PRC residents or entities who have contributed legitimate domestic or offshore interests or assets to SPVs but have yet to obtain SAFE registration before the implementation of the Circular 37 shall register their ownership interests or control in such SPVs with SAFE or its local branch. An amendment to the registration is required if there is a material change in the SPV registered, such as any change of basic information (including change of such PRC residents, name and operation term), increases or decreases in investment amount, transfers or exchanges of shares, or mergers or divisions. Failure to comply with the registration procedures set forth in Circular 37, or making misrepresentation on or failure to disclose controllers of FIE that is established through round-trip investment, may result in restrictions on the foreign exchange activities of the relevant FIEs, including payment of dividends and other distributions, such as proceeds from any reduction in capital, share transfer or liquidation, to its offshore parent or affiliate, and the capital inflow from the offshore parent, and may also subject relevant PRC residents or entities to penalties under PRC foreign exchange administration regulations.

We have completed the foreign exchange registration of PRC resident shareholders for Mr. Yan Tang, Mr. Yong Li, Mr. Zhiwei Li, and Mr. Xiaoliang Lei with respect to our financings and share transfer.

M&A Rules and Overseas Listing

In August 2006, six PRC regulatory agencies, including China Securities Regulatory Commission, or CSRC, jointly adopted the Provisions Regarding Mergers and Acquisitions of Domestic Enterprises by Foreign Investors, or the M&A Rules, which became effective in September 2006 and was further amended by MOFCOM on June 22, 2009. This M&A Rule purports to require, among other things, offshore SPVs, formed for listing purposes through acquisition of PRC domestic companies and controlled by PRC companies or individuals, to obtain the approval of the CSRC prior to publicly listing their securities on an overseas stock exchange. We believe that CSRC approval is not required in the context of our initial public offering as we are not a special purpose vehicle formed for listing purpose through acquisition of domestic companies that are controlled by our PRC individual shareholders, as we acquired contractual control rather than equity interests in our domestic affiliated entities.

However, we cannot assure you that the relevant PRC government agency, including the CSRC, would reach the same conclusion as we do. If the CSRC or other PRC regulatory agency subsequently determines that we need to obtain the CSRC’s approval for our initial public offering or if CSRC or any other PRC government authorities will promulgate any interpretation or implementing rules before our listing that would require CSRC or other governmental approvals for our initial public offering, we may face sanctions by the CSRC or other PRC regulatory agencies. In such event, these regulatory agencies may impose fines and penalties on our operations in the PRC, limit our operating privileges in the PRC, delay or restrict the repatriation of the proceeds from our initial public offering into the PRC, or take other actions that could have a material adverse effect on our business, financial condition, results of operations, and prospects, as well as the trading price of our ADSs.

SAFE Regulations on Employee Share Options

Pursuant to the Notice on Issues Concerning the Foreign Exchange Administration for Domestic Individuals Participating in Stock Incentive Plan of Overseas Publicly Listed Company, or Circular 7, issued by SAFE in February 2012, employees, directors, supervisors and other senior management participating in any stock incentive plan of an overseas publicly listed company who are PRC citizens or who are

non-PRC

citizens residing in China for a continuous period of not less than one year, subject to a few exceptions, are required to register with SAFE through a domestic qualified agent, which could be a PRC subsidiary of such overseas listed company, and complete certain other procedures. Failure to complete the SAFE registrations may subject them to fines and legal sanctions and may also limit our ability to contribute additional capital into our wholly-owned subsidiaries in China and limit these subsidiaries’ ability to distribute dividends to us. In addition, the SAT has issued certain circulars concerning employee share options or restricted shares. Under these circulars, the employees working in the PRC who exercise share options or are granted restricted shares will be subject to PRC individual income tax. The PRC subsidiaries of such overseas listed company have obligations to file documents related to employee share options or restricted shares with relevant tax authorities and to withhold individual income taxes of those employees who exercise their share options. If the employees fail to pay or the PRC subsidiaries fail to withhold their income taxes according to relevant laws and regulations, the PRC subsidiaries may face sanctions imposed by the tax authorities or other PRC government authorities. These registrations and filings are a matter of foreign exchange control and tax procedure and the grant of share incentive awards to employees is not subject to the government’s discretionary approval. Compliance with PRC regulations on employee incentive plans has not had, and we believe will not in the future have, any material adverse effect on the implementation of our 2012 Plan and 2014 Plan.

61

C. |

Organizational Structure |

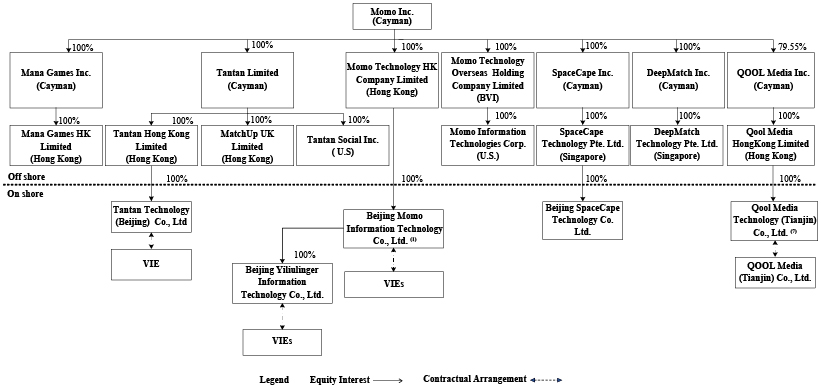

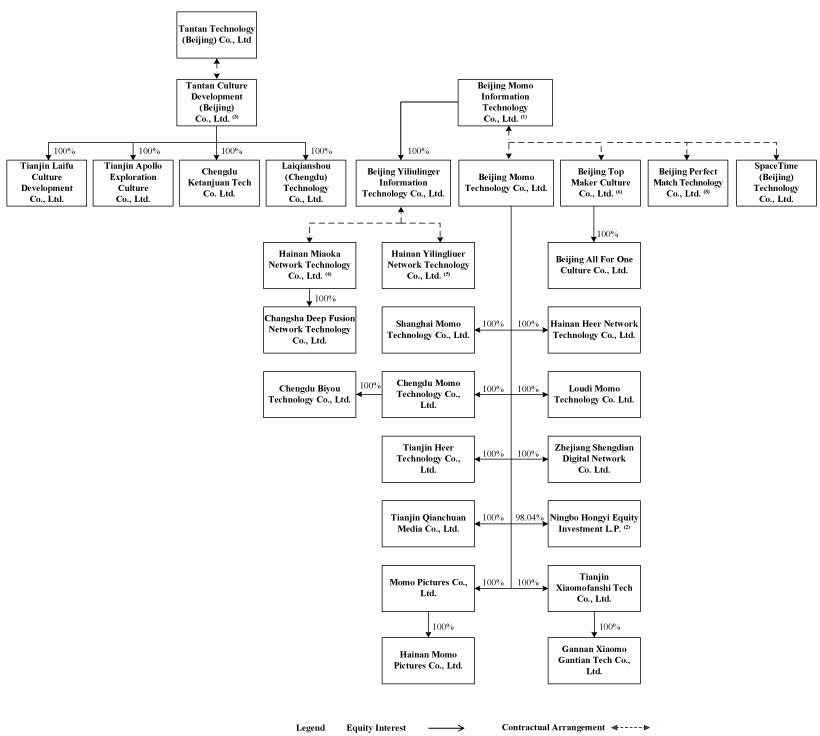

The following diagram illustrates our corporate structure, including our subsidiaries, consolidated affiliated entities and their subsidiaries as of the date of this annual report.

Notes:

| (1) | We exercise effective control over Beijing Momo through contractual arrangements among Beijing Momo IT, Beijing Momo and Messrs. Yan Tang, Yong Li, Xiaoliang Lei and Zhiwei Li, each of whom holds 72.0%, 16.0%, 6.4% and 5.6% of the equity interest in Beijing Momo, respectively. Except for Zhiwei Li and Xiaoliang Lei, the shareholders of Beijing Momo are our shareholders and directors. |

62

| (2) | Ningbo Hongyi Equity Investment L.P. is a limited partnership organized in September 2015. We invested in it and became a limited partner starting from February 2018. |

| (3) | We exercise effective control over Tantan Culture through contractual arrangements among Tantan Technology (Beijing) Co., Ltd., or Tantan Technology, Tantan Culture and Beijing Momo. |

| (4) | We exercise effective control over Hainan Miaoka through contractual arrangements among Beijing Yiliulinger, Hainan Miaoka and Messrs. Xiaoliang Lei and Li Wang, each of whom holds 50% and 50% of the equity interest in Hainan Miaoka, respectively. The shareholders of Hainan Miaoka are our directors or officers. |

| (5) | We exercise effective control over Hainan Yilingliuer, through contractual arrangements among Beijing Yiliulinger, Hainan Yilingliuer and Messrs. Xiaoliang Lei and Li Wang, each of whom holds 50% and 50% of the equity interest in Hainan Yilingliuer, respectively. The shareholders of Hainan Yilingliuer are our directors or officers. |

| (6) | Beijing Top Maker was established in March 2019, and changed to its current name in March 2021. We exercise effective control over Beijing Top Maker through contractual arrangements among Beijing Top Maker, Beijing Momo Information Technology Co., Ltd, and Messrs. Kuan He and Luyu Fan, each of whom holds 99% and 1% of the equity interest in Beijing Top Maker ,respectively. |

| (7) | QOOL Media (Tianjin) Co., Ltd. was established in November 2016. We exercise effective control over Tianjin QOOL Media through contractual arrangements among Tianjin QOOL Media, QOOL Media Technology (Tianjin) Co., Ltd., Beijing Momo and Tianjin Mingqiao Media Partnership (Limited Partner), or Tianjin Mingqiao, each of which holds 70% and 30% of the equity interest in Tianjin QOOL Media, respectively. Mr. Chen Feng and Mr. Ridan Da are two partners of Tianjin Mingqiao. |

| (8) | Beijing Perfect Match Technology Co., Ltd. was established in April 2019. We exercise effective control over Beijing Perfect Match through contractual arrangements among Beijing Perfect March, Beijing Momo IT, and Mr. Yu Dong and Ms. Min Liu, each of whom holds 99% and 1% of the equity interest in Beijing Perfect Match, respectively. |

Contractual Arrangements with Our Consolidated Affiliated Entities and Their Respective Shareholders

PRC laws and regulations place certain restrictions on foreign investment in and ownership of internet-based businesses. Accordingly, we conduct our operations in China principally through Beijing Momo and its subsidiaries, Tantan Culture, Hainan Miaoka, Hainan Yilingliuer, Beijing Top Maker, Tianjin QOOL Media , Beijing Perfect Match and SpaceTime Beijing. Beijing Momo IT entered into contractual arrangements with Beijing Momo, Beijing Top Maker, Beijing Perfect Match, SpaceTime Beijing and their respective shareholders. Beijing Yiliulinger, a wholly owned subsidiary of Beijing Momo IT, entered into contractual arrangements with Hainan Miaoka, Hainan Yilingliuer and their respective shareholders. QOOL Media Technology (Tianjin) Co., Ltd. entered into contractual arrangements with Tianjin QOOL Media and its shareholders. Tantan Technology entered into contractual arrangements with Tantan Culture and its shareholder. Beijing Momo, Tantan Culture, Hainan Miaoka, Hainan Yilingliuer, Beijing Top Maker, Tianjin QOOL Media, Beijing Perfect Match and SpaceTime Beijing are all of our consolidated affiliated entities.

The contractual arrangements allow us to:

| • | exercise effective control over our consolidated affiliated entities; |

| • | receive substantially all of the economic benefits of our consolidated affiliated entities; and |

| • | have an option to purchase all or part of the equity interests in our consolidated affiliated entities when and to the extent permitted by PRC law. |

As a result of these contractual arrangements, we are the primary beneficiary of our consolidated affiliated entities and their subsidiaries, and, therefore, have consolidated the financial results of our consolidated affiliated entities and their subsidiaries in our consolidated financial statements in accordance with U.S. GAAP.

The following is a summary of the currently effective contractual arrangements by and among our wholly-owned subsidiary, Beijing Momo IT, Beijing Momo and the shareholders of Beijing Momo. We also entered into contractual arrangements with Tantan Culture, Hainan Miaoka, Hainan Yilingliuer, Beijing Fancy Reader, Tianjin QOOL Media, Beijing Perfect Match and SpaceTime Beijing. The contractual arrangements entered into by our other PRC subsidiaries with our other consolidated affiliated entities and their respective shareholders contain substantially the same terms as described below.

63

Business operation agreement

day-to-day

Exclusive call option agreements

Equity interest pledge agreements

Powers of attorney

attorney-in-fact

Spousal consent letters

64

Exclusive cooperation agreements

non-technical

services to Beijing Momo, Chengdu Momo, Tianjin Heer and Loudi Momo and receive service fees and license fees as consideration. Beijing Momo, Chengdu Momo, Tianjin Heer and Loudi Momo will maintain a pre-determined

level of operating profit and remit any excess operating profit to Beijing Momo IT and its Chengdu branch as consideration for the licenses, copyrights, technical and non-technical

services provided by Beijing Momo IT and its Chengdu branch. Each agreement has an initial term of ten years from the date of execution, and may be extended at the sole discretion of Beijing Momo IT and its Chengdu branch. Beijing Momo IT and its Chengdu branch may terminate the agreement at any time with a 30-day

notice to Beijing Momo, Chengdu Momo, Tianjin Heer and Loudi Momo, as applicable, but Beijing Momo, Chengdu Momo, Tianjin Heer and Loudi Momo may not terminate the agreement. In the opinion of Han Kun Law Offices, our PRC counsel:

| • | the ownership structures of Beijing Momo IT and Beijing Momo will not result in any violation of PRC laws or regulations currently in effect; and |

| • | the contractual arrangements among Beijing Momo IT, Beijing Momo and the shareholders of Beijing Momo governed by PRC law are valid, binding and enforceable, and do not and will not result in any violation of PRC laws or regulations currently in effect. |

We are further advised by Han Kun Law Offices that the ownership structures of our other wholly-owned entities in China and our other consolidated affiliated entities in China do not violate any applicable PRC law, regulation or rule currently in effect, and the contractual arrangements among our other wholly-owned entities in China, our other consolidated affiliated entities in China and their respective shareholders governed by PRC law are valid, binding and enforceable in accordance with their terms and applicable PRC laws and regulations currently in effect. However, there are substantial uncertainties regarding the interpretation and application of current and future PRC laws, regulations and rules. Accordingly, the PRC regulatory authorities may in the future take a view that is contrary to the above opinion of our PRC counsel. If the PRC government finds that the agreements that establish the structure for operating our business do not comply with PRC government restrictions on foreign investment in our businesses, we could be subject to severe penalties, including being prohibited from continuing operations. See “Item 3. Key Information—D. Risk Factors—Risks Related to Our Corporate Structure—If the PRC government finds that the agreements that establish the structure for operating our businesses in China do not comply with PRC Foreign Investment Law or other regulations on foreign investment in internet and other related businesses, or if these regulations or their interpretation change in the future, we could be subject to severe penalties or be forced to relinquish our interests in those operations,” and “Item 3. Key Information—D. Risk Factors—Risks Related to Doing Business in China—Uncertainties in the interpretation and enforcement of PRC laws and regulations could limit the legal protections available to you and us.”

D. |

Property, Plant and Equipment |

Our headquarters and our principal service development facilities are located in Beijing. We leased an aggregate of approximately 42,553 square meters of office space in Beijing, Chengdu, Tianjin, Haikou, Guangzhou and Kuala Lumpur as of March 31, 2021. These leases vary in duration from one year to five years.

The servers that we use to provide our services are primarily maintained at various third-party internet data centers in Beijing.

Item 4A. |

Unresolved Staff Comments |

None.

65