UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): November 13, 2017 (November 10, 2017)

Spirit International, Inc.

(Exact name of registrant as specified in its charter)

| Nevada | 333-199965 | 47-1662242 | ||

| (State

or other jurisdiction of incorporation) |

(Commission File Number) | (IRS

Employer Identification No.) |

56 Jianguo Rd, Chaoyang Qu, Beijing, China |

100020 | |

| (Address of principal executive offices) | (Zip Code) |

| +86 001 400-004-8181 |

| (Registrant’s telephone number, including area code) |

2620 Regatta Drive

Suite 102

Las Vegas, NV 89128

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

TABLE OF CONTENTS

i

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Current Report contains forward-looking statements, including, without limitation, in the sections captioned “Description of Business,” and “Management’s Discussion and Analysis of Financial Condition and Plan of Operations,” and elsewhere. Any and all statements contained in this Report that are not statements of historical fact may be deemed forward-looking statements. Terms such as “may,” “might,” “would,” “should,” “could,” “project,” “estimate,” “pro-forma,” “predict,” “potential,” “strategy,” “anticipate,” “attempt,” “develop,” “plan,” “help,” “believe,” “continue,” “intend,” “expect,” “future,” and terms of similar import (including the negative of any of the foregoing) may be intended to identify forward-looking statements. However, not all forward-looking statements may contain one or more of these identifying terms. Forward-looking statements in this Report may include, without limitation, statements regarding (i) the plans and objectives of management for future operations, (ii) a projection of income (including income/loss), earnings (including earnings/loss) per share, capital expenditures, dividends, capital structure or other financial items, (iii) our future financial performance, including any such statement contained in a discussion and analysis of financial condition by management or in the results of operations included pursuant to the rules and regulations of the SEC, and (iv) the assumptions underlying or relating to any statement described in points (i), (ii), or (iii) above.

Readers are cautioned not to place undue reliance on forward-looking statements because of the risks and uncertainties related to them and to the risk factors. We disclaim any obligation to update the forward-looking statements contained in this Report to reflect any new information or future events or circumstances or otherwise.

Readers should read this Report in conjunction with our financial statements and the related notes thereto in this Report, and other documents which we may file from time to time with the Securities and Exchange Commission (the “SEC”).

The forward-looking statements are not meant to predict or guarantee actual results, performance, events or circumstances and may not be realized because they are based upon our current projections, plans, objectives, beliefs, expectations, estimates and assumptions and are subject to a number of risks and uncertainties and other influences, many of which we have no control over. Actual results and the timing of certain events and circumstances may differ materially from those described by the forward-looking statements as a result of these risks and uncertainties. Factors that may influence or contribute to the inaccuracy of the forward-looking statements or cause actual results to differ materially from expected or desired results may include, without limitation, our inability to obtain adequate financing, the significant length of time and resources associated with the development of our products and services and related insufficient cash flows and resulting illiquidity, our inability to expand our business, significant government regulation of our industry, existing or increased competition, results of arbitration and litigation, stock volatility and illiquidity, and our failure to implement our business plans or strategies. A description of some of the risks and uncertainties that could cause our actual results to differ materially from those described by the forward-looking statements in this Report and includes the following:

| ● | our relationship with, and our ability to influence the actions of, our members; |

| ● | improper action by our employees or members in violation of applicable law; |

| ● | adverse publicity associated with our products, services or network marketing organization, including our ability to comfort the marketplace and regulators regarding our compliance with applicable laws; |

| ● | changing consumer preferences and demands; |

| ● | our reliance upon, or the loss or departure of any member of, our senior management team which could negatively impact our member relations and operating results; |

| ● | the competitive nature of our business; |

| ● | regulatory matters governing our products and services, including potential governmental or regulatory actions concerning our products and services risks associated with operating internationally and the effect of economic factors, including foreign exchange, inflation, disruptions or conflicts with our partners, pricing and currency devaluation risks; |

| ● | uncertainties relating to the application of transfer pricing, duties, value added taxes, and other tax regulations, and changes thereto; |

| ● | adverse changes in the Chinese economy; |

| ● | our dependence on increased penetration of existing markets; |

| ● | contractual limitations on our ability to expand our business; |

| ● | our reliance on our information technology infrastructure and outside service providers and manufacturers; |

| ● | the sufficiency of trademarks and other intellectual property rights; |

| ● | changes in tax laws, treaties or regulations, or their interpretation; |

| ● | taxation relating to our members; and |

| ● | share price volatility related to, among other things, speculative trading and certain traders shorting our common shares. |

ii

We were incorporated as Sprit International, Inc. in Nevada on March 10, 2014. Prior to the Share Exchange (as defined below), we were an imported liquor distributor.

On November 10, 2017, we completed and closed a share exchange (the “Share Exchange”) under a Share Exchange Agreement (the “Share Exchange Agreement”) of the same date by and among us, I JIU JIU Limited, a British Virgin Island company (“I JIU JIU”) and the shareholders of I JIU JIU pursuant to which I JIU JIU became a wholly owned subsidiary of ours. In the Share Exchange, all of the outstanding shares of I JIU JIU were converted into shares of our Common Stock, as described in more detail below.

As a result of the Share Exchange, we discontinued our pre-Share Exchange business and acquired the businesses of I JIU JIU and will continue the existing business operations of I JIU JIU as a publicly-traded company.

In accordance with the “reverse acquisition” accounting treatment, our historical financial statements as of period ends, and for periods ended, prior to the acquisition, will be replaced with the historical financial statements of Beijing Jiucheng Asset Management Co. Ltd. prior to the Share Exchange in all future filings with the SEC.

As used in this Current Report henceforward, unless otherwise stated or the context clearly indicates otherwise, the terms the “Company,” the “Registrant,” “we,” “us,” and “our” refer to Spirit International, Inc., incorporated in Nevada, after giving effect to the Share Exchange.

This Current Report contains summaries of the material terms of various agreements executed in connection with the transactions described herein. Such agreements are filed as exhibits hereto and incorporated herein by reference.

This Current Report is being filed in connection with a series of transactions consummated by the Company and certain related events and actions taken by the Company.

This Current Report responds to the following Items in Form 8-K:

| Item 1.01 | Entry into a Material Definitive Agreement |

| Item 2.01 | Completion of Acquisition or Disposition of Assets |

| Item 3.02 | Unregistered Sales of Equity Securities |

| Item 5.01 | Changes in Control of Registrant |

| Item 5.02 | Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers |

| Item 8.01 | Other Events |

| Item 9.01 | Financial Statements and Exhibits |

iii

ITEM 1.01 ENTRY INTO A MATERIAL DEFINITIVE AGREEMENT

The information contained in Item 2.01 below relating to the various agreements described therein is incorporated herein by reference.

ITEM 2.01 COMPLETION OF ACQUISITION OR DISPOSITION OF ASSETS

THE SHARE EXCHANGE AND RELATED TRANSACTIONS

Share Exchange Agreement

On November 10, 2017 (the “Closing Date”), the Company, I JIU JIU Limited (“I JIU JIU”) and the shareholders of I JIU JIU entered into the Share Exchange Agreement, which closed on the same date. Pursuant to the terms of the Share Exchange Agreement, we issued 8,000,000 new shares of our common stock, par value $0.0001 per share (the “Common Stock”) for all of the outstanding capital stock of I JIU JIU with the result that I JIU JIU became a wholly owned subsidiary of ours.

Pursuant to the Share Exchange, we acquired the business of the I JIU JIU, which is to engage in online consumer finance business and facilitate loan process for small and medium sized enterprises (“SMEs”) and individuals in the People’s Republic of China (“PRC” or “China”) through online platform. As a result, we have ceased to be a shell company.

At the closing of the Share Exchange, 50,000 shares of I JIU JIU’s capital stock issued and outstanding immediately prior to the closing of the Share Exchange were exchanged for 8,000,000 shares of our common stock.

As a result, an aggregate of 8,000,000 shares of our common stock were issued to the stockholders of I JIU JIU.

The Share Exchange Agreement contained customary representations and warranties and pre- and post-closing covenants of each party and customary closing conditions.

The Share Exchange will be treated as a recapitalization of the Company for financial accounting purposes. I JIU JIU will be considered as the accounting acquirer for accounting purposes, and our historical financial statements before the Share Exchange will be replaced with the consolidated historical financial statements of I JIU JIU before the Share Exchange in all future filings with the SEC.

The Share Exchange is intended to be treated as a tax-free reorganization under the Internal Revenue Code of 1986, as amended.

The issuance of shares of our Common Stock to holders of I JIU JIU’s capital stock in connection with the Share Exchange was not registered under the Securities Act, in reliance upon the exemption from registration provided by Section 4(a)(2) of the Securities Act, which exempts transactions by an issuer not involving any public offering, Regulation D promulgated by the SEC under that section and/or Regulation S promulgated by the SEC. These securities may not be offered or sold in the United States absent registration or an applicable exemption from the registration requirement, and some of these securities are subject to further contractual restrictions on transfer as described below.

The form of the Share Exchange Agreement is filed as an exhibit 2.1 to this Report.

Share Cancellation Agreement

In connection with the Share Exchange Agreement, the Company’s majority shareholder, Kimho Consultants Company Limited, (“Kimho” or the “Majority Shareholder”) entered into a share cancellation agreement with I JIU JIU’s stockholders whereby Kimho, owning an aggregate of 4,000,000 shares of the Company’s Common Stock agreed to cancel all its 4,000,000 shares of Common Stock in exchange of $440,000 paid by I JIU JIU’s stockholders (“Share Cancellation”).

The form of the Share Cancellation Agreement is filed as an exhibit 2.2 to this Report.

Departure and Appointment of Directors and Officers

Our Board of Directors currently consists of one member. On November 10, 2017, Zur Dadon, our current sole director, resigned his position as a director, which will become effective on November 22, 2017 and Xiangbin Meng was appointed to the Board of Directors, effective on November 22, 2017.

| 1 |

On November 10, 2017, pursuant to the Share Exchange Agreement, Mr. Zur Dadon, our Chief Executive Officer, Chief Financial Officer, President, Secretary and Treasurer before the Share Exchange, resigned from these positions (“Resignations”), and Xiangbin Meng was appointed as our President, Xuefei Kang was appointed as our Chief Executive Officer, and Jinhua Shao was appointed as Chief Financial Officer and Secretary (“Appointments”). Both Resignations and Appointment will become effective on November 22, 2017.

See “Management – Directors and Executive Officers” below for information about our new directors and executive officers.

Pro Forma Ownership

Immediately after giving effect to the Share Exchange, there were 9,110,000 issued and outstanding shares of our Common Stock, as follows:

| ● | the stockholders of I JIU JIU prior to the Share Exchange hold 8,000,000 shares of our Common Stock; and |

| ● | the stockholders of the Company prior to the Share Exchange hold the remaining 1,110,000 shares of our Common Stock. |

No other securities convertible into or exercisable or exchangeable for our Common Stock are outstanding.

Our Common Stock is quoted on the OTC Pink Markets (“OTC Pink”) under the symbol “SRTN.”

Accounting Treatment; Change of Control

The Share Exchange is being accounted for as a “reverse acquisition,” and I JIU JIU is deemed to be the accounting acquirer in the reverse acquisition. Consequently, the assets and liabilities and the historical operations that will be reflected in the financial statements prior to the Share Exchange will be those of I JIU JIU and will be recorded at the historical cost basis of I JIU JIU and the consolidated financial statements after completion of the Share Exchange will include the assets and liabilities of I JIU JIU, historical operations of I JIU JIU and operations of the Company and its subsidiary from the closing date of the Share Exchange. As a result of the issuance of the shares of our Common Stock pursuant to the Share Exchange, a change in control of the Company occurred as of the date of consummation of the Share Exchange. Except as described in this Current Report, no arrangements or understandings exist among present or former controlling stockholders with respect to the election of members of our Board of Directors and, to our knowledge, no other arrangements exist that might result in a change of control of the Company.

We continue to be a “smaller reporting company,” as defined under the Exchange Act, following the Share Exchange.

Immediately following the Share Exchange, the businesses of Beijing Jiucheng became our businesses. Beijing Jiucheng is engaged in consumer lending and risk management services.

Overview

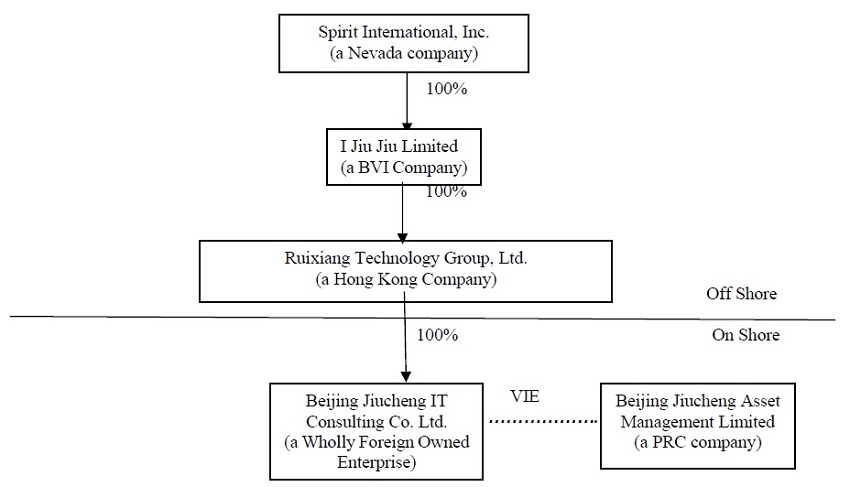

We are a holding company that, through our wholly-owned subsidiaries, I JIU JIU Limited, a British Virgin Islands company (“I JIUJIU”), Ruixiang Technology Group, Ltd., a Hong Kong company (“Ruixiang”) and Beijing Jiucheng IT Consulting Enterprise Co. Ltd, a People’s Republic of China company (“Jiucheng Consulting” or “WFOE”) and our contractually controlled and managed company, Beijing Jiucheng Asset Management Co., Ltd., a People’s Republic of China company (“Beijing Jiucheng”), operates an electronic online financial platform, “www.9caitong.com,” which is designed to match investors with small and medium-sized enterprises (“SMEs”) and individual borrowers in China. We believe our services provide an effective solution for under-served SME and individual borrowers who need access to financing.

We generate revenue from our services that facilitate matching lenders, who we refer to as investors, with individual and SME borrowers. We typically charge borrowers a loan facilitation process and matching services fee between 1% and 1.5% per month of the loan amount, depending on the duration of the loan, for each effected loan facilitated by us. Additionally we charge a separate fee from borrowers for each loan repayment facilitated by us, which is based on an agreed upon percentage around 0.5% per month on the borrowing times the duration of the loan.

| 2 |

Due to PRC legal restrictions on foreign ownership and investment in, among other areas, value-added telecommunications services, which include internet content providers, or ICPs, we, similar to all other entities with foreign-incorporated holding company structures operating in our industry in China, have to operate our internet businesses and other businesses in which foreign investment is restricted or prohibited in the PRC through wholly foreign-owned enterprises, majority-owned entities and variable interest entities. Accordingly, we plan to continue operating our online financial platform in China through Beijing Jiucheng, which is wholly-owned by two Chinese shareholders, but is contractually controlled and managed through our wholly-owned WFOE.

The contractual arrangements between WFOE and Beijing Jiucheng (defined below) collectively enable us to exercise effective control over, and realize substantially all of the economic risks and benefits arising from Beijing Jiucheng. See “Contractual Arrangements among WFOE, Beijing Jiucheng and Beijing Jiucheng’s Shareholders.” The contractual arrangements may not be as effective in providing operational control as direct ownership. As a result, we include the financial results of Beijing Jiucheng in our consolidated financial statements in accordance with generally accepted accounting principles in the United States, or U.S. GAAP, as if it were our wholly-owned subsidiary.

We conduct our business primarily in Beijing, People’s Republic of China. Our principal executive offices are located at G2 Tianyangyunhe, No. 56, Jianguo Road, Chaoyang District, Beijing, China.

Corporate History and Structure of our PRC Operation

Corporate Organization Chart

The following is an organizational chart setting forth our corporate structure, immediately following the Closing:

History

As described above, we were incorporated in Nevada as Sprit International, Inc. on March 10, 2014. Our original business was to engage in imported liquor distribution. In connection with the Share Exchange, our Board determined to discontinue operations in this area and to seek the new business opportunity prescribed by the acquisition of I JIU JIU. As a result of the Share Exchange, we have acquired the business of I JIU JIU.

Share Purchase by Kimho Consultants Company Limited

On October 16, 2017, the Company entered into a Stock Purchase Agreement (the “SPA”) with Kimho Consultants Company Limited, a Hong Kong limited liability company (the “Purchaser”) and Mr. Zur Dadon (the “Seller”), pursuant to which the Purchaser acquired 4,000,000 shares of common stock of the Company (the “Shares”) from Seller for an aggregate purchase price of $430,000 (“Stock Purchase”). The transaction contemplated in the SPA closed on October 17, 2017 (the “Closing”). The Stock Purchase is a private transaction exempt from registration pursuant to Regulation S of the Securities Act of 1933, as amended (the “Act”).

| 3 |

As the result of the Closing, the Purchaser became the beneficial owner of approximately 78.3% of the Company’s issued and outstanding common stock. The Shares constitute “restricted securities” within the meaning of Rule 144 of the Act and may not be sold, pledged, or otherwise disposed of by the Purchaser without restriction under the Act and applicable state securities laws. The transaction has resulted in a change in control of the Company.

I JIU JIU is a limited liability company organized on April 12, 2017 under the laws of the British Virgin Islands and after the Share Exchange is a direct, wholly-owned subsidiary of the Company. I JIU JIU is a holding company that has no operations and no assets other than its ownership of Ruixiang Technology Group, Ltd. (“Ruixiang”).

Ruixiang is a limited liability company organized on September 12, 2016 under the laws of the Hong Kong Special Administrative Region of the PRC. It is the wholly owned subsidiary of I JIU JIU. Ruixiang is a holding company that has no operations and no assets other than its ownership of Beijing Jiucheng IT Consulting Co. Ltd. (“Jiucheng Consulting” or “WFOE”).

Jiucheng Consulting is a limited liability company organized on Janaury 24, 2017 under the laws of the PRC. Jiucheng Consulting is a wholly-owned subsidiary of Ruixiang with the business purposes of providing risk management-related financial consulting services to Beijing Jiucheng Asset Management Co. Ltd. (“Beijing Jiucheng”) and to enter into certain agreements with Beijing Jiucheng and its shareholders pursuant to which Jiucheng Consulting provides certain services to Beijing Jiucheng.

Beijing Jiucheng is a limited liability company organized on January 13, 2012 under the laws of the PRC and is specialized in providing an online consumer lending platform facilitating loans to SMEs, sole proprietors and individuals in China. Beijing Jiucheng is owned by two shareholders, one is a legal person and the other one is a natural person. Beijing Jiucheng and its shareholders entered into certain variable interest entity contracts with WFOE pursuant to which 90% of the total profits of Beijing Jiucheng are paid to WFOE, and in connection with entering into such contracts, Beijing Jiucheng is contractually controlled by WFOE.

Contractual Arrangements among WFOE, Beijing Jiucheng and Beijing Jiucheng’s Shareholders

WFOE, Beijing Jiucheng and/or Beijing Jiucheng shareholders have executed the following agreements and instruments, pursuant to which the Company, through its subsidiary WFOE, controls Beijing Jiucheng: Equity Pledge Agreement, Exclusive Technical Consultancy and Services Agreement , Exclusive Call Option Agreement, Shareholder Proxy Agreement, and Operating Agreement (the “VIE Agreements”). Each of the VIE Agreements is described below and became effective upon its execution.

Exclusive Technical Consultancy and Services Agreement

Pursuant to the Exclusive Technical Consultancy and Services Agreement (“Consulting Service Agreement”‘) between Beijing Jiucheng and WFOE, WFOE provides Beijing Jiucheng with certain technical consulting and related services as below on an exclusive basis (“Services”):

| a). | To provide series of services to maintain the server and manage the network platform; |

| b). | To develop and update the Internet applications of the server, and its application to www.9caitong.com operated by Beijing Jiucheng; |

| c). | To develop and update the application software of the Internet users; |

| d). | To provide technical services of electronic commerce, including but not limited to the design and maintenance of the electronic commerce platform; |

| e). | To provide technical services of advertising design plan, software design, website programming etc., and administrative and consulting advices to Beijing Jiucheng in connection with the advertising operation of Beijing Jiucheng; |

| f). | To provide the training of technology and technicians; |

| g). | To support the needs of Beijing Jiucheng for personnel; |

| h). | Other services recognized by both Jiucheng Consulting and Beijing Jiucheng. |

For Services rendered to Beijing Jiucheng by WFOE under this Consulting Service Agreement, WFOE is entitled to collect a service fee calculated based on an amount equal to 90% of Beijing Jiucheng’s profits before tax for the period the Services were provided by WFOE. In the event that Beijing Jiucheng makes a loss, no amount shall be paid or refunded to Beijing Jiucheng by WFOE. The service fees will be calculated and paid by Beijing Jiucheng quarterly in arrears within one month of the end of each financial quarter of Beijing Jiucheng in respect of the Services provided during that quarter.

| 4 |

The Consulting Service Agreement shall remain in effect for 10 years unless it is terminated by WFOE at its discretion with 30-days prior notice. Beijing Jiucheng does not have the right to terminate the Consulting Service Agreement unilaterally. WFOE may at its discretion unilaterally extend the term of the Consulting Service Agreement for another 10 years.

The foregoing description of the Exclusive Technical Consultancy and Services Agreement does not purport to be complete and is qualified in its entirety by reference to the Exclusive Technical Consultancy and Services Agreement, a copy of which is filed herewith as Exhibit 10.1 and is incorporated herein by reference.

Equity Pledge Agreement

Under the equity pledge agreement (“Equity Pledge Agreement”) between the shareholders of Beijing Jiucheng (“Shareholders”) and WFOE, 2 shareholders of Beijing Jiucheng pledged all of their equity interests in Beijing Jiucheng to WFOE to guarantee the secured indebtedness caused by failure of performance of Beijing Jiucheng’s and its shareholders’ obligations under the Exclusive Technical Consultancy and Services Agreement. Shareholders agree that during the terms of Equity Pledge Agreement, without the prior written consent of Jiucheng Consulting (the pledgee), Shareholders shall not transfer or seek to transfer the equity Interests, nor shall they establish or permit to be established any liens, pledges, mortgages, claims or other guarantee rights, or restrictions in favor of any third party, that may affect the rights and interests of WFOE. WFOE is entitled to collect all dividends declared and paid arising out of the pledged equity interests. During the term of the Pledge Agreement, the pledged equity interests cannot be transferred without Beijing Jiucheng’s prior written consent. The Shareholders of Beijing Jiucheng also agreed that upon occurrence of any event of default, WFOE is entitled to exercise the right of pledge, meaning the priority right entitled by WFOE to claim the consulting and services fees, which WFOE is entitled to under the Consulting Service Agreement from funds obtained through conversion, auction or sale of the pledged equity interests. The Shareholders of Beijing Jiucheng further agreed not to dispose of the pledged equity interests or take any actions that would prejudice WFOE’s interest.

The Equity Pledge Agreement shall be effective until all obligations under the Consulting Service Agreements have been performed by Beijing Jiucheng or when the Consulting Service Agreement is terminated.

The foregoing description of the Equity Pledge Agreement does not purport to be complete and is qualified in its entirety by reference to the Equity Pledge Agreement, a copy of which is filed herewith as Exhibit 10.2 and is incorporated herein by reference.

Exclusive Call Option Agreement

Pursuant to the Exclusive Call Option Agreement, each shareholder of Bejing Jiucheng has irrevocably granted Ruixiang Technology Group Limited (“Ruixiang”) an exclusive option to purchase, or have its designated person or persons to purchase, at its discretion, to the extent permitted under PRC Law, all or part of the equity interests in Beijing Jiucheng. When Ruixiang exercises the aforesaid call option, Ruixiang shall send to shareholders of Beijing Jiucheng a Notice of Equity Purchase and such Notice shall contain the following matters: (a) the decision of Ruixiang to exercise the call option; (b) the number of shares to be purchased by Ruixiang; and (c) purchase date and transfer date of the equity interests.

The Price for the aforesaid equity interests will be agreed in good faith between the parties as soon as reasonably practicable following service of a Notice of Equity Purchase and in any event the price shall be the lowest price permitted by PRC Law.

The Exclusive Call Option Agreement will remain effective for a term of 10 years and may be renewed at WFOE’s discretion for another 10 years.

The foregoing description of the Exclusive Purchase Option Agreement does not purport to be complete and is qualified in its entirety by reference to the Exclusive Purchase Option Agreement, a copy of which is filed herewith as Exhibit 10.3 and is incorporated herein by reference.

Shareholder Proxy Agreement

Pursuant to the Shareholders’ Proxy Agreement, each shareholder of Beijing Jiucheng has irrevocably appoints WFOE to act as a shareholder of the Company and to exercise all shareholder rights, including, but not limited to, attending shareholder meeting, voting on all matters that require shareholder resolution and any other shareholder rights empowered by article of association of the Company.

| 5 |

The Shareholder Proxy Agreement shall be continuously valid with respect to each Beijing Jiucheng shareholder from the date of execution of the Power of Attorney, so long as such Beijing Jiucheng shareholder is a shareholder of Beijing Jiucheng. WFOE is entitled to terminate the Power of Attorney unilaterally at its discretion by the written notice to Beijing Jiucheng.

The foregoing description of the Shareholder Proxy Agreement does not purport to be complete and is qualified in its entirety by reference to the Power of Attorney, a copy of which is filed herewith as Exhibit 10.4 and is incorporated herein by reference.

Operating Agreement

Pursuant to the Operating Agreement (“Operating Agreement”) entered among WFOE, Beijing Jiucheng, and shareholders of Beijing Jiucheng, whenever Beijing Jiucheng enters into a business contract or agreement with any third party, WFOE shall sign, with such third party upon its request, a written agreement to be the performance guarantor of Beijing Jiucheng by furnishing a guaranty for Beijing Jiucheng’s performance under such contract or agreement in order to ensure the normal operation of Bejing Jiucheng’s business. As counter security, Beijing Jiucheng agrees that it shall mortgage and assign absolutely to WFOE its accounts receivable and all of its assets.

Beijing Jiucheng and its shareholders also irrevocably undertakes to and covenants with WFOE that the Company, without the prior written consent of WFOE or its designee, shall not engage in any transaction that may materially and adversely affect the assets, obligations, rights, and operations of the Company.

Beijing Jiucheng and its shareholders agree to accept company policies and instructions provided by WFOE from time to time concerning the employment and termination of working staff, daily operations and management, and financial management systems and other similar policies relating to Beijing Jiucheng

.

Beijing Jiucheng and its shareholders shall also appoint and, if requested by WFOE, remove the persons designated by WFOE to be the directors of the Company, and senior management personnel employed by, and as designated by, WFOE to be the general manager, chief financial officer and other senior management personnel of the Company. If the directors or senior management personnel designated by WFOE as aforesaid cease to be employed or engaged by Beijing Jiucheng, regardless of whether they resign or are dismissed by WFOE, such persons shall lose the qualification of being in charge of any post of the Company. Under such circumstances, Beijing Jiucheng and its shareholders shall appoint other senior management personnel designated by WFOE to assume such posts.

Beijing Jiucheng and its shareholders, agree and confirm that, if Beijing Jiucheng is in need of any other guaranty for its performance or security for borrowing to finance its working capital, it shall first seek guaranty or security from WFOE. Under such circumstances, WFOE is entitled to decide whether to furnish proper guaranty or security for Beijing Jiucheng based on its own judgment. If WFOE decides not to furnish such guaranty or security for Beijing Jiucheng, it shall notify Beijing Jiucheng in writing in time, and thereafter, Beijing Jiucheng can seek guaranty or security from any Third Party.

This Operating Agreement is valid for a term of 10 years unless terminated earlier by WFOE with a 30-day written notice, provided that WFOE can extend the agreement before its expiration.

In the opinion of our PRC counsel, Beijing Dentons Law Offices, LLP (Shenzhen), these contractual arrangements are valid, binding and enforceable under current PRC laws. There are substantial uncertainties regarding the interpretation and application of current or future PRC laws and regulations, and there can be no assurance that the PRC government will ultimately take a view that is consistent with the opinion of our PRC counsel.

The foregoing description of the Power of Attorney does not purport to be complete and is qualified in its entirety by reference to the Power of Attorney, a copy of which is filed herewith as Exhibit 10.5 and is incorporated herein by reference.

Our authorized capital stock currently consists of 75,000,000 shares of Common Stock, par value $0.0001. Our Common Stock is quoted on the OTC Pink Markets (Pink) under the symbol “SRTN.”

Our principal executive office is located at G2 Tianyangyunhe, No. 56, Jianguo Road, Chaoyang District, Beijing, China. Our telephone number is (86) (001) 400-004-8181. Our website address is http://www.9caitong.com.

| 6 |

Our Service

We primarily operate our business through an electronic online financial platform, www.9caitong.com (“website”), which is designed to match investors with SME and individual borrowers in China. We have developed user-friendly mobile applications for borrowers and investors (“mobile apps”, collectively with our website, the “platform”), which enable borrowers and investors alike to access our platform at any time or location that is convenient. We launched our first mobile application in April, 2016.

Our online platform only offers secured loan, particularly loan secured by vehicles owned by borrowers. Unlike most other Peer-to-Peer (“P2P”) lending companies which provide unsecured loans supported only by the borrower’s creditworthiness, our online platform offers secured auto equity loans and is only accessible to borrowers who can pledge their own automobiles as collaterals.

Historically, we employed a business model where the borrower does not directly sign the loan and loan contract. Instead, the borrower signs a loan contract with a third-party individual called personal loan provider. Personal loan provider lends the money to the borrower, and then transfer the debt to the investors via an intermediary. Under this business model, we provided intermediary platform to a personal loan provider, personal loan borrowers and investors and charges fees for our services. In light of the recent development of the PRC regulations regarding P2P companies, we ceased to operate under this creditor transfer model in April 2016.

We currently adopt the entrusted loan structure as we believe this particular business model is effective and safe for both borrowers and investors.

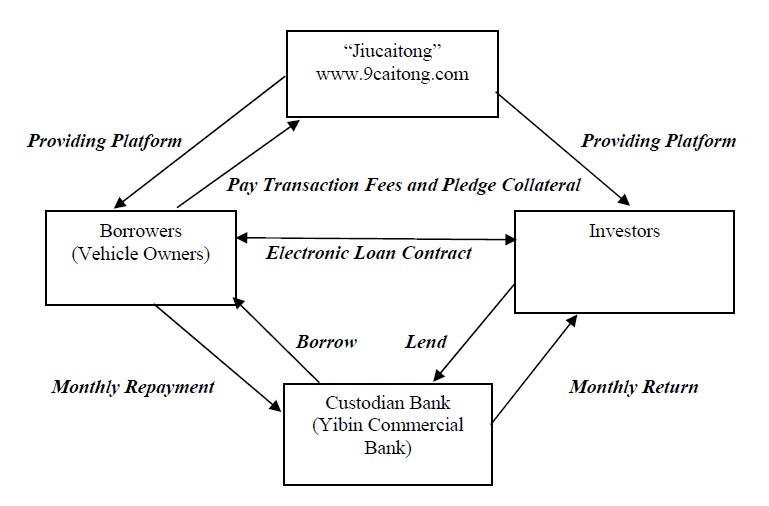

The following diagram illustrates our current business model

Our Online Platform

Our online platform “Jiucaitong” captures significant opportunities presented by a financial system that leaves many creditworthy individuals and SMEs underserved. We match qualified borrowers who have completed profiles that are available on the platform with investors. Once an investor decides to proceed with a specific loan, and the borrower accepts the terms of the loan, our system automatically generates electronic loan contracts for execution. When the closing conditions are satisfied, our system directs the investors to the third party payment platform to consummate the loan. The loan is deposited to a third-party custodian bank “Yibin Commercial Bank” (“Custodian Bank”). The Custodian Bank provides the loan to qualified borrower according to the terms of the loan contract. Borrowers provide monthly repayments to the Custodian Bank, while the Custodian Bank directs monthly return to investors. The loans we facilitate are usually short term loans that range from one month to twelve months with interest rates ranging from 6% to 10% per annum.

| 7 |

Loan Transaction Process

We provide a streamlined application process combining both online and offline features. To borrowers and investors alike, we have designed the process to appear simple, seamless and efficient, utilizing sophisticated, proprietary technology to make it possible. The entire process, from posting the loan application on our platform to disbursement of funds, takes no longer than 20 days but, more typically, only one to three days. Although we do allow a borrower to have multiple outstanding loans on our platform, as a safety measure to prevent loan default, each vehicle a borrower owns can only secure one loan. Using one vehicle as collateral for multiple loans is strictly prohibited. This restriction on lending prevents a borrower from borrowing a new loan to pay off the old loan resulting in an increase in the borrower’s total debt. The platform monitors and review borrowers, therefore preventing a “roll over” of loans.

Set forth below is a description of the steps in our online loan transaction.

Step 1: Online Application Submission

Our borrower application process begins with the submission of a loan application by a prospective borrower. Borrowers can apply through either our website or mobile applications. As part of our online application process, the prospective borrower is asked to provide various personal background information. The specific personal information required will depend upon the borrower’s desired loan product, but typically include PRC identity card information, employer information, bank account information, credit card information and a credit report from the People’s Bank of China (“PBOC”). Given that we almost exclusively provide secured loans with vehicles as collaterals, namely auto equity loan, we also require prospective borrowers to provide documentation specifically related to the vehicles they intend to use as collaterals (“Vehicle-Related Documents”). Vehicle-Related Documents typically include motor-vehicle registration certificate, vehicle license of PRC, and certificate of title for a vehicle and etc.

New investors can register an account with our online platform in which they input their PRC identity card information and bank account information. We employ a system whereby Yibin Commercial Bank is in charge of the investor custody accounts.

Step 2: On-Site Inspection and In-Person Interview

Once we receive a prospective borrower’s application, we then proceed to schedule an on-site inspection of such borrower’s collateral. Our in-house collateral specialist conducts a full aspect of inspection regarding a vehicle’s purchase date, mileage, whether it has been in a serious accident, whether the borrower has a good title to the vehicle and etc. We have the right to deny a borrower’s application right after inspection if any serious problem is identified in connection with the vehicle purported to be used as collateral.

Once the 1 to 3 days on-site inspection completed, our risk management manager then requests a prospective borrower to come to our office for an in-person interview. This is an opportunity for our risk management team to have an in-depth examination of the information supplied by a prospective borrower. During the in-person interview, our risk management manager typically evaluates the following issues regarding a prospective borrower:

confirm the loan amount, term and purpose of the loan;

confirm the source of repayment and the prospective borrower’s ability to repay;

confirm the ownership of the collateral;

investigate whether the prospective borrower has other debt obligations;

Based on the evaluation, our risk management manager may choose to allow a prospective borrower to pass the interview, request a prospective borrower to provide more evidence in support of his/her loan application, or deny the loan application altogether. Risk management manager is responsible for preparing an inspection report after on-site inspection and in-person interview.

| 8 |

Step 3: Verification

After a prospective borrower passes on-site inspection and in-person interview, all information contained in the submitted loan application and inspection report are cataloged and categorized based on the type such as identity information, personal credit information, vehicle-related information and etc. Additional data from several internal and external sources is then matched with the different types of information contained in an application, including but not limited to the following:

Internal

historical credit data accumulated through our online platform; and

behavioral data that we glean from an applicant’s behavior as they apply to us for loans, such as the self-reported use of proceeds or use of multiple devices to access our platform;

External

credit database maintained by our risk management department;

personal identity information maintained by an organization operated under the Ministry of Public Security;

personal credit information maintained by an organization operated under PBOC;

vehicle valuation report issued by reputable auto appraiser;

lien search report from local Motor Vehicle Administration;

online data from internet or wireless service providers, including social network information;

credit card statement data authorized by applicants; and

fraud list and database.

This data is gathered for the purpose of verifying an applicant’s identity and financial status, for possible fraud detection and for assessment and determination of creditworthiness.

Step 4: Anti-Fraud, Credit Assessment and Determination

Once an application has been verified, we then begin the process of screening applicants. For the purpose of efficiently screening applicants, we review the basic information regarding a prospective borrower that has been submitted with the application and gathered by us from available sources. We currently permit borrowers to hold multiple loans on our platform, but each vehicle a borrower owns can only secure one loan. A borrower is strictly prohibited from using the same vehicle to secure loans from multiple lending platforms. Because motor vehicles are heavily regulated by Motor Vehicle Administration in China, we can effectively determine whether a borrower has used his/her vehicle to obtain loans through other consumer finance marketplaces. Once complete, an initial check is performed using our anti-fraud system, and the prospective borrower’s loan application either proceeds to the next phase of the application process or the prospective borrower is notified of the decision to deny the application.

Following initial qualification, we will assign a credit rating to the perspective borrower based on his credit history, business activities being undertaken, assets and other criteria. Our credit scoring system utilizes our own scoring criteria, and is routinely monitored, tested, updated and validated by our risk management team. Following the generation of the credit ratings, we make a determination as to whether the prospective borrower is qualified. Unqualified borrowers are notified of the decision to deny their applications for failing to meet minimum requirements.

Step 5: Approval, Listing and Funding

Once the loan application is approved, a loan agreement is generated online for the prospective borrower’s review and approval. This loan agreement is between the borrower, the investors who fund the borrower’s loan and our platform. Upon acceptance of the loan agreement, the loan is then listed on our online platform for investors to view. Once a loan is listed on our online platform, investors may then subscribe to the loan using our self-directed investing tools. Due to recent development in PRC regulations on illegal fund raising, we act as a platform for borrowers and investors and are not a party to the loans facilitated through our platform. In addition, we do not directly receive any funds from investors in our own accounts as funds loaned through our platform are deposited into and settled by a third-party bank Yibin Commercial Bank., a qualified banking financial institution, as our funding depository service provider. Yibin Commercial Bank is in charge of disbursing and repaying loans. Both the investor and the borrower open accounts with Yibin Commercial Bank and authorize Yibin Commercial Bank to manage their accounts. The investor funds the loan amount in his/her account with Yibin Commercial Bank, which disburses loan amount to the borrower net of our service fees, which is remitted to us.

| 9 |

When the borrower repays the loan to Yibin Commercial Bank, they deposit the loan repayment management fee along with the principal loan amount and interest. Yibin Commercial Bank then disburses the principal loan amount and interest back to the investor and remits the repayment management fee to us.

Currently, investors are not charged for deposits made to their accounts in Yibin Commercial Bank. However, borrowers are charged for a processing fee by Yibin Commercial Bank in the amount of 0.15% per month (with a minimum of RMB2) of the loan amount when the funds are deposited into the borrower’s Yibin Commercial Bank account. When borrowers and investors withdraw money from their Yibin Commercial Bank accounts, they pay a processing fee ranging between RMB 2 to RMB 8. Our liquidity management system is designed to ensure the fast and effective matching of borrowers’ loan applications and investors’ investment demand through the use of a detailed demand forecasting model and real time monitoring. Once a loan is fully subscribed, funds are then drawn from a custody account and disbursed to the borrower.

Step 6: Post-Funding Supervisory

After the loan is provided to the borrower, Yibin Commercial Bank will monitor the borrower’s performance and will provide the platform with the feedback on the borrower’s credit condition, contract performance and debt repayment capabilities. In the event of any material development resulting in a negative turn in a borrower’s financial standing and potential ability to repay its loan, our risk management team will take the proper action to avert or minimize the risk of non-payment. One week before the loan is due, the risk control department informs Yibin Commercial Bank if any and the borrower and supervise the repayment of the loan.

Step 7: Collections

Our online platform is well equipped to constantly monitor and track payment activity. With most advanced built-in payment tracking functionality and automated missed payment notifications, the online platform enables us to monitor the performance of outstanding loans on a daily basis. As part of risk management procedure, we also provide service to the investors and assist the investors in collection of any outstanding debts in connection with the loan facilitated on our platform.

In the event of a non- or partial repayment of a loan by the borrower, we reserve the right to start vehicle repossession process to reduce or eliminate the outstanding debt.

We may also assist investors with the sale or auction of collateral or directly initiate actions to recover payment from the borrower.

Fees

For our major services of matching investors and borrowers through our online platform, we typically charge borrowers a loan facilitation process and matching services fee between 1% to 1.5% per month of the loan amount facilitated by us, depending on, among other things, the duration of the loan. The loan facilitation process and matching services fee is payable when the borrowers receive the loans in their accounts with Yibin Commercial Bank, which will separate the loan facilitation process and matching services fee from the loan amount and send it to our account. Additionally we charge a separate fee from borrowers for each loan repayment facilitated by us, which is based on an agreed upon percentage around 0.5% per month on the borrowing times the duration of the loan. The loan repayment management fee is payable when the borrower repays its loan. In addition to the loan amount, they would have to deposit the repayment management fee to their accounts with Yibin Commercial Bank, which will send the loan repayment to the investors’ accounts and repayment management fee to our account. Currently, we do not charge any service fees to our investors.

Risk Management Service

Although financial risk management industry is still in its infancy in China, we are confident that our risk management capabilities give us an edge in attracting capitals to our online platform by consistently offering investors assurance that they are investing in high quality loans through a sustainable and secure channel.

We minimize credit risk on behalf of our investors by implementing the following measures:

| i. | We evaluate the borrower’s repayment ability by conducting on-site inspection and in-person interviews; a prospective borrower is required to go through multiple round of reviews before his/her loan application is approved; |

| ii. | We fully utilize third-party tools and services to obtain accurate and objective evaluation of a prospective borrower’s collateral; we allow and encourage our investors to review our collateral evaluation report before they enter into loan contracts; |

| iii. | We maintain effective communication channel with our custodian bank to closely monitor borrowers’ repayment performance and provide timely updates to our investors to reduce the risks of bad debts. |

| 10 |

Risk management is an inseparable part of the financial services we provide. Our risk management department functions independently, creates detailed risk management policies, loan management rules, and operation guidelines. The risk management department provides an independent expert assessment on the borrowers’ credentials in accordance with our loan policy and resolutely denies the applications of unqualified borrowers.

We always strive to be one step ahead of our peers in terms of technology. Our online platform employs a third-party credit assessment system for our Peer-to-Peer (“P2P”) loan business. The borrower’s actual financial condition and credit history provided by third-party credit assessment agencies greatly assist our evaluation of the borrower’s loan application. The purpose of the risk management in the financial business we engaged in is to minimize the risk of investor’s investment and to protect the safety of the online platform and therefore increase lending activities.

We also implement a popular risk management model that covers the entire loan transaction process. Our risk management department divides risk managements into three stages: pre-lending, during-lending, and post-lending. “Pre-lending stage” emphasizes due diligence, including on-site inspections in order to obtain first-hand materials. “During-lending stage” emphasizes standardized operations and execution of operating procedures according to the contract in order to avoid mistakes. “Post-lending stage” emphasizes notification mechanism and implements all-around debt collection mechanism for post-due debt, including on-site inspection, account review, control of material assets, exposure of delinquent activities, and legal recourse of litigation in order to protect the investor’s rights.

After the loan is provided to the borrower, Yibin Commercial Bank will monitor the borrower’s performance and will provide us with the feedback on the borrower’s credit condition, contract performance and debt repayment capabilities. In the event of any material development resulting in a negative turn in a borrower’s financial standing and potential ability to repay its loan, our management will recommend the proper action to take to minimize the risk of non-payment.

Finally, we also provide assistance to the investors in taking all necessary legal recourse against a defaulted party. As an intermediary between the borrower and the investor, we deem ourselves to be independent from the debtor-creditor relationship and do not believe that we are a proper party to any lawsuits arising from the borrowers’ defaults. However, we may offer necessary assistance to the investors, such as by disclosing the information of the borrowers, provided that such disclosure is permitted under any relevant agreement and pertinent laws.

Since the launch of our online platform, no borrower has defaulted on any loan payments. All investors through the platform have timely received repayment of their investment funds.

Intellectual Property

At the present time, we do not have any patents or trademarks. We do not have any intellectual property. Each of the following intellectual property is registered under and owned by Beijing Jiucheng:

Any unpublished software will lose the copyright after 50th year of the completion.

Copyrights: In China, the term of copyrights related to published software is from the date of the publishing to December 31 of the 50th year of the publishing

| Computer Software | Registered Area | Registration Number | Description | Registering Authority | Registration Date | |||||

| Jiucaitong (Android) V1.2.1 | China | 2016SR138804 | Financial management software | National Copyright Administration of the People’s Republic of China (“NCAC”) | 05/26/2016 |

| 11 |

Trademarks: In China, the term of a registered trademark is 10 years. The owner can apply extension with the trademark office within six months before or after the expiration. The review process of a trademark application usually takes about one year in China.

| Trademarks | Registered Area | Registration Number |

Category Description | Registering Authority | Term | |||||

|

China | 16870232

|

Category 36(1)

|

Trademark Office of The State Administration For Industry & Commerce of the People’s Republic of China (the “Trademark Office”) | 07/28/2016-07/27/2026 | |||||

|

China | 16870231 | Category 36

|

The Trademark Office | 06/28/2016-06/27/2026 | |||||

|

China | 16274829 | Category 36 | The Trademark Office | 11/14/2016-11/13/2026 | |||||

|

China | 20149663 | Category 35(2) | The Trademark Office | 07/28/2017-07/27/2027 | |||||

|

China | 20149623 20149573 |

Category 35 Category 36 |

The Trademark Office | 07/28/2017-07/20/2027 07/28/2017-07/20/2017 | |||||

|

China | 20149496 | Category 35 | The Trademark Office | 07/28/2017-07/20/2027 | |||||

|

China | 20478024 | Category 35 | The Trademark Office | Processing, approval pending | |||||

|

China | 20477999 20477946 |

Category 35 Category 36 |

The Trademark Office | Processing, approval pending | |||||

|

China | 20477973

|

Category 35 | The Trademark Office | Processing, approval pending | |||||

|

China | 20149756 | Category 36 | The Trademark Office | Processing, approval pending | |||||

|

China | 26053689 26043067 26043061 |

Category 9(3) Category 38(4) Category 42(5)

|

The Trademark Office | Processing, approval pending | |||||

|

China | 26053676 26037368 26033902 |

Category 9 Category 38 Category 42 |

The Trademark Office | Processing, approval pending | |||||

|

China | 20478025 | Category 36 | The Trademark Office | Initial application denied; second round of review pending | |||||

|

China | 20149806 | Category 36 | The Trademark Office | Initial application denied; second round of review pending |

| (1) | Category 36 includes insurance; financial services; real estate agency services; building society services; banking; stockbroking; financial services provided via the Internet; issuing of tokens of value in relation to bonus and loyalty schemes; provision of financial information. |

| 12 |

| (2) | Category 35 includes advertising; business management; business administration; office functions; organisation, operation and supervision of loyalty and incentive schemes; advertising services provided via the Internet; production of television and radio advertisements; accountancy; auctioneering; trade fairs; opinion polling; data processing; provision of business information; retail services connected with the sale of [list specific goods]. |

| (3) | Category 9 includes data processing equipment; computer storage device; computer; recorded computer operating program; disk; floppy disk; recorded computer operating program; encoded magnetic card; microprocessor; computer software (recorded). |

| (4) | Category 38 includes telecommunications services; chat room services; portal services; e-mail services; providing user access to the Internet; radio and television broadcasting.. |

| (5) | Category 42 includes computer software design; computer software update; computer hardware design and development consulting; computer software rental; recovery of computer data; computer software design; computer software design; computer software maintenance; computer software system analysis; computer system design; computer program copy; tangible data or files into electronic media; computer software installation; computer program and data conversion (non-tangible conversion); computer software consulting ; network server rental; provide internet search engine. |

Domains: In China, the registration of domains can be extended by annual renewal or periodic renewal by paying the annual or periodic registration fee. If renewal registration fee is not paid timely, the domain will become available to the public. Beijing Jiucheng has timely paid annual registration fee for all its domains.

| Names | Registration Date |

Registering Authority | ||

| www.9caitong.com | 08/08/2017 | China Internet Network Information Center (“CNNIC”) | ||

| www.jiuchengjr.com | 09/23/2015 | CNNIC | ||

| www.jczchmt.com | 09/23/2015 | CNNIC |

Our Strategy

We aim at connecting SMEs and individual borrowers with investors so that borrowers can have easy and effective access to affordable financing while at the same time investors earns a safe and acceptable investment returns. To achieve this goal we have implemented the following strategies, each of which we intend to continue to expand.

Develop new consumer financing products and penetrate niche markets

We are constantly developing and promoting new personal consumer financing products to SME and individual borrowers, such as automobile financing and consumer financing. In addition, we will continue our efforts to design and develop diversified financing products to satisfy market demand.

Our online platform also allows investors to diversify their wealth management strategies by providing easy access to various lending opportunities that can be designed with flexible terms.

Strengthen and enhance our position in the auto equity loan market

We are one of the few P2P companies specializing in providing auto equity loan services. As auto equity loan gradually gains popularity in China and has been favored by both borrowers and investors alike, we plan to continue to make significant investment in optimizing our services to increase loan activities on our online platform and establish a leading position in this niche market.

Further enhance our risk management capabilities

As loan volume in our online platform continue to grow and auto and consumer financing products expand, we have implemented protocols to enhance our risk management capabilities. As for individual borrowers, we have improved the risk management model for individual credit control so that risk management testing will be more effective and reasonable. For SME borrowers, besides the due diligence process that our cooperative partners undertake, we have enhanced the onsite due diligence process and appoint a risk management team.

In addition, we have upgraded our bad debt monitoring system by enhancing our cooperation with other third party credit investigators to obtain more accurate information about the credit history of the borrowers so we can make reasonable and accurate assessments of borrower applications to reduce and avoid bad debts.

Continue to invest in our technology platform

We have made significant investments in our proprietary technologies in the areas of data collection and processing algorithms to increase the precision, speed and scale at which we match the demand and supply of loans. Enhanced data analytics improves our conversion of online leads into successful borrowers and investors. With the further application of big data, we can acquire members of our target borrower and investor groups in a more focused and cost efficient way. Furthermore, we will continue to leverage technology to further automate our processes and improve the safety and efficiency of matching the loans with investors. At the same time, we will also benefit from the operating leverage associated with our scalable platform as our loan volume increases. We believe these investments will facilitate the long-term growth of our platform.

| 13 |

Increase our merger and acquisition activities to enhance our competitive advantage in the financing technology ecosystem and to improve the efficiency of our products and services

We will continue expanding strategic relationships with internet financing companies, internet companies, technology companies and financing companies, by mergers and acquisitions to enhance our competitive advantage in the financing technology ecosystem and to improve the efficiency of our products and services.

Various Product and Service Offerings

As part of our long term plan, we are crafting a financial ecosystem for SME customers who find difficult to finance their businesses in China’s current financial system. We seek to expand our intermediary services, both online and offline, to meet the demands of various customers. We will continue to devise customized product and service offerings to meet customer demands and expand the scale and scope of our operations.

Enhance brand awareness

We believe that enhancing awareness of “jiucaitong” brand is important to achieve our business objectives. We intend to continue to promote and increase recognition of our brand through a variety of marketing and promotional campaigns. These may include marketing agreements with companies that have a significant online presence and advertising through internet media, such as weibo and wechat. We may also use leading websites and other media such as affiliate programs, banner advertisements and keyword searches. In addition, we believe that by constantly delivering top notch P2P lending consumer experience, we promote greater brand awareness through word of mouth.

Governmental Regulation

We are subject to Chinese state and local laws and regulations applied to businesses in general. We believe that we comply with the requirements in China for any licenses or approvals to pursue our proposed business plan. In locations where we operate, the applicable laws and regulations are subject to amendment or interpretation by regulatory authorities. Generally, such authorities are vested with relatively broad discretion to grant, renew and revoke licensee and approvals, and to implement regulations. Possible sanctions which may be imposed include the suspension of individual employees, limitations on engaging in a particular business for specific periods of time, revocation of licenses, censures, redress to customers and fines. We believe that we are in conformity with all applicable laws in all relevant jurisdictions.

Below is a summary of the most significant rules and regulations that affect our business activities in China:

As an online financial platform matching investors with individual borrowers, we are regulated by various government authorities, including, among others:

● the Ministry of Industry and Information Technology, or the MIIT, regulating the telecommunications and telecommunications-related activities, including, but not limited to, the internet information services and other value-added telecommunication services;

● the People’s Bank of China, or the PBOC, as the central bank of China, regulating the formation and implementation of monetary policy, issuing the currency, supervising the commercial banks and assisting the administration of the financing;

● China Banking Regulatory Commission, or the CBRC, regulating financial institutions and promulgating the regulations related to the administration of financial institutions.

● the Ministry of Public Security, taking the lead in security supervision of the internet services of internet lending information intermediaries, and penalizing violations of laws and regulations on network security, and cracking down on financial crimes and relevant crimes involved in internet lending.

● the State Internet Information Office, supervising financial information services and the content of internet information.

Regulation on P2P Companies

In July 2015, ten PRC central government ministries and regulators, including the PBOC, the CBRC, the Ministry of Finance, the Ministry of Public Security and the Cyberspace Administration of China, together released the Guidelines to Promote the Healthy Growth of Internet Finance (the “Guidelines”), which identified the CBRC as the supervisory regulator for the online lending industry. According to the Guidelines, online marketplace lending platforms shall only serve as intermediaries to provide information services to borrowers and investors, and shall not provide credit enhancement services or illegally conduct fundraising. The Guidelines also outlined certain regulatory propositions, which would require Internet finance companies, including marketplace lending platforms, to (i) complete website registration procedures with the administrative departments overseeing telecommunications; (ii) use banking financial institutions’ depository accounts to hold lending capital, and engage an independent auditor to audit such accounts and publish audit results to customers; (iii) improve the disclosure of operational and financial information, provide sufficient risk disclosure, and set up thresholds for qualified investors to provide better protections to investors; (iv) enhance online security management to protect customers’ personal and transactional information; and (v) take measures against anti-money laundering and other financial crimes.

| 14 |

In August 2016, the CBRC, the MIIT, the Ministry of Public Security and the State Internet Information Office jointly promulgated the Interim Measures. Apart from what had already been emphasized in the Guidelines and other previously released guidance, the Interim Measures include (i) general principles; (ii) filing administration; (iii) business rules and risk management guidelines; (iv) protection measures for investors and borrowers; (v) rules on information disclosure; (vi) supervision and administrative mechanisms; and (vii) legal liabilities.

Under the general principles and filing administration sections, the Interim Measures provide that online lending intermediaries shall not engage in credit enhancement services, direct or indirect cash concentration or illegal fundraising. The sections also stipulate a supervisory system and list the administrative responsibilities of different supervisory authorities, including the CBRC and its local counterpart and local financial regulators. Furthermore, these sections require online lending intermediaries to file with the local financial regulators, to apply for value-added telecommunications business licenses thereafter in accordance with the provisions of the relevant telecommunications authorities and to include serving as an Internet lending information intermediary in its business scope.

Under the business rules and risk management guidelines section, the Interim Measures stipulate that online lending intermediaries shall not engage in or be commissioned to engage in thirteen prohibited activities, including: (i) directly or indirectly financing its own projects; (ii) directly or indirectly receiving or collecting lenders’ funds; (iii) directly or indirectly offering guarantees to lenders or guaranteeing principal and interest payments; (iv) commissioning or authorizing a third party to advertise or promote financing projects at any physical locations other than through electronic channels such as the Internet and mobile phones; (v) providing loans (unless otherwise permitted by laws and regulations); (vi) dividing the term of financing projects; (vii) offering its own wealth management products or other financial products to raise funds or act as a proxy in the selling of banks’ wealth management products, brokers’ asset management products, funds, insurance or trust products; (viii) providing services similar to asset-based securitization services or conducting credit assignment activities in the form of asset packaging, asset securitization, asset trusts or fund shares; (ix) mixing with, bundling with or acting as a proxy in relation to investment, sales agent and brokerage services of other businesses (unless permitted by laws and regulations); (x) fabricating or exaggerating the authenticity or earnings outlook of a financing project, concealing its flaws and risks, falsely advertising or promoting a project with intentional ambiguity or other deceptive means, or spreading false or incomplete information to damage the commercial reputation of others, or to mislead lenders or borrowers; (xi) providing intermediary services for loans used to invest in high-risk financing projects such as stocks, over-the-counter margin financing, futures contracts, structured products and other derivatives; (xii) operating equity-based crowd-funding; and (xiii) other activities prohibited by laws and regulations. The Interim Measures, under the business rules and risk management section, also stipulate specific obligations or business principles of online lending intermediaries, including but not limited to online dispute resolution services, examination and verification functions, anti-fraud measures, risk education and training, information reporting, anti-money laundering, anti-terrorist financing, systems, facilities and technologies, service fees, electronic signatures and loan management. In addition, the Interim Measures stipulate that online lending intermediaries shall not operate businesses other than risk management and necessary business processes such as information collection and confirmation, post-loan tracking and pledge management in accordance with online-lending regulations, via offline physical locations. Furthermore, the Interim Measures provide that online lending intermediaries shall, based on their risk management capabilities, set upper limits on the loan balance of a single borrower borrowing both from one online lending intermediary and from all online lending intermediaries. In the case of natural persons, this limit shall not be more than RMB200,000 (approximately $29,397) for one online lending intermediary and not more than RMB1 million (approximately $146,985) in total from all platforms, while the limit for a legal person or organization shall not be more than RMB1 million (approximately $146,985) for one online lending intermediary and not more than RMB5 million (approximately $734,927) in total from all platforms.

In accordance with the Guidelines and the Interim Measures, the CBRC, MIIT, and Administration for Industry and Commerce jointly issued The Guidelines for Record Filing on the Administration of Online Lending Information Intermediary Institution, which become effective on December 28, 2016. The Record Filing Guidelines further clarifies the requirement and procedures to online lending intermediaries of conducting filing with local financial regulators.

In accordance with the Guidelines and the Interim Measures, the CBRC issued the Guidelines for the Funds Custodian Business of Online Lending, or the Custodian Guidelines on February 22, 2017. The Custodian Guidelines further clarifies the custodian requirement for the funds of investors and borrowers held by online lending intermediaries.

The Custodian Guidelines specifies that an online lending intermediary may only designate one qualified commercial bank as its fund custodian institution for the funds of lenders and borrowers held by it, and further clarifies detailed requirements and procedures for setting up custody accounts with commercial banks. To the extent that the relevant online lending intermediary and commercial banks are not in full compliance with the Custodian Guidelines, they are required to make correction or rectification within a six-month rectification period specified by the Custodian Guidelines.

In accordance with the Guidelines and the Interim Measures, the CBRC further issued the Guidelines on Information Disclosure of the Business Activities of Online Lending Information Intermediaries, or the Disclosure Guidelines, on August 23, 2017. The Disclosure Guidelines further clarified the disclosure requirements for online lending intermediaries.

Pursuant to the Disclosure Guidelines, online lending intermediaries should disclose certain information on their websites and all other internet channels, including mobile applications, WeChat official accounts or Weibo, including, among others (i) the record-filing and registration information, the organization information, the examination and verification information, and transaction related information, including transactions matched through the online lending intermediary for the previous month, all of which shall be disclosed to the public; (ii) the basic information of the borrowers and the loans, the risk assessment of such loans, and the information of the outstanding transactions matched, all of which shall be disclosed to the investors; and (iii) any event that would result in a material adverse effect to the operations of online lending information providers, which shall be disclosed to the public within 48 hours upon occurrence.

| 15 |

The Disclosure Guidelines also require online lending intermediary to record all the disclosed information and retain such information for no less than five years from the date of the disclosure. To the extent that the relevant online lending intermediary are not in full compliance with the Disclosure Guidelines, they are required to make correction or rectification within a six-month rectification period starting from the date the Disclosure Guidelines was issued.

In accordance with the Provisions on Several Issues Concerning Laws Applicable to Trials of Private Lending Cases issued by the Supreme People’s Court on August 6, 2015, or the Private Lending Judicial Interpretations, which came into effect on September 1, 2015, in the event that loans are made through an online lending information intermediary platform and the platform only provides intermediary services, courts shall dismiss any claim concerned against the platform demanding the repayment of loans by the platform as a guarantor.

The Private Lending Judicial Interpretations also provide that agreements between lenders and borrowers on loans with interest rates below 24% per annum are valid and enforceable. As to the loans with interest rates per annum between 24% (exclusive) and 36% (inclusive), if the interest on the loans has already been paid to the lender, and so long as such payment has not damaged the interest of the state, the community and any third parties, the courts will turn down the borrower’s request to demand the return of the excess interest payment. If the annual interest rate of a private loan is higher than 36%, the agreement on the excess part of the interest is invalid, and if the borrower requests the lender to return the part of interest exceeding 36% of the annual interest that has been paid, the courts will support such requests.