and Exchange Commission, or the SEC.

We intend to report under the Securities Exchange Act of 1934, as amended, or the Exchange Act, as a non-U.S. company with foreign private issuer status. Even after we no longer qualify as an emerging growth company, as long as we continue to qualify as a foreign private issuer under the Exchange Act, we will be exempt from certain provisions of the Exchange Act that are applicable to U.S. domestic public companies, including:

| ● | the sections of the Exchange Act regulating the solicitation of proxies, consents or authorizations with respect to a security registered under the Exchange Act; | |

| ● | the sections of the Exchange Act requiring insiders to file public reports of their share ownership and trading activities and liability for insiders who profit from trades made in a short period of time; and | |

| ● | the rules under the Exchange Act requiring the filing with the SEC of quarterly reports on Form 10-Q containing unaudited financial statements and other specified information, and current reports on Form 8-K upon the occurrence of specified significant events, although we report our results of operations on a quarterly basis under the Canadian securities laws. |

Both foreign private issuers and emerging growth companies are also exempt from certain more stringent executive compensation disclosure rules. Thus, even if we no longer qualify as an emerging growth company, but remain a foreign private issuer, we will continue to be exempt from the more stringent compensation disclosures required of companies that are neither an emerging growth company nor a foreign private issuer.

We would cease to be a foreign private issuer at such time as more than 50% of our outstanding voting securities are held by U.S. residents, and any one of the following three circumstances applies: (i) the majority of our executive officers or directors are U.S. citizens or residents, (ii) more than 50% of our assets are located in the United States or (iii) our business is administered principally in the United States.

In this prospectus, we have taken advantage of certain of the reduced reporting requirements as a result of being an emerging growth company and a foreign private issuer. Accordingly, the information contained herein may be different than the information you receive from other public companies in which you hold equity securities.

Reverse Split

On October 22, 2019, our shareholders approved a reverse stock split of our issued and outstanding common shares at a ratio of between 1-for-2 and 1-for-300, with the specific ratio and effective time of the reverse stock split to be determined by our Board of Directors, or our Board. In November, our Board of Directors approved a 1-for-300 reverse stock split, or the Reverse Split, which was implemented on January 2, 2020. The Reverse Split was intended to allow us to meet the minimum share price requirement of The Nasdaq Capital Market. We have applied for listing of our common shares and Warrants on The Nasdaq Capital Market, which listing we expect to occur upon the consummation of this offering. However, there are no assurances that such listing application will be approved. If the application is not approved, our common shares will continue to be traded on the OTCQB, TSXV and Frankfurt Stock Exchange and we will be unable to complete this offering.

| 15 |

THE OFFERING

The information below is only a summary of more detailed information included elsewhere in this prospectus. This summary may not contain all the information that is important to you or that you should consider before making a decision to invest in our securities. Please read this entire prospectus, including the risk factors, carefully.

| Common Units offered | 2,952,587 Common Units, each consisting of one common share and one Warrant, each whole Warrant exercisable for one common share. The Warrants included within the units are exercisable immediately, have an exercise price of US$______ per share, equal to 125% of the public offering price of one unit, and expire five years from the date of issuance. The common shares and Warrants that are part of the Common Units are immediately separable and will be issued separately in this offering. | |

| Pre-Funded Units offered | We are also offering to those purchasers, if any, whose purchase of Common Units in this offering would otherwise result in the purchaser, together with its affiliates and certain related parties, beneficially owning more than 4.99% (or, at the election of the purchaser, 9.99%) of our outstanding common shares immediately following the consummation of this offering, the opportunity to purchase, if the purchaser so chooses, pre-funded units (each a “Pre-funded Unit”) in lieu of Common Units that would otherwise result in the purchaser’s beneficial ownership exceeding 4.99% (or, at the election of the purchaser, 9.99%) of our outstanding common shares. Each Pre-funded Unit will consist of a pre-funded warrant to purchase one common share at an exercise price of US$0. 01 per share (each a “Pre-funded Warrant”) and a Warrant. The purchase price of each Pre-funded Unit is equal to the price per Common Unit being sold to the public in this offering, minus US$0. 01 . The Pre-funded Warrants will be immediately exercisable and may be exercised at any time until all of the Pre-funded Warrants are exercised in full. For each Pre-funded Unit we sell, the number of Common Units we are offering will be decreased on a one-for-one basis. We are offering a maximum of 2,952,587 Pre-funded Units. Because we will issue one Warrant as part of each Common Unit or Pre-funded Unit, the number of Warrants sold in this offering will not change as a result of a change in the mix of the Common Units and Pre-funded Units sold. This prospectus also relates to the offering of the common shares issuable upon exercise of the Pre-funded Warrants. | |

| Public offering price | The assumed public offering price is US$4.64 per Common Unit and US$4.63 per Pre-Funded Unit | |

| Over-allotment option | We have granted the underwriters a 45-day option to purchase up to additional common shares and/or Pre-Funded Warrants, representing 15% of the common shares and Pre-Funded Warrants sold in the offering and/or up to additional Warrants, representing 15% of the Warrants sold in the offering.

The purchase price to be paid per additional Common Unit or Pre-Funded Warrant by the underwriters shall be equal to the public offering price of one Common Unit or one Pre-funded Warrant, as applicable, less the underwriting discount, and the purchase price to be paid per additional Warrant by the underwriters shall be US$0.00001. | |

| Common shares outstanding prior to this offering | 771,962 common shares, after giving effect to the Reverse Split. | |

| Common shares outstanding after this offering (1)(2) | 3,724,549 shares (or 4,167,437 shares if the underwriters exercise their over-allotment option in full). | |

| Use of proceeds | We expect to receive approximately US$11,900,000 in net proceeds from the sale of securities offered by us in this offering (approximately US$13,800,000 if the underwriters exercise their over-allotment option in full), after deducting estimated underwriting discounts and commissions and estimated offering expenses payable by us, based on an assumed offering price of US $4.64 per Common Unit. We intend to use the net proceeds from this offering to advance our clinical trials and as further set forth in the “Use of Proceeds” section. | |

| Risk factors | An investment in our securities involves significant risks. See the section entitled “Risk Factors” and other information included in this prospectus for a discussion of factors you should carefully consider before deciding to invest in our securities. | |

| Lock-up | We and our directors and executive officers have agreed with the underwriters not to offer, issue, sell, contract to sell, encumber, grant any option for the sale of or otherwise dispose of any of our securities for a period of six months commencing on the date of this prospectus. See “ Underwriting ” beginning on page 123 . | |

| Market and trading symbol for our common shares and Warrants | Our common shares are currently quoted on the OTCQB under the symbol “BCTXF”, on the TSXV under the symbol “BCT.V” and on the Frankfurt Stock Exchange under the symbol “8BTA”. We have applied to list the common shares and Warrants included within the Common Units and Pre-funded Units on the Nasdaq Capital Market under the symbols “BCTX” and “BCTXW”, respectively. No assurance can be given that such listings will be approved. We do not plan to list the Pre-funded Warrants on any market or exchange. |

| 16 |

| (1) | The number of common shares to be outstanding after this offering is based on 771,962 common shares outstanding as of September 17, 2020 and excludes the following: |

| ● | 178,528 common shares issuable upon the exercise of outstanding warrants, at a weighted average exercise price of $44.19; | |

| ● | 13,790 common shares issuable upon the exercise of outstanding compensation warrants, at a weighted average exercise price of $45.00; | |

| ● | 912 common shares issuable upon the granting of 912 warrants arising from the exercise of 912 compensation warrants at a weighted average exercise price of $90.00; and | |

| ● | 19,969 common shares issuable upon the exercise of outstanding options, at a weighted average exercise price of $49. |

| (2) | Except as otherwise indicated herein, all information in this prospectus assumes no sale of Pre-funded Units in this offering, no exercise of the warrants being offered in this offering, no exercise of the underwriters’ over-allotment option and no exercise of the underwriter warrants. |

| 17 |

Summary Financial Data

The summary financial information set forth below has been derived from our unaudited condensed consolidated interim financial statements for the three and nine months ended April 30 , 2020 and our audited financial statements for the fiscal years ended July 31, 2019, 2018, 2017, 2016 and 2015. You should read the following summary financial data for the three and nine months ended April 30 , 2020 and the years ended July 31, 2019 and 2018 together with our historical financial statements and the notes thereto included elsewhere in this prospectus and with the information set forth in the section titled “Management’s Discussion and Analysis of Financial Conditions and Results of Operations”. The audited financial statements for the years ended July 31, 2017, 2016 and 2015 are not included in this prospectus.

As of April 30 , | As of July 31, | |||||||||||||||||||||||

| 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | |||||||||||||||||||

| Balance Sheet Data | ||||||||||||||||||||||||

| Cash and cash equivalents | 74,244 | 192,916 | 938,448 | 1,264,429 | 171,865 | 464,732 | ||||||||||||||||||

| Total Assets | 610,281 | 546,259 | 2,977,140 | 2,039,199 | 1,091,587 | 1,660,288 | ||||||||||||||||||

| Total Liabilities | 4,434,430 | 1,392,396 | 1,745,850 | 1,104,147 | 63,470 | 152,425 | ||||||||||||||||||

| Total Shareholders’ Equity (deficit) | ( 3,824,149 | ) | (846,137 | ) | 1,231,290 | 935,052 | 1,028,117 | 1,507,863 | ||||||||||||||||

Nine months ended April 30 , | Year ended July 31, | |||||||||||||||||||||||

| 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | |||||||||||||||||||

| Operating Data | ||||||||||||||||||||||||

| Revenues and other income | - | - | - | - | - | - | ||||||||||||||||||

| Expenses: | ||||||||||||||||||||||||

| Research costs | 2, 502,374 | 4,917,287 | 3,112,579 | 2,125,941 | 944,942 | 390,036 | ||||||||||||||||||

| General and administrative costs | 1, 633,919 | 1,244,471 | 1,387,713 | 820,281 | 584,105 | 892,611 | ||||||||||||||||||

| Share-based compensation | 2,071 | 60,586 | 476,211 | 272,014 | 648,149 | 516,288 | ||||||||||||||||||

| Listing costs | - | - | - | - | 1,599,488 | |||||||||||||||||||

| Surrender of royalty rights | - | - | - | - | - | 150,000 | ||||||||||||||||||

| Total expenses | 4,138,364 | 6,222,344 | 4,976,503 | 3,218,236 | 2.177,196 | 3,548,423 | ||||||||||||||||||

| Operating loss | ( 4,138,364 | ) | (6,222,344 | ) | (4,976,503 | ) | (3,218,236 | ) | (2.177,196 | ) | (3,548,423 | ) | ||||||||||||

| Interest income | - | 12,004 | 15,991 | 6,428 | 4,738 | 9,227 | ||||||||||||||||||

| Interest expenses | ( 11,154 | ) | (31,317 | ) | (20,364 | ) | - | - | - | |||||||||||||||

| Change in fair value of convertible debt | (79,119 | ) | 420,585 | (407,709 | ) | - | - | - | ||||||||||||||||

| Loss on available for sale investments | - | - | - | - | (27,763 | ) | - | |||||||||||||||||

| Foreign exchange gain (loss) | (20, 033 | ) | 31,410 | (24,078 | ) | (8,913 | ) | (14,561 | ) | 50,385 | ||||||||||||||

| ( 110,306 | ) | 432,682 | (436,160 | ) | (2,485 | ) | (37,586 | ) | 59,612 | |||||||||||||||

| Loss For The Period | ( 4,248,670 | ) | (5,789,662 | ) | (5,412,663 | ) | (3,220,721 | ) | (2,214,782 | ) | (3,488,811 | ) | ||||||||||||

| Items That Will Subsequently Be Reclassified To Profit Or Loss | ||||||||||||||||||||||||

| Foreign currency translation adjustment | ( 146,157 | ) | (18,781 | ) | (33,340 | ) | 41,828 | 18,575 | (48,921 | ) | ||||||||||||||

| Unrealized loss on available for sale investments | - | - | - | - | (6,892 | ) | (20,871 | ) | ||||||||||||||||

| Items Reclassified To Profit Or Loss | - | |||||||||||||||||||||||

| Reclass of unrealized losses on available for sale investments | - | - | - | - | 27,763 | - | ||||||||||||||||||

| Comprehensive loss for the year | ( 4,394,827 | ) | (5,808,443 | ) | (5,446,003 | ) | (3,178,893 | ) | (2,175,336 | ) | (3,558,603 | ) | ||||||||||||

| Basic and Fully Diluted Loss Per Share | ( 6.20 | ) | (10.02 | ) | (12.73 | ) | (9.36 | ) | (7.54 | ) | (14.28 | ) | ||||||||||||

| Weighted Average Number Of Shares Outstanding | 708,572 | 579,664 | 427,815 | 339,707 | 288,472 | 249,203 | ||||||||||||||||||

| 18 |

An investment in our common shares involves a high degree of risk. You should carefully consider the following factors and other information in this prospectus before deciding to invest in us. If any of the following risks actually occur, our business, financial condition, results of operations and prospects for growth would likely suffer. As a result, you could lose all or part of your investment. Additional risks and uncertainties not presently known to us or that we currently deem immaterial also may materially and adversely affect our business, financial condition and results of operations. See also “Cautionary Statement Regarding Forward-Looking Statements.”

Risks Related to Our Business

We have a history of losses, may incur future losses and may not achieve profitability

BriaCell is a development stage immune-oncology biotechnology corporation that to date has not recorded any revenues from the sale of diagnostic or therapeutic products. Since incorporation, BriaCell has accumulated net losses and expects such losses to continue as it commences product and pre-clinical development and eventually enters into license agreements for its technology. We incurred net losses of $ 4,248,670 , $3,220,721, $5,412,663 and $5,789,662 in the nine months ended April 30 , 2020 and the fiscal years ended July 31, 2017, 2018 and 2019, respectively. Management expects to continue to incur substantial operating losses unless and until such time as product sales generate sufficient revenues to fund continuing operations. BriaCell has neither a history of earnings nor has it paid any dividends and it is unlikely to pay dividends or enjoy earnings in the immediate or foreseeable future.

We are an early stage development company

The Company expects to spend a significant amount of capital to fund research and development. As a result, the Company expects that its operating expenses will increase significantly and, consequently, it will need to generate significant revenues to become profitable. Even if the Company does become profitable, it may not be able to sustain or increase profitability on a quarterly or annual basis. The Company cannot predict when, if ever, it will be profitable. There can be no assurances that the Intellectual Property of BriaCell, or other technologies it may acquire, will meet applicable regulatory standards, obtain required regulatory approvals, be capable of being produced in commercial quantities at reasonable costs, or be successfully marketed. The Company will be undertaking additional laboratory studies or trials with respect to the Intellectual Property of BriaCell, and there can be no assurance that the results from such studies or trials will result in a commercially viable product or will not identify unwanted side effects.

We have an unproven market for our product candidates

The Company believes that the anticipated market for its potential products and technologies if successfully developed will continue to exist and expand. These assumptions may prove to be incorrect for a variety of reasons, including competition from other products and the degree of commercial viability of the potential product.

We may not succeed in adapting to and meeting the business needs associated with our anticipated growth